| |

|

|

|

|

| Mutual Funds |

| |

Equity |

| |

1.31.2023 |

Guggenheim Funds Summary Prospectus

Class A, Class C, Institutional Class, and Class P

| Ticker Symbol |

Fund Name | |||

| Class A |

Class C |

Institutional |

Class P |

|

| SEVAX |

SEVSX |

SVUIX |

SEVPX |

Guggenheim SMid Cap Value Fund |

Before you invest, you may wish to review the Fund’s Prospectus, which contains more information about the Fund and its risks. You may obtain the Prospectus and other information about the Fund, including the Statement of Additional Information (SAI) and most recent reports to shareholders, at no cost by visiting guggenheiminvestments.com/services/prospectuses-and-reports,

calling 800.820.0888 or e-mailing services@guggenheiminvestements.com. The Fund’s Prospectus and SAI, both dated January 31, 2023, as revised from time to time, and the Fund’s most recent shareholder reports, dated September 30, 2022, are incorporated by reference into this Summary Prospectus.

| SUMMCV-0123x0124 |

guggenheiminvestments.com |

Guggenheim

SMid Cap Value Fund

INVESTMENT OBJECTIVE

The

Guggenheim SMid Cap Value Fund (the “Fund”) seeks long-term growth of capital.

FEES AND EXPENSES OF THE FUND

This table describes the fees and expenses that you may pay if you buy, hold and sell shares of

the Fund. You may pay other fees, such as brokerage commissions and

other fees to financial intermediaries, which are not reflected in the tables and examples below. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $100,000 in the Family of Funds, as defined on page

178 of the Fund’s

prospectus. This amount may vary depending on the Guggenheim Fund in which you invest. More information about these and other discounts is available from your financial professional and in the “Sales Charges-Class A Shares” section on page 112 of the Fund’s

prospectus and the “How to Purchase Shares” section on page 91 of the Fund’s Statement of Additional Information. Different intermediaries and financial professionals may impose different sales

charges or offer different sales charge waivers or discounts. These variations are described in Appendix A to the Fund’s prospectus (Intermediary-Specific Sales Charge Waivers and Discounts).

SHAREHOLDER FEES (fees paid directly from your investment)

| |

Class A |

Class C |

Institutional

Class |

Class P |

| Maximum Sales Charge (Load) Imposed on

Purchases (as a percentage of offering price) |

4.75% |

None |

None |

None |

| Maximum Deferred Sales Charge (Load) (as a

percentage of original purchase price or

redemption proceeds, whichever is lower) |

None* |

1.00%** |

None |

None |

*

A 1.00% deferred sales charge will normally be imposed on purchases of $1,000,000 or

more on Fund shares purchased without an initial sales charge that are redeemed within 12 months of purchase.

**

A 1.00% deferred sales charge will be imposed if Fund shares are redeemed within 12

months of purchase.

ANNUAL FUND OPERATING EXPENSES (expenses that you pay each year as a percentage of the value of your investment)

| |

Class A |

Class C |

Institutional

Class |

Class P |

| Management Fees |

0.75% |

0.75% |

0.75% |

0.75% |

| Distribution and/or Service (12b-1) Fees |

0.25% |

1.00% |

None |

0.25% |

| Other Expenses |

0.19% |

0.34% |

0.28% |

0.30% |

| Total Annual Fund Operating Expenses |

1.19% |

2.09% |

1.03% |

1.30% |

| Fee Waiver (and/or expense reimbursement)1 |

-0.01% |

-0.07% |

-0.02% |

-0.04% |

| Total Annual Fund Operating Expenses After Fee

Waiver (and/or expense reimbursement) |

1.18% |

2.02% |

1.01% |

1.26% |

1

Total Annual Fund Operating Expenses After Fee Waiver (and/or expense reimbursement)

have been restated for Class C and Class P to reflect the current expense limitation agreement. Security

Investors, LLC, also known as Guggenheim Investments (the “Investment Manager”), has contractually agreed through February 1, 2024 to waive fees and/or reimburse expenses to the extent necessary to limit the ordinary operating expenses (including distribution (12b-1) fees (if any), but exclusive of brokerage costs, dividends on securities sold short, acquired fund fees and expenses, interest, taxes, litigation, indemnification, and extraordinary expenses) (“Operating Expenses”) of the Fund to the annual percentage of average daily net assets for each class of shares as follows: Class A-1.30%, Class C-2.05%, Institutional Class-1.05% and Class P-1.30%. The Investment Manager is entitled to reimbursement by the Fund of fees waived or expenses reimbursed during any of the previous 36 months beginning on the date of the expense limitation agreement, provided that the Operating Expenses do not exceed the then-applicable expense cap. The agreement will expire when it reaches its termination or when the Investment Manager ceases to serve as such and it can be terminated by the Fund’s Board of Trustees, with certain waived fees and reimbursed expenses subject to the recoupment rights of the Investment Manager.

