Table of Contents

As filed with the Securities and Exchange Commission on May 3, 2023

Registration No. 333 -

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Linde plc

(Exact name of registrant as specified in its charter)

| Ireland | 98-1448883 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 10 Riverview Drive Danbury, Connecticut 06810 United States +1 (203) 837-2000 |

Forge 43 Church Street West Woking, Surrey GU21 6HT United Kingdom +44 1483 242200 | |

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

| Linde Inc. | Linde Finance B.V. | Linde GmbH | ||

| (Exact name of registrant as specified in its charter) |

(Exact name of registrant as specified in its charter) |

(Exact name of registrant as specified in its charter) | ||

| Delaware | Netherlands | Germany | ||

| (State or other jurisdiction of incorporation or organization) |

(State or other jurisdiction of incorporation or organization) |

(State or other jurisdiction of incorporation or organization) | ||

| 06-124-9050 | N/A | N/A | ||

| (I.R.S. Employer Identification Number) |

(I.R.S. Employer Identification Number) |

(I.R.S. Employer Identification Number) | ||

| 10 Riverview Drive Danbury, Connecticut +1 (203) 837-2000 |

43 Fitzwilliam Square West Dublin 2, D02 K792 Ireland + 353 1 905 3587 |

Dr.-Carl-von-Linde-Strasse 6-14 82049 Pullach Germany +49 89 3575701 | ||

| (Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices) | (Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices) | (Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices) | ||

Guillermo Bichara Executive Vice President and Chief Legal Officer Linde plc

Forge 43 Church Street West

Woking, Surrey GU21 6HT United Kingdom +44 1483 242200

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Susanna M. Suh, Esq. Timothy B. Howell, Esq. Cahill Gordon & Reindel LLP 32 Old Slip New York, NY 10005 (212) 701-3000 |

Byron Rooney, Esq. Davis Polk & Wardwell LLP | |||||||

Table of Contents

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this Registration Statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☒

If this form is a post-effective amendment to a registration statement filed pursuant to General Instruction 1.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☒ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ | |||

| Emerging growth company | ☐ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

Table of Contents

PROSPECTUS

| Linde plc

Debt Securities Guarantees of Debt Securities Preferred Shares Ordinary Shares Depositary Shares |

Linde Inc.

Debt Securities Guarantees of Debt Securities

Linde Finance B.V.

Debt Securities

Linde GmbH

Guarantees of Debt Securities |

Warrants

Securities Purchase Contracts

Units

We may offer, issue and sell the types of securities set forth above from time to time, together or separately. This prospectus describes some of the general terms that may apply to these securities. We will provide a prospectus supplement each time we offer and issue any of these securities. The specific terms of any securities to be offered will be described in the related prospectus supplement. You should read this prospectus, any prospectus supplement, any related free writing prospectus and any documents incorporated by reference herein and therein carefully before making an investment decision. This prospectus may not be used unless accompanied by a prospectus supplement.

The ordinary shares of Linde plc are listed on the New York Stock Exchange under the trading symbol “LIN.” Any ordinary shares offered pursuant to a prospectus supplement will be listed, subject to notice of issuance, on the New York Stock Exchange.

Investing in these securities involves risk. See “Risk Factors” on page 4 of this prospectus.

Neither the Securities and Exchange Commission, any state securities commission nor any other regulatory board has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

We may sell these securities on a continuous or delayed basis directly, through agents, dealers or underwriters as designated from time to time, or through a combination of these methods. We reserve the sole right to accept, and together with any agents, dealers and underwriters, reserve the right to reject, in whole or in part, any proposed purchase of securities. If any agents, dealers or underwriters are involved in the sale of any securities, the applicable prospectus supplement will set forth any applicable commission or discounts. Our net proceeds from the sale of securities will also be set forth in the applicable prospectus supplement.

The date of this prospectus is May 3, 2023.

Table of Contents

Prospectus

| Page | ||||

| ii | ||||

| iii | ||||

| 1 | ||||

| 4 | ||||

| 4 | ||||

| 4 | ||||

| 4 | ||||

| 4 | ||||

| 5 | ||||

| 5 | ||||

| 5 | ||||

| 6 | ||||

| Limitations on Validity and Enforcement of the Guarantees and Certain Insolvency Law Considerations |

29 | |||

| 38 | ||||

| 42 | ||||

| 44 | ||||

| 44 | ||||

| 45 | ||||

i

Table of Contents

Unless we have indicated or the context requires otherwise, references in this prospectus to:

| • | “we,” “us,” “our,” the “Company,” the “Linde Group” and “Linde” are to Linde plc and its subsidiaries; |

| • | “Linde Inc.” are to Linde Inc., a Delaware corporation (formerly known as Praxair, Inc.); |

| • | “Linde plc” are to Linde plc, an Irish public limited company; |

| • | “Linde Finance” are to Linde Finance B.V., a Netherlands private company with limited liability; and |

| • | “Linde GmbH” are to Linde GmbH, a German limited liability company (formerly known as Linde AG). |

References herein to “$,” “dollars” and “U.S. dollars” are to the currency of the United States. References to “€” and “euro” are to the lawful currency of the member states of the European Monetary Union that have adopted or that adopt the single currency in accordance with the Treaty on the Functioning of the European Union, as amended by the Treaty on European Union.

This prospectus is part of a “shelf” registration statement filed by us with the United States Securities and Exchange Commission (the “SEC”). By using a shelf registration statement, we may sell an unlimited aggregate principal amount of any combination of the securities described in this prospectus from time to time and in one or more offerings. This prospectus provides you with only a general description of the securities that we may offer. Each time we sell securities, we will provide a supplement to this prospectus that contains specific information about the terms of the securities. The prospectus supplement may also add, update or change information contained in this prospectus. Before purchasing any securities, you should carefully read both this prospectus and any prospectus supplement, together with the additional information described under the heading “Where You Can Find More Information.”

The registration statement containing this prospectus, including the exhibits to the registration statement, provides additional information about us and the securities offered under this prospectus.

The exhibits to the registration statement contain the full text of certain contracts and other important documents we have summarized in this prospectus. You should review the full text of these documents because these summaries may not contain all the information that you may find important in deciding whether to purchase the securities we offer. The registration statement, including the exhibits, can be read at the SEC’s website mentioned under the heading “Where You Can Find More Information.”

We have not authorized anyone to provide you with any information or to make any representation that is different from, or in addition to, the information contained in this prospectus or any documents incorporated by reference in this prospectus. We take no responsibility for, and can provide no assurances as to the reliability of, any other information that others may give you or representations that others may make. You should not assume that the information contained in this prospectus, or the information contained in any document incorporated by reference in this prospectus, is accurate as of any date other than the date of each such document, unless the information specifically indicates that another date applies.

This prospectus does not constitute an offer to sell or the solicitation of an offer to buy any securities in any jurisdiction to any person to whom it is unlawful to make the offer or solicitation in such jurisdiction.

ii

Table of Contents

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This document contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are identified by terms and phrases such as: anticipate, believe, intend, estimate, expect, continue, should, could, may, plan, project, predict, will, potential, forecast, and similar expressions. They are based on management’s reasonable expectations and assumptions as of the date the statements are made but involve risks and uncertainties. These risks and uncertainties include, without limitation: the performance of stock markets generally; developments in worldwide and national economies and other international events and circumstances, including trade conflicts and tariffs; changes in foreign currencies and in interest rates; the cost and availability of electric power, natural gas and other raw materials; the ability to achieve price increases to offset cost increases; catastrophic events, including natural disasters, epidemics, pandemics such as COVID-19 and acts of war and terrorism; the ability to attract, hire, and retain qualified personnel; the impact of changes in financial accounting standards; the impact of changes in pension plan liabilities; the impact of tax, environmental, healthcare and other legislation and government regulation in jurisdictions in which the company operates; the cost and outcomes of investigations, litigation and regulatory proceedings; the impact of potential unusual or non-recurring items; continued timely development and market acceptance of new products and applications; the impact of competitive products and pricing; future financial and operating performance of major customers and industries served; the impact of information technology system failures, network disruptions and breaches in data security; and the effectiveness and speed of integrating new acquisitions into the business. These risks and uncertainties may cause future results or circumstances to differ materially from adjusted projections, estimates or other forward-looking statements.

