| |

|

|

|

|

| Mutual Funds |

| |

Fixed-Income |

| |

1.31.2022 |

Guggenheim Funds Summary Prospectus

January 31, 2022, as supplemented May 4, 2022

Class

R6

| Ticker Symbol |

Fund Name |

| Class R6 |

|

| SHYSX |

Guggenheim High Yield Fund |

Before you invest, you may wish to review the Fund’s Prospectus, which contains more

information about the Fund and its risks. You may obtain the Prospectus and other information about the Fund, including the Statement of Additional Information (SAI) and most recent reports to shareholders, at no cost by visiting guggenheiminvestments.com/services/prospectuses-and-reports,

calling 800.820.0888 or e-mailing services@guggenheiminvestements.com. The Fund’s Prospectus and SAI, both dated January 31, 2022, as revised from time to time, and the Fund’s most recent shareholder reports, dated September 30, 2021, are incorporated by reference into this Summary Prospectus.

| SUMHYR6-0122x0123 |

guggenheiminvestments.com |

Guggenheim High Yield Fund

INVESTMENT OBJECTIVE

The Guggenheim High Yield Fund (the “Fund”) seeks high current income. Capital appreciation

is a secondary objective.

FEES AND EXPENSES OF THE FUND

This table describes the fees and expenses that you may pay if you buy, hold and sell shares of the

Fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the tables and examples below.

SHAREHOLDER FEES (fees paid directly from your investment)

| |

Class R6 |

| Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering

price) |

None |

| Maximum Deferred Sales Charge (Load) (as a percentage of original purchase price or

redemption proceeds, whichever is lower) |

None |

| Redemption Charge (as a percentage of amount redeemed or exchanged)

|

2.00%*

|

*

A 2.00% redemption charge will be imposed if Fund shares are redeemed within 90 days of purchase. The Fund reserves the right to waive the redemption charge in its discretion.

ANNUAL FUND OPERATING EXPENSES (expenses that you pay each year as a percentage of the value of your investment)

| |

Class R6 |

| Management Fees |

0.60% |

| Distribution and/or Service (12b-1) Fees |

None |

| Other Expenses |

0.17% |

| Interest and Other Related Expenses |

0.02% |

| Remaining Other Expenses |

0.15% |

| Total Annual Fund Operating Expenses |

0.77% |

| Fee Waiver (and/or expense reimbursement)1 |

-0.01% |

| Total Annual Fund Operating Expenses After Fee Waiver (and/or expense

reimbursement) |

0.76% |

1

Security Investors, LLC, also known as Guggenheim Investments (the “Investment

Manager”), has contractually agreed through February 1, 2023, to waive the amount of the Fund’s

management fee to the extent necessary to offset the proportionate share of any management fee paid by the Fund with respect to any Fund investment in an underlying fund for

which the Investment Manager or any of its affiliates also serves as investment manager. The agreement will expire when it reaches its termination or when the Investment Manager

ceases to serve as such and it can be terminated by the Fund’s Board of Trustees.

EXAMPLE

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you

invest $10,000 in the Fund for the time periods indicated. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses

remain the same. Although the actual costs may be higher or lower, based on these assumptions your costs (whether or not you redeem your shares at the end of the given period) would

be:

| 1 Year |

3 Years |

5 Years |

10 Years |

| $78 |

$245 |

$427 |

$953 |

The above Example reflects applicable contractual fee waiver/expense reimbursement arrangements for the current duration of the arrangements only.

1 | SUMMARY PROSPECTUS

PORTFOLIO TURNOVER

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when

Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 86% of the average value of its

portfolio.

PRINCIPAL INVESTMENT STRATEGIES

The Fund pursues its objective by investing at least 80% of its assets (net assets, plus the amount

of any borrowings for investment purposes), under normal circumstances, in a broad range of high yield, high risk debt securities rated below the top four long-term rating categories by a nationally recognized statistical rating organization or, if unrated, determined by Security Investors, LLC, also known as Guggenheim Investments (the “Investment Manager”), to be of comparable quality (also known as “junk bonds”). If nationally recognized statistical rating organizations assign different ratings to the same security, the Fund will use the higher rating for purposes of determining the security’s credit quality. These debt securities may include, without limitation: corporate bonds and notes, convertible securities, commercial paper, discount notes, securities issued by the U.S. government or its agencies and instrumentalities

