UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-01136

SECURITY EQUITY FUND

(Exact name of registrant as specified in charter)

ONE SECURITY BENEFIT PLACE, TOPEKA, KANSAS 66636-0001

(Address of principal executive offices) (Zip code)

DONALD C. CACCIAPAGLIA, PRESIDENT

SECURITY EQUITY FUND

ONE SECURITY BENEFIT PLACE

TOPEKA, KANSAS 66636-0001

(Name and address of agent for service)

Registrant’s telephone number, including area code: (785) 438-3000

Date of fiscal year end: September 30

Date of reporting period: March 31, 2012

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. §3507.

| Item 1. | Reports to Stockholders. |

MARCH 31, 2012

GUGGENHEIM FUNDS

SEMI-ANNUAL REPORT

FUNDAMENTAL ALPHA

LARGE CAP CORE FUND

ALL CAP VALUE FUND

MID CAP VALUE FUND

MID CAP VALUE INSTITUTIONAL FUND

SMALL CAP GROWTH FUND

SMALL CAP VALUE FUND

LARGE CAP CONCENTRATED GROWTH FUND

MSCI EAFE EQUAL WEIGHT FUND

OPPORTUNISTIC

ALPHA OPPORTUNITY FUND

GO GREEN!

ELIMINATE MAILBOX CLUTTER

Go paperless with Guggenheim Investments eDelivery—a service giving you full online access to account information and documents. Save time, cut down on mailbox clutter and be a friend to the environment with eDelivery.

With Guggenheim Investments eDelivery you can:

| • | View online confirmations and statements at your convenience. |

| • | Receive email notifications when your most recent confirmations, statements and other account documents are available for review. |

| • | Access prospectuses, annual reports and semiannual reports online. |

If you have questions about Guggenheim Investments eDelivery services, contact one of our Shareholder Service Representatives at 800.820.0888.

This report and the financial statements contained herein are submitted for the general information of our shareholders. The report is not authorized for distribution to prospective investors unless preceded or accompanied by an effective prospectus.

Distributed by Rydex Distributors, LLC.

| 2 | ||||

| 4 | ||||

| 7 | ||||

| 14 | ||||

| 21 | ||||

| 28 | ||||

| 34 | ||||

| 41 | ||||

| 48 | ||||

| 54 | ||||

| 68 | ||||

| 78 | ||||

| 90 | ||||

| 92 | ||||

| 95 | ||||

THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 1

Dear Shareholders:

A restructuring of Greece’s massive debt, continued accommodation by the world’s major central banks and better news on the U.S. economy helped support financial markets over the six months ended March 31, 2012. Market optimism peaked in early 2012, when several major equity indices pushed to the highest levels in four years or more. But the mood grew more cautious late in the period after the Federal Reserve (the “Fed”) expressed views that continued weakness in housing and employment may pose a risk to the strength of the recovery.

U.S. equities began the period rebounding from the loss of the U.S. AAA credit rating in August. But after touching the low for 2011 in early October, improving U.S. economic data and European Central Bank’s injections of three-year loans into the continent’s banking system helped markets make up lost ground, which carried over into a strong first quarter of 2012.

Among the upbeat U.S. economic reports in recent months: more than 600,000 jobs have been added since the beginning of 2012; house prices have fallen enough to start to spur demand, lifting sales and new construction; and the U.S. GDP expanded at an annual rate of 3% in the fourth quarter of 2011, its strongest rate in a year and a half. Consumer confidence climbed in March to its highest level in a year.

While acknowledging the good news, the Fed warned that policymakers cannot be sure the recent pace of improvement will be sustained unless growth picks up. To foster growth, the Fed has said it will leave its key interest rate close to zero at least through 2014, despite arguments by some Fed officials and investors that the Fed may have to consider raising rates much earlier than that to prevent inflation. For now, the Fed’s leadership appears to be committed to keeping rates low, thus reducing borrowing costs for businesses and consumers. Consumer spending remains sluggish, and lackluster forecasts for first-quarter corporate profits were a reminder that the economic recovery remains fragile.

The world’s leading central bankers have continued to take steps to recharge the global economy. Greece’s debt restructuring enabled a new international bailout, while an injection of liquidity from the European Central Bank lessened financial stresses across the continent and contributed to improvement in global financial markets. However, March manufacturing gauges indicated that the eurozone has entered a period of economic contraction, meaning that policy makers may need to do more to revive economic growth across the region. The Bank of England and the Bank of Japan have also increased asset-buying programs. In China, recent strong factory data eased fears that a hard landing could wreak havoc on the global economy. The country cut its annual growth target to 7.5%, as its policymakers are trying to shift the country away from investment and exports and to greater domestic consumption.

Improvement in the U.S. economy is luring investors from ultra-safe, but often low-yielding assets. Falling U.S. Treasury bond prices, for example, boosted yields from a 70-year low last fall to a recent range of around 2% for the 10-year note. After outperforming equities for much of the past decade, and drawing heavy asset flows, many analysts are cautious about certain fixed-income sectors, particularly government debt, as the economy improves and the potential grows for a rise in interest rates. Investment-grade and higher-yielding corporates, however, are expected to continue to outperform.

Likewise, commodities, which had been slumping since mid-2011 due to slowing economic activity and the European debt crisis, rebounded in early 2012 on stronger macroeconomic data, with the price of a barrel of oil surging from last October’s $77 to a peak of $113 in late February. Investors also have been shifting out of gold to assets with greater return potential; after peaking at nearly $2,000 last summer, the price per ounce has fallen back to around $1,600.

2 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT

LETTER TO OUR SHAREHOLDERS (concluded)

The U.S. economy seems to be decoupling from slowing growth in the rest of the world and from ongoing uncertainty in the European debt crisis, as well as the domestic debate over tax and spending policy. In this resiliency, we see potential in U.S. investments, including equities, high yield bonds, bank loans and other risk assets. It appears that the U.S. may have entered a period of self-sustaining, if modest, economic expansion, driven primarily by the aggressive monetary policy of the Fed and reinforced by the ECB, and is increasingly becoming the economic locomotive of the global economy.

We look forward to continuing our service to you. Thank you for investing in our funds.

Sincerely,

Donald C. Cacciapaglia

President, Guggenheim Funds

Performance displayed represents past performance which is no guarantee of future results. Of course, fund performance is subject to daily market volatility and may be better or worse since the end of the last quarter. For up-to-date fund performance, call us at 800.820.0888 or visit www.rydex-sgi.com.

Read each fund’s prospectus and summary prospectus (if available) carefully before investing. It contains the fund’s investment objectives, risks, charges, expenses and other information, which should be considered carefully before investing. Obtain a prospectus and summary prospectus (if available) at www.rydex-sgi.com or call 800.820.0888.

The referenced funds are distributed by Rydex Distributors, LLC. Guggenheim Investments represents the investment management business of Guggenheim Partners, LLC, which includes Security Investors, LLC, the investment advisor to the referenced funds. Rydex Distributors, LLC is affiliated with Guggenheim Partners, LLC and Security Investors, LLC.

THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 3

ABOUT SHAREHOLDERS’ FUND EXPENSES (Unaudited)

All mutual funds have operating expenses and it is important for our shareholders to understand the impact of costs on their investments. Shareholders of a Fund incur two types of costs: (i) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, or other distributions; and exchange fees; and (ii) ongoing costs, including management fees, administrative services, and shareholder reports, among others. These ongoing costs, or operating expenses, are deducted from a fund’s gross income and reduce the investment return of the fund.

A fund’s expenses are expressed as a percentage of its average net assets, which is known as the expense ratio. The following examples are intended to help investors understand the ongoing costs (in dollars) of investing in a Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000 made at the beginning of the period and held for the entire six-month period beginning September 30, 2011 and ending March 31, 2012.

The following tables illustrate a Fund’s costs in two ways:

Table 1. Based on actual Fund return. This section helps investors estimate the actual expenses paid over the period. The “Ending Account Value” shown is derived from the Fund’s actual return, and the fourth column shows the dollar amount that would have been paid by an investor who started with $1,000 in the Fund. Investors may use the information here, together with the amount invested, to estimate the expenses paid over the period. Simply divide the Fund’s account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number provided under the heading “Expenses Paid During Period.”

Table 2. Based on hypothetical 5% return. This section is intended to help investors compare a Fund’s cost with those of other mutual funds. The table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses paid during the period. The example is useful in making comparisons because the U.S. Securities and Exchange Commission (the “SEC”) requires all mutual funds to calculate expenses based on the 5% return. Investors can assess a Fund’s costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

The calculations illustrated above assume no shares were bought or sold during the period. Actual costs may have been higher or lower, depending on the amount of investment and the timing of any purchases or redemptions.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) on purchase payments, and contingent deferred sales charges (“CDSC”) on redemptions, if any. Therefore, the second table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

More information about a Fund’s expenses, including annual expense ratios for the past five years, can be found in the Financial Highlights section of this report. For additional information on operating expenses and other shareholder costs, please refer to the appropriate Fund prospectus.

