Table of Contents

As filed with the Securities and Exchange Commission on October 18, 2001

Registration No. 333-65988

SECURITIES AND EXCHANGE COMMISSION

Amendment No. 4

Universal Hospital Services, Inc.

|

Minnesota (prior to the proposed reincorporation in Delaware) (State or other jurisdiction of incorporation or organization) |

7352 (Primary Standard Industrial Classification Code Number) |

41-0760940 (I.R.S. Employer Identification Number) |

DAVID E. DOVENBERG

Copies to:

|

ELIZABETH C. HINCK, ESQ. Dorsey & Whitney LLP 220 South Sixth Street Minneapolis, Minnesota 55402-1498 (612) 340-8877 |

FREDERICK W. KANNER, ESQ. Dewey Ballantine LLP 1301 Avenue of the Americas New York, New York 10019 (212) 259-8000 |

Approximate date of commencement of proposed sale to the public:

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earliest effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earliest effective registration statement for the same offering. o

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box. o

CALCULATION OF REGISTRATION FEE

| Proposed Maximum | Proposed Maximum | |||||||

| Title of Each Class of | Amount to be | Offering Price Per | Aggregate | Amount of | ||||

| Securities to be Registered | Registered(1) | Share(2) | Offering Price(2) | Registration Fee | ||||

|

Common stock, par value $.01 per share

|

5,750,000 shares | $15.00 | $86,250,000 | $21,563(3) | ||||

| (1) | Includes 750,000 shares that the underwriters have the option to purchase to cover over-allotments, if any. |

| (2) | Estimated solely for purposes of calculating the registration fee pursuant to Rule 457(a). |

| (3) | $25,875 of this fee was previously paid with the original filing and $1,438 was previously paid with the filing of Amendment No. 1. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

|

The information in this

prospectus is not complete and may be changed. We may not sell

these securities until the registration statement filed with the

Securities and Exchange Commission is effective. This prospectus

is not an offer to sell these securities and we are not

soliciting offers to buy these securities in any state where the

offer or sale is not permitted. |

| PRELIMINARY PROSPECTUS | October 18, 2001 |

5,000,000 Shares

Common Stock

This is our initial public offering of shares of our common stock. No public market currently exists for our common stock.

We currently anticipate the initial public offering price to be between $14.00 and $15.00 per share. The Nasdaq National Market has approved our common shares for quotation under the symbol “UHOS.”

Before buying any shares, you should read the discussion of material risks of investing in our common stock in “Risk factors” beginning on page 9.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is accurate or complete. Any representation to the contrary is a criminal offense.

| Per | ||||||||

| share | Total | |||||||

|

Public offering price

|

$ | $ | ||||||

|

Underwriting discounts and commissions

|

$ | $ | ||||||

|

Proceeds, before expenses, to us

|

$ | $ | ||||||

The underwriters may also purchase up to 750,000 shares of common stock from certain of our shareholders identified under “Principal and selling shareholders” at the public offering price, less the underwriting discounts and commissions, to cover over-allotments, if any, within 30 days of the date of this prospectus. If the underwriters exercise the option in full, the total underwriting discounts and commissions will be $ . Except to the extent the shareholders referred to above sell shares to cover over-allotments, if any, all shares offered by this prospectus will be sold by us. We will not receive any proceeds from the sale of any common stock sold by the shareholders referred to above.

The underwriters are offering the common stock as set forth under “Underwriting.” Delivery of the shares will be on or about October , 2001.

| Sole Book-Runner and Co-Lead Manager | Co-Lead Manager | |

| UBS Warburg | U.S. Bancorp Piper Jaffray |

CIBC World Markets

Table of Contents

Table of Contents

No dealer, salesperson or any other person has been authorized to give any information or to represent anything not contained in this prospectus. You must not rely on any unauthorized information or representations. This prospectus is an offer to sell only the shares offered hereby but only under circumstances and in jurisdictions where it is lawful to do so.

TABLE OF CONTENTS

|

Prospectus summary

|

1 | |||

|

The offering

|

5 | |||

|

Summary financial data

|

6 | |||

|

Risk factors

|

9 | |||

|

Our 1998 recapitalization

|

19 | |||

|

Forward-looking information

|

23 | |||

|

Use of proceeds

|

23 | |||

|

Dividend policy

|

23 | |||

|

Capitalization

|

24 | |||

|

Dilution

|

25 | |||

|

Selected financial data

|

26 | |||

|

Management’s discussion and analysis of

financial condition and results of operations

|

29 | |||

|

Business

|

42 | |||

|

Management

|

57 | |||

|

Principal and selling shareholders

|

66 | |||

|

Certain relationships and related transactions

|

69 | |||

|

Description of indebtedness

|

71 | |||

|

Description of capital stock

|

73 | |||

|

Shares eligible for future sale

|

76 | |||

|

Underwriting

|

78 | |||

|

Legal matters

|

81 | |||

|

Experts

|

81 | |||

|

Where you can find more information

|

81 | |||

|

Index to financial statements

|

F-1 |

UHS® and Universal Hospital Services® are registered trademarks of Universal Hospital Services, Inc. Other trademarks and trade names appearing in this prospectus are the property of their respective holders.

As used in this prospectus, references to “we,” “our,” “us,” “UHS” and “Universal Hospital Services” refer to Universal Hospital Services, Inc. unless the context requires otherwise.

Table of Contents

(This page intentionally left blank)

Table of Contents

Prospectus summary

This summary highlights important information about our company and this offering. Because it is only a summary, however, it does not contain all of the information you should consider before investing in our common stock. You should read this entire prospectus carefully, especially the risks of investing in our common stock discussed under “Risk factors” and the financial statements and related notes, before making an investment decision.

OUR COMPANY

We are a leading nationwide provider of movable medical equipment outsourcing services (excluding bed outsourcing) to the healthcare industry, based on revenues. Our diverse customer base includes more than 2,500 of the 5,800 acute care hospitals nationwide and approximately 2,700 alternate site providers, such as home care providers, nursing homes, surgery centers, subacute care facilities and outpatient centers. We offer our customers a wide range of programs to help them increase productivity while reducing costs. Our principal program is the innovative Pay-Per-UseTM program where we charge our customers a per use fee based on daily use of equipment per patient. We also offer other programs where we charge customers an equipment fee on a daily, weekly or monthly basis. Through our Asset Management Partnership Program, or AMPP, we enable customers to outsource substantially all, or a significant portion of, their movable medical equipment needs by providing, maintaining, managing, documenting and tracking that equipment for them. As of June 30, 2001, we had 19 AMPP customers. Our fees are paid directly by our customers rather than through reimbursement from government or other third-party payors.

Our outsourcing programs differ from traditional purchase or lease alternatives for obtaining movable medical equipment. Under our outsourcing programs, customers are able to use our equipment and to rely on us to upgrade, maintain and manage that equipment. All of our outsourcing programs include a comprehensive range of support services, including equipment delivery, training, technical and educational support, inspection, maintenance and comprehensive documentation. We seek to maintain high utilization of our equipment by pooling and redeploying that equipment among a diverse customer base and adjusting pricing on a customer-by-customer basis to compensate for their varying usage rates. We also sell disposable medical supplies to customers in conjunction with our outsourcing programs. In addition, we offer repair, inspection, preventive maintenance and logistic services for the movable medical equipment that our customers own.