(including those not backed by the full faith and credit of the U.S. government), agency and non-agency mortgage-backed securities and other asset-backed securities (including collateralized debt obligations), participations in and

assignments of loans (such as senior floating rate loans, syndicated bank loans, secured or unsecured loans, bridge loans and other loans), floating rate revolving credit facilities (“revolvers”), debtor-in-possession loans (“DIPs”) and other loans, and sovereign debt securities and Eurodollar bonds and obligations. These securities may pay fixed or

variable rates of interest. These securities also may be restricted securities, including Rule 144A securities that are eligible for resale to qualified institutional buyers.

The Fund also may invest in a variety of investment vehicles, principally closed-end funds,

exchange-traded funds (“ETFs”) and other mutual funds. The Fund may invest up to 10% of its net assets in securities that are in default at the time of purchase. The debt securities in which the Fund invests will primarily be domestic securities, but may also

include foreign securities. Such securities may be denominated in foreign currencies. The Investment Manager may attempt to reduce foreign currency exchange rate risk by entering into contracts with banks, brokers or dealers to

purchase or sell securities or foreign currencies at a future date. The Fund may also invest in preferred securities.

The Fund also may seek exposures through derivative transactions, including: foreign exchange

forward contracts; futures on securities, indices, currencies and other investments; Eurodollar futures; options; interest rate swaps; cross-currency swaps; total return swaps; and credit default swaps, which may also create economic leverage in the

Fund. The Fund may engage in derivative transactions for speculative purposes to enhance total return, to seek to hedge against fluctuations in securities prices, interest rates or currency rates, to change the effective duration of its portfolio, to manage certain investment risks, as a substitute for the purchase or sale of securities or currencies

and/or to obtain or replicate market exposure. The Fund may use leverage to the extent permitted by applicable law by entering into reverse repurchase agreements and transactions equivalent to a borrowing for investment purposes.

The Fund also may engage, without limitation, in repurchase agreements, forward commitments,

short sales and securities lending. The Fund may, without limitation, seek to obtain exposure to the securities in which it primarily invests by entering into a series of purchase and sale contracts or by using other investment techniques (such as

dollar rolls).

The Investment Manager, with assistance from Guggenheim Partners Advisors, LLC, as investment

sub-adviser (the “Sub-Adviser”), selects securities and other investments for purchase and sale based on intensive credit research involving extensive due diligence on each issuer, region and sector, and also considers macroeconomic outlook and

geopolitical issues.

The Investment Manager may determine to sell a security for several reasons, including but not limited to the following: (1) to adjust the portfolio’s average maturity or duration, or to shift assets into or out of higher-yielding securities; (2) if a security’s credit rating has been changed, the Investment Manager's credit outlook has changed, or for other similar reasons; (3) to meet redemption requests; (4) to take gains; or (5) due to relative value. Under

adverse or unstable market conditions or abnormal circumstances (for example, in the event of credit events, where it is deemed opportune to preserve gains, or to preserve the relative value of investments or in the case of large cash

inflows or anticipated large redemptions), the Fund can make temporary investments and may not be able to pursue or achieve its investment objective.

SUMMARY PROSPECTUS | 2

PRINCIPAL RISKS

The value of an investment in the Fund will fluctuate and is subject to investment risks, which means investors could lose money. An investment in

the Fund is not a bank deposit and is not insured or guaranteed by the FDIC or any governmental agency. There is no assurance that the Fund will achieve its investment objective. The principal risks of investing in the Fund are summarized below.

Asset-Backed Securities Risk—Investors in asset-backed securities, including

residential mortgage-backed securities, commercial mortgage-backed securities and other structured finance investments, generally receive payments that are part interest and part return of principal. These payments may vary based on the rate at which the

underlying borrowers pay off their loans. Some asset-backed securities, including mortgage-backed securities, may have structures that make their performance based on changes in interest rates and other factors difficult to predict,

causing their prices to be volatile. In particular, during periods of falling interest rates, asset-backed securities are more likely to be called or prepaid, which can result in the Fund having to reinvest proceeds in other investments at a

lower interest rate or less advantageous terms, which would adversely affect the Fund. These instruments are particularly subject to interest rate, credit and liquidity and valuation risks. The terms of many structured finance

investments and other instruments are tied to interbank reference rates (referred to collectively as the “London Interbank Offered Rate” or “LIBOR”), which function as a reference rate or benchmark for many underlying collateral investments, securities and transactions. It is anticipated that LIBOR ultimately will be discontinued, which may

cause increased volatility and illiquidity in the markets for instruments with terms tied to LIBOR or other adverse consequences, such as decreased yields and reduction in value, for these instruments. These events may adversely

affect the Fund and its investments in such instruments.

