UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the quarterly period ended September 30, 2019 | |

| Or | |

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the transition period from _________ to _________ |

Commission File Number: 001-34499

GULF RESOURCES, INC.

(Exact name of registrant as specified in its charter)

| Nevada | 13-3637458 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

|

Level 11,Vegetable Building, Industrial Park of the East City, Shouguang City, Shandong, |

262700 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: +86 (536) 567 0008

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer o |

| Non-accelerated filer x | Smaller reporting company x |

| Emerging Growth Company o |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes o No x

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Common Stock, $0.0005 par value | GURE | NASDAQ Global Select Market |

As of November 9, 2019, the registrant had outstanding 47,583,072 shares of common stock.

PART I—FINANCIAL INFORMATION

| GULF RESOURCES, INC. |

| AND SUBSIDIARIES |

| CONDENSED CONSOLIDATED BALANCE SHEETS |

| (Expressed in U.S. dollars) |

| September 30, 2019 Unaudited | December 31, 2018 Audited | |||||||

| Current Assets | ||||||||

| Cash | $ | 105,218,569 | $ | 178,998,935 | ||||

| Accounts receivable | 9,673,967 | — | ||||||

| Inventories, net | 680,650 | — | ||||||

| Prepayments and deposits | 1,375,450 | 8,096,636 | ||||||

| Prepaid land leases | 175,550 | 235,459 | ||||||

| Other receivable | 559 | 12,506 | ||||||

| Total Current Assets | 117,124,745 | 187,343,536 | ||||||

| Non-Current Assets | ||||||||

| Property, plant and equipment, net | 139,548,193 | 82,282,630 | ||||||

| Finance lease right-of use assets | 178,381 | 250,757 | ||||||

| Operating lease right-of –use assets | 8,817,327 | — | ||||||

| Prepaid land leases, net of current portion | 8,818,657 | 9,639,009 | ||||||

| Deferred tax assets | 13,459,527 | 19,030,858 | ||||||

| Total non-current assets | 170,822,085 | 111,203,254 | ||||||

| Total Assets | $ | 287,946,830 | $ | 298,546,790 | ||||

| Liabilities and Stockholders’ Equity | ||||||||

| Current Liabilities | ||||||||

| Payable and accrued expenses | $ | 3,870,516 | $ | 905,258 | ||||

| Retention payable | 3,753,447 | 332,416 | ||||||

| Taxes payable-current | 4,020,792 | 1,188,687 | ||||||

| Finance lease liability, current portion | 162,132 | 197,480 | ||||||

| Operating lease liabilities, current portion | 406,156 | — | ||||||

| Total Current Liabilities | 12,213,043 | 2,623,841 | ||||||

| Non-Current Liabilities | ||||||||

| Finance lease liability, net of current portion | 1,879,713 | 2,069,545 | ||||||

| Operating lease liabilities, net of current portion | 7,731,385 | — | ||||||

| Total Non-Current Liabilities | $ | 9,611,098 | $ | 2,069,545 | ||||

| Total Liabilities | $ | 21,824,141 | $ | 4,693,386 | ||||

| Stockholders’ Equity | ||||||||

| PREFERRED STOCK; $0.001 par value; 1,000,000 shares authorized; none outstanding | ||||||||

| COMMON STOCK; $0.0005 par value; 80,000,000 shares authorized; 47,812,221 and 47,052,940 shares issued; and 47,583,072 and 46,803,791 shares outstanding as of September 30, 2019 and December 31, 2018 | $ | 23,904 | $ | 23,525 | ||||

| Treasury stock; 229,149 and 249,149 shares as of September 30, 2019 and December 31, 2018 at cost | (510,329 | ) | (554,870 | ) | ||||

| Additional paid-in capital | 95,043,388 | 95,020,808 | ||||||

| Retained earnings unappropriated | 166,937,574 | 185,608,445 | ||||||

| Retained earnings appropriated | 24,233,544 | 24,233,544 | ||||||

| Accumulated other comprehensive loss | (19,605,392 | ) | (10,478,048 | ) | ||||

| Total Stockholders’ Equity | 266,122,689 | 293,853,404 | ||||||

| Total Liabilities and Stockholders’ Equity | $ | 287,946,830 | $ | 298,546,790 | ||||

See accompanying notes to the condensed consolidated financial statements.

1

GULF RESOURCES, INC.

AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF LOSS AND COMPREHENSIVE LOSS

(Expressed in U.S. dollars)

(UNAUDITED)

| Three-Month Period Ended September 30, | Nine-Month Period Ended September 30, | |||||||||||||||

| 2019 | 2018 | 2019 | 2018 | |||||||||||||

| NET REVENUE | ||||||||||||||||

| Net revenue | $ | 4,548,542 | $ | 343,080 | $ | 10,596,521 | $ | 2,594,941 | ||||||||

| OPERATING INCOME (EXPENSE) | ||||||||||||||||

| Cost of net revenue | (2,403,532 | ) | (68,456 | ) | (5,430,269 | ) | (1,310,272 | ) | ||||||||

| Sales, marketing and other operating expenses | (5,821 | ) | (10,112 | ) | (12,434 | ) | (66,111 | ) | ||||||||

| Write-off/Impairment on property, plant and equipment | — | (1,397,313 | ) | — | (1,397,313 | ) | ||||||||||

| Loss on demolition of factory | — | (18,644,473 | ) | — | (18,644,473 | ) | ||||||||||

| Direct labor and factory overheads incurred during plant shutdown | (3,485,383 | ) | (5.563,494 | ) | (10,653,690 | ) | (16,948,499 | ) | ||||||||

| General and administrative expenses | (5,020,215 | ) | (1,323,933 | ) | (8,460,733 | ) | (6,021,561 | ) | ||||||||

| Other operating income (loss) | — | (134,216 | ) | — | (134,216 | ) | ||||||||||

| (10,914,951 | ) | (27,141,997 | ) | (24,557,126 | ) | (44,522,445 | ) | |||||||||

| LOSS FROM OPERATIONS | (6,366,409 | ) | (26,798,917 | ) | (13,960,605 | ) | (41,927,504 | ) | ||||||||

| OTHER INCOME (EXPENSE) | ||||||||||||||||

| Interest expense | (34,310 | ) | (37,220 | ) | (111,530 | ) | (123,749 | ) | ||||||||

| Interest income | 101,130 | 161,582 | 369,582 | 509,738 | ||||||||||||

| LOSS BEFORE TAXES | (6,299,589 | ) | (26,674,555 | ) | (13,702,553 | ) | (41,541,515 | ) | ||||||||

| INCOME TAX (EXPENSE) BENEFIT | (6,729,439 | ) | 7,181,521 | (4,968,318 | ) | 10,258,508 | ||||||||||

| NET LOSS | $ | (13,029,028 | ) | $ | (19,493,034 | ) | $ | (18,670,871 | ) | $ | (31,283,007 | ) | ||||

| COMPREHENSIVE LOSS: | ||||||||||||||||

| NET LOSS | $ | (13,029,028 | ) | $ | (19,493,034 | ) | $ | (18,670,871 | ) | $ | (31,283,007 | ) | ||||

| OTHER COMPREHENSIVE LOSS | ||||||||||||||||

| - Foreign currency translation adjustments | (8,690,103 | ) | (14,738,766 | ) | (9,127,344 | ) | (19,376,831 | ) | ||||||||

| COMPREHENSIVE LOSS | $ | (21,719,131 | ) | $ | (34,231,800 | ) | $ | (27,798,215 | ) | $ | (50,659,838 | ) | ||||

| LOSS PER SHARE: | ||||||||||||||||

| BASIC AND DILUTED | $ | (0.27 | ) | $ | (0.42 | ) | $ | (0.40 | ) | $ | (0.67 | ) | ||||

| WEIGHTED AVERAGE NUMBER OF SHARES: | ||||||||||||||||

| BASIC AND DILUTED | 47,583,072 | 46,803,791 | 47,241,854 | 46,803,791 | ||||||||||||

See accompanying notes to the condensed consolidated financial statements.

