| Mutual Funds | Equity | January 28, 2014 | ||||||||||

Guggenheim Funds Summary Prospectus

Class A, Class B, Class C and Institutional

| Ticker Symbol | Fund Name | |||||||

| Class A | Class B | Class C | Institutional | |||||

| SECEX | SEQBX | SFECX | GILIX | Guggenheim StylePlus—Large Core Fund | ||||

Before you invest, you may wish to review the Fund’s Prospectus, which contains more information about the Fund and its risks. You may obtain the Prospectus and other information about the Fund, including the Statement of Additional Information (SAI) and most recent reports to shareholders, at no cost by visiting guggenheiminvestments.com/services/prospectuses-and-reports, calling 800.820.0888 or e-mailing services@guggenheiminvestments.com. The Fund’s Prospectus and SAI, both dated January 28, 2014, as revised from time to time, and the Fund’s most recent shareholder reports, are incorporated by reference into this Summary Prospectus.

| SUMLCC-0114x0115 | guggenheiminvestments.com |

Guggenheim StylePlus—Large Core Fund

INVESTMENT OBJECTIVE

Guggenheim StylePlus—Large Core Fund seeks long-term growth of capital.

FEES AND EXPENSES OF THE FUND

This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $100,000 in the Family of Funds, as defined on page 84 of the Fund’s prospectus. More information about these and other discounts is available from your financial professional and in the “Sales Charges—Class A Shares” section on page 58 of the Fund’s prospectus and the “How to Purchase Shares” section on page 49 of the Fund’s Statement of Additional Information.

| Class A | Class B | Class C | Institutional | |||||||||||||

| SHAREHOLDER FEES (fees paid directly from your investment) |

||||||||||||||||

| Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) |

4.75% | |

Closed to new subscriptions |

|

None | None | ||||||||||

| Maximum Deferred Sales Charge (Load) (as a percentage of original purchase price or redemption proceeds, whichever is lower) |

None | 5.00% | 1.00% | None | ||||||||||||

| ANNUAL FUND OPERATING EXPENSES (expenses that you pay each year as a percentage of the value of your investment) |

||||||||||||||||

| Management Fees |

0.75% | 0.75% | 0.75% | 0.75% | ||||||||||||

| Distribution and Service (12b-1) Fees |

0.25% | 1.00% | 1.00% | None | ||||||||||||

| Other Expenses |

0.37% | 0.84% | 0.59% | 0.50% | ||||||||||||

| Acquired Fund Fees and Expenses |

0.02% | 0.02% | 0.02% | 0.02% | ||||||||||||

| Total Annual Fund Operating Expenses |

1.39% | 2.61% | 2.36% | 1.27% | ||||||||||||

EXAMPLE

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds.

The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although the actual costs may be higher or lower, based on these assumptions your costs would be:

| Redeemed | Not Redeemed | |||||||||||||||||||||||||||||||

| Class | 1 Year | 3 Years | 5 Years | 10 Years | 1 Year | 3 Years | 5 Years | 10 Years | ||||||||||||||||||||||||

| A |

$ | 610 | $ | 894 | $ | 1,199 | $ | 2,064 | $ | 610 | $ | 894 | $ | 1,199 | $ | 2,064 | ||||||||||||||||

| B |

764 | 1,111 | 1,585 | 2,646 | 264 | 811 | 1,385 | 2,646 | ||||||||||||||||||||||||

| C |

339 | 736 | 1,260 | 2,696 | 239 | 736 | 1,260 | 2,696 | ||||||||||||||||||||||||

| Institutional |

129 | 403 | 697 | 1,534 | 129 | 403 | 697 | 1,534 | ||||||||||||||||||||||||

PORTFOLIO TURNOVER

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 217% of the average value of its portfolio.

PRINCIPAL INVESTMENT STRATEGIES

The Fund seeks to exceed the total return of the S&P 500 Index (the “Index”). The Fund pursues its objective by investing, under normal market conditions, at least 80% of its assets (net assets, plus the amount of any borrowings for investment purposes) in: (i) equity securities issued by companies that have market capitalizations within the range of companies in the Index; (ii) investment vehicles that provide exposure to companies that have market capitalizations within the range of companies in the Index; and (iii) equity derivatives that, when purchased, provide exposure to (i.e., economic characteristics similar to) equity

| 2 | SUMMARY PROSPECTUS |

securities of companies with market capitalizations usually within the range of companies in the Index and equity derivatives based on large-capitalization indices, including large-capitalization growth indices and large capitalization value indices deemed appropriate by Security Investors, LLC, also known as Guggenheim Investments (the “Investment Manager”). The Fund will usually also invest in fixed income securities and cash investments to collateralize derivatives positions and to increase investment return. As of December 31, 2013, the Index consisted of securities of companies with market capitalizations that ranged from $1.04 billion to $500.74 billion.