Collateralized Loan Obligations and Collateralized Debt Obligations

Risk—Collateralized loan obligations (“CLOs”) bear many of the same risks as other

forms of asset-backed securities, including interest rate risk, credit risk and default risk. As they are backed by pools of loans, CLOs also bear similar risks to investing in

loans directly. CLOs issue classes or “tranches” that vary in risk and yield. CLOs may experience substantial losses attributable to loan defaults. Losses caused by defaults on underlying assets are borne first by the holders of subordinate tranches.

The Fund’s investment in CLOs may decrease in market value when the CLO experiences loan defaults or credit impairment, the disappearance of a subordinate tranche, or market anticipation of defaults and investor aversion to

CLO securities as a class.

Collateralized debt obligations (“CDOs”) are structured similarly to CLOs and bear the same risks as CLOs including interest rate risk, credit risk and default risk. CDOs are subject to additional risks because they are backed by pools

of assets other than loans including securities (such as other asset-backed securities), synthetic instruments or bonds and may be highly leveraged. Like CLOs, losses incurred by a CDO are borne first by holders of subordinate

tranches. Accordingly, the risks of CDOs depend largely on the type of underlying collateral and the tranche of CDOs in which the Fund invests. For example, CDOs that obtain their exposure through synthetic investments entail the risks

associated with derivative instruments. The terms of many structured finance investments, including CLOs and CDOs, are tied to LIBOR, which functions as a reference rate or

benchmark for many underlying collateral investments, securities and transactions. It is anticipated that LIBOR will be discontinued, which may cause increased volatility and illiquidity in the markets for instruments with terms tied to LIBOR or other adverse

consequences, such as decreased yields and reduction in value, for these instruments. Some structured finance investments are tied to relatively new and developing reference rates, such as SOFR or other reference rates based on

SOFR. These relatively new and developing rates may behave differently than LIBOR would have or may not match the reference rate applicable to the underlying assets related to

these investments. These events may adversely affect the Fund and its investments in such instruments.

Commercial Paper Risk—The value of the Fund’s investment in commercial paper, which is an unsecured promissory note that

generally has a maturity date between one and 270 days and is issued by a U.S. or foreign entity, is susceptible to changes in the issuer’s financial condition or credit

quality. Investments in commercial paper are usually discounted from their value at maturity. Commercial paper can be fixed-rate or variable rate and can be adversely affected by changes in interest rates.

Convertible Securities Risk—Convertible securities may be subordinate to other

securities. The total return for a convertible security depends, in part, upon the performance of the underlying security into which it can be converted. The value of convertible securities tends to decline as interest rates increase. Convertible securities generally offer

lower interest or dividend yields than non-convertible securities of similar quality.

3 | SUMMARY PROSPECTUS

Counterparty Credit

Risk—The Fund makes investments in financial instruments and OTC-traded derivatives involving

counterparties to gain exposure to a particular group of securities, index, asset class or other reference asset without actually purchasing those securities or investments, to

hedge a position, or for other investment purposes. Through these investments and related arrangements (e.g., prime brokerage or securities lending arrangements or derivatives transactions), the Fund is exposed to credit risks that the counterparty may be unwilling

or unable to make timely payments or otherwise to meet its contractual obligations. If the counterparty becomes bankrupt or defaults on (or otherwise becomes unable or unwilling to perform) its payment or other obligations to the

Fund, the Fund may not receive the full amount that it is entitled to receive or may experience delays in recovering the collateral or other assets held by, or on behalf of, the counterparty. If this occurs, the value of your shares in the Fund will decrease.

