Exhibit 10.1 12-13-2013

After Recording Return to:

Thompson & Knight LLP

1722 Routh Street, Suite 1500

Dallas, Texas 75201

Attention: Mark M. Sloan

FIFTH MODIFICATION AND EXTENSION AGREEMENT

This FIFTH MODIFICATION AND EXTENSION AGREEMENT (this “Agreement”) is executed on the date of acknowledgment below but is dated effective as of December 12, 2013 (the “Effective Date”) by and among TRACT 107, L.L.C., a Texas limited liability company (“Borrower”), STRATUS PROPERTIES, INC., a Delaware corporation (“Guarantor”, and together with Borrower herein sometimes collectively referred to as the “Loan Parties” or “Loan Party”, as the context may require) and COMERICA BANK (“Lender”);

W I T N E S S E T H:

WHEREAS, the following documents have previously been executed and delivered by Borrower to Lender relating to a loan (the “Original Loan”), inter alia,

| |

1. | that certain Promissory Note dated as of May 17, 2011, payable to the order of Lender in the original principal sum of $13,664,456.00, with interest and principal payable as therein provided (as amended by the Modification Agreements [as hereinafter defined], the “Original Note”); |

| |

2. | that certain Construction Loan Agreement dated of even date with the Original Note between Borrower and Lender (as amended by the Modification Agreements, the “Loan Agreement”); and |

| |

3. | that certain Deed of Trust, Security Agreement and Fixture Filing dated of even date with the Original Note from Borrower to David J. Neumeyer, Trustee, securing the payment of, inter alia, the Original Note, covering certain real and personal property described therein (the “Mortgaged Property”), recorded under Clerk’s File No. 2011080017 of the Real Property Records of Travis County, Texas (as modified by the Modification Agreements, the “Deed of Trust”). |

| |

4. | that certain Assignment of Leases dated of even date with the Original Note from Borrower to Lender, securing the payment of, inter alia, the Original Note, , recorded under Clerk’s File No. 2011080018 of the Real Property Records of Travis County, Texas (the “Assignment of Leases”). |

The instruments described above and all other documents evidencing, securing or otherwise executed in connection with the Original Loan, including the Original

-1-

017104 000576 8313483.4

Guaranty described below, and the Modification Agreements, being herein collectively called the “Original Loan Documents”;

WHEREAS, Stratus Properties, Inc., a Delaware corporation, has guaranteed certain obligations of Borrower pursuant to that certain Guaranty (the “Original Guaranty”);

WHEREAS, Borrower and Lender entered into that certain Modification Agreement dated December 31, 2012, recorded under Clerk’s File No. 2013018037 of the Real Property Records of Travis County, Texas (the “First Modification”);

WHEREAS, Borrower and Lender entered into that certain Modification and Extension Agreement dated May 31, 2013, recorded under Clerk’s File No. 2013099527 of the Real Property Records of Travis County, Texas (the “Second Modification”), pursuant to which the amount of the Original Loan was reduced to $11,000,000;

WHEREAS, Borrower and Lender entered into that certain Third Modification and Extension Agreement dated August 31, 2013, recorded under Clerk’s File No. 2013171559 of the Real Property Records of Travis County, Texas (the “Third Modification”);

WHEREAS, Borrower and Lender entered into that certain Fourth Modification and Extension Agreement dated October 31, 2013, recorded under Clerk’s File No. 2013202987 of the Real Property Records of Travis County, Texas (the “Fourth Modification”, together with the First Modification, Second Modification and Third Modification, herein collectively referred to as the “Modification Agreements”);

WHEREAS, Borrower has requested that Lender (i) increase the committed amount of the Original Loan by $8,672,500.00 (the “Loan Increase”) for a total loan amount of $19,672,500.00, (ii) extend the maturity date of the Loan and (iii) make certain other amendments and modifications to the Original Loan Documents, and Lender is willing to do so on the terms and conditions hereinafter set forth;

WHEREAS, contemporaneously herewith Borrower has executed and delivered to Lender that certain Amended and Restated Promissory Note (the “Amended and Restated Note”) in the stated principal amount of Nineteen Million Six Hundred Seventy-Two Thousand Five Hundred and No/100 Dollars ($19,672,500.00), in substitution of the Original Note;

WHEREAS, contemporaneously herewith Stratus Properties Inc. a Delaware corporation, has executed and delivered to Lender that certain Amended and Restated Guaranty (the “Amended and Restated Guaranty”), as a complete amendment, restatement and substitution of the Original Guaranty;

WHEREAS, Lender is the owner and holder of the Original Note and the Amended and Restated Note and Borrower is the owner of the legal and equitable title to the Mortgaged Property;

NOW, THEREFORE, for and in consideration of the mutual covenants contained herein and for other valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto agree as follows:

-2-

017104 000576 8313483.4

1.Defined Terms. Capitalized terms used but not defined in this Agreement shall have the meaning given to such capitalized terms in the Loan Agreement. The instruments described above, including this Agreement, the Amended and Restated Note and the Amended and Restated Guaranty, constitute “Loan Documents”, as such term is defined in the Loan Agreement.

