Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K/A

(Amendment No. 1)

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2014

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 001-36172

ARIAD Pharmaceuticals, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 22-3106987 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

26 Landsdowne Street, Cambridge, Massachusetts 02139-4234

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (617) 494-0400

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| Common Stock, $.001 par value Preferred Stock Purchase Rights |

The NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | x | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the registrant’s common stock held by nonaffiliates of the registrant (without admitting that any person whose shares are not included in such calculation is an affiliate), computed by reference to the price at which the common stock was last sold, as of the last business day of the registrant’s most recently completed second fiscal quarter was approximately $1.1 billion.

As of April 27, 2015, the registrant had 188,545,350 shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE: None

Table of Contents

This Amendment No. 1 on Form 10-K/A (this “Form 10-K/A”) amends the Annual Report on Form 10-K of ARIAD Pharmaceuticals, Inc. (the “Company,” “we,” “our,” “us” or “ARIAD”) for the fiscal year ended December 31, 2014, as originally filed with the Securities and Exchange Commission (the “SEC”) on March 2, 2015 (the “Original Filing”). This Form 10-K/A amends the Original Filing to include the information required by Part III of the Original Filing because the Company has not and will not file a definitive proxy statement within 120 days after the end of its 2014 fiscal year. In addition, this Form 10-K/A amends Item 15 of Part IV of the Original Filing to update the Exhibit List and to include new certifications by our principal executive officer and principal financial officer under Section 302 of the Sarbanes-Oxley Act of 2002, as required by Rule 12b-15 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Except for the foregoing, we have not modified or updated disclosures presented in the Original Filing in this Form 10-K/A. Accordingly, this Form 10-K/A does not modify or update the disclosures in the Original Filing to reflect subsequent events, results or developments or facts that have become known to us after the date of the Original Filing. Information not affected by this amendment remains unchanged and reflects the disclosures made at the time the Original Filing was filed. Therefore, this Form 10-K/A should be read in conjunction with any documents incorporated by reference therein and our filings made with the SEC subsequent to the Original Filing.

This Form 10-K/A contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements are based on management’s expectations and are subject to certain factors, risks and uncertainties that may cause actual results, outcome of events, timing and performance to differ materially from those expressed or implied by such forward-looking statements. Forward-looking statements should be evaluated together with the many uncertainties that affect our business, particularly those mentioned in the section entitled “Certain Factors That May Affect Future Results of Operations” and in the Risk Factors in Item 1A of our Original Filing and in our periodic reports on Form 10-Q and Form 8-K. We are not under any obligation, and we expressly disclaim any obligation, to update or alter any forward-looking statements, whether as a result of new information, future events or otherwise. All subsequent forward-looking statements attributable to us or to any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this section.

Unless the content requires otherwise, references to “ARIAD,” “Company,” “we,” “our,” and “us,” in this Form 10-K/A refer to ARIAD Pharmaceuticals, Inc. and our subsidiaries.

1

Table of Contents

| 1 | ||||||||

| 1 | ||||||||

| PART III | 3 | |||||||

| Item 10: | 3 | |||||||

| Item 11: | 12 | |||||||

| Item 12: | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

47 | ||||||

| Item 13: | Certain Relationships and Related Transactions, and Director Independence |

49 | ||||||

| Item 14: | 51 | |||||||

| PART IV | 53 | |||||||

| Item 15: | Exhibits, Financial Statement Schedules | 53 | ||||||

| Signature Page | 54 | |||||||

2

Table of Contents

| ITEM 10: | DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE |

Board of Directors

Our Board of Directors (the “Board”) currently consists of nine members classified into three classes. Listed below are our nine directors by class. At each annual meeting of stockholders, the term for one class of directors expires, and directors are elected for a full term of three years to succeed the directors of such class.

| Class | Name | Position with ARIAD | Age* | Director Since | ||||

| 1 | Alexander J. Denner, Ph.D. | Director | 45 | 2014 | ||||

| Athanase Lavidas, Ph.D. | Director | 67 | 2003 | |||||

| Massimo Radaelli, Ph.D. | Director | 57 | 2008 | |||||

| 2 | Jay R. LaMarche | Director | 68 | 1992 | ||||

| Anna Protopapas | Director | 50 | 2015 | |||||

| Norbert G. Riedel, Ph.D. | Director | 57 | 2011 | |||||

| 3 | Harvey J. Berger, M.D. | Chairman of the Board, Chief Executive Officer and President | 64 | 1991 | ||||

| Sarah J. Schlesinger, M.D. | Director | 55 | 2013 | |||||

| Wayne Wilson | Lead Director | 66 | 2008 |

| * | Ages are provided as of April 20, 2015 |

Certain biographical information is set forth below for our directors. Additionally, information about the specific experience, qualifications, attributes or skills that led to our Board of Directors’ conclusion that each person listed below should serve as a director is also set forth below.

Class 1 Directors (Term to Expire in 2016)

Alexander J. Denner, Ph.D. has been a member of our Board since February 2014. He is a founding partner and Chief Investment Officer of Sarissa Capital Management LP, a registered investment advisor formed in 2012. Sarissa Capital focuses on improving the strategies of companies to better provide shareholder value. From 2006 to 2011, Dr. Denner served as a Senior Managing Director of Icahn Capital, an entity through which Carl C. Icahn conducts his investment activities. Prior to that, he served as a portfolio manager at Viking Global Investors, a private investment fund, and Morgan Stanley Investment Management, a global asset management firm. Dr. Denner has also served as a director of Biogen Inc. since June 2009 and as a director of VIVUS, Inc. since July 2013, all biopharmaceutical companies. Previously, Dr. Denner had also served as a director of the following healthcare companies: Amylin Pharmaceuticals, Inc., Enzon Pharmaceuticals and ImClone Systems Incorporated, where he also served as Chairman of the Executive Committee.

Dr. Denner is a member of our Board’s Nominating and Corporate Governance Committee. Dr. Denner brings to the Board a strong background overseeing the operations and research and development of biopharmaceutical companies and evaluating corporate governance matters. He also has extensive experience as an investor, particularly with respect to healthcare companies and has broad healthcare-industry knowledge.

Dr. Denner received his S.B. degree from the Massachusetts Institute of Technology and his M.S., M.Phil. and Ph.D. degrees from Yale University.

Athanase Lavidas, Ph.D. has been a member of our Board since September 2003 and served as our Lead Director from November 2008 until January 2014. He has been the Chairman and Chief Executive Officer of the Lavipharm Group, a pharmaceutical, cosmetics and consumer health-products company headquartered in Greece, since 1976. Dr. Lavidas is also Chairman of the Greece-U.S. Business Council and Chairman of SEV Business Council for International Activities, the international arm of the Hellenic Federation of Industries and Enterprises (SEV).

3

Table of Contents

Dr. Lavidas is Chair of our Board’s Nominating and Corporate Governance Committee and a member of our Board’s Compensation Committee. Dr. Lavidas brings to the Board over 30 years of international pharmaceutical industry experience in strategic development and operational management. Dr. Lavidas has expertise in the research, development and commercialization of innovative pharmaceutical and cosmetic products, as well as global pharmaceutical and biotechnology collaborations.

Dr. Lavidas received his S.B. and M.S. in chemistry from the University of Munich, his M.B.A. from the Institut Superieur de Marketing et de Management in Paris and his Ph.D. degree in pharmaceutical chemistry from the University of Athens.

