GFT 2/2015 497 Combined Document

|

| | | | | | | | |

Mutual Funds | | | | | Equity | | | | | 1.28.2015 |

| | | | | | | | |

Guggenheim Funds Prospectus |

January 28, 2015, as supplemented March 19, 2015 |

Class A, Class B, Class C and Institutional |

|

| | | | |

Ticker Symbol | | | Fund Name |

Class A | Class B | Class C | Institutional | |

GEEWX | | GEEFX | GEEGX | Guggenheim Enhanced World Equity Fund |

SECIX | SECBX | SEGIX | GILCX | Guggenheim Large Cap Value Fund |

SEVAX | SVSBX | SEVSX | | Guggenheim Mid Cap Value Fund |

| | | SVUIX | Guggenheim Mid Cap Value Institutional Fund |

GURAX | | GURCX | GURIX | Guggenheim Risk Managed Real Estate Fund |

SSUAX | | SSVCX | SSUIX | Guggenheim Small Cap Value Fund |

SECEX | SEQBX | SFECX | GILIX | Guggenheim StylePlus—Large Core Fund |

SECUX | SEUBX | SUFCX | GIUIX | Guggenheim StylePlus—Mid Growth Fund |

SEQAX | SGOBX | SFGCX | SEWIX | Guggenheim World Equity Income Fund |

The U.S. Securities and Exchange Commission and the Commodity Futures Trading Commission have not approved or disapproved these securities, or passed upon the accuracy or adequacy of this Prospectus. Any representation to the contrary is a criminal offense.

|

| |

460602600-0115x0116 | guggenheiminvestments.com |

Table of Contents

FUND SUMMARIES

|

| |

| |

Guggenheim Enhanced World Equity Fund | |

Guggenheim Large Cap Value Fund | |

Guggenheim Mid Cap Value Fund | |

Guggenheim Mid Cap Value Institutional Fund | |

Guggenheim Risk Managed Real Estate Fund | |

Guggenheim Small Cap Value Fund | |

Guggenheim StylePlus—Large Core Fund | |

Guggenheim StylePlus—Mid Growth Fund | |

Guggenheim World Equity Income Fund | |

ADDITIONAL INFORMATION REGARDING INVESTMENT OBJECTIVES AND STRATEGIES | |

DESCRIPTIONS OF PRINCIPAL RISKS | |

PORTFOLIO HOLDINGS | |

INVESTMENT MANAGER | |

MANAGEMENT FEES | |

PORTFOLIO MANAGERS | |

SUB-ADVISERS | |

BUYING, SELLING AND EXCHANGING FUND SHARES | |

OPENING YOUR ACCOUNT | |

TIPS TO SUCCESSFULLY COMPLETE YOUR ACCOUNT APPLICATION | |

TRANSACTION INFORMATION | |

TRANSACTION CUT-OFF TIMES | |

TRANSACTIONS THROUGH YOUR FINANCIAL INTERMEDIARY | |

SALES CHARGES | |

CLASS A SHARES | |

HOW TO REDUCE YOUR SALES CHARGE | |

SALES CHARGE WAIVERS | |

SALES CHARGE EXCEPTIONS | |

CLASS B SHARES | |

CLASS C SHARES | |

WAIVER OF CDSC | |

BUYING FUND SHARES | |

PURCHASE PROCEDURES | |

CANCELLED PURCHASE ORDERS | |

SELLING FUND SHARES | |

REDEMPTION PROCEDURES | |

DISTRIBUTIONS FROM QUALIFIED RETIREMENT ACCOUNTS | |

RECEIVING YOUR REDEMPTION PROCEEDS | |

SIGNATURE GUARANTEES | |

UNCASHED CHECK POLICY | |

EXCHANGING FUND SHARES | |

EXCHANGE PROCEDURES | |

DOLLAR-COST AVERAGING | |

|

| |

| |

ACCOUNT POLICIES | |

SHAREHOLDER IDENTIFICATION AND VERIFICATION | |

CHANGES TO YOUR ACCOUNT | |

TRANSACTIONS OVER TELEPHONE OR INTERNET | |

STATEMENTS & CONFIRMATIONS | |

eDELIVERY SERVICES | |

HOUSEHOLDING | |

GUGGENHEIM INVESTMENTS EXPRESS LINE—800.717.7776 | |

SERVICE AND OTHER FEES | |

RETIREMENT ACCOUNT FEES | |

MARKET TIMING/SHORT-TERM TRADING | |

RIGHTS RESERVED BY THE FUNDS | |

DISTRIBUTION AND SHAREHOLDER SERVICES | |

CLASS A SHARES | |

CLASS B SHARES | |

CLASS C SHARES | |

COMPENSATION TO DEALERS | |

SHAREHOLDER SERVICES | |

SUB-TRANSFER AGENCY SERVICES | |

SYSTEMATIC WITHDRAWAL PLAN | |

EXCHANGE PRIVILEGE | |

DIVIDENDS AND TAXES | |

DIVIDEND PAYMENT OPTIONS | |

TAX ON DISTRIBUTIONS | |

TAXES ON SALES, REDEMPTIONS OR EXCHANGES | |

MEDICARE TAX | |

BACK-UP WITHHOLDING | |

FOREIGN TAXES | |

FOREIGN SHAREHOLDERS | |

COST BASIS | |

DETERMINATION OF NET ASSET VALUE | |

GENERAL INFORMATION | |

SHAREHOLDER INQUIRIES | |

FINANCIAL HIGHLIGHTS | |

FOR MORE INFORMATION | |

ANNUAL/SEMI-ANNUAL REPORT | |

STATEMENT OF ADDITIONAL INFORMATION | |

Guggenheim Enhanced World Equity Fund

INVESTMENT OBJECTIVE

The Guggenheim Enhanced World Equity Fund (the “Fund”) seeks to achieve total return, comprised of capital appreciation and current income.

FEES AND EXPENSES OF THE FUND

This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $100,000 in the Family of Funds, as defined on page 107 of the Fund’s prospectus. More information about these and other discounts is available from your financial professional and in the “Sales Charges-Class A Shares” section on page 72 of the Fund’s prospectus and the “How to Purchase Shares” section on page 51 of the Fund’s Statement of Additional Information.

|

| | | |

| Class A | Class C | Institutional Class |

SHAREHOLDER FEES (fees paid directly from your investment) | | | |

Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) | 4.75% | None | None |

Maximum Deferred Sales Charge (Load) (as a percentage of original purchase price or redemption proceeds, whichever is lower) | None | 1.00% | None |

|

| | | |

ANNUAL FUND OPERATING EXPENSES (expenses that you pay each year as a percentage of the value of your investment) | | | |

Management Fees | 0.70% | 0.70% | 0.70% |

Distribution and Service (12b-1) Fees | 0.25% | 1.00% | None |

Acquired Fund Fees and Expenses | 0.29% | 0.29% | 0.29% |

Other Expenses | 3.09% | 2.87% | 2.89% |

Total Annual Fund Operating Expenses | 4.33% | 4.86% | 3.88% |

Fee Waiver (and/or expense reimbursement)1 | -2.78% | -2.57% | -2.58% |

Total Annual Fund Operating Expenses After Fee Waiver (and/or expense reimbursement) | 1.55% | 2.29% | 1.30% |

| |

1 | Guggenheim Partners Investment Management, LLC, also known as Guggenheim Investments (the "Investment Manager"), has contractually agreed through February 1, 2016 to waive fees and/or reimburse expenses to the extent necessary to limit the ordinary operating expenses (including distribution (12b-1) fees, but exclusive of brokerage costs, dividends on securities sold short, acquired fund fees and expenses, interest, taxes, litigation, indemnification, and extraordinary expenses) (“Operating Expenses”) of the Fund to the annual percentage of average daily net assets for each class of shares as follows: Class A-1.25%, Class C-2.00% and Institutional Class-1.00%. The Fund may have “Total Annual Fund Operating Expenses After Fee Waiver” greater than the expense cap as a result of any acquired fund fees and expenses or other expenses that are excluded from the calculation. The Investment Manager has also agreed through February 1, 2016, to waive the amount of the Fund’s management fee to the extent necessary to offset the proportionate share of any management fee paid by the Fund with respect to any Fund investment in an underlying fund for which the Investment Manager or any of its affiliates also serves as investment manager. The Investment Manager is entitled to reimbursement by the Fund of fees waived or expenses reimbursed during any of the previous 36 months beginning on the date of the expense limitation agreement provided the Operating Expenses do not exceed the then-applicable expense cap. Each agreement will expire when it reaches its termination or when the Investment Manager ceases to serve as such and it can be terminated by the Fund’s Board of Trustees, with certain waived fees and reimbursed expenses subject to the recoupment rights of the Investment Manager. |

EXAMPLE

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds.

