Table of Contents

As filed with the Securities and Exchange Commission on October 5, 2011

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

KENNEDY-WILSON, INC.

(Exact name of registrant as specified in its charter)

SEE TABLE OF ADDITIONAL REGISTRANTS

| Delaware | 6500 | 95-4364537 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

9701 Wilshire Boulevard, Suite 700

Beverly Hills, California 90212

(310) 887-6400

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

William J. McMorrow

Chief Executive Officer

Kennedy-Wilson, Inc.

9701 Wilshire Boulevard, Suite 700

Beverly Hills, California 90212

(310) 887-6400

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With a copy to:

Julian T.H. Kleindorfer

Latham & Watkins LLP

355 South Grand Avenue

Los Angeles, California 90071

(213) 485-1234

Fax: (213) 891-8763

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement is declared effective.

If the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | x | |||||

| Non-accelerated filer | ¨ | (Do not check if a smaller reporting company) | Smaller reporting company | ¨ |

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross-Border Issuer Tender Offer) ¨

Exchange Act Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) ¨

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of Each Class of Securities to be Registered |

Amount to be Registered |

Maximum Offering Price Per Note(1) |

Maximum Aggregate Offering Price |

Amount of Registration Fee | ||||

| 8.750 % Senior Notes due 2019 |

$250,000,000 | 100% | $250,000,000 | $28,650 | ||||

| Guarantees of 8.750% Senior Notes due 2019(2) |

N/A | N/A | N/A | (3) | ||||

|

| ||||||||

|

| ||||||||

| (1) | Estimated solely for the purpose of calculating the registration fee under Rule 457(f) of the Securities Act of 1933, as amended (the “Securities Act”). |

| (2) | See inside facing page for additional registrant guarantors. |

| (3) | Pursuant to Rule 457(n) under the Securities Act, no separate filing fee is required for the guarantees. |

The registrants hereby amend this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrants shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

TABLE OF ADDITIONAL REGISTRANTS

Additional Registrants (as Guarantors of 8.750% Senior Notes due 2019)

| Exact Name of Registrant as Specified in its Charter |

State or

Other |

I.R.S. Employer Identification Number |

Primary Standard Industrial Classification Code Number |

Address, Including Zip Code and Telephone Number, Including Area Code of Registrant’s Principal Executive Offices | ||||

| Kennedy-Wilson Holdings, Inc. | DE | 26-0508760 | 6531-04 | 97016 Wilshire Boulevard, Suite 700 Beverly Hills, California 90212 (310) 887-6400 | ||||

| Kennedy-Wilson Properties, Ltd. |

DE | 95-4697159 | 6531-08 | 9701 Wilshire Boulevard, Suite 700 Beverly Hills, California 90212 (310) 887-6400 | ||||

| Kennedy-Wilson Property Services, Inc. |

DE | 95-4812579 | 6531-08 | 9701 Wilshire Boulevard, Suite 700 Beverly Hills, California 90212 (310) 887-6400 | ||||

| Kennedy-Wilson Property Services, II, Inc. |

DE | 20-3693493 | 6531-06 | 9701 Wilshire Boulevard, Suite 700 Beverly Hills, California 90212 (310) 887-6400 | ||||

| Kennedy Wilson Property Services III, L.P. |

DE | 26-1558520 | 6531-06 | 9701 Wilshire Boulevard, Suite 700 Beverly Hills, California 90212 (310) 887-6400 | ||||

| Kennedy-Wilson Property Equity, Inc. |

DE | 95-4812580 | 6531-04 | 9701 Wilshire Boulevard, Suite 700 Beverly Hills, California 90212 (310) 887-6400 | ||||

| Kennedy-Wilson Property Equity II, Inc. |

DE | 20-3812712 | 6531-04 | 9701 Wilshire Boulevard, Suite 700 Beverly Hills, California 90212 (310) 887-6400 | ||||

| Kennedy-Wilson Property Special Equity, Inc. |

DE | 95-4812583 | 6531-04 | 9701 Wilshire Boulevard, Suite 700 Beverly Hills, California 90212 (310) 887-6400 | ||||

| Kennedy-Wilson Property Special Equity II, Inc. |

DE | 20-3693618 | 6531-04 | 9701 Wilshire Boulevard, Suite 700 Beverly Hills, California 90212 (310) 887-6400 | ||||

| Kennedy Wilson Property Special Equity III, LLC |

DE | 26-1558607 | 6531-04 | 9701 Wilshire Boulevard, Suite 700 Beverly Hills, California 90212 (310) 887-6400 | ||||

| K-W Properties | CA | 95-4492564 | 6531-04 | 9701 Wilshire Boulevard, Suite 700 Beverly Hills, California 90212 (310) 887-6400 | ||||

| Kennedy Wilson Property Services III GP, LLC |

DE | 26-3806726 | 6531-06 | 9701 Wilshire Boulevard, Suite 700 Beverly Hills, California 90212 (310) 887-6400 | ||||

| KW BASGF II Manager, LLC | DE | 20-5523327 | 6531-04 | 9701 Wilshire Boulevard, Suite 700 Beverly Hills, California 90212 (310) 887-6400 |

Table of Contents

| Exact Name of Registrant as Specified in its Charter |

State or

Other |

I.R.S. Employer Identification Number |

Primary Standard Industrial Classification Code Number |

Address, Including Zip Code and Telephone Number, Including Area Code of Registrant’s Principal Executive Offices | ||||

| KWF Investors I, LLC | DE | 27-3337920 | 6531-04 | 9701 Wilshire Boulevard, Suite 700 Beverly Hills, California 90212 (310) 887-6400 | ||||

| KWF Investors II, LLC | DE | 27-3788594 | 6531-04 | 9701 Wilshire Boulevard, Suite 700 Beverly Hills, California 90212 (310) 887-6400 | ||||

| KWF Investors III, LLC | DE | 27-4110400 | 6531-04 | 9701 Wilshire Boulevard, Suite 700 Beverly Hills, California 90212 (310) 887-6400 | ||||

| KWF Manager I, LLC | DE | 27-3337771 | 6531-04 | 9701 Wilshire Boulevard, Suite 700 Beverly Hills, California 90212 (310) 887-6400 | ||||

| KWF Manager II, LLC | DE | 27-3788479 | 6531-04 | 9701 Wilshire Boulevard, Suite 700 Beverly Hills, California 90212 (310) 887-6400 | ||||

| KWF Manager III, LLC | DE | 27-4110811 | 6531-04 | 9701 Wilshire Boulevard, Suite 700 Beverly Hills, California 90212 (310) 887-6400 | ||||

| Kennedy Wilson Overseas Investments, Inc. |

DE | 20-2715619 | 6531-04 | 9701 Wilshire Boulevard, Suite 700 Beverly Hills, California 90212 (310) 887-6400 | ||||

| Fairways 340 Corp. | DE | 20-4169707 | 6531-04 | 9701 Wilshire Boulevard, Suite 700 Beverly Hills, California 90212 (310) 887-6400 | ||||

| KW-Richmond, LLC | DE | 26-2852263 | 6531-04 | 9701 Wilshire Boulevard, Suite 700 Beverly Hills, California 90212 (310) 887-6400 | ||||

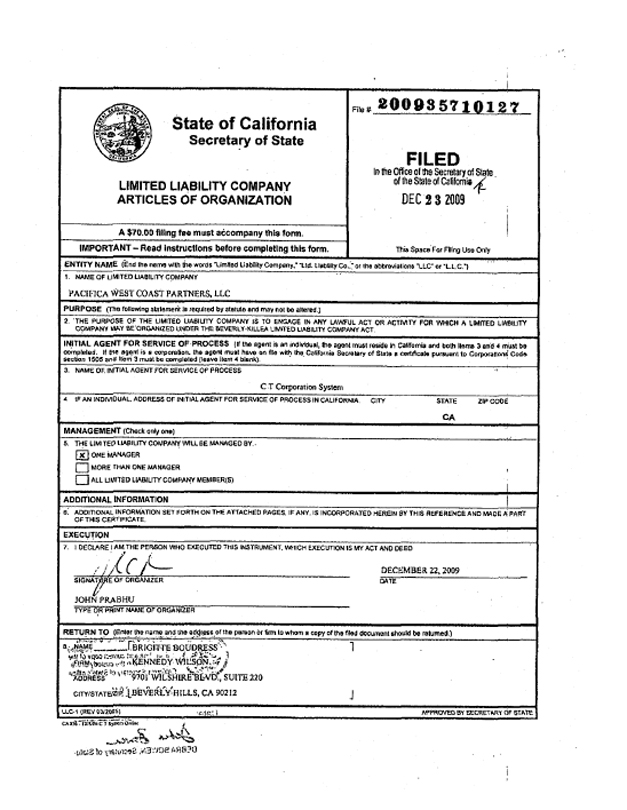

| Pacifica West Coast Partners, LLC |

CA | 27-1533980 | 6531-04 | 9701 Wilshire Boulevard, Suite 700 Beverly Hills, California 90212 (310) 887-6400 | ||||

| SG KW Venture I Manager LLC |

DE | 27-1366657 | 6531-04 | 9701 Wilshire Boulevard, Suite 700 Beverly Hills, California 90212 (310) 887-6400 | ||||

| KW Loan Partners I LLC | DE | 27-1944476 | 6162-01 | 9701 Wilshire Boulevard, Suite 700 Beverly Hills, California 90212 (310) 887-6400 | ||||

| KW Loan Partners II LLC | CA | 27-2450209 | 6162-01 | 9701 Wilshire Boulevard, Suite 700 Beverly Hills, California 90212 (310) 887-6400 | ||||

| KW Sunrise Carlsbad, LLC | DE | 27-3576271 | 6531-04 | 9701 Wilshire Boulevard, Suite 700 Beverly Hills, California 90212 (310) 887-6400 | ||||

| Sunrise Property Associates, LLC |

DE | 95-3825023 |

6531-04 | 9701 Wilshire Boulevard, Suite 700 Beverly Hills, California 90212 (310) 887-6400 |