2.Substitution of Promissory Note. Lender acknowledges receipt of the Amended and Restated Note and confirms that the Amended and Restated Note is in substitution for (and not in addition to), the Original Note, and amends and restates the Original Note in its entirety. From and after the date hereof, all references in the Loan Documents to the “Note” shall mean the Amended and Restated Note and all references to the “Loan” or the “Loan Amount” (or which otherwise reference the principal amount of the Loan) contained in the Loan Documents are hereby amended to reflect a loan in the principal amount of Nineteen Million Six Hundred Seventy-Two Thousand Five Hundred and No/100 Dollars ($19,672,500.00).

3.Extension of Maturity Date. Borrower and Lender acknowledge and agree that the term of Original Note was extended by the Amended and Restated Note to December 31, 2020 (the “Maturity Date”). The liens, security interests, assignments and other rights evidenced by the Deed of Trust and other Loan Documents are hereby renewed and extended to secure payment of the Note as extended by the Amended and Restated Note. The definition of “Maturity Date” and all references to the maturity of the Loan which appear in the Loan Documents shall hereafter mean and refer to December 31, 2020. Notwithstanding any provisions contained in the Loan Documents to the contrary, Borrower acknowledges and agrees that (i) Section 2.9 of the Loan Agreement and all references to the “Loan Extension” in the Loan Agreement are hereby deleted in their entirety and of no further force and effect, and (ii) Borrower has no further right to extend the maturity of the Loan.

4.Loan Increase. Effective as of the Effective Date, the total committed amount of the Loan is increased by the amount of the Loan Increase to the stated principal sum of $19,672,500.00. Contemporaneously with the execution of this Agreement and the closing of the transaction evidenced hereby, Lender will make an additional, special Advance to Borrower in the amount of $7,465,018 (the “Special Advance”), and Lender and Borrower each hereby acknowledge and agree that the unpaid balance of the Amended and Restated Note as of the date hereof, after giving effect to the Special Advance, is $17,672,499.54, with interest paid up to and including December 4, 2013. The Special Advance is not required to be reflected in the Budget and is not subject to compliance with the requirements for an Advance under the Loan Agreement except for the items listed in Section 3.1 (a), (b), (c), and (i) (1 – 6), execution and delivery of the Amended and Restated Note and Amended and Restated Guaranty, and payment of the Loan Fee. Subject to the satisfaction of the requirements in the foregoing sentence, Lender will fund the Special Advance contemporaneously with the full execution and delivery of this Agreement.

5.Loan Fee. As consideration for the Loan Increase, contemporaneously with the execution and delivery of this Agreement and as a condition to its effectiveness, Borrower shall pay to Lender a loan fee (the “Loan Fee”) in the amount of $245,906.25, which Loan Fee shall be due and payable contemporaneously with the execution of this Agreement.