Our movable medical equipment outsourcing programs enable healthcare providers to replace the fixed costs of owning and/or leasing medical equipment with variable costs that are more closely related to current needs and utilization rates. The increased flexibility and services associated with our programs are designed to lower overall operating costs for our customers by enabling them to:

| o | Increase equipment productivity rates. Our outsourcing programs enable healthcare providers to increase the productivity of their movable medical equipment by accurately tracking their utilization rates and matching equipment availability with actual need. |

| o | Outsource support services. We believe that our movable medical equipment support services substantially reduce the operating cost and administrative burden associated with equipment ownership or lease. We also believe our services reduce the time that nurses and other medical staff devote to the management of movable medical equipment rather than direct patient care, thereby increasing job satisfaction, productivity and performance and reducing staff turnover. |

Table of Contents

| o | Eliminate equipment obsolescence risk. Healthcare providers can effectively eliminate the risk of equipment obsolescence through our short-term and Pay-Per-UseTM outsourcing programs. |

OUR 1998 RECAPITALIZATION

Our common stock was publicly traded and listed on the Nasdaq National Market from 1992 until our recapitalization in February 1998, at which time we delisted our common stock from Nasdaq. Our prior board of directors approved and recommended the recapitalization and concurrent Nasdaq delisting because it determined that it was in the best interests of our then current shareholders to realize the value of their shares. This was due to factors that adversely affected the market price for our common stock in the years preceding the recapitalization, including a limited public float and low trading volumes for our stock and our failure to meet earnings expectations on several occasions under prior management.

In connection with the recapitalization, our officers and directors and our principal stockholder received the following benefits:

| o | our management team and employees retained 1,307,432 shares of our common stock and options to purchase 710,654 shares of our common stock; as of the date of this prospectus based on an assumed public offering price per share of $14.50, these shares would be valued at $19.0 million and $9.5 million (net of option exercise price), respectively; |

| o | members of our management team entered into employment agreements with us that provided for new option grants and severance benefits; |

| o | two of our officers received an aggregate of $120,000 in loans from us to purchase shares of our common stock; |

| o | one non-management director received a cash payment of $73,125 when his options were cashed out; |

| o | an affiliate of J.W. Childs Equity Partners, L.P. entered into a management agreement with us, which it intends to terminate upon the completion of this offering, under which it received $240,000 per year in consideration for consulting and management advisory services; and |

| o | J.W. Childs and its affiliates made an aggregate equity contribution of $20.7 million in cash for 9,369,681 shares of common stock and management investors made an equity contribution of $0.6 million in cash for 260,012 shares of common stock, all at a price per share of approximately $2.21 (adjusted for stock splits); as of the date of this prospectus based on an assumed public offering price per share of $14.50, those shares would be valued at approximately $135.9 million for the shares held by J.W. Childs and affiliates and $3.8 million for the shares held by management investors. |

Developments since our 1998 recapitalization

| o | installing a new senior management team comprised of experienced senior operating managers from within our company and other key individuals with broad healthcare experience; |

| o | acquiring five companies in strategic locations to expand our national network of district offices; |

| o | entering into key national contracts with group purchasing organizations, or GPOs, including Premier Technology Management, L.L.C., Novation, LLC and AmeriNet, Inc.; and |

| o | placing a renewed emphasis on our AMPP total outsourcing program, increasing the number of our AMPP customers from 9 to 19. |

Table of Contents

These changes have significantly improved our operating revenues and adjusted EBITDA over the last several years. We believe that this offering will improve our financial position and provide us with additional financing flexibility. We believe that, as a result of the other developments in our business described above, we are better positioned for growth than we were at the time of our recapitalization.

Prior to this offering, J.W. Childs Equity Partners, L.P. owned approximately 77% of our common stock. Following this offering, J.W. Childs Equity Partners, L.P. will own approximately 53% of our common stock. Accordingly, J.W. Childs Equity Partners, L.P. will be able to elect our entire board of directors, control our management and policies and determine, without the consent of our other shareholders, the outcome of any corporate transaction or other matter submitted to our shareholders for approval.

INDUSTRY BACKGROUND

In recent years, particularly following the enactment of the Balanced Budget Act of 1997, acute care hospitals and alternate site providers have faced increasing pressure due to a reduction in resources and the increased complexity in delivering healthcare services. Reimbursement pressure from government payors, such as Medicare and Medicaid, and private insurers are forcing healthcare providers to contain costs. The national shortage of medical support staff, including nurses, has placed greater constraints on such individuals, requiring them to perform more tasks in less time.

As a result of these pressures, acute care hospitals and alternate site providers have increasingly turned to equipment outsourcing. We believe the market potential for movable medical equipment outsourcing is greater than $1.5 billion. This estimate is based on our average monthly AMPP revenue per bed of $200 (or $2,400 annually) and our estimate of a 65% occupancy rate at the 990,000 total registered hospital beds in the United States as estimated by the American Hospital Association. Our average monthly AMPP revenue is derived from our 18 acute care hospital accounts consisting of approximately 4,200 census beds in the aggregate and a diverse group of hospitals. We believe the demand for outsourcing movable medical equipment will continue to expand as acute care hospitals and alternate site providers continue to try to reduce costs and increase medical staff satisfaction while providing high quality, patient-specific medical care.

OUR STRENGTHS

We attribute our historical revenue growth to, and believe that our potential for future growth comes from, the following strengths:

| • | superior service and strong customer relationships, as evidenced by the growth in revenues from existing customers and the value-added, full-service features of our outsourcing programs; |

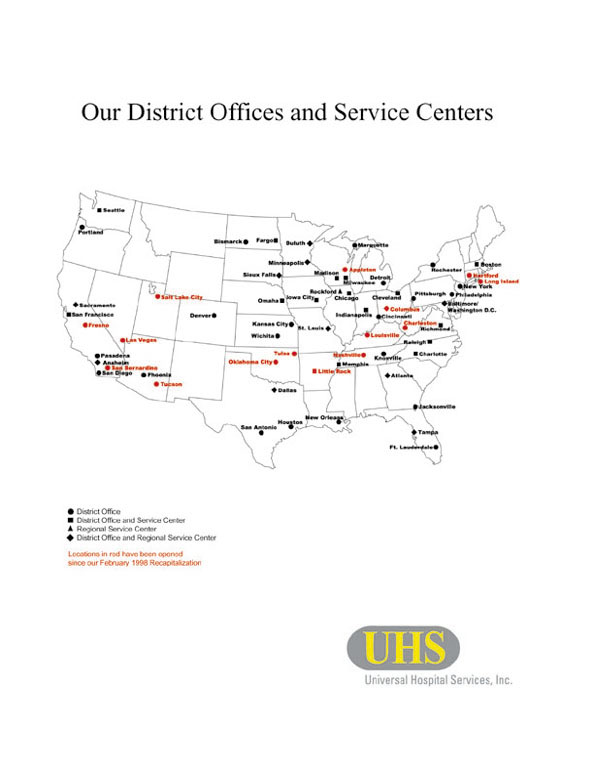

| • | national scope and leading market position, stemming from our national network of 61 district offices and 12 regional service centers and from our position as one of only two national providers of movable medical equipment outsourcing programs; |

| • | reduced reimbursement risk, resulting from the payment of fees to us directly by our acute care hospital and alternate site customers rather than through third party payors; |

| • | depth and breadth of our equipment pool, including approximately 107,000 pieces of movable medical equipment purchased from approximately 90 leading manufacturers; |

Table of Contents

| o | attractive return on our movable medical equipment, achieved through our pricing strategy designed to generate a payback period that is substantially shorter than the useful life of a particular piece of equipment; |

| o | sophisticated use of information technology, allowing our customers to meet their equipment documentation needs under applicable industry standards and regulations and to track the location, productivity and availability of all of their movable medical equipment; |

| o | experienced and committed management team, comprised of experienced senior operating managers promoted from within our company and other key individuals with broad healthcare experience who joined us through acquisitions or strategic hiring; and |

| o | large and diversified customer base, consisting of more than 2,500 acute care hospitals and approximately 2,700 alternate site providers including homecare providers, nursing homes, surgery centers, subacute care facilities and outpatient centers throughout the United States. |

OUR GROWTH STRATEGY

We believe that the aging population, increased life expectancy, advancements in medical technology and greater emphasis on managed care will provide us significant growth opportunities for movable medical equipment outsourcing in both acute care hospital and alternate site settings. Our strategy is to achieve continued growth by:

| o | continuing to increase business with our existing customers; |

| o | providing comprehensive equipment management and outsourcing programs through our AMPP total outsourcing program; |

| o | developing business with new customers by further penetrating the acute care hospital and alternate site markets and through relationships with GPOs; |

| o | expanding geographic coverage through new office openings; and |

| o | continuing to pursue strategic acquisitions. |

Despite our strengths and opportunities for growth, discussed above, we face a number of challenges and risks in growing our business, including the following:

| o | We have a history of net losses and may not be profitable in the future. |

| o | We will continue to have a substantial amount of debt after this offering, which will continue to place financial and other limitations on our business. |

| o | We will continue to have a significant amount of goodwill recorded on our balance sheet. |

| o | Our customers are generally not obligated to outsource our equipment under long-term commitments and many of our customers do not sign written agreements with us. |

Our business is also subject to a number of other risks described in the “Risk factors” which follow this summary.

