UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2019

Or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ________________ to ________________

Commission file number 001-34499

Gulf

Resources, Inc.

(Exact name of registrant as specified in its charter)

| Nevada | 13-3637458 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

| Level 11,Vegetable Building, Industrial Park of the East Shouguang City, Shandong, China | 262700 | |

| (Address of principal executive offices) | (Zip Code) |

+86 (536) 567-0008

Registrant’s telephone number, including area code

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol (s) | Name of each exchange on which registered |

| Common Stock, $0.0005 par value | GURE | NASDAQ Global Select Market |

Securities registered pursuant to section 12(g) of the Act:

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically, every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ _ No ☐_

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ |

| Non-accelerated filer ☐ | Smaller reporting company ☒ |

| Emerging Growth Company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

As of June 28, 2019, the aggregate market value of the common stock of the registrant held by non-affiliates (excluding shares held by directors, officers and others holding more than 5% of the outstanding shares of the class) was approximately $27 million based upon a closing sale price of $1.00.

APPLICABLE ONLY TO REGISTRANTS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PRECEDING FIVE YEARS:

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15 of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

Yes ☐ No ☐

(APPLICABLE ONLY TO CORPORATE REGISTRANTS)

As of April 14, 2020, the registrant had outstanding 9,517,427 shares of common stock.

i

Special Note Regarding Forward Looking Information

This report contains forward-looking statements that reflect management’s current views and expectations with respect to our business, strategies, future results and events, and financial performance. All statements made in this report other than statements of historical fact, including statements that address operating performance, events or developments that management expects or anticipates will or may occur in the future, including statements related to future reserves, cash flows, revenues, profitability, adequacy of funds from operations, statements expressing general optimism about future operating results and non-historical information, are forward-looking statements. In particular, the words “believe”, “expect”, “intend”, “anticipate”, “estimate”, “plan”, “may”, “will”, variations of such words and similar expressions identify forward-looking statements, but are not the exclusive means of identifying such statements and their absence does not mean that the statement is not forward-looking. Readers should not place undue reliance on forward-looking statements which are based on management’s current expectations and projections about future events, are not guarantees of future performance, are subject to risks, uncertainties and assumptions. Our actual results, performance or achievements could differ materially from the results expressed in, or implied by, these forward-looking statements. Factors that could cause or contribute to such differences include those discussed in this report, particularly under the caption “Risk Factors”. Except as required under the federal securities laws, we do not undertake any obligation to update the forward-looking statements in this report.

Introduction

We manufacture and trade bromine and crude salt, natural gas, manufacture and sell chemical products used in oil and gas field exploration, oil and gas distribution, oil field drilling, papermaking chemical agents, and manufacture and sell materials for human and animal antibiotics. To date, our products have been sold only within the People’s Republic of China. As used in this report, the terms “we,” “our,” “Company” and “Gulf Resources” refers to Gulf Resources, Inc. and its wholly-owned subsidiaries, and the terms “ton” and “tons” refers to metric tons, in each case, unless otherwise stated or the context requires otherwise.

The functional currency of the Company’s operating foreign subsidiaries is the Renminbi (“RMB”), which had an average exchange rate of $0.15143 and $0.14509 during fiscal years 2018 and 2019, respectively. he reporting currency of the Company is the United States dollar (“USD” or $”).

Our Corporate History

We were originally incorporated in Delaware and subsequently re-incorporated in Nevada. From November 1993 through August 2006, we were engaged in the business of owning, leasing and operating coin and debit card pay-per copy photocopy machines, fax machines, microfilm reader-printers and accessory equipment under the name “Diversifax, Inc.”. Due to the increased use of internet services, demand for our services declined sharply, and in August 2006, our Board of Directors decided to discontinue our operations.

Upper Class Group Limited, incorporated in the British Virgin Islands in July 2006, acquired all the outstanding stock of Shouguang City Haoyuan Chemical Company Limited (“SCHC”), a company incorporated in Shouguang City, Shandong Province, the People’s Republic of China (the “PRC”), in May 2005. At the time of the acquisition, members of the family of Mr. Ming Yang, our president and former chief executive officer, owned approximately 63.20% of the outstanding shares of Upper Class Group Limited. Since the ownership of Upper Class Group Limited and SCHC was then substantially the same, the acquisition was accounted for as a transaction between entities under common control, whereby Upper Class Group Limited recognized the assets and liabilities transferred at their carrying amounts.

1

On December 12, 2006, our Company, then known as Diversifax, Inc., a public “shell” company, acquired Upper Class Group Limited and SCHC. Under the terms of the agreement, the stockholders of Upper Class Group Limited received 13,250,000 (restated for the 2-for-1 stock split in 2007 and the 1-for-4 stock split in 2009) shares of our voting common stock in exchange for all outstanding shares of Upper Class Group Limited. Members of the Yang family received approximately 62% of our common stock as a result of the acquisition. Under accounting principles generally accepted in the United States, the share exchange is considered to be a capital transaction rather than a business combination. That is, the share exchange is equivalent to the issuance of stock by Upper Class Group Limited for the net assets of Gulf Resources, Inc., accompanied by a recapitalization, and is accounted for as a change in capital structure. Accordingly, the accounting for the share exchange is identical to that resulting from a reverse acquisition, except no goodwill is recorded. Under reverse takeover accounting, the post reverse acquisition comparative historical consolidated financial statements of the legal acquirer, Diversifax, Inc., are those of the legal acquiree, Upper Class Group Limited. Share and per share amounts stated have been retroactively adjusted to reflect the share exchange. On February 20, 2007, we changed our corporate name to Gulf Resources, Inc.

On February 5, 2007, we acquired Shouguang Yuxin Chemical Industry Co., Limited (“SYCI”), a company incorporated in the People’s Republic of China. Under the terms of the acquisition agreement, the stockholders of SYCI received a total of 8,094,059 (restated for the 2-for-1 stock split in 2007 and the 1-for-4 stock split in 2009) shares of common stock of Gulf Resources, Inc. in exchange for all outstanding shares of SYCI’s common stock. Simultaneously with the completion of the acquisition, a dividend of $2,550,000 was paid to the former stockholders of SYCI. At the time of the acquisition, approximately 49.1% of the outstanding shares of SYCI were owned by Ms. Yu, Mr. Yang’s wife, and the remaining 50.9% of the outstanding shares of SYCI were owned by SCHC, all of whose outstanding shares were owned by Mr. Yang and his wife. Since the ownership of Gulf Resources, Inc. and SYCI are substantially the same, the acquisition was accounted for as a transaction between entities under common control, whereby Gulf Resources, Inc. recognized the assets and liabilities of SYCI at their carrying amounts. Share and per share amounts have been retroactively adjusted to reflect the acquisition.

To satisfy certain ministerial requirements necessary to confirm certain government approvals required in connection with the acquisition of SCHC by Upper Class Group Limited, all of the equity interest of SCHC were transferred to a newly formed Hong Kong corporation named Hong Kong Jiaxing Industrial Limited (“Hong Kong Jiaxing”) all of the outstanding shares of which are owned by Upper Class Group Limited. The transfer of all of the equity interest of SCHC to Hong Kong Jiaxing received approval from the local State Administration of Industry and Commerce on December 10, 2007.

As a result of the transactions described above, our corporate structure is linear. That is Gulf Resources owns 100% of the outstanding shares of Upper Class Group Limited, which owns 100% of the outstanding shares of Hong Kong Jiaxing, which owns 100% of the outstanding shares of SCHC, which owns 100% of the outstanding shares of SYCI. Further, as a result of our acquisitions of SCHC and SYCI, our historical consolidated financial statements, as contained in our Consolidated Financial Statements and Management’s Discussion and Analysis, appearing elsewhere in the report, reflect the accounts of SCHC and SYCI.

