UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark one)

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the fiscal year ended December 31 , 2023

OR

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the transition period from to

Commission file number: 001-37716

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |||||||

| (Address of principal executive offices) | (Zip Code) | |||||||||||||||||||

(512 ) 478-5788

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. o Yes þ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. o Yes þ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. þ Yes o No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). þ Yes o No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | ||||||||||||||

| ☑ | Smaller reporting company | Emerging growth company | |||||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). ☐ Yes þ No

The aggregate market value of common stock held by non-affiliates of the registrant was $131.7 million on June 30, 2023.

Common stock issued and outstanding was 8,065,322 shares on March 25, 2024.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s proxy statement for its 2024 annual meeting of stockholders are incorporated by reference into Part III of this report. | ||

| STRATUS PROPERTIES INC. | |||||

| TABLE OF CONTENTS | |||||

| Page | |||||

PART I

Items 1. and 2. Business and Properties

All of our periodic reports filed with the United States (U.S.) Securities and Exchange Commission (SEC) pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, are available, free of charge, through our website, “stratusproperties.com,” including our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and any amendments to those reports. These reports and amendments are available through our website as soon as reasonably practicable after we electronically file such material with, or furnish such material to, the SEC. Our website is intended to provide information that may be of interest to investors and other stakeholders. None of the information on, or accessible through, our website is part of this Form 10-K or is incorporated by reference herein.

Except as otherwise described herein or where the context otherwise requires, all references to “Stratus,” “we,” “us” and “our” refer to Stratus Properties Inc. and all entities owned or controlled by Stratus Properties Inc. References to “Notes” refer to the Notes to Consolidated Financial Statements included herein (refer to Item 8.), and references to “MD&A” refer to Management’s Discussion and Analysis of Financial Condition and Results of Operations and Quantitative and Qualitative Disclosures About Market Risk included herein (refer to Items 7. and 7A.). The following discussion includes forward-looking statements and actual results may differ materially from those anticipated in the forward-looking statements (refer to Item 1A. “Risk Factors” and “Cautionary Statement” in MD&A for additional information).

Overview

We are a diversified real estate company with headquarters in Austin, Texas. We are engaged primarily in the entitlement, development, management, leasing and sale of multi-family and single-family residential and commercial real estate properties in the Austin, Texas area and other select markets in Texas.

We generate revenues and cash flows primarily from the sale of our developed and undeveloped properties and the lease of our retail, mixed-use and multi-family properties. Developed property sales can include an individual tract of land that has been developed and permitted for residential use, a developed lot with a residence built on the lot or a property that has been developed for lease. In addition to our developed and leased properties, we have a development portfolio that consists of approximately 1,600 acres of commercial and multi-family and single-family residential projects under development or undeveloped land held for future use. We may sell properties under development, undeveloped properties or leased properties if opportunities arise that we believe will maximize overall asset value as part of our business strategy. Our leasing operations primarily involve the lease of space at retail and mixed-use properties that we developed, and the lease of residences in multi-family properties that we developed. Tenants in our retail and mixed-use properties are diverse and include grocery stores, restaurants, healthcare services, fitness centers, a movie theater, and other retail products and services.

During the last three fiscal years we produced substantial earnings and cash primarily from the following transactions:

•In 2023, the formation of a joint venture to develop our 495-acre Holden Hills residential project within the Barton Creek community in Austin, resulting in a cash distribution and payment of $35.8 million to us.

•In 2022, the sale of our mixed-use real estate property Block 21 in downtown Austin, producing net cash proceeds of $112.3 million and a pre-tax gain of $119.7 million. We also completed the sale of substantially all of our non-core assets.

•In 2021, the sale of multi-family properties in Austin, The Santal within the Barton Creek community and The Saint Mary located in the Circle C community. The sale of The Santal generated net cash proceeds of approximately $74 million and a pre-tax gain of $83.0 million. The sale of The Saint Mary, after establishing a reserve for remaining costs of the partnership, produced $20.9 million in cash and a pre-tax gain of $22.9 million ($16.2 million net of noncontrolling interests).

•Over the last three fiscal years, we have raised third-party equity capital for development projects, totaling $101.3 million, including the Holden Hills third-party contribution mentioned above.

3

After the sale of Block 21 in May 2022, which eliminated our Hotel and Entertainment segments, our Board of Directors (the Board) and management team engaged in a strategic planning process, which included consideration of the uses of proceeds from recent property sales and our future business strategy. In September 2022, our Board declared a special cash dividend of $4.67 per share (totaling $40.0 million) on our common stock. Our Board also approved a share repurchase program authorizing repurchases of up to $10.0 million of our common stock, which was completed in October 2023. In November 2023, our Board authorized a new $5.0 million share repurchase program. Our Board decided to continue our successful development program, with our proven team focusing on pure residential and residential-centric mixed-use projects in Austin and other select markets in Texas, which we believe continue to be attractive locations. We also decided to continue to focus on developing properties using project-level debt and third-party equity capital through joint ventures in which we receive development management fees and asset management fees, with our potential returns increasing above our relative equity interest in each project as negotiated return hurdles are achieved.

Largely as a result of cash received from the property sales and joint venture distribution discussed above and focused liquidity management on our part, as of December 31, 2023, consolidated cash and cash equivalents totaled $31.4 million, and we had $40.5 million available under our revolving credit facility, net of $13.3 million of letters of credit committed against the facility, with no amounts drawn on the facility.

We were challenged by difficult conditions in the real estate business in 2023. Interest rates, which began rising in 2022, continued to increase, and costs remained elevated. We saw limited opportunities for transactions on favorable terms. Accordingly, during this market cycle, we have been working to maintain our business, advance our projects under construction or development, control costs, and advance entitlements, relationships and opportunities to position us to capture value when market conditions improve. During 2023, among other things, we completed construction and began lease-up of The Saint June multi-family project in Austin, continued construction of the Saint George multi-family project in Austin, advanced construction on the Holden Hills project in Austin, managed our completed retail projects and advanced entitlements on other projects.

Although 2023 was challenging, we see reasons for optimism regarding improving real estate market conditions in our markets as the year 2024 progresses. Our retail portfolio consists of five stabilized projects, namely Jones Crossing, Kingwood Place, Lantana Place, Magnolia Place and West Killeen Market, and we are in the process of engaging brokers to explore the sale of these properties. In connection with any such sales, we anticipate returning capital to stockholders, subject to obtaining required consents from Comerica Bank. We believe we have sufficient liquidity and access to capital to sell properties when market conditions are favorable to us and to hold our properties or to continue to develop our properties, as applicable, through the market cycle. We expect to re-evaluate our strategy as sales and development progress on the projects in our portfolio and as market conditions continue to evolve. Refer to “Business Strategy” in MD&A for further discussion.

Continuing Operations

The following discussion describes the properties included in our Real Estate Operations and Leasing Operations segments. Refer to Note 10, the section “Properties” below, and MD&A for more detailed discussion of the properties.

Real Estate Operations. Our Real Estate Operations segment is comprised of our operations with respect to our properties under various stages of development: developed for sale, under development and available for development. As part of our real estate operations, we entitle, develop and sell properties, focused on the Austin, Texas area and other select markets in Texas. The current focus of our real estate operations is developing multi-family and single-family residential properties and residential-centric mixed-use properties. We may sell or lease the real estate we develop, depending on market conditions. Real estate that we develop and then lease becomes part of our Leasing Operations (refer to “Leasing Operations” below).