Equity securities in which the Fund may invest include common stocks, rights and warrants, and American Depository Receipts (“ADRs”). Derivatives in which the Fund may invest include options, futures contracts, swap agreements, and forward contracts. Fixed income securities and other securities in which the Fund may invest include debt securities selected from a variety of sectors and credit qualities (principally, investment grade), principally, corporate bonds, participations in and assignments of syndicated bank loans, asset-backed securities (including mortgage-backed securities and structured finance investments), U.S. government and agency securities (including those not backed by the full faith and credit of the U.S. government), mezzanine and preferred securities, commercial paper, zero-coupon bonds, non-registered or restricted securities (consisting of securities originally issued in reliance on Rule 144A and Regulation S), step-up securities (such as step-up bonds) and convertible securities that Guggenheim Investments believes offer attractive yield and/or capital appreciation potential. The Fund may invest in securities listed, traded or dealt in other countries. The Fund may hold securities of any duration or maturity. Fixed income securities in which the Fund may invest may pay fixed or variable rates of interest. The Fund may invest in a variety of investment vehicles, principally closed-end funds, exchange-traded funds (“ETFs”) and other mutual funds.

Allocation decisions within the asset categories are at the discretion of the Investment Manager and are based on the Investment Manager’s judgment of the current investment environment (including market volatility), the attractiveness of each asset category, the correlations among Index components, individual positions or each asset category, and expected returns. In selecting investments for the Fund, the Investment Manager uses quantitative analysis, credit research and due diligence on issuers, regions and sectors to select the Fund’s investments and other proprietary strategies to identify securities and other assets that, in combination, are expected to contribute to exceeding the total return of the Index. Derivative instruments may be used extensively by the Investment Manager to maintain exposure to the equity and fixed income markets, to hedge the Fund’s portfolio, or to increase returns. The Investment Manager may determine to sell a security for several reasons including the following: (1) to meet redemption requests; (2) to close-out or unwind derivatives transactions; (3) to realize gains; or (4) if market conditions change.

Under certain circumstances the Fund may invest a substantial portion of its assets in other short-term fixed-income investment companies advised by the Investment Manager, or an affiliate of the Investment Manager, for liquidity management purposes, including in order to increase yield on liquid investments used to collateralize derivatives positions. Investments in these investment companies will significantly increase the portfolio’s exposure to certain other asset categories, including: (i) a broad range of high yield, high risk debt securities rated below the top four long-term rating categories by a nationally recognized statistical rating organization or, if unrated, determined by the Investment Manager, to be of comparable quality (also known as “junk bonds”); (ii) securities issued by the U.S. government or its agencies and instrumentalities; (iii) collateralized loan obligations (“CLOs”) and similar investments; and (iv) other short-term fixed income securities. Such investments will expose the Fund to the risks of these asset categories and may cause the Fund to deviate from its principal investment strategy.

Under adverse or unstable market conditions, the Fund could invest some or all of its assets in cash, fixed income securities, government bonds, money market securities, or repurchase agreements. Although the Fund would do this only in seeking to avoid losses, the Fund may be unable to pursue its investment objective during that time, and it could reduce the benefit from any upswing in the market.

PRINCIPAL RISKS

An investment in the Fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. The value of an investment in the Fund will fluctuate and is subject to investment risks, which means investors could lose money. The principal risks of investing in the Fund are listed below.

Asset-Backed and Mortgage-Backed Securities Risk—Investors in asset-backed securities, including mortgage-backed securities and structured finance investments, generally receive payments that are part interest and part return of principal. These payments may vary based on the rate at which the underlying borrowers pay off their loans. Some asset-backed securities, including mortgage-backed securities, may have structures that make their reaction to interest rates and other factors difficult to predict, making their prices very volatile and they are subject to liquidity risk.

