Mutual Funds | | | Equity | | | 1.31.2019 | ||||

Guggenheim Funds Summary Prospectus | ||||||||

January 31, 2019, as supplemented February 4, 2019 | ||||||||

Class A, Class C, Institutional and Class P | ||||||||

Ticker Symbol | Fund Name | |||

Class A | Class C | Institutional | Class P | |

SEQAX | SFGCX | SEWIX | SEQPX | Guggenheim World Equity Income Fund |

Before you invest, you may wish to review the Fund’s Prospectus, which contains more information about the Fund and its risks. You may obtain the Prospectus and other information about the Fund, including the Statement of Additional Information (SAI) and most recent reports to shareholders, at no cost by visiting guggenheiminvestments.com/services/prospectuses-and-reports, calling 800.820.0888 or e-mailing services@guggenheiminvestements.com. The Fund’s Prospectus and SAI, both dated January 31, 2019, as revised from time to time, and the Fund’s most recent shareholder reports, are incorporated by reference into this Summary Prospectus.

Beginning on January 1, 2021, paper copies of the Fund’s annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change, and you need not take any action. At any time, you may elect to receive reports and other communications from the Fund electronically by calling 800.820.0888 or going to guggenheiminvestments.com/myaccount or contacting your financial intermediary.

You may elect to receive all future shareholder reports in paper free of charge. If you hold shares of the Fund directly, you can inform the Fund that you wish to receive paper copies of reports by calling 800.820.0888. If you hold shares of the Fund through a financial intermediary, please contact the financial intermediary to make this election. Your election to receive reports in paper will apply to all Guggenheim Funds in which you are invested and may apply to all funds held with your financial intermediary.

SUMMEEW-0219x0120 | guggenheiminvestments.com |

Guggenheim World Equity Income Fund

INVESTMENT OBJECTIVE

The Guggenheim World Equity Income Fund (the “Fund”) seeks to provide total return, comprised of capital appreciation and income.

FEES AND EXPENSES OF THE FUND

This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. You may be required to pay a commission to your financial intermediary for effecting transactions in a class of shares of the Fund without any initial sales charge, contingent deferred sales charge, or other asset-based fee for sales or distribution. These commissions are not reflected in the fee and expense table or expense example below. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $100,000 in the Family of Funds, as defined on page 147 of the Fund’s prospectus. This amount may vary depending on the Guggenheim Fund in which you invest. More information about these and other discounts is available from your financial professional and in the “Sales Charges-Class A Shares” section on page 101 of the Fund’s prospectus and the “How to Purchase Shares” section on page 80 of the Fund’s Statement of Additional Information. Different intermediaries and financial professionals may impose different sales charges or offer different sales charge waivers or discounts. These variations are described in Appendix A to the Fund’s prospectus (Intermediary-Specific Sales Charge Waivers and Discounts).

Class A | Class C | Institutional Class | Class P | |

SHAREHOLDER FEES (fees paid directly from your investment) | ||||

Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) | 4.75% | None | None | None |

Maximum Deferred Sales Charge (Load) (as a percentage of original purchase price or redemption proceeds, whichever is lower) | None* | 1.00%** | None | None |

* | A 1.00% deferred sales charge will normally be imposed on purchases of $1,000,000 or more on Fund shares purchased without an initial sales charge that are redeemed within 12 months of purchase. |

** | A 1.00% deferred sales charge will be imposed if Fund shares are redeemed within 12 months of purchase. |

ANNUAL FUND OPERATING EXPENSES (expenses that you pay each year as a percentage of the value of your investment) | ||||

Management Fees | 0.70% | 0.70% | 0.70% | 0.70% |

Distribution and Service (12b-1) Fees | 0.25% | 1.00% | None | 0.25% |

Other Expenses | 0.42% | 0.48% | 0.32% | 0.45% |

Total Annual Fund Operating Expenses | 1.37% | 2.18% | 1.02% | 1.40% |

Fee Waiver (and/or expense reimbursement)1 | -0.15% | -0.21% | -0.05% | -0.18% |

Total Annual Fund Operating Expenses After Fee Waiver (and/or expense reimbursement) | 1.22% | 1.97% | 0.97% | 1.22% |

