UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant Filed by a Party other than the Registrant

Check the appropriate box:

|

|

Preliminary Proxy Statement |

|

|

|

|

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

|

|

|

|

Definitive Proxy Statement |

|

|

|

|

|

Definitive Additional Materials |

|

|

|

|

|

Soliciting Material Pursuant to §240.14a-12 |

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

No fee required. |

||

|

|

|||

|

|

Fee paid previously with preliminary materials |

||

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

||

|

|

|

|

|

3451 Plano Parkway

Lewisville, Texas 75056

Dear Shareholders:

We will hold the 2023 Annual Meeting of Shareholders of Orthofix Medical Inc. on June 19, 2023 at 9:00 a.m. Central Daylight Time at the Four Seasons Resort and Club Dallas at Las Colinas, 4150 North MacArthur Boulevard, Irving, Texas 75038.

This booklet includes the notice of annual meeting and the proxy statement. The proxy statement describes the business that we will conduct at the meeting.

Your vote is important. Please refer to the proxy card or other voting instructions included with these proxy materials for information on how to vote by proxy or in person.

Sincerely, |

|

|

|

Catherine M. Burzik |

|

Lead Independent Director |

|

|

|

April __, 2023 |

|

Notice of Annual Meeting of Shareholders and Proxy Statement |

Meeting Date: |

|

June 19, 2023 9:00 a.m. Central Daylight Time |

Meeting Place: |

|

Four Seasons Resort and Club Dallas at Las Colinas 4150 North MacArthur Boulevard Irving, Texas 75038 |

Notice and Proxy Statement for Shareholders of |

ORTHOFIX MEDICAL INC.

3451 Plano Parkway

Lewisville, Texas 75056

for

2023 ANNUAL MEETING OF SHAREHOLDERS

to be held on June 19, 2023

This notice and the accompanying proxy statement are being furnished to the shareholders of Orthofix Medical Inc., a Delaware corporation (“Orthofix” or the “Company”), in connection with the upcoming 2023 Annual Meeting of Shareholders (the “Annual Meeting”) and the related solicitation of proxies by the Board of Directors of Orthofix (the “Board of Directors” or “Board”) from holders of outstanding shares of common stock, par value $0.10 per share (“common stock”), of Orthofix as of the record date for the Annual Meeting for use at the Annual Meeting and at any adjournment or postponement thereof. In this notice and the accompanying proxy statement, all references to “we,” “our” and “us” refer to the Company, except as otherwise provided.

Time, Date and Place of Annual Meeting

Notice is hereby given that the Annual Meeting will be held on June 19, 2023 at 9:00 a.m. Central Daylight Time, at the Four Seasons Resort and Club Dallas at Las Colinas, 4150 North MacArthur Boulevard, Irving, Texas 75038.

Proposals to be Considered at the Annual Meeting

1 |

Election of Directors. Shareholders will be asked to elect the following nine persons to the Board: Wayne Burris, Catherine M. Burzik, Stuart M. Essig, Ph.D., Jason M. Hannon, John B. Henneman, III, James F. Hinrichs, Shweta Singh Maniar, Michael E. Paolucci, and Keith C. Valentine. The Board unanimously recommends that shareholders vote “FOR” each of the foregoing director nominees. |

2 |

Advisory and Non-Binding Resolution to Approve Executive Compensation. Shareholders will be asked to approve an advisory and non-binding resolution on the compensation of the Company’s named executive officers, as described in the “Compensation Discussion and Analysis” and the related compensation tables beginning on page 25 of this proxy statement. The Board unanimously recommends that shareholders vote “FOR” this proposal. |

3 |

Ratification of the Appointment of EY as Independent Registered Public Accounting Firm for 2023. Shareholders will be asked to approve a resolution to ratify the appointment of Ernst & Young LLP as the independent registered public accounting firm for Orthofix and its subsidiaries for the fiscal year ending December 31, 2023. The Board unanimously recommends that shareholders vote “FOR” this proposal. |

4 |

Approval of an Amended and Restated Certificate of Incorporation to Increase the Authorized Number of Shares of Common Stock From 50 Million to 100 Million. Shareholders will be asked to approve an Amended and Restated Certificate of Incorporation, including a proposal to increase the number of authorized shares of common stock from 50 million to 100 million. The Board unanimously recommends that shareholders vote "FOR" this proposal. |

5 |

Approval of an Amended and Restated Certificate of Incorporation to Provide for Exculpation of Officers as Permitted by Recent Amendments to Delaware Law. Shareholders will be asked to approve an Amended and Restated Certificate of Incorporation, including a proposal to provide for exculpation of officers as permitted by recent amendments to Delaware law. The Board unanimously recommends that shareholders vote "FOR" this proposal. |

6 |

Approval of an Amendment and Restatement of the Certificate of Incorporation to Add Forum Selection Provisions. Shareholders will be asked to approve an Amended and Restated Certificate of Incorporation, including a proposal regarding the addition of forum selection provisions. The Board unanimously recommends that shareholders vote "FOR" this proposal. |

7 |

Approval of Amendment No. 4 to the Amended and Restated 2012 LTIP. Shareholders will be asked to approve Amendment No. 4 to the Company’s Amended and Restated 2012 Long-Term Incentive Plan. The Board unanimously recommends that shareholders vote “FOR” this proposal. |

8 |

Approval of Amendment No. 3 to the Second Amended and Restated Stock Purchase Plan. Shareholders will be asked to approve Amendment No. 3 to the Company’s Second Amended and Restated Stock Purchase Plan to increase the number of shares available for issuance thereunder. The Board unanimously recommends that shareholders vote “FOR” this proposal. |

9 |

Advisory and Non-Binding Vote on the Preferred Frequency of Holding an Advisory and Non-Binding Resolution to Approve Executive Compensation. Shareholders will be asked to indicate, on an advisory basis, their preferred frequency of holding an advisory vote on the compensation of our named executive officers. The frequency options are to hold the advisory vote every year, every two years or every three years. The Board unanimously recommends that shareholders vote to hold the advisory vote on the compensation of our named executive officers every year. |

10 |

Miscellaneous. Shareholders will be asked to transact such other business as may come before the Annual Meeting or any adjournment or postponement thereof. |

Please read a detailed description of proposals 1 through 9 stated above beginning on page 64 of the proxy statement.

Shareholders Entitled to Vote

All record holders of shares of Orthofix common stock at the close of business on the record date for the Annual Meeting, ________, 2023, are being sent this notice and will be entitled to vote at the Annual Meeting. Each record holder on such date is entitled to cast one vote per share of common stock.

By Order of the Board of Directors |

|

Patrick L. Keran |

Chief Legal Officer |

|

April ___, 2023 |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SHAREHOLDERS MEETING TO BE HELD JUNE 19, 2023: A COPY OF THIS PROXY STATEMENT, PROXY VOTING CARD, AND THE ORTHOFIX ANNUAL REPORT ON FORM 10-K FOR THE YEAR ENDED DECEMBER 31, 2022 ARE AVAILABLE AT WWW.PROXYDOCS.COM/OFIX.

Proxy Summary |

The summary highlights certain information about our business and 2022 performance, and about other information in the proxy statement. This summary does not contain all of the information that you should consider, and we encourage you to read the entire proxy statement before voting.

2022 Business Highlights

Notable financial results and operational accomplishments in 2022 include the following:

Merger with SeaSpine

On October 10, 2022, Orthofix entered into an agreement and plan of merger with SeaSpine, a global medical technology company focused on surgical solutions for the treatment of spinal disorders. On January 5, 2023, the merger was consummated, and SeaSpine became a wholly-owned subsidiary of Orthofix following the transaction.

Pursuant to the terms of the merger agreement, as of the effective time of the merger, the board of directors of the combined company consisted of nine individuals, including five individuals who were members of the board of directors of Orthofix immediately prior to the merger and four individuals who were members of the board of directors of SeaSpine immediately prior to the merger.

Effective as of the closing of the merger, the Board appointed Keith C. Valentine as President and Chief Executive Officer (succeeding Jon C. Serbousek, who was appointed to serve as Executive Chairman), John J. Bostjancic as Chief Financial Officer (succeeding Douglas C. Rice in such role), and Patrick L. Keran as Chief Legal Officer (succeeding Kimberley A. Elting, who now serves as President, Global Orthopedics). Catherine M. Burzik, who previously served as Chair of the Board, was appointed as Lead Independent Director.

Our Business Segments

Historically, Orthofix managed its business by two reporting segments, Global Spine and Global Orthopedics, which accounted for 77% and 23%, respectively, of our total net sales in 2022. The chart below presents our net sales, which includes product sales and marketing service fees, by reporting segment for each of the years ended December 31, 2022, 2021, and 2020. These amounts do not include the net sales of SeaSpine.