We develop properties on our own and also through joint ventures in which we partner with third-party equity investors, serve as general partner, receive fees for development and asset management and may receive a preferred return after negotiated returns are reached. We may develop projects on land we have owned for many years, such as in Barton Creek in Austin, Texas, or on land that we purchase to develop in the future, such as The Saint George project described herein. We may enter into land purchase contracts in which we obtain the right, but not the obligation, to buy land at an agreed-upon price within a specified period of time. These contracts generally limit our financial exposure to our earnest money deposited into escrow and pre-acquisition diligence and planning costs we incur.

4

We engage and manage third-party general contractors to construct our projects typically on a fixed-price basis. Our employees oversee extensive work done by individuals and companies we engage as consultants for services including site selection, obtaining entitlements, architecture, engineering, landscaping and land preservation, design, sustainability, and developing and implementing marketing and sales plans.

Revenue from our Real Estate Operations segment accounted for 15 percent of our total revenue for 2023 and 66 percent for 2022. Revenue from our Real Estate Operations segment was a lower percentage of total revenue in 2023 compared to 2022 primarily due to significant revenue from sales of undeveloped properties during 2022 as compared to 2023.

Real estate held for sale includes developed properties in the Real Estate Operations segment and at December 31, 2023 consisted of two residential lots in Amarra Drive Phase III and two Amarra Villas homes. See “Properties – Barton Creek” for further discussion.

The acreage under development and undeveloped as of December 31, 2023 that comprise our real estate operations other than real estate held for sale is presented in the following table.

•Acreage under development includes real estate for which infrastructure work over the entire property has been completed, is currently being completed or is able to be completed and for which necessary permits have been obtained.

•Undeveloped acreage is presented according to anticipated uses for multi-family units, single-family lots and commercial space based upon our understanding of the properties’ existing entitlements. However, because of the nature and cost of the approval and development process and uncertainty regarding market demand for a particular use, the anticipated use of the undeveloped acreage may change over time, and there is no assurance that it will ever be developed. Undeveloped acreage includes vacant pad sites at Magnolia Place (which were sold in February 2024), Jones Crossing and Kingwood Place, as well as other real estate that can be sold “as is.”

| Acreage Under Development | Undeveloped Acreage | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Single Family | Multi- family | Commercial | Total | Single Family | Multi- family | Commercial | Total | Total Acreage | |||||||||||||||||||||||||||||||||||||||||||||

| Austin: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

Barton Creek a | 503 | — | — | 503 | 17 | 215 | 394 | 626 | 1,129 | ||||||||||||||||||||||||||||||||||||||||||||

Circle C b | — | — | — | — | — | 21 | 216 | 237 | 237 | ||||||||||||||||||||||||||||||||||||||||||||

| Lantana | — | — | — | — | — | 12 | 5 | 17 | 17 | ||||||||||||||||||||||||||||||||||||||||||||

| The Annie B | — | — | — | — | — | 1 | — | 1 | 1 | ||||||||||||||||||||||||||||||||||||||||||||

| The Saint George | — | 4 | — | 4 | — | — | — | — | 4 | ||||||||||||||||||||||||||||||||||||||||||||

| Lakeway | — | — | — | — | — | 35 | — | 35 | 35 | ||||||||||||||||||||||||||||||||||||||||||||

Magnolia Place c | — | — | — | — | — | 29 | 31 | 60 | 60 | ||||||||||||||||||||||||||||||||||||||||||||

| Jones Crossing | — | — | — | — | — | 21 | 23 | 44 | 44 | ||||||||||||||||||||||||||||||||||||||||||||

| Kingwood Place | — | — | — | — | — | — | 8 | 8 | 8 | ||||||||||||||||||||||||||||||||||||||||||||

| New Caney | — | — | — | — | — | 10 | 28 | 38 | 38 | ||||||||||||||||||||||||||||||||||||||||||||

| Total | 503 | 4 | — | 507 | 17 | 344 | 705 | 1,066 | 1,573 | ||||||||||||||||||||||||||||||||||||||||||||

a.Refer to “Properties – Barton Creek” below for a discussion of our properties within Barton Creek. The single-family acreage under development includes 495 acres in Holden Hills on which we commenced infrastructure construction during first-quarter 2023. The multi-family and commercial undeveloped acreage includes approximately 570 acres representing our Section N project.

b.We are pursuing rezoning of approximately 216 undeveloped acres from commercial to multi-family.

c.In February 2024, we completed the sale of approximately 47 acres planned for up to 600 multi-family units, a second phase of retail development of approximately 15,000 square feet and all remaining pad sites in Magnolia Place for $14.5 million. As of March 25, 2024, the remaining potential development is approximately 11 acres planned for 275 multi-family units.

5

The following table summarizes the estimated development potential of our acreage under development and undeveloped acreage as of December 31, 2023:

| Single Family | Multi-family | Commercial | |||||||||||||||

| (lots) | (units) | (gross square feet) | |||||||||||||||

Barton Creek a | 495 | 1,412 | 1,648,891 | ||||||||||||||

Circle C b | — | 56 | 660,985 | ||||||||||||||

| Lantana | — | 306 | 160,000 | ||||||||||||||

| The Annie B | — | 316 | 8,325 | ||||||||||||||

| The Saint George | — | 316 | — | ||||||||||||||

| Lakeway | — | 270 | — | ||||||||||||||

Magnolia Place c | — | 875 | 15,000 | ||||||||||||||

| Jones Crossing | — | 275 | 104,750 | ||||||||||||||

| New Caney | — | 275 | 145,000 | ||||||||||||||

| Other | — | — | 7,285 | ||||||||||||||

| Total | 495 | 4,101 | 2,750,236 | ||||||||||||||

a.Substantially all of the single-family lots relate to Holden Hills and substantially all of the multi-family and commercial relates to Section N. Refer to “Properties – Barton Creek” below for further discussion of recent legal developments and ongoing development planning that may result in changes in our development plans and increased densities for Holden Hills and Section N.

b.We are pursuing rezoning of approximately 216 undeveloped acres planned for 660,985 square feet of commercial space from commercial to multi-family.

c.In February 2024, we completed the sale of approximately 47 acres planned for up to 600 multi-family units, a second phase of retail development of approximately 15,000 square feet and all remaining pad sites in Magnolia Place for $14.5 million. As of March 25, 2024, the remaining potential development is approximately 11 acres planned for 275 multi-family units.

Real estate under development as of December 31, 2023 in the tables above included a multi-family property under construction in Austin, Texas: The Saint George, a 316-unit luxury wrap-style project. The Saint George is expected to be reclassified into the Leasing Operations segment upon its completion, which is expected to occur by third-quarter 2024.

The development potential of our undeveloped acreage at December 31, 2023 also included the following, which are not reflected in the table above:

•13 acres planned for up to seven retail pad sites at Magnolia Place, which were sold in February 2024;

•one retail pad site at Kingwood Place; and

•four retail pad sites at Jones Crossing.

For additional information regarding the estimated development potential for each of our properties under development and undeveloped properties, please refer to “Recent Development Activities” in MD&A.

Leasing Operations. Our Leasing Operations segment primarily involves the lease of space at retail and mixed-use properties that we developed and the lease of residences in multi-family projects that we developed. We engage third-party leasing and property management companies to manage our leased operations. Tenants in our retail and mixed-use projects are diverse and include grocery stores, restaurants, healthcare services, fitness centers, a movie theater and other retail products and services.

