UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

|

Investment Company Act file number |

811-06637 | |||||||

|

| ||||||||

|

The UBS Funds | ||||||||

|

(Exact name of registrant as specified in charter) | ||||||||

|

| ||||||||

|

One North Wacker Drive, Chicago, IL |

|

60606-2807 | ||||||

|

(Address of principal executive offices) |

|

(Zip code) | ||||||

|

| ||||||||

|

Mark F. Kemper, Esq. | ||||||||

|

(Name and address of agent for service) | ||||||||

|

| ||||||||

|

Copy to: | ||||||||

|

| ||||||||

|

Registrant’s telephone number, including area code: |

212-821-3000 |

| ||||||

|

| ||||||||

|

Date of fiscal year end: |

June 30 |

| ||||||

|

| ||||||||

|

Date of reporting period: |

June 30, 2011 |

| ||||||

Item 1. Reports to Stockholders.

UBS Fixed

Income Funds

June 30, 2011

The UBS Funds—Fixed Income

Annual Report

| Table of contents | |||||||

| President's letter | 1 | ||||||

| Market commentary | 2 | ||||||

| Fixed Income | |||||||

| UBS Absolute Return Bond Fund | 3 | ||||||

| UBS Core Plus Bond Fund (formerly, UBS U.S. Bond Fund) | 20 | ||||||

| UBS Fixed Income Opportunities Fund | 33 | ||||||

| UBS Global Bond Fund | 52 | ||||||

| UBS High Yield Fund | 65 | ||||||

| Explanation of expense disclosure | 82 | ||||||

| Statement of assets and liabilities | 86 | ||||||

| Statement of operations | 90 | ||||||

| Statement of changes in net assets | 92 | ||||||

| Financial highlights | 94 | ||||||

| Notes to financial statements | 104 | ||||||

| Report of independent registered public accounting firm | 127 | ||||||

| General information | 128 | ||||||

| Board approval of investment advisory agreements | 129 | ||||||

| Trustee and Officer information | 134 | ||||||

| Federal tax information | 140 | ||||||

This page has been left blank intentionally.

President's letter

August 15, 2011

Dear Shareholder,

I'm writing this letter to you following what have easily been two of the most tumultuous weeks that the financial markets have seen in a while.

Standard & Poor's decision to downgrade US long-term sovereign debt from AAA to AA+ on Friday, August 5, 2011, came at the end of a five-day period that had already seen the Dow Jones Industrial Average (DJIA) fall over 700 points. News of the downgrade triggered further volatility in the equity market, and the ensuing days were characterized by sharp market declines, and equally steep gains.

Today, the equity market is in calmer territory, having already reclaimed, for the time being, the losses of the past week. While no one can predict with any certainty what will transpire in the days and weeks to come, we believe that the longer term implications of the downgrade, though still unclear, are likely to be limited. However, in the near-term, we expect market volatility to persist.

When I last wrote to you six months ago, I noted that irrational fear has the unfortunate result of leading investors to make the wrong decisions, for the wrong reasons, at the wrong times—and, ultimately, may have a profound negative impact on their portfolios.1 This is an important point to remember in the current atmosphere of uncertainty. The truth is, ups and downs in the market—though never welcome—are a fact of life. A market decline of 15% or more, similar to that which we have just seen, has occurred in the DJIA, on average, once every two years.2 However, equally as certain is that every market decline is also followed by a market recovery.

Against the current market backdrop, it is never more important for investors to maintain a long-term perspective. History has shown that investors with the fortitude to remain invested through a crisis have been rewarded, while those reacting to short-term volatility have met with less success. Arguably, staying the course is easier said than done. To that end, an actively managed, diversified portfolio of stocks and bonds may provide you with smoother returns, and thus make it easier for you to stay on track.3

In a few months, UBS Global Asset Management will reach a major milestone: 30 years of managing clients' assets in a constantly evolving global marketplace. For as long as we have been managing money, our formidable history of experience has shown us that only by adhering to our disciplined processes through up and down markets are we best positioned to seek to achieve the type of long-term investment results that will help our clients achieve their financial goals. This is a standard that we will resolutely adhere to in managing our asset allocation, equity and fixed income funds in the days and weeks, and years to come.

As always, we remain firmly dedicated to your investment success. Thank you for your continued support.

Sincerely,

Mark E. Carver

President

The UBS Funds

Managing Director

UBS Global Asset Management (Americas) Inc.

1 Source: Dalbar.

2 Source: Ned Davis. Covers the period from 1/2/1900 to 8/15/2011.

3 Diversification and asset allocation do not ensure gains or guarantee against loss.

1

The markets in review

Decelerating Growth in Developed Countries

The US and many developed countries abroad experienced decelerating economic growth during the reporting period. Oil and food prices moved higher during this time, which had a negative impact on consumer spending. In addition, supply disruptions following the devastating earthquake and tsunami in Japan last March led to moderating growth in the manufacturing sector. In the US, gross domestic product ("GDP") growth was 2.5% and 2.3% during the third and fourth quarter of 2010, respectively. The Commerce Department then reported that first and second quarter 2011 GDP growth was 0.4% and 1.3%, respectively.

In contrast to their developed country counterparts, growth in most emerging market economies, such as China and India, remained robust. Against a backdrop of higher inflation, several emerging market central banks raised their interest rates and took other actions in an effort to cool growth and stem rising prices. By the end of the period, commodity prices had declined from their peaks and inflationary pressures appeared to have eased.

Riskier fixed income securities outperform

There was also a meaningful shift in investor sentiment in the fixed income market during the reporting period. This, in turn, impacted the performance of the spread sectors (non-Treasuries). During the first nine months of the period, there were hopes for improving economic conditions, coupled with sharply rising oil and commodity prices. Despite hostilities in the Middle East and Northern Africa, the natural disaster in Japan and the European sovereign debt crisis, most spread sectors outperformed Treasuries and yields moved higher. Nonetheless, it was a different story during the last three months of the period. High oil prices hurt consumer spending and economic data pointed to a soft patch in many developed countries. Against this backdrop, Treasury yields declined and nearly every spread sector lagged Treasuries. All told, during 12 months ended June 30, 2011, the spread sectors typically outperformed Treasuries, and the overall US bond market (as measured by the Barclays Capital US Aggregate Index1) returned 3.90%.

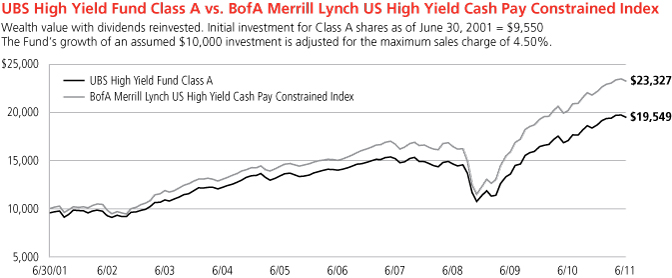

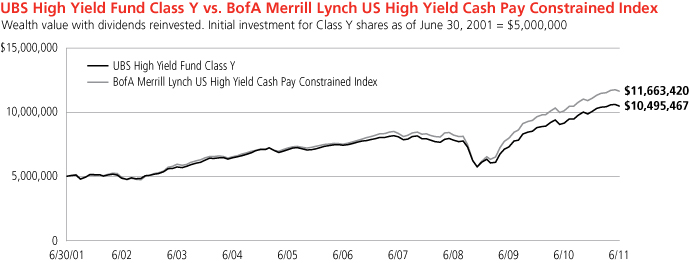

Despite increased volatility and periodic flights to quality, riskier fixed income asset classes generated solid gains during the reporting period, as the BofA Merrill Lynch US High Yield Cash Pay Constrained Index2 returned 15.21%, and the J.P. Morgan Emerging Markets Bond Index Global (EMBI Global)3 rose 11.73%.

1 The Barclays Capital US Aggregate Index is an unmanaged broad based index designed to measure the US dollar-denominated, investment-grade, fixed rate taxable bond market. The index includes bonds from the Treasury, government-related, corporate, mortgage-backed, asset-backed and commercial mortgage-backed sectors. US agency hybrid adjustable rate mortgage (ARM) securities were added to the Index on April 1, 2007. Investors should note that indices do not reflect the deduction of fees and expenses.

2 The BofA Merrill Lynch US High Yield Cash Pay Constrained Index is an unmanaged index of publicly placed non-convertible, coupon-bearing US dollar-denominated below investment grade corporate debt with a term to maturity of at least one year. The index is market weighted, so that larger bond issuers have a greater effect on the index's return. However, the representation of any single bond issue is restricted to a maximum of 2% of the total index. Investors should note that indices do not reflect the deduction of fees and expenses.

3 The J.P. Morgan Emerging Markets Bond Index Global (EMBI Global) is an unmanaged index which is designed to track total returns for US-dollar-denominated debt instruments issued by emerging market sovereign and quasi-sovereign entities: Brady bonds, loans and Eurobonds. Investors should note that indices do not reflect the deduction of fees and expenses.

2

UBS Absolute Return Bond Fund

Portfolio performance

For the 12 months ended June 30, 2011, Class A shares of UBS Absolute Return Bond Fund (the "Fund") returned 2.47% (Class A shares declined 0.07% after the deduction of the maximum sales charge), while Class Y shares returned 2.50%. For purposes of comparison, the BofA Merrill Lynch US Treasury 1-3 Year Index returned 1.34%, and the US LIBOR 3-Month Index (the "Index") returned 0.33% over the same period. (Class Y shares have lower expenses than other share classes of the Fund. Returns for all share classes over various time periods are shown on page 5; please note that the Fund's returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares, while the Index returns do not reflect the deduction of fees and expenses.)

The Fund generated a positive absolute return during the reporting period. Notably, spread and currency management enhanced the Fund's results.

Portfolio performance summary1

What worked

• The Fund's allocation to the corporate bond sector contributed to performance. In particular, our US and European financial holdings were rewarded. Spreads in these sectors narrowed as corporate profits were generally better than expected and there was overall strong demand from investors seeking to generate additional yield in the low interest rate environment. (Spread measures the difference in yield between a fixed income security and a government bond of similar duration.)

• The Fund's positions in the securitized sector were beneficial. We actively managed the Fund's exposure to the securitized sector and, overall, our holdings enhanced results.

• Active currency management was beneficial. Throughout the 12-month period, we implemented a number of tactical currency trades to take advantage of opportunities in the foreign exchange markets. In particular, the Fund's exposures to the Swedish krona and Norwegian krone contributed to performance.

• Several derivative instruments were used during the period. Certain bond futures and options were utilized to manage the Fund's duration and yield curve exposure. Credit default swaps were used to implement specific credit-related investment strategies. Additionally, foreign exchange futures were utilized to manage the Fund's currency exposures. Overall, the Fund's use of derivatives was within our expectations, and they were successful in helping us to manage the Fund's overall risk exposure.