Massimo Radaelli, Ph.D. has been a member of our Board since October 2008. He is the President and Chief Executive Officer of Noventia Pharma, a specialty pharmaceutical company focused on orphan drugs for the treatment of rare diseases, in particular for the central nervous system and respiratory system. Before joining Noventia in May 2009, Dr. Radaelli was President and Chief Executive Officer of Dompé International SA, the international pharmaceutical company of the Dompé Group. He joined Dompé in 1996 as director of corporate business development. Dr. Radaelli is also Executive Chairman of Bioakos Pharma Laboratories, a specialty pharmaceuticals company concentrated in the fields of gynecology, dermatology, ear, nose and throat and pediatrics and a director of Arriani International, SA, the international subsidiary of Arriani Pharmaceuticals, a pharmaceutical company in southeastern Europe. Since January 2014, Dr. Radaelli has served as a director of NovaBay Pharmaceuticals, Inc., a clinical-stage biopharmaceutical company. He also serves as a director of Innotex SA, a privately held specialty pharmaceuticals and cosmetics business, and IDRI, a non-profit organization focused on neglected diseases. Dr. Radaelli is a member of the Italian Society of Pharmacology and has been awarded the highest ranking honor of the Italian Republic by the President and Prime Minister of Italy for merit acquired in the fields of science and biopharma and for his commitment to patients with rare diseases and unmet medical needs.

Dr. Radaelli is a member of our Board’s Audit Committee and Science and Medicine Committee. He brings over 25 years of industry experience to the Board, including senior leadership positions with major European pharmaceutical companies. Dr. Radaelli also brings to the Board significant strategic and operational industry experience, including expertise in pharmaceutical business development, strategic planning, alliance management, and product development and commercialization.

Dr. Radaelli received a University Degree in pharmaceutical sciences and a Ph.D. in clinical pharmacology from the University of Milan and an Executive Master of Business from Bocconi University of Milan.

Class 2 Directors (Term to Expire in 2017)

Jay R. LaMarche has been a member of our Board since January 1992. He is a retired financial executive who served us in executive leadership positions including Chief Financial Officer and Treasurer from January 1992 to November 2000. Mr. LaMarche was our Executive Vice President from March 1997 to November 2000 and Senior Vice President, Finance from January 1992 to February 1997. Before joining ARIAD, he was Chief Financial Officer and a director of ChemDesign Corporation, a fine chemicals manufacturer. Previously, Mr. LaMarche was an audit partner with Deloitte Haskins & Sells, a public accounting firm. Mr. LaMarche also served as an officer in the United States Navy.

Mr. LaMarche is a member of our Board’s Audit Committee and Nominating and Corporate Governance Committee. Mr. LaMarche brings to our Board more than 40 years of financial and senior operating experience. He has extensive knowledge of our operations, as well as expertise in financial and accounting issues, particularly as they relate to the pharmaceutical and biotechnology industry. Mr. LaMarche’s management experience and financial background serve him well in providing guidance concerning our operations and business strategy.

Mr. LaMarche received his B.B.A. degree in public accountancy from the University of Notre Dame.

Anna Protopapas has been a member of our Board since April 2015. She has been the President and Chief Executive Officer of Mersana Therapeutics, Inc. (“Mersana”), a biotechnology company focused on engineering novel antibody-drug conjugates, since March 2015. From October 2010 to October 2014, she served as a member of the Executive Committee of Takeda Pharmaceutical Company Limited, a global pharmaceutical company, and held various senior management positions, including serving as President of Millennium Pharmaceuticals, a wholly owned subsidiary of Takeda focused in oncology, where she was responsible for leading Takeda’s oncology business, and Executive Vice President of Global Business Development, where she was responsible for global acquisitions, partnering, licensing and venture investing. From October 1997 to October 2010, Ms. Protopapas served in various positions at Millennium Pharmaceuticals, including as the Senior Vice President of Strategy and Business Development and a member of the Executive Committee, where she led the company’s business development initiatives. Ms. Protopapas has been a member of the board of directors of Mersana since March 2015 and was a member of the board of directors of Ensemble Therapeutics, a company focused on engineering novel therapeutics, from 2006 to 2013.

4

Table of Contents

Ms. Protopapas brings significant industry experience to the Board, including extensive transactional and senior management experience in the oncology industry.

Ms. Protopapas received a B.S. in engineering from Princeton University, an M.S. in chemical engineering practice from Massachusetts Institute of Technology and a MBA from Stanford Graduate School of Business.

Norbert G. Riedel, Ph.D. has been a member of our Board since April 2011. He is the President and Chief Executive Officer of Naurex Inc., a clinical-stage biopharmaceutical company developing therapies for difficult-to-treat depression as well as orphan and other challenging diseases of the central nervous system. Before joining Naurex Inc. in January 2014, he was Corporate Vice President and Chief Scientific Officer of Baxter International Inc., a diversified healthcare company from March 2001 until January 2013. Before assuming this role, from 1998 to 2001, Dr. Riedel served as President and General Manager of the recombinant therapeutic proteins business unit and Vice President of Research and Development at Baxter’s bioscience business. Prior to joining Baxter, from 1996 to 1998, he was head of worldwide biotechnology and worldwide core research functions at Hoechst-Marion Roussel, now Sanofi, a global pharmaceutical company. Previously, he held a series of scientific management positions at Hoechst-Marion Roussel and Hoechst AG. Dr. Riedel has been a member of the board of directors of Jazz Pharmaceuticals since May 2013 and was a member of the Supervisory Board of MediGene AG, a biotechnology company from 2003 to 2013. He is a member of the Board of Directors of the Illinois Biotechnology Industry Organization and also serves on the Advisory Board of Northwestern University’s Kellogg School of Management Center for Biotechnology, and the McCormick School of Engineering. In 2011, Dr. Riedel was appointed to the Illinois Innovation Council. From 1999 to 2010, Dr. Riedel was a member of the board of directors of Oscient Pharmaceuticals Corporation, a biopharmaceutical company, and its predecessor company, Genome Therapeutics Corporation, a genomics company. Dr. Riedel was a postdoctoral fellow at Harvard University from 1984 to 1987 and an Assistant Professor and Associate Professor of medicine and biochemistry at Boston University School of Medicine from 1987 to 1991, is an adjunct professor at Boston University School of Medicine, and an adjunct professor of Medicine at Northwestern University’s Feinberg School of Medicine and was a visiting professor at Massachusetts Institute of Technology in 1992. In 2009, Dr. Riedel was elected as a member of the Austrian Academy of Sciences.

Dr. Riedel is the Chair of our Board’s Compensation Committee and a member of the Science and Medicine Committee. Given his experience as a senior executive in the healthcare field, Dr. Riedel brings to the Board invaluable scientific and commercial expertise, as well as a keen understanding of the biotechnology industry, drug discovery and development and pharmaceutical management.

Dr. Riedel received his Diploma in biochemistry from the University of Frankfurt in 1981 and his Ph.D. in biochemistry from the University of Frankfurt in 1983.

Class 3 Directors (Term to Expire in 2015)

Harvey J. Berger, M.D. is our principal founder and has served as our Chairman of the Board and Chief Executive Officer since April 1991. He served as our President from April 1991 to September 2003 and from December 2004 to present. From 1986 to 1991, Dr. Berger held a series of executive management positions at Centocor, Inc., a biotechnology company, including Executive Vice President and President, Research and Development Division. He has also held senior academic and administrative appointments at Emory University, Yale University and the University of Pennsylvania and was an Established Investigator of the American Heart Association. Dr. Berger currently serves as a member of the Dean’s Council of Yale School of Medicine.

Dr. Berger plays a critical role in developing our research and development platform. Dr. Berger brings to the Board a unique combination of strategic vision, leadership skills and critical knowledge of our operations, research and development programs, commercialization efforts and the biopharmaceutical industry generally. Under his leadership, ARIAD discovered five new drug candidates and successfully led the development of Iclusig for refractory CML and Ph+ ALL. He brings over 30 years of experience in designing and running clinical trials, working successfully with the U.S. Food and Drug Administration (“FDA”) and other regulatory agencies, overseeing complex research and development programs, negotiating global transactions and managing a fully integrated oncology business. Following suspension of Iclusig in October 2013, Dr. Berger worked closely with the FDA and led the development and strategy to get Iclusig back on the market in less than two months, an unusually short period of time. Since then, he has overseen its successful broadened clinical development and commercialization. Dr. Berger has built and led the ARIAD organization since its inception, and his leadership of the ARIAD team is essential, especially at this time, to delivering on the Company’s three-year plan to profitability. In addition, Dr. Berger is one of our largest stockholders, beneficially owning approximately 2.5% of our common stock, which directly aligns his interests with those of all of our stockholders. These attributes, together with Dr. Berger’s demonstrated years of success in building ARIAD into a biopharmaceutical company with its first marketed cancer medicine and an advancing pipeline of highly promising drug candidates, distinctly qualify him for service as a director and as the Chairman of the Board.