-3-

017104 000576 8313483.4

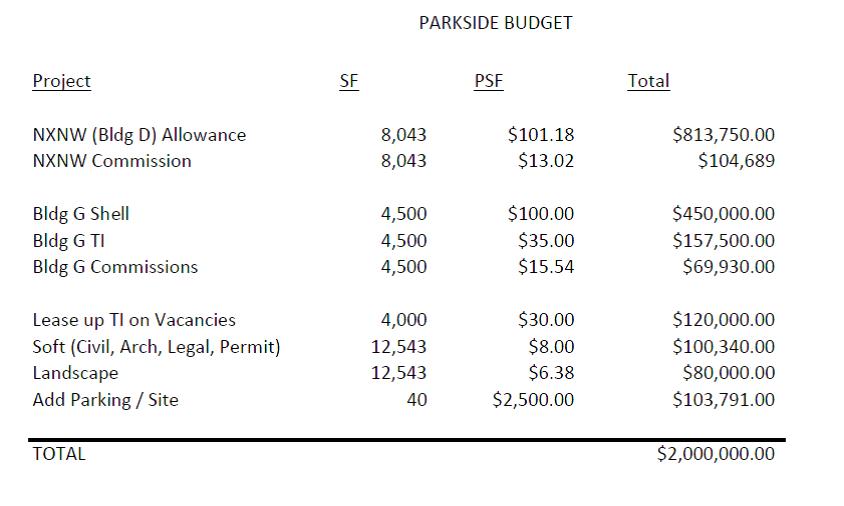

6.Holdback. $2,000,000.46 of principal of the Loan shall be withheld by Lender (the “Holdback”), and shall be available as Advances to be disbursed to Borrower to pay for (i) construction costs incurred by Borrower in connection with the construction of the following: (A) an approximately 8,043 square foot building (“Building D”) and (B) an approximately 4,500 square foot building (“Building G”, together with Building D, herein collectively called the “Additional Improvements”), which Additional Improvements are to be constructed on the Mortgaged Property, (ii) the cost of tenant finish improvements or tenant finish allowances payable in connection with Tenant Leases covering any of the Additional Improvements and (iii) the payment of leasing commissions incurred and payable with respect to Tenant Leases of the Additional Improvements. Such Holdback shall be disbursed to Borrower in accordance with the terms and conditions to funding Advances set forth in the Loan Agreement. With regard to the Holdback and the construction of the Additional Improvements, the Loan Agreement is hereby modified as follows:

| |

(i) | The term “Budget” with regard to Building D and Building G and for purposes of Debt Yield means the Budget attached hereto as Exhibit “B”. |

| |

(ii) | The term “Commencement Date” with regard to Building D and Building G means April 30, 2014. |

| |

(iii) | The term “Completion Date” with regard to Building D and Building G means August 30, 2014. |

| |

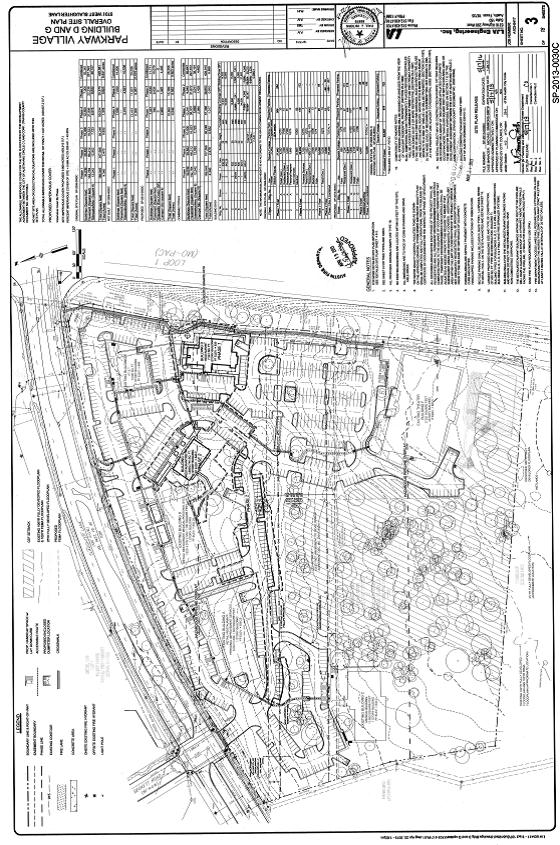

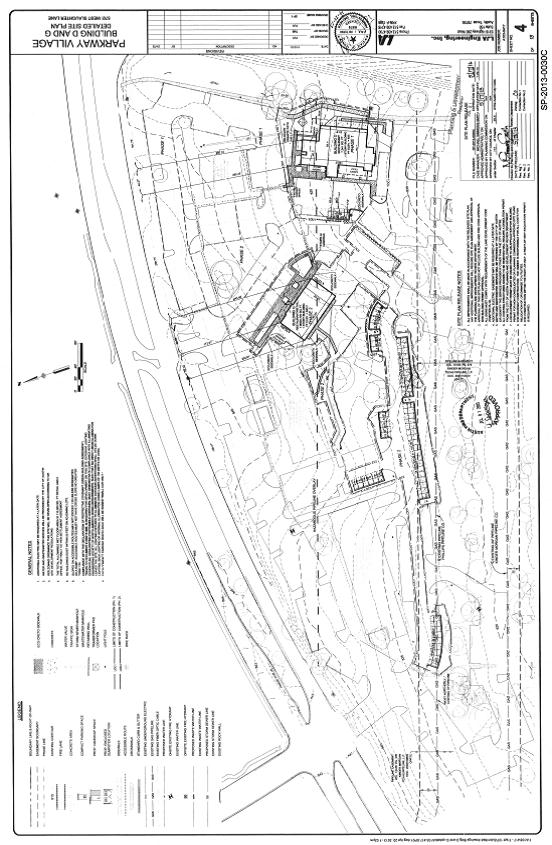

(iv) | The “Site Plan” is the site plan for the improvements as depicted on the site plan on Exhibit A-1 attached hereto and incorporated herein by this reference, and which reflects the location of Buildings A, B, C, D, E, F, and G constructed or to be constructed on the Land. Exhibit A-1 attached hereto replaces Exhibit A-1 that was originally attached to the Loan Agreement. |