Linde plc assumes no obligation to update or provide revisions to any forward-looking statement in response to changing circumstances. The above listed risks and uncertainties are further described in Item 1A (Risk Factors) in Linde plc’s Form 10-K for the fiscal year ended December 31, 2022 filed with the SEC on February 28, 2023, Form 10-Q for the fiscal quarter ended March 31, 2023 filed with the SEC on April 27, 2023 and in subsequent filings with the SEC, which should be reviewed carefully. Please consider Linde plc’s forward-looking statements in light of those risks.

iii

Table of Contents

Linde plc

Linde plc is an incorporated public limited company formed under the laws of Ireland with its principal offices in the United Kingdom and United States. Linde plc’s registered office is in Ireland and it is a tax resident in the United Kingdom.

On January 18, 2023, Linde shareholders approved the Company’s proposal for an intercompany reorganization that resulted in the delisting of its ordinary shares from the Frankfurt Stock Exchange, on March 1, 2023, after the completion of legal and regulatory approvals. In connection with the closing of the intercompany reorganization on March 1, 2023, Linde assumed by operation of law all obligations of the predecessor and shareholders automatically received one share of the new holding company, listed on the New York Stock Exchange in exchange for each share of Linde plc that was previously owned. The new holding company is also named “Linde plc” and trades under the existing ticker LIN.

Linde is the largest industrial gas company worldwide and is a major technological innovator in the industrial gases industry. Its primary products in its industrial gases business are atmospheric gases (oxygen, nitrogen, argon, and rare gases) and process gases (carbon dioxide, helium, hydrogen, electronic gases, specialty gases, and acetylene etc.). The Company also designs and builds equipment that produces industrial gases and offers customers a wide range of gas production and processing services such as olefin plants, natural gas plants, air separation plants, hydrogen and synthesis gas plants and other types of plants.

Linde serves a diverse group of industries including healthcare, chemicals and energy, manufacturing, metals and mining, food and beverage, and electronics.

Linde plc may offer debt securities, preferred shares, depositary shares and ordinary shares under this prospectus, and debt securities exchangeable for or convertible into preferred shares, ordinary shares or other debt securities. Debt securities of Linde plc may be guaranteed by Linde Inc. and/or Linde GmbH. Linde plc may provide guarantees of debt securities offered by its wholly owned subsidiaries Linde Inc. or Linde Finance under this prospectus.

Linde plc has filed a base prospectus with the Luxembourg Stock Exchange for a €10.0 billion debt issuance program, under which Linde plc may offer debt securities. Linde Inc. and Linde GmbH have provided to Linde plc upstream guarantees in relation to debt securities of Linde plc offered under the European debt program.

The Company’s principal offices are located at Forge, 43 Church Street West, in Woking, Surrey, United Kingdom GU21 6HT, and 10 Riverview Drive, Danbury, Connecticut 06810, United States, and the telephone numbers of the Company’s principal offices are +44 1483 242200 and +1 (203) 837-2000.

Linde Inc.

Linde Inc. is a corporation formed under the laws of the State of Delaware and is a wholly owned subsidiary of Linde plc.

Linde Inc. may offer debt securities under this prospectus. Debt securities of Linde Inc. will be guaranteed by Linde plc, and such guarantees by Linde plc may be guaranteed by Linde GmbH. Linde Inc. may also provide (i) guarantees of debt securities offered by Linde plc under this prospectus and (ii) guarantees of the guarantees provided by Linde plc of debt securities of Linde Finance offered under this prospectus.

Separately, Linde Inc. has provided to Linde plc upstream guarantees under the European debt program as described above under “—Linde plc.”

1

Table of Contents

As of December 31, 2022, Linde Inc. had approximately $5.3 billion of notes outstanding under (i) the indenture dated as of July 15, 1992 (the “1992 Indenture” and such notes, the “1992 Indenture Linde Inc. notes”) between Linde Inc. (formerly Praxair, Inc.) and U.S. Bank Trust Company, National Association (as successor in interest to U.S. Bank National Association) and (ii) the indenture dated as of August 10, 2020 (the “2020 Indenture” and such notes, the “2020 Indenture Linde Inc. notes” and together with the 1992 Indenture Linde Inc. notes, the “existing Linde Inc. notes”) among Linde Inc. (formerly Praxair, Inc.), Linde plc and U.S. Bank Trust Company, National Association (as successor in interest to U.S. Bank National Association). In September 2019, Linde Inc., Linde plc, Linde GmbH and U.S. Bank Trust Company, National Association (as successor in interest to U.S. Bank National Association) entered into a supplemental indenture to the 1992 Indenture (the “2019 supplemental indenture”), pursuant to which Linde plc provided downstream guarantees of all of the 1992 Indenture Linde Inc. notes, and Linde GmbH provided upstream guarantees of Linde plc’s downstream guarantees. Linde plc provided downstream guarantees of all of the 2020 Indenture Linde Inc. notes, and Linde GmbH has provided upstream guarantees of Linde plc’s downstream guarantees. There are certain limitations under German law on the enforceability of Linde GmbH’s existing upstream guarantees, which are the same as those that would apply to Linde GmbH’s upstream guarantees provided under this prospectus, as described under “Description of Debt Securities—Guarantees—Limitations on Enforceability.” In addition, Linde GmbH’s existing upstream guarantees of Linde plc’s downstream guarantees may be released under the same circumstance as Linde GmbH’s upstream guarantees of Linde plc’s downstream guarantees provided under this prospectus, as described under “Description of Debt Securities—Guarantees—Release Under Certain Circumstances.”

Linde Finance B.V.

Linde Finance B.V. is a private company with limited liability (besloten vennootschap met beperkte aansprakelijkheid) incorporated under the laws of the Netherlands with its corporate seat (statutaire zetel) at Amsterdam, the Netherlands, having its registered office at 43 Fitzwilliam Square West, Dublin 2, Ireland. It is registered with the Dutch trade register of the Chamber of Commerce under number 34115238, and registered with the Irish Companies Registration Office as an “external company” for the purposes of Part 21 of the Irish Companies Act 2014 (the “2014 Act”) under number 909743, and is a tax resident of Ireland and is a wholly owned subsidiary of Linde plc.

Linde Finance acts as a finance company for the benefit of the Linde Group. Its principal activities are to issue debt in the public and private markets and to use the proceeds to make intercompany loans to other companies within the Linde Group.

Linde Finance may offer debt securities under this prospectus. Linde plc will guarantee debt securities of Linde Finance offered under this prospectus. Linde GmbH and Linde Inc. may guarantee Linde plc’s obligations under its downstream guarantee.

As of December 31, 2022, Linde Finance had approximately €3,869 million of notes outstanding, which are guaranteed by Linde GmbH (the “existing Linde Finance notes”). In September 2019, Linde plc provided downstream guarantees of all of the existing Linde Finance notes, and Linde Inc. provided upstream guarantees of Linde plc’s downstream guarantees. Linde Inc.’s existing upstream guarantees of Linde plc’s downstream guarantees may be released under the same circumstance as Linde Inc.’s upstream guarantees of Linde plc’s downstream guarantees provided under this prospectus, as described under “Description of Debt Securities—Guarantees—Release Under Certain Circumstances.”