5

Table of Contents

Dr. Berger received his A.B. degree in Biology from Colgate University and his M.D. degree from Yale University School of Medicine. He obtained further medical and research training at the Massachusetts General Hospital and Yale-New Haven Hospital.

Sarah J. Schlesinger, M.D. has been a member of our Board since July 2013. She has spent more than 20 years working in the field of cellular immunity, including as clinical director of the laboratory led by the late Ralph M. Steinman, M.D., 2011 Nobel Laureate in Physiology or Medicine. She is currently Senior Attending Physician and Associate Professor of Clinical Investigation at the Laboratory of Molecular Immunology at The Rockefeller University. Before joining The Rockefeller University in 2003, Dr. Schlesinger was a scientist at the International AIDS Vaccine Initiative in New York City from 2002 to 2003. From 1996 to 2002, Dr. Schlesinger was a Research Physician/Pathologist at the Division of Retrovirology at Walter Reed Army Institute of Research, having previously served, from 1994 to 2002, as Staff Pathologist at the Armed Force Institute of Pathology in Washington, DC. Dr. Schlesinger trained in Surgery at the Albert Einstein College of Medicine and began her career in pathology at Georgetown University in Washington, DC, and hospitals in New York including Buffalo General, Hospital New York and the Manhattan Eye, Ear and Throat Hospital. Dr. Schlesinger leads clinical trials and also chairs the research education and training committee of the Center for Clinical and Translational Science at The Rockefeller University Hospital. She is co-director of Rockefeller’s Clinical Scholars program, the Certificate in Clinical and Translational Sciences program and is the vice-chair of the hospital’s Institutional Review Board. Widely published in her field, Dr. Schlesinger has been recognized with numerous awards for her research and teaching. She also belongs to a number of prominent medical societies including the United States and Canadian Academy of Pathology, the American Association for the Advancement of Science and the College of American Pathologists.

Dr. Schlesinger’s experience leading clinical trials and dealing with the FDA in regulatory matters, coupled with her research expertise, have proven invaluable in her role as Chair of our Board’s Science and Medicine Committee. Her knowledge and expertise will play a vital role as we move forward with plans for broadened clinical development of its products and product candidates.

Dr. Schlesinger received her A.B. degree from Wellesley College in Wellesley, MA, and her M.D. from Rush Medical College in Chicago. She obtained further medical training in Pathology at The New York Hospital – Cornell Medical Center where she was chief resident.

Wayne Wilson has been a member of our Board since October 2008 and was appointed as Lead Director in January 2014. He has over 30 years of business, financial and accounting experience. He has been an independent business advisor since 2002. From 1995 to 2002, he served in various roles, including as President, Chief Operating Officer and Chief Financial Officer at PC Connection, Inc., a Fortune 1000 direct marketer of information technology products and services. From 1986 to 1995, Mr. Wilson was a partner in the assurance and advisory services practice of Deloitte & Touche LLP, a public accounting firm. Mr. Wilson is also a member of the boards of directors of FairPoint Communications, Inc., a telecommunications company, Hologic, Inc., a medical diagnostics and device company focusing on women’s health, and Edgewater Technology, Inc., a technology management consulting firm. He previously served as a director of Cytyc Corporation, a medical diagnostics and device company.

Mr. Wilson is Chair of our Board’s Audit Committee and a member of our Board’s Nominating and Corporate Governance Committee. Mr. Wilson brings substantial general business and financial expertise to the Board, as well as the Audit Committee. Mr. Wilson’s background and extensive experience in financial accounting and reporting make him well-equipped to evaluate financial results and to oversee the financial reporting process of a publicly traded corporation, making him highly qualified to be the Board’s Lead Director. Mr. Wilson’s six years of experience as an independent director of ARIAD, role as Lead Director and involvement in our critical business and strategic decisions, especially during the challenges of 2013, make him optimally positioned to act as a strong, independent voice for stockholders and the other directors in working with management. In addition to his tenure on our Board, he has substantial healthcare industry experience, having served, or currently serving, on the boards of two medical technology companies, including Hologic.

Mr. Wilson received an A.B. degree in political science from Duke University and an M.B.A. from the University of North Carolina at Chapel Hill.

Agreements with Dr. Denner and Sarissa

On February 20, 2014, we entered into a nomination and settlement agreement (the “Existing Settlement Agreement”) with Dr. Denner and Sarissa Capital Management LP and certain of its affiliated funds and entities (collectively, “Sarissa”). Pursuant to this agreement, the Board increased the size of the Board from eight to nine members and appointed Dr. Denner to the Board as a Class 1 director to serve until the 2016 annual meeting of stockholders (the “2016 Annual Meeting”). Dr. Denner was also appointed as a member of the Nominating and Corporate Governance Committee of the Board. We also agreed to appoint an additional director, referred to as the Additional Designee, selected by the Board and approved by Dr. Denner, as a Class 2 director with a term expiring at the 2017 annual meeting of stockholders (the “2017 Annual Meeting”).

6

Table of Contents

The agreement provides that, for so long as Dr. Denner is a member of the Board, we will give prior notice to Sarissa before the advance notice deadline in our bylaws if Dr. Denner or the Additional Designee (when appointed) will not be nominated for election at any future annual meeting of stockholders when their current terms expire. Following the appointment of the Additional Designee and for so long as Dr. Denner is a member of the Board, we have agreed not to increase the size of the Board above 10 members. Pursuant to the agreement, Dr. Denner will resign from the Board and any committee thereof if Sarissa no longer beneficially owns at least 6 million shares of our common stock.

In conjunction with the Existing Settlement Agreement, we and Sarissa also entered into a Confidentiality Agreement governing the provision of confidential information, obtained by Dr. Denner during his service on the Board, to Sarissa.

The foregoing is not a complete description of the terms of the Existing Settlement Agreement and the Confidentiality Agreement. For a further description of the terms of the agreements, including copies thereof, please see our Current Report on Form 8-K that we filed with the SEC on February 21, 2014.

In February 2015, Sarissa notified the Company of its intent to nominate a slate of three alternative directors in opposition to the nominees recommended by the Company’s Board of Directors for election at the Company’s 2015 annual meeting of stockholders (the “2015 Annual Meeting”).

On April 28, 2015, we entered into an agreement (the “New Settlement Agreement”) with Sarissa. Pursuant to this agreement, the Company and Sarissa agreed to settle the proxy contest pertaining to the election of directors to the Board at the 2015 Annual Meeting. In addition, Dr. Berger decided to retire as Chairman, Chief Executive Officer and President of the Company, upon the appointment of his permanent successor or December 31, 2015, whichever is earlier.

In addition, pursuant to the New Settlement Agreement, the Company agreed to promptly commence a search for a new Chief Executive Officer and formed a new committee of the Board chaired by Dr. Denner (the “CEO Search Committee”), which will be responsible for running the process for the selection of the new Chief Executive Officer. The other members of the CEO Search Committee are Dr. Riedel, Dr. Schlesinger and Mr. Wilson.

Pursuant to the New Settlement Agreement, effective as of April 28, 2015, the Board appointed Ms. Protopapas as a Class 2 director, with a term expiring at the 2017 Annual Meeting, by filling an existing vacancy in such class. The New Settlement Agreement provides that, for so long as each of Dr. Denner and Ms. Protopapas is a member of the Board, we will give prior notice to Sarissa before the advance notice deadline in our bylaws if Ms. Protopapas will not be nominated for election at any future annual meeting of stockholders when her current term expires. Pursuant to the New Settlement Agreement, Ms. Protopapas will resign from the Board and any committee thereof if Sarissa no longer beneficially owns at least 6 million shares of our common stock.

