Mutual Funds | | | Fixed-Income | | | 1.28.2015 | ||||

Guggenheim Funds Summary Prospectus | ||||||||

January 28, 2015, as supplemented May 1, 2015 | ||||||||

Class A, Class C and Institutional | ||||||||

Ticker Symbol | Fund Name | ||

Class A | Class C | Institutional | |

GIFAX | GIFCX | GIFIX | Guggenheim Floating Rate Strategies Fund |

Before you invest, you may wish to review the Fund’s Prospectus, which contains more information about the Fund and its risks. You may obtain the Prospectus and other information about the Fund, including the Statement of Additional Information (SAI) and most recent reports to shareholders, at no cost by visiting guggenheiminvestments.com/services/prospectuses-and-reports, calling 800.820.0888 or e-mailing services@guggenheiminvestements.com. The Fund’s Prospectus and SAI, both dated January 28, 2015, as revised from time to time, and the Fund’s most recent shareholder reports, are incorporated by reference into this Summary Prospectus.

SUMFRACI-1-0115x0116 | guggenheiminvestments.com |

Guggenheim Floating Rate Strategies Fund

INVESTMENT OBJECTIVE

The Guggenheim Floating Rate Strategies Fund (the “Fund”) seeks to provide a high level of current income while maximizing total return.

FEES AND EXPENSES OF THE FUND

This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in the Family of Funds, as defined on page 104 of the Fund’s prospectus. More information about these and other discounts is available from your financial professional and in the “Sales Charges-Class A Shares” section on page 70 of the Fund’s prospectus and the “How to Purchase Shares” section on page 54 of the Fund’s Statement of Additional Information.

Class A | Class C | Institutional Class | |

SHAREHOLDER FEES (fees paid directly from your investment) | |||

Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) | 4.75% | None | None |

Maximum Deferred Sales Charge (Load) (as a percentage of original purchase price or redemption proceeds, whichever is lower) | None | 1.00% | None |

ANNUAL FUND OPERATING EXPENSES (expenses that you pay each year as a percentage of the value of your investment) | |||

Management Fees | 0.65% | 0.65% | 0.65% |

Distribution and Service (12b-1) Fees | 0.25% | 1.00% | None |

Other Expenses | 0.28% | 0.24% | 0.22% |

Total Annual Fund Operating Expenses | 1.18% | 1.89% | 0.87% |

Fee Waiver (and/or expense reimbursement)1 | -0.14% | -0.10% | -0.07% |

Total Annual Fund Operating Expenses After Fee Waiver (and/or expense reimbursement) | 1.04% | 1.79% | 0.80% |

1 | Guggenheim Partners Investment Management, LLC, also known as Guggenheim Investments (the "Investment Manager"), has contractually agreed through February 1, 2016 to waive fees and/or reimburse expenses to the extent necessary to limit the ordinary operating expenses (including distribution (12b-1) fees (if any), but exclusive of brokerage costs, dividends on securities sold short, acquired fund fees and expenses, interest, taxes, litigation, indemnification, and extraordinary expenses) (“Operating Expenses”) of the Fund to the annual percentage of average daily net assets for each class of shares as follows: Class A-1.02%, Class C-1.77% and Institutional Class-0.78%. The Fund may have “Total Annual Fund Operating Expenses After Fee Waiver” greater than the expense cap as a result of any acquired fund fees and expenses or other expenses that are excluded from the calculation. The Investment Manager has also agreed through February 1, 2016, to waive the amount of the Fund’s management fee to the extent necessary to offset the proportionate share of any management fee paid by the Fund with respect to any Fund investment in an underlying fund for which the Investment Manager or any of its affiliates also serves as investment manager. The Investment Manager is entitled to reimbursement by the Fund of fees waived or expenses reimbursed during any of the previous 36 months beginning on the date of the expense limitation agreement provided the Operating Expenses do not exceed the then-applicable expense cap. Each agreement will expire when it reaches its termination or when the Investment Manager ceases to serve as such and it can be terminated by the Fund’s Board of Trustees, with certain waived fees and reimbursed expenses subject to the recoupment rights of the Investment Manager. |

EXAMPLE

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds.