Table of Contents

| Exact Name of Registrant as Specified in its Charter |

State or

Other |

I.R.S. Employer Identification Number |

Primary Standard Industrial Classification Code Number |

Address, Including Zip Code and Telephone Number, Including Area Code of Registrant’s Principal Executive Offices | ||||

| KW Summer House Manager, LLC |

DE | 27-2502491 | 6531-04 | 9701 Wilshire Boulevard, Suite 700 Beverly Hills, California 90212 (310) 887-6400 | ||||

| KW Mill Creek Property Manager, LLC |

CA | 26-0301460 | 6531-04 | 9701 Wilshire Boulevard, Suite 700 Beverly Hills, California 90212 (310) 887-6400 | ||||

| KW Montclair, LLC | DE | 26-2942185 | 6531-04 | 9701 Wilshire Boulevard, Suite 700 Beverly Hills, California 90212 (310) 887-6400 | ||||

| KW Blossom Hill Manager, LLC |

DE | 26-3330309 | 6531-04 | 9701 Wilshire Boulevard, Suite 700 Beverly Hills, California 90212 (310) 887-6400 | ||||

| KW Serenade Manager, LLC | DE | 27-3271987 | 6531-04 | 9701 Wilshire Boulevard, Suite 700 Beverly Hills, California 90212 (310) 887-6400 | ||||

| K-W Santiago Inc. | CA | 95-4704530 | 6531-04 | 9701 Wilshire Boulevard, Suite 700 Beverly Hills, California 90212 (310) 887-6400 | ||||

| KW Anaheim Land Partners LLC |

DE | 20-5046652 | 6531-04 | 9701 Wilshire Boulevard, Suite 700 Beverly Hills, California 90212 (310) 887-6400 | ||||

| KW Redmond Manager, LLC | DE | 26-2773678 | 6531-04 | 9701 Wilshire Boulevard, Suite 700 Beverly Hills, California 90212 (310) 887-6400 | ||||

| Dillingham Ranch Aina LLC | DE | 20-4635382 | 6531-04 | 9701 Wilshire Boulevard, Suite 700 Beverly Hills, California 90212 (310) 887-6400 | ||||

| 68-540 Farrington, LLC | DE | 20-4879846 | 6531-04 | 9701 Wilshire Boulevard, Suite 700 Beverly Hills, California 90212 (310) 887-6400 | ||||

| KW Dillingham Aina LLC | DE | 20-4788802 | 6531-04 | 9701 Wilshire Boulevard, Suite 700 Beverly Hills, California 90212 (310) 887-6400 | ||||

| Kennedy Wilson Fund Management Group, LLC |

CA | 20-8342380 | 6531-08 | 9701 Wilshire Boulevard, Suite 700 Beverly Hills, California 90212 (310) 887-6400 | ||||

| Kennedy-Wilson International | CA | 95-3379144 | 6521-18 | 9701 Wilshire Boulevard, Suite 700 Beverly Hills, California 90212 (310) 887-6400 | ||||

| Kennedy-Wilson Tech, Ltd. | CA | 95-4725845 | 6531-08 | 9701 Wilshire Boulevard, Suite 700 Beverly Hills, California 90212 (310) 887-6400 | ||||

| KW Multi-Family Management Group, LLC |

DE | 20-3909439 | 6531-08 | 9701 Wilshire Boulevard, Suite 700 Beverly Hills, California 90212 (310) 887-6400 | ||||

| KWP Financial I | CA | 95-4506679 | 6162-01 | 9701 Wilshire Boulevard, Suite 700 Beverly Hills, California 90212 (310) 887-6400 |

Table of Contents

| Exact Name of Registrant as Specified in its Charter |

State or

Other |

I.R.S. Employer Identification Number |

Primary Standard Industrial Classification Code Number |

Address, Including Zip Code and Telephone Number, Including Area Code of Registrant’s Principal Executive Offices | ||||