1 | SUMMARY

PROSPECTUS

EXAMPLE

This Example is intended to help you compare the cost of investing in the Fund with the cost of

investing in other mutual funds.

The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods, unless otherwise indicated. The Example also assumes that your investment has a 5%

return each year and that the Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would

be:

| |

1 Year |

3 Years |

5 Years |

10 Years |

| Class A |

$590 |

$834 |

$1,097 |

$1,849 |

| Class C |

$305 |

$648 |

$1,117 |

$2,415 |

| Institutional |

$103 |

$326 |

$567 |

$1,258 |

| Class P |

$128 |

$408 |

$709 |

$1,564 |

You

would pay the following expenses if you did not redeem your shares:

| |

1 Year |

3 Years |

5 Years |

10 Years |

| Class C |

$205 |

$648 |

$1,117 |

$2,415 |

The above Example reflects applicable contractual fee waiver/expense reimbursement arrangements for the current duration of the arrangements only.

PORTFOLIO TURNOVER

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when

Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 39% of the average value of its

portfolio.

PRINCIPAL INVESTMENT STRATEGIES

The Fund pursues its objective by investing, under normal circumstances, at least 80% of its

assets (net assets, plus the amount of any borrowings for investment purposes) in a diversified portfolio of equity securities, which include common stocks, rights, options, warrants, convertible debt securities, and American Depositary Receipts (“ADRs”), that, when purchased, have market capitalizations that are usually within the range of companies in the Russell

2500® Value Index. Although a universal definition of small- and mid-capitalization (i.e., SMid-capitalization) companies

does not exist, the Fund generally defines SMid-capitalization companies as those whose market capitalization is similar to the market capitalization of companies in the Russell

2500® Value Index, which is an unmanaged index measuring the performance of securities of small-to-mid cap U.S. companies with greater-than-average

value orientation. As of December 31, 2022, the Russell 2500® Value

Index consisted of securities of companies with market capitalizations that ranged from $3.8 million to $20.2 billion.

In choosing securities, Security Investors, LLC, also known as Guggenheim Investments (the

“Investment Manager”), primarily invests in value-oriented companies. Value-oriented companies are companies that appear to be undervalued relative to assets, earnings, growth potential or cash flows. The Investment Manager uses a blend of

quantitative and fundamental analysis to identify securities that appear favorably priced and have the potential to appreciate in value. The Investment Manager regularly evaluates the metrics and data underlying the quantitative model

and, from time to time, may make adjustments for a variety of reasons, including, without limitation, to account for changing market, financial or economic conditions.

The

Fund may invest a portion of its assets in derivatives, including options and futures contracts. These instruments are used to hedge the Fund’s portfolio, to maintain

exposure to the equity markets or to increase returns.

The Fund may invest in a

variety of investment vehicles, including those that seek to track the composition and performance of a specific index, such as exchange-traded funds (“ETFs”) and

other mutual funds. The Fund may use these investments as a way of managing its cash position or to gain exposure to the equity markets or a particular

SUMMARY PROSPECTUS | 2

sector of the equity markets. These investments may be more liquid than investing directly in individual issuers. Certain investment vehicles’ securities and other securities in which the Fund may invest are restricted securities (consisting of securities originally issued in reliance on Rule 144A and Regulation S securities), which may be

illiquid.

The Fund typically sells a security when its issuer is no longer considered a value company,

shows deteriorating fundamentals or falls short of the Investment Manager’s expectations, among other reasons.

The Fund may invest in a limited number of sectors or industries.

Under adverse or unstable market conditions or abnormal circumstances, the Fund could invest some

or all of its assets in cash, derivatives, fixed-income instruments, government bonds, money market instruments, repurchase agreements or securities of other investment companies. The Fund may be unable to pursue or achieve its investment

objective during that time and temporary investments could reduce the benefit from any upswing in the market.

