UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934s |

|

|

For the fiscal year ended |

or

Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

|

|

For the Transition period from ____________ to ___________ |

Commission file number

(Exact name of registrant as specified in its charter)

|

||

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

|

|

|

|

||

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code (

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulations S-T (232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

☒ |

|

Accelerated Filer |

|

☐ |

|

Non-Accelerated Filer |

|

☐ |

|

Smaller Reporting Company |

|

|

|

|

|

|

Emerging Growth Company |

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C.7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No

At July 29, 2022, the aggregate market value of the voting stock of the Registrant held by shareholders who were not affiliates of the Registrant was approximately $

At March 8, 2023, the Registrant had outstanding an aggregate of

Documents Incorporated by Reference:

Portions of the Definitive Proxy Statement for the Registrant’s 2023 Annual Meeting of Shareholders are incorporated into Part III.

KOHL’S CORPORATION

INDEX

|

|||

Item 1. |

3 |

||

Item 1A. |

7 |

||

Item 1B. |

14 |

||

Item 2. |

14 |

||

Item 3. |

15 |

||

Item 4. |

15 |

||

Item 4A. |

16 |

||

|

|

|

|

|

|||

Item 5. |

17 |

||

Item 6. |

19 |

||

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

20 |

|

Item 7A. |

33 |

||

Item 8. |

35 |

||

Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosures |

57 |

|

Item 9A. |

58 |

||

Item 9B. |

60 |

||

Item 9C. |

Disclosure Regarding Foreign Jurisdictions That Prevent Inspections |

60 |

|

|

|

||

|

|||

Item 10. |

60 |

||

Item 11. |

60 |

||

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

60 |

|

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

61 |

|

Item 14. |

61 |

||

|

|

||

|

|||

Item 15. |

62 |

||

Item 16. |

64 |

||

|

|

|

|

65 |

|||

|

|

||

PART I

Item 1. Business

Kohl’s Corporation (the “Company," “Kohl’s,” "we," "our," or "us") was organized in 1988 and is a Wisconsin corporation. As of January 28, 2023, we operated 1,170 Kohl's stores and a website (www.Kohls.com). Our Kohl's stores and website sell moderately-priced private and national brand apparel, footwear, accessories, beauty, and home products. Our Kohl's stores generally carry a consistent merchandise assortment with some differences attributable to local preferences, store size, and Sephora. Our website includes merchandise which is available in our stores, as well as merchandise that is available only online.

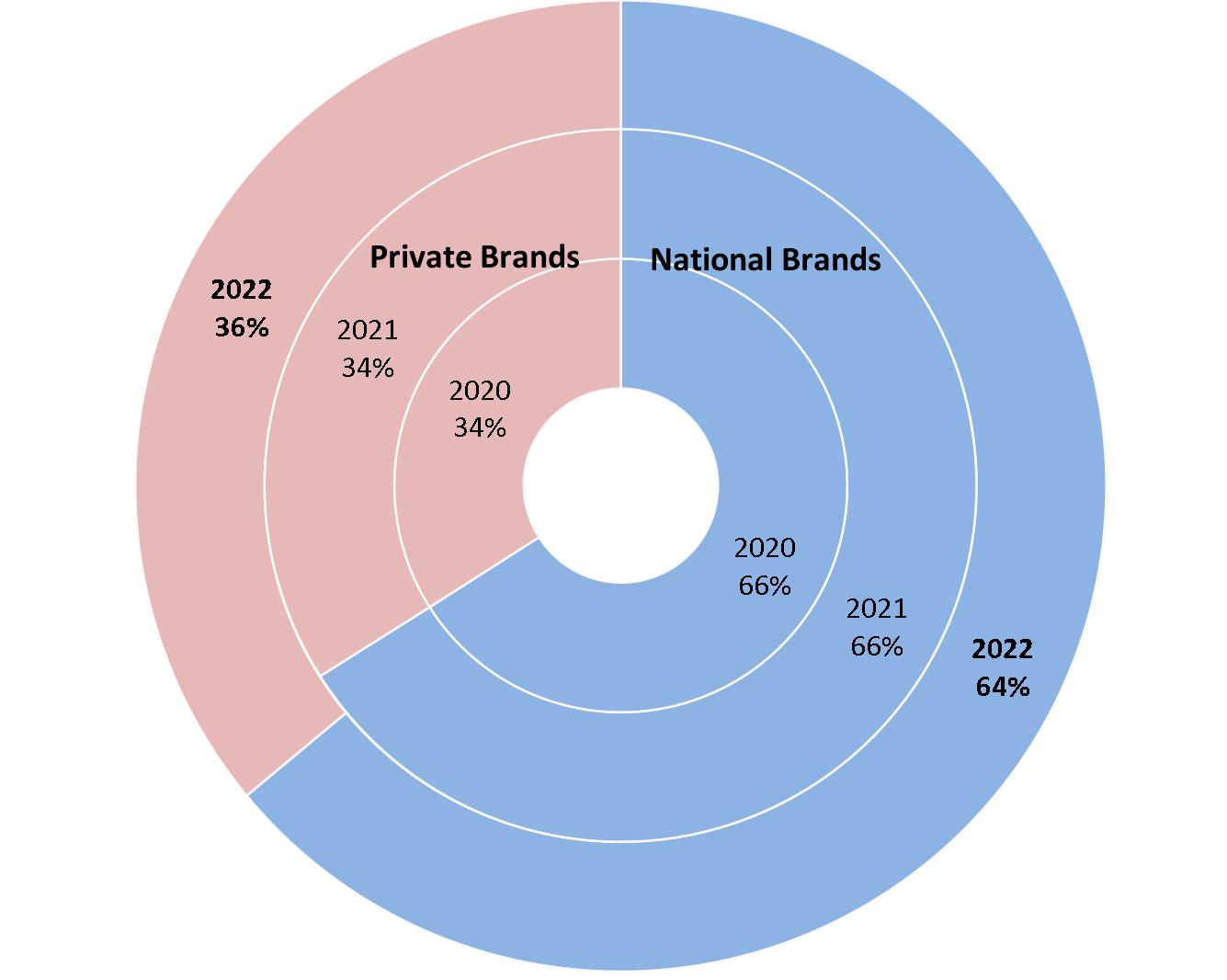

Our merchandise mix includes both national brands and private brands that are available only at Kohl's. Our private portfolio includes well-known established brands such as Croft & Barrow, Jumping Beans, SO, Sonoma Goods for Life, and Tek Gear, and exclusive brands that are developed and marketed through agreements with nationally-recognized brands such as Food Network, LC Lauren Conrad, Nine West, and Simply Vera Vera Wang. Compared to national brands, private brands generally have lower selling prices, but higher gross margins.

The following tables summarize our net sales penetration by line of business and brand type over the last three years:

Our fiscal year ends on the Saturday closest to January 31st each year. Unless otherwise stated, references to years in this report relate to fiscal years rather than to calendar years. The following fiscal periods are presented in this report:

Fiscal Year |

Ended |

Number of Weeks |

2022 |

January 28, 2023 |

52 |

2021 |

January 29, 2022 |

52 |

2020 |

January 30, 2021 |

52 |

For discussion of our financial results, see Item 7, "Management's Discussion and Analysis of Financial Condition and Results of Operations."

3

Distribution

We receive substantially all of our merchandise at our nine retail distribution centers and six e-fulfillment centers. A small amount of our merchandise is delivered directly to the stores by vendors or their distributors. The retail distribution centers, which are strategically located throughout the United States, ship merchandise to each store by contract carrier several times a week. Digital sales may be picked up in our stores or are shipped to the customer from a Kohl’s e-fulfillment center, retail distribution center or store, or directly by a third-party vendor.

See Item 2, “Properties,” for additional information about our distribution and e-fulfillment centers.

Human Capital

At Kohl’s, our purpose is to inspire and empower families to lead fulfilled lives. We are committed to creating a culture where everyone belongs, where diversity and inclusion drive innovation and business results, while enabling associates and customers to be their authentic selves every single day.

Employee Count

During 2022, we employed an average of approximately 97,000 associates, which included approximately 36,000 full-time and 61,000 part-time associates. The number of associates varies during the year, peaking during the back-to-school and holiday seasons. None of our associates are represented by a collective bargaining unit. We believe we maintain positive relations with our associates.

