UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

|

☑ |

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended June 27, 2015

or

|

☐ |

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 1-4224

Avnet, Inc.

(Exact name of registrant as specified in its charter)

|

New York (State or other jurisdiction of incorporation or organization) |

|

11-1890605 (I.R.S. Employer Identification No.) |

|

|

|

|

|

2211 South 47th Street, Phoenix, Arizona (Address of principal executive offices) |

|

85034 (Zip Code) |

Registrant’s telephone number, including area code (480) 643-2000

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class |

|

Name of Each Exchange on Which Registered |

|

Common Stock |

|

New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☑ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☑ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ☑ |

|

Accelerated filer ☐ |

|

Non-accelerated filer ☐ (Do not check if a smaller reporting company) |

|

Smaller reporting company ☐ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

The aggregate market value (approximate) of the registrant’s common equity held by non-affiliates based on the closing price of a share of the registrant’s common stock for New York Stock Exchange composite transactions on December 26, 2014 (the last business day of the registrant’s most recently completed second fiscal quarter) was $5,931,014,369.

As of July 24, 2015, the total number of shares outstanding of the registrant’s Common Stock was 134,457,853 shares, net of treasury shares.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement (to be filed pursuant to Reg. 14A) relating to the Annual Meeting of Shareholders anticipated to be held on November 12, 2015 are incorporated herein by reference in Part III of this Report.

TABLE OF CONTENTS

2

Avnet, Inc., incorporated in New York in 1955, together with its consolidated subsidiaries (the “Company” or “Avnet”), is a global value-added distributor of electronic components, enterprise computer and storage products, IT solutions and services and embedded subsystems. Avnet creates a vital link in the technology supply chain that connects the world’s leading electronic component and computer product manufacturers and software developers with a global customer base of original equipment manufacturers (“OEMs”), electronic manufacturing services (“EMS”) providers, original design manufacturers (“ODMs”), systems integrators (“SIs”), independent software vendors (“ISVs”) and value-added resellers (“VARs”). Avnet distributes electronic components, computer products and software, as received from its suppliers or through a customized solution, and offers assembly and other value-added services. In addition, Avnet provides engineering design, materials management and logistics services, system integration and configuration and supply chain services customized to meet specific requirements of customers and suppliers.

Organizational Structure

Avnet has two primary operating groups — Electronics Marketing (“EM”) and Technology Solutions (“TS”). Both operating groups have operations in each of the three major economic regions of the world: the Americas; Europe, the Middle East and Africa (“EMEA”); and Asia/Pacific, consisting of Asia, Australia and New Zealand (“Asia” or “Asia/Pac”). Each operating group has its own management team led by a group president and includes regional presidents and senior executives within the operating group who manage various functions within the businesses. Each operating group also has distinct financial reporting that is evaluated at the corporate level on which operating decisions and strategic planning for the Company as a whole are made. Divisions (“business units”) exist within each operating group that serve primarily as sales and marketing units to further streamline the sales and marketing efforts within each operating group and enhance each operating group’s ability to work with its customers and suppliers, generally along more specific product lines or geographies. However, each business unit relies heavily on the support services provided by the operating group as well as centralized support at the corporate level.

A description of each operating group is presented below. Further financial information by operating group and region is provided in Note 16 to the consolidated financial statements appearing in Item 15 of this Annual Report on Form 10-K.

Avnet’s foreign operations are subject to a variety of risks. These risks are discussed further under Risk Factors in Item 1A and under Quantitative and Qualitative Disclosures About Market Risk in Item 7A of this Report. Additionally, the specific translation impacts of foreign currency fluctuations, most notably the Euro, on the Company’s consolidated financial statements are further discussed in Management’s Discussion and Analysis of Financial Condition and Results of Operations in Item 7 of this Report.

Electronics Marketing

EM markets and sells semiconductors, interconnect, passive and electromechanical devices (“IP&E”) and embedded products for the world’s leading electronic component manufacturers. With a global reach that extends to more than 70 countries, EM’s products and services cater to a diverse customer base serving many end-markets including automotive, communications, computer hardware and peripherals, industrial and manufacturing, medical equipment, and defense and aerospace. EM also offers an array of value-added support and services that help customers evaluate, design-in and procure electronic components throughout the lifecycle of their technology products and systems. By working with EM, customers and suppliers can accelerate their time to market and realize cost efficiencies in both the design and manufacturing process.

3

EM Design Chain Solutions

EM offers design chain support and services that provide engineers with a host of technical design solutions that serve as an extension of a supplier’s sales force, which helps make it economically viable to reach a customer segment that seeks complex products and technologies. With access to a suite of design tools and engineering support from any point in the design cycle, customers can get product specifications along with evaluation kits and reference designs that enable a broad range of applications from concept through detailed design including new product introduction. EM also offers engineering and technical resources deployed globally to support product design, bill of materials development, design support and services and technical education and training. By utilizing EM’s design chain support and services, customers can optimize their component selection and accelerate their time to market. The extensive technology line card EM offers provides customers access to a diverse range of products from electronic component manufacturers.

EM Supply Chain Solutions

EM supply chain support and services provide end-to-end solutions focused on OEMs, EMS providers and electronic component manufacturers, enabling them to optimize supply chains on a local, regional or global basis. By combining internal competencies in global warehousing and logistics, finance, information technology and asset management with its global footprint and extensive partner relationships, EM’s supply chain support and services develop a deeper level of engagement with its customers. These customers can continuously manage their supply chains to meet the demands of a competitive environment globally without a commensurate investment in physical assets, systems and personnel. With proprietary planning tools and a variety of inventory management solutions, EM can provide unique solutions that meet a customer’s just-in-time requirements and minimize risk in a variety of scenarios including lean manufacturing, demand flow and outsourcing.

Embedded Solutions

Avnet Embedded provides embedded computing solutions including technical design, integration and assembly to developers of application-specific computing solutions in the non-PC market. Avnet Embedded also provides solutions for intelligent embedded and innovative display solutions primarily targeting industrial applications, including touch and passive displays. In addition, Avnet Embedded develops and manufactures standard board and industrial subsystems and application-specific devices that enable it to produce specialized systems tailored to specific customer requirements. Avnet Embedded serves OEMs that require embedded systems and solutions, including engineering, product prototyping, integration and other value-added services in the medical, telecommunications, industrial and digital editing markets.

EM Sales and Marketing Divisions

Each of EM’s regions has sales and marketing business units that generally focus on a specific customer segment, particular product lines or a specific geography. The business units offer access to one of the industry’s broadest line cards and convenient one-stop shopping with an emphasis on responsiveness, engineering support, on-time delivery and quality. Certain specialty services are made available to the individual business units through common support service units. Customers are further supported by a sophisticated e-Commerce platform, which includes a host of powerful functions such as parametric search capabilities for component part selection, bill of material optimization and component cross-referencing. The site enables end-to-end online service from part and inventory searches, price checking and ordering to online payment. EM Americas addresses the needs of its customers and suppliers through focused channels to service small- to medium-sized customers, global customers, defense and aerospace customers and contract manufacturers. In EMEA, business units, which are organized by semiconductors, IP&E and embedded products and design and supply

4

chain solutions, address customers on both a pan-European and regional basis. EM Asia goes to market with sales and marketing business units within China, South Asia, Australia, New Zealand, Taiwan and Japan.

