INVESTOR GROUP NOMINATES NINE HIGHLY-QUALIFIED INDEPENDENT CANDIDATES FOR ELECTION TO KOHL’S BOARD

| · | Believes poor retail strategy and execution have led to stagnant sales, declining operating margins, a 44% drop in operating profits between 2011 and 2019 and a chronically underperforming stock price |

| · | Views Board as deeply entrenched with insufficient retail expertise and sees directors’ lack of meaningful stock ownership as an impediment to serving shareholder interests |

| · | Plans to address the tremendous potential of unlocking $7-8 billion of real estate value trapped on the Company’s balance sheet |

| · | The Investor Group believes Kohl’s has opportunity to generate more than $10 in annual earnings per share within the next few years and drive the stock price over 2x higher than current levels with a sale-leaseback program for $3 billion of real estate and a properly executed large share repurchase program |

| · | The Investor Group has proposed a diverse slate of retail experts who will be focused on reversing Kohl’s chronic underperformance and repositioning it for future success |

NEW YORK – February 22, 2021 – Macellum Advisors GP, LLC (together with its affiliates, “Macellum”), Ancora Holdings, Inc. (together with its affiliates, “Ancora”), Legion Partners Asset Management, LLC (together with its affiliates, “Legion Partners”), and 4010 Capital, LLC (together with its affiliates, “4010 Capital” and, together with Macellum, Ancora and Legion Partners, the “Investor Group”) today issued an open letter to shareholders of Kohl’s Corporation (NYSE: KSS) (“Kohl’s” or the “Company”) and announced the nomination of nine highly-qualified, independent candidates for election to the Company’s Board of Directors (the “Board”) at the 2021 annual meeting of shareholders (the “2021 Annual Meeting”). The Investor Group is deemed to beneficially own, in the aggregate, 14,950,632 shares of the Company’s common stock, including 3,481,600 shares underlying call options currently exercisable, constituting approximately 9.5% of the Company’s outstanding common stock.

In the letter, the Investor Group highlights the following:

| • | Poor retail execution and strategy have led to stagnant sales and declining operating margins.

The Board has overseen a long list of sales and margin driving initiatives which have created no meaningful value for shareholders.

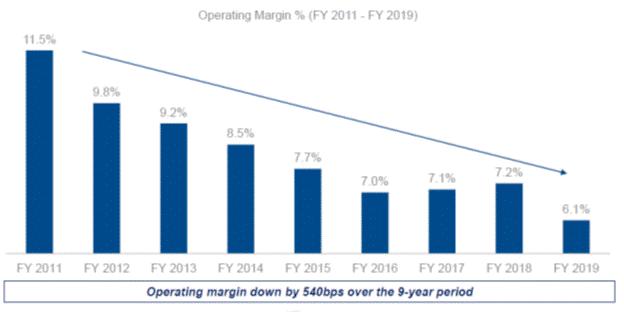

As a result, Kohl’s has suffered from stagnant sales, market share loss, declining gross margins and bloated SG&A –

all of which has contributed to operating income margins declining from 11.5% in 2011 to 6.1% in 2019. In 2019, Kohl’s

earned nearly $1 billion less in operating profit, or ~44%, less than it did in 2011, despite similar total sales and $6.6 billion

in cumulative capital expenditures. |

| • | Long-tenured Board with insufficient retail experience and lack of any material share ownership is an impediment to serving shareholder interests. Until the recent addition of a new director last week, likely in response to our recent private engagement, the Board’s average tenure was approximately 10 years. We also believe the Board lacks relevant retail expertise. Despite this long average tenure, the Board collectively owns just ~0.5% of Kohl’s outstanding shares, which the Investor Group believes has prevented proper oversight of management and shows a lack of alignment with shareholders’ interests. |

•

| Excessive executive compensation and poor alignment between pay and performance. The Board has developed and implemented a compensation plan that has increased total compensation despite deteriorating results. From 2010 to 2019, Kohl’s top five executives have increased their total compensation from $20 million to $30 million, despite relatively flat sales and a decline in operating profit by ~42% over the same period. |

| • | Systemic inability to achieve stated goals. Many of the initiatives Kohl’s is currently targeting to improve performance were the focus of the “Greatness Agenda” Kohl’s delivered to investors in 2013. The agenda called for $21 billion in sales and $1.9 billion in operating profit by 2017. Those targets were missed by 9% and 25%, respectively, by 2017. By 2019, the operating profit target was missed by 36%. |

| · | Kohl’s has tremendous potential with the right Board and leadership in place. Kohl’s has a valuable and dedicated workforce of more than 120,000 employees that can thrive under the right strategic plan. The Investor Group has identified significant opportunities to generate improvements in sales and margins through changes in merchandising, inventory management, customer engagement and expense rationalization, as well as the potential to unlock $7-8 billion of real estate value trapped on the Company’s balance sheet. |

| · | The Investor Group proposes a strong slate of directors with extensive retail, turnaround, capital allocation and strategic experience, who are well-positioned to create significant shareholder value. The Investor Group’s diverse slate of retail experts will be focused on repositioning Kohl’s for profitable growth and efficient capital allocation, and instituting best-in-class corporate governance. |

| · | With the right Board and strategic plan in place, the Investor Group believes that the Company has the potential to generate more than $10 in annual earnings per share (EPS) within the next few years. In the coming months, the Investor Group looks forward to sharing a detailed plan, developed together with its director nominees, that it believes could drive a material increase in Kohl’s stock price. A sale-leaseback program for $3 billion of real estate, combined with a properly executed large share repurchase program, could be at least 25% accretive to EPS. |

The full letter can be found here https://createvalueatkohls.com/wp-content/uploads/2021/02/The-Investor-Groups-Letter-to-KSS-Stockholders.pdf.

Additional information can be found at https://createvalueatkohls.com/.

|

|

|

|

February 22, 2021, 2021

Dear Fellow Stockholders,

Macellum Advisors GP, LLC (together with its affiliates, “Macellum”), Ancora Holdings, Inc. (together with its affiliates, “Ancora”), Legion Partners Asset Management, LLC (together with its affiliates, “Legion Partners”), and 4010 Capital, LLC (together with its affiliates, “4010 Capital” and, together with Macellum, Ancora and Legion Partners, the “Investor Group” or “we”) beneficially own, in the aggregate, 14,950,632 shares of common stock of Kohl’s Corporation (NYSE: KSS) (“Kohl’s” or the “Company”), including 3,481,600 shares underlying call options currently exercisable, constituting approximately 9.5% of Kohl’s outstanding stock. We have nominated nine highly-qualified, independent candidates for election to the Company’s Board of Directors (the “Board”) at the 2021 annual meeting of shareholders (the “2021 Annual Meeting”).

The Investor Group believes Kohl’s stock price has chronically underperformed against its peers and relevant indices because the Board has failed to help develop and oversee a strategic plan to respond to a rapidly-changing retail landscape. Over the past decade, the Company has lost market share to other retailers and suffered declining gross margins, despite increasing SG&A spend, capital investments and executive compensation. These persistent failures have been led by several different senior executive teams but overseen by substantially the same Board. The Investor Group’s belief that change is necessary stems from performance of the business over the decade leading up to 2020, prior to the pandemic, and the implication for future performance, once the economy reopens, based on the systemic inability of the Company to execute a plan that creates shareholder value.

Until the recent addition of a new director last week, likely in response to our private engagement to date, the Board had an average director tenure of 10 years. The Investor Group believes that significant Board refreshment is long overdue and must occur at the 2021 Annual Meeting.

The Board Has Overseen Long-Term Stock Price Underperformance

The Investor Group is alarmed by the prolonged underperformance of the Company’s stock price relative to its peers, the Russell 2000 Index and the S&P 500 Index, over multiple time periods.

|

Share Price Performance (Total Shareholder Returns Including Dividends) | ||||

| 1 Year | 3 Year | 5 Year | 10 Year | |

| Kohl's Corporation | 7% | (23%) | 10% | 23% |

| Peer Group (1) | 35% | 24% | 52% | 186% |

| ISS Peer Group (2) | 34% | 27% | 93% | 431% |

| Russell 2000 Index | 30% | 37% | 115% | 205% |

| S&P 500 Index | 17% | 39% | 111% | 255% |

| XRT | 107% | 95% | 131% | 331% |

| Kohl's Relative Performance: | ||||

| Peer Group (1) | (28%) | (48%) | (42%) | (162%) |

| ISS Peer Group (2) | (27%) | (51%) | (82%) | (408%) |

| Russell 2000 Index | (23%) | (60%) | (104%) | (181%) |

| S&P 500 Index | (10%) | (63%) | (101%) | (231%) |

| XRT | (101%) | (118%) | (121%) | (307%) |

Source: Company SEC Filings, Capital IQ as of 01/31/2021

(1) Peer Group includes M, DDS, TJX, ROST, BURL, JWN, GPS, BBBY, LB

(2) ISS Peer Group includes AN, BBY, KMX, DG, DLTR, FL, LAD, PAG, LB, M, JWN, ROST, GPS

The Board Has Overseen Long-Term Operating Underperformance

Kohl’s results highlighted below demonstrates the weakness in its operating performance. The Investor Group believes that these problems are fixable, but will require a high-powered Board with relevant expertise and experience that does not shy away from its oversight role and will hold management accountable. We note that the Company’s October 2020 investor presentation was long on platitudes and generalizations, but short on details and rigorous analysis, giving us no reason to believe that lackluster operating performance will improve under the current Board.