The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although the actual costs may be higher or lower, based on these assumptions your costs would be:

|

| | | | | | | | | |

| Redeemed | | Not Redeemed |

Class | 1 Year | 3 Years | 5 Years | 10 Years | | 1 Year | 3 Years | 5 Years | 10 Years |

A | $625 | $1,484 | $2,355 | $4,583 | | $625 | $1,484 | $2,355 | $4,583 |

C | $332 | $1,232 | $2,234 | $4,753 | | $232 | $1,232 | $2,234 | $4,753 |

Institutional | $132 | $946 | $1,778 | $3,941 | | $132 | $946 | $1,778 | $3,941 |

The above Example reflects applicable contractual fee waiver/expense reimbursement arrangements for the duration of the arrangements only.

PORTFOLIO TURNOVER

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 633% of the average value of its portfolio.

PRINCIPAL INVESTMENT STRATEGIES

The Fund will invest in a broadly diversified portfolio of equity securities selected to gain exposure to the global equity markets. In addition, the Fund will seek to generate current income and reduce portfolio volatility through the use of derivative strategies. The Fund will make cash investments to collateralize derivatives positions and it may also invest in fixed-income securities.

The Fund will invest, under normal circumstances, at least 80% of its assets (net assets plus the amount of borrowings for investment purposes) in equity or equity-like securities, including individual securities, exchange-traded funds (“ETFs”), and derivatives (based on their notional value for purposes of this 80% strategy) giving exposure (i.e., economic characteristics similar to) to the equity markets, to gain access to targeted geographic regions, countries and sectors.

The Fund’s holdings will be determined through a process that includes both quantitative and qualitative inputs designed to represent a global equity allocation. The Fund is not limited in the percentage of assets it may invest in securities listed, traded or dealt in any one country, region or geographic area and it will invest in a number of countries throughout the world, including emerging markets. The Fund can invest in securities of companies that represent a broad range of market capitalizations and will not be constrained by capitalization limits. The composition of the portfolio will vary over time.

To enhance the Fund’s equity exposure and seek to increase the Fund’s yield, at the discretion of Guggenheim Partners Investment Management, LLC, also known as Guggenheim Investments (the "Investment Manager”), the direct equity portfolio may be combined with a derivative strategy. This strategy could include the purchase or sale of call options, put options or a combination of call and put options. These investments would be made as a means of generating income to enhance the Fund’s returns or to seek to manage the Fund’s volatility. The Fund may also utilize foreign currency exchange contracts, stock index futures contracts and other derivative instruments such as swaps. These instruments may be used to hedge the Fund’s portfolio, to maintain exposure to the equity markets, to increase returns, to generate income, or to seek to manage volatility of the portfolio.

Equity securities in which the Fund may invest include common stocks, ETFs, exchange-traded notes (“ETNs”) giving exposure to the equity markets, rights and warrants, and American Depositary Receipts (“ADRs”). Fixed-income securities and other securities in which the Fund may invest include debt securities selected from a variety of sectors and credit qualities, including, corporate bonds, participations in and assignments of syndicated bank loans, asset-backed securities (including mortgage-backed securities and structured finance investments), U.S. government and agency securities (including those not backed by the full faith and credit of the U.S. government), ETNs giving exposure to the fixed-income markets, mezzanine and preferred securities, commercial paper, zero-coupon bonds, non-registered or restricted securities (consisting of securities originally issued in reliance on Rule 144A and Regulation S), step-up securities (such as step-up bonds) and convertible securities that the Investment Manager believes offer attractive yield and/or capital appreciation potential. The Fund may hold fixed-income securities of any quality, rated or unrated, including those that are rated below investment grade, or if unrated, determined to be of comparable quality (also known as “high yield securities” or “junk bonds”).

Under adverse or unstable market conditions, at the discretion of the Investment Manager, the Fund could invest some or all of its assets in cash, derivative instruments, ETFs, fixed-income securities, government bonds, money market securities, or repurchase agreements. The Fund may be unable to pursue or achieve its investment objective during that time and temporary defensive investments could reduce the benefit from any upswing in the market.

PRINCIPAL RISKS

The value of an investment in the Fund will fluctuate and is subject to investment risks, which means investors could lose money. The principal risks of investing in the Fund are summarized below.

Asset-Backed and Mortgage-Backed Securities Risk—Investors in asset-backed securities, including mortgage-backed securities and structured finance investments, generally receive payments that are part interest and part return of principal. These payments may vary based on the rate at which the underlying borrowers pay off their loans. Some asset-backed securities, including mortgage-backed securities, may have structures that make their reaction to interest rates and other factors difficult to predict, making their prices very volatile and they are subject to liquidity risk.

Commercial Paper Risk—The value of the Fund’s investment in commercial paper, which is an unsecured promissory note that generally has a maturity date between one and 270 days and is issued by a U.S. or foreign entity, is susceptible to changes in the issuer’s financial condition or credit quality. Investments in commercial paper are usually discounted from their value at maturity. Commercial paper can be fixed-rate or variable rate and can be adversely affected by changes in interest rates.

Convertible Securities Risk—Convertible securities may be subordinate to other securities. The total return for a convertible security depends, in part, upon the performance of the underlying security into which it can be converted. The value of convertible securities tends to decline as interest rates increase. Convertible securities generally offer lower interest or dividend yields than non-convertible securities of similar quality.

Correlation Risk—A number of factors may affect the ability to track an underlying investment, such as an index, through a management strategy or a derivative instrument or an underlying fund. Factors may include, for example, derivatives contracts costs or underlying fund fees and expenses. There can be no guarantee that an investment or strategy will achieve a high degree of correlation. Failure to achieve a high degree of correlation may prevent the Fund from achieving the objective pursued by an investment.

Counterparty Credit Risk—The Fund makes investments in financial instruments and OTC-traded derivatives involving counterparties to gain exposure to a particular group of securities, index or asset class without actually purchasing those securities or investments, or to hedge a position. Through these investments, the Fund is exposed to credit risks that the counterparty may be unwilling or unable to make timely payments to meet its contractual obligations or may fail to return holdings that are subject to the agreement with the counterparty. If the counterparty becomes bankrupt or defaults on its payment obligations to the Fund, the Fund may not receive the full amount that it is entitled to receive. If this occurs, the value of your shares in the Fund will decrease.

Credit Risk—The Fund could lose money if the issuer or guarantor of a fixed-income instrument or a counterparty to a derivatives transaction or other transaction is unable or unwilling, or perceived to be unable or unwilling, to pay interest or repay principal on time or defaults. The issuer, guarantor or counterparty could also suffer a rapid decrease in credit quality rating, which would adversely affect the volatility of the value and liquidity of the instrument.

Currency Risk—Indirect and direct exposure to foreign currencies subjects the Fund to the risk that those currencies will decline in value relative to the U.S. Dollar, which would cause a decline in the U.S. value of the holdings of the Fund. Currency rates in foreign countries may fluctuate significantly over short periods of time for a number of reasons, including changes in interest rates and the imposition of currency controls or other political, economic and tax developments in the U.S. or abroad.