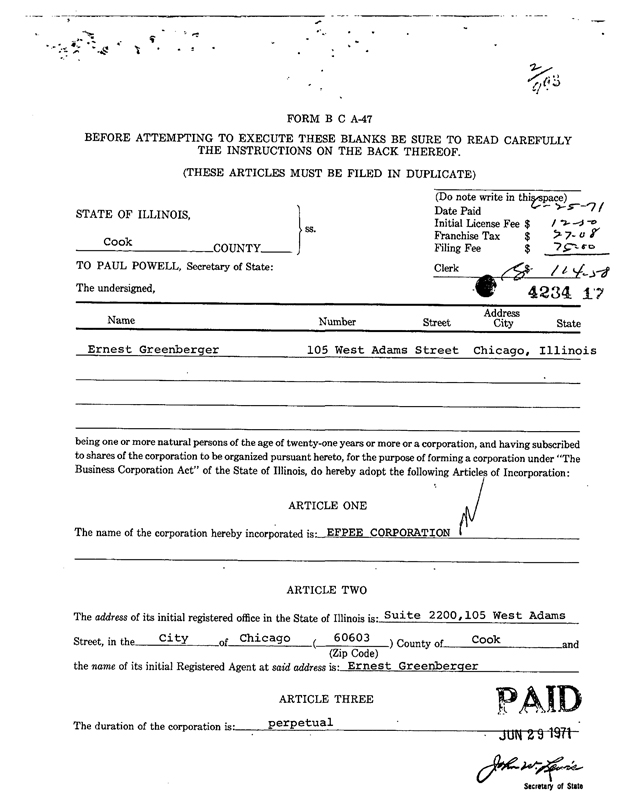

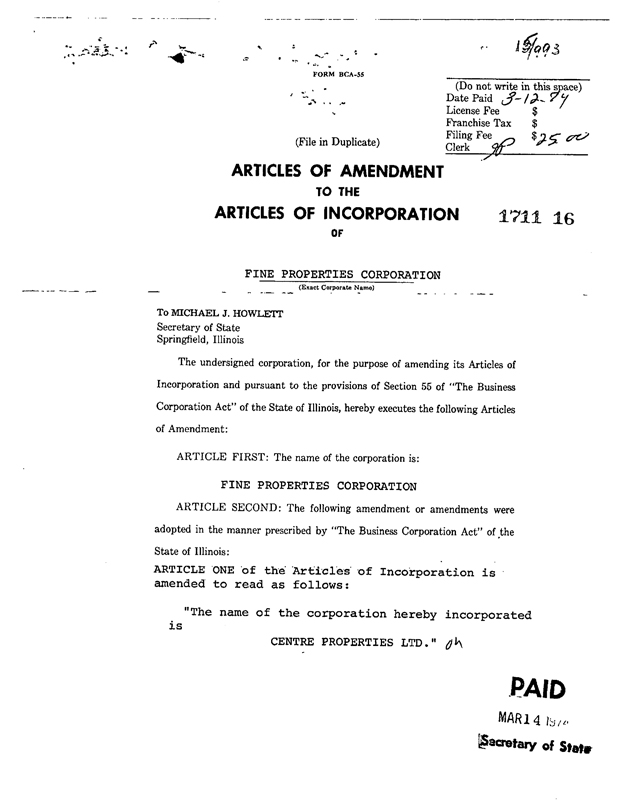

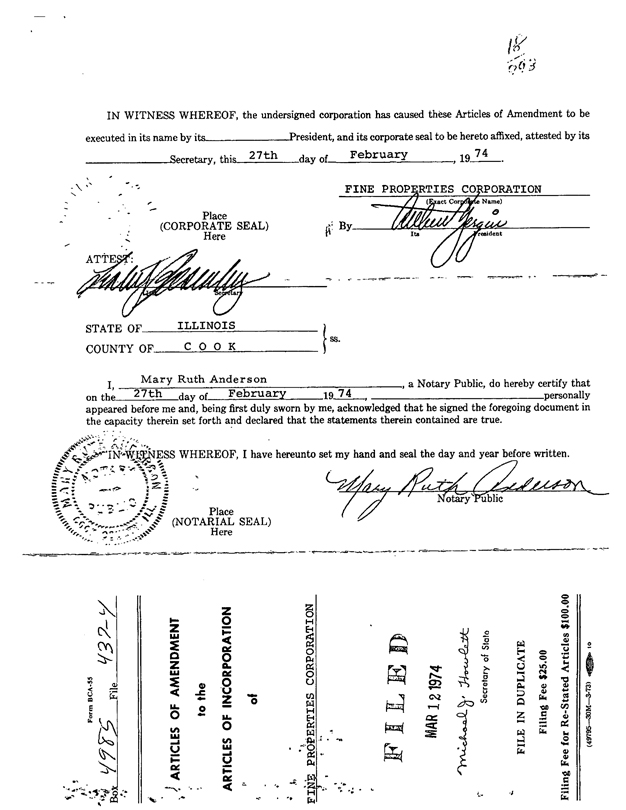

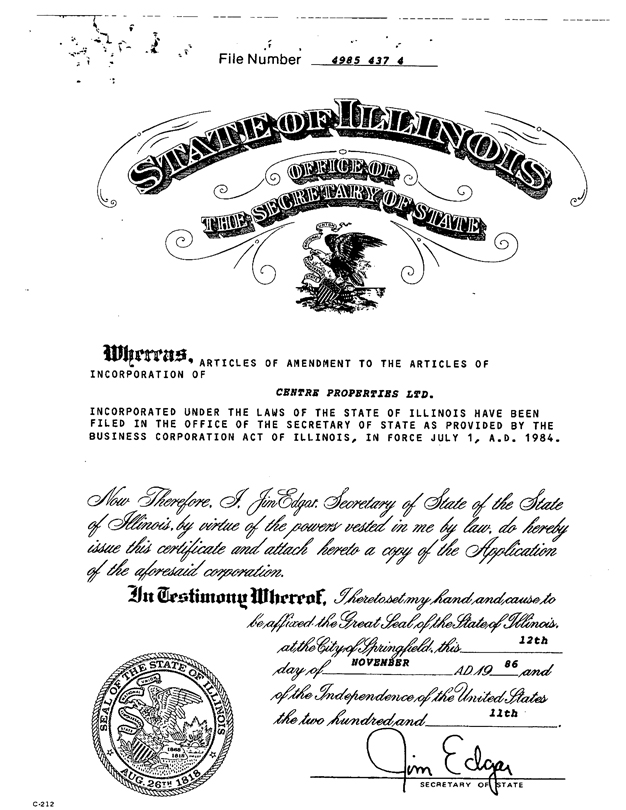

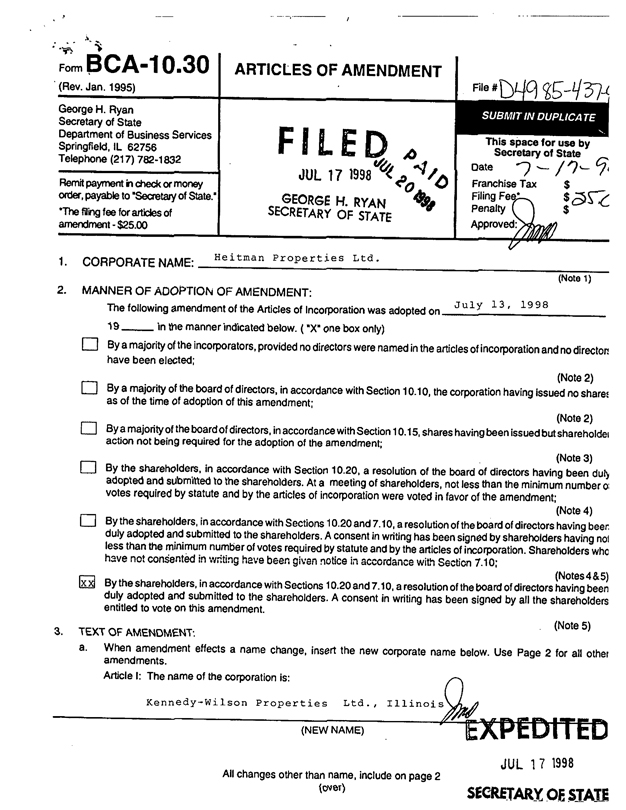

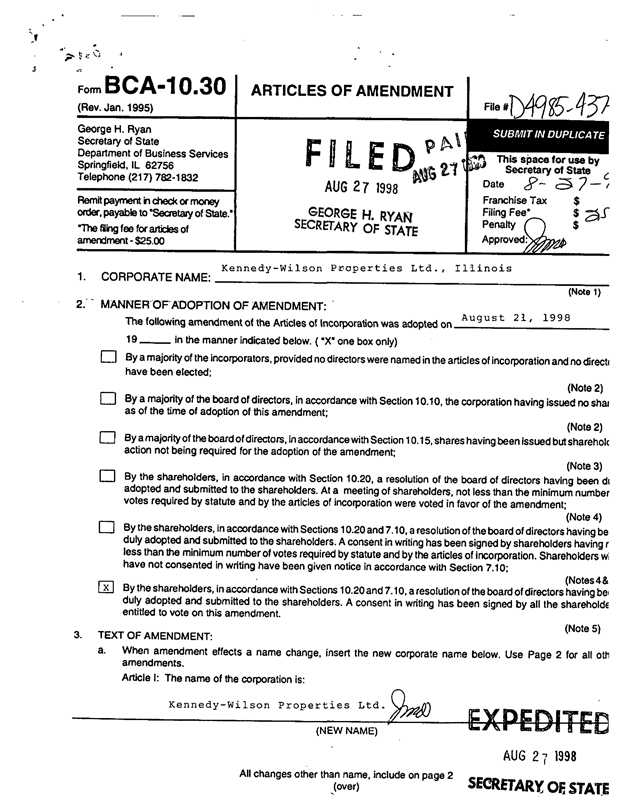

| Kennedy-Wilson Properties, LTD |

IL | 36-2709910 | 6531-08 | 9701 Wilshire Boulevard, Suite 700 Beverly Hills, California 90212 (310) 887-6400 | ||||

| Kennedy Wilson Auction Group Inc. |

CA | 26-0808460 | 6531-08 | 9701 Wilshire Boulevard, Suite 700 Beverly Hills, California 90212 (310) 887-6400 | ||||

| KWF Manager IV, LLC | DE | 45-1836132 | 6531-04 | 9701 Wilshire Boulevard, Suite 700 Beverly Hills, California 90212 (310) 887-6400 | ||||

| KWF Manager V, LLC | DE | 45-2477455 | 6531-04 | 9701 Wilshire Boulevard, Suite 700 Beverly Hills, California 90212 (310) 887-6400 | ||||

| KW Ireland, LLC | DE | 45-1840083 | 6531-04 | 9701 Wilshire Boulevard, Suite 700 Beverly Hills, California 90212 (310) 887-6400 | ||||

| Kennedy Wilson Property Equity IV, LLC |

DE | 45-2147199 | 6531-04 | 9701 Wilshire Boulevard, Suite 700 Beverly Hills, California 90212 (310) 887-6400 | ||||

| KW Residential Group, Inc. | DE | 45-2718656 | 6531-06 | 9701 Wilshire Boulevard, Suite 700 Beverly Hills, California 90212 (310) 887-6400 | ||||

| KWF Fund IV – Kohanaiki, LLC |

DE | 45-2718657 | 6531-04 | 9701 Wilshire Boulevard, Suite 700 Beverly Hills, California 90212 (310) 887-6400 | ||||

| KW Telstar Partners, LLC | DE | 45-2718658 | 6531-04 | 9701 Wilshire Boulevard, Suite 700 Beverly Hills, California 90212 (310) 887-6400 | ||||

| KWF Investors IV, LLC | DE | 45-837186 | 6531-04 |

9701 Wilshire Boulevard, Suite 700 Beverly Hills, California 90212 (310) 887-6400 | ||||

| KWF Investors V, LLC | DE | 45-477357 | 6531-04 |

9701 Wilshire Boulevard, Suite 700 Beverly Hills, California 90212 (310) 887-6400 |

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. We may not offer or sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities, nor a solicitation of an offer to buy these securities, in any jurisdiction where the offering, solicitation or sale is not permitted.

SUBJECT TO COMPLETION, DATED October 5, 2011

PRELIMINARY PROSPECTUS

$250,000,000

Kennedy-Wilson, Inc.

Exchange Offer for

8.750% Senior Notes due 2019

We are offering to exchange up to $250,000,000 of our new 8.750% Senior Notes due 2019, which are wholly and unconditionally guaranteed by Kennedy-Wilson Holdings, Inc., the parent company of Kennedy-Wilson, Inc., and certain subsidiaries of Kennedy-Wilson, Inc. (the “exchange notes”), which will be registered under the Securities Act of 1933, as amended (the “Securities Act”), for any and all of our outstanding 8.750% Senior Notes due 2019, which are wholly and unconditionally guaranteed by Kennedy-Wilson Holdings, Inc., the parent company of Kennedy-Wilson, Inc., and certain subsidiaries of Kennedy-Wilson, Inc., (the “outstanding notes”). We are offering to exchange the exchange notes for the outstanding notes to satisfy our obligations contained in the registration rights agreement that we entered into when the outstanding notes were sold pursuant to Rule 144A and Regulation S under the Securities Act.

The Exchange Offer

| • | We will exchange all outstanding notes that are validly tendered and not validly withdrawn for an equal principal amount of exchange notes that are freely tradable, except in limited circumstances as described below. |

| • | You may withdraw tenders of outstanding notes at any time prior to the expiration date of the exchange offer. |

| • | The exchange offer expires at 5:00 p.m., New York City time, on , , unless extended. We do not currently intend to extend the expiration date. |

| • | The exchange of the outstanding notes for exchange notes in the exchange offer will not be a taxable event for U.S. federal income tax purposes. |

| • | We will not receive any proceeds from the exchange offer. |

The Exchange Notes

| • | The terms of the exchange notes to be issued in the exchange offer are identical in all material respects to the outstanding notes, except that the exchange notes will be freely tradable, except in limited circumstances described below. |

Resales of the Exchange Notes

| • | The exchange notes may be sold in the over-the-counter market, in negotiated transactions or through a combination of such methods. We do not plan to list the notes on any securities exchange or market. |

Table of Contents

All untendered outstanding notes will continue to be subject to the restrictions on transfer set forth in the outstanding notes and in the related indenture. In general, the outstanding notes may not be offered or sold, unless registered under the Securities Act, except pursuant to an exemption from, or in a transaction not subject to, the Securities Act and applicable state securities laws. Other than in connection with the exchange offer, we currently do not anticipate that we will register the outstanding notes under the Securities Act.

See “Risk Factors” beginning on page 20 for a discussion of certain risks that you should consider before participating in the exchange offer.