| Fiscal year | ||||||||||

| 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | Change | |

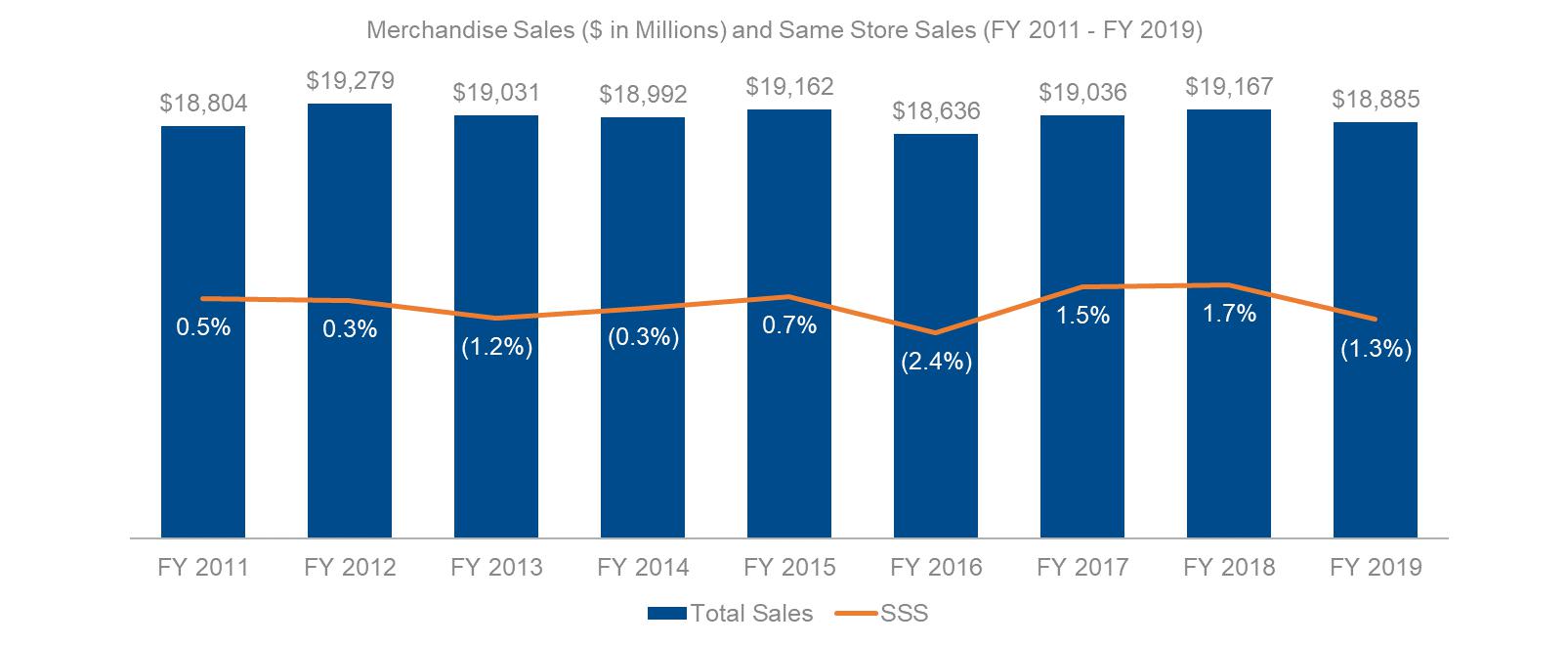

| Same-Store Sales | 0.5% | 0.3% | (1.2%) | (0.3%) | 0.7% | (2.4%) | 1.5% | 1.7% | (1.3%) | (0.6%)1 |

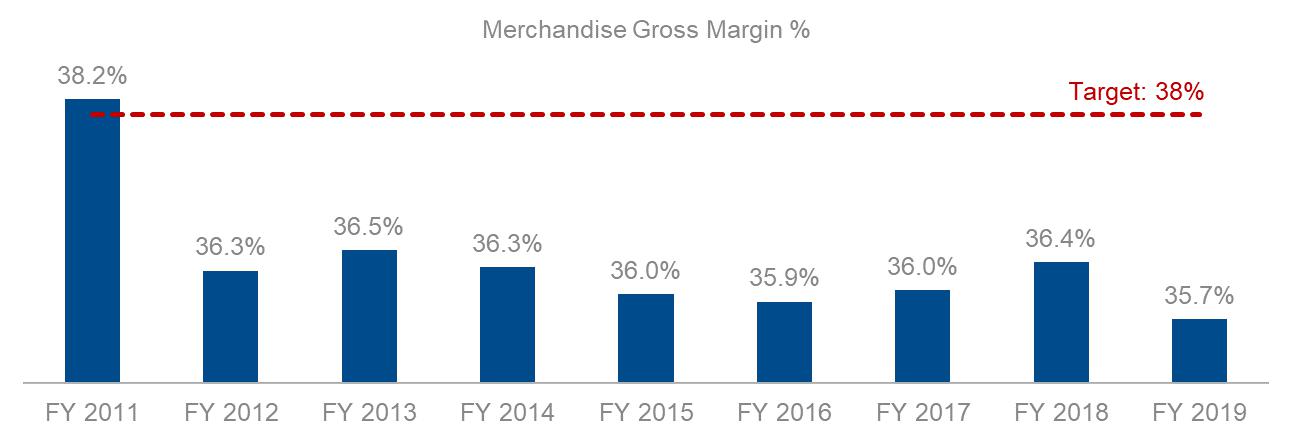

| Gross Margin % | 38.2% | 36.3% | 36.5% | 36.3% | 36.0% | 35.9% | 36.0% | 36.4% | 35.7% | (246bps) |

| Operating Profit | $2,158 | $1,890 | $1,742 | $1,689 | $1,553 | $1,369 | $1,416 | $1,465 | $1,212 | ($946) |

| Operating Margin % | 11.5% | 9.8% | 9.2% | 8.5% | 7.7% | 7.0% | 7.1% | 7.2% | 6.1% | (541bps) |

| Adjusted ROIC | 16.8% | 14.3% | 13.0% | 13.0% | 12.1% | 11.2% | 12.0% | 13.2% | 11.2% | (5.5%) |

| Total | ||||||||||

| Capital Expenditures | $927 | $785 | $643 | $682 | $690 | $768 | $672 | $578 | $855 | $6,600 |

Source: Company SEC Filings, Investor Group Estimates

Note: 1. Represents compounding same-store sales change FY 2011 – FY 2019

The Board Has Overseen a Series of Failed Initiatives and Substantial Value Destruction

Below is a summary of the reasons the Investor Group believes Kohl’s has struggled to create shareholder value over the last decade. Many of the initiatives Kohl’s is currently targeting to improve performance were articulated in the “Greatness Agenda” Kohl’s delivered to investors in 2014. The agenda called for $21 billion in sales and $1.9 billion in operating profit by 2017. Those targets were missed by 9% and 25%, respectively, by 2017. By 2019, the operating profit target was missed by 36%. The initiatives supporting the “Greatness Agenda” are strikingly similar to the initiatives communicated to investors in the Kohl’s October 2020 investor presentation. The Investor Group believes that without material change to the Board, the Company and shareholders will experience the same disappointments outlined below.

| · | Stagnant Sales – Kohl’s approach to merchandising and marketing has resulted in a loss of market share to competitors. Since 2011, Kohl’s has experienced a decline in compounded same store sales of (0.6%) while the industry grew 17% (according to U.S. Census Bureau data). |

| · | Declining Gross Margins – A combination of excess inventory and poor merchandise mix has led to a substantial decline in gross margins. |

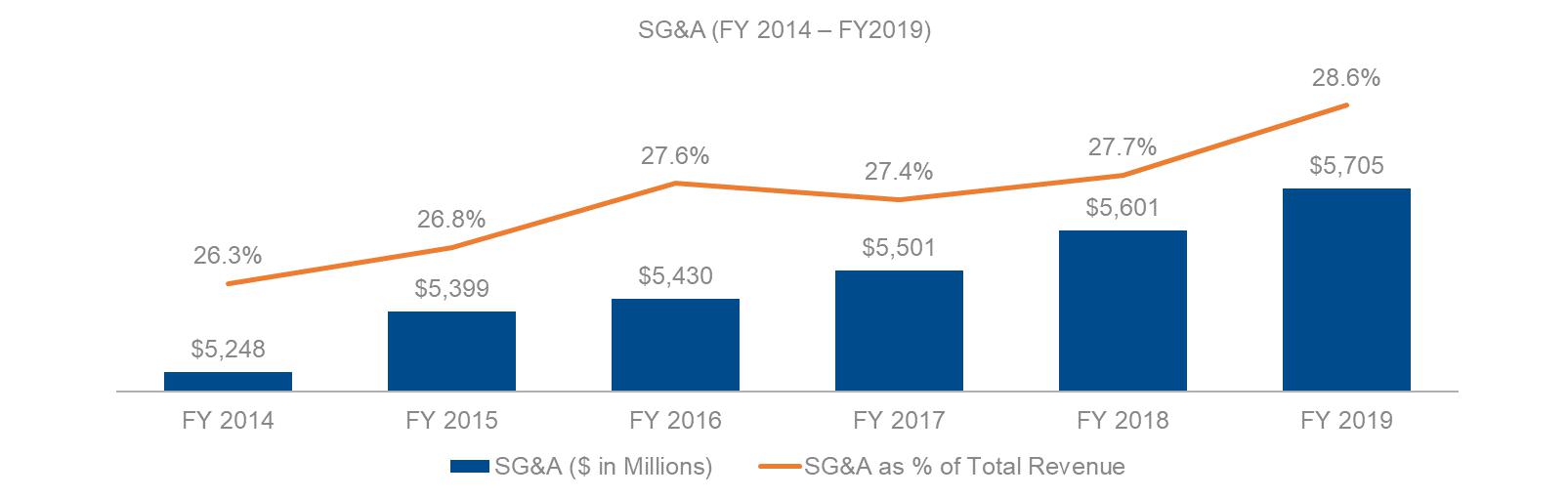

| · | SG&A Bloat – Weak cost management discipline has led to deleveraging of expenses. |

| · | Ineffective Marketing and Promotional Stance – Kohl’s value proposition has been disrupted by the onslaught of confusing promotional activity. |

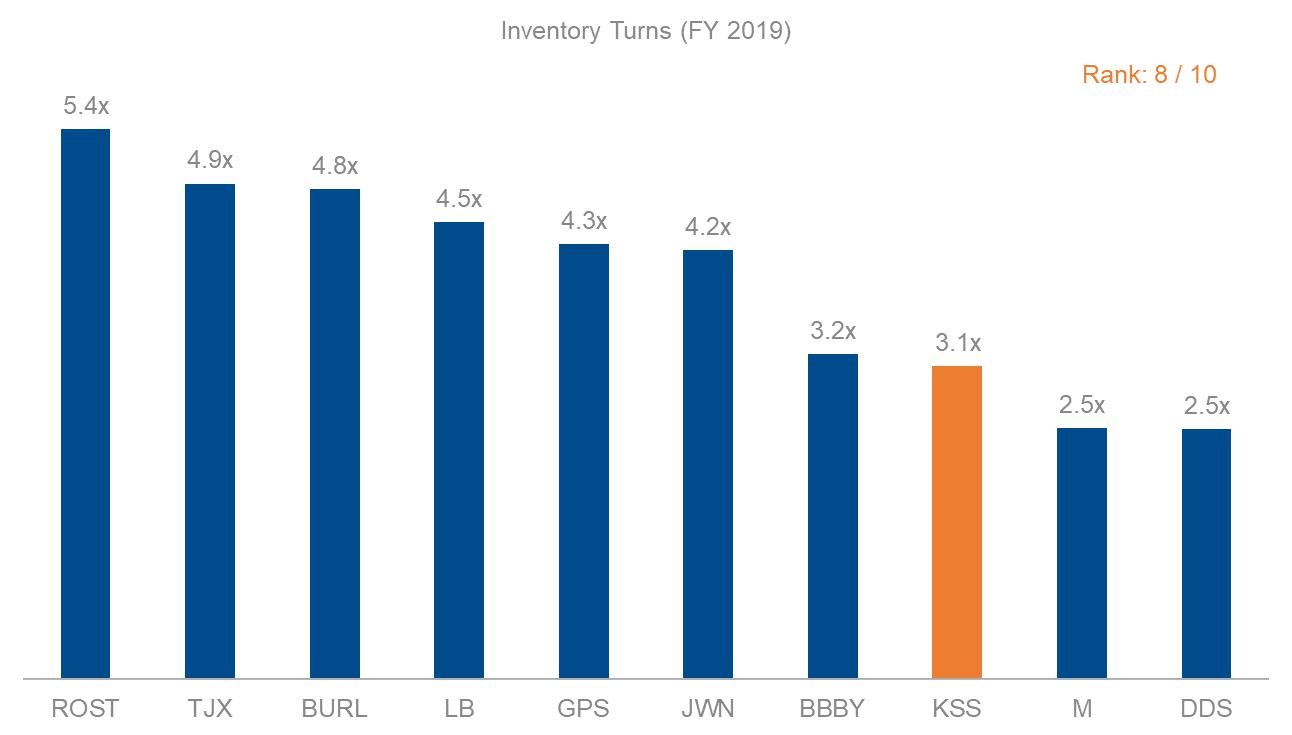

| · | Declining Inventory Turns – Excess inventory is at the root of many problems suppressing sales and margins as well as consuming working capital. |