On January 12, 2015, the Company and SCHC entered into an Equity Interest Transfer Agreement with Shouguang City Rongyuan Chemical Co., Ltd (“SCRC”) pursuant to which SCHC agreed to acquire SCRC and all rights, title and interest in and to all assets owned by SCRC, a leading manufacturer of materials for human and animal antibiotics in China and other parts of Asia.

On February 4, 2015 the Company closed the transactions contemplated by the agreement between the Company, SCHC and SCRC.

On the closing Date, the Company issued 7,268,011 shares of its common stock, par value $0.0005 per share (the “Shares”), at the closing market price of $1.84 per Share on the closing date to the four former equity owners of SCRC .The issuance of the Shares was exempt from registration pursuant to Regulation S of the Securities Act of 1933, as amended. On the Closing Date, the Company entered into a lock-up agreement with the four former equity owners of SCRC. In accordance with the terms of the lock-up agreement, the shareholders agreed not to sell or transfer the Shares for five years from the date the stock certificates evidencing the Shares were issued.

2

The sellers of SCRC agreed as part of the purchase price to accept the Shares, based on a valuation of $2.00, which was a 73% premium to the price on the day the agreement was reached. For accounting purposes, the Shares were valued at $1.84, which was the closing price of our stock on the closing date of the agreement. The price difference between the original sale price of $2.00 and the $1.84 closing price of our stock on the closing date of the agreement is solely for accounting purposes. There has been no change in the number of shares issued.

On November 24, 2015, Gulf Resources, Inc., a Delaware corporation consummated a merger with and into its wholly-owned subsidiary, Gulf Resources, Inc., a Nevada corporation. As a result of the reincorporation, the Company is now a Nevada corporation.

On December 15, 2015, the Company registered a new subsidiary in the Sichuan Province of the PRC named Daying County Haoyuan Chemical Company Limited (“DCHC”) with registered capital of RMB50,000,000, and there was RMB13,848,730 capital contributed by SCHC as of December 31, 2018. DCHC was established to further explore and develop natural gas and brine resources (including bromine and crude salt) in China.

On September 2, 2016, the Company announced the planned merger of two of its 100% owned subsidiaries, ShouguanYuxin Chemical Co., Limited (“SYCI”) and ShouguanRongyuan Chemical Co., Ltd (“SCRC”). On March 24, 2017, the legal process of the merger was completed and SCRC was officially deregistered on March 28, 2017. The results of these two subsidiaries were reported under SYCI in the fiscal year 2018.

On January 27, 2020, we completed a 1-for-5 reverse stock split of our common stock, such that for each five shares outstanding prior to the stock split there was one share outstanding after the reverse stock split. All shares of common stock referenced in this report have been adjusted to reflect the stock split figures. On January 28, 2020, our shares began trading on the NASDAQ Global Select Market under the new CUSIP # 40251W 408.

Our current corporate structure chart is set forth in the following diagram:

Our executive offices are located at Level 11, Vegetable Building, Industrial Park of the East in Shouguang City, Shandong Province, P.R.C. Our telephone number is +86 (536) 5670008. Our website address is www.gulfresourcesinc.com. The information contained on or accessed through our website is not intended to constitute and shall not be deemed to constitute part of this Form 10-K.

3

Closure and rectification process of our Bromine, Crude Salt and Chemical Products factories

On September 1, 2017, the Company received letters from the People’s Government of Yangkou Town, Shouguang City to each of its subsidiaries, Shouguang City Haoyuan Chemical Company Limited and Shouguang Yuxin Chemical Industry Co., Limited, which stated that in an effort to improve the safety and environmental protection management level of chemical enterprises, the plants are requested to immediately stop production and perform rectification and improvements in accordance with the country’s new safety, environmental protection requirements. As a result, our facilities located in Yangkou Town were closed on September 1, 2017 to allow for rectification.

Subsequently, the Safety Supervision and Administration Department and the Environmental Protection Departments of the local government conducted inspections of every bromine production enterprise within its jurisdiction including our facilities, in order to improve security, environmental protections, pollution, and safety.

The Company has been working closely with the county authorities to develop rectification plans for both its bromine and crude salt businesses and agreed on a rectification plan in October 2017. As part of the rectification plan, the Company has converted its bromine and crude salt factories from coal to electricity, installed computerized production monitoring and safety equipment, lined all of the salt ponds, paved roads, and performed some other upgrades. In the fiscal year ended December 31, 2018, the Company incurred $16,243,677 in the rectification and improvements of plant and equipment of the bromine and crude salt factories resulting in a cumulative amount of $34,182,329 incurred as of December 31, 2018 since the beginning of the rectification. The Company entered into contracts related to building new extraction wells for bromine facilities in the aggregate amount of approximately $40 million. The Company has built new extraction wells for bromine facilities and incurred $ 40,135,280 for such purpose during the fiscal year ended December 31, 2019.

On September 21, 2018, the Company received a closing notice from the People’s Government of Yangkou Town, Shouguang City informing it to close its three bromine factories (Number 3, Number 4, and Number 11.) and not allowed to resume production. The crude salt fields surrounding these factories have been reclaimed as cultivated or construction land and hence did not meet the requirement for bromine and crude salt co-production set by the relevant authority. In closing these factories, the Company wrote off net book value of these factories’ property, plant and equipment in the amount of $18,644,473 in the loss on demolition of the factory in the consolidated statements of loss for the fiscal year ended December 31, 2018, recorded an impairment loss on the related mineral rights of these three factories of $1,284,832 included in the impairment of property, plant and equipment in the consolidated statements of loss for the fiscal year ended December 31, 2018 and wrote off $52,926 of prepaid land lease recorded in other operating loss in the consolidated statements of loss for fiscal year ended December 31, 2018. The Company incurred dismantling fee in the amount of $273,757 recorded in other operating loss in the consolidated statements of loss for fiscal year ended December 31, 2018. The Company negotiated with the local villages over compensation for the payment already made for these land leases and mineral rights in the past. This part of the cost has been used as the resumption of land use, so the village committee will not be compensated.

The Company has completed all the rectification and improvements in accordance with the government requirements, and we are currently waiting for any further notices from the government. We will still need to fulfill project approval, planning approval, land use rights approval and environmental protection assessment approval, by working closely with the local government.

Because many smaller producers have not had the capital to conduct the rectification required by the government, management believes there could be some extremely attractive acquisition opportunities in bromine. However, at the present time, all of management’s attention is focused on getting its facilities approved and in full production. Management may consider acquisition opportunities in this segment in the future if the prices were sufficiently attractive.

4

To date, we have secured the land for our new chemical factory. The Company also has had the final approval regarding environmental protection assessment. The Company expects to start our new chemical factory construction in May 2020. There was an impairment loss on the property, plant and equipment related to the relocation of our chemical plants to Bohai Park in the amount of $16,636,322, since much of the equipment that was used in the chemical factories was relatively old. Further, even if it had been newer, we believe that it might not have passed new environmental tests. The total cost of building the new factory is currently estimated to be approximately $60 million. The Company incurred relocation costs in the amount of $10,320,017 and $10,489,930 as of December 31, 2019 and 2018.

In January 2017, the Company completed the first brine water and natural gas well field construction in Daying located in Sichuan Province and commenced trial production in January 2019. On May 29, 2019, the Company received a verbalnotice from the government of Tianbao Town ,Daying County, Sichuan Province, whereby the Company is required to obtain project approval for its well located in Daying, including the whole natural gas and brine water project, and approvals for safety production inspection, environmental protection assessment, and to solve the related land issue. Until these approvals have been received, the Company has to temporarily halt trial production at its natural gas well in Daying.

We are not writing off any of the goodwill related to our chemicals business. We believe the new chemical factory could produce strong sales and profits. We believe there may be much less capacity in the chemical industry, as many factories may be permanently closed. In addition, other competitor factories may reduce their production capacity. We expect to have a factory that operates efficiently. Considering the above factors and our strength with better equipment, we expect to generate sales and earnings in this segment at a level well above previous periods.

