UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. 2)

Filed by the Registrant ¨ Filed by a Party other than the Registrant x

Check the appropriate box:

| x | Preliminary Proxy Statement | |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ¨ | Definitive Proxy Statement | |

| ¨ | Definitive Additional Materials | |

| ¨ | Soliciting Material Pursuant to §240-14a-12 | |

Stratus Properties Inc.

(Name of Registrant as Specified In Its Charter)

Carl Berg, David M. Dean and Michael Knapp

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

PRELIMINARY PROXY STATEMENT - SUBJECT TO COMPLETION DATED MAY 13, 2016

2016 ANNUAL MEETING OF STOCKHOLDERS OF STRATUS PROPERTIES INC.

PROXY STATEMENT OF THE BERG GROUP

PLEASE SIGN, DATE AND MAIL THE ENCLOSED GOLD PROXY CARD TODAY

This Proxy Statement (the “Proxy Statement”) and the enclosed GOLD proxy card are being mailed and otherwise made available to stockholders of Stratus Properties Inc. (“Stratus” or the “Company”) in connection with the solicitation of proxies by Carl Berg, David M. Dean and Michael Knapp (Messrs. Berg, Dean and Knapp are sometimes hereinafter referred to collectively as “we” or the “Berg Group”). Those proxies will be used to vote shares of the common stock, $0.01 par value per share (“Common Stock”), of Stratus at the 2016 annual meeting of stockholders of Stratus, including any adjournments, postponements, recesses or delays thereof and at any meeting held in lieu thereof (the “2016 Annual Meeting”) in the manner described in this Proxy Statement. The 2016 Annual Meeting is scheduled to be held at 200 Lavaca Street, Austin, Texas 78701, on Monday, June 6, 2016, at 9:30 a.m. (Central Time). This Proxy Statement and the enclosed GOLD proxy card are first being sent to stockholders on or about May , 2016.

The Berg Group is soliciting your proxy for the 2016 Annual Meeting in connection with the following proposals:

1. To elect David M. Dean and Michael Knapp (each a “Berg Nominee”) to serve as directors of the Company;

2. To vote, on an advisory basis, on the compensation of the Company’s named executive officers as described in the Company’s Proxy Statement;

3. To ratify the appointment of BKM Sowan Horan, LLP (“BKM”) as the independent registered public accounting firm of the Company;

4. To vote on a stockholder proposal that requests that Stratus’ board of directors immediately engage a nationally recognized investment banking firm to explore the prompt sale, merger or other business combination of Stratus so shareholders may realize the true value of their Shares (the “Berg Stockholder Proposal”); and

5. To vote, in the discretion of the proxies, on such other business as may properly come before the 2016 Annual Meeting.

Stratus has disclosed that the record date for determining stockholders entitled to notice of and to vote at the 2016 Annual Meeting is May 2, 2016 (the “Record Date”). Stockholders of record of Stratus at the close of business on the Record Date will be entitled to vote at the 2016 Annual Meeting. According to the Company’s Definitive Proxy Statement for the 2016 Annual Meeting, filed with the Securities and Exchange Commission (the “SEC”) on April 15, 2016 (the “Company’s Proxy Statement”), as of March 31, 2016, there were 8,092,140 shares of Common Stock outstanding and entitled to vote at the 2016 Annual Meeting (the “Shares”). Each Share has one vote.

As of the date of this Proxy Statement, Mr. Berg beneficially owns, and the members of the Berg Group may be deemed to beneficially own, an aggregate of 1,421,002 Shares, representing approximately 17.6% of the Company’s outstanding Shares (based on information disclosed in the Company’s Proxy Statement regarding the number of outstanding Shares as of March 31, 2016).

1

WE URGE YOU NOT TO SIGN ANY PROXY CARD SENT TO YOU BY THE COMPANY. IF YOU HAVE ALREADY DONE SO, YOU MAY REVOKE ANY PROXY THAT YOU PREVIOUSLY SIGNED AND RETURNED TO THE COMPANY BY SIGNING AND RETURNING A LATER-DATED GOLD PROXY CARD IN THE ENCLOSED POSTAGE-PAID ENVELOPE, BY DELIVERING A WRITTEN NOTICE OF REVOCATION TO THE BERG GROUP OR TO THE CORPORATE SECRETARY OF THE COMPANY, OR BY INSTRUCTING US BY TELEPHONE OR VIA THE INTERNET AS TO HOW YOU WOULD LIKE YOUR SHARES VOTED (INSTRUCTIONS FOR HOW TO DO SO ARE ON YOUR GOLD PROXY CARD).

IF YOU EXECUTE AND RETURN THE BERG GROUP GOLD PROXY CARD, YOU DO NOT NEED TO, AND WE URGE YOU NOT TO, RETURN THE STRATUS WHITE PROXY CARD.

OUR NOMINEES ARE COMMITTED TO ACTING IN THE BEST INTERESTS OF ALL STOCKHOLDERS OF STRATUS. WE BELIEVE THAT YOUR VOICE IN THE FUTURE OF STRATUS CAN BEST BE EXPRESSED THROUGH THE ELECTION OF OUR NOMINEES. ACCORDINGLY, THE BERG GROUP URGES YOU TO COMPLETE THE GOLD PROXY CARD PROVIDED TO YOU TO VOTE:

| • | FOR THE BERG NOMINEES, |

| • | AGAINST PROPOSAL 2 AND |

| • | FOR PROPOSALS 3 AND 4. |

Important Notice Regarding the Availability of Proxy Materials for the

Shareholder Meeting to be Held on June 6, 2016

This Proxy Statement and our GOLD proxy card will be mailed to you and are available at www.sec.gov

2

IMPORTANT

Your vote is important, no matter how few Shares you own. We urge you to sign, date and return the enclosed GOLD proxy card today to vote FOR the election of the Berg Nominees and FOR the Berg Stockholder Proposal and in accordance with our recommendations on the other proposals on the agenda for the 2016 Annual Meeting.

| • | If your Shares are registered in your own name, please sign and date the enclosed GOLD proxy card and return it to the Berg Group, c/o Morrow & Co., LLC in the enclosed postage-paid envelope today. If your Shares are registered in your own name, you may vote electronically by following the instructions shown on the enclosed GOLD proxy card. |

| • | If your Shares are held in a brokerage account or bank, you are considered the beneficial owner of the Shares, and these proxy materials, together with a GOLD voting form, are being forwarded to you by your broker or bank. As a beneficial owner, you must instruct your broker, trustee or other representative how to vote. Without those instructions, your broker cannot vote your Shares on your behalf on any matter. |

| • | Even if your Shares are not registered in your name, depending upon your broker or custodian, you may be able to vote either by toll-free telephone or by the Internet. Please refer to the enclosed voting instruction form for instructions on how to vote by toll-free telephone or electronically. You may also vote by signing, dating and returning the enclosed voting instruction form. |

Since only your latest dated proxy card will count and will be voted, we urge you not to return any proxy card you receive from the Company. Even if you return the management proxy card marked “withhold vote for all nominees” as a protest against the incumbent director nominees, doing so will revoke any proxy card you may have previously sent to us or your instructions given to us over the telephone or internet. Remember, you can vote for our two (2) Berg Nominees only on our GOLD proxy card or by giving us voting instructions over the telephone or internet. So please make certain that the latest dated proxy card you return is the GOLD proxy card or your latest voting instructions are dated or given to us.

|

If you have any questions, require assistance in voting your GOLD proxy card, or need additional copies of the Berg Group’s proxy materials, please call or email Morrow & Co., LLC at the phone numbers or email address listed below.

Morrow & Co., LLC 470 West Avenue Stamford, CT 06902

Banks and Brokers Call Toll-Free: 800-662-5200 Stockholders Call TOLL-FREE: 877-849-0763 Email: bergproxy@morrowco.com

|

PLEASE VOTE THE GOLD PROXY.