1 | Total Annual Fund Operating Expenses After Fee Waiver (and/or expense reimbursement) have been restated to reflect the current expense limitation agreement. Security Investors, LLC, also known as Guggenheim Investments (the "Investment Manager"), has contractually agreed through February 1, 2020 to waive fees and/or reimburse expenses to the extent necessary to limit the ordinary operating expenses (including distribution (12b-1) fees (if any), but exclusive of brokerage costs, dividends on securities sold short, acquired fund fees and expenses, interest, taxes, litigation, indemnification, and extraordinary expenses) (“Operating Expenses”) of the Fund to the annual percentage of average daily net assets for each class of shares as follows: Class A-1.22%, Class C-1.97%, Institutional Class-0.97%, and Class P-1.22%. The Investment Manager is entitled to reimbursement by the Fund of fees waived or expenses reimbursed during any of the previous 36 months beginning on the date of the expense limitation agreement, provided that the Operating Expenses do not exceed the then-applicable expense cap. The agreement will expire when it reaches its termination or when the Investment Manager ceases to serve as such and it can be terminated by the Fund’s Board of Trustees, with certain waived fees and reimbursed expenses subject to the recoupment rights of the Investment Manager. |

EXAMPLE

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds.

The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although the actual costs may be higher or lower, based on these assumptions your costs would be:

2 | SUMMARY PROSPECTUS

Class A | Class C | Institutional | Class P | ||

Redeemed | Not Redeemed | ||||

1 Year | $593 | $300 | $200 | $99 | $124 |

3 Years | $874 | $662 | $662 | $320 | $425 |

5 Years | $1,176 | $1,150 | $1,150 | $558 | $749 |

10 Years | $2,031 | $2,497 | $2,497 | $1,243 | $1,664 |

The above Example reflects applicable contractual fee waiver/expense reimbursement arrangements for the current duration of the arrangements only.

PORTFOLIO TURNOVER

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 125% of the average value of its portfolio.

PRINCIPAL INVESTMENT STRATEGIES

Under normal circumstances, the Fund will invest at least 80% of its assets (net assets, plus the amount of any borrowings for investment purposes) in equity securities. Generally, the Fund intends to invest in higher dividend-yielding equity securities. The Fund is not limited in the percentage of assets it may invest in securities listed, traded or dealt in any one country, region or geographic area and it may invest in a number of countries throughout the world, including emerging markets.

While the Fund tends to focus its investments in equity securities of large- and mid-capitalization companies, it can also invest in equity securities of companies that represent a broad range of market capitalizations and will not be constrained by capitalization limits. At times, the Fund may thus invest a significant portion of its assets in small- and mid-capitalization companies. The equity securities in which the Fund may invest include, but are not limited to, common stock, preferred stock, American Depositary Receipts (“ADRs”), Global Depositary Receipts (“GDRs”), American Depositary Shares (“ADS”), convertible securities and warrants and rights. The Fund invests in securities denominated in a wide variety of currencies.

The Fund may invest in a variety of investment vehicles, such as exchange-traded funds (“ETFs”) and other mutual funds to manage its cash position, or to gain exposure to the equity markets or a particular sector of the equity markets. These investments may be more liquid than investing directly in individual issuers.

The Fund may also hold up to 20% of its assets (net assets, plus the amount of any borrowing for investment purposes) in non-equity securities of foreign or U.S. issuers.

While the Fund generally does not intend to usually hold a significant portion of its assets in derivatives, the Fund may invest in derivatives, consisting of forwards, options, swaps and futures contracts (some of these instruments may be traded in the over-the-counter market) in order to maintain exposure to the securities and currency markets at times when it is unable to purchase the corresponding securities and currencies directly, or it believes that it is more appropriate to use derivatives to obtain the desired exposure to the underlying assets. Further, the Fund may seek to reduce the Fund's foreign currency exposure associated with its foreign investments by engaging in transactions and derivatives designed to hedge against adverse movements in foreign currencies, including forward foreign currency contracts, spot market transactions, currency futures, and options. At times, the Fund may engage in extensive foreign currency hedging transactions.