2

| GULF RESOURCES, INC. |

| AND SUBSIDIARIES |

| CONDENSED CONSOLIDATED STATEMENT OF STOCKHOLDERS’ EQUITY |

| NINE-MONTH PERIOD ENDED SEPTEMBER 30, 2019 |

| (Expressed in U.S. dollars) |

| Common stock | Accumulated | |||||||||||||||||||||||||||||||||||||||

| Number | Number | Number | Additional | Retained | Retained | other | ||||||||||||||||||||||||||||||||||

| of shares | of shares | of treasury | Treasury | paid-in | earnings | earnings | comprehensive | |||||||||||||||||||||||||||||||||

| issued | outstanding | stock | Amount | stock | capital | unappropriated | appropriated | loss | Total | |||||||||||||||||||||||||||||||

| BALANCE AT JUNE 30, 2019 (Unaudited) | 47,812,221 | 47,583,072 | 229,149 | $ | 23,904 | $ | (510,329 | ) | $ | 95,043,388 | $ | 179,966,602 | $ | 24,233,544 | $ | (10,915,289 | ) | $ | 287,841,820 | |||||||||||||||||||||

| Translation adjustment | — | — | — | — | — | — | — | (8,690,103 | ) | (8,690,103 | ) | |||||||||||||||||||||||||||||

| Net loss for three-month period ended September 30, 2019 | — | — | — | — | — | — | (13,029,028 | ) | — | — | (13,029,028 | ) | ||||||||||||||||||||||||||||

| BALANCE AT SEPTEMBER 30, 2019 (Unaudited) | 47,812,221 | 47,583,072 | 229,149 | $ | 23,904 | $ | (510,329 | ) | $ | 95,043,388 | $ | 166,937,574 | $ | 24,233,544 | $ | (19,605,392 | ) | $ | 266,122,689 | |||||||||||||||||||||

| Common stock | Accumulated | |||||||||||||||||||||||||||||||||||||||

| Number | Number | Number | Additional | Retained | Retained | other | ||||||||||||||||||||||||||||||||||

| of shares | of shares | of treasury | Treasury | Paid-in | earnings | earnings | comprehensive | |||||||||||||||||||||||||||||||||

| issued | outstanding | stock | Amount | stock | capital | unappropriated | appropriated | (loss) income | Total | |||||||||||||||||||||||||||||||

| BALANCE AT JUNE 30 , 2018(Unaudited) | 47,052,940 | 46,803,791 | 249,149 | $ | 23,525 | $ | (554,870 | ) | $ | 94,524,608 | $ | 243,782,458 | $ | 24,233,544 | $ | 3,524,893 | $ | 365,534,158 | ||||||||||||||||||||||

| Translation adjustment | - | — | — | - | - | - | - | (14,738,766 | ) | (14,738,766 | ) | |||||||||||||||||||||||||||||

| Net loss for three-month period ended September 30, 2018 | - | — | — | - | — | - | (19,493,034 | ) | — | - | (19,493,034 | ) | ||||||||||||||||||||||||||||

| BALANCE AT SEPTEMBER 30, 2018 (Unaudited) | 47,052,940 | 46,803,791 | 249,149 | $ | 23,525 | $ | (554,870 | ) | $ | 94,524,608 | $ | 224,289,424 | $ | 24,233,544 | $ | (11,213,873 | ) | $ | 331,302,358 | |||||||||||||||||||||

| Common stock | Accumulated | |||||||||||||||||||||||||||||||||||||||

| Number | Number | Number | Additional | Retained | Retained | other | ||||||||||||||||||||||||||||||||||

| of shares | of shares | of treasury | Treasury | paid-in | earnings | earnings | comprehensive | |||||||||||||||||||||||||||||||||

| issued | outstanding | stock | Amount | stock | capital | unappropriated | appropriated | loss | Total | |||||||||||||||||||||||||||||||

| BALANCE AT DECEMBER 31, 2018 (Audited) | 47,052,940 | 46,803,791 | 249,149 | $ | 23,525 | $ | (554,870 | ) | $ | 95,020,808 | $ | 185,608,445 | $ | 24,233,544 | $ | (10,478,048 | ) | $ | 293,853,404 | |||||||||||||||||||||

| Translation adjustment | — | — | — | — | — | — | — | (9,127,344 | ) | (9,127,344 | ) | |||||||||||||||||||||||||||||

| Common stock issued for services | 20,000 | (20,000 | ) | — | 44,541 | (22,941 | ) | — | — | — | 21,600 | |||||||||||||||||||||||||||||

| Cashless exercise of stock options | 759,281 | 759,281 | — | 379 | — | (379 | ) | — | —- | — | — | |||||||||||||||||||||||||||||

| Issuance of stock options to employees | 45,900 | 45,900 | ||||||||||||||||||||||||||||||||||||||

| Net loss for nine-month period ended September 30, 2019 | — | — | — | — | — | — | (18,670,871 | ) | — | — | (18,670,871 | ) | ||||||||||||||||||||||||||||

| BALANCE AT SEPTEMBER 30, 2019 (Unaudited) | 47,812,221 | 47,583,072 | 229,149 | $ | 23,904 | $ | (510,329 | ) | $ | 95,043,388 | $ | 166,937,574 | $ | 24,233,544 | $ | (19,605,392 | ) | $ | 266,122,689 | |||||||||||||||||||||

| Common stock | Accumulated | |||||||||||||||||||||||||||||||||||||||

| Number | Number | Number | Additional | Retained | Retained | other | ||||||||||||||||||||||||||||||||||

| of shares | of shares | of treasury | Treasury | Paid-in | earnings | earnings | comprehensive | |||||||||||||||||||||||||||||||||

| issued | outstanding | stock | Amount | stock | capital | unappropriated | appropriated | (loss) income | Total | |||||||||||||||||||||||||||||||

| BALANCE AT DECEMBER 31, 2017 (Audited) | 47,052,940 | 46,803,791 | 249,149 | $ | 23,525 | $ | (554,870 | ) | $ | 94,524,608 | $ | 255,572,431 | $ | 24,233,544 | $ | 8,162,958 | $ | 381,962,196 | ||||||||||||||||||||||

| Translation adjustment | - | — | — | - | - | - | - | (19,376,831 | ) | (19,376,831 | ) | |||||||||||||||||||||||||||||

| Net loss for nine-month period ended September 30, 2018 | - | — | — | - | — | - | (31,283,007 | ) | — | - | (31,283,007 | ) | ||||||||||||||||||||||||||||

| Transfer to statutory common reserve fund | — | — | — | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||

| BALANCE AT SEPTEMBER 30, 2018 (Unaudited) | 47,052,940 | 46,803,791 | 249,149 | $ | 23,525 | $ | (554,870 | ) | $ | 94,524,608 | $ | 224,289,424 | $ | 24,233,544 | $ | (11,213,873 | ) | $ | 331,302,358 | |||||||||||||||||||||

See accompanying notes to the condensed consolidated financial statements.

3

| GULF RESOURCES, INC. |

| AND SUBSIDIARIES |

| CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS |

| (Expressed in U.S. dollars) |

| (UNAUDITED) |

| Nine -Month Period Ended September 30, | ||||||||

| 2019 | 2018 | |||||||

| CASH FLOWS FROM OPERATING ACTIVITIES | ||||||||

| Net loss | $ | (18,670,871 | ) | $ | (31,283,007 | ) | ||

| Adjustments to reconcile net loss to net cash provided (used by) operating activities: | ||||||||

| Interest on finance lease obligation | 111,020 | 123,352 | ||||||

| Amortization of prepaid land leases | — | 546,767 | ||||||

| Depreciation and amortization | 10,599,011 | 14,177,727 | ||||||

| Write-off/Impairment loss on property, plant and equipment | — | 1,397,313 | ||||||

| Loss on demolition of factory | — | 18,644,473 | ||||||

| Unrealized exchange gain on inter-company balances | (778,420 | ) | (1,374,315 | ) | ||||

| Deferred tax asset | 4,968,318 | (10,258,506 | ) | |||||

| Common stock issued for services | 21,600 | — | ||||||

| Issuance of stock options to employee | 45,900 | — | ||||||

| Changes in assets and liabilities: | ||||||||

| Accounts receivable | (9,962,625 | ) | 29,847,286 | |||||

| Inventories | (700,476 | ) | 1,148,833 | |||||

| Prepayments and deposits | (28,577 | ) | 4,944 | |||||

| Other receivables | 11,794 | (11,289 | ) | |||||

| Payable and accrued expenses | 2,708,456 | (211,728 | ) | |||||

| Retention payable | — | (312,429 | ) | |||||

| Taxes payable | (437,560 | ) | 541,241 | |||||

| Operating lease | (208,210 | ) | — | |||||

| Net cash (used in) provided by operating activities | (12,320,640 | ) | 22,980,662 | |||||

| CASH FLOWS USED IN INVESTING ACTIVITIES | ||||||||

| Additions of prepaid land leases | — | (684,627 | ) | |||||

| Purchase of property, plant and equipment | (57,317,368 | ) | (11,412,848 | ) | ||||

| Net cash used in investing activities | (57,317,368 | ) | (12,097,475 | ) | ||||

| CASH FLOWS USED IN FINANCING ACTIVITIES | ||||||||

| Repayment of finance lease obligation | (275,506 | ) | (294,295 | ) | ||||

| Net cash used in financing activities | (275,506 | ) | (294,295 | ) | ||||

| EFFECTS OF EXCHANGE RATE CHANGES ON CASH AND CASH EQUIVALENTS | (3,866,852 | ) | (11,249,711 | ) | ||||

| NET DECREASE IN CASH AND CASH EQUIVALENTS | (73,780,366 | ) | (660,819 | ) | ||||

| CASH AND CASH EQUIVALENTS - BEGINNING OF PERIOD | 178,998,935 | 208,906,759 | ||||||

| CASH AND CASH EQUIVALENTS - END OF PERIOD | $ | 105,218,569 | $ | 208,245,940 | ||||

| SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION | ||||||||

| Cash paid during the periods for: | ||||||||

| Income taxes | $ | — | $ | — | ||||

| Operating right-of-use assets obtained in exchange for lease obligations | $ | 8,241,818 | $ | — | ||||

| SUPPLEMENTAL DISCLOSURE OF NON-CASH INVESTING AND FINANCING ACTIVITIES | ||||||||

| Purchase of Property, plant and equipment included in Retention payable and taxes payable | $ | 7,116,066 | $ | — | ||||

| Par value of common stock issued upon cashless exercise of options | $ | 379 | $ | — | ||||

See accompanying notes to the condensed consolidated financial statements.

