10-K

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

| |

ý | Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

| For the fiscal year ended January 30, 2016 |

or

|

| |

¨ | Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

| For the Transition period from ____________ to ___________ |

Commission file number 1-11084

KOHL’S CORPORATION

(Exact name of registrant as specified in its charter)

|

| | |

Wisconsin | | 39-1630919 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | |

N56 W17000 Ridgewood Drive, Menomonee Falls, Wisconsin | | 53051 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code (262) 703-7000

Securities registered pursuant to Section 12(b) of the Act: |

| | |

Title of each class | | Name of each exchange on which registered |

Common Stock, $.01 Par Value | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: | | None |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes X No .

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes No X .

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes X No .

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulations S-T (232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes X No .

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. X .

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer X Accelerated filer Non-accelerated filer (Do not check if a smaller reporting company) Smaller reporting company

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes No X .

At July 31, 2015, the aggregate market value of the voting stock of the Registrant held by stockholders who were not affiliates of the Registrant was approximately $12.0 billion (based upon the closing price of Registrant’s Common Stock on the New York Stock Exchange on such date). At March 9, 2016, the Registrant had outstanding an aggregate of 185,168,909 shares of its Common Stock.

Documents Incorporated by Reference:

Portions of the Proxy Statement for the Registrant’s Annual Meeting of Shareholders to be held on May 11, 2016 are incorporated into Parts II and III.

KOHL’S CORPORATION

INDEX

|

| | |

| | |

| |

Item 1. | | |

Item 1A. | | |

Item 1B. | | |

Item 2. | | |

Item 3. | | |

Item 4. | | |

| |

| |

Item 5. | | |

Item 6. | | |

Item 7. | | |

Item 7A. | | |

Item 8. | | |

Item 9. | | |

Item 9A. | | |

Item 9B. | | |

| |

| |

Item 10. | | |

Item 11. | | |

Item 12. | | |

Item 13. | | |

Item 14. | | |

| |

| |

Item 15. | | |

| | |

| | |

| | F-1 |

PART I

Item 1. Business

Kohl’s Corporation (the “Company” or “Kohl’s”) was organized in 1988 and is a Wisconsin corporation. As of January 30, 2016, we operated 1,164 department stores in 49 states and an E-Commerce website (www.Kohls.com). We sell moderately-priced private label, exclusive and national brand apparel, footwear, accessories, beauty and home products. Our stores generally carry consistent merchandise with assortment differences attributable to local preferences. Our website includes merchandise which is available in our stores, as well as merchandise which is available only on-line.

Our merchandise mix includes both national brands and private and exclusive brands which are available only at Kohl's. National brands generally have higher selling prices, but lower gross margins, than private and exclusive brands. Most of our private brands are well-known established brands such as Apt. 9, Croft & Barrow, Jumping Beans, SO and Sonoma Goods for Life. Despite having lower selling prices, private brands generally have higher gross margins than exclusive and national brands. Exclusive brands are developed and marketed through agreements with nationally-recognized brands. Examples of our exclusive brands include Food Network, Jennifer Lopez, Marc Anthony, Rock & Republic and Simply Vera Vera Wang. Exclusive brands have selling prices which are generally lower than national brands, but higher than private brands. Their gross margins are generally higher than national brands, but lower than private brands.

|

| |

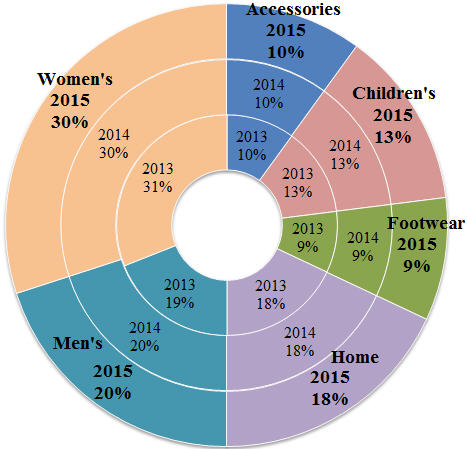

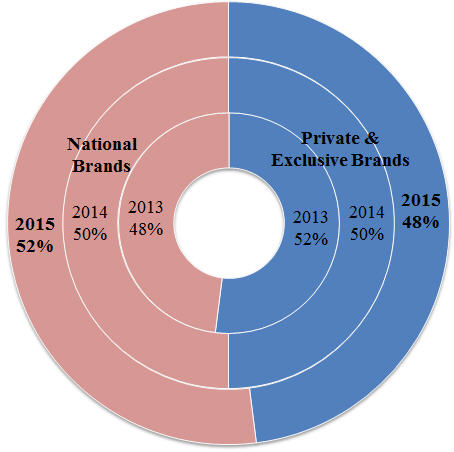

As reflected in the chart below, our merchandise mix by line of business has remained generally consistent over the last three years. | As reflected in the chart below, we have increased our emphasis on national brands in recent years as we believe they drive customer traffic. |

Our fiscal year ends on the Saturday closest to January 31st each year. Unless otherwise stated, references to years in this report relate to fiscal years rather than to calendar years. The following fiscal periods are presented in this report.

|

| | | |

Fiscal Year | Ended | | Number of Weeks |

2015 | January 30, 2016 | | 52 |

2014 | January 31, 2015 | | 52 |

2013 | February 1, 2014 | | 52 |

For discussion of our financial results, see Item 7, "Management's Discussion and Analysis of Financial Condition and Results of Operations."

Distribution

We receive substantially all of our store merchandise at our nine retail distribution centers. A small amount of our merchandise is delivered directly to the stores by vendors or their distributors. The retail distribution centers, which are strategically located throughout the United States, ship merchandise to each store by contract carrier several times a week. On-line sales may be picked up in our stores or are shipped from a Kohl’s fulfillment center, retail distribution center or store; by a third-party fulfillment center; or directly by a third-party vendor.

See Item 2, “Properties,” for additional information about our distribution centers.

Employees

As of January 30, 2016, we employed approximately 140,000 associates, including approximately 32,000 full-time and 108,000 part-time associates. The number of associates varies during the year, peaking during the back-to-school and holiday seasons. None of our associates are represented by a collective bargaining unit. We believe our relations with our associates are very good.

Competition

The retail industry is highly competitive. Management considers style, quality and price to be the most significant competitive factors in the industry. Merchandise mix, brands, service, loyalty programs, credit availability, and customer experience and convenience are also key competitive factors. Our primary competitors are traditional department stores, upscale mass merchandisers, off-price retailers, specialty stores, internet and catalog businesses and other forms of retail commerce. Our specific competitors vary from market to market.

Merchandise Vendors

We purchase merchandise from numerous domestic and foreign suppliers. All business partners must meet certain requirements in order to do business with us. These Terms of Engagement include provisions regarding laws and regulations, employment practices, ethical standards, environmental and legal requirements, communication, monitoring/compliance, record keeping, subcontracting and corrective action. Our expectation is that all business partners will comply with these Terms of Engagement and quickly remediate any deficiencies, if noted, in order to maintain our business relationship.

Approximately 30% of the merchandise we sell is sourced through a third-party purchasing agent. None of our vendors individually accounted for more than 5% of our net purchases during 2015. We have no significant long-term purchase commitments or arrangements with any of our suppliers, and believe that we are not dependent on any one supplier. We believe we have good working relationships with our suppliers.

Seasonality

Our business, like that of most retailers, is subject to seasonal influences. The majority of our sales and income are typically realized during the second half of each fiscal year. The back-to-school season extends from August through September and represents approximately 15% of our annual sales. Approximately 30% of our annual sales occur during the holiday season in the months of November and December. Because of the seasonality of our business, results for any quarter are not necessarily indicative of the results that may be achieved for the fiscal year.

Trademarks and Service Marks

The name “Kohl’s” is a registered service mark of one of our wholly-owned subsidiaries. We consider this mark and the accompanying name recognition to be valuable to our business. This subsidiary has over 190 additional registered trademarks, trade names and service marks, most of which are used in connection with our private label program.