Security Investors, LLC, also known as Guggenheim Investments (the “Investment Manager”), will actively manage the Fund’s portfolio while utilizing quantitative analysis to forecast risk. The Investment Manager’s goal will be to construct a well diversified portfolio comprised of securities that have historically demonstrated low volatility in their returns and that collectively have the ability to provide dividend yields in excess of the Fund’s benchmark, the MSCI World Index (Net) ("MSCI Index"). In selecting investments, the Investment Manager will consider the dividend yield potential of each security, the historic volatility of each security, the correlation between securities, trading liquidity and market capitalization, among other factors or security characteristics. The Investment Manager also may consider transaction costs and overall exposures to countries, sectors and stocks. While the portfolio may be comprised of a large portion of securities that are included within the MSCI Index, a broad-based index that captures large- and mid-cap representations across a large number of developed markets countries globally, the Fund will also invest in securities that are not included in the MSCI Index. The Investment Manager may determine to sell a

SUMMARY PROSPECTUS | 3

security for several reasons including the following: (1) better investment opportunities are available; (2) to meet redemption requests; (3) to close-out or unwind derivatives transactions; (4) to realize gains; or (5) if market conditions change.

The Fund may invest in a limited number of industries or industry sectors, including the technology and financial sectors.

Under adverse or unstable market conditions or abnormal circumstances, the Fund could invest some or all of its assets in cash, derivatives, fixed-income instruments, government bonds, money market instruments, repurchase agreements or securities of other investment companies. The Fund may be unable to pursue or achieve its investment objective during that time and temporary investments could reduce the benefit from any upswing in the market.

PRINCIPAL RISKS

The value of an investment in the Fund will fluctuate and is subject to investment risks, which means investors could lose money. An investment in the Fund is not a bank deposit and is not insured or guaranteed by the FDIC or any governmental agency. There is no assurance that the Fund will achieve its investment objective. The principal risks of investing in the Fund are summarized below.

Capitalization Securities Risk—The Fund may have significant exposure to securities in a particular capitalization range, e.g., large-, mid- or small-cap securities. As a result, the Fund may be subject to the risk that the pre-dominate capitalization range may underperform other segments of the equity market or the equity market as a whole.

Convertible Securities Risk—Convertible securities may be subordinate to other securities. The total return for a convertible security depends, in part, upon the performance of the underlying security into which it can be converted. The value of convertible securities tends to decline as interest rates increase. Convertible securities generally offer lower interest or dividend yields than non-convertible securities of similar quality.

Counterparty Credit Risk—The Fund makes investments in financial instruments and over-the-counter ("OTC")-traded derivatives involving counterparties to gain exposure to a particular group of securities, index, asset class or other reference asset without actually purchasing those securities or investments, to hedge a position, or for other investment purposes. Through these investments and related arrangements (e.g., prime brokerage or securities lending arrangements or derivatives transactions), the Fund is exposed to credit risks that the counterparty may be unwilling or unable to make timely payments or otherwise to meet its contractual obligations. If the counterparty becomes bankrupt or defaults on (or otherwise becomes unable or unwilling to perform) its payment or other obligations to the Fund, the Fund may not receive the full amount that it is entitled to receive or may experience delays in recovering the collateral or other assets held by, or on behalf of, the counterparty. If this occurs, the value of your shares in the Fund will decrease.

Credit Risk—The Fund could lose money if the issuer or guarantor of a fixed-income instrument or a counterparty to a derivatives transaction or other transaction is unable or unwilling, or perceived to be unable or unwilling, to pay interest or repay principal on time or defaults. The issuer, guarantor or counterparty could also suffer a rapid decrease in credit quality rating, which would adversely affect the volatility of the value and liquidity of the instrument. Credit ratings may not be an accurate assessment of liquidity or credit risk.

Currency Risk—Indirect and direct exposure to foreign currencies subjects the Fund to the risk that those currencies will decline in value relative to the U.S. Dollar, which would cause a decline in the U.S. value of the holdings of the Fund. Currency rates in foreign countries may fluctuate significantly over short periods of time for a number of reasons, including changes in interest rates and the imposition of currency controls or other political, economic and tax developments in the U.S. or abroad. The Fund's foreign currency hedging transactions and techniques may not be effective and, in certain cases, may adversely affect the Fund. In addition, the Fund’s ability to engage in these transactions and techniques may be limited under certain circumstances.

Depositary Receipt Risk—The Fund may hold the securities of non-U.S. companies in the form of depositary receipts. The underlying securities of the depositary receipts in the Fund’s portfolio are subject to fluctuations in foreign currency exchange rates that may affect the value of the Fund’s portfolio. In addition, the value of the securities underlying the depositary receipts may change materially when the U.S. markets are not open for trading. Investments in the underlying foreign securities also involve political and economic risks distinct from those associated with investing in the securities of U.S. issuers.