Our principal properties in our Leasing Operations segment at December 31, 2023 consisted of:

•a 154,092-square-foot retail property representing the first retail phase of Jones Crossing;

•a 151,877-square-foot retail property at Kingwood Place;

•a 99,377-square-foot retail property representing the first phase of Lantana Place;

•a 44,493-square-foot retail property at West Killeen Market;

6

•a 18,582-square-foot retail property representing the first phase of Magnolia Place; and

•The Saint June, a luxury garden-style multi-family project consisting of 182 units.

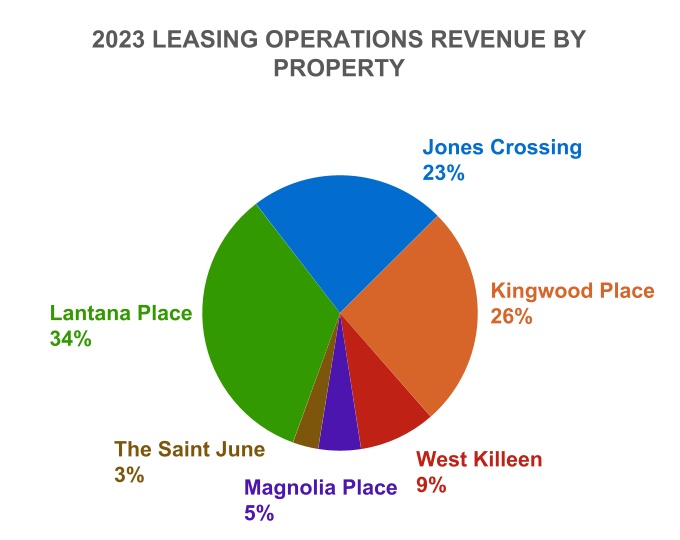

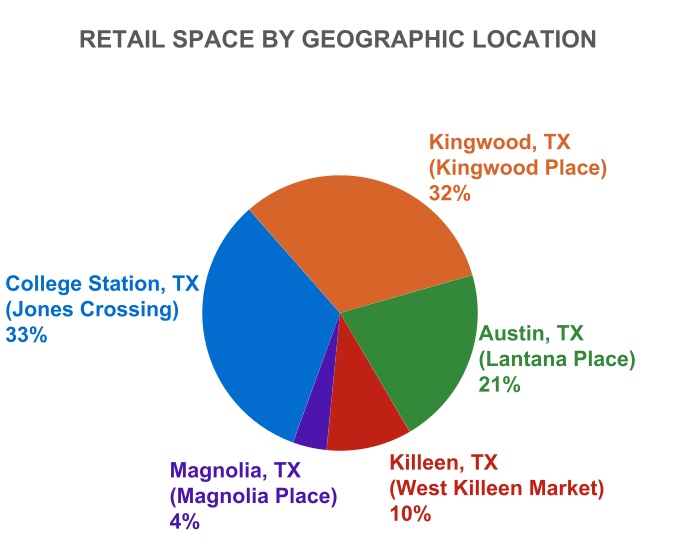

Revenue from our Leasing Operations segment accounted for 85 percent of our total revenue for 2023 and 34 percent for 2022. Revenue from our Leasing Operations segment was a higher percentage of total revenue in 2023 compared to 2022 primarily due to lower revenue in our Real Estate Operations segment in 2023 compared to 2022, which had significant revenue from sales of undeveloped properties. Leasing Operations segment revenue increased $2.0 million in 2023 compared to 2022, as a result of the commencement of operations at Magnolia Place in late 2022 and The Saint June in mid-2023, as well as, increased revenue at Kingwood Place, in connection with new leases. Refer to the charts below for our leasing operations revenue by property during 2023 and our developed square feet of retail space by geographic location as of December 31, 2023.

Retail properties in our Leasing Operations segment had average rentals of $22.29 per square foot as of December 31, 2023, compared to $20.27 per square foot as of December 31, 2022. Our scheduled expirations of leased retail square footage as of December 31, 2023 as a percentage of total space leased was 2 percent in 2024, none in 2025, 1 percent in 2026, 4 percent in 2027, 8 percent in 2028 and 85 percent thereafter.

For additional information about our operating segments refer to “Results of Operations” in MD&A. Refer to Note 10 for a summary of our revenues, operating income or loss and total assets by operating segment.

Properties

Our properties are primarily located in the Austin, Texas area, but include properties in other select markets in Texas. Substantially all of our properties are encumbered pursuant to the terms of our debt agreements. Refer to Note 6 for further discussion. Our Austin-area properties include the following:

Barton Creek

We have several properties that are located in the Barton Creek community, which is a 4,000-acre upscale community located southwest of downtown Austin.

Amarra Drive. Amarra Drive is a subdivision featuring lots ranging from one to over five acres.

In 2015, we completed the development of the Amarra Drive Phase III subdivision, which consists of 64 lots on 166 acres. As of December 31, 2023, two developed Phase III lots remained unsold.

Amarra Multi-family and Commercial. We also have multi-family and commercial lots in the Amarra development of Barton Creek. The Amarra Villas and The Saint June are located on two of these multi-family lots. During 2022, we sold a six-acre multi-family tract of land. As of December 31, 2023, we have one undeveloped approximately 11-acre multi-family lot and one undeveloped 22-acre commercial lot.

Amarra Villas. The Villas at Amarra Drive (Amarra Villas) is a 20-unit project within the Amarra development. The homes average approximately 4,400 square feet and are being marketed as “lock and leave” properties, with golf

7

course access and cart garages. We completed construction and sale of the first seven homes between 2017 and 2019. We began construction on the next two Amarra Villas homes in first-quarter 2020, one of which was completed and sold for $2.4 million in second-quarter 2022. In 2021, we began construction of one additional home and in 2022, we began construction on the remaining ten homes. In fourth-quarter 2022, we completed and sold one home for $3.6 million. In first-quarter 2023, we completed and sold one home for $2.5 million. Construction was completed on two of the homes in fourth-quarter 2023, and one home was completed and sold in February 2024 for $4.0 million. Construction on the last seven homes continues to progress. As of March 25, 2024, one home was under contract to sell for $3.6 million and eight homes remain available for sale.

The Saint June. In third-quarter 2021, we began construction on The Saint June, a 182-unit luxury garden-style multi-family project within the Amarra development. The Saint June is comprised of multiple buildings featuring one, two and three bedroom units for lease with amenities that include a resort-style clubhouse, fitness center, pool and extensive green space. The first units were available for occupancy in July 2023, and construction was completed in fourth-quarter 2023. As of March 25, 2024, we had signed leases for approximately 75 percent of the units. We own this project through a limited partnership with a third-party equity investor. Refer to Note 2 for further discussion.

Holden Hills. Our final large residential development within the Barton Creek community, Holden Hills, consists of 495 acres. The community has been designed to feature unique residences to be developed in multiple phases with a focus on health and wellness, sustainability and energy conservation.

We entered into a limited partnership agreement with a third-party equity investor for this project in January 2023, and in February 2023 obtained construction financing for Phase I of the project and commenced infrastructure construction. We are currently continuing development of Phase I of our Holden Hills project according to our previously disclosed plans and anticipate that we could start building homes and/or selling home sites in 2025. As a result of the ETJ process described below, our development plans for Holden Hills are under review. For additional discussion, refer to “Recent Development Activities” in MD&A and Notes 2 and 6.