Available Information

Our corporate website is www.KohlsCorporation.com. Through the “Investors” portion of this website, we make available, free of charge, our proxy statements, Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, SEC Forms 3, 4 and 5 and any amendments to those reports as soon as reasonably practicable after such material has been filed with, or furnished to, the Securities and Exchange Commission (“SEC”).

The following have also been posted on our website, under the caption “Investors”:

| |

• | Committee charters of our Board of Directors’ Audit Committee, Compensation Committee and Governance & Nominating Committee |

| |

• | Corporate Governance Guidelines |

Our Corporate Social Responsibility report can be found on our corporate website under the caption "Corporate Responsibility" and sub-heading "Sustainability".

Any amendment to or waiver from the provisions of the Code of Ethics that is applicable to our Chief Executive Officer, Chief Financial Officer or other key finance associates will be disclosed on the “Corporate Governance” portion of the website.

Information contained on our website is not part of this Annual Report on Form 10-K. Paper copies of any of the materials listed above will be provided without charge to any shareholder submitting a written request to our Investor Relations Department at N56 W17000 Ridgewood Drive, Menomonee Falls, Wisconsin 53051 or via e-mail to Investor.Relations@Kohls.com.

Item 1A. Risk Factors

Forward-Looking Statements

This Form 10-K contains “forward-looking statements” made within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as "believes," "anticipates," "plans," "may," "intends," "will," "should," "expects" and similar expressions are intended to identify forward-looking statements. Forward-looking statements also include comments about our future sales or financial performance and our plans, performance and other objectives, expectations or intentions, such as statements regarding our liquidity, debt service requirements, planned capital expenditures, future store initiatives, adequacy of capital resources and reserves and statements contained in the "2016 Outlook" section of "Management's Discussion and Analysis of Financial Condition and Results of Operations". There are a number of important factors that could cause our results to differ materially from those indicated by the forward-looking statements including, among others, those risk factors described below. Forward-looking statements relate to the date made, and we undertake no obligation to update them.

Our sales, gross margin and operating results could be negatively impacted by a number of factors including, but not limited to those described below. Many of these risk factors are outside of our control. If we are not successful in managing these risks, they could have a negative impact on our sales, gross margin and/or operating results.

•Declines in general economic conditions, consumer spending levels and other conditions could lead to reduced consumer demand for our merchandise.

Consumer spending habits, including spending for the merchandise that we sell, are affected by many factors including prevailing economic conditions, levels of employment, salaries and wage rates, prevailing interest rates, housing costs, energy and fuel costs, income tax rates and policies, consumer confidence, consumer perception of economic conditions, and the consumer’s disposable income, credit availability and debt levels. The moderate income consumer, which is our core customer, is especially sensitive to these factors. A continued or incremental slowdown in the U.S. economy and the uncertain economic outlook could continue to adversely affect consumer spending habits. As all of our stores are located in the United States, we are especially susceptible to deteriorations in the U.S. economy.

Consumer confidence is also affected by the domestic and international political situation. The outbreak or escalation of war, or the occurrence of terrorist acts or other hostilities in or affecting the United States, could lead to a decrease in spending by consumers.

•Actions by our competitors.

The retail industry is highly competitive. We compete for customers, associates, locations, merchandise, services and other important aspects of our business with many other local, regional and national retailers. Those competitors include traditional department stores, upscale mass merchandisers, off-price retailers, specialty stores, internet and catalog businesses and other forms of retail commerce.

We consider style, quality and price to be the most significant competitive factors in our industry. The continuing migration and evolution of retailing to on-line and mobile channels has increased our challenges in differentiating ourselves from other retailers especially as it relates to national brands. In particular, consumers are able to quickly and conveniently comparison shop with digital tools, which can lead to decisions based solely on price. Unanticipated changes in the pricing and other practices of our competitors may adversely affect our performance.

•Our inability to offer merchandise that resonates with existing customers and helps to attract new customers and failure to successfully manage our inventory levels.

Our business is dependent on our ability to anticipate fluctuations in consumer demand for a wide variety of merchandise. Failure to accurately predict constantly changing consumer tastes, preferences, spending patterns and other lifestyle decisions could create inventory imbalances and adversely affect our performance and long-term relationships with our customers. Additionally, failure to accurately predict changing consumer tastes may result in excess inventory, which could result in additional markdowns and adversely affect our operating results.

•We may be unable to source merchandise in a timely and cost-effective manner.

Approximately 30% of the merchandise we sell is sourced through a third-party purchasing agent. The remaining merchandise is sourced from a wide variety of domestic and international vendors. Our ability to find qualified vendors and access products in a timely and efficient manner is a significant challenge which is typically even more difficult for goods sourced outside the United States, substantially all of which is shipped by ocean to ports in the United States. Political or financial instability, trade restrictions, tariffs, currency exchange rates, transport capacity and costs, work stoppages, port strikes, port congestion and delays and other factors relating to foreign trade are beyond our control and could adversely impact our performance.

Increases in the price of merchandise, raw materials, fuel and labor or their reduced availability could increase our cost of merchandise sold. The price and availability of raw materials may fluctuate substantially, depending on a variety of factors, including demand, weather, supply conditions, transportation costs, energy prices, work stoppages, government regulation and government policy, economic climates, market speculation and other unpredictable factors. An inability to mitigate these cost increases, unless sufficiently offset with our pricing actions, might cause a decrease in our profitability. Any related pricing actions might cause a decline in our sales volume. Additionally, a decrease in the availability of raw materials could impair our ability to meet our production or purchasing requirements in a timely manner. Both the increased cost and lower availability of merchandise, raw materials, fuel and labor may also have an adverse impact on our cash and working capital needs as well as those of our suppliers.

If any of our significant vendors were to become subject to bankruptcy, receivership or similar proceedings, we may be unable to arrange for alternate or replacement contracts, transactions or business relationships on terms as favorable as current terms, which could adversely affect our sales and operating results.

| |

• | Failure of our vendors to adhere to our Terms of Engagement and applicable laws. |

A substantial portion of our merchandise is received from vendors and factories outside of the United States. We require all of our suppliers to comply with all applicable local and national laws and regulations and our Terms of Engagement for Kohl's Business Partners. These Terms of Engagement include provisions regarding laws and regulations, employment practices, ethical standards, environmental and legal requirements, communication, monitoring/compliance, record keeping, subcontracting and corrective action. From time to time, suppliers may not be in compliance with these standards or applicable laws. Significant or continuing noncompliance with such standards and laws by one or more suppliers could have a negative impact on our reputation and our results of operations.

•Ineffective marketing.

We believe that differentiating Kohl's in the marketplace is critical to our success. We design our marketing and loyalty programs to increase awareness of our brands and to build personalized connections with our customers. We believe these programs will strengthen customer loyalty, increase the number and frequency of customers that shop our stores and website and increase our sales. If our marketing and loyalty programs are not successful, our sales and operating results could be adversely affected.

•Damage to the reputation of the Kohl's brand or our private and exclusive brands.

We believe the Kohl's brand name and many of our private and exclusive brand names are powerful sales and marketing tools. We devote significant resources to promoting and protecting them. We develop and promote private and exclusive brands that have generated national recognition. In some cases, the brands or the marketing of such brands are tied to or affiliated with well-known individuals. Damage to the reputations (whether or not justified) of the Kohl’s brand, our private and exclusive brand names or any affiliated individuals, could arise from product failures; concerns about human rights, working conditions and other labor rights and conditions where merchandise is produced; perceptions of our pricing and return policies; litigation; vendor violations of our Terms of Engagement; or various other forms of adverse publicity, especially in social media outlets. Damage to our reputation may generate negative customer sentiment, potentially resulting in a reduction in sales, earnings, and shareholder value.

•Product safety concerns.

If our merchandise offerings do not meet applicable safety standards or our customers' expectations regarding safety, we could experience lost sales, experience increased costs and/or be exposed to legal and reputational risk. Events that give rise to actual, potential or perceived product safety concerns could expose us to government enforcement action and/or private litigation. Reputational damage caused by real or perceived product safety concerns, could have a negative impact on our sales and operating results.

•Disruptions in our information systems or an inability to adequately maintain and update those systems.

