United States

Securities and Exchange Commission

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☑ Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

☐ |

Preliminary Proxy Statement | ||

|

☐ |

Confidential, for use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | ||

|

☑ |

Definitive Proxy Statement | ||

|

☐ |

Definitive Additional Materials | ||

|

☐ |

Soliciting Material Pursuant to §240.14a-12 | ||

|

American Locker Group Incorporated | |||

|

(Name of Registrant as Specified in its Charter) | |||

|

| |||

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | |||

|

Payment of Filing Fee (Check the appropriate box): | |||

|

☑ |

No fee required. | ||

|

☐ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||

|

|

(1) |

Title of each class of securities to which transaction applies: | |

|

|

|

| |

|

|

(2) |

Aggregate number of securities to which transaction applies: | |

|

|

|

| |

|

|

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

|

|

|

| |

|

|

(4) |

Proposed maximum aggregate value of transaction: | |

|

|

|

| |

|

|

(5) |

Total fee paid: | |

|

|

|

| |

|

☐ |

Fee paid previously with preliminary materials. | ||

|

☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | ||

|

|

(1) |

Amount Previously Paid: | |

|

|

|

| |

|

|

(2) |

Form, Schedule or Registration Statement No.: | |

|

|

|

| |

|

|

(3) |

Filing Party: | |

|

|

|

| |

|

|

(4) |

Date Filed: | |

AMERICAN LOCKER GROUP INCORPORATED

2701 Regent Boulevard, Suite 200

DFW Airport, Texas 75261

April 14, 2014

Dear Stockholder:

You are cordially invited to attend the 2014 Annual Meeting of Stockholders of American Locker Group Incorporated to be held on May 14, 2014 at 9:00 a.m., local time, at 2701 Regent Boulevard, Suite 200, DFW Airport, Texas 75261. Please find enclosed a notice to stockholders, a Proxy Statement describing the business to be transacted at the annual meeting, a proxy card for use in voting at the meeting and American Locker Group Incorporated’s Annual Report on Form 10-K for the year ended December 31, 2013.

Your vote is important, regardless of the number of shares you hold. We hope that you will be able to attend the Annual Meeting, and we urge you to read the enclosed Proxy Statement before you decide to vote. Whether or not you plan to attend, please complete, sign, date and return the enclosed proxy card as soon as possible. It is important that your shares be represented at the meeting.

|

Very truly yours, |

|

|

|

Anthony B. Johnston |

|

Chairman, President and Chief Executive Officer |

YOUR VOTE IS IMPORTANT

All stockholders are cordially invited to attend the Annual Meeting in person. However, to ensure your representation at the meeting, you are urged to complete, sign, date and return, in the enclosed postage paid envelope, the enclosed proxy card as soon as possible. Returning your proxy will help us assure that a quorum will be present at the meeting and avoid the additional expense of duplicate proxy solicitations. Any stockholder attending the meeting may vote in person, even if he or she has returned a proxy.

TABLE OF CONTENTS

|

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS |

i |

|

PROXY STATEMENT |

1 |

|

GENERAL INFORMATION |

1 |

|

SOLICITATION AND REVOCABILITY OF PROXIES |

1 |

|

VOTING |

1 |

|

QUORUM |

2 |

|

ABSTENTIONS AND BROKER NON-VOTES |

2 |

|

PROPOSAL ONE — ELECTION OF DIRECTORS |

2 |

|

PROPOSAL TWO — RATIFICATION OF SELECTION OF INDEPENDENT AUDITORS |

3 |

|

PROPOSAL THREE – APPROVAL OF 2014 STOCK INCENTIVE PLAN OF AMERICAN LOCKER GROUP INCORPORATED |

3 |

|

BOARD OF DIRECTORS |

6 |

|

DIRECTOR COMPENSATION |

8 |

|

CORPORATE GOVERNANCE |

8 |

|

MEETINGS AND COMMITTEES OF DIRECTORS |

10 |

|

EXECUTIVE OFFICERS |

12 |

|

EXECUTIVE COMPENSATION |

13 |

|

AUDIT COMMITTEE REPORT |

14 |

|

INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS |

15 |

|

BENEFICIAL OWNERSHIP OF STOCK BY PRINCIPALS AND MANAGEMENT |

16 |

| TRANSACTIONS WITH RELATED PERSONS | 17 |

|

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE |

17 |

|

ADDITIONAL INFORMATION |

18 |

|

OTHER MATTERS |

18 |

|

APPENDIX A – 2014 STOCK INCENTIVE PLAN OF AMERICAN LOCKER GROUP INCORPORATED |

|

|

APPENDIX B – AMENDED AND RESTATED AUDIT COMMITTEE CHARTER |

AMERICAN LOCKER GROUP INCORPORATED

2701 Regent Boulevard, Suite 200

DFW Airport, Texas 75261

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held May 14, 2014

The annual meeting (the “Annual Meeting”) of stockholders of American Locker Group Incorporated, a Delaware corporation (the “Company”), will be held on May 14, 2014, at 9:00 a.m., local time, at the Company’s headquarters located at 2701 Regent Boulevard, Suite 200, DFW Airport, Texas 75261, to consider and vote on the following matters:

|

|

• |

the election of seven directors to serve on the Board of Directors of the Company, each to serve until the annual meeting of the Company’s stockholders following the fiscal year ending December 31, 2014 or until his or her respective successor is duly elected and qualified, or until his or her earlier death, resignation or removal from office; |

|

|

• |

the ratification of the appointment of Travis Wolff, LLP as independent auditors for the Company for the fiscal year ending December 31, 2014; |

|

|

• |

the approval of the 2014 Stock Incentive Plan of American Locker Group Incorporated; and |

|

|

• |

the transaction of such other business as may properly come before the Annual Meeting or any adjournments or postponements thereof. |

These matters are more fully discussed in the attached Proxy Statement.

The close of business on March 27, 2014 (the “Record Date”) has been fixed as the record date for the determination of stockholders entitled to receive notice of, and to vote at, the Annual Meeting and any adjournment or postponement thereof. Only holders of record of shares of the Company’s common stock, $1.00 par value per share (the “Common Stock”), at the close of business on the Record Date are entitled to receive notice of, and to vote at, the Annual Meeting. A list of stockholders entitled to vote at the Annual Meeting will be available for inspection by any stockholder at the Annual Meeting and at the Company’s offices at the address on this notice for any purpose germane to the Annual Meeting during ordinary business hours for the 10 days preceding the Annual Meeting.

Stockholders will need to register at the Annual Meeting in order to attend. You will need proof of your identity and proof of ownership of shares of Common Stock as of the Record Date in order to register. If your shares are not registered in your name, you will need to bring to the Annual Meeting either a copy of an account statement or a letter from the broker, bank or other institution in which your shares are registered that shows your ownership as of the Record Date.

Your vote is important. Whether or not you plan to attend the Annual Meeting, please complete, sign, date and return the enclosed proxy card as promptly as possible. You may revoke your proxy before the Annual Meeting as described in the Proxy Statement under the heading “Solicitation and Revocability of Proxies.”

Important Notice Regarding the Availability of Proxy Materials For the Stockholder Meeting To Be Held On May 14, 2014:

The annual report and proxy statement are available to you online. If your shares are registered directly in your name with the Company’s stock transfer agent, you may access these materials at http://www.envisionreports.com/ALGI. If your shares are held in a stock brokerage account or by a bank or other nominee, you may access these materials at http://www.edocumentview.com/ALGI.

