Document | | | | | | | | | | | | | | | | | |

| |

| Dated 21 June 2023 | |

Royal Caribbean Cruises Ltd. (1)

(the Borrower) KfW IPEX-Bank GmbH (2)

(the Facility Agent) KfW IPEX-Bank GmbH (3)

(the Hermes Agent) The banks and financial institutions listed in Schedule 1 (4)

(the Lenders) |

| Amendment No. 6 in connection with

the Credit Agreement in respect of

Hull S-719 | |

|

Contents

Clause Page

| | | | | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Exhibit A Form of Loan Request | 10 |

Exhibit B Table of Commitments | 11 |

Exhibit C Dollar Floating Rate Loan Provisions | 12 |

Exhibit D Form of Further Withdrawal Request | 13 |

THIS AMENDMENT NO. 6 (this Amendment) is dated 21 June 2023 and made BETWEEN:

(1) Royal Caribbean Cruises Ltd. (a corporation organised and existing under the laws of The Republic of Liberia) (the Borrower);

(2) KfW IPEX-Bank GmbH as facility agent (the Facility Agent);

(3) KfW IPEX-Bank GmbH as Hermes agent (the Hermes Agent); and

(4) The banks and financial institutions listed in Schedule 1 as lenders (the Lenders).

WHEREAS:

(A) The Borrower, the Facility Agent, the Hermes Agent and the Lenders are parties to a credit agreement dated 19 September 2019 (as amended, restated and novated from time to time, the Existing Credit Agreement), in respect of the vessel bearing Builder’s hull number S-719 (the Vessel) whereby it was agreed that the Lenders would make available to the Borrower, upon the terms and conditions therein, a US dollar loan facility (the Facility) up to the US Dollar Equivalent of EUR 434,201,000 (including the amount of the First Increase Loan Amount (as defined in the Existing Credit Agreement) and calculated on the amount equal to the sum of (a) up to eighty per cent (80%) of the Contract Price of the Vessel but which Contract Price will not exceed EUR 526,800,000 and (b) up to 100% of the Hermes Fee.

(B) The Original Borrower, the Guarantor and the Builder shall, on or prior to the Amendment Effective Date, enter into an addendum to the Construction Contract (the Addendum) pursuant to which it shall be agreed that the Contract Price may be further increased on the basis to be set out therein.

(C) In connection with the arrangements referred to in Recital (B) above, the Parties have agreed to amend and restate the Existing Credit Agreement on the basis set out in this Amendment in order to reflect (i) an increase to the Commitments by an amount equal to 80% of the maximum increased cost of the Vessel and 100% of the Second Additional Hermes Fee (as such term is defined in the Amended Credit Agreement) and (ii) certain changes to the interest rate provisions.

NOW IT IS AGREED as follows:

1 Interpretation and definitions

1.1 Definitions in the Existing Credit Agreement

(a) Unless the context otherwise requires or unless otherwise defined in this Amendment, words and expressions defined in the Existing Credit Agreement shall have the same meanings when used in this Amendment.

(b) The principles of construction set out in the Existing Credit Agreement shall have effect as if set out in this Amendment.

1.2 Definitions

In this Amendment (including its recitals):

Amended Credit Agreement means the Existing Credit Agreement as amended and restated in accordance with this Amendment.

Amendment Effective Date has the meaning given to it in clause 3.

Fee Letter means any letter between the Facility Agent and the Borrower, setting out the fees payable in connection with this Amendment.

Finance Parties means the Facility Agent, the Hermes Agent and the Lenders.

Party means each of the parties to this Amendment.

Second Increase Commitment has the meaning given to it in the form of the Amended Credit Agreement set out in Schedule 3.

Second Increase Tranche has the meaning given to it in the form of the Amended Credit Agreement set out in Schedule 3.

Second Security Enhancement Guarantor Confirmation Agreement means the agreement referred to in clause 3.1(b).

1.3 Third party rights

Other than KfW in respect of the rights of KfW under the Loan Documents, unless expressly provided to the contrary in a Loan Document, no term of this Amendment is enforceable under the Contracts (Rights of Third Parties) Act 1999 by any person who is not a Party.

1.4 Designation

Each of the Parties designates this Amendment as a Loan Document.

2 Amendment of the Existing Credit Agreement

In consideration of the mutual covenants in this Amendment, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties hereby agree that, subject to the satisfaction of the conditions precedent set forth in clause 3:

(a) the Existing Credit Agreement (but without all its Exhibits which, other than in the case of Exhibit A and Exhibit Q thereto (which shall be replaced pursuant to paragraph (b) below), shall remain in the same form and continue to form part of the Existing Credit Agreement) is hereby amended on the Amendment Effective Date so as to read in accordance with the form of the amended and restated credit agreement set out in Schedule 3, which will, together with the Exhibits to the Existing Credit Agreement (save for Exhibit A and Exhibit Q thereto) continue to be binding upon each of the Parties in accordance with its terms as so amended and restated;

(b) Exhibit A hereto shall be attached to the Amended Credit Agreement in replacement of Exhibit A thereto and Exhibit B hereto shall be attached to the Amended Credit Agreement in replacement of Exhibit Q thereto;

(c) Exhibit C hereto shall be attached to the Amended Credit Agreement as a new Exhibit R thereto; and

(d) Exhibit D hereto shall be attached to the Amended Credit Agreement as a new Exhibit S thereto.

3 Conditions of effectiveness of Amended Credit Agreement

3.1 The Amended Credit Agreement shall become effective in accordance with the terms of this Amendment on the date (the Amendment Effective Date) upon which each of the following conditions has been satisfied to the reasonable satisfaction of the Facility Agent:

(a) the Facility Agent shall have received from the Borrower:

(i) a certificate of its Secretary or Assistant Secretary as to the incumbency and signatures of those of its officers authorised to act with respect to this Amendment and as to the truth and completeness of the attached resolutions of its Board of Directors then in full force and effect authorising the execution, delivery and performance of this Amendment (including the borrowing of the Second Increase Commitment), and upon which certificate the Lenders may conclusively rely until the Facility Agent shall have received a further certificate of the Secretary or Assistant Secretary of the Borrower cancelling or amending such prior certificate; and

(ii) a Certificate of Good Standing issued by the relevant authorities in respect of the Borrower;

(b) the Facility Agent and each Security Enhancement Guarantor shall have entered into an agreement pursuant to which the Security Enhancement Guarantors shall acknowledge the amendments to the Existing Credit Agreement contained in this Amendment and:

(i) agree that the relevant Security Enhancement Guarantee and each other Loan Document to which that Security Enhancement Guarantor is a party shall remain and continue in full force and effect notwithstanding the amendment and restatement of the Existing Credit Agreement;

(ii) agree that the relevant Security Enhancement Guarantee and the Guaranteed Liabilities (as defined in the relevant Security Enhancement Guarantee) shall extend to any obligations of the Borrower under the Amended Credit Agreement; and

(iii) confirm that guaranteeing the obligations of the Borrower does not cause any borrowing, guaranteeing or similar limit binding on the relevant Security Enhancement Guarantor to be exceeded,

and the Facility Agent shall have received evidence of the authority of the relevant signatory of each Security Enhancement Guarantor to execute the Second Security Enhancement Guarantor Confirmation Agreement;

(c) the Facility Agent shall have received a duly executed copy of each Fee Letter;

(d) the Facility Agent shall have received evidence that all invoiced expenses of the Facility Agent and KfW (including the agreed fees and expenses of counsel to the Facility Agent and KfW) required to be paid by the Borrower pursuant to clause 6 below, and all other documented fees and expenses that the Borrower has otherwise agreed in writing to pay to the Facility Agent or KfW, have been paid or will be paid promptly upon being demanded;

(e) the Facility Agent shall have received opinions, addressed to the Facility Agent (and capable of being relied upon by each Lender) from:

(i) Watson Farley & Williams LLP, counsel to the Borrower, as to matters of Liberian law (and being issued in substantially the same form as the corresponding Liberian legal opinion issued in connection with the previous amendment to the Existing Credit Agreement);

(ii) Norton Rose Fulbright LLP, counsel to the Facility Agent as to matters of English law (and being issued in substantially the same form as the corresponding English legal opinion issued in connection with the previous amendment to the Existing Credit Agreement); and

(iii) Skadden, Arps, Slate, Meagher & Flom LLP, counsel to the Facility Agent as to matters of New York law in respect of the Second Security Enhancement Guarantor Confirmation Agreement,

or, where applicable, a written approval in principle (which can be given by email) by any of the above counsel of the arrangements contemplated by this Amendment and a confirmation that a formal opinion will follow promptly after the Amendment Effective Date;