1

BACKGROUND TO THE SOLICITATION

The following is a chronology of events that led to this proxy solicitation:

| • | Mr. Berg is a longtime stockholder of the Company and acquired all of his Shares from July 1997 through December 2001 because he believed, at the time, that the Shares represented an attractive investment opportunity. Based on a review of information filed with the SEC, Mr. Berg has been the Company’s largest stockholder for over ten years. He currently owns 1,421,002 Shares, which is approximately 17.6% of the Company’s common stock outstanding based on the most recently available information regarding the number of outstanding Shares as of March 31, 2016. |

| • | Bruce G. Garrison, a director designated by Mr. Berg, served on the Company’s board of directors (the “Board”) for approximately ten years from July 2002 to May 2012. |

| • | On January 10, 2012, Mr. Berg notified the Company of his intention to nominate William H. Lenehan IV as an independent director for election to the Board at the Company’s 2012 annual meeting of stockholders (the “2012 Annual Meeting”). After discussions with Mr. Berg and meetings with Mr. Lenehan and considering Mr. Lenehan’s qualifications, skills and attributes, the Board nominated Mr. Lenehan to stand for election as a Class II director at the annual meeting of Stockholders of the Company held on May 24, 2012. He was elected as a Class II director of the Company at that meeting. The Company had, at that time as it does today, a classified, i.e., a staggered, board of directors. At this meeting, Mr. Lenehan was elected to serve for a three-year term. Unfortunately, the Board did not nominate Mr. Garrison, an incumbent, independent director, to stand for re-election at the 2012 Annual Meeting. |

| • | Although Mr. Berg requested the Board to nominate Mr. Lenehan to stand for election as a director of the Company, as a result of Mr. Lenehan’s previous indications to Mr. Berg, Mr. Berg does not believe that Mr. Lenehan considered himself to be Mr. Berg’s designee on the Board with any responsibilities to Mr. Berg that were different from, or in addition to, the responsibilities Mr. Lenehan had as a director to all other stockholders of the Company. |

| • | As Mr. Lenehan has previously indicated to Mr. Berg, during his tenure as a director of the Company, Mr. Lenehan advocated for the Company to adopt a strategic plan intended to increase stockholder value, for the Company to provide greater transparency with respect to the operations and plans to its stockholders, and for the Company to make significant changes in the corporate governance practices of the Company, including declassifying the Board and terminating the Company’s Amended and Restated Rights Plan, i.e., its poison pill. From April 1, 2013, until March 12, 2015, Mr. Lenehan served as the chairman of the Nominating and Corporate Governance Committee of the Board. |

| • | On February 20, 2015, Mr. Berg wrote a letter to the Board criticizing the Board for the Company’s lackluster performance over an extended period of time and for the Board’s failure to make stockholder-friendly improvements, such as removing the Company’s poison pill plan and declassifying the Board. As a precondition to further engagement with Mr. Berg, the Company proposed that Mr. Berg execute a standstill agreement that contained restrictions on Mr. Berg’s activities regarding the Company taking certain actions with respect to the Company’s stock. Mr. Berg rejected the Company’s draft of the standstill agreement because he believed it to be overly aggressive and perpetuating the entrenchment of management, but Mr. Berg did offer to not take control of the Company or purchase additional Shares so he would own more than 24.5% of the outstanding Shares if the Board would remove the poison pill and declassify the Board. In Mr. Berg’s view, his requests asked the Board to adopt policies that are commonplace among well-run public companies. The Company did not respond to Mr. Berg’s letter, or his offer, which was made public as an amendment to Mr. Berg’s Schedule 13D. |

| • | On March 16, 2015, the Company announced that the Board unanimously approved a five-year plan to create value for stockholders by developing certain existing assets and actively marketing other assets for sale at appropriate values. Although Mr. Lenehan indicated to Mr. Berg that he believed the five-year plan had shortcomings, Mr. Lenehan voted in favor of it. Mr. Lenehan has informed Mr. Berg that |

2

| he had pushed for such a plan to be adopted based on his view that the Company needed to have, but did not have, a strategic plan and voted in favor of the adoption of the five-year plan despite his concern that the plan had certain shortcomings. On April 20, 2015, the Company posted an investor presentation on the Company’s website detailing the five-year plan. Mr. Lenehan has also informed Mr. Berg that he believes that shortly after the adoption of that plan, the Company commenced entering into transactions that deviated significantly from the plan. |

| • | In the Company’s proxy statement relating to its annual meeting of stockholders held on May 7. 2015 (the “2015 Annual Meeting”), the Company disclosed that on March 12, 2015, a majority of the directors of the Company voted to remove Mr. Lenehan from the nominating and corporate governance committee of the Board, of which he was then the chairman. Mr. Lenehan has informed Mr. Berg that this action was taken in the face of Mr. Lenehan’s attempts to change the Company’s compensation and corporate governance practices in a manner he thought was for the better. The Company also disclosed in the proxy statement relating to the 2015 Annual Meeting that the removal of Mr. Lenehan from the nominating and corporate committee occurred before that committee’s consideration of nominees for election at the 2015 Annual Meeting. Mr. Lenehan was not nominated to stand for re-election as a director of the Company at the 2015 Annual Meeting and ceased to be a director of the Company on May 7, 2015. |

| • | In May 2015, the Board amended and renewed the Company’s poison pill plan, despite Mr. Berg’s previously noted objections to the Company’s poison pill plan. |

| • | On December 8, 2015, Mr. Berg submitted the Berg Stockholder Proposal to the Company for inclusion in the Company’s proxy materials for the 2016 Annual Meeting pursuant to Rule 14a-8 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), in which he proposed that the Board immediately engage a nationally recognized investment banking firm to explore the prompt sale, merger or other business combination of the Company so stockholders could, in Mr. Berg’s opinion, realize the true value of their shares. Mr. Berg also informed the Company that he intended to nominate two individuals as directors of the Company at the 2016 Annual Meeting. At the time, the Board was composed of four directors. As a result, the election of Mr. Berg’s nominees would have resulted in Mr. Berg’s nominees occupying one-half of the Board’s seats. Mr. Berg publicly disclosed his proposal through a press release and amendment to his Schedule 13D filing. Mr. Berg affirmatively stated to the Company that he did not want to buy or run the Company, but wanted all of the Company’s stockholders to have a better chance to realize the fair market value of their Shares. Mr. Berg did not receive a response from the Company. |

| • | On December 11, 2015, after receipt of Mr. Berg’s proposal, the Company announced that the Board had expanded the size of the Board from four to six directors, and appointed two new directors to the Board, James E. Joseph and John G. Wenker. These directors were added as a Class I director (with a term expiring at the Company’s 2017 annual meeting of stockholders) and as a Class II director (with a term expiring at the Company’s 2018 annual meeting of stockholders). These elections had the effect of ensuring that, even if Mr. Berg’s nominees were elected to the Board, Mr. Berg’s nominees would only constitute a minority of the Board. |

| • | In response to the Company’s 50% expansion of its Board and the appointment of two new Board members on December 19, 2015, Mr. Berg sent a letter via email (the “December 19 Letter”) to the newly appointed directors. In the December 19 Letter, Mr. Berg outlined his concerns with the Company’s management to the new directors and detailed his reasons and the background for submitting the Berg Stockholder Proposal for inclusion in the Company’s proxy statement for the 2016 annual meeting of stockholders and for a stockholder vote at that meeting. As expressed in his letter, Mr. Berg’s concerns and reasons for submitting the Berg Stockholder Proposal included his belief as a fifteen year Stratus stockholder of: (1) the chronic underperformance of Stratus’ stock price over the past decade; (2) the misallocation of Stratus’ capital towards high-leverage, high-profile developments to the exclusion of strategically advantageous opportunities; (3) the large discount at which Stratus’ shares trade compared to its net asset value; (4) the lack of effective board oversight of executive |

