Document | | | | | | | | |

|

| 2021 Boston Scientific Annual Bonus Plan Performance Period January 1 - December 31 Version: November 2020 |

I. Establishment and Purpose of the Plan

Boston Scientific Corporation has established the Boston Scientific Corporation Annual Bonus Plan ("Plan"). As explained in detail below, the Plan basically works as follows. For each Performance Year, there is an Aggregate Bonus Pool, which is the sum of the bonus targets of all eligible participants. After the end of the Performance Year, the Committee determines the percentage of the pool that will be paid out as bonus for the year, based on the Company’s performance as to Sales, Adjusted Earnings Per Share, Human Capital Scorecard, and its attainment of quality goals. The percentage will be between 0% and 150%. The payable portion of the pool is then separated into an Assigned Bonus Pool for each Business Group, Region and Unit, based on their performance as to their respective Scorecards. The Compensation Management System then allocates the Assigned Bonus Pools among the managers, who evaluate the performance of the participants under their management and determine, for each participant, the percentage (between 0% and 150%) of the participant’s Target Annual Bonus that will be the participant’s Bonus Award for the Performance Year.

The Plan's purpose is to align the Company's interests and your interests as a Plan participant by providing incentive compensation for the achievement of Company and individual performance objectives.

The capitalized words and terms that are used throughout the Plan are defined in the Glossary in Article IX.

II. Eligibility and Participation

You are eligible to participate in the Plan for a Performance Year if you satisfy all of the following eligibility criteria:

•You are either a Regular Exempt Employee or an Eligible International Employee;

•You are not eligible for commissions under any sales compensation plan of the Company;

•You are not eligible to participate in any other incentive plan or program of the Company (unless the written terms of that plan or program expressly permit participation in both that plan or program and the Plan); and

•You complete at least two full months of Eligible Service during the Performance Year.

If you are eligible to participate in the Plan for only part of the Performance Year (for example, because you change positions or business units during the Performance Year), then you may participate in the Plan on a prorated basis for the Performance Year, provided that you complete at least two full months of Eligible Service during the Performance Year. If you are eligible for prorated participation, the Bonus Award, if any, otherwise payable to you for the Performance Year will be prorated based on your percentage of time in an eligible position during the Performance Year.

III. Target Annual Bonus

For each Performance Year in which you are eligible to participate, you will be assigned a Target Annual Bonus, which will be a specified percentage of your annual base salary, determined based on your position. The Bonus Award, if any, that you ultimately receive for the Performance Year will be a percentage of your Target Annual Bonus, determined pursuant to Article IV. The Aggregate Bonus Pool for a Performance Year will be the sum of the Target Annual Bonuses of all employees who are eligible to participate in the Plan for the Performance Year. All Bonus Awards will be based on your salary and incentive target as of December 31 of the Performance Year.

| | | | | | | | |

|

| 2021 Boston Scientific Annual Bonus Plan Performance Period January 1 - December 31 Version: November 2020 |

IV. Steps For Determining Bonus Awards

Bonus Awards for a Performance Year will be determined pursuant to the following steps:

Step One: Establish performance goals, quality goals and the Corporate Performance Scale

On or before March 15 of a Performance Year, the Committee will establish performance goals for each of the Plan's Performance Metrics and quality goals for the Performance Year. The Performance Metrics are Sales, Adjusted Earnings Per Share and a Human Capital Scorecard. The Committee will also approve the Corporate Performance Scale for the Performance Year, which will be set forth in a separate schedule.

Step Two: Measure achievement and determine Total Annual Bonus

After the end of the Performance Year, the Committee will evaluate the Company's financial performance results for the Performance Year and determine the extent to which the performance goals were attained. The Committee will adopt a written resolution as to the extent of the attainment of the performance goals with respect to each of the Performance Metrics. Based on the extent to which the performance goals were attained, the Chief Executive Officer will make a recommendation to the Committee, consistent with the Corporate Performance Scale, as to the Applicable Percentage of the Aggregate Bonus Pool to be paid by the Company as the Total Annual Bonus for the Performance Year. Taking into account the Chief Executive Officer's recommendation and any other factors that the Committee, in its discretion, deems appropriate, the Committee will approve an Applicable Percentage for the Performance Year, which must be consistent with the Corporate Performance Scale. The Committee retains the right to reduce the Total Annual Bonus for the Performance Year based on the Committee's assessment of Quality.