(f) the representations and warranties set out in clause 4 are true and correct in all material respects (except for such representations and warranties that are qualified by materiality or non-existence of a Material Adverse Effect (which shall be accurate in all respects)) as of the Amendment Effective Date;

(g) no Event of Default or Prepayment Event shall have occurred and be continuing or would result from the amendment of the Existing Credit Agreement pursuant to this Amendment;

(h) the Borrower shall, as required pursuant to clause 5, have provided a letter to the Facility Agent which confirms that RCL Cruises Ltd. has accepted its appointment as process agent in respect of this Amendment;

(i) KfW has confirmed to the Facility Agent that all relevant Lenders have executed (i) respective amendments to their Option A Refinancing Agreements required in connection with the arrangements contemplated by this Amendment and (ii) any replacement security documents required to be entered into between the Lenders and KfW pursuant to the terms of such amended Option A Refinancing Agreements, and any relevant legal opinions required by KfW in connection with such arrangements have been issued;

(j) the Facility Agent shall have received from Hermes an approval in principle that the Hermes Insurance Policy will be amended in respect of, and shall cover, the increased Maximum Loan Amount and the Second Increase Tranche;

(k) the Facility Agent shall have received such documentation and information as any Finance Party shall reasonably request to comply with “know your customer” or similar identification procedures under all laws and regulations applicable to the Finance Parties; and

(l) the Facility Agent shall have received a duly executed copy of the Addendum, evidencing a potential increase of the Contract Price to a maximum of EUR 563,800,000 (or such other amount as may be approved by the Lenders).

3.2 The Facility Agent shall notify the Lenders and the Borrower of the Amendment Effective Date by way of a confirmation in the form set out in Schedule 2 and such confirmation shall be conclusive and binding.

4 Representations and Warranties

(a) The Borrower represents and warrants that each of the representations and warranties in:

(i) Article VI of the Existing Credit Agreement; and

(ii) clause 4(b) of Amendment Agreement Number One,

are deemed to be made by the Borrower on the date of this Amendment and on the Amendment Effective Date, in each case as if reference to the Loan Documents in each such representation and warranty was a reference to this Amendment Agreement and the Second Security Enhancement Guarantor Confirmation Agreement.

5 Incorporation of Terms

The provisions of Section 11.2 (Notices), Section 11.6 (Severability) and Subsections 11.14.2 (Jurisdiction), 11.14.3 (Alternative Jurisdiction) and 11.14.4 (Service of Process) of the Existing Credit Agreement shall be incorporated into this Amendment as if set out in full in this Amendment and as if references in those sections to “this Agreement” were references to this Amendment and references to each Party are references to each Party to this Amendment.

6 Fees, Costs and Expenses

6.1 The Borrower shall pay to the Facility Agent (for its own account and for the account of the Lenders (as applicable)) the fees in the amounts and at the times agreed in the Fee Letters.

6.2 The Borrower shall also pay to the Facility Agent (for the account of KfW) a non-refundable refinancing fee in an amount of (a) €1,000 per Option A Refinancing Agreement entered into with a Lender whose Commitments (including the Second Increase Commitment) are equal to or less than €20,000,000 and (b) €2,000 per Option A Refinancing Agreement entered into with a Lender whose Commitments (including the Second Increase Commitment) are greater than €20,000,000.

6.3 The payment of the above fees shall be made free and clear of any deduction, restriction or withholding and in immediately available freely transferable cleared funds to such account(s) as the Facility Agent shall notify the Borrower of in advance or, where applicable, in the relevant Fee Letter.

6.4 The Borrower agrees to pay on demand all reasonable out-of-pocket costs and expenses of:

(a) the Facility Agent in connection with the preparation, execution, delivery and administration, modification and amendment of this Amendment and the documents to be delivered hereunder or thereunder; and

(b) KfW, the Facility Agent and any Lender in connection with the preparation, execution, delivery and administration, modification and amendment of any Option A Refinancing Agreement and any security or other documents executed or to be executed and delivered (including any legal opinions required to be provided by legal counsel to KfW) as a consequence of the parties entering into this Amendment and any other documents to be delivered under this Amendment,

(including the reasonable and documented fees and expenses of counsel for the Facility Agent and KfW with respect hereto and thereto as agreed with the Facility Agent and KfW) in accordance with the terms of Section 11.3 (Payment of Costs and Expenses) of the Existing Credit Agreement and as if references in that section to the Facility Agent are references to the Facility Agent and KfW.

7 Counterparts

This Amendment may be executed in any number of counterparts and by the different Parties on separate counterparts, each of which when so executed and delivered shall be an original but all counterparts shall together constitute one and the same instrument. The Parties acknowledge and agree that they may execute this Amendment and any variation or amendment to the same, by electronic instrument. The Parties agree that the electronic signatures appearing on the document shall have the same effect as handwritten signatures and the use of an electronic signature on this Amendment shall have the same validity and legal effect as the use of a signature affixed by hand and is made with the intention of authenticating this Amendment, and evidencing the Parties’ intention to be bound by the terms and conditions contained herein. For the purposes of using an electronic signature, the Parties authorise each other to conduct the lawful processing of personal data of the signers for contract performance and their legitimate interests including contract management.

8 Governing Law

This Amendment, and all non-contractual obligations arising in connection with it, shall be governed by and construed in accordance with English law.

The Parties have executed this Amendment the day and year first before written.

Schedule 1

The Lenders

Lenders

KfW IPEX-Bank GmbH

MUFG Bank, Ltd.

Société Générale

Landesbank Hessen-Thüringen Girozentrale (Helaba)

DZ BANK AG, New York Branch

Standard Chartered Bank

Bayerische Landesbank, New York Branch

Commerzbank AG, New York Branch

AKA AUSFUHRKREDIT-GESELLSCHAFT MBH

Oldenburgische Landesbank Aktiengesellschaft

Schedule 2

Form of Amendment Effective Date confirmation – Hull S-719

To: Royal Caribbean Cruises Ltd.

To: The Lenders (as set out in Schedule 1 to the Amendment (as defined below))

Builder’s Hull No S-719

We, KfW IPEX-Bank GmbH, refer to amendment no. 6 dated [] 2023 (the Amendment) relating to a credit agreement dated 19 September 2019 (as previously amended, supplemented, novated and/or restated from time to time) (the Credit Agreement) made between (among others) Royal Caribbean Cruises Ltd. as the Borrower, the financial institutions listed in it as the Lenders and ourselves as the Hermes Agent and the Facility Agent in respect of a loan to be made available to the Borrower from the Lenders of up to the Maximum Loan Amount (as defined in the Credit Agreement).

We hereby confirm that all conditions precedent referred to in clause 3.1 of the Amendment have been satisfied. In accordance with clause 3 of the Amendment, the Amendment Effective Date is the date of this confirmation and the amendment and restatement of the Credit Agreement in accordance with the Amendment is now effective.

Dated: 2023

Signed: _______________________________

For and on behalf of

KfW IPEX-Bank GmbH

(as Facility Agent)

Schedule 3

Amended and Restated Credit Agreement

_________________________________________

AMENDED AND RESTATED

HULL NO. S-719 CREDIT AGREEMENT

_________________________________________

Dated September 19, 2019

(as further amended and restated on June , 2023)

BETWEEN,

Royal Caribbean Cruises Ltd.

as the Borrower,

the Lenders from time to time party hereto,

KfW IPEX-Bank GmbH

as Hermes Agent and Facility Agent

and

KfW IPEX-Bank GmbH

as Initial Mandated Lead Arranger and Sole Bookrunner

Hermes Backed Term Facility Agreement (Hull S-719)

Up to the US Dollar Equivalent of EUR 452,701,631

TABLE OF CONTENTS

PAGE

EXHIBITS

EXHIBIT A Form of Loan Request

EXHIBIT B-1 [INTENTIONALLY OMITTED]

