BOSTON SCIENTIFIC CORP0000885725DEF 14AFALSE00008857252023-01-012023-12-31iso4217:USD00008857252022-01-012022-12-3100008857252021-01-012021-12-3100008857252020-01-012020-12-310000885725bsx:AdjustmentChangeInPensionValueAndNonQualifiedDeferredCompensationEarningsMemberecd:PeoMember2023-01-012023-12-310000885725bsx:AdjustmentChangeInPensionValueAndNonQualifiedDeferredCompensationEarningsMemberecd:PeoMember2022-01-012022-12-310000885725bsx:AdjustmentChangeInPensionValueAndNonQualifiedDeferredCompensationEarningsMemberecd:PeoMember2021-01-012021-12-310000885725bsx:AdjustmentChangeInPensionValueAndNonQualifiedDeferredCompensationEarningsMemberecd:PeoMember2020-01-012020-12-310000885725ecd:PeoMemberbsx:AdjustmentServiceCostMember2023-01-012023-12-310000885725ecd:PeoMemberbsx:AdjustmentServiceCostMember2022-01-012022-12-310000885725ecd:PeoMemberbsx:AdjustmentServiceCostMember2021-01-012021-12-310000885725ecd:PeoMemberbsx:AdjustmentServiceCostMember2020-01-012020-12-310000885725bsx:AdjustmentStockAwardsMemberecd:PeoMember2023-01-012023-12-310000885725bsx:AdjustmentStockAwardsMemberecd:PeoMember2022-01-012022-12-310000885725bsx:AdjustmentStockAwardsMemberecd:PeoMember2021-01-012021-12-310000885725bsx:AdjustmentStockAwardsMemberecd:PeoMember2020-01-012020-12-310000885725bsx:AdjustmentOptionAwardsMemberecd:PeoMember2023-01-012023-12-310000885725bsx:AdjustmentOptionAwardsMemberecd:PeoMember2022-01-012022-12-310000885725bsx:AdjustmentOptionAwardsMemberecd:PeoMember2021-01-012021-12-310000885725bsx:AdjustmentOptionAwardsMemberecd:PeoMember2020-01-012020-12-310000885725ecd:PeoMemberbsx:AdjustmentEquityAwardsGrantedDuringTheYearUnvestedMember2023-01-012023-12-310000885725ecd:PeoMemberbsx:AdjustmentEquityAwardsGrantedDuringTheYearUnvestedMember2022-01-012022-12-310000885725ecd:PeoMemberbsx:AdjustmentEquityAwardsGrantedDuringTheYearUnvestedMember2021-01-012021-12-310000885725ecd:PeoMemberbsx:AdjustmentEquityAwardsGrantedDuringTheYearUnvestedMember2020-01-012020-12-310000885725ecd:PeoMemberbsx:AdjustmentEquityAwardsGrantedInPriorYearsUnvestedMember2023-01-012023-12-310000885725ecd:PeoMemberbsx:AdjustmentEquityAwardsGrantedInPriorYearsUnvestedMember2022-01-012022-12-310000885725ecd:PeoMemberbsx:AdjustmentEquityAwardsGrantedInPriorYearsUnvestedMember2021-01-012021-12-310000885725ecd:PeoMemberbsx:AdjustmentEquityAwardsGrantedInPriorYearsUnvestedMember2020-01-012020-12-310000885725bsx:AdjustmentEquityAwardsGrantedInPriorYearsVestedMemberecd:PeoMember2023-01-012023-12-310000885725bsx:AdjustmentEquityAwardsGrantedInPriorYearsVestedMemberecd:PeoMember2022-01-012022-12-310000885725bsx:AdjustmentEquityAwardsGrantedInPriorYearsVestedMemberecd:PeoMember2021-01-012021-12-310000885725bsx:AdjustmentEquityAwardsGrantedInPriorYearsVestedMemberecd:PeoMember2020-01-012020-12-310000885725bsx:AdjustmentEquityAwardsGrantedInPriorYearsForfeitedMemberecd:PeoMember2023-01-012023-12-310000885725bsx:AdjustmentEquityAwardsGrantedInPriorYearsForfeitedMemberecd:PeoMember2022-01-012022-12-310000885725bsx:AdjustmentEquityAwardsGrantedInPriorYearsForfeitedMemberecd:PeoMember2021-01-012021-12-310000885725bsx:AdjustmentEquityAwardsGrantedInPriorYearsForfeitedMemberecd:PeoMember2020-01-012020-12-310000885725ecd:PeoMember2023-01-012023-12-310000885725ecd:PeoMember2022-01-012022-12-310000885725ecd:PeoMember2021-01-012021-12-310000885725ecd:PeoMember2020-01-012020-12-310000885725bsx:AdjustmentChangeInPensionValueAndNonQualifiedDeferredCompensationEarningsMemberecd:NonPeoNeoMember2023-01-012023-12-310000885725bsx:AdjustmentChangeInPensionValueAndNonQualifiedDeferredCompensationEarningsMemberecd:NonPeoNeoMember2022-01-012022-12-310000885725bsx:AdjustmentChangeInPensionValueAndNonQualifiedDeferredCompensationEarningsMemberecd:NonPeoNeoMember2021-01-012021-12-310000885725bsx:AdjustmentChangeInPensionValueAndNonQualifiedDeferredCompensationEarningsMemberecd:NonPeoNeoMember2020-01-012020-12-310000885725bsx:AdjustmentServiceCostMemberecd:NonPeoNeoMember2023-01-012023-12-310000885725bsx:AdjustmentServiceCostMemberecd:NonPeoNeoMember2022-01-012022-12-310000885725bsx:AdjustmentServiceCostMemberecd:NonPeoNeoMember2021-01-012021-12-310000885725bsx:AdjustmentServiceCostMemberecd:NonPeoNeoMember2020-01-012020-12-310000885725bsx:AdjustmentStockAwardsMemberecd:NonPeoNeoMember2023-01-012023-12-310000885725bsx:AdjustmentStockAwardsMemberecd:NonPeoNeoMember2022-01-012022-12-310000885725bsx:AdjustmentStockAwardsMemberecd:NonPeoNeoMember2021-01-012021-12-310000885725bsx:AdjustmentStockAwardsMemberecd:NonPeoNeoMember2020-01-012020-12-310000885725bsx:AdjustmentOptionAwardsMemberecd:NonPeoNeoMember2023-01-012023-12-310000885725bsx:AdjustmentOptionAwardsMemberecd:NonPeoNeoMember2022-01-012022-12-310000885725bsx:AdjustmentOptionAwardsMemberecd:NonPeoNeoMember2021-01-012021-12-310000885725bsx:AdjustmentOptionAwardsMemberecd:NonPeoNeoMember2020-01-012020-12-310000885725bsx:AdjustmentEquityAwardsGrantedDuringTheYearUnvestedMemberecd:NonPeoNeoMember2023-01-012023-12-310000885725bsx:AdjustmentEquityAwardsGrantedDuringTheYearUnvestedMemberecd:NonPeoNeoMember2022-01-012022-12-310000885725bsx:AdjustmentEquityAwardsGrantedDuringTheYearUnvestedMemberecd:NonPeoNeoMember2021-01-012021-12-310000885725bsx:AdjustmentEquityAwardsGrantedDuringTheYearUnvestedMemberecd:NonPeoNeoMember2020-01-012020-12-310000885725ecd:NonPeoNeoMemberbsx:AdjustmentEquityAwardsGrantedInPriorYearsUnvestedMember2023-01-012023-12-310000885725ecd:NonPeoNeoMemberbsx:AdjustmentEquityAwardsGrantedInPriorYearsUnvestedMember2022-01-012022-12-310000885725ecd:NonPeoNeoMemberbsx:AdjustmentEquityAwardsGrantedInPriorYearsUnvestedMember2021-01-012021-12-310000885725ecd:NonPeoNeoMemberbsx:AdjustmentEquityAwardsGrantedInPriorYearsUnvestedMember2020-01-012020-12-310000885725bsx:AdjustmentEquityAwardsGrantedInPriorYearsVestedMemberecd:NonPeoNeoMember2023-01-012023-12-310000885725bsx:AdjustmentEquityAwardsGrantedInPriorYearsVestedMemberecd:NonPeoNeoMember2022-01-012022-12-310000885725bsx:AdjustmentEquityAwardsGrantedInPriorYearsVestedMemberecd:NonPeoNeoMember2021-01-012021-12-310000885725bsx:AdjustmentEquityAwardsGrantedInPriorYearsVestedMemberecd:NonPeoNeoMember2020-01-012020-12-310000885725bsx:AdjustmentEquityAwardsGrantedInPriorYearsForfeitedMemberecd:NonPeoNeoMember2023-01-012023-12-310000885725bsx:AdjustmentEquityAwardsGrantedInPriorYearsForfeitedMemberecd:NonPeoNeoMember2022-01-012022-12-310000885725bsx:AdjustmentEquityAwardsGrantedInPriorYearsForfeitedMemberecd:NonPeoNeoMember2021-01-012021-12-310000885725bsx:AdjustmentEquityAwardsGrantedInPriorYearsForfeitedMemberecd:NonPeoNeoMember2020-01-012020-12-310000885725ecd:NonPeoNeoMember2023-01-012023-12-310000885725ecd:NonPeoNeoMember2022-01-012022-12-310000885725ecd:NonPeoNeoMember2021-01-012021-12-310000885725ecd:NonPeoNeoMember2020-01-012020-12-31000088572522023-01-012023-12-31000088572512023-01-012023-12-31000088572532023-01-012023-12-31000088572542023-01-012023-12-31000088572552023-01-012023-12-31000088572562023-01-012023-12-31000088572572023-01-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to §240.14a‐12

| | |

Boston Scientific Corporation |

| (Name of Registrant as Specified in its Charter) |

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

☒ No fee required.