Credit Risk—The Fund could lose money if the issuer or guarantor of a

fixed-income or other debt instrument or a counterparty to a derivatives transaction or other transaction is unable or unwilling, or perceived to be unable or unwilling, to pay interest or repay principal on time, defaults or otherwise fails to meet its obligations. Actual or

perceived changes in economic, social, public health, financial or political conditions in general or that affect a particular type of instrument, issuer, guarantor or counterparty can reduce the ability of the party to meet its

obligations, which can affect the credit quality, liquidity and/or value of an instrument. The value of an instrument also may decline for reasons that relate directly to the issuer, guarantor or counterparty, such as management

performance, financial leverage and reduced demand for goods and services. The issuer, guarantor or counterparty could also suffer a rapid decline in credit rating, which would adversely affect the volatility of the value and liquidity of the instrument. Credit ratings may not be an accurate assessment of liquidity or credit risk.

Currency Risk—Indirect and direct exposure to foreign currencies subjects the

Fund to the risk that those currencies will decline in value relative to the U.S. Dollar, which would cause a decline in the U.S. value of the holdings of the Fund. Currency rates in foreign countries may fluctuate significantly over short periods of time for a

number of reasons, including changes in interest rates and the imposition of currency controls or other political, economic and tax developments in the U.S. or abroad.

Derivatives Risk—Derivatives may pose risks in addition to and greater than

those associated with investing directly in securities, currencies or other investments, including risks relating to leverage, imperfect correlations with underlying investments or the Fund’s other portfolio holdings, high price volatility, lack of availability, counterparty credit, liquidity, valuation and legal restrictions. Their use is a highly specialized activity that involves investment

techniques and risks different from those associated with ordinary portfolio securities transactions. If the Investment Manager is incorrect about its expectations of market conditions, the use of derivatives could also result in a loss,

which in some cases may be unlimited. In addition, the Fund’s use of derivatives may cause the Fund to realize higher amounts of short term capital gains (generally taxed at ordinary income tax rates) than if the Fund had not

used such instruments. Some of the derivatives in which the Fund invests may be traded (and privately negotiated) in the OTC market. OTC derivatives are subject to heightened counterparty credit, liquidity and valuation risks.

Forward Foreign Currency Exchange Contracts Risk—A forward foreign currency exchange contract is an OTC obligation to purchase or sell a specific currency at a

future date at a price set at the time of the contract. Foreign currency transactions can be affected unpredictably by intervention (or the failure to intervene) by U.S. or foreign governments or central banks, or by currency controls or political developments. Such events may prevent or

restrict the Fund’s ability to enter into foreign currency transactions, force the Fund to exit a foreign currency transaction at a disadvantageous time or price or result

in penalties for the Fund, any of which may result in a loss to the Fund. A contract to sell a foreign currency would limit any potential gain that might be realized if the value of the currency increases. Suitable hedging transactions may not be available in all

circumstances. Engaging in forward foreign currency exchange contracts will subject the Fund to counterparty credit risk and any failure to perform by a counterparty could result in a loss to the Fund.

Dollar Roll Transaction Risk—The Fund may enter into dollar roll transactions,

in which the Fund sells a mortgage-backed or other security for settlement on one date and buys back a substantially similar security for settlement at a later date. Dollar rolls involve a risk of loss if the market value of the securities that the Fund is committed to buy

declines below the price of the securities the Fund has sold.

Equity Securities Risk—Equity securities include common stocks and other equity

and equity-related securities (and securities convertible into stocks). The prices of equity securities generally fluctuate in value more than fixed-income investments, may rise or fall rapidly or unpredictably and may reflect real or perceived changes in the issuing

company’s financial condition and changes in the overall market or economy. A decline in the value of equity

SUMMARY

PROSPECTUS | 4

securities held by the Fund will adversely affect the value of your investment in the Fund. Common stocks generally

represent the riskiest investment in a company and dividend payments (if declared) to preferred stockholders generally rank junior to payments due to a company’s debtholders. The Fund may lose a substantial part, or even all, of its investment in a company’s stock.

Extension Risk—Certain debt instruments, including mortgage- and other

asset-backed securities, are subject to the risk that payments on principal may occur at a slower rate or later than expected. In this event, the expected maturity could lengthen and the Fund’s investment may sharply decrease in value and the Fund’s income from the investment may quickly decline. These types of instruments are particularly subject to extension risk, and offer less

potential for gains, during periods of rising interest rates. In addition, the Fund may be delayed in its ability to reinvest income or proceeds from these instruments in potentially higher yielding investments, which would adversely affect the

Fund.