Health, Safety, and Wellness

We lead initiatives that ensure the way we communicate, work, and develop our product enables our customers and associates to shop, work, and engage in a safe environment. We have a team dedicated to defining plans and preparing for business crisis events, including natural disasters and other unplanned disruptions like those brought on by the COVID-19 pandemic. To keep a healthy workforce, we maintain an advocacy program that provides associates with 24/7 access to medical professionals following a work accident. We continue to pursue innovative ways to educate our teams on safety. Associates at our stores, distribution, and e-fulfillment centers receive specialized training to enhance our safety culture and reduce associate accidents.

Diversity, Equity, and Inclusion

At Kohl’s, we are committed to our Diversity, Equity, and Inclusion ("DEI") strategy focused on Our People, Our Customers, and Our Community. This strategy accelerates how we are embedding DEI throughout our business by being intentional about our programs and practices and holding ourselves accountable with measurable goals and results. The work is rooted in our Core Beliefs:

We are committed to creating an environment where diversity is valued at all levels, everyone feels a sense of equity, and where inclusion is evident across our business. We strive to be purposeful in attracting, growing, and engaging more diverse talent while giving associates equitable opportunities for career growth. We administer our recruiting

4

efforts with a focus on education, training, and sourcing strategies for increasing our diverse talent pipeline. Our diversity and inclusion strategy is embedded into our onboarding for all associates. We endeavor to drive economic prosperity through conversations, programs, and partnerships that improve quality of life.

We are focused on growing diverse leaders by engaging top and emerging talent in internal and external professional development offerings. Diversity is embedded within our organizational planning for the future, with diversity being an area of consideration during succession planning. We are working to develop inclusive leaders through programs aimed at building awareness and encouraging advocacy.

In the space of continuous development and engagement, we have eight Business Resource Groups ("BRGs") with approximately 20,000 members focused on driving the business by recognizing and championing DEI in its multiple forms. BRG’s continue to be leveraged and seen as the “culture keepers” to support honest and reflective dialogue and accelerate the company forward in inclusion and belonging. The BRG’s are also positioned to provide key development and growth opportunities for associates to build their cache of skills and connections while bringing their authentic selves to their work and the organization. The BRGs serve as champions for enhancing our diversity and inclusion efforts across our business and make an impact across the organization with a focus on our three diversity and inclusion pillars. We work to provide learning opportunities for our leaders and associates to build a more diverse and inclusive workforce and engage associates on how that creates a competitive advantage.

At Kohl's, we believe our leaders are accountable for strengthening, modeling, and supporting our DEI efforts by ensuring that they are building a culture and environment where our associates feel seen, and their unique needs, experiences, abilities, and perspectives are valued and heard. Each leader is responsible for creating a caring culture and experience for our team, one that embraces and strives to understand our differences, and provides an inclusive environment for all.

Compensation and Benefits

We are committed to providing competitive and fair compensation and benefits programs to our associates. All eligible associates receive a 100% match (up to 5% of pay) in Kohl’s 401(k) Savings Plan after one year of employment. Full-time associates are offered medical, dental, vision, prescription drug, disability and life insurance coverage, paid time off, and a merchandise discount. Part-time associates are offered dental, vision, supplementary life insurance, and a merchandise discount. We empower our associates’ work-life balance by giving them access to a full range of professional resources.

Training and Development

Behind our success are great teams of talented individuals who embody our values. We actively attract, engage, and hire talent who drive our purpose. Our talent management team brings together performance management, talent assessment, succession planning, and career planning. This team provides tools, resources, and best practices to ensure we have the right talent in the right roles at the right time. We invest in executive coaching, assessments, internal programs, external courses, peer networks, and more.

From initial onboarding to high potential leadership development, we believe in training and career growth for our associates. We continue to leverage new technologies and encourage our associates to keep their skills fresh through our learning management system, which includes more than 1,000 online and in-person courses. We are committed to the highest standards of integrity and maintain a Code of Ethics to guide ethical decision-making for associates. We require associates to take annual ethics training, which is refreshed each year to cover relevant topics.

Competition

The retail industry is highly competitive. Management considers style, quality, price, and convenience to be the most significant competitive factors in the industry. Merchandise mix, brands, service, loyalty programs, credit availability,

5

and customer experience are also key competitive factors. Our primary competitors are traditional department stores, mass merchandisers, off-price retailers, specialty stores, internet businesses, and other forms of retail commerce. Our specific competitors vary from market to market.

Merchandise Vendors

We purchase merchandise from numerous domestic and foreign suppliers. All suppliers must meet certain requirements to do business with us. Our Terms of Engagement are part of our purchase order terms and conditions and include provisions regarding laws and regulations, employment practices, ethical standards, environmental requirements, communication, monitoring and compliance, record keeping, subcontracting, and corrective action. We expect that all suppliers will comply with our purchase terms and quickly remediate any deficiencies, if noted, to maintain our business relationship.

A third-party purchasing agent sources approximately 20% of the merchandise we sell. No vendor individually accounted for more than 10% of our net purchases in 2022. We have no significant long-term purchase commitments with any of our suppliers and believe that we are not dependent on any one supplier or one geographical location. We believe we have good working relationships with our suppliers.

Seasonality

Our business, like that of other retailers, is subject to seasonal influences. Sales and income are typically higher during the back-to-school and holiday seasons. Because of the seasonality of our business, results for any quarter are not necessarily indicative of the results that may be achieved for a full fiscal year.

Trademarks and Service Marks

KOHL'S® is a registered trademark owned by one of our wholly-owned subsidiaries. This subsidiary has over 200 additional registered trademarks, most of which are used in connection with our private brand products.

We consider the KOHL'S® mark, all other trademarks, and the accompanying goodwill to be valuable to our business.

Available Information

Our corporate website is https://corporate.kohls.com. Through the “Investors” portion of this website, we make available, free of charge, our proxy statements, Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, Securities and Exchange Commission (“SEC”) Forms 3, 4, and 5, and any amendments to those reports filed or furnished pursuant to Sections 13(a) and 15(d) of the Securities Exchange Act of 1934, as amended, as soon as reasonably practicable after such material has been filed with, or furnished to, the SEC.

The following have also been posted on our website, under the caption “Investors” and sub-captions "Corporate Governance" or “ESG”:

The information contained on our website is not part of this Annual Report on Form 10-K. Paper copies of any of the materials listed above will be provided without charge to any shareholder submitting a written request to our Investor Relations Department at N56 W17000 Ridgewood Drive, Menomonee Falls, Wisconsin 53051 or via e-mail to Investor.Relations@Kohls.com.

6

Item 1A. Risk Factors

This Form 10-K contains “forward-looking statements” made within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as "believes," "anticipates," "plans," "may," "intends," "will," "should," "expects," and similar expressions are intended to identify forward-looking statements. Forward-looking statements include the statements under management's discussion and analysis, financial and capital outlook and may include comments about our future sales or financial performance and our plans, performance and other objectives, expectations or intentions, such as statements regarding our liquidity, debt service requirements, planned capital expenditures, future store initiatives, and adequacy of capital resources and reserves. Forward-looking statements are based on management’s then current views and assumptions and, as a result, are subject to certain risks and uncertainties that could cause actual results to differ materially from those projected. As such, forward-looking statements are qualified by those risk factors described below. Forward-looking statements relate to the date made, and we undertake no obligation to update them.

Our sales, revenues, gross margin, expenses, and operating results could be negatively impacted by a number of factors including, but not limited to those described below. Many of these risk factors are outside of our control. If we are not successful in managing these risks, they could have a negative impact on our sales, revenues, gross margin, expenses, and/or operating results.

Macroeconomic and Industry Risks

General economic conditions, consumer spending levels, and/or other conditions could decline.

Consumer spending habits, including spending for the merchandise that we sell, are affected by many factors including prevailing economic conditions, levels of employment, salaries and wage rates, prevailing interest rates, housing costs, energy and fuel costs, income tax rates and policies, consumer confidence, consumer perception of economic conditions, and the consumer’s disposable income, credit availability, and debt levels. The moderate-income consumer, which is our core customer, is especially sensitive to these factors. A slowdown in the U.S. economy or an uncertain economic outlook could adversely affect consumer spending habits. As all of our stores are located in the United States, we are especially susceptible to deteriorations in the U.S. economy.

Consumer confidence is also affected by the domestic and international political situation. The outbreak or escalation of war, or the occurrence of terrorist acts or other hostilities in or affecting the United States, could lead to a decrease in spending by consumers.