Section N. Using an entitlement strategy similar to that used for Holden Hills, we continue to progress the development plans for Section N, our approximately 570-acre tract located along Southwest Parkway in the southern portion of the Barton Creek community adjacent to Holden Hills. We are designing a dense, mid-rise, mixed-use project, with extensive multi-family and retail components, coupled with limited office, entertainment and hospitality uses, surrounded by extensive outdoor recreational and greenspace amenities, which is expected to result in a significant increase in development density as compared to our prior plans. As a result of the ETJ process described below, our development plans for Section N are under review.

ETJ Process. Texas Senate Bill 2038 (the ETJ Law) became effective September 1, 2023. We have completed the statutory process to remove all of our relevant land subject to development, including primarily Holden Hills and Section N from the extraterritorial jurisdiction (ETJ) of the City of Austin, as permitted by the ETJ Law. We have also made filings with Travis County to grandfather the Holden Hills and Section N projects under most laws in effect in Travis County at the time of the filings. Several cities in Texas have brought a lawsuit challenging the ETJ Law. If the ETJ Law is upheld, we expect that the removal of our properties from the ETJ of the City of Austin will streamline the development permitting process, allow greater flexibility in the design of projects, potentially decrease certain development costs and potentially permit meaningful increases in development density. In light of the ETJ Law, we have begun work on assessing potential revisions to our development plans for Holden Hills and Section N. For additional discussion, refer to Item 1A. “Risk Factors.”

Circle C Community

The Circle C community is a master-planned community located in Austin, Texas. In 2002, the city of Austin granted final approval of a development agreement (the Circle C settlement), which firmly established all essential municipal development regulations applicable to our Circle C properties until 2032. Refer to Note 9 for a summary of incentives we received in connection with the Circle C settlement.

The Circle C settlement, as amended in 2004, permits development of 1.16 million square feet of commercial space, 504 multi-family units and 830 single-family residential lots. As of December 31, 2023, our Circle C community had remaining entitlements for 660,985 square feet of commercial space and 56 residential units. We are pursuing rezoning that would reallocate the commercial space to multi-family use.

8

Lantana

Lantana is a community south of Barton Creek in Austin. Regional utility and road infrastructure is in place with capacity to serve Lantana at full build-out as permitted under our existing entitlements. Lantana Place is a partially developed, mixed-use development project within the Lantana community. In addition to Lantana Place, we have remaining entitlements for 160,000 square feet of commercial use on five acres (which we refer to as Tract G07) in the Lantana community.

Lantana Place – Retail. We completed construction of the 99,377-square-foot first phase of Lantana Place in 2018. As of December 31, 2023, we had signed leases for substantially all of the retail space, including the anchor tenant, Moviehouse & Eatery, and a ground lease for an AC Hotel by Marriott, which opened in November 2021.

Lantana Place – The Saint Julia. We have advanced development plans for The Saint Julia, an approximately 300-unit multi-family project that is part of Lantana Place. Our goal is to commence construction as soon as financing and other market conditions warrant. Refer to Note 6 for additional discussion.

The Annie B

In September 2021, we announced plans for The Annie B, a proposed luxury high-rise rental project in downtown Austin. Based on preliminary plans, The Annie B would be developed as a 400-foot tower, consisting of approximately 420,000 square feet with 316 luxury multi-family units for lease. The project includes the historic AO Watson house, which will be renovated and expanded to offer amenities that may include a restaurant, pool and garden, while preserving the property’s historic and architectural features. We closed the land purchase in September 2021. We continue to work to finalize our development plans and to evaluate whether the project is most profitable as a for rent or for sale product. Our goal is to commence construction as soon as financing and other market conditions warrant. We own this project through a limited partnership with third-party equity investors. Refer to Notes 2 and 6 for further discussion.

The Saint George

In third-quarter 2022, we began construction on The Saint George, a 316-unit luxury wrap-style multi-family project in north central Austin. The Saint George is being built on approximately four acres and is comprised of studio, one and two bedroom units for lease and an attached parking garage. We purchased the land and entered into third-party equity financing for the project in December 2021. We entered into a construction loan for the project in July 2022 and began construction in third-quarter 2022. We currently expect to achieve substantial completion by third-quarter 2024. We own this project through a limited partnership with a third-party equity investor. Refer to Notes 2 and 6 for further discussion.

Lakeway

After extensive negotiation with the City of Lakeway, utility suppliers and neighboring property owners, during 2023 we secured the right to develop a multi-family project on approximately 35 acres of undeveloped property in Lakeway, Texas located in the greater Austin area. The multi-family project is expected to utilize the road, drainage and utility infrastructure we are required to build, subject to certain conditions, which is secured by a $2.3 million letter of credit under our revolving credit facility. Refer to Note 6 and “Capital Resources and Liquidity – Revolving Credit Facility and Other Financing Arrangements” below for additional discussion. Refer to Note 9 for discussion of our sale of The Oaks at Lakeway in 2017.

Our other Texas properties include:

Magnolia Place

In August 2021, we began construction on the first phase of development of Magnolia Place, our H-E-B, L.P (H-E-B) grocery shadow-anchored, mixed-use project in Magnolia, Texas. The first phase of development consists of two retail buildings totaling 18,582 square feet, all pad sites, and the road, utility and drainage infrastructure necessary to support the entire development. Except for a storm water drainage pond and certain City of Magnolia water supply upgrades, which are expected to be completed by the end of 2024, the first phase of development was completed in third-quarter 2022, and the two retail buildings were turned over to our retail tenants to begin their finish-out process. H-E-B completed construction and opened its 95,000-square-foot grocery store on an adjoining 18-acre site in fourth-quarter 2022. As of December 31, 2023, we had signed leases for all the retail space in the first phase of development and all tenants were open for business. During second-quarter 2022, we sold one retail pad site for $2.3 million and sold another retail pad site in third-quarter 2022 for $1.1 million. In third-quarter 2022, we also sold 28 acres consisting of all of the undeveloped single-family residential land for $3.2 million. In February 2024, we completed the sale of approximately 47 acres planned for a second phase of retail development, all

9

remaining pad sites and up to 600 multi-family units, for $14.5 million. As of March 25, 2024, the remaining Magnolia Place project consists of the two fully-leased retail buildings and potential development of approximately 11 acres planned for 275 multi-family units.

Jones Crossing

In 2017, we entered into a 99-year ground lease pursuant to which we leased a 72-acre tract of land in College Station, Texas, the location of Texas A&M University, for Jones Crossing, an H-E-B-anchored, mixed-use project. Construction of the first phase of the retail component of the Jones Crossing project was completed in 2018, consisting of 154,092 square feet. The H-E-B grocery store opened in September 2018, and, as of December 31, 2023, we had signed leases for substantially all of the retail space, including the H-E-B grocery store. As of December 31, 2023, we had approximately 23 undeveloped commercial acres with estimated development potential of approximately 104,750 square feet of commercial space and four retail pad sites. We continue to evaluate options for the 21-acre multi-family component of this project. During 2023, we separated the ground lease for the multi-family parcel from the primary ground lease.

Kingwood Place

In 2018, we purchased a 54-acre tract of land in Kingwood, Texas (in the greater Houston area) to be developed as Kingwood Place, an H-E-B-anchored, mixed-use development project. The Kingwood Place project includes 151,877 square feet of retail lease space, anchored by a 103,000-square-foot H-E-B grocery store, and five pad sites. Construction of two retail buildings, totaling approximately 41,000 square feet, was completed in August 2019, and the H-E-B grocery store opened in November 2019. An 8,000-square-foot retail building was completed in June 2020. We have signed ground leases on four retail pad sites and one retail pad site remains available for lease. As of December 31, 2023, we had signed leases for substantially all of the retail space, including the H-E-B grocery store. We own this project through a limited partnership with third-party equity investors. Refer to Notes 2 and 6 for further discussion.