3

| compensation, especially as compared to Stratus’ financial performance; (5) management’s vague and self-contradictory “five-year plan”; (6) Stratus’ excessive overhead, which would continue under management’s five-year plan; (7) Stratus’ Board’s active attempts to prevent independent oversight, including refusing to nominate certain independent directors for re-election and filling the Board with management-friendly directors; and (8) Stratus’ overutilization of antitakeover defenses, costly severance packages for its executives and poor corporate governance practices, which in Mr. Berg’s opinion have the effect of entrenching management to the detriment of stockholders. The December 19 Letter expressed Mr. Berg’s belief that a sale of the Company is in the best interests of the Company and its stockholders. Mr. Berg wanted the new directors to be aware of the many objections that Mr. Berg has had with respect to the operation of the Board and the activities of the Company, that in Mr. Berg’s view, are not in the best interest of the Company’s stockholders. Mr. Berg reported the action in a press release and amendment to his Schedule 13D filing. |

| • | On January 8, 2016, in accordance with the Company’s bylaws, Mr. Berg delivered notices of nomination for David M. Dean and Michael Knapp for election to the Board at the Company’s 2016 annual meeting of stockholders and in opposition to the two directors nominated by the Board. The Company’s Board is staggered and, as a result, the Company’s stockholders will only be electing two directors at the 2016 Annual Meeting. Both of Mr. Berg’s nominees have significant experience in the real estate industry. Mr. Berg also notified the Company that he and Mr. Dean had an agreement in principle pursuant to which Mr. Berg intended to sell to Mr. Dean 45,000 of Mr. Berg’s Shares at a price of $18 per share. Mr. Berg did not receive a response from the Company. Mr. Berg issued a press release and filed an amendment to his Schedule 13D filing and a group Schedule 13D disclosing these nominations. |

| • | Also, on January 8, 2016, Mr. Berg sent an email to the members of the Board (“January 8 Email”) addressing the change of control agreement with William H. Armstrong III, the Company’s chairman of the board, president and chief executive officer, which was due to expire on March 31, 2016. Mr. Berg advised the Board to assess whether any renewal of this and similar change of control or golden parachute agreements would be consistent with the proper performance of their fiduciary duties and whether the golden parachute would truly serve the best interests of the Company’s stockholders. Mr. Berg stated his strong objection to such agreements. Mr. Berg did not receive a response to his email. |

| • | On January 14, 2016, Mr. Berg, Mr. Dean and Mr. Knapp entered into a joint filing and solicitation agreement. Pursuant to this agreement, Mr. Dean and Mr. Knapp agreed, among other things, not to engage in any transaction in securities of the Company without the prior consent of Mr. Berg, to provide written notice of any purchase or sale of securities of the Company, and to act together and cooperatively with Mr. Berg acting as the primary decision maker to seek election of Mr. Dean and Mr. Knapp to the Company’s Board. Mr. Berg agreed to reimburse Mr. Dean and Mr. Knapp for expenses incurred in connection with their election. |

| • | On January 15, 2016, Mr. Berg filed a joint filing for himself, Mr. Dean and Mr. Knapp. As of the date of the event that required such filing, January 7, 2016, neither Mr. Dean non Mr. Knapp beneficially owned any Shares, and Mr. Berg owned 17.6% of the outstanding Shares (based on 8,067,356 shares of the Company’s common stock outstanding as of October 30, 2015). |

| • | On January 28, 2016, Mr. Berg, along with several other large stockholders of the Company, received a copy of a letter dated January 22, 2016 from Capretta Properties Inc. (“Capretta”) addressed to Mr. William Armstrong at the Company (the “Capretta Letter”). In the Capretta Letter, Capretta offered to purchase the real property assets of the Company for cash in the amount of $435 million (the “Capretta Offer”). The Capretta Offer contemplates that the debt encumbering the real property assets would be paid from the proceeds of the purchase to the extent necessary to release the assets acquired from the liens securing Company debt. In the alternative, Capretta offered to assume certain of that debt on the condition that the amount of the debt assumed would reduce the purchase price for the assets on a dollar-for-dollar basis. |

4

| • | After the Company had not announced that it had received the Capretta Offer for a number of days after Mr. Berg received his copy of the Capretta Letter, Mr. Berg issued a press release announcing his receipt of the letter (which was sent to several large Company stockholders, but not to all stockholders, giving vise to unequal distribution of information in the marketplace), after which the Company filed a Current Report on Form 8-K with the SEC disclosing its receipt of the Capretta Offer. A press release made by the Company announcing its receipt of the Capretta Offer was an exhibit to that report. That press release announced the receipt of the Capretta Offer and noted that the Board: |

“in accordance with its fiduciary duties, and consistent with its commitment to maximize long-term stockholder value, is in the process of carefully reviewing and considering the proposal. The Board maintains its commitment to engaging in constructive dialogue with all stockholders. There can be no assurance that this process will result in any transaction in the future, and no decision has been made to enter into any transaction at this time.”

The Capretta letter stated that Mr. Capretta had left five messages for Mr. Armstrong in December 2015 and January 2016, but that Mr. Armstrong had not returned any of Mr. Capretta’s calls.

| • | Despite this representation, the Company requested that Capretta execute what Mr. Capretta stated in a letter to the Company he considered a one-sided and onerous nondisclosure agreement, which version Capretta has declined to execute. We are unaware of any substantive response being made to the Capretta Offer by the Company other than what Mr. Capretta has characterized as a very brief telephone call between Mr. Armstrong and the chief executive officer of Capretta. |

| • | On February 3, 2016, Mr. Berg wrote to Erin Pickens, senior vice president and chief financial officer of Stratus, requesting copies of certain documentation that Stratus had referenced in its SEC filings and press releases, but had not filed, certain of which Mr. Berg believes to be material. The requested documentation includes: (1) the buy-sell agreement indirectly referenced in Stratus’ Form 8-K dated as of September 28, 2015, whereby Stratus’ partner in the Block 21 project forced Stratus to either sell its interest in Block 21 for $44.5 million or purchase its partner’s interest; (2) the services agreement referenced in Stratus’ Form 10-K for 2014, whereby FM Services Company, a wholly owned subsidiary of Freeport-McMoRan Inc. provides “certain services necessary for Stratus’ business and operations, including certain administrative, financial reporting and other services”; (3) the right of first refusal pursuant to which Stratus sold certain of its undeveloped commercial tracts for $15.8 million in cash on August 2012 as more particularly set forth in Stratus’ press release filed with the SEC on August 24, 2012; and (4) the joint venture agreement with Moffett Holdings in the Parkside project, together with an explanation of why Stratus’ right of redemption contained therein was not exercised, the incremental returns that accrued to Moffett Holdings as a result of Stratus’ non-exercise of its redemption rights and whether the Board unanimously approved (x) the initial decision to pursue the Parkside joint venture with Moffett Holdings and (y) the decision to not exercise the redemption option. |

| • | Mr. Berg received a response from Ms. Pickens, dated February 22, 2016, indicating generally and not specifically as to Mr. Berg’s request that the documents he requested either never existed or were not required to be filed with the SEC. |

| • | On March 4, 2016, Mr. Berg sent a request (the “Initial 220 Request”) pursuant to Section 220 of the General Corporation Law of the State of Delaware (the “DGCL”) for a list of the Company’s stockholders to facilitate communications between Mr. Berg and the Company’s stockholders, including to enable Mr. Berg to solicit proxies from the stockholders. |

| • | On March 7, 2016, Mr. Berg wrote a letter to the members of the Board inquiring as to the status of the Capretta Offer, as Mr. Berg and other large Stratus stockholders had been copied on a letter from Capretta to the Company in which Mr. Capretta stated his objections to what he characterized in the letter as a one-sided and onerous confidentiality agreement. Mr. Berg also urged the Board not to miss the opportunity to engage Capretta in dialogue regarding the Capretta Offer and expressed his concern |

5

| over what Mr. Berg believes to be Mr. Armstrong’s continually appearing and serious conflicts of interest regarding his job position and compensation and potential transactions that would disrupt his situation. |

| • | On March 9, 2016, the Board approved certain changes to the Company’s bylaws: |

| ¡ | to provide the Board with explicit authority to cancel, postpone or reschedule a stockholder meeting upon prior notice; |

| ¡ | to enhance the powers of the chairman of any stockholder meeting, including giving that person the authority to adjourn or recess a stockholder meeting for any reason to be reconvened at the same or some other place; |

| ¡ | to establish the Court of Chancery of the State of Delaware as the exclusive forum for certain actions and proceedings; and |

| ¡ | to impose an explicit confidentiality obligation on directors, which reads: |

“Each director shall hold all Confidential Information in the strictest confidence and shall take all appropriate measures to ensure that no other person shall have access to the Confidential Information.” “Confidential Information” is defined to mean “all nonpublic information (whether or not material to the Corporation) entrusted to or obtained by a director by reason of his or her position as a director of the Corporation.” (Bold emphasis added.)

