UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________________________________________________________________________

FORM 10-K

_____________________________________________________________________________________________

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the Fiscal Year Ended December 31 , 2022

OR

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the transition period from to .

Commission File No. 001-33093

(Exact name of registrant as specified in its charter)

(State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) | |||||||

| (Address of Principal Executive Offices) | (Zip Code) | |||||||

Registrant’s telephone number, including area code: (858 ) 550-7500

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol | Name of Each Exchange on Which Registered | ||||||

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934. Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definition of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

☒ | Accelerated Filer | ☐ | Non-accelerated Filer | ☐ | Smaller reporting company | Emerging growth company | ||||||||||||||||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Exchange Act Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the Registrant’s voting and non-voting stock held by non-affiliates was approximately $1.0 billion based on the last sales price of the Registrant’s Common Stock on the Nasdaq Global Market of the Nasdaq Stock Market LLC on June 30, 2022. For purposes of this calculation, shares of Common Stock held by directors, officers and 10% stockholders known to the Registrant have been deemed to be owned by affiliates which should not be construed to indicate that any such person possesses the power, direct or indirect, to direct or cause the direction of the management or policies of the Registrant or that such person is controlled by or under common control with the Registrant.

As of February 22, 2023, the Registrant had 17,076,658 shares of Common Stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Table of Contents

| Part I | ||||||||

| Item 1. | ||||||||

| Item 1A. | ||||||||

| Item 1B. | ||||||||

| Item 2. | ||||||||

| Item 3. | ||||||||

| Item 4. | ||||||||

| Part II | ||||||||

| Item 5. | ||||||||

| Item 6. | ||||||||

| Item 7. | ||||||||

| Item 7A. | ||||||||

| Item 8. | ||||||||

| Item 9. | ||||||||

| Item 9A. | ||||||||

| Item 9B. | ||||||||

| Item 9C. | ||||||||

| Part III | ||||||||

| Item 10. | ||||||||

| Item 11. | ||||||||

| Item 12. | ||||||||

| Item 13. | ||||||||

| Item 14. | ||||||||

| Part IV | ||||||||

| Item 15. | ||||||||

| Item 16. | ||||||||

| GLOSSARY OF TERMS AND ABBREVIATIONS | |||||

| Abbreviation | Definition | ||||

| 2023 Notes | $750.0 million aggregate principal amount of convertible senior unsecured notes due 2023 | ||||

| Aldeyra | Aldeyra Therapeutics, Inc. | ||||

| Amgen | Amgen, Inc. | ||||

| ASC | Accounting Standards Codification | ||||

| ASU | Accounting Standards Update | ||||

| Aziyo | Aziyo Med, LLC | ||||

| Baxter | Baxter International, Inc. | ||||

| BeiGene | BeiGene, Ltd. | ||||

| BendaRx | BendaRx Corp. | ||||

| BLA | Biologics license application | ||||

| CASI | CASI Pharmaceuticals, Inc. | ||||

| cGMP | Current Good Manufacturing Practice | ||||

| Company | Ligand Pharmaceuticals Incorporated, including subsidiaries | ||||

| Convertible Note | Senior Convertible Promissory Note | ||||

| COPD | Chronic obstructive pulmonary disease | ||||

| Cormatrix | Cormatrix Cardiovascular, Inc. | ||||

| Corvus | Corvus Pharmaceuticals, Inc. | ||||

| CVR | Contingent value right | ||||

| CyDex | CyDex Pharmaceuticals, Inc. | ||||

| Daiichi Sankyo | Daiichi Sankyo Company, Ltd. | ||||

| Dianomi | Dianomi Therapeutics, Inc. | ||||

| DMF | Drug Master File | ||||

| ESG | Environmental, Social and Governance | ||||

| ECM | Extracellular matrix | ||||

| Eisai | Eisai Inc. | ||||

| EPA | Environmental Protection Agency | ||||

| ESPP | Employee Stock Purchase Plan, as amended and restated | ||||

| EU | European Union | ||||

| Exelixis | Exelixis, Inc. | ||||

| FASB | Financial Accounting Standards Board | ||||

| FDA | U.S. Food and Drug Administration | ||||

| FSGS | Focal segmental glomerulosclerosis | ||||

| FY 2022 | The Company's fiscal year ended December 31, 2022 | ||||

| FY 2021 | The Company's fiscal year ended December 31, 2021 | ||||

| FY 2020 | The Company's fiscal year ended December 31, 2020 | ||||

| GAAP | Generally accepted accounting principles in the United States | ||||

| GCSF | Granulocyte-colony stimulating factor | ||||

| Gilead | Gilead Sciences, Inc. | ||||

| HBV | Hepatitis B Virus | ||||

| Hikma | Hikma Pharmaceuticals PLC | ||||

| Hovione | Hovione FarmCiencia, S.A. | ||||

| Icagen | Icagen, Inc. | ||||

| IM | Intramuscular | ||||

| IND | Investigational New Drug | ||||

| IRS | Internal Revenue Service | ||||

| IV | Intravenous | ||||

| Jazz | Jazz Pharmaceuticals, Inc. | ||||

| Ligand | Ligand Pharmaceuticals Incorporated, including subsidiaries | ||||

| LTP | Liver targeting prodrug | ||||

| Marinus | Marinus Pharmaceuticals, Inc. | ||||

| Melinta | Melinta Therapeutics, Inc. | ||||

| Merck | Merck & Co., Inc. | ||||

| Metabasis | Metabasis Therapeutics, Inc. | ||||

| NDA | New Drug Application | ||||

| NOLs | Net Operating Losses | ||||

| Novan | Novan, Inc. | ||||

| Novartis | Novartis AG | ||||

| Nucorion | Nucorion Pharmaceuticals, Inc. | ||||

| OmniAb | OmniAb Operations, Inc. (f/k/a OmniAb, Inc.) | ||||

| OMT | Open Monoclonal Technology, Inc. | ||||

| Ono | Ono Pharmaceutical Co., Ltd. | ||||

| Opthea | Opthea Limited | ||||

| Orange Book | Publication identifying drug products approved by the FDA based on safety and effectiveness | ||||

| Palvella | Palvella Therapeutics, Inc. | ||||

| Par | Par Pharmaceutical, Inc. | ||||

| Pfenex | Pfenex Inc. | ||||

| Pfizer | Pfizer, Inc. | ||||

| Phoenix Tissue | Phoenix Tissue Repair | ||||

| PSU | Performance stock unit | ||||

| R&D | Research and Development | ||||

| RSU | Restricted stock unit | ||||

| Sage | Sage Therapeutics, Inc. | ||||

| SARM | Selective Androgen Receptor Modulator | ||||

| SEC | Securities and Exchange Commission | ||||

| Sedor | Sedor Pharmaceuticals, Inc., or RODES, Inc. | ||||

| Seelos | Seelos Therapeutics, Inc. | ||||

| Selexis | Selexis, SA | ||||

| Sermonix | Sermonix Pharmaceuticals, LLC | ||||

| SII | Serum Institute of India | ||||

| SQ Innovation | SQ Innovation, Inc. | ||||

| Sunshine Lake Pharma | Sunshine Lake Pharma Co., Ltd. | ||||

| Takeda | Takeda Pharmaceuticals Company Limited | ||||

| Taurus | Taurus Biosciences LLC | ||||

| Tax Act | The Tax Cuts and Jobs Act | ||||

| Teva | Teva Pharmaceuticals USA, Inc., Teva Pharmaceutical Industries Ltd. and Actavis, LLC | ||||

| Travere | Travere Inc. | ||||

| TR-Beta | Thyroid hormone receptor beta | ||||

| Vernalis | Vernalis plc | ||||

| Verona | Verona Pharma plc | ||||

| Viking | Viking Therapeutics | ||||

| xCella Biosciences | xCella Biosciences, Inc. | ||||

| Xi'an Xintong | Xi'an Xintong Medicine Research | ||||

| Zydus Cadila | Zydus Cadila Healthcare, Ltd | ||||

PART I

Cautionary Note Regarding Forward-Looking Statements:

You should read the following report together with the more detailed information regarding our company, our common stock and our financial statements and notes to those statements appearing elsewhere in this document.

This report contains forward-looking statements that involve a number of risks and uncertainties. Although our forward-looking statements reflect the good faith judgment of our management, these statements can only be based on facts and factors currently known by us. Consequently, these forward-looking statements are inherently subject to risks and uncertainties, and actual results and outcomes may differ materially from results and outcomes discussed in the forward-looking statements.

Forward-looking statements can be identified by the use of forward-looking words such as “believes,” “expects,” “may,” “will,” “plan,” “intends,” “estimates,” “would,” “continue,” “seeks,” “pro forma,” or “anticipates,” or other similar words (including their use in the negative), or by discussions of future matters such as those related to our future results of operations and financial position, royalties and milestones under license agreements, Captisol material sales, product development, and product regulatory filings and approvals, and the timing thereof, Ligand's status as a high-growth company, as well as other statements that are not historical. You should be aware that the occurrence of any of the events discussed under the caption “Risk Factors” could negatively affect our results of operations and financial condition and the trading price of our stock.

The cautionary statements made in this report are intended to be applicable to all related forward-looking statements wherever they may appear in this report. We urge you not to place undue reliance on these forward-looking statements, which speak only as of the date of this report. Except as required by law, we assume no obligation to update our forward-looking statements, even if new information becomes available in the future. This caution is made under the safe harbor provisions of Section 21E of the Securities Exchange Act of 1934, as amended.