4

GULF RESOURCES, INC.

AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2019

(Expressed in U.S. dollars)

(UNAUDITED)

NOTE 1 – BASIS OF PRESENTATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

(a) Basis of Presentation and Consolidation

The accompanying condensed financial statements have been prepared by Gulf Resources, Inc (“Gulf Resources”). a Nevada corporation and its subsidiaries (collectively, the “Company”), without audit, in accordance with the instructions to Form 10-Q and, therefore, do not necessarily include all information and footnotes necessary for a fair statement of its financial position, results of operations and cash flows in accordance with accounting principles generally accepted in the United States (“US GAAP”).

In the opinion of management, the unaudited financial information for the three and nine months ended September 30, 2019 presented reflects all adjustments, which are only normal and recurring, necessary for a fair statement of results of operations, financial position and cash flows. These condensed financial statements should be read in conjunction with the financial statements included in the Company’s 2018 Form 10-K. Operating results for the interim periods are not necessarily indicative of operating results for an entire fiscal year.

The preparation of financial statements in conformity with US GAAP requires management to make estimates and assumptions that affect the amounts that are reported in the financial statements and accompanying disclosures. Although these estimates are based on management’s best knowledge of current events and actions that the Company may undertake in the future, actual results may be different from the estimates. The Company also exercises judgments in the preparation of these condensed financial statements in certain areas, including classification of leases and related party transactions.

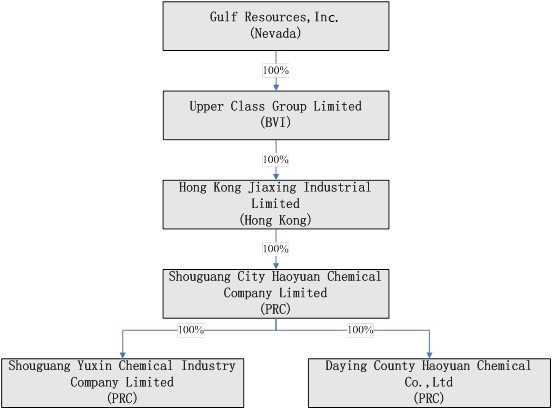

The consolidated financial statements include the accounts of Gulf Resources, Inc. and its wholly-owned subsidiary, Upper Class Group Limited, a company incorporated in the British Virgin Islands, which owns 100% of Hong Kong Jiaxing Industrial Limited, a company incorporated in Hong Kong (“HKJI”). HKJI owns 100% of Shouguang City Haoyuan Chemical Company Limited ("SCHC") which owns 100% of Shouguang Yuxin Chemical Industry Co., Limited (“SYCI”) and Daying County Haoyuan Chemical Company Limited (“DCHC”). All material intercompany transactions have been eliminated on consolidation.

(b) Nature of Business

The Company manufactures and trades bromine and crude salt through its wholly-owned subsidiary, Shouguang City Haoyuan Chemical Company Limited ("SCHC") and manufactures chemical products for use in the oil industry, pesticides, paper manufacturing industry and for human and animal antibiotics through its wholly-owned subsidiary, Shouguang Yuxin Chemical Industry Co., Limited ("SYCI") in the People’s Republic of China (“PRC”). DCHC was established to further explore and develop natural gas and brine resources (including bromine and crude salt) in the PRC. DCHC’s business commenced trial operation in January 2019 but suspended production temporarily in May 2019 as required by the government to obtain project approval (see Note 1 (b)(iii)).

(i) Bromine and Crude Salt Segments

On September 1, 2017, the Company received notification from the Government of Yangkou County, Shouguang City of PRC that production at all its factories should be halted with immediate effect in order for the Company to perform rectification and improvement in accordance with the county’s new safety and environmental protection requirements.

The Company worked closely with the county authorities to develop rectification plans for both its bromine and crude salt businesses and agreed on a plan in October 2017. In the fiscal year ended December 31, 2018, the Company incurred $16,243,677 in the rectification and improvements of plant and equipment of the bromine and crude salt factories resulting in a cumulative amount of $34,182,329 incurred as of December 31, 2018 recorded in the plant, property and equipment in the consolidated balance sheet. No such costs were incurred in the three-month and nine-month periods ended September 30, 2019 and the Company does not expect to incur any additional capital expenditure in the rectification of its bromine and crude salt factories in respect of meeting the county's new safety and environmental protection requirement.

In the first quarter of 2018, six out of its ten bromine factories completed their rectification process within factory areas (i.e. excluding crude salt field area) and were approved and scheduled for production commencement by April 2018 as verbally indicated by the local government. The remaining four factories were still undergoing rectification at that time. Three factories (Factory no. 3, Factory no. 4 and Factory no. 11) had to be demolished in September 2018 as required by the government and rectification for Factory no. 10 was completed in November 2018.

In 2018, the Shandong Provincial government required the local government to conduct “four rating and one comprehensive evaluation” for all of the chemical companies within its jurisdiction. This has delayed the production commencement schedule of the six bromine and crude salt factories in which rectification work was completed. On June 29 2018, the Company received a formal notice (dated June 25, 2018) jointly issued by various provincial government agencies in Shandong Province (the “Notice”) forwarded by the Weifang City Special Operations Leading Group Office of Safe Production, Transformation and Upgrading of Chemical Industry. In the Notice, the provincial government agencies set forth further requirements and procedures covering the following four aspects for the chemical industrial enterprises: project approval, planning approval, land use rights approval and environmental protection assessment approval. Those standards and procedures apply to all chemical industrial enterprises in Shandong Province including the Company’s bromine plants that have not completed project approval procedures, planning approval procedures, land use rights approval procedures and environmental protection assessment procedures. The Company believes that the government will not grant approval to the Company to allow its bromine and crude salt plants to resume operations until the Company has fully complied with the aforesaid rules set forth in the Notice.

The Shouguang City Bromine Association, on behalf of all the bromine plants in Shouguang, has started discussions with the local government agencies. The local governmental agencies confirmed the facts that their initial requirements for the bromine industry did not include the project approval, the planning approval and the land use rights approval and that those three additional approvals were new requirements of the provincial government. The Company understood from the local government that it has been coordinating with several government agencies to solve these three outstanding approval issues in a timely manner and that all the affected bromine plants are not allowed to commence production prior to obtaining those approvals. In April 2019, Factory No.1, Factory No.5 and Factory No.7 (Factory no. 5 is considered part of Factory no.7 and both are managed as one factory since 2010) restarted operations upon receipt of verbal notification from local government of Yangkou County. On May 7, 2019, the Company renamed its Subdivision Factory No. 1 to Factory No. 4; and Factory No. 5 (which was previously considered part of Factory No. 7) to Factory No. 7.

The Company is not certain when the issuance of the approval documents will be effected. The Company believes that this is another step by the government to improve the environment. It further believes the goal of the government is not to close all plants, but rather to codify the regulations related to project approval, land use, planning approval and environmental protection assessment approval so that illegal plants are not able to open in the future and so that plants close to population centers do not cause serious environmental damage. In addition, the Company believes that the Shandong provincial government wants to assure that each of its regional and county governments has applied the Notice in a consistent manner.

The Company believes the issues related to the remaining five bromine and crude salt factories which have passed inspection are almost resolved. The Company is actively working with the local government to obtain the documentation for approval of project, planning, land use rights and environmental protection evaluation.

(ii) Chemical Segment

On November 24, 2017, the Company received a letter from the Government of Yangkou County, Shouguang City notifying the Company to relocate its two chemical production plants located in the second living area of the Qinghe Oil Extraction to the Bohai Marine Fine Chemical Industrial Park (“Bohai Park”). This is because the two plants are located in a residential area and their production activities will impact the living environment of the residents. This is as a result of the country’s effort to improve the development of the chemical industry, manage safe production and curb environmental pollution accidents effectively, and ensure the quality of the living environment of residents. All chemical enterprises which do not comply with the requirements of the safety and environmental protection regulations will be ordered to shut down.