1 For a detailed commentary on the market environment in general during the reporting period, see page 2.

3

UBS Absolute Return Bond Fund

What didn't work

• Security selection detracted from performance over the period.

– While the Fund's exposure to US financials aided performance, this was somewhat offset by issue selection within the sector.

– Issue selection of certain US mortgage-backed securities was, overall, a drag on the Fund's performance.

This letter is intended to assist shareholders in understanding how the Fund performed during the 12 months ended June 30, 2011. The views and opinions in the letter were current as of August 15, 2011. They are not guarantees of future performance or investment results and should not be taken as investment advice. Investment decisions reflect a variety of factors, and we reserve the right to change our views about individual securities, sectors and markets at any time. As a result, the views expressed should not be relied upon as a forecast of the Fund's future investment intent. We encourage you to consult your financial advisor regarding your personal investment program.

Mutual funds are sold by prospectus only. You should read it carefully and consider a fund's investment objectives, risks, charges, expenses and other important information contained in the prospectus before investing. Prospectuses for most of our funds can be obtained from your financial advisor, by calling UBS Funds at 800-647 1568 or by visiting our Web site at www.ubs.com.

4

UBS Absolute Return Bond Fund

Average annual total returns for periods ended 6/30/2011 (unaudited)

| 1 year | 5 years | Inception1 | |||||||||||||

| Before deducting maximum sales charge | |||||||||||||||

| Class A2 | 2.47 | % | (4.43 | )% | (2.88 | )% | |||||||||

| Class C3 | 2.08 | (4.77 | ) | (3.22 | ) | ||||||||||

| Class Y4 | 2.50 | (4.27 | ) | (2.70 | ) | ||||||||||

| After deducting maximum sales charge | |||||||||||||||

| Class A2 | (0.07 | )% | (4.91 | )% | (3.28 | )% | |||||||||

| Class C3 | 1.59 | (4.77 | ) | (3.22 | ) | ||||||||||

| BofA Merrill Lynch US Treasury 1-3 Year Index5 | 1.34 | % | 4.14 | % | 3.74 | % | |||||||||

| US LIBOR 3-Month Index6 | 0.33 | 2.53 | 2.88 | ||||||||||||

The annualized gross and net expense ratios, respectively, for each class of shares as in the October 28, 2010 prospectuses were as follows: Class A—1.14% and 1.00%; Class C—1.42% and 1.35%; Class Y—0.80% and 0.80%. Net expenses reflect fee waivers and/or expense reimbursements, if any, pursuant to an agreement that is in effect to cap the expenses. The Trust, with respect to the Fund, and UBS Global Asset Management (Americas) Inc., the Fund's investment advisor ("UBS Global AM (Americas)" or the "Advisor"), have entered into a written agreement pursuant to which the Advisor has agreed to waive a portion of its management fees and/or to reimburse expenses (excluding expenses incurred through investment in other investment companies, interest, taxes, brokerage commissions, extraordinary expenses and securities loan fees and dividend expense for securities sold short) to the extent necessary so that the Fund's ordinary operating expenses (excluding expenses incurred through investment in other investment companies, interest, taxes, brokerage commissions, extraordinary expenses and securities loan fees and dividend expense for securities sold short), through the 12-month period ending October 27, 2011, do not exceed 1.00% for Class A shares, 1.35% for Class C shares and 0.85% for Class Y shares. Pursuant to the written agreement, the Advisor is entitled to be reimbursed for any fees it waives and expenses it reimburses for a period of three years following such fee waivers and expense reimbursements to the extent that such reimbursement of the Advisor by the Fund will not cause the Fund to exceed any applicable expense limit that is in place for the Fund.

1 Inception date of all shares of UBS Absolute Return Bond Fund is April 27, 2005. Inception date of the indices, for the purpose of this illustration, is April 30, 2005.

2 Maximum sales charge for Class A shares is 2.5%. Class A shares bear ongoing 12b-1 service fees.

3 Maximum contingent deferred sales charge for Class C shares is 0.5% imposed on redemptions and is reduced to 0% after one year. Class C shares bear ongoing 12b-1 service and distribution fees.

4 The Fund offers Class Y shares to a limited group of eligible investors, including certain qualifying retirement plans. Class Y shares do not bear initial or contingent deferred sales charges or ongoing 12b-1 service and distribution fees.

5 The BofA Merrill Lynch US Treasury 1-3 Year Index is an unmanaged index designed to track short-term US Treasury securities with maturities between 1 and 3 years. Investors should note that indices do not reflect the deduction of fees and expenses.

6 The US LIBOR 3-Month Index is based on LIBOR, the London Interbank Offered Rate, a short-term interest rate that banks charge one another and that is generally representative of short-term interest rates. The US LIBOR 3-Month Index is designed to track the interest rate earned on three month inter-bank US dollar denominated deposits. Investors should note that indices do not reflect the deduction of fees and expenses.

If an investor sells or exchanges shares less than 90 days after purchase, a redemption fee of 1.00% of the amount sold or exchanged will be deducted at the time of the transaction, except as noted otherwise in the prospectus.

Past performance does not predict future performance, and the performance information provided does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The return and principal value of an investment will fluctuate, so that an investor's shares, when redeemed, may be worth more or less than their original cost. Performance results assume reinvestment of all dividends and capital gain distributions at net asset value on the ex-dividend dates. Current performance may be higher or lower than the performance data quoted. For month-end performance figures, please visit http://www.ubs.com.

5

UBS Absolute Return Bond Fund

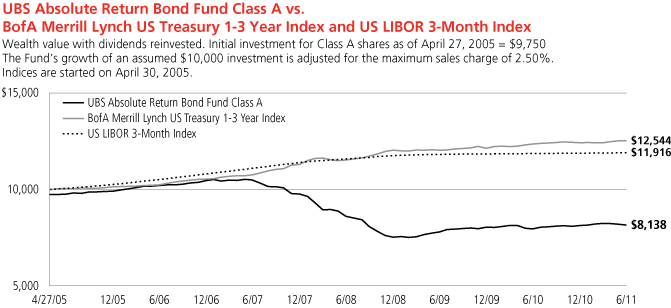

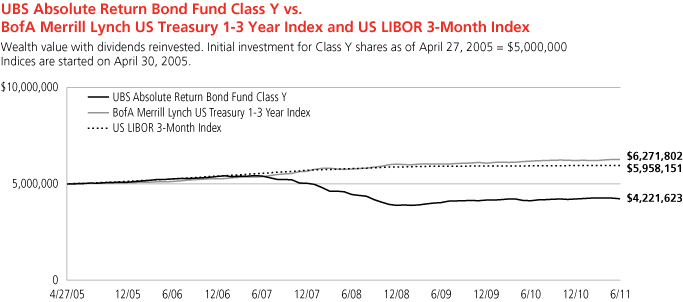

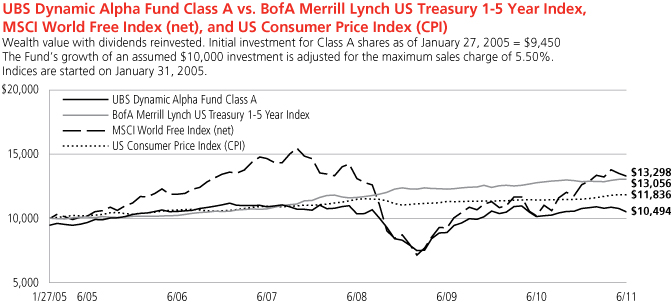

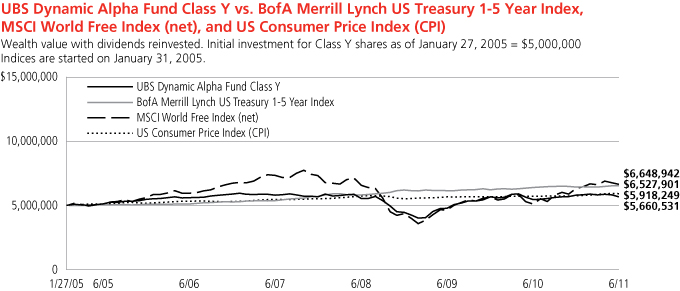

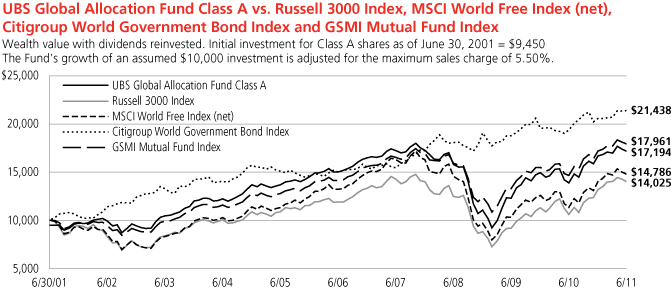

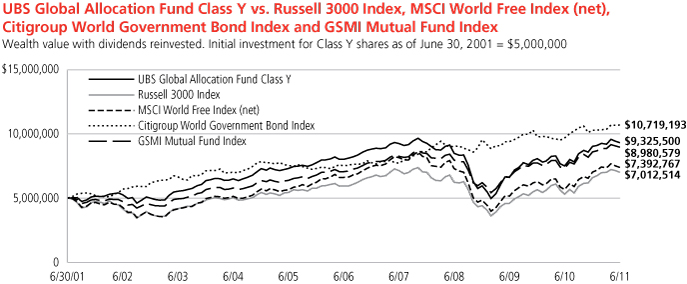

Illustration of an assumed investment of $10,000 in Class A shares (adjusted for 2.50% maximum sales charge) and $5,000,000 in Class Y shares (unaudited)

The following two graphs depict the performance of UBS Absolute Return Bond Fund Class A and Class Y shares versus the BofA Merrill Lynch US Treasury 1-3 Year Index and the US LIBOR 3-Month Index from April 27, 2005, which is the inception date of the two classes, through June 30, 2011. The performance of Class C shares will vary based upon the different class specific expenses and sales charges. The performance provided does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is no guarantee of future results. Share price and returns will vary with market conditions; investors may realize a gain or loss upon redemption.

Past performance does not predict future performance, and the performance information provided does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The return and principal value of an investment will fluctuate, so that an investor's shares, when redeemed, may be worth more or less than their original cost. Performance results assume reinvestment of all dividends and capital gain distributions at net asset value on the ex-dividend dates. Current performance may be higher or lower than the performance data quoted. For month-end performance figures, please visit http://www.ubs.com.

