| Mutual Funds | Equity | January 28, 2014 | ||||||||||

Guggenheim Funds Summary Prospectus

Class A, Class B and Class C

| Ticker Symbol | Fund Name | |||||

| Class A | Class B | Class C | ||||

| SEVAX | SVSBX | SEVSX | Guggenheim Mid Cap Value Fund | |||

Before you invest, you may wish to review the Fund’s Prospectus, which contains more information about the Fund and its risks. You may obtain the Prospectus and other information about the Fund, including the Statement of Additional Information (SAI) and most recent reports to shareholders, at no cost by visiting guggenheiminvestments.com/services/prospectuses-and-reports, calling 800.820.0888 or e-mailing services@guggenheiminvestments.com. The Fund’s Prospectus and SAI, both dated January 28, 2014, as revised from time to time, and the Fund’s most recent shareholder reports, are incorporated by reference into this Summary Prospectus.

| SUMMCV-0114x0115 | guggenheiminvestments.com |

Guggenheim Mid Cap Value Fund

INVESTMENT OBJECTIVE

The Guggenheim Mid Cap Value Fund seeks long-term growth of capital.

FEES AND EXPENSES OF THE FUND

This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $100,000 in the Family of Funds, as defined on page 84 of the Fund’s prospectus. More information about these and other discounts is available from your financial professional and in the “Sales Charges—Class A Shares” section on page 58 of the Fund’s prospectus and the “How to Purchase Shares” section on page 49 of the Fund’s Statement of Additional Information.

| Class A | Class B | Class C | ||||||||||

| SHAREHOLDER FEES (fees paid directly from your investment) |

||||||||||||

| Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) |

4.75% | |

Closed to new subscriptions |

|

None | |||||||

| Maximum Deferred Sales Charge (Load) (as a percentage of original purchase price or redemption proceeds, whichever is lower) |

None | 5.00% | 1.00% | |||||||||

| ANNUAL FUND OPERATING EXPENSES (expenses that you pay each year as a percentage of the value of your investment) |

||||||||||||

| Management Fees |

0.79% | 0.79% | 0.79% | |||||||||

| Distribution and Service (12b-1) Fees |

0.25% | 1.00% | 1.00% | |||||||||

| Other Expenses |

0.35% | 0.37% | 0.33% | |||||||||

| Total Annual Fund Operating Expenses |

1.39% | 2.16% | 2.12% | |||||||||

EXAMPLE

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds.

The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although the actual costs may be higher or lower, based on these assumptions your costs would be:

| Redeemed | Not Redeemed | |||||||||||||||||||||||||||||||

| Class | 1 Year | 3 Years | 5 Years | 10 Years | 1 Year | 3 Years | 5 Years | 10 Years | ||||||||||||||||||||||||

| A |

$ | 610 | $ | 894 | $ | 1,199 | $ | 2,064 | $ | 610 | $ | 894 | $ | 1,199 | $ | 2,064 | ||||||||||||||||

| B |

719 | 976 | 1,359 | 2,297 | 219 | 676 | 1,159 | 2,297 | ||||||||||||||||||||||||

| C |

315 | 664 | 1,139 | 2,452 | 215 | 664 | 1,139 | 2,452 | ||||||||||||||||||||||||

PORTFOLIO TURNOVER

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 23% of the average value of its portfolio.

PRINCIPAL INVESTMENT STRATEGIES

The Fund pursues its objective by investing, under normal market conditions, at least 80% of its assets (net assets, plus the amount of any borrowing for investment purposes) in a diversified portfolio of equity securities, which include common stocks, rights, options, warrants, convertible debt securities, and American Depositary Receipts (“ADRs”), that, when purchased, have market capitalizations that are usually within the range of companies in the Russell 2500 Value Index. Although a universal definition of mid-capitalization companies does not exist, the Fund generally defines mid-capitalization companies as those whose market capitalization is similar to the market capitalization of companies in the Russell 2500 Value Index, which is an unmanaged index that measures the performance of securities of small-to-mid cap U.S. companies with greater-than-average value orientation. As of

| 2 | SUMMARY PROSPECTUS |

December 31, 2013, the Index consisted of securities of companies with market capitalizations that ranged from $36.77 million to $10.81 billion.