☐ Fee paid previously with preliminary materials.

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0‐11.

| | | | | |

| |

| A Letter from our CEO

Michael F. Mahoney |

| |

March 20, 2024Dear Boston Scientific Stockholder:

You are cordially invited to attend the Annual Meeting of Stockholders (Annual Meeting) of Boston Scientific Corporation (the Company or Boston Scientific) to be held on May 2, 2024, at 8:00 a.m. Eastern Time. The Annual Meeting will be held in a virtual format only, via live webcast over the internet. You will be able to join the Annual Meeting and vote and submit your questions online by visiting www.virtualshareholdermeeting.com/BSX2024. We have designed the virtual Annual Meeting to ensure that stockholders are afforded the same opportunity to participate as they would have at an in‐person meeting, including the right to vote and ask questions through the virtual meeting platform. Reference to “in person” attendance or voting in our proxy materials refers, therefore, to attending or voting at the Annual Meeting virtually.

On or about March 20, 2024, we will mail to our stockholders of record at the close of business on Friday, March 8, 2024, the record date for our Annual Meeting, an Important Notice of Internet Availability of Proxy Materials (Notice) containing instructions on how to access our Proxy Statement and Annual Report for the year ended December 31, 2023 (Annual Report) on the internet and how to vote their shares via the internet. If you received a Notice by mail, you will not receive printed proxy materials unless you specifically request them. Both the Notice and the Proxy Statement contain instructions on how you can request a paper copy of our Proxy Statement and Annual Report.

The Board of Directors appreciates and encourages stockholder participation in the Company’s affairs. Whether or not you plan to virtually attend the Annual Meeting, we encourage you to vote your shares. Accordingly, we request that as soon as possible, you vote via the internet or, if you have received printed proxy materials, you vote via the internet, by telephone or by mailing your completed proxy card or voter instruction form.

In 2023, we set our goals high at Boston Scientific, aiming to take our innovation, collaboration and growth to the next level. Thanks to the tremendous talent and dedication of our global teams, I am gratified to say that we not only met our goals but exceeded them, achieving one of the strongest years in company history.

Working together, we reached milestone moments that help lay the groundwork for future success. We launched nearly 90 products, fueled our pipeline with significant merger and acquisition developments, generated clinical evidence through 63 clinical trials that enrolled more than 23,000 patients, enhanced our supply chain agility and continued expanding our digital and operational capabilities. Most importantly, we improved the lives of more than 37 million patients around the world.

The key to our successes is our values-driven team of approximately 48,000 employees worldwide. Their winning spirit and unwavering focus on patients are what enable Boston Scientific to innovate and execute at such a high level. And we’re not nearly finished, because our 2023 results reflect a planful long-term strategy intended to establish us as an extraordinary company for years to come.

Looking forward, we continue to focus on our long-range financial goals of above market revenue growth, expanding operating margins, double-digit adjusted EPS growth and strong cash flow generation. We have confidence in our long-term goal to move from consistently outperforming our peer group to becoming the highest-performing large cap company in MedTech. Boston Scientific is in an excellent position to continue increasing value for customers, employees and stockholders.

Positioned for Growth

Boston Scientific devices and therapies help physicians diagnose and treat complex cardiovascular, respiratory, digestive, oncological, neurological, and urological diseases and conditions. Our growth strategy is built around developing category leadership – becoming the go-to company within those targeted segments – by deepening our portfolio in those areas, as well as expanding into high-growth markets and adjacencies that present a strategic fit. In 2023, that deliberate growth strategy was further supported by improvements in hospital staffing constraints, which allowed more patients to be treated. We expect healthy procedural volumes to continue in 2024.

Expanding and Deepening our Portfolio: Business development announcements supported our strategy in 2023. Our completed acquisition of Apollo Endosurgery, Inc., expands our endoluminal surgery portfolio – technology seen by many as a major advancement in minimally invasive surgery – while enabling our entry into the endobariatric market. Our majority stake investment in Acotec Scientific Holdings Limited, a leader in innovative medical solutions for treating vascular diseases, strengthens our presence in China and creates shared value through R&D collaboration, manufacturing and commercial strategies. The close of our Relievant Medsystems, Inc., acquisition adds the U.S. Food and Drug Administration (FDA)-cleared Intracept™ Procedure for vertebrogenic pain to our array of existing chronic pain offerings. Finally, in January 2024 we announced our entry into a definitive agreement to acquire Axonics, Inc., which will add differentiated devices to treat urinary and bowel dysfunction to our robust urology portfolio. The transaction is expected to close in the first half of 2024, subject to customary closing conditions.

Supporting Patients Along the Care Continuum

Across the specialties we serve, our diversified portfolio of technologies and solutions helps physicians access, diagnose and treat conditions, and supports patients along the continuum of care.

With the release of pivotal data and regulatory milestones, 2023 was an important year for our extensive Cardiovascular portfolio for managing atrial fibrillation (AF), a serious heart condition that affects millions of people and requires treatment to prevent stroke. Significant developments included:

•Our newest-generation left atrial appendage closure (LAAC) technology, the WATCHMAN FLX™ Pro device, received FDA approval. Built upon the proven safety and performance of the WATCHMAN FLX™ LAAC device, this new technology is designed to enhance post-procedural healing, improve implantation precision and expand the size range of treatable appendages, which will enable greater efficiency and optimize treatment for patients with non-valvular AF. We believe it also holds the promise for a simpler post-implant drug regimen in the future, which will be studied in our SIMPLAAFY trial.

•The FDA approval of our POLARx™ Cryoablation System marks an exciting advancement in the treatment of paroxysmal AF. The new system features the POLARx FIT Cryoablation Balloon Catheter, a device with the unique capability of enabling two balloon sizes from a single catheter, providing procedural flexibility and individualized patient care.

•The results of the pivotal ADVENT trial demonstrated our novel FARAPULSE™ Pulsed Field Ablation (PFA) System to be as safe and effective as standard-of-care thermal ablation, with significantly shorter procedure times. Two additional studies of this unique and transformative product are now underway: ADVANTAGE AF will further test safety and efficacy in the persistent AF patient population; and AVANT GUARD will evaluate FARAPULSE as first-line therapy vs. anti-arrhythmic drugs for persistent AF. This important data, combined with the January 2024 FDA approval of the device, and our experience in clinical and commercial settings with more than 40,000 patients, positions us well to lead in the growing pulsed field ablation space.

Enabling Better Patient Outcomes and Improving Efficiency

Working collaboratively with customers helps us understand the clinical challenges they face so that we can design meaningful solutions:

•In patients with coronary artery disease, coronary stenting is commonly used to restore blood flow to the heart – but in some cases, those stented vessels become blocked or narrowed once again. Our AGENT™ Drug-Coated Balloon (DCB), already in use in Europe and Japan, is designed to reopen those vessels, then transfer a therapeutic drug to help prevent reoccurrence. AGENT IDE, the first U.S. clinical trial of a DCB, found AGENT more effective than uncoated balloon angioplasty, including a significant reduction in heart attack.

•New interventional therapies have advanced the treatment of pulmonary embolism, but few clinical guidelines exist to help physicians determine which device to use. The REAL-PE study was launched in search of clarity and found significantly lower major bleeding rates with our EKOS™ Endovascular System compared to a mechanical thrombectomy device. Notably, the study used a novel, AI-assisted approach to evaluate comprehensive patient data by using de-identified electronic health records, providing unprecedented insight into the real-world performance of medical devices.

•Boston Scientific is advancing the treatment paradigms for people living with chronic pain. The FDA approved an expanded indication of our WaveWriter Alpha™ Spinal Cord Stimulator System to manage painful diabetic peripheral neuropathy, providing physicians with more choices to help their patients find relief.

•Demand for kidney stone care is outpacing the number of qualified urologists available to provide care. In 2023, the FDA cleared our next-generation LithoVue™ Elite Single-Use Digital Flexible Ureteroscope, designed with procedural efficiency and patient outcomes in mind. It builds on our market-leading LithoVue single-use scope and is the first ureteroscope with a built-in sensor that enables doctors to monitor intrarenal pressure in real time.