The foregoing is not a complete description of the terms of the New Settlement Agreement. For a further description of the terms of the New Settlement Agreement, including a copy thereof, please see our Current Report on Form 8-K that we filed with the SEC on April 29, 2015.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires our directors and officers, and persons who own more than 10% of our common stock, to file reports of securities ownership and changes in that ownership with the SEC. Officers, directors and greater than 10% beneficial owners are required by SEC regulations to furnish us with copies of all Section 16(a) forms they file. To our knowledge, based solely upon a review of the copies of the forms furnished to us and written representations that no other forms were required, we believe that all Section 16(a) filing requirements were timely met during the fiscal year ended December 31, 2014, except that a Form 4 report covering shares purchased pursuant to 10b5-1 plans by each of (i) Harvey J. Berger, M.D. on September 2, 2014 and September 3, 2014 and (ii) Sarah J. Schlesinger, M.D. on August 12, 2014 and August 13, 2014 was filed late.

Corporate Code of Conduct and Ethics

Our Corporate Code of Conduct and Ethics applies to all of our employees and directors. Any changes in or waivers from our Corporate Code of Conduct and Ethics will be included in a Current Report on Form 8-K within four business days following the date of the change or waiver, unless website posting of the amendments or waivers is then permitted by the rules of The NASDAQ Stock Market LLC (“NASDAQ”). Our Corporate Code of Conduct and Ethics is publicly available on the Investors section of our website at http://investor.ariad.com under the heading “Corporate Governance” and is also available upon request, without charge, by contacting us at (617) 503-7028 or through an e-mail request to Investor.Relations@ariad.com.

7

Table of Contents

Corporate Governance Guidelines

Our Corporate Governance Guidelines, which were developed and are overseen by the Nominating and Corporate Governance Committee, establish basic principles of corporate governance by which the Board operates. These guidelines address selection, composition and independence of the Board, director compensation, majority voting in uncontested director elections and director resignation in the event of a failure to receive the required vote, evaluation of the performance of the Board and its committees, the structure and operations of the committees of the Board, the establishment and implementation of corporate governance guidelines, principles and practices, leadership development and succession planning.

Under our Corporate Governance Guidelines, so long as the Chief Executive Officer is also Chairman of the Board, the Board shall appoint one of the independent directors to serve in the role of lead director. His or her role is to support the independent directors in meeting their responsibilities as independent directors. As such, he or she is responsible for oversight of those processes of the Board that independent directors are required to perform. In addition, he or she presides at meetings of the non-management directors.

The Nominating and Corporate Governance Committee is responsible for the establishment, implementation and oversight of our Corporate Governance Guidelines, Conflict of Interest Policy for Board of Directors and other corporate governance guidelines, policies and practices. Our Corporate Governance Guidelines and Conflict of Interest Policy are publicly available on the Investors section of our website at http://investor.ariad.com under the heading “Corporate Governance.”

Majority Voting in Director Elections

In April 2014, we amended our Amended and Restated Bylaws to provide that our directors must be elected by a majority of votes cast in uncontested elections and by a plurality of votes cast in contested elections.

In connection with the April 2014 change, we adopted a director resignation policy as part of our Corporate Governance Guidelines. Under this policy, the Board will only nominate directors for election or re-election who have submitted an irrevocable letter of resignation that will be effective upon (1) their failure to receive the required number of votes for reelection at the next annual meeting of stockholders at which they face re-election and (2) acceptance of such resignation by the Board. If an incumbent director fails to receive the number of votes required for re-election, the Nominating and Corporate Governance Committee will act on an expedited basis to determine whether to accept the director’s resignation and will submit its recommendation for prompt consideration to the Board, who, with the director in question abstaining, will decide whether to accept the director’s resignation, taking into account such factors as it deems relevant. Such factors may include the stated reasons why stockholders voted against such director’s reelection, the qualifications of the director and whether accepting the resignation would cause us to fail to meet any applicable listing standards or would violate state law.

8

Table of Contents

Board Committees

The Board currently has four standing committees: the Audit Committee, the Compensation Committee, the Nominating and Corporate Governance Committee and the Science and Medicine Committee. We previously had an Executive Committee, but the committee did not meet in 2014 and we eliminated the committee in February 2014. The Board created the Science and Medicine Committee in October 2013 to assist management in promoting, maintaining and continually enhancing ARIAD’s scientific excellence and clinical scholarship as fundamental corporate values and drivers of corporate success. Each committee meets periodically throughout the year, reports its actions and recommendations to the Board, receives reports from senior management, annually evaluates its performance and has the authority to retain outside advisors in its discretion. The primary responsibilities of each committee are summarized below and set forth in more detail in each committee’s written charter, which can be found on the Investors section of our website at http://investor.ariad.com under the heading “Corporate Governance.”

The information under the heading “Director Independence and Committee Qualifications” in Item 13 of this Form 10-K/A is incorporated herein by reference.

Committee Responsibility Summary

Audit Committee

|

• Oversees management’s maintenance of the reliability and integrity of our accounting policies and financial reporting and disclosure practices. |

CURRENT COMMITTEE MEMBERS:

Wayne Wilson, Chair Jay R. LaMarche Massimo Radaelli, Ph.D.

OTHER COMMITTEE MEMBERS DURING 2014:

Robert M. Whelan, Jr. | |

|

• Oversees management’s establishment and maintenance of processes to ensure that we have an adequate system of internal control. |

||

|

• Oversees management’s establishment and maintenance of processes to ensure our compliance with legal and regulatory requirements that may impact our financial reporting and disclosure obligations. |

||

|

• Reviews our independent registered public accounting firm’s qualifications and independence. |

||

|

• Appoints, compensates and oversees the work of our independent registered public accounting firm. |

||

|

• Pre-approves all audit and non-audit services performed by our independent registered public accounting firm. |

||

|

• Reviews, in consultation with our management and independent registered public accounting firm, the scope and results of reviews of our quarterly financial statements, audits of our annual financial statements and audits of our system of internal control over financial reporting. |

||

|

• Performs other duties, including reviewing, evaluating and approving related person or similar transactions or relationships and recommending approval of such transactions to the disinterested and independent members of the Board, if necessary. |

||

|

• Oversees our compliance with applicable laws, regulations and corporate policies, including our Code of Conduct and Ethics. |

9

Table of Contents

| Compensation Committee | ||

|

• Assesses the performance of and approves, or recommends for approval by the Board, the compensation of our executive officers. |

CURRENT COMMITTEE MEMBERS:

Norbert G. Riedel, Ph.D., Chair Athanase Lavidas, Ph.D.

OTHER COMMITTEE MEMBERS DURING 2014:

Robert M. Whelan, Jr. | |

|

• Analyzes our officer and director compensation plans, policies and programs. |

||

|

• Administers our stock-based compensation and executive compensation plans. |

||

|

• Reviews and approves all proposed compensation disclosures, including the Compensation Discussion and Analysis (“CD&A”), for inclusion in our proxy statement or Form 10-K/A and reviews all recommendations by stockholders of the compensation of our named executive officers (the “NEOs”) and the frequency of voting by stockholders on the compensation of our NEOs. |

||

|

Nominating and Corporate Governance Committee | ||

|

• Identifies and evaluates individuals to become directors. |

CURRENT COMMITTEE MEMBERS:

Athanase Lavidas, Ph.D., Chair Jay R. LaMarche Wayne Wilson Alexander J. Denner, Ph.D.

