Gulf Resources, Inc.

99 Wengchang Road, Chenming Industrial Park,

Shouguang City, Shandong, China 262714

July 29, 2011

Terence O’Brien

Accounting Branch Chief

Division of Corporation Finance

Securities and Exchange Commission

100 F Street, N.E.

Washington, D.C. 20549

|

|

Re:

|

Gulf Resources, Inc.

|

Form 10-K for the Fiscal Year Ended December 31, 2011

Filed March 16, 2011

Definitive Proxy Statement on Schedule 14A

Filed April 29, 2011

Form 10-Q for the Fiscal Quarter Ended March 31, 2011

Filed May 16, 2011

File No. 1-34499

Dear Mr. O’Brien:

Gulf Resources, Inc. (“we” or the “Company”) is submitting this correspondence via Edgar in response to a comment letter issued by the Staff of the Securities and Exchange Commission (the “Commission”) on July 15, 2011 (the “Comment Letter”). In order to facilitate your review, we have restated and responded, to each of the comments set forth in the Staff’s Letter on a point-by-point basis. The numbered paragraphs set forth below correspond to the numbered paragraphs in the Staff’s Letter. We have included in this letter our responses to 29 of the Staff’s 63 comments. The Company intends to provide Staff with responses to the rest of Staff’s comments by August 31, 2011 and requests an extension until such date.

Form 10-K for the Fiscal Year Ended December 31, 2010

Item 1. Business, page 1

Our Corporate History, page 1

|

1.

|

We note your disclosure in the third paragraph on page two in which your state that your corporate structure is linear. Please tell us how you exercise effective control over your PRC operating subsidiaries in light of the restrictions on foreign investment in China. To the extent that you exercise control over your PRC operating subsidiaries through contractual arrangements, please include in future filings a separate section to describe your corporate structure. The disclosure should include a chart of your corporate structure and a description of such contractual arrangements. Please show us what your disclosure will look like in future filings.

|

Response to Comment 1:

|

|

The relevant PRC law restricting foreign investment in China, also know as the Rule on Mergers and Acquisitions of Domestic Enterprises by Foreign Investors (hereinafter “Circular 10”), were not effective until September 8, 2006 and does not have a retroactive effect on the foreign investment made before such effective date. Upper Class Group Limited, our subsidiary incorporated in the British Virgin Islands, acquired all the outstanding stock of Shouguang City Haoyuan Chemical Company Limited (“SCHC”) in May 2005, prior to the effective date of Circular 10. Therefore, we believe that such existing historical direct acquisition was not restricted by Circular 10 and that therefore, contractual arrangements were not necessary for the exercise of control over the subsidiaries.

|

|

|

Attached Exhibit A provides the proposed requested disclosure which we intend to include in future filings.

|

Item 1A. Risk Factors, page 10

General

|

3.

|

Please add a risk factor that includes the risks associated with the fact that you do not claim proven or probable reserves for your operations.

|

Response to Comment 3:

We intend to add the following risk factor to our future filings regarding this risk:

“Because we do not have any proven or probable reserves of brine water, we may not be able to continue to produce bromine and crude salt at existing levels in the future which could harm our business, results or operations and financial condition.

The SEC’s Industry Guide 7, which relates to businesses with mining operations such as ours defines “reserves” as: “that part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination.” In addition, Industry Guide 7 provides the following definitions with respect to the classification of reserves for mining companies:

2

· “Proven (Measured) Reserves” - Reserves for which (a) quantity is computed from dimensions revealed in outcrops, trenches, workings or drill holes; grade and/or quality are computed from the results of detailed sampling and (b) the sites for inspection, sampling and measurement are spaced so closely and the geologic character is so well defined that size, shape, depth and mineral content of reserves are well-established.

· “Probable (Indicated) Reserves” - Reserves for which quantity and grade and/or quality are computed form information similar to that used for proven (measure) reserves, but the sites for inspection, sampling, and measurement are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for proven (measured) reserves, is high enough to assume continuity between points of observation.

We do not have any proven or probable reserves of brine water on our mining properties. Therefore, we can not provide investors with any assurance that there will be adequate volume or concentration of brine water on our mining properities to continue our bromine and crude salt operations at existing levels or to expand our production capacity of bromine and crude salt. If we experience decreases in the volume and/or concentration of brine water we are able to extract from our mining properties, our business, results of operations and financial condition may be adversely affected.”

Conflicts, page 11

|

4.

|

In future filings, please revise the heading for this risk factor so that it adequately describes the risk. In addition, please revise the risk factor disclosure to better explain the potential or actual conflicts of interest, providing sufficient detail so that investors can fully understand the risks or potential risks associated with these relationships. In your response to this comment, please show us what your revised disclosure will look like.

|

Response to Comment 4:

We will make the following changes to our future filings:

“Mr. Ming Yang, our Chairman and a substantial shareholder, has potential conflicts of interest with us, which may adversely affect our business.