Derivatives Risk—Derivatives may pose risks in addition to and greater than those associated with investing directly in securities, currencies or other investments, including risks relating to leverage, imperfect correlations with underlying investments or the Fund’s other portfolio holdings, high price volatility, lack of availability, counterparty credit, liquidity, valuation and legal restrictions. Their use is a highly specialized activity that involves investment techniques and risks different from those associated with ordinary portfolio securities transactions. The use of

4 | SUMMARY PROSPECTUS

derivatives may result in leverage, which may cause the Fund to be more volatile and riskier than if it had not been leveraged. If the Investment Manager is incorrect about its expectations of market conditions, the use of derivatives could also result in a loss, which in some cases may be unlimited. In addition, the Fund’s use of derivatives may cause the Fund to realize higher amounts of short term capital gains (generally taxed at ordinary income tax rates) than if the Fund had not used such instruments. Some of the derivatives in which the Fund invests may be traded (and privately negotiated) in the OTC market. OTC derivatives are subject to heightened credit, liquidity and valuation risks.

Dividend-Paying Stock Risk—As a category, dividend-paying stocks may underperform non-dividend paying stocks (and the stock market as a whole) over any period of time. In addition, issuers of dividend-paying stocks may have discretion to defer or stop paying dividends for a stated period of time. If the dividend-paying stocks held by the Fund reduce or stop paying dividends, the Fund’s ability to generate income may be adversely affected.

Emerging Markets Risk—Investments in or exposure to emerging markets are generally subject to a greater level of those risks associated with investing in or being exposed to developed foreign markets, as emerging markets are considered to be less developed than developing countries. Furthermore, investments in or exposure to emerging markets are generally subject to additional risks, including the risks associated with trading in smaller markets, lower volumes of trading, and being subject to lower levels of government regulation and less extensive accounting, financial and other reporting requirements.

Equity Securities Risk—Equity securities include common stocks and other equity and equity-related securities (and securities convertible into stocks). The prices of equity securities generally fluctuate in value more than fixed-income investments, may rise or fall rapidly or unpredictably and may reflect real or perceived changes in the issuing company’s financial condition and changes in the overall market or economy. A decline in the value of equity securities held by the Fund will adversely affect the value of your investment in the Fund. Common stocks generally represent the riskiest investment in a company and dividend payments (if declared) to preferred stockholders generally rank junior to payments due to a company’s debtholders. The Fund may lose a substantial part, or even all, of its investment in a company’s stock.

Foreign Securities and Currency Risk—Foreign securities carry unique or additional risks when compared to U.S. securities, including currency fluctuations, adverse political and economic developments, unreliable or untimely information, less liquidity and more volatility, limited legal recourse and higher transactional costs.

Geographic Focus Risk—Asia. Because the Fund may focus its investments in Asia, the Fund’s performance may be particularly susceptible to adverse social, political and economic conditions or events within Asia. As a result, the Fund’s performance may be more volatile than the performance of a more geographically diversified fund.

Geographic Focus Risk—Europe. Because the Fund may focus its investments in Europe, the Fund’s performance may be particularly susceptible to adverse social, political and economic conditions or events within Europe. As a result, the Fund’s performance may be more volatile than the performance of a more geographically diversified fund.

Interest Rate Risk—Investments in fixed-income instruments and other debt instruments are subject to the possibility that interest rates could rise sharply, which may cause the value of the Fund’s holdings and share price to decline. The risks associated with rising interest rates are heightened given the recent near historically low interest rate environment and, as of the date of this prospectus, increasing interest rate environment. Interest rates may continue to rise in the future, possibly suddenly and significantly, with unpredictable effects on the financial markets and the Fund’s investments. Fixed-income instruments with longer durations are subject to more volatility than those with shorter durations. During periods of rising interest rates, because changes in interest rates on adjustable rate securities may lag behind changes in market rates, the value of such securities may decline until their interest rates reset to market rates. During periods of declining interest rates, because the interest rates on adjustable rate securities generally reset downward, their market value is unlikely to rise to the same extent as the value of comparable fixed rate securities.

Investment in Investment Vehicles Risk—Investing in other investment vehicles, including ETFs, closed-end funds and other mutual funds, subjects the Fund to those risks affecting the investment vehicle, including the possibility that the value of the underlying securities held by the investment vehicle could decrease or the portfolio becomes illiquid. Moreover, the Fund and its shareholders will incur its pro rata share of the underlying vehicles’ expenses, which will reduce the Fund’s performance. In addition, investments in an ETF are subject to, among other risks, the risk that the ETF's shares may trade at a discount or premium relative to the net asset value of the shares and the listing exchange may halt trading of the ETF's shares.