EXHIBIT B-2 Form of Opinion of Liberian Counsel to Borrower

EXHIBIT B-3 Form of Opinion of English Counsel to Facility Agent and Lenders

EXHIBIT B-4 Form of Opinion of German Counsel to Facility Agent and Lenders

EXHIBIT B-5 Form of Opinion of US Tax Counsel to Lenders

EXHIBIT C Form of Lender Assignment Agreement

EXHIBIT D Form of Option A Refinancing Agreement

EXHIBIT E Form of Pledge Agreement

EXHIBIT F Form of Currency Election Notice

EXHIBIT G Principles

EXHIBIT H Form of Information Package

EXHIBIT I Form of First Priority Guarantee

EXHIBIT J Form of Second Priority Guarantee

EXHIBIT K Form of Third Priority Guarantee

EXHIBIT L Form of Senior Parties Subordination Agreement

EXHIBIT M Form of Other Senior Parties Subordination Agreement

EXHIBIT N Framework

EXHIBIT O Debt Deferral Extension Regular Monitoring Requirements

EXHIBIT P Replacement covenants with effect from the Security Enhancement Guarantee Release Date

EXHIBIT Q Table of Commitments

EXHIBIT R USD Floating Rate Loan Provisions

EXHIBIT S Form of Further Withdrawal Request

CREDIT AGREEMENT

HULL NO. S-719 CREDIT AGREEMENT, dated as of September 19, 2019 (the "Effective Date") as amended, restated and novated from time to time, originally among Silversea Cruise Holding Ltd., a Bahamian company (the "Original Borrower"), Royal Caribbean Cruises Ltd., a Liberian corporation as original guarantor and, on and following the date of Amendment Number Three, the nominee borrower (“the Borrower”), KfW IPEX-Bank GmbH, in its capacity as agent for the Lenders referred to below in respect of CIRR and Hermes-related matters (in such capacity, the "Hermes Agent"), in its capacity as facility agent (in such capacity, the "Facility Agent"), in its capacity as sole bookrunner (in such capacity, the "Bookrunner") and in its capacity as a lender (in such capacity, together with each other Person that shall become a "Lender" in accordance with Section 11.11.1 hereof, each, individually, a "Lender" and, collectively, the "Lenders").

W I T N E S S E T H

WHEREAS:

(A) The Original Borrower, the Borrower and Meyer Werft GmbH & Co. KG (the "Builder") have on 16 April 2019, entered into a Contract for the Construction and Sale of Hull No. S-719 (as amended from time to time, the "Construction Contract") pursuant to which the Builder has agreed to design, construct, equip, complete, sell and deliver the passenger cruise vessel bearing Builder's hull number S-719 (the "Purchased Vessel");

(B) The Lenders have agreed to make available to the Borrower, upon the terms and conditions contained herein, a US dollar loan facility calculated on the amount (the "Maximum Loan Amount") (and being comprised of the Original Loan Amount, the First Increase Loan Amount and the Second Increase Loan Amount) equal to (x) eighty per cent (80%) of the Contract Price (as defined below) of the Purchased Vessel, as adjusted from time to time in accordance with the Construction Contract to reflect, among other adjustments, change orders, but which Contract Price shall not exceed for this purpose EUR 563,800,000 (the "Contract Price Proceeds"), plus (y) 100% of the Hermes Fee (as defined below) (the "Hermes Fee Proceeds") and being made available in the US Dollar Equivalent of that Maximum Loan Amount;

(C) The Lenders have also agreed, upon the terms and conditions contained herein, that the loan facility up to the Maximum Loan Amount may be made available in EUR to the Borrower instead of Dollars if an election is made by the Borrower for the Loan to be denominated in EUR pursuant to Section 2.4(e);

(D) The Contract Price Proceeds will be provided to the Borrower either two (2) Business Days prior to the anticipated Delivery Date (if the Loan is denominated in Dollars) or one (1) Business Day prior to the anticipated Delivery Date (if the Loan is denominated in EUR) for the purpose of paying a portion of the Contract Price in connection with the Borrower's purchase of the Purchased Vessel. The Hermes Fee Proceeds will be provided on the Disbursement Date and paid as set forth in Section 2.4(c) and (d);

(E) The Parties hereto have previously amended this Agreement pursuant to that certain financial covenant waiver extension consent letter, dated as of July 23, 2020 (the "Waiver Letter");

(F) The Parties hereto have previously amended and restated this Agreement pursuant to Amendment No. 1, dated as of December 21, 2020 (the "Amendment Number One") pursuant to which the Original Borrower and the Borrower agreed to procure the execution of the Security Enhancement Guarantees and to make certain amendments to this Agreement to reflect the existence of such Security Enhancement Guarantees.

(G) Pursuant to Amendment No. 2 dated as of March 26, 2021 (the "Amendment Number Two"), the Parties agreed to further amendments to this Agreement in accordance with the Framework.

(H) Pursuant to Amendment No. 3 dated as of September 27, 2021 (the "Amendment Number Three"), this Agreement was amended and restated to, amongst other things, reflect (1) the increase in the Maximum Loan Amount by an amount equal to the First Increase Loan Amount to be made available by the First Increase Lenders and (2) the nomination of the Borrower as borrower under this Agreement and the other Loan Documents in accordance with Section 2.6 and clause 5 of Amendment Number Three.

(I) Pursuant to Amendment No. 4 dated as of December 22, 2021 (the "Amendment Number Four"), the Parties agreed to amend the financial covenants set out in this Agreement.

(J) Pursuant to Amendment No. 5 dated as of July 21, 2022 (the "Amendment Number Five"), the Parties agreed to further amend the financial covenants set out in this Agreement.

(K) Pursuant to Amendment No. 6 dated as of June ,2023 (the "Amendment Number Six"), and upon satisfaction of the conditions set forth therein, this Agreement is being amended and restated in the form of this Agreement and the Maximum Loan Amount (as already increased by the First Increase Loan Amount) is being increased by an amount equal to the Second Increase Loan Amount to be made available by the Second Increase Lenders.

NOW, THEREFORE, the parties hereto agree as follows:

ARTICLE I

DEFINITIONS AND ACCOUNTING TERMS

SECTION 1.1. Defined Terms.

The following terms (whether or not underscored) when used in this Agreement, including its preamble and recitals, shall, when capitalised, except where the context otherwise requires, have the following meanings (such meanings to be equally applicable to the singular and plural forms thereof):

“2.875% Converted Debt” means the aggregate amount of debt securities issued by the Borrower pursuant to the 2.875% Convertible Notes Indenture which are, in accordance with the provisions of the said 2.875% Convertible Notes Indenture, converted, or remain to be converted, into equity securities of the Borrower on the 2.875% Maturity Date.

“2.875% Convertible Notes Indenture” means that certain Indenture, dated as of October 16, 2020, (as amended, supplemented, extended and/or otherwise modified from time to time) in respect of the $575,000,000 2.875% convertible senior notes due 2023, by and among the Borrower as issuer and THE BANK OF NEW YORK MELLON TRUST COMPANY, N.A., as trustee.

“2.875% Maturity Date” has the meaning given to the term Maturity Date in the 2.875% Convertible Notes Indentures (and being, as at the date of Amendment Number Five, November 15, 2023).

“4.25% Converted Debt” means the aggregate amount of debt securities issued by the Borrower pursuant to the 4.25% Convertible Notes Indenture which are, in accordance with the provisions of the said 4.25% Convertible Notes Indenture, converted, or remain to be converted, into equity securities of the Borrower on the 4.25% Maturity Date.

“4.25% Convertible Notes Indenture” means that certain Indenture, dated as of June 9, 2020, (as amended, supplemented, extended and/or otherwise modified from time to time) in respect of the $1,150,000,000 4.250% convertible senior notes due 2023, by and among the Borrower as issuer and THE BANK OF NEW YORK MELLON TRUST COMPANY, N.A., as trustee.

“4.25% Maturity Date” has the meaning given to the term Maturity Date in the 4.25% Convertible Notes Indenture (and being, as at the date of Amendment Number Five, June 15, 2023).

"Accumulated Other Comprehensive Income (Loss)" means at any date the Borrower’s accumulated other comprehensive income (loss) on such date, determined in accordance with GAAP.

"Additional Guarantee" means a guarantee of the Obligations provided by a New Subsidiary Guarantor in a form and substance substantially the same as the other Security Enhancement Guarantees (reflecting any necessary logical and factual changes), with such changes, or otherwise in form and substance, reasonably satisfactory to each of the Agents.

"Additional Subordination Agreement" means any subordination agreement with respect to the Second Priority Guarantee or the Third Priority Guarantee, as applicable, in a form and substance substantially the same as the other Subordination Agreements (reflecting any necessary logical and factual changes), with such changes, or otherwise in form and substance, reasonably satisfactory to each of the Agents and the beneficiaries of any Indebtedness incurred by the relevant Security Enhancement Guarantor, as applicable.

“Adjustable Amount” means, as of any time of determination, $500,000,000; provided if the aggregate amount of New Capital is equal to or greater than $500,000,000, then the Adjustable Amount shall be $350,000,000.