OTHER COMMITTEE MEMBERS DURING 2014:

None | |

|

• Makes recommendations to the Board concerning the size, structure and composition of the Board and its committees. |

||

|

• Monitors the process to assess the Board’s effectiveness. |

||

|

• Reviews and assesses the adequacy of our corporate governance, including our Corporate Governance Guidelines and our Board Conflict of Interest Policy. |

||

|

• Oversees matters relating to the independence (including potential conflicts of interest), education, operation and effectiveness of the Board and its committees. |

||

|

Science and Medicine Committee | ||

|

• Consults with and advises management on the strategy, focus and direction of our research and development, clinical programs and initiatives, as well as competitive and other factors that may affect those programs and initiatives. |

CURRENT COMMITTEE MEMBERS:

Sarah J. Schlesinger, M.D., Chair Norbert G. Riedel, Ph.D. Massimo Radaelli, Ph.D.

OTHER COMMITTEE MEMBERS DURING 2014:

None | |

|

• Identifies and discusses significant emerging science and technology trends and issues and their potential impact on our research and development and clinical programs, plans or policies. |

||

|

• Leads periodic updates and discussions with the Board on our progress in achieving our strategic research, development and clinical goals and objectives. |

||

|

• Consults with and advises management, as appropriate, on our internal and external investments in science and technology and for any material external investments in research and development that require approval by the Board, and assists the Board in evaluating such opportunities. |

||

10

Table of Contents

Executive Officers

The following table sets forth certain information regarding our executive officers, including their ages as of April 20, 2015.

| Name |

Age | Position | ||

| Harvey J. Berger, M.D. |

64 | Chairman of the Board, Chief Executive Officer and President | ||

| Timothy P. Clackson, Ph.D. |

49 | President of Research and Development and Chief Scientific Officer | ||

| Edward M. Fitzgerald |

60 | Executive Vice President, Chief Financial Officer and Treasurer | ||

| Martin J. Duvall |

53 | Executive Vice President and Chief Commercial Officer | ||

| Thomas J. DesRosier, J.D. |

60 | Executive Vice President, Chief Legal and Administrative Officer and Secretary | ||

| Daniel M. Bollag, Ph.D |

54 | Senior Vice President, Regulatory Affairs and Quality | ||

| Maria E. Cantor |

47 | Senior Vice President, Corporate Affairs | ||

| Hugh M. Cole |

50 | Senior Vice President, Chief Business Officer | ||

| Frank G. Haluska, M.D., Ph.D. |

56 | Senior Vice President, Clinical Research and Development and Chief Medical Officer |

For biographical information pertaining to Dr. Berger, who is a director and executive officer of ARIAD, see Item 10 of this Form 10-K/A under the heading “Class 3 Directors (Term to Expire in 2015).”

Timothy P. Clackson, Ph.D. has served as our President of Research and Development and Chief Scientific Officer since June 2010. Previously, he served as our Senior Vice President and Chief Scientific Officer from September 2003 to June 2010.

Edward M. Fitzgerald has served as our Executive Vice President, Chief Financial Officer and Treasurer since June 2010. Previously, he served as our Senior Vice President, Chief Financial Officer and Treasurer from May 2002 to June 2010.

Martin J. Duvall has served as our Executive Vice President, Chief Commercial Officer since December 2013, having served as our Senior Vice President, Commercial Operations since September 2011. Previously, from 2010 to 2011, he served as Senior Vice President and General Manager of the global oncology franchise at Merck & Co., Inc., a global healthcare company. From 2009 to 2010, Mr. Duvall led global marketing and commercial operations at Abraxis Bioscience, Inc., an immunochemistry products manufacturing company. From 2004 to 2009, Mr. Duvall held roles leading commercial operations, commercial development and oncology strategy for MGI Pharma, Inc., a biopharmaceutical company, and its acquirer, Eisai Pharmaceuticals, a global pharmaceutical company.

Thomas J. DesRosier, J.D. has served as our Executive Vice President, Chief Legal and Administrative Officer and Secretary since January 2015. Previously, he served as Executive Vice President, Chief Legal and Administrative Officer and Secretary of Cubist Pharmaceuticals, Inc., a biopharmaceutical company, from 2014 to 2015 and as Senior Vice President, Chief Legal Officer and Secretary from 2013 to 2014. Before that, Mr. DesRosier served as Senior Vice President, General Counsel North America of Sanofi, a global biopharmaceutical company, from 2011 to 2013. From 1999 to 2011, Mr. DesRosier held several increasing leadership roles within the legal group of Genzyme Corporation, a biotechnology company, culminating in his role as Senior Vice President, Chief Legal Officer.

Daniel M. Bollag, Ph.D. has served as our Senior Vice President, Regulatory Affairs and Quality since January 2009. He previously was Vice President, Regulatory Affairs for Genzyme Corporation from 2006 to 2008.

Maria E. Cantor has served as our Senior Vice President, Corporate Affairs since January 2012. Previously, she served as our Vice President, Corporate Communications and Investor Relations since July 2008. Ms. Cantor held several positions of increasing responsibility at Genzyme Corporation from 2001 to 2008, most recently serving as Senior Director, Corporate Communications.

Hugh M. Cole has served as our Senior Vice President and Chief Business Officer since March 2014. Previously, from 2007 to 2014, Mr. Cole held management positions at Shire Pharmaceuticals, a biopharmaceutical company, most recently as Senior Vice President, Strategic Planning and Program Management and, previously, as a global franchise head, and before that, as Vice President, Business Development. Previously he held senior positions in business and corporate development at Oscient Pharmaceuticals (formerly, Genome Therapeutics), a pharmaceutical company, and at Millennium Pharmaceuticals, a biopharmaceutical company, and its affiliates.

Frank G. Haluska, M.D., Ph.D. has served as our Senior Vice President, Clinical Research and Development and Chief Medical Officer since January 2012, having held the position of Vice President and Chief Medical Officer since June 2010. Previously, he served as our Vice President, Clinical Affairs from May 2009 to June 2010, Vice President, Clinical Research from July 2008 to May 2009, and Senior Medical Director from October 2007 to July 2008.

11

Table of Contents

| ITEM 11: | EXECUTIVE COMPENSATION |

Compensation Discussion and Analysis

Our long-term success has been made possible in large measure by our ability to attract, retain and motivate talented and experienced individuals across all areas of our business, including our senior executives. Our NEOs for 2014 were the following:

| Name |

Position | |

| Harvey J. Berger, M.D. |

Chairman of the Board, Chief Executive Officer and President | |

| Timothy P. Clackson, Ph.D. |

President of Research and Development and Chief Scientific Officer | |

| Edward M. Fitzgerald |

Executive Vice President, Chief Financial Officer and Treasurer | |

| Martin J. Duvall |

Executive Vice President and Chief Commercial Officer | |

| Daniel M. Bollag, Ph.D |

Senior Vice President, Regulatory Affairs and Quality |

Executive Summary

BUSINESS OVERVIEW

ARIAD is a global oncology company focused on transforming the lives of cancer patients with breakthrough medicines. Our mission is to discover, develop and commercialize small-molecule drugs to treat cancer in patients with the greatest unmet medical need—aggressive cancers for which current therapies are inadequate. We are focused on value-driving investments in commercialization, research and development and new business development initiatives that we expect will lead to sustained profitability beginning in 2018 and increased shareholder value.