Technology Solutions

As a leading global IT solutions distributor, TS works with its business partners in the supply chain to create and deliver effective datacenter and IT lifecycle solutions that solve the business challenges of end-users around the world. These complex IT solutions span the entire IT lifecycle and are sold and delivered to a variety of TS’ customer partners, including VARs, ISVs, SIs and OEMs. These solutions can include any combination of services, software and hardware that address among other items, infrastructure and application management, cloud computing, automation, orchestration, datacenter transformation, security, big data, aftermarket and IT lifecycle services, and multilingual vendor accredited training. TS also serves non-PC OEMs requiring embedded systems and solutions, including engineering, product prototyping, integration and other value-added products and services. In addition, TS provides the latest hard disk drives and microprocessor, motherboard and DRAM module technologies to manufacturers of general-purpose computers and system builders.

Customer partners rely on TS’ supplier relationships and experienced logistics, sales, marketing, financial, technical and IT services experts to help them identify and capitalize on business opportunities in high-growth technologies, vertical markets and geographies. Suppliers rely on TS’ technology expertise and global scale and scope to broaden their customer base and grow sales in markets around the world. TS and its ecosystem of highly trained and knowledgeable channel partners serve as an extension of suppliers' salesforces to sell and deliver end-to-end IT solutions to end users. Through dedicated practices and partnerships, TS and its channel partners provide the education, tools, resources, skills and support needed around core technologies like storage, networking and security, along with industry-leading solutions and services incorporating next-generation technologies like big data and analytics, cloud computing and converged infrastructure. They also provide the specialization required to successfully implement and maintain these solutions in high-growth vertical markets, including energy, finance, government, healthcare and retail.

To continue to meet customer expectations in an evolving IT ecosystem, TS and its channel partners are focused on delivering solutions that expand end users' product delivery capabilities, extend their reach and resources, and enhance project success and return on investment for deployments that span the entire IT lifecycle.

Acquisitions

Avnet has historically pursued a strategic acquisition program to further its strategic objectives and support key business initiatives. This program was a significant factor in Avnet becoming one of the largest value-added distributors of electronic components, enterprise computer and storage products, IT services and embedded subsystems. Avnet expects to continue to pursue strategic acquisitions to expand its market presence, increase its scale and scope, and increase its product and service offerings.

There were no acquisitions in fiscal 2015. During fiscal 2014, the Company completed three acquisitions with aggregate annualized sales of approximately $492.0 million. See Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations in Part II of this Annual Report on Form 10-K for additional information on acquisitions completed during fiscal 2014 and 2013.

Major Products

One of Avnet’s competitive strengths is the breadth and quality of the suppliers whose products it distributes. IBM products accounted for approximately 11%, 13% and 12% of the Company’s consolidated sales during fiscal 2015, 2014

5

and 2013, respectively, and was the only supplier from which sales of its products exceeded 10% of consolidated sales. Listed in the table below are the major product categories and the Company’s approximate sales of each during the past three fiscal years.

|

|

|

Years Ended |

|

|||||||

|

|

|

June 27, |

|

June 28, |

|

June 29, |

|

|||

|

|

|

2015 |

|

2014 |

|

2013 |

|

|||

|

|

|

(Millions) |

|

|||||||

|

Semiconductors |

|

$ |

15,715.8 |

|

$ |

14,558.4 |

|

$ |

13,720.8 |

|

|

Computer products |

|

|

9,614.2 |

|

|

10,571.6 |

|

|

9,346.0 |

|

|

Connectors, passives, electromechanical and other |

|

|

2,594.7 |

|

|

2,369.7 |

|

|

2,392.1 |

|

|

|

|

$ |

27,924.7 |

|

$ |

27,499.7 |

|

$ |

25,458.9 |

|

Certain prior year product sales have been reclassified into different product categories to conform to the fiscal 2015 product categorization.

Competition & Markets

The electronic components and computer products industries continue to be extremely competitive and are subject to rapid technological advances. The Company’s major competitors include Arrow Electronics, Inc., Future Electronics and World Peace Group, and, to a lesser extent, Ingram Micro, Inc. and Tech Data Corp. There are also certain smaller, specialized competitors who generally focus on narrower regions, markets, products or particular sectors. In addition, the Company may compete with its own suppliers that maintain a direct salesforce. As a result of these factors, Avnet must remain competitive in its pricing of goods and services.

A key competitive factor in the electronic component and computer product distribution industry is the need to carry a sufficient amount of inventory to meet customers’ rapid delivery requirements. To minimize its exposure related to valuation of inventory on hand, the majority of the Company’s products are purchased pursuant to non-exclusive distributor agreements, which typically provide certain protections for product obsolescence and price erosion. These agreements are generally cancelable upon 30 to 180 days’ notice and, in most cases, provide for inventory return privileges upon cancellation. In addition, the Company enhances its competitive position by offering a variety of value-added services, which entail the performance of services and/or processes tailored to individual customer specifications and business needs such as point of use replenishment, testing, assembly, supply chain management and materials management. For the year ended June 27, 2015, service sales constituted less than 10% of the Company’s total sales.

A competitive advantage is the size of the Company’s supplier base. Because of the number of Avnet’s suppliers, many customers can simplify their procurement process and make all of their required purchases from Avnet, rather than purchasing from several different vendors.

Seasonality

Historically, Avnet’s business has not been materially impacted by seasonality, with the exception of a relatively minor impact on consolidated results from the growth in sales at the TS business during the December quarter primarily driven by the calendar year end selling and buying patterns of key suppliers and customers, respectively.

Number of Employees

At June 27, 2015, Avnet had approximately 18,800 employees.

6

Available Information

The Company files its annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, proxy statements and other documents with the U.S. Securities and Exchange Commission (“SEC”) under the Securities Exchange Act of 1934. A copy of any document the Company files with the SEC is available for review at the SEC’s public reference room, 100 F Street, N.E., Washington, D.C. 20549. The public may obtain information on the public reference room by calling the SEC at 1-800-SEC-0330. The Company’s SEC filings are also available to the public on the SEC’s website at http://www.sec.gov and through the New York Stock Exchange (“NYSE”), 20 Broad Street, New York, New York 10005, on which the Company’s common stock is listed.

A copy of any of the Company’s filings with the SEC, or any of the agreements or other documents that constitute exhibits to those filings, can be obtained by request directed to the Company at the following address and telephone number:

Avnet, Inc.

2211 South 47th Street

Phoenix, Arizona 85034

(480) 643-2000

Attention: Corporate Secretary

The Company also makes these filings available, free of charge, through its website (see “Avnet Website” below).

Avnet Website

In addition to the information about Avnet contained in this Report, extensive information about the Company can be found at www.avnet.com, including information about its management team, products and services and corporate governance practices.

The corporate governance information on the website includes the Company’s Corporate Governance Guidelines, the Code of Conduct and the charters for each of the committees of Avnet’s Board of Directors. In addition, amendments to the Code of Conduct, committee charters and waivers granted to directors and executive officers under the Code of Conduct, if any, will be posted in this area of the website. These documents can be accessed at www.avnet.com under the “Investors — Corporate governance” caption. Printed versions of the Corporate Governance Guidelines, Code of Conduct and charters of the Board committees can be obtained, free of charge, by writing to the Company at the address listed above in “Available Information.”