“Adjusted Cash Balance” means, as of any date (the “Measurement Date”), the aggregate amount of unrestricted cash and Cash Equivalents of the Borrower and its Subsidiaries as determined in accordance with GAAP plus (a) any amounts available to be drawn by the Borrower and/or any of its Subsidiaries under committed but undrawn term loan or revolving credit facility agreements (excluding any amounts available under agreements where the proceeds are only intended to be used to fund the purchase of new Vessels) and less (b) the sum of (i) any scheduled payments of principal or interest (but for the purposes of anticipating any interest liabilities, the interest rate of any floating rate debt shall be determined based on reference rates then in effect at the Measurement Date) in respect of debt during the period commencing on the Measurement Date and ending on the date that is six months thereafter, (ii) any customer deposits held by the Borrower or its Subsidiaries for cruises that are scheduled to commence within three months of the Measurement Date and (iii) any planned Non-Financed Capex during the period commencing on the Measurement Date and ending on the date that is six months thereafter.

“Adjusted EBITDA after Interest” means, for any Last Reported Fiscal Quarter, the Borrower’s EBITDA for such period, excluding those items, if any, that the Borrower has excluded in determining “Adjusted Net Income” for such period as disclosed in the Borrower’s annual report on Form 10-K or quarterly report on Form 10-Q, as applicable, for such Last Reported Fiscal Quarter, as evidenced pursuant to the relevant certificate to be submitted by the Borrower pursuant to Section 7.1.1(l).

"Affiliate" of any Person means any other Person which, directly or indirectly, controls, is controlled by or is under common control with such Person. A Person shall be deemed to be "controlled by" any other Person if such other Person possesses, directly or indirectly, power to direct or cause the direction of the management and policies of such Person whether by contract or otherwise.

"Agent" means either the Hermes Agent or the Facility Agent and "Agents" means both of them.

"Agreement" means, on any date, this credit agreement as originally in effect on the Effective Date and as thereafter from time to time amended, supplemented, amended and restated, or otherwise modified and in effect on such date.

“Amendment Number Five” is defined in the preamble.

“Amendment Number Four” is defined in the preamble.

“Amendment Number One” is defined in the preamble.

“Amendment Number Six” is defined in the preamble.

“Amendment Number Three” is defined in the preamble.

“Amendment Number Two” is defined in the preamble.

“Amendment Six Effective Date” has the meaning ascribed to the term “Amendment Effective Date” in Amendment Number Six.

“Amendment Three Effective Date” has the meaning ascribed to the term “Amendment Effective Date” in Amendment Number Three.

“Amendment Two Effective Date” has the meaning ascribed to the term “Amendment Effective Date” in Amendment Number Two.

“Annex VI” means Annex VI of the Protocol of 1997 (as subsequently amended from time to time) to amend the International Convention for the Prevention of Pollution from Ships 1973 (Marpol), as modified by the Protocol of 1978 relating thereto.

"Annualized Net Cash from Operating Activities" means, with respect to any calculation of net cash from operating activities for any period:

(a) in the case of the period of four consecutive Fiscal Quarters ending with the first Fiscal Quarter ending after the last day of the Fiscal Quarter ending on September 30, 2022, the product of (A) net cash from operating activities for such first Fiscal Quarter and (B) four,

(b) in the case of the period of four consecutive Fiscal Quarters ending with the second Fiscal Quarter ending after the last day of the Fiscal Quarter ending on September 30, 2022, the product of (i) the sum of net cash from operating activities for such second Fiscal Quarter and the immediately preceding Fiscal Quarter and (ii) two; and

(c) in the case of the period of four consecutive Fiscal Quarters ending with the third Fiscal Quarter ending after the last day of the Fiscal Quarter ending on September 30, 2022, the product of (i) the sum of net cash from operating activities for such third Fiscal Quarter and the two immediately preceding Fiscal Quarters and (ii) four-thirds,

in each case determined in accordance with GAAP as shown in the Borrower’s consolidated statements of cash flows for such period.

"Anti-Corruption Laws" means all laws, rules, and regulations of any jurisdiction applicable to the Borrower or any of its Affiliates from time to time concerning or relating to bribery or corruption.

"Applicable Commitment Rate" means (x) from and including the Effective Date through and including 31 March 2020 (being the date falling 24 months before the anticipated Delivery Date as at the Effective Date), 0.15% per annum, (y) from and including 1 April 2020 through and including 31 March 2021 (being the date falling 12 months before the anticipated Delivery Date as at the Effective Date), 0.25% per annum, and (z) from and including 1 April 2021 through but excluding the Commitment Fee Termination Date, 0.30% per annum.

"Applicable Jurisdiction" means the jurisdiction or jurisdictions under which an Obligor is organised, domiciled or resident or from which any of its business activities are conducted or in which any of its properties are located and which has jurisdiction over the subject matter being addressed.

"Assignee Lender" is defined in Section 11.11.1.

"Authorised Officer" means any of the officers of the Borrower authorised to act with respect to the Loan Documents and whose signatures and incumbency shall have been certified to the Facility Agent by the Secretary or an Assistant Secretary of the Borrower.

"Balance Amount" means the amount of the Loan which, in accordance with Section 2.4(d)(iii), is to be retained in the EUR Pledged Account until the Further Withdrawal Date (as such amount shall be notified to the Facility Agent in the Loan Request).

"Bank Indebtedness" means the Borrower's Indebtedness up to a maximum aggregate principal amount of $5,300,000,000 under the following agreements (as amended, restated, supplemented, extended, refinanced, replaced or otherwise modified from time to time): (a) the USD1,550,000,000 revolving credit facility maturing in 2022 with Nordea Bank AB (publ), New York Branch as agent, (b) the USD1,925,000,000 revolving credit facility maturing in 2024 with The Bank of Nova Scotia as agent, (c) the USD1,000,000,000 term loan maturing on 5 April 2022 with Bank of America, N.A. as agent, (d) the USD300,000,000 term loan maturing on 7 June 2028 with Nordea Bank ABP, New York Branch as agent, (e) the USD55,827,065 term loan maturing on 5 December 2022 with Sumitomo Mitsui Banking Corporation as agent, (f) the €80,000,000 term loan maturing in November 2024 with Skandinaviska Enskilda Banken AB (publ) as agent, (g) the USD130,000,000 term loan maturing on 2 February 2023 with Industrial and Commercial Bank of China Limited, New York Branch as agent, (h) that certain guarantee dated 18 July 2016 with SMBC Leasing and Finance, Inc. as agent in connection with liabilities relating to the "Lease", the "Construction Agency Agreement", the "Participation Agreement" and any other "Operative Document" (as each term is defined in such guarantee) and (i) any other agreement (other than in connection with Credit Card Obligations) as to which the Second Priority Guarantors provide a first priority guarantee package.

"Bank of Nova Scotia Agreement" means the U.S. $1,925,000,000 amended and restated credit agreement dated as of December 4, 2017 among the Borrower, as borrower, the various financial institutions as are or shall become parties thereto, as lenders, and The Bank of Nova Scotia, as administrative agent, as amended, restated, supplemented or otherwise modified from time to time.

"Borrower" is defined in the preamble.

"Builder" is defined in the preamble.

"Business Day" means any day which is neither a Saturday or Sunday nor a legal holiday on which banks are authorised or required to be closed in New York City, London or Frankfurt, and if:

(a) the Loan is, or is to be, denominated in EUR, (in relation to any date for payment or purchase of EUR) any TARGET Day or if the applicable Business Day relates to an advance of all or part of the Loan, an Interest Period, prepayment or conversion, in each case with respect to the Loan bearing interest by reference to

the EURO Rate, a day on which dealings in deposits in EUR are carried on in the interbank market within the Participating Member States; or

(b) the Loan is, or is to be, denominated in USD and the Floating Rate applies, or is to apply:

(i) in the case of an advance of all or part of the Loan, an Interest Period, prepayment or conversion, in each case with respect to the Loan bearing interest by reference to the Floating Rate;

(ii) in the case of any date for payment or purchase of an amount relating to the Compounded Reference Rate (if applicable); or

(iii) in the case of the determination of the first day or the last day of an Interest Period for the Compounded Reference Rate (if applicable) or otherwise in relation to the determination of the length of such Interest Period,

any day which is a US Government Securities Business Day.

"Buyer's Allowance" has the meaning assigned to "NYC Allowance" in Article II.1.1 of the Construction Contract and, when such expression is prefaced by the word "incurred", shall mean such amount of the Buyer's Allowance, not exceeding EUR 64,300,000 as shall at the relevant time have been paid, or become payable, to the Builder by the Borrower under the Construction Contract as part of the Contract Price.