Universal Hospital Services, Inc. is a Delaware corporation originally incorporated in 1954 in Minnesota. Our principal executive office is located at 1250 Northland Plaza, 3800 West 80th Street, Bloomington, Minnesota 55431-4442. Our telephone number is (952) 893-3200. We maintain a Web site on the Internet at www.uhs.com. Our Web site, and the information contained therein, is not a part of this prospectus.

Table of Contents

The offering

| Common stock we are offering | 5,000,000 shares | |

| Common stock to be outstanding after this offering | 16,275,044 shares | |

| Nasdaq National Market symbol | UHOS | |

| Use of proceeds | Repayment of indebtedness, redemption of preferred stock and warrant and general corporate purposes. | |

| Risk factors | Investing in our common stock involves significant risks. See “Risk factors.” |

Common stock to be outstanding after this offering is based on the number of shares outstanding as of June 30, 2001 adjusted only for the issuance of 5,000,000 shares in this offering. It does not include:

| o | 2,276,545 shares issuable upon exercise of stock options outstanding as of June 30, 2001, with a weighted average exercise price of $2.38 per share; |

| o | 1,700,000 shares available for future grant or issuance under our 2001 stock option plan; and |

| o | 245,000 shares issuable upon exercise of a warrant that will be redeemed in connection with this offering. |

Except as otherwise noted, all information in this prospectus:

| o | assumes no exercise of the underwriters’ over-allotment option; |

| o | reflects our reincorporation in Delaware prior to completion of this offering; |

| o | reflects the 10-for-1 stock split of our common stock effected on February 25, 1998; and |

| o | reflects the 0.70-for-1 reverse stock split of our common stock effected on October 5, 2001. |

Table of Contents

Summary financial data

The following table summarizes financial data regarding our business and should be read together with “Management’s discussion and analysis of financial condition and results of operations,” our financial statements and the related notes included elsewhere in this prospectus.

| Year ended December 31, | Six months ended June 30, | |||||||||||||||||||||||||||||||||

| Pro | Pro | Pro | ||||||||||||||||||||||||||||||||

| forma(6) | forma(6) | forma(6) | ||||||||||||||||||||||||||||||||

| Statements of operation data: | 1998 | 1999 | 2000 | 2000 | 2000 | 2001 | 2000 | 2001 | ||||||||||||||||||||||||||

| (in thousands, except per share amounts and other operating data) | ||||||||||||||||||||||||||||||||||

|

Revenues:

|

||||||||||||||||||||||||||||||||||

|

Equipment outsourcing

|

$ | 61,701 | $ | 79,345 | $ | 94,028 | $ | 94,028 | $ | 45,818 | $ | 54,731 | $ | 45,818 | $ | 54,731 | ||||||||||||||||||

|

Sales of supplies and equipment, and other

|

7,672 | 12,878 | 11,977 | 11,977 | 6,127 | 6,130 | 6,127 | 6,130 | ||||||||||||||||||||||||||

|

Total revenues

|

69,373 | 92,223 | 106,005 | 106,005 | 51,945 | 60,861 | 51,945 | 60,861 | ||||||||||||||||||||||||||

|

Cost of equipment outsourcing and sales:

|

||||||||||||||||||||||||||||||||||

|

Cost of equipment outsourcing

|

16,312 | 22,398 | 26,092 | 26,092 | 12,483 | 15,577 | 12,483 | 15,577 | ||||||||||||||||||||||||||

|

Movable medical equipment depreciation

|

14,432 | 18,865 | 22,387 | 22,387 | 10,593 | 12,652 | 10,593 | 12,652 | ||||||||||||||||||||||||||

|

Cost of supplies and equipment sales

|

4,867 | 8,354 | 8,147 | 8,147 | 4,313 | 3,718 | 4,313 | 3,718 | ||||||||||||||||||||||||||

|

Loss on equipment disposal(1)

|

2,866 | — | — | — | — | — | — | — | ||||||||||||||||||||||||||

|

Total cost of equipment outsourcing and sales

|

38,477 | 49,617 | 56,626 | 56,626 | 27,389 | 31,947 | 27,389 | 31,947 | ||||||||||||||||||||||||||

|

Gross profit

|

30,896 | 42,606 | 49,379 | 49,379 | 24,556 | 28,914 | 24,556 | 28,914 | ||||||||||||||||||||||||||

|

Selling, general and administrative:

|

||||||||||||||||||||||||||||||||||

|

Selling, general and administrative, excluding

additional retirement benefits

|

21,300 | 30,570 | 33,868 | 33,868 | 17,013 | 18,919 | 17,013 | 18,919 | ||||||||||||||||||||||||||

|

Additional retirement benefits including

$1.2 million of non-cash based compensation

|

— | — | — | — | — | 1,553 | — | 1,553 | ||||||||||||||||||||||||||

|

Total selling, general and administrative

|

21,300 | 30,570 | 33,868 | 33,868 | 17,013 | 20,472 | 17,013 | 20,472 | ||||||||||||||||||||||||||

|

Recapitalization and transaction costs

(2)

|

5,099 | — | — | — | — | — | — | — | ||||||||||||||||||||||||||

|

Operating income

|

4,497 | 12,036 | 15,511 | 15,511 | 7,543 | 8,442 | 7,543 | 8,442 | ||||||||||||||||||||||||||

|

Interest expense

|

11,234 | 18,012 | 20,747 | 15,678 | 10,222 | 10,104 | 7,913 | 8,158 | ||||||||||||||||||||||||||

|

Income (loss) before income taxes and

extraordinary charge

|

(6,737 | ) | (5,976 | ) | (5,236 | ) | (167 | ) | (2,679 | ) | (1,662 | ) | (370 | ) | 284 | |||||||||||||||||||

|

Income taxes

|

(1,097 | ) | (1,655 | ) | (158 | ) | 559 | (92 | ) | 28 | 196 | 28 | ||||||||||||||||||||||

|

Income (loss) before extraordinary charge

|

(5,640 | ) | (4,321 | ) | (5,078 | ) | (726 | ) | (2,587 | ) | (1,690 | ) | (566 | ) | 256 | |||||||||||||||||||

|

Extraordinary charge, net of tax benefits of

$1,300 and $474

|

1,863 | 812 | — | — | — | — | — | — | ||||||||||||||||||||||||||

|

Net income (loss)

|

$ | (7,503 | ) | $ | (5,133 | ) | $ | (5,078 | ) | $ | (726 | ) | $ | (2,587 | ) | $ | (1,690 | ) | $ | (566 | ) | $ | 256 | |||||||||||

|

Net income (loss) per share applicable to common

shareholders:

|

||||||||||||||||||||||||||||||||||

|

basic

|

$ | (0.78 | ) | $ | (0.53 | ) | $ | (0.53 | ) | $ | (0.05 | ) | $ | (0.27 | ) | $ | (0.20 | ) | $ | (0.04 | ) | $ | 0.02 | |||||||||||

|

diluted

|

$ | (0.78 | ) | $ | (0.53 | ) | $ | (0.53 | ) | $ | (0.05 | ) | $ | (0.27 | ) | $ | (0.20 | ) | $ | (0.04 | ) | $ | 0.01 | |||||||||||