|

DFW Airport, Texas |

|

By Order of the Board of Directors, |

|

|

April 14, 2014 |

|

|

|

|

|

|

|

|

|

|

|

Anthony B. Johnston |

|

|

|

|

Chairman, President and Chief Executive Officer |

|

AMERICAN LOCKER GROUP INCORPORATED

2701 Regent Boulevard, Suite 200

DFW Airport, Texas 75261

PROXY STATEMENT

GENERAL INFORMATION

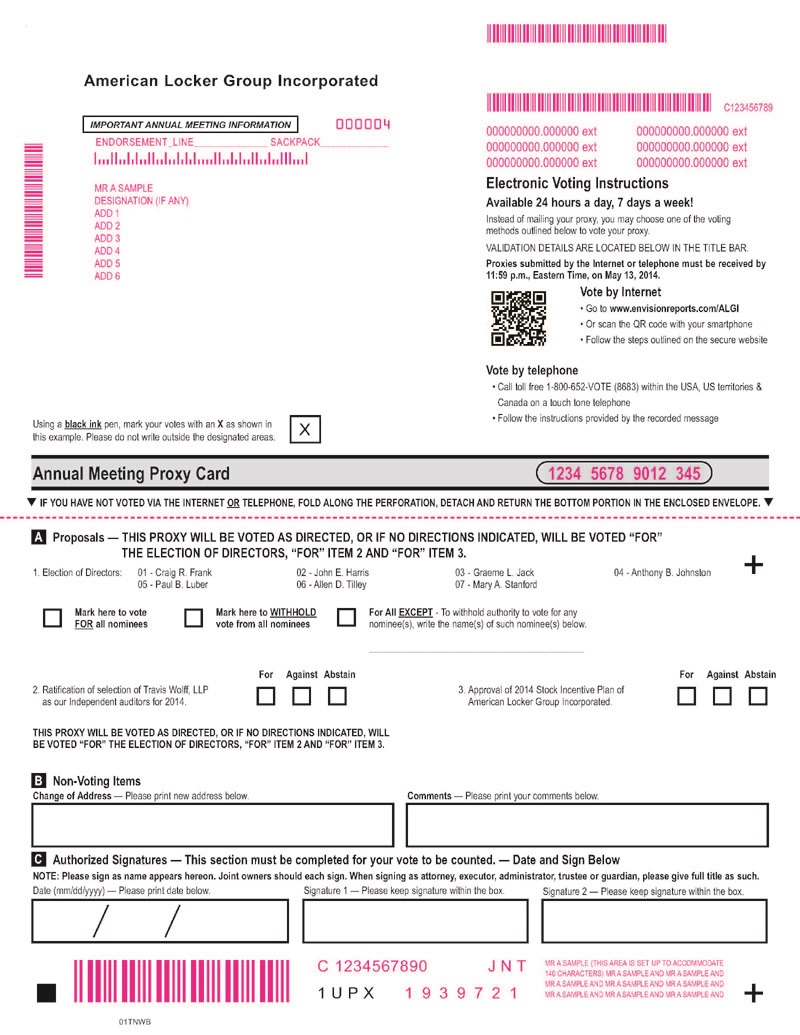

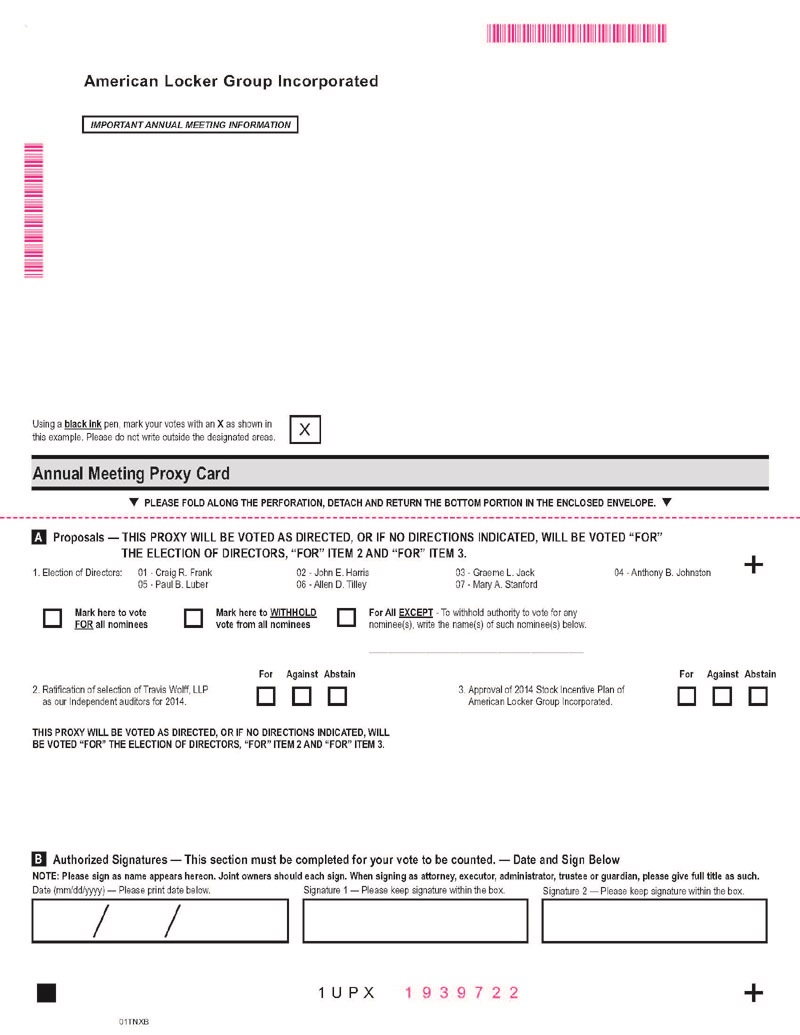

The board of directors of American Locker Group Incorporated (the “Board of Directors”) requests your proxy for use at the Annual Meeting of the stockholders of the Company to be held on May 14, 2014, at 9:00 a.m., local time, at the Company’s headquarters located at 2701 Regent Boulevard, Suite 200, DFW Airport, Texas 75261, and at any adjournment or postponement thereof. By signing and returning the enclosed proxy card, you authorize the persons named on the proxy to represent you and to vote your shares at the Annual Meeting. This Proxy Statement and the form of proxy card were first mailed to stockholders of the Company on or about April 21, 2014.

As used in this proxy statement, the terms “we,” “our,” “us” and “Company” refer to American Locker Group Incorporated and its subsidiaries.

SOLICITATION AND REVOCABILITY OF PROXIES

This solicitation of proxies is made by the Board of Directors and will be conducted primarily by mail. Officers, directors and employees of the Company may solicit proxies personally or by telephone, telegram or other forms of electronic, wire or facsimile communication. The Company will not pay any compensation for the solicitation of proxies but will reimburse banking institutions, brokerage firms, custodians, nominees and fiduciaries that hold Common Stock of record for their reasonable expenses incurred in forwarding solicitation materials to the beneficial owners of the Common Stock. All costs of the solicitation, including reimbursement of forwarding expenses, will be paid by the Company.

If you attend the Annual Meeting, you may vote in person. If you are not present at the Annual Meeting, your shares can be voted only if you have returned a properly signed proxy or if you are represented by another proxy. You may revoke your proxy at any time before it is exercised at the Annual Meeting if you:

|

(a) |

sign and timely submit a later-dated proxy to the Secretary of the Company; |

|

(b) |

deliver written notice of revocation of the proxy to the Secretary of the Company; or |

|

(c) |

attend the Annual Meeting and vote in person. |

In the absence of any such proxy revocation, shares represented by the owners of Common Stock named on the proxies will be voted at the Annual Meeting by the persons holding the proxies for such shares.

VOTING

Voting. YOUR VOTE IS IMPORTANT. Stockholders will be asked to vote on three proposals. Each outstanding share of Common Stock is entitled to one vote.

Voting Stock. The only outstanding voting securities of the Company are shares of Common Stock. As of the close of business on the Record Date, there were 1,687,319 shares of Common Stock outstanding and entitled to be voted at the Annual Meeting.

Proxy Voting. Whether or not you plan to attend the Annual Meeting, please complete, sign and date the accompanying proxy card and return it in the enclosed prepaid envelope. If your shares are held in “street name,” you should instruct your broker, bank or other nominee how to vote in accordance with the voting instruction form furnished to you by your broker, bank or other nominee. If you attend the Annual Meeting, you may revoke your previously returned proxy and vote in person if you wish.

Record Date. Only holders of our Common Stock on the close of business on March 27, 2014 are entitled to notice of, and to vote at, the Annual Meeting. If you were a holder of record of our Common Stock on the Record Date, you are entitled to vote at the Annual Meeting.

Use of Proxies. All shares of Common Stock represented by properly executed proxies received before or at the Annual Meeting (and that are not revoked) will be voted as indicated in those proxies. If no instructions are indicated on a returned proxy, the proxy will be voted “FOR” the Board of Directors nominees named in this Proxy Statement, “FOR” the ratification of Travis Wolff, LLP (“Travis Wolff”) as the Company’s independent auditors for the 2014 fiscal year and “FOR” approval of the 2014 Stock Incentive Plan of American Locker Group Incorporated.