7.Building D. Notwithstanding anything to the contrary contained herein or in the other Loan Documents, Lender acknowledges and agrees that (i) Borrower and North By Northwest Parkside LLC, a Texas limited liability company, (“NXNW”) entered into a Standard Commercial Shopping Center Lease dated July 9, 2012 covering the entire Building D, which was amended by First Amendment to Lease Agreement dated effective July 25, 2013 and by Second Amendment to Lease Agreement dated effective September 13, 2013 (as amended, the “NXNW Lease”). Borrower contemplates entering into a Third Amendment to Lease Agreement (“NXNW Third Amendment”), and pursuant to such NXNW Third Amendment, Tenant will be responsible for the construction of Building D, as well as the tenant finish improvements for the premises, and Tenant will be entitled to an Allowance (as will be defined in the NXNW Third Amendment and as reflected in the Budget) for reimbursement of costs incurred by NXNW for the construction of Building D and the tenant finish improvements therein. Upon (i) execution of the NXNW Third Amendment in form and substance reasonably acceptable to Lender and (ii) request by Borrower, Lender agrees to make Advances to Borrower to pay installments of the Allowance to NXNW as provided in the NXNW Third Amendment, as approved by Lender, so long as Borrower or NXNW satisfy the requirements for an Advance (other than an assignment of Tenant’s construction contract for such work). Lender also acknowledges that Borrower will make a limited assignment of Plans and Specifications for Building D and the Design Services Contract to NXNW to the extent required for NXNW to use

-4-

017104 000576 8313483.4

the Plans and Specifications and construction phase services of Design Professional in the construction of Building D.

8.Construction Due Diligence. Prior to the Commencement Date with regard to Building D and Building G, Borrower shall provide Lender with any contracts entered into by Borrower for the construction of Building D and Building G. Borrower shall use its best efforts to obtain (i) an assignment of rights and subordination agreement with regard to the contracts entered into by Borrower, including, but not limited to, the construction contract and architect’s contract, as amended, in a form reasonably approved by Lender, and (ii) any other documentation reasonably requested by Lender. Lender hereby acknowledges that upon the execution of the NXNW Third Amendment the tenant under the NXNW Lease may be obligated to construct Building D. If such tenant becomes obligated to construct Building D, Lender hereby acknowledges that such construction contract will not be assigned to Lender.

9.Modification of Deed of Trust. From and after the Effective Date, the Deed of Trust is hereby amended as follows:

(a)The term “Indebtedness” in Section 1.1 of the Deed of Trust is hereby amended and restated in its entirety to read as follows:

“Indebtedness: (i) The principal of, interest on, or other sums evidenced by the Note or the Loan Documents; (ii) any other amounts, payments, or premiums payable under the Loan Documents; (iii) such additional sums, with interest thereon, as may hereafter be borrowed from Beneficiary, its successors or assigns, by the then record owner of the Mortgaged Property, when evidenced by a promissory note which, by its terms, is secured hereby (it being contemplated by Grantor and Beneficiary that such future indebtedness may be incurred); (iv) payment of and performance of any and all present or future obligations of Grantor according to the terms of any present or future interest or hedge agreement, currency rate swap, rate cap, rate floor, rate collar, exchange transaction, forward rate agreement, or other exchange or rate protection agreements or any option with respect to any such transaction now existing or hereafter entered into between Grantor and Beneficiary (or any one or more affiliates of Beneficiary) (any of the foregoing herein called a “Hedging Agreement”); and (v) any and all other indebtedness, obligations, and liabilities of any kind or character of the Grantor to Beneficiary, now or hereafter existing, absolute or contingent, due or not due, arising by operation of law or otherwise, or direct or indirect, primary or secondary, joint, several, joint and several, fixed or contingent, secured or unsecured by additional or different security or securities, including indebtedness, obligations, and liabilities to Beneficiary of the Grantor as a member of any partnership, corporation, limited liability company, joint venture, trust or other type of business association, or other group, and whether incurred by Grantor as principal, surety, endorser, guarantor, accommodation party or otherwise, it being contemplated by Grantor and Beneficiary that Grantor may hereafter become indebted to Beneficiary in further sum or sums. Notwithstanding the foregoing provisions of this definition, this Deed of Trust shall not secure any such other loan, advance, debt, obligation or liability with respect to which Beneficiary is by applicable law prohibited from obtaining a lien

-5-

017104 000576 8313483.4

on real estate, nor shall this definition operate or be effective to constitute or require any assumption or payment by any person, in any way, of any debt or obligation of any other person to the extent that the same would violate or exceed the limit provided in any applicable usury or other law.”