We will continue to control the land and buildings where the old chemical factories are located. At this time, we have not considered how or if we can monetize those assets.

Our Business Segments

Our business operations are conducted in four segments, bromine, crude salt, chemical products, and natural gas. We manufacture and trade bromine, crude salt and natural gas, and manufacture and sell chemical products used in oil and gas field exploration, oil and gas distribution, oil field drilling, papermaking chemical agents and manufacturer of materials for human and animal antibiotics. We conduct all of our operations in China.

Bromine and Crude Salt

We manufacture and distribute bromine through our wholly-owned subsidiary, Shouguang City Haoyuan Chemical Company Limited, or SCHC. Bromine (Br2) is a halogen element and it is a red volatile liquid at standard room temperature which has reactivity between chlorine and iodine. Elemental bromine is used to manufacture a wide variety of bromine compounds used in industry and agriculture. Bromine is also used to form intermediates in organic synthesis, which is somewhat preferable over iodine due to its lower cost. Our bromine is commonly used in brominated flame retardants, fumigants, water purification compounds, dyes, medicines and disinfectants.

The extraction of bromine in the Shandong Province is limited by the provincial government to licensed operations. We hold one such license. As part of our business strategy, it is our plan to continue acquiring smaller scaled and unlicensed producers and to use our bromine to expand our downstream chemical operations

Location of Production Sites

Our production sites are located in the Shandong Province in northeastern China. The productive formation (otherwise referred to as the “working region”), extends from latitude N 36°56’ to N 37°20’ and from longitude E 118°38’ to E 119°14’, in the north region of Shouguang city, from the Xiaoqing River of Shouguang city to the west of the Dan River, bordering on Hanting District in the east, from the main channel of “Leading the Yellow River to Supply Qingdao City Project” in the south to the coastline in the north. The territory is classified as coastal alluvial – marine plain with an average height two to seven meters above the sea level. The terrain is relatively flat.

5

Geological background of this region

The Shandong Province working region is located to the east of Lubei Plain and on the south bank of Bohai Laizhou Bay. The geotectonic location bestrides on the North China Platte (I) and north three-level structure units, from west to east including individually the North China Depression, Luxi Plate, and Jiaobei Plate. Meanwhile, 4 V-level structure units including the Dongying Sag of Dongying Depression (IV) of North China Depression, the Buried Lifting Area of Guangrao, Niutou sag and Buried Lifting Area of Shuanghe and are all on two V-level structure units including Xiaying Buried Lifting Area of Weifang Depression (IV) of Luxi Plate and Chuangyi Sag, as well as on a V-level structure units of Jiaobei Buried Lifting Area of Jiaobei Plate.

Processing of Bromine

Natural brine is a complicated salt-water system, containing many ionic compositions in which different ions have close interdependent relationships and which can be reunited to form many dissolved soluble salts such as sodium chloride, potassium chloride, calcium sulfate, potassium sulfate and other similar soluble salts. The goal of natural brine processing is to separate and precipitate the soluble salts or ions away from the water. Due to the differences in the physical and chemical characteristics of brine samples, the processing methods are varied, and can result in inconsistency of processing and varied technical performance for the different useful components from the natural brine.

Bromine is the first component extracted during the processing of natural brine. In natural brine, the bromine exists in the form of bromine sodium and bromine magnesium and other soluble salts.

The bromine production process is as follows:

| 1. | natural brine is pumped from underground through extraction wells by subaqueous pumps; | |

| 2. | the natural brine then passes through transmission pipelines to storage reservoirs; | |

| 3. | the natural brine is sent to the bromine refining plant where bromine is extracted from the natural brine. In neutral or acidic water, the bromine ion is easily oxidized by adding the oxidative of chlorine, which generates the single bromine away from the brine. Thereafter the extracted single bromine is blown out by forced air, then absorbed by sulfur dioxide or soda by adding acid, chlorine and sulfur. Extracted bromine is stored in containers of different sizes; and | |

| 4. | the wastewater from this refining process is then transported by pipeline to brine pans. |

Our production feeds include (i) natural brine; (ii) vitriol; (iii) chlorine; (iv) sulfur; and (v) coal.

Crude Salt

We also produce crude salt, which is produced from the evaporation of the wastewater after our bromine production process. Once the brine is returned to the surface and the bromine is removed, the remaining brine is pumped to on-site containing pools and then exposed to natural sunshine. This causes the water to evaporate from the brine, resulting in salt being left over afterwards. Crude salt is the principal material in alkali production as well as chlorine alkali production and is widely used in the chemical, food and beverage, and other industries.

Chemical Products

We produce chemical products through our wholly-owned subsidiary, Shouguang Yuxin Chemical Industry Company Limited, or SYCI. At the present time, SYCI is closed pursuant to the letter from government dated on November 24, 2017. It will be relocated to Bohai Marine Fine Chemical Industry Park, Shouguang City. SYCI paid $9,115,276 for a 50-year lease of a piece of land for its new factories at Bohai Marine Fine Chemical Industrial Park in December, 2017 and leased another piece of land from the third party for its new chemical factory. We have had the final approval for our new chemical factory and expect to start construction around in May 2020.

6

Historically, SYCI concentrated its efforts on the production and sale of chemical products that are used in oil and gas field exploration, oil and gas distribution, oil field drilling, papermaking chemical agents, inorganic chemicals and materials that are used for human and animal antibiotics. SYCI engaged in depth study of existing products and new product research and development at the same time. SYCI’s annual production of oil and gas field exploration products and related chemicals was over 26,000 tons, and its production of papermaking-related chemical products was over 5,000 tons. SYCI’s annual production capacity of materials that are used for human and animal antibiotics was over 6,800 tons.

Sales and Marketing

We have an in-house sales staff of 19 persons. Our customers send their orders to us first. Our in-house sales staff then attempts to satisfy these orders based on our actual production schedules and inventories on hand. Many of our customers have a long term relationship with us. We expect this to continue due to stable demand for mineral products, however, these relationships cannot be guaranteed in the future.

Principal Customers

We sell a substantial portion of our products to a limited number of PRC customers. Our principal customers during 2019 were Shandong Morui Chemical Company Limited, Shandong Brother Technology Limited, and Shouguang Weidong Chemical Company Limited. We have ongoing policies in place to ensure that sales are made to customers who are credit-worthy.

During the year ended December 31, 2019, sales to our three largest bromine customers, based on net revenue from such customers, aggregated $5,371,125, or approximately 54% of total net revenue from sale of bromine; and sales to our largest customer represented approximately 22%, respectively, of total net revenue from the sale of bromine. During the year ended December 31, 2018, the net revenue for the bromine segment was $0 due to the closure of all of our plant and factories in order to perform rectification and improvement since September 1, 2017.

During each of the years ended December 31, 2019 and 2018, sales to our three largest crude salt customers, based on net revenue from such customers, aggregated $522,758 and $1,981,573, respectively, or approximately 100% and 100% of total net revenue from sale of crude salt; and sales to our largest customer represented approximately 37% and 39%, respectively, of total net revenue from the sale of crude salt.

During the year ended December 31, 2019, the net revenue for the chemical products was $0, During the year ended December 31, 2018, there were limited chemical products for sale due to the closure of our chemical factories since September 1, 2017, we only sold limited chemical products and raw materials to our customers in the aggregate amount of $613,368.

Principal Suppliers

Our principal external suppliers are Laizhou Shengfu Chemical Company Limited, Shandong Xinlong Group Company Limited, Weifang Wanhong Chemical Company Limited.

During the year ended December 31, 2019, we purchased 100% of raw materials for our bromine and crude production from our top three suppliers. During the year ended December 31, 2018, we did not purchase any raw materials for our bromine and crude production.