We currently are commercializing or developing the following three products and product candidates:

| • | Iclusig® (ponatinib) is our first approved cancer medicine, which we are commercializing in the United States, Europe and other areas for the treatment of certain patients with rare forms of leukemia. We plan to initiate three new randomized clinical trials beginning in 2015 to evaluate Iclusig in earlier lines of treatment and potentially to expand its addressable market. |

| • | Brigatinib (AP26113) is our next most advanced drug candidate, which we are developing for the treatment of certain patients with a form of non-small cell lung cancer (“NSCLC”). We are focused on securing a brigatinib co-development and co-commercialization partnership and on accelerating a randomized trial evaluating brigatinib as a first line therapy. |

| • | AP32788 is our most recent, internally discovered drug candidate. We are conducting studies necessary to support the filing of an investigational new drug application (“IND”), which we expect to submit in 2015. We expect to commence clinical trials in 2016. |

COMPANY PERFORMANCE HIGHLIGHTS

2014 was an important year for ARIAD, as we made progress across all aspects of our business:

| • | We successfully re-launched Iclusig in the United States and expanded its commercialization in Europe, generating $55.7 million in net product revenue from sales of Iclusig during 2014. |

| • | We secured an exclusive agreement for the co-development and commercialization of Iclusig in Japan and nine other Asian countries with Otsuka Pharmaceutical Co., Ltd. (“Otsuka”). |

| • | Pursuant to the agreement, we received an upfront payment of $77.5 million, less a refundable withholding tax in Japan of $15.8 million, and are entitled to receive milestone payments, royalty payments and other payments upon regulatory approvals and commercialization of Iclusig in Otsuka’s territory. |

| • | The partnership with Otsuka is an important step in expanding the global commercial reach of Iclusig. |

| • | The non-dilutive funding from the agreement with Otsuka, coupled with a restructured license agreement with Bellicum Pharmaceuticals, Inc. that resulted in payments to us of $50 million, strengthened our balance sheet. |

12

Table of Contents

| • | We continued to advance our research and development pipeline. |

| • | We advanced brigatinib to a pivotal trial in anaplastic lymphoma kinase positive (“ALK+”) NSCLC. |

| • | We received FDA Breakthrough Therapy designation for the treatment of patients with ALK+ NSCLC whose tumors are resistant to crizotinib, the current first line therapy. |

| • | We nominated AP32788 as our next internally-discovered oncology drug candidate. |

The previous year, 2013, was challenging for ARIAD, even though we achieved our key strategic objectives in the first three quarters of the year. These achievements included initial commercial launch of Iclusig in the United States, marketing authorization for Iclusig by the European Commission as an orphan drug medicinal product and the commencement of sales in Europe. However, in October 2013 the FDA placed a partial clinical hold on all additional patient enrollment in clinical trials of Iclusig and issued several Drug Safety Communications. On October 31, 2013, we temporarily suspended marketing and commercial distribution of Iclusig in the United States, in response to a request by the FDA, while we negotiated an update to the prescribing information and a risk mitigation strategy.

Following the suspension of commercial distribution of Iclusig in the United States, ARIAD management worked with the FDA to gain re-approval of Iclusig and resume commercial distribution of the drug. On December 20, 2013, we obtained FDA approval to resume marketing and commercial distribution of Iclusig with revised prescribing information and shortly thereafter resumed marketing and commercial distribution. We believe that the resumption of marketing and commercial distribution less than two months after suspension is much quicker than is typical and represents a significant achievement of the ARIAD management team.

EXECUTIVE COMPENSATION PHILOSOPHY

Our compensation philosophy has three fundamental objectives:

| • | We endeavor to attract and retain the best available executive talent to lead our Company, recognizing that we do so in a highly competitive environment. |

| • | We seek to motivate our executives to perform by placing a substantial portion of our executives’ compensation at-risk such that it may not be realized if Company and individual goals are not achieved. This includes heavy reliance on performance shares. We consider this “pay-for-performance” philosophy to be central to our success to date and expect this to continue into the future. |

| • | We strive to align the interests of our executive officers with those of our shareholders. We do this not only by paying for performance aimed at enhancing shareholder value, but also by structuring a substantial portion of our executives’ compensation as long-term equity compensation. While we believe use of equity in long-term compensation promotes alignment with the interests of stockholders, we also carefully manage potential dilution from employee equity plans. |

ALIGNMENT OF COMPENSATION COMPONENTS WITH COMPANY PERFORMANCE

Our compensation plan for our Chief Executive Officer (our “CEO”) and for our NEOs other than our CEO (which we refer to as our “Other NEOs”) incorporates three primary sources: base salary, annual performance awards and long-term equity incentives. The annual performance awards and long-term equity incentives are variable and highly performance-based, while our perquisites are minimal.

13

Table of Contents

Structural Alignment of Pay with Performance

Our Compensation Committee is strongly committed to alignment of senior executive compensation with value creation for our shareholders:

| • | Executive compensation is linked firmly to the financial and operational performance of the business. In 2014, 85% of our CEO’s total compensation is at-risk such that it may not be realized if Company and individual goals are not achieved, with 73% of total compensation delivered through equity. Equity was granted through performance shares and restricted stock units in 2014 and 2015. |

| • | Performance shares represent 52% of the total long-term awards and 35% of total compensation for our CEO in 2014, which is among the highest of our peers. |

| • | In 2015, we added as an additional metric to our performance shares a relative total shareholder return (“TSR”) performance goal, which is used by only 5% of our peers. |

| • | Stock ownership guidelines require our CEO to hold common stock with a value of at least six times his salary and non-employee directors to hold common stock with a value at least five times their annual cash compensation. |

The following table summarizes the key components of each our NEO’s compensation for 2014 and our Other NEO’s compensation for 2015:

| Primary Components of Executive Compensation for 2014 and 2015

| ||||

| Component | Vehicle | Relevant Performance Metrics | ||

| Base Salary | Cash | N/A | ||

| Annual Performance Awards | Cash | Corporate Objectives and Individual Performance Metrics. See “Annual Performance Award Compensation” below. | ||

| Long-Term Equity Incentives | Performance Shares | Research and Development Goals | ||

|

Commercial Goals | ||||

|

Relative TSR (for 2015 only) | ||||

| Restricted Stock Units | Long Term Stock Price | |||

14

Table of Contents

Realizable Pay Demonstrates Alignment

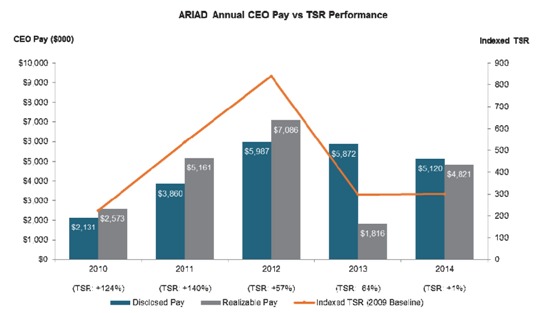

Our stock price increased substantially in the past five years, but with significant volatility. It increased by 124%, 140% and 57% in 2010, 2011 and 2012, respectively. 2013 was a particularly volatile year, with a sharp stock price decline of almost 90% after the temporary suspension of marketing and distribution of Iclusig in the U.S. in the fall of 2013, followed by an increase of more than 150% from its price nadir by the end 2013. In aggregate, over the five years ended December 31, 2014, our annualized TSR was 25%.

The following chart compares our cumulative TSR over the last five years with both the total reported grant date fair value compensation of our CEO (disclosed pay per the Summary Compensation Table from this Form 10-K/A and our prior proxy statements or Forms 10-K/A) and “realizable” CEO pay, which reflects cash plus the value of equity grants measured at year end:

As demonstrated above, the realizable compensation awarded to our CEO has strongly tracked TSR over the same period, consistent with our objective to align the interests of our executives and shareholders. In addition, a more significant portion of 2014 realizable pay is derived from performance shares than in prior years.

15

Table of Contents

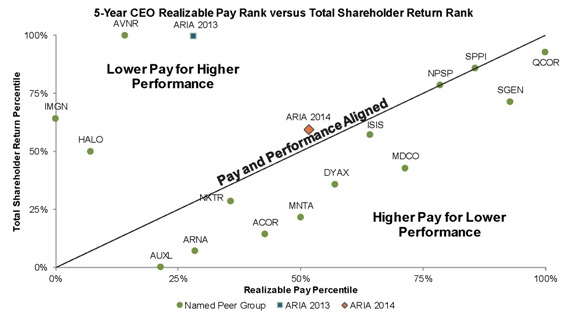

To further assess the degree of alignment between our CEO’s pay and performance, the Compensation Committee also considers “realizable” pay relative to our peer group. The following chart shows the five-year relative shareholder return and realizable pay against those of ARIAD’s 2014 peer group for the five years ended December 31, 2013. The information for the five-year period ended December 13, 2013 is the most current public information available for most of ARIAD’s peers. The line titled “Pay and Performance Aligned” represents the points at which relative performance equals relative pay. If a company is delivering higher relative performance than relative pay, it will appear above the line, and conversely will appear below the line for lower relative performance compared to relative pay.