Our competitors could make changes to their pricing and other practices.

The retail industry is highly competitive. We compete for customers, associates, locations, merchandise, services, and other important aspects of our business with many other local, regional, and national retailers. Those competitors include traditional department stores, mass merchandisers, off-price retailers, specialty stores, internet businesses, and other forms of retail commerce.

We consider style, quality, price, and convenience to be the most significant competitive factors in our industry. The continuing migration and evolution of retailing to digital channels has increased our challenges in differentiating ourselves from other retailers especially as it relates to national brands. In particular, consumers can quickly and conveniently comparison shop with digital tools, which can lead to decisions based solely on price. Unanticipated changes in the pricing and other practices of our competitors may adversely affect our performance and lead to loss of market share in one or more categories.

7

Tax, trade and climate, and other ESG-related policies and regulations could change or be implemented and adversely affect our business and results of operations.

Uncertainty with respect to tax and trade policies, tariffs, and government regulations affecting trade between the United States and other countries has recently increased. The majority of goods sourced are manufactured outside of the United States, primarily in Asia. Major developments in tax policy or trade relations, such as the imposition of tariffs on imported products, could have a material adverse effect on our business, results of operations, and liquidity. Furthermore, increased governmental focus on climate change and other ESG matters may result in complex regulatory requirements that may directly or indirectly have a significant impact on the costs of our operations, including energy, resources used to produce our products and compliance costs, which may have a material adverse effect on our business and results of operations.

The impact of future outbreaks of COVID-19 or future pandemics could have a material adverse impact on our business, financial condition, and results of operations.

The impact of and actions taken in response to COVID-19 had a significant impact on the retail industry generally and our business specifically, starting in the first quarter of fiscal year 2020. Further outbreaks of COVID-19 or future pandemics could have a material adverse impact on our business, financial condition, and results of operations.

Risks Relating to Revenues

On March 20, 2020, we temporarily closed our stores nationwide, and were fully reopened as of July 2020. In connection with the store closures, we temporarily furloughed store and store distribution center associates, as well as some corporate office associates whose work was significantly reduced by the store closures. Due to the store closures, we experienced a temporary material decline in revenue and operating cash flow. We cannot predict if further outbreaks or future pandemics would necessitate store closures again.

Our response to future outbreaks or pandemics may also impact our customer loyalty. If our customer loyalty is negatively impacted or consumer discretionary spending habits change, our market share and revenue may suffer as a result. To the extent any such outbreak or pandemic significantly impacts spending or payment patterns of our private label credit card holders, we may receive lower fees from our private label credit card program.

Risks Relating to Operations

If we are unable to attract and retain associates in the future, we may experience operational challenges. These risks related to our business, financial condition, and results of operations, were especially heightened given the uncertainty as to the extent and duration of COVID-19’s impact and could be again during any future outbreak or pandemic. We may also face demands or requests from our associates for additional compensation, healthcare benefits, or other terms as a result of a future outbreak or pandemic that could increase costs, and we could experience labor disputes or disruptions as we implement our mitigation plans.

Our mitigation plans may require a large investment of time and focus. To the extent these measures are ineffective or perceived as ineffective, it may harm our reputation and customer loyalty and make our customers less likely to shop in our stores.

Our corporate office associates may work remotely in a hybrid work environment, posing operational risks, including heightened cybersecurity risks that may continue past the time when our associates return to work. We cannot predict if further outbreaks or new variants would necessitate corporate office closures again.

In addition, we cannot predict the impact that future outbreaks or pandemics may have on our suppliers, vendors, and other business partners, and each of their financial conditions; however, any material effect on these parties could adversely impact us.

8

Risks Relating to Liquidity

Future outbreaks or pandemics may require us to take actions to increase our cash position and preserve financial flexibility similar to those we took in 2020. These actions may have a negative effect on our credit ratings, access to capital, and the cost and terms of debt financing, which may have a material adverse effect on our results of operations and liquidity.

Future outbreaks or pandemics could also cause or aggravate other risk factors that we identify in this section, which in turn could materially and adversely impact our business, financial condition, and results of operations. Further, any such outbreaks or pandemics may also affect our business, financial condition, and results of operations in a manner that is not presently known to us or that we currently do not consider to present significant risks to our business, financial condition, and results of operations.

Operational Risks

We may be unable to offer merchandise that resonates with existing customers and attracts new customers as well as successfully manage our inventory levels.

Our business is dependent on our ability to anticipate fluctuations in consumer demand for a wide variety of merchandise. Failure to accurately predict constantly changing consumer tastes, preferences, spending patterns, and other lifestyle decisions could create inventory imbalances and adversely affect our performance and long-term relationships with our customers. Additionally, failure to accurately predict changing consumer tastes may result in excess inventory, which could result in additional markdowns and adversely affect our operating results. As with most retailers, we also experience inventory shrinkage due to theft or damage. Higher rates of inventory shrinkage or increased security or other costs to combat inventory shrinkage could adversely affect our results of operations and financial condition, and our efforts to contain or reduce inventory shrinkage may not be successful.

We may be unable to source merchandise in a timely and cost-effective manner.

A third-party purchasing agent sources approximately 20% of the merchandise we sell. The remaining merchandise is sourced from a wide variety of domestic and international vendors. Our ability to find qualified vendors and access to brands or products in a timely and efficient manner is a significant challenge which is typically even more difficult for goods sourced outside the United States, substantially all of which are shipped by ocean to ports in the United States. Political or financial instability, trade restrictions, tariffs, currency exchange rates, transport capacity and costs, pandemic outbreaks, work stoppages, port strikes, port congestion and delays, and other factors relating to foreign trade are beyond our control and have or could continue to adversely impact our performance and cause us to pay more to obtain inventory or result in having the wrong inventory at the wrong time.

Increases in the price of merchandise, raw materials, fuel, and labor, or their reduced availability, increase our cost of merchandise sold. The price and availability of raw materials may fluctuate substantially, depending on a variety of factors, including demand, weather, supply conditions, transportation costs, energy prices, work stoppages, government regulation and policy, economic climates, market speculation, and other unpredictable factors. An inability to mitigate these cost increases, unless sufficiently offset with our pricing actions, might cause a decrease in our operating results. Any related pricing actions might cause a decline in our sales volume. Additionally, a reduction in the availability of raw materials could impair the ability to meet production or purchasing requirements in a timely manner. Both the increased cost and lower availability of merchandise, raw materials, fuel, and labor may also have an adverse impact on our cash and working capital needs as well as those of our suppliers.

If any of our significant vendors were to become subject to bankruptcy, receivership, or similar proceedings, we may be unable to arrange for alternate or replacement contracts, transactions, or business relationships on terms as favorable as current terms, which could adversely affect our sales and operating results.

9

Our vendors may not adhere to our Terms of Engagement or to applicable laws.

A substantial portion of our merchandise is received from vendors and factories outside of the United States. We require all of our suppliers to comply with all applicable local and national laws and regulations and our Terms of Engagement for Kohl's Business Partners. These Terms of Engagement include provisions regarding laws and regulations, employment practices, ethical standards, environmental and legal requirements, communication, monitoring/compliance, record keeping, subcontracting, and corrective action. From time to time, suppliers may not be in compliance with these standards or applicable laws. Significant or continuing noncompliance with such standards and laws by one or more suppliers could have a negative impact on our reputation and our results of operations.

Our marketing may be ineffective.

We believe that differentiating Kohl's in the marketplace is critical to our success. We design our marketing and loyalty programs to increase awareness of our brands and to build personalized connections with new and existing customers. We believe these programs will strengthen customer loyalty, increase the number and frequency of customers that shop our stores and website, and increase our sales. If our marketing and loyalty programs are not successful or efficient, our sales and operating results could be adversely affected.

The reputation and brand image of Kohl’s and the brands and products we sell could be damaged.

