UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

or

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number

(Exact name of registrant as specified in its charter)

(State or other jurisdiction of incorporation or organization) |

| (I.R.S. Employer Identification No.) |

(Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code (

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class |

| Trading Symbol |

| Name of Each Exchange on Which registered: |

|

|

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ◻

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Accelerated Filer ◻ |

| Non-accelerated Filer ◻ |

| Smaller Reporting Company | Emerging Growth Company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ◻

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements

Indicate by check mark whether any of those error corrections are restatements that require a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to Section 240.10D-1(b). ◻

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

The aggregate market value (approximate) of the registrant’s common equity held by non-affiliates based on the closing price of a share of the registrant’s common stock for Nasdaq Global Select Market composite transactions on December 29, 2023 (the last business day of the registrant’s most recently completed second fiscal quarter) was $

As of August 2, 2024, the total number of shares outstanding of the registrant’s Common Stock was

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement (to be filed pursuant to Reg. 14A) relating to the Annual Meeting of Shareholders anticipated to be held on November 22, 2024, are incorporated herein by reference in Part III of this Report.

TABLE OF CONTENTS

2

PART I

Item 1. Business

Avnet, Inc. and its consolidated subsidiaries (collectively, the “Company” or “Avnet”), is a leading global electronic component technology distributor and solutions provider that has served customers’ evolving needs for more than a century. Founded in 1921, the Company works with electronic component manufacturers (suppliers) in every major electronic component segment to serve customers in more than 140 countries.

Avnet serves a wide range of customers: from startups and mid-sized businesses to enterprise-level original equipment manufacturers (“OEMs”), electronic manufacturing services (“EMS”) providers, and original design manufacturers (“ODMs”).

Organizational Structure

Avnet has two primary operating groups — Electronic Components (“EC”) and Farnell (“Farnell”). Both operating groups have operations in each of the three major economic regions of the world: (i) the Americas, (ii) Europe, Middle East, and Africa (“EMEA”) and (iii) Asia/Pacific (“Asia”). Each operating group has its own management team, who manage various functions within each operating group. Each operating group also has distinct financial reporting to the executive level, which informs operating decisions, strategic planning, and resource allocation for the Company as a whole. Regional divisions (“business units”) within each operating group serve primarily as sales and marketing units to streamline sales efforts and enhance each operating group’s ability to work with its customers and suppliers, generally along more specific geographies or product lines. However, each business unit relies heavily on support services from the operating groups, as well as centralized support at the corporate level.

A description of each operating group is presented below. Further financial information by operating group is provided in Note 16 “Segment information” to the consolidated financial statements appearing in Item 8 of this Annual Report on Form 10-K.

Electronic Components

Avnet’s EC operating group primarily supports high and medium-volume customers. It markets, sells, and distributes electronic components from many of the world’s leading electronic component manufacturers, including semiconductors, IP&E components (interconnect, passive and electromechanical components), and other integrated and embedded components.

EC serves a variety of markets ranging from industrial to automotive to defense and aerospace. It offers an array of customer support options throughout the entire product lifecycle, including both turnkey and customized design, supply chain, programming, logistics, and post-sales services.

Within the EC operating group for 2024, net sales of approximately 85% consist of semiconductor products, approximately 14% consist of interconnect, passive, and electromechanical components, and approximately 1% consist of computers.

Design Chain Solutions

EC offers design chain support that provides engineers with a host of technical design solutions, which helps EC support a broad range of customers seeking complex products and technologies. With access to a suite of design tools and engineering support, customers can get product specifications along with evaluation kits and reference designs that

3

enable a broad range of applications from any point in the design cycle. EC also offers engineering and technical resources deployed globally to support product design, bill of materials development, and technical education and training. By utilizing EC’s design chain support, customers can optimize their component selection and accelerate their time to market. EC’s extensive electronic component offerings provides customers access to a diverse range of products from a complete spectrum of suppliers.

Supply Chain Solutions

EC’s supply chain solutions provide procurement support and warehousing and logistics services to OEMs, EMS providers, and electronic component manufacturers, enabling them to optimize supply chains on a local, regional, or global basis. EC’s internal competencies in supply chain, global warehousing and logistics, information technology, and asset management, combined with its global footprint and extensive supplier relationships, allows EC to develop supply chain solutions that provide for a deeper level of engagement with its customers. These customers can manage their supply chains to meet the demands of a competitive global environment without a commensurate investment in physical assets, systems, and personnel. With supply chain planning tools and a variety of electronic component management solutions, EC provides various solutions that meet a customer’s requirements and minimize supply chain risk in a variety of scenarios.

Embedded and Integrated Solutions

EC provides embedded solutions, including technical design and integration and assembly of embedded products, systems, and solutions for a variety of end markets, including industrial and healthcare. EC also provides embedded display solutions, including touch and passive displays. In addition, EC develops and produces standard board and industrial subsystems and application-specific devices that enable it to produce specialized systems tailored to specific customer requirements. EC serves OEMs that require embedded systems and solutions, including engineering, product prototyping, integration, and other value-added services in the medical, telecommunications, industrial, and digital editing markets.

EC also provides integrated solutions and services for software companies that bring their intellectual property to market via hardware solutions, including custom-built servers.

Farnell

Avnet’s Farnell operating group primarily supports lower-volume customers that need electronic components quickly to develop, prototype, and test their products. It distributes a comprehensive portfolio of kits, tools, electronic components, industrial automation components, and test and measurement products to both engineers and entrepreneurs, primarily through an e-commerce channel. Farnell also distributes new product introductions for its suppliers across their various product categories.

Within the Farnell operating group for 2024, net sales of approximately 16% consists of semiconductor products, approximately 45% consists of interconnect, passive, and electromechanical components, approximately 5% consists of single-board computers, and approximately 34% consists of other products and services, including test and measurement and maintenance, repair, and operations products.

Major Products

One of Avnet’s competitive strengths is the breadth and quality of the suppliers whose products it distributes. Products from one supplier were approximately 10% of consolidated sales during fiscal years 2024 and 2023, and no

4

single supplier exceeded 10% of consolidated sales during fiscal year 2022. Listed in the table below are the major product categories and the Company’s approximate sales of each during the past three fiscal years. “Other” consists primarily of test and measurement and maintenance, repair, and operations (MRO) products.

Years Ended | ||||||||||

| June 29, |

| July 1, |

| July 2, |

| ||||

2024 | 2023 | 2022 | ||||||||

(Millions) | ||||||||||

Semiconductors | $ | 19,030.3 | $ | 21,366.5 | $ | 18,380.2 | ||||

Interconnect, passive & electromechanical (IP&E) |

| 3,745.9 |

| 4,150.6 |

| 4,639.1 | ||||

Computers | 382.8 | 520.8 | 663.2 | |||||||

Other |

| 598.1 |

| 499.0 |

| 628.2 | ||||

Sales | $ | 23,757.1 | $ | 26,536.9 | $ | 24,310.7 | ||||

Competition & Markets

The electronic components industry is competitive. The Company’s major competitors include: Arrow Electronics, Future Electronics, World Peace Group, and WT Microelectronics for EC; Mouser Electronics, Digi-Key Electronics, and RS Components for Farnell. There are also certain smaller, specialized competitors who generally focus on particular sectors or on narrower geographic locations, markets, or products. As a result of these factors, Avnet’s pricing and product selection and availability must remain competitive.