The efficient operation of our business is dependent on our information systems. In particular, we rely on our information systems to effectively manage sales, distribution, and merchandise planning and allocation functions. We also generate sales though the operations of our Kohls.com website. We frequently make investments that will help maintain and update our existing information systems. The potential problems and interruptions associated with implementing technology initiatives or the failure of our information systems to perform as designed could disrupt our business and harm sales and profitability.

•Weather conditions could adversely affect consumer shopping patterns.

A significant portion of our business is apparel and is subject to weather conditions. As a result, our operating results may be adversely affected by severe or unexpected weather conditions. Frequent or unusually heavy snow, ice or rain storms; natural disasters such as earthquakes, tornadoes, floods and hurricanes; or extended periods of unseasonable temperatures could adversely affect our performance by affecting consumer shopping patterns, diminishing demand for seasonal merchandise and/or causing physical damage to our properties.

•Inability to successfully execute a profitable omni-channel strategy.

Our business has evolved from an in-store only shopping experience to an omni-channel experience which includes in-store, on-line, mobile, social media and/or other interactions. We strive to offer a desirable omni-channel shopping experience for our customers and use social media as a way to interact with our customers and enhance their shopping experiences.

Customer expectations about the methods by which they purchase and receive products or services are also evolving. Customers are increasingly using technology and mobile devices to rapidly compare products and prices and to purchase products. Once products are purchased, customers are seeking alternate options for delivery of those products. We must continually anticipate and adapt to these changes in the purchasing process. Our ability to compete with other retailers and to meet our customer expectations may suffer if we are unable to provide relevant customer-facing technology. Our ability to compete may also suffer if Kohl’s, our suppliers, or our third-party shipping and delivery vendors are unable to effectively and efficiently fulfill and deliver orders, especially during the holiday season when sales volumes are especially high. Consequently, our results of operations could be adversely affected.

Our omni-channel business currently generates a lower operating margin than we have historically reported when we were primarily a store-only retailer. This profitability variance is due to a variety of factors including, but not limited to, an increase in the volume of lower margin merchandise, especially home products; costs to ship merchandise to our customers; and investments to provide the infrastructure necessary to expand our omni-channel strategy. There has been rapid growth in penetration of these less profitable omni-channel sales. There can be no assurances that future profitability will return to historical levels.

Our revenues, operating results and cash requirements are affected by the seasonal nature of our business.

Our business is subject to seasonal influences, with a major portion of sales and income historically realized during the second half of the fiscal year, which includes the back-to-school and holiday seasons.

If we do not properly stock or restock popular products, particularly during the back-to-school and holiday seasons, we may fail to meet customer demand, which could affect our revenue and our future growth. If we overstock products, we may be required to take significant inventory markdowns or write-offs, which could reduce profitability.

We may experience an increase in costs associated with shipping on-line orders due to complimentary upgrades, split shipments, and additional long-zone shipments necessary to ensure timely delivery for the holiday season. If too many customers access our website within a short period of time, we may experience system interruptions that make our website unavailable or prevent us from efficiently fulfilling orders, which may reduce the volume of goods we sell and the attractiveness of our products and services. Also, third-party delivery, direct ship vendors and customer service co-sourcers may be unable to deliver merchandise on a timely basis.

This seasonality causes our operating results and cash needs to vary considerably from quarter to quarter. Additionally, any decrease in sales or profitability during the second half of the fiscal year could have a disproportionately adverse effect on our results of operations.

Our inability to raise additional capital and maintain bank credit on favorable terms could adversely affect our business and financial condition.

We have historically relied on the public debt markets to raise capital to partially fund our operations and growth. We have also historically maintained lines of credit with financial institutions. Changes in the credit and capital markets, including market disruptions, limited liquidity and interest rate fluctuations, may increase the cost of financing or restrict our access to these potential sources of future liquidity. Our continued access to these liquidity sources on favorable terms depends on multiple factors, including our operating performance and maintaining strong debt ratings. If our credit ratings fall below desirable levels, our ability to access the debt markets and our cost of funds for new debt issuances could be adversely impacted. Additionally, if unfavorable capital market conditions exist if and when we were to seek additional financing, we may not be able to raise sufficient capital on favorable terms and on a timely basis (if at all). If our access to capital was to become significantly constrained or our cost of capital was to increase significantly, our financial condition, results of operations and cash flows could be adversely affected.

Inefficient or ineffective allocation of capital could adversely affect our operating results and/or shareholder value.

Our goal is to invest capital to maximize our overall long-term returns. This includes spending on inventory, capital projects and expenses, managing debt levels, and periodically returning value to our shareholders through share repurchases and dividends. To a large degree, capital efficiency reflects how well we manage our other key risks. The actions taken to address other specific risks may affect how well we manage the more general risk of capital efficiency. If we do not properly allocate our capital to maximize returns, we may fail to produce optimal financial results and we may experience a reduction in shareholder value.

Changes in our credit card operations could adversely affect our sales and/or profitability.

Our credit card operations facilitate merchandise sales and generate additional revenue from fees related to extending credit. The proprietary Kohl's credit card accounts are owned by an unrelated third-party, but we share in the net risk-adjusted revenue of the portfolio, which is defined as the sum of finance charges, late fees and other revenue less write-offs of uncollectible accounts. Changes in funding costs related to interest rate fluctuations will be shared similar to the revenue if interest rates exceed defined amounts. Though management currently believes that increases in funding costs will be largely offset by increases in finance charge revenue, increases in funding costs could adversely impact the profitability of this program.

Changes in credit card use, payment patterns and default rates may also result from a variety of economic, legal, social and other factors that we cannot control or predict with certainty. Changes that adversely impact our ability to extend credit and collect payments could negatively affect our results.

An inability to attract and retain quality associates could result in higher payroll costs and adversely affect our operating results.

Our performance is dependent on attracting and retaining a large number of quality associates. Many of those associates are in entry level or part-time positions with historically high rates of turnover. Many of our strategic initiatives require that we hire and/or develop associates with appropriate experience. Our staffing needs are especially high during the holiday season. Competition for these associates is intense. We cannot be sure that we will be able to attract and retain a sufficient number of qualified personnel in future periods.

Our ability to meet our labor needs while controlling costs is subject to external factors such as unemployment levels, prevailing wage rates, minimum wage legislation, actions by our competitors in compensation levels and changing demographics. Competitive and regulatory pressures have already significantly increased our labor costs. Further changes that adversely impact our ability to attract and retain quality associates could adversely affect our performance and/or profitability. In addition, changes in federal and state laws relating to employee benefits, including, but not limited to, sick time, paid time off, leave of absence, wage-and-hour, overtime, meal-and-break time and joint/co-employment could cause us to incur additional costs, which could negatively impact our profitability.

Regulatory and litigation developments could adversely affect our business operations and financial performance.

Various aspects of our operations are subject to federal, state or local laws, rules and regulations, any of which may change from time to time. The costs and other effects of new or changed legal requirements cannot be determined with certainty. For example, new legislation or regulations may result in increased costs directly for our compliance or indirectly to the extent such requirements increase prices of goods and services, reduce the availability of raw materials or further restrict our ability to extend credit to our customers.

We continually monitor the state and federal legal/regulatory environment for developments that may impact us. Failure to detect changes and comply with such laws and regulations may result in an erosion of our reputation, disruption of business and/or loss of associate morale. Additionally, we are regularly involved in various litigation matters that arise out of the conduct of our business. Litigation or regulatory developments could adversely affect our business operations and financial performance.

Unauthorized disclosure of sensitive or confidential customer, associate or company information could severely damage our reputation, expose us to risks of litigation and liability, disrupt our operations and harm our business.

As part of our normal course of business, we collect, process and retain sensitive and confidential customer, associate and company information. The protection of this data is extremely important to us, our associates and our customers. Despite the considerable security measures we have in place, our facilities and systems, and those of our third-party service providers, may be vulnerable to security breaches, acts of vandalism, computer viruses, misplaced or lost data, programming and/or human errors, or other similar events. Any security breach involving the misappropriation, loss or other unauthorized disclosure of confidential information, whether by us or our vendors, could disrupt our operations, damage our reputation and customers' willingness to shop in our stores or on our website, violate applicable laws, regulations, orders and agreements, and subject us to additional costs and liabilities which could be material.