We believe the Kohl's brand name and many of our private brand names are powerful sales and marketing tools. We devote significant resources to develop, promote, and protect private brands that generate national recognition. In some cases, the private brands or the marketing of such brands are tied to or affiliated with well-known individuals. We also associate the Kohl’s brand with third-party national brands that we sell in our store and through our partnerships with companies in pursuit of strategic initiatives. Further, we focus on ESG as a key component of our strategy, and we have made regular public disclosures on our ESG efforts. For example, we publish an annual ESG report to share information with our partners, shareholders, customers, and associates regarding our ESG progress. These disclosures reflect our goals and other expectations and assumptions, which are necessarily uncertain and may not be realized. At the same time, investor and other stakeholder expectations, and voluntary and regulatory ESG disclosure standards and policies continue to evolve. Damage to the reputations (whether or not justified) of the Kohl’s brand, our private brand names, or any affiliated individuals or companies with which we have partnered, could arise from product failures; concerns about human rights, working conditions, and other labor rights and conditions where merchandise is produced; perceptions of our pricing and return policies; litigation; vendor violations of our Terms of Engagement; perceptions of the national vendors and/or third party companies with which we partner; failure to realize our ESG goals on a timely basis or at all; failure to meet evolving investor and other stakeholder expectations with respect to ESG matters; or various other forms of adverse publicity, especially in social media outlets. This type of reputational damage may result in a reduction in sales, operating results, and shareholder value.

There may be concerns about the safety of products that we sell.

If our merchandise offerings do not meet applicable safety standards or our customers' expectations regarding safety, we could experience lost sales, experience increased costs, and/or be exposed to legal and reputational risk. Events that give rise to actual, potential, or perceived product safety concerns could expose us to government enforcement action and/or private litigation. Reputational damage caused by real or perceived product safety concerns could have a negative impact on our sales and operating results.

We may be unable to adequately maintain and/or update our information systems.

The efficient operation of our business is dependent on our information systems. In particular, we rely on our information systems to effectively manage sales, distribution, and merchandise planning and allocation functions. We also generate sales through the operations of our Kohls.com website. We frequently make investments that will help

10

maintain and update our existing information systems. We also depend on third parties as it relates to our information systems. The potential problems and interruptions associated with implementing technology initiatives, the failure of our information systems to perform as designed, or the failure to successfully partner with our third party service providers, such as our cloud platform providers, could disrupt our business and harm our sales and profitability.

Our information technology projects may not yield their intended results.

We regularly have internal information technology projects in process. Although the technology is intended to increase productivity and operating efficiencies, these projects may not yield their intended results or may deliver an adverse user or customer experience. We may incur significant costs in connection with the implementation, ongoing use, or discontinuation of technology projects, or fail to successfully implement these technology initiatives, or achieve the anticipated efficiencies from such projects, any of which could adversely affect our operations, liquidity, and financial condition.

Weather conditions and natural disasters could adversely affect consumer shopping patterns and disrupt our operations.

A significant portion of our business is apparel and is subject to weather conditions. As a result, our operating results may be adversely affected by severe or unexpected weather conditions (including those that may be caused by climate change). Frequent or unusually heavy snow, ice, or rain storms; natural disasters such as earthquakes, tornadoes, floods, fires, and hurricanes; or extended periods of unseasonable temperatures could adversely affect our performance by affecting consumer shopping patterns and diminishing demand for seasonal merchandise. In addition, these events could cause physical damage to our properties or impact our supply chain, making it difficult or impossible to timely deliver seasonally appropriate merchandise. Although we maintain crisis management and disaster response plans, our mitigation strategies may be inadequate to address such a major disruption event.

We may be unable to successfully execute an omnichannel strategy.

Customer expectations about the methods by which they purchase and receive products or services are evolving. Customers are increasingly using technology and mobile devices to rapidly compare products and prices, and to purchase products. Once products are purchased, customers are seeking alternate options for delivery of those products. We must continually anticipate and adapt to these changes in the purchasing process. Our ability to compete with other retailers and to meet our customers' expectations may suffer if we are unable to provide relevant customer-facing technology and omnichannel experiences. Our ability to compete may also suffer if Kohl’s, our suppliers, or our third-party shipping and delivery vendors are unable to effectively and efficiently fulfill and deliver orders, especially during the holiday season when sales volumes are especially high. Consequently, our results of operations could be adversely affected.

Our business is seasonal in nature, which could negatively affect our sales, revenues, operating results, and cash requirements.

Our business is subject to seasonal influences, with a major portion of sales and income historically realized during the second half of the fiscal year, which includes the back-to-school and holiday seasons.

If we do not adequately stock or restock popular products, particularly during the back-to-school and holiday seasons, we may fail to meet customer demand, which could affect our revenue and our future growth. If we overstock products, we may be required to take significant inventory markdowns or write-offs, which could reduce profitability. Underestimating customer demand, or failing to timely receive merchandise to meet demand, can lead to inventory shortages and missed sales opportunities, as well as negative customer experiences.

We have and may continue to experience an increase in costs associated with shipping digital orders due to complimentary upgrades, split shipments, freight surcharges due to peak capacity constraints, and additional

11

long-zone shipments necessary to ensure timely delivery for the holiday season. If too many customers access our website within a short period of time, we may experience system interruptions that make our website unavailable or prevent us from efficiently fulfilling orders, which may reduce the volume of goods we sell and the attractiveness of our products and services. Also, third-party delivery and direct ship vendors may be unable to deliver merchandise on a timely basis.

This seasonality causes our operating results and cash needs to vary considerably from quarter to quarter. Additionally, any decrease in sales or profitability during the second half of the fiscal year could have a disproportionately adverse effect on our results of operations.

Changes in credit card operations could adversely affect our sales, revenues, and/or profitability.

Our credit card operations facilitate merchandise sales and generate additional revenue from fees related to extending credit. The private Kohl's credit card accounts are owned by an unrelated third-party, but we share in the net risk-adjusted revenue of the portfolio, which is defined as the sum of finance charges, late fees, and other revenue less write-offs of uncollectible accounts. Changes in funding costs related to interest rate fluctuations are shared similar to the revenue when interest rates exceed defined amounts. Though management currently believes that increases in funding costs will be largely offset by increases in finance charge revenue, increases in funding costs could adversely impact the profitability of this program.

Changes in credit card use and applications, payment patterns, credit fraud, and default rates may also result from a variety of economic, legal, social, and other factors that we cannot control or predict with certainty. Changes that adversely impact our ability to extend credit and collect payments could negatively affect our results.

We may be unable to attract, develop, and retain quality associates while controlling costs, which could adversely affect our operating results.

Our performance is dependent on attracting and retaining a large number of quality associates, including our senior management team and other key associates. Many associates are in entry-level or part-time positions with historically high rates of turnover. Many of our strategic initiatives require that we hire and/or develop associates with appropriate experience. Our staffing needs are especially high during the holiday season. Competition for these associates is intense. We cannot be sure that we will be able to attract and retain a sufficient number of qualified personnel in future periods.

Our ability to meet our labor needs while controlling costs is subject to external factors such as government benefits, unemployment levels and labor participation rates, prevailing wage rates, minimum wage legislation, actions by our competitors in compensation levels, potential labor organizing efforts, and changing demographics. Competitive and regulatory pressures have already significantly increased our labor costs. Further changes that adversely impact our ability to attract and retain quality associates could adversely affect our performance and/or profitability. In addition, changes in federal and state laws relating to employee benefits, including, but not limited to, sick time, paid time off, leave of absence, minimum wage, wage-and-hour, overtime, meal-and-break time, and joint/co-employment could cause us to incur additional costs, which could negatively impact our profitability.

Capital Risks

We may be unable to raise additional capital or maintain bank credit on favorable terms, which could adversely affect our business and financial condition.

We have historically relied on the public debt markets to raise capital to partially fund our operations and growth. We have also historically maintained lines of credit with financial institutions. In January 2023, we upsized our unsecured credit facility with a $1.5 billion senior secured, asset based revolving credit facility. Changes in the credit and capital markets, including market disruptions, limited liquidity, and interest rate fluctuations may increase the cost of financing

12

or restrict our access to these potential sources of future liquidity. Our continued access to these liquidity sources on favorable terms depends on multiple factors, including our operating performance and debt ratings. During 2022, our credit ratings were reduced below investment grade, which resulted in an increase in the interest rate on a portion of our long-term debt. Further downgrades would cause our cost of borrowing to further increase. Declines in our credit ratings may also adversely affect our ability to access the debt markets and the terms and our cost of funds for new debt issuances. If our credit ratings were to be further downgraded, or general market conditions were to ascribe higher risk to our credit rating levels, our industry, or our Company, our access to capital and the cost of debt financing may be negatively impacted. Additionally, if unfavorable capital market conditions exist if and when we were to seek additional financing, we may not be able to raise sufficient capital on favorable terms and on a timely basis (if at all). The terms of current and future debt agreements could restrict our business operations or cause future financing to be unavailable due to our covenant restrictions then in effect. Also, if we are unable to comply with the covenants under our revolving credit facility, the lenders under that agreement will have the right to terminate their commitments thereunder and declare the outstanding loans thereunder to be immediately due and payable. A default under our revolving credit facility could trigger a cross-default, acceleration, or other consequences under other indebtedness or financial instruments to which we are a party. If our access to capital was to become significantly constrained or our cost of capital was to increase significantly our financial condition, results of operations, and cash flows could be adversely affected.