6

UBS Absolute Return Bond Fund

Top ten long-term fixed income holdings (unaudited)

As of June 30, 2011

|

Percentage of net assets |

|||||||

|

Federal Home Loan Bank, 5.250%, due 06/18/14 |

3.1 | % | |||||

|

Federal Home Loan Mortgage Corp., 5.000%, due 02/16/17 |

3.0 | ||||||

|

Eurohypo AG, 3.750%, due 03/24/14 |

2.9 | ||||||

|

Kreditanstalt fuer Wiederaufbau, 3.375%, due 01/16/12 |

2.8 | ||||||

|

Kreditanstalt fuer Wiederaufbau, 5.550%, due 06/07/21 |

2.2 | ||||||

|

Federal National Mortgage Association, 4.125%, due 04/15/14 |

2.2 | ||||||

|

Federal National Mortgage Association Pools, #933765, 4.500%, due 04/01/38 |

2.1 | ||||||

|

Inter-American Development Bank, 3.250%, due 11/15/11 |

1.8 | ||||||

|

European Investment Bank, 6.250%, due 04/15/14 |

1.6 | ||||||

|

Telecom Italia SpA, 5.625%, due 12/29/15 |

1.5 | ||||||

| Total | 23.2 | % | |||||

Country exposure by issuer, top five (unaudited)

As of June 30, 2011

|

Percentage of net assets |

|||||||

| United States | 41.3 | % | |||||

| United Kingdom | 14.1 | ||||||

| Germany | 9.9 | ||||||

| Netherlands | 4.7 | ||||||

| Italy | 3.7 | ||||||

| Total | 73.7 | % | |||||

Industry diversification (unaudited)1

As a percentage of net assets as of June 30, 2011

| Bonds | |||||||

| Corporate bonds | |||||||

| Aerospace & defense | 0.40 | % | |||||

| Auto components | 0.18 | ||||||

| Building materials | 0.45 | ||||||

| Chemicals | 0.54 | ||||||

| Commercial banks | 9.36 | ||||||

| Communications equipment | 0.27 | ||||||

| Construction & engineering | 1.14 | ||||||

| Consumer finance | 0.54 | ||||||

| Diversified financial services | 11.16 | ||||||

| Diversified telecommunication services | 2.87 | ||||||

| Electric utilities | 0.77 | ||||||

| Energy | 0.07 | ||||||

| Food & staples retailing | 0.58 | ||||||

| Health care equipment & supplies | 0.52 | ||||||

| Household durables | 0.17 | ||||||

| Industrial conglomerates | 0.29 | ||||||

| Insurance | 3.54 | ||||||

| Media | 1.23 | ||||||

| Metals & mining | 1.75 | ||||||

| Oil, gas & consumable fuels | 3.24 | ||||||

| Pharmaceuticals | 0.25 | ||||||

| Road & rail | 0.45 | ||||||

| Semiconductors & semiconductor equipment | 0.19 | ||||||

| Sovereign | 1.22 | ||||||

| Specialty retail | 0.60 | ||||||

| Telecommunications | 0.19 | ||||||

| Thrifts & mortgage finance | 3.08 | ||||||

| Tobacco | 2.33 | ||||||

| Wireless telecommunication services | 2.13 | ||||||

| Total corporate bonds | 49.51 | % | |||||

| Asset-backed securities | 1.76 | ||||||

| Collateralized debt obligations | 1.02 | ||||||

| Commercial mortgage-backed securities | 0.47 | ||||||

| Mortgage & agency debt securities | 23.23 | ||||||

| Non-US government obligations | 12.22 | ||||||

| Supranational bonds | 4.56 | ||||||

| Total bonds | 92.77 | % | |||||

| Short-term investment | 6.76 | ||||||

| Total investments | 99.53 | % | |||||

| Cash and other assets, less liabilities | 0.47 | ||||||

| Net assets | 100.00 | % | |||||

1 Figures represent the industry breakdown of direct investments of UBS Absolute Return Bond Fund. Figures would be different if a breakdown of the derivatives exposure was included.