In October 2022, we closed on the sale of a 10-acre multi-family tract of land at Kingwood Place for $5.5 million. In connection with the sale, we made a $5.0 million principal payment on the Kingwood Place construction loan.

West Killeen Market

In 2015, we acquired approximately 21 acres in Killeen, Texas, near Fort Cavazos, to develop the West Killeen Market project, an H-E-B shadow-anchored retail project and sold 11 acres to H-E-B. The project encompasses 44,493 square feet of commercial space and three pad sites adjacent to a 90,000 square-foot H-E-B grocery store. Construction at West Killeen Market was completed and the H-E-B grocery store opened in 2017. As of December 31, 2023, we had signed leases for approximately 74 percent of the retail space at West Killeen Market. During third-quarter 2022, we sold the last remaining retail pad site for $1.0 million.

New Caney

In 2018, we purchased a 38-acre tract of land, in partnership with H-E-B, in New Caney, Texas, originally planned for the future development of an H-E-B-anchored, mixed-use project. Subject to completion of development plans, we anticipate that the New Caney project will include restaurants and retail services, totaling approximately 145,000 square feet, five pad sites and a 10-acre multi-family parcel planned for approximately 275 multi-family units. We finalized the lease for the H-E-B grocery store in March 2019, and upon execution of this lease, we acquired H-E-B’s interests in the partnership for approximately $5 million. Due to changes in H-E-B’s development timeline, the H-E-B lease was terminated in fourth-quarter 2022. We are currently working on options for an alternative retail anchor and do not plan to commence construction of the New Caney project prior to 2025.

Our development plans for The Annie B, Section N and The Saint Julia will require significant additional capital, which we currently intend to pursue through project-level debt and third-party equity capital arrangements through joint ventures in which we receive development management fees and asset management fees and with our potential returns increasing above our relative equity interest in each project as negotiated return hurdles are achieved. We anticipate seeking additional debt to finance the development of Phase II of Holden Hills. We are also pursuing other development projects. These potential development projects and projects in our portfolio could require extensive additional permitting and will be dependent on market conditions and financing. Because of the nature and cost of the approval and development process and uncertainty regarding market demand for a particular use, there is uncertainty regarding the nature of the final development plans and whether we will be able to successfully execute the plans.

10

Competition

We operate in highly competitive industries, namely the real estate development and leasing industries. Refer to Part I, Item 1A. “Risk Factors” for further discussion of competitive factors relating to our businesses.

Revolving Credit Facility and Other Financing Arrangements

Obtaining and maintaining adequate financing is a critical component of our business. For information about our revolving credit facility and other financing arrangements, refer to “Capital Resources and Liquidity – Revolving Credit Facility and Other Financing Arrangements” in MD&A and Notes 2 and 6.

Regulation and Environmental Matters

Our real estate investments are subject to extensive and complex local, city, county and state laws, rules and regulations regarding permitting, zoning, subdivision, utilities and water quality as well as federal laws, rules and regulations regarding air and water quality, and protection of the environment, endangered species and their habitats. Such regulation has delayed and may continue to delay development of our properties and may result in higher development and administrative costs. Refer to Part I, Item 1A. “Risk Factors” for further discussion.

We have made, and will continue to make, expenditures for the protection of the environment with respect to our real estate development activities. Emphasis on environmental matters will result in additional costs in the future. Further, regulatory and societal responses intended to reduce potential climate change impacts may increase our costs to develop, operate and maintain our properties.

Corporate Responsibility

With the oversight of the Nominating and Corporate Governance Committee of our Board, we have posted to our website information regarding our corporate responsibility performance and objectives, including discussions about our human capital management, governance, sustainability objectives and related policies adopted by our Board.

Human Capital

We believe that our employees are one of our greatest resources and that our dedicated and talented team is the foundation of our success and achievements. We are committed to supporting inclusion in the workplace and encouraging the health and well-being of our employees. At December 31, 2023, we had a total of 33 employees, all of whom were full-time employees. We believe we have a good relationship with our employees, none of whom are represented by a union. We adopted a Labor and Human Rights Policy, recommended by our Board’s Nominating and Corporate Governance Committee and approved by our Board.

Sustainability

As a real estate development company centered in Austin, Texas, we understand the value that a healthy environment and healthy people bring to our projects, our company and our stakeholders. As a member of the U.S. Green Building Council (USGBC), we work along with council members with the goal of transforming the way buildings and communities are designed, built and operated in order to create environmentally and socially responsible properties for a more sustainable life. For more than 15 years, we have partnered with leaders in sustainable development, engineering and design, including, among others, USGBC and The Center for Maximum Potential Building Systems. We have built a range of projects recognized as being on the leading edge of sustainable practices, including Block 21, the first mixed-use high rise tower in Austin to receive the USGBC LEED (Leadership in Energy & Environmental Design) Silver certification, and many of our residential communities and retail developments. Our Holden Hills project is being designed to focus on health and wellness, sustainability and energy conservation. The Saint June project was designed to celebrate the natural landscape and provides a guidebook describing ways residents can use the green features of the community to further enhance its sustainability. We believe that our customers recognize our environmental stewardship and will continue to reward thoughtful and sustainable development. We adopted an Environmental Policy and a Vendor Code of Conduct, recommended by our Board’s Nominating and Corporate Governance Committee and approved by our Board.

11

Item 1A. Risk Factors

This report contains “forward-looking statements” within the meaning of the United States (U.S.) federal securities laws. Forward-looking statements are all statements other than statements of historical fact, such as plans, projections or expectations. For additional information, refer to “Cautionary Statement” in Items 7. and 7A. Management’s Discussion and Analysis of Financial Condition and Results of Operations and Quantitative and Qualitative Disclosures About Market Risk.

We undertake no obligation to update our forward-looking statements, which speak only as of the date made, notwithstanding any changes in our assumptions, business plans, actual experience, or other changes. We caution readers that forward-looking statements are not guarantees of future performance, and our actual results may differ materially from those anticipated, expected, projected or assumed in the forward-looking statements. Important factors that can cause our actual results to differ materially from those anticipated in the forward-looking statements are discussed below. Investors should carefully consider the risks described below in addition to the other information set forth in this Annual Report on Form 10-K. The risk factors described herein are not all of the risks we may face. Other risks not presently known to us or that we currently believe are immaterial may materially and adversely affect our business if they occur, and the trading price of our securities could decline, and you may lose part or all of your investment. Moreover, new risks emerge from time to time. Further, our business may also be affected by general risks that apply to all companies operating in the U.S., which we have not included below.

Risks Relating to our Business and Industry

We cannot assure you that our current business strategy will be successful.