As demonstrated above, we believe that the compensation awarded to our CEO in the last five years displays a strong connection to our TSR performance relative to the companies in our peer group. As you can see in the table above, ARIAD’s performance for the five years ended December 31, 2013 (denoted “ARIA 2013”) was at the 99th percentile relative to its peers, while realizable pay was only at the 28th percentile. ARIAD’s performance for the five years ended December 31, 2014 ranks at the 60th percentile, with CEO realizable pay for that period at the 52nd percentile as compared with peer CEO realizable pay for the five years ending December 31, 2013.

Disciplined Approach to Compensation

Our NEO compensation is based on clear, measureable goals related to Company and individual performance. The Compensation Committee sets performance objectives that are designed to be challenging but achievable. Annual performance awards and long-term equity incentive compensation levels are determined based on pre-determined, measurable corporate objectives and individual performance reviews. The Company’s performance shares, which comprise a higher percentage of long-term compensation relative to our peers, possess a second layer of objective metrics that must be achieved before realization.

At the beginning of each year, our Compensation Committee evaluates management’s progress towards each corporate objective for the prior year. Specific corporate objectives for 2013 and 2014 are set forth in detail below under the heading “Executive Compensation Determinations – Evaluation of Company Performance Against Corporate Objectives.” NEOs are further evaluated based on detailed self and peer evaluations, as well as the CEO’s review and evaluation of all of these assessments and overall evaluation of performance for each officer for the year. Performance ratings of each NEO are based on both achievement of these corporate objectives and these evaluations of individual performance, which our Compensation Committee uses to determine our executives’ annual performance awards, long-term equity incentive grants and base salary increases.

In addition, the Compensation Committee has adjusted compensation when appropriate to further align pay with performance. In 2014, in light of the FDA action and the resulting impact on our stockholders, the Compensation Committee made the following decisions:

| • | Not awarding any cash bonuses to executives under the 2013 annual performance award program, regardless of individual performance and the achievement of most corporate goals (including quickly returning Iclusig to the market). As a result, each of our NEOs was positioned below the market 25th percentile of total cash compensation for 2013. |

16

Table of Contents

| • | Not making any base salary merit or market-based adjustment increases for 2014. |

| • | Increasing the proportion of executives’ target equity awards tied to key performance milestones from approximately 33% of the equity awarded in 2013 to approximately 50% in 2014. |

The Compensation Committee seeks to be prudent in use of both cash and equity in executive compensation. While our use of equity compensation is more broad-based than at peer companies on average (we grant equity to employees across all levels of our organization), we manage equity usage (“burn rate”) to conservative levels well below the median of our peer group. Our average annual equity burn rate for 2012 – 2014 as calculated by our compensation consultant, Radford, an Aon Hewitt company (“Radford”), according to the ISS methodology is 3.3%, compared with 4.0% for the median of our 2014 peer group at the time that Radford conducted their review.

COMPENSATION PROGRAM CHANGES

Over the past year we have discussed our executive compensation program and corporate governance more generally with a substantial number of our shareholders. We will continue to engage with our investors to discuss their concerns and potential ways to refine our executive compensation program. Recent changes to our compensation program include:

| Recent Program Changes |

Description/Rationale | |

| More strongly aligned long-term equity incentives with Company performance by adding relative TSR metric to 2015 performance share grants | Provides a direct link in the long-term equity incentive plan to long-term stock price | |

| Enhanced CD&A disclosure | Provides our shareholders with additional information regarding performance targets and associated levels of payouts under our performance share grants | |

| Adopted robust recoupment (clawback) policy based on principles developed by 13 institutional investors (led by the UAW Retiree Medical Benefits Trust) and six major pharmaceutical companies | Provides broad discretion for the Compensation Committee to recover any equity or equity-based award or any cash performance or incentive compensation if a material violation of law or written Company policy causes significant financial harm to the Company. Goes beyond Sarbanes-Oxley and Dodd-Frank Acts relating to material misstatements in financial statements. | |

| Strengthened stock ownership guidelines for non-employee directors | Requires non-employee directors to hold stock worth at least five times annual cash compensation, increased from three times | |

The following additional changes were made either in 2014 or in prior years, demonstrating the Compensation Committee’s commitment to continuously improving the executive compensation program and maintaining pace with evolving market practices:

| Program Changes in 2014 and Prior |

Description/Rationale | |

| Revised our executive compensation peer group | Aligns the 2013 and 2014 peer group to the Company’s smaller size | |

| More strongly aligned executive compensation with performance by weighting performance shares more heavily than time based grants and weighting long-term equity incentives more heavily in overall compensation | Provides a direct link in the long-term equity incentive plan to Company performance through an important, value-driving metric (e.g. specific Research & Development (“R&D”) and commercial milestones) and the stock price | |

| Adopted stock ownership guidelines | Requires specific threshold of stock ownership: six times salary for CEO and three times (amended to five times in 2015) annual cash compensation for non-employee directors | |

17

Table of Contents

STRONG COMPENSATION GOVERNANCE AND PRACTICES

The following are characteristics of our compensation program that demonstrate its strong governance principles:

18

Table of Contents

Components of Executive Compensation

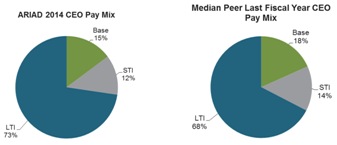

Our compensation plan for our NEOs incorporates three primary sources: base salary, annual performance awards and long-term equity incentives. We emphasize variable, long-term, performance-based compensation for our most senior executives, in line with their level of responsibility for and impact on our results. We intend for total compensation to vary based on progress towards achievement of corporate, departmental and team objectives, as well as individual performance goals. The mix of long-term equity incentive awards (including the value of unrealized performance shares awarded at target level), annual performance awards and base salary for 2014 is set forth below for our CEO and the median CEO of our 2014 peers:

Our Compensation Committee considers the mix of the elements of compensation discussed above to be critical in driving our “pay-for-performance” philosophy. The vast majority of our executives’ annual compensation is delivered in either annual performance awards or long-term incentive compensation with value contingent on the achievement of specific performance targets, appreciation of our stock value, or both. In 2014, more than 85% of our CEO’s pay mix was comprised of performance-based compensation via our annual performance awards and grants of restricted stock units and performance shares. Only 15% of our CEO’s pay was delivered via “guaranteed” compensation in the form of his base salary versus 18% for our 2014 peers.

BASE SALARY

Base salary is intended to provide a fair and competitive base level of compensation that reflects job function, organizational level, experience and tenure and sustained performance over time. On an annual basis, our executives are eligible for a salary increase. The amount of this increase, if any, is determined by our Compensation Committee, and recommended to our Board for approval in the case of our CEO. Any target salary increase is based on analysis of market compensation data, demonstrated levels of core job competency and effective leadership, performance in achieving key corporate and individual objectives established at the beginning of the previous year, internal pay equity and the recommendation of the Committee’s independent compensation consultant. The executive’s performance rating leads to the application of a performance multiplier, which, in conjunction with peer information, directly influences the actual salary adjustment. Adjustments to base salary levels typically are made in the first quarter of each year and are paid retroactively to January 1 of that year. Our NEOs did not receive any salary increases in 2014 for 2013 performance.

VARIABLE AND PERFORMANCE-BASED COMPENSATION

We believe that one of the most important motivators for our executives is the opportunity to earn compensation greater than the established targets by exceeding applicable performance requirements. We accomplish this through a system of “performance multipliers” that reward exceptional performance at substantially higher levels than performance that merely meets requirements of the position.