Item 1B. Unresolved Staff Comments

Not applicable

Item 2. Properties

Stores

As of January 30, 2016, we operated 1,164 stores with 83.8 million selling square feet in 49 states. Our typical, or “prototype,” store has approximately 88,000 gross square feet of retail space and serves trade areas of 150,000 to 200,000 people. Most “small” stores are 55,000 to 68,000 gross square feet and serve trade areas of 100,000 to 150,000 people.

Our typical store lease has an initial term of 20-25 years and four to eight renewal options for consecutive five-year extension terms. Substantially all of our leases provide for a minimum annual rent that is fixed or adjusts to set levels during the lease term, including renewals. Approximately one-fourth of the leases provide for additional rent based on a percentage of sales over designated levels.

The following tables summarize key information about our stores as of January 30, 2016:

|

| | | | | | |

| Number of Stores by State | | | Number of Stores by State |

| | | | |

Mid-Atlantic Region: | | | South Central Region: | |

Delaware | 5 |

| | Arkansas | 8 |

|

Maryland | 23 |

| | Kansas | 12 |

|

Pennsylvania | 50 |

| | Louisiana | 9 |

|

Virginia | 30 |

| | Missouri | 27 |

|

West Virginia | 7 |

| | Oklahoma | 11 |

|

Total Mid-Atlantic | 115 |

| | Texas | 84 |

|

Midwest Region: | | | Total South Central | 151 |

|

Illinois | 66 |

| | Southeast Region: | |

Indiana | 39 |

| | Alabama | 14 |

|

Iowa | 18 |

| | Florida | 53 |

|

Michigan | 45 |

| | Georgia | 35 |

|

Minnesota | 26 |

| | Kentucky | 17 |

|

Nebraska | 7 |

| | Mississippi | 5 |

|

North Dakota | 4 |

| | North Carolina | 31 |

|

Ohio | 58 |

| | South Carolina | 16 |

|

South Dakota | 3 |

| | Tennessee | 20 |

|

Wisconsin | 40 |

| | Total Southeast | 191 |

|

Total Midwest | 306 |

| | West Region: | |

Northeast Region: | | | Alaska | 1 |

|

Connecticut | 22 |

| | Arizona | 26 |

|

Maine | 5 |

| | California | 125 |

|

Massachusetts | 25 |

| | Colorado | 24 |

|

New Hampshire | 11 |

| | Idaho | 5 |

|

New Jersey | 38 |

| | Montana | 3 |

|

New York | 51 |

| | Nevada | 12 |

|

Rhode Island | 3 |

| | New Mexico | 5 |

|

Vermont | 1 |

| | Oregon | 11 |

|

Total Northeast | 156 |

| | Utah | 12 |

|

| | | Washington | 19 |

|

| | | Wyoming | 2 |

|

| | | Total West | 245 |

|

| | | Total Kohl’s | 1,164 |

|

|

| | | | | | | | | | | | |

Number of Stores by |

| Store Type | | | | | Location | | | Ownership |

Prototype | 986 |

| | Strip centers | 782 |

| | Owned | 414 |

|

Small | 178 |

| | Community & regional malls | 85 |

| | Leased | 510 |

|

| 1,164 |

| | Freestanding | 297 |

| | Ground leased | 240 |

|

| | | | | | 1,164 |

| | | 1,164 |

|

| | | | | | | | | |

Distribution Centers

The following table summarizes key information about each of our distribution centers.

|

| | | | |

| Year Opened | | Square Footage |

Store distribution centers: | | | |

Findlay, Ohio | 1994 | | 780,000 |

|

Winchester, Virginia | 1997 | | 420,000 |

|

Blue Springs, Missouri | 1999 | | 540,000 |

|

Corsicana, Texas | 2001 | | 540,000 |

|

Mamakating, New York | 2002 | | 605,000 |

|

San Bernardino, California | 2002 | | 575,000 |

|

Macon, Georgia | 2005 | | 560,000 |

|

Patterson, California | 2006 | | 360,000 |

|

Ottawa, Illinois | 2008 | | 328,000 |

|

On-line fulfillment centers: | | | |

Monroe, Ohio | 2001 | | 1,200,000 |

|

San Bernardino, California | 2010 | | 970,000 |

|

Edgewood, Maryland | 2011 | | 1,450,000 |

|

DeSoto, Texas | 2012 | | 1,200,000 |

|

We own all of the distribution centers except Corsicana, Texas, which is leased.

Corporate Facilities

We own our corporate headquarters in Menomonee Falls, Wisconsin. We also own or lease additional buildings and office space which are used by various corporate departments, including our credit operations.

Item 3. Legal Proceedings

We are not currently a party to any material legal proceedings, but are subject to certain legal proceedings and claims from time to time that arise out of the conduct of our business.

Item 4. Mine Safety Disclosures

Not applicable

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

(a) Market information

Our Common Stock has been traded on the New York Stock Exchange ("NYSE") since May 19, 1992, under the symbol “KSS.” The prices in the table set forth below indicate the high and low sales prices of our Common Stock per the New York Stock Exchange Composite Price History and our quarterly cash dividends per common share for each quarter in 2015 and 2014.

|

| | | | | | | | | | | | | | | | | |

| 2015 | | 2014 |

| High | | Low | | Dividend | | High | | Low | | Dividend |

| | | | | | | | | | | |

Fourth Quarter | $50.86 | | $42.85 | | $0.45 | | $61.54 | | $54.95 | | $0.39 |

Third Quarter | 61.60 |

| | 44.06 |

| | 0.45 |

| | 62.50 |

| | 53.74 |

| | 0.39 |

|

Second Quarter | 74.51 |

| | 61.17 |

| | 0.45 |

| | 55.89 |

| | 51.00 |

| | 0.39 |

|

First Quarter | 79.07 |

| | 61.44 |

| | 0.45 |

| | 57.89 |

| | 49.09 |

| | 0.39 |

|

On February 24, 2016, our Board of Directors approved an 11% increase in our dividend to $0.50 per common share which will be paid on March 23, 2016 to shareholders of record as of March 9, 2016. In 2015, we paid aggregate cash dividends of $349 million.

(b) Holders

As of March 9, 2016, there were approximately 4,100 record holders of our Common Stock.

(c) Securities Authorized For Issuance Under Equity Compensation Plans

See the information provided in the “Equity Compensation Plan Information” section of the Proxy Statement for our May 11, 2016 Annual Meeting of Shareholders, which information is incorporated herein by reference.

(d) Performance Graph

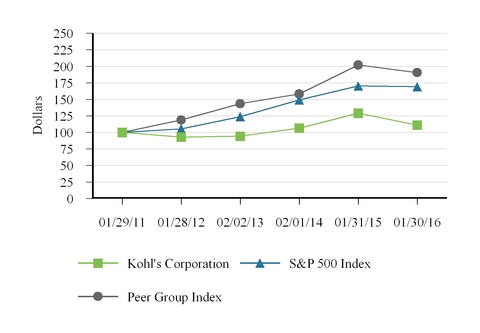

The graph below compares our cumulative five-year shareholder return to that of the Standard & Poor’s 500 Index and a Peer Group Index that is consistent with the retail peer group used in the Compensation Discussion & Analysis section of our Proxy Statement for our May 11, 2016 Annual Meeting of Shareholders. The Peer Group Index was calculated by Capital IQ, a Standard & Poor’s business and includes Bed, Bath & Beyond Inc.; The Gap, Inc.; J.C. Penney Company, Inc.; Limited Brands, Inc.; Macy’s, Inc.; Nordstrom, Inc.; Ross Stores, Inc.; Sears Holding Corporation; Target Corporation; and The TJX Companies, Inc. The Peer Group Index is weighted by the market capitalization of each component company at the beginning of each period. The graph assumes an investment of $100 on January 29, 2011 and reinvestment of dividends. The calculations exclude trading commissions and taxes.

|

| | | | | | | | | | | | | | | | | |

Company / Index | Jan 29,

2011 | | Jan 28,

2012 | | Feb 2,

2013 | | Feb 1,

2014 | | Jan 31,

2015 | | Jan 30,

2016 |

Kohl’s Corporation | $100.00 | | $93.05 | | $94.23 | | $106.55 | | $129.22 | | $111.10 |

S&P 500 Index | 100.00 |

| | 105.33 |

| | 123.87 |

| | 149.02 |

| | 170.22 |

| | 169.09 |

|

Peer Group Index | 100.00 |

| | 118.84 |

| | 143.36 |

| | 158.29 |

| | 202.09 |

| | 190.58 |

|

(e) Recent Sales of Unregistered Securities; Use of Proceeds from Registered Securities

We did not sell any equity securities during 2015 which were not registered under the Securities Act.