Linde GmbH

Linde GmbH is a German limited liability company (Gesellschaft mit beschränkter Haftung) and a wholly owned subsidiary of Linde plc.

2

Table of Contents

Linde GmbH may provide (i) guarantees of debt securities offered by Linde plc under this prospectus and (ii) upstream guarantees of downstream guarantees provided by Linde plc of debt securities of Linde Inc. or Linde Finance offered under this prospectus.

As of December 31, 2022, Linde GmbH guarantees (i) the existing Linde Finance notes and (ii) Linde plc’s downstream guarantees of the existing Linde Inc. notes.

Linde GmbH has provided guarantees under the European debt program as described above under “—Linde plc.”

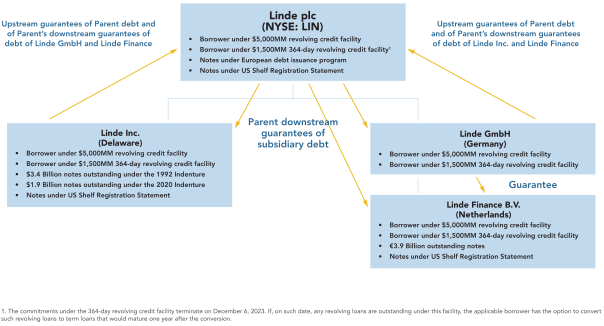

Debt Securities and Guarantee Structure

As a result of the guarantee structure described below, debt securities of Linde plc, Linde Inc. and Linde Finance (whether issued before the business combination, or under this prospectus or the European debt program) will rank pari passu in right of payment.

The following simplified structure chart illustrates the guarantee structure:

3

Table of Contents

Our business is subject to risks and uncertainties. Such risks and uncertainties are described in Item 1A (Risk Factors) in the Annual Report on Form 10-K for the year ended December 31, 2022 filed by Linde plc with the SEC, as updated by Linde plc’s SEC filings filed after such Annual Report, which should be reviewed carefully. It is possible that our business, financial condition, liquidity or results of operations could be materially adversely affected by any of these risks.

Risks related to securities offered by a prospectus supplement will be described in such prospectus supplement.

Except as otherwise described in the applicable prospectus supplement, the applicable issuers of the securities offered under this prospectus will use the net proceeds from the sale or sales of such securities for general corporate purposes, which may include, without limitation, the repayment of outstanding indebtedness, repurchases or redemptions of ordinary shares of Linde plc, working capital, capital expenditures and acquisitions. Prior to their application, the proceeds may be invested in short-term investments.

DESCRIPTION OF ORDINARY SHARES

Linde plc may offer its ordinary shares under this prospectus. Linde plc’s ordinary shares are described in Exhibit 4.3 to Linde plc’s Form 8-K filed with the SEC on March 1, 2023, which is incorporated by reference herein.

DESCRIPTION OF PREFERRED SHARES

Linde plc may offer its preferred shares under this prospectus. Certain terms of Linde plc’s preferred shares are described in Exhibit 4.3 to Linde plc’s Form 8-K filed with the SEC on March 1, 2023, which is incorporated by reference herein. We will set forth in the applicable prospectus supplement a description of the additional terms of preferred shares that may be offered under this prospectus.

DESCRIPTION OF DEPOSITARY SHARES

Linde plc may issue preferred shares either separately or represented by depositary shares. Linde plc may also, at its option, elect to offer fractional interests of preferred shares. If Linde plc exercises this option, it will issue receipts for depositary shares, each of which will represent a fraction of a share of a particular class or series of preferred shares, to be described in an applicable prospectus supplement.

The class or series of preferred shares represented by depositary shares will be deposited under a deposit agreement between Linde plc and a bank or trust company selected by Linde plc. Subject to the terms of the deposit agreement, each owner of a depositary share will be entitled, in proportion to the applicable preferred share or fraction of a preferred share represented by the depositary share, to all of the rights and preferences, if any, of the preferred share represented by such depositary share, including any dividend, voting, redemption, conversion, exchange and liquidation rights. The depositary shares will be evidenced by depositary receipts issued pursuant to the deposit agreement.

The prospectus supplement relating to any depositary shares being offered will include specific terms relating to the offering.

4

Table of Contents

Linde plc will include a copy of the form of deposit agreement, including the form of depositary receipt, and any other instrument establishing the terms of any depositary shares it offers as exhibits to a filing it will make with the SEC in connection with that offering.

Linde plc may issue warrants to purchase its equity securities. Linde plc, Linde Inc. or Linde Finance may issue warrants to purchase its debt securities or securities of third parties or other rights, including rights to receive payment in cash or securities based on the value, rate or price of one or more specified commodities, currencies, securities or indices, or any combination of the foregoing. Warrants may be issued independently or together with any other warrants or equity or debt securities and may be attached to, or separate from, such securities. Each series of warrants will be issued under a separate warrant agreement to be entered into between the applicable issuer and a warrant agent. The terms of any warrants to be issued and a description of the material provisions of the applicable warrant agreement will be set forth in the applicable prospectus supplement.

DESCRIPTION OF SECURITIES PURCHASE CONTRACTS

Linde plc may issue purchase contracts for the purchase or sale of its equity securities. Linde plc, Linde Inc. or Linde Finance may issue purchase contracts for the purchase or sale of its debt securities or securities of third parties including any of our affiliates, a basket of such securities, an index or indices of such securities or any combination of the above as specified in the applicable prospectus supplement.

Linde plc, Linde Inc. or Linde Finance may issue purchase contracts obligating holders to purchase from it, and obligating the applicable issuer to sell to holders, at a future date, a specified or varying number of securities at a purchase price, which may be based on a formula. Alternatively, an issuer may issue purchase contracts obligating it to purchase from holders, and obligating holders to sell to the issuer, at a future date, a specified or varying number of securities at a purchase price, which may be based on a formula. The issuer may satisfy its obligations, if any, with respect to any purchase contract by delivering the subject securities or by delivering the cash value of such purchase contract or the cash value of the property otherwise deliverable, as set forth in the applicable prospectus supplement. The applicable prospectus supplement will specify the methods by which the holders may purchase or sell such securities and any acceleration, cancellation or termination provisions or other provisions relating to the settlement of a purchase contract.

The purchase contracts may require the issuer to make periodic payments to the holders thereof or vice versa, and these payments may be unsecured or prefunded and may be paid on a current or deferred basis. The purchase contracts may require holders thereof to secure their obligations under the contracts in a specified manner to be described in the applicable prospectus supplement. Alternatively, purchase contracts may require holders to satisfy their obligations thereunder when the purchase contracts are issued as described in the applicable prospectus supplement.

Units comprising two or more securities described in this prospectus in any combination may be offered. The particular terms of the units will be described in the applicable prospectus supplement, including, to the extent applicable, the designation and terms of the units and the securities comprising the units.

5

Table of Contents

DESCRIPTION OF DEBT SECURITIES

General

Each of Linde plc, Linde Inc. and Linde Finance may offer its debt securities (the “Debt Securities”) under this prospectus.

Capitalized terms in this “Description of Debt Securities” section have the meanings given to them under “—Certain Definitions” or elsewhere in this “Description of Debt Securities” section.

Each Issuer’s Debt Securities will be issued under one or more Indentures to be entered into between such Issuer and The Bank of New York Mellon Trust Company, N.A., as trustee, or another trustee selected by the Issuer and appointed under an Indenture or a supplemental indenture. Each Indenture will be governed by the Trust Indenture Act. The form of each Indenture has been filed as an exhibit to the registration statement of which this prospectus is a part and is incorporated by reference into this prospectus.