4 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT

ABOUT SHAREHOLDERS’ FUND EXPENSES (Unaudited) (continued)

| Expense Ratio1 |

Fund Return |

Beginning Account Value September 30, 2011 |

Ending Account Value March 31, 2012 |

Expenses Paid During Period2 |

||||||||||||||||

| Table 1. Based on actual Fund return3 |

||||||||||||||||||||

| Large Cap Core Fund |

||||||||||||||||||||

| A-Class |

1.39 | % | 27.19 | % | $ | 1,000.00 | $ | 1,271.90 | $ | 7.89 | ||||||||||

| B-Class |

2.37 | % | 26.52 | % | 1,000.00 | 1,265.20 | 13.42 | |||||||||||||

| C-Class |

2.19 | % | 26.67 | % | 1,000.00 | 1,266.70 | 12.41 | |||||||||||||

| Institutional Class4 |

1.59 | % | 2.35 | % | 1,000.00 | 1,023.50 | 1.32 | |||||||||||||

| All Cap Value Fund |

||||||||||||||||||||

| A-Class |

1.27 | % | 26.04 | % | 1,000.00 | 1,260.40 | 7.18 | |||||||||||||

| C-Class |

2.02 | % | 25.48 | % | 1,000.00 | 1,254.80 | 11.39 | |||||||||||||

| Institutional Class |

1.02 | % | 26.15 | % | 1,000.00 | 1,261.50 | 5.77 | |||||||||||||

| Mid Cap Value Fund |

||||||||||||||||||||

| A-Class |

1.44 | % | 24.99 | % | 1,000.00 | 1,249.90 | 8.10 | |||||||||||||

| B-Class |

2.24 | % | 24.48 | % | 1,000.00 | 1,244.80 | 12.57 | |||||||||||||

| C-Class |

2.18 | % | 24.57 | % | 1,000.00 | 1,245.70 | 12.24 | |||||||||||||

| Mid Cap Value Institutional Fund |

0.90 | % | 25.18 | % | 1,000.00 | 1,251.80 | 5.07 | |||||||||||||

| Small Cap Growth Fund |

||||||||||||||||||||

| A-Class |

2.23 | % | 32.33 | % | 1,000.00 | 1,323.30 | 12.95 | |||||||||||||

| B-Class |

3.38 | % | 31.58 | % | 1,000.00 | 1,315.80 | 19.57 | |||||||||||||

| C-Class |

2.97 | % | 31.84 | % | 1,000.00 | 1,318.40 | 17.21 | |||||||||||||

| Institutional Class4 |

2.36 | % | 0.51 | % | 1,000.00 | 1,005.10 | 1.94 | |||||||||||||

| Small Cap Value Fund |

||||||||||||||||||||

| A-Class |

1.30 | % | 34.12 | % | 1,000.00 | 1,341.20 | 7.61 | |||||||||||||

| C-Class |

2.05 | % | 33.69 | % | 1,000.00 | 1,336.90 | 11.98 | |||||||||||||

| Institutional Class |

1.05 | % | 34.34 | % | 1,000.00 | 1,343.40 | 6.15 | |||||||||||||

| Large Cap Concentrated Growth Fund |

||||||||||||||||||||

| A-Class |

1.35 | % | 27.84 | % | 1,000.00 | 1,278.40 | 7.69 | |||||||||||||

| B-Class |

2.10 | % | 27.53 | % | 1,000.00 | 1,275.30 | 11.95 | |||||||||||||

| C-Class |

2.10 | % | 27.56 | % | 1,000.00 | 1,275.60 | 11.95 | |||||||||||||

| Institutional Class4 |

1.09 | % | 2.94 | % | 1,000.00 | 1,029.40 | 0.91 | |||||||||||||

| MSCI EAFE Equal Weight Fund |

||||||||||||||||||||

| A-Class |

1.61 | % | 13.05 | % | 1,000.00 | 1,130.50 | 8.58 | |||||||||||||

| B-Class5 |

1.36 | % | 13.21 | % | 1,000.00 | 1,132.10 | 7.25 | |||||||||||||

| C-Class |

2.36 | % | 12.73 | % | 1,000.00 | 1,127.30 | 12.55 | |||||||||||||

| Institutional Class |

1.34 | % | 12.39 | % | 1,000.00 | 1,123.90 | 7.12 | |||||||||||||

| Alpha Opportunity Fund6 |

||||||||||||||||||||

| A-Class |

2.22 | % | 32.28 | % | 1,000.00 | 1,322.80 | 12.89 | |||||||||||||

| B-Class |

2.96 | % | 31.75 | % | 1,000.00 | 1,317.50 | 17.15 | |||||||||||||

| C-Class |

2.97 | % | 31.75 | % | 1,000.00 | 1,317.50 | 17.21 | |||||||||||||

| Institutional Class |

1.97 | % | 32.45 | % | 1,000.00 | 1,324.50 | 11.45 | |||||||||||||

THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 5

ABOUT SHAREHOLDERS’ FUND EXPENSES (Unaudited) (concluded)