SeaSpine has historically managed its business as one operating segment, but with revenue reported in two product categories: (i) Biologics (formerly recognized as Orthobiologics) and (ii) Spinal Implants and Enabling Technologies. As a result of the merger with SeaSpine, which was consummated on January 5, 2023, we reassessed our previously identified reporting segments and identified two reporting segments based on how the operations of the newly combined company will be managed, which consist of (i) Global Spine and (ii) Global Orthopedics.

Director Nominees

Name |

Age |

Director |

Independent |

Audit & |

Compensation |

Compliance |

Nominating, Governance & Sustainability Committee |

Catherine M. Burzik |

72 |

2021 |

|

|

|

|

|

Wayne Burris |

67 |

NEW (1) |

|

|

|

|

|

Stuart M. Essig, Ph.D. |

61 |

2023 |

|

|

|

|

Chair |

Jason M. Hannon |

51 |

2020 |

|

|

|

Chair |

|

John B. Henneman, III |

61 |

2023 |

|

|

|

|

|

James F. Hinrichs |

55 |

2014 |

|

Chair |

|

|

|

Shweta Singh Maniar |

39 |

2023 |

|

|

|

|

|

Michael E. Paolucci |

63 |

2016 |

|

|

Chair |

|

|

Keith C. Valentine |

55 |

2023 |

|

|

|

|

|

(1) Mr. Burris previously served as a director between September 2021 and January 2023. He has been nominated to fill the Board seat currently occupied by Mr. Serbousek, who is not standing for reelection

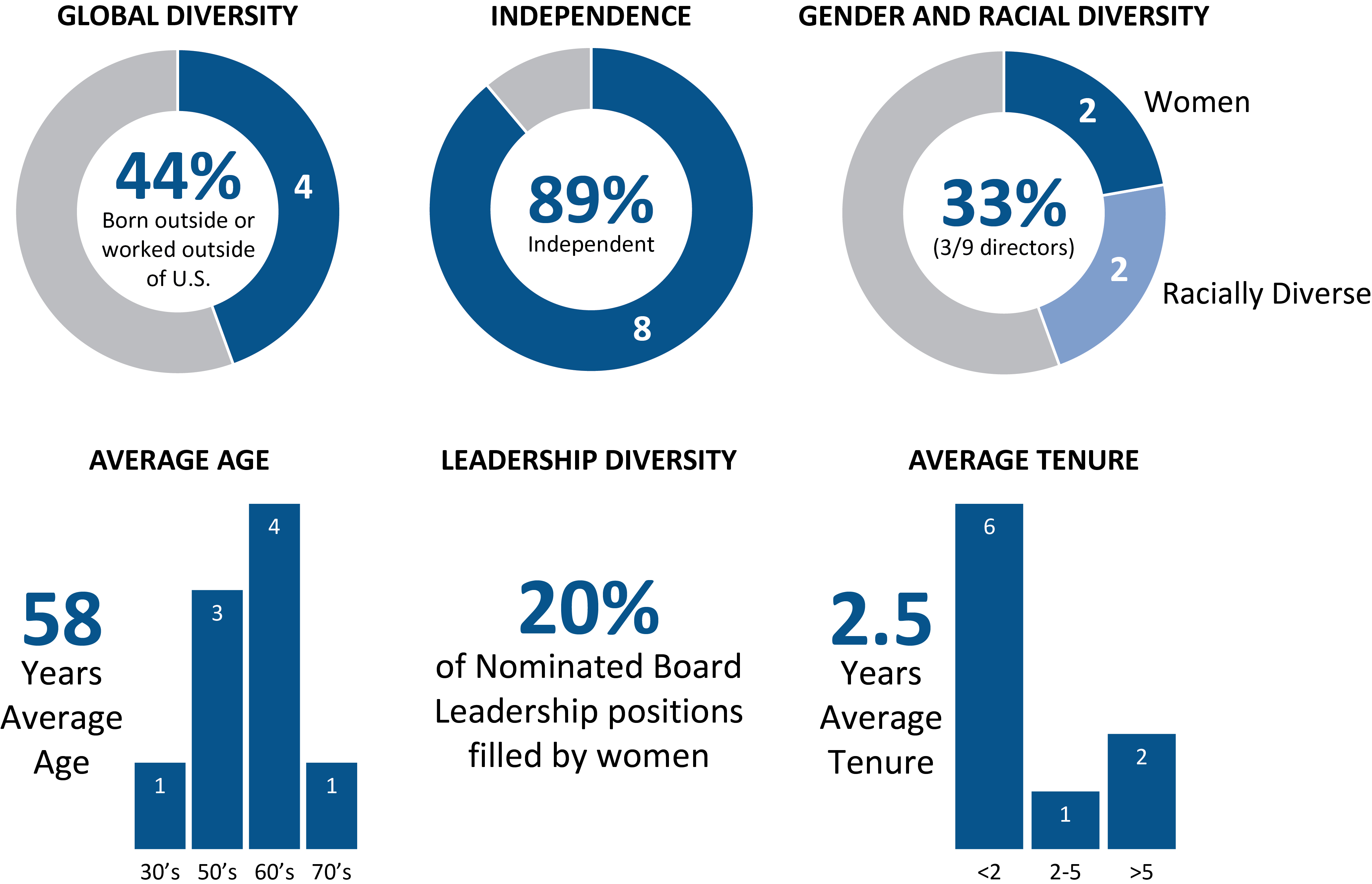

Director Diversity and Qualifications

The following graphics highlight the diversity and qualifications of our director nominees, both individually and in the aggregate.

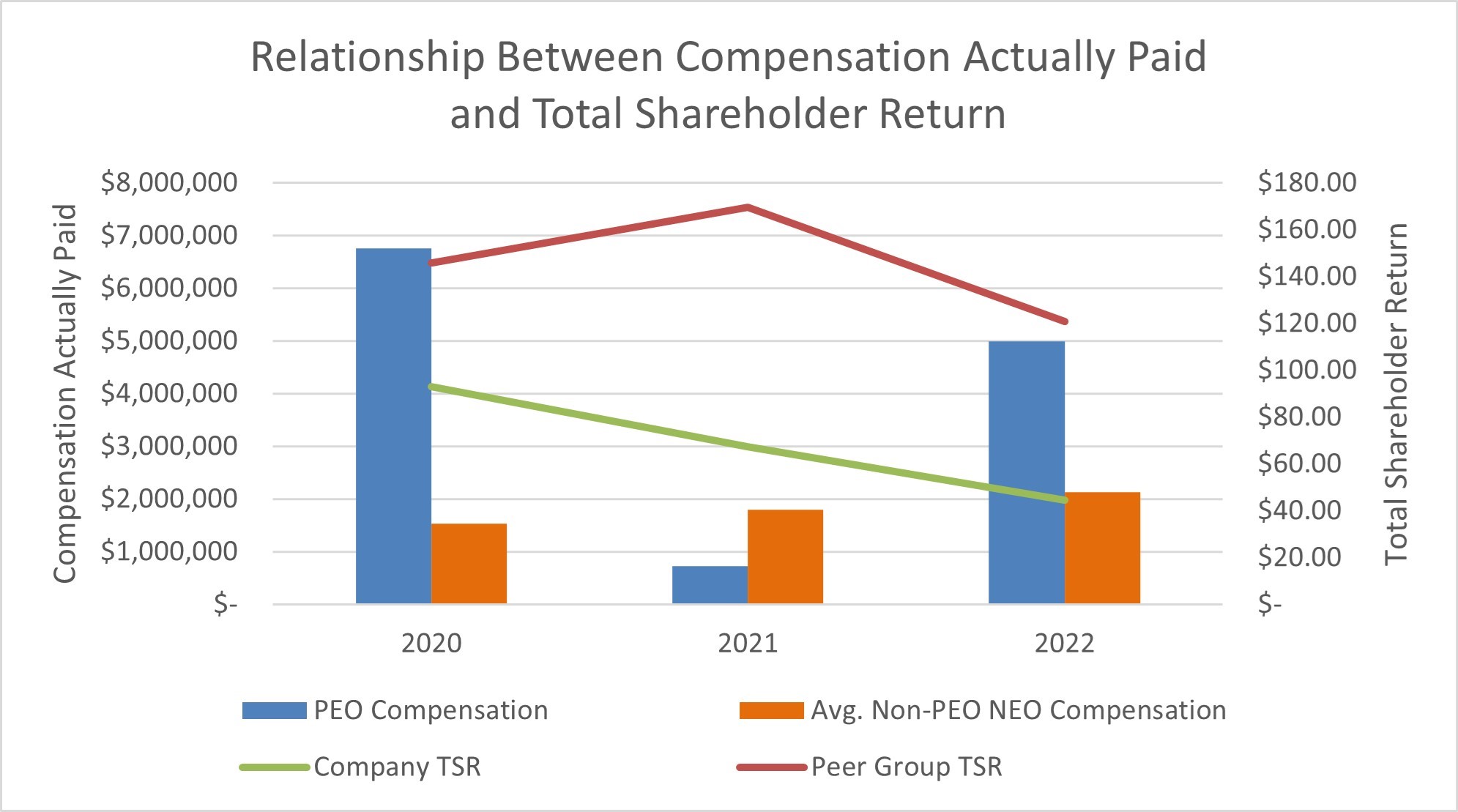

Executive Compensation Highlights

We focus our compensation program for our named executive officers and other executive officers on financial, strategic, and operational goals established by the Board of Directors, upon the recommendation of its Compensation and Talent Development Committee, designed to create sustained value for our shareholders. Our guiding compensation principle is to pay-for-performance. Our compensation program is also designed to motivate, measure, and reward the successful achievement of our strategic and operating goals without promoting excessive or unnecessary risk taking. We consider the input of our shareholders on our executive compensation program. At our 2022 annual meeting of shareholders, 97% of the votes cast were in favor of the advisory vote on our executive compensation, or the say-on-pay proposal. At our 2021 and 2020 annual meetings of shareholders, 97% and 95%, respectively, of the votes cast were in favor of the say-on-pay proposal at those meeting. We believe this shareholder support validates our “pay-for-performance” approach to executive compensation.