Step Three: Allocate the Total Annual Bonus

The Chief Executive Officer will make a recommendation to the Committee as to how the Total Annual Bonus for the Performance Year should be allocated among the Business Groups and Regions, based on their overall and relative performance against their respective applicable Scorecards for the Performance Year. Taking into account the Chief Executive Officer's recommendation and any other factors that the Committee, in its discretion, deems appropriate, the Committee will approve an allocation of the Total Annual Bonus among the Business Groups and Regions for the Performance Year. The portion of the Total Annual Bonus allocated to a Business Group or Region (its Assigned Bonus Pool) will be a percentage of the total Target Annual Bonuses of all its employees who participate in the Plan for the Performance Year. If a Business Group or Region has Units, the leader of the Business Group or Region will divide the Assigned Bonus Pool among the Units, based on their overall and relative performance against each Unit's applicable Scorecard for the Performance Year, so that each Unit will then have its own Assigned Bonus Pool. A Business Group or Region that does not have Units (for example, Corporate) will have a single Assigned Bonus Pool.

Step Four: Determine participants' individual Bonus Awards

Once the Assigned Bonus Pool is determined for each Business Group, Region, or Unit, the amount of the Assigned Bonus Pool will be entered into the Compensation Management System, which allocates a portion of the Assigned Bonus Pool to each manager of Plan participants. Each manager will evaluate the performance of each participant under his or her management and enter into the Compensation Management System a rating percentage, from 0% to 150%, for each evaluated participant. The rating percentage that your manager assigns to you will, in turn, determine the percentage of your Target Annual Bonus that will be your Bonus Award for the Performance Year.

| | | | | | | | |

|

| 2021 Boston Scientific Annual Bonus Plan Performance Period January 1 - December 31 Version: November 2020 |

If participants leave the Company before the Payment Date and, as a result, do not earn their Bonus Awards for the Performance Year, their Bonus Awards will be reallocated by the Chief Executive Officer, in his or her discretion, to other participants who are employed on the Payment Date and will become part of the Bonus Awards paid to those other participants. As provided in Article V, all Bonus Awards for a Performance Year (including those reallocated pursuant to the previous sentence) will be paid to eligible participants no later than March 15 of the following year.

V. Payment Conditions

Payment Date and Form of Payment. Bonus Awards in the United States will be made by March 15 of the year following the Performance Year for which the Bonus Awards are made. Bonus Awards outside the United States will be processed as soon as administratively possible in each region following the end of the Performance Year and after the Committee has adopted its written resolution as to the attainment of performance goals pursuant to Article IV. Your Bonus Award, if any, will be paid in a single lump sum payment.

Required Employment on the Payment Date. Except as otherwise expressly provided in this Article V, to be eligible to receive payment of any Bonus Award, you must be employed by the Company on the Payment Date for that Bonus Award. In other words, except as expressly provided in this Article V, if you cease employment with Boston Scientific Corporation and all of its Affiliates before the Payment Date, you will not be eligible to receive any Bonus Award that would otherwise have been payable to you if you had been a Company employee on that date. Conversely, if you are an employee of the Company on the Payment Date, you will be entitled to your Bonus Award, if any, even if you are not actively performing duties on that date. For example, if you are not required to report to work during a notification period applicable under a Company severance or separation plan, but you are still a Company employee during that period, and the Payment Date occurs during your notification period, you will remain eligible to receive your Bonus Award.

Exception Under Written Company Plan or Agreement. If you are specifically exempted, under a written Company plan or agreement, from the requirement to be employed on the Payment Date, you may remain eligible for payment of your Bonus Award, depending on the terms of the applicable written plan or agreement. In such cases, the terms of such written plan or agreement will govern in all respects.