| Expense Ratio1 |

Fund Return |

Beginning Account Value September 30, 2011 |

Ending Account Value March 31, 2012 |

Expenses Paid During Period2 |

||||||||||||||||

| Table 2. Based on hypothetical 5% return (before expenses) |

|

|||||||||||||||||||

| Large Cap Core Fund |

||||||||||||||||||||

| A-Class |

1.39 | % | 5.00 | % | $ | 1,000.00 | $ | 1,018.05 | $ | 7.01 | ||||||||||

| B-Class |

2.37 | % | 5.00 | % | 1,000.00 | 1,013.15 | 11.93 | |||||||||||||

| C-Class |

2.19 | % | 5.00 | % | 1,000.00 | 1,014.05 | 11.03 | |||||||||||||

| Institutional Class4 |

1.59 | % | 5.00 | % | 1,000.00 | 1,017.05 | 8.02 | |||||||||||||

| All Cap Value Fund |

||||||||||||||||||||

| A-Class |

1.27 | % | 5.00 | % | 1,000.00 | 1,018.65 | 6.41 | |||||||||||||

| C-Class |

2.02 | % | 5.00 | % | 1,000.00 | 1,014.90 | 10.18 | |||||||||||||

| Institutional Class |

1.02 | % | 5.00 | % | 1,000.00 | 1,019.90 | 5.15 | |||||||||||||

| Mid Cap Value Fund |

||||||||||||||||||||

| A-Class |

1.44 | % | 5.00 | % | 1,000.00 | 1,017.80 | 7.26 | |||||||||||||

| B-Class |

2.24 | % | 5.00 | % | 1,000.00 | 1,013.80 | 11.28 | |||||||||||||

| C-Class |

2.18 | % | 5.00 | % | 1,000.00 | 1,014.10 | 10.98 | |||||||||||||

| Mid Cap Value Institutional Fund |

0.90 | % | 5.00 | % | 1,000.00 | 1,020.50 | 4.55 | |||||||||||||

| Small Cap Growth Fund |

||||||||||||||||||||

| A-Class |

2.23 | % | 5.00 | % | 1,000.00 | 1,013.85 | 11.23 | |||||||||||||

| B-Class |

3.38 | % | 5.00 | % | 1,000.00 | 1,008.10 | 16.97 | |||||||||||||

| C-Class |

2.97 | % | 5.00 | % | 1,000.00 | 1,010.15 | 14.93 | |||||||||||||

| Institutional Class4 |

2.36 | % | 5.00 | % | 1,000.00 | 1,013.20 | 11.88 | |||||||||||||

| Small Cap Value Fund |

||||||||||||||||||||

| A-Class |

1.30 | % | 5.00 | % | 1,000.00 | 1,018.50 | 6.56 | |||||||||||||

| C-Class |

2.05 | % | 5.00 | % | 1,000.00 | 1,014.75 | 10.33 | |||||||||||||

| Institutional Class |

1.05 | % | 5.00 | % | 1,000.00 | 1,019.75 | 5.30 | |||||||||||||

| Large Cap Concentrated Growth Fund |

||||||||||||||||||||

| A-Class |

1.35 | % | 5.00 | % | 1,000.00 | 1,018.25 | 6.81 | |||||||||||||

| B-Class |

2.10 | % | 5.00 | % | 1,000.00 | 1,014.50 | 10.58 | |||||||||||||

| C-Class |

2.10 | % | 5.00 | % | 1,000.00 | 1,014.50 | 10.58 | |||||||||||||

| Institutional Class4 |

1.09 | % | 5.00 | % | 1,000.00 | 1,019.55 | 5.50 | |||||||||||||

| MSCI EAFE Equal Weight Fund |

||||||||||||||||||||

| A-Class |

1.61 | % | 5.00 | % | 1,000.00 | 1,016.95 | 8.12 | |||||||||||||

| B-Class5 |

1.36 | % | 5.00 | % | 1,000.00 | 1,018.20 | 6.86 | |||||||||||||

| C-Class |

2.36 | % | 5.00 | % | 1,000.00 | 1,013.20 | 11.88 | |||||||||||||

| Institutional Class |

1.34 | % | 5.00 | % | 1,000.00 | 1,018.30 | 6.76 | |||||||||||||

| Alpha Opportunity Fund6 |

||||||||||||||||||||

| A-Class |

2.22 | % | 5.00 | % | 1,000.00 | 1,013.90 | 11.18 | |||||||||||||

| B-Class |

2.96 | % | 5.00 | % | 1,000.00 | 1,010.20 | 14.88 | |||||||||||||

| C-Class |

2.97 | % | 5.00 | % | 1,000.00 | 1,010.15 | 14.93 | |||||||||||||

| Institutional Class |

1.97 | % | 5.00 | % | 1,000.00 | 1,015.15 | 9.92 | |||||||||||||

| 1 | Annualized. |

| 2 | Expenses are equal to the Fund’s annualized expense ratio, net of any applicable fee waivers, multiplied by the average account value over the period, multiplied by 183/366 (to reflect the one-half year period). |

| 3 | Actual cumulative return at net asset value for the period September 30, 2011 to March 31, 2012. |

| 4 | Since the commencement of operations: March 1, 2012. Due to the limited length of Class operations, current expense ratios may not be indicative of future expense ratios. Expenses paid based on actual fund return are calculated using 30 days from the commencement of operations. Expenses paid based on the hypothetical 5% return are calculated using 183 days. |

| 5 | B-Class shares did not charge 12b-1 fees during the period. |

| 6 | This ratio represents annualized net expenses, which includes interest and dividend expense related to securities sold short. Excluding short dividend and prime broker interest expense, the operating expense ratio would be 0.11%, 0.10%, 0.11%, and 0.11% lower for the A-Class, B-Class, C-Class, and Institutional Class, respectively. |

6 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT

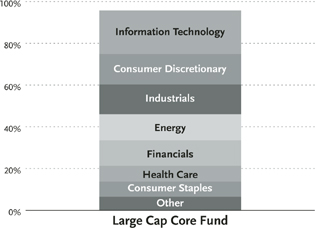

| FUND PROFILE (Unaudited) |

March 31, 2012 |

THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 7

| SCHEDULE OF INVESTMENTS (Unaudited) |

March 31, 2012 | |

|

LARGE CAP CORE FUND |

| 8 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT |

SEE NOTES TO FINANCIAL STATEMENTS. |

| SCHEDULE OF INVESTMENTS (Unaudited) (concluded) |

March 31, 2012 | |

|

LARGE CAP CORE FUND |

| * | Non-income producing security. |

| † | Value determined based on Level 1 inputs — See Note 4. |

plc — Public Limited Company

| SEE NOTES TO FINANCIAL STATEMENTS. |

THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 9 |

LARGE CAP CORE FUND

| 10 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT |

SEE NOTES TO FINANCIAL STATEMENTS. |

LARGE CAP CORE FUND

STATEMENTS OF CHANGES IN NET ASSETS

| Period Ended March 31, 2012 (Unaudited) |

Year Ended September 30, 2011 |

|||||||

| INCREASE (DECREASE) IN NET ASSETS FROM OPERATIONS: |

||||||||

| Net investment income |

$ | 174,337 | $ | 54,220 | ||||

| Net realized gain on investments |

3,274,214 | 15,933,509 | ||||||

| Net change in unrealized appreciation (depreciation) on investments |

39,856,700 | (21,397,112 | ) | |||||

|

|

|

|

|

|||||

| Net increase (decrease) in net assets resulting from operations |

43,305,251 | (5,409,383 | ) | |||||

|

|

|

|

|

|||||

| DISTRIBUTIONS TO SHAREHOLDERS FROM: |

||||||||

| Net investment income |

||||||||

| A-Class |

(200,269 | ) | (546,823 | ) | ||||

|

|

|

|

|

|||||

| Total distributions to shareholders |

(200,269 | ) | (546,823 | ) | ||||

|

|

|

|

|

|||||

| CAPITAL SHARE TRANSACTIONS: |

||||||||

| Proceeds from sale of shares |

||||||||

| A-Class |

2,316,519 | 9,715,889 | ||||||

| B-Class |

64,695 | 1,180,154 | ||||||

| C-Class |

67,172 | 177,237 | ||||||

| Institutional Class1 |

10,000 | — | ||||||

| Distributions reinvested |

||||||||

| A-Class |

187,681 | 502,041 | ||||||

| Cost of shares redeemed |

||||||||

| A-Class |

(10,863,212 | ) | (22,520,161 | ) | ||||

| B-Class |

(933,237 | ) | (2,775,354 | ) | ||||

| C-Class |

(211,113 | ) | (716,944 | ) | ||||

| Institutional Class1 |

— | — | ||||||

|

|

|

|

|

|||||

| Net decrease from capital share transactions |

(9,361,495 | ) | (14,437,138 | ) | ||||

|

|

|

|

|

|||||

| Net increase (decrease) in net assets |

33,743,487 | (20,393,344 | ) | |||||

| NET ASSETS: |

||||||||

| Beginning of period |

162,953,145 | 183,346,489 | ||||||

|

|

|

|

|

|||||

| End of period |

$ | 196,696,632 | $ | 162,953,145 | ||||

|

|

|

|

|

|||||

| Accumulated/(Undistributed) net investment income/(loss) at end of period |

$ | (12,848 | ) | $ | 13,084 | |||

|

|

|

|

|

|||||

| CAPITAL SHARE ACTIVITY: |

||||||||

| Shares sold |

||||||||

| A-Class2 |

120,481 | 493,303 | ||||||

| B-Class2 |

4,240 | 73,162 | ||||||

| C-Class2 |

4,085 | 10,210 | ||||||

| Institutional Class1 |

480 | — | ||||||

| Shares issued from reinvestment of distributions |

||||||||

| A-Class2 |

10,200 | 26,342 | ||||||

| Shares redeemed |

||||||||

| A-Class2 |

(559,429 | ) | (1,144,274 | ) | ||||

| B-Class2 |

(59,461 | ) | (172,978 | ) | ||||

| C-Class2 |

(12,441 | ) | (40,853 | ) | ||||

| Institutional Class1 |

— | — | ||||||

|

|

|

|

|

|||||

| Net decrease in shares |

(491,845 | ) | (755,088 | ) | ||||

|

|

|

|

|

|||||

| 1 | Since the commencement of operations: March 1, 2012. |

| 2 | The share activity for the period October 1, 2010 through April 8, 2011 have been restated to reflect a 1:4 reverse share split effective April 8, 2011. |

| SEE NOTES TO FINANCIAL STATEMENTS. |

THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 11 |

LARGE CAP CORE FUND

FINANCIAL HIGHLIGHTS

This table is presented to show selected data for a share outstanding throughout each period and to assist shareholders in evaluating a Fund’s

| A-Class |

Period Ended March 31, 2012a |

Year Ended September 30, 2011f |

Year Ended September 30, 2010f |

Year Ended September 30, 2009f |

Year Ended September 30, 2008f |

Year Ended September 30, 2007f |

||||||||||||||||||

| Per Share Data |

||||||||||||||||||||||||

| Net asset value, beginning of period |

$ | 16.79 | $ | 17.56 | $ | 16.20 | $ | 17.04 | $ | 27.36 | $ | 27.40 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Income (loss) from investment operations: |

||||||||||||||||||||||||

| Net investment incomeb |

.02 | .01 | .04 | .04 | .04 | — | c | |||||||||||||||||

| Net gain (loss) on investments |

4.54 | (.74 | ) | 1.32 | (.80 | ) | (6.44 | ) | 2.76 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total from investment operations |