Mr. Ming Yang, our chairman, was a substantial owner of SCHC and SCYI before their acquisition by us, and remains, with the shares held by him, both individually and through Shandong Haoyuan Industry Group Ltd., and by his wife and son, Wenxiang Yu and Zhi Yang, a substantial owner of our securities. There may have been conflicts of interest between Mr. Yang and our Company as a result of such ownership interests. The terms on which we acquired SCHC and SCYI may have been different from those that would have been obtained if SCHC and SCYI were owned by unrelated parties. In addition, conflicts of interest between Mr. Yang’s dual roles as our shareholder and our director may arise. We cannot assure you that, when conflicts of interest arise, Mr. Yang will act in the best interests of the Company or that conflicts of interest will be resolved in our favor.

3

Currently, we do not have existing arrangements to address potential conflicts of interest between Mr. Yang and us. We rely on these Mr. Yang to abide by the laws of the State of Delaware, which provide that directors owe a fiduciary duty to the Company, and which require them to act in good faith and in the best interests of the Company, and not use their positions for personal gain. If we cannot resolve any conflicts of interest or disputes between us and Mr. Yang, we would have to rely on legal proceedings, which could result in disruption of our business and substantial uncertainty as to the outcome of any such legal proceedings. ”

Risks Related to Doing Business in the People’s Republic of China, page 12

|

5.

|

In future filings, please include a risk factor that discloses the risks associated with your holding company structure and your resulting indirect ownership of your PRC operating subsidiaries.

|

Response to Comment 5:

|

|

As described in our response to Comment 1 above, our current company structure does not include indirect ownership of any PRC operating subsidiaries. Therefore, we respectfully submit that the requested risk factor is not relevant to our corporate structure

|

|

6.

|

In future filings, please disclose whether your industry is an industry in which foreign investment is restricted or forbidden by the PRC government. To the extent that you are engaged in a restricted industry, please include a risk factor to adequately describe the risk to your company.

|

Response to Comment 6:

|

|

In our future filings, we will further clarify that Chinese laws and regulations currently do not prohibit or restrict foreign ownership in crude salt, bromine and brominated specialty chemicals businesses. For the future risks with this respect, we believe that our disclosure in “Risks Related to Doing Business in China” is adequate.

|

|

7.

|

We note that the PRC government exercises substantial control over virtually all sectors of China’s economy through regulation and state ownership. In future filings, please include a risk factor that discusses how the PRC government exerts substantial influence over how you conduct your business activities.

|

4

Response to Comment 7:

In our future filings, we will include the following risk factor:

We are subject to comprehensive regulation by the PRC legal system, which is uncertain. As a result, it may limit the legal protections available to you and us and we may not now be, or remain in the future, in compliance with PRC laws and regulations.

SCHC and SYCI, our PRC operating companis, are incorporated under and are governed by the laws of the PRC; all of our operations are conducted in the PRC; and our suppliers and customers are all located in the PRC. The PRC government exercises substantial control over virtually every sector of the PRC economy, including the production, distribution and sale of bromine, brominated chemical products and crude salt. In particular, we are subject to regulation by local and national branches of the Ministry of Land and Resources, as well as the State Administration of Foreign Exchange, and other regulatory bodies. In order to operate under PRC law, we require valid licenses, certificates and permits, which must be renewed from time to time. If we were to fail to obtain the necessary renewals for any reason, including sudden or unexplained changes in local regulatory practice, we could be required to shut down all or part of our operations temporarily or permanently.

SCHC and SYCI are subject to PRC accounting laws, which require that an annual audit be performed in accordance with PRC accounting standards. The PRC foreign-invested enterprise laws require that our subsidiary, SCHC, submit periodic fiscal reports and statements to financial and tax authorities and maintain its books of account in accordance with Chinese accounting laws. If PRC authorities were to determine that we were in violation of these requirements, we could lose our business license and be unable to continue operations temporarily or permanently.

The legal and judicial systems in the PRC are still rudimentary. The laws governing our business operations are sometimes vague and uncertain and enforcement of existing laws is inconsistent. Thus, we can offer no assurance that we are, or will remain, in compliance with PRC laws and regulations.

|

8.

|

We note your disclosure regarding the rates of inflation in the third paragraph under “Economic Reform Issues.” In future filings, please revise the title of the risk factor to adequately describe the risk to your company as it relates to the economic reforms. Also, please create a separate risk factor to discuss how fluctuations in exchange rates could adversely affect your business and the value of your securities.

|

5

Response to Comment 8:

In our future filings, we will revise the title of the risk factor to adequately describe the risk to our company as it relates to the economic reforms. In addition, in our future filings, we will add the following risk factor regarding fluctuations in exchange rates:

“Fluctuations in the value of the RMB may reduce the value of your investment.

The value of the RMB against the U.S. dollar and other currencies is affected by, among other things, changes in China's political and economic conditions and China's foreign exchange policies. The conversion of RMB into foreign currencies, including U.S. dollars, has been based on exchange rates set by the People's Bank of China. On July 21, 2005, the PRC government changed its decade-old policy of pegging the value of the RMB solely to the U.S. dollar. Under this revised policy, the RMB is permitted to fluctuate within a narrow and managed band against a basket of certain foreign currencies. Following the removal of the U.S. dollar peg, the RMB appreciated more than 20% against the U.S. dollar over the following three years. However, the People’s Bank of China regularly intervenes in the foreign exchange market to prevent significant short-term fluctuations in the exchange rate and achieve policy goals. For almost two years after July 2008, the RMB traded within a narrow range against the U.S. dollar. As a consequence, the RMB fluctuated significantly during that period against other freely traded currencies, in tandem with the U.S. dollar. In June 2010, the PRC government announced that it would increase RMB exchange rate flexibility. However, it remains unclear how this flexibility might be implemented. There remains significant international pressure on the PRC government to adopt a more flexible currency policy, which could result in a further and more significant appreciation of the RMB against the U.S. dollar.