References to “Ligand Pharmaceuticals Incorporated,” “Ligand,” the “Company,” “we,” “our” and “us” include Ligand Pharmaceuticals Incorporated and our wholly-owned subsidiaries.

Partner Information

Information regarding partnered products and programs comes from information publicly released by our partners and licensees.

Trademarks

This Annual Report on Form 10-K includes trademarks, trade names and service marks owned by us. Ligand®, Advasep®, BEPro™, Bonsity®, Captisol®, CyDex®, LTP®, LTP Technology™, Pelican Expression Technology™, PeliCRM™, Pfenex Expression Technology™ and XRPro® are protected under applicable intellectual property laws and are our property. All other trademarks, trade names and service marks including, but not limited to OmniAb® Kyprolis®, Evomela®, Veklury®, Livogiva®, Bonteo®, Zulresso®, Rylaze®, VAXNEUVANCE™, Pneumosil®, Minnebro®, Baxdela®, Conbriza®, Nexterone®, Noxafil®, Duavee®, OTORIN™, FILSPARI™ and LYTENAVA™ are the property of their respective owners. Solely for convenience, trademarks, trade names and service marks referred to in this report may appear without the ®, ™ or SM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the right of the applicable licensor to such trademarks, trade names and service marks. Use or display by us of other parties’ trademarks, trade dress or products is not intended to and does not imply a relationship with, or endorsement or sponsorship of, us by the trademark or trade dress owners.

1

| Item 1. | Business | ||||

Overview

Our business is focused on acquiring or funding programs and technologies that pharmaceutical companies use to discover and develop medicines. Our business model provides a diversified portfolio of biotech and pharmaceutical product revenue streams that are supported by an efficient and low corporate cost structure. The biotechnology industry is characterized by a binary clinical risk, in that, either a drug candidate is successfully developed and receives regulatory marketing approval, or the drug candidate fails in clinical trials. Our goal is to offer investors an opportunity to participate in the promise of the biotech industry in a profitable and diversified manner while mitigating the binary clinical risk associated with developing a single program.

Our business model is focused on funding mid to late-stage drug development in return for economic rights and out-licensing our technology platforms to help partners discover and develop medicines. We partner with other pharmaceutical companies to leverage what they do best (late-stage development, regulatory management and commercialization) ultimately to generate our revenue. Our Captisol platform technology is a chemically modified cyclodextrin with a structure designed to optimize the solubility and stability of drugs. Our Pelican Expression Technology is a robust, validated, cost-effective and scalable platform for recombinant protein production that is especially well-suited for complex, large-scale protein production where traditional systems are not. We have established multiple alliances, licenses and other business relationships with the world’s leading pharmaceutical companies including Amgen, Merck, Pfizer, Jazz, Takeda, Gilead Sciences and Baxter International.

Our revenue consists of three primary elements: royalties from commercialized products, sales of Captisol material, and contract revenue from license, milestone and other service payments. We selectively pursue acquisitions and drug development funding opportunities that address high unmet clinical needs to bring in new assets, pipelines, and technologies to aid in generating additional potential new revenue streams.

OmniAb Separation and Spin-Off

On March 23, 2022, we entered into an Agreement and Plan of Merger (the Merger Agreement), by and among our company, Avista Public Acquisition Corp. II (New OmniAb) and OmniAb, Inc., a Delaware corporation and then wholly-owned subsidiary of our company (OmniAb), and Orwell Merger Sub Inc. (Merger Sub), pursuant to which New OmniAb combined with OmniAb, our then-antibody discovery business (the OmniAb Business), in a Reverse Morris Trust transaction. Pursuant to a Separation and Distribution Agreement, dated as of March 23, 2022, among New OmniAb, our company and OmniAb (the Separation Agreement), we transferred the OmniAb Business, including certain of our related subsidiaries, to OmniAb and, in connection therewith, distributed (the Distribution) to Ligand stockholders 100% of the common stock of OmniAb. Immediately following the Distribution, in accordance with and subject to the terms and conditions of the Merger Agreement, Merger Sub merged with and into OmniAb (the Merger), with OmniAb continuing as the surviving company in the Merger and as a wholly-owned subsidiary of New OmniAb.

Technologies

Through a combination of research and acquisitions, we have created a partnered portfolio with a wide variety of underlying technologies. This diversification provides the added benefits of exposure to a wider variety of science, more licensing opportunities and lower impact of individual patent expiry.

Captisol Technology

Captisol is a patent-protected, chemically modified cyclodextrin with a structure designed to optimize the solubility and stability of drugs. This unique technology has enabled several FDA-approved products, including Gilead’s Veklury, Amgen’s Kyprolis, Baxter International’s Nexterone, Acrotech Biopharma’s and CASI Pharmaceuticals’ Evomela, Melinta Therapeutics’ Baxdela and Sage Therapeutics’ Zulresso. There are many Captisol-enabled products currently in various stages of development. We maintain a broad global patent portfolio for Captisol with the latest expiration date in 2035. Other patent applications covering methods of making Captisol, if issued, extend to 2041.

In addition to solid Captisol powder, we offer our partners access to cGMP manufactured aqueous Captisol concentrate. This product offering was established in 2017 to reduce cycle time and increase Captisol production capacity for large volume drug products. We maintain both Type IV and Type V DMFs with the FDA. These DMFs contain manufacturing and safety information relating to Captisol that our licensees can reference when developing Captisol-enabled drugs. We also have active DMFs in Japan, China and Canada. In 2022, commercial products using Captisol made up over half of our total royalty revenue.

2

Pelican Expression Technology™ Platform

The Pelican Expression Technology platform is a robust, validated, cost-effective and scalable platform for recombinant protein production, and is especially well-suited for complex, large-scale protein production. Global manufacturers have demonstrated consistent success with the platform and the technology is currently out-licensed for multiple commercial and development-stage programs. The versatility of the platform has been demonstrated in the production of enzymes, peptides, antibody derivatives and engineered non-natural proteins. Partners seek the platform as it contributes significant value to biopharmaceutical development programs by reducing timelines and costs associated with research and development through commercial manufacturing of therapeutics and vaccines. Given pharmaceutical industry trends toward large molecules with increased structural complexities, the Pelican Expression Technology platform is well positioned to meet these growing needs as one of the most comprehensive and broadly available, commercially validated protein production platform in the industry.

We acquired the Pelican Expression Technology through our acquisition of Pfenex in October 2020. Several of our partners have commercial products and late stage clinical product candidates utilizing Pelican Expression Technology. In 2022, commercial products acquired from the Pfenex acquisition made up over one-third of our total royalty revenue.

HepDirect, LTP, and BEPro Technology Platform

The HepDirect and LTP platforms are our proprietary liver-targeting prodrug technologies that can deliver many different chemical classes of drugs to the liver by using a chemical modification that renders an active pharmaceutical ingredient (API) biologically inactive until cleaved by a liver-specific enzyme. These technologies may improve the efficacy and/or safety of certain drugs and can be applied to marketed or new drug products to treat liver diseases or diseases caused by hemostasis imbalance of circulating molecules controlled by the liver.

The BEPro technology platform is a next generation prodrug technology distinct from HepDirect and LTP prodrug technologies, expanding use to non-liver related diseases. BEPro is specifically applicable to nucleotides and nucleotide analogs for the development of compounds with improved product profiles. Ligand has demonstrated improvements in cell penetration and oral, intravenous and inhaled pharmacokinetics with BEPro-enabled nucleotide analogs.

SUREtechnology Platform (owned by Selexis)

We acquired economic rights to various SUREtechnology Platform programs from Selexis. The SUREtechnology Platform, developed and owned by Selexis, is a novel technology that improves the way that cells are utilized in the development and manufacturing of recombinant proteins and drugs.

Recent Business Updates

Travere Therapeutics recently received FDA accelerated approval for FILSPARI (sparsentan) for the treatment of immunoglobulin A nephropathy (IgAN). FILSPARI is the first and only dual endothelin angiotensin receptor antagonist in development for rare kidney diseases and is the first non-immunosuppressive treatment indicated for IgAN. Travere anticipates a review decision by the EMA on the potential approval for sparsentan for the treatment of IgAN in Europe in the second half of 2023. Additionally, Travere announced that they expect to report top line results from the two-year confirmatory endpoints in the ongoing Phase 3 DUPLEX Study of sparsentan in focal segmental glomerulosclerosis (FSGS) in the second quarter of 2023, with anticipated submission for full approval in the second half of 2023 in both the U.S. and Europe. Travere reported that it ended 2022 with approximately $450 million in cash, cash equivalents and marketable securities, which would be available to support the commercial launch of sparsentan.

Novan announced it has submitted an NDA to the FDA seeking marketing approval for berdazimer gel, 10.3% (SB206) for the topical treatment of molluscum contagiosum (MC). MC is an infection that causes skin lesions and affects approximately six million people in the U.S. annually. Novan anticipates a potential first quarter 2024 approval assuming the filing is accepted by the FDA and standard review timelines.