PRINCIPAL RISKS

The value of an investment in the Fund will fluctuate and is subject to investment risks, which

means investors could lose money, including all or part of their investments in the Fund. An investment in the Fund is not a bank deposit and is not insured or guaranteed by the FDIC or any governmental agency. There is no assurance that the Fund will achieve its investment objective. The Fund is subject to certain risks and

the principal risks of investing in the Fund are summarized below in alphabetical order, and not in the order of importance or potential exposure.

Convertible Securities Risk—Convertible securities may be subordinate to other securities. The total return for a convertible security

depends, in part, upon the performance of the underlying security into which it can be converted. The value of convertible securities tends to decline as interest rates

increase. Convertible securities generally offer lower interest or dividend yields than non-convertible securities of similar quality.

Counterparty Credit Risk—The Fund makes investments in financial instruments and OTC-traded derivatives involving counterparties to gain

exposure to a particular group of securities, index, asset class or other reference asset without actually purchasing those securities or investments, to hedge a position, or

for other investment purposes. Through these investments and related arrangements (e.g., prime brokerage or securities lending arrangements or derivatives transactions), the Fund is exposed to credit risks that the counterparty may be unwilling

or unable to make timely payments or otherwise to meet its contractual obligations. If the counterparty becomes bankrupt or defaults on (or otherwise becomes unable or unwilling to perform) its payment or other obligations to the

Fund, the Fund may not receive the full amount that it is entitled to receive or may experience delays in recovering the collateral or other assets held by, or on behalf of, the counterparty. If this occurs, the value of your shares in the Fund will decrease. Counterparty credit risk also includes the related risk of having concentrated exposure to such a

counterparty.

Depositary Receipt Risk—The Fund may hold the securities of non-U.S. companies

in the form of depositary receipts. The underlying securities of the depositary receipts in the Fund’s portfolio are subject to fluctuations in foreign currency exchange rates that may affect the value of the Fund’s portfolio. In addition, the value of the

securities underlying the depositary receipts may change materially when the U.S. markets are not open for trading. Investments in the underlying foreign securities also involve political and economic risks distinct from those

associated with investing in the securities of U.S. issuers.

Derivatives Risk—Derivatives and other instruments (collectively referred to in

this paragraph as “derivatives”) pose risks in addition to and greater than those associated with investing directly in securities, currencies or other investments, including risks relating to leverage, market conditions and market risk, imperfect correlations with

underlying investments or the Fund’s other portfolio holdings, high price volatility, lack of availability, counterparty credit, illiquidity, valuation, operational and legal restrictions and risk. Their use is a highly specialized activity that involves investment techniques and risks different from those associated with ordinary portfolio securities

transactions.The use of derivatives may result in leverage, which may cause the Fund to be more volatile and riskier than if it had not been leveraged. Changes in the value of a derivative may also create sudden margin delivery or

settlement payment obligations for the Fund, which can materially affect the performance of the Fund and its liquidity and other risk profiles. If the Investment Manager is incorrect about its expectations of market conditions, the use of

3 | SUMMARY

PROSPECTUS

derivatives could also result in a loss, which in some cases may be unlimited. Some of the derivatives in which the Fund invests may be traded (and privately negotiated) in the OTC market. OTC derivatives are subject to heightened

counterparty, credit, legal, liquidity and valuation risks.

Equity Securities Risk—Equity securities include common stocks and other equity and equity-related securities (and securities

convertible into stocks). The prices of equity securities generally fluctuate more than those of fixed-income investments, may rise or fall rapidly or unpredictably, and may

reflect real or perceived changes in the issuing company’s financial condition and changes in the overall market or economy. A decline in the value of equity securities held by the Fund will adversely affect the value of your investment in the Fund. Common stocks generally

represent the riskiest investment in a company and dividend payments (if declared) to preferred stockholders generally rank junior to payments due to a company’s debtholders. The Fund may lose a substantial part, or even all, of its investment in a company’s stock.

Foreign Securities and Currency Risk—Foreign securities carry unique or

additional risks when compared to U.S. securities, including currency fluctuations, adverse political (including geopolitical) and economic developments, unreliable or untimely information, less liquidity and more volatility, limited legal recourse and higher transactional

costs.

Investment in Investment Vehicles Risk—Investing in other investment vehicles,

including ETFs, closed-end funds and other mutual funds, subjects the Fund to those risks affecting the investment vehicle, including the possibility that the value of the underlying securities held by the investment vehicle could decrease or the portfolio becomes illiquid.