7

UBS Absolute Return Bond Fund

Portfolio of investments

June 30, 2011

|

Face amount |

Value | ||||||||||

| Bonds: 92.77% | |||||||||||

| Corporate bonds: 49.51% | |||||||||||

| Australia: 0.92% | |||||||||||

|

Rio Tinto Finance USA Ltd., 4.125%, due 05/20/21 |

$ | 1,000,000 | $ | 993,310 | |||||||

|

Westpac Banking Corp., 4.200%, due 02/27/15 |

350,000 | 370,366 | |||||||||

| Total Australia corporate bonds | 1,363,676 | ||||||||||

| Canada: 0.57% | |||||||||||

|

Barrick Gold Corp., 2.900%, due 05/30/161 |

400,000 | 399,685 | |||||||||

|

Nova Chemicals Corp., 8.625%, due 11/01/19 |

195,000 | 217,181 | |||||||||

|

Teck Resources Ltd., 3.150%, due 01/15/17 |

220,000 | 220,143 | |||||||||

| Total Canada corporate bonds | 837,009 | ||||||||||

| Denmark: 0.26% | |||||||||||

|

Dong Energy A/S, 4.875%, due 05/07/14 |

EUR | 250,000 | 381,286 | ||||||||

| France: 1.72% | |||||||||||

|

AXA SA, 6.667%, due 07/06/162,3 |

GBP | 525,000 | 754,126 | ||||||||

|

Casino Guichard Perrachon SA, 5.500%, due 01/30/15 |

EUR | 550,000 | 847,932 | ||||||||

|

CNP Assurances, 6.875%, due 09/30/412 |

500,000 | 715,105 | |||||||||

|

Compagnie de Financement Foncier, 3.625%, due 01/16/12 |

145,000 | 212,373 | |||||||||

| Total France corporate bonds | 2,529,536 | ||||||||||

| Germany: 3.45% | |||||||||||

|

Commerzbank AG, 6.375%, due 03/22/19 |

350,000 | 479,797 | |||||||||

|

Eurohypo AG, 3.750%, due 03/24/14 |

2,900,000 | 4,330,353 | |||||||||

|

HeidelbergCement Finance BV, 8.500%, due 10/31/19 |

160,000 | 259,287 | |||||||||

| Total Germany corporate bonds | 5,069,437 | ||||||||||

| Ireland: 0.71% | |||||||||||

|

Allied Irish Banks PLC, 4.500%, due 10/01/12 |

300,000 | 363,263 | |||||||||

|

GE Capital UK Funding, 6.000%, due 04/11/13 |

GBP | 400,000 | 681,770 | ||||||||

| Total Ireland corporate bonds | 1,045,033 | ||||||||||

| Italy: 2.60% | |||||||||||

|

Intesa Sanpaolo SpA, 2.658%, due 02/24/141,2 |

$ | 600,000 | 598,531 | ||||||||

| 6.625%, due 05/08/18 | EUR | 500,000 | 733,308 | ||||||||

|

Face amount |

Value | ||||||||||

|

Telecom Italia SpA, 5.625%, due 12/29/15 |

GBP | 1,350,000 | $ | 2,225,681 | |||||||

|

Wind Acquisition Finance SA, 11.750%, due 07/15/174 |

EUR | 160,000 | 261,027 | ||||||||

| Total Italy corporate bonds | 3,818,547 | ||||||||||

| Luxembourg: 1.51% | |||||||||||

|

ArcelorMittal, 9.000%, due 02/15/15 |

$ | 350,000 | 417,756 | ||||||||

|

Boardriders SA, 8.875%, due 12/15/174 |

EUR | 200,000 | 303,806 | ||||||||

|

Fiat Industrial Finance Europe SA, 6.250%, due 03/09/18 |

550,000 | 791,601 | |||||||||

|

GAZ Capital SA for Gazprom, 6.580%, due 10/31/13 |

GBP | 250,000 | 426,315 | ||||||||

|

Intelsat Jackson Holdings SA, 7.250%, due 10/15/201 |

$ | 285,000 | 283,575 | ||||||||

| Total Luxembourg corporate bonds | 2,223,053 | ||||||||||

| Mexico: 0.50% | |||||||||||

|

America Movil SAB de CV, 3.625%, due 03/30/15 |

700,000 | 733,571 | |||||||||

| Netherlands: 4.41% | |||||||||||

|

Allianz Finance II BV, 4.750%, due 07/22/19 |

EUR | 850,000 | 1,288,609 | ||||||||

|

Conti-Gummi Finance BV, 7.125%, due 10/15/184 |

175,000 | 262,024 | |||||||||

|

CRH Finance BV, 7.375%, due 05/28/14 |

250,000 | 399,734 | |||||||||

|

ELM BV for Swiss Reinsurance Co., 5.252%, due 05/25/162,3 |

650,000 | 829,505 | |||||||||

|

MDC BV, 5.750%, due 05/06/141 |

$ | 1,650,000 | 1,802,625 | ||||||||

|

Rabobank Nederland NV, 4.000%, due 09/10/15 |

GBP | 230,000 | 387,691 | ||||||||

|

Repsol International Finance BV, 4.750%, due 02/16/17 |

EUR | 300,000 | 449,497 | ||||||||

|

Scotland International Finance BV, 4.250%, due 05/23/131 |

$ | 800,000 | 802,520 | ||||||||

|

Ziggo Bond Co. BV, 8.000%, due 05/15/184 |

EUR | 175,000 | 260,755 | ||||||||

| Total Netherlands corporate bonds | 6,482,960 | ||||||||||

| Portugal: 0.51% | |||||||||||

|

EDP Finance BV, 5.375%, due 11/02/121 |

$ | 750,000 | 750,981 | ||||||||

| Qatar: 0.30% | |||||||||||

|

Qtel International Finance Ltd., 6.500%, due 06/10/141 |

400,000 | 442,500 | |||||||||

| South Africa: 0.20% | |||||||||||

|

Edcon Proprietary Ltd., 9.500%, due 03/01/184 |

EUR | 215,000 | 294,634 | ||||||||

8

UBS Absolute Return Bond Fund

Portfolio of investments

June 30, 2011

|

Face amount |

Value | ||||||||||

| Bonds—(Continued) | |||||||||||

| Corporate bonds—(Continued) | |||||||||||

| South Korea: 0.52% | |||||||||||

|

Hyundai Capital Services, Inc., 4.375%, due 07/27/161 |

$ | 750,000 | $ | 769,067 | |||||||

| Spain: 0.51% | |||||||||||

|

Telefonica Emisiones SAU, 5.431%, due 02/03/14 |

EUR | 500,000 | 758,363 | ||||||||

| Sweden: 0.26% | |||||||||||

|

Vattenfall Treasury AB, 4.250%, due 05/19/14 |

250,000 | 376,262 | |||||||||

| Switzerland: 0.91% | |||||||||||

|

Credit Suisse/London, 6.125%, due 05/16/14 |

850,000 | 1,337,818 | |||||||||

| United Kingdom: 10.09% | |||||||||||

|

Anglo American Capital PLC, 9.375%, due 04/08/141 |

$ | 450,000 | 537,983 | ||||||||

|

Aviva PLC, 4.729%, due 11/28/142,3 |

EUR | 675,000 | 856,495 | ||||||||

|

BAA Funding Ltd., 3.975%, due 02/15/121 |

1,150,000 | 1,680,947 | |||||||||

|

Barclays Bank PLC, 2.500%, due 01/23/13 |

$ | 950,000 | 967,476 | ||||||||

|

BP Capital Markets PLC, 1.550%, due 08/11/11 |

100,000 | 100,115 | |||||||||

|

Brambles Finance PLC, 4.625%, due 04/20/18 |

EUR | 550,000 | 816,997 | ||||||||

|

HSBC Holdings PLC, 4.500%, due 04/30/14 |

250,000 | 376,566 | |||||||||

| 6.250%, due 03/19/18 | 300,000 | 462,199 | |||||||||

|

Imperial Tobacco Finance PLC, 4.500%, due 07/05/18 |

550,000 | 798,380 | |||||||||

| 8.375%, due 02/17/16 | 450,000 | 777,430 | |||||||||

|

Lloyds TSB Bank PLC, 2.624%, due 01/24/142 |

$ | 1,500,000 | 1,520,863 | ||||||||

|

Nationwide Building Society, 4.650%, due 02/25/151 |

550,000 | 569,552 | |||||||||

|

Reed Elsevier Investments PLC, 5.625%, due 10/20/16 |

GBP | 450,000 | 779,428 | ||||||||

|

Royal Bank of Scotland Group PLC, 5.250%, due 05/15/13 |

EUR | 1,000,000 | 1,498,114 | ||||||||

|

Smiths Group PLC, 6.050%, due 05/15/141 |

$ | 400,000 | 433,620 | ||||||||

|

Standard Chartered Bank PLC, 3.850%, due 04/27/151 |

1,400,000 | 1,449,272 | |||||||||

|

Vodafone Group PLC, 5.750%, due 03/15/16 |

650,000 | 734,731 | |||||||||

|

WPP PLC, 6.625%, due 05/12/16 |

EUR | 300,000 | 485,549 | ||||||||

| Total United Kingdom corporate bonds | 14,845,717 | ||||||||||

|

Face amount |

Value | ||||||||||

| United States: 19.56% | |||||||||||

|

Ally Financial, Inc., 4.500%, due 02/11/14 |

$ | 215,000 | $ | 215,000 | |||||||

|

Altria Group, Inc., 9.250%, due 08/06/19 |

300,000 | 391,184 | |||||||||

|

American Honda Finance Corp., 3.875%, due 09/16/14 |

EUR | 200,000 | 298,109 | ||||||||

|

American International Group, Inc., 3.650%, due 01/15/14 |

$ | 750,000 | 764,318 | ||||||||

|

Anadarko Petroleum Corp., 5.750%, due 06/15/14 |

1,000,000 | 1,103,971 | |||||||||

| 7.625%, due 03/15/14 | 325,000 | 372,658 | |||||||||

|

AT&T, Inc., 4.850%, due 02/15/14 |

750,000 | 814,626 | |||||||||

|

BAE Systems Holdings, Inc., 4.950%, due 06/01/141 |

550,000 | 590,919 | |||||||||

|

Bank of America Corp., 4.900%, due 05/01/13 |

710,000 | 747,962 | |||||||||

| 5.650%, due 05/01/18 | 650,000 | 685,315 | |||||||||

|

Boston Scientific Corp., 4.500%, due 01/15/15 |

720,000 | 759,149 | |||||||||

|

Celanese US Holdings LLC, 6.625%, due 10/15/18 |

285,000 | 300,675 | |||||||||

|

Cellco Partnership, 7.625%, due 12/19/11 |

EUR | 500,000 | 743,362 | ||||||||

| 8.500%, due 11/15/18 | $ | 500,000 | 649,282 | ||||||||

|

Citigroup, Inc., 4.750%, due 05/31/172 |

EUR | 400,000 | 533,798 | ||||||||

| 5.625%, due 08/27/12 | $ | 540,000 | 564,134 | ||||||||

|

Comcast Corp., 6.300%, due 11/15/17 |

620,000 | 718,659 | |||||||||

|

CSX Corp., 5.750%, due 03/15/13 |

610,000 | 656,326 | |||||||||

|

DirecTV Holdings LLC, 7.625%, due 05/15/16 |

550,000 | 599,500 | |||||||||

|

Enterprise Products Operating LLC, 3.700%, due 06/01/15 |

380,000 | 398,381 | |||||||||

| Series I, 5.000%, due 03/01/15 | 330,000 | 359,264 | |||||||||

|

ERAC USA Finance Co., 2.750%, due 07/01/131 |

400,000 | 408,079 | |||||||||

|

Freescale Semiconductor, Inc., 9.250%, due 04/15/181 |

260,000 | 280,150 | |||||||||

|

General Electric Capital Corp., 0.367%, due 12/20/132 |

240,000 | 237,106 | |||||||||

| Series A, 3.750%, due 11/14/14 | 1,410,000 | 1,492,496 | |||||||||

| Series A, 6.750%, due 03/15/32 | 1,500,000 | 1,666,578 | |||||||||

|

Goldman Sachs Group, Inc., 7.500%, due 02/15/19 |

1,300,000 | 1,512,606 | |||||||||

|

JPMorgan Chase & Co., 3.400%, due 06/24/15 |

1,350,000 | 1,385,979 | |||||||||

| 6.300%, due 04/23/19 | 1,200,000 | 1,352,563 | |||||||||

9

UBS Absolute Return Bond Fund

Portfolio of investments

June 30, 2011

|

Face amount |

Value | ||||||||||

| Bonds—(Continued) | |||||||||||

| Corporate bonds—(Concluded) | |||||||||||

| United States—(Concluded) | |||||||||||

|

Morgan Stanley, 5.950%, due 12/28/17 |

$ | 1,300,000 | $ | 1,397,561 | |||||||

|

Motorola Solutions, Inc., 6.000%, due 11/15/17 |

350,000 | 398,257 | |||||||||

|

Nalco Co., 6.625%, due 01/15/191 |

275,000 | 281,875 | |||||||||

|

ONEOK Partners LP, 8.625%, due 03/01/19 |

550,000 | 699,224 | |||||||||

|

Petrohawk Energy Corp., 7.875%, due 06/01/15 |

275,000 | 288,063 | |||||||||

|

Pfizer, Inc., 3.625%, due 06/03/13 |

EUR | 250,000 | 370,285 | ||||||||

|

Quicksilver Resources, Inc., 11.750%, due 01/01/16 |

$ | 245,000 | 280,525 | ||||||||

|

Reynolds Group Issuer LLC, 7.750%, due 10/15/164 |

EUR | 170,000 | 255,154 | ||||||||

|

SLM Corp., 6.250%, due 01/25/16 |

$ | 350,000 | 363,125 | ||||||||

|

Toys R Us Property Co. II LLC, 8.500%, due 12/01/17 |

265,000 | 276,925 | |||||||||

|

UST, Inc., 6.625%, due 07/15/12 |

1,375,000 | 1,453,022 | |||||||||

|

Wells Fargo & Co., 5.250%, due 10/23/12 |

2,000,000 | 2,110,184 | |||||||||

|

Total United States corporate bonds |

28,776,349 | ||||||||||

|

Total corporate bonds (cost $69,122,620) |

72,835,799 | ||||||||||

| Asset-backed securities: 1.76% | |||||||||||

| United Kingdom: 0.78% | |||||||||||

|

Chester Asset Receivables Dealings, Series 2004-1, Class A, 1.012%, due 04/15/162 |

GBP | 150,000 | 234,495 | ||||||||

|

2003-B PLC, Series A, 4.650%, due 07/15/13 |

240,000 | 400,066 | |||||||||

|

Permanent Financing PLC, Series 6, Class 5A2, 0.984%, due 06/10/422,4 |

320,000 | 512,390 | |||||||||

|

Total United Kingdom asset-backed securities |

1,146,951 | ||||||||||

| United States: 0.98% | |||||||||||

|

Bank of America Corp., Series 2008-A5, Class A5, 1.387%, due 12/16/132 |

$ | 300,000 | 300,135 | ||||||||

|

Series 2004-A1, 4.500%, due 01/17/14 |

EUR | 270,000 | 400,306 | ||||||||

|

Face amount |

Value | ||||||||||

|

Chase Issuance Trust, Series 2007-A16, Class A16, 0.547%, due 06/16/142 |

$ | 300,000 | $ | 300,572 | |||||||

|

MBNA Credit Card Master Note Trust, Series 2002-A2, Class A, 5.600%, due 07/17/14 |

EUR | 300,000 | 442,058 | ||||||||

|

Total United States asset-backed securities |

1,443,071 | ||||||||||

|

Total asset-backed securities (cost $2,484,875) |

2,590,022 | ||||||||||

| Collateralized debt obligations: 1.02% | |||||||||||

| Cayman Islands: 0.44% | |||||||||||

|

Denali Capital CLO VII Ltd., Series 2007-1A, Class B2L, 4.524%, due 01/22/221,2,5,6 |

$ | 290,000 | 216,224 | ||||||||

|

FM Leveraged Capital Fund, Series 2006-2A, Class E, 4.011%, due 11/15/202,5,6 |

400,000 | 272,000 | |||||||||

|

Trimaran CLO Ltd., Series 2007-1A, Class B2L, 3.647%, due 06/15/211,2,5,6 |

200,000 | 162,360 | |||||||||

|

Total Cayman Islands collateralized debt obligations |

650,584 | ||||||||||

| Netherlands: 0.34% | |||||||||||

|

Highlander Euro CDO, Series 2006-2CA, Class E, 5.126%, due 12/14/221,5,6,7 |

EUR | 250,000 | 195,770 | ||||||||

|

Queen Street CLO, Series 2007-1A, Class F, 6.980%, due 08/15/241,5,6 |

350,000 | 304,532 | |||||||||

|

Total Netherlands collateralized debt obligations |

500,302 | ||||||||||

| United States: 0.24% | |||||||||||

|

Axius Europe CLO SA, Series 2007-1A, Class D, 4.699%, due 11/15/231,2,5,6 |

350,000 | 350,211 | |||||||||

|

Total collateralized debt obligations (cost $2,128,374) |

1,501,097 | ||||||||||

| Commercial mortgage-backed securities: 0.47% | |||||||||||

| United States: 0.47% | |||||||||||

|

Greenwich Capital Commercial Funding Corp., Series 2007-GG11, Class A4, 5.736%, due 12/10/49 |

$ | 175,000 | 187,784 | ||||||||

|

GS Mortgage Securities Corp. II, Series 2007-GG10, Class A4, 5.992%, due 08/10/452 |

300,000 | 322,080 | |||||||||

10

UBS Absolute Return Bond Fund

Portfolio of investments

June 30, 2011

|

Face amount |

Value | ||||||||||

| Bonds—(Continued) | |||||||||||

| Commercial mortgage-backed securities—(Concluded) | |||||||||||

| United States—(Concluded) | |||||||||||

|

Morgan Stanley Dean Witter Capital I, Series 2002-IQ3, Class B, 5.240%, due 09/15/37 |