The Company believes this relocation process will cost approximately $60 million in total. The Company incurred relocation costs comprising prepaid land lease and professional fees related to the design of the new chemical factory in the amount of $10,925,081, which were recorded in the prepaid land leases and property, plant and equipment in the consolidated balance sheets as of September 30, 2019 and December 31, 2018.

The Company does not anticipate that the Company’s new chemical factory to be significantly impacted by the Notice. The Company has secured from the government the land use rights for its chemical plants located at the Bohai Park and presented a completed construction design draft and other related documents to the local authorities for approval. The Company is still waiting for the last approval report and is uncertain when the approval will be issued. There could be a delay in the approval process given the ongoing rectification and approvals process for the Company’s other plants. As the construction of the new factory cannot commence until the final approval from the government is received, the delay in the receipt of the final approval will delay the commencement date of the construction of the new factory.

(iii) Natural Gas Segment

In January 2017, the Company completed the first brine water and natural gas well field construction in Daying located in Sichuan Province and commenced trial production in January 2019. On May 29, 2019, the Company received a verbal notice from the government of Tianbao Town ,Daying County, Sichuan Province, whereby the Company is required to obtain project approval for its well located in Daying, including the whole natural gas and brine water project, and approvals for safety production inspection, environmental protection assessment, and to solve the related land issue. Until these approvals have been received, the Company has to temporarily halt trial production at its natural gas well in Daying.

(c) Allowance for Doubtful Accounts

As of September 30, 2019 and December 31, 2018, There were no allowances for doubtful accounts. No allowances for doubtful accounts were charged to the condensed consolidated statements of loss for the three-month and nine-month periods ended September 30, 2019 and 2018.

(d) Concentration of Credit Risk

The Company is exposed to credit risk in the normal course of business, primarily related to accounts receivable and cash and cash equivalents. Substantially all of the Company’s cash and cash equivalents are maintained with financial institutions in the PRC, namely, Industrial and Commercial Bank of China Limited, China Merchants Bank Company Limited and Sichuan Rural Credit Union, which are not insured or otherwise protected. The Company placed $105,218,569 and $178,998,935 with these institutions as of September 30, 2019 and December 31, 2018, respectively. The Company has not experienced any losses in such accounts in the PRC.

Concentrations of credit risk with respect to accounts receivable exists as the Company sells a substantial portion of its products to a limited number of customers. However, such concentrations of credit risks are limited since the Company performs ongoing credit evaluations of its customers’ financial condition and extends credit terms as and when appropriate.

As of September 30, 2019, proceeds from accounts receivable balance outstanding of $0.58 million was collected in October 2019, In the amount collected, $0.47 million was for receivable more than 90 days old. As of December 31, 2018, there were no accounts receivable balances as they were all collected in the year ended December 31, 2018.

5

GULF RESOURCES, INC.

AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2019

(Expressed in U.S. dollars)

(UNAUDITED)

NOTE 1 – BASIS OF PRESENTATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES – Continued

(e) Property, Plant and Equipment

Property, plant and equipment are stated at cost less accumulated depreciation and any impairment losses. Expenditures for new facilities or equipment, and major expenditures for betterment of existing facilities or equipment are capitalized and depreciated, when available for intended use, using the straight-line method at rates sufficient to depreciate such costs less 5% residual value over the estimated productive lives. All other ordinary repair and maintenance costs are expensed as incurred.

Mineral rights are recorded at cost less accumulated depreciation and any impairment losses. Mineral rights are amortized ratably over the term of the lease, or the equivalent term under the units of production method, whichever is shorter.

Construction in process primarily represents direct costs of construction of property, plant and equipment. Costs incurred are capitalized and transferred to property, plant and equipment upon completion and depreciation will commence when the completed assets are placed in service.

The Company’s depreciation and amortization policies on property, plant and equipment, other than mineral rights and construction in process, are as follows:

|

Useful life (in years) | ||

| Buildings (including salt pans) | 8 - 20 | |

| Plant and machinery (including protective shells, transmission channels and ducts) | 3 - 8 | |

| Motor vehicles | 5 | |

| Furniture, fixtures and equipment | 3-8 |

Property, plant and equipment under the finance lease are depreciated over their expected useful lives on the same basis as owned assets, or where shorter, the term of the lease, which is 20 years.

Producing oil and gas properties are depreciated on a unit-of-production basis over the proved developed reserves. Common facilities that are built specifically to service production directly attributed to designated oil and gas properties are depreciated based on the proved developed reserves of the respective oil and gas properties on a pro-rata basis. Common facilities that are not built specifically to service identified oil and gas properties are depreciated using the straight-line method over their estimated useful lives. Costs associated with significant development projects are not depreciated until commercial production commences and the reserves related to those costs are excluded from the calculation of depreciation.

(f) Retirement Benefits

Pursuant to the relevant laws and regulations in the PRC, the Company participates in a defined contribution retirement plan for its employees arranged by a governmental organization. The Company makes contributions to the retirement plan at the applicable rate based on the employees’ salaries. The required contributions under the retirement plans are charged to the condensed consolidated statement of loss on an accrual basis when they are due. The Company’s contributions totaled $207,175 and $308,669 for the three-month period ended September 30, 2019 and 2018, respectively, and totaled $810,911 and $912,744 for the nine-month period ended September 30, 2019 and 2018, respectively.

(g) Revenue Recognition

Net revenue is net of discount and value added tax and comprises the sale of bromine, crude salt and chemical products. Revenue is recognized when the control of the promised goods is transferred to the customers in an amount that reflects the consideration that the Company expects to receive from the customers in exchange for those goods. The acknowledgement of receipt of goods by the customers is when control of the product is deemed to be transferred. Invoicing occurs upon acknowledgement of receipt of the goods by the customers. Customers have no rights to return the goods upon acknowledgement of receipt of goods.

6

GULF RESOURCES, INC.

AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2019

(Expressed in U.S. dollars)

(UNAUDITED)

NOTE 1 – BASIS OF PRESENTATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES – Continued

(h) Recoverability of Long-lived Assets

In accordance with Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 360-10-35“Impairment or Disposal of Long-lived Assets”, long-lived assets to be held and used are analyzed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be fully recoverable or that the useful lives of those assets are no longer appropriate. The Company evaluates at each balance sheet date whether events and circumstances have occurred that indicate possible impairment.

The Company determines the existence of such impairment by measuring the expected future cash flows (undiscounted and without interest charges) and comparing such amount to the carrying amount of the assets. An impairment loss, if one exists, is then measured as the amount by which the carrying amount of the asset exceeds the discounted estimated future cash flows. Assets to be disposed of are reported at the lower of the carrying amount or fair value of such assets less costs to sell. Asset impairment charges are recorded to reduce the carrying amount of the long-lived asset that will be sold or disposed of to their estimated fair values. Charges for the asset impairment reduce the carrying amount of the long-lived assets to their estimated salvage value in connection with the decision to dispose of such assets.

For the three and nine months period ended September 30, 2019, the Company determined that there were no events or circumstances indicating possible impairment of its long-lived assets.

In the three and nine- month periods ended September 30, 2018, the Company recorded an impairment loss of $1,284,832 for the mineral rights for factories No 3 and No 4 due to closure notice from the People's Government of Yangkou Town, Shouguang City and a write-off of $112,481 for write-offs of certain wells and equipments damaged by flood from a typhoon during third quarter 2018.

(i) Basic and Diluted Earnings per Share of Common Stock

Basic earnings per common share are based on the weighted average number of shares outstanding during the periods presented. Diluted earnings per share are computed using weighted average number of common shares plus dilutive common share equivalents outstanding during the period. Potential common shares that would have the effect of increasing diluted earnings per share are considered to be anti-dilutive, i.e. the exercise prices of the outstanding stock options were greater than the market price of the common stock. Anti-dilutive common stock equivalents which were excluded from the calculation of number of dilutive common stock equivalents amounted to 587,720 and 259,590 shares for the three-month period ended September 30, 2019 and 2018, respectively, and amounted to 362,206 and 141,629 shares for the nine-month period ended September 30, 2019 and 2018, respectively. These awards could be dilutive in the future if the market price of the common stock increases and is greater than the exercise price of these awards.

Because the Company reported a net loss for the three and nine months ended September 30, 2019 and 2018, common stock equivalents including stock options and warrants were anti-dilutive, therefore the amounts reported for basic and diluted loss per share were the same.

7

GULF RESOURCES, INC.

AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2019

(Expressed in U.S. dollars)

(UNAUDITED)

NOTE 1 – BASIS OF PRESENTATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES – Continued

(i) Reporting Currency and Translation

The financial statements of the Company’s foreign subsidiaries are measured using the local currency, Renminbi (“RMB”), as the functional currency; whereas the functional currency and reporting currency of the Company is the United States dollar (“USD” or “$”).

As such, the Company uses the “current rate method” to translate its PRC operations from RMB into USD, as required under FASB ASC 830 “Foreign Currency Matters”. The assets and liabilities of its PRC operations are translated into USD using the rate of exchange prevailing at the balance sheet date. The capital accounts are translated at the historical rate. Adjustments resulting from the translation of the balance sheets of the Company’s PRC subsidiaries are recorded in stockholders’ equity as part of accumulated other comprehensive loss. The statement of loss and comprehensive loss is translated at average rate during the reporting period. Gains or losses resulting from transactions in currencies other than the functional currencies are recognized in net loss for the reporting periods as part of general and administrative expense. The statement of cash flows is translated at average rate during the reporting period, with the exception of the consideration paid for the acquisition of business which is translated at historical rates.

(j) Foreign Operations

All of the Company’s operations and assets are located in PRC. The Company may be adversely affected by possible political or economic events in this country. The effect of these factors cannot be accurately predicted.

(k) Exploration Costs

Exploration costs, which included the cost of researching appropriate places to drill wells and the cost of well drilling in search of potential natural brine or other resources, are charged to the loss statement as incurred. Once the commercial viability of a project has been confirmed, all subsequent costs are capitalized.

For oil and gas properties, the successful efforts method of accounting is adopted. The Company carries exploratory well costs as an asset when the well has found a sufficient quantity of reserves to justify its completion as a producing well and where the Company is making sufficient progress assessing the reserves and the economic and operating viability of the project. Exploratory well costs not meeting these criteria are charged to expenses. Exploratory wells that discover potentially economic reserves in areas where major capital expenditure will be required before production would begin and when the major capital expenditure depends upon the successful completion of further exploratory work remain capitalized and are reviewed periodically for impairment.

(l) Leases

The Company determines if an arrangement is a lease at inception. Operating leases are included in operating lease right-of-use (“ROU”) assets and operating lease liabilities in the consolidated balance sheets. Finance leases are included in finance lease ROU assets and finance lease liabilities in the consolidated balance sheets.

ROU assets represent the Company’s right to use an underlying asset for the lease term and lease liabilities represent the Company’s obligation to make lease payments arising from the lease. Operating lease and finance lease ROU assets and liabilities are recognized at January 1, 2019 based on the present value of lease payments over the lease term discounted using the rate implicit in the lease. In cases where the implicit rate is not readily determinable, the Company uses its incremental borrowing rate based on the information available at commencement date in determining the present value of lease payments. Lease expense for lease payments is recognized on a straight-line basis over the lease term.

(m) Stock-based Compensation

Common stock, stock options and stock warrants issued are recorded at their fair values estimated at grant date using the Black-Scholes model and the portion that is ultimately expected to vest is recognized as compensation cost over the requisite service period.

The Company has elected to account for the forfeiture of stock-based awards as they occur.

(n) New Accounting Pronouncements

Recent accounting pronouncements adopted

In February 2016, the FASB issued ASU No. 2016-02, Leases (Topic 842). The amendments in this Update specify the accounting for leases. The core principle of Topic 842 is that a lessee should recognize the assets and liabilities that arise from operating leases. The Company adopted the standard effective January 1, 2019 under the optional transition method which allows an entity to apply the new lease standard at the adoption date and recognize a cumulative-effect adjustment, if any, to the opening balance of retained earnings in the period of adoption. The Company elected the available practical expedients. As a result of the adoption of this standard, the Company recognized operating lease ROU assets of $8,817,327, operating lease liabilities of $8,137,541, and the remaining balance in the prepaid land lease and accrued expense in the condensed consolidated financial statements as of and for the nine months ended September 30, 2019 with no cumulative-effect adjustment to retained earnings as of January 1, 2019.

In June 2018, the FASB issued ASU No.2018-07, Compensation- Stock Compensation (Topic 718). Improvements to Nonemployee Share-Based Payment Accounting. The amendments in this update expand the scope of Topic 718 to include share-based payment transactions for acquiring goods and services from nonemployees. Prior to this update, Topic 718 applied only to share-based transactions to employees. Consistent with the accounting requirements for employee share-based payment awards, nonemployee share-based payment awards within the scope of Topic 718 are measured at grant-date fair value of the equity instruments that an entity is obligated to issue when the good has been delivered or the service has been rendered and any other conditions necessary to earn the right to benefit from the instruments have been satisfied. The amendments in the Update are effective for public business entities form fiscal years beginning after December 15, 2018, including interim periods within that fiscal year. The Company adopted this standard as of January 1, 2019. This adoption of this standard does not have a material impact on the Company’s condensed consolidated financial statements.

Recently Issued Accounting Pronouncements Not Yet Adopted

In June 2016, the FASB issued ASU No. 2016-13, Financial Instruments – Credit Losses (Topic 326), Measurement of Credit Losses on Financial Instruments. The amendments in this Update affect loans, debt securities, trade receivables, and any other financial assets that have the contractual right to receive cash. The ASU requires an entity to recognize expected credit losses rather than incurred losses for financial assets. For public entities, the amendments are effective for fiscal years beginning after December 15, 2019, including interim periods within those fiscal years. The Company is currently evaluating the effect of this on the condensed consolidated financial statements and related disclosure.

8

GULF RESOURCES, INC.

AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

September 30, 2019

(Expressed in U.S. dollars)

(UNAUDITED)

NOTE 2 – INVENTORIES

Inventories consist of:

| September 30, 2019 | December 31, 2018 | |||||||

| Raw materials | $ | 20,642 | $ | — | ||||

| Finished goods | 660,008 | 65,169 | ||||||

| Allowance for obsolete and slow-moving inventory | — | (65,169 | ) | |||||

| $ | 680,650 | $ | — | |||||

NOTE 3 – PREPAID LAND LEASES

The Company has the rights to use certain parcels of land located in Shouguang, the PRC, through lease agreements signed with local townships or the government authority. The production facilities and warehouses of the Company are located on these parcels of land. The lease term ranges from ten to fifty years. Some of the lease contracts were paid in one lump sum upfront and some are paid annually at the beginning of each anniversary date. These leases have no purchase option at the end of the lease term and were classified as operating lease prior to and as of January 1, 2019 when the new lease standard was adopted. Prior to January 2019, the prepaid land lease was amortized on a straight line basis. As of January 1, 2019, all these leases that have commenced were classified as operating lease right-of-use assets (“ROU”). See Note 6.

In December 2017, the Company paid a one lump sum upfront amount of $8,990,636 for a 50-year lease of a parcel of land at Bohai Marine Fine Chemical Industrial Park (“Bohai”) for the new chemical factory to be built. There is no purchase option at the end of the lease term. This was classified as an operating lease prior to and as of January 1, 2019. The land use certificate is being processed by the government and the commencement date of the lease will be known upon completion of the application process. Since the construction plan of the factory at Bohai is still in the process of being approved by the government and the lease term of the land has not commenced, the Company classified the lease payment in prepaid land lease instead of Right-of –use assets. No amortization of this prepaid land lease was recorded as of September 30, 2019.

During the three and nine months period ended September 30, 2018, amortization of prepaid land leases totaled $252,091 and $546,767, which amounts were recorded as direct labor and factory overheads incurred during plant shutdown.

For parcels of land that are collectively owned by local townships, the Company cannot obtain land use rights certificates. The parcels of land of which the Company cannot obtain land use rights certificates cover a total of approximately 38.6 square kilometers with aggregate carrying value of $599,747 as at December 31, 2018 and the parcels of land of which the Company cannot obtain land use rights certificates covers a total of approximately 38.6 square kilometers with an aggregate operating lease right-of-use assets amount of $8,570,115 as at September 30, 2019.

9

GULF RESOURCES, INC.

AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2019

(Expressed in U.S. dollars)

(UNAUDITED)

NOTE 4 – PROPERTY, PLANT AND EQUIPMENT, NET

Property, plant and equipment, net consist of the following:

| September 30, 2019 | December 31, 2018 | |||||||

| At cost: | ||||||||

| Mineral rights | $ | 2,726,661 | $ | 2,809,977 | ||||

| Buildings | 59,061,773 | 60,866,462 | ||||||

| Plant and machinery | 231,460,194 | 161,178,816 | ||||||

| Motor vehicles | 6,045 | 6,230 | ||||||

| Furniture, fixtures and office equipment | 3,191,491 | 3,289,010 | ||||||

| Construction in process | 1,188,268 | 6,535,808 | ||||||

| Total | 297,634,432 | 234,686,303 | ||||||

| Less: Accumulated depreciation and amortization | (140,889,652 | ) | (134,681,628 | ) | ||||

| Impairment | (17,196,587 | ) | (17,722,045 | ) | ||||

| Net book value | $ | 139,548,193 | $ | 82,282,630 | ||||

The Company has certain buildings and salt pans erected on parcels of land located in Shouguang, PRC, and such parcels of land are collectively owned by local townships or the government authority. The Company has not been able to obtain property ownership certificates over these buildings and salt pans. The aggregate carrying values of these properties situated on parcels of the land are $19,881,983 and $20,409,998 as at September 30, 2019 and December 31, 2018, respectively.