Layoff. Also notwithstanding any other provision of the Plan, if you are a participant and your employment ceases prior to the Payment Date by reason of Layoff, you may be eligible for payment of part or all of your Bonus Award, depending on the terms and conditions of the applicable severance pay plan, if any, for the country in which you are employed at the time of layoff. In the event that there is no country-specific severance plan for the country in which you are employed at the time of your Layoff, applicable law will apply. In the event a previously eligible participant is re-hired within the Performance Year after a layoff and meets the eligibility criteria, if they were paid out a pro-rated bonus at the time of severance, then the payout period would not be bridged. If the re-hire had not received pro-rated bonus at the time of severance, then the payout period would be bridged, and they would receive a pro-rated bonus for the Performance Year.

Leaves of Absence: Also notwithstanding any other provision of the Plan, if you are a participant on a paid leave of absence, you are bonus eligible as long as you meet performance expectations during the Performance Year. Your bonus award will be made on the payment date within the applicable country. If you are a participant on an unpaid leave of absence, your bonus award, if any, will be pro-rated if the unpaid leave is longer than a continuous six (6) months in duration during the Performance Year. Country specific regulations regarding leaves of absence and bonus eligibility supersede this Plan document.

| | | | | | | | |

|

| 2021 Boston Scientific Annual Bonus Plan Performance Period January 1 - December 31 Version: November 2020 |

Retirement. Also notwithstanding any other provision of the Plan, if you are a participant and your employment ceases prior to the Payment Date for a Bonus Award but after September 30 of the Performance Year to which the Bonus Award pertains, and you had at least nine months of Eligible Service in the Performance Year, you will be entitled to a prorated portion of the Bonus Award, if any, that would otherwise be paid you if, as of the date of your cessation of employment, (1) you had attained age 55, (2) you had accrued at least five years of service with the Company and (3) the sum of your age and years of service as of your date of cessation of employment equals or exceeds 65. In such a case, proration will be based on the percentage of time in the Performance Year during which you were employed and eligible to participate in the Plan. The prorated Bonus Award, if any, will be paid on the Payment Date.

Death. If your employment ceases prior to the Payment Date by reason of your death, but you otherwise met all eligibility criteria specified in Article II, your estate may receive a prorated portion of the Bonus Award, if any, that would have been paid had you lived to the Payment Date. In such a case, proration will be based on the percentage of time in the Performance Year during which you were employed and eligible to participate in the Plan. The prorated Bonus Award, if any, will be paid on the Payment Date.

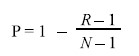

Adjustment for Changes in Standard Hours. Also notwithstanding any other provision of the Plan, if you are a participant and have a change in standard hours (part-time to full-time, full-time to part-time) during a Performance Year, your Bonus Award, if any, for the Performance Year will be calculated as follows: Target Annual Bonus percentage multiplied by the average annualized base salary for each period of employment at a specific salary divided by the percentage of the year during which that salary was earned. For example, if your Target Annual Bonus percentage is 10% and you worked full-time for six (6) months at an annual base pay of 100,000 and moved to a part-time arrangement for the remaining (6) months at an annual base pay of 50,000, your bonus award, if any, would be 7,500. [0.10 x (100,000 x 0.50) = 5,000] and [0.10 x (50,000 x 0.50) = 2,500].

No Guarantee of a Bonus Award. Nothing in this Plan guarantees that any Bonus Award will be made to any individual. Receipt of a Bonus Award in one year does not guarantee eligibility in any future year.

VI. Incentive Compensation Recoupment Policy

General Recoupment Policy. To the extent permitted by governing law, the Board, in its discretion, may seek reimbursement of a Bonus Award paid to you if you are a Current Executive Officer or Former Executive Officer and you, in the judgment of the Board, commit misconduct or a gross dereliction of duty that results in a material violation of Company policy and causes significant harm to the Company while serving in your capacity as Executive Officer. Further, in such case:

•if you are a Current Executive Officer, the Board may seek reimbursement of all or a portion of the Bonus Award paid to you during the one-year period preceding the date on which such misconduct or dereliction of duty was discovered by the Company, or

•if you are a Former Executive Officer, the Board may seek reimbursement of all or a portion of the Bonus Award paid to you during the one-year period preceding the last date on which you were a Current Executive Officer.