| · | Excessive Executive Compensation – The Board has approved compensation that has handsomely rewarded management despite declining sales and earnings. |

| · | Ineffective Capital Allocation – The Company has $7-8 billion in value trapped in non-core, non-earning real estate assets and has experienced declining ROIC for many years. |

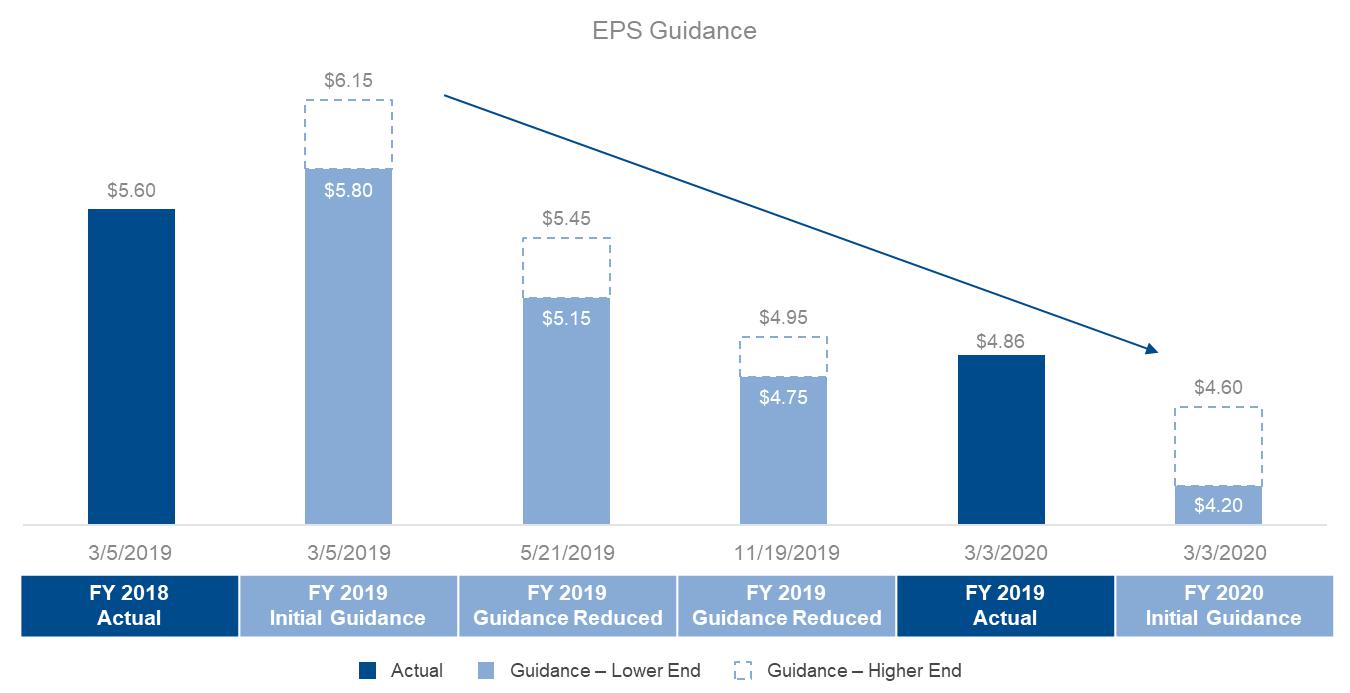

| · | Persistently Deteriorating EPS – Kohl’s began 2019 guiding to $5.98 in EPS at the midpoint of guidance and ended the year earning $4.86. Continuing this dismal earnings trend, Kohl’s guided 2020, prior to the start of the COVID-19 pandemic, to a midpoint EPS of $4.40. The 2020 guidance represented a decline of 26% from the Company’s original 2019 guidance. |

Stagnant Sales

Kohl’s generated $18.9 billion in net sales in 2019, approximately the same as the $18.8 billion reported for 2011, eight years earlier. Over this same period the industry grew 17%. This is particularly troubling given the large number of competitive store closures and bankruptcies that the industry experienced during this time period. The Investor Group estimates that from 2015 to 2019, key competitors of the Company (including Kmart/Sears, Bon Ton, Macy’s, JCPenney and Dillard’s) lost more than $12 billion in sales that could have accrued to Kohl’s. Yet, over that same period Kohl’s lost nearly $300 million in sales. The Company’s inability to gain market share despite spending approximately $1 billion a year on marketing and hundreds of millions of dollars on e-commerce fulfillment capabilities is highly disappointing. The Investor Group believes that this is caused by a dated approach to merchandising and marketing that does not resonate in today’s retail landscape.

Below are some of the issues we view as contributing to the Company’s stagnant sales:

| 1. | Repetitive and Over-Assorted Collection – The approach to merchandise assortment and architecture has resulted in too many choices, too much overlap and little differentiation between the “good, better, best” price schemes, and a poor articulation of “features and benefits”. |

| 2. | Disappointing New Brand Launches – The addition of new brands has not increased sales. The use of cheaper designs to hit certain price points for premium brands seems to have caused a degradation to the customer quality perception. |

| 3. | Private Label Failure – Repeated, costly private label launches have failed to connect with customers, leading to declining results and frequent exits. |

| 4. | Missed Trends – Sales in Women’s declined by $460 million and Accessories by $230 million from fiscal 2015 to fiscal 2019. We believe this decline was due to Kohl’s failure to understand and respond to changes in consumer tastes. |

| 5. | Losing Share in Home – Although the Home category grew 4% from 2015 to 2019, this growth pales in comparison to that of competitors such as Target, TJX and Burlington Stores, who grew their home sales 15%, 48% and 94%, respectively, over the same period. |

| 6. | Excess Inventory – Declining inventory turns have resulted in excess aged product, which necessitates steeper promotions to ultimately sell the goods. |

| 7. | Confusing Promotional Cadence – Kohl’s uses a dizzying array of promotional gimmicks that makes it difficult for many customers to know the actual price of an item, contributing to a lack of purchasing confidence with the consumer. |

| 8. | Overlapping Loyalty Programs – Kohl’s currently operates multiple reward/point programs, which is highly confusing for many customers and likely makes it difficult for any program to reach critical mass and have an accretive impact. |

| 9. | Missed Opportunities to Grab Greater Market Share – The Company has been unable to grow sales, despite more than a $12 billion sales opportunity resulting from key competitors’ store closures and bankruptcies. |

Source: Company SEC Filings

Declining Gross Margins

Kohl’s gross margin has declined by 250 bps from 2011 to 2019. We believe this is a result of several factors including:

| 1. | Slow Inventory Turns – Low inventory turnover generally leads to large markdowns in an effort to sell excess inventory and aged products. Kohl’s inventory turnover in fiscal 2019 was 3.1x, compared to best-in-class competitors that are well above 4x as noted in the chart below. Kohl’s carried 11% more inventory at the end of 2019 than it did in 2011, with similar sales volumes. |

Source: Company SEC Filings, Investor Group Estimates

| 2. | Unproductive Mix – The merchandise process has not developed a product and pricing mix that delivers an increase in gross margins. Adjustments to the balance of different categories, as well as private labels versus national brands, has not resulted in an expansion in gross profits or sales. |

| 3. | Failure to Offset Higher Expenses – As shipping costs have increased, the Company has apparently not been able to offset them with lower product costs or higher initial mark ups. |

| 4. | Inefficient Sourcing – Kohl’s is operating under a historical sourcing agreement with a third-party sourcing agent that accounts for roughly 20% of the Company’s total purchases and at least 60% of its private label purchases. The Investor Group believes that Kohl’s is overpaying under this agreement, given the size and scale of the Company’s business. |

| 5. | Private Label Failure – Kohl’s inability to generate traction with customers for its private label products not only contributes to missed sales opportunities, but also constitutes a drag on margin mix. Additionally, when private label inventory misses sales targets, the markdowns required to sell excess and aging products ultimately leads to declining profitability. |

| 6. | Poor E-commerce Execution – Poor e-commerce execution has caused significant unnecessary expenditures due to excessive split shipments. |

Selling, General & Administrative Bloat

The Investor Group believes that Kohl’s lack of SG&A discipline has also contributed to a material deterioration in operating and EBITDA margins. Despite Kohl’s commitment to its so-called “operational excellence” initiative, reckless spending has resulted in an increase of more than $450 million in SG&A from 2014 to 2019, amid flat sales. This increase in SG&A equates to roughly 21% of 2019 EBITDA. The Investor Group believes there are several reasons for the increase in SG&A:

| 1. | Unproductive Advertising – The advertising budget has grown consistently and is up 18% from $869 million in FY 2010 to $1,026 million in FY 2019. At 5.4%, Kohl’s now has the highest advertising budget on a percent-of-sales basis among its peers. By comparison, Target, whose sales base is 4x Kohl’s, spent just 60% more than Kohl’s on marketing in fiscal 2019. |