QUORUM

In order for any business to be conducted at the Annual Meeting, the holders of more than 50% of the shares of Common Stock issued and outstanding and entitled to vote as of the Record Date must be represented at the Annual Meeting, either in person or by proxy. The presence, in person or by proxy, of such number of shares of Common Stock at the Annual Meeting will constitute a quorum. If a quorum is not present, in person or by proxy, at the Annual Meeting or any adjournment thereof, the Chairman of the Board or the holders of a majority of the Common Stock entitled to vote who are present or represented by proxy at the Annual Meeting have the power to adjourn the Annual Meeting from time to time without notice, other than an announcement at the Annual Meeting (unless the Board of Directors, after such adjournment, fixes a new record date for the adjourned meeting), until a quorum is present. At any such adjourned meeting at which a quorum is present, any business may be transacted that may have been transacted at the Annual Meeting had a quorum originally been present, except that if the adjournment is for more than 30 days, or if after the adjournment a new record date is fixed for the adjourned meeting, notice of the adjourned meeting shall be given to each stockholder of record entitled to vote at the adjourned meeting.

ABSTENTIONS AND BROKER NON-VOTES

If you own shares held in “street name” by a broker, then the broker, as the record holder of the shares, is required to vote those shares in accordance with your instructions. If you do not give instructions to the broker, the broker will nevertheless be entitled to vote the shares with respect to “discretionary” items but will not be permitted to vote the shares with respect to “non-discretionary” items. A “broker non-vote” occurs when a broker or other nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee has not received voting instructions from the beneficial owner of the shares or does not have the discretionary authority to vote on the beneficial owner’s behalf with respect to that item. Broker non-votes will count in determining if a quorum is present at the Annual Meeting.

If you abstain from voting, your shares will be deemed present at the Annual Meeting for purposes of determining whether a quorum is present.

PROPOSAL ONE — ELECTION OF DIRECTORS

The Company’s Board of Directors currently consists of seven directors. There is only one class of directors, and each director elected at the Annual Meeting will serve until the next annual meeting of stockholders, or until his or her successor, if any, is duly elected and qualified, or until his or her earlier death, resignation or removal from office. All of the directors nominated for election at the Annual Meeting have served as directors since the last annual meeting and are being nominated by the Board of Directors for election at the Annual Meeting. The nominees for director this year are our seven current directors: Messrs. Craig R. Frank, John E. Harris, Graeme L. Jack, Anthony B. Johnston, Paul B. Luber and Allen D. Tilley, and Dr. Mary A. Stanford.

Each of the nominees has confirmed that he or she will be able and willing to serve as a director if elected. If any of the nominees becomes unable or unwilling to serve, your proxy will be voted for the election of a substitute nominee recommended by the current Board of Directors.

Required Vote and Recommendation

The election of directors requires the affirmative vote of a plurality of the votes cast on the matter. For purposes of determining the number of votes cast on the matter, only those votes cast “for” and “against” are included and abstentions are not counted when determining whether a nominee is elected. The seven nominees receiving the highest number of affirmative votes will be elected. The election of directors is considered a “non-discretionary” item and brokers and other nominees who have not received voting instructions from the beneficial owner of the shares held by such broker do not have the authority to vote in the election of directors. Accordingly, broker non-votes will not have any effect on the election of a particular director. Unless otherwise instructed or unless authority to vote is withheld, shares represented by executed proxies will be voted “FOR” the election of the nominees.

The Board of Directors recommends that the stockholders vote “FOR” the election of Messrs. Craig R. Frank, John E. Harris, Graeme L. Jack, Anthony B. Johnston, Paul B. Luber and Allen D. Tilley, and Dr. Mary A. Stanford.

PROPOSAL TWO — RATIFICATION OF SELECTION OF INDEPENDENT AUDITORS

The Audit Committee of the Board of Directors (the “Audit Committee”) has selected Travis Wolff as the Company’s independent auditors for the fiscal year ending December 31, 2014. Representatives of Travis Wolff are expected to be present at the Annual Meeting.

The Audit Committee has responsibility for selecting the Company’s independent auditors, and stockholder approval is not required. However, the selection of Travis Wolff is being submitted to the stockholders for ratification at the Annual Meeting with a view towards soliciting the stockholders’ opinion, which the Audit Committee will take into consideration in future deliberations. If the selection of Travis Wolff as the Company’s independent auditors is not ratified at the Annual Meeting, the Audit Committee will investigate the possible bases for the negative vote and will consider the appointment in light of the results of its investigation. Even if the selection is ratified, the Audit Committee in its discretion may select different independent auditors at any time during the year if it determines that such a change would be in the best interests of the Company and the stockholders.

Required Vote and Recommendation

Approval of this proposal to ratify the appointment of Travis Wolff as the Company’s independent auditors for the fiscal year ending December 31, 2014 requires the affirmative vote of a majority of the votes cast on this matter. Only those votes cast “for” or “against” are included and abstentions are not counted in determining whether this proposal is ratified. Brokers have the discretionary authority to vote your shares of Common Stock if you have not given voting instructions. Unless otherwise instructed on the proxy or unless authority to vote is withheld, shares represented by executed proxies will be voted “FOR” the ratification of Travis Wolff as the Company’s independent auditors for the fiscal year ending December 31, 2014.

The Board of Directors recommends that stockholders vote “FOR” the ratification of the selection of Travis Wolff as the Company’s independent auditors for the fiscal year ending December 31, 2014.

PROPOSAL THREE — APPROVAL OF 2014 STOCK INCENTIVE PLAN OF

AMERICAN LOCKER GROUP INCORPORATED

General

Upon recommendation by the Executive Compensation – Stock Option Committee (the “Compensation Committee”) of the Board of Directors, the Board of Directors has adopted the 2014 Stock Incentive Plan of American Locker Group Incorporated (the “Stock Incentive Plan”). If approved by the stockholders, the Stock Incentive Plan will allow the Company to issue options to its directors and executive officers and 150,000 shares of Common Stock have been reserved for issuance under the Stock Incentive Plan. A copy of the Stock Incentive Plan is attached as Appendix A to this Proxy Statement and is subject to approval by the Company's stockholders. The Board of Directors believes that the adoption of this proposal is in the best interests of the Company for the reasons discussed below.

The Company desires to attract and retain the best available employees and directors, and to encourage the highest level of performance by those persons, thereby enhancing the value of the Company for the benefit of our stockholders. The Board of Directors believes that to accomplish these objectives it is necessary to (1) meet the competitive requirements of the workforce marketplace; (2) offer equity incentives as part of the total compensation to be paid; and (3) reward the performance of existing and prospective directors, executive officers, and key employees, as well as increase the proprietary and vested interest of all such persons in the Company’s growth and performance, in a manner that provides them with a means to increase their holdings of Common Stock, thus better aligning their interests with the interests of our stockholders. The Company does not currently have a compensation plan in place under which equity incentives are available for issuance to employees or directors to accomplish these objectives.

Summary of Material Provisions of the Stock Incentive Plan

The following is a summary of the material provisions of the Stock Incentive Plan, as proposed. The summary does not purport to be complete and is qualified in its entirety by reference to the text of the Stock Incentive Plan as set forth in Appendix A to this proxy statement.

Eligibility/Participation. The Stock Incentive Plan allows the Company to issue stock options to certain employees and non-employee directors. Directors, officers, key employees and consultants of the Company and its subsidiaries are eligible to participate in the Stock Incentive Plan. Participants will be selected by the Compensation Committee. Approximately nine persons will initially be eligible to participate, representing six independent directors and three officers, one of which also serves as a director.

Administration. The Compensation Committee will be responsible for the administration of the Stock Incentive Plan. The Compensation Committee will have discretionary authority to prescribe, amend and rescind the rules of the Stock Incentive Plan and to provide for conditions it determines advisable to protect the interests of the Company. The Compensation Committee will also interpret the Stock Incentive Plan and make all other determinations necessary for the administration and interpretation of the Plan. The Compensation Committee will determine the individuals who will participate in the Stock Incentive Plan and the amount, terms and conditions of such any awards granted, including the number of shares of Common Stock subject to an award, the time or times at which awards shall be granted, the provisions of the instruments by which such awards shall be evidenced, and whether or not the award shall designate options as incentive stock options.