(b)The term “Note” in Section 1.1 of the Deed of Trust is hereby amended and restated in its entirety to read as follows:

“Note: That certain Amended and Restated Promissory Note dated as of December 12, 2013, and incorporated herein by this reference, executed by Grantor, as the maker therein, and payable to the order of Beneficiary, as the payee therein, in the principal amount of NINETEEN MILLION SIX HUNDRED SEVENTY-TWO THOUSAND FIVE HUNDRED AND NO/100 DOLLARS ($19,672,500.00), and any and all renewals, modifications, rearrangements, reinstatements, enlargements, or extensions of such promissory note or of any promissory note or notes given in renewal, substitution or replacement therefor.”

10.Debt Yield. From and after the Effective Date, Section 5.20 of the Loan Agreement is hereby amended as follows:

(a)The first paragraph of Section 5.20 (the beginning paragraph prior to subparagraph (a)) is hereby amended and restated in its entirety to read as follows:

“5.20 Debt Yield. If, at any time after December 31, 2014, the Debt Yield (hereinafter defined) is less than 9.1% for two (2) consecutive Calendar Periods (hereinafter defined), then such failure shall constitute an Event of Default; however, such Event of Default may be cured by Borrower by making a prepayment of the outstanding principal of the Note in an amount equal to the Curative Amount (hereinafter defined), as hereinafter set forth.”

(b)Section 5.20(a) is hereby amended and restated in its entirety to read as follows:

“(a) Calculation. The Debt Yield calculation shall be undertaken for each three (3) month calendar period (the “Calendar Period”). The term “Debt Yield” means the ratio, expressed as a percentage, of (i) the Net Operating Income (hereinafter defined) for the applicable Calendar Period and annualized, to (ii) the Commitment Amount (hereinafter defined) as of the date of such calculation, and the term “Commitment Amount” means the stated principal amount of the Loan ($19,672,500), reduced by any principal payments made by Borrower after December 1, 2013. Borrower shall provide written evidence and documents to Lender indicating the calculations and backup information for the Debt Yield for each Calendar Period within forty-five (45) days after the expiration of each such Calendar Period. Lender shall be entitled to request and require such backup documentation, including but not limited to certified financial information, as may be reasonably required by Lender in order to satisfy itself as to the correct calculation of the Debt Yield for any Calendar Period.”

-6-

017104 000576 8313483.4

(c)Section 5.20(b) is hereby deleted in its entirety.

(d)Section 5.20(c) is hereby amended as follows:

(i) All references in Section 5.20(c) to “on a cash basis” or “on a cash basis of accounting” is hereby amended to be “in accordance with Generally Accepted Accounting Principles.”

(ii) Item (v) of Section 5.20(c)(1) is hereby deleted in its entirety.

(ii) The first paragraph of Section 5.20(c)(2) is hereby amended to read in its entirety as follows:

(2) Operating Expenses. The term “Operating Expenses” shall mean those amounts actually incurred and paid with respect to the ownership, operation, management, leasing and occupancy of the Mortgaged Property, determined in accordance with Generally Accepted Accounting Principles, except as otherwise specified herein, including, but not limited to any and all of the following (but without duplication of any item):

(ii) Item (vi) of Section 5.20(c)(2) is hereby amended to replace “four percent (4%)” with “two and seven tenths percent (2.7%).

(e)Sections 5.20(d) and 5.20(e) are hereby amended and restated in their entirety to read as follows:

“(d) Curative Amount. In the event the Debt Yield is less than 9.1% for two (2) consecutive Calendar Periods, and unless Borrower otherwise elects to pledge Additional Collateral as provided in Section 5.20(e) below, then, within fifteen (15) days after written notice from Lender to Borrower, Borrower shall prepay a portion of the outstanding principal of the Note in the amount necessary (the “Curative Amount”) such that a minimum Debt Yield of 9.1% or more is created based on (1) the actual Net Operating Income for the immediately preceding Calendar Period (and annualized) and (2) the Commitment Amount then outstanding as of the end of such Calendar Period, after giving effect to the Curative Amount. Failure of Borrower to timely fund any required Curative Amount shall be deemed an “Event of Default” pursuant to this Agreement in addition to any other “Events of Default” specified herein.