During the year ended December 31, 2019 and 2018, we did not purchase any raw materials for chemical products production. This supplier concentration makes us vulnerable to a near-term adverse impact, should the relationships be terminated.

Business Strategy

Expansion of Production Capacity to Meet Demand

▼ Bromine and Crude Salt

In view of keen competition and the trend of less bromine contraction of brine water being extracted in Shouguang City, Shandong Province, the Company intended to access more bromine and crude salt resources by finding new underground brine water resources in the Sichuan Province. On January 30, 2015 we announced that we had found natural gas resources under our bromine well in the Sichuan area. On November 23, 2015, the Company’s wholly owned subsidiary SCHC entered into an agreement with the People’s Government of Daying County in Sichuan Province for the exploration and development of natural gas and brine resources (including bromine and crude salt). In January 2017, the Company completed the first brine water and natural gas well field construction in Sichuan Province and announced the commencement of trial production. Then later on, the Company found some issues related to the water and other potential impurities in the natural gas during trial production. In resolving the problem, the Company purchased customized equipment for its natural gas project. The installation of such equipment, including providing piping and electricity, was completed in July 2018. The Company completed the test production at its first natural gas well in Sichuan Province and commenced trial production in January 2019. On May 29, 2019, the Company received a verbal notice from the government of Tianbao Town ,Daying County, Sichuan Province, whereby the Company is required to obtain project approval for its well located in Daying, including the whole natural gas and brine water project, and approvals for safety production inspection, environmental protection assessment, and to solve the related land issue. Until these approvals have been received, the Company has to temporarily halt trial production at its natural gas well in Daying.

7

On September 1, 2017, the Company received notification from the Government of Yangkou Town, Shouguang City of PRC that required production at all its factories be halted with immediate effect in order for the Company to perform rectification and improvement in accordance with the local new safety and environmental protection requirements.

The Company has been working closely with the County authorities to develop rectification plans for both its bromine and crude salt businesses and had agreed on a plan in October 2017. In the fiscal year ended December 31, 2018, the Company incurred $16,243,677 in the rectification and improvements of plant and equipment of the bromine and crude salt factories resulting in a cumulative amount of $34,182,329 incurred as of December 31, 2018. The Shouguang City Bromine Association, on behalf of all the bromine plants in Shouguang, has started discussions with the local government agencies. The local governmental agencies confirmed the facts that their initial requirements for the bromine industry did not include the project approval, the planning approval and the land use rights approval and that those three additional approvals were new requirements of the provincial government. The Company understood from the local government that it has been coordinating with several government agencies to solve these three outstanding approval issues in a timely manner and that all the affected bromine plants are not allowed to commence production prior to obtaining those approvals. In April 2019, Factory No.1, Factory No.5 and Factory No.7 (Factory no. 5 is considered part of Factory no.7 and both are managed as one factory since 2010) restarted operations upon receipt of verbal notification from local government of Yangkou County. On May 7, 2019, the Company renamed its Subdivision Factory No. 1 to Factory No. 4; and Factory No. 5 (which was previously considered part of Factory No. 7) to Factory No. 7.

The Company is not certain when the approval documents will be obtained. The Company believes that this is another step by the government to improve the environment. It further believes the goal of the government is not to close all plants, but rather to codify the regulations related to project approval, land use, planning approval and environmental protection assessment approval so that illegal plants are not able to open in the future and so that plants close to population centers do not cause serious environmental damage.

The Company believes the issues related to the remaining five bromine and crude salt factories which have passed inspection are almost resolved. The Company is actively working with the local government to obtain the documentation for approval of project, planning, land use rights and environmental protection evaluation.

On November 25, 2019, the government of Shouguang City issued a notice ordering all bromine facilities in Shouguang City, including the Company’s all bromine facilities, including Factory No.1 and Factory No. 7, to temporarily stop production from December 16, 2019 to February 10, 2020. Subsequently, due to the coronavirus outbreak in China, the local government ordered those bromine facilities to postpone the commencement of production. Subsequently, the Company received an approval dated on February 27, 2020 issued by the local governmental authority which allows us to resume production after the winter temporary closure. Further, the Company received another approval from the Shouguang Yangkou People’s Government dated on March 5, 2020 to resume production at its bromine factories No.1, No. 4, No.7 and No. 9 in order to meet the needs of bromide products for epidemic prevention and control (the “March 2020 Approval”). The Company’s factories No.7 and No.1 started trial production on middle of March, 2020, and commenced commercial production on April 3rd, 2020.

8

▼ Chemical Products

On November 24, 2017, the Company received a letter from the Government of Yangkou County, Shouguang City notifying the Company to relocate its two chemical production plants located in the second living area of the Qinghe Oil Extraction Plant to the Bohai Marine Fine Chemical Industrial Park (the “November 2017 Letter”). Since then, our chemical factory has been shut down. We believe this is part of the country’s efforts to improve the development of the chemical industry, facilitate safe production and curb environmental pollution, and ensure the quality of living environment of residents. The Company expects to cost approximately $60 million in total in connection with the relocation. The Company incurred relocation costs in the amount of $10,320,017 as of December 31, 2019.

In January 2020, the Company obtained the environmental protection assessment approval performed by the government of Shouguang City, Shandong Province for the proposed new Yuxin chemical factory. With this approval, the Company is permitted to construct our new chemical factory and the Company plans to begin construction in May 2020.

Competition

To date, our sales have been limited to customers within the PRC and we expect that our sales will remain primarily domestic for the immediate future. Our marketing strategy involves developing long term ongoing working relationships with customers based on large multi-year agreements which foster mutually advantageous relationships.

We compete with PRC domestic private companies and state owned companies. Certain state owned and state backed competitors are more established and have more control of certain resources in terms of pricing than we do. We compete in our business based on price, our reputation for quality and on-time delivery, our relationship with suppliers and our geographical proximity to natural brine deposits in the PRC for bromine, crude salt and chemical productions. Management believes that our stable quality, manufacturing processes and plant capacity for the production of bromine, crude salt and chemical products are key considerations in awarding contracts in the PRC.

Our principal competitors in the bromine business are Shandong Yuyuan Group Company Limited, Shandong Haihua Group Company Limited, Shandong Dadi Salt Chemical Group Company Limited and Shandong Haiwang Chemical Company Limited, all of which produce bromine principally for use in their chemicals businesses and sell part of the bromine produced to customers. These companies may switch to selling bromine to the market if they no longer use bromine in their chemical businesses.

Our principal competitors in the crude salt business are Shandong Haiwang Chemical Company Limited, Shandong Haihua Group Company Limited, Shandong Weifang Longwei Industrial Company Limited, Shandong Yuyuan Group Company Limited and Shandong Caiyangzi Saltworks.

Our principal competitors in the chemical business are Beijing Shiji Zhongxing Energy Technology Co., Ltd, Yanan Chaozheng Nijiang Co., Ltd, Shandong Dacheng Pesticides Company Limited, Binhua Group Company Limited, Dongying City Dongchen (Group) Chemical Industry Company Limited, Beijing Peikangjiaye Technologies Limited, Shouguang Fukang Pharmaceutical Co., Ltd. Shandong Xinhua Pharmaceutical Limited by Share Ltd, Hunan Erkang Pharmaceutical Limited by Share Ltd and Xinan Synthetic Pharmaceutical Limited by Share Ltd.

9

Government Regulation

China has begun to reinforce the environmental requirements for the entire chemical industry, demanding the closure or rectification of those factories that do not meet the emission requirements and are highly polluting. In early 2017, the government announced the closure or relocation of those chemical industry facilities that are close to residential areas and the new environmental law officially came into full effect in January 2018.

The following is a summary of the principal governmental laws and regulations that are or may be applicable to our operations in the PRC. The scope and enforcement of many of the laws and regulations described below are uncertain. We cannot predict the effect of further developments in the Chinese legal system, including the promulgation of new laws, changes to existing laws or the interpretation or enforcement of laws.