Common Stock Subject to Stock Incentive Plan. The number of shares of Common Stock subject to awards under the Stock Incentive Plan is limited to 150,000 shares. Any shares of Common Stock subject to an award that for any reason has expired or is canceled, terminated, forfeited, substituted for or otherwise settled without the issuance of such shares will be available for future awards under the Stock Incentive Plan. If any stock split, share combination, extraordinary cash dividend, recapitalization, reorganization, merger, consolidation, split-up, spin-off, combination, exchange of shares or other similar event affect the Common Stock, the number of shares of Common Stock available for awards or subject to outstanding awards and their respective exercise prices and/or purchase prices (if any), will be proportionately adjusted to reflect, as deemed equitable and appropriate by the Committee, any such event.

Grant of Options. The Compensation Committee may grant options to participants at any time. The grant date may be the date on which the Compensation Committee awards the option or it may be the date on which a condition precedent to the grant of the option occurs. When a grant of an option is awarded, the Compensation Committee will determine the number of shares of Common Stock subject to the option. Each option will be evidenced by an option agreement specifying the exercise price of the option, the duration of the option, the number of shares of Common Stock subject to the option, the conditions upon which the option or any portion thereof shall become vested and exercisable, and the treatment of the option upon any termination of the participant’s employment with the Company and any subsidiary.

Option Price The Compensation Committee will determine the exercise price per share of Common Stock subject to an option. The exercise price will not be less than fair market value of the Common Stock on the date the option is granted. If the grant is made to an individual who owns more than 10% of the total combined voting power of the Company, the exercise price must be at least 110% of the fair market value of the Common Stock on the date the option is granted. Fair market value is defined as the mean between the highest and lowest quoted selling prices for the Common Stock on the OTCQB Market on the valuation date. In the event there are no Common Stock transactions reported on such date, the fair market value of the Common Stock will be the weighted average of the means between the highest and lowest selling prices on the nearest date before and the nearest date after the valuation date, with the average weighted inversely by the respective numbers of trading days between the selling dates and the valuation date.

Exercise of Options. The Compensation Committee will determine when an option may be exercised and what restrictions, if any, apply at the time of grant of such option. After becoming exercisable, an option (or portion thereof) will remain exercisable until expiration, termination or cancellation of the option. All options will terminate on the 10th anniversary of their grant date, or on the 5th anniversary of their grant date in the case of an option held by an individual who owns more than 10% of the total combined voting power of the Company.

Termination of Employment. Except as otherwise provided in any employment agreement between the Company and a participant, in the event of termination of a participant’s employment with the Company or any subsidiary other than as a result of such participant’s death, disability or as a result of a termination for cause, vested options will no longer be exercisable three months following the date of termination of a participant’s employment, and no unvested options will vest after such participant’s termination.

Except as otherwise provided in any employment agreement between the Company and a participant, in the event of the death or disability of a participant while employed by the Company or any subsidiary, vested options will be exercisable for one year following the date of death or disability or until the expiration of such option, if earlier. In the event of the participant’s death, vested options may be exercised by the participant’s designated beneficiary or the executor or administrator of the participant’s estate. In the event of the participant’s disability, vested options may be exercised by the participant’s personal representative. Except as otherwise provided in any employment agreement between the Company and the participant, no unvested options will vest after such participant’s death or disability.

Except as otherwise provided in any employment agreement between the Company and a participant, in the event of a participant’s termination of employment with the Company or any subsidiary for cause, any options granted to the participant pursuant to Stock Incentive Plan shall expire on the participant’s date of termination, whether or not the options were vested on the date of termination.

Effective Date and Termination. The Stock Incentive Plan is effective upon adoption by the Board of Directors or such later date, as the Board of Directors may specify, and shall automatically expire on the 10th anniversary of its adoption.

Income Tax Consequences. Set forth below is a brief summary of some of the income tax consequences of exercise of an option and disposition of shares under present tax law. This summary is necessarily incomplete and the tax laws and regulations are subject to change.

|

• |

Exercise of Option – Incentive Stock Option. If the option qualifies as an incentive stock option, there will be no regular U.S. federal income tax liability or state income tax liability upon the exercise of the option, although the excess, if any, of the fair market value of the shares on the date of exercise over the exercise price will be treated as a tax preference item for U.S. federal alternative minimum tax purposes and may subject purchaser to the alternative minimum tax in the year of exercise. The Company is not entitled to a deduction upon exercise of an incentive stock option. |

|

• |

Exercise of Option - Nonqualified Stock Option. If the option does not qualify as an incentive stock option, there may be a regular U.S. federal income tax liability and a state income tax liability upon the exercise of the option. The participant will be treated as having received compensation income (taxable at ordinary income tax rates) equal to the excess, if any, of the fair market value of the shares on the date of exercise over the exercise price. The Company will be allowed a deduction equal to the amount of ordinary income recognized by the participant. |

|

• |

Disposition of Shares - Incentive Stock Option. If the shares are held for more than one year after the date of the transfer of the shares pursuant to the exercise of an incentive stock option and more than two years after the grant date, any gain realized on disposition of the shares will be treated as long-term capital gain for federal and state income tax purposes. In general, if shares purchased under an incentive stock option are disposed of within the applicable one-year or two-year period, any gain realized on such disposition will be treated as compensation income (taxable at ordinary income rates) in the year of the disposition to the extent of the excess, if any, of the fair market value of the shares on the date of exercise over the exercise price and the Company will be entitled to a deduction in a like amount. |

|

• |

Disposition of Shares - Nonqualified Stock Option. If the shares are held for more than one year after the date of the transfer of the shares pursuant to the exercise of a nonqualified stock option, any gain realized on disposition of the shares will be treated as long-term capital gain. |

New Plan Benefits

Because awards granted under the Stock Incentive Plan will be at the discretion of the Compensation Committee, the awards that will be granted in the future are not currently determinable. However, pursuant to accepted terms of offers of employment, and contingent upon stockholder approval of the Stock Incentive Plan, the Compensation Committee has agreed to grant stock option awards to certain executive officers of the Company as set forth below.

|

Name & Position |

Number of Shares (1) |

|||

|

Anthony B Johnston, Chairman, President and Chief Executive Officer |

80,000 | |||

|

Stephen P. Slay, Chief Financial Officer |

10,000 | |||

|

David Denton, Chief Operating Officer |

10,000 | |||

|

Executive Group |

100,000 | |||

|

Non-Executive Director Group |

0 | |||

|

Non-Executive Officer Employee Group |

0 | |||

|

(1) |

The Compensation Committee will determine the exercise price of the options and the exercise price will not be less than fair market value of the Common Stock on the date the option is granted. As of April 11, 2014, the closing market price per share of the Common Stock was $2.15, as reported by the OTCQB. |

Other than those set forth above, the Compensation Committee has not made or entered into any commitments, agreements or understandings related to any future Stock Incentive Plan awards.

Securities Authorized for Issuance Under Equity Compensation Plans

As of December 31, 2013, the Company did not have an equity compensation plan in place and there were no stock appreciation rights or stock options outstanding under any equity compensation plans the Company previously had in place.

Required Vote and Recommendation

Approval of the Stock Incentive Plan requires the affirmative vote of a majority of the votes cast on the matter. Only those votes cast “for” and “against” are included and abstentions are not counted when determining whether the Stock Incentive Plan is approved. Brokers and other nominees who have not received voting instructions from the beneficial owner of the shares held by such broker do not have the authority to vote on this proposal. Accordingly, broker non-votes will not have any effect on the approval of the Stock Incentive Plan. Unless otherwise instructed on the proxy or authority to vote is withheld, shares represented by executed proxies will be voted “FOR” approval of the 2014 Stock Incentive Plan. If the stockholders do not approve the Stock Incentive Plan, it will not be implemented, but the Company reserves the right to adopt such other compensation plans and programs as it deems appropriate and in the best interests of the Company and its stockholders

The Board of Directors has unanimously approved the Stock Incentive Plan and recommends that the stockholders vote “FOR” approval of the Stock Incentive Plan.