Depositary Receipt Risk—The Fund may hold the securities of non-U.S. companies in the form of ADRs and GDRs. The underlying securities of the ADRs and Global Depositary Receipts ("GDRs") in the Fund’s portfolio are subject to fluctuations in foreign currency exchange rates that may affect the value of the Fund’s portfolio. In addition, the value of the securities underlying the ADRs and GDRs may change materially when the U.S. markets are not open for trading. Investments in the underlying foreign securities also involve political and economic risks distinct from those associated with investing in the securities of U.S. issuers.

Derivatives Risk—Derivatives may pose risks in addition to and greater than those associated with investing directly in securities or other investments, including risks relating to leverage, imperfect correlations with underlying investments or the Fund’s other portfolio holdings, high price volatility, lack of availability, counterparty credit, liquidity, valuation and legal restrictions. Their use is a highly specialized activity that involves investment techniques and risks different from those associated with ordinary portfolio securities transactions. If the Investment Manager is incorrect about its expectations of market conditions, the use of derivatives could also result in a loss, which in some cases may be unlimited. In addition, the Fund’s use of derivatives may cause the Fund to realize higher amounts of short term capital gains (generally taxed at ordinary income tax rates) than if the Fund had not used such instruments. Some of the derivatives in which the Fund invests are traded (and privately negotiated) in the over-the-

counter ("OTC") market. OTC derivatives are subject to heightened credit, liquidity and valuation risks. Certain risks also are specific to the derivatives in which the Fund invests.

Swap Agreements Risk—Swap agreements are contracts among the Fund and a counterparty to exchange the return of the pre-determined underlying investment (such as the rate of return of the underlying index). Swap agreements may be negotiated bilaterally and traded OTC between two parties or, in some instances, must be transacted through a futures commission merchant and cleared through a clearinghouse that serves as a central counterparty. Risks associated with the use of swap agreements are different from those associated with ordinary portfolio securities transactions, due in part to the fact they could be considered illiquid and many swaps trade on the OTC market. Swaps are particularly subject to counterparty credit, correlation, valuation, liquidity and leveraging risks. Certain standardized swaps are subject to mandatory central clearing. Central clearing is intended to reduce counterparty credit risk and increase liquidity, but central clearing does not make swap transactions risk-free.

Futures Contracts Risk—Futures contracts are typically exchange-traded contracts that call for the future delivery of an asset at a certain price and date, or cash settlement of the terms of the contract. Risks of futures contracts may be caused by an imperfect correlation between movements in the price of the instruments and the price of the underlying securities. In addition, there is the risk that the Fund may not be able to enter into a closing transaction because of an illiquid market. Exchanges can limit the number of positions that can be held or controlled by the Fund or its Investment Manager, thus limiting the ability to implement the Fund’s strategies. Futures markets are highly volatile and the use of futures may increase the volatility of the Fund’s NAV. Futures are also subject to leverage risks and to liquidity risk.

Options Risk—Options or options on futures contracts give the holder of the option the right to buy (or to sell) a position in a security or in a contract to the writer of the option, at a certain price. They are subject to correlation risk because there may be an imperfect correlation between the options and the securities markets that cause a given transaction to fail to achieve its objectives. The successful use of options depends on the Investment Manager’s ability to predict correctly future price fluctuations and the degree of correlation between the options and securities markets. Exchanges can limit the number of positions that can be held or controlled by the Fund or its Investment Manager, thus limiting the ability to implement the Fund’s strategies. Options are also particularly subject to leverage risk and can be subject to liquidity risk.

Emerging Markets Risk—Investments in emerging markets securities are generally subject to a greater level of those risks associated with investing in foreign securities, as emerging markets are considered less developed than developing countries. Furthermore, investments in emerging market countries are generally subject to additional risks, including trading on smaller markets, having lower volumes of trading, and being subject to lower levels of government regulation and less extensive accounting, financial and other reporting requirements.

Equity Securities Risk—Equity securities include common stocks and other equity securities (and securities convertible into stocks), and the prices of equity securities fluctuate in value more than other investments. They reflect changes in the issuing company’s financial condition and changes in the overall market. Common stocks generally represent the riskiest investment in a company. The Fund may lose a substantial part, or even all, of its investment in a company’s stock. Growth stocks may be more volatile than value stocks.

Exchange-Traded Notes Risk—The value of an ETN may be influenced by time to maturity, level of supply and demand for the ETN, volatility and lack of liquidity in underlying investments, changes in the applicable interest rates, changes in the issuer’s credit rating and economic, legal, political or geographic events that affect the referenced investments. The Fund’s decision to sell its ETN holdings may also be limited by the availability of a secondary market. If the Fund must sell some or all of its ETN holdings and the secondary market is weak, it may have to sell such holdings at a discount. ETNs also are subject to counterparty credit risk (which includes the risk that the issuer may fail).

Foreign Securities and Currency Risk—Foreign securities carry additional risks when compared to U.S. securities, including currency fluctuations, adverse political and economic developments, unreliable or untimely information, less liquidity, limited legal recourse and higher transactional costs.

High Yield and Unrated Securities Risk—High yield, below investment grade and unrated high risk debt securities may present additional risks because these securities may be less liquid, and therefore more difficult to value accurately and sell at an advantageous price or time, and present more credit risk than investment grade bonds. The price of high yield securities tends to be subject to greater volatility due to issuer-specific operating results and outlook and to real or perceived adverse economic and competitive industry conditions. This exposure may be obtained through investments in other investment companies.

Interest Rate Risk—Investments in fixed-income securities are subject to the possibility that interest rates could rise sharply, causing the value of the Fund’s securities and share price to decline. The risks associated with rising interest

rates are heightened given the historically low interest rate environment. Fixed-income securities with longer durations are subject to more volatility than those with shorter durations.

Investment in Investment Vehicles Risk—Investing in other investment vehicles, including ETFs, closed-end funds and other mutual funds, subjects the Fund to those risks affecting the investment vehicle, including the possibility that the value of the underlying securities held by the investment vehicle could decrease or the portfolio becomes illiquid. Moreover, the Fund and its shareholders will incur its pro rata share of the underlying vehicles’ expenses.

Investments in Loans Risk—Investments in loans involve special types of risks, including credit risk, interest rate risk, counterparty risk and prepayment risk. Loans may offer a fixed or floating interest rate. Loans are often generally below investment grade and may be unrated. The Fund’s investments in loans can be difficult to value accurately and may be more susceptible to liquidity risk than fixed-income instruments of similar credit quality and/or maturity. Transactions in loans are subject to delayed settlement periods, thus potentially limiting the ability of the Fund to invest sale proceeds in other investments and to meet its redemption obligations.

Leverage Risk—The Fund’s use of leverage, through borrowings or instruments such as derivatives, may cause the Fund to be more volatile and riskier than if it had not been leveraged.

Liquidity and Valuation Risk—In certain circumstances, it may be difficult for the Fund to purchase and sell particular investments within a reasonable time at a fair price, or the price at which it has been valued by the Investment Manager for purposes of the Fund’s net asset value, causing the Fund to be less liquid and unable to realize what the Investment Manager believes should be the price of the investment.

Management Risk—The Fund is actively managed, which means that investment decisions are made based on investment views. There is no guarantee that the investment views will produce the desired results or expected returns, causing the Fund to fail to meet its investment objective or underperform its benchmark index or funds with similar investment objectives and strategies. Furthermore, active trading that can accompany active management, also called “high turnover,” may have a negative impact on performance. Active trading may result in higher brokerage costs or mark-up charges, which are ultimately passed on to shareholders of the Fund.

Market Risk—The value of, or income generated by, the securities held by the Fund may fluctuate rapidly and unpredictably as a result of factors affecting individual companies or changing economic, political, social or financial market conditions throughout the world because of the interconnected global economies and financial markets.