Source: Company SEC Filings, Investor Group Estimates

| 2. | Overly Optimistic Projections – Kohl’s has missed its own, seemingly conservative same-store sales budgets in four of the past six years (through 2019). Furthermore, it appears that once costs are set at the beginning of each year, little is done to mitigate expenses when sales come up short, as they often do. This has resulted in a perpetual cycle of SG&A deleveraging. |

| 3. | Lack of Rigorous Cost/Benefit Analysis – Significant planned cost increases across many categories without commensurate increases in sales leave us with the impression that ROI discipline has not been enforced with respect to these expense investments and did not drive their required sales-growth goals. |

| 4. | Cost Culture – Kohl’s does not appear to have a commitment to cost discipline. Despite suffering from chronic stock price and operating underperformance, the Company still maintains a full-time flight crew and two private jets. |

| 5. | Amazon Returns Program – Despite the Company’s insistence that the Amazon program is an accretive arrangement, we are skeptical. We routinely hear from industry sources familiar with the deal that it is costly for Kohl’s, which, perhaps, explains the Company’s reluctance to share detailed information about the program with investors. |

Source: Company SEC Filings, Investor Group Estimates

Excessive Executive Compensation

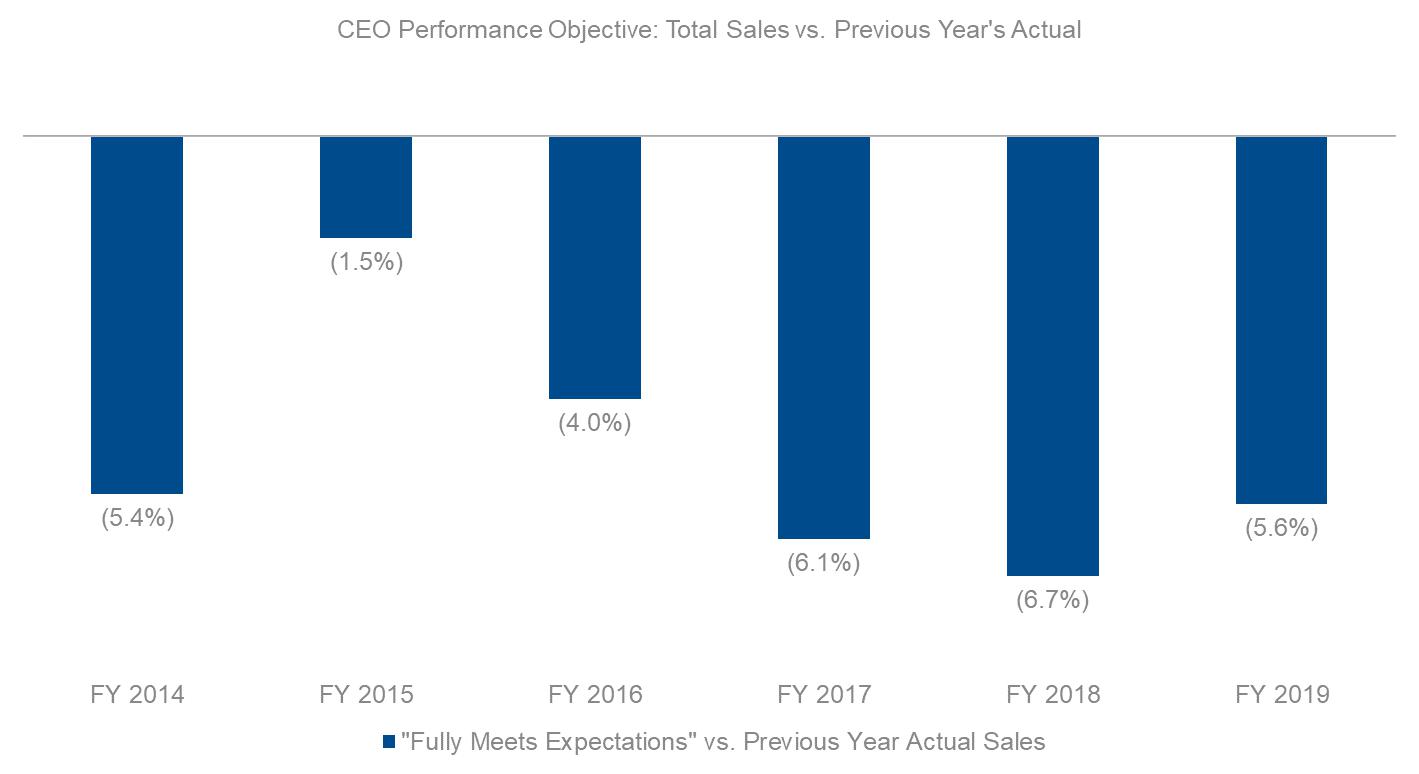

We believe that the Board has approved a poorly designed executive compensation program that insufficiently ties rewards to performance, both in the short-term and long-term. In 2010, Kohl’s top five executives earned a healthy $20 million in total compensation, at a time when sales were $18.4 billion and operating income was $2.1 billion. Fast-forward to 2019, when sales had increased slightly, to just under $19 billion, but operating income had declined by ~42%, to $1.2 billion. While one may think that such weak results should justify lower executive pay, compensation for the top five executives instead increased to $30 million in 2019.

This is made possible by an arrangement, approved by the Board, that pays executives a target bonus for achieving declining sales results. In 2017, for example, the long-term incentive plan (LTIP) goals set by the Board for fiscal years 2017 through 2019 implied that executives could receive target bonuses (100% of base) with average annual sales and average annual adjusted net income 2% and 23% below 2016 levels, respectively. We find this shocking. It is difficult to believe that the Board possibly had the best interest of the Company’s shareholders in mind when approving such an ill-conceived, misaligned plan that intended to reward management for worse performance than the prior years.

As noted in the chart below, Kohl’s CEO can qualify for incentive compensation for achieving total sales that decline each year. No wonder the sales at Kohl’s don’t grow! The Board has constructed a compensation plan which systematically rewards the CEO for not growing sales year over year. We find this appalling and completely at odds with any focus on driving shareholder value.

Source: Company SEC Filings, Investor Group Estimates

The Board Has a History of Poor Capital Allocation

Ineffective Oversight of ROIC

The Investor Group believes that the Board has done a poor job overseeing return on invested capital (“ROIC”). Over the last decade, ROIC has declined from approximately 17% to 11%. We find this deterioration unacceptable, and highly indicative of the Board’s lack of appropriate capital allocation skillsets. Rather than address the problem head on, the Board has apparently turned a blind eye to it, going so far as to remove ROIC as a key metric in executive compensation. This, we think, speaks volumes about the culture and commitment deficit of this Board.

Increase in Capital Spending Without Commensurate Benefits

From 2011 to 2019, the Board has overseen the deployment of $6.6 billion in capital expenditures, including approximately $2.7 billion on technology, $2.4 billion on stores, $900 million on distribution centers and omnichannel, and $600 million on corporate and other projects. While there is ample return potential from investments in technology, we find little evidence that Kohl’s is achieving anywhere near adequate returns on such investments. We also have found significant amounts wasted on costly initiatives with no discernable benefit, such as non-core retail ventures like FILA outlets and Off-Aisle clearance centers. The Investor Group believes that the Board has not demonstrated sufficient discipline in overseeing a prudent capital spending program.

Recent Financing on Highly Unattractive Terms

We are concerned by the Company’s questionable decision in April 2020 to raise $600 million of debt due in 2025 with a 9.5% interest rate. While we acknowledge that there was a high degree of uncertainty at the time of this capital raise, we believe this issuance was ill-conceived and would have been challenged by any well-functioning board of directors. Not only was the decision misguided from the perspective of cash flows and liquidity (Kohl’s has generated positive cash flow throughout 2020 and is currently sitting on $1.9 billion in cash, after paying down all its bank debt) – the deal appears poorly negotiated, with a 9.5% interest rate and a prohibitively expensive make-whole call premium that would cost the Company $224 million if the notes were repaid today. In our view, this financing was one of the worst capital allocation decisions by a Fortune 500 company in 2020, especially since Kohl’s did not need the capital as it had significant additional sources of liquidity at the time. Unlike the Board, the market quickly figured out the appropriate interest rate for these notes, as the notes traded up to 117 per note within 45 days of issuance, and are now trading at 130 per note, representing a yield-to-worst of 2.0%. This poor decision will cost stakeholders for many years to come. The Investor Group notes that at roughly the same time Kohl’s priced this financing, many other retailers were executing sale-leaseback transactions to shore up their balance sheets which carried a rent expense significantly below the coupon of the Kohl’s debt and did not add a long-term debt maturity or a punitive make-whole to the Company’s capital structure.

We Believe the Board Has Failed to Optimize the Balance Sheet

We believe that the Board has failed to capitalize on a significant opportunity to create value. According to our estimates, Kohl’s owns $7-8 billion in non-core, non-earning real estate assets. This value is trapped on the balance sheet, creating no shareholder value and forcing the Company to pursue an asset-intensive, inflexible model that obscures its operational underperformance. It seems to us that the Board is aware of this, as the Company executed a small sale-leaseback transaction in 2020, but lacks the shareholder alignment to further optimize the balance sheet and create value.

| Square | Property | Price/ | Market | ||

| City | State | Footage | Use | Sq. Ft. | Value |

| Menomonee Falls | WI | 683,747 | Corporate HQ | $350 | $239,311,450 |

| Additional Office | Various | 500,000 | Various | $300 | $150,000,000 |

| Findlay | OH | 780,000 | Distribution | $85 | $66,300,000 |

| Winchester | VA | 450,000 | Distribution | $85 | $38,250,000 |

| Blue Springs | MO | 540,000 | Distribution | $85 | $45,900,000 |

| Mamakating | NY | 605,000 | Distribution | $85 | $51,425,000 |

| Macon | GA | 560,000 | Distribution | $85 | $47,600,000 |

| Patterson | CA | 365,000 | Distribution | $85 | $31,025,000 |

| Ottawa | IL | 330,000 | Distribution | $85 | $28,050,000 |

| Monroe | OH | 1,225,000 | Fulfillment | $85 | $104,125,000 |

| Edgewood | MD | 1,450,000 | Fulfillment | $85 | $123,250,000 |

| DeSoto | TX | 1,515,000 | Fulfillment | $85 | $128,775,000 |

| Plainfield | IN | 975,000 | Fulfillment | $85 | $82,875,000 |

| Etna | OH | 1,300,000 | Fulfillment | $85 | $110,500,000 |

| Retail Portfolio | Various | 29,039,000 | Retail Stores | $215 | $6,243,385,000 |

| Totals: | 40,317,747 | $186 | $7,490,771,450 |

Source: Company SEC Filings, Investor Group estimates, property records

We are aware of at least one private equity real estate investor that has approached the Company on multiple occasions about executing more sizable sale-leaseback transactions, but has been turned away each time. The Investor Group believes that the Company could unlock at least $3 billion through sale-leaseback transactions with a high degree of certainty in 60 to 90 days. Such transactions would enable Kohl’s to effectively sell non-core, non-earning assets for approximately 14-15x EBITDA, representing a substantial premium to the Company’s current enterprise value to 2019 EBITDA multiple of 4.8x. The Investor Group estimates that $3 billion in sale-leaseback proceeds, combined with an effectively executed share repurchase program, could increase EPS by at least 25%. Depending on when and at what level the Company reinstates the dividend, it is possible to retire a significant amount of the outstanding shares such that a sale-leaseback transaction would result in little to no annual cash flow impact.