2022 Executive Total Compensation Mix

The charts below show the annual total target direct compensation (full-year base salary, target annual cash incentive compensation and long-term incentive equity compensation awarded) for Jon C. Serbousek, our President and Chief Executive Officer during 2022, and our other named executive officers for 2022. These charts illustrate that 88% of our Chief Executive Officer's annual total target direct compensation and 81% of our other named executive officers' annual total target direct compensation was performance-based or variable.

Governance of Executive Compensation

Consistent with shareholder interests and market best practices, our executive compensation program includes the following sound governance features:

What we do:

Align a significant amount of executive pay with the overall performance of our business and the Company’s common stock

Set meaningful performance targets for annual and performance-based stock awards, approved by our Compensation and Talent Development Committee

Include caps on annual cash incentive plan payments and shares earned under performance-based stock awards

Discourage unnecessary and inappropriate risk taking and we obtain an annual independent risk assessment analysis of our executive compensation program

Maintain robust stock ownership guidelines for our executive officers and directors

Maintain an incentive compensation clawback policy for executive officers

Include “double-trigger” change in control vesting provisions in all equity grants to executive officers; we have no “single-trigger” cash or similar payment rights upon a change in control

Our Compensation and Talent Development Committee directly retains an independent compensation consultant who conducts an annual benchmarking of our executive compensation program against an industry peer group

What we don’t do:

X Pay dividends or dividend equivalents on unvested stock options, time-based vesting stock awards, or unearned performance-based vesting stock awards

X Have employment agreements with our executive officers

X Pay excise tax gross-ups for change in control payments

X Reprice stock options without shareholder approval

X Provide excessive perquisites

X Permit hedging or pledging of our securities by employees, including our executive officers, or directors

Corporate Governance Highlights

We are committed to effective corporate governance and the regular review of our corporate governance practices to continue building on our success and long-term shareholder value.

Director Election

Board Independence

Standing Board Committees

Practices and Policies

TABLE OF CONTENTS

1 |

||

|

|

|

|

||

|

|

|

108 |

||

|

|

|

108 |

||

|

|

|

110 |

||

|

|

|

115 |

||

|

|

|

144 |

||

PROXY STATEMENT FOR THE ORTHOFIX MEDICAL INC. 2023 ANNUAL MEETING OF SHAREHOLDERS |

THIS PROXY STATEMENT IS BEING DISTRIBUTED TO SHAREHOLDERS ON OR ABOUT APRIL ___, 2023.

ABOUT VOTING |

Who can vote?

All record holders of shares of Orthofix common stock at the close of business on _______, 2023 (the “Record Date”), are entitled to notice of, and will be entitled to vote at, the 2023 Annual Meeting of Shareholders (the “Annual Meeting”). Each record holder on such date is entitled to cast one vote per share of common stock. As of the Record Date, there were ______________ shares of Orthofix common stock outstanding.

How to vote?

YOUR VOTE IS IMPORTANT. If you are a record holder, you may cast your vote online, by phone, by mail, or in person at the Annual Meeting. See your proxy card for your online control number in order to vote.

Vote Via the Internet: www. proxypush.com/OFIX

|

Call Toll Free: 1-866-240-4561 |

Mail Signed Proxy Card: Follow the instructions on your proxy card or voting instruction form |

If you hold your shares in an account at a bank, broker, or other organization, then you are the “beneficial owner of shares held in street name.” As a beneficial owner, you have the right to instruct the person or organization holding your shares how to vote your shares. Most individual shareholders are beneficial owners of shares held in street name. If you hold shares in street name, please follow the voting instructions provided to you by your broker. If your shares of common stock are held in street name, you will receive instructions from your broker, bank, or other nominee that you must follow in order to have your shares of common stock voted.

What constitutes a quorum?

The presence, in person or represented by proxy, of the holders of a majority of the shares of Orthofix common stock outstanding on the Record Date is required to constitute a quorum at the Annual Meeting. Abstentions and “broker non-votes” (described below) are counted as shares present for purposes of determining the presence of a quorum.

1

What are broker-non-votes?

If you are a beneficial owner of shares held in a brokerage account and you do not instruct your broker, bank or other agent how to vote your shares, your broker, bank or other agent may still be able to vote your shares in its discretion. Brokers, banks and other securities intermediaries that are subject to New York Stock Exchange ("NYSE") rules may use their discretion to vote your uninstructed shares on matters considered to be “routine” under NYSE rules, but not with respect to “non-routine” matters. The NYSE rules apply to broker, bank and other securities intermediary's discretion in voting your uninstructed shares shares regardless of the fact that we are a Nasdaq-listed company. A broker non-vote occurs when a broker, bank or other agent who has record ownership of the shares held in an account for its client has not received voting instructions from the client who is the beneficial owner of the shares and the broker, bank or other agent cannot vote the shares because the matter is considered “non-routine” under NYSE rules. Proposals 1, 2, 5, 6, 7, 8 and 9 are considered to be “non-routine” under NYSE rules and applicable interpretations and your broker, bank or other agent may not vote your shares on those proposals in the absence of your voting instructions. Conversely, Proposals 3 and 4 are considered to be “routine” under NYSE rules and applicable interpretations, and, thus, if you do not return voting instructions to your broker, bank or other agent, your broker, bank or other agent may vote your shares in its discretion on those proposals.

What vote is required to approve each proposal?

Assuming a quorum is present, each director nominee will be elected by a majority of the votes cast with respect to such nominee. In other words, a director nominee will be elected if the number of shares voted “FOR” such nominee exceeds the number of shares voted “AGAINST” such nominee. For purposes of Proposal 1, abstentions and broker non-votes are not counted as votes cast either "FOR” or “AGAINST” a nominee, and have no effect on the outcome of the vote.

Assuming a quorum is present, with respect to each of Proposals 2, 3, 7, and 8, the particular proposal will be approved if it receives the affirmative vote of a majority in voting power of the shares present in person or represented by proxy at the Annual Meeting and entitled to vote on the applicable proposal. For each of these proposals, abstentions will have the same effect as a vote “AGAINST” the applicable proposal, and broker non-votes (to the extent applicable) will have no effect on the outcome of the vote for the applicable proposal.

Assuming a quorum is present, with respect to each of Proposals 4, 5 and 6, the particular proposal will be approved if it receives “FOR” votes from the holders of common stock representing a majority of our outstanding shares of common stock as of the Record Date. For each of these proposals, abstentions and broker non-votes (to the extent applicable) will have the same effect as a vote “AGAINST” the applicable proposal.

With respect to Proposal 9, the advisory vote on frequency of say-on-pay votes, shareholders may cast their advisory votes to hold the say-on-pay vote every year, every two years, or every three years. Shareholders may also abstain from voting on this proposal. Assuming a quorum is present, the frequency (1 Year, 2 Years or 3 Years) that receives the affirmative vote of a majority in voting power of the shares present in person or represented by proxy at the Annual Meeting and entitled to vote on the proposal will be considered the frequency selected by the shareholders. Abstentions will make it more difficult for any of the frequency options to obtain such majority vote. If no frequency receives such majority vote, then the frequency that receives the greatest number of votes will be considered the frequency selected by the shareholders, on an advisory basis. Broker non-votes will have no effect on the outcome of the vote for this proposal.

2

Proxies

This proxy statement is being furnished to holders of shares of Orthofix common stock in connection with the solicitation of proxies by and on behalf of the Board for use at the Annual Meeting.