A key competitive factor in the electronic component distribution industry is the need to carry a sufficient amount and selection of inventory to meet customers’ demand and various delivery requirements. To minimize its exposure related to inventory on hand, the Company purchases most of its products pursuant to franchised distribution agreements, which typically provide certain protections for product obsolescence and price erosion. These agreements are generally cancelable upon 30 to 180 days’ notice and, in most cases, provide for or require inventory return privileges upon cancellation. In addition, the Company enhances its competitive position by offering a variety of value-added services, which are tailored to individual customer specifications and business needs, such as design support, point of use replenishment, labelling, testing, assembly, programming, supply chain management, and materials management.

A competitive advantage is the breadth of the Company’s supplier product line card. Because of the number of Avnet’s suppliers, many customers can simplify their procurement process and can make all or substantially all of their required electronic component purchases from Avnet, rather than purchasing from several different parties.

Seasonality

Historically, Avnet’s business has not been materially impacted by seasonality, except for an impact on consolidated results from shifts in geographic sales trends from Asia in the first half of a fiscal year to the Americas and EMEA regions in the second half of a fiscal year, which impact gross profit and operating income margins as a result of such seasonal geographic sales mix changes.

Human Capital

The Company values its employees and recognizes their significant contributions to the Company’s success. Its core values of integrity, customer focus, ownership, teamwork, and inclusiveness provide a foundation for its culture and are key expectations of employees. The Company’s culture and commitment to its employees are vital to attracting, motivating, and retaining exceptional talent. Consequently, the Company invests in its global workforce to drive

5

diversity and inclusion; provide fair and competitive pay and benefits; foster employee development; promote employees health and safety; and understand employees’ experiences and identify opportunities to improve.

Additional information regarding the Company’s Human Capital programs, initiatives, and metrics can be found on its website, including in its Sustainability Reports accessible on its website. The Sustainability Reports and other information contained on the Company’s website are not incorporated by reference into this Annual Report.

Number of Employees

As of June 29, 2024, the Company’s global workforce totaled approximately 15,462 employees across 48 countries. Broken down by geographic region, approximately 4,294 employees are in the Americas, 6,494 employees are in EMEA, and 4,674 employees are in Asia.

Compensation, Benefits and Wellness

The Company strives to pay all its employees competitively and fairly, without regard to gender, race, or other personal characteristics. The Company sets pay ranges based on market data and considers an employee’s role, experience, tenure, job location, and job performance. The Company periodically reviews its compensation practices, both in terms of its overall workforce and individual employees, to help ensure that pay remains competitive and fair.

The Company offers an array of benefits that support employees’ well-being. Through its THRIVE program, the Company offers resources covering (1) physical and mental health, fitness, and well-being; (2) professional growth, skills, and development; (3) total rewards, retirement planning and money management; and (4) community connections, networks, and social interests.

Development and Training

The Company provides career development training and opportunities to help employees reach their potential. The performance management process provides ongoing performance, goals, and development discussions between employees and their leaders. Learning and development resources include mentoring programs and internal and external trainings, which cover a variety of technical, business, interpersonal, and leadership topics. Additionally, certain programs are available for leaders to develop skills in effective goal setting, coaching, feedback, and development. Talent and succession planning activities are conducted for the Company’s executive officers at least annually and periodically for other senior leaders.

Health and Safety

The Company strives to create workspaces and practices that foster a safe and secure work environment. In fiscal 2024, continued progress was made with implementing the multi-year plan to improve alignment and consistency of management systems, policies, and procedures; provide comprehensive health and safety training to employees relevant to their specific work functions; drive continual improvement processes with a focus on identified risks; and increase ISO certifications at operational sites. As of June 29, 2024, the Company has 26 operational sites, of which eight are certified to ISO 45001 and 17 are certified to ISO 14001.

Diversity, Equity, and Inclusion (“DEI”)

The Company’s DEI vision is (i) an employee population that reflects the diverse communities in which they live, work, and do business, and (ii) a culture that seeks out varying perspectives, which allows the best ideas to come to light. The Company is committed to making employment decisions based on merit and the needs of the Company’s business,

6

while ensuring equal employment opportunities for all applicants and employees regardless of race, gender, national origin, or other protected characteristic. The Company’s Global DEI Council, a global cross-functional team of leaders, oversees inclusion efforts. The council meets regularly and engages with colleagues across the Company to connect DEI initiatives to the Company’s broader business strategy.

The Company’s Equal Opportunity, Diversity, and Inclusion Policy actively promotes DEI in the Company’s talent management practices. The Company’s commitment to diversity is evidenced by the makeup of its Board of Directors, which as of June 29, 2024, was 30% women and 50% racially and ethnically diverse (including Middle Eastern origin). In addition, for fiscal years 2021 through 2024, executive’s annual incentive compensation included non-financial performance goals that consist in part on DEI.

The Company’s employee-led Employee Resource Groups (ERGs) provide a forum for employees to communicate and exchange ideas, build a network of relationships across the Company, and support each other in personal and career development. The Company’s eight ERGs support the following communities: women, Asian and Pacific Islanders, Blacks, Hispanic and Latinos, U.S. veterans, LGBTQ+, later career employees; and environmental and sustainability causes.

Employee Engagement

The Company engages with its employees and encourages open and direct feedback through employee engagement surveys. Through such surveys, the Company regularly collects feedback to better understand its employees’ experiences and identify opportunities to improve the work environment, increase employee satisfaction, and strengthen its culture. In fiscal 2024, the Company conducted its regular global employee engagement survey and achieved a participation rate of 71.6%, an increase over fiscal 2023.

Available Information

The Company files its annual report on Form 10-K, quarterly reports on Form 10-Q, Current Reports on Form 8-K, proxy statements, and other documents (including registration statements) with the U.S. Securities and Exchange Commission (“SEC”) under the Securities Exchange Act of 1934 or the Securities Act of 1933, as applicable. The Company’s SEC filings are available to the public on the SEC’s website at http://www.sec.gov and through The Nasdaq Global Select Market (“Nasdaq”), 165 Broadway, New York, New York 10006, on which the Company’s common stock is listed.

A copy of any of the Company’s filings with the SEC, or any of the agreements or other documents that constitute exhibits to those filings, can be obtained by request directed to the Company at the following address and telephone number:

Avnet, Inc.

2211 South 47th Street

Phoenix, Arizona 85034

(480) 643-2000

Attention: Corporate Secretary

The Company also makes these filings available, free of charge, through its website (see “Avnet Website” below).

7

Avnet Website

In addition to the information about the Company contained in this Report, extensive information about the Company can be found at http://www.avnet.com, including information about its management team, products and services, and corporate governance practices.

The corporate governance information on the Company’s website includes the current version of the Company’s Corporate Governance Guidelines, the Code of Conduct, and the charters for each of the committees of its Board of Directors. Waivers granted to directors and executive officers under the Code of Conduct, if any, will be posted in this area of the website. These documents can be accessed at ir.avnet.com/documents-charters. Printed versions can be obtained, free of charge, by writing to the Company at the address listed above in “Available Information.”

The Company’s filings with the SEC, as well as Section 16 filings made by any of the Company’s executive officers or directors with respect to the Company’s common stock, are available on the Company’s website (ir.avnet.com/financial-information/sec-filings) as soon as reasonably practicable after the filing is electronically filed with, or furnished to, the SEC.