| • | Mr. Berg received a letter dated March 10, 2016, from Mr. Michael Madden, Lead Independent Director for Stratus, wherein he stated the Board declined to provide the stockholders any update on the Capretta Offer. |

| • | On March 10, 2016, despite the concerns Mr. Berg raised in the December 19 Letter and January 8 Email, the Board approved new severance and change of control agreements with Mr. Armstrong and Ms. Pickens, (collectively, the “Executives”). These agreements, which run from April 1, 2016 through March 31, 2019, entitle the Executives to receive benefits in the event their employment is terminated, including, if such executive is terminated following a change of control, a lump-sum cash payment equal to the sum of his or her prorated bonus for the year of termination plus the sum of (a) the Executive’s base salary in effect at the time of termination and (b) the average annual bonus awarded to the Executive for the three fiscal years immediately preceding the termination date. In addition, the Company agrees to continue to provide insurance and welfare benefits to the Executive until the earlier of (a) December 31 of the first calendar year following the calendar year of the termination or (b) the date the Executive accepts new employment. If any part of the payments or benefits received by the Executive in connection with a termination following a change of control constitutes an excess parachute payment under Section 4999 of the Internal Revenue Code, the Executive will receive the greater of (1) the amount of such payments and benefits reduced so that none of the amount constitutes an excess parachute payment, net of income taxes, or (2) the amount of such payments and benefits, net of income taxes and net of excise taxes under Section 4999 of the Internal Revenue Code. To date, the Company has not filed copies of these severance agreements with the SEC. |

| • | On March 11, 2016, the Company’s outside counsel informed Mr. Berg that the Company believed the Initial 220 Request requesting stockholder list materials was not made for a proper purpose under the DGCL. |

| • | On March 18, 2016, Mr. Berg filed a lawsuit in Delaware Court of Chancery to require that the Company comply with the Initial 220 Request. |

| • | From March 22, 2016, through April 20, 2016, counsel for Mr. Berg and counsel for the Company discussed and exchanged drafts of confidentiality agreements, which, in Mr. Berg’s view, reflected the Company’s unreasonable attempt to limit his use of the stockholder information that he requested in |

6

| the Initial 220 Request. A confidentiality agreement was signed by Mr. Berg on April 20, 2016, and the Company promised to comply with the Initial 220 Request. |

| • | On March 23, 2016, Mr. Wenker resigned as a director of the Company. |

| • | On March 25, 2016, the Board appointed John C. Schweitzer to fill the vacancy created by Mr. Wenker’s resignation. He is serving as a Class II director, the term of which class of directors is scheduled to end in 2018, and, effective as of the date of the Company’s 2016 Annual Meeting, he will be a member of each of the audit committee and compensation committee. |

| • | On March 28, 2016, April 7, 2013 and April 13, 2013, the Company filed its preliminary proxy statements with the SEC in connection with the 2016 Annual Meeting, noting, as permitted by the SEC rules, that such preliminary proxy statements were subject to completion. Only the preliminary proxy statement filed on April 13, 2016, disclosed the record date and the date of the 2016 Annual Meeting. The preliminary proxy statements of the Company disclosed that the two nominees of the Board for election as directors of the Company at the 2016 Annual Meeting are Mr. Armstrong, the Company’s chairman of the board, president and chief executive officer, and Mr. Charles W. Porter, an incumbent director of the Company. The preliminary proxy statements of the Company discloses that Mr. Porter is the designated director of LCHM Holdings, LLC, which is disclosed to be the holder of 7.7% of the outstanding Shares as of March 31, 2016. |

| • | On April 2, 2016, the Company filed an answer to Mr. Berg’s lawsuit. |

| • | On April 6, 2016, Capretta sent another letter to Mr. Armstrong, still looking for a response to the Capretta Offer, dated January 22, 2015, and sent copies to Mr. Berg and other large stockholders of the Company. Apparently, the Company has conditioned any dialogue with Capretta upon signing what Mr. Capretta characterized in a letter to the Company as a one-sided and onerous confidentiality agreement, including an infinite confidentiality agreement term for at least some information, despite the fact that the Capretta Offer is based upon public information regarding the Company and Capretta does not seek any confidential information at this time. |

| • | On April 7, 2016, the Company issued a press release announcing that the board had authorized management to explore a full range of strategic alternatives and that the Company had engaged Hentschel & Company, LLC, a three year old investment banking advisory firm (“Hentschel”), as financial advisor in connection with that review. |

| • | On April 15, 2016, the Company filed with the SEC its definitive proxy statement. |

| • | On April 21, 2016, the Berg Group filed with the SEC its preliminary proxy statement in connection with the 2016 Annual Meeting. |

| • | On April 27, 2016, the Board issued a letter urging Stratus stockholders to vote its white proxy card. In this letter, the Board touts its own nominees for election as directors, claims that it has overseen significant value creation and, in our view, unfairly characterizes the Berg Proposal as a hasty attempt to force a sale of the company at “fire-sale” prices. The Board also touts the increase in Stratus’ stock price over 2015 as evidence that its five-year plan is creating value for shareholders even though a significant portion of this increase occurred only after Mr. Berg’s announcement of the Berg Proposal and the Capretta Offer (see chart on page 10). In addition, the Board dismisses Mr. Berg’s legitimate concerns with Stratus’ governance policies as unfounded. The letter also speaks of “the curious coincidence that Mr. Capretta and… [Mr. Lenehan] are neighbors who live on the same street.” Finally, the Board unfairly describes Mr. Berg’s motivations in bringing the Berg Proposal as “self-serving,” despite its potential to secure value for all of Stratus’ stockholders, not just Mr. Berg. |

| • | On May 2, 2016, Mr. Capretta responded to the April 27 letter from Stratus’ Board, copying Stratus major stockholders and Hentschel. Mr. Capretta took exception to Stratus’ characterization of the |

7

| Capretta Offer and Mr. Capretta’s actions. Specifically, among other things, Mr. Capretta characterized three statements in the April 27 letter as containing factual misrepresentations: (1) the Board’s description of its proposed confidentiality agreement as “customary” despite several onerous and one-sided terms; (2) the Board’s expression of its concerns that Capretta had no publicly available track record even though Mr. Capretta personally conveyed to Hentschel an internet brochure summarizing Capretta’s background in the real estate industry; and (3) the Board’s statement that Capretta had not provided any evidence of its ability to finance a purchase of Stratus’ assets despite having been notified by Capretta of its equity relationships with large institutional partners and 28-year relationship with Wells Fargo Bank. Finally, Mr. Capretta stated that he did not believe he had ever met Mr. Lenehan or spoken with him before the April 27 letter was issued and vehemently denied the Board’s groundless insinuation that he had or was acting in concert with Mr. Berg or Mr. Lenehan. |

| • | As discussed under “Additional Participant Information” below, on May 5, 2016, Mr. Berg and David Dean entered into a Stock Purchase and Option Agreement. |

| • | On May 6, 2016, Stratus’ Board issued a letter to its stockholders, urging them to vote its proxy card. In this letter, the Board characterizes the Berg Proposal as a self-serving attempt by Mr. Berg to exit his substantial investment in the Company to the detriment of other stockholders, despite Mr. Berg’s avowed intentions to secure value for all stockholders and Mr. Berg spending a significant amount of his own funds in that regard. The Board continues to refer to the Berg Proposal as a “fire sale” plan and to denigrate the experience and qualifications of the Berg Nominees. In addition, the Board touts the supposedly “solid financial position” of the Company and the effectiveness of its five-year plan to date. The Board also opine, without any real evidence, that the Berg Proposal will harm the value of the Company and damage relationships with community leaders, lenders, developers, tenants and partners. Finally, the Board claims that it has attempted to accommodate Mr. Berg’s desire to explore a sale of the Company or its assets through its hiring of Hentschel and its ongoing “strategic review process,” despite making only token efforts to engage with Capretta and, to our knowledge, no efforts to engage with other potential buyers. |

| • | On May 6, 2016, and May 13, 2016, Mr. Berg filed with the SEC amended preliminary proxy statements. |

8

REASONS FOR THE SOLICITATION

The Berg Group wants all of the stockholders of Stratus to realize the maximum value of their Shares. Mr. Berg is interested in having Stratus or its assets sold because he believes, after holding his Shares for more than fifteen years, that the sale of the Company or its assets is the method by which the stockholders will realize the highest value for their Shares. Recently, and months after Mr. Berg submitted the Berg Stockholder Proposal, the Company announced on April 7, 2016, the decision of the Board of Directors to conduct a review of strategic alternatives and retain Hentschel, a three year old investment banking advisory firm, as financial advisor in connection with the review (but without disclosing whether or not the investment banker would help the Board consider the Capretta Offer, which has been outstanding since January 22, 2016). Despite this effort, the Berg Group believes it important to indicate to the Board the Company’s stockholders preference regarding the sale of the Company or its assets. The Berg Group would prefer that the Board pursue a rigorous, focused exploration of such a sale, merger or other business combination that will allow the stockholders to realize the highest possible value for their Shares.