The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although the actual costs may be higher or lower, based on these assumptions your costs would be:

2 | SUMMARY PROSPECTUS

Redeemed | Not Redeemed | ||||||||

Class | 1 Year | 3 Years | 5 Years | 10 Years | 1 Year | 3 Years | 5 Years | 10 Years | |

A | $576 | $819 | $1,080 | $1,827 | $576 | $819 | $1,080 | $1,827 | |

C | $282 | $584 | $1,012 | $2,203 | $182 | $584 | $1,012 | $2,203 | |

Institutional | $82 | $271 | $475 | $1,066 | $82 | $271 | $475 | $1,066 | |

The above Example reflects applicable contractual fee waiver/expense reimbursement arrangements for the duration of the arrangements only.

PORTFOLIO TURNOVER

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 58% of the average value of its portfolio.

PRINCIPAL INVESTMENT STRATEGIES

The Fund will normally invest at least 80% of its assets (net assets, plus the amount of any borrowing for investment purposes) in floating rate senior secured syndicated bank loans, floating rate revolving credit facilities (“revolvers”), floating rate unsecured loans, floating rate asset backed securities (including floating rate collateralized loan obligations (“CLOs”)), other floating rate bonds, loans, notes and other securities (which may include, principally, senior secured, senior unsecured and subordinated bonds), fixed income instruments with respect to which the Fund has entered into derivative instruments to effectively convert the fixed rate interest payments into floating rate income payments, and derivative instruments (based on their notional value for purposes of this 80% strategy) that provide exposure (i.e., economic characteristics similar) to floating rate or variable rate loans, obligations or other securities. The loans in which the Fund will invest, generally made by banks and other lending institutions, are made to (or issued by) corporations, partnerships and other business entities. Floating rate loans feature rates that reset regularly, maintaining a fixed spread over the London InterBank Offered Rate (“LIBOR”) or the prime rates of large money-center banks. The interest rates for floating rate loans typically reset quarterly, although rates on some loans may adjust at other intervals.

The Fund invests in other fixed-income instruments of various maturities which may be represented by bonds, debt securities, forwards, derivatives or other similar instruments that Guggenheim Partners Investment Management, LLC, also known as Guggenheim Investments (the "Investment Manager"), believes provide the potential to deliver a high level of current income. Securities in which the Fund invests also may include, corporate bonds, convertible securities (including those that are deemed to be “busted” because they are trading well below their equity conversion value), fixed rate asset-backed securities (including collateralized mortgage-backed securities) and CLOs. The Fund may invest in a variety of investment vehicles, such as closed-end funds, exchange-traded funds (“ETFs”) and other mutual funds.

The Fund may hold securities of any quality, rated or unrated, including, those that are rated below investment grade, or, if unrated, determined to be of comparable quality (also known as “high yield securities” or “junk bonds”). The Fund may hold below investment grade securities with no limit. The Fund may hold non-registered or restricted securities (consisting of securities originally issued in reliance on Rule 144A and Regulation S securities). The Fund may also invest in securities of real estate investment trusts (“REITs”) and other real estate companies.

The Fund will principally invest in U.S. dollar denominated loans and other securities of U.S. companies, but may also invest in securities of non-U.S. companies and non-U.S. dollar denominated loans and securities (e.g., denominated in Euros, British pounds, Swiss francs or Canadian dollars), including loans and securities of emerging market countries. The Investment Manager may attempt to reduce foreign currency exchange rate risk by entering into contracts with banks, brokers or dealers to purchase or sell securities or foreign currencies at a future date (“forward contracts”).

The Fund also may seek certain exposures through derivative transactions, including foreign exchange forward contracts, futures on securities, indices, currencies and other investments; options; interest rate swaps, cross-currency swaps, total return swaps; and credit default swaps, which may also create economic leverage in the Fund. The Fund may engage in derivative transactions for speculative purposes to enhance total return, to seek to hedge against fluctuations in securities prices, interest rates or currency rates, to change the effective duration of its portfolio, to manage certain investment risks and/or as a substitute for the purchase or sale of securities or currencies. The Fund may use leverage to the extent permitted by applicable law by entering into reverse repurchase agreements and borrowing transactions (principally lines of credit) for investment purposes.