(e) Pledge of Liquid Collateral. As an alternative to payment of the Curative Amount, Borrower shall be entitled, in the event the Debt Yield for any Calendar Period should be determined to be less than 9.1%, to pledge additional collateral to secure the Loan. The collateral to be so pledged to Lender must be in the form of cash, certificates of deposit, letters of credit, stocks, bonds or other

-7-

017104 000576 8313483.4

highly liquid investments acceptable in all respects to Lender in its sole and absolute discretion (for purposes of this Agreement, the term “Additional Collateral” shall mean and refer to such additional collateral as shall be approved by Lender and pledged pursuant to this Section 5.20[e]). The amount or value of the Additional Collateral required to be pledged shall be a function of the liquidation value of such collateral, as determined by Lender in its reasonable discretion, and shall be such amount properly margined (i.e., the liquidation value) as would, if subtracted from the total amount of indebtedness evidenced and represented by the Note at such time, result in a Debt Yield (calculated as provided above) equal to 9.1%. In connection with such pledge of Additional Collateral, and not later than fifteen (15) days after written notice from Lender to Borrower of Borrower’s obligation to either pay the Curative Amount or to pledge the Additional Collateral, and provided that Borrower has not instead paid the Curative Amount required at that time pursuant to Section 5.20(d) above, Borrower shall execute and deliver to Lender all pledge and security agreements, financing statements and other instruments, certificates and agreements as Lender shall reasonably require, and shall deliver to Lender the Additional Collateral or such instruments, certificates, acknowledgments, stock powers, authorizations, powers of attorney, consents and any and all other documentation, as executed by all appropriate parties as may be necessary to effectuate the collateral pledge and assignment of such collateral to Lender, as Lender and its counsel shall reasonably deem necessary or appropriate. If, after Borrower’s provision of Additional Collateral, the Debt Yield should improve so as to be 9.1% or more for any Calendar Period (without taking into account the Additional Collateral), and provided no Event of Default is then existing, then Borrower shall be entitled to a release of the Additional Collateral. Borrower shall thereafter be required to either pay to Lender the Curative Amount or repledge Additional Collateral to the extent the required Debt Coverage Ratio should fail to be met during any subsequent Calendar Period and shall likewise be entitled to a re-release of any such subsequently pledged Additional Collateral consistent with the immediately preceding sentence.”

11.Hedging Agreement. In addition to the Events of Default set forth in the Loan Agreement, Borrower agrees that any default or event of default by Borrower under any Hedging Agreement (as defined in the Deed of Trust), after the expiration of any applicable grace or cure period, shall constitute an Event of Default under the Loan Agreement and each of the other Loan Documents.

12.Representations and Warranties. Borrower hereby represents and warrants that (a) Borrower is the sole legal and beneficial owner of the Mortgaged Property; (b) the Loan Documents to which Borrower is a party and this Agreement constitute the legal, valid and binding obligations of Borrower enforceable in accordance with their terms, subject to bankruptcy, insolvency, reorganization, fraudulent conveyance, moratorium and other laws applicable to creditors’ rights or the collection of debtors’ obligations generally; (c) the execution and delivery of, and performance under this Agreement are within Borrower’s power and authority without the joinder or consent of any other party and have been duly authorized by all requisite action and are not in contravention of law or the powers of Borrower’s articles of

-8-

017104 000576 8313483.4

incorporation and bylaws; (d) this Agreement constitutes the legal, valid and binding obligations of Borrower enforceable in accordance with its terms; (e) the execution and delivery of this Agreement by Borrower do not contravene, result in a breach of or constitute a default under any deed of trust, loan agreement, indenture or other contract, agreement or undertaking to which Borrower is a party or by which Borrower or any of its properties may be bound (nor would such execution and delivery constitute such a default with the passage of time or the giving of notice or both) and do not violate or contravene any law, order, decree, rule or regulation to which Borrower is subject; (f) to the best of Borrower’s knowledge there exists no uncured default under any of the Loan Documents; (g) there are no offsets, claims or defenses to the Loan Documents; and (h) there has been no change in the organizational structure of Borrower since the date of the closing of the Original Loan and Borrower is currently duly organized and legally existing under the laws of its state of organization. Borrower agrees to indemnify and hold Lender harmless against any loss, claim, damage, liability or expense (including without limitation reasonable attorneys’ fees) incurred as a result of any representation or warranty made by it herein proving to be untrue in any respect.

13.Further Assurances. Loan Parties, upon request from Lender, agrees to execute such other and further documents as may be reasonably necessary or appropriate to consummate the transactions contemplated herein or to perfect the liens and security interests intended to secure the payment of the Loan evidenced by the Amended and Restated Promissory Note.

14.Default. If Loan Parties shall fail to keep or perform any of the covenants or agreements contained herein or if any statement, representation or warranty contained herein is false, misleading or erroneous in any material respect, Borrower shall be deemed to be in default under the Loan Documents and Lender shall be entitled at its option to exercise any and all of the rights and remedies granted pursuant to the Loan Documents or to which Lender may otherwise be entitled, whether at law or in equity.