Verona Pharma announced positive results of its Phase 3 ENHANCE-1 trial evaluating nebulized ensifentrine for the maintenance treatment of COPD. The ENHANCE-1 trial met its primary and key secondary endpoints demonstrating significant improvements in lung function, symptoms and quality of life measures. In addition, ensifentrine substantially reduced the rate and risk of COPD exacerbations. Ensifentrine was well tolerated over 24 and 48 weeks. In 2022, Verona announced that the Phase 3 ENHANCE-2 trial successfully met its primary endpoint and secondary endpoints evaluating lung function and symptoms, and also significantly reduced the rate and risk of COPD exacerbations. Verona plans to file an NDA for inhaled ensifentrine for the maintenance treatment of COPD with the FDA in the first half of 2023.

Viking Therapeutics announced the completion of patient enrollment in its Phase 2b clinical trial of VK2809, a novel liver-selective thyroid hormone receptor beta agonist, in patients with biopsy-confirmed non-alcoholic steatohepatitis (NASH). Viking expects to report data for the study's primary endpoint in the first half of 2023.

3

Palvella Therapeutics announced its initial closing of up to $37.7 million in financing with proceeds to be used to advance the development of QTORIN rapamycin for the treatment of pachyonychia congenita, microcystic lymphatic malformations (MLM), and for the prevention of basal cell carcinomas in Gorlin syndrome. Palvella expects top-line data in mid-2023 from the Phase 3 pivotal study evaluating QTORIN rapamycin in pachyonychia congenita. Palvella is currently enrolling patients in a multicenter Phase 2b clinical study in the U.S. and Europe for the prevention of basal cell carcinomas in patients with Gorlin syndrome, with data expected in the first half of 2023. Additionally, Palvella expects to report data in the first quarter of 2023 from a multicenter Phase 2 study in the U.S. investigating QTORIN rapamycin for the treatment of MLM.

In 2022, Jazz Pharmaceuticals announced FDA approval of Monday/Wednesday/Friday intramuscular dosing of Rylaze (asparaginase erwinia chrysanthemi (recombinant)-rywn) and submission of a supplemental BLA under the Real-time Oncology Review Program seeking approval for IV administration. Jazz also completed the Marketing Authorization Application submission to the EMA for both IV and IM administration, with a potential approval in 2023. Jazz is also advancing the program for potential submission, approval and launch in Japan.

Xi'an Xintong Pharmaceuticals announced pradefovir reached the primary and secondary endpoints in its Phase 3 clinical trial in China for the treatment of chronic hepatitis B. The 48-week statistical analysis showed that pradefovir was comparable to the first-line drug, tenofovir disoproxil fumarate, with a better safety profile. Xi'an Xintong has submitted a pre-NDA conference communication application with China’s National Medical Products Administration (NMPA) and expects to submit an NDA in the first quarter of 2023.

China Resources Double-Crane Pharmaceuticals announced the IND for CX2101A, a small molecule, RNA-dependent RNA polymerase inhibitor of SARS-CoV-2 that utilizes Ligand's proprietary BEPro prodrug technology, was approved by the NMPA for use in clinical trials for the treatment of novel coronavirus pneumonia in China.

Aldeyra announced the submission of an NDA to the FDA for topical ocular reproxalap for the treatment of signs and symptoms of dry eye disease. Reproxalap is a small-molecule modulator of RASP (reactive aldehyde species), which are elevated in ocular and systemic inflammatory disease.

Arcellx initiated a Phase 1 study of ARCL-002 in acute myeloid leukemia and myelodysplastic syndromes. ARCL-002 utilizes the Pelican Expression Technology.

Merck announced the European Medicines Agency has recommended approval of VAXNEUVANCE for active immunization for the prevention of invasive disease, pneumonia and acute otitis media caused by Streptococcus pneumoniae in individuals from 6 weeks to less than 18 years of age. VAXNEUVANCE is a 15-valent pneumococcal vaccine utilizing Ligand’s CRM197 vaccine carrier protein and is currently authorized for use in the European Union for individuals 18 years of age and older and is approved in the United States for individuals 6 weeks of age and older. In July 2022 Merck started a broad Phase 3 program for V116, their investigational 21-valent pneumococcal conjugate vaccine utilizing Ligand’s CRM197 vaccine carrier protein.

Sermonix Pharmaceuticals announced results of its ELAINE 1 Phase 2 study of lasofoxifene vs. fulvestrant in postmenopausal women with locally advanced or metastatic ER+/HER2- breast cancer and an ESR1 mutation. Median progression-free survival was 6.04 months for lasofoxifene vs. 4.04 months for fulvestrant (p=0.138). Objective response rate was 13.2% for lasofoxifene vs. 2.9% for fulvestrant, (p=0.12), with 1 complete response and 4 partial responses in the lasofoxifene arm vs. no complete responses and 1 partial response in the fulvestrant arm. While the study was not powered for statistical significance, all endpoints numerically favored lasofoxifene.

In February 2022, BeiGene, Ltd. announced the launch of KYPROLIS® (carfilzomib) for injection in China for patients with relapsed/refractory (R/R) multiple myeloma. KYPROLIS is licensed to BeiGene in China under a strategic collaboration with Amgen, and was approved in July 2021 by the China National Medical Products Administration (NMPA) in combination with dexamethasone for the treatment of adult patients with R/R multiple myeloma who have received at least two prior therapies, including a proteasome inhibitor and an immunomodulatory agent.

Outlook Therapeutics announced it submitted a BLA to the FDA for ONS-5010, an investigational ophthalmic formulation of bevacizumab for the treatment of wet age-related macular degeneration that, if approved, will be branded as LYTENAVA™ (bevacizumab-vikg).

Corporate and Governance Highlights

We are committed to policies and practices focused on environmental sustainability, positively impacting our social community and maintaining and cultivating good corporate governance. By focusing on such ESG policies and practices, we believe we can affect a meaningful and positive change in our community and maintain our open, collaborative corporate culture. We will continue our proactive shareholder and employee engagement in 2023. See www.ligand.com for information about our ESG policies and practices. The information contained on our website is not intended to be part of this filing.

4

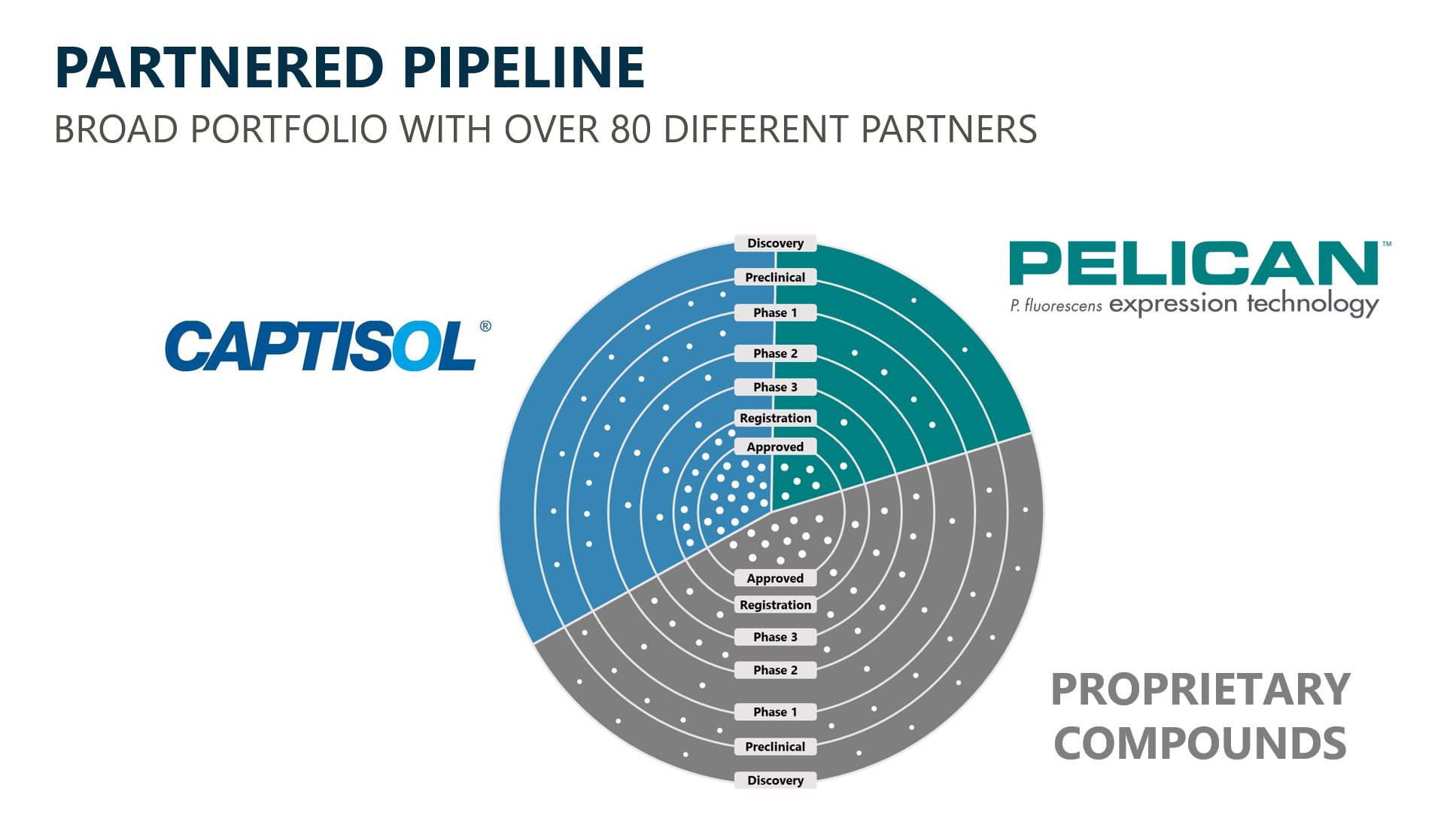

Commercial and Clinical Stage Partnered Portfolio

We have a large portfolio of assets currently generating royalties and future potential revenue-generating programs, including over 100 fully-funded by our partners. Each white dot on our partnered pipeline chart below represents a fully-funded partnered program, with each section of the chart representing a major Ligand technology or platform.