The statements in this “Description of Debt Securities” section are summaries of certain provisions to be contained in the applicable Indenture, do not purport to be complete and are qualified in their entirety by reference to the applicable Indenture, including the definitions therein of certain terms. Capitalized terms used herein and not defined shall have the meanings to be assigned to them in the related Indenture. The particular terms of the Debt Securities and any variations from such general provisions applicable to any series of Debt Securities will be set forth in the prospectus supplement applicable to such series.

No Indenture will limit the amount of Debt Securities that can be issued thereunder, and each will provide that the Debt Securities may be issued in series up to the aggregate principal amount which may be authorized from time to time by the applicable Issuer. Unless otherwise provided, a series may be reopened for issuance of additional Debt Securities of such series.

Debt securities may be issued either separately, or together with, or upon the conversion of, or in exchange for, other securities, from time to time in one or more series, under the applicable Indenture.

Guarantees

Unless the prospectus supplement specifies otherwise:

| • | Debt Securities offered by Linde plc will be guaranteed by Linde Inc. and Linde GmbH; |

| • | Debt Securities offered by Linde Inc. will be guaranteed by Linde plc, and Linde plc’s downstream guarantee of Linde Inc.’s Debt Securities will be guaranteed by Linde GmbH; and |

| • | Debt Securities offered by Linde Finance will be guaranteed by Linde plc, and Linde plc’s downstream guarantee of Linde Finance’s Debt Securities may be guaranteed by Linde Inc. and Linde GmbH. |

The guarantee structures for Debt Securities of Linde Inc. and Linde Finance are intended to generally align with those for the existing Linde Inc. notes and the existing Linde Finance notes, respectively.

By virtue of these guarantee structures, unless the prospectus supplement specified otherwise, Debt Securities of Linde plc, Linde Inc. and Linde Finance B.V. offered under this prospectus will be pari passu in right of payment with each other and with the existing Linde Inc. notes, the existing Linde Finance notes, any Linde plc notes issued under the European debt program and Linde Finance notes issued under the European debt program. See “The Company—Linde Inc.” and “The Company—Linde Finance B.V.”

The guarantees of Debt Securities will guarantee (i) the due and punctual payment of the principal of, premium, if any, and interest on the Debt Securities issued by the applicable Issuer, when and as the same shall

6

Table of Contents

become due and payable, whether at maturity, upon redemption, by acceleration or otherwise and (ii) all other obligations of the applicable Issuer to the holders of such Debt Securities or the trustee under the indenture. The Guarantees will provide that in the event of a default in payment on a Debt Security, the holder of the Debt Security may institute legal proceedings directly against any Guarantor thereof to enforce the Guarantee without first proceeding against the applicable Issuer.

Each Guarantee will be full and unconditional, subject only to limitations on enforceability as required by applicable law.

Limitations on Enforceability

Each Guarantee will be limited to the maximum amount that would not render the Guarantor’s obligations subject to avoidance under applicable fraudulent conveyance provisions of applicable law. Each Guarantee is limited further by the laws of the country in which the Guarantor is organized, which laws include, but are not limited to, corporate benefit, the regulation of distributions of assets and the maximum amount that may be payable by a Guarantor. Furthermore, each Guarantee does not apply to the extent that it would result in such Guarantee’s constituting unlawful financial assistance or misuse of corporate assets under the applicable laws of the country in which the Guarantor is organized. By virtue of these limitations and restrictions, a Guarantor’s obligation under its Guarantee could be significantly less than amounts payable with respect to the Debt Securities, or a Guarantor may have effectively no obligation under its Guarantee. See also “Limitations on Validity and Enforcement of the Guarantees and Certain Insolvency Law Considerations.”

Linde GmbH is organized in the form of a German limited liability company (Gesellschaft mit beschränkter Haftung). Under German law, a limited liability company may refuse to make any payments under its Guarantee to the extent any such payment would result in a violation of Sections 30 et seq. or Section 43 of the German Limited Liability Companies Act (Gesetz betreffend die Gesellschaften mit beschränkter Haftung) (or a successor provision of such law or comparable provision under any successor law) or would otherwise lead to personal liability of its managing directors (Geschäftsführer).

Linde GmbH will covenant to use all commercially reasonable efforts to maximize the amount payable under its Guarantee to the extent permitted by applicable German law.

Release Under Certain Circumstances

Each Guarantor of any series of Debt Securities (or of any guarantee of such guarantee) will be released from all of its obligations under its Guarantee upon legal defeasance or covenant defeasance of such series of Debt Securities in accordance with the applicable Indenture or upon satisfaction and discharge of such series of Debt Securities or the applicable Indenture.

Linde GmbH will be automatically released from all of its obligations under its Guarantees provided under this prospectus if and when (i) (x) it has been, is or will be, substantially concurrently released from all of its guarantee obligations (including guarantees of guarantees) with respect to Funded Debt of Linde plc and Linde Inc. and (y) the aggregate outstanding principal amount of Funded Debt of Linde Finance is not greater than $100.0 million or (ii) Linde GmbH is no longer a subsidiary of Linde plc.

Linde Inc. will be automatically released from all of its obligations under its Guarantees provided under this prospectus if and when (i) (x) it has been, is or will be, substantially concurrently released from all of its guarantee obligations (including guarantees of guarantees) with respect to Funded Debt of Linde plc and Linde Finance and (y) the aggregate outstanding principal amount of Funded Debt of Linde Inc. is not greater than $100.0 million or (ii) Linde Inc. is no longer a subsidiary of Linde plc.

7

Table of Contents

Ranking

The Debt Securities will be unsecured general obligations of the Issuer thereof and will rank equal in right of payment with other unsecured and unsubordinated debt of such Issuer. The Guarantees will be unsecured general obligations of the applicable Guarantor and will rank equal in right of payment with other unsecured and unsubordinated debt of such Guarantor.

The Debt Securities and the Guarantees will be effectively subordinated to any secured indebtedness of the applicable Issuer or Guarantor to the extent of the value of the assets securing such indebtedness.

The Debt Securities will be obligations exclusively of the applicable Issuer and the Guarantors thereof. Subsidiaries of an Issuer (other than Linde Inc. and Linde GmbH, if they are Guarantors) have no obligation to pay any amounts due on the Debt Securities or, subject to existing or future contractual obligations between an Issuer and its subsidiaries, to provide the Issuer with funds for its payment obligations, whether by dividends, distributions, loans or other payments. An Issuer’s right to receive any assets of any of its subsidiaries upon liquidation or reorganization, and, as a result, the right of the holders of the Debt Securities to such assets or the proceeds thereof, will be structurally subordinated to the claims of that subsidiary’s creditors, including trade creditors and preferred shareholders, if any.

Payment of Additional Amounts

Unless the applicable prospectus supplement provides otherwise, the following provisions will apply to Debt Securities issued by Linde plc or Linde Finance:

Any payment of principal, premium (if any) or interest on a Debt Security or any Guarantee thereof shall be made free and clear of, and without withholding or deduction for or on account of, any present or future taxes, assessments or similar governmental charges (collectively, “Taxes”) imposed or levied by or on behalf of any jurisdiction in which the Issuer or any Guarantor is organized or resident for tax purposes (or any jurisdiction through which a paying agent of the Issuer makes payments on the Debt Security or any Guarantee thereof), or any governmental authority or political subdivision thereof or therein having the power to tax (each, a “Relevant Jurisdiction”), unless such withholding or deduction is required by applicable law.