Moreover, the Fund and its shareholders will incur its pro rata share of the underlying vehicles’ expenses, which will reduce the Fund’s performance. In addition, investments in an ETF or a listed closed-end fund are subject to, among other risks, the risk that the shares may trade at a discount or premium relative to the net asset value of the shares

and the listing exchange may halt trading of the shares.

Liquidity and Valuation Risk—It may be difficult for the Fund to purchase and

sell particular investments within a reasonable time at a fair price, or the price at which it has been valued by the Investment Manager for purposes of the Fund’s net asset value, causing the Fund to be less liquid and unable to realize what the Investment Manager

believes should be the price of the investment. Valuation of portfolio investments may be difficult, such as during periods of market turmoil or reduced liquidity, and for investments that may, for example, trade infrequently or

irregularly. In these and other circumstances, an investment may be valued using fair value methodologies, which are inherently subjective, reflect good faith judgments based on available information and may not accurately estimate the

price at which the Fund could sell the investment at that time. These risks are heightened in a rising interest rate environment.

Management Risk—The Fund is actively managed, which means that investment decisions are made based on investment views. There

is no guarantee that the investment views will produce the desired results or expected returns. As a result of these factors, the Fund may lose value or fail to meet its

investment objective or underperform its benchmark index or funds with similar investment objectives and strategies. Furthermore, active and frequent trading that can accompany active management, also called “high turnover,” may have a negative impact on

performance. Active and frequent trading may result in higher brokerage costs or mark-up charges and tax costs, which are ultimately passed on to shareholders of the Fund. Active and frequent trading may also result in adverse tax

consequences.

Market Risk—The value of, or income generated by, the investments held by the Fund may fluctuate rapidly and unpredictably.

These fluctuations may be frequent and significant. In addition, the Fund may incur losses as a result of various market and economic factors, such as those affecting individual

companies or issuers or particular industries. In addition, developments related to economic, political (including geopolitical), social, public health, market or other conditions may cause volatility in financial markets and reduced liquidity in equity, credit and/or debt

markets, which could adversely impact the Fund and its investments and their value and performance. Under such conditions, the Fund may experience significant redemption activity by shareholders and could be forced to sell

portfolio securities or other assets at unfavorable prices in an effort to generate sufficient cash to pay redeeming shareholders. The Fund's investments may perform poorly or underperform the general securities markets or other types

of securities.

SUMMARY PROSPECTUS | 4

Mid-Capitalization Securities Risk—The Fund is subject to the risk that

mid-capitalization securities may underperform other segments of the equity market or the equity market as a whole. Securities of mid-capitalization companies may be more speculative, volatile and less liquid than securities of large companies. Mid-capitalization

companies tend to have inexperienced management as well as limited product and market diversification and

financial resources, and may be more vulnerable to adverse developments than large capitalization companies.

Quantitative Investing Risk—There is no guarantee that a quantitative model or algorithm used by the Investment Manager, and the

investments selected based on the model or algorithm, will produce the desired results. The Fund may be adversely affected by imperfections, errors or limitations in the

construction and implementation of the model or algorithm and the Investment Manager’s ability to properly analyze or timely adjust the metrics or update the data underlying the model or features of the algorithm. Other quantitative methods and techniques used by the Investment

Manager, and the investments selected based on these methods and techniques, are also subject to these types of risks.

Real Estate Investments Risk—The Fund may invest in securities of real estate companies and companies related to the real estate industry,

which are subject to the same risks as direct investments in real estate. These risks include, among others: changes in national, state or local real estate conditions;

obsolescence of properties; changes in the availability, cost and terms of mortgage funds; changes in the real estate values and interest rates; and the generation of sufficient income. Real estate companies tend to have micro-, small- or mid-capitalization,

making their securities more volatile and less liquid than those of companies with larger-capitalizations. Real estate companies may use leverage (and some may be highly leveraged), which increases investment risk and the risks normally

associated with debt financing and could adversely affect a real estate company’s operations and market value in periods of rising interest rates. These risks are

especially applicable in conditions of declining real estate values, such as those experienced during 2007 through 2009.

Regulatory and Legal Risk—U.S. and non-U.S. governmental agencies and other regulators regularly implement additional regulations and

legislators pass new laws that affect the investments held by the Fund, the strategies used by the Fund or the level of regulation or taxation applying to the Fund (such as

regulations related to investments in derivatives and other transactions). These regulations and laws impact the investment strategies, performance, costs and operations of the Fund or taxation of shareholders.