Foreign Securities and Currency Risk—Foreign securities carry unique or additional risks when compared to U.S. securities, including currency

fluctuations, adverse political (including geopolitical) and economic developments, unreliable or untimely information, less liquidity and more volatility, limited legal

recourse and higher transactional costs.

High Yield and Unrated Securities Risk—High yield, below investment grade and

unrated high risk debt securities (which also may be known as “junk bonds”) may present additional risks because these securities may be less liquid, and therefore more difficult to value accurately and sell at an advantageous price or time, and present more credit

risk than investment grade bonds. The price of high yield securities tends to be subject to greater volatility due to issuer-specific factors, such as operating results and outlook and to real or perceived adverse economic and

competitive industry conditions. This exposure may be obtained through investments in other investment companies. Based on its investment strategies, a significant portion of the Fund’s investments can be comprised of high yield

and unrated securities and thus particularly prone to the foregoing risks, which may result in losses to the Fund.

Interest Rate Risk—Fixed-income and other debt instruments are subject to the possibility that interest rates could change.

Changes in interest rates may adversely affect the Fund’s investments in these instruments, such as the value or liquidity of, and income generated by, the investments.

Interest rates may change as a result of a variety of factors, and the change may be sudden and significant, with unpredictable impacts on the financial markets and the Fund’s investments. Fixed-income and other debt instruments with longer durations are more sensitive to changes in

interest rates and, thus, subject to more volatility than similar instruments with shorter durations. Generally, when interest rates increase, the values of fixed-income and other debt instruments decline and when interest rates

decrease, the values of fixed-income and other debt instruments rise. During periods of rising interest rates, as is the case currently, because changes in interest rates on adjustable rate securities may lag behind changes in market

rates, the value of such securities may decline until their interest rates reset to market rates. During periods of declining interest rates, because the interest rates on adjustable rate securities generally reset downward, their

market value is unlikely to rise to the same extent as the value of comparable fixed rate securities. During periods when interest rates are low or negative, the Fund’s yield and performance may be adversely affected and the Fund may be unable to maintain positive returns or minimize the volatility of the Fund's net asset value per share. The

risks associated with rising interest rates are heightened given the current interest rate environment.

Investment in Investment Vehicles Risk—Investing in other investment vehicles, including ETFs, closed-end funds and other mutual funds, subjects the

Fund to those risks affecting the investment vehicle, including the possibility that the value of the underlying securities held by the investment vehicle could decrease or the

portfolio becomes illiquid. Moreover, the Fund and its shareholders will incur its pro rata share of the underlying vehicles’ expenses, which will reduce the Fund’s performance. In addition, investments in an ETF are subject to, among other risks, the risk that the ETF’s shares may trade at a discount or premium relative to the net asset value of the shares and the listing

exchange may halt trading of the ETF’s shares.

Investment in Loans Risk—The Fund may invest in loans directly or indirectly

through assignments or participations. Investments in loans, including loan syndicates and other direct lending opportunities, involve special types of risks, including credit risk, interest rate risk, counterparty risk, prepayment risk and extension risk. Loans

may offer a fixed or floating interest rate. Loans are often below investment grade and may be unrated. The Fund’s investments in loans can also be difficult to value accurately and may be more susceptible to liquidity risk than fixed-income instruments of similar credit quality and/or maturity. The Fund is also subject to the risk that the value of any

collateral for the loan may be insufficient or unavailable to cover the borrower’s obligations should the borrower fail to make payments, become insolvent, or otherwise default. Transactions in loans are often subject to long settlement

5 | SUMMARY

PROSPECTUS

periods and often require consent from borrowers and/or an agent acting for the lenders, thus potentially limiting

the ability of the Fund to invest sale proceeds in other investments and to use proceeds to meet its current redemption obligations. The Fund thus is subject to the risk of selling other investments at disadvantageous times or prices or

taking other actions necessary to raise cash to meet its redemption obligations. Participations in loans may subject the Fund to the credit risk of both the borrower and the seller of the participation and may make enforcement of loan

covenants, if any, more difficult for the Fund as legal action may have to go through the seller of the participation (or an agent acting on its behalf). Covenants contained in loan documentation are intended to protect lenders and

investors by imposing certain restrictions and other limitations on a borrower’s operations or assets and by providing certain information and consent rights to lenders. In addition to operational covenants, loans and other debt

obligations often contain financial covenants which require a borrower to satisfy certain financial tests at periodic intervals or to maintain compliance with certain financial metrics. The Fund invests in or is exposed to loans and

other similar debt obligations that are sometimes referred to as “covenant-lite” loans or obligations, which generally are loans or other similar debt obligations that lack financial maintenance covenants or possess fewer or contingent

financial maintenance covenants and other financial protections for lenders and investors. These “covenant-lite” loans or obligations typically are particularly subject to the risks associated with investments in loans as described

above.

