UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Proxy Statement Pursuant to Section

14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

| ☑ | Filed by the Registrant | ☐ | Filed by a party other than the Registrant |

| CHECK THE APPROPRIATE BOX: | ||

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☑ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material under §240.14a-12 | |

(Name of Registrant as Specified In Its

Charter)

(Name of Person(s) Filing Proxy

Statement, if other than the Registrant)

| PAYMENT OF FILING FEE (CHECK ALL BOXES THAT APPLY): | ||

| ☑ | No fee required | |

| ☐ | Fee paid previously with preliminary materials | |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 | |

Who We Are

We are one of the largest and most successful cruise companies in the world operating through our three global brands: Royal Caribbean International, Celebrity Cruises and Silversea Cruises, and also through our partner brands: TUI Cruises and Hapag-Lloyd Cruises, in which we own a 50% stake. Together, our brands represent a combined total of 64 ships in the cruise vacation industry with an aggregate capacity of approximately 150,005 berths as of December 31, 2022.

Letter from the

Chief Executive Officer

|

“The future of our company is bright, and we are well-positioned to achieve both our near-term goals and succeed for the long-term.” Jason T. Liberty |

|

Dear fellow shareholders,

On behalf of Royal Caribbean Group’s nearly 100,000 employees and crew members, I want to express how pleased we are with the progress our company has made over the past year. While 2022 had its challenges, it was a transitional year full of many notable achievements, including returning our business to full operations and delivering memorable vacations to 6 million guests.

We finished the year on a high note, and we will continue to build on that momentum throughout 2023. The normalization of our operations provide the visibility needed for us to resume annual guidance. Additionally, we have developed a strong foundation to achieve our goals on Trifecta, our three-year initiative designed to drive record financial performance. I am incredibly proud of everyone at Royal Caribbean Group for the work they do each day to execute on our mission and further strengthen the foundation for our future growth.

Supporting our communities and people

Our environmental, social and governance (ESG) ambitions help inform our strategic and financial decisions on a daily basis, ensuring that we always act responsibly while achieving our long-term profitability goals. In the year ahead, we will:

Our future

Looking to the rest of 2023 and beyond, we will remain focused on our strategic and operational journey – while never losing sight of our Trifecta goals. We’ll also be hard at work executing on our strategic pillars, which are deepening customer relationships, delivering the best hardware and destinations, and excelling in the core of our business. As we move forward, I want to also acknowledge our unwavering commitment to our people, guests, communities, travel partners and shareholders. Royal Caribbean Group wouldn’t be the company it is without the support of all our stakeholders.

The future of our company is bright, and we are well-positioned to achieve both our near-term goals and succeed for the long-term. I have no doubt that this next chapter of the Royal Caribbean Group will be a great one, and I look forward to all we will accomplish in the year ahead, together.

Sincerely,

Jason T. Liberty

President and Chief Executive Officer

|

2023 Proxy – Letter from the Chief Executive Officer | 1 | |

2022 Performance Highlights

Key 2022 Successes

| Successful Return to Full Operations |

100% | 95% | +3.5% | 6 M | ||||

| of fleet in operation since June 2022 |

Significant ramp-up in load factors, from 57% in first quarter to 95% in the fourth quarter of 2022 |

Strong demand for our vacation experiences; 3.5% increase in revenue per passenger cruise day versus 2019 |

6 million vacations delivered during 2022 at high guest satisfaction scores | |||||

| Enhancing Platform for Long-Term Growth |

|

≈1,000 |

|

| ||||

|

Launched 3 new ships Strong pipeline capacity of 10 new ships to be delivered in 2023-2026 |

Destinations visited Advanced critical port and destination efforts for a diversified port portfolio |

Continued investments in private destinations and our digital infrastructure to enhance our guest experience and commercial capabilities | In November 2022, the Company introduced the Trifecta program, a new three-year initiative designed to drive superior performance | |||||

| Strong Liquidity and Improving Financial Performance |

> $2.9 B |

|

|

| ||||

| Year-end liquidity | Disciplined cost management and focus on profitability, abating inflationary cost increases of more than 25% since 2019 | Successfully refinanced $6.9 billion of debt to manage debt maturity profile |

Generated approximately $500M of operating cash flow | |||||

| ESG is Core to our Business |

|

|

|

| ||||

| Opened the first net zero cruise terminal in Galveston, Texas | Launched a new environmental protection initiative – “Blue Green Promise” – aimed at supporting resilient and sustainable ocean communities | Set a short-term target for Destination Net Zero to reduce carbon intensity by double digits by 2025. |

Introduced our “Propelled by People” campaign, a new platform to increase employee engagement. |

| 2 |  |

2023 Proxy – 2022 Performance Highlights | |

Proxy Summary

We look forward to welcoming you to our 2023 Annual Meeting of Shareholders. This important meeting provides the Board of Directors and management with an opportunity to receive collective feedback from you, our shareholders. We place significant value on your opinion, and we have strived to highlight in this summary key information for your consideration. We recommend, however, that you read the entire proxy statement carefully before voting.

| PROPOSAL 1 Election of Directors |

|

The board recommends a vote “FOR” each nominee. |

|||

Director Nominees

|

Committee | ||||||||||

|

Name and Primary Occupation |

Age |

Director Since |

AC |

TCC |

NGC |

SESH | ||||

|

John F. Brock INDEPENDENT Former Chairman & CEO, Coca-Cola European Partners |

74 |

2014 |

|

|

|||||

|

Richard D. Fain Chairman, Former CEO Royal Caribbean Group |

75 |

1981 |

|||||||

|

Stephen R. Howe, Jr. INDEPENDENT Former U.S. Chairman & Managing Partner, Ernst & Young |

61 |

2018 |

|

|

|||||

|

William L. Kimsey LEAD DIRECTOR Former CEO, Ernst & Young Global |

80 |

2003 |

|

|

|||||

|

Michael O. Leavitt INDEPENDENT Co-Chairman, Health Management Associates and Chairman, Leavitt Equity Partners |

72 |

2022 |

| ||||||

|

Jason T. Liberty President and CEO, Royal Caribbean Group |

47 |

2021 |

|||||||

|

Amy McPherson INDEPENDENT Former President & Managing Director, Europe, Marriott |

61 |

2020 |

|

||||||

|

Maritza G. Montiel INDEPENDENT Former Deputy CEO & Vice Chairman, Deloitte |

71 |

2015 |

|

||||||

|

Ann S. Moore INDEPENDENT Former Chairman & CEO, Time |

72 |

2012 |

|

||||||

|

Eyal M. Ofer INDEPENDENT Chairman, Ofer Global and Zodiac Group |

72 |

1995 |

|

| |||||

|

Vagn O. Sørensen INDEPENDENT Former President & CEO, Austrian Airlines Group |

63 |

2011 |

|

|

|||||

|

Donald Thompson INDEPENDENT Former President & CEO, McDonald’s |

60 |

2015 |

|

| |||||

|

Arne Alexander Wilhelmsen INDEPENDENT Chairman, AWILHELMSEN AS |

57 |

2003 |

|

| |||||

|

Rebecca Yeung INDEPENDENT Corporate Vice President at FedEx Corporation |

51 |

2023 |

|||||||

| AC |

Audit Committee |

SESH |

Safety, Environment, Sustainability and Health Committee |

|

Chair | ||

| NGC |

Nominating and Corporate Governance Committee |

TCC |

Talent and Compensation Committee |

|

Member |

|

2023 Proxy – Proxy Summary | 3 | |

Proxy Summary

Board Snapshot

|

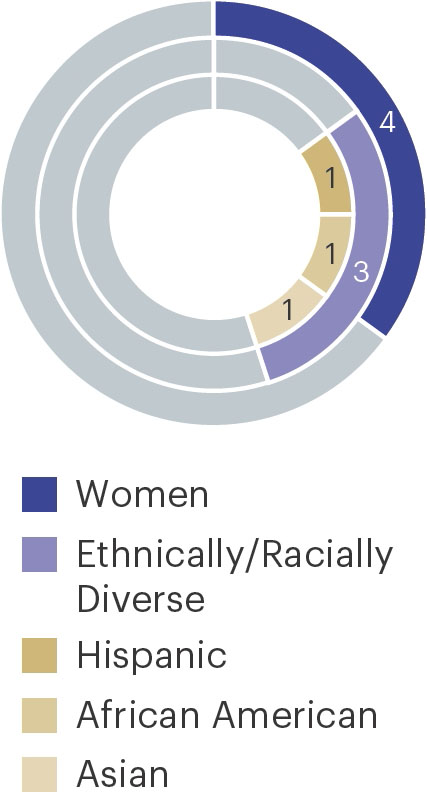

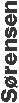

Diversity |

Independence |

Tenure |

Age | |||

|

|

|

|

| Skills and Experience | |||||

|

INDUSTRY |

Experience in industries such as hospitality, travel, tourism and shipping results in a deep understanding of consumer expectations and business strategy |