In addition, the Company’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports, if any, filed or furnished pursuant to Section 13(a) or 15(d) of Securities Exchange Act of 1934, as well as Section 16 filings made by any of the Company’s executive officers or directors with respect to Avnet common stock, are available on the Company’s website (www.avnet.com under the “Investors — SEC filings” caption) as soon as reasonably practicable after the report is electronically filed with, or furnished to, the Securities and Exchange Commission.

These details about Avnet’s website and its content are only for information. The contents of the Company’s website are not, nor shall they be deemed to be, incorporated by reference in this Report.

7

Forward-Looking Statements and Risk Factors

This Report contains forward-looking statements with respect to the financial condition, results of operations and business of Avnet. These statements are generally identified by words like “believes,” “plans,” “expects,” “anticipates,” “should,” “will,” “may,” “estimates” or similar expressions. Forward-looking statements are subject to numerous assumptions, risks and uncertainties. Except as required by law, Avnet does not undertake any obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise. Factors that may cause actual results to differ materially from those contained in the forward-looking statements include those discussed below.

The factors discussed below make the Company’s operating results for future periods difficult to predict and, therefore, prior results are not necessarily indicative of results to be expected in future periods. Any of the below factors, or any other factors discussed elsewhere in this Report, may have an adverse effect on the Company’s financial results, operations, prospects and liquidity. The Company’s operating results have fluctuated in the past and likely will continue to do so. If the Company’s operating results fall below its forecasts and the expectations of public market analysts and investors, the trading price of the Company’s common stock will likely decrease.

Economic weakness and uncertainty could adversely affect the Company’s results and prospects.

The Company’s financial results, operations and prospects depend significantly on worldwide economic conditions, the demand for its products and services, and the financial condition of its customers and suppliers. Economic weakness and uncertainty have in the past resulted, and may result in the future, in decreased sales, margins and earnings. Economic weakness and uncertainty may also lead the Company to impair assets, including goodwill, intangible assets and other long-lived assets, take restructuring actions and reduce expenses in response to decreased sales or margins. The Company may not be able to adequately adjust its cost structure in a timely fashion, which may adversely impact its profitability. Uncertainty about economic conditions may increase foreign currency volatility in markets in which the Company transacts business, which may negatively impact the Company’s results. Economic weakness and uncertainty also make it more difficult for the Company to manage inventory levels and/or collect customer receivables, which may result in provisions to create reserves, write-offs, reduced access to liquidity and higher financing costs.

The electronic components and computer industries are highly competitive and if the Company fails to compete effectively, its sales, gross profit margins and prospects may decline.

The market for the Company’s products and services is very competitive and subject to rapid technological advances, new market entrants, non-traditional competitors, changes in industry standards and changes in customer needs. Not only does the Company compete with other global distributors, it also competes for customers with regional distributors and some of the Company’s own suppliers that maintain direct sales efforts. The Company’s failure to maintain and enhance its competitive position could adversely affect its business and prospects. Furthermore, the Company’s efforts to compete in the marketplace could cause deterioration of gross profit margins and, thus, overall profitability.

The size of the Company’s competitors vary across market sectors, as do the resources the Company has allocated to the sectors and geographic areas in which it does business. Therefore, some competitors may have greater resources or a more extensive customer base than the Company has in one or more of its market sectors and geographic areas, which may result in the Company not being able to effectively compete in certain markets which could impact the Company’s profitability and prospects.

8

An industry down-cycle in semiconductors, IT hardware or software products could significantly affect the Company’s operating results.

The semiconductor and technology industries historically have experienced periodic fluctuations in product supply and demand, often associated with changes in technology and manufacturing capacity, and are generally considered to be highly cyclical. During each of the last three fiscal years, sales of semiconductors represented approximately 50% of the Company’s consolidated sales, and the Company’s sales, particularly those of EM, closely follow the strength or weakness of the semiconductor industry. Further, economic weakness or changes in customer needs could cause a decline in spending on information technology, hardware or software products, which could have a negative impact on TS. While the Company attempts to identify changes in market conditions as soon as possible, the dynamics of these industries make prediction of and timely reaction to such changes difficult. Future downturns in the semiconductor and technology industries could adversely affect the Company’s operating results and negatively impact the Company’s ability to maintain its current profitability levels.

Failure to maintain its relationships with key suppliers could adversely affect the Company’s sales.

One of the Company’s competitive strengths is the breadth and quality of the suppliers whose products the Company distributes. However, sales of products and services from one of the Company’s suppliers, IBM, accounted for approximately 11% of the Company’s consolidated sales in fiscal 2015. Management expects IBM products and services to continue to account for roughly a similar percentage of the Company’s consolidated sales in fiscal 2016. The Company’s contracts with its suppliers, including those with IBM, vary in duration and are generally terminable by either party at will upon notice. To the extent IBM or other primary suppliers significantly reduce their volume of business with the Company in the future, because of a product shortage, an unwillingness to do business with Avnet, changes in strategy or otherwise, the Company’s business and relationships with its customers could be negatively affected because its customers depend on the Company’s distribution of electronic components and computer products from the industry’s leading suppliers. In addition, suppliers’ strategy shifts or performance issues may negatively affect the Company’s financial results. The competitive landscape has also experienced a consolidation among suppliers, which could negatively impact the Company’s profitability and customer base. Further, to the extent that any of the Company’s key suppliers modify the terms of their contracts including, without limitation, the terms regarding price protection, rights of return, rebates or other terms that protect or enhance the Company’s gross margins, it could negatively affect the Company’s results of operations, financial condition or liquidity.

The Company’s non-U.S. locations represent a significant portion of its sales and, consequently, the Company is exposed to risks associated with operating internationally.

During fiscal 2015, 2014 and 2013 approximately 64%, 65% and 63%, respectively, of the Company’s sales came from its operations outside the United States. As a result of the Company’s international operations, in particular those in emerging and developing economies, the Company’s operations are subject to a variety of risks that are specific to international operations, including, but not limited to, the following:

|

· |

potential restrictions on the Company’s ability to repatriate funds from its foreign subsidiaries; |

|

· |

foreign currency and interest rate fluctuations and the impact on the Company’s results of operations; |

|

· |

import and export duties and value-added taxes; |

|

· |

compliance with foreign and domestic import and export regulations, data privacy regulations, business licensing requirements, environmental regulations and anti-corruption laws, the failure of which could result in severe penalties including monetary fines, criminal proceedings and suspension of import or export privileges; |

9

|

· |

complex and changing tax laws and regulations; |

|

· |

regulatory requirements and prohibitions that differ between jurisdictions; |

|

· |

economic and political instability, terrorism and potential military conflicts or civilian unrest; |

|

· |

fluctuations in freight costs, limitations on shipping and receiving capacity, and other disruptions in the transportation and shipping infrastructure; |

|

· |

natural disasters and health concerns; |

|

· |

differing environmental regulations and employment practices and labor issues; and |

|

· |

the risk of non-compliance with local laws. |

In addition to the cost of compliance, the potential criminal penalties for violations of import or export regulations and anti-corruption laws by the Company or its third-party agents create heightened risks for the Company’s international operations. In the event that a governing regulatory body determined that the Company had violated applicable import or export regulations or anti-corruption laws, the Company could be fined significant sums, incur sizable legal defense costs and/or its import or export capabilities could be restricted, which could have a material and adverse effect on the Company’s business. Additionally, allegations that the Company has violated a governmental regulation may negatively impact the Company’s reputation, which may result in customers or suppliers being unwilling to do business with the Company. While the Company has adopted measures and controls designed to ensure compliance with these laws, the Company cannot be assured that such measures will be adequate or that its business will not be materially and adversely impacted in the event of an alleged violation.