(f) Purchases of Equity Securities by the Issuer and Affiliated Purchasers

In 2012, our Board of Directors authorized the repurchase of $3.5 billion of our shares of common stock. Purchases under the repurchase program may be made in the open market, through block trades and other negotiated transactions. We expect to execute the share repurchase program primarily in open market transactions, subject to market conditions. There is no fixed termination date for the repurchase program, and the program may be suspended, discontinued or accelerated at any time.

The following table contains information for shares repurchased and shares acquired from employees in lieu of amounts required to satisfy minimum tax withholding requirements upon the vesting of the employees’ restricted stock during the three fiscal months ended January 30, 2016:

|

| | | | | | | | | | | | | |

Period | Total Number of Shares Purchased During Period | | Average Price Paid Per Share | | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs | | Approximate Dollar Value of Shares that May Yet Be Purchased Under the Plans or Programs |

| | | | | | | (Dollars in Millions) |

November 1 – November 28, 2015 | 1,232,778 |

| |

| $45.75 |

| | 1,231,525 |

| |

| $799 |

|

November 29, 2015 – January 2, 2016 | 1,847,094 |

| | 46.94 |

| | 1,845,092 |

| | 712 |

|

January 3 – January 30, 2016 | 1,442,582 |

| | 48.64 |

| | 1,416,962 |

| | 643 |

|

Total | 4,522,454 |

| |

| $47.16 |

| | 4,493,579 |

| |

| $643 |

|

Item 6. Selected Consolidated Financial Data

The selected consolidated financial data presented below should be read in conjunction with our consolidated financial statements and related notes included elsewhere in this document.

|

| | | | | | | | | | | | | | | | | | | |

| 2015 | | 2014 | | 2013 | | 2012 (d) | | 2011 |

| (Dollars in Millions, Except per Share and per Square Foot Data) |

Statements of Income Data: | | | | | | | | | |

Net sales | $ | 19,204 |

| | $ | 19,023 |

| | $ | 19,031 |

| | $ | 19,279 |

| | $ | 18,804 |

|

Cost of merchandise sold | 12,265 |

| | 12,098 |

| | 12,087 |

| | 12,289 |

| | 11,625 |

|

Gross margin | 6,939 |

| | 6,925 |

| | 6,944 |

| | 6,990 |

| | 7,179 |

|

Selling, general and administrative expenses | 4,452 |

| | 4,350 |

| | 4,313 |

| | 4,267 |

| | 4,243 |

|

Depreciation and amortization | 934 |

| | 886 |

| | 889 |

| | 833 |

| | 778 |

|

Operating income | 1,553 |

| | 1,689 |

| | 1,742 |

| | 1,890 |

| | 2,158 |

|

Interest expense, net | 327 |

| | 340 |

| | 338 |

| | 329 |

| | 299 |

|

Loss on extinguishment of debt | 169 |

| | — |

| | — |

| | — |

| | — |

|

Income before income taxes | 1,057 |

| | 1,349 |

| | 1,404 |

| | 1,561 |

| | 1,859 |

|

Provision for income taxes | 384 |

| | 482 |

| | 515 |

| | 575 |

| | 692 |

|

Net income | $ | 673 |

| | $ | 867 |

| | $ | 889 |

| | $ | 986 |

| | $ | 1,167 |

|

Basic earnings per share | $ | 3.48 |

| | $ | 4.28 |

| | $ | 4.08 |

| | $ | 4.19 |

| | $ | 4.33 |

|

Diluted earnings per share | $ | 3.46 |

| | $ | 4.24 |

| | $ | 4.05 |

| | $ | 4.17 |

| | $ | 4.30 |

|

Dividends per share | $ | 1.80 |

| | $ | 1.56 |

| | $ | 1.40 |

| | $ | 1.28 |

| | $ | 1.00 |

|

Operating and Other Data: | | | | | | | | | |

Net sales growth | 1.0 | % | | 0.0 | % | | (1.3 | )% | | 2.5 | % | | 2.2 | % |

Comparable sales growth (a) | 0.7 | % | | (0.3 | )% | | (1.2 | )% | | 0.3 | % | | 0.5 | % |

Net sales per selling square foot (b) | $ | 228 |

| | $ | 226 |

| | $ | 227 |

| | $ | 231 |

| | $ | 232 |

|

As a percent of sales: | | | | | | | | | |

Gross margin | 36.1 | % | | 36.4 | % | | 36.5 | % | | 36.3 | % | | 38.2 | % |

Operating income | 8.1 | % | | 8.9 | % | | 9.2 | % | | 9.8 | % | | 11.5 | % |

Return on average shareholders’ equity (c) | 11.8 | % | | 14.7 | % | | 14.8 | % | | 15.8 | % | | 16.4 | % |

Excluding loss on extinguishment of debt: | | | | | | | | | |

Net income | $ | 781 |

| | $ | 867 |

| | $ | 889 |

| | $ | 986 |

| | $ | 1,167 |

|

Diluted earnings per share | $ | 4.01 |

| | $ | 4.24 |

| | $ | 4.05 |

| | $ | 4.17 |

| | $ | 4.30 |

|

Return on average shareholders' equity (c) | 13.5 | % | | 14.7 | % | | 14.8 | % | | 15.8 | % | | 16.4 | % |

Total square feet of selling space (in thousands) | $ | 83,810 |

| | $ | 83,750 |

| | $ | 83,671 |

| | $ | 83,098 |

| | $ | 82,226 |

|

Number of stores (end of period) | 1,164 |

| | 1,162 |

| | 1,158 |

| | 1,146 |

| | 1,127 |

|

Working capital | $ | 2,362 |

| | $ | 2,721 |

| | $ | 2,412 |

| | $ | 2,061 |

| | $ | 2,111 |

|

Total assets | $ | 13,606 |

| | $ | 14,333 |

| | $ | 14,228 |

| | $ | 13,761 |

| | $ | 14,021 |

|

Long-term debt | $ | 2,792 |

| | $ | 2,780 |

| | $ | 2,777 |

| | $ | 2,478 |

| | $ | 2,128 |

|

Capital lease and financing obligations | $ | 1,916 |

| | 1,968 |

| | $ | 2,069 |

| | $ | 2,061 |

| | $ | 2,103 |

|

Shareholders’ equity | $ | 5,491 |

| | $ | 5,991 |

| | $ | 5,978 |

| | $ | 6,048 |

| | $ | 6,508 |

|

Cash flow from operations | $ | 1,474 |

| | $ | 2,024 |

| | $ | 1,884 |

| | $ | 1,265 |

| | $ | 2,139 |

|

Capital expenditures | $ | 690 |

| | $ | 682 |

| | $ | 643 |

| | $ | 785 |

| | $ | 927 |

|

| |

(a) | Comparable sales include sales for stores (including relocated or remodeled stores) which were open throughout both the full current and prior year periods. We also include omni-channel sales in our comparable sales. Adjustments for omni-channel sales that have been shipped, but not yet received by the customer are included in net sales, but are not included in our comparable sales. Fiscal 2013 comparable sales growth compares the 52 weeks ended February 1, 2014 to the 52 weeks ended February 2, 2013. Fiscal 2012 comparable sales growth compares the 52 weeks ended January 26, 2013 to the 52 weeks ended January 28, 2012. |

| |

(b) | Net sales per selling square foot includes omni-channel sales and stores open for the full current period. 2012 excludes the impact of the 53rd week. |

| |

(c) | Average shareholders’ equity is based on a 5-quarter average. |

| |

(d) | Fiscal 2012 was a 53-week year. During the 53rd week, total sales were $169 million; selling, general and administrative expenses were approximately $30 million; interest was approximately $2 million; net income was approximately $15 million and diluted earnings per share was approximately $0.06. |

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Executive Summary

As of January 30, 2016, we operated 1,164 family-focused, value-oriented department stores and a website (www.Kohls.com) that sell moderately-priced private label, exclusive and national brand apparel, footwear, accessories, beauty and home products. Our stores generally carry a consistent merchandise assortment with some differences attributable to regional preferences. Our website includes merchandise which is available in our stores, as well as merchandise which is available only on-line.