In the natural resources sector, the PRC and the various provinces have enacted a series of laws and regulations over the past 20 years, including laws and regulations designed to improve safety and decrease environmental degradation. The “China Mineral Resources Law” declares state ownership of all mineral resources in the PRC. However, mineral exploration rights can be purchased, sold and transferred to foreign owned companies. Mineral resource rights are granted by the Central Government permitting recipients to conduct mineral resource activities in a specific area during the license period. These rights entitle the licensee to undertake mineral resource activities and infrastructure and ancillary work, in compliance with applicable laws and regulations, within the specific area covered by the license during the license period. The licensee is required to submit a proposal and feasibility studies to the relevant authority and to pay the Central Government a natural resources tax in an amount equal to a percent of annual crude salt sales and tones of bromine sold. Shandong Province has determined that bromine is to be extracted only by licensed entities and we hold one of such licenses. Despite the province desire to limit extraction to licensed entities hundreds of smaller operations continue to extract bromine without licenses.

The Ministry of Land and Resources (“MLR”) is the principal regulator of mineral rights in China. The Ministry has authority to grant licenses for land-use and exploration rights, issue permits for mineral rights and leases, oversee the fees charged for them and their transfer, and review reserve evaluations. We are required to hold a bromine and salt production license in order to operate our bromine and salt production business in the PRC. Our bromine and salt production license is subject to a yearly audit. If we do not successfully pass the yearly approval by relevant government authorities, our bromine and salt production operations may be suspended until we are able to comply with the license requirements which could have a material adverse effect on our business, financial condition and results of operations.

Employees

As of December 31, 2019, we employed approximately 606 full-time employees, of whom approximately 59% are with SCHC and DCHC, and 41% are with SYCI. Approximately 6% of our employees are management personnel and 4% are sales and procurement staff. None of our employees are represented by a union.

Our employees in China participate in a state pension arrangement organized by Chinese municipal and provincial governments. We are required to contribute to the arrangement at the rate of 21% of the average monthly salary. In addition, we are required by Chinese law to cover employees in China with other types of social insurance. Our total contribution amounts to 33% of the average monthly salary. We have purchased social insurance for almost all of our employees. Expense related to social insurance was approximately $1,035,687 for fiscal year 2019.

Available Information

We make available free of charge on or through our internet website, www.gulfresourcesinc.com, our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, including exhibits, and all amendments to those reports, if any, filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 as soon as reasonably practicable after they are electronically filed with, or furnished to, the Securities and Exchange Commission. The SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers like our Company that file electronically with the SEC at http://www.sec.gov. The information contained on our website is not intended to be incorporated into this Annual Report on Form 10-K.

10

Pursuant to Item 301(c) of Regulation S-K (§ 229.301(c)), the Company is not required to provide the information required by this Item as it is a “smaller reporting company,” as defined by Rule 229.10(f)(1).

Item 1B. Unresolved Staff Comments.

None.

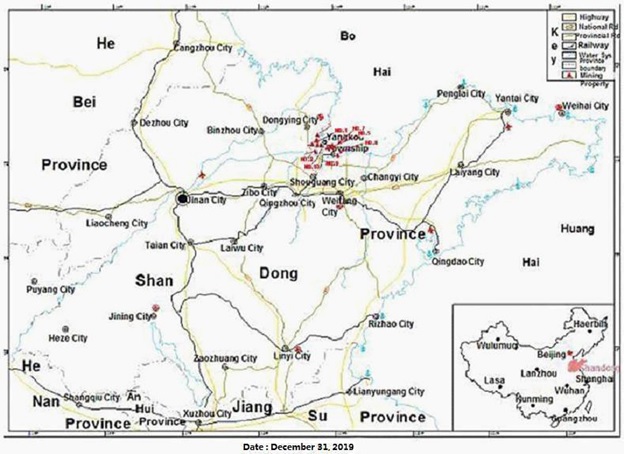

FIGURE 2.1 - REGIONAL MAP OF MINING PROPERTIES

11

FIGURE 2.2 – DETAIED MAP OF MINING PROPERTIES

We do not own any land, although we do own some of the buildings on land we lease. Our executive offices are located at Level 11, Vegetable Building, Industrial Park of the East in Shouguang City, Shandong Province, P.R.C, which also is the headquarters of SCHC and SYCI. These offices were purchased from Shandong Shouguang Vegetable Seed industry Group Co., Ltd, in which Mr. Ming Yang, the Chairman of the Company, had 99% equity interest.

SYCI concentrates its efforts on the production and sale of chemical products that are used in oil and gas field exploration, oil and gas distribution, oil field drilling, papermaking chemical agents, and manufacture and sell materials that are used for human and animal antibiotics in China. Currently, SYCI is closed according to the November 2017 Letter. It will be relocated to Bohai Marine Fine Chemical Industry Park, Shouguang City, Shandong Province, China.

12

DCHC, is a registered company exploring and developing natural gas and brine resources (including bromine and crude salt) in China located in No.14 team, Liguanggou Village, Tianbao Township, Daying County, Suining City, Sichuan Province, China.

In the first quarter of 2018, six out of its ten bromine factories completed their rectification process within factory areas (i.e. excluding crude salt field area) and were approved and scheduled for production commencement by April 2018 as verbally indicated by the local government. The remaining four factories were still undergoing rectification at that time. Three factories (Factory No. 3, Factory No. 4 and Factory No. 11) had to be demolished in September 2018 as required by the government and rectification for Factory No. 10 was completed in November 2018.

The Company operates its bromine and crude salt production facilities through its wholly-owned subsidiary SCHC. SCHC has land use rights to one property (10,790 square meters, or approximately 3 acre) as bromine production area for Factory No. 1 and land lease contracts to seven properties (approximately 17,816 acre), totaling nearly 17,819 acre, located on the south bank of Laizhou Bay on the Shandong Peninsula of the People’s Republic of China (“China”). Each of the properties is accessible by road. The Yiyang railway line is within 50 kilometers and the Yangkou port is five kilometers away.

Each of the seven properties contains natural brine deposits which are extracted through wells and are used to extract bromine and produce crude salt. Bromine is a simple molecular element which is produced by extracting the bromine ion from natural brine. Crude salt is sodium chloride. Bromine is an important chemical raw material in flame retardants, fire extinguishing agents, refrigerants, photographic materials, pharmaceuticals, pesticides, and oil and other industries. Crude salt, also known as industrial salt, is used in a wide range of chemical industries, is the major raw material in the soda and chlor-alkali industries and can be widely used in agricultural, animal husbandry, fisheries and food processing industries. Crude salt is also the main raw material for edible salt.

Nature of Ownership Interest in the Properties

All of the land in the PRC is owned by the state. Individuals and companies are permitted to acquire rights to use land or land use rights for specific purposes at no cost. In the case of land used for industrial purposes, the land use rights are granted for a period of 50 years. This period may be renewed at the expiration of the initial and any subsequent terms. Granted land use rights are transferable and may be used as security for borrowings and other obligations. The Company does not own any land but has entered into contracts with the local government and original owners of the land use rights to acquire their rights for a period of 50 years. The contracts required us to pay a one-time fee plus an annual rent.

Mineral Rights

The Chinese and provincial governments have enacted a series of laws and regulations relating to the natural resources sector over the past 20 years, including laws and regulations designed to improve safety and decrease environmental degradation. The “China Mineral Resources Law” declares state ownership of all mineral resources in China. However, mineral exploration rights can be purchased, sold and transferred to both domestic and foreign owned companies. Mineral resource rights are granted by the central government permitting recipients to conduct mineral resource activities in a specific area during the license period. These rights entitle the licensee to undertake mineral resource activities and infrastructure and ancillary work, in compliance with applicable laws and regulations, within the specific area covered by the license during the license period. The licensee is required to submit a proposal and feasibility studies to the relevant authority and to pay the central government a natural resources tax in an amount equal to RMB 1,050 per tonne of bromine sales volumes. The Company was exempt from paying the fee prior to January 1, 2008. Shandong province has determined that bromine is to be extracted only by licensed entities.