Because substantially all of our revenues and expenditures are denominated in RMB and our cash is denominated in U.S. dollars, fluctuations in the exchange rate between the U.S. dollar and RMB will affect the relative purchasing power of such amounts and our balance sheet and earnings per share in U.S. dollars. In addition, we report financial results in U.S. dollars, and appreciation or depreciation in the value of the RMB relative to the U.S. dollar would affect our financial results reported in U.S. dollars terms without giving effect to any underlying change in our business or results of operations. Fluctuations in the exchange rate will also affect the relative value of earnings from and the value of any U.S. dollar-denominated investments we make in the future.

6

Very limited hedging transactions are available in China to reduce our exposure to exchange rate fluctuations. To date, we have not entered into any hedging transactions in an effort to reduce our exposure to foreign currency exchange risk. While we may decide to enter into hedging transactions in the future, the availability and effectiveness of these hedging transactions may be limited and we may not be able to successfully hedge our exposure at all. In addition, our currency exchange losses may be magnified by PRC exchange control regulations that restrict our ability to convert RMB into foreign currency.”

|

9.

|

Please tell us what consideration you have given to discussing whether, and if so, how you are impacted by SAFE Circular 75. In future filings, to the extent applicable, please include a risk factor to discuss how your ability to comply with the PRC regulations relating to the establishment of offshore special purpose companies by PRC residents may subject your PRC resident shareholders to personal liability, limit your ability to acquire PRC companies or to inject capital into your PRC subsidiaries, and limit their ability to distribute profits to you.

|

Response to Comment 9:

In our future filings, we intend to include the following risk factor.

Failure of our PRC resident shareholders to comply with regulations on foreign exchange registration of overseas investment by PRC residents could cause us to lose our ability to contribute capital to SCHC and remit profits out of the PRC as dividends.

The Notice on Relevant Issues Concerning Foreign Exchange Administration for Domestic Residents to Engage in Overseas Financing and Round Trip Investment via Overseas Special Purpose Vehicles (“Circular 75”), issued by the SAFE and effective on November 1, 2005, regulates the foreign exchange matters in relation to the use of a “special purpose vehicle” by PRC residents to seek offshore equity financing and conduct a ‘‘round trip investment’’ in China. Under Circular 75, a “special purpose vehicle” refers to an offshore entity directly established or indirectly controlled by PRC resident natural or legal persons (“PRC residents”) for the purpose of seeking offshore equity financing using assets or interests owned by such PRC residents in onshore companies, while “round trip investment” refers to the direct investment in China by such PRC residents through the “special purpose vehicles,” including, without limitation, establishing foreign-invested enterprises and using such foreign-invested enterprises to purchase or control onshore assets through contractual arrangements. Circular 75 requires that, before establishing or controlling a “special purpose vehicle”, PRC residents and PRC entities are required to complete a foreign exchange registration with the competent local branches of the SAFE for their overseas investments. After the completion of a round-trip investment or the overseas equity financing, the PRC residents are required to go through foreign exchange registration alteration formalities of overseas investment in respect of net assets of special purpose vehicles that such PRC residents hold and the variation thereof.

7

In addition, an amendment to the registration is required if there is a material change in the “special purpose vehicle,” such as increase or reduction of share capital and transfer of shares. Failure to comply with the registration procedures set forth in Circular 75 may result in restrictions on the foreign exchange activities of the relevant foreign-invested enterprises, including the payment of dividends and other distributions, such as proceeds from any reduction in capital, share transfer or liquidation, to its offshore parent or affiliate and the capital inflow from the offshore parent, and may also subject the relevant PRC residents to penalties under PRC foreign exchange administration regulations.

We have requested our current PRC resident shareholders and/or beneficial owners to disclose whether they or their shareholders or beneficial owners fall within the scope of the Circular 75 and urges PRC residents to register with the local SAFE branch as required under the Circular 75. Our affiliates subject to the SAFE registration requirements, including Mr. Ming Yang, our Chairman, Ms. Wenxiang Yu, the wife of Mr. Yang, and Mr. Zhi Yang, Mr. Yang’s son, have informed us that they have not made their initial registrations with SAFE. The failure of our PRC resident shareholders and/or beneficial owners to timely furnish or amend their SAFE registrations pursuant to the Circular 75 or the failure of our future shareholders and/or beneficial owners who are PRC residents to comply with the registration requirement set forth in the Circular 75 may subject such shareholders, beneficial owners and/or SCHC to fines and legal sanctions. Any such failure may also limit our ability to contribute additional capital into SCHC, limit SCHC’s ability to distribute dividends to us or otherwise adversely affect our business.

The PRC government could restrict access in the future to foreign currencies for current account transactions. If the foreign exchange control system prevents us from obtaining sufficient foreign currency to satisfy our currency demands, we may not be able to pay certain expenses as they come due.

|

10.

|

In future filings, please include a risk factor to disclose that you may be deemed as a “resident enterprise” of China under the Enterprise Income Tax Law and discuss the potential tax consequences such classification would cause to you and your non-PRC shareholders.

|

Response to Comment 10:

We intend to include the following risk factor in our future filings:

“We may be treated as a resident enterprise for PRC tax purposes under the currently effective EIT Law, which may subject us to PRC income tax on our taxable global income.