Royalties on Commercial Products

We currently receive royalties on more than ten commercial products. The following table provides an overview of our current portfolio of royalties:

| Product | Partner | Therapeutic Area | Royalty Rate | 2022 Royalty Revenue (in millions) | Estimated 2022 Product Revenue (in millions) | ||||||||||||

| Kyprolis | Amgen/Ono/Beigene | Cancer | 1.5% - 3.0% | $30.1 | $1,275.6 | ||||||||||||

| Teriparatide | Alvogen | Women's Health | 25%-40%¹ | $15.8 | N/A | ||||||||||||

| Evomela | Acrotech/CASI | Cancer | 20% | $10.2 | $51.0 | ||||||||||||

| Rylaze | Jazz | Cancer | Low single digit | $8.8 | $278.7 | ||||||||||||

| Nexterone | Baxter | Cardiovascular | Low single digit | $3.6 | $56.8 | ||||||||||||

| Pneumosil | Serum Institute | Infectious Disease | Low single digit | $2.6 | $114.7 | ||||||||||||

| Vaxneuvance | Merck | Infectious Disease | Low single digit | $1.1 | $159.0 | ||||||||||||

| Other | Various | Various | Various | $0.3 | $18.0 | ||||||||||||

(¹) We receive tiered profit sharing of 25% on quarterly profits less than $3.75 million, 35% on quarterly profits greater than $3.75 million but less than $7.5 million and 40% on quarterly profits greater than $7.5million. If therapeutic equivalence is achieved, quarterly profit changes to 50% of quarterly profits.

5

Portfolio Overview

We have assembled one of the largest portfolios of biopharmaceutical assets in the industry which provides investors the opportunity to participate in the biotech industry while mitigating the clinical binary risk typically associated with the industry. Our portfolio consists of assets which currently generate revenue through royalties on commercial products as well as Captisol sales on commercial products. In addition to these assets, we have a substantial pipeline of development stage assets that currently generate contractual payments through milestone and license fees with future potential for royalties and Captisol material sales for those programs under our Captisol technology.