We also believe that several additional, positive benefits can be achieved and financed by Kohl’s partner in such sale-leaseback transactions, including:

| · | LEED certifications for relevant properties and reduced energy consumption, speeding up progress towards the Company’s 2025 Sustainability Goals; |

| · | Expanded electric charging station infrastructure to better serve customers (Kohl’s currently only has 229 electric charging spots across 100 locations); |

| · | Installation of rooftop solar panels (Kohl’s currently operates only 164 solar arrays across the country) and wind turbines, dramatically lowering power costs; and |

| · | Significantly reduced future Company capital expenditures for the properties included in the sale-leaseback portfolio. |

We believe that a large-scale sale-leaseback program, coupled with initiatives like these, would be viewed favorably by Kohl’s shareholder and customers alike.

Board Lacks Alignment with Shareholders

The Investor Group believes that the Board’s failure to create value for Kohl’s investors is in part attributable to its own lack of skin in the game (as well as management’s). It is easy to rubberstamp one failed growth strategy after the other, sign off on enormous capital expenditures and approve excessive operating expenses when you have no material exposure to the Company’s share price. Since 2011, directors have purchased a mere $1.2 million in Company stock while collecting over $23 million in director compensation. We think that a Board that invests just 5% of its fees in the Company is woefully misaligned and must lack conviction and confidence in Kohl’s.

It Will Not Be Different This Time

As this Board has overseen steady value destruction for many years, we think that shareholders should remain highly skeptical that the “new strategic vision” promised by the Company will deliver anything else. Many initiatives outlined in the Company’s October 2020 investor presentation sound hauntingly familiar to the “Greatness Agenda” released six years earlier, in which Kohl’s highlighted the need to “turn our stores into more inspiring destinations” and set a goal of $21 billion in sales and $1.9 billion in operating income by 2017. Those targets were missed by 9% and 25%, respectively, by 2017. By 2019, the operating profit target was missed by 36%. The confidence exuded by management then is strikingly similar to the unbridled optimism that shareholders are subjected to now. Yet, between 2014 and 2019, the Company missed its own annual expectations three out of five years, and was one of the few retailers to guide to a decline in annual earnings (21% below 2018) at the beginning of 2020, prior to the start of the COVID-19 pandemic. We do not give much credence to the recent Company plan and do not believe that significant change will occur at Kohl’s without oversight from a reconstituted Board.

Recent History of Significantly Missed Guidance Suggest Ineffective Board Oversight

Kohl’s, similar to many other retailers, was able to navigate through the pandemic. This, however, does not mean that we harbor much optimism about its future under the guidance of the current Board. Rather, we think it is more likely that management’s new goals and visions will turn out to be as detached from reality as its previous plans. Management started 2019 by guiding investors to expect $5.98 in EPS at the midpoint, a target approved by the Board. After lowering guidance twice during the year, Kohl’s ultimately earned $4.86, or 19% less than the initial starting point. Leading to further value destruction, Kohl’s guided 2020, prior to any impact of the COVID-19 pandemic, to $4.40 in EPS, or 26% below 2019’s starting point.

Source: Company SEC Filings

Management has postulated many times in the past that they were on a path to improving sales growth, only to be proven wrong. Coming off an uptrend in same store sales in 2018, on March 5, 2019, Michelle Gass, CEO, offered the following assessment:

“Our strong performance reflects the compelling product offering, great marketing strategy and consistent execution in stores and online…We are working from a position of strength, and as we look ahead, we are guiding to another year of positive sales growth and improved profitability. We will continue to work with speed and agility while also remaining disciplined and thoughtful in our efforts to drive stakeholder value” – 2018 Q4 earnings conference call

However, just two-and-a-half months later, on May 21, 2019, Ms. Gass offered a different assessment after delivering the worst same store sales results in the last eleven quarters:

“The first quarter featured a lot of volatility, with February being particularly tough. And while March and April trends did improve, they were below our expectation. This is reflected in our Q1 comparable sales decline of 3.4%. While we are disappointed in our sales performance, the team was agile and reacted appropriately by managing expenses while continuing to invest in future growth. It's a highly competitive market, and we've seen more aggressive pricing and promotion in categories like Home. Looking ahead, we plan to be more aggressive in driving top-line sales to regain our momentum and grow market share.” – 2019 Q1 earnings conference call

Kohl’s never did regain momentum in 2019, and on the 2019 Q4 earnings conference call, Ms. Gass finally acknowledged that rather than “working from a position of strength” as had been asserted earlier in the year, Kohl’s was facing a host of problems that needed to be addressed:

“As we look back at 2019, our results did not meet our expectations primarily due to 3 key factors: Home, Women's and gross margin.

First, our Home business had a tough first half driven by competitive pressures, pricing challenges and not enough newness. The team responded with agility by adjusting our pricing strategies and introducing new brands and category innovation. Together, these led to materially better performance in the second half.

Second, our Women's business remained challenged throughout the year. We recognize that we need a much more significant reinvention in Women's to improve the trajectory moving forward. I will discuss some of the actions we are taking in a moment.

Third, as it relates to margin, our performance was pressured due to a combination of category mix and aggressive promotional stance to protect market share and a more pronounced shift to digital than expected, which resulted in a greater cost-of-shipping headwind.”

The glaring inaccuracy of Ms. Gass’ statements earlier in the year imply to us that there are a wide range of oversight and management issues which must be addressed to actually execute on a strategic plan and facilitate more consistent, profitable growth.

Failure of New Brands Launches

Kohl’s appears to be in a perennial cycle of introducing new brands in an attempt to stimulate top-line growth; however, they often struggle with or exit brands not long after launching them.

“We announced yesterday that we are partnering with POPSUGAR, a leading digital media company to launch POPSUGAR at Kohl's this September. This new innovative apparel brand will be targeted toward millennial women and will tap into POPSUGAR's audience of more than 100 million readers and 31 million social followers to both inform the assortment and drive a unique joint marketing approach.” – Michelle Gass, CEO 5/22/2018

“We launched POPSUGAR in mid-September, and we're encouraged by the initial response from the younger demographic that we targeted, as well as early online sales…Certainly, POPSUGAR is a big one as we look ahead into next year.” – Michelle Gass, CEO 11/20/2018

Just two years later, POPSUGAR was announced as a brand exit. Brand launches reek of “shiny object syndrome.” They are exciting to talk about, but often are too small to move the needle and/or ultimately distract the management team from the bigger picture issues. While any one brand will inevitably grow from zero, in the aggregate, they don’t seem to generate any meaningful top-line growth as they merely move sales dollars from one pocket to another.

Failure of Active and Athleisure to drive top-line growth

Similarly, as early as February 2014, Kohl’s noted a focus on Active – yet this initiative has not been able to drive overall top-line growth.

“…we are most interested in accelerating our brand penetration. An easy example would be active and wellness. Active is an area we are highly penetrated in. We have a huge opportunity to expand that platform...and increase what we are doing in active.” – Kevin Mansell, Former CEO 2/27/2014

In almost every investor communication since, Kohl’s stressed the opportunity in Active and again, at the beginning of 2019, the Company dedicated itself to driving top-line growth with a focus on the Active category.

“…we will extend our active and wellness expansion to approx. 160 of highest performing active stores, significantly increasing the amount of space allocated to active in 2019.” – Michelle Gass, CEO 3/5/2019

Despite identifying Active as a potential sales driver over six years ago, total sales have remained stagnant as the category has not made a significant enough contribution to generate overall top-line growth. The Investor Group is hopeful this can be achieved but to date there appears very little evidence of a strategy to take market share in this incredibly competitive segment of retail.

Failure to Reduce Inventory

As early as February 2014, the Company prioritized increasing inventory turns.

“...our goal really over the next 3 years...is to take inventory down roughly 5% on an annual basis.” – Wesley MacDonald, Former CFO 2/27/2014

However, two years later, ending inventories were up 4.2% vs. 2013 – a 14% unfavorable variance vs. the goal. On a subsequent call, the Company acknowledged its failure to lower inventory and adjusted its goal.

“…another area of opportunity is the work being done around lowering the level of our inventory…Since 2011 our average inventory per store has grown approximately 15%...I expect we can lower inventory per store by 10% for 2017.” – Wesley MacDonald, Former CFO 2/25/2016

“…we are signing up for 3% [decline] a year for now.” – Wesley MacDonald, Former CFO 2/23/2017

Ms. Gass also cited increasing inventory turn as an important initiative early on in her tenure as CEO.

“… And that is a focus, it's a multiyear focus for us, drive sales up, bring inventories down.” – Michelle Gass, CEO 11/20/18

The following year, Kohl’s was still struggling to bring inventories down in 2019:

“In 2019, we expect a mid-single-digit percentage decrease in our inventory levels in dollars.” – Bruce Besanko, Former CFO 3/5/2019

Unfortunately, inventory dollars actually increased during 2019 – and at the end of 2019, inventories stood at $3.5 billion, up 11% since 2011, as compared with relatively flat sales and modestly lower square footage.

Fixing the Loyalty Program

Kohl’s management enjoys referring to the Kohl’s loyalty program as “industry-leading”. While we agree that the program seems to do a good job retaining the most loyal shoppers, the program is nearly impossible to understand for new customers. This is critically important as Kohl’s needs to attract new customers to meaningfully grow same store sales. While there have been some recently announced changes to simplify the program, more needs to be done in our view. The mere fact that Kohl’s has a publicly stated “playbook” for how to slowly introduce new customers into the loyalty program, because of how overwhelming it is, speaks volumes about the need to simplify the program. Back in 2017, on the August 10, 2017 Q2 conference call, former CEO Kevin Mansell mentioned a focus on improving the loyalty program and trying to make it simpler to understand:

“As you know, the components of our loyalty platform, Kohl's Cash, Yes2You Rewards and Kohl's Charge card, have continued to grow an importance for us, and the platform has been successful in driving customer behavior. We believe it's the best loyalty program in retail. In order to further improve the impact of this program on driving traffic and sales, we intend to pilot an evolution of that platform next spring that, we think, will make it even better. We have 3 objectives in that loyalty pilot: simplify it; broaden the reach; and make a platform even more rewarding. Expect to hear more details about that in our third quarter earnings call in November.”

Then in August of 2018, Ms. Gass took the baton from Mr. Mansell, though she likely had already been focused on this issue as Chief Customer Officer from 2013 to 2015, and highlighted her renewed attention on fixing the loyalty program.