Table of Contents

| Year ended December 31, | Six months ended June 30, | |||||||||||||||||||||||||||||||

| Pro | Pro | Pro | ||||||||||||||||||||||||||||||

| forma(6) | forma(6) | forma(6) | ||||||||||||||||||||||||||||||

| Other financial data: | 1998 | 1999 | 2000 | 2000 | 2000 | 2001 | 2000 | 2001 | ||||||||||||||||||||||||

| (in thousands, except per share amounts and other operating data) | ||||||||||||||||||||||||||||||||

|

EBITDA(3)

|

$ | 22,145 | $ | 35,853 | $ | 43,173 | $ | 43,173 | $ | 20,839 | $ | 23,846 | $ | 20,839 | $ | 23,846 | ||||||||||||||||

|

Adjusted EBITDA(4)

|

30,317 | 35,301 | 43,873 | 43,873 | 20,985 | 25,548 | 20,985 | 25,548 | ||||||||||||||||||||||||

|

Net cash provided by (used in) operating

activities

|

9,740 | 15,192 | 28,177 | — | 16,141 | 13,138 | — | — | ||||||||||||||||||||||||

|

Net cash provided by (used in) investing

activities

|

(62,896 | ) | (49,441 | ) | (31,504 | ) | — | (14,707 | ) | (14,081 | ) | — | — | |||||||||||||||||||

|

Net cash provided by (used in) financing

activities

|

53,156 | 34,249 | 3,327 | — | (1,434 | ) | 943 | — | — | |||||||||||||||||||||||

|

Movable medical equipment expenditures

(including

acquisitions) |

42,588 | 41,587 | 31,158 | — | 13,700 | 14,447 | — | — | ||||||||||||||||||||||||

|

Other operating data:

|

||||||||||||||||||||||||||||||||

|

Movable medical equipment (units at end of period)

|

76,000 | 93,000 | 101,000 | — | 97,000 | 107,000 | — | — | ||||||||||||||||||||||||

|

Offices (at end of period)

|

50 | 56 | 60 | — | 56 | 61 | — | — | ||||||||||||||||||||||||

|

Number of hospital customers (at end of period)

|

1,850 | 2,325 | 2,545 | — | 2,420 | 2,510 | — | — | ||||||||||||||||||||||||

|

Number of total customers (at end of period)

|

4,450 | 4,860 | 5,275 | — | 5,125 | 5,210 | — | — | ||||||||||||||||||||||||

|

Number of AMPP accounts (at end of period)

|

10 | 15 | 19 | — | 17 | 19 | — | — | ||||||||||||||||||||||||

| As of June 30, 2001 | ||||||||

| Pro forma | ||||||||

| Balance sheet data: | Actual | as adjusted(7) | ||||||

|

Working capital(5)

|

$ | 10,834 | $ | 10,834 | ||||

|

Total assets

|

180,787 | 180,787 | ||||||

|

Total debt

|

194,000 | 140,114 | ||||||

|

Series B 13% Cumulative Pay-In-Kind Stock

|

7,811 | — | ||||||

|

Common stock subject to put

|

3,445 | — | ||||||

|

Shareholders’ equity (deficiency)

|

(51,668 | ) | 13,474 | |||||

| (1) | Represents loss on disposal of movable medical equipment that did not meet outsourcing demand expectations. |

| (2) | Reflects expenses consisting primarily of legal, investment banking and severance payments incurred by us related to the recapitalization. |

| (3) | EBITDA represents earnings before interest expense, income taxes, depreciation and amortization. Management understands that some industry analysts and investors consider EBITDA to be useful in analyzing the operating performance of a company and its ability to service debt. EBITDA, however, is not a measure of financial performance under generally accepted accounting principles and should not be considered as an alternative to, or more meaningful than, net income as a measure of operating performance or to cash flows from operating, investing or financing activities or as a measure of liquidity. Since EBITDA is not a measure determined in accordance with generally accepted accounting principles and is thus susceptible to varying interpretations and calculations, EBITDA, as presented, may not be comparable to other similarly titled measures of other companies. EBITDA does not represent an amount of funds that is available for management’s discretionary use. |

| (4) | Adjusted EBITDA reflects EBITDA, adjusted to exclude: the loss on equipment disposal of $2.9 million for the year ended December 31, 1998; management fees to J. W. Childs Associates, L.P. of $207,000, $294,000, $286,000, $146,000 and $149,000 for years ended December 31, 1998, 1999 and 2000 and for the six months ended June 30, 2000 and 2001, respectively; recapitalization and transaction costs of $5.1 million for the year ended December 31, 1998; the primarily non-cash charges due to the reissuance of stock options to a retiring employee at exercise prices below the anticipated offering price for the six months ended June 30, 2001 of $1.6 million; and legal fees related to an employee settlement of $414,000 for the year ended December 31, 2000. Adjusted EBITDA also excludes an $846,000 gain from the one time sale of equipment in the year ended December 31, 1999. Management understands that some industry analysts and investors |

Table of Contents

| consider adjusted EBITDA to be a better indicator of our operating performance and our ability to service debt than EBITDA since it excludes one-time non-recurring expenses or gains. Adjusted EBITDA, however, is not a measure of financial performance under generally accepted accounting principles and should not be considered as an alternative to, or more meaningful than, net income as a measure of operating performance or to cash flows from operating, investing or financing activities or as a measure of liquidity. Since adjusted EBITDA is not a measure determined in accordance with generally accepted accounting principles and is thus susceptible to varying interpretations and calculations, Adjusted EBITDA, as presented, may not be comparable to other similarly titled measures of other companies. Adjusted EBITDA does not represent an amount of funds that is available for management’s discretionary use. | |

| (5) | Represents total current assets (excluding cash and cash equivalents) less total current liabilities, excluding current portion of long-term debt. |

| (6) | Pro forma financial data is presented to give effect to the use of a portion of the proceeds from this offering to pay off a portion of the amount outstanding on the revolving credit facility as if such event had occurred at the beginning of such applicable periods. Pro forma financial data are provided for informational purposes only and are not necessarily indicative of the actual results that would have been achieved had the offering occurred on the date indicated or that may be achieved in the future. |

| (7) | The pro forma as adjusted balance sheet data gives effect to receipt of the net proceeds from the sale in this offering of shares of common stock at an assumed initial public offering price of $14.50 per share, after deducting underwriting discounts and commissions and the estimated offering expenses payable by us, and the application of the net proceeds as described under “Use of proceeds,” as if each had occurred on June 30, 2001. In addition it reflects the termination of certain put provisions of the stockholders’ agreement upon completion of this offering. |

Table of Contents

Risk factors

Before you invest in our common stock, you should be aware of various risks, including those described below. You should carefully consider these risk factors, together with all of the other information included in this prospectus, before you decide to purchase shares of our common stock. Additional risks not presently known to us or that we currently deem immaterial may also impair our business, operations or financial results. This could cause the trading price of our common shares to decline, and you may lose all or part of your investment.

RISKS RELATED TO OUR BUSINESS

We have a history of net losses and may not be profitable in the future.

Primarily because of our debt service obligations, we have had a history of net losses. If we continue to incur net losses, our stock price could decline and adversely affect our ability to finance our business in the future. Our net losses of $7.5 million, $5.1 million, and $5.1 million for the years ended 1998, 1999 and 2000, respectively, and $1.7 million for the six months ended June 30, 2001, were primarily attributable to interest costs we must pay under the indenture related to our senior notes and our revolving credit facility. Although we intend to use part of the net proceeds from this offering to repay our outstanding indebtedness under our revolving credit facility, we anticipate that our debt service obligations will continue to be substantial and to affect our results of operations in future periods. Consequently, we anticipate we will report a net loss for the quarter ended September 30, 2001, and may do so in future periods.