Each broker-dealer that receives exchange notes for its own account pursuant to the exchange offer must acknowledge that it will deliver a prospectus in connection with any resale of such exchange notes. The letter of transmittal states that by so acknowledging and delivering a prospectus, a broker-dealer will not be deemed to admit that it is an “underwriter” within the meaning of the Securities Act. This prospectus, as it may be amended or supplemented from time to time, may be used by a broker-dealer in connection with resales of exchange notes received in exchange for outstanding notes where such outstanding notes were acquired by such broker-dealer as a result of market-making activities or other trading activities. In addition, all dealers effecting transactions in the exchange notes may be required to deliver a prospectus. We have agreed that, for a period of 180 days after the date of this prospectus, we will make this prospectus available to any broker-dealer for use in connection with such resale. See “Plan of Distribution.”

If you are our affiliate or are engaged in, or intend to engage in, or have an agreement or understanding to participate in, a distribution of the exchange notes, you cannot rely on the applicable interpretations of the Securities and Exchange Commission and you must comply with the registration requirements of the Securities Act in connection with any resale transaction.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these notes or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , .

Table of Contents

| ii | ||||

| iii | ||||

| 1 | ||||

| 20 | ||||

| 38 | ||||

| 40 | ||||

| 41 | ||||

| 42 | ||||

| 46 | ||||

| 57 | ||||

| 104 | ||||

| 105 | ||||

| 106 | ||||

| 106 | ||||

| Index to the Consolidated Financial Statements and Schedules |

F-1 |

You should rely only on the information contained or incorporated by reference in this prospectus or in any additional written communication prepared by or authorized by us. We have not authorized anyone to provide you with any information or represent anything about us, our financial results or the exchange offer that is not contained in or incorporated by reference into this prospectus or in any additional written communication prepared by or on behalf of us. If given or made, any such other information or representation should not be relied upon as having been authorized by us. We are not making an offer to exchange the outstanding notes in any jurisdiction where the offer or sale is not permitted. You should assume that the information in this prospectus or in any additional written communication prepared by or on behalf of us is accurate only as of the date on its cover page and that any information incorporated by reference herein is accurate only as of the date of the document incorporated by reference.

As used in this prospectus, references to “our company,” “we,” “us” and “our” and similar expressions refer to Kennedy-Wilson Holdings, Inc., and its consolidated subsidiaries, including Kennedy-Wilson, Inc., the issuer of the notes, unless otherwise stated or the context otherwise requires. However, in the “Prospectus Summary—The Exchange Offer,” “Prospectus Summary—The Exchange Notes,” the “Description of the Notes” and “The Exchange Offer” sections of this prospectus, references to “we,” “us” and “our” and similar expressions refer only to Kennedy-Wilson, Inc. and not to its subsidiaries or Kennedy-Wilson Holdings, Inc.

i

Table of Contents

WHERE YOU CAN FIND MORE INFORMATION

Kennedy-Wilson Holdings, Inc., Kennedy-Wilson, Inc. and certain subsidiaries of Kennedy-Wilson, Inc., have filed with the United States Securities and Exchange Commission (the “SEC”) a registration statement on Form S-4 under the Securities Act with respect to the notes being offered hereby. This prospectus, which forms a part of the registration statement, does not contain all of the information set forth in the registration statement. For further information with respect to us and the exchange notes, reference is made to the registration statement. Statements contained in this prospectus as to the contents of any contract or other document are not necessarily complete.

Kennedy-Wilson Holdings, Inc. is subject to the requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and files periodic reports, proxy statements and other information with the SEC. Materials that it files with the SEC may be read and copied at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. Information on the operation of the Public Reference Room may be obtained by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains an Internet website at http://www.sec.gov, from which interested persons can electronically access reports, proxy statements and other information relating to SEC registrants, including our company. Kennedy-Wilson Holdings, Inc.’s common stock is listed on the New York Stock Exchange and reports, proxy statements and other information that it provides to the New York Stock Exchange can be inspected at the offices of the New York Stock Exchange, 20 Broad Street, New York, New York 10005.

Our Internet website at http://www.kennedywilson.com contains information concerning us. On the Investor Relations page of that website, we provide access to all of Kennedy-Wilson Holdings, Inc.’s SEC filings free of charge, as soon as reasonably practicable after filing with the SEC. The information at our Internet website is not incorporated in this prospectus by reference, and you should not consider it a part of this prospectus.

ii

Table of Contents

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

The SEC allows certain issuers, including our company, to “incorporate by reference” information into this prospectus, which means that we can disclose important information about us by referring you to those documents that are considered part of this prospectus but are filed separately with the SEC. Any statement contained in this prospectus or a document incorporated by reference in this prospectus will be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained herein or therein, or in any other subsequently filed document that also is deemed to be incorporated herein or therein by reference, modifies or supersedes such statement. A statement so modified or superseded will not be deemed, except as so modified or superseded, to constitute a part of this prospectus. We incorporate by reference into this prospectus the documents set forth below that have been previously filed with the SEC; provided, however, that we are not incorporating any information furnished rather than filed on any Current Report on Form 8-K or Form 8-K/A:

| • | Our Annual Report on Form 10-K for the year ended December 31, 2010, as filed with the SEC on March 14, 2011 (File No. 001-33824); |

| • | Our Quarterly Report on Form 10-Q for the quarter ended March 31, 2011, as filed with the SEC on May 9, 2011 (File No. 001-33824); |

| • | Our Quarterly Report on Form 10-Q for the quarter ended June 30, 2011, as filed with the SEC on August 9, 2011 (File No. 001-33824); |

| • | Our Current Report on Form 8-K filed with the SEC on March 28, 2011 (File No. 001-33824); |

| • | Our Current Report on Form 8-K filed with the SEC on April 7, 2011 (File No. 001-33824); |

| • | Our Current Report on Form 8-K filed with the SEC on April 13, 2011 (File No. 001-33824); |

| • | Our Current Report on Form 8-K filed with the SEC on June 1, 2011 (File No. 001-33824); |

| • | Our Current Report on Form 8-K filed with the SEC on June 21, 2011 (File No. 001-33824); |

| • | Our Current Report on Form 8-K filed with the SEC on June 24, 2011 (File No. 001-33824); |

| • | Our Current Report on Form 8-K filed with the SEC on June 29, 2011 (File No. 001-33824); |

| • | Our Current Report on Form 8-K filed with the SEC on August 4, 2011 (File No. 001-33824); |

| • | Our Current Report on Form 8-K filed with the SEC on August 19, 2011 (File No. 001-33824); |

| • | Our Current Report on Form 8-K filed with the SEC on October 3, 2011 (File No. 001-33824); and |

| • | any future filings we make with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act until we complete the exchange offer for the notes or terminate the exchange offer. |

See “Where You Can Find More Information” above for further information concerning how to obtain copies of these SEC filings.

This prospectus incorporates by reference important business and financial information about us that is not included in or delivered with this prospectus. We will provide without charge to each person to whom a copy of this prospectus has been delivered, upon the written or oral request of such person, a copy of any and all of the documents that have been or may be incorporated by reference into this prospectus. Requests for copies of any such document should be directed to the Secretary, Kennedy-Wilson Holdings, Inc., 9701 Wilshire Boulevard, Suite 700, Beverly Hills, California 90212, phone: (310) 887-6400.

IN ORDER TO OBTAIN TIMELY DELIVERY, YOU MUST REQUEST THE INFORMATION NO LATER THAN , , WHICH IS FIVE BUSINESS DAYS BEFORE THE EXPIRATION OF THE EXCHANGE OFFER.

iii

Table of Contents

This summary highlights selected information contained or incorporated by reference in this prospectus and is not complete and does not contain all of the information that you should consider before tendering your notes in the exchange offer. To understand all of the terms of the exchange offer and for a more complete understanding of our business, you should read this summary together with the entire prospectus, including the documents incorporated by reference in this prospectus. References to EBITDA, Adjusted EBITDA and other financial terms shall have the meanings set forth on page 44 under “Selected Historical Consolidated Financial Data.” EBITDA and Adjusted EBITDA are not recognized terms under accounting principles generally accepted in the United Stated (“GAAP”). For a discussion of the use of these measures and directly comparable GAAP measures, see pages 44-45 under “Selected Historical Consolidated Financial Data.”

Our Company

Founded in 1977, we are a diversified, international real estate investment and services firm. We are a vertically-integrated real estate operating company with over 300 professionals in 23 offices throughout the U.S., Japan and Europe. As of June 30, 2011, we had approximately $9.8 billion of real estate assets under our management totaling over 50 million square feet of properties throughout the U.S., Japan and Europe. In addition, we hold ownership interests in 12,906 multifamily apartment units, of which 204 units are owned by our consolidated subsidiaries and 12,702 are held in joint ventures.

Our operations are comprised of two core business units: KW Investments and KW Services.

We have an integrated business model in which our services and investments segments complement each other and drive business across the platform. Our clients consist of a broad range of financial institutions (including banks and insurance companies) and real estate owners who require a full complement of real estate services. We have developed a network of established industry relationships through our services platform, which we believe provides us access to off-market investments, which we source primarily from financial institutions. Since January 1, 2010, approximately 80% of our deals, many of which originated from distressed situations at the seller, have been sourced directly from banks as opposed to competitive auction processes. For the fiscal year ended December 31, 2010 and the six month period ended June 30, 2011, we generated Adjusted EBITDA of $58.4 million and $32.6 million, respectively.

Our Business Segments

KW Investments invests our capital and our equity partners’ capital in multifamily, residential and office properties as well as loans secured by real estate. KW Services provides a full array of real estate-related services to investors and lenders, with a focus on financial institution based clients.