"Capital Lease Obligations" means obligations of the Borrower or any Subsidiary of the Borrower under any leasing or similar arrangement which, in accordance with GAAP, would be classified as capitalised leases.

"Capitalisation" means, at any date, the sum of (a) Net Debt on such date, plus (b) Stockholders' Equity on such date.

"Capitalised Lease Liabilities" means the principal portion of all monetary obligations of the Borrower or any of its Subsidiaries under any leasing or similar arrangement which, in accordance with GAAP, would be classified as capitalised leases, and, for purposes of this Agreement and each other Loan Document, the amount of such obligations shall be the capitalised amount thereof, determined in accordance with GAAP.

"Cash Equivalents" means all amounts other than cash that are included in the "cash and cash equivalents" shown on the Borrower's balance sheet prepared in accordance with GAAP.

"Change of Control" means, in relation to the Borrower, an event or series of events by which (A) any "person" or "group" (as such terms are used in Sections 13(d) and 14(d) of the Securities Exchange Act of 1934, but excluding any employee benefit plan of such person or its subsidiaries, and any person or entity acting in its capacity as trustee, agent or other fiduciary or administrator of any such plan) becomes the "beneficial owner" (as defined in Rules 13d-3 and 13d-5 under the Securities Exchange Act of 1934, except that a person or group shall be deemed to have "beneficial ownership" of all securities that such person or group has the right to acquire, whether such right is exercisable immediately or only after the passage of time (such right, an "option right")), directly or indirectly, of 50% or more of the equity securities of the Borrower entitled to vote for members of the board of directors or equivalent governing body of the

Borrower on a fully-diluted basis (and taking into account all such securities that such person or group has the right to acquire pursuant to any option right); or (B) during any period of 24 consecutive months, a majority of the members of the board of directors or other equivalent governing body of the Borrower cease to be composed of individuals (i) who were members of that board or equivalent governing body on the first day of such period, (ii) whose election or nomination to that board or equivalent governing body was approved by individuals referred to in clause (i) above constituting at the time of such election or nomination at least a majority of that board or equivalent governing body or (iii) whose election or nomination to that board or other equivalent governing body was approved by individuals referred to in clauses (i) and (ii) above constituting at the time of such election or nomination at least a majority of that board or equivalent governing body.

"Change in Law" means (a) the adoption after the date of this Agreement of any law, rule or regulation or (b) any change after the date of this Agreement in any law, rule or regulation or in the interpretation or application thereof by any governmental authority.

"CIRR" means:

(a) where the Loan is denominated in Dollars:

(i) the CIRR in respect of USD based on the OECD Arrangement for Officially Supported Export Credits and as set by KfW on behalf of the Federal Republic of Germany pursuant to section 3.4.1(c) and includes the CIRR administrative margin of 0.20% per annum and which shall, in aggregate, be equal or greater than the USD CIRR Floor; or

(ii) where Section 3.4.1(c) applies and KfW has not set a CIRR for Dollars, the USD CIRR Cap; or

(iii) where Section 3.4.1(b) applies, the KfW Fixed Rate for Dollars; or

(b) where the Loan is denominated in EUR:

(i) the CIRR in respect of EUR based on the OECD Arrangement for Officially Supported Export Credits and as set by KfW pursuant to section 3.4.1(c) and includes the CIRR administrative margin of 0.20% per annum and which shall, in aggregate, be equal to or greater than the EUR CIRR Floor; or

(ii) where Section 3.4.1(c) applies and KfW has not set a CIRR for EUR, the EUR CIRR Cap; or

(iii) where Section 3.4.1(b) applies, the KfW Fixed Rate for EUR.

"CIRR Agreement" means either an Option A Refinancing Agreement or an Option B Interest Make-Up Agreement

"CIRR Guarantee" means the interest make-up guarantee provided by the Federal Republic of Germany to a Lender pursuant to Section 1.1 of the Terms and Conditions.

"Code" means the Internal Revenue Code of 1986, as amended, reformed or otherwise modified from time to time.

"Commitment" means in respect of a Lender as at the Amendment Six Effective Date, the amount set opposite that Lender’s name under the column titled “Total Commitment” in Exhibit Q and which:

(i) in the case of an Increase Lender, shall include that Increase Lender’s Increase Commitment; and

(ii) in the case of any Lender that becomes a Lender after the Amendment Six Effective Date pursuant to an assignment pursuant to Section 11.11.1, the amount set forth as such Lender's Commitment (including any Increase Commitment (if applicable)) in the related Lender Assignment Agreement,

in each case as such amount may be reduced from time to time pursuant to Section 2.3 or reduced or increased from time to time pursuant to assignments by or to such Lender pursuant to Section 11.11.1.

"Commitment Fees" is defined in Section 3.5.

"Commitment Fee Termination Date" is defined in Section 3.5.

"Commitment Letter" means the letter dated 11 February 2019 (as amended from time to time) issued by the Facility Agent to the Original Borrower and the Borrower and which sets out the principal terms and conditions of this Agreement.

"Commitment Termination Date" means 31 December 2023.

“Compounded Reference Rate” has the meaning given to it in, and is determined in accordance with, Exhibit R.

“Compounded Reference Rate Supplement” has the meaning given to it in Exhibit R.

“Compounding Methodology Supplement” has the meaning given to it in Exhibit R.

"Construction Contract" is defined in the preamble.

"Construction Mortgage" means the first ranking shipbuilding mortgage (Hoechstbetragsschiffshypothek) in respect of the Purchased Vessel executed or to be executed by the Builder in favour of banks and financial institutions designated by the Builder to secure loans made or to be made to the Builder to finance the construction of the Purchased Vessel.

"Contract Price" is as defined in the Construction Contract and includes the Buyer's Allowance.

"Covered Taxes" is defined in Section 4.6.

"Credit Adjustment Spread" has the meaning given to it in Exhibit R.

"Credit Card Obligations" means any obligations of the Borrower under credit card processing arrangements or other similar payment processing arrangements entered into in the ordinary course of business of the Borrower.

“Cumulative Compounded RFR Rate” has the meaning given to it in, and is determined in accordance with, Exhibit R.

“Daily Non-Cumulative Compounded RFR Rate” has the meaning given to it in, and is determined in accordance with, Exhibit R.

"DDTL Indebtedness" means the Borrower's Indebtedness (or, if such Indebtedness has not yet been incurred, the commitments by lenders to provide Indebtedness to the Borrower as of the effectiveness of the Amendment Number One) in connection with that certain Commitment Letter, dated as of August 12, 2020, between the Borrower and MORGAN STANLEY SENIOR FUNDING INC. (as amended, restated, extended, supplemented, refinanced, replaced or otherwise modified from time to time).

“Debt Deferral Extension Regular Monitoring Requirements" means the general test scheme/reporting package in the form set out in Exhibit O to this Agreement submitted or to be submitted (as the case may be) by the Borrower in accordance with Section 7.1.1(i).

"Debt Incurrence" means any incurrence of indebtedness for borrowed money by any Group Member, whether pursuant to a public offering or a Rule 144A or other private placement of debt securities (and including any secured debt securities (but excluding any unsecured debt securities) which are convertible into equity securities of the Borrower) or an incurrence of loans under any loan or credit facility, or any issuance of bonds, other than:

(a) any indebtedness (but having regard, in respect of any secured and/or guaranteed indebtedness, to the restrictions set out in Section 7.2.10(b)) incurred by a Group Member between April 1, 2020 and December 31, 2022 (or such later date as may, with the prior consent of Hermes, be agreed between the Borrower and the Lenders) for the purpose of providing crisis and/or recovery-related funding;

(b) indebtedness incurred by a Group Member pursuant to an intra-Group loan from another Group Member, provided that no Group Member shall be permitted to incur any such Indebtedness at any time where an Event of Default or a Prepayment Event has occurred and is continuing;

(c) indebtedness incurred to refinance (and for this purpose having regard to the applicable provisions of Section 7.2.10) a maturity payment under any existing loan or credit facility (including any crisis and/or recovery-related indebtedness incurred by a Group Member between April 1, 2020 and December 31, 2022) or issued bonds of a Group Member, provided that:

(i) in the case of any such refinancing, the amount of such indebtedness being used in connection with that refinancing does not increase the aggregate principal amount of such indebtedness or the commitments outstanding at the time of that refinancing and is otherwise incurred on a basis permitted pursuant to this Agreement (including, without limitation, in relation to the provision of any Liens or guarantees that may be provided to support the relevant refinancing arrangement); and