4.56 | (.73 | ) | 1.36 | (.76 | ) | (6.40 | ) | 2.76 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Less distributions from: |

||||||||||||||||||||||||

| Net investment income |

(.02 | ) | (.04 | ) | — | (.04 | ) | — | — | |||||||||||||||

| Net realized gains |

— | — | — | — | (3.88 | ) | (2.80 | ) | ||||||||||||||||

| Return of capital |

— | — | — | (.04 | ) | (.04 | ) | — | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total distributions |

(.02 | ) | (.04 | ) | — | (.08 | ) | (3.92 | ) | (2.80 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net asset value, end of period |

$ | 21.33 | $ | 16.79 | $ | 17.56 | $ | 16.20 | $ | 17.04 | $ | 27.36 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total Returnd |

27.19 | % | (4.11 | %) | 8.40 | % | (4.32 | %) | (26.12 | %) | 10.33 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Ratios/Supplemental Data |

||||||||||||||||||||||||

| Net assets, end of period (in thousands) |

$ | 189,293 | $ | 156,232 | $ | 174,371 | $ | 175,404 | $ | 205,908 | $ | 322,850 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Ratios to average net assets: |

||||||||||||||||||||||||

| Net investment income |

0.23 | % | 0.06 | % | 0.31 | % | 0.28 | % | 0.15 | % | 0.02 | % | ||||||||||||

| Total expensesg |

1.39 | % | 1.35 | % | 1.43 | % | 1.49 | % | 1.36 | % | 1.34 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Portfolio turnover rate |

56 | % | 92 | % | 100 | % | 69 | % | 111 | % | 20 | % | ||||||||||||

| B-Class |

Period Ended March 31, 2012a |

Year Ended September 30, 2011f |

Year Ended September 30, 2010f |

Year Ended September 30, 2009f |

Year Ended September 30, 2008f |

Year Ended September 30, 2007f |

||||||||||||||||||

| Per Share Data |

||||||||||||||||||||||||

| Net asset value, beginning of period |

$ | 13.69 | $ | 14.40 | $ | 13.36 | $ | 14.12 | $ | 23.56 | $ | 24.16 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Income (loss) from investment operations: |

||||||||||||||||||||||||

| Net investment lossb |

(.06 | ) | (.11 | ) | (.08 | ) | (.04 | ) | (.12 | ) | (.16 | ) | ||||||||||||

| Net gain (loss) on investments |

3.69 | (.60 | ) | 1.12 | (.68 | ) | (5.40 | ) | 2.36 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total from investment operations |

3.63 | (.71 | ) | 1.04 | (.72 | ) | (5.52 | ) | 2.20 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Less distributions from: |

||||||||||||||||||||||||

| Net realized gains |

— | — | — | — | (3.88 | ) | (2.80 | ) | ||||||||||||||||

| Return of capital |

— | — | — | (.04 | ) | (.04 | ) | — | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total distributions |

— | — | — | (.04 | ) | (3.92 | ) | (2.80 | ) | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net asset value, end of period |

$ | 17.32 | $ | 13.69 | $ | 14.40 | $ | 13.36 | $ | 14.12 | $ | 23.56 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total Returnd |

26.52 | % | (4.93 | %) | 7.78 | % | (4.96 | %) | (26.69 | %) | 9.33 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Ratios/Supplemental Data |

||||||||||||||||||||||||

| Net assets, end of period (in thousands) |

$ | 5,524 | $ | 5,121 | $ | 6,817 | $ | 7,784 | $ | 10,621 | $ | 19,928 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Ratios to average net assets: |

||||||||||||||||||||||||

| Net investment loss |

(0.76 | %) | (0.70 | %) | (0.48 | %) | (0.46 | %) | (0.61 | %) | (0.74 | %) | ||||||||||||

| Total expensesg |

2.37 | % | 2.10 | % | 2.17 | % | 2.24 | % | 2.11 | % | 2.09 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Portfolio turnover rate |

56 | % | 92 | % | 100 | % | 69 | % | 111 | % | 20 | % | ||||||||||||

| 12 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT |

SEE NOTES TO FINANCIAL STATEMENTS. |

LARGE CAP CORE FUND

FINANCIAL HIGHLIGHTS (concluded)

This table is presented to show selected data for a share outstanding throughout each period and to assist shareholders in evaluating a Fund’s performance for the periods presented.

| C-Class |

Period Ended March 31, 2012a |

Year Ended September 30, 2011f |

Year Ended September 30, 2010f |

Year Ended September 30, 2009f |

Year Ended September 30, 2008f |

Year Ended September 30, 2007f |

||||||||||||||||||

| Per Share Data |

||||||||||||||||||||||||

| Net asset value, beginning of period |

$ | 14.81 | $ | 15.56 | $ | 14.48 | $ | 15.24 | $ | 25.12 | $ | 25.56 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Income (loss) from investment operations: |

||||||||||||||||||||||||

| Net investment lossb |

(.05 | ) | (.12 | ) | (.08 | ) | (.04 | ) | (.12 | ) | (.20 | ) | ||||||||||||

| Net gain (loss) on investments |

3.99 | (.63 | ) | 1.16 | (.68 | ) | (5.84 | ) | 2.56 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total from investment operations |

3.94 | (.75 | ) | 1.08 | (.72 | ) | (5.96 | ) | 2.36 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Less distributions from: |

||||||||||||||||||||||||

| Net realized gains |

— | — | — | — | (3.88 | ) | (2.80 | ) | ||||||||||||||||

| Return of capital |

— | — | — | (.04 | ) | (.04 | ) | — | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total distributions |

— | — | — | (.04 | ) | (3.92 | ) | (2.80 | ) | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net asset value, end of period |

$ | 18.75 | $ | 14.81 | $ | 15.56 | $ | 14.48 | $ | 15.24 | $ | 25.12 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total Returnd |

26.67 | % | (4.82 | %) | 7.46 | % | (4.60 | %) | (26.79 | %) | 9.45 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Ratios/Supplemental Data |

||||||||||||||||||||||||

| Net assets, end of period (in thousands) |

$ | 1,870 | $ | 1,600 | $ | 2,158 | $ | 2,244 | $ | 2,915 | $ | 5,048 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Ratios to average net assets: |

||||||||||||||||||||||||

| Net investment loss |

(0.58 | %) | (0.70 | %) | (0.44 | %) | (0.47 | %) | (0.60 | %) | (0.73 | %) | ||||||||||||

| Total expensesg |

2.19 | % | 2.10 | % | 2.18 | % | 2.24 | % | 2.11 | % | 2.09 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Portfolio turnover rate |

56 | % | 92 | % | 100 | % | 69 | % | 111 | % | 20 | % | ||||||||||||

| Institutional Class |

Period Ended March 31, 2012a,e |

|||

| Per Share Data |

||||

| Net asset value, beginning of period |

$ | 20.84 | ||

|

|

|

|||

| Income (loss) from investment operations: |

||||

| Net investment lossb |

(— | )c | ||

| Net gain on investments (realized and unrealized) |

.48 | |||

|

|

|

|||

| Total from investment operations |

.48 | |||

|

|

|

|||

| Net asset value, end of period |

$ | 21.32 | ||

|

|

|

|||

| Total Returnd |

2.35 | % | ||

|

|

|

|||

| Ratios/Supplemental Data |

||||

| Net assets, end of period (in thousands) |

$ | 10 | ||

|

|

|

|||

| Ratios to average net assets: |

||||

| Net investment loss |

(0.08 | %) | ||

| Total expensesg,h |

1.59 | % | ||

|

|

|

|||

| Portfolio turnover rate |

56 | % | ||

| a | Unaudited figures for the period ended March 31, 2012. Percentage amounts for the period, except total return and portfolio turnover rate, have been annualized. |

| b | Net investment income (loss) per share was computed using average shares outstanding throughout the period. |

| c | Net investment income is less than $0.01 per share. |

| d | Total return does not reflect the impact of any applicable sales charges and has not been annualized. |

| e | Since commencement of operations: March 1, 2012. Percentage amounts for the period, except total return and portfolio turnover rate, have been annualized. |

| f | Per share amounts for years ended September 30, 2007–September 30, 2010 and the period October 1, 2010 through April 8, 2011 have been restated to reflect a 1:4 reverse share split effective April 8, 2011. |

| g | Does not include expenses of the underlying funds in which the Funds invests. |

| h | Due to the limited length of Class operations, current expense ratios may not be indicative of future expense ratios. |

| SEE NOTES TO FINANCIAL STATEMENTS. |

THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 13 |

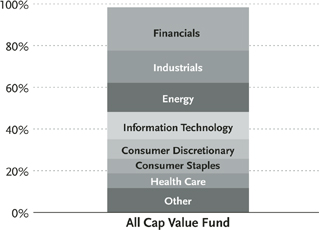

| FUND PROFILE (Unaudited) |

March 31, 2012 |

OBJECTIVE: Seeks long-term growth of capital.