Advancing Health and Addressing Inequities

Protecting the environment is central to our work because a healthier planet leads to healthier people. So too do diverse perspectives and equitable opportunities for all, which is why meaningful diversity, equity and inclusion (DE&I) progress is a priority for us.

There is always more to do, but we are making strong strides toward our goals. Some highlights from 2023:

•Further defining the path to achieve our 2050 goals for net-zero greenhouse gas emissions across our value chain.

•Donating more than $76 million to fund medical research, fellowships and charitable organizations around the world. Our Signature Global Health Grant Program is supporting education and development for health care workers in vulnerable communities worldwide.

•Increasing diversity in clinical trials, including a goal to enroll a cohort of 200 diverse patients in our latest WATCHMAN FLX™ Pro Left Atrial Appendage clinical trial, HEAL-LAA. In addition, our ongoing ELEGANCE global patient registry and post-market study in peripheral artery disease continues to exceed enrollment targets to include more than 40 percent women and 40 percent underrepresented minorities.

•Improving the gender, race and ethnicity balance of our workforce at all levels to 49.3 percent women (global), and 38.3 percent multicultural talent (U.S. and Puerto Rico).

Additional details about our environmental, social and governance initiatives will be available in our 2023 Performance Report.

Looking Forward

Our extraordinary 2023 results confirm the many ways Boston Scientific is bringing shared value to customers, employees, communities and stockholders. Our high-performing global teams remain committed to the invigorating work of challenging what’s possible. I am grateful for their passion, commitment and caring, and I am grateful for the patients and customers who place their trust in our devices and therapies every day.

On behalf of all of us at Boston Scientific, I would like to thank our Board of Directors for their dedicated service, and you, our stockholders, for your continued support. Working together, we continue to advance science and improve the lives of patients around the world.

Michael F. Mahoney

Chairman of the Board of Directors

President and Chief Executive Officer

Notice of Annual Meeting of Stockholders

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | |

| | Date and Time Thursday, May 2, 2024, at 8:00 a.m. Eastern Time | | Who Can Vote Only stockholders of record at the close of business on Friday, March 8, 2024, are entitled to notice of and to vote at the meeting or any adjournments | |

| | | | | |

| | Location Online only at www.virtualshareholdermeeting.com/BSX2024 | | |

| | | | | | | |

| Voting Items | |

| PROPOSAL | BOARD VOTING

RECOMMENDATION | |

| 1 | Elect to the Board of Directors nine nominees for director; |  FOR each director nominee FOR each director nominee | |

| | | | |

| 2 | Approve, on a non-binding, advisory basis, the compensation of our named executive officers; |  FOR FOR | |

| | | | |

| 3 | Approve an amendment and restatement of our By-Laws to provide for advance notice and universal proxy rule updates; and |  FOR FOR | |

| | | |

| 4 | Ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the 2024 fiscal year. |  FOR FOR | |

| | | |

Voting Methods

Your vote is important. We encourage you to vote by proxy, even if you plan to attend the virtual meeting.

| | | | | | | | | | | |

| By Internet www.proxyvote.com | | By Mail Vote Processing, c/o Broadridge Financial Solutions, Inc., 51 Mercedes Way, Edgewood, NY 11717 |

| | | |

| By QR Code Scan with your smartphone | | Online at Annual Meeting www.virtualshareholdermeeting.com/BSX2024 |

| | | |

| By Phone 1-800-690-6903 | | |

Notice of Annual Meeting of Stockholder

Marlborough, Massachusetts

March 20, 2024

The 2024 Annual Meeting of Stockholders of Boston Scientific Corporation (Annual Meeting) will be held on Thursday, May 2, 2024, at 8:00 a.m. Eastern Time. To maximize stockholder participation and provide a consistent experience regardless of location, our 2024 Annual Meeting will be held in a virtual format only, via live webcast over the internet. You will be able to join the Annual Meeting and vote and submit your questions online during the Annual Meeting by visiting www.virtualshareholdermeeting.com/BSX2024. We have designed the virtual Annual Meeting to ensure stockholders are afforded the same opportunity to participate as they would have at an in-person meeting, including the right to vote and ask questions on the virtual meeting platform. The Annual Meeting will take place for the following purposes:

| | | | | |

1. | |

to elect to the Board of Directors nine nominees for director; |

2. | |

to approve, on a non-binding, advisory basis, the compensation of our named executive officers; |

| |

3. | to approve an amendment and restatement of our By-Laws to provide for advance notice and universal proxy rule updates; |

| |

4. | to ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the 2024 fiscal year; and |

| |

5. | to consider and vote upon such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof. |

Only stockholders of record at the close of business on Friday, March 8, 2024, are entitled to notice of and to vote at the meeting or any adjournments or postponements thereof.

| | |

|

It is important that your shares be represented and voted at the Annual Meeting. Whether you plan to attend the Annual Meeting, we encourage you to submit your proxy as soon as possible. For specific instructions, please refer to your Important Notice of Internet Availability of Proxy Materials or to the question on page 10 of the accompanying Proxy Statement entitled “How do I vote by proxy?” |

|

At the direction of the Board of Directors,

Vance R. Brown

Corporate Secretary

Table of Contents

Information About the Annual Meeting and Voting

The Annual Meeting

The 2024 Annual Meeting of Stockholders (Annual Meeting) of Boston Scientific Corporation (the Company) will be held on Thursday, May 2, 2024, at 8:00 a.m. Eastern Time. To maximize stockholder participation and provide a consistent experience regardless of location, our Annual Meeting will be held in a virtual format only, via live webcast over the internet. You will be able to join the Annual Meeting and vote and submit your questions online during the Annual Meeting by visiting www.virtualshareholdermeeting.com/BSX2024. We have designed the virtual Annual Meeting to ensure stockholders are afforded the same opportunity to participate as they would have at an in-person meeting, including the right to vote and ask questions through the virtual meeting platform.

At this meeting, stockholders will be asked to elect nine nominees for director; approve, on a non-binding, advisory basis, the compensation of our named executive officers; approve an amendment and restatement of our By-Laws to provide for advance notice and universal proxy rule updates; and ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the 2024 fiscal year. Management will also respond to questions from stockholders.

Our principal executive offices are located at 300 Boston Scientific Way, Marlborough, Massachusetts 01752, and our telephone number is (508) 683-4000. When used in this Proxy Statement, the terms “we,” “us,” “our,” “Boston Scientific” and “the Company” mean Boston Scientific Corporation and its businesses and subsidiaries.

| | | | | |

| Why am I receiving these materials? |

In connection with its solicitation of proxies for use at our Annual Meeting, our Board of Directors (Board) (i) has made these materials available to you via the internet or, upon your request, via email; or (ii) upon your request, has delivered or will deliver printed versions of these materials to you by mail. As a stockholder of record of our common stock at the close of business on March 8, 2024, the record date for our Annual Meeting, you are invited to attend the virtual Annual Meeting, and are entitled to and requested to vote on the items of business described in this Proxy Statement.

| | | | | |

| Why did I receive a notice in the mail regarding the internet availability of proxy materials instead of a full set of printed proxy materials? |

Pursuant to rules adopted by the U.S. Securities and Exchange Commission (SEC), we are making this Proxy Statement and our Annual Report for the year ended December 31, 2023 (Annual Report and, together with this Proxy Statement, the proxy materials) available to stockholders electronically via the internet. Stockholders will be able to access the proxy materials on the website referred to in the Notice of Internet Availability of Proxy Materials (Notice) or request to receive printed copies of the proxy materials and a proxy card. Instructions on how to access the proxy materials via the internet or to request a printed copy may be found in the Notice and in this Proxy Statement. We believe this electronic process expedites your receipt of the proxy materials and reduces the cost and environmental impact of printing proxy materials for our Annual Meeting. On or about March 20, 2024, stockholders of record and beneficial owners of our common stock at the close of business on March 8, 2024 will be sent a Notice instructing them as to how to receive their proxy materials via the internet. The proxy materials will be available on the internet as of March 20, 2024.

| | | | | |

| Why is the meeting being held virtually again this year? |

We believe a virtual meeting will facilitate expanded stockholder access and participation and provide a consistent experience to stockholders, regardless of location. You will be able to join the Annual Meeting and vote and submit questions online during the Annual Meeting by visiting www.virtualshareholdermeeting.com/BSX2024 and using the 16-digit control number included on the Notice, on your proxy card, or on your voting instruction form provided by your broker, bank or other nominee. Online check-in will be available at the virtual meeting site approximately 15 minutes prior to the beginning of the Annual Meeting.