Liquidity and Valuation Risk—It may be difficult for the Fund to purchase and sell particular investments within a reasonable time at a fair price, or the price at which it has been valued by the Investment Manager for purposes of the Fund’s net asset value, causing the Fund to be less liquid and unable to realize what the Investment Manager

SUMMARY PROSPECTUS | 5

believes should be the price of the investment. Valuation of portfolio investments may be difficult, such as during periods of market turmoil or reduced liquidity, and for investments that may, for example, trade infrequently or irregularly. In these and other circumstances, an investment may be valued using fair value methodologies, which are inherently subjective, reflect good faith judgments based on available information and may not accurately estimate the price at which the Fund could sell the investment at that time. These risks may be heightened for fixed-income instruments because of the near historically low interest rate environment as of the date of this prospectus.

Management Risk—The Fund is actively managed, which means that investment decisions are made based on investment views. There is no guarantee that the investment views will produce the desired results or expected returns, causing the Fund to fail to meet its investment objective or underperform its benchmark index or funds with similar investment objectives and strategies. Furthermore, active and frequent trading that can accompany active management, also called “high turnover,” may have a negative impact on performance. Active and frequent trading may result in higher brokerage costs or mark-up charges, which are ultimately passed on to shareholders of the Fund. Active and frequent trading may also result in adverse tax consequences.

Market Risk—The value of, or income generated by, the securities held by the Fund may fluctuate rapidly and unpredictably as a result of factors affecting individual companies or changing economic, political, social or financial market conditions throughout the world. The performance of these investments may underperform the general securities markets or other types of securities.

Preferred Securities Risk—A company’s preferred stock generally pays dividends only after the company makes required payments to holders of its bonds and other debt. For this reason, the value of preferred stock will usually react more strongly than bonds and other debt to actual or perceived changes in the company’s financial condition or prospects.

Regulatory and Legal Risk—U.S. and non-U.S. governmental agencies and other regulators regularly implement additional regulations and legislators pass new laws that affect the investments held by the Fund, the strategies used by the Fund or the level of regulation or taxation applying to the Fund (such as regulations related to investments in derivatives and other transactions). These regulations and laws impact the investment strategies, performance, costs and operations of the Fund or taxation of shareholders.

Sector Emphasis Risk-Financial Sector Risk—The financial sector can be significantly affected by changes in interest rates, government regulation, the rate of defaults on corporate, consumer and government debt, the availability and cost of capital, and the impact of more stringent capital requirements. The Fund may be adversely affected by events or developments negatively impacting the financial sector or issuers within the financial sector, including banks.

Sector Emphasis Risk-Technology Stocks Risk—Stocks of companies involved in the technology sector, including information technology companies, may be very volatile. The Fund may be adversely affected by events or developments negatively impacting the technology sector or issuers within the technology sector.

PERFORMANCE INFORMATION

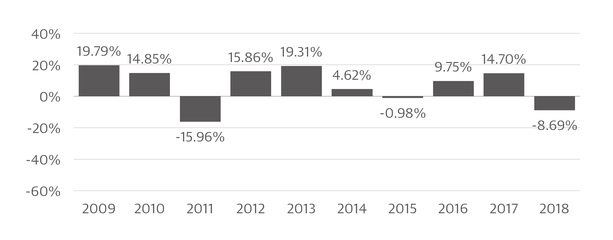

The following chart and table provide some indication of the risks of investing in the Fund by showing the Fund’s Class A share calendar year performance from year to year and average annual returns for the one, five and ten year or since inception periods (if shorter), as applicable, for the Fund’s Class A, Class C, Institutional Class, and Class P shares compared to those of a broad measure of market performance. As with all mutual funds, past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. Updated performance information is available on the Fund’s website at www.guggenheiminvestments.com or by calling 800.820.0888.

Effective August 15, 2013, certain changes were made to the Fund’s investment objective, principal investment strategies and portfolio management team. Performance prior to that date, as well as prior to April 29, 2011, was achieved when the Fund had a different investment objective and used different strategies.

The bar chart does not reflect the impact of the sales charge applicable to Class A shares which, if reflected, would lower the returns shown.