14 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT

| SCHEDULE OF INVESTMENTS (Unaudited) |

March 31, 2012 | |

|

ALL CAP VALUE FUND |

| SEE NOTES TO FINANCIAL STATEMENTS. |

THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 15 |

| SCHEDULE OF INVESTMENTS (Unaudited) (concluded) |

March 31, 2012 | |

|

ALL CAP VALUE FUND |

| * | Non-income producing security. |

| † | Value determined based on Level 1 inputs — See Note 4. |

plc — Public Limited Company

| 16 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT |

SEE NOTES TO FINANCIAL STATEMENTS. |

ALL CAP VALUE FUND

| SEE NOTES TO FINANCIAL STATEMENTS. |

THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 17 |

ALL CAP VALUE FUND

STATEMENTS OF CHANGES IN NET ASSETS

| Period Ended March 31, 2012 (Unaudited) |

Year Ended September 30, 2011 |

|||||||

| INCREASE (DECREASE) IN NET ASSETS FROM OPERATIONS: |

||||||||

| Net investment income |

$ | 2,784 | $ | 2,892 | ||||

| Net realized gain on investments |

27,597 | 186,457 | ||||||

| Net change in unrealized appreciation (depreciation) on investments |

716,453 | (392,697 | ) | |||||

|

|

|

|

|

|||||

| Net increase (decrease) in net assets resulting from operations |

746,834 | (203,348 | ) | |||||

|

|

|

|

|

|||||

| DISTRIBUTIONS TO SHAREHOLDERS FROM: |

||||||||

| Net investment income |

||||||||

| A-Class |

(1,457 | ) | (2,929 | ) | ||||

| Institutional Class |

(1,267 | ) | (1,040 | ) | ||||

| Net realized gains |

||||||||

| A-Class |

(97,073 | ) | (89,465 | ) | ||||

| C-Class |

(65,107 | ) | (51,878 | ) | ||||

| Institutional Class |

(19,564 | ) | (18,694 | ) | ||||

|

|

|

|

|

|||||

| Total distributions to shareholders |

(184,468 | ) | (164,006 | ) | ||||

|

|

|

|

|

|||||

| CAPITAL SHARE TRANSACTIONS: |

||||||||

| Proceeds from sale of shares |

||||||||

| A-Class |

601,052 | 509,310 | ||||||

| C-Class |

975,210 | 500,554 | ||||||

| Institutional Class |

373,000 | 23,672 | ||||||

| Distributions reinvested |

||||||||

| A-Class |

98,113 | 92,394 | ||||||

| C-Class |

64,307 | 51,833 | ||||||

| Institutional Class |

20,830 | 19,734 | ||||||

| Cost of shares redeemed |

||||||||

| A-Class |

(932,091 | ) | (547,992 | ) | ||||

| C-Class |

(686,130 | ) | (166,421 | ) | ||||

| Institutional Class |

(372,827 | ) | (25,872 | ) | ||||

|

|

|

|

|

|||||

| Net increase from capital share transactions |

141,464 | 457,212 | ||||||

|

|

|

|

|

|||||

| Net increase in net assets |

703,830 | 89,858 | ||||||

| NET ASSETS: |

||||||||

| Beginning of period |

2,818,329 | 2,728,471 | ||||||

|

|

|

|

|

|||||

| End of period |

$ | 3,522,159 | $ | 2,818,329 | ||||

|

|

|

|

|

|||||

| Undistributed net investment income at end of period |

$ | 2,784 | $ | 2,724 | ||||

|

|

|

|

|

|||||

| CAPITAL SHARE ACTIVITY: |

||||||||

| Shares sold |

||||||||

| A-Class |

52,976 | 44,039 | ||||||

| C-Class |

89,297 | 42,478 | ||||||

| Institutional Class |

32,266 | 1,966 | ||||||

| Shares issued from reinvestment of distributions |

||||||||

| A-Class |

9,544 | 7,993 | ||||||

| C-Class |

6,392 | 4,547 | ||||||

| Institutional Class |

2,026 | 1,706 | ||||||

| Shares redeemed |

||||||||

| A-Class |

(81,597 | ) | (46,034 | ) | ||||

| C-Class |

(61,651 | ) | (14,749 | ) | ||||

| Institutional Class |

(32,251 | ) | (2,076 | ) | ||||

|

|

|

|

|

|||||

| Net increase in shares |

17,002 | 39,870 | ||||||

|

|

|

|

|

|||||

| 18 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT |

SEE NOTES TO FINANCIAL STATEMENTS. |

ALL CAP VALUE FUND

FINANCIAL HIGHLIGHTS

This table is presented to show selected data for a share outstanding throughout each period and to assist shareholders in evaluating a Fund’s performance for the periods presented.

| A-Class |

Period Ended March 31, 2012a |

Year Ended September 30, 2011 |

Year Ended September 30, 2010 |

Period

Ended September 30, 2009b |

||||||||||||

| Per Share Data |

||||||||||||||||

| Net asset value, beginning of period |

$ | 9.91 | $ | 11.11 | $ | 10.21 | $ | 10.00 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Income (loss) from investment operations: |

||||||||||||||||

| Net investment incomec |

.02 | .04 | .03 | .04 | ||||||||||||

| Net gain (loss) on investments |

2.47 | (.61 | ) | .89 | .17 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total from investment operations |

2.49 | (.57 | ) | .92 | .21 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Less distributions from: |

||||||||||||||||

| Net investment income |

(.01 | ) | (.02 | ) | (.02 | ) | — | |||||||||

| Net realized gains |

(.65 | ) | (.61 | ) | — | — | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total distributions |

(.66 | ) | (.63 | ) | (.02 | ) | — | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net asset value, end of period |

$ | 11.74 | $ | 9.91 | $ | 11.11 | $ | 10.21 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Returnd |

26.04 | % | (5.93 | %) | 8.97 | % | 2.10 | % | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Ratios/Supplemental Data |

||||||||||||||||

| Net assets, end of period (in thousands) |

$ | 1,537 | $ | 1,487 | $ | 1,601 | $ | 1,319 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Ratios to average net assets: |

||||||||||||||||

| Net investment income |

0.43 | % | 0.31 | % | 0.31 | % | 0.51 | % | ||||||||

| Total expensese |

2.99 | % | 2.78 | % | 3.71 | % | 6.75 | % | ||||||||

| Net expensesf |

1.27 | % | 1.27 | % | 1.29 | % | 1.35 | % | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Portfolio turnover rate |

17 | % | 30 | % | 55 | % | 17 | % | ||||||||

| C-Class |

Period Ended March 31, 2012a |

Year Ended September 30, 2011 |

Year Ended September 30, 2010 |

Period Ended September 30, 2009b |

||||||||||||

| Per Share Data |

||||||||||||||||

| Net asset value, beginning of period |

$ | 9.72 | $ | 10.97 | $ | 10.13 | $ | 10.00 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Income (loss) from investment operations: |

||||||||||||||||

| Net investment lossc |

(.02 | ) | (.05 | ) | (.04 | ) | (.02 | ) | ||||||||

| Net gain (loss) on investments |

2.41 | (.59 | ) | .88 | .15 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total from investment operations |

2.39 | (.64 | ) | .84 | .13 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Less distributions from: |

||||||||||||||||

| Net realized gains |

(.65 | ) | (.61 | ) | — | — | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total distributions |

(.65 | ) | (.61 | ) | — | — | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net asset value, end of period |

$ | 11.46 | $ | 9.72 | $ | 10.97 | $ | 10.13 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Returnd |

25.48 | % | (6.65 | %) | 8.29 | % | 1.30 | % | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Ratios/Supplemental Data |

||||||||||||||||

| Net assets, end of period (in thousands) |

$ | 1,606 | $ | 1,031 | $ | 809 | $ | 436 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Ratios to average net assets: |

||||||||||||||||

| Net investment loss |

(0.32 | %) | (0.42 | %) | (0.41 | %) | (0.18 | %) | ||||||||

| Total expensese |

3.73 | % | 3.52 | % | 4.47 | % | 8.89 | % | ||||||||

| Net expensesf |

2.02 | % | 2.02 | % | 2.04 | % | 2.10 | % | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Portfolio turnover rate |

17 | % | 30 | % | 55 | % | 17 | % | ||||||||

| SEE NOTES TO FINANCIAL STATEMENTS. |

THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 19 |

ALL CAP VALUE FUND

FINANCIAL HIGHLIGHTS (concluded)

This table is presented to show selected data for a share outstanding throughout each period and to assist shareholders in evaluating a Fund’s performance for the periods presented.