$ | 175,000 | $ | 179,623 | |||||||

|

Total commercial mortgage-backed securities (cost $592,938) |

689,487 | ||||||||||

| Mortgage & agency debt securities: 23.23% | |||||||||||

| United Kingdom: 3.19% | |||||||||||

|

Arkle Master Issuer PLC, Series 2010-1A, Class 2A, 1.411%, due 05/17/601,2 |

500,000 | 499,194 | |||||||||

|

Arran Residential Mortgages Funding PLC, Series 2011-1A, Class A1C, 1.537%, due 11/19/471,2 |

1,700,000 | 1,700,401 | |||||||||

|

Holmes Master Issuer PLC, Series 2011-1A, Class A2, 1.628%, due 10/15/541,2 |

1,500,000 | 1,501,859 | |||||||||

|

Permanent Master Issuer PLC, Series 2011-1A, Class 1A1, 1.669%, due 07/15/421,2 |

1,000,000 | 1,002,418 | |||||||||

|

Total United Kingdom mortgage & agency debt securities |

4,703,872 | ||||||||||

| United States: 20.04% | |||||||||||

|

Federal Home Loan Bank, 5.250%, due 06/18/14 |

4,100,000 | 4,620,987 | |||||||||

|

Federal Home Loan Mortgage Corp.,8 4.750%, due 03/05/12 |

1,300,000 | 1,339,209 | |||||||||

| 5.000%, due 02/16/17 | 3,900,000 | 4,452,275 | |||||||||

|

Federal Home Loan Mortgage Corp. Gold Pools,8 #Q01348, 4.500%, due 06/01/41 |

150,000 | 155,190 | |||||||||

|

#G04668, 5.000%, due 03/01/38 |

635,494 | 676,000 | |||||||||

|

#G08307, 5.000%, due 11/01/38 |

955,481 | 1,015,786 | |||||||||

|

#A60064, 5.500%, due 04/01/37 |

1,900,000 | 2,057,114 | |||||||||

|

#G06381, 5.500%, due 08/01/40 |

779,375 | 845,649 | |||||||||

|

Federal National Mortgage Association,8 4.125%, due 04/15/14 |

2,950,000 | 3,212,582 | |||||||||

|

Federal National Mortgage Association Pools,8 #992260, 4.000%, due 01/01/39 |

1,981,210 | 1,986,482 | |||||||||

|

#AH6655, 4.000%, due 02/01/41 |

550,000 | 550,776 | |||||||||

|

#933765, 4.500%, due 04/01/38 |

2,937,095 | 3,046,747 | |||||||||

|

Face amount |

Value | ||||||||||

|

#AE0106, 4.500%, due 06/01/40 |

$ | 369,982 | $ | 383,503 | |||||||

| 5.000%, TBA | 1,270,000 | 1,349,375 | |||||||||

| 5.500%, TBA | 75,000 | 81,094 | |||||||||

| 6.000%, TBA | 1,200,000 | 1,318,126 | |||||||||

| 6.500%, TBA | 425,000 | 481,180 | |||||||||

|

Federal Home Loan Mortgage Corp., Multifamily Structured Pass Through Certificates, Series K-012, Class A-1,8 3.427%, due 10/25/20 |

1,307,024 | 1,353,803 | |||||||||

|

Government National Mortgage Association Pools, #741646, 4.500%, due 06/15/41 |

525,000 | 555,133 | |||||||||

|

Total United States mortgage & agency debt securities |

29,481,011 | ||||||||||

|

Total mortgage & agency debt securities (cost $32,957,832) |

34,184,883 | ||||||||||

| Non-US government obligations: 12.22% | |||||||||||

| Denmark: 0.86% | |||||||||||

|

Government of Denmark, 1.875%, due 03/16/12 |

1,250,000 | 1,262,222 | |||||||||

| Germany: 6.45% | |||||||||||

|

Bundesobligation, 4.000%, due 04/13/12 |

EUR | 1,420,000 | 2,099,903 | ||||||||

|

Kreditanstalt fuer Wiederaufbau, 3.375%, due 01/16/12 |

2,800,000 | 4,100,484 | |||||||||

| 5.550%, due 06/07/21 | GBP | 1,800,000 | 3,285,653 | ||||||||

| 9,486,040 | |||||||||||

| Italy: 1.13% | |||||||||||

|

Republic of Italy, 4.750%, due 01/25/16 |

$ | 1,565,000 | 1,662,418 | ||||||||

| Japan: 1.08% | |||||||||||

|

Japan Bank for International Cooperation, 5.250%, due 03/23/16 |

1,400,000 | 1,589,322 | |||||||||

| Spain: 2.70% | |||||||||||

|

Instituto de Credito Oficial, 5.375%, due 07/02/12 |

1,800,000 | 1,859,202 | |||||||||

|

Kingdom of Spain, 4.700%, due 07/30/41 |

EUR | 1,775,000 | 2,123,023 | ||||||||

| 3,982,225 | |||||||||||

|

Total Non-US government obligations (cost $17,391,117) |

17,982,227 | ||||||||||

11

UBS Absolute Return Bond Fund

Portfolio of investments

June 30, 2011

|

Face amount |

Value | ||||||||||

| Bonds—(Concluded) | |||||||||||

| Supranational bonds: 4.56% | |||||||||||

|

European Investment Bank, 2.500%, due 04/15/12 |

EUR | 1,225,000 | $ | 1,789,686 | |||||||

| 6.250%, due 04/15/14 | GBP | 1,270,000 | 2,286,695 | ||||||||

|

Inter-American Development Bank, 3.250%, due 11/15/11 |

$ | 2,600,000 | 2,628,899 | ||||||||

|

Total supranational bonds (cost $6,425,166) |

6,705,280 | ||||||||||

|

Total bonds (cost $131,102,922) |

136,488,795 | ||||||||||

| Shares | Value | ||||||||||

| Short-term investment: 6.76% | |||||||||||

| Investment company: 6.76% | |||||||||||

|

UBS Cash Management Prime Relationship Fund9 (cost $9,946,180) |

9,946,180 | $ | 9,946,180 | ||||||||

|

Total investments: 99.53% (cost $141,049,102) |

146,434,975 | ||||||||||

|

Cash and other assets, less liabilities: 0.47% |

693,971 | ||||||||||

| Net assets: 100.00% | $ | 147,128,946 | |||||||||

Notes to portfolio of investments

Aggregate cost for federal income tax purposes was $141,049,102; and net unrealized appreciation consisted of:

| Gross unrealized appreciation | $ | 6,570,368 | |||||

| Gross unrealized depreciation | (1,184,495 | ) | |||||

| Net unrealized appreciation of investments | $ | 5,385,873 | |||||

For a listing of defined portfolio acronyms and currency abbreviations that are used throughout the Portfolio of investments as well as the tables that follow, please refer to page 81.

1 Security exempt from registration pursuant to Rule 144A under the Securities Act of 1933. These securities are considered liquid, unless noted otherwise, and may be resold in transactions exempt from registration, normally to qualified institutional buyers. At June 30, 2011, the value of these securities amounted to $18,014,850 or 12.24% of net assets.

2 Variable or floating rate security—The interest rate shown is the current rate as of June 30, 2011 and changes periodically.

3 Perpetual bond security. The maturity date reflects the next call date.

4 Security exempt from registration pursuant to Regulation S under the Securities Act of 1933. Regulation S applies to securities offerings that are made outside of the United States and do not involve direct selling efforts in the United States. At June 30, 2011, the value of these securities amounted to $2,149,790 or 1.46% of net assets.

5 Security is illiquid. At June 30, 2011, the value of these securities amounted to $1,501,097 or 1.02% of net assets.

6 These securities, which represent 1.02% of net assets as of June 30, 2011, are considered restricted. (See restricted securities table below for more information.)

12

UBS Absolute Return Bond Fund

Portfolio of investments

June 30, 2011

| Restricted securities |

Acquisition date |

Acquisition cost |

Acquisition cost as a percentage of net assets |

Value 06/30/11 |

Value as a percentage of net assets |

||||||||||||||||||

|

Axius Europe CLO SA, Series 2007-1A, Class D, 09/28/07- 4.699%, due 11/15/23 |

11/01/09 | $ | 466,689 | 0.32 | % | $ | 350,211 | 0.24 | % | ||||||||||||||

|

Denali Capital CLO VII Ltd., Series 2007-1A, Class B2L, 4.524%, due 01/22/22 |

04/27/07 | 285,865 | 0.19 | 216,224 | 0.15 | ||||||||||||||||||

|

FM Leveraged Capital Fund Series 2006-2A, Class E 4.011%, due 11/15/20 |

10/31/06 | 400,000 | 0.27 | 272,000 | 0.18 | ||||||||||||||||||

|

Highlander Euro CDO, Series 2006-2CA, Class E, 5.126%, due 12/14/22 |

11/28/06 | 329,608 | 0.22 | 195,770 | 0.13 | ||||||||||||||||||

|

Queen Street CLO, Series 2007-1A, Class F, 6.980%, due 08/15/24 |

05/18/07 | 463,444 | 0.32 | 304,532 | 0.21 | ||||||||||||||||||

|

Trimaran CLO Ltd., Series 2007-1A, Class B2L, 3.647%, due 06/15/21 |

03/09/07 | 198,806 | 0.14 | 162,360 | 0.11 | ||||||||||||||||||

| $ | 2,144,412 | 1.46 | % | $ | 1,501,097 | 1.02 | % | ||||||||||||||||

7 This security is the equity tranche of a collateralized debt obligation. The Fund receives periodic payments, which may vary, from the issuer of this security.

8 On September 7, 2008, the Federal Housing Finance Agency placed the Federal Home Loan Mortgage Corporation and the Federal National Mortgage Association into conservatorship, and the US Treasury guaranteed the debt issued by those organizations.