8

On March 16, 2007, the National People’s Congress approved and promulgated a new tax law, the PRC Enterprise Income Tax Law (“EIT Law”). On November 28, 2007, the PRC State Council passed the implementing rules of the EIT Law. Both the EIT Law and the implementing rules of the EIT Law took effect on January 1, 2008. Under the EIT Law, enterprises are classified as “resident enterprises” and “non-resident enterprises.” An enterprise established outside of China with “de facto management bodies” within China is considered a “resident enterprise,” meaning that it can be treated in a manner similar to a Chinese enterprise for enterprise income tax purposes. The implementing rules of the EIT Law define “de facto management bodies” as a managing body that in practice exercises “substantial and overall management and control over the production and operations, personnel, accounting, and properties” of the enterprise; however, it remains unclear whether the PRC tax authorities would deem our managing body as being located within China. Due to the short history of the EIT Law and lack of applicable legal precedents, the PRC tax authorities determine the PRC tax resident treatment of a foreign (non-PRC) company on a case-by-case basis.

If the PRC tax authorities determine that we are a “resident enterprise” for PRC enterprise income tax purposes, a number of PRC tax consequences could follow. First, we may be subject to the enterprise income tax at a rate of 25% on our global taxable income, as well as PRC enterprise income tax reporting obligations. Second, under the EIT Law and its implementing rules, dividends paid between “qualified resident enterprises” are exempt from enterprise income tax. It is unclear whether the dividends we receive will constitute dividends between “qualified resident enterprises” and would therefore qualify for tax exemption, because the definition of qualified resident enterprises is unclear and the relevant PRC governmental authorities have not yet issued guidance with respect to the processing of outbound remittances to entities that are treated as resident enterprises for PRC enterprise income tax purposes.

In addition to the uncertainty as to the application of the “resident enterprise” classification, there can be no assurance that the PRC governmental authorities will not amend or revise the taxation laws, rules and regulations to impose stricter tax requirements, higher tax rates or retroactively apply the EIT Law, or any subsequent changes in PRC tax laws, rules or regulations. If such changes occur and/or if such changes are applied retroactively, such changes could materially and adversely affect our results of operations and financial condition.”

We may issue shares of our capital stock or debt securities . . . , page 16

|

11.

|

We note your disclosure in the last paragraph regarding your significant indebtedness. Please tell us in detail your basis for this disclosure and provide us with a quantitative disclosure of your indebtedness as of the most practicable date. We note from you balance sheet that you have $14,035,830 in total liabilities, all of which are current liabilities.

|

9

Response to Comment 11:

As of March 31, 2011, we had $19.3 million in current liabilities and $87.9 million in cash. In light of our decision to file a withdrawal request on July 20, 2011 for our Registration Statement on Form S-3 (File No. 333-168591), we would consider deleting this risk factor from future filings until such time that we determine to pursue additional debt or equity financings..

|

35.

|

(Not applicable)

|

Consolidated Statements of Cash Flows, page F-8

|

36.

|

It appears from the title of your line item, allowance/(reversal of allowance) for obsolete and slow-moving inventories, that you reversed a previously recognized adjustment to your inventories during fiscal year 2009. Please provide us with a comprehensive explanation as to what the $9.2 million adjustment recognized during fiscal year 2009 represents. Please refer to ASC 330-10-S99-2 (SAB Topic 5:BB) for guidance.

|

Response to Comment 36:

We note that the reversal of allowance was for $9,182, not $9.2 million. It is the reversal of an impairment made in 2008. The Company made a general provision for the carrying value of inventory on hand at year end of December 31, 2008. In 2009, the inventory was sold at higher than cost. Therefore, the Company reversed the provision in 2009

(n) Reporting Currency and Translation, page F-12

|

40.

|

Please disclose and tell us the functional currency of the Gulf Resources, Inc., the parent company, in addition to the two operating subsidiaries in future filings.

|

Response to Comment 40:

The functional currency of Gulf Resources, Inc. is U.S. dollars and we confirm that we will include this disclosure, in addition to the functional currency of our two operating subsidiaries, in future filings.

Note 2 – Assets Acquisitions, page F-15

|

41.

|

We note that your acquisition of assets on January 7, 2009 and September 7, 2009 included the issuance of common stock in addition to cash. For the January 7, 2009 transaction, we note that you estimated the fair value of the shares of your common stock to be $1.64 per share. For the September 7, 2009 transaction, we note that you estimated the fair value of the shares of your common stock to be $5.12 per share. We further note that these per share prices significantly exceeded the closing price of your shares of common stock on the corresponding day. Finally, we note that the per share price of your common stock on January 7, 2009 was significantly less than the per share price of the shares of your common stock issued in connection with the settlement of $21.3 million in debt obligations on January 24, 2009, in which you did not recognize a gain on extinguishment. Please provide us with a comprehensive explanation as to how you determined the estimated fair value of your shares of common stock for these two asset acquisition transactions in light of the trading price of your shares of common stock on the respective dates.