These details about the Company’s website and its content are only for information. The contents of the Company’s website are not, nor shall they be deemed to be, incorporated by reference in this Report.

Item 1A. Risk Factors

Forward-Looking Statements and Risk Factors

This Report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (“Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) with respect to the financial condition, results of operations, and business of Avnet. These statements are generally identified by words like “believes,” “plans,” “projects,” “expects,” “anticipates,” “should,” “will,” “may,” “estimates,” or similar expressions. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties, and actual results and other outcomes could differ materially from those expressed or implied in the forward-looking statements. Any forward-looking statement speaks only as of the date on which that statement is made. Except as required by law, the Company does not undertake any obligation to update any forward-looking statements to reflect events or circumstances that occur after the date on which the statement is made.

Risks and uncertainties that may cause actual results to differ materially from those contained in the forward-looking statements include the risk factors discussed below as well as risks and uncertainties not presently known to the Company or that management does not currently consider material. Such factors make the Company’s operating results for future periods difficult to predict and, therefore, prior results do not necessarily indicate results in future periods. Some of the risks disclosed below may have already occurred, but not to a degree that management considers material unless otherwise noted. Any of the below factors, or any other factors discussed elsewhere in this Report, may have an adverse effect on the Company’s financial condition, operating results, prospects, and liquidity. Similarly, the price of the Company’s common stock is subject to volatility due to fluctuations in general market conditions; actual financial results that do not meet the Company’s or the investment community’s expectations; changes in the Company’s or the investment community’s expectations for the Company’s future results, dividends, or share repurchases; and other factors, many of which are beyond the Company’s control.

8

Business and Operations Risks

Changes in customer needs and consumption models

Changes in customer product demands and consumption models may cause a decline in the Company’s billings, which would have a negative impact on the Company’s financial results. Changes in technology (such as artificial intelligence) could reduce the types or quantity of services that customers require from the Company. While the Company attempts to identify changes in market conditions as soon as possible, the dynamics of the industries in which it operates make it difficult to predict and timely react to such changes, including those relating to product capacity and lead times. Also, future downturns, inflation, or supply chain challenges, including in the semiconductor, embedded solutions, maintenance, and test and measurement industries, could adversely affect the Company’s relationships with its customers, operating results, and profitability.

Specifically, the semiconductor industry experiences periodic fluctuations in product supply and demand (often associated with changes in economic conditions, technology, and manufacturing capacity) and suppliers may not adequately predict or meet customer demand. Geopolitical uncertainty (including from military conflicts, health-related crises, and international trade disputes) have led, and may continue to lead, to shortages, extended lead times, and unpredictability in the supply of certain semiconductors and other electronic components. In reaction, customers may over order to ensure sufficient inventory, which, when the shortage lessens, may result in order cancellations and decreases. In cases where customers have non-cancellable/ non-returnable orders, customers may not be able or willing to carry out the terms of the orders. The Company’s prices to customers depend on many factors, including product availability, supplier costs, and competitive pressures. In fiscal 2024 and 2023, pricing to customers increased due to higher costs from suppliers, as well as higher freight and other costs. However, the Company may not be able to maintain higher prices to customers in the future. As product becomes more available, customer and competitive pressures may lower prices to customers, which could reduce the Company’s margins. In addition, the Company may be unable to increase prices to customers to offset higher internal costs, which could also reduce margins. During fiscal 2024, 2023, and 2022, sales of semiconductors represented approximately 80%, 81%, and 76% of the Company’s consolidated sales, respectively, and the Company’s sales closely follow the strength or weakness of the semiconductor industry. These conditions make it more difficult to manage the Company’s business and predict future performance.

Disruptions to key supplier and customer relationships

One of the Company’s competitive strengths is the breadth and quality of the suppliers whose products the Company distributes. For fiscal 2024, one supplier accounted for approximately 10% of the Company’s consolidated billings. The Company’s contracts with its suppliers vary in duration and are generally terminable by either party at will upon notice. The Company’s suppliers may terminate or significantly reduce their volume of business with the Company because of a product shortage, an unwillingness to do business with the Company, changes in strategy, or otherwise.

Shortages of products or loss of a supplier may negatively affect the Company’s business and relationships with its customers, as customers depend on the Company’s timely delivery of technology hardware and software from the industry’s leading suppliers. In addition, shifts in suppliers’ strategies, or performance and delivery issues, may negatively affect the Company’s financial results. These conditions make it more difficult to manage the Company’s business and predict future performance. The competitive landscape has also experienced consolidation among suppliers and capacity constraints, which could negatively impact the Company’s profitability and customer base.

Further, if key suppliers modify the terms of their contracts (including terms regarding price protection, rights of return, order cancellation rights, delivery commitments, rebates, or other terms that protect or enhance the Company’s gross margins), it could negatively affect the Company’s results of operations, financial condition, or liquidity. Due to recent global shortages of semiconductors, some suppliers have increased the amount of non-cancellable/ non-returnable

9

orders, which limited the Company’s ability to adjust down its inventory levels. The Company may attempt to limit associated risks by passing such terms on to its customers, but this may not be possible.

Risks related to international operations

During fiscal 2024, 2023, and 2022 approximately 77%, 76% and 77%, respectively, of the Company’s sales came from its operations outside the United States. The Company’s operations are subject to a variety of risks that are specific to international operations, including, but not limited to, the following:

| ● | potential restrictions on the Company’s ability to repatriate funds from its foreign subsidiaries; |

| ● | foreign currency and interest rate fluctuations; |

| ● | non-compliance with foreign and domestic data privacy regulations, business licensing requirements, environmental regulations, and anti-corruption laws, the failure of which could result in severe penalties, including monetary fines and criminal proceedings; |

| ● | non-compliance with foreign and domestic import and export regulations and adoption or expansion of trade restrictions, including technology transfer restrictions, additional license, permit or authorization requirements for shipments, specific company sanctions, new and higher duties, tariffs or surcharges, or other import/export controls; |

| ● | complex and changing tax laws and regulations; |

| ● | regulatory requirements and prohibitions that differ between jurisdictions; |

| ● | economic and political instability, terrorism, military conflicts, or civil unrest; |

| ● | fluctuations in freight costs (both inbound and outbound), limitations on shipping and receiving capacity, and other disruptions in the transportation and shipping infrastructure; |

| ● | natural disasters (including due to climate change), pandemics, and other public health crises; |

| ● | differing employment practices and labor issues; and |

| ● | non-compliance with local laws. |

In addition to the cost of compliance, the potential criminal penalties for violations of import or export regulations and anti-corruption laws, by the Company or its third-party agents, create heightened risks for the Company’s international operations. If a regulatory body determines that the Company has violated such laws, the Company could be fined significant sums, incur sizable legal defense costs, have its import or export capabilities restricted or denied, or have its inventories seized, which could have a material and adverse effect on the Company’s business. Additionally, allegations that the Company has violated any such regulations may negatively impact the Company’s reputation, which may result in customers or suppliers being unwilling to do business with the Company. While the Company has adopted measures and controls designed to ensure compliance with these laws, these measures may not be adequate, and the Company may be materially and adversely impacted in the event of an actual or alleged violation.