Mr. Berg has had concerns with Stratus’ management

Because of Mr. Berg’s concerns with the manner in which the Company’s operations have been managed and the direction in which the Board and management have been taking those operations, Mr. Berg desires to have a sale of Stratus or its assets seriously and adequately explored by the Board or a committee of independent directors of the Board. Mr. Berg had and has concerns that the Board and management will take a dismissive approach to possible transactions that would be accretive to stockholder value, if management would not be continued in its current positions after the transaction is consummated, and that the statements of Capretta regarding the Company’s actions relating to by the Capretta Offer reinforce Mr. Berg’s view that such a sale is necessary if the Company’s stockholders are ever to realize the intrinsic value of their Shares. It is for those reasons that Mr. Berg enlisted David Dean and Michael Knapp to serve as the Berg Nominees.

The Berg Group understands that there may be legitimate reasons why a sale, merger or other business combination of Stratus may not be in the best interests of the stockholders as a group, and is interested in understanding if there are such reasons . If there are such reasons, the Berg Group wants the corporate governance practices of the Company to be reformed to be in accord with best corporate governance practices and to ensure that the Board gives the kind of independent, objective oversight to the Company’s management that the best boards give to their managements.

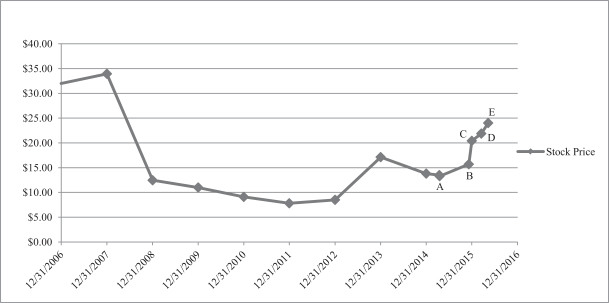

Mr. Berg’s Activism has Positively Impacted Stratus’ Stock Price

Stockholders have suffered from a declining stock price from the end of 2006 ($32.00 closing price per share at December 29, 2006) until Carl Berg began his recent efforts to hold the Board accountable to the Company’s stockholders and to persuade the Board to explore the sale of Stratus ($15.69 closing price per share on December 7, 2015), after which an unsolicited offer to acquire Stratus’ real property assets was made by Capretta. Mr. Berg has already made a positive impact on value creation at the Company and the market has responded very positively to news of Carl Berg’s engagement with the Company and the Board. In that regard, stockholders should consider the following summary of the movement of the Company’s stock price.

9

STRATUS (STRS) STOCK PERFORMANCE CHART—2006 – YEAR-TO-DATE 2016

| A | 12/7/15: The stock price was $15.69 on the day before Mr. Berg notified Stratus of shareholder proposal and intent to nominate two directors at 2016 Annual Meeting. |

| B | 12/19/15: Carl Berg announces letter to Stratus Board advocating sale and announcing intent to nominate two directors. Stock price increases 9% from $16.13 on December 21, 2015 to $17.63 on December 24, 2016. |

| C | 1/28/16: Stratus announces $435 million unsolicited bid from Capretta Properties. Stock price increases almost 22% over three days to $24.30 on February 1, 2016, from $19.96 on day prior to the announcement. |

| D | 3/6/16: Three days after Stratus released year-end earnings and update of five-year plan. Stock price declined 2.8% from $22.40 on March 15, 2016, to $21.77 on March 18, 2016. |

| E | 5/12/16: Current price $23.77. |

Source: NASDAQ as of May 12, 2016; all Stratus stock prices are closing prices on the date or dates indicated.

As stockholder value had continued to languish under the leadership of the incumbent board and the Company’s long-time management as indicated in the chart above, the Company was offered $435 million in cash in late January, 2016 in the Capretta Offer, under which Capretta proposed to acquire a significant portion of Stratus’ real estate properties, representing a substantial gain to the Company’s stockholders. When Mr. Capretta refused to sign a nondisclosure agreement that he characterized as one-sided and onerous, which agreement the Board required Capretta to sign before Stratus would enter into a dialogue with Capretta, the Board did not have to address the Capretta Offer, give it serious consideration or have significant discussion or any negotiation with Capretta regarding the terms of the Capretta Offer. According to Capretta, it based the Capretta Offer entirely on public information and did not require any confidential information from the Company.

We will leave it to the stockholders to judge whether the actions of Mr. Berg that were aimed at having the board immediately commence exploring a sale, merger or other business combination resulted in Capretta making its offer to the Company, although the original Capretta Letter cites Mr. Berg’s actions as one of its considerations in making the Capretta Offer. Prompting a sale of the Company that is in the best interest of all stockholders has been Mr. Berg’s motivation behind his attempts to engage with the Company and the Board. After Mr. Berg announced that the Capretta Offer had been received by Stratus (which Stratus did not disclose until after Mr. Berg made his announcement), the Share price increased by 21.7% (or $4.34 per Share) over the next two trading days.

10

We Believe Stratus Defensive Corporate Governance Policies Serves Only the Entrenched Management and the Current Board

Mr. Berg has a significant amount of money invested in the Shares he owns, which total 1,421,002 or 17.6% of the outstanding Shares. That ownership makes him the Company’s largest stockholder and he has been such at least since 2002. He has been concerned for some time that Stratus has not performed as it should have and could have in the Austin, Texas real estate market and in the other markets in which Stratus has held properties over the past several years. Mr. Berg has also been concerned that, in his opinion, the performance of Stratus has been the result of a lack of appropriate stewardship on the part of what he believes to be an entrenched management. While enduring what Mr. Berg believes to be a lackluster performance of the Share price over a number of years (as indicated in the chart above), Mr. Berg has viewed the Board of Stratus as providing less than effective oversight of Stratus’ management. He has been concerned that the Board does not have the independence from management that it must have to provide appropriate oversight of management and he believes the Board has been dominated by Mr. Armstrong, Stratus’ chief executive officer for over twenty years. Mr. Berg also believes that Stratus’ corporate governance practices are wholly unacceptable for a company with publicly traded stock. In fact, those practices are real limitations on stockholder democracy for the Stratus stockholders. For example, Stratus has:

| • | a staggered board of directors, which means that if the owners of a majority of the Shares are dissatisfied with the manner in which the board is managing the affairs of Stratus and with the direction the board is giving Stratus’ management, those Share owners can only effect a change in the majority of the directors over the course of two annual meetings of stockholders; |

| • | a very restrictive rights plan that, after Carl Berg has been engaged in his recent advocacy for the stockholders of Stratus, has been made even more restrictive and has given management a stronger means for protecting its positions and compensation; |

| • | a newly adopted bylaw provision that allows the chairman of a stockholders’ meeting to adjourn the meeting for any reason to be reconvened at the same place or any other place, a provision that will allow the chairman of the stockholders’ meeting to adjourn the meeting if the vote on a proposals being voted on by stockholders appears to be going against the board’s and management’s favored position on such proposal; and |

| • | a bylaw provision that effectively keeps directors from making any statement to the stockholders of Stratus containing any information (whether or not material) relating to Stratus that the directors receive in their capacity as directors that is not contained in the Company’s filings with the SEC, press releases or public presentations. |

We believe that, if Stratus or its assets cannot be sold for their fair market value, the Board needs new members who are independent of management, have no ties to the current management and are not dominated by another member of the Board, who will work to effect appropriate changes in the corporate governance of Stratus and will be objective in their oversight of management.