9 The table below details the Fund's investments in a fund that is advised by the same advisor as the Fund. The advisor does not earn a management fee from the affiliated UBS Relationship Fund.

| Security description |

Value 06/30/10 |

Purchases during the year ended 06/30/11 |

Sales during the year ended 06/30/11 |

Value 06/30/11 |

Income earned from affiliate for the year ended 06/30/11 |

||||||||||||||||||

| UBS Cash Management Prime Relationship Fund | $ | 5,509,864 | $ | 49,570,026 | $ | 45,133,710 | $ | 9,946,180 | $ | 16,199 | |||||||||||||

Forward foreign currency contracts

| Counterparty |

Contracts to deliver |

In exchange for |

Maturity date |

Unrealized appreciation/ (depreciation) |

|||||||||||||||||||||||

| Barclays Bank PLC | EUR | 512,500 | JPY | 58,814,039 | 07/27/11 | $ | (12,107 | ) | |||||||||||||||||||

| Barclays Bank PLC | JPY | 167,315,550 | USD | 2,075,000 | 07/27/11 | (3,552 | ) | ||||||||||||||||||||

| Barclays Bank PLC | USD | 6,562,688 | NOK | 36,620,000 | 07/27/11 | 215,497 | |||||||||||||||||||||

| HSBC Bank, N.A. | EUR | 33,540,000 | USD | 47,695,792 | 07/27/11 | (912,724 | ) | ||||||||||||||||||||

| HSBC Bank, N.A. | GBP | 11,780,000 | USD | 19,057,071 | 07/27/11 | 155,944 | |||||||||||||||||||||

| JPMorgan Chase Bank | CAD | 2,535,000 | USD | 2,576,953 | 07/27/11 | (50,090 | ) | ||||||||||||||||||||

| JPMorgan Chase Bank | JPY | 423,800,000 | USD | 5,280,043 | 07/27/11 | 15,198 | |||||||||||||||||||||

| JPMorgan Chase Bank | SEK | 16,496,104 | EUR | 1,785,000 | 07/27/11 | (17,640 | ) | ||||||||||||||||||||

| JPMorgan Chase Bank | USD | 5,838,813 | SEK | 37,730,000 | 07/27/11 | 118,415 | |||||||||||||||||||||

Net unrealized depreciation on forward foreign currency contracts $(491,059)

13

UBS Absolute Return Bond Fund

Portfolio of investments

June 30, 2011

Futures contracts

|

Expiration date |

Cost/ (proceeds) |

Value |

Unrealized appreciation/ (depreciation) |

||||||||||||||||

| US Treasury futures sell contracts: | |||||||||||||||||||

| 2 Year US Treasury Notes, 113 contracts (USD) | September 2011 | $ | (24,759,184 | ) | $ | (24,785,844 | ) | $ | (26,660 | ) | |||||||||

| 5 Year US Treasury Notes, 310 contracts (USD) | September 2011 | (36,889,510 | ) | (36,950,547 | ) | (61,037 | ) | ||||||||||||

| 10 Year US Treasury Notes, 110 contracts (USD) | September 2011 | (13,472,252 | ) | (13,456,094 | ) | 16,158 | |||||||||||||

| Interest rate futures buy contracts: | |||||||||||||||||||

| Euro-Bund, 60 contracts (EUR) | September 2011 | 10,996,800 | 10,917,890 | (78,910 | ) | ||||||||||||||

| Interest rate futures sell contracts: | |||||||||||||||||||

| Euro-Bobl, 149 contracts (EUR) | September 2011 | (25,123,728 | ) | (25,189,714 | ) | (65,986 | ) | ||||||||||||

| Euro-Schatz, 36 contracts (EUR) | September 2011 | (5,605,243 | ) | (5,614,952 | ) | (9,709 | ) | ||||||||||||

| Long Gilt, 20 contracts (GBP) | September 2011 | (3,845,980 | ) | (3,856,695 | ) | (10,715 | ) | ||||||||||||

| Net unrealized depreciation on futures contracts | $ | (236,859 | ) | ||||||||||||||||

Interest rate swap agreements

| Counterparty |

Notional amount |

Termination date |

Payments made by the Fund1 |

Payments received by the Fund1 |

Upfront payments made |

Value |

Unrealized depreciation |

||||||||||||||||||||||||

| Deutsche Bank AG | CHF | 6,490,000 | 02/03/16 | 1.5575 | % | 0.2400 | %2 | — | $ | (149,064 | ) | $ | (149,064 | ) | |||||||||||||||||

1 Payments made or received are based on the notional amount.

2 Rate based on 6 month LIBOR (CHF BBA).

14

UBS Absolute Return Bond Fund

Portfolio of investments

June 30, 2011

Credit default swaps on credit indices—buy protection1

| Counterparty |

Notional amount |

Termination date |

Payments made by the Fund2 |

Payments received by the Fund |

Upfront payments (made)/ received |

Value |

Unrealized appreciation/ (depreciation) |

||||||||||||||||||||||||

| Barclays Bank PLC | USD | 4,500,000 | 06/20/16 | 1.0000 | % | —3 | $ | 5,864 | $ | (12,434 | ) | $ | (6,570 | ) | |||||||||||||||||

| JP Morgan Chase Bank | EUR | 500,000 | 06/20/16 | 5.0000 | —4 | 40,184 | (27,066 | ) | 13,118 | ||||||||||||||||||||||

| JP Morgan Chase Bank | EUR | 2,800,000 | 06/20/16 | 1.0000 | —5 | 2,405 | 18,586 | 20,991 | |||||||||||||||||||||||

| JP Morgan Chase Bank | EUR | 5,100,000 | 06/20/16 | 1.0000 | —5 | (43,000 | ) | 33,854 | (9,146 | ) | |||||||||||||||||||||

| Morgan Stanley & Co. Inc. | EUR | 800,000 | 06/20/16 | 5.0000 | —4 | 52,740 | (43,306 | ) | 9,434 | ||||||||||||||||||||||

| Morgan Stanley & Co. Inc. | EUR | 3,150,000 | 06/20/16 | 1.0000 | —5 | (9,105 | ) | 20,910 | 11,805 | ||||||||||||||||||||||

| Morgan Stanley & Co. Inc. | USD | 1,500,000 | 06/20/16 | 5.0000 | —6 | 34,167 | (14,318 | ) | 19,849 | ||||||||||||||||||||||

| Morgan Stanley & Co. Inc. | USD | 3,900,000 | 06/20/16 | 1.0000 | —3 | 11,951 | (10,776 | ) | 1,175 | ||||||||||||||||||||||

| $ | 95,206 | $ | (34,550 | ) | $ | 60,656 | |||||||||||||||||||||||||

1 If the Fund is a buyer of protection and a credit event occurs, as defined under the terms of that particular swap agreement, the Fund will either (i) receive from the seller of protection an amount equal to the notional amount of the swap and deliver the referenced obligation or underlying securities comprising the referenced index or (ii) receive a net settlement amount in the form of cash or securities equal to the notional amount of the swap less the recovery value of the referenced obligation or underlying securities comprising the referenced index.

2 Payments made are based on the notional amount.

3 Payment from the counterparty will be received upon the occurrence of a succession event with respect to the CDX.NA.IG Series 16 Index.

4 Payment from the counterparty will be received upon the occurrence of a succession event with respect to the iTraxx Europe Crossover Series 15 Index.

5 Payment from the counterparty will be received upon the occurrence of a succession event with respect to the iTraxx Europe Series 15 Index.

6 Payment from the counterparty will be received upon the occurrence of a succession event with respect to the CDX.NA.HY Series 16 Index.

Credit default swaps on corporate issues—buy protection1

| Counterparty |

Notional amount |

Termination date |

Payments made by the Fund2 |

Payments received by the Fund |

Upfront payments (made)/ received |

Value |

Unrealized appreciation/ (depreciation) |

||||||||||||||||||||||||

| Barclays Bank PLC | EUR | 540,000 | 06/20/16 | 1.0000 | % | —3 | $ | (6,409 | ) | $ | 6,065 | $ | (344 | ) | |||||||||||||||||

| Barclays Bank PLC | EUR | 1,080,000 | 06/20/16 | 1.0000 | —4 | 34,972 | (23,336 | ) | 11,636 | ||||||||||||||||||||||

| Barclays Bank PLC | USD | 750,000 | 09/20/16 | 1.0000 | —5 | (7,194 | ) | 16,808 | 9,614 | ||||||||||||||||||||||

| Deutsche Bank AG | USD | 1,130,000 | 03/20/14 | 1.0000 | —6 | 10,693 | (3,021 | ) | 7,672 | ||||||||||||||||||||||

| Deutsche Bank AG | USD | 750,000 | 06/20/16 | 1.0000 | —7 | 23,183 | (22,300 | ) | 883 | ||||||||||||||||||||||

| Deutsche Bank AG | USD | 1,500,000 | 06/20/16 | 1.0000 | —8 | (27,459 | ) | 29,571 | 2,112 | ||||||||||||||||||||||

| Deutsche Bank AG | USD | 750,000 | 09/20/16 | 1.0000 | —5 | (7,561 | ) | 16,808 | 9,247 | ||||||||||||||||||||||

| Goldman Sachs International | USD | 2,260,000 | 03/20/14 | 1.0000 | —9 | 25,005 | (35,881 | ) | (10,876 | ) | |||||||||||||||||||||

| Goldman Sachs International | USD | 300,000 | 03/20/16 | 1.0000 | —10 | 1,344 | 979 | 2,323 | |||||||||||||||||||||||

| JPMorgan Chase Bank | EUR | 1,680,000 | 03/20/14 | 5.0000 | —11 | 270,721 | (187,698 | ) | 83,023 | ||||||||||||||||||||||

| JPMorgan Chase Bank | EUR | 540,000 | 06/20/16 | 1.0000 | —3 | (7,112 | ) | 6,065 | (1,047 | ) | |||||||||||||||||||||

| JPMorgan Chase Bank | USD | 1,100,000 | 03/20/14 | 1.0000 | —6 | 9,401 | (2,941 | ) | 6,460 | ||||||||||||||||||||||

15

UBS Absolute Return Bond Fund

Portfolio of investments

June 30, 2011

| Counterparty |

Notional amount |

Termination date |

Payments made by the Fund2 |

Payments received by the Fund |

Upfront payments (made)/ received |

Value |

Unrealized appreciation/ (depreciation) |

||||||||||||||||||||||||

| JPMorgan Chase Bank | USD | 300,000 | 03/20/16 | 1.0000 | % | —10 | $ | 1,344 | $ | 979 | $ | 2,323 | |||||||||||||||||||

| JPMorgan Chase Bank | USD | 1,500,000 | 06/20/16 | 1.0000 | —12 | 44,201 | (46,017 | ) | (1,816 | ) | |||||||||||||||||||||

| JPMorgan Chase Bank | USD | 1,500,000 | 06/20/16 | 1.0000 | —13 | (1,966 | ) | 6,482 | 4,516 | ||||||||||||||||||||||

| Merrill Lynch International | EUR | 1,100,000 | 06/20/16 | 1.0000 | —14 | (2,402 | ) | 8,497 | 6,095 | ||||||||||||||||||||||

| $ | 360,761 | $ | (228,940 | ) | $ | 131,821 | |||||||||||||||||||||||||

1 If the Fund is a buyer of protection and a credit event occurs, as defined under the terms of that particular swap agreement, the Fund will either (i) receive from the seller of protection an amount equal to the notional amount of the swap and deliver the referenced obligation or (ii) receive a net settlement amount in the form of cash or securities equal to the notional amount of the swap less the recovery value of the referenced obligation.

2 Payments made are based on the notional amount.

3 Payment from the counterparty will be received upon the occurrence of bankruptcy and/or restructuring event with respect to the Legal & General Finance PLC 5.875% bond, due 12/11/31.