BOARD OF DIRECTORS

The following table sets forth certain information regarding the nominees for election as directors of the Company. There are no family relationships between any directors and executive officers.

|

Name of Nominee |

Age |

Title | ||

|

Anthony B. Johnston |

53 |

Chairman of the Board , President and Chief Executive Officer | ||

|

John E. Harris |

53 |

Vice Chairman of the Board | ||

|

Craig R. Frank |

53 |

Director | ||

|

Graeme L. Jack |

46 |

Director | ||

|

Paul B. Luber |

53 |

Director | ||

|

Mary A. Stanford |

53 |

Director | ||

|

Allen D. Tilley |

76 |

Director |

Anthony B. Johnston. Mr. Johnston, age 53, has served on the Company’s Board of Directors since February 2007 and was appointed Chairman of the Board, President and Chief Executive Officer on April 2, 2013. He has over 28 years of public company experience in both the manufacturing and service sectors. Previously, Mr. Johnston served as the Chief Financial Officer of Uniglobe Beacon Travel, a corporate travel management company based in Western Canada, from 2008 to 2013. From October 1996 until November 2007, he was a Senior Vice President with The Westaim Corporation, located in Calgary, Alberta, Canada, and during the period from 2002 to 2005, was President of iFire Technologies, a subsidiary of The Westaim Corporation. Prior to joining Westaim, Mr. Johnston spent 15 years with Canadian Airlines International in a variety of senior management and executive positions. Mr. Johnston serves on the board of directors of a privately-held company, EssentialTalk Corporate Services. The Board considered Mr. Johnston’s extensive financial and managerial experience in determining that he was qualified to serve on the Board of Directors.

John E. Harris. Mr. Harris, 53, serves as the Vice Chairman of the Board and has been a Director since July 2005. Mr. Harris is a Vice President and Portfolio Manager for the Bank of Texas. From August 2006 until February 2008, Mr. Harris was a Portfolio Manager for US Trust, Bank of America Private Wealth Management. Before that, Mr. Harris was a Principal of Harris Capital Advisors, a consulting, investment analysis and private equity financing firm, from 2001 through August 2006. Mr. Harris also served as Vice President of Emerson Partners, a real estate private equity fund, from 2001 to 2003. Mr. Harris is a Chartered Financial Analyst and holds a Master of Business Administration from Southern Methodist University. The Board determined that Mr. Harris is qualified to serve on the Board of Directors as a result of his extensive management, operational, financial and investment banking experience as well as his track record of achievement and sound judgment as demonstrated by his experience in the banking and private equity industries.

Craig R. Frank. Mr. Frank, 53, has been a Director of the Company since March 2006. Mr. Frank has served as Chief Executive Officer of Tudog International Consulting, a business consulting firm, since 2002. Mr. Frank also served as the Chairman and Chief Executive Officer of Alternative Fuels Americas (AFAI.PK), a farm-to-fuel biodiesel company, during 2007, and has continued to serve in that role since 2010. In deciding to nominate Mr. Frank, the Board of Directors considered his extensive marketing and international business experience with a broad range of clients and industries.

Graeme L. Jack. Mr. Jack, 46, is an executive in the banking industry. Mr. Jack was an Executive Vice President with Busey Bank in Champaign, Illinois from August 2011 to January 2014. Before joining Busey Bank, he was a Senior Vice President with Fifth Third Bank in Chicago from 2003 until August 2011. Before joining Fifth Third Bank, Mr. Jack spent five years in the Corporate Finance Department of J.P. Morgan and Chase Securities in both Brazil and New York. From 1989 through 1996, he served as a Company Executive Officer and Platoon Leader in the United States Marine Corps. Mr. Jack earned an MBA from Northwestern University and a B.A. from the University of Illinois. In deciding to nominate Mr. Jack, the Board of Directors considered his extensive corporate finance and commercial banking experience.

Paul B. Luber. Mr. Luber, 53, has been a Director of the Company since February 2010. Mr. Luber has served as President and CEO of The Jor-Mac Company from 2008 to present and, prior to that, he served as CEO of The Jor-Mac Company from 2000 through 2008. The Jor-Mac Company is a contract manufacturer of engineered metal fabrications that serves Fortune 1000 and middle market original equipment manufacturers throughout the United States, Canada, Mexico and Brazil. Mr. Luber serves as an active investor, board member, advisor and partner in other operating businesses and non-profit entities and as a Regent at the Milwaukee School of Engineering. Mr. Luber earned a degree in Mechanical Engineering and Master of Business Administration from the University of Wisconsin — Madison. Mr. Luber also serves on the board of directors of Universal Mfg. Co. (UFMG), a public company headquartered in Lincoln, Nebraska. In deciding to nominate Mr. Luber, the Board of Directors considered his extensive management, operational and engineering business expertise, in addition to his track record of achievement and sound judgment as demonstrated by his history as the CEO of The Jor-Mac Company.

Mary A. Stanford. Dr. Stanford, 53, has been a Director since July 2005. Dr. Stanford has been a Professor of Accounting at the Neeley School of Business at Texas Christian University since 2002. Dr. Stanford previously was an Associate Professor of Accounting at Syracuse University from 1999 to 2002. In deciding to nominate Dr. Stanford, the Board of Directors considered her extensive accounting experience and corporate governance knowledge, including her tenure as a Professor of Accounting at the Neeley School of Business and Texas Christian University.

Allen D. Tilley. Mr. Tilley, 76, has been a Director of the Company since September 2007 and was appointed Chief Executive Officer in February 2008. Mr. Tilley served as Chief Executive Officer until his retirement on September 1, 2011. Since September 2006, Mr. Tilley has served as an adjunct professor at Southern Methodist University’s School of Engineering. From 1998 through December 2006, Mr. Tilley was the President, CEO and partner of Schubert Packaging Systems (“SPS”), a subsidiary of a German-based packaging machine manufacturer and, from 1997 to 1998, served as a consultant to the packaging machine manufacturer prior to starting SPS. Prior to that, Mr. Tilley spent more than 20 years in various executive positions with Frito Lay and PepsiCo Foods International (“PFI”), divisions of PepsiCo, last serving as Vice President of Operations for PFI. Mr. Tilley holds a BS in Engineering from Kansas State University and a Master of Business Administration from Southern Methodist University. In deciding to nominate Mr. Tilley, the Board of Directors considered his extensive manufacturing and engineering experience and his more than 20 years of operational experience in large, diversified businesses.

There have been no events under any bankruptcy law, no criminal proceedings (excluding traffic violations and other minor offenses) and no judgments, orders, decrees or injunctions material to the evaluation of the ability and integrity of any executive officer, nominee or director of the Company during the past ten years.

DIRECTOR COMPENSATION

The following table sets forth certain information with respect to the compensation of all members of the Board of Directors for the year ended December 31, 2013:

|

Name |

Fees Earned or |

Total Compensation |

||||||

|

Craig R. Frank |

$ | 12,000 | $ | 12,000 | ||||

|

John E. Harris |

32,000 | 32,000 | ||||||

|

Graeme L. Jack |

12,000 | 12,000 | ||||||

|

Anthony B. Johnston (1) |

18,000 | 18,000 | ||||||

|

Paul B. Luber |

12,000 | 12,000 | ||||||

|

Mary A. Stanford |

15,500 | 15,500 | ||||||

|

Allen D. Tilley |

12,000 | 12,000 | ||||||

_________________________________

|

(1) |

Anthony Johnston was appointed Chairman, President and Chief Executive Officer effective April 2, 2013. Prior to this appointment, Mr. Johnston was compensated $3,000 for his service as an independent Director. Mr. Johnston was compensated $15,000 for his service as Chairman from the date of his appointment through the end of fiscal 2013. |

During the year ended December 31, 2013, each director who was not a salaried employee of the Company was paid an annual base director fee of $10,000, payable in quarterly installments. In recognition of the additional responsibilities and time commitment associated with their positions, the Non-Executive Vice Chairman, Mr. John Harris, and the Chair of the Audit Committee, Dr. Stanford, received additional fees of $20,000 and $3,500, respectively, on an annual basis, payable in cash at the end of each calendar quarter. Each director received $500 for each meeting of the Board of Directors attended in person or by conference telephone, payable in cash at the end of each calendar quarter. No director received additional compensation for attendance at any meeting of any committee of the Board of Directors.

Anthony Johnston was appointed Chairman of the Board, President and Chief Executive Officer of the Company effective April 2, 2013. Mr. Johnston continues to be a member of the Board of Directors and participate in its meetings but is not an independent Director and does not serve on any committee of the Board of Directors. The only compensation he receives for his services as a Director is $20,000 for his role as Chairman of the Board.

CORPORATE GOVERNANCE

Our Board of Directors oversees our overall performance on behalf of our stockholders. Members of our Board stay informed of our business through discussions with our Chief Executive Officer and other members of our executive team, by reviewing materials provided to them, and by participating in regularly scheduled Board and committee meetings.