| Approved | ||||||||

| Partner Name | Program | Therapeutic Area | ||||||

| Acrotech/CASI | Evomela | Cancer | ||||||

| Alvogen/Adalvo | Teriparatide | Women's Health | ||||||

| Alvogen/Hikma/Nanjing King-Friend | Voriconazole | Infectious Disease | ||||||

| Amgen/Beigene/Ono | Kyprolis | Cancer | ||||||

| Aziyo | ECM portfolio | Medical device/Cardiology | ||||||

| Baxter | Nexterone | Cardiovascular | ||||||

| Biocad | Teberif | Inflammatory/Metabolic | ||||||

| Exelixis/Daiichi-Sankyo | Minnebro | Cardiovascular | ||||||

| Gilead | Veklury | Infectious Disease | ||||||

| Jazz | Rylaze | Cancer | ||||||

| Melinta | Baxdela | Infectious Disease | ||||||

| Menarini | Frovatriptan | Central Nervous System | ||||||

| Merck | Noxafil-IV | Infectious Disease | ||||||

| Merck | Vaxneuvance | Infectious Disease | ||||||

| Par | Posaconazole | Infectious Disease | ||||||

| Pfizer | Duavee | Inflammatory/Metabolic | ||||||

| Pfizer | Vfend-IV | Infectious Disease | ||||||

| Sage | Zulresso | Central Nervous System | ||||||

| Sedor/Lupin | Sesquient | Central Nervous System | ||||||

| Serum Institute of India | Pneumosil | Infectious Disease | ||||||

| Zydus Cadila | Vivitra | Cancer | ||||||

| Zydus Cadila | Bryxta/ZyBev | Cancer | ||||||

| Zydus Cadila | Maropitant | Central Nervous System | ||||||

| Zydus Cadila | Exemptia | Inflammatory/Metabolic | ||||||

| Zydus Cadila | Vortuxi | Inflammatory/Metabolic | ||||||

| Phase 3/Pivotal or Regulatory Submission Stage | ||||||||

| Partner Name | Program | Therapeutic Area | ||||||

| Aldeyra | Reproxalap | Other/Undisclosed | ||||||

| BendaRx | Bendamustine | Oncology | ||||||

| Cantex | CX-01 | Oncology | ||||||

| Eisai | FYCOMPA | Central Nervous System | ||||||

| Escape Bio | S1P5 agonist | TBD | ||||||

| Marinus | Ganaxalone IV | Central Nervous System | ||||||

6

| Meridian | ML-141 | Oncology | ||||||

| Merck | V116 | Pneuococcal adult | ||||||

| Novan | SB206 | Infectious Disease | ||||||

| Novartis | Mekinist (CE-Trametinib) | Cancer | ||||||

| Opthea | OPT-302 | Ophthalmology | ||||||

| Outlook Therapeutics | ONS-5010 | Other/Undisclosed | ||||||

| Palvella | PTX-022 | Other/Undisclosed | ||||||

| Serum Institute | CRM197 | Infectious Disease | ||||||

| SQ Innovation | CE-Furosemide | Cardiovascular disease | ||||||

| Sunshine Lake | Vilazodone | Central Nervous System | ||||||

| Travere | Sparsentan | Severe and Rare | ||||||

| Verona | Ensifentrine (RPL554) | Respiratory Disease | ||||||

| Various | Teriparatide | Women's Health | ||||||

| Xi'an Xintong | Pradefovir | Infectious Disease | ||||||

| Phase 2 | ||||||||

| Partner Name | Program | Therapeutic Area | ||||||

| Acrivon | ACR-368 | Cancer | ||||||

| Corvus | Ciforadenant | Cancer | ||||||

| DeNovo | Lisfensine | Neurology | ||||||

| Merck | V116 | Infectious Disease | ||||||

| Oncternal | Cirmtuzumab | Cancer | ||||||

| Phoenix Tissue | PTR-01 | Genetic Disease | ||||||

| Seelos | Aplindore | Central Nervous System | ||||||

| Sermonix | Lasofoxifene | Cancer | ||||||

| Ohara Pharmaceuticals | JPH-203 | Cancer | ||||||

| Verona | Ensifentrine | Asthma | ||||||

| Verona | Ensifentrine | Cystic Fibrosis | ||||||

| Viking | VK5211 | Inflammatory/Metabolic | ||||||

| Viking | VK2809 | Inflammatory/Metabolic | ||||||

| Xi'an Xintong | MB07133 | Cancer | ||||||

| Phase 1 | ||||||||

| Partner Name | Program | Therapeutic Area | ||||||

| Apotex | Meloxicam | Migraine | ||||||

| China Resources Double Crane | CX2101A | COVID 19 | ||||||

| CSL | CSL-324 | Immunology | ||||||

| Foghorn | FHD-609/BRD9 | Cancer | ||||||

| Jazz | JZP-341 | Long Acting Erwinia Asparaginase | ||||||

| MEI Pharma | ME-344 | Cancer | ||||||

| Merck | V117 | Pneumococcal | ||||||

| Novartis | MIK-665 | Cancer | ||||||

| Novartis | BCL-201 | Cancer | ||||||

7

| Nucorion | NUC-1010 | Infectious disease | ||||||

| Revision Therapeutics | Rev0100 | Ophthalmology | ||||||

| Sage | SAGE-689 | Central Nervous System | ||||||

| Takeda | TAK-925 | Severe and Rare | ||||||

| Takeda | TAK-243 | Cancer | ||||||

| Vaxxas | Nanopatch | Infectious Disease | ||||||

| Viking | VK-0214 | Genetic Disease | ||||||

| Jupiter Biomed | Viright | Cancer | ||||||

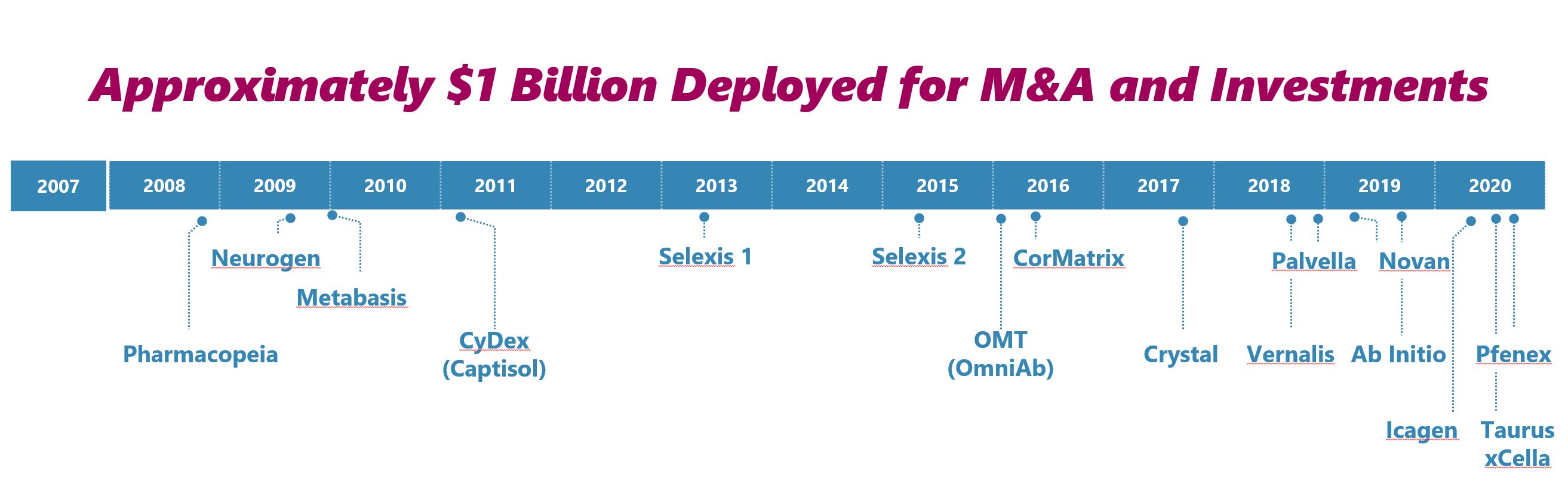

Acquisitions

We are a company devoted to identifying cutting-edge science and have exhibited a track record of capital deployment to create a high growth business model that operates with an efficient and low corporate cost structure. Over the last 15 years we have deployed approximately $1 billion of capital to build our portfolio. Following the spin-off of our OmniAb antibody discovery business, our strategy is to continue to expand our pipeline by acquiring additional revenue streams on both early and late stage drug product candidates from third parties, as well as acquiring commercial stage drugs for sale. Expanding our pipeline through these acquisitions can allow for further diversification across therapeutic areas and development stages. The following is a timeline of acquisitions we've completed over the last 15 years:

Selected Commercial Programs

The following programs represent important revenue-generating components of our current portfolio. For information about the royalties owed to us for these programs, see “Royalties” later in this business section.

Kyprolis (Amgen, Ono, BeiGene)

We supply Captisol to Amgen for use with Kyprolis (carfilzomib), and granted Amgen an exclusive product-specific license under our patent rights with respect to Captisol. Kyprolis is formulated with Ligand’s Captisol technology and is approved in the United States for the following:

•In combination with dexamethasone, lenalidomide plus dexamethasone, daratumumab plus dexamethasone, or daratumumab and hyaluronidase-fihj and dexamethasone, or isatuximab and dexamethasone for the treatment of patients with relapsed or refractory multiple myeloma who have received one to three lines of therapy.

•As a single agent for the treatment of patients with relapsed or refractory multiple myeloma who have received one or more lines of therapy.

Our agreement with Amgen may be terminated by either party in the event of material breach or bankruptcy, or unilaterally by Amgen with prior written notice, subject to certain surviving obligations. Absent early termination, the agreement will terminate upon expiration of the obligation to pay royalties. Under this agreement, we are entitled to receive revenue from clinical and commercial Captisol material sales and royalties on annual net sales of Kyprolis based on our patents and applications relating to the Captisol component of Kyprolis which are not expected to expire until 2033.

8

Teriparatide Injection Product (PF708) (Alvogen/Adalvo)

We acquired the Teriparatide Injection product with the acquisition of Pfenex in October 2020. Teriparatide Injection is a drug indicated for uses including the treatment of osteoporosis in certain patients at high risk for fracture. Teriparatide Injection was developed using our Pelican Expression Technology™ and was approved by the FDA in 2019 in accordance with the 505(b)(2) regulatory pathway, with FORTEO as the reference product. Our commercialization partner, Alvogen launched the product in June 2020 in the United States.

Our partner Alvogen has exclusively licensed the rights to commercialize and manufacture the Teriparatide Injection product in the United States, while Adalvo has the rights to commercialize in the EU, certain countries in the Middle East and North Africa (MENA), and the rest of world (ROW) territories (the latter defined as all countries outside of the EU, U.S. and MENA, excluding Mainland China, Hong Kong, Singapore, Malaysia and Thailand). In August 2020, marketing authorizationb throughout the EU was received under the trade name Livogiva and in December 2020 in Saudi Arabia under the name Bonteo. In December of 2022, we terminated a license agreement with Beijing Kangchen Biological Technology Co., Ltd. (Kangchen) thereby regaining the right to commercialize PF708 in Mainland China, Hong Kong, Singapore, Malaysia and Thailand along with a non-exclusive right to conduct development activities in such countries with respect to PF708.

In accordance with our agreements with Alvogen, we are eligible to receive tiered gross profit sharing of between 25% and 40% of quarterly profits prior to an “A” therapeutic equivalence designation, which increases to a flat 50% if an “A” rating is achieved.

In accordance with our EU, MENA and ROW agreements with Adalvo, we may be eligible to receive additional upfront and milestone payments of $1.5 million and may also be eligible to receive up to 60% of gross profit derived from product sales and regional license fees, if approved, depending on geography, cost of goods sold and sublicense fees.

Evomela (Acrotech and CASI)

We supply Captisol to, and receive royalties from, Acrotech Biopharma for sales of Evomela in the U.S., and CASI Pharmaceuticals for sales in China. Evomela received market approval by the NMPA in August of 2019. It is the only approved and commercially available melphalan product in China. Evomela is a Captisol-enabled melphalan IV formulation which is approved by the FDA for use in two indications:

•a high-dose conditioning treatment prior to autologous stem cell transplantation (ASCT) in patients with multiple myeloma; and

•for the palliative treatment of patients with multiple myeloma for whom oral therapy is not appropriate.

Evomela has been granted Orphan Designation by the FDA for use as a high-dose conditioning regimen for patients with multiple myeloma undergoing ASCT. The Evomela formulation avoids the use of propylene glycol, which has been reported to cause renal and cardiac side-effects that limit the ability to deliver higher quantities of therapeutic compounds. The use of the Captisol technology to reformulate melphalan is anticipated to allow for longer administration durations and slower infusion rates, potentially enabling clinicians to safely achieve a higher dose intensity of pre-transplant chemotherapy.

Under the terms of the license agreement, Acrotech Biopharma has marketing rights worldwide excluding China and CASI Pharmaceuticals has rights to market in China. We are eligible to receive over $50 million in potential milestone payments under this agreement, royalties on global net sales of the Captisol-enabled melphalan product and revenue from Captisol material sales. Acrotech and CASI’s obligation to pay royalties will expire at the end of the life of the relevant patents or when a competing product is launched, whichever is earlier, but in no event before ten years after the commercial launch. Our patents and applications relating to the Captisol component of melphalan are not expected to expire until 2033. As described herein, we have entered into a settlement agreement with Teva and Acrotech Biopharma (the holder of the NDA for Evomela) which will allow Teva to market a generic version of Evomela in the United States in 2026, or earlier under certain circumstances. Absent early termination, the agreement will terminate upon expiration of the obligation to pay royalties. The agreement may be terminated by either party for an uncured material breach or unilaterally by Acrotech and CASI by prior written notice.

Vaxneuvance (Merck)

Vaxneuvance, a 15-valent pneumococcal conjugate vaccine, also known as V114, was approved in the U.S. in July of 2021 for the prevention of invasive disease caused by Streptococcus pneumoniae serotypes 1, 3, 4, 5, 6A, 6B, 7F, 9V, 14, 18C, 19A, 19F, 22F, 23F and 33F in adults 18 years of age and older, and subsequently in children 6 weeks through 17 years of age in June of 2022. Vaxneuvance was also approved in Europe in October 2022 for the prevention of invasive disease and pneumonia caused by Streptococcus pneumoniae in individuals 18 years and older and in infants, children and adolescents from 6 weeks to less than 18 years of age. VAXNEUVANCE utilizes CRM197 vaccine carrier protein, which is produced using the patent-protected Pelican Expression Technology™ platform. We are entitled to low single digit royalties derived from net sales

9

of Vaxneuvance.

Pneumosil (Serum Institute of India, SII)

SII began commercialization of its 10-valent pneumococcal conjugate vaccine, Pneumosil, which is produced using CRM197 made in the Pelican Expression Technology platform, in the second quarter of 2020. Pneumosil is designed primarily to help fight against pneumococcal pneumonia among children, with an advantage of targeting the most prevalent serotypes of the bacterium causing serious illness in developing countries. Pneumosil achieved WHO Prequalification in December 2019, allowing the product to be procured by United Nations agencies and Gavi, the Vaccine Alliance, and subsequently achieved Indian Marketing Authorization in July 2020, and SII announced commercial launch of the product in India in December 2020.

Rylaze (Jazz Pharmaceuticals)

In July 2021, Jazz announced the US launch of Rylaze (asparaginase erwinia chrysanthemi (recombinant)-rywn), previously referred to as JZP458. Rylaze, which was approved by the FDA in June 2021, is a recombinant erwinia asparaginase used as a component of a multi-agent chemotherapeutic regimen for the treatment of acute lymphoblastic leukemia (ALL) or lymphoblastic lymphoma (LBL) in adult and pediatric patients one month or older who have developed hypersensitivity to E. coli-derived asparaginase. Additionally, Jazz is utilizing our technology for the development of PF745 (JZP341), a long-acting Erwinia asparaginase for the treatment of ALL and other hematological malignancies. Jazz has worldwide rights to develop and commercialize PF745.