Restatement of Financial Results. To the extent permitted by governing law, if you are an Executive Officer, the Board will seek reimbursement of a Bonus Award paid to you in the event of a restatement of the Company's financial results that reduced a previously granted Bonus Award's size or payment. In that event, the Board will seek to recover the amount of the Bonus Award paid to you that exceeded the amount that would have been paid based on the restated financial results.

| | | | | | | | |

|

| 2021 Boston Scientific Annual Bonus Plan Performance Period January 1 - December 31 Version: November 2020 |

Provisions Required by Law. If the Company subsequently determines that it is required by law to apply a "clawback" or alternate recoupment provision to a Bonus Award, under the Dodd-Frank Wall Street Reform and Consumer Protection Act or otherwise, then such clawback or recoupment provision also shall apply to the Bonus Award, as applicable, as if it had been included on the date the Plan was established and the Company shall notify you of such additional provision.

VII. Termination, Suspension or Modification and Interpretation of the Plan

The Board may terminate, suspend or modify (and if suspended, may reinstate with or without modification) all or part of the Plan at any time, with or without notice to participants. The Committee has sole authority over administration and interpretation of the Plan, and the Committee retains its right to exercise discretion as it sees fit.

The Committee reserves the exclusive right to determine eligibility to participate in this Plan and to interpret all applicable terms and conditions, including eligibility criteria, performance objectives and payment conditions, for the Company's executive officers. The Committee delegates to the Company’s highest human resources officer the authority to administer, and determine eligibility to participate in, the Plan and interpret all applicable terms and conditions for employees who are not executive officers of the Company. The determinations and interpretations of the Committee and its delegates will be conclusive.

All Bonus Awards are paid from the Company's general assets. No trust, account or other separate collection of amounts will be established for the payment of Bonus Awards under the Plan. Bonus Awards are unfunded obligations of the Company, so if and when a Bonus Award becomes due, a participant's rights to payment are no greater than the rights of a general unsecured creditor.

VIII. Other

This document sets forth the terms of the Plan and is not intended to be a contract or employment agreement between you or any other participant and the Company. As applicable, it is understood that both you and the Company have the right to terminate your employment with the Company at any time, with or without cause and with or without notice, in acknowledgement of the fact that your employment relationship with the Company is “at will.”

IX. Glossary

As used in the Plan, the following words and terms, when capitalized, have the following meanings:

Adjusted Earnings Per Share means, with respect to a Performance Year, Adjusted Net Income divided by weighted average shares outstanding for the Performance Year (determined in accordance with generally accepted accounting principles).

Adjusted Net Income means the Company's GAAP Net Income (as defined for purposes of the Boston Scientific Corporation 2011 Long-Term Incentive Plan) excluding goodwill and intangible asset impairments, acquisition, divestiture, and purchased research and development charges, restructuring expenses, certain tax-related items, and certain litigation and amortization expenses.

Affiliate means any corporation, trust, partnership, or any other entity that is considered to be a single employer with Boston Scientific Corporation under Code sections 414(b), (c), (m), or (o), such as a wholly-owned (or at least 80%-owned) subsidiary of Boston Scientific Corporation.

Aggregate Bonus Pool means, with respect to a Performance Year, the sum of the Target Annual Bonuses of all employees who are eligible to participate in the Plan for the Performance Year.

| | | | | | | | |

|

| 2021 Boston Scientific Annual Bonus Plan Performance Period January 1 - December 31 Version: November 2020 |

Applicable Percentage means, with respect to a Performance Year, a percentage, determined by the Committee in accordance with the Corporate Performance Scale, which cannot be less than 50% or more than 150%. The Applicable Percentage is used to determine the portion of the Aggregate Bonus Pool that the Company will pay out as the Total Annual Bonus for the Performance Year.

Assigned Bonus Pool means, with respect to a Business Group, Region, or Unit for a Performance Year, the portion of the Total Annual Bonus assigned to the Business Group, Region, or Unit to be paid as Bonus Awards for the Performance Year to eligible participants who worked for the Business Group, Region, or Unit during the Performance Year.

Board means the Board of Directors of Boston Scientific Corporation.

Bonus Award means, with respect to a participant for a Performance Year, the annual incentive bonus, if any, payable to the participant for the Performance Year, subject to the terms and conditions of the Plan.