All shares of Orthofix common stock that are represented at the Annual Meeting by properly executed proxies received prior to or at the Annual Meeting and which are not validly revoked, will be voted at the Annual Meeting in accordance with the instructions indicated on such proxies. If no instructions are indicated on a properly executed proxy, such proxy will be voted “FOR” the election of each director nominee identified in this proxy statement, for “1 year” with respect to the advisory vote on frequency of say-on-pay votes, and “FOR” each of the other proposals. The Board does not know of any other matters that are to be presented for consideration at the Annual Meeting.

Any proxy delivered by a record shareholder may be revoked by the person giving it at any time before voting begins at the Annual Meeting. Proxies may be revoked by (1) timely delivery to our Corporate Secretary of a written notice of revocation bearing a later date than the proxy sought to be revoked, (2) timely delivery to Orthofix of a valid, later-dated proxy (including a proxy given by telephone or online) relating to the same shares of Orthofix common stock or (3) attending the Annual Meeting and voting at the Annual Meeting in person. Attending the Annual Meeting will not in and of itself constitute the revocation of a proxy. Any written notice of revocation or later-dated proxy should be sent so as to be received in a timely manner to: Orthofix Medical Inc., Attn: Corporate Secretary, 3451 Plano Parkway, Lewisville, Texas 75056.

Voting is confidential

We maintain a policy of keeping all proxies and ballots confidential.

The costs of soliciting these proxies and who will pay them

We will pay all the costs of soliciting these proxies, including reimbursing banks, brokers, nominees and other fiduciaries for the expenses they incur in forwarding the proxy materials to beneficial owners. Our directors and employees may also solicit proxies by telephone or electronic means of communication, or in person, and no additional compensation will be paid to such individuals.

Obtaining an Annual Report on Form 10-K

We have filed our Annual Report on Form 10-K for the fiscal year ended December 31, 2022 (the “2022 Form 10-K”) with the U.S. Securities and Exchange Commission (the “SEC”). The 2022 Form 10-K is available on our website at www.orthofix.com and at http://www.proxydocs.com/OFIX. If you would like to receive an additional copy of the 2022 Form 10-K, we will send you one free of charge. Please write to:

Orthofix Medical Inc.

3451 Plano Parkway

Lewisville, Texas 75056

Attention: Ms. Alexa Huerta, Investor Relations

You may also contact Ms. Huerta at (214) 937-3190 or at AlexaHuerta@orthofix.com.

The information on our website is not incorporated by reference in, or considered part of, this proxy statement.

3

The voting results

We will publish the voting results from the Annual Meeting in a Current Report on Form 8-K filed with the SEC within four business days after the Annual Meeting. You will also be able to find the Form 8-K on our website at www.orthofix.com.

Whom to call if you have any questions

If you have questions about the Annual Meeting, voting or your ownership of shares of Orthofix common stock, please contact Alexa Huerta at (214) 937-3190 or at AlexaHuerta@orthofix.com. Directions to the meeting can be found at http://www.proxydocs.com/OFIX.

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting To Be Held on June 19, 2023

This proxy statement, your proxy voting card, and the 2022 Form 10-K are available at http://www.proxydocs.com/OFIX.

4

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED SHAREHOLDERS |

Who are the principal owners of shares of Orthofix common stock?

The following table shows each person, or group of affiliated persons, who beneficially owned, directly or indirectly, at least 5% of the shares of our common stock. Our information is based on reports filed with the SEC by each of the firms or individuals listed in the table below. You may obtain these reports from the SEC.

The Percent of Class figures for the shares of our common stock are based on 36,535,215 shares of our common stock outstanding as of April 12, 2023. Except as otherwise indicated, each shareholder has sole voting and dispositive power with respect to the shares indicated.

Name and Address of Beneficial Owner |

|

Amount and |

Percent of |

|||

BlackRock, Inc. |

|

|

3,862,706 |

|

(1) |

10.6% |

First Light Asset Management, LLC |

|

|

2,654,616 |

|

(2) |

7.3% |

Segall Bryant & Hamill, LLC |

|

|

2,727,650 |

|

(3) |

7.5% |

(1) Based solely on information obtained from a Schedule 13G/A filed with the SEC by BlackRock, Inc. (“BlackRock”) on January 23, 2023 disclosing that BlackRock has sole power to vote or direct the vote of 3,756,635 shares, shared power to vote or direct the vote of 0 shares, sole power to dispose of or to direct the disposition of 3,862,706 shares, and shared power to dispose of or to direct the disposition of 0 shares.

(2) Based solely on formation obtained from a Schedule 13G filed with the SEC by First Light Asset Management, LLC (“First Light”) on February 14, 2023 disclosing that First Light has sole power to vote or direct the vote of 0 shares, shared power to vote or direct the vote of 2,654,616 shares, sole power to dispose of or to direct the disposition of 0 shares, and shared power to dispose of or to direct the disposition of 2,654,616 shares.

(3) Although no 13G/A was filed with the SEC by Segall Bryant & Hamill, LLC (“Segall”) in 2023, a Schedule 13F was filed on February 14, 2023 disclosing that Segall has sole power to vote or direct the vote of 1,911,177 shares, shared power to vote or direct the vote of 0 shares, sole power to dispose of or to direct the disposition of 2,727,650 shares, and shared power to dispose of or to direct the disposition of 0 shares.

5

Shares of common stock owned by Orthofix’s directors and executive officers

The following table sets forth the beneficial ownership of shares of our common stock, including stock options currently exercisable and exercisable within 60 days of April 12, 2023, by each current director, each director nominee, each named executive officer listed in the Summary Compensation Table, each current executive officer, and all current directors and executive officers as a group. The Percent of Class figure is based on 36,535,215 shares of our common stock outstanding as of April 12, 2023. Our current directors and executive officers as a group beneficially owned 1,772,083 shares of our common stock as of such date. Unless otherwise indicated, the beneficial owners exercise sole voting and/or investment power over their shares.

Name and Address of Beneficial Owner |

Amount and |

Percent of |

|||

Jon C. Serbousek |

|

257,921 |

|

(1) |

* |

Wayne Burris |

|

6,383 |

|

(2) |

* |

Catherine M. Burzik |

|

24,042 |

|

(3) |

* |

Stuart M. Essig, Ph.D. |

|

245,811 |

|

(4) |

* |

Jason M. Hannon |

|

35,758 |

|

(5) |

* |

John B. Henneman, III |

|

66,186 |

|

(6) |

* |

James F. Hinrichs |

|

93,505 |

|

(7) |

* |

Shweta Singh Maniar |

|

5,726 |

|

(8) |

* |

Michael E. Paolucci |

|

64,635 |

|

(9) |

* |

Keith C. Valentine |

|

500,709 |

|

(10) |

1.4% |

John Bostjancic |

|

153,417 |

|

(11) |

* |

Kimberley A. Elting |

|

112,331 |

|

(12) |

* |

Kevin J. Kenny |

|

73,872 |

|

(13) |

* |

Patrick L. Keran |

|

131,787 |

|

(14) |

* |

All current directors and executive officers as a group (14 persons) |

|

1,772,083 |

|

|

4.7% |

* Represents less than one percent.

(1) Reflects 78,273 shares owned directly, 179,648 shares issuable pursuant to stock options that are currently exercisable or exercisable within 60 days of April 12, 2023.

(2) Reflects 6,383 shares owned directly.

(3) Reflects 3,882 shares owned directly, 14,820 shares issuable pursuant to deferred stock units that are vested or potentially issuable within 60 days of April 12, 2023 and 5,340 shares issuable pursuant to stock options that are currently exercisable or exercisable within 60 days of April 12, 2023.

(4) Reflects 191,612 shares owned directly and 54,199 shares issuable pursuant to stock options that are currently exercisable or exercisable within 60 days of April 12, 2023.

(5) Reflects 1,949 shares owned directly, 15,284 shares issuable pursuant to deferred stock units that are vested or potentially issuable within 60 days of April 12, 2023 and 18,525 shares issuable pursuant to stock options that are currently exercisable or exercisable within 60 days of April 12, 2023.

(6) Reflects 34,408 shares owned directly and 31,778 shares issuable pursuant to stock options that are currently exercisable or exercisable within 60 days of April 12, 2023.

(7) Reflects 38,311 shares owned directly, 25,194 shares issuable pursuant to deferred stock units that are vested or potentially issuable within 60 days of April 12, 2023 and 30,000 shares issuable pursuant to stock options that are currently exercisable or exercisable within 60 days of April 12, 2023.

(8) Reflects 5,726 shares owned directly.

6

(9) Reflects 9,441 shares owned directly, 25,194 shares issuable pursuant to deferred stock units that are vested or potentially issuable within 60 days of April 12, 2023, and 30,000 shares issuable pursuant to stock options that are currently exercisable or exercisable within 60 days of April 12, 2023.

(10) Reflects 160,067 shares owned directly and 340,102 shares issuable pursuant to stock options that are currently exercisable or exercisable within 60 days of April 12, 2023.