Tariffs, trade restrictions, sanctions, or changes in trade policies may adversely affect the Company’s sales and profitability. For example, various governments imposed trade measures applicable to China and Hong Kong. The United States, European Union, United Kingdom, and others initiated a variety of trade measures and other restrictions against Russia in response to the Russian-Ukraine conflict. In response, the Chinese and Russian governments initiated trade measures against various countries and covering a variety of products. These actions have resulted in losses; increased costs, which the Company may not be able to pass on to customers; shortages of materials and electronic components;

10

increased cyber security attacks; credit market disruptions; and inflation. In addition, increased operational expenses incurred in minimizing the number of products subject to tariffs could adversely affect the Company’s operating profits. These measures have not yet had a material impact, but future actions or escalations that affect trade relations could materially affect the Company’s sales and results of operations.

The Company transacts sales, pays expenses, owns assets, and incurs liabilities in countries using currencies other than the U.S. Dollar. Because the Company’s consolidated financial statements are presented in U.S. Dollars, the Company must translate such activities and amounts into U.S. Dollars at exchange rates in effect during each reporting period. Therefore, increases or decreases in the exchange rates between the U.S. Dollar and other currencies affect the Company’s reported amounts of sales, operating income, and assets and liabilities denominated in foreign currencies. In addition, unexpected and dramatic changes in foreign currency exchange rates may negatively affect the Company’s earnings from those markets. While the Company may use derivative financial instruments to reduce its net exposure, foreign currency exchange rate fluctuations may materially affect the Company’s financial results. Further, foreign currency instability and disruptions in the credit and capital markets may increase credit risks for some of the Company’s customers and may impair its customers’ ability to repay existing obligations.

Internal information systems failures

The Company depends on its information systems to facilitate its day-to-day operations and to produce timely, accurate, and reliable information on financial and operational results. Currently, the Company’s global operations are tracked with multiple information systems, including systems from acquired businesses, some of which are subject to ongoing IT projects designed to streamline or optimize the Company’s systems. These IT projects are extremely complex, in part because of wide ranging processes, use of on-premise and cloud environments, the Company’s business operations, and changes in information technology. The Company may not always succeed at these efforts. Implementation or integration difficulties may adversely affect the Company’s ability to complete business transactions and ensure accurate recording and reporting of financial data. In addition, IT projects may not achieve the expected efficiencies and cost savings, which could negatively impact the Company’s financial results. A failure of any of these information systems (including due to power losses, computer and telecommunications failures, cyber security incidents, or manmade or natural disasters), or material difficulties in upgrading these information systems, could have an adverse effect on the Company’s business, internal controls, and reporting obligations under federal securities laws.

Due to the Company’s increased online sales, system interruptions and delays that make its websites and services unavailable or slow to respond may reduce the attractiveness of its products and services to its customers. If the Company is unable to continually improve the efficiency of its systems, it could cause systems interruptions or delays and adversely affect the Company’s operating results.

Logistics disruptions

The Company’s global logistics services are operated through specialized and centralized distribution centers around the globe, some of which are outsourced. The Company also depends almost entirely on third-party transportation service providers to deliver products to its customers. A major interruption or disruption in service at one or more of its distribution centers for any reason, or significant disruptions of services from the Company’s third-party transportation providers, could cause a delay in expected cost savings or an increase in expenses, which may not be possible to pass on to customers. Such disruptions could result from risks related to information technology, data security, or any of the General Risk Factors, as discussed herein. In addition, as the Company continues to increase capacity at various distribution centers, it may experience operational challenges, increased costs, decreased efficiency, and customer delivery delays and failures. Such operational challenges could have an adverse impact on the Company’s business partners, and on the Company’s business, operations, financial performance, and reputation.

11

Data security and privacy threats

Threats to the Company’s data and information technology systems (including cybersecurity attacks such as phishing and ransomware) are becoming more frequent and sophisticated, including through the use of artificial intelligence and machine learning. Threat actors have successfully breached the Company’s systems and processes in various ways, and such cybersecurity breaches expose the Company to significant potential liability and reputational harm. Cybersecurity attacks have not yet materially impacted the Company’s data (including data about customers, suppliers, and employees) or the Company’s operations, financial condition, or data security, but future attacks could have a material impact. Threat actors, including sophisticated nation-state actors, seek unauthorized access to intellectual property, or confidential or proprietary information regarding the Company, its customers, its business partners, or its employees, and may target the Company’s systems for espionage, intellectual property theft, or disruption of operations. They deploy malicious software programs that exploit security vulnerabilities, including ransomware designed to encrypt the Company’s files so an attacker may demand a ransom for restored access. They also seek to misdirect money, sabotage data and systems, takeover internal processes, and induce employees or other system users to disclose sensitive information, including login credentials. In addition, some Company employees continue to work from home on a full-time or hybrid basis, which increases the Company’s vulnerability to cyber and other information technology risks. Further, the Company’s business partners and service providers (such as suppliers, customers, and hosted solution providers) pose a security risk because their own security systems or infrastructure may become compromised.

The Company seeks to protect and secure its systems and information, prevent, and detect evolving threats, and respond to threats as they occur. Measures taken include implementing and enhancing information security controls such as enterprise-wide firewalls, intrusion detection, endpoint protection, email security, disaster recovery, vulnerability management, and cybersecurity training for employees to enhance awareness of general security best practices, financial fraud, and phishing. Despite these efforts, the Company may not always be successful. Threat actors frequently change their techniques and technology (such as implementing artificial intelligence) and, consequently, the Company may not always promptly detect the existence or scope of a security breach. As these types of threats grow and evolve, the Company may make further investments to protect its data and information technology infrastructure, which may impact the Company’s profitability. The Company’s insurance coverage for protecting against cyber attacks may not be sufficient to cover all possible claims, and the Company may suffer losses that could have a material adverse effect on its business. As a global enterprise, the Company may be negatively impacted by existing and proposed laws and regulations, as well as government policies and practices, related to cybersecurity, data privacy, data localization, and data protection. Failure to comply with such requirements could have an adverse effect on the Company’s reputation, business, financial condition, and results of operations, as well as subject the Company to significant fines, litigation losses, third-party damages, and other liabilities.

Financial Risks

Inventory value decline

The electronic components and integrated products industries are subject to technological change, new and enhanced products, changes in customer needs, and changes in industry standards and regulatory requirements, which can cause the Company’s inventory to decline in value or become obsolete. Regardless of the general economic environment, prices may decline due to a decrease in demand or an oversupply of products, which may increase the risk of declines in inventory value. Many of the Company’s suppliers offer certain protections from the loss in value of inventory (such as price protection and limited rights of return), but such policies may not fully compensate for the loss. Also, suppliers may not honor such agreements, some of which are subject to supplier discretion. In addition, most Company sales are made pursuant to individual purchase orders, rather than through long-term sales contracts. Where there are contracts, such contracts are generally terminable at will upon notice. Unforeseen product developments,

12

inventory value declines, or customer cancellations may adversely affect the Company’s business, results of operations, financial condition, or liquidity.

Accounts receivable defaults

Accounts receivable are a significant portion of the Company’s working capital. If entities responsible for a significant amount of accounts receivable cease doing business, direct their business elsewhere, fail to pay, or delay payment, the Company’s business, results of operations, financial condition, or liquidity could be adversely affected. An economic or industry downturn could adversely affect the Company’s ability to collect receivables, which could result in longer payment cycles, increased collection costs, and defaults exceeding management’s expectations. A significant deterioration in the Company’s ability to collect accounts receivable in the United States could impact the cost or availability of financing under its accounts receivable securitization program.