Business Group means a functional or product-based area of the Company's business, as designated by the Chief Executive Officer from time to time.

Chief Executive Officer means the Chief Executive Officer of Boston Scientific Corporation.

Code means the Internal Revenue Code of 1986, as amended, and its interpretive rules and regulations.

Committee means the Executive Compensation and Human Resources Committee of the Board.

Company means Boston Scientific Corporation and its Affiliates.

Compensation Management System means the software tool used by the Company for various compensation management purposes.

Corporate Performance Scale means, with respect to a Performance Year, the schedule used to determine, based on the extent of attainment of the performance goals for the Performance Year, the Applicable Percentage of the Aggregate Bonus Pool to be paid as the Total Annual Bonus for the Performance Year. The Corporate Performance Scale must provide that the Applicable Percentage for a Performance Year cannot be less than 50%.

Current Executive Officer means any individual currently designated as an “officer” by the Board for purposes of Section 16 of the Securities Exchange Act of 1934, as amended.

Eligible International Employee means an international, international operations, or expatriate employee of the Company working in a position designated by the Company as eligible to participate in the Plan.

Eligible Service means periods in which you are considered, under the rules and procedures of the Company, to be in active service as a Regular Exempt Employee or Eligible International Employee (including, but not limited to, time away from work for approved vacation, recognized holidays, and FMLA leave).

Executive Officer means any Current Executive Officer or Former Executive Officer.

Former Executive Officer means any individual previously (but not currently) designated as an “officer” by the Board for purposes of Section 16 of the Securities Exchange Act of 1934, as amended.

| | | | | | | | |

|

| 2021 Boston Scientific Annual Bonus Plan Performance Period January 1 - December 31 Version: November 2020 |

Human Capital Scorecard means, with respect to a Performance Year, performance against global gender and US (inclusive of Puerto Rico) multicultural goals that are aligned to 3UP 2023 goals, leadership bench retention goals, and performance against annual renewable energy and recycling index goals that are aligned with environmental strat plan goals.

Layoff means a layoff or similar involuntary termination from employment that renders you eligible for severance pay under a Company severance plan or applicable law.

Payment Date means, with respect to a Performance Year, the date on which Bonus Awards for the Performance Year are paid to participants, which will be no later than March 15 of the following year.

Performance Metrics means Sales, Adjusted Earnings Per Share, and Human Capital Scorecard.

Performance Year means the 12-month period beginning on January 1 and ending on the following December 31.

Plan means the Boston Scientific Annual Bonus Plan, which is set forth in this document, as it may be amended from time to time.

Quality Assessment means the process undertaken by the Committee following the end of each Performance Year, to evaluate the Company's progress made toward achievement of its quality objectives and the performance of the Company-wide quality system.

Region means a geographic region, as designated by the Chief Executive Officer from time to time, comprising a portion of the Company's international business.

Regular Exempt Employee means an employee of the Company who is on the Company's United States payroll and (1) classified by the Company as a regular full-time or regular part-time Employee; (2) performs a job that the Company has determined to be exempt from the minimum wage and overtime requirements of the Fair Labor Standards Act of 1938, as amended (FLSA); and (3) is not any of the following:

•classified by the Company as an intern, summer student, co-op employee, or similar short-term employee; or

•classified by the Company as a consultant, temporary or defined-term employee (such as temporary fellowship program employees), or similar category of limited-term employment, regardless of their work schedule or number of hours worked.

Sales means "BSC Global Sales" as that term is defined for purposes of the Boston Scientific Corporation 2011 Long-Term Incentive Plan, which measures sales using constant currency rates.

Scorecard means, with respect to a Performance Year, the tool used to establish performance measures and objectives with respect to a Business Group, Region, or Unit for the Performance Year.

Target Annual Bonus has the meaning given to that term in Article III.

Total Annual Bonus represents, with respect to a Performance Year, the total dollars to be paid out by the Company to all participating employees as Bonus Awards for the Performance Year.

Unit means a business unit of Business Group or Region, such as a plant or division (for a Business Group) or a country or group of countries (for a Region); the Units of a Business Group or Region may change from time to time.