SUMMARY PROSPECTUS | 3

The Fund also may engage, without limit, in repurchase agreements, forward commitments, short sales and securities lending. The Fund may, without limitation, seek to obtain exposure to the securities in which it primarily invests by entering into a series of purchase and sale contracts or by using other investment techniques (such as buy backs and or dollar rolls).

The Investment Manager’s investment philosophy is predicated upon the belief that thorough research and independent thought are rewarded with performance that has the potential to outperform benchmark indexes with both lower volatility and lower correlation of returns as compared to such benchmark indexes.

The Investment Manager may determine to sell a security for several reasons including the following: (1) to adjust the portfolio’s average maturity, or to shift assets into or out of higher-yielding securities; (2) if a security’s credit rating has been changed or for other credit reasons; (3) to meet redemption requests; (4) to take gains; or (5) due to relative value. The Fund will not invest in securities that are in default at the time of investment, but if a security defaults subsequent to purchase by the Fund, the Investment Manager will determine in its discretion whether to hold or dispose of such security. Under adverse market conditions (for example, in the event of credit events, where it is deemed opportune to preserve gains, or to preserve the relative value of investments), the Fund can make temporary defensive investments and may not be able to pursue or achieve its objective.

PRINCIPAL RISKS

The value of an investment in the Fund will fluctuate and is subject to investment risks, which means investors could lose money. The principal risks of investing in the Fund are summarized below.

Asset-Backed and Mortgage-Backed Securities Risk—Investors in asset-backed securities, including mortgage-backed securities and structured finance investments, generally receive payments that are part interest and part return of principal. These payments may vary based on the rate at which the underlying borrowers pay off their loans. Some asset-backed securities, including mortgage-backed securities, may have structures that make their reaction to interest rates and other factors difficult to predict, making their prices very volatile and they are subject to liquidity risk.

Collateralized Debt Obligations Risk—CDOs, including CDOs collateralized by a pool of bonds ("CBOs") and CDOs collateralized by a pool of loans (CLOs), issue classes or “tranches” that vary in risk and yield, and may experience substantial losses due to actual defaults, decrease of market value due to collateral defaults and disappearance of subordinate tranches, market anticipation of defaults, and investor aversion to CDO securities as a class. The risks of CDOs depend largely on the type of the underlying collateral and the tranche of CDOs in which the Fund invests. In addition, CDOs carry risks including interest rate risk, credit risk and default risk. Certain CDOs obtain their exposure through synthetic investments. These CDOs entail the risks associated with derivative instruments.

Convertible Securities Risk—Convertible securities may be subordinate to other securities. The total return for a convertible security depends, in part, upon the performance of the underlying security into which it can be converted. The value of convertible securities tends to decline as interest rates increase. Convertible securities generally offer lower interest or dividend yields than non-convertible securities of similar quality.

Counterparty Credit Risk—The Fund makes investments in financial instruments and OTC-traded derivatives involving counterparties to gain exposure to a particular group of securities, index or asset class without actually purchasing those securities or investments, or to hedge a position. Through these investments, the Fund is exposed to credit risks that the counterparty may be unwilling or unable to make timely payments to meet its contractual obligations or may fail to return holdings that are subject to the agreement with the counterparty. If the counterparty becomes bankrupt or defaults on its payment obligations to the Fund, the Fund may not receive the full amount that it is entitled to receive. If this occurs, the value of your shares in the Fund will decrease.

Credit Risk—The Fund could lose money if the issuer or guarantor of a fixed-income instrument or a counterparty to a derivatives transaction or other transaction is unable or unwilling, or perceived to be unable or unwilling, to pay interest or repay principal on time or defaults. The issuer, guarantor or counterparty could also suffer a rapid decrease in credit quality rating, which would adversely affect the volatility of the value and liquidity of the instrument.