During the three-month period ended September 30, 2019, depreciation and amortization expense totaled $3,632,805 of which $2,449,352, $201,182 and $982,271 were recorded in direct labor and factory overheads incurred during plant shutdown, administrative expenses and cost of net revenue. During the nine-month period ended September 30, 2019,depreciation and amortization expense totaled $10,530,985 of which $7,535,376, $648,456 and $2,347,153 were recorded in direct labor and factory overheads incurred during plant shutdown, administrative expenses and cost of net revenue.

During the three-month period ended September 30, 2018, depreciation and amortization expense totaled $4,601,338, of which $4,353,824 and $247,514 were recorded in direct labor and factory overheads incurred during plant shutdown and administrative expenses, respectively. During the nine-month period ended September 30, 2018, depreciation and amortization expense totaled $13,974,456, of which $13,210,971 and $763,485 were recorded in direct labor and factory overheads incurred during plant shutdown and administrative expenses, respectively.

NOTE 5 –FINANCE LEASE RIGHT-OF-USE ASSETS

Property, plant and equipment under finance leases, net consist of the following:

| September 30, 2019 | December 31, 2018 | |||||||

| At cost: | ||||||||

| Buildings | $ | 116,344 | $ | 119,899 | ||||

| Plant and machinery | 2,128,342 | 2,193,375 | ||||||

| Total | 2,244,686 | 2,313,274 | ||||||

| Less: Accumulated depreciation and amortization | (2,066,305 | ) | (2,062,517 | ) | ||||

| Net book value | $ | 178,381 | $ | 250,757 | ||||

The above buildings erected on parcels of land located in Shouguang, PRC, are collectively owned by local townships. The Company has not been able to obtain property ownership certificates over these buildings as the Company could not obtain land use rights certificates on the underlying parcels of land.

During the three and nine months period ended September 30, 2019, depreciation and amortization expense totaled $1,326 and $68,027, respectively, which was recorded in direct labor and factory overheads incurred during plant shutdown.

During the three and nine months period ended September 30, 2018, depreciation and amortization expense totaled $64,874 and $203,271, respectively, which was recorded in direct labor and factory overheads incurred during plant shutdown.

10

GULF RESOURCES, INC.

AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2019

(Expressed in U.S. dollars)

(UNAUDITED)

NOTE 6 – OPERATING LEASE RIGHT–OF-USE ASSETS

As of September 30, 2019, the total operating lease ROU assets was $8,817,327. The total operating lease cost for the three-month period ended September 30, 2019 and 2018 was $219,411 and $266,875.

The total operating lease cost for the nine-month period ended September 30, 2019 and 2018 was $671,652 and $831,539.

The Company has the rights to use certain parcels of land located in Shouguang, the PRC, through lease agreements signed with local townships or the government authority (See Note 3). For parcels of land that are collectively owned by local townships, the Company cannot obtain land use rights certificates. The parcels of land of which the Company cannot obtain land use rights certificates covers a total of approximately 38.6 square kilometers with an aggregate operating lease right-of-use assets amount of $8,570,115 as at September 30, 2019.

NOTE 7 – OTHER PAYABLE AND ACCRUED EXPENSES

Payable and accrued expenses consist of the following:

| September 30, | December 31, | |||||||

| 2019 | 2018 | |||||||

| Accounts payable | $ | — | $ | — | ||||

| Salary payable | 308,181 | 241,343 | ||||||

| Social security insurance contribution payable | 104,480 | 140,326 | ||||||

| Other payable-related party (see Note 8) | 66,151 | 90,900 | ||||||

| Deposit on subscription of a subsidiary's share | 141,380 | — | ||||||

| Accrued expense-for repair work | 2,912,355 | 104,246 | ||||||

| Accrued expense-others | 337,969 | 328,443 | ||||||

| Total | $ | 3,870,516 | $ | 905,258 | ||||

The deposit on subscription of a subsidiary's share of $141,380 as of September 30, 2019 relates to sale of non-controlling interests in DCHC.

NOTE 8 – RELATED PARTY TRANSACTIONS

During the three-month period ended September 30, 2019, the Company borrowed a sum of $299,995 from Jiaxing Lighting Appliance Company Limited (Jiaxing Lighting”), in which Mr. Ming Yang, a shareholder and the Chairman of the Company, has a 100% equity interest. The amount due to Jiaxing Lighting was unsecured, interest free and repayable on demand and was fully settled in the three-month period ended September 30, 2019. There was no balance owing to Jiaxing Lighting as of September 30, 2019 and December 31, 2018.

On September 25, 2012, the Company purchased five floors of a commercial building in the PRC, through SYCI, from Shandong Shouguang Vegetable Seed Industry Group Co., Ltd. (the “Seller”) at a cost of approximately $5.7 million in cash, of which Mr. Ming Yang, the Chairman of the Company, had a 99% equity interest in the Seller. During the first quarter of 2018, the Company entered into an agreement with the Seller, a related party, to provide property management services for an annual amount of approximately $88,202 for five years from January 1, 2018 to December 31, 2022. The expense associated with this agreement for the three and nine months ended September 30, 2019 was approximately $22,050 and $67,900.The expense associated with this agreement for the three and nine months ended September 30, 2018 was approximately $23,000 and $72,000.

NOTE 9 – TAXES PAYABLE

| September 30, | December 31, | |||||||

| 2019 | 2018 | |||||||

| Land use tax payable | $ | 768,962 | $ | 1,188,687 | ||||

| Value-added tax withheld from suppliers | 2,977,283 | — | ||||||

| Other tax payable | 274,547 | — | ||||||

| $ | 4,020,792 | $ | 1,188,687 | |||||

NOTE 10 –LEASE LIABILITIES-FINANCE AND OPERATING LEASE

The components of finance lease liabilities were as follows:

| Imputed | September 30, | December 31, | |||||||||

| Interest rate | 2019 | 2018 | |||||||||

| Total finance lease liability | 6.7% | $ | 2,041,845 | $ | 2,267,025 | ||||||

| Less: Current portion | (162,132 | ) | (197,480 | ) | |||||||

| Finance lease liability, net of current portion | $ | 1,879,713 | $ | 2,069,545 | |||||||

Interest expenses from capital lease obligations amounted to $34,080 and $37,138 for the three-month period ended September 30, 2019 and 2018, respectively, which were charged to the condensed consolidated statement of income (loss). Interest expenses from capital lease obligations amounted to $111,020 and $123,352 for the nine-month period ended September 30, 2019 and 2018, respectively, which were charged to the condensed consolidated statement of income (loss).

The components of operating lease liabilities as follows:

| Imputed | September 30, | December 31, | |||||||||

| Interest rate | 2019 | 2018 | |||||||||

| Total Operating lease liabilities | 4.89% | $ | 8,137,541 | $ | - | ||||||

| Less: Current portion | (406,156 | ) | - | ||||||||

| Operating lease liabilities, net of current portion | $ | 7,731,385 | $ | - | |||||||

The weighted average remaining operating lease term at September 30, 2019 was 23 years and the weighted average discounts rate was 4.89%, This discount rates used are based on the base rate quoted by the People's Bank of China and vary with the remaining term of the lease.

Maturities of lease liabilities were as follows:

| Financial lease | Operating Lease | |||||||

| Payable within: | ||||||||

| the next 12 months | $ | 265,370 | $ | 762,298 | ||||

| the next 13 to 24 months | 265,370 | 775,828 | ||||||

| the next 25 to 36 months | 265,370 | 628,579 | ||||||

| the next 37 to 48 months | 265,370 | 635,341 | ||||||

| the next 49 to 60 months | 265,370 | 633,168 | ||||||

| thereafter | 1,592,225 | 11,285,715 | ||||||

| Total | 2,919,075 | 14,720,929 | ||||||

| Less: Amount representing interest | (877,230 | ) | (6,583,388 | ) | ||||

| Present value of net minimum lease payments | $ | 2,041,845 | $ | 8,137,541 | ||||

11

GULF RESOURCES, INC.

AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2019

(Expressed in U.S. dollars)

(UNAUDITED)

NOTE 11 ––EQUITY

Retained Earnings - Appropriated

In accordance with the relevant PRC regulations and the PRC subsidiaries’ Articles of Association, the Company’s PRC subsidiaries are required to allocate its profit after tax to the following reserve:

Statutory Common Reserve Funds

SCHC, SYCI and DCHC are required each year to transfer at least 10% of the profit after tax as reported under the PRC statutory financial statements to the Statutory Common Reserve Funds until the balance reaches 50% of the registered share capital. This reserve can be used to make up any loss incurred or to increase share capital. Except for the reduction of losses incurred, any other application should not result in this reserve balance falling below 25% of the registered capital. The Statutory Common Reserve Fund as of September 30, 2019 for SCHC, SYCI and DCHC is 46%, 14% and 0% of its registered capital respectively.

NOTE 12 – TREASURY STOCK

In January 2019, the Company issued 20,000 shares of common stock from the treasury shares to one of its consultants. The shares were valued at the closing market price on the date of the agreement and recorded as general and administrative expense in the condensed consolidated statement of loss and comprehensive loss for the nine months ended September 30, 2019. The shares issued were deducted from the treasury shares at weighted average cost and the excess of the cost over the closing market price was charged to additional paid-in-capital.

On September 13, 2019, the Company received a staff deficiency notice from The Nasdaq Stock Market informing the Company that it has failed to comply with Nasdaq's shareholder approval requirements relating to shares issued to this consultant. A total of 40,000 restricted shares issued to this consultant from treasury will be canceled. The Company will reissue the same amount of shares from the 2019 Omnibus Equity Incentive Plan adopted by the board of directors of the Company subject to the approval by the stockholders of the Company at the annual meeting of the stockholders. This annual meeting of the stockholders of the Company is scheduled to take place on December 18, 2019.

On October 30, 2019, the Company received a letter from Nasdaq notifying the Company that Nasdaq has granted the Company an extension until January 7, 2020, to regain compliance with the Rule. Under the terms of the extension, the Company must provide, on or before January 7, 2020, evidence that it has cancelled the Consultant Shares and re-issued the shares under the Plan. In the event that the Company does not satisfy the terms set forth in the extension, Nasdaq will provide written notification that the Company's securities will be delisted. In such an event, the Company may appeal Nasdaq's determination to a hearing panel.

NOTE 13 – STOCK-BASED COMPENSATION

Pursuant to the Company’s Amended and Restated 2007 Equity Incentive Plan approved in 2011(“Plan”), the aggregate number shares of the Company’s common stock available for grant of stock options and issuance is 4,341,989 shares. On October 5, 2015, during the annual meeting of the Company’s stockholders, the aggregate number of shares reserved and available for grant and issuance pursuant to the Plan was increased to 10,341,989. As of September 30, 2019, the number of shares of the Company’s common stock available for issuance under the Plan is 4,920,989.

The fair value of each option award is estimated on the date of grant using the Black-Scholes option-pricing model. The risk free rate is based on the yield-to-maturity in continuous compounding of the US Government Bonds with the time-to-maturity similar to the expected tenor of the option granted, volatility is based on the annualized historical stock price volatility of the Company, and the expected life is based on the historical option exercise pattern.

On April 01, 2019, the Company granted to one employee staff options to purchase 150,000 shares of the Company’s common stock, at an exercise price of $0.91 per share and the options vested immediately. The options were valued at $45,900 fair value, with assumed 45.26% volatility, a four-year expiration term with an expected tenor of 1.60 years, a risk free rate of 2.37% and no dividend yield.

During the three months ended September 30, 2019, there were no options issued to employees or non-employees.

The following table summarizes all Company stock option transactions between January 1, 2019 and September 30, 2019.

| Number of Option and Warrants Outstanding and exercisable |

Weighted- Average Exercise price of Option and Warrants |

Range of Exercise Price per Common Share | ||||||||||

| Balance, January 1, 2019 | 2,518,000 | $0.97 | $0.71 - $4.80 | |||||||||

| Granted and vested during the period ended September 30, 2019 | 150,000 | $0.91 | $0.91 | |||||||||

| Exercised during the period ended September 30, 2019 | (1,897,000) | $0.73 | $0.73 | |||||||||

| Expired/cancelled during the period ended September 30, 2019 | (65,500) | $2.31 | $2.61 | |||||||||

| Balance, September 30, 2019 | 705,500 | $1.47 | $0.71 - $2.10 | |||||||||

| Stock and Warrants Options Exercisable and Outstanding | ||||||||||||

| Weighted Average | ||||||||||||

| Remaining | ||||||||||||

| Outstanding at September 30, 2019 |

Range of Exercise Prices |

Contractual Life (Years) |

||||||||||

| Exercisable and outstanding | 705,500 | $0.71 - $2.10 | 1.74 | |||||||||

The aggregate intrinsic value of options outstanding and exercisable as of September 30, 2019 was $0.

During the three months ended September 30, 2019, 0 shares of common stock were issued upon cashless exercise of 0 options.

During the nine months ended September 30, 2019, 759,281 shares of common stock were issued upon cashless exercise of 1,897,000 options.

The aggregate intrinsic value of options exercised during the three months ended September 30, 2019 was $0. There was no option exercised during the three months ended September 30, 2018.

The aggregate intrinsic value of options exercised during the nine months ended September 30, 2019 was $922,429. There was no option exercised during the nine months ended September 30, 2018.

12

GULF RESOURCES, INC.

AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2019

(Expressed in U.S. dollars)

(UNAUDITED)

NOTE 14 – INCOME TAXES

The Company utilizes the asset and liability method of accounting for income taxes in accordance with FASB ASC 740-10. If it is more likely than not that some portion or all of a deferred tax asset will not be realized, a valuation allowance is recognized.

(a) United States (“US”)

Gulf Resources, Inc. may be subject to the United States of America Tax laws at a tax rate of 21%. No provision for the US federal income taxes has been made as the Company had no US taxable income for the three-month and nine-month periods ended September 30, 2019 and 2018, and management believes that its earnings are permanently invested in the PRC.

On December 22, 2017, the Tax Cuts and Jobs Act (“TCJA”) was enacted in law. With the new tax law, the corporation income tax rate is reduced from 35% to 21% and there is a one-time mandatory transition tax on accumulated foreign earnings. The Company computed this one-time mandatory transition tax on accumulated foreign earnings to be approximately $5.4 million. However, as the Company has available US federal net operating loss carry forwards and foreign tax credit to fully offset the mandatory inclusion of the accumulated foreign earnings, no net tax liability arose from the inclusion of these accumulated foreign earnings.

(b) British Virgin Islands (“BVI”)

Upper Class Group Limited, a subsidiary of Gulf Resources, Inc., was incorporated in the BVI and, under the current laws of the BVI, it is not subject to tax on income or capital gain in the BVI. Upper Class Group Limited did not generate assessable profit for the three-month and nine-month periods ended September 30, 2019 and 2018.

(c) Hong Kong

HKJI, a subsidiary of Upper Class Group Limited, was incorporated in Hong Kong and is subject to Hong Kong taxation on its activities conducted in Hong Kong and income arising in or derived from Hong Kong. No provision for income tax has been made as it has no taxable income for the three-month and nine-month periods ended September 30, 2019 and 2018. The applicable statutory tax rates for the three-month and nine-month periods ended September 30, 2019 and 2018 are 16.5%. There is no dividend withholding tax in Hong Kong.

(d) PRC

Enterprise income tax (“EIT”) for SCHC, SYCI and DCHC in the PRC is charged at 25% of the assessable profits.

The operating subsidiaries SCHC, SYCI and DCHC are wholly foreign-owned enterprises (“FIE”) incorporated in the PRC and are subject to PRC Local Income Tax Law. The PRC tax losses may be carried forward to be utilized against future taxable profit for ten years for High-tech enterprises and small and medium-sized enterprises of science and technology and for five years for other companies. Tax losses of the operating subsidiaries of the Company may be carried forward for five years.

On February 22, 2008, the Ministry of Finance (“MOF”) and the State Administration of Taxation (“SAT”) jointly issued CaiShui [2008] Circular 1 (“Circular 1”). According to Article 4 of Circular 1, distributions of accumulated profits earned by a FIE prior to January 1, 2008 to foreign investor(s) in 2008 will be exempted from withholding tax (“WHT”) while distribution of the profit earned by an FIE after January 1, 2008 to its foreign investor(s) shall be subject to WHT at 5% effective tax rate.

As of September 30, 2019 and December 31, 2018, the accumulated distributable earnings under the Generally Accepted Accounting Principles (GAAP”) of PRC that are subject to WHT are $215,205,425 and $240,563,868, respectively. Since the Company intends to reinvest its earnings to further expand its businesses in mainland China, its foreign invested enterprises do not intend to declare dividends to their immediate foreign holding companies in the foreseeable future. Accordingly, as of September 30, 2019 and December 31, 2018, the Company has not recorded any WHT on the cumulative amount of distributable retained earnings of its foreign invested enterprises that are subject to WHT in China. As of September 30, 2019 and December 31, 2018, the unrecognized WHT are $9,797,344 and $11,035,843, respectively.