We cannot assure you that our current business strategy will be successful. For a description of our current business strategy, refer to “Business Strategy” in MD&A. Results of the past sales of our properties are not indicative of results of future sales. The timing of property sales and proceeds from such sales are difficult to predict and depend on market conditions and other factors. Our ability to generate revenue in our leasing operations depends on our ability to successfully develop new projects and our ability to obtain attractive rental and occupancy rates on existing and new projects. Austin, our primary market, has experienced significant growth in demand for residential projects in recent years, particularly during 2020 and 2021 related in part to COVID-19 pandemic-influenced in-migration; however, prices and demand for residential real estate in the Austin area have generally moderated and in some submarkets declined. In addition, we have faced challenging market conditions in recent periods due to high interest rates, tightened bank credit and high inflation, among other things. During 2023, we made operating loans totaling $3.3 million to two of our joint ventures to pay costs that were higher than anticipated and in first-quarter 2024, we made operating loans totaling $2.7 million to two of our joint ventures to pay costs that were higher than anticipated. We anticipate making future operating loans to three of our joint ventures totaling up to $3.8 million over the next 12 months. Our estimates of future operating loans are based on estimates of future costs of the partnerships and anticipated future operating loans from the Class B limited partners of approximately $2.5 million. Our development plans for our undeveloped land and land under development may change over time, including as a result of changes in real estate market conditions, economic conditions, the cost and availability of capital and changes in laws, such as changes resulting from Texas Senate Bill 2038 enacted in 2023, discussed further below.

Our development plans for future projects require significant additional debt and equity capital. We have increasingly raised equity capital from third parties through joint venture structures, which have their own risks. We may not be able to obtain the funding necessary to implement our business strategy on acceptable terms or at all. Furthermore, our business strategy may not produce sufficient revenues even if we are able to obtain the necessary capital. Due to the nature of our development-focused business, we do not expect to generate sufficient recurring cash flow to cover our general and administrative expenses each period. Our long-term success will depend on our ability to profitably execute our development plans over time.

Inflation, higher borrowing costs, tightened bank credit, more limited availability of equity capital, increased construction and labor costs and supply chain constraints have had an adverse impact on us and may continue to do so.

Our industry has been experiencing inflation, higher borrowing costs, tightened bank credit, more limited availability of equity capital, increased construction costs, higher labor costs, labor shortages, and supply chain constraints. Inflation in the U.S. increased rapidly during 2021 through June 2022. Since June 2022, the rate of inflation

12

generally has declined; however, it has remained at high levels compared to recent historical periods. In response, the Federal Reserve raised the federal funds target rate multiple times from March 2022 through July 2023, by 525 basis points on a cumulative basis. These factors have increased our costs, adversely impacted the projected profitability of our new projects, delayed the start of or completion of projects, adversely impacted our ability to raise equity capital on attractive terms and in our desired time frame and adversely impacted our ability to sell some properties at attractive prices in our desired time frame; these trends may continue or worsen.

On completed projects, we have experienced increased borrowing costs on our variable rate debt due to higher interest rates and increased operating costs due to inflation. As of December 31, 2023, all of our consolidated debt was variable rate debt. For all such debt, the average interest rate increased for 2023 compared to 2022 and may continue to rise in the future if prevailing market interest rates rise. Refer to Note 6 for additional information. Further increases in interest rates would further increase our interest costs and the costs of refinancing existing debt or incurring new debt, which would adversely affect our profits and cash flow. Our operating expenses impacted by inflation include contracted services for our properties such as janitorial and engineering services, utilities, repairs and maintenance and insurance. Inflation may cause the value of our properties to rise, which could lead to higher property taxes. Our general and administrative expenses include compensation costs, professional fees and technology services, all of which may continue to increase due to inflation.

Inflation and higher interest rates may also adversely impact a potential buyer’s ability to obtain financing on favorable terms, decreasing demand for the purchase of our properties and lowering their market value. High inflation could have a negative impact on our tenants’ ability to pay rent or absorb rent increases. In addition, rising costs and delays in delivery of materials may increase the risk of default by contractors and subcontractors on ongoing construction projects.

If we are unable to offset rising costs by value engineering or raising rents and sales prices, our profitability and cash flows would be adversely impacted, and we may be required to recognize additional impairment charges in the future. Further, these factors have caused and may continue to cause a decline in demand for our real estate, which could harm our revenues, profits and cash flow.

A decline in general economic conditions, particularly in the Austin, Texas area, could harm our business.

Our business may be adversely affected by periods of economic uncertainty, economic weakness or recession, declining employment levels, declining consumer confidence and spending, declining access to capital, geopolitical instability, or the public’s perception that any of these events or conditions may occur, be present or worsen. Our business is especially sensitive to economic conditions in the Austin, Texas area, where the majority of our properties are located. As discussed elsewhere in this report, our business was adversely impacted during 2022 and 2023 by rising inflation and interest rates and other adverse economic conditions. Further, Russia’s invasion of Ukraine beginning in February 2022 and the war in Israel and surrounding areas beginning in the fourth quarter of 2023 have adversely affected global stability.

These types of adverse economic conditions can result in a general decline in real estate acquisition, disposition, development and leasing activity, a general decline in the value of real estate and in rents and increases in tenant defaults. As a result of a decline in economic conditions, the demand for and value of our real estate may be reduced, our development projects may be further delayed, and we could realize losses, diminished profitability or additional asset impairments.

We are vulnerable to concentration risks because our operations are primarily located in the Austin, Texas area and are primarily focused on residential, residential-centric mixed-use, and retail real estate.

Our real estate operations are primarily located in the Austin, Texas area. While our real estate operations have expanded to include select markets in Texas outside of the Austin area, the geographic concentration of the majority of our operations and of the properties we may have under development at any given time means that our business is more vulnerable to negative changes in local economic, regulatory, weather and other conditions than the businesses of larger, more geographically diversified companies. The performance of the Austin area’s economy and our other select markets in Texas greatly affects our revenue and the values of our properties. We cannot assure you that these markets will grow or that underlying real estate fundamentals will be favorable in these markets.

13

As a result of our focus on residential, residential-centric mixed-use, and retail projects in Austin, we may be exposed to greater risks than if our investment focus was based on more diversified types of properties. Weakening in the Austin residential market generally makes it more difficult for us to sell our residential properties at attractive prices or to rent our properties at attractive rents. Weakening in the Austin residential market may also adversely impact the demand for retail projects, as may any other trends that cause consumers not to shop at retail locations. Refer to “Overview of Financial Results for 2023 – Real Estate Market Conditions” in Part II, Items 7. and 7A. for more information.

We may not be able to raise additional capital for future projects on acceptable terms, if at all.

Our industry is capital-intensive and requires significant up-front expenditures to secure land and pursue development and construction. We have relied on proceeds from property sales and debt financing and cash flow from operations as our primary sources of funding. We have also relied on third-party project-level equity financing of our subsidiaries, which we expect to continue to increase in the future. Our ability to raise additional capital in the future will depend on conditions in the equity and debt markets, general economic and real estate conditions and our financial condition, performance and prospects, among other factors, many of which are not within our control. We may not be able to raise additional capital on acceptable terms if at all. Costs of debt and equity capital increased substantially during 2022 and 2023 and may continue to be high or increase. Any inability to raise additional capital on acceptable terms when needed for existing or future projects could delay or terminate future projects, hinder our ability to complete projects, and prevent us from refinancing debt obligations, which could have a material adverse effect on our business, financial condition and results of operations.

Part of our business strategy depends on maintaining strong relationships with key tenants and our inability to do so could adversely affect our business.