Currency Risk—Indirect and direct exposure to foreign currencies subjects the Fund to the risk that those currencies will decline in value relative to the U.S. Dollar, which would cause a decline in the U.S. value of the holdings of the Fund. Currency rates in foreign countries may fluctuate significantly over short periods of time for a number of reasons, including changes in interest rates and the imposition of currency controls or other political, economic and tax developments in the U.S. or abroad.

4 | SUMMARY PROSPECTUS

Derivatives Risk—Derivatives may pose risks in addition to and greater than those associated with investing directly in securities or other investments, including risks relating to leverage, imperfect correlations with underlying investments or the Fund’s other portfolio holdings, high price volatility, lack of availability, counterparty credit, liquidity, valuation and legal restrictions. Their use is a highly specialized activity that involves investment techniques and risks different from those associated with ordinary portfolio securities transactions. If the Investment Manager is incorrect about its expectations of market conditions, the use of derivatives could also result in a loss, which in some cases may be unlimited. In addition, the Fund’s use of derivatives may cause the Fund to realize higher amounts of short term capital gains (generally taxed at ordinary income tax rates) than if the Fund had not used such instruments. Some of the derivatives in which the Fund invests are traded (and privately negotiated) in the over-the-counter ("OTC") market. OTC derivatives are subject to heightened credit, liquidity and valuation risks.

Dollar Roll Transaction Risk—The Fund may enter into dollar roll transactions, in which the Fund sells a mortgage-backed or other security for settlement on one date and buys back a substantially similar security for settlement at a later date. Dollar rolls involve a risk of loss if the market value of the securities that the Fund is committed to buy declines below the price of the securities the Fund has sold.

Emerging Markets Risk—Investments in emerging markets securities are generally subject to a greater level of those risks associated with investing in foreign securities, as emerging markets are considered less developed than developing countries. Furthermore, investments in emerging market countries are generally subject to additional risks, including trading on smaller markets, having lower volumes of trading, and being subject to lower levels of government regulation and less extensive accounting, financial and other reporting requirements.

Foreign Securities and Currency Risk—Foreign securities carry additional risks when compared to U.S. securities, including currency fluctuations, adverse political and economic developments, unreliable or untimely information, less liquidity, limited legal recourse and higher transactional costs.

High Yield and Unrated Securities Risk—High yield, below investment grade and unrated high risk debt securities may present additional risks because these securities may be less liquid, and therefore more difficult to value accurately and sell at an advantageous price or time, and present more credit risk than investment grade bonds. The price of high yield securities tends to be subject to greater volatility due to issuer-specific operating results and outlook and to real or perceived adverse economic and competitive industry conditions. This exposure may be obtained through investments in other investment companies.

Interest Rate Risk—Investments in fixed-income securities are subject to the possibility that interest rates could rise sharply, causing the value of the Fund’s securities and share price to decline. The risks associated with rising interest rates are heightened given the historically low interest rate environment. Fixed-income securities with longer durations are subject to more volatility than those with shorter durations.

Investment in Investment Vehicles Risk—Investing in other investment vehicles, including ETFs, closed-end funds and other mutual funds, subjects the Fund to those risks affecting the investment vehicle, including the possibility that the value of the underlying securities held by the investment vehicle could decrease or the portfolio becomes illiquid. Moreover, the Fund and its shareholders will incur its pro rata share of the underlying vehicles’ expenses.

Investments in Loans Risk—Investments in loans, including loan syndicates and other direct lending opportunities, involve special types of risks, including credit risk, interest rate risk, counterparty risk and prepayment risk. Loans may offer a fixed or floating interest rate. Loans are often generally below investment grade and may be unrated. The Fund’s investments in loans can be difficult to value accurately and may be more susceptible to liquidity risk than fixed-income instruments of similar credit quality and/or maturity. The Fund is also subject to the risk that the value of the collateral for the loan may be insufficient to cover the borrower’s obligations should the borrower fail to make payments or become insolvent. Participations in loans may subject the Fund to the credit risk of both the borrower and the issuer of the participation and may make enforcement of loan covenants more difficult for the Fund as legal action may have to go through the issuer of the participations. Transactions in loans are subject to delayed settlement periods, thus potentially limiting the ability of the Fund to invest sale proceeds in other investments and to meet its redemption obligations.