Liquidity and capital resources constraints

The Company’s ability to satisfy its cash needs and implement its capital allocation strategy depends on its ability to generate cash from operations and to access the financial markets, both of which are subject to general economic, financial, competitive, legislative, regulatory, and other factors that are beyond the Company’s control. In addition to cash on hand, the Company relies on external financing to help satisfy its cash needs. However, various factors affect external financing, including general market conditions, interest rate fluctuations, and the Company’s debt ratings and operating results. Consequently, external financing may not be available on acceptable terms or at all. An increase in the Company’s debt or deterioration of its operating results may cause a reduction in its debt ratings. Any such reduction could negatively impact the Company’s ability to obtain additional financing or renew existing financing, and could result in reduced credit limits, increased financing expenses, and additional restrictions and covenants. A reduction in its current debt rating may also negatively impact the Company’s working capital and impair its relationship with its customers and suppliers.

As of June 29, 2024, the Company had debt outstanding with financial institutions under various notes, secured borrowings, and committed and uncommitted lines of credit. The Company needs cash to pay debt principal and interest, and for general corporate purposes, such as funding its ongoing working capital and capital expenditure needs. Under certain of its credit facilities, the applicable interest rate and costs are based in part on the Company’s current debt rating. If its debt rating is reduced, higher interest rates and increased costs would result. Any material increase in the Company’s financing costs or loss of access to cost-effective financing could have an adverse effect on its profitability, results of operations, and cash flows.

Under some of its credit facilities, the Company is required to maintain a maximum leverage ratio and pass certain financial tests. If the Company increases its level of debt or its operating results deteriorate, it may fail to meet this financial ratio or pass these tests, which may result in an event of default. In such an event, lenders may accelerate payment and the Company may be unable to continue to utilize these facilities. If the Company is unable to utilize these facilities or is required to repay debt earlier than management expected, it may not have sufficient cash available to make interest payments, to repay indebtedness, or for general corporate needs.

General economic or business conditions, both domestic and foreign, may be less favorable than management expects and could adversely impact the Company’s sales or its ability to collect receivables from its customers, which may impact access to the Company’s accounts receivable securitization program.

13

Financing covenants and restrictions may limit management discretion

The agreements governing the Company’s financing, including its credit facility, accounts receivable securitization program, and the indentures governing the Company’s outstanding notes, contain various covenants and restrictions that, in certain circumstances, limit the Company’s ability, and the ability of certain subsidiaries, to:

| ● | grant liens on assets; |

| ● | make restricted payments (including, under certain circumstances, paying dividends on, redeeming, or repurchasing common stock); |

| ● | make certain investments; |

| ● | merge, consolidate, or transfer all, or substantially all, of the Company’s assets; |

| ● | incur additional debt; or |

| ● | engage in certain transactions with affiliates. |

As a result of these covenants and restrictions, the Company may be limited in the future in how it conducts its business and may be unable to raise additional debt, repurchase common stock, pay a dividend, compete effectively, or make further investments.

Tax law changes and compliance

As a multinational corporation, the Company is subject to the tax laws and regulations of the United States and many foreign jurisdictions. From time to time, governments enact or revise tax laws and regulations, which are further subject to interpretations, guidance, amendments, and technical corrections from international, federal, and state tax authorities. Such changes to tax law may adversely affect the Company’s cash flow, costs of share buybacks, and effective tax rate, including through decreases in allowable deductions and higher tax rates.

Many countries are adopting provisions to align their international tax rules with the Base Erosion and Profit Shifting Project, led by the Organisation for Economic Co-operation and Development (“OECD”) and supported by the United States. The project aims to standardize and modernize global corporate tax policy, including tax rate increases and a 15% global minimum corporate tax rate that would apply to companies with revenue over a set threshold. The project is expected to impact the Company’s taxes in fiscal year 2025. Furthermore, many countries are independently evaluating their corporate tax policy, which could result in tax legislation and enforcement that adversely impacts the Company’s tax provision and value of deferred assets and liabilities.

The tax laws and regulations of the various countries where the Company has operations are extremely complex and subject to varying interpretations. The Company believes that its historical tax positions are sound and consistent with applicable law, and that it has adequately reserved for taxes. However, taxing authorities may challenge such positions and the Company may not be successful in defending against any such challenges. The Company’s future income tax expense could be adversely affected by changes in the mix of earnings in countries with differing statutory tax rates, changes in the valuation of deferred tax assets, and liabilities and changes to its operating structure.

Constraints on internal controls

Effective internal controls are necessary for the Company to provide reliable financial reports, safeguard its assets, and prevent and detect fraud. If the Company cannot do so, its brand and operating results could be harmed. Internal controls over financial reporting are intended to prevent and detect material misstatements in its financial reporting and material fraudulent activity, but are limited by human error, circumventing or overriding controls, and fraud. As a result,

14

the Company may not identify all material activity or all immaterial activity that could aggregate into a material misstatement. Therefore, even effective internal controls cannot guarantee that financial statements are wholly accurate or prevent all fraud and loss of assets. Management continually evaluates the effectiveness of the design and operation of the Company’s internal controls. However, if the Company fails to maintain the adequacy of its internal controls, including any failure to implement required new or improved internal controls, or if the Company experiences difficulties in their implementation, the Company’s business and operating results could be harmed. Additionally, the Company may be subject to sanctions or investigations by regulatory authorities, or the Company could fail to meet its reporting obligations, all of which could have an adverse effect on its business or the market price of the Company’s securities.

Acquisition expected benefits shortfall

The Company has made, and expects to make, strategic acquisitions or investments globally to further its strategic objectives and support key business initiatives. Acquisitions and investments involve risks and uncertainties, some of which may differ from those associated with the Company’s historical operations. Examples include risks relating to expanding into emerging markets and business areas, adding additional product lines and services, impacting existing customer and supplier relationships, incurring costs or liabilities associated with the companies acquired, incurring potential impairment charges on acquired goodwill and other intangible assets, and diverting management’s attention from existing operations and initiatives. As a result, the Company’s profitability may be negatively impacted. In addition, the Company may not successfully integrate the acquired businesses, or the integration may be more difficult, costly, or time-consuming than anticipated. Further, any litigation involving the potential acquisition or acquired entity may increase expenses associated with the acquisition, cause a delay in completing the acquisition, or impact the ability to integrate the acquired entity, all of which may impact the Company’s profitability. The Company may experience disruptions that could, depending on the size of the acquisition, have an adverse effect on its business, especially where an acquisition target may have pre-existing regulatory issues or deficiencies, or material weaknesses in internal controls over financial reporting. Furthermore, the Company may not realize all benefits anticipated from its acquisitions, which could adversely affect the Company’s financial performance.

Legal and Regulatory Risks

Legal proceedings costs and damages

From time to time, the Company may become involved in legal proceedings, including government investigations, that arise out of the ordinary conduct of the Company’s business, including matters involving intellectual property rights, commercial matters, merger-related matters, product liability, and other actions. Legal proceedings could result in substantial costs and diversion of management’s efforts and other resources, and could have an adverse effect on the Company’s operations and business reputation. The Company may be obligated to indemnify and defend its customers if the products or services that the Company sells are alleged to infringe any third party’s intellectual property rights. The Company may not be able to obtain supplier indemnification for itself and its customers against such claims, or such indemnification may not fully protect the Company and its customers against such claims. Also, the Company is exposed to potential liability for technology and products that it develops for which it has no indemnification protections. If an infringement claim against the Company is successful, the Company may be required to pay damages or seek royalty or license arrangements, which may not be available on commercially reasonable terms. The Company may have to stop selling certain products or services, which could affect its ability to compete effectively. In addition, the Company’s expanding business activities may include the assembly or manufacture of electronic component products and systems. Product defects, whether caused by a design, assembly, manufacture or component failure or error, or manufacturing processes not in compliance with applicable statutory and regulatory requirements, may result in product liability claims,

15

product recalls, fines, and penalties. Product liability risks could be particularly significant with respect to aerospace, automotive, and medical applications because of the risk of serious harm to users of such products.