Preferred Securities Risk—A company’s preferred stock generally pays dividends only after the company makes required payments to holders of its bonds and other debt. For this reason, the value of preferred stock will usually react more strongly than bonds and other debt to actual or perceived changes in the company’s financial condition or prospects.

Prepayment Risk—Securities subject to prepayment risk generally offer less potential for gains when interest rates decline, because issuers of the securities may be able to prepay the principal due on the securities, and may offer a greater potential for income loss when interest rates rise.

Regulatory and Legal Risk—U.S. and other regulators and governmental agencies may implement additional regulations and legislators may pass new laws that affect the investments held by the Fund, the strategies used by the Fund or the level of regulation or taxation applying to the Fund (such as regulations related to investments in derivatives). These may impact the investment strategies, performance, costs and operations of the Fund or taxation of shareholders.

Restricted Securities Risk—Restricted securities generally cannot be sold to the public and may involve a high degree of business, financial and liquidity risk, which may result in substantial losses to the Fund.

U.S. Government Securities Risk—U.S. government securities may or may not be backed by the full faith and credit of the U.S. government. U.S. government securities are subject to the risks associated with fixed-income and debt securities, particularly interest rate risk and credit risk.

Zero Coupon Securities Risk—Zero coupon securities pay no cash income and are sold at substantial discounts from their value at maturity. Zero coupon securities are subject to greater market value fluctuations from changing interest rates than debt obligations of comparable maturities, which make current distributions of cash.

PERFORMANCE INFORMATION

The following chart and table provide some indication of the risks of investing in the Fund by showing the Fund’s Class A share performance for one year and average annual returns for the one-year and since inception periods for the Fund’s Class A, Class C and Institutional Class shares compared to those of a broad measure of market performance. As with all mutual funds, past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. Updated performance information is available on the Fund’s website at www.guggenheiminvestments.com or by calling 800.820.0888.

The bar chart does not reflect the impact of the sales charge applicable to Class A shares which, if reflected, would lower the returns shown.

|

| | |

Highest Quarter Return Q2 2014 3.19% | | Lowest Quarter Return Q3 2014 -2.22% |

AVERAGE ANNUAL TOTAL RETURNS

(For the periods ended December 31, 2014)

After-tax returns shown in the table are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of any state or local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts ("IRAs").

|

| | |

| 1 Year | Since Inception1 |

Class A | | |

Return Before Taxes | -5.72% | 3.39% |

Return After Taxes on Distributions | -6.31% | 1.65% |

Return After Taxes on Distributions and Sale of Fund Shares | -3.23% | 1.80% |

Class C | -1.93% | 6.32% |

Institutional Class | -0.72% | 7.02% |

Index | | |

MSCI All Country World Index (Net) (reflects no deductions for fees, expenses or taxes)2 | 4.71% | 11.25% |

1 Since inception of June 18, 2013.

2 The MSCI All Country World Index (Net) returns reflect reinvested dividends net of foreign withholding taxes, but reflect no deductions for fees, expenses or other taxes. The returns are calculated by applying withholding rates applicable to non-resident persons who do not benefit from double taxation treaties. Withholding rates applicable to the Fund may be lower.

MANAGEMENT OF THE FUND

Guggenheim Partners Investment Management, LLC, also known as Guggenheim Investments (the “Investment Manager”), serves as the investment manager of the Fund. Jayson Flowers and Daniel Cheeseman are primarily responsible for the day-to-day management of the Fund. They hold the titles of Senior Managing Director and Portfolio Manager, and Portfolio Manager, respectively, with the Investment Manager. Jayson Flowers has co-managed the Fund since its inception in June 2013. Daniel Cheeseman has managed the Fund since September 2014.

PURCHASE AND SALE OF FUND SHARES

You may purchase or redeem Fund shares through your broker/dealer, other financial intermediary that has an agreement with Guggenheim Funds Distributors, LLC, the Fund’s distributor, or through the Fund’s transfer agent. You may purchase, redeem or exchange shares of any class of the Fund on any day the New York Stock Exchange is open for business. The minimum initial investment for Class A and Class C shares is $2,500. The minimum subsequent investment is $100. Class A and Class C do not have a minimum account balance.

The Institutional Class minimum initial investment is $2 million, although the Investment Manager may waive this requirement at its discretion. The Institutional Class has a minimum account balance of $1 million. Due to the relatively high cost of maintaining accounts below the minimum account balance, the Fund reserves the right to redeem shares if an account balance falls below the minimum account balance for any reason. Investors will be given 60 days advance notice to reestablish the minimum account balance. If the account balance is not increased, the account may be closed, and the proceeds sent to the investor. Fund shares will be redeemed at net asset value on the day the account is closed.

TAX INFORMATION

Fund distributions are taxable as ordinary income or capital gains (or a combination of both), unless your investment is in an IRA or other tax-advantaged retirement account. Investments through tax-advantaged accounts may sometimes become taxable upon withdrawal.

PAYMENTS TO BROKER/DEALERS AND OTHER FINANCIAL INTERMEDIARIES

If you purchase Fund shares through a broker/dealer or other financial intermediary, the Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker/dealer or other intermediary and your sales person to recommend the Fund over another investment. Ask your sales person or visit your financial intermediary’s website for more information.

Guggenheim Large Cap Value Fund

INVESTMENT OBJECTIVE

The Guggenheim Large Cap Value Fund (the “Fund”) seeks long-term growth of capital.

FEES AND EXPENSES OF THE FUND

This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $100,000 in the Family of Funds, as defined on page 107 of the Fund’s prospectus. More information about these and other discounts is available from your financial professional and in the “Sales Charges-Class A Shares” section on page 72 of the Fund’s prospectus and the “How to Purchase Shares” section on page 51 of the Fund’s Statement of Additional Information.

|

| | | | |

| Class A | Class B | Class C | Institutional Class |

SHAREHOLDER FEES (fees paid directly from your investment) | | | | |

Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) | 4.75% | Closed to new subscriptions | None | None |

Maximum Deferred Sales Charge (Load) (as a percentage of original purchase price or redemption proceeds, whichever is lower) | None | 5.00% | 1.00% | None |

|

| | | | |

ANNUAL FUND OPERATING EXPENSES (expenses that you pay each year as a percentage of the value of your investment) | | | | |

Management Fees | 0.65% | 0.65% | 0.65% | 0.65% |

Distribution and Service (12b-1) Fees | 0.25% | 1.00% | 1.00% | None |

Other Expenses | 0.58% | 1.13% | 0.68% | 0.43% |

Total Annual Fund Operating Expenses | 1.48% | 2.78% | 2.33% | 1.08% |

Fee Waiver (and/or expense reimbursement)1 | -0.31% | -0.86% | -0.41% | -0.16% |

Total Annual Fund Operating Expenses After Fee Waiver (and/or expense reimbursement) | 1.17% | 1.92% | 1.92% | 0.92% |

| |

1 | Security Investors, LLC, also known as Guggenheim Investments (the “Investment Manager”), has contractually agreed through February 1, 2016 to waive fees and/or reimburse expenses to the extent necessary to limit the ordinary operating expenses (including distribution (12b-1) fees, but exclusive of brokerage costs, dividends on securities sold short, acquired fund fees and expenses, interest, taxes, litigation, indemnification, and extraordinary expenses) (“Operating Expenses”) of the Fund to the annual percentage of average daily net assets for each class of shares as follows: Class A-1.15%, Class B-1.90%, Class C-1.90% and Institutional Class-0.90%. The Fund may have “Total Annual Fund Operating Expenses After Fee Waiver” greater than the expense cap as a result of any acquired fund fees and expenses or other expenses that are excluded from the calculation. The Investment Manager has also agreed through February 1, 2016, to waive the amount of the Fund’s management fee to the extent necessary to offset the proportionate share of any management fee paid by the Fund with respect to any Fund investment in an underlying fund for which the Investment Manager or any of its affiliates also serves as investment manager. The Investment Manager is entitled to reimbursement by the Fund of fees waived or expenses reimbursed during any of the previous 36 months beginning on the date of the expense limitation agreement provided the Operating Expenses do not exceed the then-applicable expense cap. Each agreement will expire when it reaches its termination or when the Investment Manager ceases to serve as such and it can be terminated by the Fund’s Board of Trustees, with certain waived fees and reimbursed expenses subject to the recoupment rights of the Investment Manager. |

EXAMPLE

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds.