(ii) in the case of the refinancing of crisis and/or recovery-related indebtedness of the type referred to above, that refinancing shall either (A) reduce the interest burden of the Borrower (and for such purposes the interest rate of any floating rate debt shall be determined based on reference rates then in effect at the time of the new debt incurrence) or (B) replace the existing secured and/or guaranteed indebtedness with unsecured and unguaranteed debt;

(d) indebtedness provided by banks or other financial institutions under the Borrower’s senior unsecured revolving credit facilities in an aggregate amount not greater than the commitments thereunder as in effect on 19 February 2021 plus the amount of any existing uncommitted incremental facilities (for example, any unused accordion) on such facilities;

(e) indebtedness provided by banks or other financial institutions which, as at 19 February 2021, is committed but yet to be incurred in respect of the DDTL Indebtedness (but, in respect of that DDTL Indebtedness, up to a maximum amount of $700,000,000 or, where the Borrower has exercised the pre-existing accordion option in respect of that DDTL Indebtedness, a maximum amount of $1,000,000,000 (but on the basis that, following the exercise of that accordion option, an amount equal to the additional $300,000,000 or, if the amount of indebtedness incurred under such accordion option is less, the relevant amount made available under the DDTL Indebtedness shall be included in the overall limit on secured and/or guaranteed indebtedness set out in Section 7.2.10(b)));

(f) any of the following types of indebtedness in each case incurred in the ordinary course of business of any Group Member:

(i) the issuances of commercial paper;

(ii) Capitalized Lease Liabilities;

(iii) purchase money indebtedness;

(iv) indebtedness under overdraft facilities; and

(v) financial obligations in connection with repurchase agreements and/or securities lending arrangements; and

(g) vessel financings (including the financing of pre-delivery contract installments, change orders, owner furnished equipment costs or other such similar arrangements) in respect of vessels for which shipbuilding contracts have been executed on or prior to 1 April 2020 (provided, however, that a refinancing of a vessel financing shall not be included in this carve-out (g).

There shall be a presumption that any indebtedness incurred by the Borrower between April 1, 2020 and December 31, 2022 shall be for the purpose of providing crisis and/or recovery-related funding unless the intended use of proceeds from such indebtedness are specifically identified to be used for an alternative purpose. In the event there is any question as to whether funding qualifies as "crisis and/or recovery-related", Hermes, the Facility Agent and the Borrower shall negotiate a resolution in good faith for a maximum period of fifteen (15) Business Days.

"Default" means any Event of Default or any condition, occurrence or event which, after notice or lapse of time or both, would constitute an Event of Default.

"Defaulting Lender" means any Lender:

(a) which has failed to make its participation in the Loan available (or has notified the Facility Agent or the Borrower (which has notified the Facility Agent) that it will not make its participation in the Loan available) by the Disbursement Date;

(b) which has otherwise rescinded or repudiated a Loan Document; or

(c) with respect to which a Lender Insolvency Event has occurred and is continuing,

unless, in the case of paragraph (a) above:

(i) its failure to pay is caused by:

(A) administrative or technical error; or

(B) a Disruption Event; and

payment is made within three Business Days of its due date; or

(ii) the Lender is disputing in good faith whether it is contractually obliged to make the payment in question.

"Delivery Date" means the date on which the Purchased Vessel is delivered by the Builder to, and accepted by, the Borrower under the Construction Contract.

"Disbursement Date" means the date on which the Loan is advanced; provided that if the Loan is re-borrowed pursuant to Section 3.8, then, for all purposes of this Agreement concerning such re-borrowed Loan, the Disbursement Date shall be the date of such re-borrowing. When such expression is prefaced by the word "expected", it shall denote the date on which the Borrower then reasonably expects the Loan to be disbursed based upon the then-scheduled Delivery Date of the Purchased Vessel.

"Dispose" means to sell, transfer, license, lease, distribute or otherwise transfer, and "Disposition" shall have a correlative meaning.

"Disruption Event" means either or both of:

(a) a material disruption to those payment or communications systems or to those financial markets which are, in each case, required to operate in order for payments to be made in connection with this loan facility (or otherwise in order for the transactions contemplated by the Loan Documents to be carried out) which disruption is not caused by, and is beyond the control of, any of the parties to this Agreement; or

(b) the occurrence of any other event which results in a disruption (of a technical or systems-related nature) to the treasury or payments operations of a party to this Agreement preventing that, or any other party to this Agreement:

(i) from performing its payment obligations under the Loan Documents; or

(ii) from communicating with other parties to this Agreement in accordance with the terms of the Loan Documents,

and which (in either such case) is not caused by, and is beyond the control of, the party to this Agreement whose operations are disrupted.

"Dollar", "USD" and the sign "$" mean lawful money of the United States.

"Dollar Pledged Account" means the Dollar account referred to in the Pledge Agreement.

“Early Warning Monitoring Period” means the period beginning on the Amendment Two Effective Date and ending on the last day of two consecutive Fiscal Quarters where the Borrower’s Adjusted EBITDA after Interest for each such Fiscal Quarter is a positive number, as evidenced pursuant to the certificate to be submitted by the Borrower pursuant to Section 7.1.1.(l) (and such day shall be notified to the Borrower by the Facility Agent).

“EBITDA” means, for any Last Reported Fiscal Quarter, the Borrower’s consolidated operating income for such period plus any depreciation and amortization expenses that were deducted in calculating consolidated operating income for such period and minus consolidated interest expense of the Borrower for such period (net of any capitalized interest and interest income), in each case as determined in accordance with GAAP.

"ECA Financed Vessel" means any Vessel subject to any ECA Financing.

"ECA Financing" means any financing arrangement pursuant to which one or more ECA Guarantor provides guarantees or other credit support (including but not limited to a sale and leaseback transaction or bareboat charter or lease or an arrangement whereby a Vessel under construction is pledged as collateral to secure the indebtedness of a shipbuilder, and, for the avoidance of doubt, committed but undrawn export credit agency facilities), entered into by the Borrower or a Subsidiary for the purpose of financing or refinancing all or any part of the purchase price, cost of design or construction of a Vessel or Vessels or the acquisition of Equity Interests of entities owning, or to own, Vessels.

“ECA Guarantor” means BpiFrance Assurance Export, Finnvera plc or Euler Hermes Aktiengesellschaft (or, in each case, any successor thereof).

"Effective Date" is defined in the preamble.

"Election Date" means the date falling 65 days prior to the actual Disbursement Date.

"Environmental Laws" means all applicable federal, state, local or foreign statutes, laws, ordinances, codes, rules and regulations (including consent decrees and administrative orders) relating to the protection of the environment.

"Equity Interests" means, with respect to any Person, all of the shares, interests, rights, participations or other equivalents (however designated) of capital stock of (or other ownership or profit interests or units in) such Person and all of the warrants, options or other rights for the purchase, acquisition or exchange from such Person of any of the foregoing (including through convertible securities) but excluding any debt securities convertible into such Equity Interests.

"EUR" and the sign "€" mean the currency of participating member states of the European Monetary Union pursuant to Council Regulation (EC) 974/98 of 3 May 1998, as amended from time to time.

"EUR CIRR Cap" means 2.70% per annum.

"EUR CIRR Floor" means the CIRR in respect of EUR at the time of signing of the Construction Contract which is equal to 0.82% per annum.

"EUR Fixed Rate Margin" means 0.40% per annum.

"EUR Floating Rate Margin" means 0.60% per annum.

"EUR Pledged Account" means the EUR account referred to in the Pledge Agreement.

"EUR Reference Banks" means, if the Loan is, or is to be, denominated in EUR and the EURO Rate for any Interest Period cannot be determined pursuant to paragraph (a) of the definition of "EURO Rate", those banks designated as EUR Reference Banks by the Facility Agent from time to time that are reasonably acceptable to the Borrower, and each additional EUR Reference Bank and/or each replacement EUR Reference Bank appointed by the Facility Agent pursuant to Section 3.4.6.

"EUR Screen Rate" means, in relation to EUR, the euro interbank offered rate administered by the Banking Federation of the European Union (or any other person which takes over the administration of that rate) for the relevant period displayed on page EURIBOR01 of the Thomson Reuters screen (or any replacement Thomson Reuters page which displays that rate or on the appropriate page of such other information service which publishes that rate from time to time in place of Thomson Reuters. If such page or service ceases to be available, the Facility Agent may specify another page or service displaying the relevant rate after consultation with the Borrower.