The Company transacts sales, pays expenses, owns assets and incurs liabilities in countries using currencies other than the U.S. Dollar. Because the Company’s consolidated financial statements are presented in U.S. Dollars, the Company must translate sales, income and expenses, as well as assets and liabilities, into U.S. Dollars at exchange rates in effect during each reporting period. Therefore, increases or decreases in the exchanges rates between the U.S. Dollar and other currencies the Company transacts in affect the Company’s reported amounts of sales, operating income, assets and liabilities denominated in foreign currencies. In addition, unexpected and dramatic changes in foreign currency exchange rates may negatively affect the Company’s earnings from those markets. While the Company may use derivative financial instruments to further reduce its net exposure to foreign currency exchange rate fluctuations, there can be no assurance that fluctuations in foreign currency exchange rates will not materially affect the Company’s financial results. Further, foreign currency instability and disruptions in the credit and capital markets may increase credit risks for some of the Company’s customers and may impair its customers’ ability to repay existing obligations.

The Company’s acquisition strategy may not produce the expected benefits, which may adversely affect the Company’s results of operations.

Avnet has made, and expects to continue to make, strategic acquisitions or investments in companies around the world to further its strategic objectives and support key business initiatives. Acquisitions and investments involve risks and uncertainties, some of which may differ from those associated with Avnet’s historical operations. The risks relating to such acquisitions and investments include, but are not limited to, risks relating to expanding into emerging markets and business areas, adding additional product lines and services, impacting existing customer and supplier relationships, incurring costs or liabilities associated with the companies acquired and diverting management’s attention from existing business operations. As a result, the Company’s profitability may be negatively impacted. In addition, the Company may not be successful in integrating the acquired businesses or the integration may be more difficult, costly or time-consuming than anticipated. Further, any litigation relating to a potential acquisition will result in an increase in the expenses

10

associated with the acquisition or cause a delay in completing the acquisition, thereby impacting the Company’s profitability. The Company may experience disruptions that could, depending on the size of the acquisition, have an adverse effect on its business, especially where an acquisition target may have pre-existing compliance issues or pre-existing deficiencies or material weaknesses in internal controls. Furthermore, the Company may not realize all of the anticipated benefits from its acquisitions, which could adversely affect the Company’s financial performance.

Major disruptions to the Company’s logistics capability could have an adverse impact on the Company’s operations.

The Company’s global logistics services are operated through specialized, centralized or outsourced distribution centers around the globe. The Company also depends almost entirely on third-party transportation service providers for the delivery of products to its customers. A major interruption or disruption in service at one or more of its distribution centers for any reason (such as natural disasters, pandemics, or significant disruptions of services from the Company’s third-party transportation providers) could cause cancellations or delays in a significant number of shipments to customers and, as a result, could have an adverse impact on the Company’s business partners, and on the Company’s business, operations and financial performance.

If the Company sustains cyber attacks or other privacy or data security incidents that result in security breaches, it could suffer a loss of sales and increased costs, exposure to significant liability, reputational harm and other negative consequences.

The Company’s information technology may be subject to cyber attacks, security breaches or computer hacking. Experienced computer programmers and hackers may be able to penetrate the Company’s security controls and misappropriate or compromise sensitive personal, proprietary or confidential information, create system disruptions or cause shutdowns. They also may be able to develop and deploy viruses, worms and other malicious software programs that attack the Company’s systems or otherwise exploit any security vulnerabilities. The Company’s systems and the data stored on those systems may also be vulnerable to security incidents or security attacks, acts of vandalism or theft, coordinated attacks by activist entities, misplaced or lost data, human errors, or other similar events that could negatively affect the Company’s systems and its data, as well as the data of the Company’s business partners. Further, third parties, such as hosted solution providers, that provide services to the Company, could also be a source of security risk in the event of a failure of their own security systems and infrastructure.

The costs to eliminate or address the foregoing security threats and vulnerabilities before or after a cyber incident could be significant. The Company’s remediation efforts may not be successful and could result in interruptions, delays or cessation of service, and loss of existing or potential suppliers or customers. In addition, breaches of the Company’s security measures and the unauthorized dissemination of sensitive personal, proprietary or confidential information about the Company, its business partners or other third parties could expose the Company to significant potential liability and reputational harm. As threats related to cyber attacks develop and grow, the Company may also find it necessary to make further investments to protect its data and infrastructure, which may impact the Company’s profitability. Although the Company has insurance coverage for protecting against cyber attacks, it may not be sufficient to cover all possible claims, and the Company may suffer losses that could have a material adverse effect on its business. As a global enterprise, the Company could also be negatively impacted by existing and proposed laws and regulations, as well as government policies and practices related to cybersecurity, privacy, data localization and data protection.

If the Company’s internal information systems fail to function properly, or if the Company is unsuccessful in the implementation, integration or upgrade of information systems, its business operations could suffer.

The Company is dependent on its information systems to facilitate the day-to-day operations of the business and to produce timely, accurate and reliable information on financial and operational results. Currently, the Company’s global

11

operations are tracked with multiple information systems, some of which are subject to ongoing IT projects designed to streamline or optimize the Company’s global information systems. There is no guarantee that the Company will be successful at all times in these efforts or that there will not be implementation or integration difficulties that will adversely affect the Company’s ability to complete business transactions timely or the accurate and timely recording and reporting of financial data. A failure of any of these information systems in a way described above or material difficulties in upgrading these information systems could have an adverse effect on the Company’s business and its compliance with reporting obligations under federal securities laws.

Declines in the value of the Company’s inventory or unexpected order cancellations by the Company’s customers could adversely affect its business, results of operations, financial condition and liquidity.

The electronic components and computer products industries are subject to rapid technological change, new and enhanced products, changes in customer needs and changes in industry standards, which can contribute to a decline in value or obsolescence of inventory. Regardless of the general economic environment, it is possible that prices will decline due to a decrease in demand or an oversupply of products and, as a result of the price declines, there may be greater risk of declines in inventory value. Although it is the policy of many of the Company’s suppliers to offer certain protections from the loss in value of inventory (such as price protection and limited rights of return), the Company cannot be assured that such policies will fully compensate for the loss in value, or that the suppliers will choose to, or be able to, honor such agreements, some of which are not documented and, therefore, subject to the discretion of the supplier. In addition, the majority of the Company’s sales are made pursuant to individual purchase orders, rather than through long-term sales contracts. Where there is a contract, such contract is generally terminable at will upon notice. The Company cannot be assured that unforeseen new product developments, declines in the value of the Company’s inventory or unforeseen order cancellations by its customers will not adversely affect the Company’s business, results of operations, financial condition or liquidity.

Substantial defaults by the Company’s customers or suppliers on its accounts receivable or the loss of significant customers could have a significant negative impact on the Company’s business, results of operations, financial condition or liquidity.