| ||

|

EXECUTIVE LEADERSHIP |

Valuable in understanding and managing a range of corporate governance, risk management, strategic planning, finance, operational and management and succession planning matters |

| ||

|

REGULATED BUSINESS |

Familiarity with highly regulated industries can provide the Board with insight and understanding of effective strategies in managing the complex political and regulatory landscape in which we operate |

| ||

|

GOVERNMENT / |

Helpful to oversee management’s interactions with governing authorities while achieving desired business objectives |

| ||

|

SUSTAINABILITY / |

Strengthens the Board’s oversight and assures that strategic business imperatives and long-term value creation are achieved within a sustainable, environmentally focused model |

| ||

|

FINANCE / |

Valuable in contributing to and overseeing strong financial planning, reliable financial information, robust controls and financial reporting |

| ||

|

GLOBAL ENTERPRISE |

Experience with a global enterprise or with international markets aids the Board in understanding diverse business environments, economic conditions, and cultures associated with our global workforce and activities |

| ||

|

TECHNOLOGY / |

Helps management address innovation and competitiveness in the digital age and technology risks, including cybersecurity risks |

| ||

|

CONSUMER BUSINESS |

Valuable as the Company seeks to provide all cruising guests with memorable vacation experiences and superior customer service |

| ||

|

RISK MANAGEMENT |

Enables directors to effectively anticipate and oversee the most significant risks facing the Company |

| ||

| 4 |  |

2023 Proxy – Proxy Summary | |

Proxy Summary

| PROPOSAL 2 Advisory Vote to Approve the Compensation of Our Named Executive Officers |

|

The board recommends a vote “FOR” this proposal. |

|||

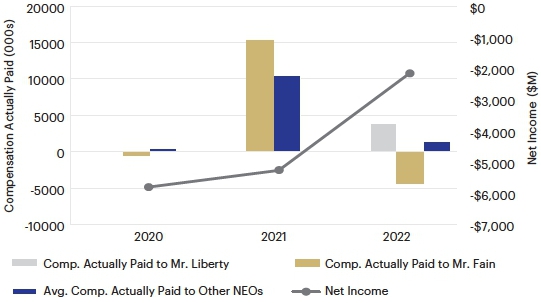

We place significant focus on the design of our executive compensation programs as we believe their effectiveness is crucial to our success as a company. We assess our programs regularly and strive to continuously make improvements as well as incorporate shareholder feedback.

Executive Compensation Program

|

Align the interests of our |

Recruit, retain, and |

Reward positive contributions |

|

PRINCIPLES |

IMPLEMENTATION | |

|

Total direct compensation levels should be sufficiently competitive to attract, motivate and retain the highest quality executives. |

Our Talent and Compensation Committee seeks to establish target total direct compensation (salary, short-term incentive and long-term incentive) at appropriate levels relative to our Market Comparison Group, providing our executives the opportunity to be competitively rewarded for our financial and operational performance. Total direct compensation opportunity (i.e., maximum achievable compensation) should increase with position and responsibility. | |

|

Performance-based and “at-risk” incentive compensation should constitute a substantial portion of total compensation. |

We seek to foster a pay-for-performance culture, with a significant portion of total direct compensation being performance-based and/ or “at risk.” Executives with greater responsibilities and the ability to directly impact our strategic and operational goals and long-term results should bear a greater proportion of the risk if these goals and results are not achieved. Therefore, the more senior the executive, the greater the percentage of total compensation in the form of performance-based and/or “at risk” compensation. | |

|

Long-term incentive compensation should align executives’ interests with our shareholders’ interests to further the creation of long-term shareholder value. |

We focus on ensuring that executive compensation includes a high proportion of long-term performance-based equity compensation. Awards of equity-based compensation encourage executives to focus on our long-term growth and prospects and incentivize executives to manage our company from the perspective of owners with a meaningful stake and to encourage them to remain with us for long and productive careers. Our stock ownership guidelines further enhance the incentive to create long-term shareholder value. Equity-based compensation also subjects our executives to market risk, a risk also borne by our shareholders. |

|

2023 Proxy – Proxy Summary | 5 | |

Proxy Summary

We provide compensation to our executives consisting of three principal elements: base salary, performance-based annual incentive bonus and long-term equity awards. The objectives and key features of each pay element are described below.

|

Pay Elements |

||||||||||||

|

CEO |

Other NEOs |

Objective |

Key Features | |||||||||

|

|

|

|

|

●Provide a base level of income in line with expertise, experience, tenure, performance, potential and scope of responsibility |

●Set annually based on market competitiveness and in-line with performance and contributions to the achievement of Company goals

●Increases, when appropriate, are provided based on market movements, scope of responsibilities, and merit

| ||||||

|

|

|

|

●To focus executives on annual financial and operational performance

●To reward executives for performance relative to our short-term goals and initiatives |

●Earned based on company-wide and, if applicable, brand-specific financial and operational objective metrics and individual performance against previously established strategic goals, including, but not limited to, Adjusted EPS (corporate), adjusted brand operating income, if applicable, and an ESG composite

●Payouts range from 0% and 200% based on achievement of results during the year

●For our President and CEO, payout is entirely based on corporate performance. For other NEOs, one-third is determined based on individual performance and two-thirds is determined by corporate and, if applicable, brand performance | |||||||

|

|

|

|

●Structured to align with shareholder interests, reward the achievement of long-term goals and promote stability and corporate loyalty among the executives |

●Earned only if specified financial performance measures are met

●Typically, with a three-year performance measure

●PSU Awards granted in 2022 for the period ended December 2024 will be earned based on Adjusted EPS, ROIC, leverage and an ESG composite

●PSU Awards granted in 2022 for the period ended December 2024 can range from 0% to 200% of target | |||||||

|

|

|

●Multi-year vesting requirements align our executives’ interests with our shareholders and incentivize retention of our executive talent |

●Set annually based on market competitiveness and in-line with performance and contributions to the achievement of Company goals

●Increases, when appropriate, are provided based on market movements, scope of responsibilities, and merit. | ||||||||

| 6 |  |

2023 Proxy – Proxy Summary | |

Proxy Summary

| PROPOSAL 3 Advisory Vote on Frequency of Shareholder Vote on Executive Compensation |

|

The board recommends a vote for the option of “ONE YEAR.” | |||

| |

Applicable SEC rules require that, at least once every six years, shareholders be given the opportunity to vote on an advisory basis regarding the frequency (i.e., annually, every two years or every three years) of future shareholder advisory “say-on-pay” votes on the compensation of our named executive officers. Our shareholders voted on a similar proposal in 2017, with the majority voting to hold the say-on-pay vote annually. We continue to believe that say-on-pay votes should be conducted every year so that our shareholders may annually express their views on our executive compensation program.

| PROPOSAL 4 Ratification of Principal Independent Registered Public Accounting Firm |

|

The board recommends a vote “FOR” this proposal. | |||

| |

Aggregate fees for professional services rendered by PricewaterhouseCoopers LLP for the fiscal years ended December 31, 2022 and 2021 were:

| 2022 | 2021 | |||||

| Audit fees(1) | $ | 5,090,316 | $ | 4,967,736 | ||

| Audit-related fees(2) | $ | 212,889 | $ | 193,375 | ||

| Tax fees(3) | $ | 12,488 | $ | 10,902 | ||

| All other fees(4) | $ | 10,000 | $ | 10,000 | ||

| Total | $ | 5,325,693 | $ | 5,182,013 |

| (1) | The audit fees for the fiscal years ended December 31, 2022 and 2021 were for professional services rendered for the integrated audits of the Company’s consolidated financial statements and system of internal control over financial reporting, quarterly reviews, statutory audits required by foreign jurisdictions, consents, issuance of comfort letters, and review of documents filed with the SEC. |

| (2) | The audit-related fees for the fiscal years ended December 31, 2022 and 2021 were for the audits of the Company’s retirement savings plan and other attest services. |

| (3) | Tax fees for the fiscal years ended December 31, 2022 and 2021 were for services performed in connection with international tax compliance, and transfer pricing. |

| (4) | All other fees for the fiscal years ended December 31, 2022 and 2021 were for subscription fees for accounting and auditing research software. |

|

2023 Proxy – Proxy Summary | 7 | |

Table of Contents

| 8 |

|

2023 Proxy – Table of Contents | |

Notice of Annual Meeting of Shareholders

|

| DATE & TIME Thursday, June 1, 2023 9:00 A.M., ET |

|

|

LOCATION |

|

|

RECORD DATE |

|

How to Vote |

|

|

BY INTERNET |

|

|

BY TELEPHONE |

|

|

BY MAIL |

| Items of Business | |||

| 1. | Election of 14 directors to the Board | ||

| Recommendation: FOR | Page Reference: 10 | ||

| 2. | Say-on-pay: advisory vote to approve the compensation of our named executive officers | ||

| Recommendation: FOR | Page Reference: 42 | ||

| 3. | Advisory vote on frequency of shareholder vote on executive compensation | ||

| Recommendation: ONE YEAR | Page Reference: 82 | ||

| 4. | Ratification of the selection of PricewaterhouseCoopers LLP as our independent registered public accounting firm for 2023 | ||

| Recommendation: FOR | Page Reference: 83 | ||

Shareholders also will transact such other business as may properly come before the Annual Meeting and any adjournment thereof.