REIT Risk—In addition to the risks pertaining to real estate investments more

generally, real estate investment trusts (“REITs”) are subject to additional risks. The value of a REIT can depend on the structure of and cash flow generated

by the REIT. REITs whose investments are concentrated in a limited number or type of properties, investments or narrow geographic area are subject to the risks affecting those properties or areas to a greater extent than a REIT

with less concentrated investments. REITs are also subject to certain provisions under federal tax law. In addition, REITs may have expenses, including advisory and administration expenses, and the Fund and its shareholders will incur

its pro rata share of the underlying expenses.

Restricted

Securities Risk—Restricted securities generally cannot be sold to the public and may involve a high

degree of business, financial and liquidity risk, which may result in substantial losses to the Fund.

Sector Emphasis Risk—If the Fund invests a significant amount of its assets in any one sector, the Fund’s performance will

depend to a greater extent on the overall condition of the sector and there is increased risk that the Fund will lose value if conditions adversely affect that sector. The

prices of securities of issuers in a particular sector may be more susceptible to fluctuations as a result of changes in economic, public health or business conditions, government regulations, availability of basic resources or supplies, or other events that affect that industry or sector

more than securities of issuers in other sectors. To the extent the Fund is heavily invested in a particular sector, the Fund’s share price may be more volatile than the value of shares of a mutual fund that invests in a broader range of sectors.

Small-Capitalization Securities Risk—The Fund is subject to the risk that small-capitalization securities may underperform other segments of the

equity market or the equity market as a whole. Securities of small-capitalization companies may be more speculative, volatile and less liquid than securities of larger

companies. Small-capitalization companies tend to have inexperienced management as well as limited product and market diversification and financial resources, and may be more vulnerable to adverse developments than mid- or large-capitalization

companies.

5 | SUMMARY PROSPECTUS

Value Stocks Risk—Value stocks are subject to the risk that the intrinsic value

of the stock may never be realized by the market or that the price goes down.

PERFORMANCE INFORMATION

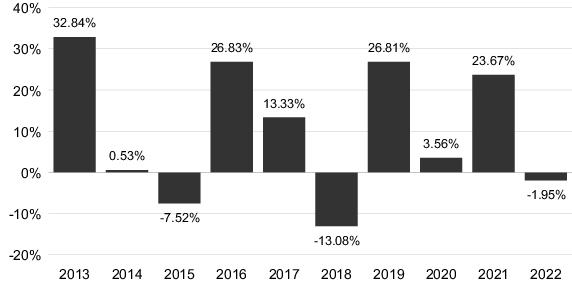

The following chart and table provide some indication of the risks of investing in the Fund by showing the Fund’s Class A share calendar year performance from year to year and average annual returns for the one, five and ten year

or, if shorter, since inception periods, as applicable, for the Fund’s Class A, Class C, Institutional Class and Class P shares compared to those of a broad measure of market performance. Performance of the benchmark index shown in the table below is shown for the same periods as shown for performance of the Class A shares.

On January 3, 2020, the Guggenheim SMid Cap Value Institutional Fund (formerly, the

Guggenheim Mid Cap Value Institutional Fund), which also was an investment company registered under the Investment Company Act of 1940 and pursued the same investment objective and principal investment strategies as the Fund and was managed in the same

manner, reorganized with and into Institutional Class shares of the Fund. The Fund has adopted the Guggenheim SMid Cap Value Institutional Fund's performance history with

respect to its Institutional Class shares. Accordingly, the performance of the Institutional Class shares of the Fund shown below is the performance of the Guggenheim SMid Cap Value Institutional Fund. The returns shown below for the Guggenheim SMid Cap Value Institutional

Fund have not been restated to reflect the fees and expenses applicable to the Institutional Class shares of the Fund and could have been lower had such an adjustment been

made.

As with all mutual funds, past performance (before and after taxes) is not

necessarily an indication of how the Fund will perform in the future. Updated performance information is

available on the Fund’s website at www.guggenheiminvestments.com or by calling 800.820.0888.

The bar chart does not reflect the impact of the sales charge applicable to Class A shares which, if reflected, would lower the returns shown. Performance reflects applicable fee waivers and/or expense limitations in effect during the

periods shown.

| During the periods shown in

the chart above: |

Quarter Ended |

Return |

| Highest Quarter |

December 31, 2020 |

23.94% |

| Lowest Quarter |

March 31, 2020 |

-31.42% |

AVERAGE ANNUAL TOTAL RETURNS (for the periods ended December 31, 2022)

After-tax returns shown in the table are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of any state or local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax

returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts

(“IRAs”). After-tax returns are shown for Class A only. After-tax returns for Class C, Institutional Class, and Class P will vary. The returns shown below reflect applicable sales charges, if any.