4 Payment from the counterparty will be received upon the occurrence of bankruptcy and/or restructuring event with respect to the Centrica PLC 7.000% bond, due 09/19/18.

5 Payment from the counterparty will be received upon the occurrence of bankruptcy and/or restructuring event with respect to the CNA Financial Corp. 5.850% bond, due 12/15/14.

6 Payment from the counterparty will be received upon the occurrence of bankruptcy and/or restructuring event with respect to the Computer Sciences Corp. 6.500% bond, due 03/15/18.

7 Payment from the counterparty will be received upon the occurrence of bankruptcy and/or restructuring event with respect to the Honeywell International, Inc 5.700% bond, due 03/15/36.

8 Payment from the counterparty will be received upon the occurrence of bankruptcy and/or restructuring event with respect to the Prudential Financial, Inc. 4.500% bond, due 07/15/13

9 Payment from the counterparty will be received upon the occurrence of bankruptcy and/or restructuring event with respect to the Motorola Solutions, Inc. 6.500% bond, due 09/01/25.

10 Payment from the counterparty will be received upon the occurrence of bankruptcy and/or restructuring event with respect to the Allstate Corp. 6.750% bond, due 05/15/18

11 Payment from the counterparty will be received upon the occurrence of bankruptcy and/or restructuring event with respect to the ITV PLC 5.375% bond, due 10/19/15

12 Payment from the counterparty will be received upon the occurrence of bankruptcy and/or restructuring event with respect to the Lockheed Martin Corp. 7.650% bond, due 01/05/16.

13 Payment from the counterparty will be received upon the occurrence of bankruptcy and/or restructuring event with respect to the Constellation Energy Group, Inc. 4.550% bond, due 06/15/15.

14 Payment from the counterparty will be received upon the occurrence of bankruptcy and/or restructuring event with respect to the Volvo Treasury AB 5.000% bond, due 05/31/17

16

UBS Absolute Return Bond Fund

Portfolio of investments

June 30, 2011

Credit default swaps on credit indices—sell protection1

| Counterparty |

Notional amount |

Termination date |

Payments made by the Fund |

Payments received by the Fund2 |

Upfront payments made |

Value |

Unrealized appreciation |

Credit spread4 |

|||||||||||||||||||||||||||

| JPMorgan Chase Bank | USD | 2,950,000 | 06/20/16 | —3 | 5.0000 | % | $ | (1,639 | ) | $ | 28,159 | $ | 26,520 | 4.8062 | % | ||||||||||||||||||||

1 If the Fund is a seller of protection and a credit event occurs, as defined under the terms of that particular swap agreement, the Fund will either (i) pay to the buyer of protection an amount equal to the notional amount of the swap and take delivery of the referenced obligation or underlying securities comprising the referenced index or (ii) pay a net settlement amount in the form of cash or securities equal to the notional amount of the swap less the recovery value of the referenced obligation or underlying securities comprising the referenced index.

2 Payments received are based on the notional amount.

3 Payment to the counterparty will be made upon the occurrence of a succession event with respect to the CDX.NA.HY. Series 16 Index.

4 Credit spreads, where available, represented in absolute terms, utilized in determining the market value as of period end serve as an indicator of the current status of the payment/performance risk and represent the likelihood or risk of default or other credit event occurring for the credit derivative. The credit spread of a particular referenced entity reflects the cost of buying/selling protection and may include upfront payments required to be made to enter into the agreement. Wider credit spreads represent a deterioration of the referenced entity's credit soundness and a greater likelihood or risk of default or other credit event occurring as defined under the terms of the agreement. A credit spread identified as "Defaulted" indicates a credit event has occurred for the referenced entity.

Credit default swaps on corporate and sovereign issues—sell protection1

| Counterparty |

Notional amount |

Termination date |

Payments made by the Fund |

Payments received by the Fund2 |

Upfront payments (made)/ received |

Value |

Unrealized appreciation/ (depreciation) |

Credit spread3 |

|||||||||||||||||||||||||||

| Barclays Bank PLC | EUR | 540,000 | 06/20/16 | —4 | 1.0000 | % | $ | 28,313 | $ | (29,069 | ) | $ | (756 | ) | 1.8312 | % | |||||||||||||||||||

| Barclays Bank PLC | EUR | 1,080,000 | 06/20/16 | —5 | 1.0000 | (21,981 | ) | 17,658 | (4,323 | ) | 0.7085 | ||||||||||||||||||||||||

| Barclays Bank PLC | USD | 750,000 | 09/20/16 | —6 | 1.0000 | 14,850 | (27,242 | ) | (12,392 | ) | 1.7588 | ||||||||||||||||||||||||

| Deutsche Bank AG | USD | 750,000 | 03/20/16 | —7 | 1.0000 | 11,204 | (21,056 | ) | (9,852 | ) | 1.6135 | ||||||||||||||||||||||||

| Deutsche Bank AG | USD | 1,500,000 | 06/20/16 | —8 | 1.0000 | 41,493 | (40,403 | ) | 1,090 | 1.5758 | |||||||||||||||||||||||||

| Deutsche Bank AG | USD | 750,000 | 09/20/16 | —6 | 1.0000 | 14,850 | (27,242 | ) | (12,392 | ) | 1.7588 | ||||||||||||||||||||||||

| Goldman Sachs International | USD | 1,490,000 | 03/20/16 | —9 | 1.0000 | 14,985 | 7,410 | 22,395 | 0.8829 | ||||||||||||||||||||||||||

| Goldman Sachs International | USD | 800,000 | 06/20/18 | —10 | 0.5140 | — | (102,511 | ) | (102,511 | ) | 2.7561 | ||||||||||||||||||||||||

| Goldman Sachs International | USD | 1,600,000 | 12/20/18 | —11 | 1.1425 | — | (66,302 | ) | (66,302 | ) | 1.7708 | ||||||||||||||||||||||||

| Goldman Sachs International | USD | 3,000,000 | 09/20/19 | —12 | 1.0000 | (19,160 | ) | 52,604 | 33,444 | 0.7561 | |||||||||||||||||||||||||

| JPMorgan Chase Bank | EUR | 430,000 | 03/20/16 | —13 | 1.0000 | 12,797 | (18,982 | ) | (6,185 | ) | 1.7098 | ||||||||||||||||||||||||

| JPMorgan Chase Bank | EUR | 1,080,000 | 03/20/16 | —14 | 5.0000 | (212,763 | ) | 117,872 | (94,891 | ) | 3.1855 | ||||||||||||||||||||||||

| JPMorgan Chase Bank | EUR | 540,000 | 06/20/16 | —4 | 1.0000 | 28,313 | (29,069 | ) | (756 | ) | 1.8312 | ||||||||||||||||||||||||

| JPMorgan Chase Bank | USD | 740,000 | 03/20/16 | —7 | 1.0000 | 12,076 | (20,775 | ) | (8,699 | ) | 1.6350 | ||||||||||||||||||||||||

| JPMorgan Chase Bank | USD | 1,500,000 | 06/20/16 | —15 | 1.0000 | 28,081 | (27,407 | ) | 674 | 1.3833 | |||||||||||||||||||||||||

| Merrill Lynch International | EUR | 1,100,000 | 06/20/16 | —16 | 1.0000 | 65,049 | (89,456 | ) | (24,407 | ) | 2.2628 | ||||||||||||||||||||||||

| $ | 18,107 | $ | (303,970 | ) | $ | (285,863 | ) | ||||||||||||||||||||||||||||

1 If the Fund is a seller of protection and a credit event occurs, as defined under the terms of that particular swap agreement, the Fund will either (i) pay to the buyer of protection an amount equal to the notional amount of the swap and take delivery of the referenced obligation or (ii) pay a net settlement amount in the form of cash or securities equal to the notional amount of the swap less the recovery value of the referenced obligation.

17

UBS Absolute Return Bond Fund

Portfolio of investments

June 30, 2011

2 Payments received are based on the notional amount.

3 Credit spreads, represented in absolute terms, utilized in determining the market value as of period end serve as an indicator of the current status of the payment/performance risk and represent the likelihood or risk of default or other credit event occurring for the credit derivative. The credit spread of a particular referenced entity reflects the cost of buying/selling protection and may include upfront payments required to be made to enter into the agreement. Wider credit spreads represent a deterioration of the referenced entity's credit soundness and a greater likelihood or risk of default or other credit event occurring as defined under the terms of the agreement. A credit spread identified as "Defaulted" indicates a credit event has occurred for the referenced entity.

4 Payment to the counterparty will be made upon the occurrence of bankruptcy and/or restructuring event with respect to the Aegon NV 4.125% bond, due 12/08/14.

5 Payment to the counterparty will be made upon the occurrence of bankruptcy and/or restructuring event with respect to the E.ON International Finance BV 6.375% bond, due 05/29/17.

6 Payment to the counterparty will be made upon the occurrence of bankruptcy and/or restructuring event with respect to the Hartford Financial Services Group, Inc. 4.000% bond, due 03/30/15.

7 Payment to the counterparty will be made upon the occurrence of bankruptcy and/or restructuring event with respect to the Computer Sciences Corp. 6.500% bond, due 03/15/18.

8 Payment to the counterparty will be made upon the occurrence of bankruptcy and/or restructuring event with respect to the MetLife, Inc. 5.000% bond, due 06/15/15.

9 Payment to the counterparty will be made upon the occurrence of bankruptcy and/or restructuring event with respect to the Motorola Solutions, Inc. 6.500% bond, due 09/1/25.

10 Payment to the counterparty will be made upon the occurrence of bankruptcy and/or restructuring event with respect to the Kingdom of Spain 5.500% bond, due 12/20/17.

11 Payment to the counterparty will be made upon the occurrence of bankruptcy and/or restructuring event with respect to the Republic of Poland 5.250% bond, due 01/15/14.

12 Payment to the counterparty will be made upon the occurrence of bankruptcy and/or restructuring event with respect to the Republic of Austria 5.250% bond, due 01/04/11.

13 Payment to the counterparty will be made upon the occurrence of bankruptcy and/or restructuring event with respect to the AXA SA 6.000% bond, due 06/18/13.

14 Payment to the counterparty will be made upon the occurrence of bankruptcy and/or restructuring event with respect to the ITV PLC 5.375% bond, due 10/19/15.

15 Payment to the counterparty will be made upon the occurrence of bankruptcy and/or restructuring event with respect to the Exelon Generation Co. LLC 6.200% bond, due 10/01/17.

16 Payment to the counterparty will be made upon the occurrence of bankruptcy and/or restructuring event with respect to the Renault SA 2.647% bond, due 08/04/14.