Our capital allocation could be inefficient or ineffective.

Our goal is to invest capital to maximize our overall long-term returns. This includes spending on inventory, capital projects and expenses, managing debt levels, and periodically returning value to our shareholders through share repurchases and dividends. To a large degree, capital efficiency reflects how well we manage our other key risks. The actions taken to address other specific risks may affect how well we manage the more general risk of capital efficiency. If we do not properly allocate our capital to maximize returns, we may fail to produce optimal financial results, and we may experience a reduction in shareholder value.

Legal and Regulatory Risks

Regulatory and legal matters could adversely affect our business operations and change financial performance.

Various aspects of our operations are subject to federal, state, or local laws, rules, and regulations, any of which may change from time to time. The costs and other effects of new or changed legal requirements cannot be determined with certainty. For example, new legislation or regulations may result in increased costs directly for our compliance or indirectly to the extent such requirements increase prices of goods and services, reduce the availability of raw materials, or further restrict our ability to extend credit to our customers.

We continually monitor the state and federal legal and regulatory environments for developments that may impact us. Failure to detect changes and comply with such laws and regulations may result in an erosion of our reputation, disruption of business, and/or loss of associate morale. Additionally, we are regularly involved in various litigation matters that arise out of the conduct of our business. Litigation or regulatory developments could adversely affect our business operations and financial performance.

Our efforts to protect the privacy and security of sensitive or confidential customer, associate, or company information could be unsuccessful, which could severely damage our reputation, expose us to risks of litigation and liability, disrupt our operations, and harm our business.

As part of our normal course of business, we collect, retain, process, and transmit sensitive and confidential customer, associate, and company information. We also engage third-party vendors that provide technology, systems, and services to facilitate our collection, retention, processing, and transmission of this information. It is possible that our

13

facilities and systems and those of our third-party vendors are vulnerable to cybersecurity threats, security breaches, system failures, acts of vandalism, fraud, misappropriation, malware, ransomware, and other malicious or harmful code, misplaced or lost data, programming and/or human errors, insider threats, or other similar events. The ever-evolving and increasingly sophisticated methods of cyber-attack may be difficult or impossible to anticipate and/or detect. Any data security incident involving the breach, misappropriation, loss, or other unauthorized disclosure of sensitive and/or confidential information, whether by us or our vendors, could disrupt our operations, damage our reputation and customers' willingness to shop in our stores or on our website, violate applicable laws, regulations, orders and agreements, and subject us to additional costs and liabilities which could be material. In addition, the regulatory environment related to data privacy and cybersecurity is constantly changing, with new and increasingly demanding requirements applicable to our business. Maintaining our compliance with those requirements, including recently enacted state consumer privacy laws, may increase our compliance costs, require changes to our business practices, limit our ability to use and collect data, impact our customers’ shopping experience, reduce our business efficiency, and subject us to additional regulatory scrutiny or data breach litigation.

Item 1B. Unresolved Staff Comments

Not applicable.

Item 2. Properties

Stores

As of January 28, 2023, we operated 1,170 Kohl's stores with 82 million selling square feet in 49 states. Our typical store lease has an initial term of 20-25 years and four to eight five-year renewal options. Substantially all of our leases provide for a minimum annual rent that is fixed or adjusts to set levels during the lease term, including renewals. Some of our store leases provide for additional rent based on a percentage of sales over designated levels.

The following tables summarize key information about our Kohl's stores as of January 28, 2023:

Number of Stores by State |

|||||

Mid-Atlantic Region: |

Northeast Region: |

South Central Region: |

|||

Delaware |

5 |

Connecticut |

20 |

Arkansas |

8 |

Maryland |

23 |

Maine |

5 |

Kansas |

11 |

Pennsylvania |

51 |

Massachusetts |

26 |

Louisiana |

7 |

Virginia |

31 |

New Hampshire |

11 |

Missouri |

27 |

West Virginia |

8 |

New Jersey |

38 |

Oklahoma |

11 |

|

|

New York |

50 |

Texas |

87 |

|

|

Rhode Island |

4 |

|

|

|

|

Vermont |

2 |

|

|

Total Mid-Atlantic |

118 |

Total Northeast |

156 |

Total South Central |

151 |

|

|

|

|

|

|

Midwest Region: |

Southeast Region: |

West Region: |

|||

Illinois |

66 |

Alabama |

14 |

Alaska |

1 |

Indiana |

41 |

Florida |

51 |

Arizona |

26 |

Iowa |

18 |

Georgia |

33 |

California |

117 |

Michigan |

46 |

Kentucky |

18 |

Colorado |

24 |

Minnesota |

28 |

Mississippi |

5 |

Idaho |

6 |

Nebraska |

8 |

North Carolina |

31 |

Montana |

3 |

North Dakota |

4 |

South Carolina |

17 |

Nevada |

13 |

Ohio |

59 |

Tennessee |

20 |

New Mexico |

5 |

South Dakota |

4 |

|

|

Oregon |

11 |

Wisconsin |

41 |

|

|

Utah |

12 |

|

|

|

|

Washington |

21 |

|

|

|

|

Wyoming |

2 |

Total Midwest |

315 |

Total Southeast |

189 |

Total West |

241 |

14

Location |

|

Ownership |

||

Strip centers |

947 |

|

Owned |

409 |

Freestanding |

160 |

|

Leased |

518 |

Community & regional malls |

63 |

|

Ground leased |

243 |

Distribution Centers

The following table summarizes key information about each of our distribution and e-fulfillment centers:

|

Year |

Square |

Store distribution centers: |

|

|

Findlay, Ohio |

1994 |

780,000 |

Winchester, Virginia |

1997 |

450,000 |

Blue Springs, Missouri |

1999 |

540,000 |

Corsicana, Texas |

2001 |

540,000 |

Mamakating, New York |

2002 |

605,000 |

San Bernardino, California |

2002 |

575,000 |

Macon, Georgia |

2005 |

560,000 |

Patterson, California |

2006 |

365,000 |

Ottawa, Illinois |

2008 |

330,000 |

E-commerce fulfillment centers: |

|

|

Monroe, Ohio |

2001 |

1,225,000 |

San Bernardino, California |

2010 |

970,000 |

Edgewood, Maryland |

2011 |

1,450,000 |

DeSoto, Texas |

2012 |

1,515,000 |

Plainfield, Indiana |

2017 |

975,000 |

Etna, Ohio |

2021 |

1,300,000 |

We own all of the distribution and e-fulfillment centers except the San Bernardino, California locations and Corsicana, Texas, which are leased.

Corporate Facilities

We own our corporate headquarters in Menomonee Falls, Wisconsin. We also own or lease additional buildings and office space, which are used by various corporate departments, including our credit operations.

Item 3. Legal Proceedings

For a description of our legal proceedings, see Note 7, Contingencies, of the notes to our consolidated financial statements included elsewhere in this Annual Report on Form 10-K, which is incorporated by reference in response to this item.

Item 4. Mine Safety Disclosures

Not applicable.

15

Item 4A. Information about Our Executive Officers

Our executive officers as of March 5, 2023 were as follows:

Name |

Age |

Position |

Thomas A. Kingsbury |

70 |

Chief Executive Officer |

Jill Timm |

49 |

Chief Financial Officer |

Marc Chini |

65 |

Senior Executive Vice President, Chief People Officer |

Jennifer Kent |

51 |

Senior Executive Vice President, Chief Legal Officer and Corporate Secretary |

Siobhán Mc Feeney |

51 |

Senior Executive Vice President, Chief Technology Officer |

Christie Raymond |

53 |

Senior Executive Vice President, Chief Marketing Officer |

Thomas A. Kingsbury

Mr. Kingsbury has served as our Chief Executive Officer since February 2023 and previously served as our Interim CEO from December 2022 through January 2023 and as a director since May 2021. Mr. Kingsbury has more than 40 years of experience in the retail industry. Prior to joining the Company in December 2022, he held a variety of company and board leadership roles at Kohl’s, Burlington Stores, Inc., and The May Department Stores Company. He led Burlington Stores, Inc. as President and Chief Executive Officer from 2008 to 2019 and served on the Burlington Stores Board of Directors from 2008 to 2020, including as Chairman from 2014 to 2019 and as Executive Chairman from 2019 to 2020.