A significant portion of the Company’s working capital consists of accounts receivable. If entities responsible for a significant amount of accounts receivable were to cease doing business, direct their business elsewhere, become insolvent or unable to pay the amount they owe the Company, or were to become unwilling or unable to make such payments in a timely manner, the Company’s business, results of operations, financial condition or liquidity could be adversely affected. An economic or industry downturn could adversely affect the collectability of these accounts receivable, which could result in longer payment cycles, increased collection costs and defaults in excess of management’s expectations. A significant deterioration in the Company’s ability to collect on accounts receivable in the United States could also impact the cost or availability of financing under its accounts receivable securitization program.

The Company may not have adequate or cost-effective liquidity or capital resources.

The Company’s ability to satisfy its cash needs and implement its capital allocation strategy depends on its ability to generate cash from operations and to access the financial markets, both of which are subject to general economic, financial, competitive, legislative, regulatory and other factors that are beyond the Company’s control.

The Company may need to satisfy its cash needs through external financing. However, external financing may not be available on acceptable terms or at all. As of June 27, 2015, Avnet had total debt outstanding of approximately $1.98 billion under various notes, secured borrowings and committed and uncommitted lines of credit with financial institutions. The Company needs cash to make interest payments on, and to repay, this indebtedness and for general corporate purposes,

12

such as funding its ongoing working capital and capital expenditure needs. Under the terms of any external financing, the Company may incur higher than expected financing expenses and become subject to additional restrictions and covenants. Any material increase in the Company’s financing costs could have an adverse effect on its profitability.

Under certain of its credit facilities, the Company is required to maintain certain specified financial ratios and meet certain tests. If the Company fails to meet these financial ratios and/or tests, it may be unable to continue to utilize these facilities. If the Company is unable to utilize these facilities, it may not have sufficient cash available to make interest payments, to repay indebtedness or for general corporate needs. General economic or business conditions, domestic and foreign, may be less favorable than management expects and could adversely impact the Company’s sales or its ability to collect receivables from its customers, which may impact access to the Company’s accounts receivable securitization program.

The agreements governing some of the Company’s financings contain various covenants and restrictions that limit the discretion of management in operating its business and could prevent engaging in some activities that may be beneficial to the Company’s business.

The agreements governing the Company’s financing, including its credit facility, accounts receivable securitization program and the indentures governing the Company’s outstanding notes, contain various covenants and restrictions that, in certain circumstances, limit the Company’s ability, and the ability of certain subsidiaries, to:

|

· |

grant liens on assets; |

|

· |

make restricted payments (including, under certain circumstances, paying dividends on common stock or redeeming or repurchasing common stock); |

|

· |

make certain investments; |

|

· |

merge, consolidate or transfer all or substantially all of the Company’s assets; |

|

· |

incur additional debt; or |

|

· |

engage in certain transactions with affiliates. |

As a result of these covenants and restrictions, the Company may be limited in the future in how it conducts its business and may be unable to raise additional debt, repurchase common stock, pay a dividend, compete effectively or make further investments.

The Company may become involved in intellectual property disputes that could cause it to incur substantial costs, divert the efforts of management or require it to pay substantial damages or licensing fees.

From time to time, the Company receives notifications alleging infringements of intellectual property rights allegedly held by others relating to the Company’s business or the products or services it sells. Litigation with respect to patents or other intellectual property matters could result in substantial costs and diversion of management and other resources and could have an adverse effect on the Company’s operations. Further, the Company may be obligated to indemnify and defend its customers if the products or services the Company sells are alleged to infringe any third party’s intellectual property rights. While the Company may be able to seek indemnification from its suppliers for itself and its customers against such claims, there is no assurance that it will be successful in realizing such indemnification or that the Company will be fully protected against such claims. In addition, the Company is exposed to potential liability for technology that it develops for which it has no indemnification protections. If an infringement claim against the Company is successful, the Company may be required to pay damages or seek royalty or license arrangements, which may not be available on

13

commercially reasonable terms. The Company may have to stop selling certain products or services, which could affect its ability to compete effectively.

Failure to comply with the requirements of environmental regulations could adversely affect the Company’s business.

The Company is subject to various federal, state, local and foreign laws and regulations addressing environmental and other impacts from product disposal, use of hazardous materials in products, recycling of products at the end of their useful life and other related matters. While the Company strives to ensure it is in full compliance with all applicable regulations, certain of these regulations impose liability without fault. Additionally, the Company may be held responsible for the prior activities of an entity it acquired. Failure to comply with these regulations could result in substantial costs, fines and civil or criminal sanctions, as well as third-party claims for property damage or personal injury. Further, environmental laws may become more stringent over time, imposing greater compliance costs and increasing risks and penalties associated with violations.

Changes in tax rules and regulations, changes in interpretation of tax rules and regulations, changes in business performance or unfavorable assessments from tax audits could affect the Company’s effective tax rates, deferred taxes, financial condition and results of operations.

As a multinational corporation, the Company is subject to the tax laws and regulations of the United States and many foreign jurisdictions. From time to time, regulations may be enacted that could adversely affect the Company’s tax positions. There can be no assurance that the Company’s cash flow, and in some cases the effective tax rate, will not be adversely affected by these potential changes in regulations or by changes in the interpretation of existing tax law and regulations. The tax laws and regulations of the various countries where the Company has operations are extremely complex and subject to varying interpretations. Although the Company believes that its historical tax positions are sound and consistent with applicable laws, regulations and existing precedent, there can be no assurance that these tax positions will not be challenged by relevant tax authorities or that the Company would be successful in defending against any such challenge.

The Company’s future income tax expense could also be adversely affected by changes in the mix of earnings in countries with differing statutory tax rates, changes in the valuation of deferred tax assets and liabilities and changes to its operating structure.

If the Company fails to maintain effective internal controls, it may not be able to report its financial results accurately or timely, or prevent or detect fraud, which could have an adverse effect on the Company’s business or the market price of the Company’s securities.

Effective internal controls over financial reporting are necessary for the Company to provide reasonable assurance with respect to its financial reports and to effectively prevent or detect fraud. If the Company cannot provide reasonable assurance with respect to its financial reports and effectively prevent or detect fraud, its brand and operating results could be harmed. Internal controls over financial reporting may not prevent or detect misstatements because of its inherent limitations, including the possibility of human error, the circumvention or overriding of controls, or fraud. Therefore, even effective internal controls cannot provide absolute assurance with respect to the preparation and fair presentation of financial statements. In addition, projections of any evaluation of effectiveness of internal controls over financial reporting to future periods are subject to the risk that the internal controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate. If the Company fails to maintain the adequacy of its internal controls, including any failure to implement required new or improved internal controls, or if the Company experiences difficulties in their implementation, the Company’s business and operating results could be harmed, the Company may be subject to sanctions or investigations by regulatory authorities, and the Company could fail to meet its reporting obligations, which could have an adverse effect on its business or the market price of the Company’s securities.

14

Item 1B. Unresolved Staff Comments

Not applicable.