|

10

Response to Comment 41:

|

|

On October 12, 2009, we completed a 1-for-4 reverse stock split of our common stock. On page F-10 of our Annual Report we disclose that all relevant share data have been adjusted retrospectively to reflect the stock split.

|

|

|

With respect to the January 7, 2009 acquisition, the closing price of our common stock on January 7, 2009 was $0.41 per share, or $1.64 per share taking into account the stock split. With respect to the September 7, 2009 acquisition, the closing stock price on September 7, 2009 was $1.28 per share, or $5.12 per share taking into account the stock split. Therefore, we believe that the estimated fair value determinations of our common stock for these two asset acquisitions were accurate.

|

Note 22 – Subsequent Events, page F-26

|

44.

|

We note your statement that there were no material subsequent events since December 31, 2010, that require disclosure. However, we note that you provided investors with a list of subsequent events that occurred subsequent to December 31, 2010, but prior to the filing of your Form 10-K in Exhibit 99.1 to your Form 8-K filed on March 17, 2011. Please confirm that you will provide investors the required disclosures in your future periodic reports, as required.

|

Response to Comment 44:

With respect to the Form 8-K filed on March 17, 2011, there were three subsequent events mentioned. The first was a lease agreement relating to property adjacent to our Factory No. 1. The details of this lease commitment was disclosed in Note 20 of the financial statements in our Form 10-K for the year ended December 31, 2010. The second event related to work performed by Deloite Touche Tohmatsu regarding our internal controls. We filed a Form 8-K on March, 4, 2011 disclosing this work and respectfully submit that such disclosure was not required by U.S. GAAP to be included in our Notes to consolidated financial statements in our 10-K. The third event related to a December 2010 acquisition of a crude salt field which was disclosed in Note 2 in our 10-K. Therefore, we respectfully submit that there were no items that should have been included as a subsequent events in our Notes to consolidated financial statements in the 10-K.

11

Item 9A. Controls and Procedures, page 39

|

45.

|

We note that in the last sentence you have qualified management’s conclusion with the phrase “in timely alerting it to material information to be disclosed in its periodic reports under the Exchange Act.” We also note your disclosure that your disclosure controls and procedures can provide only reasonable assurance. Please provide us with the conclusions of your principal executive and principal financial officers, without impermissible qualifying language, regarding the effectiveness of your disclosure controls and procedures (as defined in Rule 13a-15(e) or Rule 15d-15(e) under the Exchange Act), at the reasonable assurance level, as of the end of the period covered by the report, based on the evaluation of these controls and procedures required by paragraph (b) of Rule 13a-15 or Rule 15d-15 under the Exchange Act. In future filings, please prepare your disclosure accordingly.

|

Response to Comment 45:

|

|

We note Staff’s comment and provide the following revised conclusions of our principal executive and financial officers as of December 31, 2010:

|

Evaluation of Disclosure Controls and Procedure We maintain “disclosure controls and procedures”, as such term is defined under Exchange Act Rule 13a-15(e), that are designed to ensure that information required to be disclosed in our Exchange Act reports is recorded, processed, summarized, and reported within the time periods specified in the SEC’s rules and forms, and that such information is accumulated and communicated to our management, including our Chief Executive Officer and Chief Financial Officer, as appropriate, to allow timely decisions regarding required disclosures. In designing and evaluating the disclosure controls and procedures, our management recognized that any controls and procedures, no matter how well designed and operated, can provide only reasonable assurance of achieving the desired control objectives and in reaching a reasonable level of assurance our management necessarily was required to apply its judgment in evaluating the cost-benefit relationship of possible controls and procedures. We have carried out an evaluation as required by Rule 13a-15(d) under the supervision and with the participation of our management, including our Chief Executive Officer and Chief Financial Officer, of the effectiveness of the design and operation of our disclosure controls and procedures as of December 31, 2010. Based upon their evaluation and the identification of one material weakness in our internal control over financial reporting, as further discussed below under “Management’s Report on Internal Control over Financial Reporting”, the Chief Executive Officer and Chief Financial Officer concluded that, as of December 31, 2010, the Company did not maintain, in all material respect, effective disclosure controls and procedures.

12

Exhibit 31.1 and Exhibit 31.2

|

48.

|

We note that the identification of the certifying individual at the beginning of each certification required by Exchange Act Rule 13a-14(a) also includes the title of the certifying individuals. In future filings, the identification of the certifying individual at the beginning of each certification should be revised so as not to include the individual’s title. We also note that your certifications here and as filed with your Form 10-Q for the quarter ended March 31, 2011 alter the language in paragraph 4(d). Please use the exact form of the certification specified in Item 601(b)(31) of Regulation S-K. Generally, the only text within the form of the certification that may be changed is text that is contained within brackets in the form.

|

Response to Comment 48:

|

|

We note Staff’s comment and will make changes accordingly in our future filings.

|

Definitive Proxy Statement on Schedule 14A

Nominees of the Board of Directors, page 5

|

49.

|

In future filings, for each director or person nominated or chosen to become a director, briefly discuss the specific experience, qualifications, attributes or skills that led to the conclusion that the person should serve as a director for the registrant at the time that the disclosure is made, in light of the registrant's business and structure. See Item 401(e)(1) of Regulation S-K.

|

Response to Comment 49:

|

|

We note Staff’s comment and will make changes accordingly in our future filings.

|

|

50.

|

In future filings, please revise your disclosure of Mr. Liu’s business background to set forth only his business background experience. In this regard, we note your reference to Mr. Yang’s employment from 1992 to 1995 and 1998 to 1992. Please clarify to us whether this disclosure pertains to Mr. Yang or Mr. Liu.

|

Response to Comment 50:

We confirm that the reference to Mr. Yang in Mr. Liu’s biography was an error. The employment history referred to in your comment relates only to Mr. Liu.