The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although the actual costs may be higher or lower, based on these assumptions your costs would be:

|

| | | | | | | | | |

| Redeemed | | Not Redeemed |

Class | 1 Year | 3 Years | 5 Years | 10 Years | | 1 Year | 3 Years | 5 Years | 10 Years |

A | $589 | $892 | $1,217 | $2,134 | | $589 | $892 | $1,217 | $2,134 |

B | $695 | $1,081 | $1,593 | $2,732 | | $195 | $781 | $1,393 | $2,732 |

C | $295 | $688 | $1,208 | $2,635 | | $195 | $688 | $1,208 | $2,635 |

Institutional | $94 | $328 | $580 | $1,303 | | $94 | $328 | $580 | $1,303 |

The above Example reflects applicable contractual fee waiver/expense reimbursement arrangements for the duration of the arrangements only.

PORTFOLIO TURNOVER

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 40% of the average value of its portfolio.

PRINCIPAL INVESTMENT STRATEGIES

The Fund pursues its objective by investing, under normal market conditions, at least 80% of its assets (net assets, plus the amount of any borrowing for investment purposes) in equity securities, which include common stocks, rights, options, warrants, convertible debt securities of both U.S. and U.S. dollar-denominated foreign issuers, and American Depositary Receipts (“ADRs”), of companies that, when purchased, have market capitalizations that are usually within the range of companies in the Russell 1000 Value Index. Although a universal definition of large market capitalization companies does not exist, the Fund generally defines large market capitalization companies as those whose market capitalization is similar to the market capitalization of companies in the Russell 1000 Value Index, which is an unmanaged index measuring the performance of the large cap value segment of the U.S. equity universe and which includes companies with lower price-to-book ratios and lower expected growth values.

In choosing securities, Security Investors, LLC, also known as Guggenheim Investments (the “Investment Manager”), primarily invests in value-oriented companies. Value-oriented companies are companies that appear to be undervalued relative to assets, earnings, growth potential or cash flows. The Investment Manager uses a blend of quantitative analysis and fundamental research to identify securities that appear favorably priced and that may be able to sustain or improve their pre-tax ROIC (Return on Invested Capital) over time. The Fund may, consistent with its status as a non-diversified mutual fund, focus its investments in a limited number of issuers.

The Fund may invest a portion of its assets in futures contracts, options on futures contracts, and options on securities. These instruments are used to hedge the Fund’s portfolio, to maintain exposure to the equity markets, or to increase returns. The Fund may invest in a variety of investment vehicles, including those that seek to track the composition and performance of a specific index, such as exchange-traded funds (“ETFs”) and other mutual funds. The Fund may use these investments as a way of managing its cash position or to gain exposure to the equity markets or a particular sector of the equity markets, while maintaining liquidity.

The Fund typically sells a security when its issuer is no longer considered a value company, shows deteriorating fundamentals or falls short of the Investment Manager’s expectations, among other reasons.

The Fund may, from time to time, invest a portion of its assets in technology stocks.

Under adverse or unstable market conditions, the Fund could invest some or all of its assets in cash, fixed-income securities, government bonds, money market securities, or repurchase agreements. The Fund may be unable to pursue or achieve its investment objective during that time and temporary defensive investments could reduce the benefit from any upswing in the market.

PRINCIPAL RISKS

The value of an investment in the Fund will fluctuate and is subject to investment risks, which means investors could lose money. The principal risks of investing in the Fund are summarized below.

Depositary Receipt Risk—The Fund may hold the securities of non-U.S. companies in the form of ADRs and GDRs. The underlying securities of the ADRs and Global Depositary Receipts ("GDRs") in the Fund’s portfolio are subject to fluctuations in foreign currency exchange rates that may affect the value of the Fund’s portfolio. In addition, the value of the securities underlying the ADRs and GDRs may change materially when the U.S. markets are not open for trading. Investments in the underlying foreign securities also involve political and economic risks distinct from those associated with investing in the securities of U.S. issuers.

Derivatives Risk—Derivatives may pose risks in addition to and greater than those associated with investing directly in securities or other investments, including risks relating to leverage, imperfect correlations with underlying investments or the Fund’s other portfolio holdings, high price volatility, lack of availability, counterparty credit, liquidity, valuation and legal restrictions. Their use is a highly specialized activity that involves investment techniques and risks different from those associated with ordinary portfolio securities transactions. If the Investment Manager is incorrect about its expectations of market conditions, the use of derivatives could also result in a loss, which in some cases may be unlimited. In addition, the Fund’s use of derivatives may cause the Fund to realize higher amounts of short term capital gains (generally taxed at ordinary income tax rates) than if the Fund had not used such instruments. Some of the derivatives in which the Fund invests are traded (and privately negotiated) in the over-the-counter ("OTC") market. OTC derivatives are subject to heightened credit, liquidity and valuation risks.

Equity Securities Risk—Equity securities include common stocks and other equity securities (and securities convertible into stocks), and the prices of equity securities fluctuate in value more than other investments. They reflect changes in the issuing company’s financial condition and changes in the overall market. Common stocks generally represent the riskiest investment in a company. The Fund may lose a substantial part, or even all, of its investment in a company’s stock. Growth stocks may be more volatile than value stocks.

Foreign Securities and Currency Risk—Foreign securities carry additional risks when compared to U.S. securities, including currency fluctuations, adverse political and economic developments, unreliable or untimely information, less liquidity, limited legal recourse and higher transactional costs.

Investment in Investment Vehicles Risk—Investing in other investment vehicles, including ETFs, closed-end funds and other mutual funds, subjects the Fund to those risks affecting the investment vehicle, including the possibility that the value of the underlying securities held by the investment vehicle could decrease or the portfolio becomes illiquid. Moreover, the Fund and its shareholders will incur its pro rata share of the underlying vehicles’ expenses.

Large-Capitalization Securities Risk—The Fund is subject to the risk that large-capitalization securities may underperform other segments of the equity market or the equity market as a whole. Larger, more established companies may be unable to respond quickly to new competitive challenges such as changes in technology and may not be able to attain the high growth rate of smaller companies, especially during extended periods of economic expansion.

Leverage Risk—The Fund’s use of leverage, through borrowings or instruments such as derivatives, may cause the Fund to be more volatile and riskier than if it had not been leveraged.

Liquidity and Valuation Risk—In certain circumstances, it may be difficult for the Fund to purchase and sell particular investments within a reasonable time at a fair price, or the price at which it has been valued by the Investment Manager for purposes of the Fund’s net asset value, causing the Fund to be less liquid and unable to realize what the Investment Manager believes should be the price of the investment.

Management Risk—The Fund is actively managed, which means that investment decisions are made based on investment views. There is no guarantee that the investment views will produce the desired results or expected returns, causing the Fund to fail to meet its investment objective or underperform its benchmark index or funds with similar investment objectives and strategies. Furthermore, active trading that can accompany active management, also called “high turnover,” may have a negative impact on performance. Active trading may result in higher brokerage costs or mark-up charges, which are ultimately passed on to shareholders of the Fund.

Market Risk—The value of, or income generated by, the securities held by the Fund may fluctuate rapidly and unpredictably as a result of factors affecting individual companies or changing economic, political, social or financial market conditions throughout the world because of the interconnected global economies and financial markets.