(11) Reflects 47,286 shares owned directly and 106,131 shares issuable pursuant to stock options that are currently exercisable or exercisable within 60 days of April 12, 2023.

(12) Reflects 40,749 shares owned directly and 71,582 shares issuable pursuant to stock options that are currently exercisable or exercisable within 60 days of April 12, 2023.

(13) Reflects 30,420 shares owned directly and 43,452 shares issuable pursuant to stock options that are currently exercisable or exercisable within 60 days of April 12, 2023.

(14) Reflects 33,122 shares owned directly and 98,665 shares issuable pursuant to stock options that are currently exercisable or exercisable within 60 days of April 12, 2023.

7

INFORMATION ABOUT OUR executive officers |

Information concerning our current and former executive officers is set forth below.

Name |

Age |

Position |

Keith C. Valentine |

55 |

President and Chief Executive Officer and Director |

Jon C. Serbousek |

62 |

Executive Chairman and Former President and Chief Executive Officer |

John Bostjancic |

52 |

Chief Financial Officer |

Douglas C. Rice |

57 |

Former Chief Financial Officer |

Kimberley A. Elting |

58 |

President, Global Orthopedics and former Chief Legal and Development Officer |

Kevin J. Kenny |

58 |

President, Global Spine |

Patrick L. Keran |

51 |

Chief Legal Officer |

Paul W. Gonsalves |

57 |

Former President, Global Orthopedics |

Keith C. Valentine. Mr. Valentine was appointed President and Chief Executive Officer in January 2023 following the merger with SeaSpine. He served as the CEO and President of SeaSpine from 2015 to the effective date of the merger. Prior to joining SeaSpine, Mr. Valentine served as President and Chief Operating Officer of NuVasive Inc. from 2007 to 2012 and as President from 2004 to 2007. While at NuVasive, Keith served in various senior executive roles of increasing responsibility in marketing, development, and operations. Previously, he served as Vice President of Marketing at ORATEC Interventions Inc., a medical device company acquired by Smith & Nephew PLC, and spent eight years in various roles with Medtronic Sofamor Danek including Vice President of Marketing for the Rods Division and Group Director for the BMP Biologics program, the Interbody Sales Development Effort, and International Sales and Marketing. Keith received a B.B.A. in Management and Biomedical Sciences from Western Michigan University.

Jon C. Serbousek. Prior to being named Executive Chairman in January 2023, Mr. Serbousek served as our President and Chief Executive Office (and a member of the Board) since November 2019, after previously having joined the Company in August 2019 as our President of Global Spine. A seasoned executive with more than 30 years’ experience in the medical device and biotech industries, Mr. Serbousek previously served in several leadership positions at Biomet Inc., including Worldwide President of Biomet Biologics, Worldwide Group President of Orthopedics, and President of U.S. Orthopedics. Prior to joining Biomet, he held various general management positions within Medtronic Inc., including Worldwide Division President − Spine, and Worldwide Vice President and General Manager of Biologics for their Spine and Biologics business. Additionally, Mr. Serbousek spent 13 years with DePuy Orthopedics, a Johnson & Johnson company where he served in numerous roles of increasing responsibility, including Vice President of Marketing and Product Development and Vice President of Spinal Operations. Mr. Serbousek has held numerous board positions at for profit and not-for-profit organizations. He earned his B.S. in Engineering from Washington State University, his M.S. in Bioengineering from the University of Utah, and later completed several advanced management programs including a program at the IMD International School of Management in Lausanne, Switzerland.

John Bostjancic. Mr. Bostjancic was appointed as Chief Financial Officer in January 2023 following the Merger. Prior to the Merger, he served as Chief Financial Officer of SeaSpine since March 2015, and in May 2022 he was appointed to his expanded role of Chief Operating and Financial Officer. Prior to this, he served as Treasurer and Senior Vice President at SeaSpine. Mr. Bostjancic served as acting Chief Financial Officer of the SeaSpine business within Integra Life Sciences Holdings Corporation from 2014 to 2015 and from 2012 to 2014 he was Senior Vice President of Global Supply Chain at Integra. Mr. Bostjancic's responsibilities included global planning, kitting, distribution, logistics and customer service in the role, and he led the project team implementing the U.S. Food and Drug Administration’s “unique device identifier” rule in 2014. From 2008 to 2012, he was Senior Vice President of Financial Planning and Analysis at Integra. Since joining Integra in 1999, he held roles of increasing responsibility in the finance organization, including Corporate Controller from 2003 through 2006.

8

Before joining Integra, from 1998 through 1999 Mr. Bostjancic was a manager in the accounting standards team at Merck & Co., Inc., a publicly traded health care company. From 1993 to 1998, he worked in the business assurance organization at PricewaterhouseCoopers. Mr. Bostjancic received his B.S. in Accounting from the College of New Jersey.

Douglas C. Rice. Mr. Rice was the Company's Chief Financial Officer from 2015 through the closing of the merger in January 2023, and currently serves an executive consultant through June 2023. He joined Orthofix as the Chief Accounting Officer in 2014. Prior to joining the Company, Mr. Rice was the CFO of Vision Source, an international optometric network provider, where he had served since 2012. Mr. Rice served as the VP Finance, Treasurer of McAfee, a security technology company, from 2007 to 2012, when it was acquired by Intel. From 2000 to 2007, he served as the SVP, Corporate Controller of Concentra, Inc., a national healthcare service provider. Mr. Rice's over 30 years of finance experience also includes finance leadership positions with la Madeleine, Allied Marketing Group and PricewaterhouseCoopers (formerly Coopers & Lybrand). He is a CPA and holds an MBA and a BBA, with honors, from Southern Methodist University.

Kimberley A. Elting. Ms. Elting currently serves as our President, Global Orthopedics. She joined the Company as Chief Legal Officer in September 2016 and was named Chief Legal and Administrative Officer in 2017, Chief Legal and Development Officer in 2020, and President, Global Orthopedics in 2022. From April 2022 to the effective date of the Merger, she served as both the Chief Legal and Development Officer and President, Global Orthopedics. Before joining Orthofix, she had served since 2013 as General Counsel and Vice President Corporate Affairs at TriVascular Technologies, Inc.. In this role, she led the legal, compliance, human resources (HR) and government affairs functions for the company. Between 2007 and 2012, she served in various roles of increasing responsibility with St. Jude Medical, including General Counsel and Vice President of HR and Health Policy for the Neuromodulation Division. She was previously a partner at the Jones Day law firm where she counseled clients in the health care sector on mergers and acquisitions and regulatory matters. A graduate of Ithaca College, Ms. Elting earned her Law Degree from the University of Denver and an LL.M. in Health Law from Loyola University Chicago.

Kevin J. Kenny. Mr. Kenny became President of Global Spine in December 2019. Mr. Kenny previously served as the Chief Operating Officer for Cardiovascular Systems Incorporated where he drove business strategies focused on developing and commercializing new products worldwide. Prior to Cardiovascular Systems Incorporated, Mr. Kenny served as Vice President of U.S. Sales for Medtronic Spine and Biologics where he oversaw all sales functions for approximately 1,500 direct and non-direct sales personnel. During his nine-year tenure with Medtronic, Mr. Kenny held a variety of sales roles, each with increasing areas of responsibility. Earlier in his career, Mr. Kenny served as Vice President of Sales for Bausch and Lomb and also held various sales leadership roles with B. Braun/McGaw, a worldwide manufacturer and distributor of medical devices. Mr. Kenny serves on the Board of Directors for the Medical Device Manufacturers Association. He earned his B.S. in Business Administration from California State University in Sacramento, CA.

Patrick L. Keran. Mr. Keran was appointed Chief Legal Officer in January 2023 following the Merger. He served as the General Counsel of SeaSpine since October 2015, Secretary since June 2016 and, in June 2020 was designated a Senior Vice President. Prior to joining SeaSpine, Mr. Keran provided strategic and business advisory services to a variety of life sciences companies, including acting as Chief Legal Officer to NAIA Pharmaceuticals, Inc., a privately held international drug development company. From February 2010 to February 2015, he served as President and Chief Operating Officer of Mast Therapeutics, Inc., a publicly held clinical stage biopharmaceutical company, and from August 2006 to February 2010, he served as its General Counsel. Mr. Keran also served as Mast’s secretary from September 2006 to February 2015 and served as its Principal Financial Officer from July 2009 to January 2013. Previously, from 2004 to 2006, Mr. Keran was Associate General Counsel at Ionis Pharmaceuticals, Inc. (formerly known as Isis Pharmaceuticals, Inc.), a publicly held

9

drug discovery and development company. From 1999 to 2004, he practiced corporate law at the law firms of Heller Ehrman LLP and Brobeck Phleger & Harrison LLP, specializing in public and private financings, licensing arrangements, mergers and acquisitions and corporate governance matters. Mr. Keran is licensed to practice law in the State of California. He received a B.A. from the University of California at San Diego and a J.D. from the University of California at Berkeley, School of Law.