"EURO Rate" means the EUR Screen Rate at or about 10:00 a.m. (London time) two (2) TARGET Days before the commencement of the relevant Interest Period; provided that:

(a) subject to Section 3.4.6, if no such offered quotation appears on Thomson Reuters EURIBOR01 Page (or any successor page) at the relevant time the EURO Rate shall be the rate per annum certified by the Facility Agent to be the average of the rates quoted by the EUR Reference Banks as the rate at which each of the EUR Reference Banks was (or would have been) offered deposits of EUR by prime banks in the interbank market within the Participating Member States in an amount approximately equal to the amount of the Loan and for a period of six months;

(b) for the purposes of determining the post-maturity rate of interest under Section 3.4.4, the EURO Rate shall be determined by reference to deposits on an overnight or call basis or for such other period or periods as the Facility Agent may determine after consultation with the Lenders, which period shall be no longer than one month unless the Borrower otherwise agrees; and

(c) if the EURO Rate determined in accordance with the foregoing provisions of this definition is less than zero, such rate shall be deemed to be zero for the purpose of this Agreement.

"Event of Default" is defined in Section 8.1.

"Existing Principal Subsidiaries" means each Subsidiary of the Borrower that is a Principal Subsidiary on the Effective Date.

"Facility Agent" is defined in the preamble and includes each other Person as shall have subsequently been appointed as the successor Facility Agent, and as shall have accepted such appointment, pursuant to Section 10.5.

"FATCA" means Sections 1471 through 1474 of the Code, as in effect at the date hereof (or any amended or successor version that is substantively comparable), any current or future regulations promulgated thereunder or official interpretations thereof, any agreements entered into pursuant to Section 1471(b)(1) of the Code and any fiscal or regulatory legislation, rules or official practices adopted pursuant to any published intergovernmental agreement entered into in connection with the implementation of such sections of the Code, any published intergovernmental agreement entered into in connection with the implementation of such Sections of the Code and any fiscal or regulatory legislation, rules or practices adopted pursuant to such published intergovernmental agreements.

"FATCA Deduction" means a deduction or withholding from a payment under a Loan Document required by FATCA.

"FATCA Exempt Party" means a party to this Agreement that is entitled to receive payments free from any FATCA Deduction.

"Fee Letter" means any letter entered into by reference to this Agreement between any or all of (a) the Facility Agent, the Initial Mandated Lead Arranger and/or, the Lenders and (b) the Original Borrower or the Borrower, setting out the amount of certain fees referred to in, or payable in connection with, this Agreement.

"Final Maturity" means the date occurring 144 months (being 12 years) after the Disbursement Date.

"Financial Covenant Waiver Period" means the period from and including April 1, 2020 to and including December 31, 2022.

“First Additional Hermes Fee” means the additional premium payable to Hermes under, and in respect of, the amendment to the Hermes Insurance Policy made in connection with Amendment Number Three and the making available of the First Increase Tranche.

"First Fee" is defined in Section 11.13.

“First Increase Commitment” means, in relation to each First Increase Lender, the amount of its Commitment in respect of the First Increase Loan Amount (as more particularly set out in Exhibit Q), to the extent not cancelled, reduced or assigned by it under this Agreement.

“First Increase Lenders” means each New Lender (as defined in Amendment Number Three) and each other Lender which has, in accordance with Amendment Number Three, agreed to provide the First Increase Commitment (together with each other Person that shall become a "Lender" in respect of the First Increase Tranche in accordance with Section 11.11.1 hereof), and which in each case has not ceased to be a Lender in accordance with the terms of this Agreement.

“First Increase Loan Amount” means the increase in the amount of the Original Loan Amount in an amount of up to the US Dollar Equivalent of EUR82,621,000.

“First Increase Tranche” means the advance made available or to be made available (as the case may be) by the First Increase Lenders in an aggregate amount not to exceed the First Increase Loan Amount or, as the case may be, the aggregate outstanding amount of such advance from time to time.

"First Priority Assets" means the Vessels known on the date the Amendment Number One becomes effective as or that sailed under the name (i) Celebrity Constellation, (ii) Celebrity Equinox, (iii) Celebrity Millennium, (iv) Celebrity Silhouette, (v) Celebrity Summit, (vi) Celebrity Eclipse, (vii) Celebrity Infinity, (viii) Celebrity Reflection and (ix) Celebrity Solstice (it being understood that such Vessels shall remain "First Priority Assets" regardless of any change in name or ownership after such date).

"First Priority Guarantee" means the first priority guarantee granted by the First Priority Guarantor on or prior to the date of effectiveness of Amendment Number One (and any other first priority guarantee granted by a First Priority Holdco Subsidiary in connection with becoming a First Priority Guarantor) in favour of the Facility Agent for the benefit of the Agents and the Lenders, in each case substantially in the form attached hereto as Exhibit H.

"First Priority Guarantor" means Celebrity Cruise Lines Inc. (and any of its successors) and any other First Priority Holdco Subsidiary that has granted or, prior to that entity becoming a First Priority Holdco Subsidiary pursuant to a Disposal of a First Priority Asset in accordance with Section 7.2.8(a)(v)(A), will grant a First Priority Guarantee.

"First Priority Holdco Subsidiaries" means one or more Subsidiaries of the Borrower that directly own any of the Equity Interests issued by any other Subsidiary of the Borrower that owns any First Priority Assets.

"First Priority Release Event" means the occurrence of any event or other circumstance that results in either (x) 80% of the aggregate principal amount of Bank Indebtedness outstanding as of the effectiveness of the Amendment Number One (being $5,300,000,000 (and 80% of which is $4,240,000,000)) or (y) 100% of the aggregate principal amount of Secured Note Indebtedness outstanding as of the effectiveness of the Amendment Number One (being $3,320,000,000):

(a) no longer remaining outstanding (whether as a result of repayment, redemption or otherwise (but excluding in connection with any enforcement action taken by the relevant creditors in respect of that Indebtedness)); and

(b) not having been refinanced (whether initially or through subsequent refinancings) with Indebtedness that is (i) secured by a Lien or (ii) incurred or guaranteed by any one or more Subsidiaries of the Borrower.

Notwithstanding the foregoing, a First Priority Release Event shall in no case occur if the Borrower has failed to pay any Indebtedness that is outstanding under any ECA Financing (including this Agreement) when the same becomes due and payable (whether by scheduled maturity, required prepayment, acceleration, demand or otherwise). For the avoidance of doubt, if a First Priority Release Event would have occurred but for the continuance of the payment default described above, then a First Priority Release Event will occur immediately upon that payment default being remedied.

"Fiscal Quarter" means any quarter of a Fiscal Year.

"Fiscal Year" means any annual fiscal reporting period of the Borrower.

"Fixed Charge Coverage Ratio" means, as of the end of any Fiscal Quarter, the ratio computed for the period of four consecutive Fiscal Quarters ending on the close of such Fiscal Quarter of:

(a)

(i) save as provided in (a)(ii) below, net cash from operating activities (determined in accordance with GAAP) for such period; or

(ii) in the case of the end of each of the first three Fiscal Quarters ending after the last day of the Fiscal Quarter ending on September 30, 2022, the Annualized Net Cash from Operating Activities for such relevant Fiscal Quarter, to;

(b) the sum of:

(i) dividends actually paid by the Borrower during such period (including without limitation, dividends in respect of preferred stock of the Borrower); plus

(ii) scheduled cash payments of principal of all debt less New Financings (determined in accordance with GAAP, but in any event including Capitalised Lease Liabilities) of the Borrower and its Subsidiaries for such period.

"Fixed Rate" means:

(a) where the Loan is denominated in Dollars, a rate per annum equal to the sum of the applicable CIRR plus the relevant USD Fixed Rate Margin;

(b) where the Loan is denominated in EUR, a rate per annum equal to the sum of the applicable CIRR plus the relevant EUR Fixed Rate Margin; and

(c) where the Borrower has made an election under Section 3.4.1(b), the KfW Fixed Rate.

"Fixed Rate Loan" means the Loan bearing interest at the Fixed Rate, or that portion of the Loan that continues to bear interest at the Fixed Rate after the termination of any CIRR Agreement pursuant to Section 3.4.3.

"Fixed Rate Margin" means the relevant USD Fixed Rate Margin or, as the case may be, the relevant EUR Fixed Rate Margin.