Information About the Annual Meeting and Voting

| | | | | |

| How can I electronically access the proxy materials? |

Beginning March 20, 2024, you can access the proxy materials and vote your shares online at www.proxyvote.com. The proxy materials are also available on our own website at https://investors.bostonscientific.com/financials-and-filings/annual-results-and-proxy-statements.

| | | | | |

| How can I obtain a full set of printed proxy materials? |

You may request a free full set of printed proxy materials by (i) visiting www.proxyvote.com; (ii) calling (800) 579-1639 or (iii) sending an email to sendmaterial@proxyvote.com. If sending an email, please include your control number in the subject line. In order to receive the proxy materials prior to the Annual Meeting, you should request a copy prior to April 18, 2024.

| | | | | |

| Who is entitled to vote at the Annual Meeting? |

Stockholders who held shares of our common stock at the close of business on Friday, March 8, 2024, are entitled to vote at the Annual Meeting. Each share of our common stock is entitled to one vote.

| | | | | |

| How many shares are eligible to be voted and how many shares are required to hold the Annual Meeting? |

A quorum is required to hold the Annual Meeting and conduct business. The presence at the Annual Meeting, virtually or by proxy, of stockholders holding a majority of our common stock outstanding as of the close of business on Friday, March 8, 2024, the record date, will constitute a quorum for purposes of holding and conducting business at the Annual Meeting. As of March 8, 2024, we had 1,469,895,391 shares of our common stock outstanding — each entitled to one vote at the Annual Meeting — meaning that 734,947,696 shares of common stock must be represented virtually or by proxy to have a quorum. Our common stock is our only outstanding class of voting securities. For purposes of determining whether a quorum exists, broker non-votes (as described further below) and proxies received but marked “ABSTAIN” will be counted.

You are voting on proposals to:

1.elect to the Board nine nominees for director;

2.approve, on a non-binding, advisory basis, the compensation of our named executive officers;

3.approve an amendment and restatement of our By-Laws to provide for advance notice and universal proxy rule updates (Advance Notice and Universal Proxy Rule By-Law Amendments);

4.ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the 2024 fiscal year; and

5.consider and vote upon such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof.

| | | | | |

| How does the Board recommend that I vote? |

The Board recommends that you vote:

1.FOR the election of each of the nine director nominees;

2.FOR the compensation of our named executive officers;

3.FOR the Advance Notice and Universal Proxy Rule By-Law Amendments; and

4.FOR the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the 2024 fiscal year.

Information About the Annual Meeting and Voting

Your vote is very important. Whether or not you plan to attend the virtual Annual Meeting, you may give a proxy to be voted at the Annual Meeting either:

•via the internet pursuant to the instructions provided in the Notice; or

•if you received printed proxy materials, via the internet, telephone or mail pursuant to the instructions provided on the proxy card.

If you vote by mail, no postage is required if your proxy card is mailed in the United States. If you properly vote pursuant to the instructions provided in the Notice or properly complete and deliver your proxy card (whether electronically, by mail or telephone) and our Inspector of Election receives your instructions in time to vote at the Annual Meeting, your “proxy” (one of the individuals named on your proxy card) will vote your shares as you have directed. If you sign and return your proxy card, but do not make specific selections, your proxy will vote your shares as recommended by the Board. If any other matter is properly presented at the Annual Meeting, including a proposal to postpone or adjourn the meeting, your proxy will vote your shares in accordance with his or her discretion. At present, the Board knows of no other business that is intended to be brought before or acted upon at the Annual Meeting.

| | | | | |

| What if I need assistance with voting or have questions regarding the Annual Meeting? |

If you need assistance with the voting of your shares or have questions regarding the Annual Meeting, please contact our proxy solicitation advisor:

Alliance Advisors, LLC

200 Broadacres Drive, 3rd Floor

Bloomfield, NJ 07003

(844) 866-9429 (Toll Free in the United States)

Stockholders are encouraged to login to the virtual meeting prior to the start time in order to leave ample time to confirm the internet connection is sufficient to access the virtual meeting site and to allow sufficient time to login and familiarize themselves with the virtual meeting features. If you have technical difficulties accessing or using the virtual meeting site during the Annual Meeting, you should call the technical support number on the virtual meeting site. The virtual meeting site is supported on web browsers (e.g., Microsoft Edge, Firefox, Chrome and Safari) and devices (desktops, laptops, tablets and cell phones) running the most updated version of applicable software and plug-ins.

In the election of directors, for each of the nominees, your vote may be cast “FOR” or “AGAINST” or you may “ABSTAIN.” If you “ABSTAIN” with respect to any nominee, it will not count as a share actually voted and will have no effect on the determination as to that nominee. If you sign your proxy card with no further instructions, your shares will be voted in accordance with the recommendation of the Board.

In the advisory vote to approve the compensation of our named executive officers, your vote may be cast “FOR” or “AGAINST” or you may “ABSTAIN.” If you “ABSTAIN,” it will not count as a share actually voted and will have no effect on the determination of this proposal. If you sign your proxy card with no further instructions, your shares will be voted in accordance with the recommendation of the Board.

In the proposal to approve the Advance Notice and Universal Proxy Rule By-Law Amendments, your vote may be cast “FOR” or “AGAINST” or you may “ABSTAIN.” If you “ABSTAIN,” it will not count as a share actually voted with respect to determining if a required vote is obtained under our By-Laws but will have the same effect as a vote AGAINST this proposal. If you sign your proxy card with no further instructions, your shares will be voted in accordance with the recommendation of the Board.

In the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm, your vote may be cast “FOR” or “AGAINST” or you may “ABSTAIN.” If you “ABSTAIN,” it will not count as a share actually voted and will have no effect on the determination of this proposal. If you sign your proxy card with no further instructions, your shares will be voted in accordance with the recommendation of the Board.

Information About the Annual Meeting and Voting

| | | | | |

| How many votes are required to approve each proposal? |

1.Under our By-Laws, except as otherwise required by law, each nominee for director shall be elected to the Board by the affirmative vote of the majority of votes cast, virtually at the meeting or by proxy, by the holders of shares entitled to vote at a meeting at which a quorum is present; provided, however, that if the number of nominees exceeds the number of directors to be elected at any such meeting, as determined by the Corporate Secretary of the Company as of the record date for such meeting, the directors shall be elected by a plurality of the votes cast, virtually at the meeting or by proxy. The number of nominees does not exceed the number of directors to be elected at the Annual Meeting. The affirmative vote of the majority of votes cast means that the number of shares voted “FOR” exceeds the number of votes cast “AGAINST” with respect to a given nominee. For each nominee, you may vote “FOR,” “AGAINST” or “ABSTAIN.” If you “ABSTAIN,” it will be counted for the purpose of determining whether a quorum is present for conducting the Annual Meeting, but it will not count as a share actually voted and will have no effect on the determination of the nominee’s election. In the event that a director nominee fails to receive an affirmative majority of the votes cast in an election where the number of nominees is less than or equal to the number of directors to be elected, the Board, within its powers, may decrease the number of directors, fill the vacancy, or take other appropriate action.

2.The affirmative vote of a majority of shares with voting power present virtually or represented by proxy and which have actually voted on the proposal is required to approve, on an advisory basis, the compensation of our named executive officers. The vote is advisory and non-binding in nature, but the Executive Compensation and Human Resources Committee of our Board (Compensation Committee) will take into consideration the outcome of the vote when considering future executive compensation arrangements. You may vote “FOR,” “AGAINST” or “ABSTAIN.” If you “ABSTAIN,” it will be counted for the purpose of determining whether a quorum is present for conducting the Annual Meeting, but it will not count as a share actually voted and will have no effect on the determination of this proposal.

3.Under our Certificate of Incorporation, the affirmative vote of the holders of at least eighty percent (80%) of the outstanding shares of our common stock is required to approve the Advance Notice and Universal Proxy Rule By-Law Amendments. You may vote “FOR,” “AGAINST” or “ABSTAIN.” If you “ABSTAIN,” it will be counted for the purpose of determining whether a quorum is present for conducting the Annual Meeting, but it will not count as a share actually voted with respect to determining if a required vote is obtained under our By-Laws and will have the same effect as a vote AGAINST this proposal.

4.The affirmative vote of a majority of shares with voting power present virtually or represented by proxy and which have actually voted on the proposal is required to ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the 2024 fiscal year. You may vote “FOR,” “AGAINST” or “ABSTAIN.” If you “ABSTAIN,” it will be counted for the purpose of determining whether a quorum is present for conducting the Annual Meeting, but it will not count as a share actually voted and will have no effect on the determination of this proposal.

At present, the Board knows of no other matters to be presented for stockholder action at the Annual Meeting.

| | | | | |

| What is the difference between holding shares as a stockholder of record and as a beneficial owner? |

Most of our stockholders hold their shares through a broker, trustee, bank, other financial intermediary or other nominee rather than directly in their own name. As summarized below, there are some differences between stockholders of record and beneficial owners.