The Company owns and leases approximately 1.8 million and 5.9 million square feet of space, respectively, of which approximately 38% is located in the United States. The following table summarizes certain of the Company’s key facilities:

|

|

|

|

|

Leased |

|

|

|

|

|

|

Square |

|

or |

|

|

|

|

Location |

|

Footage |

|

Owned |

|

Primary Use |

|

|

Groveport, Ohio |

|

580,000 |

|

Leased |

|

TS warehousing, integration and value-added operations |

|

|

Chandler, Arizona |

|

400,000 |

|

Owned |

|

EM warehousing and value-added operations |

|

|

Tongeren, Belgium |

|

390,000 |

|

Owned |

|

EM and TS warehousing and value-added operations |

|

|

Poing, Germany |

|

570,000 |

|

Owned |

|

EM warehousing, value-added operations and offices |

|

|

Chandler, Arizona |

|

230,000 |

|

Leased |

|

EM and TS warehousing, integration and value-added operations |

|

|

Nettetal, Germany |

|

200,000 |

|

Owned |

|

EM and TS warehousing and value-added operations |

|

|

Hong Kong, China |

|

180,000 |

|

Leased |

|

EM warehousing and value-added operations |

|

|

Duluth, Georgia |

|

180,000 |

|

Leased |

|

TS warehousing, integration and value-added operations |

|

|

Phoenix, Arizona |

|

180,000 |

|

Leased |

|

Corporate and EM headquarters |

|

|

Tempe, Arizona |

|

130,000 |

|

Leased |

|

TS headquarters |

|

As a result primarily of certain former manufacturing operations, Avnet has incurred and may have future liability under various federal, state and local environmental laws and regulations, including those governing pollution and exposure to, and the handling, storage and disposal of, hazardous substances. For example, under the Comprehensive Environmental Response, Compensation and Liability Act of 1980, as amended (“CERCLA”) and similar state laws, Avnet is and may be liable for the costs of cleaning up environmental contamination on or from certain of its current or former properties, and at off-site locations where the Company disposed of wastes in the past. Such laws may impose joint and several liability. Typically, however, the costs for cleanup at such sites are allocated among potentially responsible parties based upon each party’s relative contribution to the contamination, and other factors.

Pursuant to SEC regulations, including but not limited to Item 103 of Regulation S-K, the Company regularly assesses the status of and developments in pending environmental legal proceedings to determine whether any such proceedings should be identified specifically in this discussion of legal proceedings, and has concluded that no particular pending environmental legal proceeding requires public disclosure. Based on the information known to date, management believes that the Company has appropriately accrued in its consolidated financial statements for its share of the estimated costs of environmental matters.

The Company is also party to various other lawsuits, claims, investigations and other legal proceedings arising from time to time in the normal course of business. While litigation is subject to inherent uncertainties, management currently believes that the ultimate outcome of these proceedings, individually and in the aggregate, will not have a material adverse effect on the Company’s financial position, liquidity or results of operations.

Item 4. Mine Safety Disclosures

Not applicable.

15

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Market price per share

The Company’s common stock is listed on the New York Stock Exchange under the symbol AVT. Quarterly high and low stock closing prices (as reported for the New York Stock Exchange composite transactions) and dividends declared for the last two fiscal years were:

|

|

|

2015 |

|

2014 |

|

||||||||||||||

|

|

|

|

|

|

|

|

|

Dividends |

|

|

|

|

|

|

|

Dividends |

|

||

|

Fiscal Quarters |

|

High |

|

Low |

|

Declared |

|

High |

|

Low |

|

Declared |

|

||||||

|

1st |

|

$ |

45.17 |

|

$ |

40.88 |

|

$ |

0.16 |

|

$ |

41.73 |

|

$ |

33.97 |

|

$ |

0.15 |

|

|

2nd |

|

|

45.05 |

|

|

36.54 |

|

|

0.16 |

|

|

43.43 |

|

|

38.77 |

|

|

0.15 |

|

|

3rd |

|

|

47.12 |

|

|

40.97 |

|

|

0.16 |

|

|

46.17 |

|

|

39.32 |

|

|

0.15 |

|

|

4th |

|

|

46.15 |

|

|

42.09 |

|

|

0.16 |

|

|

47.50 |

|

|

41.68 |

|

|

0.15 |

|

In August 2013, the Company’s Board of Directors initiated a quarterly cash dividend of $0.15 per share of outstanding common stock. In August 2014, the Board of Directors increased the quarterly cash dividend to $0.16 per share of outstanding common stock. The declaration and payment of future dividends will be at the discretion of the Board of Directors and will be dependent upon the Company’s financial condition, results of operations, capital requirements, and other factors the Board of Directors deems relevant. In addition, certain of the Company’s debt facilities may restrict the declaration and payment of dividends, depending upon the Company’s then current compliance with certain covenants.

Record Holders

As of July 24, 2015, there were 2,508 registered holders of record of Avnet’s common stock.

Equity Compensation Plan Information as of June 27, 2015

|

|

|

Number of |

|

|

|

|

|

|

|

|

|

Securities |

|

|

|

Number of |

|

|

|

|

|

to be Issued |

|

Weighted- |

|

Securities |

|

|

|

|

|

Upon |

|

Average |

|

Remaining |

|

|

|

|

|

Exercise of |

|

Exercise Price of |

|

Available for |

|

|

|

|

|

Outstanding |

|

Outstanding |

|

Future Issuance |

|

|

|

|

|

Options, |

|

Options, |

|

Under Equity |

|

|

|

|

|

Warrants and |

|

Warrants and |

|

Compensation |

|

|

|

Plan Category |

|

Rights |

|

Rights |

|

Plans |

|

|

|

Equity compensation plans approved by security holders |

|

4,580,331 |

(1) |

$ |

32.90 |

|

4,840,055 |

(2) |

|

(1) |

Includes 2,015,378 shares subject to options outstanding, 1,930,352 restricted stock units and 634,601 performance share units awarded but not yet vested or vested but not yet delivered. |

|

(2) |

Does not include 298,151 shares available for future issuance under the Employee Stock Purchase Plan, which is a non-compensatory plan. |