KW Investments

We invest our capital and our equity partners’ capital in real estate assets through joint ventures, separate accounts and commingled funds. We are an investment manager that typically acts as the general partner in these investment vehicles with ownership interests ranging from approximately 5% to 50% of the total equity investment in such vehicles. Our equity partners are not affiliated with us and include financial institutions, foundations, endowments, high net worth individuals and other institutional investors. We generally get promoted interests in the profits of our investments beyond our ownership percentage.

Our investment philosophy is based on three core fundamentals:

| • | significant proprietary deal flow from an established network of industry relationships, particularly with financial institutions; |

1

Table of Contents

| • | focus on a systematic research process with a disciplined approach to investing; and |

| • | superior in-house operating execution. |

Our target investment markets include California, Washington, Hawaii, Japan and certain markets in Europe, which we have identified as areas with dense populations, high barriers to entry, scarcity of land and supply constraints. We typically focus on the following opportunities:

| • | real estate owners or lenders seeking liquidity; |

| • | under-managed or under-leased assets; and |

| • | repositioning opportunities. |

Since 1999, we and our equity partners have invested in 206 transactions, deploying approximately $8.2 billion of capital, including over $3.0 billion of equity. We have liquidated our interests in 94 of these transactions, which have generated an internal rate of return, or IRR, of 42% and an equity multiple (excluding our promoted interest) of 1.64x. In 2010, we and our equity partners acquired over $2.0 billion of real estate assets, with approximately $600 million of equity. Of the more than $2.0 billion in acquisitions in 2010, 65% were in multifamily assets, 32% were in loans secured by real estate and 3% were in other real estate assets. Our current portfolio consists of 114 investments totaling over $3.8 billion of capital, including $1.5 billion of equity provided by our equity partners and us.

Recently, we established Kennedy Wilson Europe, or KWE, by acquiring the Bank of Ireland’s Real Estate Investment Management division, or BOI REIM, which resulted in the addition of $2.3 billion to the real estate investments under our management. KWE, with offices in Dublin and London, is currently staffed with 13 real estate professionals who were previously at BOI REIM. While at BOI REIM, our KWE professionals collectively acquired approximately $4 billion of real estate assets, primarily in Western Europe, including $1.5 billion in the United Kingdom.

Our expansion into Europe is based on the same strategy we used to establish operations in Japan nearly two decades ago. Following the global recession of the early 1990s, we began doing business in Japan in 1993 by purchasing loans and real estate assets, which culminated in the initial public offering of Kennedy Wilson Japan (our Japanese asset management division) in 2002. We subsequently sold our ownership interest in Kennedy Wilson Japan and formed KW Residential, a private company that currently owns 50 multifamily assets in Japan comprising 2,410 units. Today, we own 41.5% of KW Residential and the balance is held by subsidiaries of Fairfax Financial Holdings Limited.

2

Table of Contents

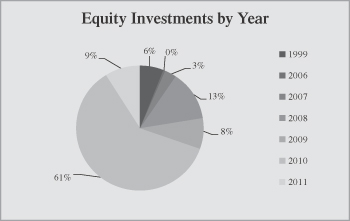

The following chart breaks down our equity investment account information by year of origination, as of June 30, 2011:

The following table breaks down our equity investment account information derived from our consolidated balance sheet by investment type and geographic location as of June 30, 2011:

| ($ in millions) | ||||||||||||||||||||||||

| Multifamily | Loans Secured by Real Estate |

Residential (1) | Office | Other | Total | |||||||||||||||||||

| California |

$ | 99.0 | $ | 68.4 | $ | 1.5 | $ | 46.0 | $ | — | $ | 214.9 | ||||||||||||

| Japan |

114.9 | — | — | 9.0 | — | 123.9 | ||||||||||||||||||

| Hawaii |

— | 10.8 | 62.0 | — | — | 72.8 | ||||||||||||||||||

| Washington |

27.3 | 3.9 | 1.8 | 1.5 | — | 34.5 | ||||||||||||||||||

| Other |

3.0 | 0.5 | 0.3 | 5.5 | 4.1 | 13.4 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total |

$ | 244.2 | $ | 83.6 | $ | 65.6 | $ | 61.9 | $ | 4.1 | $ | 459.4 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| (1) | Includes for-sale residential, condominiums and residential land. |

KW Services

KW Services offers a comprehensive line of real estate services for the full lifecycle of real estate ownership and investment to clients that include financial institutions, developers, builders and government agencies. KW Services has three business lines: real estate auction and conventional sales, property management services and real estate investment management. These three business lines generate revenue for us through commissions and fees.

Since our inception, we have sold more than $10 billion of real estate through our auction platform and are considered one of the leaders in real estate auction marketing, conducting live and online auctions. Our auction group executes accelerated marketing programs for all types of residential and commercial real estate. From January 1, 2010 through June 30, 2011, we auctioned and conventionally sold over 839 properties in two countries and 19 states, including California, Washington, Hawaii, Oregon, Texas, Nevada, Florida, Georgia, and North Carolina.

3

Table of Contents

We manage over 50 million square feet of properties for institutional clients and individual investors in the U.S., Japan and Europe, including 12,906 multifamily apartment units, of which 204 units are owned by our consolidated subsidiaries and 12,702 are held in joint ventures. With 23 offices throughout the U.S., Japan and Europe, including five regional hubs, we have the capabilities and resources to provide property management services to real estate owners globally. In addition, through our investment management business, we provide acquisition, asset management and disposition services to our equity partners and to third parties. As of June 30, 2011, we had approximately $9.8 billion of real estate assets under our management, including approximately $2.3 billion in Europe.

Additionally, KW Services plays a critical role in supporting our investment strategy by providing local market intelligence and real-time data for evaluating and valuing investments, generating proprietary transaction flow and creating value through efficient implementation of asset management or repositioning strategies.

Market Opportunity

We operate our business in three real estate markets, the United States, Japan and Europe. We believe that these three markets provide us and our capital partners compelling investment opportunities to execute and realize substantial returns.

United States

We believe that the recent economic, capital and credit markets events have and will continue to create substantial buying opportunities as properties or loans secured by real estate may be purchased at significant discounts to historical cost. Many asset and loan dispositions will result from: (i) highly leveraged property owners who will have loans coming due in 2011 and 2012 but will be unable to refinance; (ii) assets and loan sales directly from financial institutions; and (iii) companies reducing real estate portfolios to raise cash and shore up their balance sheets.

Following the economic crisis of 2008 and 2009, financial institutions continue to face significant pressure on their balance sheets. We believe that, as financial institutions remain under pressure to move assets off of their balance sheets, our strong sourcing relationships will position us to acquire properties at discounts often prior to public auction processes. We believe these institutions will look to firms with whom they have long-standing relationships and that can execute acquisitions quickly and discreetly. Additionally, we have long-standing relationships with regional and international lenders who have demonstrated an ability and willingness to offer financing for investments.

Over the past several years, many U.S. real estate markets have experienced a downturn in occupancy and property values. Unlike the last cycle, this recent downturn was driven by a lack of liquidity and a tightening of credit markets rather than by an oversupply of newly developed real estate. We believe that underlying real estate fundamentals have remained strong, particularly in major metropolitan and downtown areas where supply constraints exist.

Europe

Given the significant deleveraging that is currently taking place across the European Union, we believe that Europe presents significant opportunities for both our KW Investments and KW Services segments. Before the economic crisis of 2008 and 2009, European banks were significant lenders in both the European and U.S. real estate markets. Now that these institutions are facing similar pressure on their balance sheets as U.S. financial institutions, we believe it is likely that they will seek to sell some of their real estate assets, which will lead to increased transaction flow and opportunities for acquisition and investment.

4

Table of Contents

Japan

Japan’s current demographic trends include an influx of migration to major cities, creating strong demand for housing. Our research shows that real estate fundamentals have remained strong in greater Tokyo’s residential market and, in particular, in Tokyo’s three major wards: Minato-ku, Shibuy-ku, and Setagaya-ku. With diminishing supply of new inventory due to stricter building regulations imposed in 2007, rents for quality assets are expected to remain strong while vacancy rates remain stable. We expect that properties in the greater Tokyo area that are newer and of higher quality will remain acquisition targets for many institutional investors.

Our Competitive Strengths

We believe that we have a unique platform from which to execute our investment and services strategy. We believe the combination of a service business and an investment platform provides us with significant competitive advantages and allows us to generate superior risk adjusted returns. We use our service platform to facilitate the origination of investment opportunities, enhance the investment process and ensure the alignment of interest with our investors. Our competitive strengths include:

| • | Experienced Senior Management Team with Strong Alignment of Interests. Our senior management team has over 125 years of combined real estate experience and has been working together on average for over 15 years. Specifically, our Chief Executive Officer, William McMorrow, has over 30 years of real estate experience, including 22 years at the company, as well as substantial experience as a credit officer for various banking institutions prior to the acquisition of Kennedy-Wilson, Inc. in 1988. Additionally, Mary Ricks, our Executive Vice Chairman and Chief Executive Officer of the commercial investment group has over 23 years of real estate investment and management experience, including 20 years at the company. Members of the executive committee have collectively acquired, developed and managed in excess of $15 billion of real estate investments in the United States and Japan through multiple economic cycles. Our management team, which owns approximately 37% of our outstanding shares, is fully aligned with all of our stakeholders. Furthermore, our Chief Executive Officer and other members of the senior management team also typically contribute personal funds to investments. |

| • | Extensive Network of Deep Industry Relationships. We have an established network of long-standing relationships with financial institutions, developers, builders and government agencies that drives significant proprietary deal flow. We have developed these relationships over many years as a result of our long operating history, the significant experience of our senior management team and our local presence and reputation in nearly every major metropolitan market on the West Coast of the United States, as well as in Japan. Also, we recently established operations in Europe through the acquisition of BOI REIM and the establishment of KWE. We believe that our relationship with the Bank of Ireland and our local presence in Europe will facilitate further relationships. Additionally, we have typically developed these relationships through our services platform, where we have conducted business with various divisions of our clients, providing us with significant insight and multiple points of contact. In particular, we have developed strong relationships with a network of financial institutions from which we have directly sourced approximately 80% of our acquisition activity since January 1, 2010. |

| • | Proven Track Record. Since 1999, we have successfully liquidated our interests in 94 investments generating a gross IRR of 42% and an equity multiple (excluding our promoted interest) of 1.64x. In addition, we have typically generated a higher return and equity multiple on our invested equity given the structure of our investments, which often entitles us to earn asset, property and/or acquisition fees, together with a promoted interest beyond our ownership percentage upon a sale of the investment. |

| • | Investment Discipline and Risk Protection. We maintain a strong culture of investment discipline and risk management. We have engaged in increased investment activity during real estate downturns, when |