We Believe the Best Way to Maximize Value at Stratus is an Auction to Sell the Company

The Berg Group strongly believes that the best way for the Company to maximize value for stockholders is to work with a nationally recognized investment banker to conduct an auction to sell the Company or its assets at the highest price possible to one or multiple strategic acquirers. We believe this high strategic interest by Capretta has created a window of opportunity for the Company to realize maximum value for stockholders through a negotiated transaction with Capretta or others. We have serious concerns, however, regarding the Company’s lack of transparency in communicating to stockholders and whether the Company is taking the appropriate actions to explore or seize this opportunity to sell the Company in a transaction favorable to the stockholders. As of April 29, 2016, to Mr. Berg’s knowledge the Company had not engaged in any substantive communication with Capretta regarding the Capretta Offer or with the stockholders as to why that offer is not in the stockholders’ best interest.

11

We believe that Stratus has attractive assets that should garner substantial interest from both financial and strategic acquirers. Specifically, the Austin real estate market has experienced significant appreciation in recent years and, based upon the interest of Capretta, we believe the Company’s assets would attract significant interest.

We strongly believe the current Board’s apparent lack of engagement with Capretta regarding the Capretta Offer, combined with its general lack of communication to the investment community about its long-term intentions for the Company, calls into doubt whether this Board is taking the right steps towards maximizing stockholder value.

In nominating his slate, who Mr. Berg believes to be highly qualified candidates, to the Board at the 2016 Annual Meeting, Mr. Berg is offering stockholders a way to express their support and desire for the Company to immediately conduct an open and robust sale process. See “Election of Directors,” below.

We Believe the Company Has Unfairly Manipulated the Composition of the Board of Directors by Unilaterally First Decreasing and Then Increasing the Size of the Board

As first disclosed to stockholders in the Company’s Current Report on Form 8-K filed on December 11, 2015, after receipt of a letter from Mr. Berg indicating that Mr. Berg intended to nominate two (2) individuals for election at the 2016 Annual Meeting, the Board unilaterally increased the size of the Board from four (4) to six (6) directors and has since nominated a slate of two (2) director candidates for election to the Board at the 2016 Annual Meeting, including Mr. Armstrong. We believe this action by the Board represents a corporate action of the Company of a type invalidated in the past by the Delaware Supreme Court as disenfranchising stockholders. We believe the effect and purpose of having announced this increase in the size of the Board from four (4) to six (6) members was to further entrench the current Board and management and to deny the Berg Group the opportunity to more significantly impact the composition of the Board at the 2016 Annual Meeting. The Berg Group is further reviewing what it believes to be an action with respect to the Company’s corporate machinery that is contrary to existing Delaware corporate law and reserves all rights to take whatever actions, including instituting legal proceedings against members of the Board, it believes may be necessary to ensure a fair and democratic election process.

This improper manipulation comes on the heels of the Board’s actions a short time before the 2015 Annual Meeting of Stockholders whereby the Board arranged to remove the only truly independent director at the time, William Lenehan, from the chairmanship of the nominating committee and then did not include Mr. Lenehan for re-election to the Board. Mr. Berg believes that Mr. Lenehan was the only truly independent director because Mr. Armstrong, Mr. Madden and Mr. Leslie had served together on the Board for over fifteen consecutive years and Mr. Porter is a representative of a greater than 5% stockholder and has served on the Board with Messrs. Armstrong, Madden and Leslie for almost ten consecutive years.

We Question the Board’s Ability to Act in the Best Interests of its Stockholders and are Concerned that the Board is More Concerned with Entrenchment of Management than Creating Value for Stockholders

In addition to the Board’s apparent lack of action in exploring the Capretta Offer, we believe certain actions of the Board have called into question its ability to act as responsible stewards of stockholder capital. For example:

| • | On March 9, 2016, Stratus amended and restated its poison pill plan once again. Among other changes to that plan, the Board reduced by 40%, from 25% to 15%, the percentage of the Shares that a person or group could acquire without triggering the poison pill plan. Since March 9, 2016, if a person acquires beneficial ownership of 15% of the outstanding Shares, the rights plan would be triggered and such acquirer’s ownership interest in Stratus would be significantly diluted. The amended rights agreement did grandfather Carl Berg, providing a person’s ownership as of the date of the amendment and restatement of the rights plan and the subsequent acquisition by such person of another one |

12

| percent of the outstanding Shares would not trigger the rights plan. However, the adoption of the amended rights plan has effectively chilled the ability of Carl Berg, David Dean and Michael Knapp to acquire a significant additional number of Shares and has left the members of the Berg Group reluctant to acquire any additional Shares at all. If Ingalls & Snyder LLC were to acquire additional Shares representing more than 1.0% of the outstanding Shares, it would become an Acquiring Person as defined in the Company’s Amended and Restated Rights Plan Agreement and trigger the poison pill as to itself, unless the Board of the Company waived that result as to Ingalls & Snyder LLC. Accordingly, a large stockholder may feel a similar reluctance to increase its position in this thinly traded stock. Whether intended by the Board or not, a significant adverse consequence of this action of the Board has been to limit sources of liquidity for stockholders desiring to sell Shares. Moreover, the Board has taken an action that will preclude David Dean and Michael Knapp from purchasing any significant amount of the Shares other than from Carl Berg in order to align their interests with the interests of the stockholders of Stratus prior to the 2016 Annual Meeting. |

| • | Severance Agreements. As noted under Background to the (excluding the value of accelerated stock vesting) Solicitation, despite concerns raised by Mr. Berg in the December 19 Letter and January 8 Email, the Board approved new severance and change of control agreements with Mr. Armstrong and Ms. Pickens. These agreements provide, among other things, for significant cash payments of approximately $2,100,000 (excluding the value of accelerated stock vesting, insurance and welfare benefits) to Mr. Armstrong and Ms. Pickens in the event their employment is terminated, including if each such executive is terminated following a change of control. These payments effectively reduce, on a dollar-for-dollar basis, the funds to be received by the Company’s stockholders upon a change of control. |

| • | Initial 220 Request. As noted in the Background of the Solicitation, by insisting on a very narrow use limitation, the Company has severely limited Mr. Berg’s right to communicate with other Stratus stockholders, all despite the fact that the Board has already severely limited Mr. Berg and others by the amended rights plan (provided such plan is enforceable) and the fact that Mr. Berg has continually maintained that neither he nor any of his associates have any desire to acquire or operate Stratus. |

13

PROPOSAL NO. 1

ELECTION OF DIRECTORS

According to the Company’s Proxy Statement, two (2) directors are to be elected to the board at the 2016 Annual Meeting. The Berg Group recommends that stockholders elect David M. Dean and Michael Knapp as directors of the Company at the 2016 Annual Meeting. Each of our Berg Nominees has consented to being named in this Proxy Statement as a nominee and to serving as a director if elected and has further agreed, if elected, to abide by all policies of the board as may be in place at any time and from time to time. The Berg Nominees are prepared to abide by the confidentiality obligation imposed on directors by the recent amendments to the bylaws of the Company that specifically prevent the Berg Nominees from disclosing nonpublic information of the Company, whether material or nonmaterial information, to any stockholder of the Company without Board consent. We believe that such obligation was adopted specifically to ensure that Mr. Berg and other stockholders concerned with the conduct of the Board do not receive any information, whether or not material, regarding the deliberations of the Board or management’s actions if the Berg Nominees are elected as directors of the Company.

Stratus has a classified board, also called a “staggered board,” with the Board divided into three classes of directors with each class having a three-year term. The directors of only one class are elected at any annual stockholders’ meeting for a three-year term, a feature of a classified board making it more difficult for stockholders to change a majority of the directors except over a two-year period. At the 2016 Annual Meeting, Class III will be elected for a three-year term. There are only two (2) Class III directors and as a result, the Berg Nominees, if elected, would be all of the directors elected at the 2016 Annual Meeting. If elected, the initial term of each Berg Nominee will be for three years, i.e., until the 2019 annual meeting of stockholders, and until his respective successor shall have been duly elected and qualified in accordance with the Bylaws of the Company filed as Exhibit 3.2 to the Annual Report on Form 10-K filed with the SEC on March 15, 2016 (the “Bylaws”).