Our Board is elected by our stockholders to govern the Company’s business and affairs. Our Board selects our senior management team, which is charged with conducting our business. Having selected our senior management team, our Board acts as an advisor to senior management and monitors their performance. Our Board reviews the Company’s strategies, financial objectives and operating plans. It also plans for management succession of our Chief Executive Officer, as well as other senior management positions, and oversees our compliance efforts.

Term of Office

The Company’s Certificate of Incorporation provides for one class of directors comprising the Board of Directors. Directors serve from the time they are duly elected and qualified until the next annual meeting of the Company’s stockholders, until their respective successors are duly elected and qualified, or until their earlier death, resignation or removal from office.

Director Independence

The Board of Directors has determined that all of its members, other than Mr. Tilley, who served as the Company’s Chief Executive Officer until September 1, 2011, and Mr. Johnston, who currently serves as the Company’s Chief Executive Officer, are “independent” within the meaning of the NASDAQ and SEC rules regarding independence, and that each such person is free of any relationship that would interfere with the individual exercise of independent judgment. Our Board has further determined that each member of the Board’s three committees meets the independence requirements applicable to those committees prescribed by NASDAQ and SEC rules, including Rule 10A-3(b)(1) under the Exchange Act related to audit committee member independence.

Board Leadership

Effective April, 2, 2013, Anthony Johnston was appointed our President and Chief Executive Officer and was named the Chairman of the Board. As Chairman, he succeeded John Harris, who, until that date, had served as our Non-Executive Chairman. The Company’s corporate governance documents provide the Board with maximum flexibility to select the appropriate leadership structure for the Company. The Board of Directors strongly believes at this time that the most effective Board leadership structure is to have Mr. Johnston serve as both Chairman and Chief Executive Officer and to have Mr. Harris, an independent director, serve as the Board’s Vice-Chairman. As discussed below, the Board of Directors believes that this leadership structure at the present time strikes the optimal balance between unified leadership and effective independent oversight.

The Company’s business is complex and its products are sold throughout the world. Especially in this challenging economy, the Board of Directors believes that it is best for the Company and its stockholders to have the same individual serve as Chairman and Chief Executive Officer. First, this structure promotes efficient board meetings. A combined Chairman and Chief Executive Officer acts as a bridge between management and the Board of Directors, encouraging, along with the independent Vice-Chairman, strong information flows so that both groups act with a common purpose. Second, this structure facilitates short-term crisis management and long-term strategic planning. The Chief Executive Officer has an in-depth knowledge of Company operations and the industries and markets in which the Company competes. As such, the Board of Directors believes that Mr. Johnston, rather than an outside director, is in the best position to bring valuable insights, business issues and market opportunities and risks to the Board’s attention for review and deliberation. Third, this Board leadership structure promotes decisive, unified leadership. With a combined Chairman and Chief Executive Officer, there is clarity about responsibility and accountability. Most importantly, combining the Chairman and Chief Executive Officer builds a cohesive corporate culture, allowing the Company to speak with a single voice both inside and outside the Company.

The Company does not have a lead director and does not believe that appointing a lead director would materially impact the performance of the Board of Directors, as it currently employs a variety of structural and operational controls that serve the same purpose. For example, our Vice-Chairman is an independent director. Also, each committee chair acts as “presiding director” for Board of Directors’ discussions on topics within the sphere of his or her committee. All members of the Board of Directors are free to suggest the inclusion of items on Board of Directors and committee meeting agendas, and, to the fullest extent possible, all meeting materials and presentations are distributed to the Board of Directors in advance, allowing efficient use of time during meetings for questions and comprehensive deliberations. All members of the Board of Directors have direct and complete access to the Company’s management at all times, subject to reasonable time constraints and their judgment. Additionally, the Chief Executive Officer’s performance and compensation are evaluated and determined by the Compensation Committee, which is composed solely of independent directors. Finally, each committee of the Board of Directors, all of which are composed solely of independent directors, has the right at any time to retain independent outside financial, legal or other advisors.

Board of Directors’ Role in Risk Management

The Board of Directors takes an active role in risk oversight of the Company both as a full board and through its committees. Strategic risk, which relates to the Company properly defining and achieving its high-level goals and mission, as well as operating risk, the effective and efficient use of resources and pursuit of opportunities, are regularly monitored and managed by the full Board of Directors through regular and consistent review of the Company’s operating performance and strategic plan. For example, at the Board of Directors meetings held last year, management provided presentations on the Company’s various operations and performance as a whole. In addition, the Board of Directors discusses risks related to the Company’s business strategy at various meetings held throughout the year as appropriate. Reporting risk and compliance risk are primarily overseen by the Audit Committee. The Audit Committee meets regularly throughout the year and receives input directly from management as well as the Company’s independent registered public accounting firm, Travis Wolff, regarding the Company’s financial reporting process, internal controls and public filings.

Code of Business Conduct & Ethics

The Company has adopted a Code of Business Conduct & Ethics, which is applicable to all employees, officers and directors of the Company. The Code of Business Conduct & Ethics is intended to address conflicts of interest, corporate opportunities, confidentiality, fair dealing, protection and proper use of Company assets and compliance with laws, rules and regulations (including insider trading and reporting requirements). The Code of Business Conduct & Ethics establishes special ethical rules with respect to the executive officers of the Company. It also establishes compliance procedures and mechanisms for reporting suspected violations. The Company’s Code of Business Conduct & Ethics is available on the Company’s website (www.americanlocker.com). The Company intends to disclose amendments to, or waivers from, provisions of the Code of Business Conduct & Ethics that apply to the executive officers by posting such information on its website.

Stockholder Communications with the Board of Directors

The Board of Directors has established a process to receive communications from stockholders and other interested parties. To communicate with the Board of Directors, any individual director or any group or committee of the Board of Directors, correspondence should be addressed to the Board of Directors or such individual or group or committee and sent to:

American Locker Group Incorporated

c/o Corporate Secretary

PO Box 169

Coppell, Texas 75019

Communications sent in this manner will be reviewed by the office of the Corporate Secretary for the sole purpose of determining whether the contents represent a message to one or more of the Company’s directors.

MEETINGS AND COMMITTEES OF DIRECTORS

The Board of Directors held four meetings during the fiscal year ended December 31, 2013. The Board of Directors has three standing committees: the Audit Committee; the Executive Compensation — Stock Option Committee; and the Nominating and Governance Committee. Each committee member is appointed by the Board of Directors and is “independent” as defined under NASDAQ rules and applicable rules and regulations of the SEC. During the fiscal year ended December 31, 2013, no director attended less than 75% of the aggregate number of meetings of the Board of Directors and the number of committee meetings of which such director was a part.

It is the Company’s policy that each member of the Board of Directors attends the Annual Meeting of the Company’s stockholders. With the exception of Mary Stanford, all members of the Board of Directors were in attendance at the 2013 annual meeting of the Company’s stockholders, which was the last annual meeting of the Company’s stockholders that was held.

As of the date of this proxy statement, each director currently serves on the following committees:

|

Name of Director |

Audit Committee |

Executive |

Nominating and |

|||||||||

|

Craig R. Frank |

— |

Member |

Member |

|||||||||

|

John E. Harris |

Member |

Member |

Chair |

|||||||||

|

Graeme L. Jack |

Member |

— | — | |||||||||

|

Anthony B. Johnston |

— | — | — | |||||||||

|

Paul B. Luber |

— |

Chair |

Member |

|||||||||

|

Mary A. Stanford |

Chair |

— | — | |||||||||

|

Allen D. Tilley |

— | — | — | |||||||||

|

Number of meetings held in 2013 |

7 | 2 |

None |

|||||||||

Audit Committee

The primary function of the Audit Committee is to assist the Board of Directors in fulfilling its oversight responsibility to the stockholders, potential stockholders, the investment community and others relating to:

• the integrity of the Company’s financial statements;

• the Company’s compliance with legal and regulatory requirements;

• the Company’s system of internal account and financial controls;

• the qualifications and independence of the Company’s independent registered public accounting firm;

• the performance of the Company’s internal audit function; and

• the Company’s compliance with our Code of Business Conduct & Ethics.

The role and other responsibilities of the Audit Committee are governed by an Amended and Restated Audit Committee Charter, which is available on our website (www.americanlocker.com). In accordance with proxy rules promulgated by the Securities and Exchange Commission, we are required to file a copy of the Amended and Restated Audit Committee Charter at least once every three years as an exhibit to our Proxy Statement. The Amended and Restated Audit Committee Charter is attached as Appendix B to this Proxy Statement.