Security Investors, LLC, also known as Guggenheim Investments (the “Investment Manager”), typically chooses equity securities that appear undervalued relative to assets, earnings, growth potential or cash flows and may invest in a limited number of industries or industry sectors, including the technology sector. Due to the nature of value companies, the securities included in the Fund’s portfolio typically consist of small- to medium-sized companies.

The Fund may sell a security if it is no longer considered undervalued or when the company begins to show deteriorating fundamentals.

The Fund also may invest a portion of its assets in derivatives, including options and futures contracts. These instruments may be used to hedge the Fund’s portfolio, to maintain exposure to the equity markets or to increase returns.

The Fund may, from time to time, invest a portion of its assets in technology stocks.

The Fund may invest in a variety of investment vehicles, including those that seek to track the composition and performance of a specific index, such as exchange-traded funds (“ETFs”) and other mutual funds. The Fund may use these index-based investments as a way of managing its cash position to gain exposure to the equity markets or a particular sector of the equity market, while maintaining liquidity. Certain investment vehicles’ securities and other securities in which the Fund may invest are restricted securities, which may be illiquid.

Under adverse or unstable market conditions, the Fund could invest some or all of its assets in cash, fixed-income securities, government bonds, money market securities, or repurchase agreements. Although the Fund would do this only in seeking to avoid losses, the Fund may be unable to pursue its investment objective during that time, and it could reduce the benefit from any upswing in the market.

PRINCIPAL RISKS

An investment in the Fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. The value of an investment in the Fund will fluctuate and is subject to investment risks, which means investors could lose money. The principal risks of investing in the Fund are listed below.

Derivatives Risk—Derivatives may pose risks in addition to and greater than those associated with investing directly in securities or other investments, including risks relating to leverage, imperfect correlations with underlying investments or the Fund’s other portfolio holdings, high price volatility, lack of availability, counterparty credit, liquidity, valuation and legal restrictions. Their use is a highly specialized activity that involves investment techniques and risks different from those associated with ordinary portfolio securities transactions. If the Investment Manager is incorrect about its expectations of market conditions, the use of derivatives could also result in a loss, which in some cases may be unlimited.

Equity Securities Risk—Equity securities include common stocks and other equity securities (and securities convertible into stocks), and the prices of equity securities fluctuate in value more than other investments. They reflect changes in the issuing company’s financial condition and changes in the overall market. Common stocks generally represent the riskiest investment in a company. The Fund may lose a substantial part, or even all, of its investment in a company’s stock. Growth stocks may be more volatile than value stocks.

Foreign Securities Risk—Foreign securities carry additional risks when compared to U.S. securities, including currency fluctuations, adverse political and economic developments, unreliable or untimely information, less liquidity, limited legal recourse and higher transactional costs.

Investment in Investment Vehicles Risk—Investing in other investment vehicles, including ETFs, closed-end funds and other mutual funds, subjects the Fund to those risks affecting the investment vehicle, including the possibility that the value of the underlying securities held by the investment vehicle could decrease. Moreover, the Fund and its shareholders will incur its pro rata share of the underlying vehicles’ expenses.

Leverage Risk—The Fund’s use of leverage, through borrowings or instruments such as derivatives, may cause the Fund to be more volatile and riskier than if it had not been leveraged.

Liquidity and Valuation Risk—In certain circumstances, it may be difficult for the Fund to purchase and sell particular investments within a reasonable time at a fair price, or the price at which it has been valued by the Investment Manager for purposes of the Fund’s net asset value, causing the Fund to be less liquid and unable to realize what the Investment Manager believes should be the price of the investment.

| SUMMARY PROSPECTUS | 3 |

Management Risk—The Fund is actively managed, which means that investment decisions are made based on investment views. There is no guarantee that the investment views will be successful. Furthermore, active trading that can accompany active management, also called “high turnover,” may have a negative impact on performance. Active trading may result in higher brokerage costs or mark-up charges, which are ultimately passed on to shareholders of the Fund.

Market Risk—The market value of the securities held by the Fund may fluctuate resulting from factors affecting the individual company or other factors such as changing economic, political or financial market conditions. Moreover, changing economic, political or financial market conditions in one country or geographic region could adversely impact the market value of the securities held by the Fund in a different country or geographic region.

Mid-Capitalization Securities Risk—The Fund is subject to the risk that medium-capitalization stocks may underperform other segments of the equity market or the equity market as a whole. Securities of medium-capitalization companies may experience more price volatility, greater spreads between their bid and ask prices, lower trading volumes, and cyclical or static growth prospects. Medium-capitalization companies often have limited product lines, markets or financial resources, and may therefore be more vulnerable to adverse developments than larger capitalization companies.