19

Table of Contents

Under our performance multiplier approach, the level of performance of each executive, in conjunction with the level of achievement of our corporate goals, directly influences such executive’s base salary, annual performance award and long-term equity incentive award relative to target awards. Our Compensation Committee established the following performance multiplier scale for fiscal 2014 and 2015, which was recommended to the Board for approval for purposes of our CEO’s compensation:

| Annual Performance Award Multiplier |

Long-term Equity Incentive Multiplier |

|||||||

| Outstanding (5.0) |

200 | % | 160 | % | ||||

| (4.5) |

150 | % | 130 | % | ||||

| Exceeds Requirements (4.0) |

100 | % | 100 | % | ||||

| (3.5) |

75 | % | 85 | % | ||||

| Meets Requirements (3.0) |

50 | % | 50 | % | ||||

| Below Meets Requirements (< 3.0) |

0 | % | 0 | % | ||||

Over the last four years, the median annual performance award multiplier for our current NEOs was 83%.

ANNUAL PERFORMANCE AWARD COMPENSATION

Annual performance awards are intended to reward our executive officers for achievement of corporate, individual and key leadership and management objectives on an annual basis. Our Compensation Committee annually establishes target annual performance awards for different tiers of executives, which are expressed as a percentage of base salary. These target awards are then adjusted for each executive through the application of a performance multiplier based on the individual executive’s performance rating for the year. No annual performance awards were paid to our NEOs for 2013 performance. Annual performance awards to our NEOs for 2014 performance were paid in cash and were established in accordance with the annual performance targets for all our executives.

LONG-TERM EQUITY INCENTIVE COMPENSATION

Long-term equity incentive awards are intended to reward our executive officers for achievement of corporate, individual and key leadership and management objectives. In addition, such awards are intended to align the interests of all of our executive officers with those of our shareholders, promote progress toward achieving our long-term strategy and assist in long-term retention of our executive officers. As such, long-term equity incentive awards for our executive officers are made in the form of performance shares, restricted stock units and/or stock options.

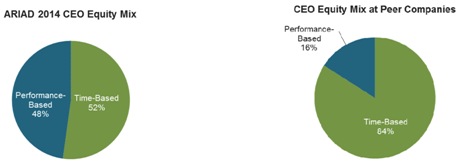

Performance shares are earned on the achievement of one or more key corporate objectives or metrics and, once achieved, are subject in certain cases to further time-based vesting to promote retention. Our restricted stock units generally vest annually over three years. In 2014, the CEO’s long-term equity incentive award consisted 52% of restricted stock units and 48% of performance shares.

Performance shares

Descriptions of historical performance shares are set forth below. Performance shares that remain outstanding are described in subsection “Narrative to Summary Compensation Table and Grants of Plan-Based Awards in 2014 Table” and detailed in the Outstanding Equity Awards at December 31, 2014 table.

20

Table of Contents

History of Performance Shares at ARIAD

Performance-based equity has been a mainstay in the ARIAD executive officer compensation program since 2011. Given the stage of the Company in 2011 and 2012, our Compensation Committee determined to tie performance shares to key regulatory approvals which, if achieved, would significantly impact shareholder return. The respective metric for these 2011 and 2012 performance shares was FDA approval of Iclusig and European Medicines Agency (“EMA”) approval of Iclusig.

2013 Performance Shares

Based on the Company’s strategic objectives in 2013, our Compensation Committee believed it was important to balance the continued advancement of promising development candidates with ongoing drug discovery. To that end, our Compensation Committee established a performance share program based on the achievement of full patient enrollment in a pivotal registration trial for a new indication of any ARIAD product, excluding the Phase 3 EPIC trial for Iclusig (which was already underway), no later than December 31, 2016.

The characteristics of the 2013 performance shares are set forth below. Each metric may pay out between 0% to 160% of target amount based on pre-determined performance thresholds.

| Metric |

Weighting | Performance Period End Date |

Vesting | |||

| R&D Goal: Clinical Trial Enrollment |

100% | 12/31/16 | 50-100% at achievement; remainder at first anniversary |

2014 Performance Shares

Consistent with ARIAD’s strategic goals for 2014, our Compensation Committee created a commercially oriented metric to emphasize the importance of commercial execution, while being directly responsive to follow-up actions stemming from FDA discussions. The commercial objective consisted of a 2-year cumulative revenue goal from Iclusig sales for fiscal years 2014 and 2015, which was structured in this manner due to a high degree of uncertainty with respect to the proximity to product re-launch, potential market reaction stemming from FDA action taken in 2013 and reimbursement and revenue recognition timing.

Based on the continued importance of R&D progress to both ARIAD and its shareholders, our Compensation Committee also incorporated an R&D metric in its 2014 performance shares: enrollment of 50% of patients in the FDA required clinical trial of Iclusig as part of the post-marketing requirements, to be completed no later than September 30, 2017.

The characteristics of the 2014 performance shares are set forth below. Each metric may pay out between 0% to 160% of target amount based on pre-determined performance thresholds.

| Metric |

Weighting | Performance Period End Date |

Vesting | |||

| R&D Goal: Clinical Trial Enrollment |

50% | 9/30/17 | 50% at achievement, 50% at first anniversary | |||

| Commercial Goal: Two-Year Cumulative Global Revenue |

50% | 12/31/15 | 50% at achievement, 50% at first anniversary |

BENEFITS AND PERQUISITES

ARIAD provides minimal executive perquisites, which are offered to help attract and retain our executive officers. In addition to general benefits offered to all other salaried employees, we provide our executive officers with supplemental long-term disability insurance and long-term care insurance, tax return preparation services and an auto allowance in accordance with their employment agreements. These were the only perquisites we provided to our executive officers during 2014. Perquisites represent less than 2% of each NEO’s total compensation as set forth in the Summary Compensation Table in this Form 10-K/A.

21

Table of Contents

Benchmarking for Executive Compensation Components

EXECUTIVE PERFORMANCE REVIEWS

Our Compensation Committee annually reviews the performance of our CEO and reviews and recommends his compensation for approval by the Board. The Compensation Committee also annually reviews the assessment of performance of our other executive officers conducted by our CEO, and reviews and approves their compensation in consultation with our CEO. While our Compensation Committee has ultimate authority and responsibility for approving all executive officer compensation, other than our CEO’s compensation, which the Board approves, our CEO plays an active role in such decisions, except with respect to his own compensation where he participates in neither the deliberations nor the decision.

Corporate Objectives

At the beginning of each year, the executive leadership team of the Company establishes annual corporate objectives, which are reviewed and discussed with the Compensation Committee and the Board and form the basis for our annual operating plan. The status of our corporate objectives, as well as our performance relative to our operating plan, are reviewed and discussed with the Board regularly during the year. Based on the annual corporate objectives and the associated operating plan, each officer is responsible for developing plans and managing the key initiatives and activities designed to achieve our objectives.

Performance Reviews of our CEO

The Compensation Committee undertakes a comprehensive review of our CEO’s overall performance based on its evaluation of the Company’s performance against its corporate objectives, the CEO’s individual contributions to achievement of key objectives, his strategic leadership of the Company and his demonstration of the Company’s vision and corporate values, including a commitment to building shareholder value. Based on this comprehensive review, the Compensation Committee assigns a performance rating. Performance ratings can range from “unsatisfactory” to “meets requirements” to “exceeds requirements” to “outstanding”. The performance rating is then used to determine the performance multiplier applicable to the CEO, which forms the basis for any increases in salary, and for any annual performance awards and long-term equity incentive awards. The Compensation Committee makes these determinations in executive session and then makes recommendations to the Board for subsequent approval.

Performance Reviews of our Other NEOs

Generally, at the end of each year, each of our executive officers is evaluated based on:

| • | A detailed self-assessment of performance relative to the established corporate and individual objectives, as well as to key leadership and management measures described below. |