16

Stock Performance Graphs and Cumulative Total Returns

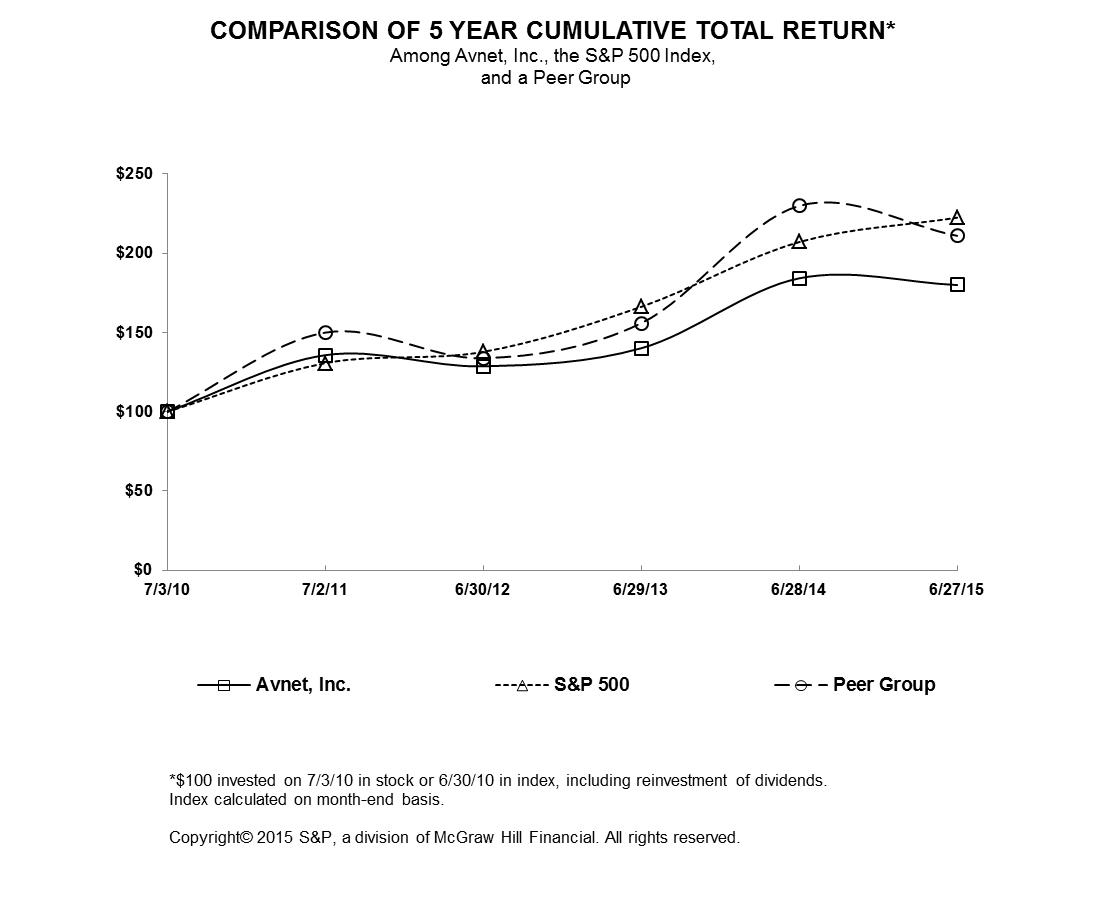

The graph below compares the cumulative 5-year total return of holders of Avnet, Inc.’s common stock with the cumulative total returns of the S&P 500 index and certain of Avnet’s peer companies (“peer group”) in the electronics and information technology distribution industry. The graph tracks the performance of a hypothetical $100 investment in Avnet’s common stock, in the peer group, and the S&P 500 index (with the reinvestment of all dividends) from July 3, 2010 to June 27, 2015. The companies comprising the peer group that Avnet has historically used are: Agilysys, Inc., Anixter International, Inc., Arrow Electronics, Inc., Ingram Micro, Inc., Insight Enterprises, Inc., Scansource, Inc., Synnex Corp. and Tech Data Corp.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7/3/2010 |

|

7/2/2011 |

|

6/30/2012 |

|

6/29/2013 |

|

6/28/2014 |

|

6/27/2015 |

|

||||||

|

Avnet, Inc. |

|

$ |

100 |

|

$ |

135.74 |

|

$ |

128.69 |

|

$ |

140.12 |

|

$ |

184.22 |

|

$ |

179.96 |

|

|

S&P 500 |

|

|

100 |

|

|

130.69 |

|

|

137.81 |

|

|

166.20 |

|

|

207.10 |

|

|

222.47 |

|

|

Peer Group |

|

|

100 |

|

|

149.95 |

|

|

133.82 |

|

|

155.90 |

|

|

229.92 |

|

|

211.04 |

|

The stock price performance included in this graph is not necessarily indicative of future stock price performance. The Company does not make or endorse any predictions as to future stock performance. The performance graph is furnished solely to accompany this Report and is not being filed for purposes of the Securities Exchange Act of 1934, as

17

amended, and is not to be incorporated by reference into any filing of the Company, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

Issuer Purchases of Equity Securities

In November 2014, the Company’s Board of Directors amended the Company’s existing share repurchase program to authorize the repurchase of up to $1.0 billion of common stock in the open market, privately negotiated transactions, block trades, accelerated share repurchase transactions or any combination of such method. The timing and actual number of shares repurchased will depend on a variety of factors such as price, corporate and regulatory requirements, and prevailing market conditions. The following table includes, if any, the Company’s monthly purchases of Avnet’s common stock during the fourth quarter ended June 27, 2015, under the share repurchase program, which is part of a publicly announced plan:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Number of |

|

Approximate Dollar |

|

|

|

|

|

Total |

|

Average |

|

Shares Purchased |

|

Value of Shares That |

|

||

|

|

|

Number |

|

Price |

|

as Part of Publicly |

|

May Yet Be |

|

||

|

|

|

of Shares |

|

Paid per |

|

Announced Plans |

|

Purchased under the |

|

||

|

Period |

|

Purchased |

|

Share |

|

or Programs |

|

Plans or Programs |

|

||

|

April |

|

— |

|

$ |

— |

|

— |

|

$ |

318,254,000 |

|

|

May |

|

40,500 |

|

$ |

42.89 |

|

40,500 |

|

$ |

316,517,000 |

|

|

June |

|

327,864 |

|

$ |

42.85 |

|

327,864 |

|

$ |

302,467,000 |

|

18

Item 6. Selected Financial Data

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Years Ended |

|

|||||||||||||

|

|

|

June 27, |

|

June 28, |

|

June 29, |

|

June 30, |

|

July 2, |

|

|||||

|

|

|

2015 |

|

2014 |

|

2013 |

|

2012 |

|

2011 |

|

|||||

|

|

|

(Millions, except for per share and ratio data) |

|

|||||||||||||

|

Income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales |

|

$ |

27,924.7 |

|

$ |

27,499.7 |

|

$ |

25,458.9 |

|

$ |

25,707.5 |

|

$ |

26,534.4 |

|

|

Gross profit |

|

|

3,193.1 |

|

|

3,225.7 |

|

|

2,979.8 |

|

|

3,050.6 |

|

|

3,107.8 |

|

|

Operating income(a) |

|

|

827.7 |

|

|

789.9 |

|

|

626.0 |

|

|

884.2 |

|

|

930.0 |

|

|

Income tax expense(b) |

|

|

141.1 |

|

|

155.5 |

|

|

99.2 |

|

|

223.8 |

|

|

201.9 |

|

|

Net income(c) |

|

|

571.9 |

|

|

545.6 |

|

|

450.1 |

|

|

567.0 |

|

|

669.1 |

|

|

Financial Position: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Working capital(d) |

|

|

4,369.8 |

|

|

3,975.4 |

|

|

3,535.4 |

|

|

3,455.7 |

|

|

3,749.5 |

|

|

Total assets |

|

|

10,800.0 |

|

|

11,255.5 |

|

|

10,474.7 |

|

|

10,167.9 |

|

|

9,905.6 |

|

|

Long-term debt |

|

|

1,646.5 |

|

|

1,213.8 |

|

|

1,207.0 |

|

|

1,272.0 |

|

|

1,273.5 |

|

|

Shareholders’ equity |

|

|

4,685.0 |

|

|

4,890.2 |

|

|

4,289.1 |

|

|

3,905.7 |

|

|

4,056.1 |

|

|

Per Share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic earnings |

|

|

4.18 |

|

|

3.95 |

|

|

3.26 |

|

|

3.85 |

|

|

4.39 |

|

|

Diluted earnings |

|

|

4.12 |

|

|

3.89 |

|

|

3.21 |

|

|

3.79 |

|

|

4.34 |

|

|

Cash dividends declared |

|

|

0.64 |

|

|

0.60 |

|

|

— |

|

|

— |

|

|

— |

|

|

Book value per diluted share |

|

|

33.8 |

|

|

34.9 |

|

|

30.64 |

|

|

26.12 |

|

|

26.28 |

|

|

Ratios: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income as a percentage of sales |