Stockholders of Record

If your shares are registered directly in your name with our transfer agent, Computershare Shareowner Services, as of the close of business on Friday, March 8, 2024, you are considered the stockholder of record with respect to those shares, and the Notice or proxy materials are being made available, electronically or otherwise, directly to you by the Company. As the stockholder of record, you have the right to grant your voting proxy directly to the Company or a third party, or to vote virtually at the Annual Meeting. The Company has made available a proxy card or electronic voting means for you to use for voting purposes.

Beneficial Owners

If your shares are held through a brokerage firm, trustee, bank, other financial intermediary or other nominee, as of the close of business on Friday, March 8, 2024, you are considered the beneficial owner of those shares held in street name, and the Notice or proxy materials are being made available, electronically or otherwise, by the Company to your broker, trustee, bank, other financial intermediary or other nominee (the intermediary) and they will forward these materials to you, together with a voting instruction form if furnished via paper copy to your intermediary. As the beneficial owner, you have

Information About the Annual Meeting and Voting

the right to direct your intermediary on how to vote and are also invited to virtually attend the Annual Meeting; however, since you are not the stockholder of record, you may not vote these shares virtually at the Annual Meeting, unless you request, complete and deliver a legal proxy from your intermediary. If you requested printed proxy materials, your intermediary will enclose a voting instruction form for you to use in directing the intermediary regarding how to vote your shares.

| | | | | |

| What discretion does my broker have to vote my shares held in “street name?” |

The NYSE rules allow your broker to vote your shares in its discretion on “routine” proposals when it has not received instructions from you at least ten days prior to the Annual Meeting. The proposal regarding the ratification of the appointment of our independent registered public accounting firm is a matter considered routine under applicable rules and, therefore, your broker may vote on your behalf for this matter if you do not otherwise provide instructions. The election of directors, the advisory vote on the compensation of our named executive officers, the vote to approve the Advance Notice and Universal Proxy Rule By-Law Amendments are not considered routine matters. If you do not instruct your broker how to vote your shares on the non-routine matters, your broker will not be permitted to vote your shares on such matters. This is referred to as a “broker non-vote.”

Broker non-votes (shares held by brokers that do not have discretionary authority to vote on the matter and that have not received voting instructions from their clients) are counted for purposes of determining whether a quorum is present, but are not counted or deemed to be present, represented or voted for the purpose of determining whether stockholders have approved a proposal. A broker non-vote will have no effect on the outcome of the election of directors or the advisory vote on the compensation of our named executive officers but will have the same effect as a vote “AGAINST” the proposal to approve the Advance Notice and Universal Proxy Rule By-Law Amendments.

| | | | | |

| How do I vote my 401(k) shares? |

If you participate in our 401(k) Retirement Savings Plan, as amended and restated (401(k) Plan), you will receive a single proxy card (together with the proxy materials) or Notice that covers all shares credited to your plan account(s) and shares that you own of record that are registered in the same name. If your plan account(s) are registered in different names, you will receive separate proxy cards or Notices for your record and plan holdings. You may vote your shares by following the instructions provided in your proxy card or Notice and utilizing the credentials provided therein. Your vote will serve to instruct the trustees and fiduciaries of our 401(k) Plan how to vote any shares of our common stock held in our 401(k) Plan on your behalf. Shares of our common stock held in our 401(k) Plan must be voted on or before 11:59 p.m. Eastern Time on April 29, 2024. The trustee and fiduciaries of our 401(k) Plan will vote shares for which timely instructions are not received in the same proportion as other plan shares that were voted.

| | | | | |

| What happens if I don’t specify how I want my shares voted on one or all of the proposals? |

If you are the stockholder of record and you sign, date and return your proxy and do not mark how you want to vote, your proxy will be counted as a vote “FOR” all of the nominees for directors, “FOR” the compensation of our named executive officers, “FOR” the Advance Notice and Universal Proxy Rule By-Law Amendments, and “FOR” the ratification of our independent registered public accounting firm, Ernst & Young. If you hold your shares in street name, please see the discussion above on “What discretion does my broker have to vote my shares held in ‘street name?’”

| | | | | |

| Can I change my vote or revoke my proxy after I have already voted or given my proxy? |

Yes. If you are a stockholder of record, you may change your vote or revoke your proxy at any time before the proxy is voted at the Annual Meeting. To revoke a previously submitted proxy and change your vote, you may:

•mail a written notice “revoking” your earlier vote to Broadridge Financial Solutions, Inc. (Broadridge), 51 Mercedes Way, Edgewood, NY 11717;

•submit to Broadridge a properly completed and signed proxy card with a later date;

•vote again telephonically at 1-800-690-6903 or electronically at www.proxyvote.com or using our QR code (available until 11:59 p.m. Eastern Time on May 1, 2024); or

•vote virtually while logged in and participating at the Annual Meeting; however, your virtual attendance at the Annual Meeting alone will not revoke your proxy.

Your last dated proxy, properly completed and timely received prior to, or vote cast at, the Annual Meeting will be counted.

Information About the Annual Meeting and Voting

If you own your shares in street name, please contact your broker or other intermediary for instructions on changing your vote or revoking your proxy.

| | | | | |

| Can I vote at the virtual meeting? |

Yes. If you are the stockholder of record of the shares, you will have the opportunity to vote virtually when you attend the virtual Annual Meeting online by visiting www.virtualshareholdermeeting.com/BSX2024. In order to vote during the Annual Meeting, you will use the 16-digit control number included on the Notice, on your proxy card, or on your voting instruction form provided by your broker, bank or other nominee. However, since a beneficial owner holding shares in street name is not the stockholder of record, if you are such a beneficial owner of shares, you may not vote your shares virtually at the virtual Annual Meeting unless you obtain a legal proxy from the broker or other intermediary that holds your shares giving you the right to vote the shares at the Annual Meeting. Please provide the legal proxy information once you log into the Annual Meeting.

| | | | | |

| Who will count the votes? |

Broadridge has been engaged as our independent agent to tabulate stockholder votes and has separately engaged Carl T. Hagberg and Associates on our behalf to act as Inspector of Election for the meeting.

Proxy instructions, ballots and voting tabulations that identify individual stockholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed either within the Company or to third parties, except:

•as necessary to meet applicable legal requirements;

•to allow for the tabulation and certification of votes; and

•to facilitate a successful proxy solicitation.

Occasionally, stockholders provide written comments on their proxy cards, which may be forwarded to the Company’s management and the Board.

| | | | | |

| How can I participate and ask questions at the Annual Meeting? |

We are committed to ensuring that our stockholders have substantially the same opportunities to participate in the virtual Annual Meeting as they would at an in-person meeting. To submit a question at the Annual Meeting, you will need your 16-digit control number that is printed on the Notice or proxy card that you received in the mail, or via email if you have elected to receive material electronically. You may log in 15 minutes before the start of the Annual Meeting and submit questions online. You will also be able to submit questions during the Annual Meeting. We encourage you to submit any question that is relevant to the business of the Annual Meeting. Appropriate questions asked during the Annual Meeting will be read and addressed during the Annual Meeting, as time permits. Questions and answers may be grouped by topic, and we will group substantially similar questions together and answer them once. Questions regarding personal matters or general economic or political questions that are not directly related to the business of our Company are not pertinent to Annual Meeting matters and, therefore, will not be answered. We will limit each stockholder to one question to allow us to answer questions from as many stockholders as possible. If there are matters of individual concern to a stockholder and not of general concern to all stockholders, or if a question posed was not otherwise answered, we encourage stockholders to contact us separately after the Annual Meeting. We encourage stockholders to log into the webcast at least 15 minutes prior to the start of the Annual Meeting to test their internet connectivity. We want to be sure that all our stockholders are afforded the same rights and opportunities to participate as they would at an in-person meeting, so all members of our Board and certain executive officers are expected to join the Annual Meeting and be available for questions.

| | | | | |

| What do I do if I have technical problems during the Annual Meeting? |

If you encounter any difficulties accessing the Annual Meeting webcast, please call the technical support number that will be posted on the Annual Meeting website login page.

Information About the Annual Meeting and Voting

| | | | | |

| What happens if the Annual Meeting is adjourned or postponed? |

Your proxy will still be effective and will be voted at the rescheduled Annual Meeting. You will still be able to change or revoke your proxy until it is voted, provided such new proxy or revocation is properly completed and timely received.

| | | | | |

| Will any other business be considered or presented at the Annual Meeting? |

Our By-Laws provide that a stockholder may present business to be considered at the Annual Meeting only if proper prior written notice was timely received by us. Other than the items of business described in this Proxy Statement, our Board is not aware of any other business to be acted upon at the Annual Meeting; however, if any other business does properly come before the Annual Meeting, the persons named as proxies on the proxy card will vote your shares in accordance with their discretion.

| | | | | |

| How can I find the results of the Annual Meeting? |

We will report the final voting results on a Current Report on Form 8-K filed with the SEC within four business days after the Annual Meeting. The Form 8-K will be available on the SEC’s website, www.sec.gov, as well as on our own website at https://investors.bostonscientific.com/financials-and-filings/sec-filings.

| | | | | |

| Who is soliciting my vote pursuant to this Proxy Statement? |

Our Board is soliciting your vote.

| | | | | |

| Is there a list of stockholders entitled to vote at the Annual Meeting? |

A list of stockholders entitled to vote at the Annual Meeting will be available for the period of ten days prior to the Annual Meeting, between the hours of 8:30 a.m. and 5:00 p.m. Eastern Time, at our Corporate Headquarters located at 300 Boston Scientific Way, Marlborough, Massachusetts 01752. If you would like to view the stockholder list, please contact our Corporate Secretary to schedule an appointment by calling (508) 683-4000 or writing to our Corporate Secretary at 300 Boston Scientific Way, Marlborough, Massachusetts 01752.