Non-Diversification Risk—The Fund is considered non-diversified because it invests a large portion of its assets in a small number of issuers. As a result, the Fund is more susceptible to risks associated with those issuers than a more diversified portfolio, and its performance may be more volatile.

Regulatory and Legal Risk—U.S. and other regulators and governmental agencies may implement additional regulations and legislators may pass new laws that affect the investments held by the Fund, the strategies used by the Fund or the level of regulation or taxation applying to the Fund (such as regulations related to investments in derivatives). These may impact the investment strategies, performance, costs and operations of the Fund or taxation of shareholders.

Technology Stocks Risk—Stocks of companies involved in the technology sector may be very volatile.

Value Stocks Risk—Value stocks are subject to the risk that the intrinsic value of the stock may never be realized by the market or that the price goes down.

PERFORMANCE INFORMATION

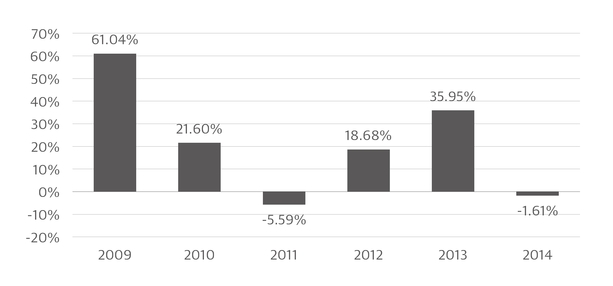

The following chart and table provide some indication of the risks of investing in the Fund by showing the Fund’s Class A share performance from year to year and average annual returns for the one, five and ten year and since inception periods, as applicable, for the Fund’s Class A, Class B, Class C and Institutional Class shares compared to those of a broad measure of market performance. As with all mutual funds, past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. Updated performance information is available on the Fund’s website at www.guggenheiminvestments.com or by calling 800.820.0888.

The bar chart does not reflect the impact of the sales charge applicable to Class A shares which, if reflected, would lower the returns shown.

|

| | |

Highest Quarter Return Q2 2009 19.19% | | Lowest Quarter Return Q4 2008 -23.63% |

AVERAGE ANNUAL TOTAL RETURNS

(for the periods ended December 31, 2014)

After-tax returns shown in the table are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of any state or local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts (“IRAs”). After-tax returns are shown for Class A only. After-tax returns for Class B, Class C and Institutional Class will vary.

|

| | | |

| 1 Year | 5 Years | 10 Years |

Class A | | | |

Return Before Taxes | 3.62% | 11.17% | 6.31% |

Return After Taxes on Distributions | 2.53% | 10.72% | 5.91% |

Return After Taxes on Distributions and Sale of Fund Shares | 2.66% | 8.76% | 4.97% |

Class B | 4.10% | 12.52% | 6.81% |

Class C | 6.96% | 11.65% | 6.09% |

Institutional Class | 9.10% | 13.90%1 | N/A |

Index | | | |

Russell 1000 Value Index (reflects no deductions for fees, expenses or taxes) | 13.45% | 15.42% | 7.30% |

1 Since inception of June 7, 2013.

MANAGEMENT OF THE FUND

Security Investors, LLC, also known as Guggenheim Investments (the “Investment Manager”), serves as the investment manager of the Fund. Mark Mitchell is primarily responsible for the day-to-day management of the Fund and holds the title of Portfolio Manager with the Investment Manager. He has managed the Fund since July 2005.

PURCHASE AND SALE OF FUND SHARES

You may purchase or redeem Fund shares through your broker/dealer, other financial intermediary that has an agreement with Guggenheim Funds Distributors, LLC, the Fund’s distributor, or through the Fund’s transfer agent. You may purchase, redeem or exchange shares of any class of the Fund on any day the New York Stock Exchange is open for business. Class B shares are closed to new subscriptions from either new or existing shareholders. The minimum initial investment for Class A and Class C shares is $2,500. The minimum subsequent investment is $100. Class A and Class C do not have a minimum account balance.

The Institutional Class minimum initial investment is $2 million, although the Investment Manager may waive this requirement at its discretion. The Institutional Class has a minimum account balance of $1 million. Due to the relatively high cost of maintaining accounts below the minimum account balance, the Fund reserves the right to redeem shares if an account balance falls below the minimum account balance for any reason. Investors will be given 60 days advance notice to reestablish the minimum account balance. If the account balance is not increased, the account may be closed and the proceeds sent to the investor. Fund shares will be redeemed at net asset value on the day the account is closed.

TAX INFORMATION

Fund distributions are taxable as ordinary income or capital gains (or a combination of both), unless your investment is in an IRA or other tax-advantaged retirement account. Investments through tax-advantaged accounts may sometimes become taxable upon withdrawal.

PAYMENTS TO BROKER/DEALERS AND OTHER FINANCIAL INTERMEDIARIES

If you purchase Fund shares through a broker/dealer or other financial intermediary, the Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker/dealer or other intermediary and your sales person to recommend the Fund over another investment. Ask your sales person or visit your financial intermediary’s website for more information.

Guggenheim Mid Cap Value Fund

INVESTMENT OBJECTIVE

The Guggenheim Mid Cap Value Fund (the “Fund”) seeks long-term growth of capital.

FEES AND EXPENSES OF THE FUND

This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $100,000 in the Family of Funds, as defined on page 107 of the Fund’s prospectus. More information about these and other discounts is available from your financial professional and in the “Sales Charges-Class A Shares” section on page 72 of the Fund’s prospectus and the “How to Purchase Shares” section on page 51 of the Fund’s Statement of Additional Information.

|

| | | |

| Class A | Class B | Class C |

SHAREHOLDER FEES (fees paid directly from your investment) | | | |

Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) | 4.75% | Closed to new subscriptions | None |

Maximum Deferred Sales Charge (Load) (as a percentage of original purchase price or redemption proceeds, whichever is lower) | None | 5.00% | 1.00% |

|

| | | |

ANNUAL FUND OPERATING EXPENSES (expenses that you pay each year as a percentage of the value of your investment) | | | |

Management Fees | 0.79% | 0.79% | 0.79% |

Distribution and Service (12b-1) Fees | 0.25% | 1.00% | 1.00% |

Other Expenses | 0.35% | 0.44% | 0.33% |

Total Annual Fund Operating Expenses | 1.39% | 2.23% | 2.12% |

EXAMPLE

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds.

The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although the actual costs may be higher or lower, based on these assumptions your costs would be:

|

| | | | | | | | | |

| Redeemed | | Not Redeemed |

Class | 1 Year | 3 Years | 5 Years | 10 Years | | 1 Year | 3 Years | 5 Years | 10 Years |

A | $610 | $894 | $1,199 | $2,064 | | $610 | $894 | $1,199 | $2,064 |

B | $726 | $997 | $1,395 | $2,353 | | $226 | $697 | $1,195 | $2,353 |

C | $315 | $664 | $1,139 | $2,452 | | $215 | $664 | $1,139 | $2,452 |

PORTFOLIO TURNOVER

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 35% of the average value of its portfolio.

PRINCIPAL INVESTMENT STRATEGIES

The Fund pursues its objective by investing, under normal market conditions, at least 80% of its assets (net assets, plus the amount of any borrowing for investment purposes) in a diversified portfolio of equity securities, which include common stocks, rights, options, warrants, convertible debt securities, and American Depositary Receipts (“ADRs”), that, when purchased, have market capitalizations that are usually within the range of companies in the Russell 2500 Value Index. Although a universal definition of mid-capitalization companies does not exist, the Fund generally defines mid-capitalization companies as those whose market capitalization is similar to the market capitalization of companies in the Russell 2500 Value Index, which is an unmanaged index that measures the performance of securities of small-to-mid cap U.S. companies with greater-than-average value orientation. As of December 31, 2014, the Index consisted of securities of companies with market capitalizations that ranged from $19.0 million to $12.8 billion.