Environmental regulations non-compliance

The Company is subject to various federal, state, local, and foreign laws and regulations addressing environmental and other impacts from industrial processes, waste disposal, carbon emissions, use of hazardous materials in products and operations, recycling products, and other related matters. While the Company strives to fully comply with all applicable regulations, certain of these regulations impose liability without fault. Additionally, the Company may be held responsible for the prior activities of an entity it acquired.

Failure to comply with these regulations could result in substantial costs, fines, and civil or criminal sanctions, as well as third-party claims for property damage or personal injury. Future environmental laws and regulations, including disclosure requirements, may become more stringent over time, imposing greater compliance costs, and increasing risks, penalties and reputational harm associated with violations.

Customers, suppliers, investors, and regulatory agencies in various jurisdictions globally are increasingly requesting or requiring disclosure and action regarding the Company’s supply chain due-diligence and environmental, social, and governance practices. Such increased expectations and regulations may increase compliance costs and result in reputational damage and loss of business if the Company is perceived to have not met such expectations.

General Risk Factors

Negative impacts of economic or geopolitical uncertainty, or a health crisis, on operations and financial results

Economic weakness and geopolitical uncertainty (including from military conflicts and international trade disputes), as well as health-related crises (including pandemics and epidemics), have resulted, and may result in the future, in a variety of adverse impacts on the Company and its customers and suppliers. Such adverse impacts include decreased sales, margins, and earnings; increased logistics costs; demand uncertainty; constrained workforce participation; global supply chain disruptions; and logistics and distribution system disruptions. Such crises and uncertainties could also result in, or heighten the risks of, customer bankruptcies, customer delayed or defaulted payments, delays in product deliveries, financial market disruption and volatility, and other risk factors described in the Company’s Annual Report. As a result, the Company may need to impair assets (including goodwill, intangible assets, and other long-lived assets), implement restructuring actions, and reduce expenses in response to decreased sales or margins.

The Company may not be able to adequately adjust its cost structure in a timely fashion, which may adversely impact its profitability. Uncertainty about economic conditions may increase foreign currency volatility, which may negatively impact the Company’s results. Economic weakness and geopolitical uncertainty also make it more difficult for the Company to manage inventory levels (including when customers decrease orders, cancel existing orders, or are unable to fulfill their obligations under non-cancelable/ non-return orders) and collect customer receivables, which may result in provisions to create reserves, write-offs, reduced access to liquidity, higher financing costs, and increased pressure on cash flows.

An increase in or prolonged period of inflation could affect the Company’s profitability and cash flows, due to higher wages, higher operating expenses, higher financing costs, and higher supplier prices. Inflation may also adversely affect foreign exchange rates. The Company may be unable to pass along such higher costs to its customers, which may result in lower gross profit margins. In addition, inflation may adversely affect customers’ financing costs, cash flows, and profitability, which could adversely impact their operations and the Company’s ability to offer credit and collect receivables.

16

Competition

The market for the Company’s products and services is very competitive and subject to technological advances (including artificial intelligence), new competitors, non-traditional competitors, and changes in industry standards. The Company competes with other global and regional distributors, as well as some of the Company’s own suppliers that maintain direct sales efforts. In addition, as the Company expands its offerings and geographies, the Company may encounter increased competition from current or new competitors. The Company’s failure to maintain and enhance its competitive position could adversely affect its business and prospects. Furthermore, the Company’s efforts to compete in the marketplace could cause deterioration of gross profit margins and, thus, overall profitability.

The size of the Company’s competitors varies across market sectors, as do the resources the Company has allocated to the sectors and geographic areas in which it does business. Therefore, some competitors may have greater resources or a more extensive customer or supplier base in some market sectors and geographic areas. As a result, the Company may not be able to effectively compete in certain markets, which could impact the Company’s profitability and prospects.

Employee retention and hiring constraints

Identifying, hiring, training, developing, and retaining qualified and engaged employees is critical to the Company’s success, and competition for experienced employees in the Company’s industry can be intense. Restrictions on immigration or changes in immigration laws, including visa restrictions, may limit the Company’s acquisition of key talent, including talent with diverse experience, background, ability, and perspectives. Changing demographics and labor work force trends may result in a loss of knowledge and skills as experienced workers leave the Company. In addition, as global opportunities and industry demands shift, and as the Company expands its offerings, the Company may encounter challenges in realigning, training, and hiring skilled personnel. Through organizational design activities, the Company periodically eliminates positions due to restructurings or other reasons, which may risk the Company’s brand reputation as an employer of choice and negatively impact the Company’s ability to hire and retain qualified personnel. Also, position eliminations may negatively impact the morale of employees who are not terminated, which could result in work stoppages or slowdowns, particularly where employees are represented by unions or works councils. If these circumstances occur, the Company’s business, financial condition, and results of operations could be seriously harmed.

Item 1B. Unresolved Staff Comments

Not applicable.

Item 1C. Cybersecurity

The Company recognizes the importance of assessing, identifying, and managing material risks associated with cybersecurity threats, as defined in Item 106(a) of Regulation S-K. These risks include operational risks; intellectual property theft; fraud; extortion; harm to employees or customers; legal risks, including violations of privacy or data protection laws; and reputational risks. The Company has implemented several cybersecurity processes, technologies, and controls to aid in its efforts.

The Company’s Global Cybersecurity & Compliance (GC&C) team maintains a comprehensive cybersecurity program that includes policies, procedures, and standards to govern the safe processing, storage, and transmission of data. GC&C team members have extensive knowledge and experience regarding cybersecurity and the Company’s information technology systems. The GC&C team leader reports directly to the Company’s Chief Information Officer. The cybersecurity program was developed using practices anchored on the National Institute of Standards and Technology (NIST) Cyber Security Framework (CSF) and seeks to align to the additional cybersecurity measures of

17

NIST 800-171 and ISO27001. Cybersecurity controls are governed by Avnet’s Global Information Security Policy (GISP).

The Company has processes for overseeing and identifying cybersecurity threats, vulnerabilities, and controls associated with third-party service providers, including evaluating providers’ (i) cybersecurity ratings, (ii) public disclosures related to cybersecurity, (iii) cybersecurity questionnaire responses, and (iv) cybersecurity and IT certifications.

The Company provides quarterly updates to, and receives oversight from, the Audit Committee on the Company’s cybersecurity program, cybersecurity incidents, and the cybersecurity threat landscape. Responsible members of management provide updates to the Company’s senior executive team regarding all cybersecurity incidents, the cybersecurity program, and the threat landscape.

The Company’s enterprise risk management program (ERM) considers cybersecurity risks (including likelihood, potential severity, and mitigation) alongside other enterprise-wide risks as part of its overall ERM process. The GC&C team administers an IT risk management program that identifies and assesses cybersecurity risks. Its assessments are shared with the Company’s enterprise risk management council (ERM Council).