13

Our mineral rights are issued by the local government and allow for a one year period of mining. The rights provide us with the exclusive rights to explore and extract natural brine under the leased land and produce bromine and crude salt. The government performs an annual inspection of the company’s previous year’s state of production & operations at beginning of each year. The annual inspection reviews: (1) whether the production is safe and if any accidents occurred during the previous year; (2) whether the natural resources tax and other taxes were timely paid; (3) whether employees’ salary and welfare benefits were timely paid; and (4) whether the Company meets environment protection meet standards. Only those companies who pass the inspection receive mineral rights for another one year term. For those companies who do not pass the inspection, additional mineral rights are not allocated until they can meet the requirements. If there is major safety accident, the government may revoke the mining permit.

The mining certificate were renewed in July 2018 with production limit of 24,000 tons of bromine production per year.

On September 21, 2018, we received a closing notice from the People’s Government of Yangkou Town, Shouguang City informing us that we had to shut down our three bromine factories (Factory No. 3,No. 4, and No. 11.).

The following is a description of the land use and mineral rights related to each of the nine properties held by SCHC as of December 31, 2019.

All of the bromine factories are under rectification process without production.

| Property | Factory No. 1 – Haoyuan General Factory |

| Area | 6,442 acres |

| Date of Acquisition | February 5, 2007 |

| Land Use Rights Lease Term | Fifty Years |

| Land Use Rights Expiration Date | 2054 (for mining areas only) |

| The number of remaining years to expiration of the of the land lease as of December 31, 2019 | 34.25 Years |

| Prior fees paid for land use rights | RMB8.6 million |

| Annual Rent | RMB186,633 |

| Mining Permit No.: | C3707002009056220022340 |

| Date of Permission: | July 2018, subject to renewal per three years |

| Period of Permission: | Three year |

| Property | Factory No. 4 (originally named as Subdivision of Factory No. 1) – State-owned Shouguang Qinshuibo Farm |

| Area | 0.79 acres |

| Date of Factory lease | January 1, 2011 |

| Factory Lease Term | Twenty Years |

| Factory lease Expiration Date | 2030 |

| The number of remaining years to expiration of the of the factory lease as of December 31, 2019 | 11.0 Years |

| Prior Fees Paid for Land Use Rights | Not applicable |

| Annual Rent | RMB5,000,000 |

| Mining Permit No.: | Under application |

14

| Property | Factory No. 2 – Yuwenbo |

| Area | 1,846 acres |

| Date of Acquisition | April 7, 2007 |

| Land Use Rights Lease Term | Fifty Years |

| Land Use Rights Expiration Date | 2052 |

| The number of remaining years to expiration of the of the land lease as of December 31, 2019 | 33 Years |

| Prior Fees Paid For Land Use Rights | RMB7.5 million |

| Annual Rent | RMB162,560 |

| Mining Permit No.: | C3707002009056220022340 |

| Date of Permission: | July 2018, subject to renewal per three years |

| Period of Permission: | Three year |

| Property | Factory No. 2 – State Operated Shouguang Qingshuibo Farm |

| Area | 568 acres |

| Date of Acquisition | December 30, 2010 |

| Land Use Rights Lease Term | Thirty Years |

| Land Use Rights Expiration Date | 2040 |

| The number of remaining years to expiration of the of the land lease as of December 31, 2019 | 21.7 Years |

| Prior Fees Paid for Land Use Rights | Not applicable |

| Annual Rent | RMB172,500 (increase 5% per year) |

| Mining Permit No.: | Under application |

| Property | Factory No. 7 (originally named as No. 5)– Wangjiancai |

| Area | 2,165 acres |

| Date of Acquisition | October 25, 2007 |

| Land Use Rights Lease Term | Fifty Years |

| Land Use Rights Expiration Date | 2054 |

| The number of remaining years to expiration of the of the land lease as of December 31, 2019 | 35 Years |

| Annual Rent | RMB176,441 |

| Prior Fees Paid for Land Use Rights | RMB8.3 million |

| Mining Permit No.: | Under application, written consent obtained from local land and resources departments |

| Property | Factory No. 7 – Qiufen Yuan |

| Area | 1,611 acres |

| Date of Acquisition | January 7, 2009 |

| Land Use Rights Lease Term | Fifty Years |

| Land Use Rights Expiration Date | 2059 |

| The number of remaining years to expiration of the of the land lease as of December 31, 2019 | 39.17 Years |

| Prior Fees Paid for Land Use Rights | Not applicable |

| Annual Rent | RMB171,150 (increase 5% per two years) |

| Mining Permit No.: | C3707002009056220022340 |

| Date of Permission: | July 2018, subject to renewal per three years |

| Period of Permission: | Three year |

15

| Property | Factory No. 8 – Fengxia Yuan |

| Area | 2,723 acres |

| Date of Acquisition | September 7, 2009 |

| Land Use Rights Lease Term | Fifty Years |

| Land Use Rights Expiration Date | 2059 |

| The number of remaining years to expiration of the of the land lease as of December 31, 2019 | 39.66 Years |

| Prior Fees Paid for Land Use Rights | Not applicable |

| Annual Rent | RMB347,130 (increase 5% per two years) |

| Mining Permit No.: | Under application, written consent obtained from local land and resources departments |

| Property | Factory No. 9 – Jinjin Li |

| Area | 759 acres |

| Date of Acquisition | June 7, 2010 |

| Land Use Rights Lease Term | Fifty Years |

| Land Use Rights Expiration Date | 2060 |

| The number of remaining years to expiration of the of the land lease as of December 31, 2019 | 40.5 Years |

| Prior Fees Paid for Land Use Rights | Not applicable |

| Annual Rent | RMB184,000 (increase 5% per two years) |

| Mining Permit No.: | Under application, written consent obtained from local land and resources departments |

| Property | Factory No. 10 – Liangcai Zhang |

| Area | 1,700 acres |

| Date of Acquisition | December 22, 2011 |

| Land Use Rights Lease Term | Ten Years |

| Land Use Rights Expiration Date | 2021 |

| The number of remaining years to expiration of the of the land lease as of December 31, 2019 | 2.0 Years |

| Prior Fees Paid for Land Use Rights | Not applicable |

| Annual Rent | RMB688,000 (increase 5% per year) |

| Mining Permit No.: | Under application |

Leased Facility

On November 5, 2010, SCHC entered into a Lease Contract with State-Operated Shouguang Qingshuibo Farm. Pursuant to the Lease Contract, SCHC shall lease certain property with an area of 3,192 square meters (or 0.8 acres) and buildings adjacent to the Company’s Factory No. 1. There are currently non-operating bromine production facilities on the property which have not been in production for more than 12 months. The annual lease payment for the property is RMB 5.0 million, approximately $794,550, per year and shall be paid by SCHC no later than June 30th of each year. The term of the Lease Contract is for twenty years commencing January 1, 2011. The Lease Contract may be renewed by SCHC for an additional twenty year period on the same terms. The Lessor has agreed to permit SCHC to reconstruct and renovate the existing bromine production facilities on the property.