The Berg Group believes good corporate governance requires that the Board be comprised of independent-minded directors, not tied to management, who are not dominated by any one other director or person, and who bring a diverse set of relevant skills and experience to their board service. Accordingly, Mr. Berg has proposed, in his opinion, two (2) highly qualified nominees who have the independence from management as well as the experience required to improve oversight, financial performance and management of the Company. Each of the Berg Nominees has a successful business background with extensive financial and real estate industry knowledge and executive experience. As a whole, the Berg Nominees are operations-focused with a long track record of working with or as a part of management teams to improve financial results and protect and build stockholder value.

The Berg Nominees

Set forth below is background information about the Berg Nominees, including their names, ages, principal occupations and employment and public company directorships held, as well as a description of the qualifications, attributes or skills that led to the conclusion that the Berg Nominees should serve as directors of the Company. Please see the section of this Proxy Statement titled “Additional Participant Information” for additional information about the Berg Nominees, including information about their beneficial ownership of Shares.

| Name |

Age | Position with Company | ||||

| David M. Dean |

55 | Berg Group Nominee | ||||

| Michael Knapp |

53 | Berg Group Nominee | ||||

Mr. Dean’s present principal occupation or employment is serving as the Chief Operating Officer of Lincoln Capital Management, LLC (“Lincoln”), an organization that specializes in providing bridge financing incident to

14

the Small Business Administration’s 504 real estate loan program. That lending has helped finance developments such as hotels, automotive repair facilities, assisted living facilities, restaurants and other types of commercial real estate developments. Mr. Dean has held that position since September 2012. From January 2008 through August 2012, Mr. Dean’s principal business activity was acting as a real estate and angel investor, investing for his own account, primarily in the Dallas/Fort Worth metropolitan area. From August 1994 through August 2007, Mr. Dean was employed by Crescent Real Estate Equities Company, a real estate investment trust that was a New York Stock Exchange listed company during Mr. Dean’s tenure (“Crescent”). At Crescent, Mr. Dean served as Senior Vice President, Law and Secretary from August 1994 to September 1999 when he became Senior Vice President, Law and Administration and Secretary, a position which he held until January 2001. From January 2001 to March 2005, Mr. Dean served as Executive Vice President, Law and Administration and Secretary of Crescent and its general partner. In March 2005, Mr. Dean’s title changed to Managing Director, Law and Secretary of Crescent and its general partner, positions he held until leaving Crescent and its general partner in August 2007, when Crescent was acquired by affiliates of Morgan Stanley Real Estate. During his tenure at Crescent, Mr. Dean worked closely with the Board of Directors and commonly attended the board meetings of Crescent. From 1992 until joining Crescent, he was an attorney for Burlington Northern Railroad Company (“BNRC”), serving as BNRC’s Assistant General Counsel in 1994. From 1986 until joining BNRC in 1992, Mr. Dean was engaged in the private practice of law at the firms of Kelly, Hart & Hallman and at Jackson Walker, L.L.P., both in Fort Worth, Texas, where he worked primarily on acquisition, financing and venture capital transactions for Richard E. Rainwater and related investor groups. During the past five years, Mr. Dean has been a director of the following privately-held companies (during the periods shown): TalentCircles, Inc. (August, 2011 to the present), S&R Online Strategies, Inc. (Sportal.com) (June, 2009 to the present) and Nelwood Corp. (Kuru shoes) (May, 2008 to the present). The experience, qualifications, attributes and skills of Mr. Dean, which he gained as a senior officer of a publicly traded real estate investment trust which had net investments in real estate of more than $3.2 billion at March 31, 2007, as an investor for his own account in real estate developments and as the operating officer of a financial company focused on real estate finance, led Mr. Berg to conclude that Mr. Dean should serve as a director of the Company.

Mr. Knapp’s present principal occupation or employment is serving as the manager of Berg & Berg Enterprises, LLC, an investment and real estate development company, and its predecessor company, Berg & Berg Enterprises, Inc. Mr. Knapp has served in that position since 1994. During the period from 1997 through December, 2012, Mr. Knapp served as a director from September 2, 1997 to March 30, 1998, and as Director of Operations and Director of Tax from 1999 to 2012 of Mission West Properties, Inc., a corporation qualified as a real estate investment trust, shares of which were listed for trading on the NASDAQ Stock Market (“Mission West”). Mission West sold its assets and was liquidated in December 2012. Mr. Knapp was the chief accounting officer of the Wooditch Company, a commercial insurance broker, from 1993 until joining Berg & Berg Enterprises, Inc. From 1988 to December 1992, Mr. Knapp served in the positions of president, chief financial officer and other executive positions at The Fairway Land Company, a real estate and country club developer located in San Juan Capistrano, California, which completed its development in 1992. From 1986 to 1988 Mr. Knapp was a staff auditor with Arthur Young who was succeeded by Ernst & Young LLP. During the past five years, Mr. Knapp has not been a director of any public or privately held company. Mr. Knapp has worked with Mr. Berg in various capacities for more than twenty years. He worked closely with Mr. Berg in successfully consummating the sale of Mission West for approximately $1.3 billion in 2012. The experience, qualifications, attributes and skills of Mr. Knapp gained as working as director of operations of Mission West Properties for thirteen years, his involvement in the sale of Mission West, and as the manager of Berg & Berg Enterprises and being involved in the real estate investments and developments of such companies have led Mr. Berg to conclude that Mr. Knapp should serve as a director of the Company.

The principal business address of David M. Dean is 16200 Addison Road, Suite 250, Addison TX 75001. The principal business address of Michael Knapp is 10050 Bandley Drive, Cupertino, CA 95014.

Messrs. Dean and Knapp have each consented to being named as a nominee in this proxy statement and to serve as a director, if elected.

15

Neither Carl Berg nor any of the Berg Nominees has failed to file reports related to the Company that are required by Section 16(a) of the Exchange Act since January 1, 2015.

The corporate governance standards of the Company, which are available on the Company’s website at http://www.stratusproperties.com/corpgovern.aspx, provide that determinations of independence shall be made in accordance with the definition of “independent” included in pertinent listing standards of The NASDAQ Stock Market LLC (“NASDAQ”) and any applicable legal requirement. The Berg Group has no knowledge of any facts that would prevent the determination that each of the Berg Group Nominees is independent in accordance with the corporate governance standards of the Company and the pertinent listing standards of NASDAQ or applicable laws, including the provisions of Section 10A of the Exchange Act and Rule 10A-3 adopted thereunder.

The Berg Group is not seeking your proxy to vote for any of the candidates who have been nominated by the Company. There is no assurance that one of the Company’s nominees will serve as a director if either of the Berg Nominees is not elected to the Board. In the event that one, but not both, of our Berg Nominees is elected and that one or more of the Company’s nominees declines to serve with such Berg Nominee or Berg Nominees, the Company’s Bylaws provide that the resulting vacancies may be filled by the directors then in office by a vote of the majority of the whole Board.

WE STRONGLY URGE YOU TO VOTE FOR THE ELECTION OF BOTH OF OUR NOMINEES ON THE ENCLOSED GOLD PROXY CARD.

16

PROPOSAL NO. 2

ADVISORY VOTE ON EXECUTIVE COMPENSATION

As discussed in further detail in the Company’s Proxy Statement, the Company is asking stockholders to indicate their support for the compensation of the Company’s named executive officers. This proposal, commonly known as a “say-on-pay” proposal, is not intended to address any specific item of compensation, but rather the overall compensation of the Company’s named executive officers and the philosophy, policies and practices as described in the Company’s Proxy Statement. Accordingly, the Company is asking stockholders to vote for the following resolution:

RESOLVED, that the stockholders of Stratus Properties Inc. (the “Company”) approve, on an advisory basis, the compensation of the Company’s named executive officers, as disclosed in the Company’s proxy statement for the 2016 annual meeting of stockholders pursuant to Item 402 of Regulation S-K of the rules of the Securities and Exchange Commission.

According to the Company’s Proxy Statement, the stockholder vote on Proposal 2 is an advisory vote only, and it is not binding on the Company, the board, or the Compensation Committee of the Board.