18

UBS Absolute Return Bond Fund

Portfolio of investments

June 30, 2011

Concluded

The following is a summary of the inputs used as of June 30, 2011 in valuing the Fund's investments:

| Measurements at 06/30/11 | |||||||||||||||||||

| Description |

Unadjusted quoted prices in active markets for identical investments (Level 1) |

Other significant observable inputs (Level 2) |

Unobservable inputs (Level 3) |

Total | |||||||||||||||

| Corporate bonds | $ | — | $ | 72,835,799 | $ | — | $ | 72,835,799 | |||||||||||

| Asset-backed securities | — | 2,590,022 | — | 2,590,022 | |||||||||||||||

| Collateralized debt obligations | — | — | 1,501,097 | 1,501,097 | |||||||||||||||

| Commercial mortgage-backed securities | — | 689,487 | — | 689,487 | |||||||||||||||

| Mortgage & agency debt securities | — | 34,184,883 | — | 34,184,883 | |||||||||||||||

| Non-US government obligations | — | 17,982,227 | — | 17,982,227 | |||||||||||||||

| Supranational bonds | — | 6,705,280 | — | 6,705,280 | |||||||||||||||

| Short-term investment | — | 9,946,180 | — | 9,946,180 | |||||||||||||||

| Forward foreign currency contracts | — | (491,059 | ) | — | (491,059 | ) | |||||||||||||

| Futures contracts | (236,859 | ) | — | — | (236,859 | ) | |||||||||||||

| Swap agreements | — | (688,365 | ) | — | (688,365 | ) | |||||||||||||

| Total | $ | (236,859 | ) | $ | 143,754,454 | $ | 1,501,097 | $ | 145,018,692 | ||||||||||

Level 3 Rollforward Disclosure

The following is a rollforward of the Fund's investments that were valued using unobservable inputs for the period:

| Measurements using unobservable inputs (Level 3) | |||||||||||

|

Collateralized debt obligations |

Total | ||||||||||

| Assets | |||||||||||

| Beginning balance | $ | 1,269,921 | $ | 1,269,921 | |||||||

| Purchases | 3,898 | 3,898 | |||||||||

| Issuances | — | — | |||||||||

| Sales | (1,126,512 | ) | (1,126,512 | ) | |||||||

| Settlements | — | — | |||||||||

| Accrued discounts (premiums) | 397 | 397 | |||||||||

| Total realized gain (loss) | (1,936,014 | ) | (1,936,014 | ) | |||||||

| Net change in unrealized appreciation/depreciation | 3,289,407 | 3,289,407 | |||||||||

| Transfers into Level 3 | — | — | |||||||||

| Transfers out of Level 3 | — | — | |||||||||

| Ending balance | $ | 1,501,097 | $ | 1,501,097 | |||||||

The change in unrealized appreciation/depreciation relating to the Level 3 investments still held at June 30, 2011 was $823,449.

See accompanying notes to financial statements.

19

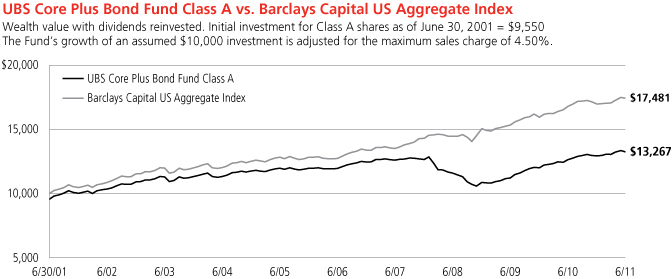

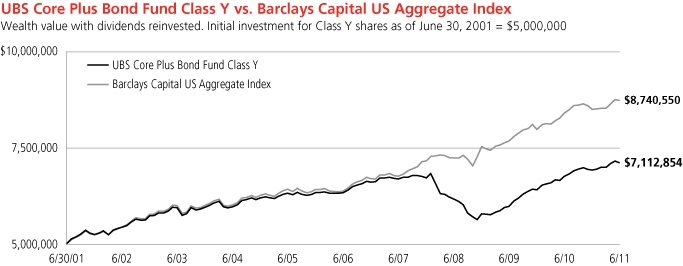

UBS Core Plus Bond Fund

Portfolio performance

For the 12 months ended June 30, 2011, Class A shares of UBS Core Plus Bond Fund (the "Fund") (formerly UBS U.S. Bond Fund) returned 5.00% (Class A shares returned 0.26% after the deduction of the maximum sales charge), while Class Y shares returned 5.26%. The Fund's benchmark, the Barclays Capital US Aggregate Index (the "Index"), returned 3.90% over the same time period. (Class Y shares have lower expenses than other share classes of the Fund. Returns for all share classes over various time periods are shown on page 22; please note that the Fund's returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares, while the Index returns do not reflect the deduction of fees and expenses.)

The Fund posted a positive return and outperformed the Index during the reporting period, largely due to sector allocation, issue selection and yield curve positioning.

Portfolio performance summary1

What worked

• The Fund's overweight to several spread sectors (non-US Treasuries) was beneficial during the reporting period.

– The largest contributor to performance was the Fund's overweight exposure to commercial mortgage-backed securities (CMBS). CMBS spreads narrowed significantly during the reporting period due, in part, to overall robust demand from investors seeking to generate incremental yield in the low interest rate environment. While CMBS prices weakened toward the end of the period given increased risk aversion, it was not enough to offset their earlier strong returns. (Spread measures the difference in yield between a fixed income security and a government bond of similar duration.)

– An overweight to investment grade bonds was rewarded. While they, too, gave back a portion of their gains late in the period, overall, the Fund's overweight added value. In particular, the Fund's allocation to investment grade bonds in the financials and industrials sectors enhanced its results.

– Out-of-index exposures to high yield bonds and emerging markets debt also enhanced the Fund's returns. Overall, these riskier asset classes generated strong returns during the period.

• Issue selection was a positive for performance.

– Within the corporate bond sector, the Fund's industrial holdings, especially its energy and natural gas credits, contributed to results. The spreads of issuers in this sector narrowed as the economic recovery continued, corporate profits generally exceeded expectations and investor demand was typically solid. Issue selection in financials was also rewarded.

– Asset-backed issue selection added value, as well. In particular, the Fund's BBB-rated credit card receivables generated solid results during the period.2

1 For a detailed commentary on the market environment in general during the reporting period, see page 2.

2 Bonds rated BBB are regarded as having an adequate capacity to pay principal and interest.

20

UBS Core Plus Bond Fund

• The Fund's yield curve positioning and, to a lesser extent, duration, meaningfully contributed to performance.

– The Fund's positioning on the yield curve was a positive for results. In particular, our positioning on the curve in July 2010 was beneficial, as we emphasized portions of the curve that generated very strong returns.

– We tactically adjusted the Fund's duration during the reporting period. Overall, duration positioning was additive for performance. (Duration measures the price sensitivity of a portfolio to interest rate changes.)

What didn't work

• Certain bonds held by the Fund somewhat held back performance. Several of the Fund's utility credits modestly detracted from performance. In addition, certain exposures to sovereign bonds also detracted from results.

• The Fund's use of derivatives was a slight detractor from performance. Several derivative instruments, namely bond and interest rate futures, were used to facilitate specific duration and yield curve strategies. Credit default swaps were used to implement specific credit-related investment strategies.

This letter is intended to assist shareholders in understanding how the Fund performed during the 12 months ended June 30, 2011. The views and opinions in the letter were current as of August 15, 2011. They are not guarantees of future performance or investment results and should not be taken as investment advice. Investment decisions reflect a variety of factors, and we reserve the right to change our views about individual securities, sectors and markets at any time. As a result, the views expressed should not be relied upon as a forecast of the Fund's future investment intent. We encourage you to consult your financial advisor regarding your personal investment program.

Mutual funds are sold by prospectus only. You should read it carefully and consider a fund's investment objectives, risks, charges, expenses and other important information contained in the prospectus before investing. Prospectuses for most of our funds can be obtained from your financial advisor, by calling UBS Funds at 800-647 1568 or by visiting our Web site at www.ubs.com.

21

UBS Core Plus Bond Fund

Average annual total returns for periods ended 6/30/2011 (unaudited)

| 1 year | 5 years | 10 years | Inception1 | ||||||||||||||||

| Before deducting maximum sales charge | |||||||||||||||||||

| Class A2 | 5.00 | % | 2.10 | % | 3.35 | % | 4.29 | % | |||||||||||

| Class B3 | 4.20 | 1.35 | N/A | 2.256 | |||||||||||||||

| Class C4 | 4.60 | 1.60 | N/A | 2.20 | |||||||||||||||

| Class Y5 | 5.26 | 2.36 | 3.59 | 4.78 | |||||||||||||||

| After deducting maximum sales charge | |||||||||||||||||||

| Class A2 | 0.26 | % | 1.17 | % | 2.87 | % | 3.95 | % | |||||||||||

| Class B3 | (0.80 | ) | 1.02 | N/A | 2.256 | ||||||||||||||

| Class C4 | 3.85 | 1.60 | N/A | 2.20 | |||||||||||||||

| Barclays Capital US Aggregate Index7 | 3.90 | % | 6.52 | % | 5.74 | % | 6.24 | % | |||||||||||

The annualized gross and net expense ratios, respectively, for each class of shares as in the October 28, 2010 prospectuses were as follows: Class A—1.41% and 0.66%; Class B—2.24% and 1.41%; Class C—1.88% and 1.16%; Class Y—1.11% and 0.41%. Net expenses reflect fee waivers and/or expense reimbursements, if any, pursuant to an agreement that is in effect to cap the expenses. The Trust, with respect to the Fund, and UBS Global Asset Management (Americas) Inc., the Fund's investment advisor ("UBS Global AM (Americas)" or the "Advisor"), have entered into a written agreement pursuant to which the Advisor has agreed to waive a portion of its management fees and/or to reimburse expenses (excluding expenses incurred through investment in other investment companies, interest, taxes, brokerage commissions and extraordinary expenses) to the extent necessary so that the Fund's ordinary operating expenses (excluding expenses incurred through investment in other investment companies, interest, taxes, brokerage commissions and extraordinary expenses), through the 12-month period ending October 27, 2011, do not exceed 0.64% for Class A shares, 1.39% for Class B shares, 1.14% for Class C shares and 0.39% for Class Y shares. Pursuant to the written agreement, the Advisor is entitled to be reimbursed for any fees it waives and expenses it reimburses for a period of three years following such fee waivers and expense reimbursements to the extent that such reimbursement of the Advisor by the Fund will not cause the Fund to exceed any applicable expense limit that is in place for the Fund.

1 Inception date of UBS Core Plus Bond Fund (formerly, UBS U.S. Bond Fund) Class A shares is June 30, 1997. Inception dates of Class B and Class C shares are November 6, 2001 and November 8, 2001, respectively. Inception date of Class Y shares and the index is August 31,1995.

2 Maximum sales charge for Class A shares is 4.5%. Class A shares bear ongoing 12b-1 service fees.