13

Executive Compensation, page 10

Compensation Discussion and Analysis, page 10

Compensation Philosophy and Objectives, page 10

|

51.

|

We note your disclosure that your executives’ overall compensation is tied to your financial and operational performance, as measured by revenues and net income, and achievement of strategic goals. In future filings, please include quantitative disclosure of any revenue and net income corporate performance targets you used and discuss how achievement or nonachievement of those targets impacted the compensation awarded to each of your named executive officers.

|

Response to Comment 51:

|

|

We note Staff’s comment and will make changes accordingly in our future filings.

|

|

52.

|

We note your disclosure that you use competitive market data to determine each executive’s total compensation. In future filings, please disclose whether you engage in any benchmarking of total compensation or any material element of compensation, identifying the benchmark and, if applicable, its components. See Item 402(b)(2)(xiv) of Regulation SK.

|

Response to Comment 52:

|

|

We note Staff’s comment and will make changes accordingly in our future filings.

|

Elements of Our Executive Compensation Programs, page 11

Base Salary, page 11

|

53.

|

We note your disclosure that the Compensation Committee may adjust base salaries annually as needed. Your Summary Compensation Table disclosure shows that the base salary of your Chief Financial Officer increased significantly on a percentage basis (by approximately 65%). With a view towards future disclosure, please tell us to the reason for this increase.

|

Response to Comment 53:

|

|

As disclosed in “Our Corporate History” in the 10-K for the fiscal year ended December 31, 2010, our shares began trading on the NASDAQ Global Select Market on October 27, 2009. On December 21, 2009, we closed a private placement financing with institutional investors in the amount of $25 million. We believe that the increase of our Chief Financial Officer’s salary was commensurate with his increased responsibilities and workload as a result of these corporate events.

|

14

Equity Incentive Compensation, page 11

|

54.

|

In future filings, please describe the elements of individual performance or individual contribution the Compensation Committee considered in determining the amount of stock options to award to each named executive officer. See Item 402(b)(2)(vii) of Regulation SK.

|

Response to Comment 54:

|

|

We note Staff’s comment and will make changes accordingly in our future filings

|

Summary Compensation Table, page 12

|

55.

|

Please tell us why you included Ming Yang in the table. We note based on your disclosures that Mr. Yang does not appear to have been an executive officer during 2010. Please refer to Item 402(a)(3) of regulation S-K.

|

Response to Comment 55:

|

|

We mistakenly included Mr. Ming Yang in the table based on the fact that he held the position of Chief Executive Officer during 2008 and part of 2009. We note Staff’s comment and confirm that Mr. Ming Yang will not be included in the Summary Compensation table in our future filings.

|

|

56.

|

We note your disclosure that you provide unlimited reimbursement of any out-of-pocket expenses incurred by your named executive officers in connection with company activities. Please tell us your consideration of additional disclosure pursuant to Item 402(c)(2)(ix)(A) of Regulation S-K.

|

Response to Comment 56:

We have reviewed Item 402(c)(2)(ix) of Regulation S-K and confirm that none of the officers included in the Summary Compensation table received perquisites, other personal benefits or property equal to in the aggregate more than $10,000.

Certain Relationships and Related Transactions, page 16

|

59.

|

In future filings, please disclosure whether your policy is in writing, and if not, how your policies and procedures are evidenced. See Item 404(b)(1)(iv) of Regulation S-K.

|

Response to Comment 59:

|

|

We confirm that we have a written related party transaction policy and will include such disclosure in our future filings.

|

15

|

60.

|

Your Item 9A Form 10-K disclosure indicates that your auditor discovered that the transaction disclosed in this section was a related party transaction. Please note that you are required to identify any transaction that either did not require review, approval or ratification or where your policies and procedures were not followed. You have not stated that the listed related party transaction was not conducted in accordance with your policies and procedures. Please comply with Item 404(b)(2) of Regulation S-K in future filings.

|

Response to Comment 60:

|

|

We confirm that the transaction was not conducted in accordance with our policies and procedures. We will include such disclosure in our future filings.

|

Note 19 – Contingency, page 17

|

62.

|

We note your statement, “the Company’s management is currently unable to reasonably estimate the amount or range of possible losses that will result from the ultimate resolution of this matter.” Please note that a statement that you are unable to estimate the ultimate outcome does not sufficiently address your disclosure requirement, as the amount to be disclosed is a best estimate based on the available information prior to releasing your consolidated financial statements rather than an ultimate or known amount. To the extent that you continue to be unable to provide a reasonable estimate of the reasonably possible loss in excess of accrual, please clarify that you are unable to estimate this amount rather than the ultimate outcome. Please refer to ASC 450-20-50-4 and Question 2 to ASC 450-20-S99-1 for guidance.

|

Response to Comment 62:

We note Staff’s comment. We intend to re-evaluate this contingency in our future periodic filings and to the extent that we continue to be unable to provide a reasonable estimate of the reasonably possible loss in excess of accrual, we will clarify that we are unable to estimate such amount rather than the ultimate outcome.