The GC&C team applies an incident response procedure. Among other things, the team appropriately escalates some incidents in real-time, depending on the incident’s potential impact and scope. Further, the GC&C team regularly collaborates with other departments—such as legal, corporate security, and human resources—when assessing, identifying, and managing cybersecurity incidents. The Company also retains external cybersecurity response consultants to assist internal resources as needed.

The Company regularly tests the effectiveness of its security program through internal audit and external assessments. The Company makes investments for continual improvements in risk and vulnerability mitigation, including ongoing monitoring, network and system updates, and employee cybersecurity awareness training.

The Company’s cybersecurity assessments and auditing include:

•Regular penetration tests conducted by external consultants;

•Regular maturity assessments conducted by external consultants;

•Quarterly self-assessments of internal cybersecurity capabilities; and

•Ongoing internal audits of cybersecurity systems and practices.

The Company’s employee communication and training program includes:

•Annual tabletop exercises performed with its executive team;

•Annual tabletop exercises with its cybersecurity incident response team;

•Annually distributing the Global Information Security Policy (GISP) to all employees;

• | New hire and biennial computer-based training on data privacy and cybersecurity for all employees, with in-person training for high-risk positions; |

•Cybersecurity awareness training videos available to employees and updated quarterly;

•Phishing simulations conducted with employees monthly; and

•Newsletters distributed to all employees on relevant cybersecurity threats.

18

Please refer to Item 1.A, Risk Factors (Data security and privacy threats) for a discussion of whether cybersecurity threats have or will materially affect the Company, as well as the potential impact on the Company’s operations and financial condition.

Item 2. Properties

The Company owns and leases approximately 2.0 million and 4.0 million square feet of space, respectively, of which approximately 25% is in the United States. The following table summarizes certain of the Company’s key facilities:

| Approximate |

| Leased |

|

| ||

Square | or |

| |||||

Location | Footage | Owned | Primary Use |

| |||

Bernburg. Germany | 680,000 | Owned | EC warehousing and value-added operations currently under construction | ||||

Chandler, Arizona |

| 400,000 | Owned |

| EC warehousing and value-added operations | ||

Tongeren, Belgium |

| 390,000 | Owned |

| EC warehousing and value-added operations | ||

Leeds, United Kingdom | 360,000 | Leased | Farnell warehousing and value-added operations | ||||

Poing, Germany |

| 300,000 | Owned |

| EC warehousing and value-added operations | ||

Chandler, Arizona |

| 230,000 | Leased |

| EC warehousing, integration and value-added operations | ||

Gaffney, South Carolina | 220,000 | Owned | Farnell warehousing | ||||

Hong Kong, China |

| 210,000 | Leased |

| EC warehousing | ||

Phoenix, Arizona | 180,000 | Leased | Corporate and EC Americas headquarters | ||||

Taipei, Taiwan | 33,000 | Leased | EC warehousing |

See Note 5, “Property, plant and equipment, net” and Note 11, “Leases” to the Company’s consolidated financial statements included in Item 8 of this Annual Report on Form 10-K for additional information on the Company’s properties.

Item 3. Legal Proceedings

Pursuant to SEC regulations, including but not limited to Item 103 of Regulation S-K, the Company regularly assesses the status of and developments in pending environmental and other legal proceedings to determine whether any such proceedings should be identified specifically in this discussion of legal proceedings, and has concluded that no particular pending legal proceeding requires public disclosure. Based on the information known to date, management believes that the Company has appropriately accrued in its consolidated financial statements for its share of the estimable costs of environmental and other legal proceedings.

The Company is also currently subject to various pending and potential legal matters and investigations relating to compliance with governmental laws and regulations, including import/export and environmental matters. The Company currently believes that the resolution of such matters will not have a material adverse effect on the Company’s financial position or liquidity, but could possibly be material to its results of operations in any single reporting period.

Item 4. Mine Safety Disclosures

Not applicable.

19

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Market Information

The Company’s common stock is listed on the Nasdaq Global Select Market under the symbol AVT.

Dividends

The declaration and payment of future dividends will be at the discretion of the Board of Directors and will be dependent upon the Company’s financial condition, results of operations, capital requirements, and other factors the Board of Directors considers relevant. In addition, certain of the Company’s debt facilities may restrict the declaration and payment of dividends, depending upon the Company’s then current compliance with certain covenants.

Record Holders

As of August 2, 2024, there were 1,309 registered holders of record of Avnet’s common stock.

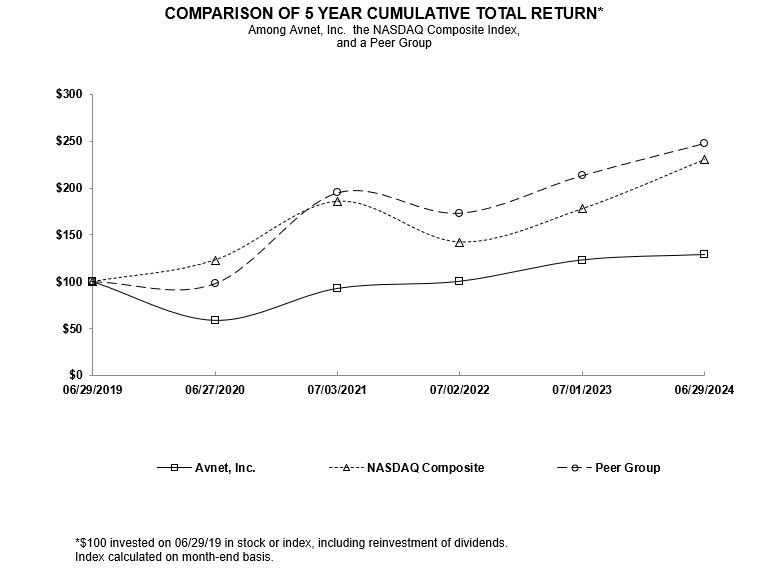

Stock Performance Graphs and Cumulative Total Returns

The graph below matches the cumulative 5-year total return of holders of Avnet’s common stock with (i) the cumulative total returns of the Nasdaq Composite Index and (ii) a customized peer group of five companies (Agilysys Inc., Arrow Electronics Inc., Insight Enterprises Inc., Scansource Inc., and TD Synnex Corporation). The graph assumes that the value of the investment in Avnet’s common stock, in each index, and in the peer group (including reinvestment of dividends) was $100 on 6/29/2019 and tracks it through 6/29/2024.

20

| 6/29/2019 |

| 6/27/2020 |

| 7/3/2021 |

| 7/2/2022 |

| 7/1/2023 |

| 6/29/2024 |

| |||||||

Avnet, Inc. | $ | 100 | $ | 58.93 | $ | 92.88 | $ | 100.49 | $ | 123.19 | $ | 128.95 | |||||||

Nasdaq Composite |

| 100 |

| 123.12 |

| 186.10 |

| 142.44 |

| 178.08 |

| 230.80 | |||||||

Peer Group |

| 100 |

| 97.85 |

| 195.13 |

| 173.37 |

| 213.64 |

| 248.09 | |||||||

The stock price performance included in this graph is not necessarily indicative of future stock price performance.