Ligand is eligible to receive up to $155.5 million in milestone payments and tiered low to mid-single digit royalties based on worldwide net sales of any products resulting from this collaboration, including Rylaze.

Nexterone (Baxter)

We have a license agreement with Baxter, related to Baxter's Nexterone, a Captisol-enabled formulation of amiodarone, which is marketed in the United States and Canada. We supply Captisol to Baxter for use in accordance with the terms of the license agreement under a separate supply agreement. Under the terms of the license agreement, we will continue to earn milestone payments, royalties, and revenue from Captisol material sales. We earn royalties on net sales of Nexterone through early 2033.

Veklury (Gilead)

We supply Captisol to Gilead for sales of Veklury (remdesivir). Gilead received marketing approval from the FDA in October 2020. Veklury is an antiviral treatment of COVID-19 that is FDA approved. The product has regulatory approvals for the treatment of moderate or severe COVID-19 in over 70 countries. We are supplying Captisol to Gilead under a 10-year supply agreement. We are also supplying Captisol to Gilead’s voluntary licensing generic partners who are manufacturing remdesivir for 127 low- and middle-income countries. We receive our commercial compensation for this program through the sale of Captisol.

Zulresso (Sage)

We have a license agreement with Sage, related to Sage''s Zulresso, a Captisol-enabled formulation of brexanolone for the treatment of postpartum depression (PPD). Under the terms of the agreement, we receive royalties and revenue from Captisol material sales.

Noxafil-IV (Merck)

We have a supply agreement with Merck related to Merck’s NOXAFIL-IV, a Captisol-enabled formulation of posaconazole for IV use. NOXAFIL-IV is marketed in the United States, EU, Japan and Canada. We receive our commercial compensation for this program through the sale of Captisol.

Duavee or Duavive (Pfizer)

Pfizer is responsible for the marketing of bazedoxifene, a synthetic drug specifically designed to reduce the risk of osteoporotic fractures while also protecting uterine tissue. Pfizer has combined bazedoxifene with the active ingredient in Premarin to create a combination therapy for the treatment of post-menopausal symptoms in women. Pfizer is marketing the combination treatment under the brand names Duavee and Duavive in various territories. Net royalties on annual net sales of Duavee/Duavive are payable to us through the life of the relevant patent or ten years from the first commercial sale, whichever is longer, on a country by country basis.

Exemptia, Vivitra, Bryxta and Zybev (Zydus Cadila)

Zydus Cadila’s Exemptia (adalimumab biosimilar) is marketed in India for autoimmune diseases. Zydus Cadila uses the Selexis technology platform for Exemptia. We earn royalties on sales by Zydus Cadila for ten years following approval.

10

Zydus Cadila’s Vivitra (trastuzumab biosimilar) is marketed in India for breast cancer. Zydus Cadila uses the Selexis technology platform for Vivitra. We are entitled to earn royalties on sales by Zydus Cadila for ten years following approval.

Zydus Cadila’s Bryxta and Zybev (bevacizumab biosimilar) is marketed in India for various indications. Zydus Cadila uses the Selexis technology platform for Bryxta and Zybev. We earn royalties on sales by Zydus Cadila for ten years following approval.

Summary of Selected Development Stage Programs

We have multiple fully-funded partnered programs that are either in or nearing the regulatory approval process, or given the area of research or value of the license terms, we consider particularly noteworthy. We are eligible to receive milestone payments and royalties on these programs. This list does not include all of our partnered programs. In the case of Captisol-related programs, we are also eligible to receive revenue for the sale of Captisol material supply. The following table represents development stage assets with disclosed royalties:

| Development stage assets with disclosed royalties | ||||||||

| Program | Licensee | Royalty Rate | ||||||

| CE-Fosphenytoin | Sedor | 11% | ||||||

| CE-Meloxicam | Sedor | 8.0% - 10.0% | ||||||

| Ciforadenant | Corvus | Mid-single digit to low-teen royalty | ||||||

| DGAT-1 | Viking | 3.0% - 7.0% | ||||||

| Ensifentrine (RPL554) | Verona | Low to mid-single digit royalty | ||||||

| FBPase Inhibitor (VK0612) | Viking | 7.5% - 9.5% | ||||||

| Lasofoxifene | Sermonix | 6.0% - 10.0% | ||||||

| MB07133 | Xi'an Xintong | 6% | ||||||

| ME-344 | MEI Pharma | Low single digit royalty | ||||||

| Oral EPO | Viking | 4.5% - 8.5% | ||||||

| Pradefovir | Xi'an Xintong | 9% | ||||||

| PTX-022 | Palvella | 5.0% - 9.8% | ||||||

| SARM (VK5211) | Viking | 7.25% - 9.25% | ||||||

| SB206 | Novan | 7.0% - 10.0% | ||||||

| Sparsentan | Travere | 9% | ||||||

| TR Beta (VK2809 and VK0214) | Viking | 3.5% - 7.5% | ||||||

| Various | Nucorion | 4.0% - 9.0% | ||||||

| Various | Seelos | 4.0% - 10.0% | ||||||

Sparsentan (Travere)

In early 2012, Ligand licensed the world-wide rights to sparsentan to Travere Therapeutics. Travere recently received FDA accelerated approval for FILSPARI (sparsentan) for the treatment of immunoglobulin A nephropathy (IgAN). FILSPARI is the first and only dual endothelin angiotensin receptor antagonist in development for rare kidney diseases and is the first non-immunosuppressive treatment indicated for IgAN. Travere anticipates a review decision by the EMA on the potential approval for sparsentan for the treatment of IgAN in Europe in the second half of 2023. Additionally, Travere announced that they expect to report top line results from the two-year confirmatory endpoints in the ongoing Phase 3 DUPLEX Study of sparsentan in focal segmental glomerulosclerosis (FSGS) in the second quarter of 2023, with anticipated submission for full approval in the second half of 2023 in both the U.S. and Europe.

Under our license agreement with Travere, we are entitled to receive over $66 million in potential milestone payments, as well as 9% in royalties on any future worldwide sales.

TR-Beta - VK2809 and VK0214 (Viking)

Our partner, Viking, is developing VK2809, a novel selective thyroid hormone receptor beta (TR-beta) agonist with potential in multiple indications, including hypercholesterolemia, dyslipidemia and NASH. VK2809 is currently in a Phase 2b clinical trial (the VOYAGE study) in patients with biopsy-confirmed NASH. VK0214, another novel, orally available, TR-beta

11

agonist, is in development for the potential treatment of X-linked adrenoleukodystrophy (X-ALD). VK0214 is currently being evaluated in a Phase 1b clinical trial in patients with the adrenomyeloneuropathy (AMN) form of X-ALD. Under the terms of the agreement with Viking, we may be entitled to up to $375 million of development, regulatory and commercial milestones and tiered royalties on potential future sales. Our TR Beta programs partnered with Viking are subject to CVR sharing and a portion of the cash received will be paid out to CVR holders.

CRM197

CRM197 is a non-toxic mutant of diphtheria toxin. It is a well characterized protein and functions as a carrier for polysaccharides and haptens, making them immunogenic. CRM197 is used in prophylactic and therapeutic vaccine candidates. We have developed CRM197 production strains using our Protein Expression Technology platform and supply preclinical grade and cGMP CRM197 (PeliCRM™) to several vaccine development focused pharmaceutical customers.

Our partners Merck and SII have exclusively licensed unique production strains for use in their conjugate vaccine products and candidates for pneumococcal and meningitis bacterial infections. Pneumococcus bacterium (Streptococcus pneumoniae) is a leading cause of severe pneumonia and major cause of morbidity and mortality worldwide. In accordance with our CRM197 commercial license agreements with Merck, we are eligible to earn an additional $8 million in development and regulatory milestones and low single digit royalties derived from net sales, depending on territory. CRM-197 made in the Pelican Expression Technology platform is also used by Merck in its investigational vaccine candidates, including V116, a 21-valent pneumococcal conjugate vaccine currently in Phase 3 clinical trials.

Ensifentrine – RPL554 (Verona)

Ensifentrine is a first-in-class, selective dual inhibitor of phosphodiesterase 3 and 4 enzymes combining bronchodilator and non-steroidal anti-inflammatory activities in one compound. Ligand obtained the rights to ensifentrine in 2018 in the acquisition of Vernalis. Our partner, Verona Pharma, recently completed the Phase 3 ENHANCE-21 and ENHANCE-12 trials evaluating nebulized ensifentrine for the maintenance treatment of chronic obstructive pulmonary disease (COPD) and plans to file a NDA with the US FDA in the first half of 2023. Under the terms of our agreement with Verona, we are entitled to development and regulatory milestones, including a £5.0 million payment upon the first approval by any regulatory authority, and royalties on potential future sales.

SARM - VK5211 (Viking)

Viking is also developing VK5211, a novel SARM for patients recovering from hip-fracture. SARMs retain the beneficial properties of androgens without undesired side-effects of steroids or other less selective androgens. In a Phase 2 clinical trial, VK5211 demonstrated statistically significant, dose dependent increases in lean body mass. Under the terms of the agreement with Viking, we may be entitled to up to $270 million of development, regulatory and commercial milestones as well as tiered royalties on potential future sales.

Ganaxalone IV (Marinus)

Our partner, Marinus, is conducting Phase 3 clinical trials with Captisol-enabled ganaxolone IV in patients with refractory status epilepticus. Marinus has exclusive worldwide rights to Captisol-enabled ganaxolone, a GABAA receptor modulator, for use in humans. We are entitled to development and regulatory milestones, revenue from Captisol material sales, and royalties on potential future sales.