In the event that any such withholding or deduction of Taxes imposed or levied by or on behalf of any Relevant Jurisdiction is required by applicable law in respect of any payment of principal, premium (if any) or interest on a Debt Security or any Guarantee thereof, subject to exceptions and limitations set forth below, the Issuer or applicable Guarantor (each, a “Payor”) will pay such additional amounts (“Additional Amounts”) as are necessary in order that the net payment to a holder, after withholding or deduction for or on account of such Taxes (including any such withholding or deduction in respect of Additional Amounts), will equal the amount which would have been received by such holder in respect of such payment in the absence of such withholding or deduction; provided that the foregoing obligation to pay Additional Amounts shall not apply:

(1) to any Tax to the extent such Tax is imposed by reason of the holder (or the beneficial owner for whose benefit such holder holds such Debt Security), or a fiduciary, settlor, beneficiary, partner, member or shareholder of the holder if the holder is an estate, nominee, trust, partnership, limited liability company or corporation, or a person holding a power over an estate or trust administered by a fiduciary holder, being considered as:

(a) being or having been engaged in a trade or business in the Relevant Jurisdiction or having or having had a permanent establishment in the Relevant Jurisdiction;

(b) having or having had any other current or former connection with the Relevant Jurisdiction (other than a connection arising solely as a result of the ownership of the Debt Security, or the receipt of any payment or the enforcement of any rights thereunder or under any Guarantee thereof), including being or having been a citizen or resident of, or physically present in, the Relevant Jurisdiction;

8

Table of Contents

(c) being or having been a personal holding company, a passive foreign investment company or a controlled foreign corporation for United States federal income tax purposes or a corporation that has accumulated earnings to avoid United States federal income tax;

(d) being or having been a “10-percent shareholder” of the Issuer as defined in section 871(h)(3) of the United States Internal Revenue Code of 1986, as amended (the “Code”) or any amended or successor provision; or

(e) being or having been a bank receiving payments on an extension of credit made pursuant to a loan agreement entered into in the ordinary course of its trade or business;

(2) to any holder that is not the sole beneficial owner of the Debt Security, or a portion of the Debt Security, or that is a fiduciary, partnership or limited liability company, but only to the extent that a beneficial owner with respect to the holder, a beneficiary or settlor with respect to the fiduciary, or a beneficial owner, partner or member of the partnership or limited liability company would not have been entitled to the payment of an Additional Amount had the beneficiary, settlor, beneficial owner, partner or member received directly its beneficial or distributive share of the payment;

(3) to any Tax to the extent such Tax would not have been imposed but for the failure of the holder, beneficial owner or any other person to comply with any certification, identification or other information reporting requirements concerning the nationality, residence, identity or connection with any Relevant Jurisdiction of the holder or beneficial owner of the Debt Security, if compliance is required by applicable statute, regulation, administrative guidance or income tax treaty as a precondition to exemption from, or reduction of, such Tax;

(4) to any Tax that is imposed otherwise than by withholding from any payment of principal, premium (if any) or interest on the Debt Security or any Guarantee thereof;

(5) to any estate, inheritance, gift, sales, value added, excise, transfer, wealth, net worth, gains, personal property or similar Taxes;

(6) to any withholding or deduction required to be made pursuant to any European Union directive on the taxation of savings, or any similar directive of any jurisdiction outside of the European Union, or any law implementing or complying with, or introduced in order to conform to any such directive;

(7) to any Tax required to be withheld by any paying agent from any payment of principal, premium (if any) or interest on the Debt Security or any Guarantee thereof, if such payment can be made without such withholding by at least one other paying agent;

(8) to any Tax to the extent such Tax would not have been imposed but for the presentation by the holder or beneficial owner of any Debt Security, where presentation is required, for payment on a date more than 30 days after the date on which payment became due and payable or the date on which payment thereof is duly provided for, whichever occurs later;

(9) to any Tax imposed under Sections 1471 through 1474 of the Code, any current or future regulations or other official interpretations thereof, any agreement entered into pursuant to Section 1471(b) of the Code (or any amended or successor provisions) or any intergovernmental agreements, treaties, conventions or similar agreements (and any related laws, regulations or administrative guidance) entered into in connection with the implementation of the foregoing;

(10) to any Tax withheld or deducted in respect of interest payments made (or deemed to be made) by the Issuer or any Guarantor to any “affiliated entity” (within the meaning of the Dutch Withholding Tax Act 2021) (Wet bronbelasting 2021), as amended from time to time;

(11) to any Tax to the extent such Tax becomes payable by reason of a holder or beneficial owner having a substantial interest (aanmerkelijk belang) in the Issuer within the meaning of the Dutch Income Tax Act 2001 (Wet inkomstenbelasting 2001), as amended from time to time;

9

Table of Contents

(12) to any Tax imposed pursuant to Section 871(h)(6) or 881(c)(6) of the Code (or any amended or successor provisions);

(13) any U.S. federal backup withholding imposed pursuant to Section 3406 of the Code (or any amended or successor provisions) or any similar provision of state, local or non-U.S. law; or

(14) in the case of any combination of items in the clauses above.

Except as specifically provided under this heading “—Payment of Additional Amounts,” the Issuer will not be required to make any payment for any Tax imposed by any government or any political subdivision or taxing authority of or in any government or political subdivision.

Neither the trustee nor any paying agent shall be responsible for determining whether and how much Additional Amounts are due and shall exclusively rely on our certification as to the foregoing.

Redemption Upon Tax Event

Unless the applicable prospectus supplement provides otherwise, the following provisions will apply to any series of Debt Securities issued by Linde plc or Linde Finance:

If, as a result of any change in, or amendment to, any laws (which includes, for the avoidance of doubt, any treaties), or any regulations or rulings promulgated thereunder, of any Relevant Jurisdiction, or any change in, or amendment to, any official position regarding the application, administration or interpretation of any such laws, regulations or rulings (including a holding, judgment or order by a court of competent jurisdiction), which change or amendment is announced and becomes effective on or after the date of the issuance of such series of Debt Securities, the Issuer or any Guarantor becomes or will become, based upon a written opinion of independent counsel selected by the Issuer, obligated to pay any Additional Amounts with respect to such series of Debt Securities, then the Issuer may at any time thereafter at its option redeem, in whole but not in part, such series of Debt Securities on not less than 10 nor more than 60 days’ prior notice given by the Issuer to the holders, at a redemption price equal to 100% of their principal amount, together with accrued and unpaid interest on such series of Debt Securities to, but not including, the date fixed for redemption (subject to the right of holders of record on the relevant record date to receive interest due on the relevant interest payment date); provided, however, that the notice of redemption shall not be given earlier than 90 days before the earliest date on which the Issuer or any Guarantor would be obligated to pay any such Additional Amounts if a payment in respect of such series of Debt Securities were then due.

Redemption

The applicable prospectus supplement will set forth the terms of optional and/or mandatory redemption of the Debt Securities offered thereunder.

In addition to any right of optional redemption, the applicable Issuer may at any time and from time to time purchase Debt Securities in open market transactions, tender offers or otherwise.

No Debt Securities of $2,000 principal amount or less (€100,000 or less if denominated in Euros) may be redeemed in part. Notice of redemption will be provided to each holder of any Debt Securities to be redeemed in accordance with customary procedures (with a copy to the applicable trustee) at least 10 but not more than 60 days before the applicable redemption date, except that redemption notices may be provided more than 60 days prior to a redemption date if the notice is issued in connection with a defeasance of the Debt Securities or a satisfaction and discharge of the applicable Indenture or series of Debt Securities. Notice of redemption of Debt Securities to be redeemed at the election of the applicable Issuer shall be given by such Issuer or, at such Issuer’s request, by the applicable trustee in the name and at the expense of such Issuer.