Issuer Purchases of Equity Securities

The Company’s Board of Directors has approved the repurchase plan of up to an aggregate of $600 million of common stock. The following table includes the Company’s monthly purchases of the Company’s common stock, excluding excise tax, during the fourth quarter of fiscal 2024, under the share repurchase program, which is part of publicly announced plans.

21

Total Number of | Approximate Dollar |

| |||||||||

Total | Average | Shares Purchased | Value of Shares That |

| |||||||

Number | Price | as Part of Publicly | May Yet Be |

| |||||||

of Shares | Paid per | Announced Plans | Purchased under the |

| |||||||

Period | Purchased |

| Share |

| or Programs |

| Plans or Programs |

| |||

March 31 – April 27 |

| — |

| $ | — |

| — |

| $ | 232,484,000 | |

April 28 – May 25 |

| 560,000 |

| $ | 53.17 |

| 560,000 | $ | 202,707,000 | ||

May 26 – June 29 |

| 920,000 |

| $ | 53.23 |

| 920,000 | $ | 153,734,000 | ||

Item 6. [Reserved]

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

For a description of the Company’s critical accounting policies and an understanding of Avnet and the significant factors that influenced the Company’s performance during the past three fiscal years, the following discussion should be read in conjunction with the description of the business appearing in Item 1 of this Report and the consolidated financial statements, including the related notes and schedule, and other information appearing in Item 8 of this Report. Discussions of fiscal 2022 items and year-to-year comparisons between fiscal years 2023 and 2022 are not included in this Form 10-K and can be found in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Part II, Item 7 of the Company’s Annual Report on Form 10-K for the fiscal year ended July 1, 2023. The Company operates on a “52/53 week” fiscal year. Fiscal years 2024, 2023 and 2022 each contained 52 weeks.

The discussion of the Company’s results of operations includes references to the impact of foreign currency translation. When the U.S. Dollar strengthens and the stronger exchange rates are used to translate the results of operations of Avnet’s subsidiaries denominated in foreign currencies, the result is a decrease in U.S. Dollars of reported results. Conversely, when the U.S. Dollar weakens, the weaker exchange rates result in an increase in U.S. Dollars of reported results. In the discussion that follows, results excluding this impact, primarily for subsidiaries in EMEA and Asia, are referred to as “constant currency.”

In addition to disclosing financial results that are determined in accordance with generally accepted accounting principles in the U.S. (“GAAP”), the Company also discloses certain non-GAAP financial information, including:

| ● | “Adjusted operating income,” which is operating income excluding (i) restructuring, integration and other expenses, (ii) Russian-Ukraine conflict related expenses, and (iii) amortization of acquired intangible assets. |

The following table provides a reconciliation of operating income to adjusted operating income:

Years Ended | |||||||||

| June 29, |

| July 1, |

| July 2, | ||||

2024 | 2023 | 2022 | |||||||

(Thousands) | |||||||||

Operating income | $ | 844,367 | $ | 1,186,800 | $ | 939,011 | |||

Restructuring, integration and other expenses |

| 52,550 |

| 28,038 |

| 5,272 | |||

Russian-Ukraine conflict related expenses | — | — | 26,261 | ||||||

Amortization of acquired intangible assets |

| 3,130 |

| 6,053 |

| 15,038 | |||

Adjusted operating income | $ | 900,047 | $ | 1,220,891 | $ | 985,582 | |||

Management believes that providing this additional information is useful to financial statement users to better assess and understand operating performance, especially when comparing results with prior periods or forecasting performance for future periods, primarily because management typically monitors the business both including and excluding these adjustments to GAAP results. Management also uses these non-GAAP measures to establish operational

22

goals and, in many cases, for measuring performance for compensation purposes. However, any analysis of results on a non-GAAP basis should be used as a complement to, and in conjunction with, results presented in accordance with GAAP.

Industry outlook

The global electronic components market has a history of cyclical downturns followed by periods of increased demand. Beginning in the second half of calendar year 2023, the industry began to experience a downturn marked by a decrease in sales due to a combination of elevated customer inventory levels and lower underlying demand for electronic components. As a result, the Company has seen elevated inventory levels and decreased sales, resulting in lower operating income. The duration of the current downturn is uncertain. The Company expects sales in the first quarter of fiscal 2025 to be flat to 5% lower than fourth quarter of fiscal 2024 sales, which will negatively impact operating income and diluted earnings per share.

Results of Operations

Years Ended | |||||||||||||

June 29, 2024 | July 1, 2023 | Variance | Variance % | ||||||||||

($ in millions, unless otherwise stated) | |||||||||||||

Sales | $ | 23,757 | $ | 26,537 | $ | (2,780) | (10.5) | % | |||||

Gross profit | 2,766 | 3,182 | (416) | (13.1) | % | ||||||||

Selling, general and administrative expenses | 1,870 | 1,967 | (98) | (5.0) | % | ||||||||

Restructuring, integration, and other expenses | 53 | 28 | 25 | 87.4 | % | ||||||||

Operating income | 844 | 1,187 | (342) | (28.9) | % | ||||||||

Adjusted operating income | 900 | 1,221 | (321) | (26.3) | % | ||||||||

Other (expense) income, net | (16) | 10 | (26) | (258.8) | % | ||||||||

Interest and other financing expenses, net | (283) | (251) | (32) | 12.8 | % | ||||||||

Gain on legal settlements and other | 86 | 37 | 49 | 133.5 | % | ||||||||

Income tax expense | 134 | 212 | (78) | (37.0) | % | ||||||||

Net income | 499 | 771 | (272) | (35.3) | % | ||||||||

Diluted earnings per share | 5.43 | 8.26 | (2.83) | (34.3) | % | ||||||||

Other Metrics | |||||||||||||

Gross profit margin | 11.6 | % | 12.0 | % | (35) | bps | (0.4) | % | |||||

Operating income margin | 3.6 | % | 4.5 | % | (92) | bps | (0.9) | % | |||||

Adjusted operating income margin | 3.8 | % | 4.6 | % | (81) | bps | (0.8) | % | |||||

Effective tax rate | 21.1 | % | 21.6 | % | (45) | bps | (0.5) | % | |||||

23

Sales

Analysis of Sales: By Operating Group and Geography

The table below provides sales decline rates for fiscal 2024 as compared to fiscal 2023 as reported and on a constant currency basis by geographic region and operating group.

Sales | ||||||||||||||||||

Year-Year % | ||||||||||||||||||

Years Ended | Sales | Change in | ||||||||||||||||

| June 29, |

| % of | July 1, |

| % of | Year-Year % | Constant | ||||||||||

2024 |

| Total |

| 2023 | Total |

| Change | Currency | ||||||||||

(Dollars in millions) | ||||||||||||||||||

Sales by Operating Group: | ||||||||||||||||||

EC | $ | 22,160.0 | 93.3 | % | $ | 24,802.6 | 93.5 | % | (10.7) | % | (11.0) | % | ||||||

Farnell | 1,597.1 | 6.7 | 1,734.3 | 6.5 | (7.9) | (9.3) | ||||||||||||

Total Avnet | $ | 23,757.1 | $ | 26,536.9 | (10.5) | (10.9) | ||||||||||||

Sales by Geographic Region: | ||||||||||||||||||

Americas | $ | 5,919.2 |

| 24.9 | % | $ | 6,807.7 |

| 25.7 | % | (13.1) | % | (13.1) | % | ||||

EMEA |

| 8,395.0 |

| 35.3 |

| 9,229.4 |