Leverage Risk—The Fund’s use of leverage, through borrowings or instruments such as derivatives, may cause the Fund to be more volatile and riskier than if it had not been leveraged.

Liquidity and Valuation Risk—In certain circumstances, it may be difficult for the Fund to purchase and sell particular investments within a reasonable time at a fair price, or the price at which it has been valued by the Investment Manager for purposes of the Fund’s net asset value, causing the Fund to be less liquid and unable to realize what the Investment Manager believes should be the price of the investment.

SUMMARY PROSPECTUS | 5

Management Risk—The Fund is actively managed, which means that investment decisions are made based on investment views. There is no guarantee that the investment views will produce the desired results or expected returns, causing the Fund to fail to meet its investment objective or underperform its benchmark index or funds with similar investment objectives and strategies. Furthermore, active trading that can accompany active management, also called “high turnover,” may have a negative impact on performance. Active trading may result in higher brokerage costs or mark-up charges, which are ultimately passed on to shareholders of the Fund.

Market Risk—The value of, or income generated by, the securities held by the Fund may fluctuate rapidly and unpredictably as a result of factors affecting individual companies or changing economic, political, social or financial market conditions throughout the world because of the interconnected global economies and financial markets.

Prepayment Risk—Securities subject to prepayment risk generally offer less potential for gains when interest rates decline, because issuers of the securities may be able to prepay the principal due on the securities, and may offer a greater potential for income loss when interest rates rise.

Real Estate Securities Risk—The Fund may invest in securities of real estate companies and companies related to the real estate industry, including real estate investment trusts (“REITs”), which are subject to the same risks as direct investments in real estate. The real estate industry is particularly sensitive to economic downturns.

Regulatory and Legal Risk—U.S. and other regulators and governmental agencies may implement additional regulations and legislators may pass new laws that affect the investments held by the Fund, the strategies used by the Fund or the level of regulation or taxation applying to the Fund (such as regulations related to investments in derivatives). These may impact the investment strategies, performance, costs and operations of the Fund or taxation of shareholders.

Repurchase Agreement and Reverse Repurchase Agreement Risk—In the event of the insolvency of the counterparty to a repurchase agreement or reverse repurchase agreement, recovery of the repurchase price owed to the Fund or, in the case of a reverse repurchase agreement, the securities sold by the Fund, may be delayed. Because reverse repurchase agreements may be considered to be the practical equivalent of borrowing funds, they constitute a form of leverage. If the Fund reinvests the proceeds of a reverse repurchase agreement at a rate lower than the cost of the agreement, entering into the agreement will lower the Fund’s yield.

Restricted Securities Risk—Restricted securities generally cannot be sold to the public and may involve a high degree of business, financial and liquidity risk, which may result in substantial losses to the Fund.

Securities Lending Risk—Securities lending involves a risk that the borrower may fail to return the securities or deliver the proper amount of collateral, which may result in a loss to the Fund. In the event of bankruptcy of the borrower, the Fund could experience losses or delays in recovering the loaned securities.

Short Sales Risk—Short selling a security involves selling a borrowed security with the expectation that the value of that security will decline so that the security may be purchased at a lower price when returning the borrowed security. The risk for loss on short selling is greater than the original value of the securities sold short because the price of the borrowed security may rise, thereby increasing the price at which the security must be purchased. Government actions also may affect the Fund’s ability to engage in short selling.

PERFORMANCE INFORMATION

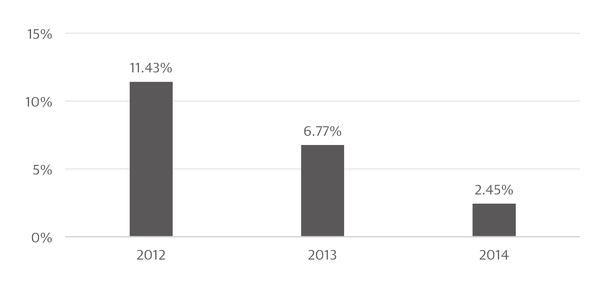

The following chart and table provide some indication of the risks of investing in the Fund by showing the Fund’s Class A share performance from year to year and average annual returns for the one year and since inception periods, as applicable, for the Fund’s Class A, Class C and Institutional Class shares compared to those of a broad measure of market performance. As with all mutual funds, past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. Updated performance information is available on the Fund’s website at www.guggenheiminvestments.com or by calling 800.820.0888.