5

Table of Contents

| we believe the best opportunities are available. For example, we and our equity partners purchased over $2 billion of real estate and loans secured by real estate in 2010, resulting in an increase of our investment account from $212 million to $364 million. We also diversify our portfolio by generally investing in smaller transactions. Since January 1, 2010, the more than $2.8 billion of purchases by our equity partners and us were spread over 174 investments (including each individual loan purchased through loan pools), representing an average transaction size of approximately $16 million. Additionally, we implement a rigorous underwriting process on all of our investments that leverages the full capabilities of our combined services and investment platform. We undertake a thorough examination of property economics and ensure that we possess a critical understanding of market dynamics and risk management strategies in order to mitigate risk and enhance our chances for success. |

| • | Conservative Balance Sheet. We maintain a conservative balance sheet with significant liquidity and limited near-term maturities. Our experience through multiple real estate cycles drives our strategy of maintaining a flexible balance sheet, which we believe provides us with a competitive advantage under adverse market conditions by allowing us to quickly capitalize on investment opportunities as they arise. As of June 30, 2011, we had a debt-to-capitalization ratio of 19.7%, net of cash, and a net debt to Adjusted EBITDA ratio of 4.2x. In addition, our equity investment account is substantial relative to our debt obligations. As of June 30, 2011, our equity investment account plus cash was $525.3 million while our total debt was $327.6 million. We have utilized our investment account to achieve an equity multiple (excluding our promoted interest) of 1.64x on investments that we have liquidated since 1999. Additionally, as of June 30, 2011, we had $266.2 million of liquidity, comprised of $191.2 million of cash and $75.0 million available under our undrawn revolving credit facility. |

6

Table of Contents

Our Business Strategy

Our primary business objectives are to increase operating cash flows, maximize the value of our investments and provide best-in-class services to our clients. Specifically, we intend to pursue the following strategies to achieve these objectives:

| • | Leverage the Full Capabilities of our Platform. The combination of a service business (including auctions) and an investment platform provides significant competitive advantages over other real estate buyers operating stand-alone service or investment-focused firms, which we believe allows us to generate superior risk-adjusted returns. The KW Services and KW Investments segments leverage their respective expertise to originate unique investment opportunities, implement a thorough underwriting process and risk mitigation procedures, and create value through intensive, hands-on management. Specifically, we consistently leverage our property management services business and other locally focused services businesses to gain discreet market information on potential investment opportunities. For example, in February 2010, we acquired a loan pool from a regional bank in an off-market transaction as a result of our long-standing relationship as the regional bank’s leasing and property manager for its entire branch banking network. Also, in 2010, we acquired a multifamily community in the San Francisco Bay area in an off-market transaction as a result of our ongoing role as the manager of the asset. |

| • | Maintain Disciplined Acquisition Strategy. We target undervalued investment opportunities where (i) real estate owners or lenders are seeking liquidity, (ii) assets are under-managed or under-leased or (iii) assets can be repositioned. We successfully executed this strategy during the recent downturn by positioning ourselves to be acquisitive when we believed real estate was most undervalued. |

| • | Cultivate and Maintain Relationships Throughout Client Organizations. Both our services and investments businesses maintain relationships at all levels of our clients’ organizations. We believe that these relationships provide us with additional insight into opportunities for investment and offer us access to proprietary deal flow. We have been able to access off-market proprietary deals through our long-standing relationships, many of which are with financial institutions. Since January 1, 2010, approximately 80% of our deals have been sourced directly from these relationships with financial institutions. |

| • | Invest through Joint Ventures. We typically invest our capital through joint ventures, separate accounts and commingled funds where we are the general partner with ownership interests ranging from 5% to 50%. As discussed above, our equity partners include financial institutions, foundations, endowments, high net worth individuals and other institutional investors. As a general partner we generally oversee the day-to-day operations of our investments and earn asset management and/or property management fees and often earn a promoted interest upon disposition of the investment. Additionally, we typically obtain mortgage debt on our properties with loan-to-cost ratios ranging from 50% to 65% that is generally non-recourse to us and our equity partners. For example, in 2010 we formed a new joint venture platform, which provides for a capital commitment from a joint venture partner in the amount of $250 million, together with our commitment of $28 million. The commitment from the partner includes a three-year investment period and we have the right to earn asset management, property management and acquisition fees, in addition to our pro rata share of cash flow from operations, sales proceeds and a promoted interest above a specified return threshold. As of June 30, 2011, the partner had contributed $208 million of capital into five joint ventures. |

| • | Apply Property Management Expertise to Improve Portfolio Operations. We consistently work to increase our portfolio’s operating efficiencies by applying our property management expertise, which we believe enhances the value of our properties and produces more compelling returns for us and our equity partners. Upon acquiring a property we typically assess the need for improvements and will |

7

Table of Contents

| invest between 5% and 50% of the property value, allowing for further asset appreciation. Additionally, our service capabilities provide us with significant insight into market conditions and trends, which allows us to evaluate and implement the optimal asset management strategy. |

| • | Maintain a Flexible Balance Sheet. We intend to maintain moderate leverage at all times given the cyclical nature of the real estate industry and our desire to be nimble and liquid during downturns. We believe such flexibility will allow us to capitalize on attractive investment opportunities. Although our debt-to-book equity increased to 0.91x at June 30, 2011 from 0.63x at June 30, 2010, we remain focused on prudently investing our cash to generate returns that will reduce that multiple. |

Our principal executive offices are located at 9701 Wilshire Boulevard, Suite 700, Los Angeles, California 90212, and our telephone number is (310) 887-6400.

8

Table of Contents

The Exchange Offer

In this prospectus, the term “outstanding notes” refers to our 8.750% Senior Notes due 2019 and the related guarantees issued in two private placements on April 5, 2011 and April 12, 2011, for a total aggregate principal amount of $250,000,000. See “Description of the Notes.” The term “exchange notes” refers to our 8.750% Senior Notes due 2019 and the related guarantees, as registered under the Securities Act, offered by this prospectus. The term “notes” refers, collectively, to the outstanding notes and the exchange notes.

The summary below describes the principal terms of the exchange offer. See also the section of this prospectus titled “The Exchange Offer,” which contains a more detailed description of the terms and conditions of the exchange offer.

| General |

In connection with the two private placements, we entered into two registration rights agreements with the purchasers in which we agreed, among other things, to deliver this prospectus to you and to obtain the effectiveness of the registration statement on Form S-4 of which this prospectus is a part within 270 days after the date of original issuance of the outstanding notes. The terms of these Registration Rights Agreements were substantially similar. You are entitled to exchange in the exchange offer your outstanding notes for exchange notes, which are identical in all material respects to the outstanding notes except: |

| • | the exchange notes will have been registered under the Securities Act; |

| • | the exchange notes are not entitled to any registration rights that are applicable to the outstanding notes under the registration rights agreement; and |

| • | the provisions of the registration rights agreements that provide for payment of additional amounts upon a registration default are no longer applicable. |

| The Exchange Offer |

We are offering to exchange up to $250,000,000 aggregate principal amount of our 8.750% Senior Notes due 2019 and the related guarantees, which have been registered under the Securities Act, for any and all of our outstanding 8.750% Senior Notes due 2019 and the related guarantees. |

| Outstanding notes may be exchanged only in denominations of $2,000 and in integral multiples of $1,000 in excess thereof. |

| Subject to the satisfaction or waiver of specified conditions, we will exchange the exchange notes for all outstanding notes that are validly tendered and not validly withdrawn prior to the expiration of the exchange offer. We will cause the exchange to be effected promptly after the expiration of the exchange offer. |

| Resale |

Based on interpretations by the staff of the SEC set forth in no-action letters issued to third parties, we believe that the exchange notes issued pursuant to the exchange offer in exchange for outstanding notes may be offered for resale, resold and otherwise transferred by you (unless you are our “affiliate” within the meaning of Rule 405 |