Collateralized Loan Obligations Risk—A CLO is a trust typically collateralized by a pool of loans, which may include, among others, domestic and foreign senior secured loans, senior unsecured loans, and subordinate corporate loans, including loans that may be

| SUMMARY PROSPECTUS | 3 |

rated below investment grade or equivalent unrated loans. The cash flows from the trust are split into two or more portions, called tranches, varying in risk and yield. CLO tranches can experience substantial losses due to actual defaults, increased sensitivity to defaults due to collateral default and disappearance of protecting tranches, market anticipation of defaults, as well as aversion to CLO securities as a class. The risks of CLOs depend largely on the type of the underlying loans and the class of the CLO in which the Fund invests. In addition, CLOs carry risks including interest rate risk, credit risks and default risk. Certain CLOs obtain their exposure through synthetic investments. These CLOs entail the risks of derivative instruments.

Convertible Securities Risk—Convertible securities may be subordinate to other securities. The total return for a convertible security depends, in part, upon the performance of the underlying security into which it can be converted. The value of convertible securities tends to decline as interest rates increase. Convertible securities generally offer lower interest or dividend yields than non-convertible securities of similar quality.

Counterparty Credit Risk—The Fund makes investments in financial instruments and OTC-traded derivatives involving counterparties to gain exposure to a particular group of securities, index or asset class without actually purchasing those securities or investments, or to hedge a position. Through these investments, the Fund is exposed to credit risks that the counterparty may be unwilling or unable to make timely payments to meet its contractual obligations or may fail to return holdings that are subject to the agreement with the counterparty. If the counterparty becomes bankrupt or defaults on its payment obligations to the Fund, the Fund may not receive the full amount that it is entitled to receive. If this occurs, the value of your shares in the Fund will decrease.

Credit Risk—The Fund could lose money if the issuer of a bond or a counterparty to a derivatives transaction or other transaction is unable to repay interest and principal on time or defaults. The issuer of a bond could also suffer a decrease in quality rating, which would affect the volatility of the price and liquidity of the bond.

Derivatives Risk—Derivatives may pose risks in addition to and greater than those associated with investing directly in securities or other investments, including risks relating to leverage, imperfect correlations with underlying investments or the Fund’s other portfolio holdings, high price volatility, lack of availability, counterparty credit, liquidity, valuation and legal restrictions. Their use is a highly specialized activity that involves investment techniques and risks different from those associated with ordinary portfolio securities transactions. If the Investment Manager is incorrect about its expectations of market conditions, the use of derivatives could also result in a loss, which in some cases may be unlimited. Certain risks also are specific to the derivatives in which the Fund invests.

Swap Agreements Risk—Swap agreements are contracts among the Fund and a counterparty to exchange the return of the pre-determined underlying investment (such as the rate of return of the underlying index). Swap agreements may be negotiated bilaterally and traded OTC between two parties or, in some instances, must be transacted through a futures commission merchant and cleared through a clearinghouse that serves as a central counterparty. Risks associated with the use of swap agreements are different from those associated with ordinary portfolio securities transactions, due in part to the fact they could be considered illiquid and many swaps trade on the OTC market. Swaps are particularly subject to counterparty credit, correlation, valuation, liquidity and leveraging risks. Certain standardized swaps are subject to mandatory central clearing. Central clearing is expected to reduce counterparty credit risk and increase liquidity, but central clearing does not make swap transactions risk-free.

Futures Contracts Risk—Futures contracts are typically exchange-traded contracts that call for the future delivery of an asset at a certain price and date, or cash settlement of the terms of the contract. Risks of futures contracts may be caused by an imperfect correlation between movements in the price of the instruments and the price of the underlying securities. In addition, there is the risk that the Fund may not be able to enter into a closing transaction because of an illiquid market. Exchanges can limit the number of positions that can be held or controlled by the Fund or its Investment Manager, thus limiting the ability to implement the Fund’s strategies. Futures markets are highly volatile and the use of futures may increase the volatility of the Fund’s NAV. Futures are also subject to leverage risks and to liquidity risk.

Options Risk—Options or options on futures contracts give the holder of the option the right to buy (or to sell) a position in a security or in a contract to the writer of the option, at a certain price. They are subject to correlation risk because there may be an imperfect correlation between the options and the securities markets that cause a given transaction to fail to achieve its objectives. The successful use of options depends on the Investment Manager’s ability to predict correctly future price fluctuations and the degree of correlation between the options and securities markets. Exchanges can limit the number of positions that can be held or controlled by the Fund or its Investment Manager, thus limiting the ability to implement the Fund’s strategies. Options are also particularly subject to leverage risk and can be subject to liquidity risk.