16

The chart below represents the annual production capacity and annualized utilization ratios for our bromine producing properties currently leased by the Company, which are all located in Shouguang City, Shandong Province, China. There are no proven and probable reserves located on our properties.

| Bromine Property | Facility Acquisition Date |

Acres |

Annual Production (in tons) |

2019 Utilization Ratio |

2018 Utilization Ratio | ||||||||||||

| Factory No. 1 | — | 6,442 | 6,681 | 28 | % | — | |||||||||||

| Factory No. 2 | April 7, 2007 | 1,846 | 4,844 | — | — | ||||||||||||

| Factory No. 7* (originally named as No. 5 and No. 7) |

October 25, 2007/ January 7, 2009 |

3,776 | 6,986 | 27 | % | — | |||||||||||

| Factory No. 8 | September 7, 2009 | 2,723 | 4,016 | — | — | ||||||||||||

| Factory No. 9 | June 7, 2010 | 759 | 2,793 | — | — | ||||||||||||

| Factory No.4 (originally named as Subdivision of Factory No. 1) | January 1, 2011 | 1 | 3,186 | — | — | ||||||||||||

| Factory No. 10 | December 22, 2011 | 1,700 | 3,000 | — | — | ||||||||||||

| * | Bromine production for Factory No. 5 and Factory No. 7 were combined in early 2010 as both factories are located adjacent to each other, and renamed Factory No. 5 (which was previously considered part of Factory No. 7) as Factory No. 7 on May 2019. |

The following table shows the annual bromine produced and sold for each of our production facilities and the weighted average price received for all products sold for the last two years.

| 2019 | 2018 | |||||||||||||||||||||||

| Bromine Facility | Produced (in tons) | Sold (in tons) | Selling price (RMB/ton) | Produced (in tons) | Sold (in tons) | Selling price (RMB/ton) | ||||||||||||||||||

| Factory No. 1 | 1,227 | 1,113 | 29,752 | — | — | — | ||||||||||||||||||

| Factory No. 2 | — | — | — | — | — | — | ||||||||||||||||||

| Factory No. 3** | — | — | — | — | — | — | ||||||||||||||||||

| Factory No. 4** | — | — | — | — | — | — | ||||||||||||||||||

| Factory No. 7* (originally named as No. 5 and No. 7) * | 1,255 | 1,207 | 29,740 | — | — | — | ||||||||||||||||||

| Factory No. 8 | — | — | — | — | — | — | ||||||||||||||||||

| Factory No. 9 | — | — | — | — | — | — | ||||||||||||||||||

| Factory No. 4( originally know Subdivision of Factory No. 1) | — | — | — | — | — | — | ||||||||||||||||||

| Factory No. 10 | — | — | — | — | — | — | ||||||||||||||||||

| Factory No. 11** | — | — | — | — | — | — | ||||||||||||||||||

| Total | 2,482 | 2,320 | — | — | ||||||||||||||||||||

| * | Bromine production for Factory No. 5 and Factory No. 7 were combined in early 2010 as both factories are located adjacent to each other., and renamed Factory No. 5 (which was previously considered part of Factory No. 7) as Factory No. 7 on May 2019. |

| ** | Factory No. 3, 4 and 11 were demolished in September 2018. |

17

The following table shows the annual crude salt produced and sold for each of our production facilities and the weighted average price received for all products sold for the last two years.

| 2019 | 2018 | |||||||||||||||||||||||

| Crude Salt Facility |

Produced (in tons) |

Sold (in tons) |

Selling price (RMB/ton) | Produced (in tons) |

Sold (in tons) |

Selling price (RMB/ton) | ||||||||||||||||||

| Factory No. 1 | 8,431 | 7,419 | 143 | — | 2,790 | 264 | ||||||||||||||||||

| Factory No. 2 | — | 1,859 | 170 | — | 6,713 | 250 | ||||||||||||||||||

| Factory No. 7* (Originally Named as No. 5 and No. 7) * |

13,131 | 15,163 | 147 | — | 10,592 | 251 | ||||||||||||||||||

| Factory No. 8 | — | — | — | — | 20,371 | 252 | ||||||||||||||||||

| Factory No. 9 | — | — | — | — | 9,941 | 255 | ||||||||||||||||||

| Total | 21,562 | 24,441 | — | 50,407 | ||||||||||||||||||||

| * | Bromine production for Factory No. 5 and Factory No. 7 were combined in early 2010 as both factories are located adjacent to each other, and renamed Factory No. 5 (which was previously considered part of Factory No. 7) as Factory No. 7 on May 2019 |

The following table shows the chemical products produced and sold for our SYCI’s production facilities and the weighted average price received for all products sold for the last two years.

| 2019 | 2018 | |||||||||||||||||||||||

| Chemical Products |

Produced (in tons) |

Sold (in tons) |

Selling price (RMB/ton) | Produced (in tons) |

Sold (in tons) |

Selling price (RMB/ton) | ||||||||||||||||||

| Oil and gas exploration additives | — | — | — | — | — | — | ||||||||||||||||||

| Paper manufacturing additives | — | — | — | — | — | — | ||||||||||||||||||

| Pesticides manufacturing additives | — | — | — | — | 14 | 44,000 | ||||||||||||||||||

| Pharmaceutical intermediates | — | — | — | — | — | — | ||||||||||||||||||

| By products | — | — | — | — | 96 | 10,222 | ||||||||||||||||||

| Total | 110 | — | ||||||||||||||||||||||

On or about August 3, 2018, written decisions of administration penalty captioned Shou Guo Tu Zi Fa Gao Zi [2018] No. 291, Shou Guo Tu Zi Fa Gao Zi [2018] No. 292, Shou Guo Tu Zi Fa Gao Zi [2018] No. 293, Shou Guo Tu Zi Fa Gao Zi [2018] No. 294, Shou Guo Tu Zi Fa Gao Zi [2018] No. 295 and Shou Guo Tu Zi Fa Gao Zi [2018] No. 296 (together, the “Written Decisions”) were served on Shouguang City Haoyuan Chemical Company Limited (“SCHC”) by the Shouguang City Natural Resources and Planning Bureau (the “Bureau”), naming SCHC as respondent. The Written Decisions challenged the land use of Factory nos. 2, 9, 7, 4, 8 and 10, respectively, and alleged, among other things, that SCHC had illegally occupied and used the land in the total area of approximately 52,674 square meter, on which Factory nos. 2, 9, 7, 4, 8 and 10 were built. The Written Decisions ordered SCHC, among other things, to return the land subject to the Written Decisions to its respective legal owner, restore the land to its original state, and demolish or confiscate all the buildings and facilities thereon and pay monetary penalty of approximately RMB 1.3 million ($184,000) in the aggregate. Each of the Written Decisions were to be executed within 15 days upon serving SCHC. Additional interest penalties would be imposed at a daily rate of 3% in the event that SCHC did not make the monetary penalty payment in a timely manner. As discussed below, the Company did not believe the local government would enforce the penalties so it did not make the payment. Subsequently, the Bureau filed enforcement actions to the People’s Court of Shouguang City, Shandong Province (the “Court”), naming SCHC as enforcement respondent and alleged, among other things, that SCHC failed to perform its obligations under each of the Written Decisions within the specified timeframe. The enforcement proceedings sought court orders to enforce the Written Decisions. On May 5, 2019, written decisions of administrative ruling captioned (2019) Lu 0783 Xing Shen No. 384, (2019) Lu 0783 Xing Shen No. 385, (2019) Lu 0783 Xing Shen No. 389, (2019) Lu 0783 Xing Shen No. 390, (2019) Lu 0783 Xing Shen No. 393, and (2019) Lu 0783 Xing Shen No. 394, respectively (together, the “Court Rulings”) were made by the Court in favor of the Bureau. The Court ordered, among other relief, to enforce each of the Written Decisions, to return each subject land to its legal owner and demolish or confiscate the buildings and facilities thereon and restore the land to its original state within 10 days from the service of the Court Rulings on SCHC. The Court Rulings became enforceable immediately upon service on SCHC on May 5, 2019.

18

In the last twenty years, we believe there were no government regulations requiring bromine manufacturers to obtain land use and planning approval documents. As such, we believe most of the bromine manufacturers in Shouguang City do not have land use and planning approval documents and lease their land parcels from the village associations and are facing the same issues in connection with land use and planning as the Company.