The bar chart does not reflect the impact of the sales charge applicable to Class A shares which, if reflected, would lower the returns shown.

6 | SUMMARY PROSPECTUS

Highest Quarter Return Q1 2012 4.58% | Lowest Quarter Return Q4 2013 -0.04% | |

AVERAGE ANNUAL TOTAL RETURNS

(For the periods ended December 31, 2014)

After-tax returns shown in the table are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of any state or local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts (“IRAs”). After-tax returns are shown for Class A only. After-tax returns for Class C and Institutional Class will vary.

1 Year | Since inception1 | |

Class A | ||

Return Before Taxes | -2.40% | 4.91% |

Return After Taxes on Distributions | -4.56% | 2.79% |

Return After Taxes on Distributions and Sale of Fund Shares | -1.34% | 2.87% |

Class C | 0.71% | 5.79% |

Institutional Class | 2.70% | 6.83% |

Index | ||

Credit Suisse Leveraged Loan Index (reflects no deductions for fees, expenses or taxes) | 2.04% | 5.85% |

1 | Since inception of November 30, 2011. |

MANAGEMENT OF THE FUND

Guggenheim Partners Investment Management, LLC, also known as Guggenheim Investments (the “Investment Manager”), serves as the investment manager of the Fund. B. Scott Minerd, Anne B. Walsh, Kevin H. Gundersen, James W. Michal and Thomas J. Hauser are primarily responsible for the day-to-day management of the Fund. They hold the titles of Global Chief Investment Officer; Senior Managing Director & Assistant Chief Investment Officer; Senior Managing Director & Portfolio Manager; Senior Managing Director & Portfolio Manager; and Managing Director & Portfolio Manager, respectively, with the Investment Manager. B. Scott Minerd, Anne B. Walsh, Kevin H. Gundersen and James W. Michal have managed the Fund since 2011, and Thomas J. Hauser has managed the Fund since November 2014.

PURCHASE AND SALE OF FUND SHARES

You may purchase or redeem Fund shares through your broker/dealer, other financial intermediary that has an agreement with Guggenheim Funds Distributors, LLC, the Fund’s distributor, or through the Fund’s transfer agent. You may purchase, redeem or exchange shares of any class of the Fund on any day the New York Stock Exchange is open for business. The minimum initial investment for Class A and Class C shares is $2,500. The minimum subsequent investment is $100. Class A and Class C do not have a minimum account balance.

SUMMARY PROSPECTUS | 7

The Institutional Class minimum initial investment is $2 million, although the Investment Manager may waive this requirement at its discretion. The Institutional Class has a minimum account balance of $1 million. Due to the relatively high cost of maintaining accounts below the minimum account balance, the Fund reserves the right to redeem shares if an account balance falls below the minimum account balance for any reason. Investors will be given 60 days notice to reestablish the minimum account balance. If the account balance is not increased, the account may be closed and the proceeds sent to the investor. Fund shares will be redeemed at net asset value on the day the account is closed.

TAX INFORMATION

Fund distributions are taxable as ordinary income or capital gains (or a combination of both), unless your investment is in an IRA or other tax-advantaged retirement account. Investments through tax-advantaged accounts may sometimes become taxable upon withdrawal.

PAYMENTS TO BROKER/DEALERS AND OTHER FINANCIAL INTERMEDIARIES

If you purchase Fund shares through a broker/dealer or other financial intermediary, the Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker/dealer or other intermediary and your sales person to recommend the Fund over another investment. Ask your sales person or visit your financial intermediary’s website for more information.

8 | SUMMARY PROSPECTUS