All members of the Audit Committee are “independent” as defined under NASDAQ and SEC rules and regulations, and each member of the Audit Committee is able to read and understand fundamental financial statements, including balance sheets, income statements and cash flow statements. The Board of Directors has determined that Dr. Stanford qualifies as an “audit committee financial expert” as defined by SEC regulations.

Executive Compensation — Stock Option Committee

The purpose of the Executive Compensation — Stock Option Committee (the “Compensation Committee”) is to assist the Board of Directors in determining the compensation of directors and senior management and to administer the Company’s benefit plans. The Compensation Committee determines the amount and form of executive officer and director compensation and recommends this to the Board of Directors as a whole. The Compensation Committee does not have a charter and does not have the authority to delegate its authority to establish compensation to other persons.

In fulfilling its duties, the Compensation Committee, among other things:

|

|

• |

reviews periodically our executive compensation plans in light of our Company’s goals and objectives with respect to such plans and, if the committee deems appropriate, adopt, or recommend to our Board the adoption of new, or the amendment of existing, executive compensation plans; |

|

|

• |

evaluates annually the performance of our Chief Executive Officer and, with our CEO’s participation and input, that of our other executive officers in light of the goals and objectives of our executive compensation plans; |

|

|

• |

approve any equity compensation awarded to any of our executive officers, subject to the requirements of the applicable compensation plans; and |

|

|

• |

with respect to SEC reporting requirements, review and discuss with management our compensation discussion and analysis, and oversee the preparation of, and approve, the Compensation Committee’s report on executive compensation to be included in our proxy statement. |

All members of the Compensation Committee are “independent” as defined under NASDAQ and SEC rules and regulations. The Compensation Committee recommends to the Board of Directors the compensation for the Company’s executive officers. The Board of Directors, as a whole, sets the compensation of the executive officers based upon the recommendations of the Compensation Committee. The Board of Directors consults with the Chief Executive Officer with respect to the compensation paid to the other executive officers.

Nominating and Governance Committee; Nominating Procedures

The Nominating and Governance Committee actively seeks and identifies individuals qualified to become members of the Board of Directors, consistent with criteria approved by the Board of Directors, and selects each nominee for election as a member of the Board of Directors. The Nominating and Governance Committee also selects the membership composition of the committees of the Board of Directors. Only directors who meet the independence standards set by NASDAQ and the SEC are permitted to serve on the Nominating and Governance Committee. The Nominating and Governance Committee does not have a written charter.

The Nominating and Governance Committee reviews periodically with the full Board of Directors the qualifications of new and existing members of the Board of Directors. The Nominating and Governance Committee also considers the level of independence of individual members and such other factors as the Board of Directors deems appropriate, including overall skills and excellence, to ensure the Company’s ongoing compliance with the independence and other standards set by NASDAQ and the SEC.

All members of the Nominating and Governance Committee are “independent” as defined under NASDAQ and SEC rules and regulations.

The Nominating and Governance Committee is responsible for evaluating potential candidates for membership on the Board of Directors and evaluates prospective nominees identified on its own initiative as well as those candidates recommended to it by members of the Board of Directors, management or stockholders. The Nominating and Governance Committee uses the same criteria for evaluating candidates recommended by stockholders in accordance with the procedures outlined below as it does for those proposed by other members of the Board of Directors or management.

To be considered for membership on the Board of Directors, a proposed candidate must: be of proven integrity with a record of substantial achievement in an area of relevance to the Company; have demonstrated ability and sound judgment that usually will be based on broad experience; be able and willing to devote the required amount of time to the Company’s affairs; possess a judicious and critical temperament that will enable objective appraisal of management’s plans and programs; and be committed to building sound, long-term Company growth. The Nominating and Governance Committee does not have a separate policy on diversity; however, diversity with regards to experience, background, skill sets, gender and racial makeup is one of the criteria to be considered for membership on the Board of Directors. The Nominating and Governance Committee believes the Company has attracted directors representing a diverse base of experience, skills and perspectives.

The Nominating and Governance Committee will consider candidates proposed by the stockholders of the Company, taking into consideration the needs of the Board of Directors and the candidate’s qualifications. To have a candidate considered by the Nominating and Governance Committee, a stockholder must submit the recommendation in writing and must include the following information:

|

|

• |

the name and address of the proposed candidate; |

|

|

• |

the proposed candidate’s resume or a list of his or her qualifications to be a director of the Company; |

|

|

• |

a description of what would make such person a good addition to the Board of Directors; |

|

|

• |

a description of any relationship that could affect such person’s qualifying as an independent director, including identifying all other public company board of directorships and committee memberships; |

|

|

• |

a confirmation of such person’s willingness to serve as a director if selected by the independent directors and the Board of Directors; |

|

|

• |

the name of the stockholder proposing the candidate, together with information as to the number of shares owned by such stockholder and the length of time of ownership; and |

|

|

• |

any information about the proposed candidate that, under the SEC’s proxy rules, would be required to be included in the Company’s proxy statement if such person were included as a nominee. |

The stockholder recommendation and information described above must be sent to the Company’s Secretary at P.O. Box 169, Coppell, Texas 75019, and, in order to allow for timely consideration, must be received not less than 120 days in advance of the anniversary date of the release of the proxy statement for the most recent annual meeting of stockholders.

Once a person has been identified by the Nominating and Governance Committee as a potential candidate, the Nominating and Governance Committee may collect and review publicly available information regarding the person to assess whether the person should be considered further. Generally, if the person expresses a willingness to be considered and to serve on the Board of Directors, and the Nominating and Governance Committee believes that the candidate has the potential to be a contributing member of the Board of Directors, the Nominating and Governance Committee would seek to gather additional information from or about the candidate, including through one or more interviews, as appropriate, and a review of his or her accomplishments and qualifications generally in light of any other candidates that the Nominating and Governance Committee may be considering.

EXECUTIVE OFFICERS

The following table sets forth information regarding the executive officers of the Company:

|

Name of Nominee |

Age |

Title | ||

|

Anthony B. Johnston |

53 |

Chairman of the Board, President and Chief Executive Officer | ||

|

David Denton |

45 |

Chief Operating Officer | ||

|

Stephen P. Slay |

51 |

Chief Financial Officer |

The executive officers named above were appointed by the Board of Directors to serve in such capacities until their respective successors have been duly appointed and qualified or until their earlier death, resignation or removal from office.

David Denton. Mr. Denton, 45, has served as the Company’s Chief Operating Officer since October 29, 2012 and is responsible for the manufacturing and logistics operations of the Company. He previously was the Operations Manager for Imperial Group, a division of Accuride Corporation. From 2005 until joining Imperial Group, he was Chief Executive Officer of Global CNC Solutions, a precision machined component manufacturer supplying product to aerospace and defense customers. Mr. Denton has a Bachelor’s Degree in Business Management and has more than 20 years of manufacturing experience. He served in the United States Air Force as an Aircraft Machinist and Certified Aircraft Welder, during which he spent the majority of his time in Saudi Arabia in support of Operation Desert Storm.

Stephen P. Slay. Mr. Slay, age 51, has served as the Company’s Chief Financial Officer since April 2, 2013 and has over 25 years of experience as an accounting and finance professional. From 2006 to 2012, Mr. Slay was with DRI Corporation, a public company headquartered in Dallas, Texas and served as its Corporate Controller, Chief Financial Officer and Chief Accounting Officer. Prior to DRI Corporation, Mr. Slay held senior accounting and finance positions at Axtive Corporation, McAfee, Inc., Zane Publishing, Inc., and Greyhound Lines, Inc., all located in the Dallas, Texas area. Mr. Slay started his career with the public accounting firm of Arthur Andersen & Company and is a 1985 graduate of the University of Oklahoma.