Internet Availability of Proxy Materials

Under rules adopted by the SEC, we are furnishing our proxy materials to our stockholders primarily via the internet instead of mailing printed copies of those materials to each stockholder. On or about March 20, 2024, we will mail to our stockholders (other than those who previously requested electronic or paper delivery) an Important Notice of Internet Availability of Proxy Materials (Notice) containing instructions on how to access our proxy materials, including our Proxy Statement and our Annual Report. The Notice also instructs stockholders on how to vote via the internet.

This process is designed to expedite stockholders’ receipt of proxy materials, lower the cost of the Annual Meeting and help conserve natural resources; however, if you would prefer to receive printed proxy materials and a proxy card, please follow the instructions included in the Notice and in this Proxy Statement. If you have previously elected to receive our proxy materials electronically, these materials will continue to be made available to you via email until you elect otherwise. If you have previously elected to receive printed proxy materials, you will continue to receive these materials and a proxy card in paper format until you elect otherwise.

Cautionary Statement Regarding

Forward-Looking and Other Statements

This Proxy Statement contains forward-looking statements within the meaning of the federal securities laws. Forward-looking statements may be identified by words like “anticipate,” “expect,” “project,” “believe,” “plan,” “may,” “estimate,” “intend” and other similar words. These forward-looking statements are based on our beliefs, assumptions and estimates using information available to us at the time and are not intended to be guarantees of future events or performance. If our underlying assumptions turn out to be incorrect, or if certain risks or uncertainties materialize, actual results could vary materially from the expectations and projections expressed or implied by our forward-looking statements. As a result, readers are cautioned not to place undue reliance on any of our forward-looking statements. Factors that may cause actual results to differ materially from those contemplated by the statements in this Proxy Statement can be found in our most recent Annual Report on Form 10-K filed with the SEC and in the Quarterly Reports on Form 10-Q that we have filed or will file hereafter under the heading “Risk Factors” and “Safe Harbor for Forward-Looking Statements.” The forward-looking statements speak only as of the date of this Proxy Statement and undue reliance should not be placed on these statements. We disclaim any intention or obligation to publicly update or revise any forward-looking statements. This cautionary statement is applicable to all forward-looking statements contained in this document.

This Proxy Statement contains statements regarding individual and Company performance objectives and targets. These objectives and targets are disclosed in the limited context of our compensation plans and programs and should not be understood to be statements of management’s future expectations or estimates of future results or other guidance. We specifically caution investors not to apply these statements to other contexts.

| | | | | |

| Proposal 1: Election of Directors |

| | | | | |

| |

Our Board of Directors unanimously recommends that you vote “FOR” the election of all nine of these nominees for director. Vote Required: Majority of votes cast | |

| |

Summary

Our entire Board is elected annually by our stockholders and currently consists of eleven members.

On November 16, 2023, Nelda J. Connors and David J. Roux, directors of the Company since December 2009 and January 2014, respectively, informed the Company that they would not be standing for re-election to the Board at the Annual Meeting and until then will each continue to serve as a director of the Company and remain in their committee roles with the Board. We are deeply grateful for the immense contributions each of Ms. Connors and Mr. Roux have made to our Company, our Board, and our stockholders.

Our remaining nine directors have been nominated by our Board, upon the recommendation of our Nominating and Governance Committee, to stand for election at the Annual Meeting for a one-year term, to hold office until the 2025 Annual Meeting of Stockholders or until their successors have been duly elected and qualified. The nominees for election at the Annual Meeting are: Charles J. Dockendorff, Yoshiaki Fujimori, Edward J. Ludwig, Michael F. Mahoney, Jessica L. Mega, Susan E. Morano, John E. Sununu, David S. Wichmann and Ellen M. Zane.

Each of the director nominees is willing and able to stand for election at the Annual Meeting, and we know of no reason why any of the nominees would be unable to serve as a director. Should such a situation arise, however, the Board may designate a substitute nominee or, alternatively, reduce the number of directors to be elected. If a substitute nominee is selected, the persons named as proxies will vote for that substitute nominee. Any vacancies not filled at the Annual Meeting may be filled by the Board.

Director Nominees at a Glance

Diverse Range of Experience, Skills and Qualifications Represented by our 2024 Director Nominees

| | | | | | | | | | | | | | | | | | | | | | | |

| Academia | | Business Strategy | | Corporate Governance | | Environmental, Health, Safety & Sustainability |

| Executive Experience | | Finance / Capital Allocation | | Financial Literacy / Accounting | | Government / Public Policy |

| Human Capital Management / Compensation | | International | | Manufacturing | | Marketing / Sales |

| Medical Device Industry | | Mergers & Acquisitions | | Operations | | Public Company Board |

| Real Estate | | Risk Management | | Technology / Systems / Cyber-Security | | |

Proposal 1: Election of Directors

Board of Director Nominees at a Glance

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

| | | | | | | | | | | | | | | |

| | | |

| | | | | | | | | | | | | | | |

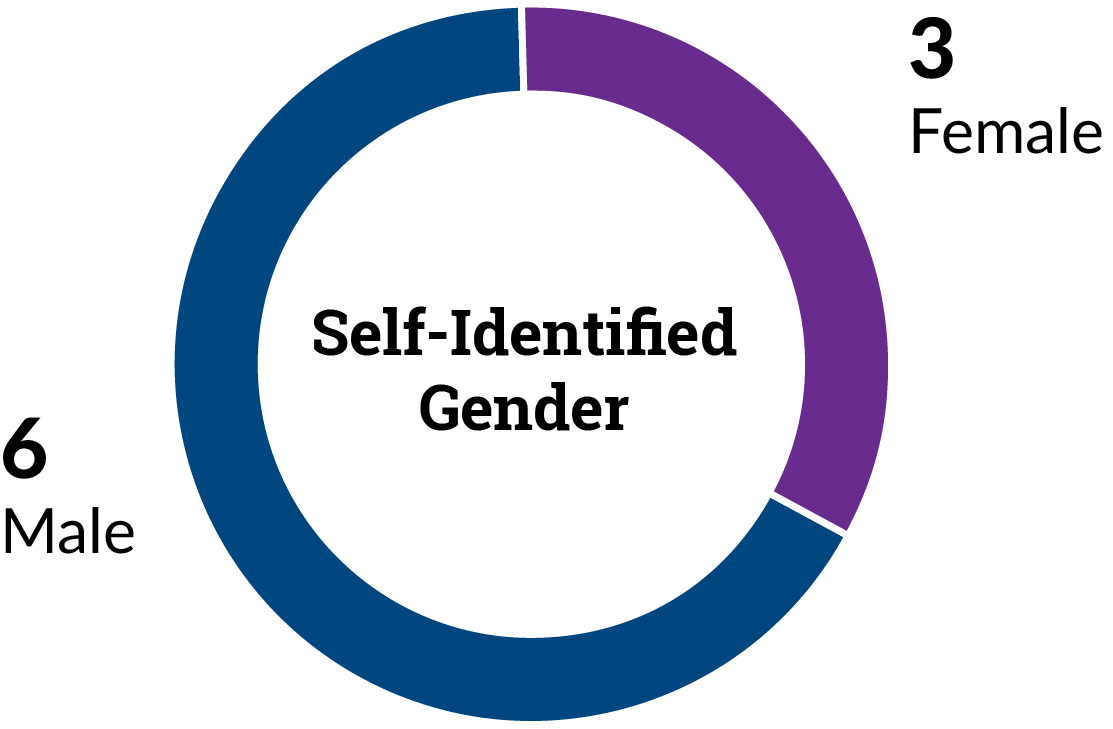

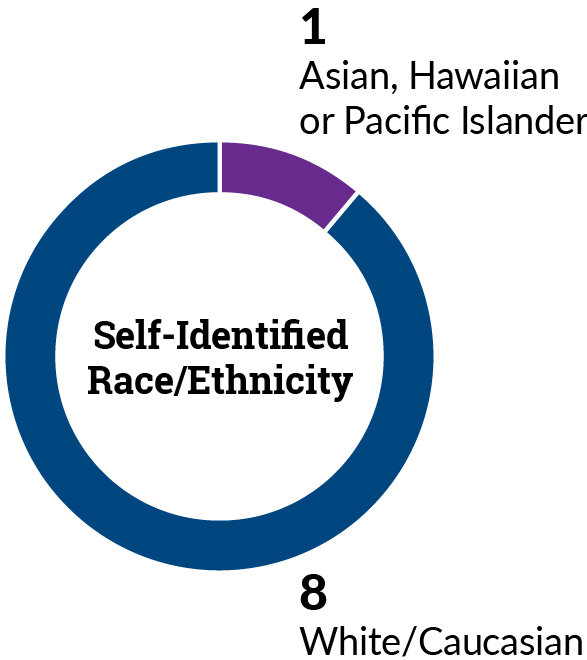

| n | Female | n | Male | n | Non-Binary | | | n | Asian, Hawaiian or Pacific Islander | n | White/ Caucasian | |