We will furnish our proxy materials over the Internet as permitted by the rules of the U.S. Securities and Exchange Commission. As a result, we are sending a Notice of Internet Availability of Proxy Materials rather than a full paper set of the proxy materials, unless you previously requested to receive printed copies. The Notice of Internet Availability of Proxy Materials contains instructions on how to access our proxy materials on the Internet, as well as instructions on how shareholders may obtain a paper copy of the proxy materials. This process will reduce the costs associated with printing and distributing our proxy materials.

Internet voting is available to make it easier for you to vote in advance of the Annual Meeting. The instructions on the Notice of Internet Availability of Proxy Materials or your proxy card describe how to use these convenient services.

All shareholders are cordially invited to attend the Annual Meeting in person. Whether or not you expect to attend, you are urged to vote as soon as possible by Internet or mail so that your shares may be voted in accordance with your wishes. Granting a proxy does not affect your right to revoke it later or to vote your shares in the event you attend the Annual Meeting.

R. Alexander Lake

Senior Vice President, Chief Legal Officer and Secretary

Royal Caribbean Cruises Ltd.

April 18, 2023

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR

THE SHAREHOLDER MEETING TO BE HELD ON JUNE 1, 2023

On or about April 18, 2023, we mailed a Notice of Internet Availability of Proxy

Materials containing instructions on how to access our proxy statement and 2022

annual report. These materials are available online at proxyvote.com.

|

2023 Proxy – Notice of Annual Meeting of Shareholders | 9 | |

Corporate Governance and Board Matters

| PROPOSAL 1 Election of Directors |

|

The board recommends a vote “FOR” this proposal. | |||

Our Board currently has 14 members, each of whom is standing for re-election to hold office until the next Annual Meeting of Shareholders and until their successors are duly elected and qualified. Each candidate has consented to being named in this proxy statement and serving as a director, if elected. However, if any nominee is not able to serve, the Board can either nominate a different person or reduce the size of the Board. If the Board nominates another individual, the persons named as proxies may vote for that nominee.

|

The Board unanimously recommends that shareholders vote “FOR” the election of each of the nominees for director named below. |

Our Director Nominees

Our Board is made up of a diverse group of leaders with substantial experience in their respective fields. Our director nominees hold and have held senior positions as leaders of various large and complex businesses and organizations and in government, demonstrating their ability to develop and execute significant policy and operational objectives at the highest levels. Our nominees include current and former chief executive officers, chief financial officers, chief operating officers and other members of senior management of large, global businesses. Through these roles, our nominees have developed expertise in, among other things, core business strategy, operations, finance, human capital management and leadership development, compliance, controls and risk management, as well as the skills to respond to rapidly evolving business environments and to foster innovation and business transformation. Additionally, our nominees’ experience serving in government and on other boards brings valuable knowledge and expertise, including in the areas of public policy, governance, succession planning, financial reporting and regulatory compliance. Our Board believes that the combination of the various skills, qualifications and experiences of the director nominees contributes to an effective and well-functioning Board and that, individually and as a whole, the director nominees possess the necessary qualifications to provide effective oversight and strategic guidance.

| 10 |

|

2023 Proxy – Corporate Governance and Board Matters | |

Corporate Governance and Board Matters

We have included below detailed biographical information for each director nominee, including career highlights, other public directorships and select professional and community contributions, along with the top qualifications, experience, skills and expertise we believe each director brings to our Board. Our Board considered all of these attributes when deciding to nominate these individuals to the Board.

|

|

John F. Brock | |

| |

BACKGROUND:

Mr. Brock retired as Chief Executive Officer of Coca Cola European Partners in December 2016, having served in that role since the formation of that company in May 2016. Prior to that, Mr. Brock served as Chairman and Chief Executive Officer of Coca Cola Enterprises Inc. since April 2008 and as Chief Executive Officer since April 2006. From February 2003 until December 2005, Mr. Brock was Chief Executive Officer of InBev, S.A., a global brewer, and from March 1999 until December 2002, he was Chief Operating Officer of Cadbury Schweppes plc, an international beverage and confectionery company. From April 2007 to December 2007, Mr. Brock served as a director of Dow Jones & Company, Inc., a publisher and provider of global business and financial news. From 2004 to 2006, he served as a director of the Campbell Soup Company, a global manufacturer and marketer of branded convenience food products. From 2003 to 2005, he served as a director of Interbrew / Inbrew, a beer brewing company. He also served as a director of Reed Elsevier, a publisher, from 1997 to 2003. Mr. Brock is a Trustee of the Georgia Tech Foundation, Director of Horizons Atlanta, a philanthropic organization that enhances education for underserved children, and a member of the Smithsonian National Board. Mr. Brock also is a member of the Advisory Board of BIP Capital, a venture capital firm. SPECIFIC QUALIFICATIONS, ATTRIBUTES, SKILLS AND EXPERIENCE: | ||

|

Age: 74 Director Since: Committees: Other Public Company Boards: |

|||

|

2023 Proxy – Corporate Governance and Board Matters | 11 | |

Corporate Governance and Board Matters

|

|

Richard D. Fain | |

| |

BACKGROUND:

Mr. Fain has served as our Chief Executive Officer from 1988 through January 2022. He has been a director of the Company since 1981 and our Chairman since 1988. Mr. Fain is a recognized industry leader, having participated in shipping for over 45 years and having held a number of prominent industry positions, such as Chairman of the Cruise Lines International Association (CLIA), the largest cruise industry trade association. He currently serves on the University of Miami Board of Trustees and the UHealth Board of Directors. He is former chairman of the University of Miami Board of Trustees, the Miami Business Forum, the Greater Miami Convention and Visitors Bureau, the UHealth Board of Directors, and the United Way of Miami Dade. SPECIFIC QUALIFICATIONS, ATTRIBUTES, SKILLS AND EXPERIENCE: | ||

|

Chairman of the Board Age: 75 Director Since: Committees: Other Public Company Boards: |

|||

|

|

Stephen R. Howe, Jr. | |

| |

BACKGROUND:

Mr. Howe served as U.S. Chairman and Managing Partner and Americas Area Managing Partner of Ernst & Young (“EY”) and was a member of EY’s Global Executive Board from 2006 until his retirement in 2018. In these roles, Mr. Howe directed strategy and operations for EY’s businesses of over 75,000 people, delivering professional services across all industry sectors. While leading EY, Mr. Howe also gained extensive board governance and regulatory experience and was executive sponsor for the firm’s focus on diversity and inclusiveness. He was with EY for over 35 years. Mr. Howe is also a member of the Board of Trustees of Carnegie Hall, the Board of the Peterson Institute for International Economics and the Board of Trustees (Chairman) of the Liberty Science Center. Mr. Howe was previously a member of the boards of Colgate University, the Center for Audit Quality and the Financial Accounting Foundation. SPECIFIC QUALIFICATIONS, ATTRIBUTES, SKILLS AND EXPERIENCE: | ||

|

Age: 61 Director Since: Committees: Other Public Company Boards: |

|||

| 12 |

|

2023 Proxy – Corporate Governance and Board Matters | |

Corporate Governance and Board Matters

|

|

William L. Kimsey | |

| |

BACKGROUND:

Mr. Kimsey was employed for 32 years through September 2002 with the independent public accounting firm Ernst & Young L.L.P. From 1998 through 2002, Mr. Kimsey served as the Chief Executive Officer of Ernst & Young Global and Global Executive Board member of Ernst & Young and from 1993 through 1998 as the Firm Deputy Chairman and Chief Operating Officer. From 2003 until 2018, Mr. Kimsey served on the board, the compensation committee, and the audit committee (serving as chair from 2011-2018) of Accenture Plc. From 2004 until 2008, he served on the board of NAVTEQ Corporation and was the chairman of its audit committee. From 2003 through 2014, Mr. Kimsey also served on the board and the audit committee of Western Digital Corporation. Mr. Kimsey is a certified public accountant and a member of the American Institute of Certified Public Accountants. SPECIFIC QUALIFICATIONS, ATTRIBUTES, SKILLS AND EXPERIENCE: | ||

|

Lead Director Age: 80 Director Since: Committees: Other Public Company Boards: |

|||

|

|

Michael O. Leavitt | |

| |

|||

| |

BACKGROUND:

Gov. Leavitt is the Co-Chairman of Health Management Associates, a health care consulting firm, and Chairman of Leavitt Equity Partners, a private equity fund. From 2009 to 2021, he served as the Chairman of Leavitt Partners, LLC, a health care consulting firm. He also previously served as the United States Secretary of Health and Human Services from 2005 to 2009, the Administrator of the Environmental Protection Agency from 2003 to 2009 and the Governor of the State of Utah from 1993 to 2003. SPECIFIC QUALIFICATIONS, ATTRIBUTES, SKILLS AND EXPERIENCE: | ||

|

Age: 72 Director Since: Committees: Other Public Company Boards: |

|||

|

2023 Proxy – Corporate Governance and Board Matters | 13 | |

Corporate Governance and Board Matters

|

|

Jason T. Liberty | |

| |

BACKGROUND:

Mr. Liberty has served as President and Chief Executive Officer since January 2022. Mr. Liberty has held several roles since joining the Company in 2005, including most recently as Executive Vice President and Chief Financial Officer since 2017 and, prior to that, as Senior Vice President and Chief Financial Officer since 2013. Before his role as Chief Financial Officer, Mr. Liberty served as Senior Vice President, Strategy and Finance from 2012 through 2013; as Vice President of Corporate and Revenue Planning from 2010 through 2012; and as Vice President of Corporate and Strategic Planning from 2008 to 2010. Before joining Royal Caribbean Group, Mr. Liberty was a Senior Manager at the international public accounting firm of KPMG LLP. SPECIFIC QUALIFICATIONS, ATTRIBUTES, SKILLS AND EXPERIENCE: | ||

|

Age: 47 Director Since: Committees: Other Public Company Boards: |

|||

|

|

Amy McPherson | |

| |

BACKGROUND:

Ms. McPherson served in various positions at Marriott International, Inc. for over 30 years. Most recently, from 2009 through 2019, she served as President & Managing Director, Europe. Under her leadership, Marriott launched five new brands in Europe and completed the successful integration of Starwood Hotels in Europe. Since 2017, Ms. McPherson has served as a non-executive member of the board of directors of PVH Corporation and is a member of its Audit and Nominating & Governance Committees. SPECIFIC QUALIFICATIONS, ATTRIBUTES, SKILLS AND EXPERIENCE: | ||

|

Age: 61 Director Since: Committees: Other Public Company Boards: |

|||

| 14 |

|

2023 Proxy – Corporate Governance and Board Matters | |

Corporate Governance and Board Matters

|

|

Maritza G. Montiel | |

| |

BACKGROUND:

Ms. Montiel served as Deputy Chief Executive Officer and Vice Chairman of Deloitte LLP from 2011 through her retirement in May 2014. Prior to these positions, she held numerous senior management roles at Deloitte, including Managing Partner (Leadership Development and Succession, Deloitte University) from 2009 to 2011, and Regional Managing Partner from 2001 to 2009. During Ms. Montiel’s tenure at Deloitte, she was the Advisory Partner for many public company registrants in addition to overseeing Deloitte’s risk function. Ms. Montiel is a board member of AptarGroup, Inc. where she chairs the audit committee, a board member of Comcast Corporation, where she is a member of the audit committee, and a board member of McCormick & Company, where she chairs the audit committee. The Board has concluded that Ms. Montiel’s simultaneous service on four public company audit committees would not impair her ability to serve on the Audit Committee. SPECIFIC QUALIFICATIONS, ATTRIBUTES, SKILLS AND EXPERIENCE: | ||

|

Age: 71 Director Since: Committees: Other Public Company Boards: |

|||

|

2023 Proxy – Corporate Governance and Board Matters | 15 | |

Corporate Governance and Board Matters

|

|

Ann S. Moore | |

| |

BACKGROUND:

Ms. Moore served as Chair and Chief Executive Officer of Time Inc. from July 2002 to September 2010 and served as Chair through December 2010. Prior to that, Ms. Moore was Executive Vice President of Time Inc., where she had executive responsibilities for a portfolio of magazines including Time, People, InStyle, Teen People, People en Español and Real Simple. Ms. Moore joined Time Inc. in 1978 in Corporate Finance. Since then, she held consumer marketing positions at Sports Illustrated, Fortune, Money and Discover, moving to general management of Sports Illustrated in 1983 and to publisher of People in 1991. From 1993 to May 2014, Ms. Moore served on the Board of Directors of Avon Products Inc. She was also a director of the Wallace Foundation from 2004 through June 2016. SPECIFIC QUALIFICATIONS, ATTRIBUTES, SKILLS AND EXPERIENCE: | ||

|

Age: 72 Director Since: Committees: Other Public Company Boards: |

|||

|

|

Eyal M. Ofer | |

| |

BACKGROUND:

Mr. Ofer has served as a director of the Company since May 1995. He is Chairman of his multi-generational family group, Ofer Global, leading a private portfolio of international businesses principally focused on maritime shipping, real estate, energy, tech, banking and large public investments. These include its shipping division, Zodiac Group, an international shipping enterprise operating a diversified fleet of over 180 vessels worldwide, and its real estate arm, Global Holdings Group, a property holding conglomerate with over 10 million square feet of real estate, specializing in large-scale office buildings, hotels and luxury residential developments, as well as other investment and development assets. He also leads the group’s O.G. Energy division, which has interests including renewable energy projects focused on wind, solar and forestry, and is a global leader in the provision of FSO and FPSO units through Omni Offshore Terminals. In 2017, Mr. Ofer launched O.G. Venture Partners, a founder-friendly multi-stage single LP Venture Capital fund focused on investing in early-growth-stage technology startups. He also sits on the advisory board of the Bloomberg New Economy Forum. SPECIFIC QUALIFICATIONS, ATTRIBUTES, SKILLS AND EXPERIENCE: | ||

|

Age: 72 Director Since: Committees: Other Public Company Boards: |

|||

| 16 |  |

2023 Proxy – Corporate Governance and Board Matters | |

Corporate Governance and Board Matters

|

|

Vagn O. Sørensen | |

| |

BACKGROUND:

Mr. Sørensen brings to the Board over 20 years of experience in the aviation industry, having served as the President and Chief Executive Officer of Austrian Airlines Group from 2001 through 2006. Prior to that, he served in a variety of roles with Scandinavian Airlines Systems, including as Executive Vice President and Deputy CEO. He currently serves as a board member and chairman for a number of corporations throughout Europe and Canada, including Air Canada, Pantheon Infrastructure Trust, Parques Reunidos SA, CNH Industrial and Scandlines. Mr. Sørensen also previously served on the board of Scandic Hotels AB, SSP Group and DFDS. SPECIFIC QUALIFICATIONS, ATTRIBUTES, SKILLS AND EXPERIENCE: | ||

|

Age: 63 Director Since: Committees: Other Public Company Boards: |

|||

|

2023 Proxy – Corporate Governance and Board Matters | 17 | |

Corporate Governance and Board Matters

|

|

Donald Thompson | |

| |

BACKGROUND:

Mr. Thompson currently serves as Chief Executive Officer of Cleveland Avenue, LLC, a food, beverage and technology investment company, which he founded in 2015. From 2012 to March 2015, Mr. Thompson served as President and Chief Executive Officer of McDonald’s Corporation. Previously, Mr. Thompson served as President and Chief Operating Officer of McDonald’s Corporation from 2010 to 2012 and President of McDonald’s USA from 2006 to 2010. Prior to joining McDonald’s, Mr. Thompson served six years as an Electrical Engineer for the Northrop Corporation, where he specialized in power supply design and manufacturing for high technology radar systems. Mr. Thompson served as director of McDonald’s Corporation from 2011 to March 2015, a director of Exelon Corporation from 2007 to 2013 and a director of Beyond Meat, Inc. from 2015 to May 2021. He also served as an Advisory Board member of DocuSign, Inc. from 2015 to 2018 and a Trustee of Purdue University from 2009 to 2022. Mr. Thompson has served as a director of Northern Trust Corporation since March 2015 and has been a member of the board of directors of Footprint International HoldCo Inc. since April 2021, and has served as chairman of the board since June 2021. He also serves on numerous civic and philanthropic boards. He is a member of the Commercial and Economic Clubs of Chicago, World Business Chicago and the Arthur M. Brazier Foundation. He serves as a director for Northwestern Memorial HealthCare and a Trustee on the board of the Cleveland Avenue Foundation for Education. SPECIFIC QUALIFICATIONS, ATTRIBUTES, SKILLS AND EXPERIENCE: | ||

|

Age: 60 Director Since: Committees: Other Public Company Boards: |

|||

| 18 |  |

2023 Proxy – Corporate Governance and Board Matters | |

Corporate Governance and Board Matters

|

|

Arne Alexander Wilhelmsen | |

| |

BACKGROUND:

Mr. Wilhelmsen is Chairman of the board of directors of AWILHELMSEN AS, the holding company for the AWILHELMSEN group of companies, after having served as the Chairman of the board of directors of AWILHELMSEN Management AS from 2008 through June 2013. He also founded, and has served since 2011 as Chairman of the Board of, AWECO AS, a family office with financial investments, significant philanthropy and social impact activities. Mr. Wilhelmsen was elected Chairman of the Board of AWILHELMSEN HOLDING AS in June 2016 and Aweco Cruise Holding AS in June 2017. He has held a variety of positions within the AWILHELMSEN group of companies since 1995. In addition, Mr. Wilhelmsen serves as Chairman of the board of his wholly-owned company, Pan Sirius AS. From 1996 through 1997, Mr. Wilhelmsen was engaged as a marketing analyst for the Company and from 2001 through 2009 served as a member of the board of directors of Royal Caribbean Cruise Line AS, a wholly-owned subsidiary of Royal Caribbean Cruises Ltd. that was responsible for sales and marketing activities in Europe. SPECIFIC QUALIFICATIONS, ATTRIBUTES, SKILLS AND EXPERIENCE: | ||

|

Age: 57 Director Since: Committees: Other Public Company Boards: |

|||

|

|

Rebecca Yeung | |

| |

BACKGROUND:

Ms. Yeung serves as Corporate Vice President, Operations Science and Advanced Technology at FedEx Corporation, a global logistics company with a broad portfolio of transportation, e-commerce and business services. In her role, she is responsible for driving critical aspects of FedEx’s innovation and transformation strategy including scaling up robotics and automation technology, autonomous vehicles, decision science, and electromobility. Ms. Yeung joined FedEx in 1998 and has served in various marketing, innovation, and technology roles since then. Prior her current role, she was Vice President – Advanced Technology & Innovation at FedEx Corporation from 2015 to 2021. She has also previously served as a Board of Director for the Mid-South Food Bank between 2013 and 2022. SPECIFIC QUALIFICATIONS, ATTRIBUTES, SKILLS AND EXPERIENCE: | ||

|

Age: 51 Director Since: Committees: Other Public Company Boards: |

|||

|

2023 Proxy – Corporate Governance and Board Matters | 19 | |

Corporate Governance and Board Matters

Our Board’s Composition

As illustrated by the director biographies above, our Board is made up of a diverse group of leaders with substantial experience in their respective fields. We believe that our directors should possess the highest personal and professional ethics, integrity and values, demonstrate the ability to act candidly, show a willingness and ability to evaluate, challenge and stimulate, have demonstrated leadership ability and a proven record of accomplishment as well as expertise in business, professional, academic, political or community affairs, and be committed to representing the long-term interests of the shareholders. Our Board believes that the combination of the various skills, qualifications and experiences of the director nominees contributes to an effective and well-functioning Board and that, individually and as a whole, the director nominees possess the necessary qualifications to provide effective oversight and insightful strategic guidance.

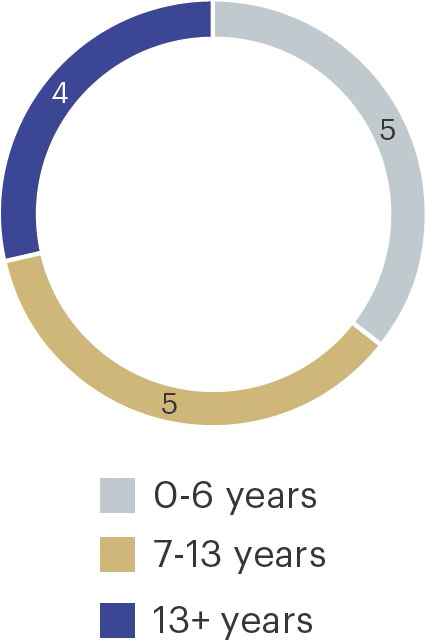

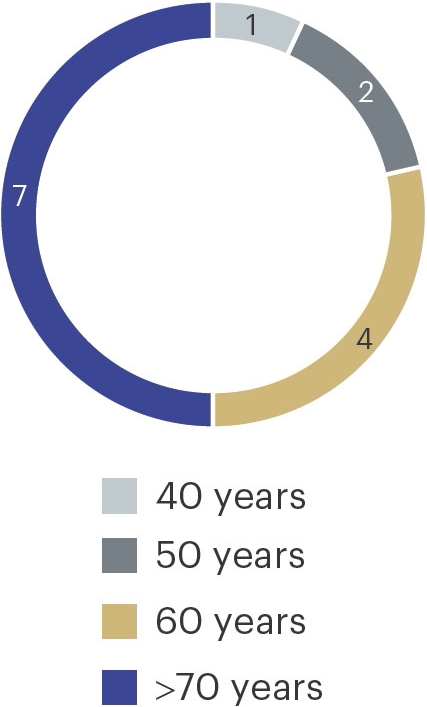

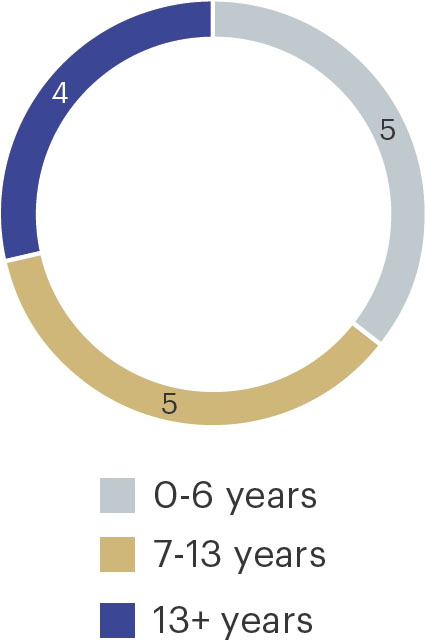

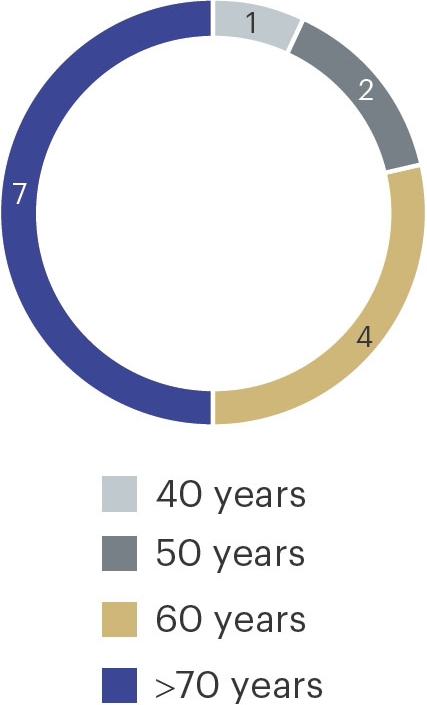

Board Snapshot

| Diversity | Independence | Tenure | Age | |||

|

|

|

|

| 20 |

|

2023 Proxy – Corporate Governance and Board Matters | |

Corporate Governance and Board Matters

Skills and Experience

Our Board periodically reviews the appropriate skills and expertise required of the Board in order to successfully carry out its responsibilities both in the near term and into the future. This assessment includes issues of diversity (including diversity of race, gender and ethnicity), business experience and expertise – all in the context of an assessment of the perceived needs of the Board at that time and does not discriminate on the basis of ethnicity, sexual orientation, culture or nationality.

| Skills and Experience |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Industry |

|

|

|

|

|

|

|

|||||||

|

Executive Leadership |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Regulated Business |

|

|

|

|

|

|

|

|||||||

|

Government / Public Policy |

|

|||||||||||||

|

Sustainability / Environmental |

|

|

|

|

|

|

|

| ||||||

|

Finance / Accounting |

|

|

|

|

|

|

|

|

||||||

|

Global Enterprise |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Technology / Innovation / Cybersecurity |

|

|

|

|

|

|

|

| ||||||

|

Consumer Business |

|

|

|

|

|

|

|

|

| |||||

|

Risk Management |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2023 Proxy – Corporate Governance and Board Matters | 21 | |

Corporate Governance and Board Matters

Board Selection and Evaluation

Process for Identifying and Adding New Directors

We believe that our directors should possess the highest personal and professional ethics, integrity and values, demonstrate the ability to act candidly, show a willingness and ability to evaluate, challenge and stimulate, have demonstrated leadership ability and a proven record of accomplishment as well as expertise in business, professional, academic, political or community affairs, and be committed to representing the long-term interests of our shareholders.

| 1 | Assessment of Potential Candidates |

The Nominating and Corporate Governance Committee assesses potential candidates based on their history of achievement, the breadth of their business experiences, whether they bring specific skills or expertise in areas that the committee has identified as desired and whether they possess personal attributes and experiences that will contribute to the sound functioning of our Board. In addition, the Board self-evaluation process described below is an important determinant for Board refreshment.

|

||

| 2 | Use of a Third-Party Search Firm |

The Nominating and Corporate Governance Committee typically uses a professional search firm to help identify, evaluate and conduct due diligence on potential director candidates. Using a professional search firm supports the committee in conducting a broad search and looking at a diverse pool of potential candidates. In 2022, this third-party search firm identified and recommended Ms. Yeung for appointment to the Board.