Security Investors, LLC, also known as Guggenheim Investments (the “Investment Manager”), typically chooses equity securities that appear undervalued relative to assets, earnings, growth potential or cash flows and may invest in a limited number of industries or industry sectors, including the technology sector. Due to the nature of value companies, the securities included in the Fund’s portfolio typically consist of small- to medium-sized companies.

The Fund may sell a security if it is no longer considered undervalued or when the company begins to show deteriorating fundamentals.

The Fund also may invest a portion of its assets in derivatives, including options and futures contracts. These instruments may be used to hedge the Fund’s portfolio, to maintain exposure to the equity markets or to increase returns.

The Fund may, from time to time, invest a portion of its assets in technology stocks.

The Fund may invest in a variety of investment vehicles, including those that seek to track the composition and performance of a specific index, such as exchange-traded funds (“ETFs”) and other mutual funds. The Fund may use these index-based investments as a way of managing its cash position to gain exposure to the equity markets or a particular sector of the equity market, while maintaining liquidity. Certain investment vehicles’ securities and other securities in which the Fund may invest are restricted securities, which may be illiquid.

Under adverse or unstable market conditions, the Fund could invest some or all of its assets in cash, fixed-income securities, government bonds, money market securities, or repurchase agreements. The Fund may be unable to pursue or achieve its investment objective during that time and temporary defensive investments could reduce the benefit from any upswing in the market.

PRINCIPAL RISKS

The value of an investment in the Fund will fluctuate and is subject to investment risks, which means investors could lose money. The principal risks of investing in the Fund are summarized below.

Depositary Receipt Risk—The Fund may hold the securities of non-U.S. companies in the form of ADRs and GDRs. The underlying securities of the ADRs and Global Depositary Receipts ("GDRs") in the Fund’s portfolio are subject to fluctuations in foreign currency exchange rates that may affect the value of the Fund’s portfolio. In addition, the value of the securities underlying the ADRs and GDRs may change materially when the U.S. markets are not open for trading. Investments in the underlying foreign securities also involve political and economic risks distinct from those associated with investing in the securities of U.S. issuers.

Derivatives Risk—Derivatives may pose risks in addition to and greater than those associated with investing directly in securities or other investments, including risks relating to leverage, imperfect correlations with underlying investments or the Fund’s other portfolio holdings, high price volatility, lack of availability, counterparty credit, liquidity, valuation and legal restrictions. Their use is a highly specialized activity that involves investment techniques and risks different from those associated with ordinary portfolio securities transactions. If the Investment Manager is incorrect about its expectations of market conditions, the use of derivatives could also result in a loss, which in some cases may be unlimited. In addition, the Fund’s use of derivatives may cause the Fund to realize higher amounts of short term capital gains (generally taxed at ordinary income tax rates) than if the Fund had not used such instruments. Some of the derivatives in which the Fund invests are traded (and privately negotiated) in the over-the-counter ("OTC") market. OTC derivatives are subject to heightened credit, liquidity and valuation risks. Certain risks also are specific to the derivatives in which the Fund invests.

Equity Securities Risk—Equity securities include common stocks and other equity securities (and securities convertible into stocks), and the prices of equity securities fluctuate in value more than other investments. They reflect changes in the issuing company’s financial condition and changes in the overall market. Common stocks generally represent the riskiest investment in a company. The Fund may lose a substantial part, or even all, of its investment in a company’s stock. Growth stocks may be more volatile than value stocks.

Foreign Securities and Currency Risk—Foreign securities carry additional risks when compared to U.S. securities, including currency fluctuations, adverse political and economic developments, unreliable or untimely information, less liquidity, limited legal recourse and higher transactional costs.

Investment in Investment Vehicles Risk—Investing in other investment vehicles, including ETFs, closed-end funds and other mutual funds, subjects the Fund to those risks affecting the investment vehicle, including the possibility that the value of the underlying securities held by the investment vehicle could decrease or the portfolio becomes illiquid. Moreover, the Fund and its shareholders will incur its pro rata share of the underlying vehicles’ expenses.

Leverage Risk—The Fund’s use of leverage, through borrowings or instruments such as derivatives, may cause the Fund to be more volatile and riskier than if it had not been leveraged.

Liquidity and Valuation Risk—In certain circumstances, it may be difficult for the Fund to purchase and sell particular investments within a reasonable time at a fair price, or the price at which it has been valued by the Investment Manager for purposes of the Fund’s net asset value, causing the Fund to be less liquid and unable to realize what the Investment Manager believes should be the price of the investment.

Management Risk—The Fund is actively managed, which means that investment decisions are made based on investment views. There is no guarantee that the investment views will produce the desired results or expected returns, causing the Fund to fail to meet its investment objective or underperform its benchmark index or funds with similar investment objectives and strategies. Furthermore, active trading that can accompany active management, also called “high turnover,” may have a negative impact on performance. Active trading may result in higher brokerage costs or mark-up charges, which are ultimately passed on to shareholders of the Fund.

Market Risk—The value of, or income generated by, the securities held by the Fund may fluctuate rapidly and unpredictably as a result of factors affecting individual companies or changing economic, political, social or financial market conditions throughout the world because of the interconnected global economies and financial markets.

Mid-Capitalization Securities Risk—The Fund is subject to the risk that mid-capitalization securities may underperform other segments of the equity market or the equity market as a whole. Securities of mid-capitalization companies may be more speculative, volatile and less liquid than securities of large companies. Mid-capitalization companies tend to have inexperienced management as well as limited product and market diversification and financial resources, and may be more vulnerable to adverse developments than large capitalization companies.

Regulatory and Legal Risk—U.S. and other regulators and governmental agencies may implement additional regulations and legislators may pass new laws that affect the investments held by the Fund, the strategies used by the Fund or the level of regulation or taxation applying to the Fund (such as regulations related to investments in derivatives). These may impact the investment strategies, performance, costs and operations of the Fund or taxation of shareholders.

Restricted Securities Risk—Restricted securities generally cannot be sold to the public and may involve a high degree of business, financial and liquidity risk, which may result in substantial losses to the Fund.

Technology Stocks Risk—Stocks of companies involved in the technology sector may be very volatile.

Value Stocks Risk—Value stocks are subject to the risk that the intrinsic value of the stock may never be realized by the market or that the price goes down.

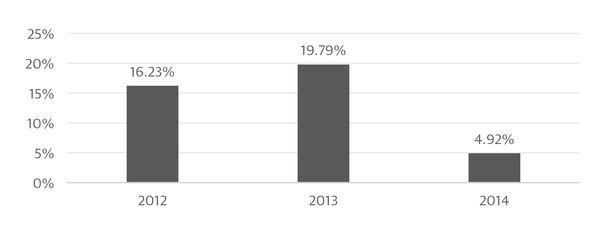

PERFORMANCE INFORMATION

The following chart and table provide some indication of the risks of investing in the Fund by showing the Fund’s Class A share performance from year to year and average annual returns for the one, five and ten year periods for the Fund’s Class A, Class B and Class C shares compared to those of a broad measure of market performance. As with all mutual funds, past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. Updated performance information is available on the Fund’s website at www.guggenheiminvestments.com or by calling 800.820.0888.