We have formed strategic relationships with key tenants as part of our overall strategy for particular retail and mixed-use development projects and may enter into other similar arrangements in the future. For example, our West Killeen Market, Jones Crossing, Kingwood Place and Magnolia Place mixed-use development projects are each anchored by an H-E-B grocery store. Any deterioration in our relationship with H-E-B or our inability to form and retain strategic relationships with key tenants or enter into other similar arrangements in the future could adversely affect our business. If we are unable to renew a lease we have with a key tenant at one of our properties, or to re-lease the space to another key tenant of similar or better quality, we could experience material adverse consequences with respect to such property, such as a higher vacancy rate, less favorable leasing terms, reduced cash flow and reduced property values. Similarly, if one or more of our key tenants becomes insolvent or enters into bankruptcy proceedings, our business could be materially adversely impacted.

Loss of key personnel could negatively affect our business.

We depend on the experience and knowledge of our executive officers and other key personnel who guide our strategic direction and execute our business strategy, have extensive market knowledge and relationships, and exercise substantial influence over our operations. Among the reasons that these individuals are important to our success is that each has a regional industry reputation that attracts business and investment opportunities and assists us in negotiations with lenders, existing and potential tenants, community stakeholders and industry personnel. The loss of any of our executive officers or other key personnel could negatively affect our business.

We could be impacted by our investments through joint ventures, which involve risks not present in investments in which we are the sole owner.

We have increased our use of third-party equity financing of our subsidiaries’ development projects. We expect to continue to fund development projects through the use of such joint ventures. Joint ventures involve risks not present with our wholly-owned properties, including but not limited to, the possibility the other joint venture partners may possess the ability to take or force action contrary to our interests or withhold consent contrary to our requests, have business goals which are or become inconsistent with ours, or default on their financial obligations to the joint venture, which may require us to fulfill the joint venture’s financial obligations as a legal or practical matter. We and our joint venture partners may each have the right to initiate a buy-sell arrangement, which could cause us to sell our interest, or acquire a joint venture partner’s interest, at a time when we otherwise would not have entered into such a transaction. In addition, a sale or transfer by us to a third party of our interests in the joint venture may be subject to consent rights or rights of first refusal in favor of our partners which would restrict our ability to dispose of our interest in the joint venture. Each joint venture agreement is individually negotiated, and our ability to operate,

14

finance, or dispose of a joint venture project in our sole discretion is limited to varying degrees depending on the terms of the applicable joint venture agreement. Refer to Note 2 for further discussion of our investments in joint ventures.

Adverse weather conditions, public safety issues, geopolitical instability, and other potentially catastrophic events in our Texas markets could adversely affect our business.

Adverse weather conditions, including natural disasters, public safety issues, geopolitical instability, and other potentially catastrophic events in our Texas markets may adversely affect our business, financial condition and results of operations. Adverse weather conditions may be amplified by or increase in frequency due to the effects of climate change. These events may delay development and sale activities, interrupt our leasing operations, reduce demand for our properties, damage roads providing access to our assets or damage our property resulting in substantial repair or replacement costs to the extent not covered by insurance. Any of these factors could cause shortages and price increases in labor or raw materials, reduce property values, or cause a loss of revenue, each of which could have a material adverse effect on our business, financial condition and results of operations.

Failure to succeed in new markets may limit our growth.

We have acquired in the past, and we could acquire in the future, properties that are outside of the Austin, Texas area, which is our primary market. Our historical experience in existing markets does not ensure that we will be able to operate successfully in new markets. Entering into new markets exposes us to a variety of risks, including difficulty evaluating local market conditions and local economies, developing new business relationships in the area, competing with other companies that already have an established presence in the area, hiring and retaining personnel, evaluating quality tenants in the area, and a lack of familiarity with local governmental and permitting procedures. Furthermore, expansion into new markets may divert management’s time and other resources away from our current primary market. As a result, we may not be successful in expanding into new markets, which could adversely impact our results of operations and limit our growth.

Our insurance coverage on our properties may be inadequate to cover any losses we may incur and our insurance costs may increase.

We maintain insurance on our properties, including business interruption, property, liability, fire and extended coverage. However, there are certain types of losses, generally of a catastrophic nature, such as floods or acts of war or terrorism that may be uninsurable or not economical to insure. Further, insurance companies often increase premiums, require higher deductibles, reduce limits, restrict coverage, and refuse to insure certain types of risks, which may result in increased costs or adversely affect our business. We may be unable to renew our current insurance coverage in adequate amounts or at reasonable premiums. We use our discretion when determining amounts, coverage limits and deductibles for insurance based on retaining an acceptable level of risk at a reasonable cost. This may result in insurance coverage that, in the event of a substantial loss, would not be sufficient to pay the full current market value or current replacement cost of our lost investment. In addition, we may become liable for injuries and accidents at our properties that are underinsured. A significant uninsured loss or increase in insurance costs could materially and adversely affect our business, liquidity, financial condition and results of operations.

Our business may be adversely affected by information technology disruptions and cybersecurity breaches of our systems or the systems of our contractors.

Many of our business processes and records depend on information systems to conduct day-to-day operations and lower costs, and therefore, we are vulnerable to the increasing threat of information system disruptions and cybersecurity incidents. We also utilize the services of a number of independent contractors, such as general construction contractors, engineers, architects, leasing agents, property managers, technology service providers and attorneys, whose businesses are also vulnerable to the increasing threat of cybersecurity incidents and other information system disruptions. These risks include, but are not limited to, installation of malicious software, phishing, ransomware, credential attacks, unauthorized access to data and other cybersecurity incidents that could lead to disruptions in information systems, unauthorized release of confidential or otherwise protected information, employee theft or misuse of confidential or otherwise protected information and the corruption of data. Increased use of remote work and virtual platforms may increase our risk of cybersecurity incidents. Our information systems and those of our contractors are also vulnerable to damage or interruption from fire, floods, power loss, telecommunications failures, computer viruses, break-ins and similar events. A significant theft, loss, loss of access

15

to, or fraudulent use of employee, tenant or other company data could adversely impact our reputation and could result in a loss of business, as well as remedial and other expenses, fines and litigation. There can be no assurance that our security efforts and measures and those of our independent contractors will be effective.

We have experienced targeted and non-targeted cybersecurity incidents in the past and may experience them in the future. While these cybersecurity incidents did not result in any material loss to us as of March 25, 2024, there can be no assurance that we will not experience any such losses in the future. Further, as cybersecurity threats continue to evolve and become more sophisticated, we may be required to expend significant additional resources to continue to modify or enhance our protective measures or to investigate and remediate any vulnerabilities to cybersecurity threats. Refer to Item 1C. “Cybersecurity” for further information on our cybersecurity governance, risk management and strategy.

Any major public health crisis could adversely affect our business.

The U.S. and other countries have experienced, and may experience in the future, outbreaks of contagious diseases or other health crises that affect public health and public perception of health risk. For example, the COVID-19 pandemic and the public health response to it, had significant disruptive effects on global economic, market and social conditions and on our business. In the event of another public health crisis, we cannot predict the extent to which individuals and businesses may voluntarily restrict their activities, the extent to which governments may reinstitute restrictions, nor the extent to which such potential events may have an adverse impact on the economy or our business. Any future major public health crisis could have a material adverse impact on our business, results of operations and financial condition.

Risks Relating to our Indebtedness

We have significant amounts of debt, may incur additional debt, and need significant amounts of cash to service our debt. If we are unable to generate sufficient cash to service our debt, or are unable to refinance our debt as it becomes due, our liquidity, financial condition and results of operations could be materially and adversely affected.