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table and the accompanying explanatory footnotes set forth the cash and non-cash compensation awarded to, earned by, and paid by the Company to, its principal executive officer and other executive officers who were the most highly compensated executive officers for services rendered in all capacities during the last two fiscal years (the “named executive officers”).

|

Name and Principal Position |

Year |

Salary |

Bonus |

Stock Awards |

All Other |

Total | ||||||

|

Paul M. Zaidins (2) |

2012 |

$190,000 |

$ — |

$ — |

$13,324 |

(1) |

$203,324 | |||||

|

President and Chief Executive Officer |

2013 |

59,192 |

— |

— |

2,625 |

(1) |

61,817 | |||||

|

Anthony B. Johnston |

2012 |

— |

— |

— |

— |

— | ||||||

|

Chairman, President and Chief Executive Officer |

2013 |

164,154 |

— |

— |

27,445 |

(3) |

191,599 | |||||

|

Stephen P. Slay |

2012 |

— |

— |

— |

— |

— | ||||||

|

Chief Financial Officer |

2013 |

85,000 |

— |

— |

86,300 |

(4) |

171,300 | |||||

|

David Denton |

2012 |

22,276 |

10,000 |

— |

— |

32,276 | ||||||

|

Chief Operating Officer |

2013 |

133,333 |

10,000 |

— |

— |

143,333 |

|

(1) |

Mr. Zaidins received $2,824 in 2012 as a tax reimbursement related to stock awards. Mr. Zaidins was allowed exclusive use of an auto leased by the Company and for which the Company made lease payments totaling $2,625 and $10,500 in 2013 and 2012, respectively. |

|

(2) |

Mr. Zaidins resigned as President and Chief Executive Officer of the Company effective April 2, 2013. |

|

(3) |

Mr. Johnston was allowed exclusive use of an auto leased by the Company and for which the Company made lease payments totaling $7,875 in 2013. Mr. Johnston was reimbursed $19,570 for temporary housing and other expenses incurred in relocating his residence to Texas. |

|

(4) |

On February 25, 2013, Mr. Slay was engaged by the Company on a consulting basis and appointed Vice President, Finance, and on April 2, 2013, Mr. Slay was appointed as the Company’s Chief Financial Officer. Mr. Slay’s engagement was governed by a professional services agreement pursuant to which he was paid $86,300. Mr. Slay was hired as a salaried employee of the Company on July 1, 2013. |

Employment Arrangements

Paul M. Zaidins resigned as President and Chief Executive Officer of the Company effective April 2, 2013. Mr. Zaidins was party to an employment agreement; however, his employment agreement terminated on the effective date of the termination of his employment. The Company has no continuing obligation with respect to Mr. Zaidins under the employment agreement and paid no severance or termination payments as a result of any provision of the employment agreement.

Effective April 2, 2013, Anthony Johnston was appointed Chairman of the Board, President and Chief Executive Officer of the Company. Mr. Johnston will receive base compensation of $220,000 per year, which includes his compensation as Chairman of the Board of $20,000 but excludes any other compensation relating to his activities on the Board. Mr. Johnston will also be eligible for an annual incentive bonus of up to 50% of his base salary, as determined annually by the Compensation Committee and based upon the Company’s performance. Mr. Johnston will also receive options to purchase 80,000 shares of the Company’s common stock upon adoption of the Stock Incentive Plan. Upon grant, the options will vest in equal annual installments over a four-year period. In addition, he received a $15,000 signing bonus, a vehicle allowance and reimbursement of certain relocation-related expenses. If Mr. Johnston’s employment is terminated without cause, he will be entitled to receive a severance payment equal to 12 months of his then-current base compensation plus any incentive bonus earned for the year, and all of his stock options will immediately vest. If Mr. Johnston’s employment is terminated within 24 months of a change in control of the Company, he will be entitled to receive a severance payment equal to 24 months of his then-current base compensation, plus an amount equal to two times the incentive bonus he received for the previous year; all of his stock options will immediately vest; and the Company will pay certain relocation expenses if Mr. Johnston relocates within 24 months of the date of termination.

On February 25, 2013, Stephen Slay was engaged by the Company on a consulting basis and appointed Vice President, Finance, and on April 2, 2013, Mr. Slay was appointed as the Company’s Chief Financial Officer. Mr. Slay’s consulting engagement was governed by a professional services agreement pursuant to which he was paid at the rate of $100 per hour for work performed. On July 1, 2013, Mr. Slay accepted an offer to become a salaried employee of the Company and to continue to serve as Chief Financial Officer. Mr. Slay receives a base annual salary of $170,000 and a signing bonus of $10,000. In addition, Mr. Slay is eligible for an annual incentive bonus of up to 30% of his base salary as determined annually by the Compensation Committee. Mr. Slay will receive options to purchase 10,000 shares of the Company’s common stock upon adoption of the Stock Incentive Plan. Upon grant, the options will vest in equal annual installments over a three-year period. If Mr. Slay’s employment is terminated without cause, he will be entitled to receive a severance payment equal to six months of his then-current base compensation. If there is an effective change of control of the Company and Mr. Slay’s employment is terminated without cause within 12 months of the change of control, Mr. Slay will be entitled to receive a severance payment equal to 12 months of his then current base compensation and all of his stock options will immediately vest.

On October 29, 2012, David Denton accepted an offer to serve as Chief Operating Officer of the Company. Mr. Denton received a base annual salary of $125,000 plus a signing bonus of $20,000. Effective September 1, 2013, the Compensation Committee approved an increase to Mr. Denton’s base annual salary to $150,000 and a grant of options to purchase 10,000 shares of the Company’s common stock upon adoption of the Stock Incentive Plan. Upon grant, the options will vest in equal annual installments over a three-year period. If Mr. Denton’s employment is terminated without cause, he will be entitled to receive a severance payment equal to six months of his then-current base compensation. If there is an effective change of control of the Company and Mr. Denton’s employment is terminated without cause within 12 months of the change of control, Mr. Denton will be entitled to receive a severance payment equal to 12 months of his then current base compensation and all of his stock options will immediately vest.

Outstanding Equity Awards at Fiscal Year-End

There were no equity awards as of December 31, 2013 for the Company’s named executive officers.

Retirement Benefits

The Company’s pension plans for salaried employees (U.S. and Canadian) provide for an annual pension upon normal retirement computed under a career average formula, presently equal to 2% of an employee’s eligible lifetime earnings, which includes salaries, commissions and bonuses. The Company’s named executive officers have accrued no benefits under the Company’s pension plans. See Note 10 to the Company’s consolidated financial statements (under Item 8 of the Company’s Annual Report on Form 10-K) for additional information about the Company’s decision, in May 2005, to freeze its obligations under the defined benefit plan for United States employees such that no benefits will accrue under this plan after July 15, 2006.

The Company maintains a 401(K) Plan under which it matches employee contributions at the rate of $0.10 per $1.00 of employee contributions up to a maximum of 10% of employee’s wages.

AUDIT COMMITTEE REPORT

The Audit Committee oversees the Company’s financial reporting process on behalf of the Board of Directors. Management has the primary responsibility for the financial statements and the reporting process, including the systems of internal controls. Travis Wolff, the Company’s independent registered public accounting firm, is responsible for performing an independent audit of the Company’s financial statements and issuing an opinion on the conformity of those audited financial statements with U.S. generally accepted accounting principles. The Audit Committee monitors the Company’s financial reporting process and reports to the Board of Directors on its findings.

In fulfilling its oversight responsibilities, the Audit Committee hereby reports as follows:

|

1. |

The Audit Committee has reviewed and discussed the audited financial statements with the Company’s management. |

|

2. |

The Audit Committee has discussed with Travis Wolff, its independent registered public accounting firm, the matters required to be discussed by the Statement on Auditing Standards No. 61, as amended (Codification of Statements on Auditing Standards, AU 380), as adopted by the Public Company Accounting Oversight Board (“PCAOB”) in Rule 3200T. |

|

3. |

The Audit Committee has received from Travis Wolff, the Company’s independent registered public accounting firm, the written disclosures regarding the independent registered public accounting firm’s independence required by PCAOB Ethics and Independence Rule 3526, Communication with Audit Committees Concerning Independence, and has discussed with Travis Wolff the firm’s independence. |

|

4. |

Based on the review and discussions referred to in paragraphs (1) through (3) above, the Audit Committee recommended to the Board of Directors, and the Board of Directors has approved, that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2013, for filing with the Securities and Exchange Commission. |

The undersigned members of the Audit Committee have submitted this Report to the Board of Directors.

THE AUDIT COMMITTEE

Mary A. Stanford, Chairperson

Graeme L. Jack

John E. Harris

INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS

The Audit Committee has selected Travis Wolff as the independent accountants of the Company for the fiscal year ending December 31, 2014. Representatives of Travis Wolff are expected to be present at the Annual Meeting and are expected to be available to respond to questions. They will also be afforded an opportunity to make a statement if they desire to do so. Travis Wolff has audited our consolidated financial statements since fiscal year 2009.