| Institutional Class |

Period Ended March 31, 2012a |

Year Ended September 30, 2011 |

Year Ended September 30, 2010 |

Period

Ended September 30, 2009b |

||||||||||||

| Per Share Data |

||||||||||||||||

| Net asset value, beginning of period |

$ | 9.93 | $ | 11.12 | $ | 10.24 | $ | 10.00 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Income (loss) from investment operations: |

||||||||||||||||

| Net investment incomec |

.04 | .07 | .06 | .07 | ||||||||||||

| Net gain (loss) on investments |

2.46 | (.62 | ) | .88 | .17 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total from investment operations |

2.50 | (.55 | ) | .94 | .24 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Less distributions from: |

||||||||||||||||

| Net investment income |

(.04 | ) | (.03 | ) | (.06 | ) | — | |||||||||

| Net realized gains |

(.65 | ) | (.61 | ) | — | — | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total distributions |

(.69 | ) | (.64 | ) | (.06 | ) | — | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net asset value, end of period |

$ | 11.74 | $ | 9.93 | $ | 11.12 | $ | 10.24 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Returnd |

26.15 | % | (5.72 | %) | 9.22 | % | 2.40 | % | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Ratios/Supplemental Data |

||||||||||||||||

| Net assets, end of period (in thousands) |

$ | 379 | $ | 300 | $ | 318 | $ | 291 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Ratios to average net assets: |

||||||||||||||||

| Net investment income |

0.69 | % | 0.56 | % | 0.55 | % | 0.81 | % | ||||||||

| Total expensese |

2.65 | % | 2.53 | % | 3.48 | % | 8.19 | % | ||||||||

| Net expensesf |

1.02 | % | 1.02 | % | 1.05 | % | 1.10 | % | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Portfolio turnover rate |

17 | % | 30 | % | 55 | % | 17 | % | ||||||||

| a | Unaudited figures for the period ended March 31, 2012. Percentage amounts for the period, except total return and portfolio turnover rate, have been annualized. |

| b | Since commencement of operations: October 3, 2008. Percentage amounts for the period, except total return and portfolio turnover rate, have been annualized. |

| c | Net investment income (loss) per share was computed using average shares outstanding throughout the period. |

| d | Total return does not reflect the impact of any applicable sales charges and has not been annualized. |

| e | Does not include expenses of the underlying funds in which the Fund invests. |

| f | Net expense information reflects the expense ratios after expense waivers and reimbursements, as applicable. |

| 20 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT |

SEE NOTES TO FINANCIAL STATEMENTS. |

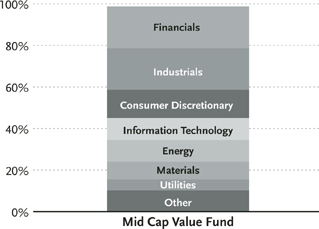

| FUND PROFILE (Unaudited) |

March 31, 2012 |

OBJECTIVE: Seeks long-term growth of capital.

THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 21

| SCHEDULE OF INVESTMENTS (Unaudited) |

March 31, 2012 | |||

|

MID CAP VALUE FUND |

| 22 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT |

SEE NOTES TO FINANCIAL STATEMENTS. |

| SCHEDULE OF INVESTMENTS (Unaudited) (concluded) | March 31, 2012 | |||

|

MID CAP VALUE FUND |

| * | Non-income producing security. |

| † | Value determined based on Level 1 inputs — See Note 4. |

| †† | Value determined based on Level 2 inputs — See Note 4. |

| 1 | PIPE (Private Investment in Public Equity) — Stock issued by a company in the secondary market as a means of raising capital more quickly and less expensively than through registration of a secondary public offering. |

| 2 | Repurchase Agreement — See Note 5. |

| 3 | Affiliated issuers — See Note 9. |

| SEE NOTES TO FINANCIAL STATEMENTS. |

THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 23 |

MID CAP VALUE FUND

| 24 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT |

SEE NOTES TO FINANCIAL STATEMENTS. |

MID CAP VALUE FUND

STATEMENTS OF CHANGES IN NET ASSETS

| Period

Ended March 31, 2012 (Unaudited) |

Year

Ended September 30, 2011 |

|||||||

| INCREASE (DECREASE) IN NET ASSETS FROM OPERATIONS: |

||||||||

| Net investment loss |

$ | (2,363,085 | ) | $ | (3,440,508 | ) | ||

| Net realized gain on investments |

34,480,190 | 96,271,687 | ||||||

| Net change in unrealized appreciation (depreciation) on investments |

253,881,843 | (202,094,392 | ) | |||||

|

|

|

|

|

|||||

| Net increase (decrease) in net assets resulting from operations |

285,998,948 | (109,263,213 | ) | |||||

|

|

|

|

|

|||||

| DISTRIBUTIONS TO SHAREHOLDERS FROM: |

||||||||

| Net investment income |

||||||||

| A-Class |

— | (2,703,664 | ) | |||||

| Net realized gains |

||||||||

| A-Class |

(19,357,542 | ) | — | |||||

| B-Class |

(613,605 | ) | — | |||||

| C-Class |

(4,226,857 | ) | — | |||||

|

|

|

|

|

|||||

| Total distributions to shareholders |

(24,198,004 | ) | (2,703,664 | ) | ||||

|

|

|

|

|

|||||

| CAPITAL SHARE TRANSACTIONS: |

||||||||

| Proceeds from sale of shares |

||||||||

| A-Class |

107,814,494 | 324,475,268 | ||||||

| B-Class |

193,365 | 1,151,877 | ||||||

| C-Class |

10,021,683 | 50,436,018 | ||||||

| Distributions reinvested |

||||||||

| A-Class |

16,566,220 | 2,286,331 | ||||||

| B-Class |

589,906 | — | ||||||

| C-Class |

3,099,596 | — | ||||||

| Cost of shares redeemed |

||||||||

| A-Class |

(218,185,329 | ) | (319,562,384 | ) | ||||

| B-Class |

(6,011,839 | ) | (13,883,753 | ) | ||||

| C-Class |

(25,485,638 | ) | (35,726,724 | ) | ||||

|

|

|

|

|

|||||

| Net increase (decrease) from capital share transactions |

(111,397,542 | ) | 9,176,633 | |||||

|

|

|

|

|

|||||

| Net increase (decrease) in net assets |

150,403,402 | (102,790,244 | ) | |||||

| NET ASSETS: |

||||||||

| Beginning of period |

1,190,172,086 | 1,292,962,330 | ||||||

|

|

|

|

|

|||||

| End of period |

$ | 1,340,575,488 | $ | 1,190,172,086 | ||||

|

|

|

|

|

|||||

| Accumulated net investment loss at end of period |

$ | (2,363,085 | ) | $ | — | |||

|

|

|

|

|

|||||

| CAPITAL SHARE ACTIVITY: |

||||||||

| Shares sold |

||||||||

| A-Class |

3,514,283 | 9,983,874 | ||||||

| B-Class |

7,083 | 41,607 | ||||||

| C-Class |

374,434 | 1,764,740 | ||||||

| Shares issued from reinvestment of distributions |

||||||||

| A-Class |

573,426 | 71,136 | ||||||

| B-Class |

24,226 | — | ||||||

| C-Class |

123,441 | — | ||||||

| Shares redeemed |

||||||||

| A-Class |

(7,059,752 | ) | (9,926,468 | ) | ||||

| B-Class |

(232,437 | ) | (506,587 | ) | ||||

| C-Class |

(953,990 | ) | (1,274,995 | ) | ||||

|

|

|

|

|

|||||

| Net increase (decrease) in shares |

(3,629,286 | ) | 153,307 | |||||

|

|

|

|

|

|||||

| SEE NOTES TO FINANCIAL STATEMENTS. |

THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 25 |

MID CAP VALUE FUND

FINANCIAL HIGHLIGHTS

This table is presented to show selected data for a share outstanding throughout each period and to assist shareholders in evaluating a Fund’s performance for the periods presented.

| A-Class |

Period Ended March 31, 2012a |

Year Ended September 30, 2011 |

Year Ended September 30, 2010 |

Year Ended September 30, 2009 |

Year Ended September 30, 2008 |

Year Ended September 30, 2007 |

||||||||||||||||||

| Per Share Data |

||||||||||||||||||||||||

| Net asset value, beginning of period |

$ | 27.13 | $ | 29.55 | $ | 26.58 | $ | 28.41 | $ | 40.79 | $ | 38.27 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Income (loss) from investment operations: |

||||||||||||||||||||||||

| Net investment income (loss)b |

(.03 | ) | (.03 | ) | .11 | .08 | .25 | .25 | ||||||||||||||||

| Net gain (loss) on investments (realized and unrealized) |

6.73 | (2.31 | ) | 2.90 | .82 | (4.77 | ) | 4.59 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total from investment operations |