In our opinion, the compensation of Mr. Armstrong and Ms. Pickens has not historically been tied to the performance of the Company and, as a result, the stockholders should not vote to approve, on an advisory basis, the compensation of the executive officers of the Company as disclosed in the Company’s Proxy Statement. Based on information disclosed in the Company’s filings with the SEC, no element of the compensation program for Mr. Armstrong or Ms. Pickens prior to 2016 was performance-based.* The summary compensation table appearing in the Company’s Proxy Statement shows, for example, Mr. Armstrong’s equity-based compensation, which is time-vested restricted stock units, and which help align his interests somewhat with the interests of the stockholders, was approximately 22% of his total compensation for 2013, 31% of his total compensation in 2014 and 26% of his total compensation in 2015. The equity awards to Mr. Armstrong have historically been made early in the fiscal year, well before the year’s results can been be estimated within a reasonable range of probability and before this award amount can be based on current year’s performance. Although the amount of those awards may be determined in part based on the prior year’s results of operations, the evidence of the last three years suggests to the contrary as Mr. Armstrong received a larger equity award in 2014 than he did in 2013 or 2015 despite the Company’s results in 2013, when the Company’s diluted net income per share was $0.32 as opposed to $1.51 and $1.66 in 2015 and 2014, respectively. We note, however, that the Company’s net cash provided by operating activities was significantly higher for 2013, at approximately $55.9 million, than in 2014 or 2015, in which the net cash used in operating activities was ($21.6 million) and ($1.8 million), respectively. As reflected in its consolidated balance sheets and income statements set forth in its Annual Reports on Form 10-K for the years ended December 31, 2014 and 2015, over that same period, the Company’s revenue has steadily decreased while its total assets and total liabilities have both increased from year to year from 2013 to 2015.

In view of the demonstrable lack of any historical linkage prior to 2016 of the pay of the Company’s executive officers to the Company’s financial performance, we believe the stockholders should not approve, on an advisory basis, the compensation of the Company’s executive officers as described in the Company’s Proxy Statement.

WE STRONGLY URGE YOU TO VOTE AGAINST PROPOSAL 2 ON THE ENCLOSED GOLD PROXY CARD.

| * | Although starting in 2016, the Board finally made a portion of the Executives’ compensation performance based, it is a very long time in coming and is too little, too late. |

17

PROPOSAL NO. 3

RATIFICATION OF APPOINTMENT OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

As discussed in further detail in the Company’s Proxy Statement, the Company and the Audit Committee of the Board is seeking approval of the appointment of BKM Sowan Horan, LLP as the Company’s independent registered public accounting firm to audit the Company’s financial statements for the fiscal year ending December 31, 2016. The Company is submitting the appointment of BKM Sowan Horan, LLP for ratification by the stockholders at the 2016 Annual Meeting.

WE URGE YOU TO VOTE FOR PROPOSAL 3 ON THE ENCLOSED GOLD PROXY CARD.

18

PROPOSAL NO. 4

THE BERG STOCKHOLDER PROPOSAL

Mr. Berg has submitted the Berg Stockholder Proposal, which is a nonbinding proposal requesting the Board to immediately engage a nationally recognized investment banking firm to explore the prompt sale, merger or other business combination of Stratus so, in Mr. Berg’s opinion, shareholders may realize the true value of their Shares. The Berg Group is asking stockholders to vote for the following resolution:

RESOLVED, the shareholders of Stratus Properties request that Stratus’s board of directors immediately engage a nationally recognized investment banking firm to explore the prompt sale, merger or other business combination of Stratus so shareholders may realize the true value of their Stratus shares.

The Berg Stockholder Proposal is accompanied by the following supporting statement.

Supporting Statement

This proposal is made by Carl Berg, Stratus’s largest shareholder since 2002.

| 1. | The resolution’s proponent believes Stratus’s share value will only be maximized if Stratus is acquired in a sale, merger or other business combination. |

| 2. | Stratus’s management has demonstrated an inability to create acceptable shareholder value. As of December 4, 2015, Stratus’s shares are down 33% from their December 31, 2005 closing price. During the same period, Austin area real estate values have appreciated dramatically, the S&P 500 index was up 68% and the MSCI REIT index was up 29%. |

| 3. | Based on the December 4, 2015 closing price of $15.69, the shares are trading at a 55% discount to management’s recently published net asset value estimate of over $35. The highest closing price over the five years preceding that date was $17.93. |

| 4. | CEO compensation is not aligned with shareholder interests or closely tied to performance. Despite Stratus’s unacceptable financial performance and share price, the CEO’s cumulative compensation totaled approximately $13.4 million between 2005 and 2014. His cash compensation increased 63% during the same period. |

| 5. | Stratus is again placing inappropriate leverage on its balance sheet to acquire more land and pursue high profile developments. In the past, similar actions have imperiled Stratus and resulted in dilutive financings and ill-timed sales of core properties it had held for years. Alarmingly, Stratus’s debt grew from $135 million (adjusted for its portion of joint venture debt) at December 31, 2014 to $255 million at September 30, 2015. |

| 6. | Stratus’s recent buyout of its partner in the Block 21 project and pursuit of new shopping-center developments has led Stratus to again encumber all of its properties with a patchwork of mortgage loans and credit facilities, most with floating interest rates and highly restrictive covenants. |

| 7. | The proponent believes that Stratus’s significant general and administrative expenses, including significant executive compensation expenses, are a substantial burden on stockholder value. From 2005 through 2014 cumulative income before general and administrative expenses (excluding changes in the deferred tax asset) was $99.5 million, but general and administrative expenses consumed $68.8 million, or 69%, of that income leaving only $30.7 million in cumulative net income applicable to common stockholders for the ten-year period. |

| 8. | The proponent believes that Stratus’s assets are relatively liquid at something close to net asset value today before transaction costs and taxes and that the Board of Directors should take immediate steps to realize this value. A five-year plan is entirely unnecessary and fraught with risks. |

19

Vote “FOR” this shareholder proposal to seek to maximize share value.

As required by Rule 14a-8 of the SEC’s proxy rules, the Company has included the Berg Stockholder Proposal and the supporting statement in its Proxy Statement. As permitted by Rule 14a-8, the Company has also included a statement in opposition to the Berg Stockholder Proposal. We strongly disagree with the Company’s Statement in Opposition and the Company’s recommendation that stockholders vote against the Berg Stockholder Proposal for three primary reasons.

(1) In the opinion of the Berg Group, the discussion of Mr. William H. Lenehan IV in the Company’s Statement in Opposition omits certain material information necessary to make statements in the Company’s Statement in Opposition not misleading and includes statements of material fact that are misleading. We do not dispute that the Board unanimously voted for the adoption of the Company’s five-year plan. We believe Mr. Lenehan urged the Board to adopt a plan (the Company had no plan) for maximizing stockholder value, which resulted in the plan being proposed, and we further believe that Mr. Lenehan voted in favor of the plan despite, as Mr. Lenehan previously indicated to Mr. Berg, believing it was deficient in certain important respects (some plan was better than no plan). Soon after adopting the plan, the Company commenced significantly deviating from the plan, particularly with respect to the Company’s Block 21 purchase from its joint venture partner, by:

| • | spending approximately $62 million to purchase the Company’s joint venture partner’s interest in the Block 21 project, |

| • | incurring new debt, increasing the Company’s debt-to-equity ratio from approximately 167% at December 31, 2014, to approximately 217% at December 31, 2015, and |

| • | concentrating its capital in too few assets, with approximately one-third of the book value of the Company’s assets now consisting of the Block 21 property. |

Such actions are contrary to the clear implication of the Company’s Statement in Opposition that the Company is faithfully executing the plan.

In addition, as Mr. Lenehan previously indicated to Mr. Berg, Mr. Lenehan was an outspoken advocate for a number of corporate governance changes that were aimed at eliminating certain corporate governance practices at the Company that are of types considered by authorities in corporate governance to be contrary to best corporate governance practices and stockholder democracy and that serve to entrench management of the Company, such as having a staggered board and a restrictive stock rights plan, i.e., a poison pill. Also, as Mr. Lenehan previously indicated to Mr. Berg, Mr. Lenehan advocated tying compensation to performance. Mr. Berg believes because, as Mr. Lenehan related, Mr. Lenehan challenged the Board and management on its corporate governance and compensation practices, the Board removed Mr. Lenehan from the chairmanship of the Nominating Committee and did not nominate Mr. Lenehan for re-election as a director at the 2015 Annual Meeting, although we believe Mr. Lenehan was able, willing and prepared to serve, and had expected to serve, as a Stratus director for at least another three-year term. All this occurred after the date that stockholders could nominate individuals to serve as a director of the Company.