|

|

3.0 |

% |

|

2.9 |

% |

|

2.5 |

% |

|

3.4 |

% |

|

3.5 |

% |

|

Net income as a percentage of sales |

|

|

2.0 |

% |

|

2.0 |

% |

|

1.8 |

% |

|

2.2 |

% |

|

2.5 |

% |

|

Return on capital |

|

|

11.6 |

% |

|

11.4 |

% |

|

10.6 |

% |

|

12.9 |

% |

|

15.2 |

% |

|

Quick ratio |

|

|

1.4:1 |

|

|

1.2:1 |

|

|

1.2:1 |

|

|

1.2:1 |

|

|

1.2:1 |

|

|

Current ratio |

|

|

2.0:1 |

|

|

1.8:1 |

|

|

1.7:1 |

|

|

1.7:1 |

|

|

1.8:1 |

|

|

Total debt to capital |

|

|

29.7 |

% |

|

29.8 |

% |

|

32.3 |

% |

|

35.4 |

% |

|

27.2 |

% |

|

(a) |

All fiscal years presented include restructuring, integration and other expenses, which totaled $90.8 million before tax, $65.9 million after tax and $0.47 per share on a diluted basis in fiscal 2015, $94.6 million before tax, $70.8 million after tax and $0.50 per share on a diluted basis in fiscal 2014, $149.5 million before tax, $116.4 million after tax and $0.83 per share on a diluted basis in fiscal 2013, $73.6 million before tax, $53.0 million after tax and $0.35 per share on a diluted basis in fiscal 2012 and $77.2 million before tax, $56.2 million after tax and $0.36 per share on a diluted basis in fiscal 2011. |

|

(b) |

Certain fiscal years presented included the impact of tax benefits primarily due to the release of valuation allowances net of additional reserves including $55.1 million and $0.39 per share on a diluted basis in fiscal 2015, $43.8 million and $0.31 per share on a diluted basis in fiscal 2014, $50.4 million and $0.36 per share on a diluted basis in fiscal 2013, $8.6 million and $0.06 per share on a diluted basis in fiscal 2012, and $32.9 million and $0.21 per share on a diluted basis in fiscal 2011. |

|

(c) |

All fiscal years presented were impacted by other expense or income amounts that impact the comparability between years including a gain on legal settlement of $22.1 million before tax, $13.5 million after tax and $0.09 per share on a diluted basis in fiscal 2014, a gain on bargain purchase and other of $31.0 million before and after tax and $0.22 per share on a diluted basis in fiscal 2013, a gain on bargain purchase and other of $2.9 million before tax, $3.5 million after tax and $0.02 per share on a diluted basis in fiscal 2012, and a gain on bargain purchase and other of $22.7 million before tax, $25.7 million after tax and $0.17 per share on a diluted basis in fiscal 2011. |

|

(d) |

This calculation of working capital is defined as current assets less current liabilities. |

19

Summary of quarterly results (unaudited):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First |

|

Second |

|

Third |

|

Fourth |

|

Fiscal |

|

|||||

|

|

|

Quarter |

|

Quarter |

|

Quarter |

|

Quarter |

|

Year(a) |

|

|||||

|

|

|

(Millions, except per share amounts) |

|

|||||||||||||

|

2015(b) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales |

|

$ |

6,839.6 |

|

$ |

7,551.9 |

|

$ |

6,736.9 |

|

$ |

6,796.3 |

|

$ |

27,924.7 |

|

|

Gross profit |

|

|

795.5 |

|

|

837.5 |

|

|

774.4 |

|

|

785.8 |

|

|

3,193.1 |

|

|

Net income |

|

|

127.9 |

|

|

163.7 |

|

|

121.5 |

|

|

158.7 |

|

|

571.9 |

|

|

Diluted earnings per share |

|

|

0.91 |

|

|

1.18 |

|

|

0.88 |

|

|

1.15 |

|

|

4.12 |

|

|

2014(c) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales |

|

$ |

6,345.5 |

|

$ |

7,421.9 |

|

$ |

6,683.6 |

|

$ |

7,048.7 |

|

$ |

27,499.7 |

|

|

Gross profit |

|

|

735.2 |

|

|

848.6 |

|

|

804.9 |

|

|

837.0 |

|

|

3,225.7 |

|

|

Net income |

|

|

120.6 |

|

|

124.9 |

|

|

113.9 |

|

|

186.3 |

|

|

545.6 |

|

|

Diluted earnings per share |

|

|

0.86 |

|

|

0.89 |

|

|

0.81 |

|

|

1.33 |

|

|

3.89 |

|

|

(a) |

Quarters may not total to the fiscal year due to rounding. |

|

(b) |

First quarter of fiscal 2015 results were impacted by restructuring, integration and other expenses of $18.3 million before tax, $13.2 million after tax and $0.09 per share on a diluted basis and an income tax benefit of $5.9 million primarily related to certain items impacting the effective income tax rate. Second quarter results were impacted by restructuring, integration and other expenses of $13.3 million before tax, $10.2 million after tax and $0.07 per share on a diluted basis and an income tax benefit of $5.6 million primarily related to certain items impacting the effective income tax rate. Third quarter results were impacted by restructuring, integration and other expenses of $15.5 million before tax, $12.0 million after tax and $0.09 per share on a diluted basis and an income tax expense of $2.2 million primarily related to certain items impacting the effective income tax rate. Fourth quarter results were impacted by restructuring, integration and other expenses of $43.7 million before tax, $30.5 million after tax and $0.22 per share on a diluted basis and an income tax benefit of $45.8 million and $0.33 per share on a diluted basis as a result of the release of valuation allowances against certain deferred tax assets. |

|

(c) |

First quarter of fiscal 2014 results were impacted by restructuring, integration and other expenses of $12.1 million before tax, $8.8 million after tax and $0.06 per share on a diluted basis and a gain on legal settlement of $19.1 million before tax, $11.7 million after tax and $0.08 per share on a diluted basis related to an award payment received. Second quarter results were impacted by restructuring, integration and other expenses of $28.4 million before tax, $21.7 million after tax and $0.15 per share on a diluted basis and an income tax expense of $8.2 million primarily related to certain items impacting the effective income tax rate. Third quarter results were impacted by restructuring, integration and other expenses of $26.1 million before tax, $19.3 million after tax and $0.14 per share on a diluted basis. Fourth quarter results were impacted by restructuring, integration and other expenses of $28.0 million before tax, $20.9 million after tax and $0.15 per share on a diluted basis and an income tax benefit of $58.2 million and $0.41 per share on a diluted basis as a result of the release of valuation allowances against certain deferred tax assets. |

20

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

For an understanding of Avnet and the significant factors that influenced the Company’s performance during the past three fiscal years, the following discussion should be read in conjunction with the description of the business appearing in Item 1 of this Report and the consolidated financial statements, including the related notes and schedule, and other information appearing in Item 15 of this Report. The Company operates on a “52/53 week” fiscal year. Fiscal 2015, 2014 and 2013 all contained 52 weeks.