The Nominating and Corporate Governance Committee also maintains an ongoing list of potential candidates and considers recommendations made by members of the Board.

|

||

| 3 | Shareholder Nominations |

In addition, the Nominating and Corporate Governance Committee considers all shareholder recommendations for director candidates and applies the same standards in considering candidates submitted by shareholders as it does in evaluating all other candidates. Shareholders can recommend candidates by writing to the committee in care of the Company’s Corporate Secretary, whose contact information is on page 35.

Shareholders who wish to submit nominees for election at an annual or special meeting of shareholders should follow the procedure described on page 91.

The Board recognizes the value of diversity and endeavors to have a Board composed of individuals with varying backgrounds (including diversity of race, gender and ethnicity) and experience in business and in other areas that may be relevant to the Company’s activities. Our Corporate Governance Principles provide that whenever the Board conducts a search for a new director, the Board will consider at least one woman and one underrepresented minority in the slate of potential candidates.

36%

5 out of 14 directors are gender/ethnically diverse

| 22 |

|

2023 Proxy – Corporate Governance and Board Matters | |

Corporate Governance and Board Matters

Director Onboarding

We maintain a comprehensive director onboarding program to familiarize all new directors with the Company’s business, including its plans, significant financial, accounting and risk management issues, policies and compliance processes, strategic priorities and members of senior management. Each director’s onboarding is tailored to take into account the individual’s prior experience and background and to ensure the director becomes knowledgeable about the most important issues affecting the Company and its business.

Our Board Evaluation Process

The Nominating and Corporate Governance Committee has oversight responsibility for the annual Board and committee evaluation process and uses feedback from the evaluation to identify director nominees.

|

Review of the Process’ Format |

The Nominating and Corporate Governance Committee periodically reviews the format of the Board and committee evaluation process to ensure that actionable feedback is solicited on the performance of the Board and the committees.

|

||

|

Discussions with Directors Utilizing Questionnaire |

For the 2022 evaluation process, the Nominating and Corporate Governance Committee decided to have the Chair of the Nominating and Corporate Governance Committee hold one-on-one discussions with directors utilizing questionnaires. The questionnaires solicited commentary on various topics, including Board and committee composition and performance, meeting materials, access to management, among other matters. Directors were also invited to discuss the performance of other individual Directors.

|

||

|

Use of Results to Guide Board Enhancement |

The Chair of the Nominating and Corporate Governance Committee aggregated the feedback received from individual discussions with directors and presented the findings to the Chair of each Committee as it relates to their respective committee. The data identified any themes or issues that had emerged and included suggestions for areas of improvement. The Chair of the Nominating and Corporate Governance Committee also presented the aggregated feedback to the full Board. The Board used these results to review and assess the Board’s and each committee’s composition and required skill sets, responsibilities, structure, processes and effectiveness.

|

2023 Proxy – Corporate Governance and Board Matters | 23 | |

Corporate Governance and Board Matters

Executive Succession Planning

Succession planning and execution is one of the Board’s most important responsibilities, and the success of the Company’s recent leadership transitions is a testament to the care and diligence that the Board has devoted to this key topic. For many years, the Board has focused attention on this area and has developed programs and procedures designed to address it. These plans became relevant and actionable when Richard Fain, the Company’s long-standing CEO, announced his intention to step down as CEO effective at the beginning of 2022. The resulting transition, which notably included Jason Liberty being promoted to CEO and Naftali Holtz being appointed as CFO, was carried out smoothly and orderly with the oversight of the Nominating and Corporate Governance Committee and the Talent and Compensation Committee.

The Board’s succession planning activities are strategic, long-term and supported by the Board’s committees and external consultants. Succession planning and talent development are important at all levels within the Company. In accordance with our Corporate Governance Principles, our Talent and Compensation Committee has primary responsibility for reviewing our talent development programs and initiatives for senior executives and for periodically reviewing our programs and practices for overseeing the continuity of capable management.

|

Evaluation of Potential Successors |

A key responsibility of the Talent and Compensation Committee is the identification and evaluation of potential successors for each business-critical position in the Company. This includes, our CEO, CFO, Brand Presidents and other positions that have been identified as integral to the delivery of our service. Regularly, the Talent and Compensation Committee, in consultation with the CEO and with the assistance of external consultants, as necessary, reviews the skills, experiences and attributes that the Committee believes are required and/or desirable for each position in light of the Company’s then current business strategy, prospects and challenges. For each candidate, the Committee evaluates strengths, contributions, candidate readiness, and areas for development.

|

||

|

Recommendations from the CEO |

The CEO makes available his recommendations and evaluations of potential successors, along with a review of any development plans recommended for such individuals.

|

||

|

CEO Succession Planning |

In the event of a CEO transition, the Nominating and Corporate Governance Committee, in consultation with the CEO, provides oversight of the CEO transition process.

|

||

|

Ongoing Review by the Board |

The Board routinely engages with the Company’s leadership team on matters of talent and culture, including around the development of the Company’s talent pipeline and advancing diversity and inclusion efforts across the enterprise.

| 24 |

|

2023 Proxy – Corporate Governance and Board Matters | |

Corporate Governance and Board Matters

Corporate Governance

Board Leadership Structure

The Board is responsible for broad corporate policy and overall performance of the Company through oversight of management and stewardship of the Company. Consequently, the Board believes that the independent directors should have a strong defined leadership roles. The current leadership structure of the Board consists of:

| Name | Title | |

| Richard Fain | Chair of the Board | |

| William Kimsey | Lead Director, Chair of Audit Committee | |

| Vagn O. Sørensen | Chair of Talent and Compensation Committee | |

| Stephen R. Howe, Jr. | Chair of Nominating and Corporate Governance Committee | |

| Gov. Michael Leavitt | Chair of Safety, Environment, Sustainability and Health Committee |

Separation of Chair and CEO Position

The Board recognizes that the leadership structure and combination or separation of the CEO and Chair roles are driven by the needs of the Company. As a result, no static policy exists requiring the combination or separation of leadership roles. The Board regularly reviews Board leadership structure and has concluded that separating the positions of Chair and CEO is appropriate at this point in time. While Mr. Fain stepped down as CEO effective January 3, 2022, we believe that the Board and the Company are best served by retaining on the Board his 30 years of experience leading our Company as Chair and CEO. Consequently, the Board asked Mr. Fain to continue to serve as the Chair of our Board. We believe that we will benefit from the strong working relationships and professional trust that Mr. Fain and Mr. Liberty have developed with other members of the Board. Further, the Board believes that the significant leadership roles undertaken by Mr. Kimsey as well as the various independent directors who chair other committees of the Board strike an appropriate balance between effective Board leadership and independent oversight of management.

Lead Independent Director

Regardless of the specific board leadership structure, our Corporate Governance Principles provides for a strong defined leadership role for a lead independent director. Our current lead independent director is Mr. Kimsey who has served in that role since 2013. Mr. Kimsey has significant experience in corporate governance, senior management of a global business and public company board experience.

Under our Corporate Governance Principles, the independent directors annually elect an independent director to serve as Lead Independent Director. While the Board has currently separated the positions of Chair and CEO, the Board believes that a lead independent director continues to bring balance to our Board management.