10

Table of Contents

If any Debt Security is to be redeemed in part only, the notice of redemption that relates to that Debt Security will state the portion of the principal amount of that Debt Security that is to be redeemed. The outstanding Debt Securities to be redeemed will be selected in accordance with a method that complies with the requirements, if any, of any stock exchange on which the Debt Securities are listed, and the applicable procedures of the depositary, if the Debt Securities are held by any depositary; provided that with respect to any Debt Securities not listed on any stock exchange and/or held by a depositary, the applicable trustee will select such Debt Securities by lot. A new Debt Security in principal amount equal to the unredeemed portion of the original Debt Security will be issued in the name of the holder of any Debt Security being redeemed in part upon surrender for cancellation of the original Debt Security. Debt Securities called for redemption become due on the date fixed for redemption and at the redemption price as set forth in the notice of redemption. On and after the applicable redemption date, interest will cease to accrue on a Debt Security or portions of a Debt Security called for redemption, unless the Issuer thereof defaults in the payment of the redemption price.

Payments

If the maturity date of any Debt Security falls on a day that is not a business day, the related payment of principal and interest will be made on the next business day as if it were made on the date such payment was due, and no interest will accrue on the amounts so payable for the period from and after such date to the next business day. If any payment date (including any date set by the Issuer as the date for redemption of a Debt Security) would otherwise be a day that is not a business day, the related payment will be made on the next business day as if it were made on the date such payment was due, and no interest will accrue on the amounts so payable for the period from and after such date to the next business day. The term “business day” with respect to any Debt Security will have the meaning set forth in such Debt Security or the resolution or supplemental indenture establishing the terms of such Debt Security.

Covenants

Unless the applicable prospectus supplement otherwise provides, each Indenture will contain the covenants summarized below (to the extent applicable to such Indenture), which will be applicable so long as any of the Debt Securities issued thereunder are outstanding:

Limitation on Liens

The Company will not, and will not permit any Material Subsidiary to, create, assume or suffer to exist any Lien (a “Triggering Lien”) securing Debt on any Restricted Property, unless all payments of principal and interest on the Debt Securities (and, in the case of Liens on Restricted Property of any Guarantor, under the Guarantee of such Guarantor), together with, if the Company shall determine, any other Debt of an Obligor then existing or thereafter created, are expressly secured equally and ratably with (or prior to) the Debt so secured until such time as such Debt is no longer secured by a Triggering Lien.

The foregoing requirement shall not apply to any of the following:

(a) Liens existing on the date of the Indenture;

(b) any Lien existing on any asset of any Person at the time such Person becomes (or merges or combines with) a Material Subsidiary and not created in contemplation of such event;

(c) any Lien on any asset (and improvements thereto and proceeds thereof) securing Debt incurred or assumed for the purpose of financing all or any part of the cost of acquiring such asset; provided that such Lien attaches to such asset concurrently with or within one year after the acquisition thereof;

(d) any Lien on any improvements constructed on any property of the Company or any such Material Subsidiary and any theretofore unimproved real property on which such improvements are located securing Debt incurred for the purpose of financing all or any part of the cost of constructing such improvements; provided that such Lien attaches to such improvements within one year after the later of (i) completion of construction of such improvements and (ii) commencement of full operation of such improvements;

11

Table of Contents

(e) any Lien existing on any asset prior to the acquisition thereof by the Company or a Material Subsidiary and not created in contemplation of such acquisition;

(f) Liens on property of the Company or a Material Subsidiary in favor of any Governmental Authority to secure partial, progress, advance or other payments pursuant to any contract or statute or to secure any Debt incurred for the purpose of financing all or any part of the purchase price or the cost of construction of the property subject to such Liens;

(g) Liens resulting from judgments that have been stayed or bonded or not exceeding $500,000,000;

(h) Liens on property of any Material Subsidiary in favor of the Company and/or one or more Material Subsidiaries;

(i) any Lien created or subsisting in order to comply with Section 8a of the German Partial Retirement Act (Altersteilzeitgesetz) or pursuant to Section 7e of the German Social Law Act No. 4 (Sozialgesetzbuch IV);

(j) any Lien entered into by the Company or any Material Subsidiary in the ordinary course of its banking arrangements for the purpose of netting debit and credit balances and any Lien arising under the general terms and conditions of banks or Sparkassen (Allgemeine Geschäftsbedingungen der Banken oder Sparkassen) with whom the Company or the relevant Material Subsidiary maintains a banking relationship in the ordinary course of business;

(k) Liens for taxes, assessments or similar governmental charges or claims that are not yet delinquent or that are being contested in good faith by appropriate proceedings; provided that any reserve or other appropriate provision as is required in conformity with applicable accounting principles has been made therefor;

(l) Liens not otherwise permitted by the foregoing clauses of this paragraph securing Debt in an aggregate principal amount at any time outstanding not to exceed the greater of (x) 15% of Consolidated Net Tangible Assets (measured at the time of incurrence of such Debt) and (y) $7,500,000,000; and

(m) any Lien arising out of the refinancing, extension, renewal or refunding of any Debt secured by any Lien permitted by any of the foregoing clauses of this paragraph (other than clause (l) above); provided that such Debt is not increased and is not secured by any additional assets other than improvements thereon and proceeds thereof.

For purposes of determining compliance with this “Limitation on Liens” covenant, whether a Lien securing an item of Debt is permitted need not be determined solely by reference to the first paragraph of this covenant or to one of the clauses (a) through (m) above (or portion thereof) but may be permitted in part under any combination thereof.

With respect to any Lien securing Debt that was permitted to secure such Debt at the time of the incurrence of such Debt, such Lien shall also be permitted to secure any Increased Amount of such Debt. The “Increased Amount” of any Debt shall mean any increase in the amount of such Debt in connection with any accrual of interest, the accretion of accreted value, the amortization of original issue discount, the payment of interest in the form of additional Debt with the same terms or in the form of common equity of the Issuer, the payment of dividends on preferred shares in the form of additional preferred shares of the same class, accretion of original issue discount or liquidation preference and increases in the amount of Debt outstanding solely as a result of fluctuations in the exchange rate of currencies or increases in the value of property securing Debt described in the definition of “Debt.”

12

Table of Contents

Merger, Consolidation or Sale of All or Substantially All Assets

| (a) | The following covenant will apply to Debt Securities issued or guaranteed by Linde plc: |

The Company will not consolidate with or merge or amalgamate into, or transfer all or substantially all of its assets to, any Person, unless (i) the Surviving Person (if not the Company) (x) is organized under the laws of a Permitted Jurisdiction and (y) assumes by supplemental indenture all the obligations of the Company under the Indenture and the Debt Securities issued under the Indenture (if the Company is the Issuer) or the Guarantees of the Company of the Debt Securities issued under the Indenture (if the Company is a Guarantor); and (ii) immediately after the transaction no Event of Default has occurred and is continuing.

The Surviving Person will be substituted for the Company under (i) the Indenture, (ii) the Debt Securities issued by the Company and (iii) Guarantees issued by the Company, and thereafter all obligations of the Company under the Indenture, the Debt Securities issued by the Company and Guarantees issued by the Company shall terminate.

| (b) | The following covenant will apply only to Debt Securities issued by Linde Inc.: |

The Issuer will not consolidate with or merge or amalgamate into, or transfer all or substantially all of its assets to, any Person, unless (i) the Surviving Person (if not the Issuer) is organized under the laws of a Permitted Jurisdiction and assumes by supplemental indenture all the obligations of the Issuer under the applicable Indenture and the Debt Securities issued under such Indenture; provided that, if such jurisdiction of organization is not the United States, any state thereof or the District of Columbia, such supplemental indenture will also contain provisions substantially similar to those described under “—Payment of Additional Amounts” and “—Redemption Upon Tax Event,” with such changes thereto as the Issuer deems reasonably necessary or appropriate given the jurisdiction of organization of the Issuer following the transaction; and (ii) immediately after the transaction no Event of Default has occurred and is continuing.