In 2014, we introduced a multi-year strategic framework which we refer to as "the Greatness Agenda". It is built on five pillars - amazing product, incredible savings, easy experience, personalized connections and winning teams. All of the Greatness Agenda initiatives are designed to increase sales, primarily by increasing the number of customers that shop at our stores and on-line.

As a retailer, product is the core of our business. During 2015, we increased our emphasis on national brands as we believe they drive customer traffic. Driven by strong sales in Nike, Skechers, Levi’s and Carters, national brand sales increased 6.2% and represented 52% of our sales in 2015. Active and wellness merchandise sales were also stronger than the company average in both national brands and our own private and exclusive brands.

During 2015, we expanded our localization assortment strategy which tailors product mix to the specific customer preferences at each of our stores. Approximately 40% of our sales were tailored by store at the end of 2015. We plan to have unique store assortments in 90% of our stores by the end of 2016.

In addition to offering amazing product, we must offer an easy and desirable shopping experience for customers both in our stores and from their digital devices. During 2015, we launched new mobile and tablet platforms which improved the digital shopping experience. We also launched buy on-line and pick-up in store (“BOPUS”) in all stores. In addition to offering a convenient shopping option for our customers, BOPUS is driving incremental sales. Customers picking up BOPUS orders have made additional in-store purchases of approximately 25% of their original order.

In 2016, we plan to make several updates to our store formats and omni-channel strategy. In the first half of the year, we intend to pilot seven new small format stores which will help inform both future store size and rationalization, and identify omni-channel opportunities. We also plan to test two more clearance stores, which are operated as Off-Aisle stores, and 12 FILA outlet stores.

We believe our personalized connections and incredible savings strategies will increase sales by strengthening the loyalty of existing customers and attracting new customers. Key to the success of these initiatives are understanding our customers and ensuring they get the most from every dollar that they spend at Kohl’s. We believe our Yes2You loyalty program will continue to drive both strategies. In 2015, approximately 65% of our sales were attributed to Yes2You members. Yes2You members consistently shop more frequently and spend more than customers who are not enrolled in the program.

To execute our Greatness Agenda vision, we rely on winning teams of engaged, talented, results-oriented and empowered management and employees. During 2015, we rounded out our leadership team by hiring Sona Chawla as our Chief Operating Officer.

We believe that the strategic framework of the Greatness Agenda is working. We are making progress towards our goal of being the most engaging retailer in America, but realize that it will take additional time to fully implement our initiatives and achieve the goals we initially established.

In 2015, comparable sales increased 0.7%; an improvement over the sales declines that we reported prior to launching the Greatness Agenda. Gross margin as a percentage of sales decreased approximately 30 basis points from 36.4% in 2014 to 36.1% in 2015. Gross margin was especially challenging in the fourth quarter due to a very competitive holiday season and deeper discounts on cold-weather apparel which did not sell due to unseasonably warm weather. Selling, general and administrative expenses increased 2% in 2015. Expenses were again well-managed against the sales increases. Excluding the loss on extinguishment of debt, our net income was $781 million and our diluted earnings per share decreased 5% to $4.01.

See "Results of Operations" and "Liquidity and Capital Resources" for additional details about our financial results, how we define comparable sales, and the loss on extinguishment of debt.

2016 Outlook

Our current expectations for 2016 are as follows:

|

| |

| |

Total sales | Decrease (0.5%) - Increase 0.5% |

Comparable sales | Increase 0 - 1% |

Gross margin as a percent of sales | Increase 0 - 20 bps |

Selling, general and administrative expenses | Increase 1 - 2% |

Depreciation | $940 million |

Interest | $310 million |

Effective tax rate | 37% |

Earnings per diluted share | $4.05 - $4.25 |

Capital expenditures | $825 million |

Share repurchases: | |

Total repurchases | $600 million |

Cost per share | $50 |

We continue to explore ways to enhance shareholder value through the optimization of our existing store portfolio. In 2016, we intend to close 18 underperforming stores, representing less than one percent of total sales. We announced the specific locations in March. The closures are expected to generate annual SG&A savings of approximately $45 million and annual depreciation savings of approximately $10 million. We currently expect to incur approximately $150 - $170 million in charges as a result of these planned closures and the organizational realignment at our corporate offices which were announced in February. We estimate that approximately $55 - $65 million of the charges will be recorded in the first quarter of 2016, with the remainder recorded in the second quarter.

Results of Operations

Net Sales

As our omni-channel strategy continues to mature, it is increasingly difficult to distinguish between a "store" sale and an "on-line" sale. Below is a list of some omni-channel examples:

| |

• | Stores increase on-line sales by providing customers opportunities to view, touch and/or try on physical merchandise before ordering on-line. |

| |

• | On-line purchases can easily be returned in our stores. |

| |

• | Kohl's Cash coupons and Yes2You rewards can be earned and redeemed on-line or in store regardless of where they were earned. |

| |

• | In-store customers can order from on-line kiosks in our stores. |

| |

• | Order on-line and pick-up in store is available in all stores. |

| |

• | Customers who utilize our mobile app while in the store may receive mobile coupons to use when they check out. |

| |

• | On-line orders may be shipped from a dedicated on-line fulfillment center, a store, a retail distribution center, direct ship vendors or any combination of the above. |

Because we do not have a clear distinction between "store" sales and "on-line" sales, we do not separately report on-line sales.

Comparable sales include sales for stores (including relocated or remodeled stores) which were open during both the current and prior year periods. We also include omni-channel sales in our comparable sales. Adjustments for omni-channel sales that have been shipped, but not yet been received by the customer are included in net sales, but are not included in our comparable sales.

The following table summarizes net sales:

|

| | | | | | | | | | | |

| 2015 | | 2014 | | 2013 |

Net sales (in Millions) | $ | 19,204 |

| | $ | 19,023 |

| | $ | 19,031 |

|

Increase (decrease) in sales: | | | | | |

Total | 1.0 | % | | 0.0 | % | | (1.3 | )% |

Comparable | 0.7 | % | | (0.3 | )% | | (1.2 | )% |

Net sales per selling square foot (a) | $ | 228 |

| | $ | 226 |

| | $ | 227 |

|

(a) Net sales per selling square foot includes on-line sales and stores open for the full current period.

Drivers of the changes in comparable sales were as follows:

|

| | | | | |

| 2015 | | 2014 |

Selling price per unit | 1.3 | % | | 2.8 | % |

Units per transaction | (0.4 | )% | | (1.7 | )% |

Average transaction value | 0.9 | % | | 1.1 | % |

Number of transactions | (0.2 | )% | | (1.4 | )% |

Comparable sales | 0.7 | % | | (0.3 | )% |

The increases in selling price per unit were a combination of increased penetration and selling prices in our national brand portfolio. The changes in units per transaction reflect customer reaction to the price changes. Generally, customers purchase more items as prices decrease and fewer items as prices increase. Transactions decreased in both periods, however trends have improved since the launch of the Greatness Agenda.

From a regional perspective, including on-line originated sales, the West, Southeast, and Midwest outperformed the Company average in 2015. The South Central, Mid-Atlantic and Northeast underperformed the Company average.

By line of business, Footwear and Home outperformed the Company average in 2015. Men's and Women's were consistent with the Company average while Children's and Accessories both underperformed the Company average.