9

Table of Contents

| under the Securities Act) without compliance with the registration and prospectus delivery provisions of the Securities Act, provided that: |

| • | you are acquiring the exchange notes in the ordinary course of your business; and |

| • | you have not engaged in, do not intend to engage in, and have no arrangement or understanding with any person to participate in, a distribution of the exchange notes. |

| If you are a broker-dealer and receive exchange notes for your own account in exchange for outstanding notes that you acquired as a result of market-making activities or other trading activities, you must acknowledge that you will deliver this prospectus in connection with any resale of the exchange notes. See “Plan of Distribution.” |

| Expiration Date |

The exchange offer expires at 5:00 p.m., New York City time, on , , unless extended by us. We do not currently intend to extend the expiration date. |

| Withdrawal |

You may withdraw any tender of your outstanding notes at any time prior to the expiration of the exchange offer. We will return to you any of your outstanding notes that are not accepted for any reason for exchange, without expense to you, promptly after the expiration or termination of the exchange offer. |

| Interest on the Exchange Notes and the Outstanding Notes |

Each exchange note bears interest at the rate of 8.750% per annum from the original issuance date of the outstanding notes or from the most recent date on which interest has been paid on the notes. The interest on the notes is payable on April 1 and October 1 of each year, beginning on October 1, 2011. No interest will be paid on outstanding notes following their acceptance for exchange. |

| Conditions to the Exchange Offer |

The exchange offer is subject to customary conditions, which we may assert or waive. See “The Exchange Offer—Conditions to the Exchange Offer.” |

| Procedures for Tendering Outstanding Notes |

If you wish to participate in the exchange offer, you must complete, sign and date the accompanying letter of transmittal, or a facsimile of the letter of transmittal, according to the instructions contained in this prospectus and the letter of transmittal. You must then mail or otherwise deliver the letter of transmittal, or a facsimile of the letter of transmittal, together with the outstanding notes and any other required documents, to the exchange agent at the address set forth on the cover page of the letter of transmittal. |

| If you hold outstanding notes through The Depository Trust Company (“DTC”) and wish to participate in the exchange offer, you must comply with the procedures under DTC’s Automated Tender Offer Program by which you will agree to be bound by the letter of |

10

Table of Contents

| transmittal. By signing, or agreeing to be bound by, the letter of transmittal, you will represent to us that, among other things: |

| • | you do not have an arrangement or understanding with any person or entity to participate in the distribution of the exchange notes; |

| • | you are not our “affiliate” within the meaning of Rule 405 under the Securities Act; |

| • | you are not engaged in, and do not intend to engage in, a distribution of the exchange notes; |

| • | you are acquiring the exchange notes in the ordinary course of your business; and |

| • | if you are a broker-dealer that receives exchange notes for your own account in exchange for outstanding notes that were acquired as a result of market-making activities, that you will deliver a prospectus, as required by law, in connection with any resale of such exchange notes. |

| Special Procedures for Beneficial Owners |

If you are a beneficial owner of outstanding notes that are registered in the name of a broker, dealer, commercial bank, trust company or other nominee, and you wish to tender those outstanding notes in the exchange offer, you should contact the registered holder promptly and instruct the registered holder to tender those outstanding notes on your behalf. If you wish to tender on your own behalf, you must, prior to completing and executing the letter of transmittal and delivering your outstanding notes, either make appropriate arrangements to register ownership of the outstanding notes in your name or obtain a properly completed bond power from the registered holder. The transfer of registered ownership may take considerable time and may not be able to be completed prior to the expiration date. |

| Guaranteed Delivery Procedures |

If you wish to tender your outstanding notes and your outstanding notes are not immediately available or you cannot deliver your outstanding notes, the letter of transmittal or any other required documents, or you cannot comply with the procedures under DTC’s Automated Tender Offer Program for transfer of book-entry interests, prior to the expiration date, you must tender your outstanding notes according to the guaranteed delivery procedures described under “The Exchange Offer—Guaranteed Delivery Procedures.” |

| Effect on Holders of Outstanding Notes |

As a result of the making of, and upon acceptance for exchange of all validly tendered outstanding notes pursuant to the terms of, the exchange offer, we will have fulfilled a covenant under the registration rights agreements. Accordingly, there will be no increase in the interest rate on the outstanding notes under the circumstances described in the registration rights agreements. If you do not tender your outstanding notes in the exchange offer, you will continue to be entitled to all the rights and limitations applicable to the outstanding notes as set forth in the indenture under which the outstanding notes were issued, except we will not have any further obligation to you to |

11

Table of Contents

| provide for the exchange and registration of the outstanding notes and related guarantees under the applicable registration rights agreement. To the extent that outstanding notes are tendered and accepted in the exchange offer, the trading market for outstanding notes could be adversely affected. |

| Consequences of Failure to Exchange |

All untendered outstanding notes will continue to be subject to the restrictions on transfer set forth in the outstanding notes and in the indenture under which the outstanding notes were issued. In general, the outstanding notes may not be offered or sold, unless registered under the Securities Act, except pursuant to an exemption from, or in a transaction not subject to, the Securities Act and applicable state securities laws. Other than in connection with the exchange offer, we do not anticipate that we will register the outstanding notes under the Securities Act. |

| U.S. Federal Income Tax Consequences of the Exchange Offer |

The exchange of outstanding notes for exchange notes in the exchange offer will not be a taxable event for United States federal income tax purposes. See “United States Federal Income Tax Considerations.” |

| Use of Proceeds |

We will not receive any cash proceeds from the issuance of exchange notes in the exchange offer. See “Use of Proceeds.” |

| Exchange Agent |

Wilmington Trust, National Association is the exchange agent for the exchange offer. The addresses and telephone numbers of the exchange agent are set forth under “The Exchange Offer—Exchange Agent.” |

12

Table of Contents

The Exchange Notes

The summary below describes the principal terms of the exchange notes. Certain of the terms and conditions described below are subject to important limitations and exceptions. The “Description of the Notes” section of this prospectus contains more detailed descriptions of the terms and conditions of the outstanding notes and the exchange notes. The exchange notes will have terms identical in all material respects to the outstanding notes, except that the exchange notes will be registered under the Securities Act and will not contain terms with respect to transfer restrictions, registration rights and additional payments upon a failure to fulfill certain of our obligations under the registration rights agreements.

| Issuer |

Kennedy-Wilson, Inc. |

| Securities Offered |

$250,000,000 in aggregate principal amount of 8.750 % Senior Notes due 2019 and the related guarantees. |

| Maturity |

April 1, 2019 |

| Interest Rate |

The exchange notes bear interest at a rate of 8.750% per annum. |

| Interest Payment Dates |

The interest on the exchange notes is payable on April 1 and October 1 of each year, beginning on October 1, 2011. Interest accrues from the original issuance date of the outstanding notes or from the most recent date on which interest has been paid on the notes. |

| Guarantees |

The exchange notes will be guaranteed by Kennedy-Wilson Holdings, Inc. and, subject to certain exceptions, each material existing and future domestic subsidiary of Kennedy-Wilson, Inc. The guarantees by the guarantors of the notes will rank equal in right of payment to all existing and future senior indebtedness of the guarantors and senior in right of payment to any of the guarantor’s existing and future subordinated indebtedness. |

| Ranking |

The exchange notes will be our senior unsecured obligations and will: |

| • | rank senior in right of payment to all of our future subordinated indebtedness; |

| • | rank equally in right of payment with all our future senior indebtedness; |

| • | be effectively subordinated in right of payment to all of our secured indebtedness to the extent of the value of the assets securing such debt; and |

| • | be structurally subordinated in right of payment to all existing and future indebtedness of any of our subsidiaries (other than indebtedness and liabilities owed to us or one of our subsidiaries). |

| As of June 30, 2011, we and our subsidiaries that are guarantors, had approximately $260 million of total senior indebtedness outstanding, of which: |

| • | $10 million consisted of secured non-recourse mortgage indebtedness; |

| • | $250 million consisted of the outstanding notes; and |

13

Table of Contents

| • | we had no indebtedness outstanding under our unsecured revolving credit facility, and would have $75 million of availability thereunder. |

| As of June 30, 2011, we had $40 million of subordinated indebtedness consisting entirely of our junior subordinated debentures due 2037 (the “2037 debentures”). |

| In addition, as of such date, we had $24 million aggregate principal amount of guarantees that we provided in connection with loans secured by assets held in various joint ventures which are recourse to us. |

| As of June 30, 2011, revenues of our non-guarantor subsidiaries constituted approximately 18.8% of our consolidated revenues and the operating income of such non-guarantor subsidiaries was approximately $0.6 million. As of June 30, 2011, the total assets of such subsidiaries constituted approximately 8.4% of our consolidated total assets, and such subsidiaries had $28.7 million of secured non-recourse mortgage indebtedness, of which none is recourse to us. |

| Optional Redemption |

At any time prior to April 1, 2015, we may redeem the exchange notes, in whole or in part, at a price equal to 100% of the principal amount, plus an applicable “make-whole” premium and accrued and unpaid interest, if any, to the redemption date, as described under the caption “Description of the Notes—Optional Redemption.” |

| At any time and from time to time on or after April 1, 2015, we may redeem the exchange notes, in whole or in part, at the redemption prices specified under the caption “Description of the Notes—Optional Redemption,” plus accrued and unpaid interest, if any, to the date of redemption. |

| Until April 1, 2015, we can choose to redeem the exchange notes in an amount not to exceed in aggregate 35% of the original principal amount of the exchange notes together with any additional notes issued under the indenture with money we or Kennedy-Wilson Holdings, Inc. raise in certain equity offerings as described under the caption “Description of the Notes—Optional Redemption.” |

| Fundamental Change |

Upon a fundamental change (as defined under “Description of the Notes”), we will be required to make an offer to purchase the exchange notes. The purchase price will equal 101% of the principal amount of the exchange notes on the date of purchase plus accrued and unpaid interest. We may not have sufficient funds available at the time of any fundamental change to make any required debt repayment (including repurchases of the notes). See “Risk Factors—Risks Related to the Notes—We may not have the ability to raise the funds necessary to finance a fundamental change offer.” |

14

Table of Contents

| Certain Covenants |

The indenture governing the exchange notes contains covenants that limit our ability and the ability of certain of our subsidiaries to: |

| • | incur or guarantee additional indebtedness; |

| • | pay dividends or distributions on capital stock or redeem or repurchase capital stock; |

| • | make investments; |

| • | create restrictions on the payment of dividends or other amounts to us; |

| • | sell stock of our subsidiaries; |

| • | transfer or sell assets; |

| • | create liens; |

| • | enter into sale/leaseback transactions; |

| • | enter into transactions with affiliates; and |

| • | enter into mergers or consolidations. |

| However, these limitations are subject to a number of important qualifications and exceptions. See “Description of the Notes – Certain Covenants.” |

| Book-Entry |

The exchange notes will be issued in book-entry form and will be represented by global certificates deposited with, or on behalf of, DTC and registered in the name of Cede & Co., DTC’s nominee. Beneficial interests in the exchange notes will be shown on, and transfers will be effected only through, records maintained by DTC or its nominee; and these interests may not be exchanged for certificated notes, except in limited circumstances. See “Description of the Notes—Book-Entry, Delivery and Form” and “Description of the Notes—Exchange of Global Notes for Certificated Notes.” |

| No Listing |

The exchange notes will not be listed on any securities exchange or market. |

Risk Factors

You should carefully consider all of the information included and incorporated by reference in this prospectus. See “Risk Factors” included in this prospectus beginning on page 20. In addition, you should review the information set forth under “Forward-Looking Statements” before deciding to tender your outstanding notes in the exchange offer.