Paul W. Gonsalves. Mr. Gonsalves was our President, Global Orthopedics from September 2020 until April 2022, at which time he ceased employment with the Company to pursue other opportunities.

10

INFORMATION ABOUT DIRECTORS |

The Board of Directors and Committees of the Board

Our amended and restated bylaws (“Bylaws”) provide that the Board shall consist of not less than six and no more than fifteen directors, the exact number to be determined from time-to-time by resolution of the Board. The Board is currently comprised of nine seats, though one serving director, Jon C. Serbousek, will not be standing for election at the Annual Meeting. Following the recommendation of the Nominating, Governance and Sustainability Committee, the Board has nominated each of the remaining eight current directors for election to the Board at the Annual Meeting and has nominated Wayne Burris for election as a director at the Annual Meeting.

Directors are elected at each annual meeting of shareholders by a majority of the votes cast with respect to the director, provided, however, that directors shall be elected by the vote of a plurality of the votes cast if (i) the Company receives a notice that a shareholder has nominated a person for election to the Board of Directors in compliance with the advance notice requirements for shareholder nominees for directors set forth in our Bylaws, which nomination is not subsequently withdrawn, or (ii) the number of nominees for election to the Board of Directors at such meeting exceeds the number of directors to be elected. For purposes of this standard, a “majority of the votes cast” means that the number of shares voted “FOR” a director nominee must exceed the number of votes cast “AGAINST” that director nominee. The Company has not received any director nominations from shareholders for the Annual Meeting, and the number of nominees is equal to the number of directors to be elected at the Annual Meeting. As such, a “majority of the votes cast” will be the standard for election at the Annual Meeting.

Under our Bylaws, any incumbent director who is nominated for election by the Board or a committee thereof must, as a condition to such nomination submit to the Chair of the Board (a) in the case of a contested election, a conditional letter of resignation, and (b) in the case of an uncontested election, a conditional and irrevocable letter of resignation. If an incumbent director is not elected (that is, the incumbent director receives more “AGAINST” votes than “FOR” votes), the Nominating, Governance and Sustainability Committee will consider the conditional resignation of such nominee and make a recommendation to the Board on whether to accept or reject the conditional resignation, or whether other action should be taken. The Board will act on the Nominating, Governance and Sustainability Committee’s recommendation and publicly disclose its decision and the rationale behind it within 90 days from the date of the certification of the election results for the Annual Meeting. If the Board’s decision is to accept the director’s resignation, then the Board may fill the resulting vacancy in accordance with our Bylaws. The director whose conditional resignation is being considered will not participate in the Nominating, Governance and Sustainability Committee's recommendation or the Board’s decision.

It is our policy that all directors attend the Annual Meeting, and at last year’s annual meeting of shareholders, all directors attended the meeting in person. We expect that all directors will attend the Annual Meeting in person.

The Board meets at least four times per year in person at regularly scheduled quarterly meetings, but will meet more often in person if necessary. In addition, the Board typically holds several additional telephonic or virtual meetings each year as events require. The Board met 29 times during 2022, all of which were in-person or virtual meetings. The Board has four standing committees: the Audit and Finance Committee, the Compensation and Talent Development Committee, the Compliance and Ethics Committee, and the Nominating, Governance and Sustainability Committee. During 2022, every director attended 75% or more of the aggregate of all

11

meetings of the Board and the committees on which he or she served that were held during the period for which he or she was a director or committee member, as applicable.

Of our nine director nominees, the Board has determined that each of Ms. Burzik, Mr. Burris, Mr. Essig, Mr. Hannon, Mr. Henneman, Mr. Hinrichs, Ms. Maniar and Mr. Paolucci are independent under the current Nasdaq listing standards. Mr. Valentine is not considered independent because he serves as our President and Chief Executive Officer. A list of our director nominees, including background information for each of them, is presented in the section “Proposal 1: Election of Directors,” beginning on page 64.

Board Leadership Structure

Ms. Burzik, who is an independent director, currently serves as the Lead Independent Director. Mr. Valentine, who is also a director, serves as the Company’s President and Chief Executive Officer. Our former Chief Executive Officer, Mr. Serbousek, currently serves as Executive Chairman of the Board; however, he will not be standing for election at the Annual Meeting.

Following this Annual Meeting, the Board of Directors will determine who will serve as the Company's Chair of the Board. Consistent with our corporate governance guidelines, we expect the Chair and CEO positions to be separate. The Board believes that the separation of these two critical roles best serves the Company’s shareholders because it allows our President and Chief Executive Officer to focus on providing leadership over our day-to-day operations while the Chair of the Board focuses on leadership of the Board.

The Audit and Finance Committee

Our Audit and Finance Committee is a separately-designated standing audit committee established in accordance with Section 3(a)(58)(A) of the Exchange Act. The committee oversees the Company’s financial reporting process on behalf of the Board. The committee is responsible for the selection, compensation, and oversight of the Company’s independent registered public accounting firm. The committee reviews matters relating to the Company’s internal controls, as well as other matters warranting committee attention. The committee also meets privately, outside the presence of Orthofix management, with our independent registered public accounting firm. The Audit and Finance Committee’s report for 2022 is printed below at page 78.

The Audit and Finance Committee also oversees the Company’s (i) enterprise risk management program, reviews risk assessments, and receives reports from management on risk areas and mitigation plans and (ii) regularly reviews the Company’s cybersecurity and other IT risks, controls, and procedures, including plans to mitigate cybersecurity risks and respond to data breaches, with updates provided on at least a quarterly basis.

The Board has adopted a written charter for the Audit and Finance Committee, a copy of which is available for review on our website at www.orthofix.com.

The Audit and Finance Committee met eight times during 2022 (either in-person or virtual meetings).

Mr. Hinrichs, Mr. Essig and Mr. Hannon currently serve as members of the Audit and Finance Committee, with Mr. Hinrichs serving as Chair. Under the current rules of Nasdaq and pursuant to Rule 10A-3 of Schedule 14A under the Exchange Act, all of the committee members are independent. The Board has determined that Mr. Hinrichs is an “audit committee financial expert” as that term is defined in Item 407(d) of Regulation S-K.

12

The Compensation and Talent Development Committee

The Compensation and Talent Development Committee is responsible for establishing compensation policies and determining, approving, and overseeing the total compensation packages for our executive officers, including all elements of compensation. The committee administers our Amended and Restated 2012 Long-Term Incentive Plan, as amended (the “2012 LTIP”), the primary equity incentive plan under which we make equity-related awards, as well as the SeaSpine Amended and Restated 2015 Incentive Award Plan, which was assumed in the merger. In addition, the committee administers our Second Amended and Restated Stock Purchase Plan, as Amended (the “SPP”), an equity plan under which most of our employees and Directors are eligible to purchase shares of Company common stock at a discount.

The Compensation and Talent Development Committee met six times during 2022 (either in-person or virtual meetings).

The Board has adopted a written charter for the Compensation and Talent Development Committee, a copy of which is available for review on our website at www.orthofix.com.

Mr. Paolucci, Mr. Hinrichs, Mr. Henneman and Ms. Maniar currently serve as members of the Compensation and Talent Development Committee, with Mr. Paolucci serving as Chair. All of these members (i) are non-employee, non-affiliated, outside directors who have been determined by the Board to be independent under the current rules of Nasdaq and (ii) satisfy the qualification standards of Section 16 of the Exchange Act.

No interlocking relationship, as defined in the Exchange Act, currently exists, nor existed during 2022, between the Board or Compensation and Talent Development Committee and the board of directors or compensation committee of any other entity.

The Compliance and Ethics Committee

The Compliance and Ethics Committee assists the Board in overseeing the Company’s Corporate Compliance and Ethics Program and the Company’s global compliance with various international and domestic laws and regulations, including those related to the U.S. Food and Drug Administration and requirements of the U.S. Foreign Corrupt Practices Act and other applicable global anti-corruption laws. The committee also assists the Board in overseeing the Company’s compliance with the Company’s own Corporate Code of Conduct, policies, and procedures.

The Compliance and Ethics Committee met four times in 2022 (either in-person or virtual meetings).

The Board has adopted a written charter for the Compliance and Ethics Committee, a copy of which is available for review on our website at www.orthofix.com.

Mr. Hannon, Ms. Maniar, and Mr. Serbousek currently serve as members of the Compliance and Ethics Committee, with Mr. Hannon serving as Chair. All of these members, excluding Mr. Serbousek, have been determined by the Board to be independent under the current Nasdaq and SEC rules. The Compliance and Ethics Committee's charter requires that a majority of members must be independent.