Net sales per selling square foot (which includes omni-channel sales and stores open for the full current period), increased 0.9% to $228 in 2015, which is consistent with the increase in comparable sales.

Net sales for 2014 were generally consistent with 2013 net sales. From a line of business perspective, Children's, Footwear, and Men's reported sales increases. Accessories was slightly above the Company average. Home and Women's both underperformed the Company average. From a regional perspective, including on-line originated sales, the West, Southeast, and Midwest reported higher sales, which were offset by sales decreases in the Northeast, Mid-Atlantic, and South Central regions.

Gross margin

|

| | | | | | | | | | | |

| 2015 | | 2014 | | 2013 |

| (Dollars in Millions) |

Gross margin | $ | 6,939 |

| | $ | 6,925 |

| | $ | 6,944 |

|

As a percent of net sales | 36.1 | % | | 36.4 | % | | 36.5 | % |

Gross margin includes the total cost of products sold, including product development costs, net of vendor payments other than reimbursement of specific, incremental and identifiable costs; inventory shrink; markdowns; freight expenses associated with moving merchandise from our vendors to our distribution centers; shipping and handling expenses of omni-channel sales; and terms cash discount. Our gross margin may not be comparable with that of other retailers because we include distribution center and buying costs in selling, general and administrative expenses while other retailers may include these expenses in cost of merchandise sold.

Gross margin as a percentage of sales decreased approximately 30 basis points from 36.4% in 2014 to 36.1% in 2015. The decrease was due to an increase in shipping costs resulting from growth in on-line originated sales, partially offset by an increase in our merchandise margin.

Gross margin as a percentage of sales decreased approximately 10 basis points from 36.5% in 2013 to 36.4% in 2014. Higher merchandise margin was more than offset by an increase in shipping costs, which was in line with our omni-channel business growth.

Selling, general and administrative expenses

|

| | | | | | | | | | | |

| 2015 | | 2014 | | 2013 |

| (Dollars in Millions) |

Selling, general, and administrative expenses ("SG&A") | $ | 4,452 |

| | $ | 4,350 |

| | $ | 4,313 |

|

As a percent of net sales | 23.2 | % | | 22.9 | % | | 22.7 | % |

SG&A expenses include compensation and benefit costs (including stores, headquarters, buying and merchandising and distribution centers); occupancy and operating costs of our retail, distribution and corporate facilities; freight expenses associated with moving merchandise from our distribution centers to our retail stores and among distribution and retail facilities; marketing expenses, offset by vendor payments for reimbursement of specific, incremental and identifiable costs; net revenues from our Kohl’s credit card operations; and other administrative revenues and expenses. We do not include depreciation and amortization in SG&A. The classification of these expenses varies across the retail industry.

The following table summarizes the changes in SG&A by expense type:

|

| | | | | | | |

| 2015 | | 2014 |

| (Dollars in Millions) |

Store expenses | $ | 77 |

| | $ | (4 | ) |

Corporate expenses | 58 |

| | 34 |

|

Distribution costs | (3 | ) | | 10 |

|

Marketing costs, excluding credit card operations | (4 | ) | | 21 |

|

Net revenues from credit card operations | (26 | ) | | (24 | ) |

Total increase | $ | 102 |

| | $ | 37 |

|

Many of our expenses, including store payroll and distribution costs, are variable in nature. These costs generally increase as sales increase and decrease as sales decrease. We measure both the change in these variable expenses and the expense as a percent of sales. If the expense as a percent of sales decreased from the prior year, the expense "leveraged" and indicates that the expense was well-managed or effectively generated additional sales. If the expense as a percent of sales increased over the prior year, the expense "deleveraged" and indicates that sales growth was less than expense growth. SG&A as a percent of sales increased, or "deleveraged," by approximately 30 basis points in 2015.

The increase in store expenses are primarily attributable to higher store payroll due to on-going wage pressure and omni-channel support of ship-from-store and buy on-line, pick-up in store operations. Property taxes and common area maintenance also increased.

Corporate expense increased over 2014 due to technology and infrastructure investments related to our omni-channel strategy and other various corporate costs.

Distribution costs, which exclude payroll related to on-line originated orders that were shipped from our stores, were $278 million for 2015, $281 million for 2014 and $271 million for 2013. Distribution costs decreased in 2015 due to lower store distribution costs and were partially offset by higher fulfillment costs related to our growing on-line business, particularly in the fourth quarter.

Marketing costs decreased in 2015 as we decreased our spending in newspaper inserts and direct mail through optimized circulation and shifted spending to digital media.

Revenues from our credit card operations were $456 million in 2015, $430 million in 2014 and $406 million in 2013. The increases in net revenues from credit card operations are due to higher finance charge revenues and late fees, partially offset by higher bad debt expense, all which were the result of growth in the portfolio. Additionally, lower marketing spend was partially offset by increased servicing costs.

SG&A for 2014 increased $37 million, or 1%, over 2013. As a percentage of sales, SG&A increased, or "deleveraged", by approximately 20 basis points in 2014. The increase in SG&A was due primarily to higher distribution costs, increased marketing, and investments in technology and infrastructure related to our on-line business, offset by higher credit card revenue.

Other Expenses

|

| | | | | | | | | | | |

| 2015 | | 2014 | | 2013 |

| (Dollars in Millions) |

Depreciation and amortization | $ | 934 |

| | $ | 886 |

| | $ | 889 |

|

Interest expense, net | 327 |

| | 340 |

| | 338 |

|

Loss on extinguishment of debt | 169 |

| | — |

| | — |

|

Provision for income taxes | 384 |

| | 482 |

| | 515 |

|

Effective tax rate | 36.3 | % | | 35.7 | % | | 36.7 | % |

Depreciation and amortization was higher in 2015 than 2014, as higher information technology ("IT") amortization was partially offset by lower store depreciation due to maturing of our stores. Depreciation and amortization was consistent in 2014 and 2013, as lower store depreciation was only partially offset by higher IT amortization.

Net interest expense decreased $13 million, or 4%, in 2015 as a result of refinancing our debt at lower interest rates during 2015. Net interest expense increased $2 million, or 1%, in 2014 due to higher outstanding long-term debt following the September 2013 debt issuance.

During 2015, we completed a cash tender offer and redemption for $1,085 million of senior unsecured debt. We recognized a $169 million loss on extinguishment of debt which included a $163 million bond tender premium paid to holders of the debt and a $6 million non-cash write-off of deferred financing costs and original issue discounts associated with the extinguished debt.

Changes in our effective tax were primarily due to favorable state audit settlements during 2014.

Inflation

Although we expect that our operations will be influenced by general economic conditions, including food, fuel and energy prices, and by costs to source our merchandise, we do not believe that inflation has had a material effect on our results of operations. However, there can be no assurance that our business will not be impacted by such factors in the future.

Liquidity and Capital Resources

The following table presents the primary cash requirements and sources of funds.

|

| | |

Cash Requirements | | Sources of Funds |

• Operational needs, including salaries, rent, taxes and other costs of running our business • Capital expenditures • Inventory (seasonal and new store) • Share repurchases • Dividend payments | | • Cash flow from operations • Short-term trade credit, in the form of extended payment terms • Line of credit under our revolving credit facility |

Our working capital and inventory levels typically build throughout the fall, peaking during the November and December holiday selling season.

The following table includes cash balances and changes.

|

| | | | | | | | | | | |

| 2015 | | 2014 | | 2013 |

| (Dollars in Millions) |

Cash and cash equivalents | $ | 707 |

| | $ | 1,407 |

| | $ | 971 |

|

| | | | | |

Net cash provided by (used in): | | | | | |

Operating activities | $ | 1,474 |

| | $ | 2,024 |

| | $ | 1,884 |

|

Investing activities | (681 | ) | | (593 | ) | | (623 | ) |

Financing activities | (1,493 | ) | | (995 | ) | | (827 | ) |

| | | | | |

Free Cash Flow (a) | $ | 671 |

| | $ | 1,234 |

| | $ | 1,127 |

|

(a) See the Free Cash Flow discussion later in this Liquidity and Capital Resources section for additional discussion of this non-GAAP financial measure.