Equity Securities Risk—Equity securities include common stocks and other equity securities (and securities convertible into stocks), and the prices of equity securities fluctuate in value more than other investments. They reflect changes in the issuing company’s

| 4 | SUMMARY PROSPECTUS |

financial condition and changes in the overall market. Common stocks generally represent the riskiest investment in a company. The Fund may lose a substantial part, or even all, of its investment in a company’s stock. Growth stocks may be more volatile than value stocks.

Foreign Securities Risk—Foreign securities carry additional risks when compared to U.S. securities, including currency fluctuations, adverse political and economic developments, unreliable or untimely information, less liquidity, limited legal recourse and higher transactional costs.

Growth Stocks Risk—Growth stocks typically invest a high portion of their earnings back into their business and may lack the dividend yield that could cushion their decline in a market downturn. Growth stocks may be more volatile than other stocks because they are more sensitive to investor perceptions regarding the growth potential of the issuing company.

High Yield and Unrated Securities Risk—Higher yielding, below investment grade and unrated high risk debt securities may present additional risk because these securities may be less liquid and present more credit risk than investment grade bonds. The price of high yield securities tends to be subject to greater volatility due to issuer-specific operating results and outlook and to real or perceived adverse economic and competitive industry conditions. This exposure may be obtained through investments in other investment companies.

Interest Rate Risk—Investments in fixed-income securities are subject to the possibility that interest rates could rise sharply, causing the value of the Fund’s securities and share price to decline. Fixed-income securities with longer durations are subject to more volatility than those with shorter durations.

Investment in Investment Vehicles Risk—Investing in other investment vehicles, including, ETFs, closed-end funds, affiliated short-term fixed-income funds and other mutual funds, subjects the Fund to those risks affecting the investment vehicle, including the possibility that the value of the underlying securities held by the investment vehicle could decrease. Moreover, the Fund and its shareholders will incur its pro rata share of the expenses of the underlying investment vehicles’ expenses.

Investments in Loans Risk—Investments in loans involve special types of risks, including credit risk, interest rate risk, counterparty risk and prepayment risk. Loans may offer a fixed or floating interest rate. Loans are often generally below investment grade and may be unrated. Loans may be difficult to value and some can be subject to liquidity risk.

Large-Capitalization Securities Risk—The Fund is subject to the risk that large-capitalization stocks may underperform other segments of the equity market or the equity market as a whole. Larger, more established companies may be unable to respond quickly to new competitive challenges such as changes in technology and may not be able to attain the high growth rate of smaller companies, especially during extended periods of economic expansion.

Leverage Risk—The Fund’s use of leverage, through borrowings or instruments such as derivatives, may cause the Fund to be more volatile and riskier than if it had not been leveraged.

Liquidity and Valuation Risk—In certain circumstances, it may be difficult for the Fund to purchase and sell particular investments within a reasonable time at a fair price, or the price at which it has been valued by the Investment Manager for purposes of the Fund’s net asset value, causing the Fund to be less liquid and unable to realize what the Investment Manager believes should be the price of the investment.

Management Risk—The Fund is actively managed, which means that investment decisions are made based on investment views. There is no guarantee that the investment views will be successful. Furthermore, active trading that can accompany active management, also called “high turnover,” may have a negative impact on performance. Active trading may result in higher brokerage costs or mark-up charges, which are ultimately passed on to shareholders of the Fund.

Market Risk—The market value of the securities held by the Fund may fluctuate resulting from factors affecting the individual company or other factors such as changing economic, political or financial market conditions. Moreover, changing economic, political or financial market conditions in one country or geographic region could adversely impact the market value of the securities held by the Fund in a different country or geographic region.

Preferred Securities Risk—A company’s preferred stock generally pays dividends only after the company makes required payments to holders of its bonds and other debt. For this reason, the value of preferred stock will usually react more strongly than bonds and other debt to actual or perceived changes in the company’s financial condition or prospects.

Prepayment Risk—Securities subject to prepayment risk generally offer less potential for gains when interest rates decline, because issuers of the securities may be able to prepay the principal due on the securities, and may offer a greater potential for income loss when interest rates rise.

| SUMMARY PROSPECTUS | 5 |

Regulatory and Legal Risk—U.S. and other regulators and governmental agencies may implement additional regulations and legislators may pass new laws that affect the investments held by the Fund, the strategies used by the Fund or the level of regulation or taxation applying to the Fund (such as regulations related to investments in derivatives). These may impact the investment strategies, performance, costs and operations of the Fund or taxation of shareholders.