Regulatory and Legal Risk—U.S. and other regulators and governmental agencies may implement additional regulations and legislators may pass new laws that affect the investments held by the Fund, the strategies used by the Fund or the level of regulation or taxation applying to the Fund (such as regulations related to investments in derivatives). These may impact the investment strategies, performance, costs and operations of the Fund or taxation of shareholders.

Restricted Securities Risk—Restricted securities generally cannot be sold to the public and may involve a high degree of business, financial and liquidity risk, which may result in substantial losses to the Fund.

Technology Stocks Risk—Stocks of companies involved in the technology sector may be very volatile.

Value Stocks Risk—Value stocks are subject to the risk that the intrinsic value of the stock may never be realized by the market or that the price goes down.

PERFORMANCE INFORMATION

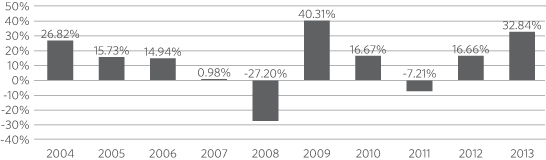

The following chart and table provide some indication of the risks of investing in the Fund by showing changes in the Fund’s Class A share performance from year to year and by showing how the Fund’s average annual returns for one, five, and ten years have compared to those of a broad measure of market performance. As with all mutual funds, past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. Updated performance information is available on the Fund’s website at www.guggenheiminvestments.com or by calling 800.820.0888.

The bar chart does not reflect the impact of the sales charge applicable to Class A shares which, if reflected, would lower the returns shown.

| Highest Quarter Return 2Q 2009 25.21% |

Lowest Quarter Return 4Q 2008 -20.21% |

| 4 | SUMMARY PROSPECTUS |

AVERAGE ANNUAL TOTAL RETURNS

(for the periods ended December 31, 2013)

After-tax returns shown in the table are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of any state or local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. After-tax returns are shown for Class A only. After-tax returns for Class B and Class C will vary.

| 1 Year | 5 Years | 10 Years | ||||||||||

| Class A |

||||||||||||

| Return Before Taxes |

26.55% | 17.28% | 10.65% | |||||||||

| Return After Taxes on Distributions |

23.10% | 16.17% | 9.20% | |||||||||

| Return After Taxes on Distributions and Sale of Fund Shares |

14.97% | 13.80% | 8.58% | |||||||||

| Class B |

26.80% | 17.53% | 10.64% | |||||||||

| Class C |

30.87% | 17.79% | 10.49% | |||||||||

| Index |

||||||||||||

| Russell 2500 Value Index (reflects no deductions for fees, expenses or taxes) |

33.32% | 19.61% | 9.29% | |||||||||

MANAGEMENT OF THE FUND

Security Investors, LLC, also known as Guggenheim Investments (the “Investment Manager”), serves as the investment manager of the Fund. James Schier is primarily responsible for the day-to-day management of the Fund and holds the title of Portfolio Manager with the Investment Manager. He has managed the Fund since May 1997.

PURCHASE AND SALE OF FUND SHARES

You may purchase or redeem Fund shares through your broker/dealer, other financial intermediary that has an agreement with Guggenheim Distributors, LLC, the Fund’s distributor, or through the Fund’s transfer agent. You may purchase, redeem or exchange shares of any class of the Fund on any day the New York Stock Exchange is open for business. Class B shares are closed to new subscriptions from either new or existing shareholders. The minimum initial investment is $100. The minimum subsequent investment is $100. Class A and Class C do not have a minimum account balance.

TAX INFORMATION

Fund distributions are taxable as ordinary income or capital gains (or a combination of both), unless your investment is in an IRA or other tax-advantaged retirement account.

PAYMENTS TO BROKER/DEALERS AND OTHER FINANCIAL INTERMEDIARIES

If you purchase Fund shares through a broker/dealer or other financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker/dealer or other intermediary and your sales person to recommend the Fund over another investment. Ask your sales person or visit your financial intermediary’s website for more information.

| PROSPECTUS | 5 |

This page intentionally left blank.

| 6 | SUMMARY PROSPECTUS |

This page intentionally left blank.

| SUMMARY PROSPECTUS | 7 |