Key Responsibilities

| ● | Calls meetings of the independent directors. |

| ● | Presides at all meetings of the Board at which the Chair is not present, including executive sessions of the independent directors. |

| ● | Facilitates communication between the independent directors, our Chair and our CEO. |

| ● | Provides independent Board leadership. |

| ● | Approves the agenda for all Board meetings and all Board materials. |

| ● | Engages with our other independent directors to identify matters for discussion at executive sessions of independent directors and advises our Chair and our CEO of any decisions reached, and suggestions made at the executive sessions. |

|

2023 Proxy – Corporate Governance and Board Matters | 25 | |

Corporate Governance and Board Matters

Independence

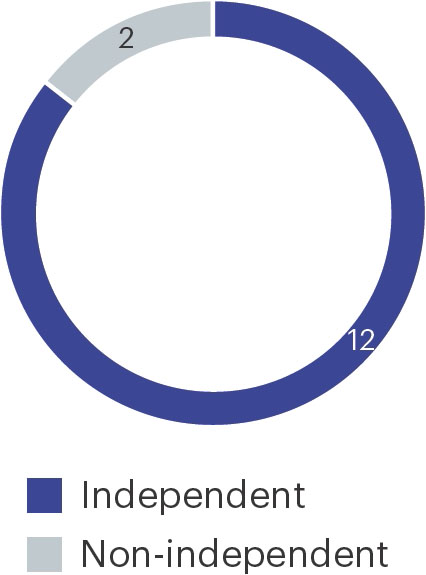

Under our corporate governance principles, at least two thirds of our directors are required to be independent within the meaning of the NYSE standards of independence for directors. Our Corporate Governance Principles contain guidelines established by the Board to assist it in determining director independence in accordance with these NYSE standards. The Board believes that directors who do not meet the NYSE independence standards also make valuable contributions to the Board and to the Company by reason of their experience and wisdom, and the Board expects that some minority of its Board will not meet the NYSE independence standards.

To be considered independent under the NYSE independence standards, the Board must determine that a director does not have any direct or indirect material relationship with the Company or any of its subsidiaries. The Board has established guidelines to assist it in determining director independence in accordance with those standards, which are available on the corporate governance section on our website at www.rclinvestor.com.

Each director must regularly disclose to the Board whether his or her relationships satisfy these independence tests. Based on these disclosures and other information available to it, the Board has determined that all of the directors are independent with the exception of Mr. Fain and Mr. Liberty due to their past and current service as CEO, respectively.

Meetings

The Board held 5 meetings during 2022. In 2022, each of our directors attended at least 75% of an aggregate of all meetings of the Board and of any committees on which and he or she served during the period the director was on the Board or committee. Our independent directors regularly meet in executive session without management directors present. The Lead Director presides at such meetings.

We do not have a formal policy regarding Board member attendance at the annual shareholders meeting. Two of our Board members were in attendance at our 2022 shareholders meeting in person.

| 26 |

|

2023 Proxy – Corporate Governance and Board Matters | |

Corporate Governance and Board Matters

Board Committees

The Board has established four standing committees: the Audit Committee, the Nominating and Corporate Governance Committee, the Safety, Environment, Sustainability and Health Committee, and the Talent and Compensation Committee. Each of the standing committees is composed solely of independent directors. Each standing committee has adopted a written charter, meets periodically throughout the year, reports its actions and recommendations to the Board, receives reports from senior management, annually evaluates its performance and has the authority to retain outside advisors in its discretion. The primary responsibilities of each committee are summarized in the charts below and set forth in more detail in each committee’s written charter, which can be found in the corporate governance section on our website at www.rclinvestor.com.

In addition to these committees, the Board, from time to time, authorizes additional Board committees to assist the Board in executing its responsibilities. Notably, the Board established the ad hoc Strategic and Financial Health Committee that existed from August 2020 to December 2021 to assist in the oversight of management’s responsibility to improve the Company’s financial health, which was adversely impacted by the effect of the COVID-19 pandemic.

|

Audit Committee Members: William L. Kimsey Meetings Held 8 |

Responsibilities: ●Oversight of

●the integrity of our financial statements

●the qualifications and independence of our principal independent auditor

●the performance of our internal audit function and principal independent auditor

●our compliance with the legal and regulatory requirements in connection with the foregoing

●Review of and discussions with management and the principal independent auditor regarding the annual audited and quarterly financial statements of the Company and related disclosures

●Discuss with management the guidelines and policies by which management assesses and manages the Company’s exposure to risk, including a discussion of the Company’s major enterprise risk exposures and the steps management has taken to monitor and mitigate such exposures

●Discuss with management policies regarding the Company’s information system and data privacy controls, and cybersecurity

●Review of the controls and procedures related to the Company’s environmental, social and governance disclosures

●Preparation of Report of the Audit Committee (page 85)

Independence and Financial Expertise: ●The Board has determined that each member of the Audit Committee is independent within the meaning of the NYSE and SEC standards of independence for directors and audit committee members

●The Board has concluded that Mr. Howe, Mr. Kimsey, Ms. Montiel and Mr. Sørensen each qualify as an “audit committee financial expert” within the meaning of SEC rules

●The Board has concluded that Ms. Montiel’s simultaneous service on four public company audit committees would not impair her ability to serve on the Audit Committee | |

|

|

||

|

2023 Proxy – Corporate Governance and Board Matters | 27 | |

Corporate Governance and Board Matters

|

Nominating Members: Stephen R. Howe, Jr. Meetings Held 4 |

Responsibilities: ●Identification of individuals qualified to become Board members

●Recommendation to the Board of director nominees

●Recommendation to the Board of Corporate Governance Principles

●Recommendation to the Board of Board committee nominees

●Recommendation to the Board of Board committee structure, operations and Board reporting

●Oversee evaluation of Board and management performance

●Oversee the CEO transition process in the event of a CEO transition

Independence: ●The Board has determined that each member of the Nominating and Corporate Governance Committee is independent within the meaning of the NYSE standards of independence for directors | |

|

|

||

|

Safety, Members: Michael O. Leavitt Meetings Held 4 |

Responsibilities: ●Oversight of our management concerning the implementation and monitoring of our safety (including security), environmental, sustainability and health programs and policies

●Review and monitor our overall strategies, policies and programs that impact the safety, environment and health of our guests, crew, the communities where we operate and the ports where our ships call

●Monitor our overall development of strategies, policies and practices in the areas of energy consumption, greenhouse gas, and other criteria pollutant emissions, waste disposal and water use

●Review of our programs and policies relative to environmental sustainability and our environmental sustainability reporting | |

|

|

||

| 28 |

|

2023 Proxy – Corporate Governance and Board Matters | |

Corporate Governance and Board Matters

|

Talent and Members: Vagn O. Sørensen Meetings Held 5 |

Responsibilities: ●Overall responsibility for approving and evaluating the executive compensation plans, policies and programs of the Company

●Annual determination of CEO compensation levels, taking into account corporate goals and CEO performance against these goals

●Annual

determination of senior executive compensation levels

●Periodic review and recommendations for director compensation

●Periodic review of talent development programs, human capital management and succession planning

●Preparation of Report of the Talent and Compensation Committee (page 65)

Independence: ●The Board has determined that each member of the Talent and Compensation Committee is independent within the meaning of the NYSE and SEC standards of independence for directors and compensation committee members | |

|

|

||

|

2023 Proxy – Corporate Governance and Board Matters | 29 | |

Corporate Governance and Board Matters

Board Risk Oversight

| Board Oversight | ||

| The Board oversees the Company’s risk profile and management’s processes for assessing and managing risk, through both the whole Board and its committees. At least annually, the Board reviews strategic risks and opportunities facing the Company and its businesses. Other important categories of risk are assigned to designated Board committees that report back to the full Board. | ||

|

||

| Committees of the Board | ||

|

Committees of the Board consider and review with management at regularly scheduled committee meetings ongoing financial, strategic, operational, legal and compliance risks inherent in the business activities applicable to each committee’s area of responsibility. The committee chairs inform the Board of the outcome of these reviews through reports to the Board at the regularly scheduled Board meetings. | ||

Audit Committee ●Reviews the Company’s guidelines and policies with respect to risk assessment.

●Oversees management of risks relating to financial accounting and compliance matters, including risks associated with financial reporting, internal controls, the internal audit function, the Company’s cybersecurity plans, and the Ethics and Compliance Program. | ||

| Nominating and Corporate Governance Committee

●Oversees risks related to the Company’s overall corporate governance, including its corporate governance principles, Board and committee structure and composition, Board’s self-evaluation process, director nominations, and the Board reporting arrangements of the various committees | ||

|

Talent and Compensation Committee ●Oversees risks that are inherent in the design of the Company’s compensation plans, policies and practices | ||

|

Safety, Environment, Sustainability and Health Committee Charter ●Oversees risks related to the Company’s programs and policies in the areas of safety, environment, sustainability, and health | ||

|

||

|

Management | ||

Management annually performs a Company-wide enterprise risk assessment under the supervision of the Audit & Advisory Services department. This assessment ●is updated at least once during the course of the year;

●identifies those risks inherent in our business plans and strategies with the greatest potential to impact the achievement of our business objectives; and

●is used to provide us with a risk-based approach to managing our business.