Investments by Investing Funds and Other Large Shareholders and Redemption

Risk—Shares of the Fund are offered as an investment to certain other investment companies, large

retirement plans and other large investors. The Fund is subject to the risk that a large investor will purchase or redeem a large percentage of Fund shares at any time. To meet large redemption requests, the Fund may have to hold large uninvested cash positions or sell a

significant amount of investments to raise the cash needed to satisfy redemption requests at times when it would not otherwise do so. In turn, the Fund’s performance may suffer and the Fund will incur higher turnover, brokerage costs, realize gains or losses at inopportune times, lose money or hold a less liquid portfolio.

Leverage Risk—The Fund’s use of leverage, through borrowings or instruments such as derivatives and reverse repurchase

agreements, may cause the Fund to be more volatile and riskier than if it had not been leveraged.

Liquidity and Valuation Risk—It may be difficult for the Fund to purchase and

sell particular investments within a reasonable time at a fair price, or the price at which it has been valued by the Investment Manager for purposes of the Fund’s net asset value, causing the Fund to be less liquid and unable to realize what the Investment Manager

believes should be the price of the investment. Valuation of portfolio investments may be difficult, such as during periods of market turmoil or reduced liquidity, and for investments that may, for example, trade infrequently or

irregularly. In these and other circumstances, an investment may be valued using fair value methodologies, which are inherently subjective, reflect good faith judgments based on available information and may not accurately estimate the

price at which the Fund could sell the investment at that time. These risks are heightened for fixed-income and other debt instruments because of the current low interest rate

environment. Based on its investment strategies, a significant portion of the Fund's investments can be difficult to value and potentially less liquid and thus particularly

prone to the foregoing risks.

Management Risk—The Fund is actively managed, which means that investment

decisions are made based on investment views. There is no guarantee that the investment views will produce the desired results or expected returns, causing the Fund to lose value or fail to meet its investment objective or underperform its benchmark index

or funds with similar investment objectives and strategies. Furthermore, active and frequent trading that can accompany active management, also called “high turnover,” may have a negative impact on performance. Active and frequent trading may result in higher brokerage costs or mark-up charges and tax costs, which are ultimately passed on

to shareholders of the Fund. Active and frequent trading may also result in adverse tax consequences.

Market Risk—The value of, or income generated by, the investments held by the

Fund may fluctuate rapidly and unpredictably. These fluctuations may be frequent and significant. In addition, the Fund may incur losses as a result of various market and economic factors, such as those affecting individual companies or issuers or particular

industries. In addition, developments related to economic, political (including geopolitical), social, public health, market or other conditions may cause volatility in financial markets and reduced liquidity in equity, credit and/or debt

markets, which could adversely impact the Fund and its investments and their value and performance. Under such conditions, the Fund may experience significant redemption activity by shareholders and could be forced to sell

portfolio securities or other assets at unfavorable prices in an effort to generate sufficient cash to pay redeeming shareholders. The Fund's investments may perform poorly or underperform the general securities markets or other types

of securities. Governmental authorities and regulators have enacted in recent years significant fiscal and monetary policy changes designed to support financial markets, which

present heightened risks to markets and Fund

SUMMARY PROSPECTUS | 6

investments and resulted in high inflation, low interest rates, and in some cases, negative yields. Risks are now

heightened as these actions are starting to be discontinued or reversed, and could be further heightened if they are ineffective in achieving their desired outcomes. It is unknown how long current circumstances will persist, whether

they will reoccur in the future and whether these efforts to support the economy and financial markets will be successful. These actions can also contribute to a risk that asset prices have a high degree of correlation across

markets and asset classes. In addition, many markets reached historical highs during recent periods and could be approaching the end of an economic expansion cycle.