6.70 | (2.34 | ) | 3.01 | .90 | (4.52 | ) | 4.84 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Less distributions from: |

||||||||||||||||||||||||

| Net investment income |

— | (.08 | ) | (.04 | ) | (.14 | ) | (.14 | ) | (.23 | ) | |||||||||||||

| Net realized gains |

(.55 | ) | — | — | (2.59 | ) | (7.72 | ) | (2.09 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total distributions |

(.55 | ) | (.08 | ) | (.04 | ) | (2.73 | ) | (7.86 | ) | (2.32 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net asset value, end of period |

$ | 33.28 | $ | 27.13 | $ | 29.55 | $ | 26.58 | $ | 28.41 | $ | 40.79 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total Returnc |

24.99 | % | (7.98 | %) | 11.32 | % | 6.90 | % | (12.48 | %) | 12.96 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Ratios/Supplemental Data |

||||||||||||||||||||||||

| Net assets, end of period (in thousands) |

$ | 1,095,291 | $ | 973,467 | $ | 1,056,655 | $ | 781,883 | $ | 656,044 | $ | 687,484 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Ratios to average net assets: |

||||||||||||||||||||||||

| Net investment income (loss) |

(0.23 | %) | (0.10 | %) | 0.38 | % | 0.40 | % | 0.79 | % | 0.61 | % | ||||||||||||

| Total expenses |

1.44 | % | 1.32 | % | 1.37 | % | 1.48 | % | 1.37 | % | 1.32 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Portfolio turnover rate |

7 | % | 28 | % | 23 | % | 31 | % | 68 | % | 44 | % | ||||||||||||

| B-Class |

Period Ended March 31, 2012a |

Year Ended September 30, 2011 |

Year Ended September 30, 2010 |

Year Ended September 30, 2009 |

Year Ended September 30, 2008 |

Year Ended September 30, 2007 |

||||||||||||||||||

| Per Share Data |

||||||||||||||||||||||||

| Net asset value, beginning of period |

$ | 22.99 | $ | 25.17 | $ | 22.78 | $ | 24.83 | $ | 36.78 | $ | 34.76 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Income (loss) from investment operations: |

||||||||||||||||||||||||

| Net investment lossb |

(.13 | ) | (.24 | ) | (.09 | ) | (.06 | ) | (— | )d | (.04 | ) | ||||||||||||

| Net gain (loss) on investments |

||||||||||||||||||||||||

| (realized and unrealized) |

5.68 | (1.94 | ) | 2.48 | .60 | (4.23 | ) | 4.15 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total from investment operations |

5.55 | (2.18 | ) | 2.39 | .54 | (4.23 | ) | 4.11 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Less distributions from: |

||||||||||||||||||||||||

| Net realized gains |

(.55 | ) | — | — | (2.59 | ) | (7.72 | ) | (2.09 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total distributions |

(.55 | ) | — | — | (2.59 | ) | (7.72 | ) | (2.09 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net asset value, end of period |

$ | 27.99 | $ | 22.99 | $ | 25.17 | $ | 22.78 | $ | 24.83 | $ | 36.78 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total Returnc |

24.48 | % | (8.66 | %) | 10.49 | % | 6.17 | % | (13.14 | %) | 12.10 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Ratios/Supplemental Data |

||||||||||||||||||||||||

| Net assets, end of period (in thousands) |

$ | 28,414 | $ | 27,960 | $ | 42,321 | $ | 58,221 | $ | 66,641 | $ | 106,179 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Ratios to average net assets: |

||||||||||||||||||||||||

| Net investment loss |

(1.04 | %) | (0.86 | %) | (0.40 | %) | (0.34 | %) | (0.01 | %) | (0.10 | %) | ||||||||||||

| Total expenses |

2.24 | % | 2.07 | % | 2.12 | % | 2.23 | % | 2.12 | % | 2.07 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Portfolio turnover rate |

7 | % | 28 | % | 23 | % | 31 | % | 68 | % | 44 | % | ||||||||||||

| 26 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT |

SEE NOTES TO FINANCIAL STATEMENTS. |

MID CAP VALUE FUND

FINANCIAL HIGHLIGHTS (concluded)

This table is presented to show selected data for a share outstanding throughout each period and to assist shareholders in evaluating a Fund’s performance for the periods presented.

| C-Class |

Period Ended March 31, 2012a |

Year Ended September 30, 2011 |

Year Ended September 30, 2010 |

Year Ended September 30, 2009 |

Year Ended September 30, 2008 |

Year Ended September 30, 2007 |

||||||||||||||||||

| Per Share Data |

||||||||||||||||||||||||

| Net asset value, beginning of period |

$ | 23.68 | $ | 25.93 | $ | 23.47 | $ | 25.49 | $ | 37.54 | $ | 35.43 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Income (loss) from investment operations: |

||||||||||||||||||||||||

| Net investment lossb |

(.13 | ) | (.24 | ) | (.09 | ) | (.07 | ) | (— | )d | (.05 | ) | ||||||||||||

| Net gain (loss) on investments |

||||||||||||||||||||||||

| (realized and unrealized) |

5.86 | (2.01 | ) | 2.55 | .64 | (4.33 | ) | 4.25 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total from investment operations |

5.73 | (2.25 | ) | 2.46 | .57 | (4.33 | ) | 4.20 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Less distributions from: |

||||||||||||||||||||||||

| Net realized gains |

(.55 | ) | — | — | (2.59 | ) | (7.72 | ) | (2.09 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total distributions |

(.55 | ) | — | — | (2.59 | ) | (7.72 | ) | (2.09 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net asset value, end of period |

$ | 28.86 | $ | 23.68 | $ | 25.93 | $ | 23.47 | $ | 25.49 | $ | 37.54 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total Returnc |

24.57 | % | (8.68 | %) | 10.48 | % | 6.13 | % | (13.15 | %) | 12.13 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Ratios/Supplemental Data |

||||||||||||||||||||||||

| Net assets, end of period (in thousands) |

$ | 216,870 | $ | 188,745 | $ | 193,986 | $ | 139,121 | $ | 113,192 | $ | 176,746 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Ratios to average net assets: |

||||||||||||||||||||||||

| Net investment loss |

(0.97 | %) | (0.85 | %) | (0.37 | %) | (0.35 | %) | (0.01 | %) | (0.12 | %) | ||||||||||||

| Total expenses |

2.18 | % | 2.07 | % | 2.12 | % | 2.22 | % | 2.12 | % | 2.07 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Portfolio turnover rate |

7 | % | 28 | % | 23 | % | 31 | % | 68 | % | 44 | % | ||||||||||||

| a | Unaudited figures for the period ended March 31, 2012. Percentage amounts for the period, except total return and portfolio turnover rate, have been annualized. |

| b | Net investment income (loss) per share was computed using average shares outstanding throughout the period. |

| c | Total return does not reflect the impact of any applicable sales charges and has not been annualized. |

| d | Net investment income is less than $0.01 per share. |

| SEE NOTES TO FINANCIAL STATEMENTS. |

THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 27 |

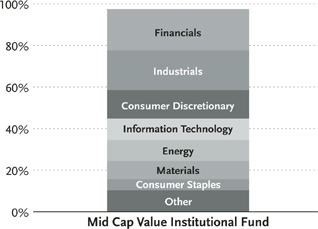

| FUND PROFILE (Unaudited) |

March 31, 2012 |

MID CAP VALUE INSTITUTIONAL FUND

OBJECTIVE: Seeks long-term growth of capital.