Jill Timm

Ms. Timm has served as Chief Financial Officer since November 2019. Ms. Timm joined the Company in 1999 and has held a number of progressive leadership roles across several areas of finance, most recently having served as Executive Vice President of Finance. Prior to joining the Company, she served as senior auditor at Arthur Andersen LLP. Ms. Timm has more than 20 years of experience in the retail industry.

Marc Chini

Mr. Chini has served as Senior Executive Vice President, Chief People Officer since November 2018. Prior to joining the Company, Mr. Chini served as Chief Human Resource Officer of Synchrony Financial where he built the newly public company’s human resources strategy and function. Mr. Chini has also held a variety of Chief Human Resources Officer roles across multiple GE business units including NBC Universal, GE Aviation & Locomotive, and GE Industrial Solutions. Mr. Chini has more than 25 years of human resources experience.

Jennifer Kent

Ms. Kent has served as Senior Executive Vice President, Chief Legal Officer and Corporate Secretary since February 2023. Prior to joining the Company, Ms. Kent served in various legal leadership roles at Quad/Graphics, Inc., a publicly traded Milwaukee-based company, since 2010, most recently having served as its Executive Vice President and Chief People & Legal Officer and Corporate Secretary since 2015. Ms. Kent also held a variety of other legal roles throughout her career, including as an Associate General Counsel at Harley-Davidson Motor Company, an Assistant United States Attorney at the U.S. Attorney’s Office, and as an associate at Foley & Lardner LLP. Ms. Kent has over 25 years of legal experience.

Siobhán Mc Feeney

Ms. Mc Feeney has served as Senior Executive Vice President, Chief Technology Officer since July 2022. She joined the Company in January 2020 as Senior Vice President, Technology. Prior to joining the Company, Ms. Mc Feeney served in a number of technology leadership roles, including leading innovation and strategy at Pivotal Software, Inc. where she focused on enabling large clients to develop new ways of working. Ms. Mc Feeney has also held various

16

leadership roles at AAA Northern California, including Chief Financial Officer, Chief Information Officer, and Interim Chief Executive Officer. Ms. Mc Feeney has more than 25 years of technology and finance experience.

Christie Raymond

Ms. Raymond has served as Senior Executive Vice President, Chief Marketing Officer since August 2022. She joined the Company in October 2017 as Senior Vice President, Media and Personalization and was promoted to Executive Vice President, Customer Engagement, Analytics & Insights in June 2020. Prior to joining the Company, she served in marketing, new business, and strategic planning leadership roles at The Walt Disney Company and Aspen Club Technologies. Ms. Raymond has nearly 15 years of marketing and retail industry experience.

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters, and Issuer Purchases of Equity Securities

Market information

Our Common Stock has been traded on the New York Stock Exchange ("NYSE") since May 19, 1992, under the symbol “KSS.”

Holders

As of March 8, 2023, there were approximately 3,300 record holders of our Common Stock.

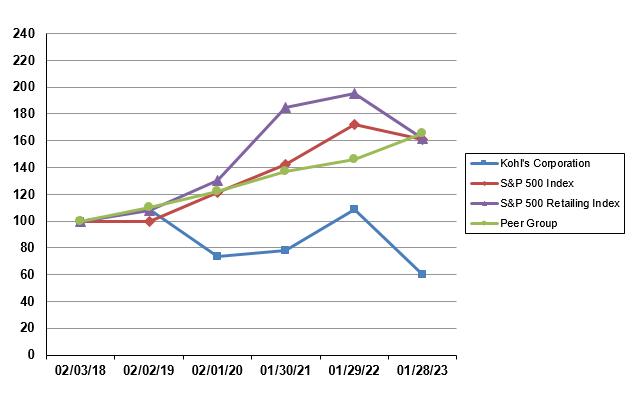

Performance Graph

The graph below compares our cumulative five-year shareholder return to that of the Standard & Poor’s (“S&P”) 500 Index, the S&P 500 Retailing Index, and the Peer Group Index. The S&P 500 Retailing Index was calculated by S&P Global, a Standard & Poor’s business and includes companies within the S&P Retailing Index. The S&P 500 Retailing Index is weighted by the market capitalization of each component company at the beginning of each period. The graph assumes an investment of $100 on February 3, 2018 and reinvestment of dividends. The calculations exclude trading commissions and taxes.

17

Company / Index |

Feb 3, |

Feb 2, |

Feb 1, |

Jan 30, |

Jan 29, |

Jan 28, |

Kohl’s Corporation |

$100.00 |

$108.79 |

$73.34 |

$78.39 |

$108.98 |

$60.28 |

S&P 500 Index |

100.00 |

99.94 |

121.49 |

142.45 |

172.36 |

160.94 |

S&P 500 Retailing Index |

100.00 |

108.22 |

130.53 |

184.54 |

195.42 |

161.84 |

Peer Group Index |

100.00 |

110.16 |

122.23 |

137.23 |

146.12 |

165.47 |

The companies included in the Peer Group are: Bed Bath & Beyond, Inc.; Best Buy Co., Inc.; Burlington Stores, Inc.; DICK'S Sporting Goods, Inc.; Dollar Tree, Inc.; Foot Locker, Inc.; The Gap, Inc.; Macy’s, Inc.; Nordstrom, Inc.; Ross Stores, Inc.; The TJX Companies, Inc.; and Ulta Beauty, Inc. The Peer group is being replaced with the S&P 500 retailing index going forward as the S&P retailing index provides a relevant comparison against which to measure our stock performance due to the broader group of participants.

Recent Sales of Unregistered Securities; Use of Proceeds from Registered Securities

We did not sell any equity securities in fiscal year 2022 that were not registered under the Securities Act.

Purchases of Equity Securities by the Issuer and Affiliated Purchasers

In February 2022, our Board of Directors increased the remaining share repurchase authorization under our existing share repurchase program to $3.0 billion. Purchases under the repurchase program may be made in the open market, through block trades, and other negotiated transactions. We expect to execute the share repurchase program primarily in open market transactions, subject to market conditions. There is no fixed termination date for the repurchase program, and the program may be suspended, discontinued, or accelerated at any time.

18

The following table contains information for shares repurchased and shares acquired from employees in lieu of amounts required to satisfy minimum tax withholding requirements upon the vesting of the employees’ restricted stock during the three fiscal months ended January 28, 2023:

Period(1) |

Total |

Average |

Total Number |

Approximate |

October 30 - November 26, 2022 |

6,140,576 |

$16.29 |

6,139,693 |

$2,476 |

November 27 – December 31, 2022 |

7,712 |

27.19 |

— |

2,476 |

January 1 - January 28, 2023 |

962 |

28.98 |

— |

2,476 |

Total |

6,149,250 |

$16.31 |

6,139,693 |

|

1) During the third quarter of 2022 we entered into a $500 million accelerated share repurchase agreement ("ASR") and received an initial delivery of 11.8 million shares, representing 80% of the total shares that were expected to be repurchased under the ASR. Final settlement occurred during the fourth quarter of 2022 with an additional 6.1 million shares of common stock being delivered. The ASR was part of the $3.0 billion share repurchase program authorized by our Board of Directors in February 2022.

Item 6. Reserved

19

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Executive Summary

Kohl's is a leading omnichannel retailer operating 1,170 stores and a website (www.Kohls.com) as of January 28, 2023. Our Kohl's stores and website sell moderately-priced private and national brand apparel, footwear, accessories, beauty, and home products. Our Kohl's stores generally carry a consistent merchandise assortment with some differences attributable to local preferences, store size, and Sephora. Our website includes merchandise which is available in our stores, as well as merchandise that is available only online.

Key financial results for 2022 as compared to 2021 include:

Our Strategy

Kohl's strategy is focused on delivering long-term shareholder value through driving improved sales and profitability. Key strategic focus areas for the Company include: driving top line growth, delivering a long-term operating margin of 7% to 8%, maintaining disciplined capital management, and sustaining an agile, accountable, and inclusive culture. In the context of these strategic focus areas, the Company outlined the following priorities for 2023: enhancing the customer experience, accelerating and simplifying its value strategies, managing inventory and expenses with discipline, and strengthening the balance sheet.