We will require substantial cash to operate and expand our business as planned, and failure to obtain needed financing from anticipated sources could impede our growth.

We require substantial cash to operate our outsourcing programs and service our debt. Our outsourcing programs, particularly our AMPP total outsourcing program, require us to invest a significant amount of cash in movable medical equipment purchases. To the extent that such expenditures cannot be funded from our operating cash flow, borrowings under our revolving credit facility or other financing sources, we may not be able to conduct our business or to grow as currently planned. We currently expect that over the next 12 months we will be required to invest approximately $10 million to $12 million to replace existing equipment in our pool and approximately $25 million to $35 million to acquire new equipment to fuel anticipated growth. Upon entering into AMPP agreements, we generally are required to purchase all, or a significant portion, of a customer’s movable medical equipment, requiring large portions of such capital expenditures to be made at the commencement of the program. In addition, a substantial portion of our cash flow from operations must be dedicated to servicing our existing debt and there are significant restrictions on our ability to incur additional indebtedness under our existing indenture and revolving credit facility.

We have substantial debt, and we may be required to take action that would adversely affect our business in order to meet our debt service obligations. If we fail to meet those obligations, our secured lenders could take and sell our assets.

We are highly leveraged and will continue to have significant debt following this offering. As of June 30, 2001, adjusted for repayment of debt from the proceeds of this offering, we would have had total long term debt of $140.1 million, or approximately 91.2% of our total capitalization. Our debt service requirements may adversely affect our ability to conduct our business as planned. Although we

Table of Contents

intend to use a portion of the proceeds from this offering to repay a portion of the outstanding debt under our revolving credit facility, we may draw down from our revolving credit facility in the future or incur other debt. The degree to which we are leveraged may also have the following effects:

| o | a substantial portion of our cash flow from operations must be dedicated to debt service and will not be available for other purposes; |

| o | a portion of our borrowings are at variable rates of interest, making us vulnerable to increases in interest rates; |

| o | we may not be able to obtain additional debt financing in the future for working capital, capital expenditures or acquisitions; |

| o | our flexibility to react to changes in the industry and economic conditions may be limited, and we may be more vulnerable to a downturn in our business or the economy generally; and |

| o | we may be at a competitive disadvantage to our competitors with less debt. |

Borrowings made as part of our February 1998 recapitalization and subsequent acquisitions resulted in a significant increase in our interest expense in 1998, 1999 and 2000 relative to prior periods, resulting in net losses for those years. Our ability to make cash payments with respect to our senior notes and to satisfy or refinance our other debt obligations will depend upon our future operating performance. If we are unable to generate sufficient cash flow from operations in order to service our debt, we will be forced to take actions such as reducing or delaying capital expenditures, selling assets, restructuring or refinancing our debt or seeking additional equity capital. If we are unable to repay our debt at maturity, we may have to obtain alternative financing, which may not be available to us. The debt under our revolving credit facility is secured by our working capital and our pool of movable medical equipment. If we default on our requirements under our revolving credit facility, our secured lenders could proceed against our working capital or our pool of movable medical equipment.

Our debt agreements significantly restrict our ability to engage in certain activities.

The indenture related to our senior notes and our revolving credit facility each restricts our ability to do the following:

| o | pay cash dividends or make certain other payments; |

| o | incur liens; |

| o | enter into leases; |

| o | incur additional indebtedness; |

| o | use proceeds from sales of assets and subsidiary stock; and |

| o | enter into certain sale and leaseback transactions and transactions with affiliates. |

Additionally, our revolving credit facility requires us to maintain specified financial ratios and satisfy certain financial condition tests. We may be unable to meet those financial ratios and tests because of events beyond our control. A violation of any of these restrictions or a failure to meet the ratios and tests could result in a default under our revolving credit facility and the indenture. If an event of default should occur under our revolving credit facility, the lenders can accelerate repayment of the debt, plus accrued interest. Our working capital and pool of movable medical equipment are pledged as security under our revolving credit facility. If we fail to repay amounts due under our revolving credit facility, the lenders could proceed against the collateral granted to them to secure that debt and other of our debt which could substantially hinder our ability to conduct our business.

Table of Contents

To achieve significant revenue growth, we must change the manner in which healthcare providers traditionally procure medical equipment. Our inability to effect such change could adversely affect our revenue growth.

We believe that the strongest competition to our programs is the traditional purchase or lease alternative for obtaining movable medical equipment. Currently, many healthcare providers view outsourcing primarily as a means of meeting short-term or peak supplemental needs, rather than as a long-term alternative to purchase or lease. We may not be able to convince healthcare providers of the operational advantages and cost-effectiveness of outsourcing movable medical equipment needs on a long-term basis. As a result, many healthcare providers may continue to purchase or lease a substantial portion of their movable medical equipment. If we fail to change the manner in which healthcare providers procure their medical equipment, we may not be able to achieve significant growth.

Our competitors providing outsourcing services may engage in significant price competition or liquidate significant amounts of surplus equipment, thereby decreasing the demand for outsourcing services.

In a number of our geographic and product markets, we compete with one principal competitor and various smaller equipment outsourcing companies that may compete primarily on the basis of price. These competitors may offer certain customers lower prices depending on utilization levels and other factors. Our largest outsourcing competitor, MEDIQ/ PRN Life Support Services, Inc., a subsidiary of MEDIQ Incorporated, has recently emerged from bankruptcy and is currently under the control of its lenders. MEDIQ/ PRN may engage in competitive practices that may undercut our pricing. In addition, MEDIQ/ PRN may liquidate significant amounts of surplus equipment, thereby decreasing the demand for outsourcing services and possibly causing us to reduce the rates we may charge for our services.

We have relationships with certain key suppliers, and adverse developments concerning these suppliers could adversely affect our business.

We purchased our movable medical equipment from approximately 90 manufacturers and our disposable medical supplies from approximately 130 suppliers in 2000. Our ten largest suppliers of movable medical equipment, which supplied approximately 68% of our direct movable medical equipment purchases for 2000, are: Baxter Healthcare Corporation; Tyco International, Ltd. (Mallinckrodt Inc. and Kendall Healthcare Products Company); Respironics, Inc.; Siemens Business Services, Inc.; Drager Medical, Inc.; Abbott Laboratories; Smith & Nephew, Inc.; Agilent Technologies; SIMS Deltec, Inc.; and Spacelabs Medical, Inc. Adverse developments concerning key suppliers or our relationships with them could force us to seek alternative sources for our movable medical equipment or to purchase such equipment on unfavorable terms. A delay in procuring equipment or an increase in the cost to purchase equipment could limit our ability to provide equipment to our customers on a timely and cost-effective basis.

A substantial portion of our revenues come from customers with whom we do not have long term commitments, and cancellations by or disputes with customers could adversely affect our cash flows and results of operations.

We derived approximately 80% of our revenues for the year ended December 31, 2000 and 78% of our revenues for the six months ended June 30, 2001 from customers with whom we do not have any formal long term commitment to use our programs. Our customers are generally not obligated to outsource our equipment under long-term commitments. In addition, many of our customers do not sign written agreements with us fixing the rights and obligations of the parties regarding matters such

Table of Contents

as billing, liability, warranty or use. Therefore, we face risks such as fluctuations in usage, inaccurate or false reporting of usage by customers and disputes over liabilities related to equipment use. Some of our AMPP total outsourcing programs with customers, under which we own substantially all of the movable medical equipment that they use and provide substantial staffing resources, are not subject to a written contract and could be terminated by the healthcare provider without notice or payment of any termination fee. Any such termination would have an adverse effect on our revenues and operating results.

We may lose existing customers if we are unable to renew our contracts with Group Purchasing Organizations.