The Company’s income tax returns are subject to the various tax authorities’ examination. The federal, state and local authorities of the United States may examine the Company’s income tax returns filed in the United States for three years from the date of filing. The Company’s US income tax returns since 2015 are currently subject to examination.

Inland Revenue Department of Hong Kong (“IRD”) may examine the Company’s income tax returns filed in Hong Kong for seven years from date of filing. For the years 2012 through 2018, HKJI did not report any taxable income. It did not file any income tax returns during these years except for 2014 and 2018. For companies which do not have taxable income, IRD typically issues notification to companies requiring them to file income tax returns once in every four years. The tax returns for 2014 and 2018 are currently subject to examination.

The components of the provision for income tax (expense) income tax benefit from continuing operations are:

| Three-Month Period Ended September 30, | Nine-Month Period Ended September 30, | |||||||||||||||

| 2019 | 2018 | 2019 | 2018 | |||||||||||||

| Current taxes – PRC | $ | — | $ | — | $ | — | $ | — | ||||||||

| Deferred taxes – PRC | 1,650,132 | 7,205,521 | 3,756,199 | 10,338,103 | ||||||||||||

| Change in valuation allowance | (8,379,571 | ) | (24,000 | ) | (8,724,517 | ) | (79,595 | ) | ||||||||

| $ | (6,729,439 | ) | $ | 7,181,521 | $ | (4,968,318 | ) | $ | 10,258,508 | |||||||

The effective income tax benefit (expense) rate differs from the PRC statutory income tax rate of 25% from continuing operations in the PRC as follows:

| Three-Month Period Ended September 30, | Nine-Month Period Ended September 30, | |||||||||||||||

| Reconciliations | 2019 | 2018 | 2019 | 2018 | ||||||||||||

| Statutory income tax rate | 25 | % | 25 | % | 25 | % | 25 | % | ||||||||

| Non-taxable income | 1 | % | 2 | % | 2 | % | — | |||||||||

| Change in valuation allowance | (133 | %) | — | (63 | %) | — | ||||||||||

| Effective income tax benefit (expense) rate | (107 | %) | 27 | % | (36 | %) | 25 | % | ||||||||

Significant components of the Company’s deferred tax assets and liabilities at September 30, 2019 and December 31, 2018 are as follows:

| September 30, | December 31, | |||||||

| 2019 | 2018 | |||||||

| Deferred tax liabilities | $ | — | $ | — | ||||

| Deferred tax assets: | ||||||||

| Allowance for obsolete and slow-moving inventories | $ | — | $ | 16,292 | ||||

| Impairment on property, plant and equipment | 3,197,763 | 3,696,332 | ||||||

| Impairment on prepaid land lease | 815,370 | 840,284 | ||||||

| Exploration costs | 1,760,181 | 1,813,965 | ||||||

| Compensation costs of unexercised stock options | 171,672 | 194,016 | ||||||

| PRC tax losses | 16,043,972 | 12,663,985 | ||||||

| US federal net operating loss and foreign tax credit | 508,102 | 119,000 | ||||||

| Total deferred tax assets | 22,497,060 | 19,343,874 | ||||||

| Valuation allowance | (9,037,533 | ) | (313,016 | ) | ||||

| Net deferred tax asset | $ | 13,459,527 | $ | 19,030,858 | ||||

The increase in valuation allowance for the three-month period ended September 30, 2019 is $8,379,571.

The increase in valuation allowance for the three-month period ended September 30, 2018 is $24,000.

The increase in valuation allowance for the nine-month period ended September 30, 2019 is $8,724,517.

The increase in valuation allowance for the nine-month period ended September 30, 2018 is $79,595.

The increase in valuation allowance in the three and nine months ended September 30, 2019 is mainly attributable to valuation allowance recorded for the deferred tax assets related to a portion of the PRC tax losses that more likely than not will expire before it could be utilized and the exploration costs which more likely than not will not be realized.

There were no unrecognized tax benefits and accrual for uncertain tax positions as of September 30, 2019 and December 31, 2018.

There were no amounts accrued for penalties and interest for the three and nine months ended September 30, 2019 and 2018. There were no change in unrecognized tax benefits during the three and nine months ended September 30, 2019 and 2018.

13

GULF RESOURCES, INC.

AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2019

(Expressed in U.S. dollars)

(UNAUDITED)

NOTE 15 – BUSINESS SEGMENTS

An operating segment’s performance is primarily evaluated based on segment operating income, which excludes share-based compensation expense, certain corporate costs and other income not associated with the operations of the segment. These corporate costs (income) are separately stated below and also include costs that are related to functional areas such as accounting, treasury, information technology, legal, human resources, and internal audit. The Company believes that segment operating income, as defined above, is an appropriate measure for evaluating the operating performance of its segments. All the customers are located in PRC.

Three-Month Period Ended September 30, 2019 | Bromine* | Crude Salt* | Chemical Products | Natural Gas | Segment Total | Corporate | Total | |||||||||||||||||||||

Net revenue (external customers) | $ | 4,270,863 | $ | 277,679 | $ | — | $ | — | $ | 4,548,542 | $ | — | $ | 4,548,542 | ||||||||||||||

Net revenue (intersegment) | — | — | — | — | — | — | — | |||||||||||||||||||||

| Income(loss) from operations before income tax benefit | (5,185,484 | ) | (1,001,988 | ) | (744,963 | ) | (62,265 | ) | (6,994,700 | ) | 628,291 | (6,366,409 | ) | |||||||||||||||

| Income tax (expense) benefit | (5,778,726 | ) | (1,116,620 | ) | 165,907 | — | (6,729,439 | ) | — | (6,729,439 | ) | |||||||||||||||||

Income(loss) from operations after income tax benefit | (10,964,210 | ) | (2,118,608 | ) | (579,056 | ) | (62,265 | ) | (13,724,139 | ) | 628,291 | (13,095,848 | ) | |||||||||||||||

| Total assets | 153,825,697 | 21,738,770 | 110,464,372 | 1,767,155 | 287,795,994 | 150,836 | 287,946,830 | |||||||||||||||||||||

| Depreciation and amortization | 3,303,155 | 182,538 | 113,357 | 35,081 | 3,634,131 | — | 3,634,131 | |||||||||||||||||||||

| Capital expenditures | 56,137,239 | 1,180,129 | — | — | 57,317,368 | — | 57,317,368 | |||||||||||||||||||||

Three-Month Period Ended September 30, 2018 | Bromine* | Crude Salt* | Chemical Products | Natural Gas | Segment Total | Corporate | Total | |||||||||||||||||||||

Net revenue (external customers) | $ | — | $ | 343,080 | $ | — | $ | — | $ | 343,080 | $ | — | $ | 343,080 | ||||||||||||||

Net revenue (intersegment) | — | — | — | — | — | — | — | |||||||||||||||||||||

| Income(loss) from operations before income tax benefit | (24,369,917 | ) | (2,611,203 | ) | (698,693 | ) | (32,079 | ) | (27,711,892 | ) | 912,975 | (26,798,917 | ) | |||||||||||||||

| Income tax benefit | 4,774,432 | 2,171,383 | 235,706 | — | 7,181,521 | — | 7,181,521 | |||||||||||||||||||||

Income (loss) from operations after income tax benefit | (19,595,485 | ) | (439,820 | ) | (462,987 | ) | (32,079 | ) | (20,530,371 | ) | 912,975 | (19,617,396 | ) | |||||||||||||||

| Total assets | 119,939,092 | 39,297,116 | 175,343,915 | 1,903,319 | 336,483,442 | 16,927 | 336,500,369 | |||||||||||||||||||||

| Depreciation and amortization | 3,948,751 | 600,912 | 116,549 | — | 4,666,212 | — | 4,666,212 | |||||||||||||||||||||

| Capital expenditures | 936,598 | 142,529 | — | — | 1,079,127 | — | 1,079,127 | |||||||||||||||||||||

| Goodwill | — | — | 27,902,709 | — | 27,902,709 | — | 27,902,709 | |||||||||||||||||||||

* Certain common production overheads, operating and administrative expenses and asset items (mainly cash and certain office equipment) of bromine and crude salt segments in SCHC were split by reference to the average selling price and production volume of respective segment.

14

GULF RESOURCES, INC.

AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2019

(Expressed in U.S. dollars)

(UNAUDITED)

NOTE 15 – BUSINESS SEGMENTS – Continued

Nine -Month Period Ended September 30, 2019 | Bromine* | Crude Salt* | Chemical Products | Natural Gas | Segment Total | Corporate | Total | |||||||||||||||||||||