Financial and Capital Outlook

For fiscal year 2023, the Company currently expects the following:

Results of Operations

For our comparison and discussion of 2021 and 2020, see Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations in Part II of our 2021 Form 10-K.

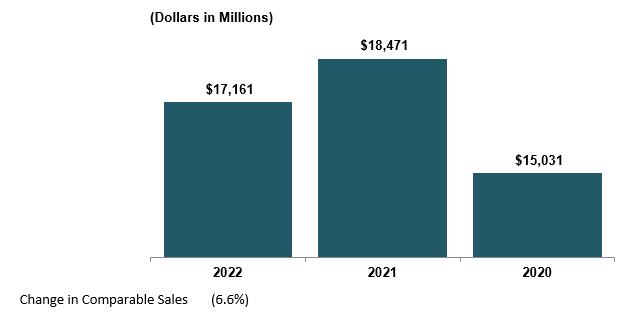

Net Sales

Net sales includes revenue from the sale of merchandise, net of expected returns, and shipping revenue.

20

Comparable sales is a measure that highlights the performance of our stores and digital channel by measuring the change in sales for a period over the comparable, prior-year period of equivalent length. Comparable sales includes all store and digital sales, except sales from stores open less than 12 months, stores that have been closed, and stores that have been relocated where square footage has changed by more than 10%. We measure the change in digital sales by including all sales initiated online or through mobile applications, including omnichannel transactions which are fulfilled through our stores.

We measure digital penetration as digital sales over net sales. These amounts do not take into consideration fulfillment node, digital returns processed in stores, and coupon behaviors.

Comparable sales and digital penetration measures vary across the retail industry. As a result, our comparable sales calculation and digital penetration are non-GAAP measures that may not be consistent with the similarly titled measures reported by other companies.

The following graph summarizes net sales dollars and comparable sales over the prior year. As our stores were closed for a period during 2020, we have not included a discussion of 2020 or 2021 comparable sales as we do not believe it is a meaningful metric over this period of time.

2022 compared to 2021

Net sales decreased $1.3 billion, or (7.1%), to $17.2 billion for 2022.

Other Revenue

Other revenue includes revenue from credit card operations, third-party advertising on our website, unused gift cards and merchandise return cards (breakage), and other non-merchandise revenue.

21

The following graph summarizes other revenue:

Other revenue decreased $25 million in 2022. The decrease in 2022 was driven by a decrease in credit revenue due to lower overall accounts receivable balances and a normalizing loss rate.

On March 14, 2022, we amended and restated our private label credit card program agreement with Capital One. The agreement ends on March 31, 2030. The agreement will operate in substantially the same manner as it currently operates, and with planned modernization of technology and processes.

Cost of Merchandise Sold and Gross Margin

Cost of merchandise sold includes the total cost of products sold, including product development costs, net of vendor payments other than reimbursement of specific, incremental, and identifiable costs; inventory shrink; markdowns; freight expenses associated with moving merchandise from our vendors to our distribution centers; shipping expenses for digital sales; and terms cash discount. Our cost of merchandise sold may not be comparable with that of other retailers because we include distribution center and buying costs in selling, general, and administrative (SG&A) expenses while other retailers may include these expenses in cost of merchandise sold.

The following graph summarizes cost of merchandise sold and gross margin as a percent of net sales:

Gross margin is calculated as net sales less cost of merchandise sold. Gross margin as a percent of net sales decreased 485 basis points in 2022 compared to 2021. The decrease in gross margin was driven by increased permanent markdowns taken to address inventory levels, elevated freight, and headwinds from product cost inflation and higher shrink.

22

We expect gross margin to stabilize in 2023 and to be in the 36.0% to 36.5% range. We expect the promotional environment to remain competitive, but expect progressive benefits as freight and product cost inflation moderate in the second half of the year.

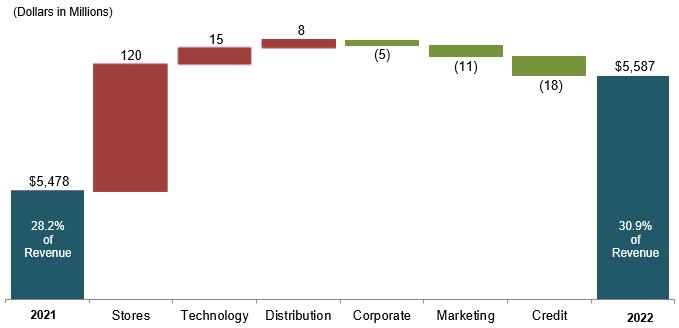

Selling, General, and Administrative Expenses

SG&A includes compensation and benefit costs (including stores, corporate, buying, and distribution centers); occupancy and operating costs of our retail, distribution, and corporate facilities; freight expenses associated with moving merchandise from our distribution centers to our retail stores and among distribution and retail facilities other than expenses to fulfill digital sales; marketing expenses, offset by vendor payments for reimbursement of specific, incremental, and identifiable costs; expenses related to our credit card operations; and other administrative revenues and expenses. We do not include depreciation and amortization in SG&A. The classification of these expenses varies across the retail industry.

Many of our expenses, including store payroll and distribution costs, are variable in nature. These costs generally increase as sales increase, and decrease as sales decrease. We measure both the change in these variable expenses and the expense as a percent of revenue. If the expense as a percent of revenue decreased from the prior year, the expense "leveraged". If the expense as a percent of revenue increased over the prior year, the expense "deleveraged".

The following graph summarizes the changes in SG&A by expense type between 2021 and 2022:

SG&A increased $109 million, or 2.0%, to $5.6 billion for 2022. As a percentage of revenue, SG&A deleveraged by (268) basis points.

The increase was primarily driven by an increase in stores as we made strategic investments in our stores to support the approximately 400 Sephora shop-in-shop openings this year compared to the 200 openings last year as well as increased wages. Technology was driven by higher investment in new technology initiatives. Distribution costs, which exclude payroll related to online originated orders that were shipped from our stores, were $457 million for 2022 compared to $449 million for 2021. Partially offsetting the increases were savings across our credit, marketing, and corporate areas.

23

In 2023, SG&A dollars are expected to deleverage slightly, with wage inflation continuing to be a headwind, offset by benefits from a more efficient organization structure, and fewer Sephora openings in 2023.

Other Expenses

(Dollars in Millions) |

2022 |

2021 |

2020 |

Depreciation and amortization |

$808 |

$838 |

$874 |

Impairments, store closing, and other costs |

— |

— |

89 |

(Gain) on the sale of real estate |

— |

— |

(127) |

Interest expense, net |

304 |

260 |

284 |

Loss on extinguishment of debt |

— |

201 |

— |

Depreciation and amortization decreased in 2022, driven by reduced capital spending in technology.

Net interest expense increased in 2022 compared to 2021 due to more financing leases as well as borrowings under the revolving credit facility. This was partially offset by less interest expense in the first quarter of 2022 due to the debt reductions in 2021.

In 2021, we completed a cash tender offer and recognized a loss of $201 million from the extinguishment of debt.

Income Taxes

(Dollars in Millions) |

2022 |

2021 |

2020 |

(Benefit) provision for income taxes |

$(39) |

$281 |

$(383) |

Effective tax rate |

68.1% |

23.1% |

70.2% |

The effective tax rate for 2022 was higher than the effective tax rate for 2021 because of the impact of favorable results from uncertain tax positions as well as federal tax credits relative to consolidated book net income (loss).