The Nominating, Governance and Sustainability Committee

The Nominating, Governance and Sustainability Committee assists the Board in identifying qualified individuals to become Board members, recommends nominees for election at each annual meeting of shareholders to the Board, develops and recommends the Company’s corporate governance principles and guidelines to the Board, and evaluates potential candidates for executive positions as appropriate. In connection with this role, the

13

committee periodically reviews the composition of the Board in light of the characteristics of independence, skills, experience, and availability of service, with an emphasis on the particular areas of skill and experience needed by the Board at any given time. The committee periodically reviews succession planning with the Chair of the Board and the President and Chief Executive Officer, and makes recommendations to the Board in connection with succession planning. The committee oversees the Board’s annual self-evaluation process, which includes the completion of questionnaires covering the Board, each committee, and individual director performance. In addition, the committee oversees the Company’s ESG programs, inclusive of climate-related matters; reviews gap analysis; progress on diversity, equity and inclusion programs; company initiatives; and receives reports from management on ESG matters.

The Nominating, Governance and Sustainability Committee met four times in 2022 (either in-person or virtual meetings).

The Board has adopted a written charter for the Nominating, Governance and Sustainability Committee, a copy of which is available for review on our website at www.orthofix.com.

Mr. Essig, Ms. Burzik, Mr. Henneman, and Mr. Paolucci currently serve as members of the Nominating, Governance and Sustainability Committee, with Mr. Essig serving as Chair. All of these members have been determined by the Board to be independent under the current rules of Nasdaq and the SEC.

Board’s Role in Risk Oversight

The Board plays an important role in overseeing various risks that we may face from time to time. While the full Board has primary responsibility for risk oversight, it utilizes its committees, as appropriate, to monitor and address the risks that may be within the scope of a particular committee’s expertise or charter. For example, the Audit and Finance Committee oversees our financial statements and receives reports on the Company’s enterprise risk management program, the Compliance and Ethics Committee assists in the Board’s oversight of compliance with certain legal and regulatory requirements, the Compensation and Talent Development Committee oversees the Company’s compensation plans and assures that such plans properly discourage unnecessary and inappropriate risk taking by management, and the Nominating, Governance and Sustainability Committee oversees the identification of potential Board or executive candidates and the Company’s ESG programs, inclusive of climate-related matters. The Board believes the composition of its committees, and the distribution of the particular expertise of each committee’s members, makes this an appropriate structure to more effectively monitor these risks.

An important feature of the Board’s risk oversight function is to receive updates from its committees and management, as appropriate. In that regard, the Board regularly receives updates from the President and Chief Executive Officer, Chief Financial Officer, Chief Legal Officer, and Chief Ethics and Compliance Officer, including in connection with material litigation and legal compliance matters. The Board also receives updates at quarterly in-person or virtual Board meetings on committee activities from each committee Chair. In addition, the senior executive of each Company division or business unit periodically reviews and assesses the most significant risks associated with his or her division or unit. These assessments are then aggregated by our management team and presented to the Board. The Board regularly discusses with management these risk assessments and includes risk management and risk mitigation as part of its oversight of the enterprise risk management program and its ongoing strategic planning process.

Cybersecurity Risk Management

14

The Audit and Finance Committee regularly reviews the Company’s cybersecurity, including IT risks, controls, procedures, and plans to mitigate cybersecurity risks and respond to data breaches. The Audit and Finance Committee periodically receives reports at its regularly scheduled meetings from the Chief Information Officer and the IT Vice President of IT Security and Controls on, among other things, the Company’s cyber risks and threats, the status of projects and management’s strategies to strengthen the Company’s IT systems, assessments of the Company’s security program and third-party assessments and testing, emerging threat landscape, and the review of the Company’s cybersecurity insurance policy. Due to the importance of this topic, the Board also receives periodic updates on cybersecurity matters. In 2021, the Company was audited by a third-party cybersecurity firm using the National Institute of Standards and Technology (NIST) standard and in 2022 implemented certain recommendations resulting from the audit. The Company also requires that cybersecurity training is part of the onboarding process for new hires and that all employees participate in annual cybersecurity training.

Corporate Code of Conduct

We maintain codes of conduct (our “Codes of Conduct”) for each of our legacy Orthofix and SeaSpine businesses that are applicable to all employees worldwide of the respective business. The Code of Conduct for the legacy Orthofix business, to which all of our directors and executive officers are subject, is available for review under the “Investors > Governance > Governance Documents” section of our website at www.orthofix.com.

The goals of our Codes of Conduct, as well as our general corporate compliance and ethics program (which we have branded the Integrity Advantage™ Program), are to deter wrongdoing and to promote (i) honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships, (ii) full, fair, accurate, timely, and understandable disclosure in reports and documents that we file with, or submit to, the SEC and in other public communications made by us, (iii) compliance with applicable governmental laws, rules, and regulations, (iv) the prompt internal reporting of violations of our Codes of Conduct to appropriate persons identified therein, and (v) accountability for adherence to our Codes of Conduct. Our Codes of Conduct apply to all areas of professional conduct, including customer relationships, conflicts of interest, financial reporting, use of company assets, insider trading, intellectual property, confidential information, and workplace conduct. Under our Codes of Conduct, employees, directors, and executive officers are responsible for promptly reporting potential violations of any law, regulation, or our Codes of Conduct to appropriate personnel or via a hotline we have established.

We intend to disclose any substantive amendment to, or a waiver from, a provision of the Code of Conduct for the legacy Orthofix business that applies to our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions and that relates to any element of the code of ethics definition enumerated in paragraph (b) of Item 406 of Regulation S-K by posting such information on our website at the address specified above.

Hedging and Pledging Policies

Under the Company’s Corporate Governance Guidelines, all directors, executives, and employees are prohibited from engaging in hedging transactions involving the Company’s common stock, including through the use of financial instruments, such as prepaid variable forwards, equity swaps, collars, and exchange funds. In addition, all such persons are prohibited from holding the Company’s common stock in a margin account or otherwise pledging such shares as collateral for a loan.

15

Shareholder Communication with the Board

To facilitate the ability of shareholders to communicate with the Board, we have established an electronic mailing address and a physical mailing address to which communications may be sent: boardofdirectors@orthofix.com, The Board of Directors, c/o Chair of the Board, Orthofix Medical Inc., 3451 Plano Parkway, Lewisville, TX 75056.

The Chair of the Board and/or Lead Independent Director reviews all correspondence addressed to the Board and presents to the Board a summary of all such correspondence and forwards to the Board or individual directors, as the case may be, copies of all correspondence that, in the opinion of the Chair of the Board and/or Lead Independent Director, deals with the functions of the Board or committees thereof or that he otherwise determines requires their attention. Examples of communications that would be logged, but not automatically forwarded, include solicitations for products and services or items of a personal nature not relevant to us or our shareholders. Directors may at any time review the log of all correspondence received by Orthofix that is addressed to members of the Board and request copies of any such correspondence.

Nomination of Directors

As provided in its charter, the Nominating, Governance and Sustainability Committee identifies and recommends nominees for election to the Board and will consider nominations submitted by shareholders. The Nominating, Governance and Sustainability Committee Charter is available for review on our website at www.orthofix.com.

The Nominating, Governance and Sustainability Committee seeks to create a Board that is strong in its collective diversity of skills and experience with respect to finance, research and development, commercialization, sales, distribution, leadership, technologies, and life science industry knowledge. The Nominating, Governance and Sustainability Committee reviews with the Board, on an annual basis, the current composition of the Board in light of the characteristics of independence, skills, experience, and availability of service to Orthofix of its members and of anticipated needs. If necessary, we will retain a third party to assist us in identifying or evaluating any potential nominees for director. When the Nominating, Governance and Sustainability Committee reviews a potential new candidate, it looks specifically at the candidate’s qualifications in light of the needs of the Board at that time given the then current mix of director attributes.

As provided for in our Corporate Governance Guidelines, in nominating director candidates, the Nominating, Governance and Sustainability Committee strives to nominate directors that exhibit high standards of ethics, integrity, commitment, and accountability. In addition, our Corporate Governance Guidelines state that all nominations should attempt to ensure that the Board shall encompass a range of talent, skills, and expertise sufficient to provide sound guidance with respect to our operations and activities. Other than as set forth in the Corporate Governance Guidelines with respect to the Board’s objective in seeking directors with a range of talent, skills and expertise, the Board and the Nominating, Governance and Sustainability Committee do not have a formal policy with respect to the diversity of directors, but seek to ensure composition of the Board meets or exceeds diversity guidelines issued by regulatory agencies and considers the policies and input of institutional investors.

Under our Corporate Governance Guidelines, directors must inform the Chair of the Board and the Chair of the Nominating, Governance and Sustainability Committee in advance of accepting an invitation to serve on another company’s board of directors. In addition, no director may sit on the board of directors of, or beneficially own a significant financial interest in, any business that is a material competitor of Orthofix. The Nominating,

16

Governance and Sustainability Committee reviews any applicable facts and circumstances relating to any such potential conflict of interest and determines in its reasonable discretion whether a conflict exists.