Our past revenue growth and our strategy for future growth depends, in part, on access to the new customers granted by our major contracts with group purchasing organizations, or GPOs, such as Premier, Novation and AmeriNet. Each of these contracts has a three year term expiring in late 2001 or 2002. In the past, we have been able to renew such contracts. If we are unable to renew or replace our current GPO contracts when they are up for renewal, we may lose the existing business with the customers who are members of such GPOs.

If we were required to write off or accelerate the amortization of our goodwill, our operations and shareholders’ equity would be adversely affected.

As a result of recent acquisitions, described in the notes to our financial statements included elsewhere in this prospectus, we have $37.2 million of goodwill recorded on our balance sheet as of December 31, 2000. Until January 1, 2002, we will be amortizing this goodwill on a straight-line basis over periods ranging from 15 to 40 years. Under new accounting rules, beginning January 1, 2002, we will no longer be able to amortize goodwill on a yearly basis. Instead, we will be required to periodically determine if our goodwill has become impaired, in which case we would be required to write off the impaired portion of goodwill. The amount of goodwill that we amortize or write off in any given year is treated as a charge against earnings under generally accepted accounting principles in the United States. If we were required to write off our goodwill, we could incur a one-time fixed charge against earnings, which would adversely affect our results of operations and shareholders’ equity.

Although we do not manufacture any medical equipment, our business entails the risk of claims related to the medical equipment that we outsource and service. We may not have adequate insurance to cover a claim, and it may be more expensive or difficult for us to obtain adequate insurance in the future.

We may be liable for claims related to the use of our movable medical equipment. Any such claims, if made, could have a material adverse effect on our business, financial condition or results of operations. We may be subject to claims exceeding our insurance coverage or we may not be able to continue to obtain liability insurance at acceptable levels of cost and coverage. In addition, litigation relating to a claim could adversely affect our existing and potential customer relationships, create adverse public relations and divert management’s time and resources from the operation of the business.

Table of Contents

Our growth strategy depends in part on our ability to successfully identify and manage our acquisitions and a failure to do so could impede our future growth and adversely affect our competitive position.

As part of our growth strategy we intend to pursue acquisitions or other strategic relationships within our industry that we believe will enable us to generate revenue growth and enhance our competitive position. Since July 1998, we have acquired five new businesses. Future acquisitions may involve significant cash expenditures and operating losses that could have a material adverse effect on our financial condition and results of operations. In addition, our efforts to execute our acquisition strategy may be affected by our ability to identify suitable candidates and negotiate and close acquisitions. We may not be successful in acquiring other businesses, and the businesses we do acquire in the future may not ultimately produce returns that justify our related investment.

Acquisitions may involve numerous risks, including:

| o | difficulties assimilating acquired personnel and integrating distinct business cultures; |

| o | diversion of management’s time and resources from existing operations; |

| o | potential loss of key employees or customers of acquired companies; and |

| o | exposure to unforeseen liabilities of acquired companies. |

If we are unable to continue to grow through acquisitions, our ability to generate revenue growth and enhance our competitive position would be impaired.

We depend on key personnel, the loss of whom could have a material adverse effect on our business.

We rely on a number of key personnel and losing any of these individuals could have a material adverse effect on our business, financial condition or results of operations. We believe that our future success will depend greatly on our continued ability to attract and retain additional highly skilled and qualified personnel. We have employment agreements with David E. Dovenberg expiring in July 2004 and John A. Gappa expiring in November 2002. We may be unable to renew these agreements prior to expiration, or Mr. Dovenberg or Mr. Gappa may choose to terminate the agreement prior to expiration. In such an event, a suitable replacement may be unavailable. Besides Mr. Dovenberg and Mr. Gappa, we also continue to need other qualified personnel. If we fail to attract or retain qualified personnel, we may be unable to execute our growth strategy.

We depend on our sales representatives and service specialists, and may lose customers when any of our sales representatives and service specialists leave us.

Our sales growth has been supported by hiring and developing new sales representatives and adding, through acquisitions, established sales representatives whose existing customers generally have become our customers. We have experienced and will continue to experience intense competition for managers and experienced sales representatives. As part of our strategy to grow our business by converting existing customers to our AMPP total outsourcing program, we have recently established a sales team which is specifically focused on and trained for AMPP sales. The success of our outsourcing programs, including AMPP, depends on the relationships developed between our sales representatives and our customers. If sales representatives or members of our AMPP team leave us we risk losing our AMPP customers and convincing other customers to convert to AMPP.

Table of Contents

Our quarterly operating results have varied and we expect them to continue to vary.

Our results of operations have been and can be expected to be subject to quarterly fluctuations. We may experience increased revenues in the first and fourth quarter of the year, depending upon the timing and severity of the cold and flu season and the related increased hospital census and movable medical equipment usage during that season. Because a significant portion of our expenses are relatively fixed over these periods, our operating income as a percentage of revenue tends to increase during the first and fourth quarter of each year. If the cold and flu season is delayed by as little as one month, or is less severe than in prior periods, our quarterly operating results for a current period can vary significantly from prior periods. Our quarterly results can also fluctuate as a result of other factors such as the timing of acquisitions, new AMPP agreements or new office openings.

RISKS RELATED TO OUR INDUSTRY

Changes in reimbursement rates and policies by third-party payors for medical equipment costs may reduce the rates that providers can pay for our services and adversely affect our operating results and financial condition.

Our healthcare provider customers, who pay us directly for the services we provide to them, substantially rely on reimbursement from third party payors for their operating revenue. These third party payors include both governmental payors, such as Medicare and Medicaid, and private payors, such as insurance companies and managed care organizations. There are widespread efforts to control healthcare costs in the United States by all of these payor groups. These cost containment initiatives have resulted in reimbursement policies based on fixed rates for a particular patient treatment that are unrelated to the provider’s actual costs or require healthcare providers to provide services on a discounted basis. Consequently, these reimbursement policies have a direct effect on healthcare providers’ ability to pay us for our services and an indirect effect on our level of charges. Ongoing concerns about rising healthcare costs may cause more restrictive reimbursement policies to be implemented in the future. Restrictions on the amounts or manner of reimbursements to healthcare providers may affect their willingness and ability to pay for the services we provide and may adversely affect our customers’ financial condition. Such restrictions could require us to reduce the rates we charge or could put at risk our ability to collect payments owed to us.

Our operating results historically have been adversely affected in periods when significant healthcare reform initiatives were under consideration and uncertainty remained as to their likely outcome. We expect the uncertainty of future significant healthcare reform initiatives may have a similar, negative effect.

Because the regulatory and political environment for healthcare significantly influences the capital equipment procurement decisions of healthcare providers, our operating results historically have been adversely affected in periods when significant healthcare reform initiatives were under consideration and uncertainty remained as to their likely outcome. To the extent general cost containment pressures on healthcare spending and reimbursement reform, or uncertainty as to possible reform, causes acute care hospitals and alternate site providers to defer the procurement of medical equipment, reduce their capital expenditures or change significantly their utilization of medical equipment, there could be a material adverse effect on our financial condition and results of operations.

Table of Contents

We have recently increased the amount of business we do with home care providers and nursing homes, and these healthcare providers may pose additional credit risks.

We may incur losses in the future due to the bankruptcy filings of our nursing home and home care customers. We derived approximately 20% of our revenues for the year ended December 31, 2000 and 18% of our revenues for the six months ended June 30, 2001 from alternate site providers such as home care providers and nursing homes. For the year ended December 31, 1997, we derived only 16% of our revenues from such providers. We expect that we will continue to increase the percentage of our revenues derived from alternative care providers. Such providers may pose additional credit risks, since such providers are generally less financially sound than hospitals. A significant number of nursing home companies in the United States have filed for Chapter 11 bankruptcy protection in the last two years.

Consolidation in the healthcare industry may lead to a reduction in the outsourcing rates we charge.

In recent years, many acute care hospitals and alternate site providers have consolidated to create larger healthcare organizations. We believe that this consolidation trend may continue. Any resulting consolidated healthcare organization may have greater bargaining power over us, which could lead to a reduction in the outsourcing rates that we are able to charge. A reduction in our outsourcing rates will decrease our revenues.