Preferred Securities Risk—A company’s preferred stock generally pays

dividends only after the company makes required payments to holders of its bonds and other debt. For this reason, the value of preferred stock will usually react more strongly than bonds and other debt to actual or perceived changes in the company’s financial condition or prospects.

Prepayment Risk—Certain debt instruments, including loans and mortgage- and other asset-backed securities, are subject to the

risk that payments on principal may occur more quickly or earlier than expected. If this occurs, the Fund might be forced to forego future interest income on the principal

repaid early and to reinvest income or proceeds at generally lower interest rates, thus reducing the Fund’s yield. These types of instruments are particularly subject to prepayment risk, and offer less potential for gains, during periods of declining interest rates.

Regulatory and Legal Risk—U.S. and non-U.S. governmental agencies and other regulators regularly implement additional regulations and

legislators pass new laws that affect the investments held by the Fund, the strategies used by the Fund or the level of regulation or taxation applying to the Fund (such as

regulations related to investments in derivatives and other transactions). These regulations and laws impact the investment strategies, performance, costs and operations of the Fund or taxation of shareholders.

Repurchase Agreements and Reverse Repurchase Agreements Risk—In the event of the

insolvency of the counterparty to a repurchase agreement or reverse repurchase agreement, recovery of the repurchase price owed to the Fund or, in the case of a reverse repurchase agreement, the securities or other assets sold by the Fund, may be

delayed. Because reverse repurchase agreements may be considered to be the practical equivalent of borrowing funds, they constitute a form of leverage. If the Fund reinvests the

proceeds of a reverse repurchase agreement at a rate lower than the cost of the agreement, entering into the agreement will lower the Fund’s yield.

Restricted Securities Risk—Restricted securities generally cannot be sold to the public and may involve a high degree of business,

financial and liquidity risk, which may result in substantial losses to the Fund.

Securities Lending Risk—Securities lending involves a risk that the borrower may

fail to return the securities or deliver the proper amount of collateral, which may result in a loss to the Fund. In the event of bankruptcy of the borrower, the Fund could experience losses or delays in recovering the loaned securities.

Short Sale Risk—Short selling a security involves selling a borrowed security

with the expectation that the value of that security will decline so that the security may be purchased at a lower price when returning the borrowed security. The risk for loss on a short sale, which, in some cases, may be theoretically unlimited, is greater than the original

value of the securities sold short because the price of the borrowed security may rise, thereby increasing the price at which the security must be purchased. Government actions also may affect the Fund’s ability to engage in short

selling.

Sovereign Debt Risk—The debt securities issued by sovereign entities may decline

as a result of default or other adverse credit event resulting from a sovereign debtor's unwillingness or inability to repay principal and pay interest in a timely manner, which may be affected by a variety of factors, including its cash flow situation, the extent of its

reserves, the availability of sufficient foreign exchange on the date a payment is due, the relative size of the debt service burden to the economy as a whole, the sovereign debtor's policy toward international lenders, and the

political constraints to which a sovereign debtor may be subject. Sovereign debt risk is increased for emerging market issuers.

Special Situation Investments/Securities in Default Risk—Investments in the securities and debt of distressed issuers or issuers in default involve far greater risk

than investing in issuers whose debt obligations are being met and whose debt trades at or close to its “par” or full value because the investments are highly

speculative with respect to the issuer’s ability to make interest payments and/or to pay its principal obligations in full and/or on time.

7 | SUMMARY

PROSPECTUS

U.S. Government Securities Risk—U.S. government securities may or may not be

backed by the full faith and credit of the U.S. government. U.S. government securities are subject to the risks associated with fixed-income and debt securities, particularly interest rate risk and credit risk.

When Issued, Forward Commitment and Delayed-Delivery Transactions

Risk—When-issued, forward-commitment and delayed-delivery transactions involve a commitment to

purchase or sell specific securities at a predetermined price or yield in which payment and delivery take place after the customary settlement period for that type of security. When purchasing securities pursuant to one of these transactions, payment for the securities is not

required until the delivery date. However, the purchaser assumes the rights and risks of ownership, including the risks of price and yield fluctuations and the risk that the security will not be issued as anticipated.