The Surviving Person will be substituted for the Issuer under the Indenture and the Debt Securities issued by the Issuer, and thereafter all obligations of the Issuer under the Indenture and the Debt Securities issued by the Issuer shall terminate.

| (c) | The following covenant will apply only to Debt Securities issued by Linde Finance: |

The Issuer will not consolidate with or merge or amalgamate into, or transfer all or substantially all of its assets to, any Person, unless (i) the Surviving Person (if not the Issuer) (x) is organized under the laws of a Permitted Jurisdiction and (y) assumes by supplemental indenture all the obligations of the Issuer under the applicable Indenture and the Debt Securities issued under such Indenture; and (ii) immediately after the transaction no Event of Default has occurred and is continuing.

The Surviving Person will be substituted for the Issuer under the Indenture and the Debt Securities issued by the Issuer, and thereafter all obligations of the Issuer under the Indenture and the Debt Securities issued by the Issuer shall terminate.

| (d) | The following covenant will apply only to Debt Securities (or Guarantees thereof) guaranteed by Linde Inc.: |

The Guarantor will not consolidate with or merge or amalgamate into, or transfer all or substantially all of its assets to, any Person, unless the Surviving Person (if not the Guarantor or the Issuer) assumes by supplemental indenture all the obligations of the Guarantor in respect of the Guarantees of Debt Securities (or guarantees thereof) issued under the Indenture. In addition, the Guarantee of Linde Inc. will be released in accordance with the provisions described under “—Guarantees—Release Under Certain Circumstances”.

The Surviving Person will be substituted for the Guarantor in respect of Guarantees issued by the Guarantor, and thereafter all obligations of the Guarantor in respect of Guarantees issued by the Guarantor shall terminate.

13

Table of Contents

| (e) | The following covenant will apply only to Debt Securities (or Guarantees thereof) guaranteed by Linde GmbH: |

The Guarantor will not consolidate with or merge or amalgamate into, or transfer all or substantially all of its assets to, any Person, unless the Surviving Person (if not the Guarantor or the Issuer) assumes by supplemental indenture all the obligations of the Guarantor in respect of the Guarantees of Debt Securities (or guarantees thereof) issued under the Indenture. In addition, the Guarantee of Linde Inc. will be released in accordance with the provisions described under “—Guarantees—Release Under Certain Circumstances”.

The Surviving Person will be substituted for the Guarantor in respect of Guarantees issued by the Guarantor, and thereafter all obligations of the Guarantor in respect of Guarantees issued by the Guarantor shall terminate.

In each case, the applicable Issuer or Guarantor shall deliver to the trustee under the applicable indenture an officers’ certificate and an opinion of counsel, each stating that such consolidation, merger, amalgamation or transfer and, if a supplemental indenture is required in connection with such transaction, such supplemental indenture, comply with the applicable provisions of the indenture and all conditions precedent provided for in the indenture relating to such transaction have been complied with.

Reporting

The Company shall deliver to the trustee, within 15 days after the Company is required to file the same with the SEC, copies of the annual reports and of the information, documents, and other reports (or such portions of the foregoing as the SEC may prescribe) which the Company is required to file with the SEC pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Any other Obligor on Debt Securities shall do likewise as to the above items which it is required to file with the SEC pursuant to those Sections of the Exchange Act. Filing on EDGAR or successor system that is publicly available on the Internet shall be deemed to constitute delivery to the trustee.

Delivery of any such reports, information, notifications and documents to the trustee will be for informational purposes only and the trustee’s receipt of such shall not constitute actual or constructive knowledge or notice of any information contained therein or determinable from information contained therein, including the Company’s compliance with any of its covenants under the applicable Indenture (as to which the trustee is entitled to rely exclusively on certificates of certain officers, managers, directors or authorized signatories of the Company). The trustee shall not have any liability or responsibility for the filing, posting, timeliness or content of any such report or information.

Defaults and Remedies

An “Event of Default” with respect to any series of Debt Securities will occur if:

(1) the Issuer defaults in any payment of interest on any Debt Securities of the series when the same becomes due and payable and the default continues for a period of 30 days;

(2) the Issuer defaults in the payment of the principal of any Debt Securities of the series when the same becomes due and payable at maturity or upon redemption, acceleration or otherwise;

(3) the Issuer defaults in the performance of any of its other agreements applicable to the series and the default continues for 90 days after the notice specified below;

(4) the Issuer or any Guarantor with respect to such Debt Securities pursuant to or within the meaning of any Bankruptcy Law:

| • | commences a voluntary case, |

| • | consents to the entry of an order for relief against it in an involuntary case, |

14

Table of Contents

| • | consents to the appointment of a Custodian for it or for all or substantially all of its property, or |

| • | makes a general assignment for the benefit of its creditors; |

(5) a court of competent jurisdiction enters an order or decree under any Bankruptcy Law that:

| • | is for relief against the Issuer or any Guarantor with respect to such Debt Securities in an involuntary case, |

| • | appoints a Custodian for the Issuer or any Guarantor with respect to such Debt Securities for all or substantially all of its respective property, or |

| • | orders the liquidation of the Issuer or any Guarantor with respect to such Debt Securities; |

and the order or decree remains unstayed and in effect for 60 days; or

(6) any other Event of Default provided for in the series.

A default under clause (3) is not an Event of Default with respect to any series of Debt Securities until the applicable trustee or the holders of at least 25% in principal amount of such series give written notice in accordance with the applicable Indenture to the Issuer (and the applicable trustee if notice is given by the holders) of the default and the default is not cured within the time specified after receipt of the notice.

If an Event of Default occurs and is continuing on a series, the applicable trustee by written notice to the Issuer, or the holders of at least 25% in principal amount of the series by written notice to the Issuer and the applicable trustee, may declare the principal of and accrued interest on all the Debt Securities of the series to be due and payable immediately. In the case of a Debt Security that is issued to investors at a price of less than the stated principal amount, the amount due upon acceleration may be reduced by the portion of the stated principal amount that is determined to constitute unearned interest.

The holders of a majority in principal amount of the series by written notice to the applicable trustee may rescind an acceleration and its consequences if the rescission would not conflict with any judgment or decree and if all existing events of default on the series have been cured or waived except nonpayment of principal or interest that has become due solely because of the acceleration.

If an Event of Default occurs and is continuing on a series, the applicable trustee may pursue any available remedy by proceeding at law or in equity to collect the payment of principal of or interest then due on the series, to enforce the performance of any provision applicable to the series, or otherwise to protect the rights of the applicable trustee and holders of the series.

If a default occurs and is continuing on a series and if it is actually known to the applicable trustee through the applicable trustee’s receipt of a written notice of such default, such trustee shall send a notice of the default within 90 days after it occurs to holders of registered Debt Securities of the series. Except in the case of a default in payment on a series, the applicable trustee may withhold the notice if and so long as the applicable trustee in good faith determines that withholding the notice is in the interest of holders of the series. The applicable trustee shall withhold notice of a default described in clause (3) of the first paragraph of this “Defaults and Remedies” section until at least 90 days after it occurs.