15.Recordation; Endorsement to Loan Title Policy. Contemporaneously herewith, Lender will deliver this Agreement for recording in the appropriate records of the county where the Property is located at Borrower’s expense and, Borrower shall, at its sole cost and expense, obtain and deliver to Lender a new Loan Policy Title of Insurance insuring the lien of the Deed of Trust, as modified hereby, and in the amount of the Commitment Amount, under issued pursuant to applicable title insurance rules and regulations, and otherwise in form and content and subject to such exceptions to coverage acceptable to Lender.

16.Ratification of Loan Documents. Except as provided herein, the terms and provisions of the Loan Documents shall remain unchanged and shall remain in full force and effect. Any modification herein of any of the Loan Documents shall in no way adversely affect the security of the Deed of Trust and the other Loan Documents for the payment of the Amended and Restated Note. The Loan Documents as modified and amended hereby are hereby ratified and confirmed in all respects. All liens, security interests, mortgages and assignments granted or created by or existing under the Loan Documents remain unchanged and continue, unabated, in full force and effect, to secure Borrower’s obligation to repay the Amended and Restated Note. All references in any of the Loan Documents to a Loan Document shall hereafter refer to such Loan Document as amended hereby.

-9-

017104 000576 8313483.4

17.Liens Valid; No Offsets or Defenses. Borrower hereby acknowledges that the liens, security interests and assignments created and evidenced by the Loan Documents are valid and subsisting and further acknowledges and agrees that there are no offsets, claims or defenses to any of the Loan Documents.

18.Merger; No Prior Oral Agreements. This Agreement supersedes and merges all prior and contemporaneous promises, representations and agreements. No modification of this Agreement or any of the Loan Documents, or any waiver of rights under any of the foregoing, shall be effective unless made by supplemental agreement, in writing, executed by Lender and Loan Parties. Lender and Loan Parties further agree that this Agreement may not in any way be explained or supplemented by a prior, existing or future course of dealings between the parties or by any prior, existing, or future performance between the parties pursuant to this Agreement or otherwise.

19.Costs and Expenses. Contemporaneously with the execution and delivery hereof, Borrower shall pay, or cause to be paid, all costs and expenses incident to the preparation hereof and the consummation of the transactions specified herein, including without limitation title insurance policy endorsement charges, recording fees and fees and expenses of legal counsel to Lender.

20.Release of Lender. Loan Parties hereby release, remise, acquit and forever discharge Lender, together with its employees, agents, representatives, consultants, attorneys, fiduciaries, servants, officers, directors, partners, predecessors, successors and assigns, subsidiary corporations, parent corporations, and related corporate divisions (all of the foregoing hereinafter called the "Released Parties"), from any and all actions and causes of action, judgments, executions, suits, debts, claims, demands, liabilities, obligations, damages and expenses of any and every character, known or unknown, direct and/or indirect, at law or in equity, of whatsoever kind or nature, whether heretofore or hereafter accruing, for or because of any matter or things done, omitted or suffered to be done by any of the Released Parties prior to and including the Effective Date, and in any way directly or indirectly arising out of or in any way connected to this Agreement or any of the Loan Documents, or any of the transactions associated therewith, or the Mortgaged Property, including specifically but not limited to claims of usury, lack of consideration, fraudulent conveyance and lender liability. THE FOREGOING RELEASE INCLUDES ACTIONS AND CAUSES OF ACTION, JUDGMENTS, EXECUTIONS, SUITS, DEBTS, CLAIMS, DEMANDS, LIABILITIES, OBLIGATIONS, DAMAGES AND EXPENSES ARISING AS A RESULT OF THE NEGLIGENCE OF ONE OR MORE OF THE RELEASED PARTIES.

21.Counterparts. This Agreement may be executed in any number of counterparts with the same effect as if all parties hereto had signed the same document. All such counterparts shall be construed together and shall constitute one instrument, but in making proof hereof it shall only be necessary to produce one such counterpart.

22.Severability. If any covenant, condition, or provision herein contained is held to be invalid by final judgment of any court of competent jurisdiction, the invalidity of such covenant, condition, or provision shall not in any way affect any other covenant, condition or provision herein contained.

-10-

017104 000576 8313483.4

23.Time of the Essence. It is expressly agreed by the parties hereto that time is of the essence with respect to this Agreement.

24.Representation by Counsel. The parties acknowledge and confirm that each of their respective attorneys have participated jointly in the review and revision of this Agreement and that it has not been written solely by counsel for one party. The parties hereto therefore stipulate and agree that the rule of construction to the effect that any ambiguities are to or may be resolved against the drafting party shall not be employed in the interpretation of this Agreement to favor either party against the other.