| |

•Mega •Morano •Zane | •Dockendorf •Fujimori •Ludwig | •Mahoney •Sununu •Wichmann | •None identified | | | | |

| | •Fujimori | •Dockendorf •Ludwig •Mahoney •Mega | •Morano •Sununu •Wichmann •Zane |

|

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | |

S&P* Average: 63.3 *per 2023 Spencer Stuart Board Index | | | S&P* Average: 7.8 *per 2023 Spencer Stuart Board Index |

Proposal 1: Election of Directors

Director Nominees

The biography of each of the nominees is listed below and contains information regarding the person’s service as a director, business experience, public company director positions currently held or held at any time during the last five years, information regarding involvement in certain legal or administrative proceedings (if applicable), and the experiences, qualifications, attributes or skills that caused the Nominating and Governance Committee and the Board to determine that the person should serve as a director. Each of the director nominees listed below exemplifies how our Board values professional experience in business, education, policy and governmental fields, as well as strong moral character and diversity in terms of viewpoint as well as age, race/ethnicity and gender. Our Board believes these strong backgrounds and sets of skills provide the Board, as a whole, with a strong foundation of technical expertise and a wealth of diverse experience in a wide variety of areas to address the current and anticipated needs of the Company as its opportunities and challenges evolve.

| | | | | | | | |

Charles J. Dockendorff Independent | Age: 69 |

| | |

| | |

Former Executive Vice President and Chief Financial Officer, Covidien plc Director since: April 2015 Board Committees: Audit (Financial Expert) Risk Other Current Public

Boards: Haemonetics Corporation Hologic, Inc. Keysight Technologies, Inc. Education: University of Massachusetts at Amherst, B.B.A. in Accounting Bentley College, M.S. in Finance | Experience Highlights: Mr. Dockendorff is the former Executive Vice President and Chief Financial Officer of Covidien plc, a publicly traded medical device and supplies company, and its predecessor, Tyco Healthcare, having served in those positions from 1995 to 2015. While Chief Financial Officer of Covidien plc, Mr. Dockendorff was also in charge of Information Security for the company. Mr. Dockendorff joined the Kendall Healthcare Products Company, the foundation of the Tyco Healthcare business, in 1989 as controller and was named Vice President and Controller in 1994. He was appointed Chief Financial Officer of Tyco Healthcare in 1995. Prior to joining Kendall/Tyco Healthcare, Mr. Dockendorff was the Chief Financial Officer, Vice President of Finance and Treasurer of Epsco Inc. and Infrared Industries, Inc. Select Skills and Qualifications: Mr. Dockendorff’s qualifications to serve on our Board include his executive leadership experience at public medical device companies, his service as a director of other public companies, as well as his extensive expertise in accounting, finance, technology and business strategy. |

Proposal 1: Election of Directors

| | | | | | | | |

Yoshiaki Fujimori Independent | Age: 72 |

| |

| |

Senior Executive Advisor, Japan to CVC Capital Partners Director since: July 2016 Board Committees: Executive Compensation and Human Resources Risk (member and Chair, effective April 1, 2024) Other Current Public

Boards: Oracle Corporation Japan Takeda Pharmaceutical Company Limited Education: Tokyo University of Science, B.A. in Petroleum Engineering Carnegie Mellon Graduate School of Business, M.B.A. | Experience Highlights: Mr. Fujimori is currently Senior Executive Advisor of Japan to CVC Capital Partners, a position he has held since February 2017. He was an advisor to the LIXIL Group Corporation from June 2016 to December 2019 and was the President and Chief Executive Officer of the LIXIL Group Corporation from August 2011 to June 2016. Prior to joining LIXIL, he was Chairman, President and Chief Executive Officer of General Electric Japan from January 2008 to June 2011. In his 25 years at General Electric Company, beginning in October 1986, he held a variety of positions including Senior Vice President and Chief Executive Officer of a number of Asian and global business divisions, including Medical Systems, Plastics, and Capital. Mr. Fujimori also served as a member of the General Electric’s Corporate Executive Council from 2001 to 2010. He formerly served as a director of Shiseido Company Limited, Toshiba Corporation, Japan Construction Material & Housing Equipment Industries Federation and Tokyo Electric Power Company Holdings. Select Skills and Qualifications: Mr. Fujimori’s qualifications to serve on our Board include his expertise in international business, including developing markets, with a particular emphasis on operations and manufacturing in Japan and Asia, technology, and his service on other public company boards. |

Proposal 1: Election of Directors

| | | | | | | | |

Edward J. Ludwig Independent | Age: 72 |

| |

| |

Former Chairman of the Board and Chief Executive Officer, Becton, Dickinson and Company Director since: March 2014; Lead Independent Director Board Committees: Executive Compensation and Human Resources Nominating and Governance Other Current Public

Boards: CVS Health Corporation Education: The College of Holy Cross, B.A., in Economics and Accounting Columbia University, M.B.A. | Experience Highlights: Mr. Ludwig is the former Chairman of the Board of Becton, Dickinson and Company (BDX), a global medical technology company, having served in that position from February 2002 through June 2012. He also served as BDX’s Chief Executive Officer from January 2000 to September 2011 and as its President from May 1999 to December 2008. Mr. Ludwig joined BDX as a senior financial analyst in 1979. Prior to joining BDX, Mr. Ludwig served as a senior auditor with Coopers and Lybrand (now PricewaterhouseCoopers), where he earned his CPA, and as a financial and strategic analyst at Kidde, Inc. Mr. Ludwig was a member of the board of directors of POCARED Diagnostics Ltd, a privately held company focused on infectious disease diagnostics from 2013 to 2022. He formerly served as a director of Aetna, Inc., Xylem, Inc. and as Vice Chair of the board of trustees of the Hackensack University Medical Center Network. Select Skills and Qualifications: Mr. Ludwig’s qualifications to serve on our Board include his executive leadership experience, specifically his service as a director and executive of a public medical technology company, along with his extensive expertise in business strategy, finance, management and manufacturing. |

Proposal 1: Election of Directors

| | | | | | | | |

Michael F. Mahoney CEO, Chairman of the Board | Age: 59 |

| |

| |

President and Chief Executive Officer, Boston Scientific Corporation Director since: November 2012 Other Current Public

Boards: CVS Health Corporation Education: University of Iowa, B.B.A. in Finance Wake Forest University, M.B.A. | Experience Highlights: Michael F. Mahoney joined the Company as our President in October 2011 and became our President, Chief Executive Officer and a Director in November 2012. Mr. Mahoney became our Chairman of the Board in May 2016. Prior to joining the Company, he was Worldwide Chairman of the Medical Devices and Diagnostics division of Johnson & Johnson from January 2011 to September 2011, overseeing 50,000 employees and seven franchises. Prior to assuming this position, Mr. Mahoney served as Worldwide Group Chairman of Johnson & Johnson’s DePuy franchise, an orthopedics and neurosciences business, from April 2007 through January 2011. From January 2001 through March 2007, Mr. Mahoney served as President and Chief Executive Officer of Global Healthcare Exchange, a provider of supply chain solutions and services that brings together hospitals, manufacturers, distributors and group purchasing organizations. From 2015 to 2023, Mr. Mahoney served as a member of the Board of Directors of Baxter International Inc., a multinational health care company. Mr. Mahoney began his career at General Electric Medical Systems, where he spent 12 years, culminating in the role of General Manager of the Healthcare Information Technology business. Mr. Mahoney also serves on the board of the Boys & Girls Club of Boston, is the Chair of the board of governors of Boston College CEO Club, and a member of the American Heart Association CEO roundtable. Select Skills and Qualifications: In addition to serving as our President and Chief Executive Officer, Mr. Mahoney’s qualifications to serve on our Board, include his management experience leading complex organizations in medical device and other healthcare-related businesses, expertise in building strong leadership teams, developing international markets, and a proven ability to execute successful business strategies and drive operational excellence. |