Operating activities

Cash provided by operations decreased $550 million, or 27%, in 2015 to $1.5 billion.

Merchandise inventory increased $224 million in 2015 to $4.0 billion. Inventory per store increased 5.7% and units per store increased 5% over 2014. The increases are primarily in national brands.

Accounts payable as a percent of inventory was 31.0% at January 30, 2016, compared to 39.6% at January 31, 2015. Almost half of the decrease was due to the anniversary of the port strike in 2014. Lower year-over-year January receipts and higher inventory levels also contributed to the decrease.

Cash provided by operations increased $140 million to $2.0 billion in 2014. The increase was primarily due to decreased inventory spending in 2014.

Investing activities

Net cash used in investing activities increased $88 million to $681 million in 2015.

Capital expenditures of $690 million in 2015 were generally consistent with 2014 as higher IT spending in 2015 was offset by the purchase and build out of a call center in Texas in 2014.

The following table summarizes expected and actual capital expenditures by major category as a percentage of total capital expenditures:

|

| | | | | | | | | | | |

| 2016 Estimate | | 2015 | | 2014 | | 2013 |

Information technology | 45 | % | | 45 | % | | 45 | % | | 45 | % |

Store strategies | 30 |

| | 36 |

| | 33 |

| | 31 |

|

Base capital | 25 |

| | 20 |

| | 22 |

| | 24 |

|

Total | 100 | % | | 100 | % | | 100 | % | | 100 | % |

We expect total capital expenditures of approximately $825 million in fiscal 2016. The actual amount of our future capital expenditures will depend on the number and timing of new stores and refreshes; expansion and renovations to distribution centers; the mix of owned, leased or acquired stores; and IT and corporate spending. We do not anticipate that our capital expenditures will be limited by any restrictive covenants in our financing agreements.

Capital expenditures totaled $682 million in 2014, a $39 million increase over 2013. The increase in capital spending is primarily due to the expansion of our corporate campus, increased IT spending and the purchase and build out of a call center in Texas, partially offset by decreased new store spending.

Proceeds from sales of investments in auction rate securities were $82 million in 2014. All of our auction rate securities were sold in 2014. Despite the non-liquid nature of these investments following market conditions that arose in 2008, we were able to sell substantially all of our investments at par.

Financing activities

Our financing activities used cash of $1.5 billion in 2015 and $1.0 billion in 2014. The increase was primarily due to greater share repurchases and premium paid on redemption of debt.

We repurchased 17 million shares of our common stock for $1.0 billion in 2015 and 12 million shares for $677 million in 2014. Share repurchases are discretionary in nature. The timing and amount of repurchases is based upon available cash balances, our stock price and other factors.

During 2015, we completed a cash tender offer and redemption for $1.1 billion of our higher coupon senior unsecured debt. We recognized a $169 million loss on extinguishment of debt which included a $163 million bond tender premium paid to holders of the debt and a $6 million non-cash write-off of deferred financing costs and original issue discounts associated with the extinguished debt.

In July 2015, we issued $650 million of 4.25% notes due in July 2025 and $450 million of 5.55% notes due in July 2045. Both notes include semi-annual, interest-only payments beginning January 17, 2016. Proceeds of the issuances and cash on hand were used to pay the principal, premium and accrued interest of the acquired and redeemed debt.

On July 1, 2015, we entered into an Amended and Restated Credit Agreement with various lenders which provides for $1.0 billion senior unsecured five-year revolving credit facility that will mature in June 2020. Among other things, the agreement includes a maximum leverage ratio financial covenant (which is consistent with the ratio under our prior credit agreement) and restrictions on liens and subsidiary indebtedness.

As of January 30, 2016, our credit ratings were as follows:

|

| | | | | |

| Moody’s | | Standard & Poor’s | | Fitch |

Long-term debt | Baa1 | | BBB | | BBB+ |

Though we have no current intentions to do so, we may again seek to retire or purchase our outstanding debt through open market cash purchases, privately negotiated transactions or otherwise. Such repurchases, if any, will depend on prevailing market conditions, our liquidity requirements, contractual restrictions and other factors. The amounts involved could be material.

During 2015, we paid cash dividends of $349 million as detailed in the following table:

|

| | | | | | | |

| First Quarter | | Second Quarter | | Third Quarter | | Fourth Quarter |

Declaration date | February 25 | | May 13 | | August 11 | | November 11 |

Record date | March 11 | | June 10 | | September 9 | | December 9 |

Payment date | March 25 | | June 24 | | September 23 | | December 23 |

Amount per common share | $0.45 | | $0.45 | | $0.45 | | $0.45 |

On February 24, 2016, our Board of Directors approved an 11% increase in our dividend to $0.50 per common share which will be paid on March 23, 2016 to shareholders of record as of March 9, 2016.

Key financial ratios

The following ratios provide additional measures of our liquidity, return on investments, and capital structure.

|

| | | | | |

| 2015 | | 2014 | | 2013 |

Liquidity Ratios: | (Dollars in Millions) |

Working capital | $2,362 | | $2,721 | | $2,412 |

Current ratio | 1.87 | | 1.95 | | 1.87 |

Free cash flow (a) | $671 | | $1,234 | | $1,127 |

Return on Investment Ratios: | | | | | |

Ratio of earnings to fixed charges | 3.1 | | 3.6 | | 3.7 |

Return on assets | 4.7% | | 6.1% | | 6.3% |

Return on gross investment (a) | 14.5% | | 15.2% | | 15.5% |

Capital Structure Ratios: | | | | | |

Debt/capitalization | 46.3% | | 44.3% | | 44.8% |

Adjusted Debt to EBITDAR (a) | 2.52 | | 2.45 | | 2.42 |

(a) Non-GAAP financial measure

Liquidity ratios

Liquidity measures our ability to meet short-term cash needs. In 2015, working capital decreased $359 million and our current ratio decreased 8 basis points from year-end 2014 due to a decrease in cash, which was partially offset by an increase in inventory and decrease in accounts payable. In 2014, working capital increased $309 million and our current ratio increased 8 basis points over year-end 2013 due to an increase in cash, which was partially offset by a decrease in inventory and increase in accounts payable.

We generated $671 million of free cash flow for 2015; a decrease of $563 million from 2014. As discussed above, the decrease is primarily the result of a decrease in cash provided by operating activities in 2015. Free cash flow is a non-GAAP financial measure which we define as net cash provided by operating activities and proceeds from financing obligations (which generally represent landlord reimbursements of construction costs) less capital expenditures and capital lease and financing obligation payments. Free cash flow should be evaluated in addition to, and not considered a substitute for, other financial measures such as net income and cash flow provided by operations. We believe that free cash flow represents our ability to generate additional cash flow from our business operations. See the key financial ratio calculations section above.

Return on investment ratios

Lower earnings, including the loss on extinguishment of debt, caused decreases in all three of our return on investment ratios - ratio of earnings to fixed charges, return on assets and return on gross investment ("ROI"). See Exhibit 12.1 to this Annual Report on Form 10-K for the calculation of our ratio of earnings to fixed charges and the key financial ratio calculations below for the return on assets and ROI calculations.

We believe that ROI is a useful financial measure in evaluating our operating performance. When analyzed in conjunction with our net earnings and total assets and compared with return on assets, it provides investors with a useful tool to evaluate our ongoing operations and our management of assets from period to period. ROI is a non-GAAP financial measure which we define as earnings before interest, taxes, depreciation, amortization and rent (“EBITDAR”) divided by average gross investment. Our ROI calculation may not be comparable to similarly-titled measures reported by other companies. ROI should be evaluated in addition to, and not considered a substitute for, other financial measures such as return on assets.

Capital structure ratios

Our debt agreements contain various covenants including limitations on additional indebtedness and a maximum permitted debt ratio. As of January 30, 2016, we were in compliance with all debt covenants and expect to remain in compliance during 2016. See the key financial ratio calculations section below for our debt covenant calculation.

Our debt/capitalization ratio was 46.3% at year-end 2015 and 44.3% at year-end 2014. The increase is primarily due to treasury stock purchases in 2015.