6 | SUMMARY PROSPECTUS

Highest Quarter Return Q2 2009 15.19% | Lowest Quarter Return Q3 2011 -18.28% | |

AVERAGE ANNUAL TOTAL RETURNS (for the periods ended December 31, 2018)

After-tax returns shown in the table are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of any state or local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts (“IRAs”). After-tax returns are shown for Class A only. After-tax returns for Class C, Institutional Class, and Class P will vary. The returns shown below reflect applicable sales charges, if any.

Inception | 1 Year | 5 Years or Since Inception | 10 Years or Since Inception | |

Class A | 10/1/1993 | |||

Return Before Taxes | -13.04% | 2.55% | 6.01% | |

Return After Taxes on Distributions | -13.97% | 1.47% | 5.29% | |

Return After Taxes on Distributions and Sale of Fund Shares | -7.55% | 1.49% | 4.48% | |

Class C | 1/29/1999 | -10.25% | 2.78% | 5.85% |

Institutional Class | 5/2/2011 | -8.46% | 3.83% | 3.63% |

Class P | 5/1/2015 | -8.69% | 2.83% | N/A |

Index | ||||

MSCI World Index (Net) (reflects no deductions for fees, expenses or taxes, except foreign withholding taxes)1 | -8.71% | 4.56% | 9.67% | |

1 | The MSCI World Index (Net) returns reflect reinvested dividends net of foreign withholding taxes, but reflect no deductions for fees, expenses or other taxes. The returns are calculated by applying withholding rates applicable to non-resident persons who do not benefit from double taxation treaties. Withholding rates applicable to the Fund may be lower. |

MANAGEMENT OF THE FUND

Security Investors, LLC, also known as Guggenheim Investments, serves as the investment manager of the Fund. Farhan Sharaff, Evan Einstein and Jayson B. Flowers are portfolio managers of the Fund. The portfolio managers hold the titles of Assistant Chief Investment Officer, Equities, Senior Managing Director and Portfolio Manager; Director and Portfolio Manager; and Senior Managing Director and Portfolio Manager, respectively, with the Investment Manager. Messrs. Sharaff and Einstein are primarily responsible for the day-to-day management of the Fund. Mr. Sharaff has co-managed the Fund since 2013. Messrs. Flowers and Einstein have co-managed the Fund since 2017.

SUMMARY PROSPECTUS | 7

PURCHASE AND SALE OF FUND SHARES

You may purchase or redeem Fund shares through your broker/dealer, other financial intermediary that has an agreement with Guggenheim Funds Distributors, LLC, the Fund’s distributor, or, for shares of each class other than Class P shares, through the Fund’s transfer agent. You may purchase, redeem or exchange shares of any class of the Fund on any day the New York Stock Exchange is open for business. The minimum initial investment for Class A and Class C shares is $2,500. The minimum subsequent investment is $100. Class A and Class C do not have a minimum account balance.

The Institutional Class minimum initial investment is $2 million, although the Investment Manager may waive this requirement at its discretion. The Institutional Class has a minimum account balance of $1 million. Due to the relatively high cost of maintaining accounts below the minimum account balance, the Fund reserves the right to redeem shares if an account balance falls below the minimum account balance for any reason. Investors will be given 60 days' notice to reestablish the minimum account balance. If the account balance is not increased, the account may be closed and the proceeds sent to the investor. Institutional Class shares of the Fund will be redeemed at net asset value on the day the account is closed.

Class P shares of the Fund are offered through broker/dealers and other financial intermediaries with which Guggenheim Funds Distributors, LLC has an agreement for the use of Class P shares of the Fund in investment products, programs or accounts. Class P shares do not have a minimum initial investment amount, subsequent investment amount or a minimum account balance. The Fund reserves the right to modify its minimum investment amount and account balance requirements at any time, with or without prior notice to you.

TAX INFORMATION

Fund distributions are taxable as ordinary income or capital gains (or a combination of both), unless your investment is through an IRA or other tax-advantaged retirement account. Investments through tax-advantaged accounts may sometimes become taxable upon withdrawal.

PAYMENTS TO BROKER/DEALERS AND OTHER FINANCIAL INTERMEDIARIES

If you purchase Fund shares through a broker/dealer or other financial intermediary, the Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker/dealer or other intermediary and your sales person to recommend the Fund over another investment. Ask your sales person or visit your financial intermediary’s website for more information.

8 | SUMMARY PROSPECTUS