Our customers operate in a highly regulated environment and the regulations affecting them could adversely affect our business.

The healthcare industry is required to comply with extensive and complex laws and regulations at the federal, state and local government levels. While many of these regulations do not directly apply to us, there are some that do, including the Food, Drug and Cosmetics Act, or FDCA, and certain state pharmaceutical licensing requirements. Although we believe we are in compliance with the FDCA, if the FDA expands the reporting requirements under the FDCA, we may be required to comply with the expanded requirements and may incur substantial additional expenses in doing so. With respect to state pharmaceutical licensing requirements, we are currently licensed in four states and may be required to be licensed in up to 15 additional states. We are currently in the process of obtaining these. Our failure to possess such licenses in these states for our existing operations may subject us to certain additional expenses.

Given that our industry is heavily regulated, we may be subject to additional regulatory requirements. If our operations are found to be in violation of any governmental regulations to which we or our clients are subject, we may be subject to the applicable penalty associated with the violation. Any penalties, damages, fines or curtailment of our operations would adversely affect our ability to operate our business and our financial results.

Table of Contents

RISKS RELATED TO THE SHARES AND THIS OFFERING

Some of our existing shareholders can exert control over us and may not make decisions that are in the best interests of all shareholders.

Immediately after the closing of this offering our officers, directors and greater than 5% shareholders, together with their affiliates, will beneficially own an aggregate of 11,124,019 common shares (including shares issuable upon exercise of fully vested outstanding options). This number represents approximately 65% of our shares to be outstanding (including shares issuable upon exercise of outstanding options) immediately after the closing of this offering (assuming no exercise by the underwriters of their over-allotment option). In particular, J.W. Childs Equity Partners, L.P., and its affiliates will beneficially own shares representing approximately 53% of our common stock immediately after this offering. As a result, these shareholders will effectively control the outcome of our actions that require shareholder approval. Together, our officers, directors and J.W. Childs (or J.W. Childs alone) have the power to elect our board of directors, appoint new management and approve any action requiring a shareholder vote, including amendments to our Certificate of Incorporation and approving mergers or sales of substantially all of our assets. The directors they elect will have the authority to make decisions affecting our capital structure, including the issuance of additional indebtedness and the declaration of dividends. There can be no assurance that these shareholders will vote their shares in a manner that is consistent with your best interests. The concentration of ownership in J.W. Childs and its affiliates may also have the effect of delaying or preventing a change in control of us.

See “Principal and selling shareholders” for additional information on the concentration of our common stock.

As a new investor, you will experience immediate dilution of 112% in the value of your common stock, and may experience additional dilution as outstanding options and warrants are exercised.

Prior investors paid a lower per share price than the price in this offering. The initial public offering price is substantially higher than the net book value per share of the outstanding common stock immediately after this offering. Accordingly, if you purchase common stock in this offering, you will incur immediate and substantial dilution of $16.24 per share. In addition, we have issued a significant number of options to acquire common stock at prices significantly below the initial public offering price. As of June 30, 2001, we had outstanding options to purchase 2,276,545 shares of common stock at a weighted average exercise price of $2.38 per share. To the extent these outstanding options are exercised, there will be further dilution to investors in this offering.

There is a large number of shares that may be sold in the market following this offering, which may depress our stock price.

Sales of a substantial number of shares of our common stock in the public market by our shareholders after this offering, or the perception that such sales are likely to occur, could depress the market price of our common stock and could impair our ability to raise capital through the sale of additional equity securities. Based on shares outstanding as of June 30, 2001, upon the completion of this offering we will have outstanding 16,275,044 shares of common stock. Of these shares, only the 5,750,000 shares of common stock sold in this offering, including the shares that may be sold in the over-allotment option, if any, will be freely tradable, without restriction, in the public market. After the lockup agreements pertaining to this offering expire 180 days from the date of this prospectus, an additional

Table of Contents

11,261,044 shares will be eligible for sale in the public market, subject to the volume limitations contained in Rule 144 under the Securities Act of 1933. In addition, 1,109,355 of the shares subject to outstanding options will be exercisable, and if exercised, available for sale 180 days after the date of this prospectus.

There is no current trading market for our common stock, and an active public market for our common stock may not develop, which could impede your ability to sell your shares and depress our stock price.

The market price of your shares may fall below the initial public offering price. Prior to our 1998 recapitalization our common stock was listed on the Nasdaq National Market. In connection with the recapitalization, we delisted our common stock from Nasdaq, and there is currently no public market for our common stock. Prior to the recapitalization, our stock was at times thinly traded and only a limited number of market makers and investment banking firms prepared research reports on us. An active public trading market for the common stock may not develop, and this could impede your ability to sell your shares or could depress our stock price. The initial price of our common stock to be sold in the offering will be determined through negotiations between us and the representatives of the underwriters and may not be indicative of prices that will prevail in the trading market.

The price of our common shares may be volatile and this may adversely affect your investment.

The market price for our common shares following this offering may be affected by a number of factors, including the following:

| o | seasonal fluctuations in operating results; |

| o | failure to achieve operating results projected by securities analysts; |

| o | changes in earnings estimates or recommendations by securities analysts; |

| o | developments in our industry; |

| o | variations in our competitors’ results of operations; and |

| o | general market conditions and other factors, including factors unrelated to our operating performance or the operating performance of our competitors. |

In the past, securities class action litigation has often been brought against a company following periods of volatility in the market price of its securities. We may become the target of similar litigation. Securities litigation may result in substantial costs and divert management’s attention and resources, which may harm our business and financial condition, as well as the market price of our common stock.

Our board of directors may authorize and issue preferred stock without your approval. Such issuances could depress our stock price and adversely affect your voting rights.

Our board of directors is authorized to establish various series of preferred stock from time to time and to determine the rights, preferences and privileges of any wholly unissued series, including, among other matters, any dividend rights, dividend rates, conversion rights, voting rights, terms of redemption, liquidation preferences, sinking fund terms, the number of shares, and the description of preferred stock, and to issue any shares of preferred stock. The creation and issuance of shares of an

Table of Contents

additional class or series of preferred stock could adversely affect the market price and the voting power of the common stock.

You are not likely to receive dividends in the foreseeable future.

We have never paid cash dividends on our capital stock and do not anticipate paying any cash dividends in the foreseeable future. In addition, our revolving credit facility and the indenture for our outstanding senior notes contain certain restrictions on our ability to pay cash dividends on the stock.

Provisions of our charter documents and Delaware law could delay or prevent an unsolicited takeover effort to acquire our company, which could inhibit your ability to receive an acquisition premium for your shares.

Some provisions of our certificate of incorporation and bylaws may discourage, delay or prevent a merger or acquisition that you may consider favorable or the removal of our current management. These provisions may:

| o | authorize the issuance of “blank check” preferred stock; |

| o | provide for a classified board of directors with staggered, three-year terms; |

| o | prohibit cumulative voting in the election of directors; |

| o | limit the persons who may call special meetings of stockholders; and |

| o | establish advance notice requirements for nominations for election to the board of directors or for proposing matters to be approved by stockholders at stockholder meetings. |

In addition, some provisions of Delaware law may also discourage, delay or prevent someone from acquiring or merging with us. See “Description of capital stock.”