15

Table of Contents

SUMMARY HISTORICAL CONSOLIDATED FINANCIAL AND OTHER DATA

The following summary historical consolidated financial data for the years ended December 31, 2010, 2009 and 2008 have been derived from our audited consolidated financial statements incorporated by reference herein. The same information for the six-month periods ended June 30, 2011 and 2010 has been derived from our unaudited consolidated financial statements incorporated by reference herein.

The financial data set forth in this table are not necessarily indicative of the results of future operations and should be read in conjunction with our SEC filings and our audited consolidated financial statements and accompanying notes thereto incorporated by reference herein.

Some of the financial data set forth below reflects the effects of, and may not total due to, rounding.

| Statements of Operations: |

Six Months

Ended June 30, |

Year Ended December 31, | ||||||||||||||||||

| 2011 | 2010 | 2010 | 2009 | 2008 | ||||||||||||||||

| Revenue |

||||||||||||||||||||

| Management and leasing fees |

$ | 4,795,000 | $ | 4,213,000 | $ | 8,913,000 | $ | 9,026,000 | $ | 10,671,000 | ||||||||||

| Management and leasing fees–related party |

5,162,000 | 5,760,000 | 12,417,000 | 10,138,000 | 8,380,000 | |||||||||||||||

| Commissions |

3,513,000 | 2,380,000 | 6,359,000 | 4,204,000 | 5,906,000 | |||||||||||||||

| Commissions–related party |

1,657,000 | 2,285,000 | 5,375,000 | 727,000 | 4,295,000 | |||||||||||||||

| Sale of real estate |

417,000 | 3,937,000 | 3,937,000 | 52,699,000 | — | |||||||||||||||

| Sale of real estate–related party |

— | — | 9,535,000 | 6,698,000 | — | |||||||||||||||

| Rental and other income |

1,693,000 | 1,297,000 | 4,000,000 | 2,743,000 | 2,973,000 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total revenue |

$ | 17,237,000 | $ | 19,872,000 | $ | 50,536,000 | $ | 86,235,000 | $ | 32,225,000 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Operating expenses |

||||||||||||||||||||

| Commission and marketing expenses |

1,373,000 | 1,769,000 | 3,186,000 | 3,411,000 | 2,827,000 | |||||||||||||||

| Compensation and related expenses |

16,089,000 | 16,986,000 | 38,155,000 | 24,789,000 | 21,292,000 | |||||||||||||||

| Merger-related compensation and related expenses |

— | — | 2,225,000 | 12,468,000 | — | |||||||||||||||

| Cost of real estate sold |

397,000 | 2,714,000 | 2,714,000 | 36,179,000 | — | |||||||||||||||

| Cost of real estate sold–related party |

— | — | 8,812,000 | 5,752,000 | — | |||||||||||||||

| General and administrative |

5,853,000 | 4,806,000 | 11,314,000 | 6,351,000 | 6,074,000 | |||||||||||||||

| Merger-related general and administrative |

— | — | — | 3,652,000 | — | |||||||||||||||

| Depreciation and amortization |

897,000 | 581,000 | 1,618,000 | 1,122,000 | 920,000 | |||||||||||||||

| Rental operating expense |

1,053,000 | 524,000 | 1,913,000 | 1,148,000 | 1,458,000 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total operating expenses |

$ | 25,662,000 | $ | 27,380,000 | $ | 69,937,000 | $ | 94,872,000 | $ | 32,571,000 | ||||||||||

| Equity in joint venture income |

7,807,000 | (29,000 | ) | 10,548,000 | 8,019,000 | 10,097,000 | ||||||||||||||

| Interest income from loan pool participations and notes receivable |

4,787,000 | 3,741,000 | 11,855,000 | — | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Operating income (loss) |

$ | 4,169,000 | ($ | 3,796,000 | ) | $ | 3,002,000 | ($ | 618,000 | ) | $ | 9,751,000 | ||||||||

16

Table of Contents

| Statements of Operations: | Six Months

Ended June 30, |

Year Ended December 31, | ||||||||||||||||||

| 2011 | 2010 | 2010 | 2009 | 2008 | ||||||||||||||||

| Non-operating income (expense) |

||||||||||||||||||||

| Interest income |

190,000 | 115,000 | 192,000 | 102,000 | 221,000 | |||||||||||||||

| Interest income–related party |

477,000 | 386,000 | 662,000 | 400,000 | 341,000 | |||||||||||||||

| Remeasurement gain |

6,348,000 | 2,108,000 | 2,108,000 | — | — | |||||||||||||||

| Gain on early extinguishment of mortgage debt |

— | 16,670,000 | 16,670,000 | — | — | |||||||||||||||

| Loss on early extinguishment of corporate debt |

— | — | (4,788,000 | ) | — | — | ||||||||||||||

| Interest expense |

(7,757,000 | ) | (4,294,000 | ) | (7,634,000 | ) | (13,174,000 | ) | (8,596,000 | ) | ||||||||||

| Other than temporary impairment |

— | — | — | (328,000 | ) | (445,000 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income (loss) before (provision for) benefit from income taxes |

$ | 3,427,000 | $ | 11,189,000 | $ | 10,212,000 | ($ | 13,618,000 | ) | $ | 1,272,000 | |||||||||

| (Provision for) benefit from income taxes |

(835,000 | ) | (3,952,000 | ) | (3,727,000 | ) | 3,961,000 | (605,000 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income (loss) |

$ | 2,592,000 | $ | 7,237,000 | $ | 6,485,000 | ($ | 9,657,000 | ) | $ | 667,000 | |||||||||

| Net income attributable to the noncontrolling interests |

(1,337,000 | ) | (1,159,000 | ) | (2,979,000 | ) | (5,679,000 | ) | (54,000 | ) | ||||||||||

| Net income (loss) attributable to Kennedy-Wilson Holdings, Inc. |

$ | 1,255,000 | $ | 6,078,000 | $ | 3,506,000 | ($ | 15,336,000 | ) | $ | 613,000 | |||||||||

| Statements of Cash Flow Data: | Six Months

Ended June 30, |

Year Ended December 31, | ||||||||||||||||||

| 2011 | 2010 | 2010 | 2009 | 2008 | ||||||||||||||||

| Cash flow (used in) provided by: |

||||||||||||||||||||

| Operating activities |

$ | (12,876,000 | ) | $ | (8,657,000 | ) | $ | 2,157,000 | $ | (25,226,000 | ) | $ | (14,669,000 | ) | ||||||

| Investing activities |

(67,331,000 | ) | (64,252,000 | ) | (114,836,000 | ) | 69,007,000 | (96,773,000 | ) | |||||||||||

| Financing activities |

223,532,000 | 103,676,000 | 91,160,000 | (15,707,000 | ) | 112,625,000 | ||||||||||||||

| Balance Sheet Data: |

||||||||||||||||||||

| Cash and cash equivalents |

$ | 191,218,000 | $ | 92,207,000 | $ | 46,968,000 | $ | 57,784,000 | $ | 25,831,000 | ||||||||||

| Total assets |

741,002,000 | 500,866,000 | 487,848,000 | 336,257,000 | 256,837,000 | |||||||||||||||

| Total debt |

327,574,000 | 183,172,000 | 127,782,000 | 127,573,000 | 131,423,000 | |||||||||||||||

| Total Kennedy-Wilson Holdings, Inc. stockholders’ equity |

348,282,000 | 285,901,000 | 300,192,000 | 177,314,000 | 105,551,000 | |||||||||||||||

| Other Selected Data: |

||||||||||||||||||||

| EBITDA(1) |

$ | 30,099,000 | $ | 24,427,000 | $ | 48,108,000 | $ | 18,620,000 | $ | 25,953,000 | ||||||||||

| Adjusted EBITDA(2) |

32,564,000 | 30,573,000 | 58,427,000 | 37,054,000 | 26,968,000 | |||||||||||||||

| Investment Account(3) |

459,400,000 | 291,792,000 | 363,700,000 | 211,522,000 | 165,165,000 | |||||||||||||||

| Certain Pro Forma Financial Ratios(4): |

Pro Forma | |||||||||||||||||||

| Ratio of Adjusted EBITDA less our share of joint venture interest expense / corporate interest expense(5) |

1.7x | 1.7x | ||||||||||||||||||

17

Table of Contents