25.Governing Law. This Agreement and the rights and duties of the parties hereunder shall be governed for all purposes by the law of the State of Texas and the law of the United States applicable to transactions within said State.

26.Successors and Assigns. The terms and provisions hereof shall be binding upon and inure to the benefit of the parties hereto and their respective successors and assigns.

27.Notice of No Oral Agreements. Loan Parties and Lender hereby take notice of and agree to the following:

A. PURSUANT TO SUBSECTION 26.02(b) OF THE TEXAS BUSINESS AND COMMERCE CODE, A LOAN AGREEMENT IN WHICH THE AMOUNT INVOLVED THEREIN EXCEEDS $50,000 IN VALUE IS NOT ENFORCEABLE UNLESS THE AGREEMENT IS IN WRITING AND SIGNED BY THE PARTY TO BE BOUND OR BY THAT PARTY’S AUTHORIZED REPRESENTATIVE.

B. PURSUANT TO SUBSECTION 26.02(c) OF THE TEXAS BUSINESS AND COMMERCE CODE, THE RIGHTS AND OBLIGATIONS OF THE PARTIES TO THE LOAN DOCUMENTS SHALL BE DETERMINED SOLELY FROM THE LOAN DOCUMENTS, AND ANY PRIOR ORAL AGREEMENTS BETWEEN THE PARTIES ARE SUPERSEDED BY AND MERGED INTO THE LOAN DOCUMENTS.

C. THE LOAN DOCUMENTS AND THIS AGREEMENT REPRESENT THE FINAL AGREEMENT BETWEEN THE PARTIES THERETO AND MAY NOT BE CONTRADICTED BY EVIDENCE OF PRIOR, CONTEMPORANEOUS OR SUBSEQUENT ORAL AGREEMENTS OF THE PARTIES THERETO. THERE ARE NO UNWRITTEN ORAL AGREEMENTS BETWEEN THE PARTIES.

[SIGNATURE PAGE FOLLOWS]

-11-

017104 000576 8313483.4

IN WITNESS WHEREOF, this Agreement is executed on the respective dates of acknowledgement below but is effective as of the Effective Date.

BORROWER:

TRACT 107, L.L.C.,

a Texas limited liability company

| |

By: | Circle C GP, L.L.C., a Delaware limited liability company, its Manager |

| |

By: | Stratus Properties Inc., a Delaware corporation, Sole Member and Manager |

By:/s/ Erin D. Pickens

Erin D. Pickens

Senior Vice President

STATE OF TEXAS §

§

COUNTY OF TRAVIS §

This instrument was acknowledged before me on the 11th day of December, 2013, by Erin D. Pickens, Sr. Vice President of Stratus Properties Inc., a Delaware corporation, on behalf of said corporation, in its capacity as the sole member and manager of Circle C GP, L.L.C., a Delaware limited liability company, on behalf of said limited liability company, in its capacity as manager of Tract 107, L.L.C., a Texas limited liability company, on behalf of said limited liability company.

/s/ Susan M. Pressler

Notary Public in and for the State of Texas

Susan M. Pressler

Printed/Typed Name of Notary

My Commission Expires:

02-24-2016.

[Signature Page – Fifth Modification and Extension Agreement]

GUARANTOR:

STRATUS PROPERTIES INC.,

a Delaware corporation

By:/s/ Erin D. Pickens

Erin D. Pickens, Senior Vice President

STATE OF TEXAS §

§

COUNTY OF TRAVIS §

This instrument was acknowledged before me on the 11th day of December, 2013, by Erin D. Pickens, Senior Vice President of Stratus Properties Inc., a Delaware corporation, on behalf of said corporation.

/s/ Susan M. Pressler

Notary Public in and for the State of Texas

Susan M. Pressler

Printed/Typed Name of Notary

My Commission Expires:

02/24/2016.

[Signature Page – Fifth Modification and Extension Agreement]

LENDER:

COMERICA BANK

By:_/s/ Sterling J. Silver

Sterling J. Silver, Senior Vice President

STATE OF TEXAS §

§

COUNTY OF TRAVIS §

This instrument was acknowledged before me on the 11th day of December, 2013, by Sterling J. Silver, Senior Vice President of Comerica Bank, on behalf of said bank.

/s/ Sarah Hanes

Notary Public, State of Texas

My Commission Expires: 07/24/2015

Printed Name of Notary: Sarah Hanes

[Signature Page – Fifth Modification and Extension Agreement]

Exhibit A-1

[Exhibit A-1 – Fifth Modification and Extension Agreement]

[Exhibit A-1 – Fifth Modification and Extension Agreement]

[Exhibit A-1 – Fifth Modification and Extension Agreement]

Exhibit B

[Exhibit B – Fifth Modification and Extension Agreement]