Ciforadenant – CPI-444 (Corvus)

Our partner, Corvus, is conducting a Phase 1b/2 clinical trial evaluating ciforadenant as a potential first line therapy for metastatic renal cell cancer (RCC) in combination with ipilimumab (anti-CTLA-4) and nivolumab (anti-PD-1). The Phase 1b/2 study is being conducted by the Kidney Cancer Research Consortium (KCRC) and is led by The University of Texas MD Anderson Cancer Center. Under the terms of our agreement with Corvus, we are entitled to development and regulatory milestones and tiered royalties on potential future sales. The aggregate potential milestone payments from Corvus are approximately $220 million for all indications.

FYCOMPA IV (Eisai)

Our partner, Eisai, is developing an intravenous Fycompa® (perampanel), formulated with Captisol, as a substitute in Japan for oral tablets as an adjunctive therapy in patients with partial onset seizures (including secondarily generalized seizures) or primary generalized tonic-clonic seizures. In August of 2022, Eisai announced it had filed a supplementary NDA in Japan for Fycompa IV seeking approval for the injection formulation as a new route of administration. We are entitled to revenue from Captisol material sales and tiered royalties on potential future sales.

12

SB206 (Novan)

We acquired certain economic rights to berdazimer gel, 10.3% (SB206) from Novan in May 2019. Berdazimer gel is a topical nitric-oxide antiviral gel for the treatment of viral skin infections, including molluscum contagiosum (MC). MC is an infection which causes skin lesions that affect approximately 6 million people in the United States annually, with the greatest incidence in children aged one to 14 years. Under a development funding and royalties agreement with Novan for berdazimer gel, Ligand is entitled to receive up to $20 million of milestone payments and tiered royalties of 7% to 10% on future worldwide sales of berdazimer gel.

PTX-022 (Palvella)

We acquired the economic rights to QTORIN™ 3.9% rapamycin anhydrous gel (QTORIN™ rapamycin, formerly PTX-022) from Palvella in December 2018. QTORIN™ rapamycin is a novel, topical formulation comprising high-strength rapamycin in development for the treatment of Pachyonychia Congenita (PC), treatment of Microcystic Lymphatic Malformations (Microcystic LM), and for the prevention of Basal Cell Carcinomas (BCCs) in Gorlin Syndrome (GS). Palvella expects to report top-line results of the Phase 3 VAPAUS study in PC in mid-2023.

Lasofoxifene (Sermonix)

Lasofoxifene is a selective estrogen receptor modulator for osteoporosis treatment and other diseases, discovered through the research collaboration between Pfizer and us. Our partner, Sermonix has a license for the development of oral lasofoxifene for the United States and additional territories and is currently developing lasofoxifene as a treatment for ESR1-mutated metastatic breast cancer. Under the terms of the agreement, we are entitled to receive over $45 million in potential regulatory and commercial milestone payments as well as royalties on potential future net sales.

Pradefovir (Xi'an Xintong)

Our Chinese licensee, Xi'an Xintong Medicine Research (following its acquisition of Chiva Pharmaceuticals), is developing pradefovir, an oral liver-targeting prodrug of the HBV DNA polymerase/reverse transcriptase inhibitor adefovir, for the potential treatment of HBV infection. Pradefovir was developed using Ligand’s HepDirect technology. Xi'an Xintong recently completed a Phase 3 HBV trial. We are entitled to an annual licensing maintenance fee and royalties on potential future sales.

MB07133 (Xi'an Xintong)

Chinese licensee Xi'an Xintong Medicine Research is also developing MB07133, a liver specific, HepDirect prodrug of cytarabine monophosphate, for the potential treatment of hepatocellular carcinoma and intrahepatic cholangiocarcinoma. MB07133 is currently in Phase 1 in China. We are entitled to an annual licensing maintenance fee and royalties on potential future sales.

CX2101A (China Resources Double-Crane Pharmaceutical)

In October of 2021, Ligand signed a collaboration agreement granting China Resources Double-Crane Pharmaceutical Co., Ltd. (CRDC) exclusive Asia territorial rights to develop a novel investigational oral COVID-19 antiviral therapeutic compound using Ligand’s BEPro technology. Ligand received an upfront payment in respect of the collaboration, and clinical and regulatory milestone payments, and tiered royalties on net sales. CRDC will be responsible for all costs related to the program. BEPro is a proprietary prodrug technology that is specifically applicable to nucleotides and nucleotide analogs for the development of compounds with improved product profiles. In December of 2022, CRDC announced that the IND for CX2101A received a "Notice of Drug Clinical Trial Approval" issued by the State Drug Administration (NMPA), approving clinical trials of the drug for the treatment of novel coronavirus pneumonia in China. CX2101A is a small molecule compound that acts on RdRp (RNA-dependent RNA polymerase) of SARS-CoV-2, using the BEPro prodrug technology. CRDC is conducting a Phase 1 trial in China.

ONS-5010 (Outlook Therapeutics)

Outlook Therapeutics announced in October of 2022 that the US FDA has accepted for filing a BLA for ONS-5010 / LYTENAVA™ (bevacizumab-vikg), an investigational ophthalmic formulation of bevacizumab for the treatment of wet age-related macular degeneration (wet AMD). Outlook uses the Selexis technology platform for ONS-5010. The FDA set a PDUFA goal date of August 29, 2023 for the BLA. ONS-5010, if approved, is expected to receive 12 years of regulatory exclusivity in the United States. In December of 2022, Outlook announced the validation of its MAA by the EMA for ONS-5010. The decision for potential approval is expected from the European Commission in early 2024. We are entitled to earn royalties on sales of ONS-5010 by Outlook.

Milestone Payments

13

Our programs under license with our partners may generate milestone payments to us if our partners reach certain development, regulatory and commercial milestones. The following table represents the maximum value of our milestone payment pipeline by technology, development stage and partner (in thousands):

| Technology* | Stage* | Partner* | |||||||||||||||||||||

| Pelican | >$215,000 | Preclinical | > $1,000 | Viking | $1,500,000 | ||||||||||||||||||

| Captisol | > $170,000 | Clinical | > $120,000 | Jazz | $150,000 | ||||||||||||||||||

| LTP/Hep Direct/BEPro | > $310,000 | Regulatory | > $1,200,000 | Seelos | $100,000 | ||||||||||||||||||

| NCE/Other | > $1,850,000 | Commercial | > $1,250,000 | Travere | $70,000 | ||||||||||||||||||

| Total | >$2,500,000 | Total | >$2,500,000 | Other | >$750,000 | ||||||||||||||||||

| Total | >$2,500,000 | ||||||||||||||||||||||

*All tables exclude any annual access fees and collaboration revenue for development work.

Summary of selected programs available for license

We have a number of unpartnered programs focused on a wide-range of potential indications or disease eligible for further development or licensing:

| Program | Development Stage | Targeted Indication or Disease | ||||||||||||

| CE-Iohexol | Phase 2 | Diagnostics | ||||||||||||

| Luminespib/Hsp90 Inhibitor | Phase 2 | Oncology | ||||||||||||

| CE-Sertraline, Oral Concentrate | Phase 1 | Depression | ||||||||||||

| PF530 Interferon Beta | Phase 1 | Immunomodulatory | ||||||||||||

| PF582 Ranibizumab | Phase 1 | Ocular | ||||||||||||

| CCR1 Antagonist | Preclinical | Oncology | ||||||||||||

| CE-Busulfan | Preclinical | Oncology | ||||||||||||

| CE-Cetirizine Injection | Preclinical | Allergy | ||||||||||||

| CE-Silymarin for Topical formulation | Preclinical | Sun damage | ||||||||||||

| FLT3 Kinase Inhibitors | Preclinical | Oncology | ||||||||||||

| GCSF Receptor Agonist | Preclinical | Blood disorders | ||||||||||||

| PF529 Pegfilgrastim | Preclinical | Oncology | ||||||||||||

| PF810 Recombinant Peptide | Preclinical | Endocrine System | ||||||||||||

Manufacturing

We contract with a third party manufacturer, Hovione, for Captisol production. Hovione operates FDA-inspected sites in the United States, Macau, Ireland and Portugal. Manufacturing operations for Captisol are performed primarily at Hovione's Portugal and Ireland facilities. We believe we maintain adequate inventory of Captisol to meet our current partner needs and that our Captisol capacity will be sufficient to meet future partner needs.

In the event of a Captisol supply interruption, we are permitted to designate and, with Hovione’s assistance, qualify one or more alternate suppliers. If the supply interruption continues beyond a designated period, we may terminate the agreement. In addition, if Hovione cannot supply our requirements of Captisol due to an uncured force majeure event, we may also obtain Captisol from a third party and have previously identified such parties.

The current term of the agreement with Hovione is through December 2024. The agreement will automatically renew for successive two year renewal terms unless either party gives written notice of its intention to terminate the agreement no less than two years prior to the expiration of the initial term or renewal term. In addition, either party may terminate the agreement for the uncured material breach or bankruptcy of the other party or an extended force majeure event. We may terminate the agreement for extended supply interruption, regulatory action related to Captisol or other specified events. We have ongoing minimum purchase commitments under the agreement.