To recommend a director nominee, a shareholder may send a notice addressed to The Board of Directors, Chair of the Nominating, Governance and Sustainability Committee of Orthofix Medical Inc., 3451 Plano Parkway, Lewisville, TX 75056. This notice must be received in a timely manner in accordance with the requirements of our Bylaws and must include certain information regarding the candidate, a statement of the qualifications of the candidate, taking into account the qualification requirements set forth above, and the candidate’s signed consent to be named in the proxy statement and to serve as a director if elected. See the section titled, "Information About Shareholder Proposals," below, for additional information. Once we receive the recommendation, the Nominating, Governance and Sustainability Committee will determine whether to contact the candidate to request that he or she provide us with additional information about the candidate’s independence, qualifications and other information that would assist the Nominating, Governance and Sustainability Committee in evaluating the candidate, as well as certain information that must be disclosed about the candidate in our proxy statement, if nominated. Candidates must respond to our inquiries within the time frame provided in order to be considered for nomination by the Nominating, Governance and Sustainability Committee.

The Nominating, Governance and Sustainability Committee has not received any nominations for director from shareholders for the Annual Meeting.

17

CORPORATE RESPONSIBILITY |

Since 1980, Orthofix has evolved and grown to become a leading medical device company focused on spine and orthopedics solutions. Our mission is to deliver innovative, quality-driven solutions while partnering with health care professionals to improve patient mobility. In this pursuit, we approach issues surrounding sustainability with a mindset that is focused on providing superior solutions to physicians worldwide to improve patient mobility.

Throughout 2022, we enhanced our ESG strategy to align with the broader transformation of our business. Our executive leadership team and Board continues to recognize the importance of embedding environmental and social priorities within our business operations and approved an enhanced and modernized ESG strategy intended to drive additional progress on initiatives that promote sustainability. The Nominating, Governance, and Sustainability Committee of the Board provides direct oversight of our practices and reporting with respect to sustainability matters, with our senior leadership team and ESG Working Group tasked with driving results in these areas. Our ESG Working Group is responsible for leading our ESG strategy and monitoring our corporate responsibility initiatives. This group includes cross-functional subject matters experts from across the Company. Against this backdrop, we have engaged with our internal and external stakeholders on ESG topics to help further inform our future direction, priorities, and strategy.

In the spring of 2022, we completed our first assessment of ESG priorities, which included examination of a range of key stakeholders, including investors, customers, employees, and ESG rating organizations and by studying industry peers. Our analysis of ESG topics included alignment to the Sustainability Accounting Standards Board (“SASB”). We also drew upon the subject matter expertise of colleagues throughout our organization to collect and organize content. In the summer of 2022, Orthofix released its inaugural SASB Fact Sheet, which detailed our progress against the SASB framework and the five tenets of our ESG strategy, which are: (1) Our People (2) Community Involvement, (3) Environmental Responsibility, (4) Governance, and (5) Safety and Quality. Orthofix also began monitoring greenhouse gas ("GHG") emissions and tracking energy usage in 2022. Thus, we have continued to expand our program, and in summer 2023, we plan to publish an updated SASB Fact Sheet that is expected to include GHG emission data, energy consumption, and additional metrics.

|

Our People: We demonstrate our commitment to providing equal and equitable opportunities to all employees through training, mentoring, education, and an inclusive culture. We engage our employees in a number of ways, including our Moving 4ward Program, which was created to improve diversity, equity and inclusion, and through the Orthofix Women’s Network, which strives to support the women of Orthofix around the globe in the areas of development, mentoring and engagement. Throughout the year, we promote a variety of diverse voices to our employees by recognizing events such as Black History Month, Martin Luther King Jr. Day, Women’s History Month, Asian Pacific American Heritage Month, LGBTQ Pride Month, Juneteenth, and Hispanic Heritage Month. We seek to embrace and encourage our employees’ differences and know that diversity, equity and inclusion help build a truly global, transformative business and will continue to be a source of our strength. Building on this |

18

|

belief, we launched a new companywide, training titled, “Hiring, Leading and Fostering Diverse and Inclusive Teams”. We intend that by end of 2023, all hiring managers, leaders, and interviewers will have completed this training.

This belief extends to our Board, with a female Lead Independent Director, and our executive leadership team. In 2022, we had a 3% increase in women hired at the director level or above and a 5% increase in diversity hires. In 2022, we successfully completed our second annual summer internship program with 80% of participating interns meeting a diversity criteria. Additionally, in 2022 we matched interns hired from our 2021 program to employee mentors, continued our 2021 Leadership Excellence and Acceleration Program (“LEAP”) inaugural cohort, and prepared for a second cohort to launch in 2023, which will include a minimum of 25% minority participation.

We have transformed and modernized our culture and talent management by implementing human capital management reporting and practices to enable leaders to better hire talent and manage teams. These practices include standards for setting goals, performance evaluations, succession planning, and learning and development. We provide a comprehensive and competitive benefits package that supports the physical and mental well-being of our workforce, including a focus on financial wellness. Common benefits offered to our associates include medical, dental, vision, life and disability coverage, an employee assistance program, parental leave, a stock purchase plan, and flexible paid time off. We also provide competitive retirement benefits, including a 401(k)-match program. |

|

|

|

Community Involvement: We support a variety of charitable organizations through donations, fundraising efforts, educational partnerships with colleges and universities, and local community development. Over the years, we have raised funds and awareness for veteran support groups, food and homebuilding organizations, and health-related institutions. In 2022, we added a corporate objective to our annual incentive program to encourage community volunteerism. Under this program, our employees contributed 1,988 hours to community outreach programs, which exceeded our communicated goal.

We proudly supported Texas Scottish Rite Hospital for Children, Pedal for the Cause, which funds worldwide cancer research, relief efforts for Ukraine, Ronald McDonald House Charities of San Diego, Casa de Amparo, a San Diego-based non-profit with a |

19

|

mission to support those affected by and at risk of child abuse and neglect, blood drives, food pantries, and other charitable initiatives in the communities we live and work in around the world. Orthofix also partners with Donate Life America, a U.S.-based nonprofit organization that promotes the importance of organ, eye, and tissue donation. |

|

|

|

Environmental Responsibility: We are committed to transitioning to lower carbon operations. We have begun to explore a decrease in our carbon footprint for the manufacturing and supply of our surgical instruments via single-use sterile packed instruments, and in 2020 launched a partnership with Neo Medical to distribute single-use sterile packed instrumentation for certain spine surgeries, and to develop single-use solutions for other procedures. These single-use sterile packed instruments eliminate high carbon cost of repeated shipping and sterilization, reducing our carbon footprint and improving the spinal surgery ecosystem with value-based care and sustainable technology solutions.

In July 2022, we announced the limited market release and first patient implant of the Virtuos Lyograft, a first-of-its-kind, shelf-stable and complete autograft substitute for spine and orthopedic procedures. Virtuos is provided in a room-temperature, ready-to-use, moldable form offers significant logistical and cost-savings advantages to the hospital with improved shipping, storage and operating room efficiency. The room temperature shipment and storage of Virtuos eliminates the use of large quantities of dry ice, Styrofoam shippers and freezer storage, enabling flexible shipping options and reduced packaging, with the aim of a reduced carbon footprint.

In February 2021, we launched a free recycling program for our patients using Bone Growth Stimulators in order to reduce the number of devices that end up in landfills after use, the first program of its kind for bone growth therapy devices. To date, we have sent shipping labels to over 8,000 patients to facilitate recycling of these devices.

We also embed the principles of advancing a circular economy into our ESG practices globally through our in-office recycling program, including recycle/reuse and a commitment to eliminate Styrofoam. Our facilities have energy efficient HVAC systems, 100 percent sustainable energy in certain locations, and our California offices also include electric vehicle charging stations to promote environmentally-friendly behaviors among employees. Further, we expect our suppliers to support our efforts in improving the |

20

|

environment and animal welfare. Our 2022 ESG Report also highlights the key initiatives we have underway and provides baseline data for important environmental measures such as GHG emissions. |

|

|

|

Governance: It is our fundamental policy to conduct business in accordance with the highest ethical and legal standards. We have a comprehensive compliance and ethics program to promote lawful and ethical business practices throughout our domestic and international businesses and offer compliance training to all of our employees. Similarly, we require that our suppliers adopt sound human rights practices designed to treat workers fairly and with dignity and respect. We responsibly manage and influence the impacts of our distributors through our robust compliance and governance training. We implement robust risk management programs to ensure compliance with applicable laws and regulations governing ethical business practices, including our relationships with suppliers, customers and business partners, and our industry. Our IT team uses a combination of industry-leading tools and innovative technologies to help protect our stakeholder’s data. Our people are responsible for complying with our data security standards and complete mandatory annual training to understand the behaviors and technical requirements necessary to keep data secure. |

|

|

|