PERFORMANCE INFORMATION

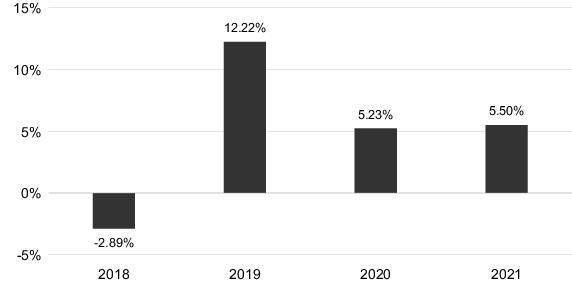

The following chart and table provide some indication of the risks of investing in the Fund by showing the Fund’s Class R6 share calendar year performance from year to year and average annual returns for the one, five and ten year

or since inception periods (if shorter), as applicable, for the Fund’s Class R6 shares compared to those of a broad measure of market performance. As with all mutual funds, past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. Updated performance information is available on

the Fund’s website at www.guggenheiminvestments.com or by calling 800.820.0888.

| |

Period Ending |

Return |

| Highest Quarter |

June 30, 2020 |

9.74% |

| Lowest Quarter |

March 31, 2020 |

-13.89% |

AVERAGE ANNUAL TOTAL RETURNS (for the periods ended December 31, 2021)

After-tax returns shown in the table are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of any state or local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax

returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts

(“IRAs”).

| |

Inception |

1 Year |

Since Inception |

| Class R6 |

5/15/2017 |

|

|

| Return Before Taxes |

|

5.50% |

4.99% |

| Return After Taxes on Distributions |

|

3.50% |

2.47% |

| Return After Taxes on Distributions and Sale of Fund Shares |

|

3.24% |

2.69% |

| Index |

|

|

|

| Bloomberg U.S. Corporate High Yield Index (reflects no deduction for fees, expenses or taxes) |

|

5.28% |

5.86% |

SUMMARY

PROSPECTUS | 8

MANAGEMENT OF THE FUND

Security Investors, LLC serves as the investment manager of the Fund and Guggenheim Partners Advisors, LLC serves as investment sub-adviser to the Fund (together referred to as Guggenheim Investments). Guggenheim Investments

utilizes a team-based approach that follows a disciplined investment process. The portfolio managers for the Fund are:

| Name* |

Experience with the Fund |

Primary Title with Investment Manager and/or Sub-

Adviser |

| B. Scott Minerd |

Since 2012 |

Chairman of Guggenheim Investments, Guggenheim Partners’ Global Chief Investment Officer and Managing Partner, and Chief Investment Officer of the Sub-Adviser |

| Thomas J. Hauser |

Since 2017 |

Senior Managing Director and Portfolio Manager |

| Richard de Wet |

Since 2017 |

Director and Portfolio Manager |

*

Each portfolio manager is primarily responsible for the day-to-day management of the Fund.

PURCHASE AND SALE OF FUND SHARES

You may purchase or redeem Fund shares through your broker/dealer, other financial intermediary

that has an agreement with Guggenheim Funds Distributors, LLC, the Fund’s distributor, or through the Fund’s transfer agent. You may purchase, redeem or exchange shares of any class of the Fund on any day the New York Stock Exchange is open

for business.

Class R6 shares generally are available to qualified retirement and

benefit plans that only have plan-level or omnibus accounts on the books of the Fund and whose record keeper does not charge service fees to the Fund. Class R6 shares also are generally available to certain plans and platforms sponsored by financial intermediaries that only

have plan or platform level or omnibus accounts held in the books of the Fund and do not charge the Fund service or account fees. Certain institutional investors and others deemed appropriate by the Investment Manager may also be

eligible to purchase Class R6 shares, subject to a $2,000,000 minimum initial investment, although the Investment Manager may waive this requirement at its discretion.

TAX INFORMATION

Fund distributions are taxable as ordinary income or capital gains (or a combination of both), unless your investment is through an IRA or other tax-advantaged retirement account. Investments through tax-advantaged accounts may

sometimes become taxable upon withdrawal.

PAYMENTS TO BROKER/DEALERS AND OTHER FINANCIAL INTERMEDIARIES

If you purchase Fund shares through a broker/dealer or other financial intermediary, the Fund and

its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker/dealer or other intermediary and your sales person to recommend the

Fund over another investment. Ask your sales person or visit your financial intermediary’s website for more information.

9 | SUMMARY PROSPECTUS