Unless the resolution or supplemental indenture establishing the terms of a series otherwise provides, the holders of a majority in principal amount of a series by written notice to the applicable trustee may waive an existing default on the series and its consequences except (1) a default in the payment of the principal of or interest on the series, or (2) a default in respect of a provision that under the applicable Indenture cannot be amended without the consent of each holder affected.

15

Table of Contents

Each Indenture will provide that in case an Event of Default occurs and is not cured, the trustee will be required, in the exercise of its power, to use the degree of care of a prudent person in similar circumstances in the conduct of such person’s own affairs. The holders of a majority in principal amount of a series may direct the time, method and place of conducting any proceeding for any remedy available to the applicable trustee, or of exercising any trust or power conferred on the applicable trustee, with respect to the series. The trustee will be under no obligation and may refuse to perform any duty or exercise any right or power under an Indenture at the request of any holder, unless such holder has provided to the trustee indemnity or security satisfactory to the trustee against any loss, liability or expense if requested by such trustee. The applicable trustee may refuse to follow any direction that conflicts with law or the applicable Indenture.

A holder of a series may pursue a remedy with respect to the series only if:

(1) the holder gives to the applicable trustee written notice of a continuing Event of Default on the series;

(2) the holders of at least 25% in principal amount of the Debt Securities of such series then outstanding make a written request to the applicable trustee to pursue the remedy;

(3) such holder or holders provide to the applicable trustee indemnity or security satisfactory to such trustee against any loss, liability or expense if requested by such trustee;

(4) the applicable trustee does not comply with the request within 60 days after receipt of the request and the offer of indemnity or security; and

(5) during such 60-day period the holders of a majority in principal amount of the Debt Securities of such series then outstanding do not give the applicable trustee a direction inconsistent with such request.

A holder may not use the applicable Indenture to prejudice the rights of another holder or to obtain a preference or priority over another holder.

No Indenture will have cross-default provisions. Thus, a default by the Company or a Subsidiary on any other debt would not constitute an Event of Default.

Amendments and Waivers

Unless the resolution or supplemental indenture establishing the terms of a series otherwise provides, the applicable Indenture and the Debt Securities of such series may be amended, and any default may be waived as follows: The Debt Securities and the applicable Indenture may be amended with the written consent of the holders of a majority in principal amount of the outstanding Debt Securities of all series affected voting as one class. A default on a series may be waived with the consent of the holders of a majority in principal amount of the Debt Securities of the series. However, without the consent of each holder affected, no amendment or waiver may:

(1) reduce the amount of Debt Securities whose holders must consent to an amendment or waiver;

(2) reduce the interest on or change the time for payment of interest on any Debt Security;

(3) change the fixed maturity of any Debt Security;

(4) reduce the principal of any Debt Security;

(5) change the currency in which principal or interest on a Debt Security is payable;

(6) waive any default in payment of interest on or principal of a Debt Security; or

(7) change certain provisions of the applicable Indenture regarding waiver of past defaults and amendments with the consent of holders other than to increase the principal amount of Debt Securities required to consent.

16

Table of Contents

Without notice to or the consent of any holder, the applicable Issuer, Guarantors and trustee may amend or supplement the Indenture and the Debt Securities:

(1) to cure any ambiguity, omission, defect or inconsistency;

(2) to provide for assumption by a Surviving Person of the obligations of the Issuer or a Guarantor under the Indenture or the applicable Debt Securities or Guarantees in the event of a merger or consolidation requiring such assumption;

(3) to provide that specific provisions of the applicable Indenture not apply to a series of Debt Securities not previously issued;

(4) to create a series and establish its terms;

(5) to provide for a separate or successor trustee for one or more series;

(6) to make any other change that does not materially adversely affect the rights of any holder; or

(7) to conform the Indenture or the securities of a series to the “Description of Debt Securities” section in this registration statement or similarly titled section in the prospectus supplement pursuant to which such securities are offered.

Legal Defeasance and Covenant Defeasance

Debt Securities of a series may be defeased in accordance with their terms and, unless the resolution or supplemental indenture establishing the terms of the series otherwise provides, as set forth below. The Issuer at any time may terminate as to a series all of its obligations (except for certain obligations with respect to the defeasance trust and obligations to register the transfer or exchange of a Debt Security, to replace destroyed, lost or stolen Debt Securities and to maintain agencies in respect of the Debt Securities, and the rights of the applicable trustee) with respect to the Debt Securities of the series and the applicable Indenture (“legal defeasance”). The Issuer at any time may terminate its obligations with respect to the Debt Securities of any series under the covenants described under “—Certain Covenants” (“covenant defeasance”).

The Company may exercise its legal defeasance option notwithstanding its prior exercise of its covenant defeasance option. If the Issuer exercises its legal defeasance option, a series may not be accelerated because of an Event of Default. If the Issuer exercises its covenant defeasance option, a series may not be accelerated by reference to the covenants described under “—Certain Covenants.”

To exercise either option as to a series, the Issuer must deposit in trust (the “defeasance trust”) with the applicable trustee funds in an amount sufficient to pay the principal, premium, if any, and interest on the Debt Securities of the series to redemption or maturity and must comply with certain other conditions. In particular, the Issuer must deliver to the applicable trustee an opinion of tax counsel confirming that the defeasance will not result in recognition for U.S. federal income tax purposes of any gain or loss to holders of the series.

Satisfaction and Discharge

In addition to the Issuer’s rights to defease Debt Securities as described above, an Issuer may terminate all of its obligations under the applicable Indenture with respect to a series of Debt Securities, and the obligations of the Guarantors of such Debt Securities shall terminate with respect to such series, when:

| • | (i) all Debt Securities of such series theretofore authenticated and delivered have been delivered to the trustee for cancellation or (ii) all such Debt Securities not theretofore delivered to the trustee for cancellation (A) have become due and payable, (B) will become due and payable at maturity within one year or (C) are to be called for redemption within one year under arrangements satisfactory to the trustee for the giving of notice of redemption by the trustee in the name, and at the expense, of the Issuer; |

17

Table of Contents

| • | the Issuer has irrevocably deposited or caused to be deposited with the applicable trustee as trust funds in trust solely for that purpose funds in an amount sufficient to pay all of the principal of and interest on and any premium on all of the Debt Securities of such series not theretofore delivered to the trustee for cancellation, to the date of such deposit (in the case of Debt Securities that have become due and payable) or to the maturity or redemption date, as the case may be; |

| • | the Issuer has paid or caused to be paid all other sums payable with respect to such Debt Securities (or in the case of a discharge of the Indenture, under the Indenture) by the Issuer; |

| • | the Issuer has delivered irrevocable instructions to the applicable trustee to apply the deposited money toward the payment of the Debt Securities of such series at maturity or redemption, as the case may be; and |

| • | the Issuer has delivered to the trustee an officers’ certificate and (in the case of discharge of the Indenture prior to the stated maturity of all Debt Securities issued under the Indenture) an opinion of counsel, stating that all conditions precedent specified above relating to the satisfaction and discharge of the Indenture have been complied with. |

Conversion and Exchange

The terms, if any, on which Debt Securities of any series are convertible into or exchangeable for ordinary shares of Linde plc, preferred shares of Linde plc, or other Debt Securities will be set forth in the applicable prospectus supplement. Those terms may include provisions for conversion or exchange, whether mandatory, at the option of the holders or at our option.

Trustee

Each trustee appointed under an Indenture or supplemental indenture and its affiliates may engage in financial or other transactions with one or more members of the Linde Group, including as (i) trustee or fiscal agent with respect to outstanding Debt Securities or other Debt Securities to be issued under this prospectus or otherwise and (ii) lender or agent under credit facilities or other financings.