“As you know, we launched a new Kohl's Rewards pilot in late May in 100 stores… the program has 3 primary goals: to acquire and retain customers, to simplify our loyalty assets and to reinvigorate Kohl's Charge...As a reminder, the new loyalty program is unified under one platform, Kohl's Rewards, with the key reward being Kohl's Cash.”

Yet on the August 18, 2020 Q2 earnings conference call, the Company was still trying to fix the loyalty program.

“Loyalty is another important piece of our strategy. We've spoken frequently about our incredibly strong loyalty program. It has been recognized as an industry leader many times and has 30 million members. It's a critical piece of the value equation we provide our customers. And as you know, we have been working on a new foundational program. I'm happy to share that next month, we will be launching our new, more integrated rewards program nationwide, bringing together all of our loyalty assets in a simplified structure with rewards earned in our iconic Kohl's Cash. We saw positive results in our pilot and are confident that this new program will further enhance our position as a leader in the industry.”

The problem, once again, is that Kohl’s has been talking about fixing its loyalty program for years and has made little progress. Based on the Company’s stagnant store sales, any improvements that have been made are not producing notable results.

Failure to Increase Gross Margin

As early as February 2014, the Company was targeting to get back to a 38% gross margin.

“Over the next 3 years we’re trying to get back to where we were in the store gross margin which is roughly a couple hundred basis point around 38% and change.” – Wesley MacDonald, Former CFO 2/27/2015

Yet, after making a little progress off a low base, the Company continued to struggle to increase margins or get anywhere close to the original goal of 38%.

Source: SEC Filings, Transcripts, Investor Group’s Estimates

Unfortunately, this is yet another significant initiative that has not been achieved. For 2019, gross margins of 35.7% reached the lowest level since 2011.

Failure to Contain SG&A

Total SG&A costs have continued to increase, while sales were essentially flat. On the Company’s May 19, 2020 Q1 earnings conference call, Ms. Gass noted that Kohl’s is committed to improving profitability, in part through reduced spending:

“As an organization, we have a long history of operational excellence discipline, which is serving us well. We are working to manage inventory lower and have reduced expenses across the business, including store payroll, marketing, technology and operations.”

Operational excellence is a term that is constantly touted by Kohl’s management. Meanwhile, their SG&A costs have continued to rise year after year. On the Company’s August 18, 2020 Q2 earnings conference call, Jill Timm, CFO, noted that Kohl’s defines tightly managing SG&A as a 1.5% per year increase in expenses:

“I think what I would tell you, as you know, it's core to us to have a strong, cost-disciplined culture. We've been talking about operational excellence for several years. And I think you know, if you look back over time, our SG&A growth rate has been around a 1.5% CAGR because we manage it so tightly.”

Before Ms. Gass and Ms. Timm took the helm, there at least appeared to be some acknowledgement that costs needed to be better controlled:

“…we know we need to do better…we’re moving to lower our leverage point to 1.5% comparable sales increase.” – Kevin Mansell, Former CEO 2/25/2016

“…after store payroll, marketing is our single-biggest expense...if we’re really going to reduce expense over time, we’ve got to do a better job of marketing.” – Kevin Mansell, Former CEO 2/25/2016

But even after those early admissions that costs needed better management, Kohl’s continued to struggle to contain costs in 2017.

“…launched a profit improvement plan that takes significant expense out of our company...the majority coming in 2018 and 2019.” – Kevin Mansell, Former CEO 2/23/2017

Again, on Ms. Gass’ first call as CEO elect in March 2018, Mr. Mansell reassured investors of a focus on lowering costs:

“On the second priority of operational excellence, we've made better-than-expected progress on our efforts to remove more than $250 million from our ongoing expense base and now expect to comfortably exceed that goal.” – Kevin Mansell, Former CEO 3/1/2018

Despite all the focus on reducing expenses from 2014 to 2019, SG&A actually increased by $457 million while sales declined. This is just another example of the Board’s inability to drive the right outcome for shareholders by failing to hold management accountable.

These failures to improve gross margins and control SG&A spending has resulted in a significant decline in both operating income and margin. From 2011 to 2019, operating income has declined nearly $1 billion despite total sales being relatively flat over the same period. The following chart illustrates this destruction in value as evidenced by the steep and continuous decline in operating margins.

Source: SEC Filings, Transcripts, Investor Group’s Estimates

Worst in Class Valuation

All of this culminates in a loss of shareholder confidence that results in one of the lowest valuations in the sector. The Investor Group believes the Company will struggle to create shareholder value and will not be rewarded a reasonable valuation until there is a refreshed Board competent to oversee management in developing a strategic plan that shareholders can believe will be successful. With the recent addition of a new director, likely due to our engagement to date, the Board is currently comprised of 12 individuals who have one thing in common, as noted on the table below, prolific value destruction.

| KSS Relative TSR over Tenure vs. Major Benchmarks | |||||||||

| Director | Tenure | KSS Own. % |

DJIA | R2K | S&P 500 | S&P 600 | S&P 400 | XRT | Nasdaq |

|

Frank V. Sica (Chair) |

33 Years | 0.032% | 1,851% | 2,020% | 1,995% | NA | NA | NA | 1,319% |

| Steven A. Burd | 19 Years | 0.017% | (392%) | (499%) | (384%) | (608%) | (551%) | NA | (593%) |

|

Stephanie A. Streeter (Audit Comm. Chair) |

14 Years | 0.020% | (211%) | (210%) | (229%) | (236%) | (227%) | (325%) | (397%) |

|

Peter Boneparth (Gov./Nom. Comm. Chair) |

13 Years | 0.023% | (192%) | (211%) | (217%) | (238%) | (209%) | (393%) | (399%) |

| John E. Schlifske | 10 Years | 0.018% | (213%) | (218%) | (263%) | (236%) | (201%) | (251%) | (409%) |

|

Jonas Prising (Comp. Comm. Chair) |

5 Years | 0.028% | (94%) | (82%) | (97%) | (80%) | (69%) | (80%) | (156%) |

| Adrianne Shapira | 4 Years | 0.011% | (39%) | (39%) | (46%) | (30%) | (21%) | (58%) | (110%) |

| H. Charles Floyd | 3 Years | 0.009% | (14%) | (23%) | (29%) | (16%) | (11%) | (102%) | (69%) |

| Michael J. Bender | 2 Years | 0.007% | (18%) | (40%) | (31%) | (33%) | (28%) | (109%) | (63%) |

| Yael Cosset | 1 Years | 0.008% | (2%) | (23%) | (10%) | (16%) | (12%) | (98%) | (36%) |

| Robbin Mitchell | 0 Years | 0.000% | -- | -- | -- | -- | -- | -- | -- |

|

Michelle Gass (CEO) |

3 Years | 0.353% | (52%) | (57%) | (67%) | (48%) | (49%) | (111%) | (100%) |

Note: Total Shareholder Return (“TSR”) figures as of respective board appointment date through 01/31/2021, except for Frank V. Sica (as of KSS IPO date 5/19/1992 through 01/31/2021 since he was appointed before IPO)

Source: SEC Filings, Investor Group’s Estimates, Capital IQ – Data as of 01/31/2021

Rather than announce the departure of some of the Company’s long-serving directors, the Board recently decided to expand the Board by one director to add Robbin Mitchell. Without more meaningful change, the Investor Group does not believe TSR will improve.

A Path Forward with a Reconstituted Board

The Investor Group has recruited a world-class team of retail industry experts with extensive retail, turnaround, capital allocation and strategic experience that can help return Kohl’s to improved performance. In nominating nine highly-qualified executives for election to the Board, the Investor Group believes the Company’s enormous potential can be realized through improving the Company’s merchandising, increasing the effectiveness of the marketing strategy, reducing SG&A costs, increasing inventory turns, driving better efficiency from capital investments, and realigning executive compensation and incentives with performance. We believe these actions, in conjunction with a sizable sale-leaseback transaction and material share repurchase, can dramatically improve revenue growth and profitability, strengthen cash flow, increase return on invested capital, and generate significant shareholder value.

The Investor Group has developed a comprehensive plan to create shareholder value that it intends to detail over the upcoming months. This will include a quantified time and action plan that prioritizes the following initiatives:

| · | Management Oversight – Provide significant added expertise at the Board level to assist senior executives in repairing major areas of operational weakness. Oversee and help develop a detailed and rigorously analyzed road map to achieve sales growth, margin expansion, and effective capital allocation. Evaluate depth and capabilities of management team including assessing the need to augment the current team in order to provide senior leadership with all tools needed for success. |

| · | Sales Growth |

| · | Fix the merchandise approach – Renew the focus on customer-centricity as well as a rigorous planning and allocation process to develop a merchandise assortment and architecture that will resonate more strongly with customers. |

| · | Increase speed within merchandising – Accelerate the time it takes to get product on the floor which will drive newness, and likely increase traffic and keep the assortment on trend. |

| · | Overhaul the assortment – Eliminate redundancies and repetition as well as delineate a “good, better, best” hierarchy that clearly identifies the features and benefits of higher value products. |

| · | Increase inventory turn – Faster turns will result in more frequently delivered, fresh inventory, less aged product, and better full-price realization per unit. |

| · | Fix problems with private label – Focus and edit the private label assortment to narrow options, focusing on labels that resonate most with customers while exiting marginal labels that have no meaning to the customer and are only adding to cost and confusion in the assortment. Once identified, back the brands with appropriate amount of marketing support to solidify these labels in customers’ minds. |

| · | Re-establish women’s apparel as a traffic driver – Make Women’s apparel a key priority. Focus on testing and reacting to what the customer wants. |

| · | Grow the home category – Kohl’s is under-penetrated in the Home category and it represents a material opportunity. |

| · | Streamline and update approach to marketing – While there have been some recently announced changes to simplify its loyalty program, more needs to be done to ensure both that the program is easy to understand and has an appropriate margin impact. |

| · | Attract new customers – Develop a strategy designed to recruit new and younger customers to experience the Kohl’s brand. |

| · | Improve the app and website – The current app and website are not visually appealing and do not do a good job showcasing the products. A more product focused approach with less focus on promotional offers and discounts that users must perpetually scroll past to begin shopping would improve the user experience. |

| · | Gross Margin Improvement |

| · | Increase inventory turns – Faster turns will reduce aged inventory and diminish the amount of mark-downs required to move clearance. |

| · | Enhance Mix – Through a rigorous planning process, drive customers to higher margin items. |

| · | Lower sourcing costs – Address the cost to produce the 20% of goods sourced by 3rd party sourcing agents. There is an opportunity to materially lower costs if done effectively. |

| · | Improve private-label programs – Identify and develop comprehensive private label brands with meaning to the customer. Eliminate costly fringe private label programs that are not meaningful and do not contribute materially. |