14

Competition

Some of the drugs we and our licensees and partners are developing may compete with existing therapies or other drugs in development by other companies. Furthermore, academic institutions, government agencies and other public and private organizations conducting research may seek patent protection with respect to potentially competing products or technologies and may establish collaborative arrangements with our competitors.

Our Captisol business may face competition from other suppliers of similar cyclodextrin excipients or other technologies that are aimed to increase solubility or stability of APIs.

Our competitive position also depends upon our ability to obtain patent protection or otherwise develop proprietary products or processes. For a discussion of the risks associated with competition, see below under “Item 1A. Risk Factors.”

Environmental, Health and Safety (EHS)

We are committed to providing a safe and healthy workplace, promoting environmental excellence in our communities, and complying with all relevant regulations and industry standards. We establish and monitor programs to reduce pollution, prevent injuries, and maintain compliance with applicable regulations. By focusing on such practices, we believe we can affect a meaningful, positive change in our community and maintain a healthy and safe environment. During 2022, we made good progress on our ESG efforts. We have initiated a $2.5 million solar investment at Kansas University Innovation Park; modified the Captisol manufacturing process resulting in water savings and packaging reduction; made ESG related charitable donations; and commenced numerous initiatives from our ESG-focused outreach committees. We expect to continue our effort and to refine our EHS policies and practices in 2023. More information on our EHS policies and initiatives is available on our website at www.ligand.com. The information contained on our website is not intended to be part of this filing.

Government Regulation

The research and development, manufacturing and marketing of pharmaceutical products are subject to regulation by numerous governmental authorities in the United States and other countries. We and our partners, depending on specific activities performed, are subject to these regulations. In the United States, pharmaceuticals are subject to regulation by both federal and various state authorities, including the FDA. The Federal Food, Drug and Cosmetic Act and the Public Health Service Act govern the testing, manufacture, safety, efficacy, labeling, storage, record keeping, approval, advertising and promotion of pharmaceutical products. These activities are subject to additional regulations that apply at the state level. There are similar regulations in other countries as well. For both currently marketed products and products in development, failure to comply with applicable regulatory requirements can, among other things, result in delays, the suspension of regulatory approvals, as well as possible civil and criminal sanctions. In addition, changes in existing regulations could have a material adverse effect on us or our partners. For a discussion of the risks associated with government regulations, see below under “Item 1A. Risk Factors.”

Patents and Proprietary Rights

We believe that patents and other proprietary rights are important to our business. Our policy is to file patent applications to protect technology, inventions and improvements to our inventions that are considered important to the development of our business. We also rely upon trade secrets, know-how, continuing technological innovations and licensing opportunities to develop and maintain our competitive position.

Patents are issued or pending for the following key products or product families. The scope and type of patent protection provided by each patent family is defined by the claims in the various patents. Patent term may vary by jurisdiction and depend on a number of factors including potential patent term adjustments, patent term extensions, and terminal disclaimers. For each product or product family, the patents and/or applications referred to are in force in at least the United States, and for most products and product families, the patents and/or applications are also in force in European jurisdictions, Japan and other jurisdictions.

Captisol

Patents and pending patent applications covering Captisol and methods of making Captisol are owned by us. The patents covering the Captisol product with the latest expiration date is set to be in 2033 (see, e.g., U.S. Patent No. 9,493,582 (expires Feb. 27, 2033)). Other patent applications covering methods of making Captisol, if issued, potentially have terms to 2041. We have asserted U.S. Patents 8,410,077, 9,200,088, and 9,493,582 against Teva in connection with their attempt to obtain FDA approval to manufacture and sell a generic version of Evomela®. We also own several patents and pending patent applications covering drug products containing Captisol as a component. Globally, we own approximately 390 issued patents covering all of the foregoing Captisol compositions, methods and related technology.

Ten Captisol patents in several families are listed in the Orange Book in connection with one or more prescription drugs currently on the market. These Captisol-enabled drugs include Nexterone (Baxter), Kyprolis (Amgen), Noxafil (Merck),

15

Evomela (Acrotech/CASI), Baxdela (Melinta) and Zulresso (Sage). These patents are listed in the table below, and each patent family containing these patents has pending and/or granted counterparts in Europe, China and Japan.

Orange Book-listed Captisol Patents | |||||||||||

Country | Patent No. | Title | Expiration (nominal) ‡ | ||||||||

United States | 7635773 | Sulfoalkyl Ether Cyclodextrin Compositions | 03/13/2029 | ||||||||

United States | 8410077 | Sulfoalkyl Ether Cyclodextrin Compositions | 03/13/2029 | ||||||||

United States | 9200088 | Sulfoalkyl Ether Cyclodextrin Compositions | 03/13/2029 | ||||||||

United States | 10117951 | Sulfoalkyl Ether Cyclodextrin Compositions | 03/13/2029 | ||||||||

United States | 9750822 | Sulfoalkyl Ether Cyclodextrin Compositions | 03/13/2029 | ||||||||

United States | 9493582 | Alkylated Cyclodextrin Compositions And Processes For Preparing And Using The Same | 2/27/2033 | ||||||||

United States | 10040872 | Alkylated Cyclodextrin Compositions And Processes For Preparing And Using The Same | 10/21/2033 | ||||||||

| United States | 10864183 | Injectable Nitrogen Mustard Compositions Comprising A Cyclodextrin Derivative And Methods Of Making And Using The Same | 5/28/2030 | ||||||||

| United States | 10940128 | Injectable Melphalan Compositions Comprising A Cyclodextrin Derivative And Methods Of Making And Using The Same | 5/28/2030 | ||||||||

| United States | 11020363 | Injectable Nitrogen Mustard Compositions Comprising A Cyclodextrin Derivative And Methods Of Making And Using The Same | 5/28/2030 | ||||||||

‡ Expiration dates are calculated as 20 years from the earliest nonprovisional filing date to which priority is claimed, and do not take into account disclaimers or extensions that are or may be available in these jurisdictions.

Subject to compliance with the terms of the respective agreements, our rights to receive royalty payments under our licenses with our exclusive licensors typically extend for the life of the patents covering such developments. For a discussion of the risks associated with patent and proprietary rights, see below under “Item 1A. Risk Factors.”

Kyprolis

Patents protecting Kyprolis include those owned by Amgen and those owned by us. The United States patent listed in the Orange Book relating to Kyprolis owned by Amgen with the latest expiration date is not expected to expire until 2029. Patents and applications owned by Ligand relating to the Captisol component of Kyprolis are not expected to expire until 2033. Amgen filed suit against several generic drug companies over their applications to make generic versions of Kyprolis. Several generics have settled with Amgen on confidential terms. However, it has been publicly reported that the U.S. launch date for at least Breckenridge Pharmaceuticals’ generic product will be on a date that is held as confidential in 2027 or sooner, depending on certain occurrences. One generic company, Cipla Limited/Cipla USA, Inc. chose not to settle the litigation with Amgen, and proceeded to trial. The District Court upheld the validity of patent claims from three of the patents and the judgment was upheld on appeal.

Ligand UK Development Limited

Under the terms of our sale of Vernalis (R&D) Limited to HitGen in December 2020, Ligand retained a portfolio of fully-funded shots on goal, which now include S65487, a Bcl-2 inhibitor, and S64315, an Mcl-1 inhibitor for treatment of cancers, both of which are partnered with Servier in collaboration with Novartis and VER250840 (an oral, selective Chk1 inhibitor for treatment of cancer). These programs and their IP are now owned by Ligand UK Development Limited, which has a worldwide patent portfolio of over 200 granted patents in over 70 countries. This patent portfolio is mature, with expected expiry dates between 2022 and 2033.

Pelican Expression Technology Platform

We acquired the Pelican Expression Technology platform through acquisition of Pfenex Inc. in October 2020. This acquisition brought a robust portfolio of patents and patent applications along with substantial know-how and trade secrets which protect various aspects of our core Pelican Expression Technology business. As of December 31, 2022, we were the sole owner of a patent portfolio that consisted of over 200 patents and 40 pending patent applications worldwide that provide material coverage for our platform technology, licensed products and product candidates. Our U.S. issued patents expire during the time period beginning in 2025 and ending in 2038. Our owned and exclusively licensed patent portfolio includes claims directed to methods for recombinant protein production and methods for rapid screening of an array of expression systems, tools for protein expression such as P. fluorescens promoters, secretion leaders, plasmid maintenance systems, improved methods for non-standard amino acid incorporation and fusion partners for peptide production. In addition, our IP covers

16

methods for producing certain classes of proteins such as cytokines, growth factors and antibody derivatives, as well as expression strains and methods for production, purification and formulation of certain vaccine antigens, peptides, therapeutic enzymes, human cytokines, etc.

Human Capital Management

We recognize and take care of our employees by offering a wide range of competitive pay, recognition, and benefit programs. We are proud to provide our employees the opportunity to grow and advance as we invest in their education and career development. As of December 31, 2022, we have 76 employees, of whom 49 are involved directly in scientific research and development activities.

We rely on skilled, experienced, and innovative employees to conduct the operations of our company. Our key human capital objectives include identifying, recruiting, retaining, incentivizing and integrating our existing and new employees. We frequently benchmark our compensation practices and benefits programs against those of comparable industries and in the geographic areas where our facilities are located. We believe that our compensation and employee benefits are competitive and allow us to attract and retain skilled labor throughout our organization. Our notable health, welfare and retirement benefits include:

•equity awards through our 2002 Stock Incentive Plan;

•subsidized health insurance;

•401(k) Plan with matching contributions;