SUMMARY PROSPECTUS | 6

| |

Inception |

1 Year |

5 Years |

10 Years or Since Inception |

| Class A |

5/1/1997 |

|

|

|

| Return Before Taxes |

|

-6.60% |

5.69% |

8.88% |

| Return After Taxes on Distributions |

|

-7.88% |

3.95% |

6.74% |

| Return After Taxes on Distributions and Sale of Fund

Shares |

|

-3.20% |

3.96% |

6.52% |

| Class C—Before Taxes |

1/29/1999 |

-3.70% |

5.85% |

8.55% |

| Institutional Class—Before Taxes |

7/11/2008 |

-1.82% |

7.04% |

9.73% |

| Class P—Before Taxes |

5/1/2015 |

-2.02% |

6.64% |

8.16% |

| Index |

|

|

|

|

| Russell 2500® Value Index (reflects no deduction for fees,

expenses or taxes) |

|

-13.08% |

4.75% |

8.93% |

MANAGEMENT OF THE FUND

Security Investors, LLC, also known as Guggenheim Investments, serves as the investment manager of the Fund. Guggenheim Investments utilizes a team-based approach that follows a disciplined investment process. The portfolio

managers for the Fund are:

| Name* |

Experience with the Fund |

Primary Title with Investment Manager |

| James P. Schier |

Since inception (1997) |

Senior Managing Director and Portfolio Manager |

| David G. Toussaint |

Since 2017 |

Managing Director and Portfolio Manager |

| Gregg Strohkorb |

Since 2015 |

Director and Portfolio Manager |

| Farhan Sharaff |

Since 2015 |

Assistant Chief Investment Officer, Equities, Senior Managing Director and Portfolio Manager |

| Burak Hurmeydan |

Since 2018 |

Director and Portfolio Manager |

*

Each portfolio manager is primarily responsible for the day-to-day management of the Fund.

PURCHASE AND SALE OF FUND SHARES

You may purchase or redeem Fund shares through your broker/dealer, other financial intermediary

that has an agreement with Guggenheim Funds Distributors, LLC, the Fund’s distributor, or, for shares of each class other than Class P shares, through the Fund’s transfer agent. You may purchase, redeem or exchange shares of any class of

the Fund on any day the New York Stock Exchange is open for business. The minimum initial investment for Class A and Class C shares is $2,500. The minimum subsequent investment is $100. Class A and Class C do not have a

minimum account balance.

The Institutional Class minimum initial investment is $2 million, although the Investment Manager may waive this requirement at its discretion. The Institutional Class has a minimum account balance of $1 million. Due to the

relatively high cost of maintaining accounts below the minimum account balance, the Fund reserves the right to redeem shares if an account balance falls below the minimum account balance for any reason. Investors will be given 60

days' notice to reestablish the minimum account balance. If the account balance is not increased, the account may be closed and the proceeds sent to the investor. Institutional

Class shares of the Fund will be redeemed at net asset value on the day the account is closed.

Class P shares of the Fund are offered through broker/dealers and other financial intermediaries

with which Guggenheim Funds Distributors, LLC has an agreement for the use of Class P shares of the Fund in investment products, programs or accounts. Class P shares do not have a minimum initial investment amount, minimum subsequent

investment amount or a minimum account balance. The Fund reserves the right to modify its minimum investment amount and account balance requirements at any time, with or without

prior notice to you.

TAX INFORMATION

Fund distributions are taxable as ordinary income or capital gains (or a combination of both),

unless your investment is through an IRA or other tax-advantaged retirement account. Investments through tax-advantaged accounts may sometimes become taxable upon withdrawal.

7 | SUMMARY

PROSPECTUS

PAYMENTS TO BROKER/DEALERS AND OTHER FINANCIAL INTERMEDIARIES

If you purchase Fund shares through a broker/dealer or other financial intermediary, the Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a

conflict of interest by influencing the broker/dealer or other intermediary and your sales person to recommend the Fund over another investment. Ask your sales person or visit

your financial intermediary’s website for more information.

SUMMARY

PROSPECTUS | 8