As of December 31, 2023, our outstanding debt totaled $175.2 million and our cash and cash equivalents totaled $31.4 million. As of March 25, 2024, principal payments due on outstanding debt during 2024 total $68.0 million. We estimate our interest payments during 2024 will total approximately $13.6 million, assuming interest rates in effect on our debt at December 31, 2023, no new debt agreements, and completed or scheduled principal payments as of March 25, 2024 on debt outstanding at December 31, 2023. Except for our Comerica Bank revolving credit facility, all of our loans are project-level loans. Our project loans are generally secured by all or substantially all of the assets of the project, and our Comerica Bank revolving credit facility is secured by substantially all of our assets other than those encumbered by separate project-level financing. Stratus, as the parent company, is typically required to guarantee the payment of the project loans, in some cases until certain development milestones and/or financial conditions are met, in some cases on a full recourse basis and in other cases on a more limited recourse basis. As of December 31, 2023, Stratus, as the parent company, guaranteed the payment of all of the project loans, except for the Jones Crossing loan and Lantana Place construction loan. In addition, as described elsewhere in this report, as of December 31, 2023, all of our consolidated debt was variable rate debt, and interest due on such debt rises as interest rates rise. Refer to Note 6 for additional discussion.

Our level of indebtedness could have significant adverse consequences. For example, it could:

•Increase our vulnerability to adverse changes in economic and industry conditions;

•Require us to dedicate a substantial portion of our cash flow from operations and proceeds from asset sales to pay or provide for our indebtedness, thus reducing the availability of cash flows to fund working capital, development projects, capital expenditures, land acquisitions and other general corporate purposes;

•Limit our flexibility to plan for, or react to, changes in our business and the markets in which we operate;

•Force us to dispose of one or more of our properties, possibly on unfavorable terms;

•Place us at a competitive disadvantage to our competitors that have less debt;

•Limit our ability to obtain future financing to fund our working capital, our development activities, capital expenditures, debt service requirements and other financing needs;

16

•Limit our ability to obtain bonds, letters of credit or guarantees to governmental authorities and others to ensure completion of certain projects; and/or

•Limit our ability to refinance our indebtedness or cause the refinancing terms to be less favorable than the terms of our original indebtedness.

Our ability to make scheduled debt service payments or to refinance our indebtedness depends on our future operating and financial performance, which is subject to economic, financial, competitive and other factors beyond our control. Our inability to extend, repay or refinance our debt when it becomes due, including upon a default or acceleration event, could allow our lenders to declare all amounts outstanding under the loans due and payable, seek to foreclose on the collateral securing the loans and/or seek to force us into involuntary bankruptcy proceedings. In addition, any difficulty in obtaining sufficient capital for planned development expenditures could also cause project delays, which could increase our costs, or could cause us to abandon projects already underway. There can be no assurance that we will generate cash flow from operations in an amount sufficient to enable us to service our debt, make necessary capital expenditures, or to fund our other liquidity needs.

Our current financing arrangements contain, and our future financing arrangements likely will contain, financial and restrictive covenants, and the failure to comply with such covenants could result in a default that accelerates the required payment of such debt.

The terms of the agreements governing our indebtedness include restrictive covenants, including covenants that require that certain financial ratios be maintained. The debt arrangements that we and our subsidiaries have contain significant limitations that may restrict our ability and the ability of our subsidiaries to, among other things:

•borrow additional money or provide guarantees;

•pay dividends, repurchase equity or make other distributions to equityholders;

•make loans, advances or other investments or create liens on assets;

•sell assets, enter into sale-leaseback transactions or enter into transactions with affiliates; or

•permit a change of management or control, sell all or substantially all of our assets, or engage in mergers, consolidations or other business combinations. Refer to “Capital Resources and Liquidity” in Part II, Items 7. and 7A. and Note 6 for additional discussion of restrictive covenants in our debt agreements.

Failure to comply with any of the restrictive covenants in our loan documents could result in a default that may, if not cured or waived, accelerate the payment under our debt obligations which would likely have a material adverse effect on our liquidity, financial condition and results of operations. We may not be able to obtain waivers or modifications of covenants from our lenders and lenders may require fees or higher interest rates to grant any such requests. Certain of our debt arrangements have cross-default or cross-acceleration provisions, which could have a wider impact on liquidity than might otherwise arise from a default or acceleration of a single debt instrument. We cannot assure you that we could adequately address any such defaults, cross-defaults or acceleration of our debt payment obligations in a sufficient or timely manner, or at all. Our ability to comply with our covenants will depend upon our future economic performance. These covenants may adversely affect our ability to finance our future operations, satisfy our capital needs or engage in other business activities that may be desirable or advantageous to us.

In order to maintain compliance with the covenants in our debt agreements and carry out our business plan, we may need to use cash to pay down the principal balance of the loan, contribute additional equity or make an operating loans to a joint venture or raise additional debt or equity capital, including project-level financing of our subsidiaries. Such additional funding may not be available on acceptable terms, if at all, when needed. If new debt is added to our current debt levels, the risks described above could intensify.

Risks Relating to Real Estate Operations

Our business, results of operations, cash flows and financial condition are greatly affected by the performance of the real estate industry.

The U.S. real estate industry is highly cyclical and is affected by global, national and local economic conditions, general employment and income levels, availability of financing, inflation, interest rates, and consumer confidence and spending. As discussed above, our industry was adversely impacted during 2022 and 2023 by rising inflation

17

and interest rates, and rising or high inflation and interest rates may continue in 2024 and beyond. Other factors that may impact real estate businesses include over-building, changes in traffic patterns, changes in demographic trends, changes in tenant and buyer preferences and changes in government requirements, including tax law changes and changes in zoning laws. These factors are outside of our control and may have a material adverse effect on our business, profits and the timing and amounts of our cash flows.

There can be no assurance that the properties in our development portfolio will be completed in accordance with the anticipated timing or cost.

We currently have several projects at various stages of development. The development of the projects in our portfolio is subject to numerous risks, many of which are outside of our control, including:

•inability to obtain, or delays in obtaining, entitlements;

•inability to obtain financing on acceptable terms, or delays in obtaining such financing;

•increases in labor costs, labor shortages, increases in the costs of building materials, other cost increases or overruns;

•inability to engage reliable contractors or default by any of the contractors that we engage to construct our projects;

•site accidents; and

•failure to secure tenants or buyers of our properties in the anticipated time frame, on acceptable terms, or at all.

We can provide no assurances that we will complete any of the projects in our development portfolio on the anticipated schedule or within the budget, or that, once completed, these properties will achieve the results that we expect. During 2023, we made operating loans totaling $3.3 million to two of our joint ventures to pay costs that were higher than anticipated and in first-quarter 2024, we made operating loans totaling $2.7 million to two of our joint ventures to pay costs that were higher than anticipated. We anticipate making future operating loans to three of our joint ventures totaling up to $3.8 million over the next 12 months. Our estimates of future operating loans are based on estimates of future costs of the partnerships and anticipated future operating loans from the Class B limited partners of approximately $2.5 million. Under our construction loans, advances are typically made in accordance with established budget allocations, and if the lender deems that the undisbursed proceeds of the loan are insufficient to meet the costs of completing the project, the lender may decline to make additional advances until the borrower deposits with the lender sufficient additional funds to cover the deficiency. If the development of our projects is not completed in accordance with our anticipated timing or cost, or the properties fail to achieve the financial results we expect, it could have a material adverse effect on our business, financial condition, results of operations and cash flows and ability to repay our debt, including project-related debt.

Our Holden Hills project involves the development of a large number of residential lots, which exposes us to risks specific to that business.