Table of Contents

Our 1998 recapitalization

BACKGROUND

In February 1998, we completed a recapitalization through the merger of a corporation controlled by J.W. Childs Equity Partners, L.P. with and into us. J.W. Childs Equity Partners, L.P. is managed by J.W. Childs Associates, L.P., a private equity investment firm based in Boston which focuses on sponsoring, along with management, leveraged buy-outs of middle-market companies that it believes have growth potential. The following members of our current senior management team also invested in the recapitalization: Gerald L. Brandt, Robert H. Braun, Michael R. Johnson and David E. Dovenberg. In addition, other employees invested in the recapitalization. In connection with the recapitalization, the following occurred:

| o | existing shareholders (other than the management investors) received, in consideration for the cancellation of approximately 37.1 million shares of our common stock, $2.21 in cash per share (adjusted for stock splits) or an aggregate of approximately $82.1 million; |

| o | we cancelled options to purchase approximately 2.3 million shares of common stock for an aggregate of $2.6 million (net of aggregate option price); |

| o | we rolled over an aggregate of 1,307,432 shares and options to purchase 710,654 shares held by management members and other employees who were continuing after the recapitalization; |

| o | we entered into employment agreements with members of our current management team that provided for new option grants and severance benefits. All of these employment agreements have expired except for the agreement with Mr. Dovenberg which is described elsewhere in this prospectus under “Management — Employment Agreements”; |

| o | we repaid outstanding borrowings of approximately $35.5 million under existing loan agreements and incurred early termination fees and a write-off of the related deferred financing costs, resulting in an extraordinary charge of approximately $1.9 million, net of a deferred tax benefit of $1.3 million; |

| o | we paid fees and expenses of approximately $11.5 million related to the recapitalization, including $3.3 million in severance expense to certain noncontinuing members of management of which $0.5 million had already been accrued; |

| o | we received an equity contribution of approximately $21.3 million in cash from J.W. Childs and its affiliates and from management investors at a price per share of common stock of approximately $2.21 (adjusted for stock splits); |

| o | we issued $100.0 million in aggregate principal amount of our senior notes and borrowed approximately $13.5 million under our revolving credit facility; |

| o | we recognized a tax benefit from the exercise of stock options of approximately $1.0 million; and |

| o | we effected a 10-for-1 stock split. |

The transaction was structured as a leveraged recapitalization for accounting purposes, with all assets and liabilities carried over at historical cost. During the year ended December 31, 1998, we incurred $5.1 million of nonrecurring expenses consisting primarily of legal, investment banking and special committee fees associated with the merger.

Table of Contents

As a result of the recapitalization, J.W. Childs Equity Partners, L.P. and its affiliates acquired approximately 77% of our common stock. An additional result of the recapitalization was that our obligation to file periodic reports with the Securities and Exchange Commission and to comply with the proxy rules under the Securities Exchange Act of 1934 terminated until the registration statement related to our senior notes was filed, and our officers and directors and stockholders owning more than 10% of the shares of our common stock were relieved of the reporting requirements and “short-swing” trading restrictions under Section 16.

After the recapitalization we increased the levels of debt incurred beyond the recapitalization to fund acquisitions and invest in equipment to grow our business. While the general nature of our business did not change during that time, we acquired five companies in strategic locations to expand our national network of district offices, which are outlined under “Management’s discussion and analysis of financial condition and results of operations.” We also installed a new senior management team, entered into key national GPO contracts and focused on increasing the growth of our AMPP accounts. Despite the increase in our level of debt, our capital expenditures more than doubled following the recapitalization, increasing from $20.2 million in 1997 to $42.6 million in 1998.

We believe that this offering will improve our financial position and provide us with additional financing flexibility. In particular, we believe this offering will allow us to reduce our debt, enhance cash flow from operations to continue to invest in our infrastructure, and enable us to use our public stock as a currency to complete acquisitions. As a result, we believe this offering will enhance our ability to grow our business.

COSTS AND BENEFITS OF THE RECAPITALIZATION TO PRINCIPAL SHAREHOLDERS AND MANAGEMENT

The $35.5 million of existing indebtedness we retired in connection with the recapitalization had a weighted average interest rate of 7.4%. The $13.5 million we borrowed under our revolving credit facility had a weighted average interest rate of 8.25% and the $100.0 million we derived through the issuance of our senior notes had an interest rate of 10.25%. The interest rates on each of those facilities represented prevailing market interest rates at the time we entered into the facilities.

The following table sets forth the aggregate sources and uses of funds for the recapitalization:

| Sources of funds | |||||

| (in millions) | |||||

|

Revolving credit facility

|

$ | 13.5 | |||

|

Proceeds from issuance of senior notes

|

100.0 | ||||

|

J.W. Childs Equity Partners, L.P. and affiliates

|

20.7 | ||||

|

Management investors

|

0.6 | ||||

|

Total sources

|

$ | 134.8 | |||

| Use of Funds | |||||

| (in millions) | |||||

|

Payment for shares and stock options

|

$ | 84.7 | |||

|

Repayment of existing indebtedness, including

interest and prepayment penalties

|

38.9 | ||||

|

Severance payments to non-continuing management

|

3.3 | ||||

|

Fees and expenses paid at closing

|

7.9 | ||||

|

Total uses

|

$ | 134.8 | |||

Upon the consummation of the merger, certain holders of our company’s options had the right to receive a cash payment when their options were cashed out. Samuel B. Humphries, a non-management member of our board, received $73,125 when his options were cashed out in connection with the recapitalization.

Table of Contents

In addition, in connection with the recapitalization, David E. Dovenberg received from us a ten-year loan in an aggregate principal amount of approximately $100,000, in connection with his purchase of shares of common stock. Gerald L. Brandt also received a ten-year loan from us, in an aggregate principal amount of approximately $20,000. Both loans were secured by a pledge of the shares of common stock then owned by Mr. Dovenberg and Mr. Brandt, respectively, and bore interest payable semiannually at a rate equal to our weighted average cost of our revolving credit facility. Each loan was payable prior to maturity upon a sale by Mr. Dovenberg or Mr. Brandt. Both loans have been paid in full.

In connection with the recapitalization, our management team and other employees who were continuing after the recapitalization retained 1,307,432 shares and options to purchase 710,654 shares.

The management agreement under which we paid J.W. Childs Associates, L.P. an annual management fee of $240,000 following the recapitalization in consideration of its ongoing provision of certain consulting and management advisory services, the stockholders’ agreement entered into by all of our shareholders, and the registration rights of holders of our common stock are outlined elsewhere in this prospectus under “Certain relationships and related transactions” and “Description of capital stock.” J.W. Childs Associates, L.P. intends to terminate the management fee upon the completion of this offering.

The following table illustrates the appreciation since the recapitalization in the value of common stock acquired by J.W. Childs Equity Partners, L.P. and its affiliates in the recapitalization, rolled over by the management investors in the recapitalization and purchased by management since the recapitalization.

| Value at initial public | ||||||||||||||||||||||||

| Acquisition price | offering price | Appreciation | ||||||||||||||||||||||

| upon | ||||||||||||||||||||||||

| Number of | Per | Per | completion of | |||||||||||||||||||||

| shares | share | Aggregate | Share | Aggregate | offering | |||||||||||||||||||

|

Acquired in the recapitalization

|

||||||||||||||||||||||||

|

J.W. Childs Equity Partners, L.P.

|

8,726,851 | $ | 2.21 | $ | 19,286,341 | $ | 14.50 | $ | 126,539,340 | $ | 107,252,999 | |||||||||||||

|

David E. Dovenberg

|

1,195,508 | 2.21 | 2,642,073 | 14.50 | 17,334,866 | 14,692,793 | ||||||||||||||||||

|

Robert H. Braun

|

31,276 | 2.21 | 69,120 | 14.50 | 453,502 | 384,382 | ||||||||||||||||||

|

Gerald L. Brandt

|

46,269 | 2.21 | 102,254 | 14.50 | 670,901 | 568,647 | ||||||||||||||||||

|

Michael R. Johnson

|

27,104 | 2.21 | 59,900 | 14.50 | 393,008 | 333,108 | ||||||||||||||||||

|

Steven G. Segal

|

108,637 | 2.21 | 240,088 | 14.50 | 1,575,280 | 1,335,192 | ||||||||||||||||||

|

Edward D. Yun

|

9,952 | 2.21 | 21,994 | 14.50 | 144,319 | 122,325 | ||||||||||||||||||

|

Acquired since the recapitalization

|