16

Item 4. Controls and Procedures, page 24

|

63.

|

Based on your disclosure, it appears that management’s based its conclusion as to the ineffectiveness of your disclosure controls and procedures as of March 31, 2011 on the evaluation conducted by management for the period ended December 31, 2010, and it is unclear whether management conducted an evaluation for the quarter ended March 31, 2011. Please note that management is required to evaluate the effectiveness of your disclosure controls and procedures as of the end of each fiscal quarter. Please refer to Item 307 of Regulation S-K and Rule 13a-15(b) under the Securities Exchange Act of 1934, as amended. Please tell us whether management evaluated the effectiveness of your disclosure controls and procedures as of March 31, 2011. If such an evaluation occurred, please amend your March 31, 2011 quarterly report to provide the disclosure required by Item 307 of Regulation S-K. In addition, in your disclosure please address whether the material weakness still exists and any actions to you have actually taken to date to correct the material weakness. Finally, we note your disclosure that your internal controls over financial reporting did not change during the quarter ended March 31, 2011. In reaching this conclusion, please tell us what consideration to gave t any changes that may have been implemented to address your material weakness. To the extent that such changes occurred, please revise your disclosure accordingly.

|

Response to Comment 63:

|

|

We have attached the proposed revised disclosure for Item 4 of our Form 10-Q as Exhibit B to this letter.

|

We hereby acknowledge that:

|

|

·

|

the Company is responsible for the adequacy and accuracy of the disclosure in the filing;

|

|

|

·

|

staff comments or changes to disclosure in response to staff comments do not foreclose the Commission from taking any action with respect to the filing; and

|

|

|

·

|

the Company may not assert staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States.

|

Your prompt attention to this response letter would be greatly appreciated. Should you have any questions concerning any of the foregoing please contact Mr Eric Doering, Esq. our U.S. legal counsel at (212) 407-4214.

17

Sincerely,

Gulf Resources, Inc.

By : /s/ Xiaobin Liu

Name: Xiaobin Liu

Title: Chief Executive Officer

c.c. Mitchell S. Nussbaum, Esq.

Eric Doering, Esq.

18

Exhibit A

Our Corporate History

We were incorporated in Delaware on February 28, 1989. From November 1993 through August 2006, we were engaged in the business of owning, leasing and operating coin and debit card pay-per copy photocopy machines, fax machines, microfilm reader-printers and accessory equipment under the name “Diversifax, Inc.”. Due to the increased use of internet services, demand for our services declined sharply, and in August 2006, our Board of Directors decided to discontinue our operations.

Upper Class Group Limited, incorporated in the British Virgin Islands in July 2006, acquired all the outstanding stock of Shouguang City Haoyuan Chemical Company Limited ("SCHC"), a company incorporated in Shouguang City, Shandong Province, the People's Republic of China, in May 2005. At the time of the acquisition, members of the family of Mr. Ming Yang, our president and former chief executive officer, owned approximately 63.20% of the outstanding shares of Upper Class Group Limited. Since the ownership of Upper Class Group Limited and SCHC was then substantially the same, the acquisition was accounted for as a transaction between entities under common control, whereby Upper Class Group Limited recognized the assets and liabilities transferred at their carrying amounts.

On December 12, 2006, we, then known as Diversifax, Inc., a public "shell" company, acquired Upper Class Group Limited and SCHC. Under the terms of the agreement, the stockholders of Upper Class Group Limited received 13,250,000 (restated for the 2-for-1 stock split in 2007 and the 1-for-4 stock split in 2009) shares of voting common stock of Gulf Resources, Inc. in exchange for all outstanding shares of Upper Class Group Limited. Members of the Yang family received approximately 62% of our common stock as a result of the acquisition. Under accounting principles generally accepted in the United States, the share exchange is considered to be a capital transaction rather than a business combination. That is, the share exchange is equivalent to the issuance of stock by Upper Class Group Limited for the net assets of Gulf Resources, Inc., accompanied by a recapitalization, and is accounted for as a change in capital structure. Accordingly, the accounting for the share exchange is identical to that resulting from a reverse acquisition, except no goodwill is recorded. Under reverse takeover accounting, the post reverse acquisition comparative historical financial statements of the legal acquirer, Gulf Resources, Inc., are those of the legal acquiree, Upper Class Group Limited. Share and per share amounts stated have been retroactively adjusted to reflect the share exchange.

19

On February 5, 2007, we acquired Shouguang Yuxin Chemical Industry Co., Limited ("SYCI"), a company incorporated in the People's Republic of China, in October 2000. Under the terms of the acquisition agreement, the stockholders of SYCI received a total of 8,094,059 (restated for the 2-for-1 stock split in 2007 and the 1-for-4 stock split in 2009) shares of common stock of Gulf Resources, Inc. in exchange for all outstanding shares of SYCI's common stock. Simultaneously with the completion of the acquisition, a dividend of $2,550,000 was paid to the former stockholders of SYCI. At the time of the acquisition, approximately 49.1% of the outstanding shares of SYCI were owned by Ms. Yu, Mr. Yang’s wife, and the remaining 50.9% of the outstanding shares of SYCI were owned by SCHC, all of whose outstanding shares were owned by Mr. Yang and his wife. Since the ownership of Gulf Resources, Inc. and SYCI are substantially the same, the acquisition was accounted for as a transaction between entities under common control, whereby Gulf Resources, Inc. recognized the assets and liabilities of SYCI at their carrying amounts. Share and per share amounts have been retroactively adjusted to reflect the acquisition.