Proposal 1: Election of Directors

| | | | | | | | |

Jessica L. Mega, M.D. Independent | Age: 49 |

| |

| |

Co-Founder and Former Chief Medical and Scientific Officer, Verily Life Sciences, LLC Director since: June 2023 Board Committees: Executive Compensation and Human Resources Risk Other Current Public

Boards: Danaher Corporation Education: Yale University School of Medicine, M.D. Harvard School of Public Health, M.P.H. Stanford University, B.A. | Experience Highlights: Dr. Mega co-founded Verily Life Sciences, LLC, a subsidiary of Alphabet Inc. focused on life sciences and healthcare, and served as Chief Medical and Scientific Officer from 2015 to the end of 2022. At Verily, Dr. Mega oversaw Verily’s clinical and science efforts, focusing on translating technological innovations and scientific insights into partnerships and programs that improve patient outcomes. Prior to Verily, she served as Cardiologist and Senior Investigator at Brigham and Women’s Hospital from 2008 to 2015. Dr. Mega has also served as a faculty member at Harvard Medical School and with the TIMI Study Group, where she led large-scale international clinical trials evaluating novel cardiovascular therapies and directed the genetics program. Dr. Mega is currently on the Board of Advisors at the Duke-Margolis Center for Health Policy and at Research!America. Select Skills and Qualifications: Dr. Mega’s qualifications to serve on the Board include her executive experience in life sciences, technology, and global business strategy, specifically her service as a director and executive and her background in academia and public policy. |

Proposal 1: Election of Directors

| | | | | | | | |

Susan E. Morano Independent | Age: 59 |

| |

| |

Former Vice President Business Development and Strategic Operations, Johnson & Johnson Medtech Director since: June 2023 Board Committees: Audit (Financial Expert) Nominating and Governance Other Current Public

Boards: None Education: Columbia University, M.B.A. Villanova University, B.S. | Experience Highlights: Ms. Morano is the former Vice President Business Development and Strategic Operations, Johnson & Johnson Medtech, having served in that position from 2020 through February 2023. Prior to this role, she served as Vice President Business Development, Johnson & Johnson Medical Devices, beginning in 2012, with responsibility for licensing, acquisitions and divestitures for its Medical Devices Group. In addition, during her time at Johnson & Johnson, Ms. Morano held a number of positions with increasing responsibility through six operating companies, primarily within Finance and Business Development, and is a former member of its MedTech Leadership Team. Select Skills and Qualifications: Ms. Morano’s qualifications to serve on the Board include her executive experience in the medtech industry, specifically extensive experience in global mergers and acquisitions, management and business strategy, in addition to her financial expertise. |

Proposal 1: Election of Directors

| | | | | | | | |

John E. Sununu Independent | Age: 59 |

| |

| |

Former United States Senator from New Hampshire Director since: April 2009 Board Committees: Nominating and Governance (Chair) Audit (Financial Expert) Other Current Public

Boards: BlueRiver Acquisition Corp. Education: Massachusetts Institute of Technology, B.S. and M.S. in Mechanical Engineering Harvard University, M.B.A. | Experience Highlights: Senator Sununu served as a U.S. Senator from New Hampshire from 2003 to 2009. He was a member of the Committees on Banking, Commerce, Finance and Foreign Relations, and he was appointed the Congressional Representative to the United Nations General Assembly. Before his election to the Senate, Senator Sununu served three terms as a member of the U.S. House of Representatives from New Hampshire’s 1st District from 1996 to 2002, where he was Vice Chairman of the Budget Committee and a member of the Appropriations Committee. During his twelve years in Congress, he drafted and helped pass several important pieces of legislation, including the Internet Tax Freedom Act, the Survivors Benefit Act and the New England Wilderness Act. Prior to serving in Congress, Senator Sununu served as Chief Financial Officer for Teletrol Systems, a manufacturer of building control systems. Senator Sununu formerly served as a Council Member of Lloyds of London and as a director of Time Warner Cable Inc. and several private and charitable entities. Select Skills and Qualifications: Senator Sununu complements our Board with his experience in government and corporate leadership. Senator Sununu provides important insights on government relations, public policy and other matters relevant to our Company due to his extensive experience in both the public and private industry sectors. |

Proposal 1: Election of Directors

| | | | | | | | |

David S. Wichmann Independent | Age: 61 |

| |

| |

Former CEO, UnitedHealth Group Incorporated Director since: June 2021 Board Committees: Audit (Chair, Financial Expert) Risk Other Current Public

Boards: Privia Health Group, Inc. Education: Illinois State University, B.S. in Accounting | Experience Highlights: Mr. Wichmann is the former Chief Executive Officer of UnitedHealth Group Incorporated, having served in that position from September 2017 through March 2021. Prior to this role, he served as President, UnitedHealth Group, beginning in November 2014, with oversight responsibility for all of UnitedHealthcare’s domestic and international businesses, and for overall UnitedHealth Group performance, and as Chief Financial Officer of the UnitedHealth Group from 2011 until 2016. In addition, during his time at UnitedHealth Group, he held positions as President, UnitedHealthcare; President and Chief Executive Officer, Specialized Care Services (now OptumHealth); and Senior Vice President, Corporate Development. Prior to joining UnitedHealth Group, Mr. Wichmann was a partner at Arthur Andersen & Co. and Chief Financial Officer of Advanced Machine Company. He previously served on the boards of UnitedHealth Group Incorporated and Tennant Company. Mr. Wichmann currently serves on the board of a private accountable care organization. Select Skills and Qualifications: Mr. Wichmann’s qualifications to serve on our Board include his executive experience in the healthcare industry as the chief executive officer of a large public health and well-being company and a current and former board member of other public companies, as well as his financial expertise and background in business strategy, operations, manufacturing, technology and environmental, health, safety and sustainability matters. |

Proposal 1: Election of Directors

| | | | | | | | |

Ellen M. Zane Independent | Age: 72 |

| | |

| |

CEO Emeritus and Founding Chair, Tufts Medicine Director since: April 2016 Board Committees: Executive Compensation and Human Resources (Chair) Nominating and Governance Other Current Public

Boards: Haemonetics Corporation Synchrony Financial Education: George Washington University, B.A. Catholic University of America, M.A. in Audiology and Speech-Language Pathology | Experience Highlights: Ms. Zane is CEO Emeritus and Founding Chair at Tufts Medicine. Ms. Zane previously served as President and Chief Executive Officer of Tufts Medical Center from 2004 to 2011 when she retired from this role. Prior to this, Ms. Zane served as Network President for Mass General Brigham (formerly Partners Healthcare System), a physician/hospital network sponsored by the Harvard-affiliated Massachusetts General Hospital and Brigham and Women’s Hospital. Ms. Zane also previously served as Chief Executive Officer of Quincy Hospital in Quincy, Massachusetts. Ms. Zane currently is a director of Savista, a Georgia-based private company involved with healthcare revenue cycle management; Fiduciary Trust Company, a privately owned wealth management company; and AgNovos Healthcare, LLC, a privately held medical device company, focused on bone health. Ms. Zane previously served as a director of Azenta, Inc., Century Capital Management, Parexel International Corporation, Lincare Holdings Inc. and Press Ganey Holdings. Ms. Zane has received Honorary Degrees from Curry College, Stonehill College, Bentley University and University of Massachusetts-Dartmouth. Select Skills and Qualifications: Ms. Zane’s qualifications to serve on our Board include her executive experience in the healthcare industry, specifically as the chief executive officer of a large urban academic (teaching and research) medical center, in addition to her experience as a director at several other public companies. |

Corporate Governance

Overview

To guide the operation and direction of the Board and its committees, our Board has established our Corporate Governance Guidelines, charters for its standing committees and our Code of Conduct to reflect our commitment to good corporate governance and to comply with Delaware law, the rules and listing standards of the NYSE, the rules and regulations of the SEC and other legal requirements. These materials are available on our website at https://investors.bostonscientific.com/environmental-social-governance/governance-overview. These materials are also available in print, free of charge to stockholders, upon written request to Boston Scientific Corporation, Investor Relations, 300 Boston Scientific Way, Marlborough, Massachusetts 01752.

Our Board believes good corporate governance is fundamental to the success of our business. To that end, our Board evaluates our corporate governance practices in light of applicable changes in Delaware law, the rules and listing standards of the NYSE and the rules and regulations of the SEC, as well as best practices suggested by recognized governance authorities and through stockholder engagement, and makes modifications to our corporate governance practices that it determines are warranted.

Director Independence

Under the NYSE’s Corporate Governance Standards, a majority of the Board must qualify as independent directors. Our Corporate Governance Guidelines require a significant majority of the Board to qualify as independent directors. The NYSE Corporate Governance Standards define specific relationships that disqualify directors from being independent and further require that for a director to qualify as independent, the Board must affirmatively determine that the director has no material relationship with our Company (either directly or indirectly as a partner, stockholder or officer of an organization that has a relationship with our Company).