Value Stocks Risk—Value stocks are subject to the risk that the intrinsic value of the stock may never be realized by the market or that the price goes down.

PERFORMANCE INFORMATION

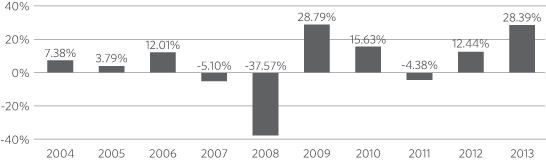

The following chart and table provide some indication of the risks of investing in the Fund by showing changes in the Fund’s Class A share performance from year to year and by showing how the Fund’s average annual returns for one, five, and ten years have compared to those of a broad measure of market performance. As with all mutual funds, past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. Updated performance information is available on the Fund’s website at www.guggenheiminvestments.com or by calling 800.820.0888.

Effective April 30, 2013, certain changes were made to the Fund’s principal investment strategies.

The bar chart does not reflect the impact of the sales charge applicable to Class A shares which, if reflected, would lower the returns shown.

| Highest Quarter Return 3Q 2009 16.38% |

Lowest Quarter Return 4Q 2008 -22.03% |

AVERAGE ANNUAL TOTAL RETURNS

(for the periods ended December 31, 2013)

After-tax returns shown in the table are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of any state or local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. After-tax returns are shown for Class A only. After-tax returns for Class B, Class C and Institutional class will vary.

| 1 Year | 5 Years | 10 Years | ||||||||||

| Class A |

||||||||||||

| Return Before Taxes |

22.27% | 14.15% | 3.66% | |||||||||

| Return After Taxes on Distributions |

16.61% | 13.01% | 2.48% | |||||||||

| Return After Taxes on Distributions and Sale of Fund Shares |

15.68% | 11.16% | 2.86% | |||||||||

| Class B |

21.60% | 14.11% | 3.65% | |||||||||

| Class C |

26.17% | 14.57% | 3.47% | |||||||||

| Institutional |

28.43% | 15.36% | 1 | N/A | ||||||||

| Index |

||||||||||||

| S&P 500 Index (reflects no deductions for fees, expenses or taxes) |

32.39% | 17.94% | 7.41% | |||||||||

| 1 | Since inception of 2/1/2012. |

| 6 | SUMMARY PROSPECTUS |

MANAGEMENT OF THE FUND

Security Investors, LLC, also known as Guggenheim Investments (the “Investment Manager”), serves as the investment manager of the Fund. B. Scott Minerd, Farhan Sharaff, Jayson B. Flowers and Scott Hammond are primarily responsible for the day-to-day management of the Fund, and each holds the title “Portfolio Manager” with the Investment Manager. Messrs. Minerd, Sharaff, Flowers and Hammond have co-managed the Fund since April 2013.

PURCHASE AND SALE OF FUND SHARES

You may purchase or redeem Fund shares through your broker/dealer, other financial intermediary that has an agreement with Guggenheim Distributors, LLC, the Fund’s distributor, or through the Fund’s transfer agent. You may purchase, redeem or exchange shares of any class of the Fund on any day the New York Stock Exchange is open for business. Class B shares are closed to new subscriptions from either new or existing shareholders. The minimum initial investment is $100. The minimum subsequent investment is $100. Class A and Class C do not have a minimum account balance.

The Institutional class minimum initial investment is $2 million, although the Fund may waive this requirement at its discretion. The Institutional class has a minimum account balance of $1 million. Due to the relatively high cost of maintaining accounts below the minimum account balance, the Fund reserves the right to redeem shares if an account balance falls below the minimum account balance for any reason. Investors will be given 60 days advance notice to reestablish the minimum account balance. If the account balance is not increased, the account may be closed and the proceeds sent to the investor. Fund shares will be redeemed at net asset value on the day the account is closed.

TAX INFORMATION

Fund distributions are taxable as ordinary income or capital gains (or a combination of both), unless your investment is in an IRA or other tax-advantaged retirement account.

PAYMENTS TO BROKER/DEALERS AND OTHER FINANCIAL INTERMEDIARIES

If you purchase Fund shares through a broker/dealer or other financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker/dealer or other intermediary and your sales person to recommend the Fund over another investment. Ask your sales person or visit your financial intermediary’s website for more information.

| SUMMARY PROSPECTUS | 7 |