To satisfy certain ministerial requirements necessary to confirm certain government approvals required in connection with the acquisition of SCHC by Upper Class Group Limited, all of the equity interest of SCHC were transferred to a newly formed Hong Kong corporation named Hong Kong Jiaxing Industrial Limited (“Hong Kong Jiaxing”) all of the outstanding shares of which are owned by Upper Class Group Limited. The transfer of all of the equity interest of SCHC to Hong Kong Jiaxing received approval from the local State Administration of Industry and Commerce on December 10, 2007.

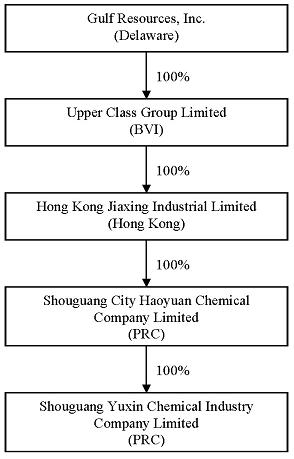

As a result of the transactions described above, our corporate structure is linear. That is Gulf Resources owns 100% of the outstanding shares of Upper Class Group Limited, which owns 100% of the outstanding shares of Hong Kong Jiaxing, which owns 100% of the outstanding shares of SCHC, which owns 100% of the outstanding shares of SYCI. Further, as a result of our acquisitions of SCHC and SYCI, our historical financial statements, as contained in our Condensed Consolidated Financial Statements and Management's Discussion and Analysis, appearing elsewhere in the report, reflect the accounts of SCHC and SYCI.

In January 2007, stockholders holding approximately 62% of the then outstanding shares of our common stock consented in writing to change our corporate name from Diversifax, Inc. to Gulf Resources, Inc. On February 20, 2007, we changed our corporate name to Gulf Resources, Inc.

On November 28, 2007, we amended our certificate of incorporation to increase our authorized shares of common stock from 70,000,000 to 400,000,000 and to effect a 2-for-1 forward stock split of our outstanding shares of common stock.

On October 12, 2009 we completed a 1-for-4 reverse stock split of our common stock, such that for each four shares outstanding prior to the stock split there was one share outstanding after the reverse stock split. All shares of common stock referenced in this report have been adjusted to reflect the stock split figures. On October 27, 2009 our shares began trading on the NASDAQ Global Select Market under the ticker symbol “GFRE” and on June 30, 2011 we changed our ticker symbol to “GURE” to better reflection of our corporate name.

20

Our current corporate structure chart is set forth in the following diagram:

Our executive offices are located in China at Chenming Industrial Park, Shouguang City, Shandong, People's Republic of China. Our telephone number is +86 (536) 5670008. Our website address is www.gulfresourcesinc.cn. The information contained on or accessed through our website is not intended to constitute and shall not be deemed to constitute part of this Form 10-K.

21

Exhibit B

Item 4. Controls and Procedures

(a) Evaluation of Disclosure Controls and Procedures

We maintain disclosure controls and procedures (as such term is defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) that are designed to ensure that information required to be disclosed in our reports filed pursuant to the Exchange Act is recorded, processed, summarized and reported within the time periods specified in the SEC’s rules, regulations and related forms, and that such information is accumulated and communicated to our management, including our Chief Executive Officer (“CEO”) and Chief Financial Officer (“CFO”), as appropriate, to allow timely decisions regarding required disclosure.

Under the supervision and with the participation of our management, including our CEO and CFO, we conducted an evaluation of the effectiveness of the design and operation of our disclosure controls and procedures as of the end of the period covered by this report. Based on this evaluation, our CEO and CFO concluded that as of March 31, 2011, our disclosure controls and procedures were not effective.

(b) Changes in internal controls.

To remediate the material weaknesses disclosed in our Annual Report on Form 10-K for the year ended December 31, 2010, related to related party transaction, we have implemented the following steps to improve our disclosure controls and procedures in relation to related party transaction disclosure requirements:

|

l

|

At beginning of each year, all employees, officers and directors are now required to sign a declaration of interest questionnaire to identify any possible conflict of interests with the Company and confirm that they have read the relevant Company’s policies. For each interim period, all officers and directors are required to provide written confirmation concerning representation of any related party transactions with the Company.

|

|

l

|

Starting from the second quarter of 2011, before accepting a new supplier, customer or a cooperative partner, we have carried out acceptance procedures to review the business reputation, the relationship of shareholders, officers and directors from each party as part of our internal control procedures to identify any related-party relationship. The acceptance form will be approved and signed by Company’s management before doing business with the new supplier, customer or the cooperative partner.

|

Except as described above, there have been no changes in our internal controls over financial reporting (as defined in Rule 13a-15(f) and 15d-15(f) under the Exchange Act of 1934) during the three months ended March 31, 2011 that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

22