Management reviews and discusses the risk assessment report and updates thereto with the Audit Committee and the Board. | ||

| 30 |

|

2023 Proxy – Corporate Governance and Board Matters | |

Corporate Governance and Board Matters

Cybersecurity Risk Oversight

Our Audit Committee and our Board oversee the Company’s management of cybersecurity risk. Cyberattacks have continued to intensify in their sophistication and ability to harness information both from the public domain and by means of data exfiltration across public and private institutions. In order to respond to the threat of security breaches and cyberattacks, we have developed a program, overseen by our Chief Information Officer and our Chief Information Security Officer, that is designed to protect and preserve the confidentiality, integrity and continued availability of all information owned by us or in our care. Using a risk-based prioritization approach, our management team focuses on securing our critical assets, updating our cybersecurity detection and prevention capabilities to the new threats, and maturing our compliance processes to protect our operations and our data. We have taken the following foundational steps to address these risks:

Our Chief Information Officer and Chief Information Security Officer meet with the Audit Committee on a quarterly basis to review our cybersecurity programs and risks, and the Chair of the Audit Committee informs the Board of the outcome of these committee reviews through updates presented to the Board at the regularly scheduled Board meetings. The full Board also receives periodic briefings on cyber threats in order to enhance our directors’ literacy on cyber issues.

Executive Compensation Risk Oversight

We monitor the risks associated with our compensation programs and individual executive compensation decisions on an ongoing basis. Each year, management undertakes a review of our various compensation programs to assess the risks arising from our compensation policies and practices in accordance with a screening methodology approved by the Talent and Compensation Committee. In 2022 management reviewed each plan and program for risk features and presented its findings to the Talent and Compensation Committee. The risk assessments included a review of the primary design features of our compensation plans, the process to determine compensation pools and awards for employees and an analysis of how those features could directly or indirectly encourage or mitigate risk-taking. As part of the risk assessments, it has been noted that the Company’s annual incentive plan allows for discretionary negative adjustments to the ultimate outcomes, which serves to mitigate risk-taking. Moreover, senior management is subject to share ownership and retention policies, and historically a large percentage of senior management compensation has been paid in the form of long-term equity awards. In addition, senior management compensation is paid over a multiple-year cycle, a compensation structure that is intended to align incentives with appropriate risk-taking. Based on this review, management and the Talent and Compensation Committee believe that the nature of our business, and the material risks we face, are such that the compensation plans, policies and programs we have put in place are not reasonably likely to give rise to risks that would have a material adverse effect on our business.

|

2023 Proxy – Corporate Governance and Board Matters | 31 | |

Corporate Governance and Board Matters

Shareholder Engagement

| WHY WE ENGAGE |

|

We maintain an ongoing, proactive outreach effort with our shareholders. Throughout the year, members of our investor relations team and members of senior management engage with shareholders in order to:

●Provide visibility and transparency into our business, our performance, and our corporate governance, ESG and compensation practices;

●Discuss with our shareholders the issues that are important to them and share our views; and

●Assess emerging issues that may affect our business, inform our decision-making, enhance our corporate disclosures, and help shape our future practices. |

| SHAREHOLDER ENGAGEMENT PROCESS | |||

|

Spring |

|

Summer |

|

Engage with shareholders to gather feedback on compensation and governance practices ahead of the Annual Meeting of Shareholders. |

Review results from the Annual Meeting of Shareholders and conduct targeted responsive engagements with shareholders who did not express support for management proposals. | ||

|

Fall |

|

Winter |

|

Conduct comprehensive engagement with shareholders to discuss developments in the Company’s business and strategy, corporate governance matters, executive compensation design, and business priorities for the upcoming year. |

Review shareholder feedback from Fall engagement and discuss with Board potential changes to executive compensation or governance practices in light of feedback received, as well as recommend enhancements to our public disclosures. | ||

| 2022 SHAREHOLDER ENGAGEMENT | |||

|

Who we contacted |

|

Who we engaged |

|

|

Who is involved in engagement

●Members of our Investor Relations team as well as our

●CEO;

●CFO;

●Chief People and Outreach Officer;

●Chief ESG Officer; and

●Relevant subject matter experts from the management team participated in these meetings as appropriate. |

Topics of engagement

During our meetings with investors, we discussed: ●The recovery of our business;

●Our plans to continue to return to consistent financial performance, restoring our balance sheet, our commitment to the improvement of our sustainability reporting and related environment, social, and governance initiatives; and

●Our executive compensation program. | ||

This engagement outreach was in addition to other meetings and discussions that management and investor relations team had throughout the year with shareholders through quarterly earnings calls, individual meetings, road shows, conferences and investor days.

| 32 |

|

2023 Proxy – Corporate Governance and Board Matters | |

Corporate Governance and Board Matters

Other Governance Highlights

We are committed to maintaining strong governance policies and practices, some of which we highlight below:

|

Board Composition, Refreshment and Diversity

✓14 directors

✓4 of 12 independent directors joined the Board within the last 5 years

✓The 14 members of our Board represent a range of backgrounds and diversity: five (36%) of our directors are gender / ethnically diverse; four (29%) of our directors are women; and three (21%) of our directors are racially / ethnically diverse

✓4 “audit committee financial experts” on our Audit Committee |

Board Independence

✓85% of our directors are independent (12 out of 14). Our Corporate Governance Principles require two thirds of our directors to be independent

✓Lead Independent Director (“Lead Director”) with robust duties and responsibilities

✓All members of our Board Committees are independent |

Board Responsibilities and Practices

✓All directors attended at least 75% of Board and applicable Board committee meetings

✓Our independent directors regularly meet in executive session without management present, during which the Lead Director presides

✓On an annual basis, the Nominating and Corporate Governance Committee oversees an evaluation of Board and Board committee performance

✓The Board, with the support of the Nominating and Corporate Governance Committee and the Talent and Compensation Committee, is actively involved in overseeing CEO succession planning |

|

Rights of Shareholders

✓Annual election of directors

✓Majority of votes cast

✓Shareholders with at least 50% of the outstanding shares can call Special Meetings

✓Annual advisory say-on-pay vote

✓No poison pill |

Compensation Accountability

✓Equity ownership guidelines

●CEO — 6x salary

●Other named executive officers — 3x salary

●Board of Directors — $300,000

✓Prohibited hedging or pledging of company securities for all employees and members of the Board of Directors

✓Equity and annual incentive plans permit recoupment in case of a restatement for material non-compliance with financial reporting requirements |

Political Contributions Disclosure

✓In response to shareholder feedback, updated U.S. Political Contributions and Disclosure Policy

●No independent expenditures directly in support of or in opposition to any candidate.

●No sponsorships of political action committees.

●Permissible contributions must be approved by Senior Vice President, Corporate Affairs (or U.S. subsidiary’s most senior officer).

✓Policy and annual voluntary disclosures posted on RCG’s website |

|

2023 Proxy – Corporate Governance and Board Matters | 33 | |

Corporate Governance and Board Matters

Certain Relationships and Related Person Transactions

Review and Approval Related Person Transactions

We have a written Related Person Transaction Policy that requires review of all relationships and transactions in which the Company is a participant and in which a “related person” (including any director, director nominee, executive officer or greater than 5% beneficial owner of the Company or any immediate family member of the foregoing) has a direct or indirect material interest. Under this policy, each director, director nominee and executive officer is required to promptly notify the Corporate Secretary of any such transaction. The Corporate Secretary then presents such transactions to the Audit Committee, which is responsible for reviewing and determining whether to approve or ratify the transactions. The following types of transactions are deemed not to create or involve a material interest on the part of the related person and do not require approval or ratification under the policy, unless the Audit Committee determines that the facts and circumstances of the transaction warrant its review:

In reviewing transactions submitted to them, the Audit Committee reviews and considers all relevant facts and circumstances to determine whether the transaction is in, or not inconsistent with, the best interests of the Company and its shareholders, including, without limitation:

If after the review described above, the Audit Committee determines not to approve or ratify the transaction, it will be cancelled or unwound as the Audit Committee considers appropriate and practicable.

Related Person Transactions

There were no related person transactions during 2022.

| 34 |

|

2023 Proxy – Corporate Governance and Board Matters | |

Corporate Governance and Board Matters

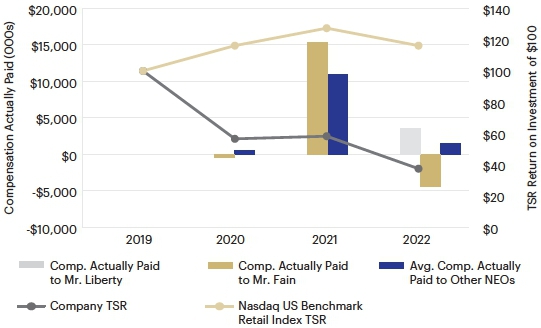

Delinquent Section 16(a) Reports