28 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT

| SCHEDULE OF INVESTMENTS (Unaudited) |

March 31, 2012 | |||

|

MID CAP VALUE INSTITUTIONAL FUND |

| SEE NOTES TO FINANCIAL STATEMENTS. | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 29 |

| SCHEDULE OF INVESTMENTS (Unaudited) (concluded) | March 31, 2012 | |||

|

MID CAP VALUE INSTITUTIONAL FUND |

| * | Non-income producing security. |

| † | Value determined based on Level 1 inputs — See Note 4. |

| †† | Value determined based on Level 2 inputs — See Note 4. |

| 1 | PIPE (Private Investment in Public Equity)—Stock issued by a company in the secondary market as a means of raising capital more quickly and less expensively than through registration of a secondary public offering. |

| 2 | Repurchase Agreement — See Note 5. |

| 3 | Affiliated issuers — Note 9. |

| 30 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT |

SEE NOTES TO FINANCIAL STATEMENTS. |

MID CAP VALUE INSTITUTIONAL FUND

| SEE NOTES TO FINANCIAL STATEMENTS. |

THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 31 |

MID CAP VALUE INSTITUTIONAL FUND

STATEMENTS OF CHANGES IN NET ASSETS

| Period Ended March 31, 2012 (Unaudited) |

Year Ended September 30, 2011 |

|||||||

| INCREASE (DECREASE) IN NET ASSETS FROM OPERATIONS: |

||||||||

| Net investment income |

$ | 760,464 | $ | 2,014,286 | ||||

| Net realized gain on investments |

9,123,173 | 46,068,916 | ||||||

| Net change in unrealized appreciation (depreciation) on investments |

103,264,759 | (93,414,074 | ) | |||||

|

|

|

|

|

|||||

| Net increase (decrease) in net assets resulting from operations |

113,148,396 | (45,330,872 | ) | |||||

|

|

|

|

|

|||||

| DISTRIBUTIONS TO SHAREHOLDERS FROM: |

||||||||

| Net investment income |

(1,977,527 | ) | (3,064,710 | ) | ||||

| Net realized gains |

(44,425,740 | ) | (22,149,496 | ) | ||||

|

|

|

|

|

|||||

| Total distributions to shareholders |

(46,403,267 | ) | (25,214,206 | ) | ||||

|

|

|

|

|

|||||

| CAPITAL SHARE TRANSACTIONS: |

||||||||

| Proceeds from sale of shares |

85,319,314 | 230,594,999 | ||||||

| Distributions reinvested |

20,469,550 | 10,706,814 | ||||||

| Cost of shares redeemed |

(101,245,682 | ) | (212,937,728 | ) | ||||

|

|

|

|

|

|||||

| Net increase from capital share transactions |

4,543,182 | 28,364,085 | ||||||

|

|

|

|

|

|||||

| Net increase (decrease) in net assets |

71,288,311 | (42,180,993 | ) | |||||

| NET ASSETS: |

||||||||

| Beginning of period |

472,266,005 | 514,446,998 | ||||||

|

|

|

|

|

|||||

| End of period |

$ | 543,554,316 | $ | 472,266,005 | ||||

|

|

|

|

|

|||||

| Undistributed net investment income at end of period |

$ | 760,442 | $ | 1,977,505 | ||||

|

|

|

|

|

|||||

| CAPITAL SHARE ACTIVITY: |

||||||||

| Shares sold |

8,058,176 | 19,002,513 | ||||||

| Shares issued from reinvestment of distributions |

2,088,722 | 905,056 | ||||||

| Shares redeemed |

(9,414,978 | ) | (17,934,768 | ) | ||||

|

|

|

|

|

|||||

| Net increase in shares |

731,920 | 1,972,801 | ||||||

|

|

|

|

|

|||||

| 32 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT |

SEE NOTES TO FINANCIAL STATEMENTS. |

MID CAP VALUE INSTITUTIONAL FUND

FINANCIAL HIGHLIGHTS

This table is presented to show selected data for a share outstanding throughout each period and to assist shareholders in evaluating a Fund’s performance for the periods presented.

| Period Ended March 31, 2012a |

Year Ended September 30, 2011 |

Year Ended September 30, 2010 |

Year Ended September 30, 2009 |

Period

Ended September 30, 2008b |

||||||||||||||||

| Per Share Data |

||||||||||||||||||||

| Net asset value, beginning of period |

$ | 9.97 | $ | 11.34 | $ | 10.49 | $ | 10.68 | $ | 10.00 | ||||||||||

| Income (loss) from investment operations: |

||||||||||||||||||||

| Net investment incomec |

.02 | .04 | .08 | .08 | .04 | |||||||||||||||

| Net gain (loss) on investments (realized and unrealized) |

2.33 | (.87 | ) | 1.13 | .27 | .64 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total from investment operations |

2.35 | (.83 | ) | 1.21 | .35 | .68 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Less distributions from: |

||||||||||||||||||||

| Net investment income |

(.04 | ) | (.06 | ) | (.01 | ) | (.06 | ) | — | |||||||||||

| Net realized gains |

(.97 | ) | (.48 | ) | (.35 | ) | (.48 | ) | — | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total distributions |

(1.01 | ) | (.54 | ) | (.36 | ) | (.54 | ) | — | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net asset value, end of period |

$ | 11.31 | $ | 9.97 | $ | 11.34 | $ | 10.49 | $ | 10.68 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total Returnd |

25.18 | % | (8.05 | %) | 11.76 | % | 5.30 | % | 6.80 | % | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Ratios/Supplemental Data |

||||||||||||||||||||

| Net assets, end of period (in thousands) |

$ | 543,554 | $ | 472,266 | $ | 514,447 | $ | 317,455 | $ | 17,436 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Ratios to average net assets: |

||||||||||||||||||||

| Net investment income |

0.30 | % | 0.34 | % | 0.78 | % | 0.82 | % | 1.81 | % | ||||||||||

| Total expenses |

0.98 | % | 0.98 | % | 0.95 | % | 0.98 | % | 1.19 | % | ||||||||||

| Net expensese |

0.90 | % | 0.90 | % | 0.90 | % | 0.91 | % | 1.10 | % | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Portfolio turnover rate |

7 | % | 38 | % | 20 | % | 76 | % | 63 | % | ||||||||||

| a | Unaudited figures for the period ended March 31, 2012. Percentage amounts for the period, except total return and portfolio turnover rate, have been annualized. |

| b | Since commencement of operations: July 11, 2008. Percentage amounts for the period, except total return and portfolio turnover rate, have been annualized. |

| c | Net investment income per share was computed using average shares outstanding throughout the period. |

| d | Total return does not reflect the impact of any applicable sales charges and has not been annualized. |

| e | Net expense information reflects the expense ratios after expense waivers and reimbursements, as applicable. |

| SEE NOTES TO FINANCIAL STATEMENTS. |

THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 33 |

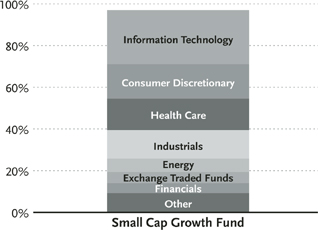

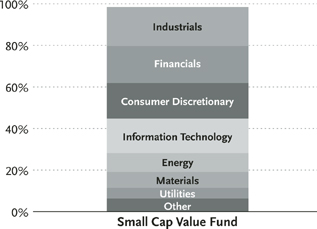

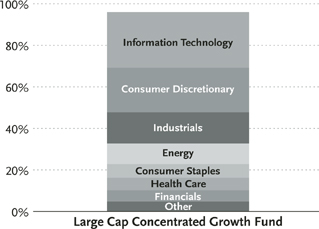

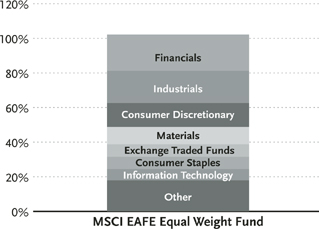

| FUND PROFILE (Unaudited) |

March 31, 2012 |

OBJECTIVE: Seeks long-term growth of capital.

34 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT

| SCHEDULE OF INVESTMENTS (Unaudited) |

March 31, 2012 | |||

|

SMALL CAP GROWTH FUND |

| SEE NOTES TO FINANCIAL STATEMENTS. |

THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 35 |

| SCHEDULE OF INVESTMENTS (Unaudited) (concluded) |

March 31, 2012 | |||

|

SMALL CAP GROWTH FUND |

| 36 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT |

SEE NOTES TO FINANCIAL STATEMENTS. |

SMALL CAP GROWTH FUND

| SEE NOTES TO FINANCIAL STATEMENTS. |

THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 37 |

SMALL CAP GROWTH FUND

STATEMENTS OF CHANGES IN NET ASSETS

| Period Ended March 31, 2012 (Unaudited) |

Year Ended September 30, 2011 |

|||||||

| INCREASE (DECREASE) IN NET ASSETS FROM OPERATIONS: |

||||||||

| Net investment loss |

$ | (145,177 | ) | $ | (308,691 | ) | ||

| Net realized gain on investments |

745,344 | 2,614,617 | ||||||

| Net change in unrealized appreciation (depreciation) on investments |

3,496,077 | (2,745,033 | ) | |||||

|

|

|

|

|

|||||

| Net increase (decrease) in net assets resulting from operations |

4,096,244 | (439,107 | ) | |||||

|

|

|

|

|

|||||

| CAPITAL SHARE TRANSACTIONS: |

||||||||

| Proceeds from sale of shares |

||||||||

| A-Class |