| · | Rationalize promotional cadence – Streamline the myriad of different promotions in the store. Eliminate confusion, not discounting, to ensure customer can buy with confidence in price integrity and perceived value. Drive customers to more cost-efficient Buy Online, Pick Up in Store (BOPIS) sales, during high volume periods through promotions. |

| · | Reengineer loyalty programs – Fully review the current loyalty program to drive better outcomes. |

| · | Improve e-commerce execution – Fix waterfall of shipping priorities to minimize split shipments or price in a way that is at least neutral to margins if not accretive. |

| · | Cost Optimization and Rationalization |

| · | Analyze with professional cost consultants – Conduct an extensive analysis of the increase in every expense category over the last decade. |

| · | Increase advertising efficiency – Determine which elements of the advertising budget are not delivering results. Redirect into higher return channels. |

| · | Reduce experimental technology spending – Eliminate the endless array of technology initiatives that have failed to produce meaningful results and focus on customer facing, traffic driving expenditures that have been tested. |

| · | Zero based budgeting – Implement zero base budget discipline that does not provide for increased spending without a corresponding reduction. |

| · | Success based spending – Develop a budget that allows for expenses to increase to fund critical projects only when sales growth is achieved. |

| · | Procurement – Assess all non-merchandise related expenditures to determine areas where increased scale can drive higher efficiency. |

| · | Variable cost model – Develop a cost model that is more variable which can flex down in challenging times of unforeseen sales weakness. |

| · | Capital Allocation |

| · | Inventory turn – Faster inventory turn will release a significant amount of cash that is currently trapped in slow moving product. |

| · | Capital expenditures – Build capital expenditure budget from zero up, ensuring every project can generate a meaningful return and improving ROIC. |

| · | Unlock significant real estate value – Kohl’s has $7-8 billion of real state value frozen on the balance sheet. A sale-leaseback will enable the Company to sell a non-earning, non-core asset for 14-15x EBITDA while the stock currently trades for 4.8x 2019 EBITDA making a share repurchase extremely accretive. Depending on when and at what level the Company reinstates the dividend, it is possible to retire a significant amount of the outstanding shares with little to no cash impact. |

| · | Executive Compensation – Meaningful improvements must be made to the Company’s executive compensation philosophy and practices to better align executive compensation with the creation of shareholder value. Targets need to be set to drive improvements in underlying operational and financial performance that support sustainable long-term stakeholder value creation. |

| · | Take Advantage of Closures and Bankruptcies – Develop specific strategies designed to gain greater market share. For the period from 2019 to 2022, the Investor Group believes that Kohl’s competitors (which include JCPenney, Macy’s, Ascena, Stage Stores, Kmart/Sears, Stein Mart, Gap, and Lord & Taylor) will lose another $15 billion in sales from closing stores, presenting significant opportunity for Kohl’s to acquire new customers. |

Our Nominees Have Extensive Retail, Capital Allocation and Strategic Experience and Are Well-Positioned to Create Significant Shareholder Value

The Investor Group believes that many of the challenges the Company has struggled with can be traced back to a lack of relevant retail expertise on the Board and a series of self-inflicted wounds. The Investor Group’s director nominees have the expertise and commitment to help develop a plan that can execute on these priorities and hold management accountable for delivering results. The Investor Group’s highly-qualified independent director nominees, who will bring substantial skills including sourcing, supply chain and private label; retail operations; apparel and accessories merchandising; marketing, branding and e-commerce; and investments, governance, real estate, and turnarounds, are:

Marjorie L. Bowen (age 55)

| · | Ms. Bowen has served as a director at over a dozen public and privately held companies, including industry participants Genesco Inc., Centric Brands, and Talbots. |

| · | As a qualified audit committee financial expert, Ms. Bowen has experience chairing Special Committees, Audit Committees, and Restructuring/Strategic Committees. She also has experience serving as a director in situations that called for improved governance transparency and accountability. |

| · | Prior to her directorships, Ms. Bowen had nearly a 20-year career in investment banking at Houlihan Lokey, serving as Managing Director from 1997 to 2008 and heading its industry leading fairness opinion practice. During her tenure at Houlihan Lokey, Ms. Bowen was the most senior woman at the firm. |

| · | As both an investment banker and corporate director, Ms. Bowen has experience across different types of corporate finance and M&A transactions for both healthy and distressed companies. In addition to the retail experience above, she has broad industry experience, including a focus in real estate intensive and related industries while at Houlihan Lokey. |

| · | Ms. Bowen holds a bachelor’s degree and graduated cum laude from Colgate University in 1987. She holds an MBAA, with a concentration in Finance from the University of Chicago in 1989. |

James T. Corcoran (age 38)

| · | Founder and Chief Executive Officer of Purple Mountain Capital Partners LLC, a private investment firm, since June 2017. |

| · | Partner at AREX Capital Management, LP, an investment management firm focused on special situations, activism and catalyst-driven investing, since August 2019. |

| · | Independent Director of Tuesday Morning Corporation since November 2017. |

| · | Previously, Mr. Corcoran served as a Principal at Highfields Capital Management, a value-oriented investment management firm, from 2010 to 2016. |

| · | Mr. Corcoran worked as an investment banking analyst for Credit Suisse (USA), Inc. in its leveraged finance and restructuring group, from 2006 to 2008, in addition to working in its hedge funds investment group, from 2005 to 2006. |

| · | Mr. Corcoran is a CFA. He received his MBA from the Harvard Business School and his bachelor’s degree with honors in Economics and Political Science from the University of Chicago. |

David A. Duplantis (age 56)

| · | Principal of Duplantis Advisory, advisor and advisory board member to early-stage companies in fashion, beauty, media, and technology with a focus on brand building and strategic business driving initiatives. |

| · | Mr. Duplantis served as President, Global Marketing, eCommerce, CRM and Customer Experience at Coach, Inc (“Coach”), a global fashion company, from 2014-2016. Prior to that Mr. Duplantis held a number of senior level management positions at Coach from November 1998. |

| · | Mr. Duplantis was a key member of the leadership team that grew Coach from a $380 million American accessories company to a $5 billion global, multi-channel, lifestyle fashion brand. During that period, total stakeholder return increased over 2,300%. |

| · | At Coach, Mr. Duplantis had a legacy of profitable innovation both online and in stores and was the founding leader and visionary of the company’s Global Web & Digital Media Group, recognized for being best in class amongst luxury brands globally. |

| · | He began his career working for a variety of clothing retailers including, J. CREW, Inc. (1995 to 1998), The GAP, Inc. (1993 to 1995), and Macy’s WEST (1986 to 1993). |

Jonathan Duskin (age 53)

| · | Mr. Duskin has served as Chief Executive Officer of Macellum Capital Management, LLC, which operates a New York-based pooled investment fund, since July 2009, and as the sole member of Macellum Advisors GP, LLC, the general partner of certain affiliated funds, since September 2011. |

| · | Mr. Duskin served as a Managing Director and Partner at Prentice Capital Management, LP, an investment management firm, from January 2005 to February 2008. |

| · | From March 2002 to January 2005, Mr. Duskin was a Managing Director at S.A.C. Capital Associates LLC, a New York-based hedge fund. From January 1998 to January 2002, Mr. Duskin was a Managing Director at Lehman Brothers Inc., an investment bank, and served as Head of Product Management and Chairman of the Investment Policy Committee within the Research Department. |

| · | Mr. Duskin currently serves on the Board of Directors of Christopher & Banks Corporation, a retail clothing company, and Citi Trends, Inc., a retail clothing chain selling discounted products targeted primarily at urban customers. |

| · | Mr. Duskin previously served on the Boards of Directors of Furniture.com, The Wet Seal, Inc. and Whitehall Jewelers, Inc. |

Margaret L. Jenkins (age 69)

| · | Ms. Jenkins has served as a director at Citi Trends Inc. since October 2017 and is Chair of the Nominating and Corporate Governance Committee and a member of the Audit Committee and the Compensation Committee. |

| · | Ms. Jenkins has an extensive background in consumer marketing and retail advertising with various management experiences. She served as a director of PVH Corp., an international apparel manufacturer and retailer, from June 2006 through May 2014. |

| · | Prior to PVH Corp., Ms. Jenkins served as Senior Vice President, Chief Marketing Officer of Denny’s Corporation, a restaurant company, from 2002 to 2007 and as Chief Marketing Officer of El Pollo Loco restaurants from 1999 through mid-2002. Ms. Jenkins also held several management positions with Taco Bell Corp. and PepsiCo International Foodservice. |

| · | Her early career in advertising included account management of brands such as McDonald’s, Sunny Delight Beverages and the Atlantic Richfield Company. |

| · | Ms. Jenkins is Chair of the Board of Directors of the Prisma Health – Upstate, one of the largest healthcare providers in the Southeast. |

| · | Ms. Jenkins holds a bachelor's degree in Communications from the University of Colorado. |

Jeffrey A. Kantor (age 61)

| · | President of JAK Consulting, a consulting services firm focused on retail/wholesale business strategy, since Sep 2019. |

| · | Mr. Kantor retired in April 2019 after serving at Macy's for 36 years. He served as the Chief Merchandising Officer at Macy’s Inc. since September 2017 until April 2019, served as the Chief Stores & Human Resources Officer at Macy's, Inc. since February 2017 until September 2017, and served as the Chief Stores Officer at Macy's Inc. since February 2015 until February 2017. |

| · | Previously, he served as Chief Stores Officer since February 2015. From February 2012 to February 2015, Mr. Kantor was the Chairman of macys.com. He was also macys.com's President for Merchandising from August 2010 to February 2012 and President of Merchandising for Home from May 2009 to August 2010. |

| · | Mr. Kantor was responsible for the buying, merchandising and marketing of home furnishings for Macy's stores nationwide. Mr. Kantor served as President of Furniture Division for Macy’s Home Store, a subsidiary of Macy's Inc. from February 2006 to May 2009. Mr. Kantor joined Macy's Home Store in February 2006. Mr. Kantor served as President of Big Ticket, Furniture and Rugs at Macy's. |

| · | Mr. Kantor started his career as an assistant buyer at the Boston-based Filene’s/Kaufmann’s division of May Department Stores Co. when he began his career in 1981. He also served as President and CEO of the Hecht’s/Strawbridge’s division of the May Co., which was acquired by Macy’s in 2005. |

| · | Mr. Kantor holds a bachelor’s degree in Marketing and Finance from University of Massachusetts Amherst. |