The bar chart does not reflect the impact of the sales charge applicable to Class A shares which, if reflected, would lower the returns shown.

|

| | |

Highest Quarter Return Q2 2009 25.21% | | Lowest Quarter Return Q4 2008 -20.21% |

AVERAGE ANNUAL TOTAL RETURNS

(for the periods ended December 31, 2014)

After-tax returns shown in the table are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of any state or local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts (“IRAs”). After-tax returns are shown for Class A only. After-tax returns for Class B and Class C will vary.

|

| | | |

| 1 Year | 5 Years | 10 Years |

Class A | | | |

Return Before Taxes | -4.24% | 9.71% | 8.11% |

Return After Taxes on Distributions | -7.07% | 8.03% | 6.48% |

Return After Taxes on Distributions and Sale of Fund Shares | -0.16% | 7.48% | 6.39% |

Class B | -4.58% | 9.84% | 8.09% |

Class C | -1.03% | 10.21% | 7.95% |

Index | | | |

Russell 2500 Value Index (reflects no deductions for fees, expenses or taxes) | 7.11% | 15.48% | 7.91% |

MANAGEMENT OF THE FUND

Security Investors, LLC, also known as Guggenheim Investments (the “Investment Manager”), serves as the investment manager of the Fund. James Schier is primarily responsible for the day-to-day management of the Fund and holds the title of Portfolio Manager with the Investment Manager. He has managed the Fund since May 1997.

PURCHASE AND SALE OF FUND SHARES

You may purchase or redeem Fund shares through your broker/dealer, other financial intermediary that has an agreement with Guggenheim Funds Distributors, LLC, the Fund’s distributor, or through the Fund’s transfer agent. You may purchase, redeem or exchange shares of any class of the Fund on any day the New York Stock Exchange is open for business. Class B shares are closed to new subscriptions from either new or existing shareholders. The minimum initial investment for Class A and Class C shares is $2,500. The minimum subsequent investment is $100. Class A and Class C do not have a minimum account balance.

TAX INFORMATION

Fund distributions are taxable as ordinary income or capital gains (or a combination of both), unless your investment is in an IRA or other tax-advantaged retirement account. Investments through tax-advantaged accounts may sometimes become taxable upon withdrawal.

PAYMENTS TO BROKER/DEALERS AND OTHER FINANCIAL INTERMEDIARIES

If you purchase Fund shares through a broker/dealer or other financial intermediary, the Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker/dealer or other intermediary and your sales person to recommend the Fund over another investment. Ask your sales person or visit your financial intermediary’s website for more information.

Guggenheim Mid Cap Value Institutional Fund

INVESTMENT OBJECTIVE

The Guggenheim Mid Cap Value Institutional Fund (the “Fund”) seeks long-term growth of capital.

FEES AND EXPENSES OF THE FUND

This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund.

|

| |

SHAREHOLDER FEES (fees paid directly from your investment) | |

Maximum Sales Charge (Load) Imposed on Purchases | None |

Maximum Deferred Sales Charge (Load) | None |

|

| |

ANNUAL FUND OPERATING EXPENSES (expenses that you pay each year as a percentage of the value of your investment) | |

Management Fees | 0.75% |

Distribution and Service (12b-1) Fees | None |

Other Expenses | 0.30% |

Total Annual Fund Operating Expenses | 1.05% |

EXAMPLE

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds.

The Example assumes that you invest $10,000 in the Fund for the time periods indicated. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although the actual costs may be higher or lower, based on these assumptions your costs would be:

|

| | | | |

Class | 1 Year | 3 Years | 5 Years | 10 Years |

Institutional | $107 | $334 | $579 | $1,283 |

PORTFOLIO TURNOVER

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 41% of the average value of its portfolio.

PRINCIPAL INVESTMENT STRATEGIES

The Fund pursues its objective by investing, under normal market conditions, at least 80% of its assets (net assets, plus the amount of any borrowing for investment purposes) in a diversified portfolio of equity securities, which include common stocks, rights, options, warrants, convertible debt securities, and American Depositary Receipts (“ADRs”), that, when purchased, have market capitalizations that are usually within the range of companies in the Russell 2500 Value Index. Although a universal definition of mid-capitalization companies does not exist, the Fund generally defines mid-capitalization companies as those whose market capitalization is similar to the market capitalization of companies in the Russell 2500 Value Index, which is an unmanaged index that measures the performance of securities of small-to-mid cap U.S. companies with greater-than-average value orientation. As of December 31, 2014, the Russell 2500 Value Index consisted of securities of companies with market capitalizations that ranged from $19.0 million to $12.8 billion.

Security Investors, LLC, also known as Guggenheim Investments (the “Investment Manager”), typically chooses equity securities that appear undervalued relative to assets, earnings, growth potential or cash flows and may invest in a limited number of industries or industry sectors, including the technology sector. Due to the nature of value companies, the securities included in the Fund’s portfolio typically consist of small-to medium-sized companies.

The Fund may sell a security if it is no longer considered undervalued or when the company begins to show deteriorating fundamentals.

The Fund also may invest a portion of its assets in derivatives, including options and futures contracts. These instruments may be used to hedge the Fund’s portfolio, to maintain exposure to the equity markets or to increase returns.

The Fund may, from time to time, invest a portion of its assets in technology stocks.

The Fund may invest in a variety of investment vehicles, including those that seek to track the composition and performance of a specific index, such as exchange-traded funds (“ETFs”) and other mutual funds. The Fund may use these index-based investments as a way of managing its cash position to gain exposure to the equity markets or a particular sector of the equity market, while maintaining liquidity. Certain investment vehicles’ securities and other securities in which the Fund may invest are restricted securities, which may be illiquid.

Under adverse or unstable market conditions, the Fund could invest some or all of its assets in cash, fixed-income securities, government bonds, money market securities, or repurchase agreements. The Fund may be unable to pursue or achieve its investment objective during that time and temporary defensive investments could reduce the benefit from any upswing in the market.

PRINCIPAL RISKS

The value of an investment in the Fund will fluctuate and is subject to investment risks, which means investors could lose money. The principal risks of investing in the Fund are summarized below.

Depositary Receipt Risk—The Fund may hold the securities of non-U.S. companies in the form of ADRs and GDRs. The underlying securities of the ADRs and Global Depositary Receipts ("GDRs") in the Fund’s portfolio are subject to fluctuations in foreign currency exchange rates that may affect the value of the Fund’s portfolio. In addition, the value of the securities underlying the ADRs and GDRs may change materially when the U.S. markets are not open for trading. Investments in the underlying foreign securities also involve political and economic risks distinct from those associated with investing in the securities of U.S. issuers.

Derivatives Risk—Derivatives may pose risks in addition to and greater than those associated with investing directly in securities or other investments, including risks relating to leverage, imperfect correlations with underlying investments or the Fund’s other portfolio holdings, high price volatility, lack of availability, counterparty credit, liquidity, valuation and legal restrictions. Their use is a highly specialized activity that involves investment techniques and risks different from those associated with ordinary portfolio securities transactions. If the Investment Manager is incorrect about its expectations of market conditions, the use of derivatives could also result in a loss, which in some cases may be unlimited. In addition, the Fund’s use of derivatives may cause the Fund to realize higher amounts of short term capital gains (generally taxed at ordinary income tax rates) than if the Fund had not used such instruments. Some of the derivatives in which the Fund invests are traded (and privately negotiated) in the over-the-counter ("OTC") market. OTC derivatives are subject to heightened credit, liquidity and valuation risks.

Equity Securities Risk—Equity securities include common stocks and other equity securities (and securities convertible into stocks), and the prices of equity securities fluctuate in value more than other investments. They reflect changes in the issuing company’s financial condition and changes in the overall market. Common stocks generally represent the riskiest investment in a company. The Fund may lose a substantial part, or even all, of its investment in a company’s stock. Growth stocks may be more volatile than value stocks.

Foreign Securities and Currency Risk—Foreign securities carry additional risks when compared to U.S. securities, including currency fluctuations, adverse political and economic developments, unreliable or untimely information, less liquidity, limited legal recourse and higher transactional costs.

Investment in Investment Vehicles Risk—Investing in other investment vehicles, including ETFs, closed-end funds and other mutual funds, subjects the Fund to those risks affecting the investment vehicle, including the possibility that the value of the underlying securities held by the investment vehicle could decrease or the portfolio becomes illiquid. Moreover, the Fund and its shareholders will incur its pro rata share of the underlying vehicles’ expenses.