"Floating Rate" means:

(a) where the Loan is denominated in Dollars, the percentage rate per annum equal to the sum of:

(i) in the case of the Floating Rate Loan (excluding the Second Increase Tranche, in respect of which sub-paragraph (ii) below shall apply), the Reference Rate (or, if applicable at the relevant time of determination, the Compounded Reference Rate) plus the relevant USD Floating Rate Margin and, without double counting (having regard to the definition of Compounded Reference Rate), the Credit Adjustment Spread; and

(ii) in the case of the Second Increase Tranche, the Reference Rate (or, if applicable at the relevant time of determination, the Compounded Reference Rate) plus the relevant USD Floating Rate Margin; or

(b) where the Loan is denominated in EUR, the percentage rate per annum equal to the sum of the EURO Rate plus the relevant EUR Floating Rate Margin.

"Floating Rate Indemnity Amount" is defined in Section 4.4.1(a).

"Floating Rate Loan" means all or any portion of the Loan bearing interest at the Floating Rate.

"Floating Rate Margin" means the relevant USD Floating Rate Margin or, as the case may be, the relevant EUR Floating Rate Margin.

“Framework” means the document titled “Debt Deferral Extension Framework” in the form set out in Exhibit N to this Agreement, and which sets out certain key principles and parameters and being applicable to Hermes-covered loan agreements such as this Agreement.

"F.R.S. Board" means the Board of Governors of the Federal Reserve System or any successor thereto.

"Funding Losses Event" is defined in Section 4.4.1.

"Further Withdrawal Date" is defined in Section 2.4(d)(iii).

"Further Withdrawal Request" means the withdrawal request duly executed by an Authorised Officer of the Borrower, substantially in the form of Exhibit S hereto.

"GAAP" is defined in Section 1.5.

"Government-related Obligations" means obligations of the Borrower or any Subsidiary of the Borrower under, or Indebtedness incurred by the Borrower or any Subsidiary of the Borrower to satisfy obligations under, any governmental requirement imposed by any Applicable Jurisdiction that must be complied with to enable the Borrower and its Subsidiaries to continue

its or their business in such Applicable Jurisdiction, excluding, in any event, any taxes imposed on the Borrower or any Subsidiary of the Borrower.

“Group” means the Borrower and its Subsidiaries from time to time.

“Group Member” means any entity that is a member of the Group.

“Group Member Guarantee” means any guarantee or other similar or analogous credit support arrangement granted by a Group Member (other than the Borrower) in support of the Indebtedness of another Group Member or any other Person.

“Guarantor” is defined in the preamble.

"Hedging Instruments" means options, caps, floors, collars, swaps, forwards, futures and any other agreements, options or instruments substantially similar thereto or any series or combination thereof used to hedge one or more interest, foreign currency or commodity exposures.

"herein", "hereof", "hereto", "hereunder" and similar terms contained in this Agreement or any other Loan Document refer to this Agreement or such other Loan Document, as the case may be, as a whole and not to any particular Section, paragraph or provision of this Agreement or such other Loan Document.

"Hermes" means Euler Hermes Aktiengesellschaft, Gasstraße 27, 22761 Hamburg, Germany acting in its capacity as representative of the Federal Republic of Germany in connection with the issuance of export credit guarantees.

"Hermes Agent" is defined in the preamble.

"Hermes EUR Equivalent" means, where the Loan is to be denominated in EUR and for the calculation and reimbursement of the Hermes Fee to the Borrower in EUR, the amount thereof paid in Dollars for the First Fee and the Second Fee converted to a corresponding EUR amount as determined by Hermes on the basis of the latest rate for the purchase of Dollars with EUR to be published by the German Federal Ministry of Finance prior to the time that Hermes issues its invoice for the Hermes Fee.

"Hermes Fee" means the aggregate of the Original Hermes Fee, the First Additional Hermes Fee and the Second Additional Hermes Fee.

"Hermes Insurance Policy" means the export credit guarantee (Finanzkreditgarantie) issued by the Federal Republic of Germany, represented by Hermes, in favour of the Lenders.

"Illegality Notice" is defined in Section 3.2(b).

“Increase Commitment” means, in relation to an Increase Lender, the aggregate amount of its First Increase Commitments and its Second Increase Commitments.

“Increase Lenders” means, together, the First Increase Lenders and the Second Increase Lenders.

“Increase Tranches” means, together, the First Increase Tranche and the Second Increase Tranche.

"Indebtedness" means, for any Person: (a) obligations created, issued or incurred by such Person for borrowed money (whether by loan, the issuance and sale of debt securities or the sale of property to another Person subject to an understanding or agreement, contingent or otherwise, to repurchase such property from such Person); (b) obligations of such Person to pay the deferred purchase or acquisition price of property or services, other than (i) trade accounts payable (other than for borrowed money) arising, and accrued expenses incurred, in the ordinary course of business so long as such trade accounts payable are payable within 180 days of the date the respective goods are delivered or the respective services are rendered and (ii) any purchase price adjustment, earnout or deferred payment of a similar nature incurred in connection with an acquisition (but only to the extent that no payment has at the time accrued pursuant to such purchase price adjustment, earnout or deferred payment obligation); (c) Indebtedness of others secured by a Lien on the property of such Person, whether or not the respective Indebtedness so secured has been assumed by such Person; (d) obligations of such Person in respect of letters of credit or similar instruments issued or accepted by banks and other financial institutions for the account of such Person; (e) Capital Lease Obligations of such Person; (f) guarantees by such Person of Indebtedness of others, up to the amount of Indebtedness so guaranteed by such Person; (g) obligations of such Person in respect of surety bonds and similar obligations; and (h) liabilities arising under Hedging Instruments.

"Indemnified Liabilities" is defined in Section 11.4.

"Indemnified Parties" is defined in Section 11.4.

"Information Package" means the general test scheme/information package in connection with the application for a debt holiday in the form of Exhibit G hereto submitted or to be submitted (as the case may be) by the Borrower in order to obtain the benefit of the measures provided for in the Principles for the purpose of this Agreement and certain of its obligations under this Agreement.

"Interest Period" means the period from and including the Disbursement Date up to and including the first Repayment Date, and subsequently each succeeding period from and including the last day of the prior Interest Period up to and including the next Repayment Date, except that:

(a) any Interest Period which would otherwise end on a day which is not a Business Day shall end on the next Business Day to occur, except if such Business Day does not fall in the same calendar month, the Interest Period will end on the last Business Day in that calendar month, the interest amount due in respect of the Interest Period in question and in respect of the next following Interest Period being adjusted accordingly;

(b) if any Interest Period is altered by the application of a) above, the subsequent Interest Period shall end on the day on which it would have ended if the preceding Interest Period had not been so altered; and

(c) where Section 3.4.2(c) applies, the Interest Period shall, but still having regard to the above provisions, be determined in accordance with Section 3.4.2(c).

"Investment Grade" means, with respect to Moody's, a Senior Debt Rating of Baa3 or better and, with respect to S&P, a Senior Debt Rating of BBB- or better.

"KfW" means KfW of Palmengartenstraße 5-9, 60325 Frankfurt am Main, Germany, in its capacities as (a) the mandated CIRR provider on behalf of the government of the Federal Republic of Germany (represented by the Federal Ministry of Economic Affairs and Energy and the Federal Ministry of Finance) or (b) as refinancing bank with respect to the Option A Refinancing Agreements, in each case with KfW in turn being represented by KfW IPEX or (c) in relation to Section 11.11.1(i) in its capacity as an Affiliate of KfW IPEX.

"KfW Fixed Rate" is defined in Section 3.4.1(b).

"KfW IPEX" means KfW IPEX-Bank GmbH.

“Last Reported Fiscal Quarter(s)” means the most recently completed Fiscal Quarter(s) for which the Borrower has filed financial statements with the SEC as part of an annual report on Form 10-Q or a quarterly report on Form 10-Q.

"Latest Date" has the meaning given to such term in Section 7.2 of the Terms and Conditions.

"Lender" and "Lenders" are defined in the preamble, and shall, from the Amendment Three Effective Date, include each New Lender (as defined in the Amendment Number Three).

"Lender Assignment Agreement" means any Lender Assignment Agreement substantially in the form of Exhibit C.

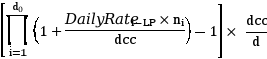

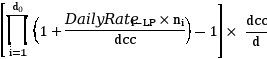

"Lender Insolvency Event" means, in relation to a Lender, the appointment of a liquidator, receiver, administrative receiver, examiner, administrator, compulsory manager or other similar officer in respect of that Lender or all or substantially all of that Lender's assets or any analogous procedure or step being taken in any jurisdiction with respect to that Lender.