Thomas A. Kingsbury (age 68)

| · | Mr. Kingsbury serves as an Independent Director at Big Lots, Inc. since April 2020, BJ’S Wholesale Club Holdings, Inc. since Feb 2020 and at Tractor Supply Co. since 2017. |

| · | Mr. Kingsbury has held many executive roles in the retail industry and has had responsibility for a wide range of business areas including operations, e-commerce, merchandising, marketing, IT, and business development. |

| · | He served as the President and CEO of Burlington Stores, Inc. from 2008 until his retirement in September 2019. Mr. Kingsbury also served as a member of the board of directors of Burlington Stores, Inc. from 2008 until February 2020, as Chairman of the board of directors from May 2014 to September 2019 and as their Executive Chairman from September 2019 to February 2020. |

| · | Prior to Burlington, Mr. Kingsbury was Senior Executive Vice President of Information Services, E-Commerce, Marketing and Business Development of Kohl’s Corporation from 2006 to 2008. |

| · | Mr. Kingsbury also held various management positions with The May Department Stores Company, an operator of department store chains, including President and Chief Executive Officer of the Filene’s division from 2000 to 2006. |

| · | Mr. Kingsbury holds a bachelor's degree from the University of Wisconsin-Madison. |

Margenett Moore-Roberts (age 50)

| · | Ms. Moore-Roberts serves as Chief Inclusion & Diversity Officer for IPG DXTRA, a global collective of 28 marketing services and agency brands as a part of Interpublic Group since January 2020. |

| · | Previously, Ms. Moore-Roberts held Corporate Diversity & Inclusion leadership roles at Golin and Yahoo. She served as VP and Global Head of Inclusive Diversity at Yahoo from 2016 to 2017 and established Yahoo’s first Office of Inclusive Diversity as a global Center of Excellence. She also established and led the growth of Yahoo’s first video advertising network |

| · | Prior to joining Yahoo in 2011, she served as VP of Client Services & Ad Operations at Scanscout / Tremor Video (now known as Telaria) from 2007 to 2011 and VP of Client Services at Muze from 2001 to 2007. |

| · | Ms. Moore-Roberts holds a bachelor’s degree from Otterbein University. |

Cynthia S. Murray (age 63)

| · | Founder and Chief Executive Officer of Stanmore Partners, a senior leadership consultant to CEOs, private equity firms, and start-ups, since July 2018. |

| · | From January 2017 to July 2018, Ms. Murray was the President of Full Beauty Brands, a plus size women’s and men’s apparel and home goods holding company. |

| · | Ms. Murray served as Brand President of Chico’s FAS, Inc., a women’s clothing chain, from February 2009 to September 2016 driving rapid turnaround at the brand. After Chico posted (8%) and (15%) same-store sales in 2007 and 2008, Ms. Murray was instrumental in driving same-store sales growth of 6%, 6%, and 8% in 2009, 2010, and 2011, respectively, while also driving dramatically higher profitability. |

| · | From 2004 to 2009, Ms. Murray served as the Executive Vice President and Chief Merchandise Officer of Stage Stores, Inc., a department store specializing in retail brand names in apparel, home, fragrance, and shoes. |

| · | Prior to Stage Stores, Mrs. Murray was the Senior Vice President of Merchandising at Talbots, Inc., a specialty retailer for women’s apparel, from 1998 to 2004. Ms. Murray was also the Vice President of Saks Off Fifth, an off-price division of Saks Fifth Avenue, responsible for all women’s apparel, from 1997 to 2009. |

| · | Ms. Murray served on the Board of Directors of Francesca’s Collections, a specialty retailer offering women’s apparel, jewelry, shoes accessories and gift items, from 2008 to 2009. |

| · | She holds a bachelor’s degree in Business from the Florida State University. |

The Investor Group agrees that Kohl’s has the potential to thrive in today’s evolving retail landscape; however, we feel strongly that substantial change to the Board is required to turnaround the Company.

Sincerely,

|

Jonathan Duskin Macellum Advisors GP, LLC |

Frederick DiSanto Ancora Holdings, Inc. |

Christopher Kiper Legion Partners Asset Management, LLC |

Steve Litt 4010 Capital, LLC |

About Macellum

Macellum Advisors GP, LLC, together with its affiliates (collectively, “Macellum”) have substantial experience investing in consumer and retail companies and assisting such companies in improving their long-term financial and stock price performance. Macellum’s historical investments include: Collective Brands, GIII Apparel Group, Hot Topic, Charming Shoppes and Warnaco, among other companies. Macellum prefers to constructively engage with management to improve its governance and performance for the benefit of all stockholders, as we did with Perry Ellis. However, when management is entrenched, Macellum has run successful proxy contests to effectuate meaningful change, including at The Children’s Place Inc., Christopher & Banks Corporation, Citi Trends, Inc. and most recently at Bed Bath and Beyond Inc.

About Ancora

Ancora Holdings, Inc. is an employee owned, Cleveland, Ohio based holding company which wholly owns four separate and distinct SEC Registered Investment Advisers and a broker dealer. Ancora Advisors LLC specializes in customized portfolio management for individual investors, high net worth investors, investment companies (mutual funds), and institutions such as pension/profit sharing plans, corporations, charitable & “Not-for Profit” organizations, and unions. Ancora Family Wealth

Advisors, LLC is a leading, regional investment and wealth advisor managing assets on behalf families and high net-worth individuals. Ancora Alternatives LLC specializes in pooled investments (hedge funds/investment limited partnerships). Ancora Retirement Plan Advisors, Inc. specializes in providing non-discretionary investment guidance for small and midsize employer sponsored retirement plans. Inverness Securities, LLC is a FINRA registered Broker Dealer.

About Legion Partners

Legion Partners is a value-oriented investment manager based in Los Angeles, with a satellite office in Sacramento, CA. Legion Partners seeks to invest in high-quality businesses that are temporarily trading at a discount, utilizing deep fundamental research and long-term shareholder engagement. Legion Partners manages a concentrated portfolio of North American small-cap equities on behalf of some of the world’s largest institutional and HNW investors.

About 4010 Capital

4010 Capital is a value-oriented investment manager with substantial experience investing in the consumer discretionary sector. 4010 Capital employs comprehensive fundamental analysis to invest in companies which it believes are trading at a discount to intrinsic value and have a pathway to improving operating performance.

Contacts

Media:

Sloane & Company

Dan Zacchei / Joe Germani

dzacchei@sloanepr.com / jgermani@sloanepr.com

Investor:

John Ferguson / Joe Mills

Saratoga Proxy Consulting LLC

(212) 257-1311

info@saratogaproxy.com

CERTAIN INFORMATION CONCERNING THE PARTICIPANTS

Macellum Badger Fund, LLC, a Delaware limited partnership (“Macellum Badger”), Legion Partners Holdings, LLC, a Delaware limited liability company (“Legion Partners Holdings”) Ancora Holdings, Inc., an Ohio corporation (“Ancora Holdings”) and 4010 Capital, LLC, a Delaware limited liability company (“4010 Capital”), together with the other participants named herein, intend to file a preliminary proxy statement and accompanying WHITE proxy card with the Securities and Exchange Commission (“SEC”) to be used to solicit votes for the election of its slate of highly-qualified director nominees at the 2021 annual meeting of shareholders of Kohl’s Corporation, a Wisconsin corporation (the “Company”).

MACELLUM BADGER, LEGION PARTNERS HOLDINGS, ANCORA HOLDINGS AND 4010 CAPITAL STRONGLY ADVISE ALL SHAREHOLDERS OF THE COMPANY TO READ THE PROXY STATEMENT AND OTHER PROXY MATERIALS AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. SUCH PROXY MATERIALS WILL BE AVAILABLE AT NO CHARGE ON THE SEC'S WEB SITE AT HTTP://WWW.SEC.GOV. IN ADDITION, THE PARTICIPANTS IN THIS PROXY SOLICITATION WILL PROVIDE COPIES OF THE PROXY STATEMENT WITHOUT CHARGE, WHEN AVAILABLE, UPON REQUEST. REQUESTS FOR COPIES SHOULD BE DIRECTED TO THE PARTICIPANTS' PROXY SOLICITOR.

The participants in the proxy solicitation are anticipated to be Macellum Badger, Macellum Badger Fund II, LP, a Delaware limited partnership (“Macellum Badger II”), Macellum Advisors, LP, a Delaware limited partnership (“Macellum Advisors”), Macellum Advisors GP, LLC, a Delaware limited liability company (“Macellum GP”), Jonathan Duskin, Legion Partners Holdings, Legion Partners, L.P. I, a Delaware limited partnership (“Legion Partners I”), Legion Partners, L.P. II, a Delaware limited partnership (“Legion Partners II”), Legion Partners Special Opportunities, L.P. XV, a Delaware limited partnership (“Legion Partners Special XV”), Legion Partners, LLC, a Delaware limited liability company (“Legion LLC”), Legion Partners Asset Management, LLC, a Delaware limited liability company (“Legion Partners Asset Management”), Christopher S. Kiper, Raymond T. White, Ancora Holdings, Ancora Catalyst Institutional, LP, a Delaware limited partnership (“Ancora Catalyst Institutional”), Ancora Catalyst, LP, a Delaware limited partnership (“Ancora Catalyst”), Ancora Merlin, LP, a Delaware limited partnership (“Ancora Merlin”), Ancora Merlin Institutional, LP, a Delaware limited partnership (“Ancora Merlin Institutional”), Ancora Catalyst SPV I LP Series M (“Ancora SPV I Series M”), a series of Ancora Catalyst SPV I LP, a

Delaware limited partnership (“Ancora SPV I”), Ancora Catalyst SPV I LP Series N, a series of Ancora SPV I (“Ancora SPV I Series N”), Ancora Catalyst SPV I LP Series O, a series of Ancora SPV I (“Ancora SPV I Series O”), Ancora Catalyst SPV I LP Series P, a series of Ancora SPV I (“Ancora SPV I Series P”), Ancora Catalyst SPV I SPC Ltd Segregated Portfolio G, a Cayman Islands segregated portfolio company (“Ancora Segregated Portfolio G”), Ancora Advisors, LLC, a Nevada limited liability company (“Ancora Advisors”), Ancora Alternatives LLC, an Ohio limited liability company (“Ancora Alternatives”), Ancora Family Wealth Advisors, LLC, an Ohio limited liability company (“Ancora Family Wealth”), The Ancora Group Inc., an Ohio corporation (“Ancora Inc.”), Inverness Holdings, LLC, a Delaware limited liability company (“Inverness Holdings”), Frederick DiSanto, 4010 Partners, LP, a Delaware limited partnership (“4010 Partners”), 4010 Capital, LLC, a Delaware limited liability company (“4010 Capital”), 4010 General Partner, LLC, a Delaware limited liability company (“4010 General Partner”), Steven E. Litt, Marjorie L. Bowen, James T. Corcoran, David A. Duplantis, Margaret L. Jenkins, Jeffrey A. Kantor, Thomas A. Kingsbury, Margenett Moore-Roberts and Cynthia S. Murray.