GAAP to Non-GAAP Reconciliation

(Dollars in Millions, Except per Share Data) |

Operating Income (Loss) |

(Loss) Income before Income Taxes |

Net (Loss) Income |

(Loss) Earnings per Diluted Share |

2022 |

|

|

|

|

GAAP |

$246 |

$(58) |

$(19) |

$(0.15) |

Loss on extinguishment of debt |

— |

— |

— |

— |

Impairments, store closing, and other costs |

— |

— |

— |

— |

(Gain) on sale of real estate |

— |

— |

— |

— |

Income tax impact of items noted above |

— |

— |

— |

— |

Adjusted (non-GAAP)(1) |

$246 |

$(58) |

$(19) |

$(0.15) |

2021 |

|

|

|

|

GAAP |

$1,680 |

$1,219 |

$938 |

$6.32 |

Loss on extinguishment of debt |

— |

201 |

201 |

1.35 |

Impairments, store closing, and other costs |

— |

— |

— |

— |

(Gain) on sale of real estate |

— |

— |

— |

— |

Income tax impact of items noted above |

— |

— |

(50) |

(0.34) |

Adjusted (non-GAAP) |

$1,680 |

$1,420 |

$1,089 |

$7.33 |

2020 |

|

|

|

|

GAAP |

$(262) |

$(546) |

$(163) |

$(1.06) |

Loss on extinguishment of debt |

— |

— |

— |

— |

Impairments, store closing, and other costs |

89 |

89 |

89 |

0.58 |

(Gain) on sale of real estate |

(127) |

(127) |

(127) |

(0.82) |

Income tax impact of items noted above |

— |

— |

15 |

0.09 |

Adjusted (non-GAAP) |

$(300) |

$(584) |

$(186) |

$(1.21) |

(1) Amounts shown for 2022 are GAAP as there are no adjustments to Non-GAAP. These amounts are shown for comparability purposes.

24

We believe the adjusted results in the GAAP to Non-GAAP table are useful because they provide enhanced visibility into our results for the periods excluding the impact of certain items such as those included in the table. However, these non-GAAP financial measures are not intended to replace the comparable GAAP measures.

Inflation

We expect that our operations will continue to be influenced by general economic conditions, including food, fuel, and energy prices, higher unemployment, wage inflation, and costs to source our merchandise, including tariffs. There can be no assurances that such factors will not impact our business in the future.

Liquidity and Capital Resources

Capital Allocation

Our capital allocation strategy is to invest to maximize our overall long-term return, maintain a strong balance sheet, and achieve an investment grade rating. We follow a disciplined approach to capital allocation based on the following priorities: first we invest in our business to drive long-term profitable growth; second we pay a quarterly dividend; and third we return excess cash to shareholders through our share repurchase program. In addition, when appropriate, we will complete debt reduction transactions.

We are committed to rebuilding our cash balances and reducing leverage to our long term target of 2.5 times utilizing an eight times cash rent calculation for lease obligations. We will continue to invest in the business, as we plan to invest $600 to $650 million in 2023, including the expansion of the Sephora arrangement and store refresh activity, and we remain committed to the dividend. On February 21, 2023, our Board of Directors of Kohl's Corporation declared a quarterly cash dividend of $0.50 per share. The dividend will be paid on March 29, 2023 to all shareholders of record at the close of business on March 15, 2023. We replaced and upsized the revolver in January 2023 to enhance our liquidity and flexibility and will utilize it to fund working capital as well as retire bonds as they become due, with the goal of reducing the debt portfolio. We retired the $164 million of notes due in February 2023, and plan on retiring the $111 million of notes due December 2023 when they mature. We are not planning any share repurchases until our balance sheet is strengthened on a path towards the long term target leverage ratio of 2.5 times.

Our period-end cash and cash equivalents balance decreased to $153 million from $1.6 billion in 2021. Our cash and cash equivalents balance includes short-term investments of $10 million and $1.5 billion as of January 28, 2023, and January 29, 2022, respectively. Our investment policy is designed to preserve principal and liquidity of our short-term investments. This policy allows investments in large money market funds or in highly rated direct short-term instruments. We also place dollar limits on our investments in individual funds or instruments.

The following table presents our primary uses and sources of cash:

Cash Uses |

Cash Sources |

• Operational needs, including salaries, rent, taxes, and other operating costs

• Inventory

• Capital expenditures

• Dividend payments

• Share repurchases

• Debt reduction |

• Cash flow from operations

• Line of credit under our revolving credit facility

• Issuance of debt

|

25

The following table includes cash balances and changes:

(Dollars in Millions) |

2022 |

2021 |

2020 |

Cash and cash equivalents |

$153 |

$1,587 |

$2,271 |

Net cash provided by (used in): |

|

|

|

Operating activities |

$282 |

$2,271 |

$1,338 |

Investing activities |

(783) |

(570) |

(137) |

Financing activities |

(933) |

(2,385) |

347 |

Free cash flow (a) |

$(639) |

$1,556 |

$908 |

Operating Activities

Our operating cash outflows generally consist of payments to our employees for wages, salaries and other employee benefits, payments to our merchandise vendors for inventory (net of vendor allowances), payments to our shipping carriers, and payments to our landlords for rent. Operating cash outflows also include payments for income taxes and interest payments on our debt borrowings.

Operating activities generated cash of $282 million in 2022 compared to $2.3 billion in 2021. Operating cash flow decreased primarily due to lower net income and a decrease in accounts payable due to late arriving receipts in 2021. Additionally in 2021 we received a tax refund related to the net loss we incurred in 2020 and the carryback provision under the Coronavirus Aid, Relief, and Economic Security ("CARES") Act.

Investing Activities

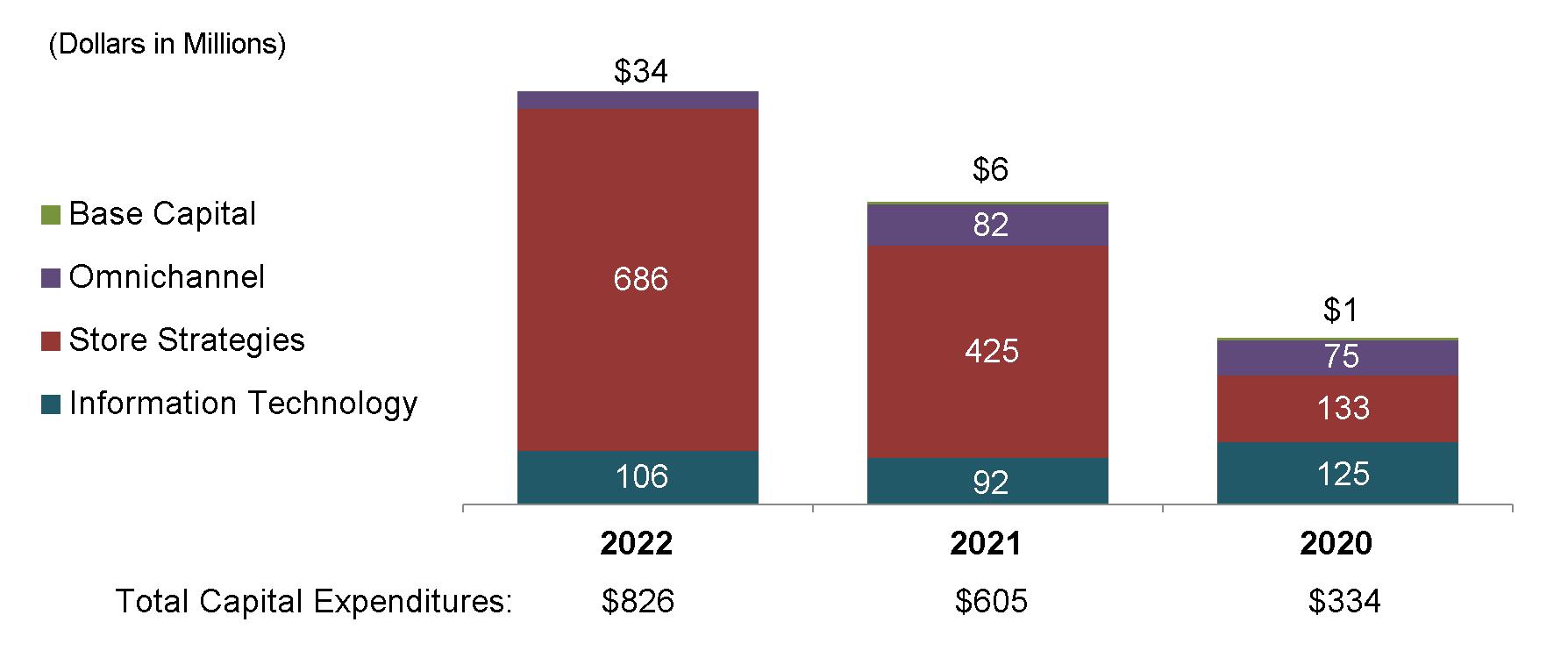

Our investing cash outflows include payments for capital expenditures, including investments in new and existing stores, improvements to supply chain, and technology costs. Our investing cash inflows are generally from proceeds from sales of property and equipment.