The Company is in the process of resolving the issues in connection with SCHC’s land use and planning diligently. The Company has been in discussions closely with the local government authorities with the help from Shouguang City Bromine Association to seek reliefs and, based on verbal confirmation by local government authorities, believes the administrative penalties imposed by the Bureau according to the Written Decisions are being re-assessed by local government authorities and may be revoked. The Company has obtained one confirmation from the local government authorities that the administrative penalty imposed on Factory No. 7 , Factory No. 8 and Factory No.10 are being revoked which are waiting for the Court formal approval ,and production of Factory No. 7 was allowed to resume in April 2019. In addition, on August 28, 2019, the People’s Government of Shandong Province, issued a regulation titled “Investment Project Management Requirements of Chemical Companies in Shandong Province” permitting the construction of facilities on existing sites or infrastructure of bromine manufacturing and other chemical industry-related types of projects (clause 11 of section 3).The Company believes that the goal of the government is to standardize and regulate the industry and not to demolish the facilities or penalize the manufacturers. As of the date of this report, the Company has not been notified by the local government that it will take any measure to enforce the administrative penalties. Based on information known to date, the Company believes that it is remote that the Written Decisions or Court Rulings will be enforced within the expected timeframe and a material penalty or costs and expenses against the Company will result. However, there can be no assurance that there will not be any further enforcement action, the occurrence of which may result in further liabilities, penalties and operational disruption.

In view of the above facts and circumstances, the Company believes that it is not necessary to accrue for any estimated losses or impairment as of December 31, 2019.

Item 4. Mine Safety Disclosures.

Not applicable.

19

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Market for Our Common Stock

Our common stock is listed for trading on the NASDAQ Global Select Market, or NASDAQ, under the symbol “GURE”.

Dividends

We have never paid cash dividends on our common stock. Holders of our common stock are entitled to receive dividends, if any, declared and paid from time to time by the Board of Directors out of funds legally available. We intend to retain any earnings for the operation and expansion of our business and do not anticipate paying cash dividends in the foreseeable future. Any future determination as to the payment of cash dividends will depend upon future earnings, results of operations, future expansion of bromine and crude salt business and other, capital requirements, our financial condition and other factors that our Board of Directors may consider.

Our Equity Compensation Plans

The following table provides information as of December 31, 2019 about our equity compensation plans and arrangements.

Equity Compensation Plan Information - December 31, 2019

| Plan category |

Number of securities to be issued upon exercise of outstanding options, warrants and rights |

Weighted-average exercise price of outstanding options, warrants and rights |

Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) |

| (a) | (b) | (c) | |

| Equity compensation plans approved by security holders | 135,100 | $7.2 | 990,198 |

| Equity compensation plans not approved by security holders | — | — | — |

| Total | 135,100 | $7.2 | 990,198 |

Purchases of Equity Securities by the Company and Affiliated Purchasers

None.

Recent Sales of Unregistered Securities

None.

Item 6. Selected Financial Data.

Pursuant to Item 301(c) of Regulation S-K (§ 229.301(c)), the Company is not required to provide the information required by this Item as it is a “smaller reporting company,” as defined by Rule 229.10(f)(1).

20

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Overview

We are a holding company which conducts operations through our wholly-owned China-based subsidiaries. Our business is conducted and reported in four segments, namely, bromine, crude salt, chemical products and natural gas.

Through our wholly-owned subsidiary, SCHC, we produce and trade bromine and crude salt. We are one of the largest producers of bromine in China, as measured by production output. Elemental bromine is used to manufacture a wide variety of bromine compounds used in industry and agriculture. Bromine also is used to form intermediary chemical compounds such as Tetramethylbenzidine. Bromine is commonly used in brominated flame retardants, fumigants, water purification compounds, dyes, medicines and disinfectants. Crude salt is the principal material in alkali production as well as chlorine alkali production and is widely used in the chemical, food and beverage, and other industries.

Through our wholly-owned subsidiary, SYCI, we manufacture and sell chemical products used in oil and gas field exploration, oil and gas distribution, oil field drilling, papermaking chemical agents, inorganic chemicals and manufacture and sell materials that are used for human and animal antibiotics.

As disclosed in the Company’s Current Report on Form 8-K filed on September 8, 2017, the Company received, on September 1, 2017, letters from the Yangkou County, Shouguang City government addressed to each of its subsidiaries, SCHC and SYCI, which stated that in an effort to improve the safety and environmental protection management level of chemical enterprises, the plants are requested to immediately stop production and perform rectification and improvements in accordance with the country’s new safety and environmental protection requirements. In the Company’s press release of August 11, 2017 and on its conference call of August 14, 2017, the Company addressed concerns that increased government enforcement of stringent environmental rules that were adopted in early 2017 to insure corporations bring their facilities up to necessary standards so that pollution and other negative environmental issues are limited and remediated, could have an impact on our business in both the short and long-term. The Company also expressed that although it believed its facilities were fully compliant at the time, the Company did not know how its facilities would fare under the new rules and that the Company expected to have a full understanding of the implications within the next two months. Teams of inspectors from the government were sent to many provinces to inspect all mining and manufacturing facilities. The local government requested that facilities be closed, so that the facilities can undergo the inspection and analysis in the most efficient manner by inspectors’ team. As a result, our facilities were closed on September 1, 2017.

Subsequently, the Safety Supervision and Administration Department and the Environmental Protection Departments of the local government conducted inspections of every bromine production enterprise within its jurisdiction, in order to improve security, environmental protections, pollution, and safety. The Company had been working closely with the County authorities to develop rectification plans for both its bromine and its chemical businesses. The Company and the government had agreed on a rectification plan for SCHC, the Company’s bromine and crude salt businesses which is currently under process. The Company worked closely with the County authorities to develop rectification plans for both its bromine and crude salt businesses and agreed on a plan in October 2017. In the fiscal year ended December 31, 2018, the Company incurred $16,243,677 in the rectification and improvements of plant and equipment of the bromine and crude salt factories resulting in a cumulative amount of $34,182,329 incurred as of December 31, 2018. Based on the renewed mining certificate, SCHC is limited to produce up to 24,000 tons of bromine per year, we believe this is sufficient for its production utilization rate ..The Shouguang City Bromine Association, on behalf of all the bromine plants in Shouguang, has started discussions with the local government agencies. The local governmental agencies confirmed the facts that their initial requirements for the bromine industry did not include the project approval, the planning approval and the land use rights approval and that those three additional approvals were new requirements of the provincial government. The Company understood from the local government that it has been coordinating with several government agencies to solve these three outstanding approval issues in a timely manner and that all the affected bromine plants are not allowed to commence production prior to obtaining those approvals. In April 2019, Factory No.1, Factory No.5 and Factory No.7 (Factory no. 5 is considered part of Factory no.7 and both are managed as one factory since 2010) restarted operations upon receipt of verbal notification from local government of Yangkou County. On May 7, 2019, the Company renamed its Subdivision Factory No. 1 to Factory No. 4; and Factory No. 5 (which was previously considered part of Factory No. 7) to Factory No. 7.

21

The Company is not certain when the issuance of the approval documents will be effected. The Company believes that this is another step by the government to improve the environment. It further believes the goal of the government is not to close all plants, but rather to codify the regulations related to project approval, land use, planning approval and environmental protection assessment approval so that illegal plants are not able to open in the future and so that plants close to population centers do not cause serious environmental damage. In addition, the Company believes that the Shandong provincial government wants to assure that each of its regional and county governments has applied the Notice in a consistent manner.

The Company believes the issues related to the remaining three bromine and crude salt factories which have passed inspection are almost resolved. The Company is actively working with the local government to obtain the documentation for approval of project, planning, land use rights and environmental protection evaluation.