Press Release

Press ReleaseUGI Reports First Quarter Results

February 5, 2019

VALLEY FORGE, PA - UGI Corporation (NYSE: UGI) reported financial results for the fiscal quarter ended December 31, 2018.

HIGHLIGHTS

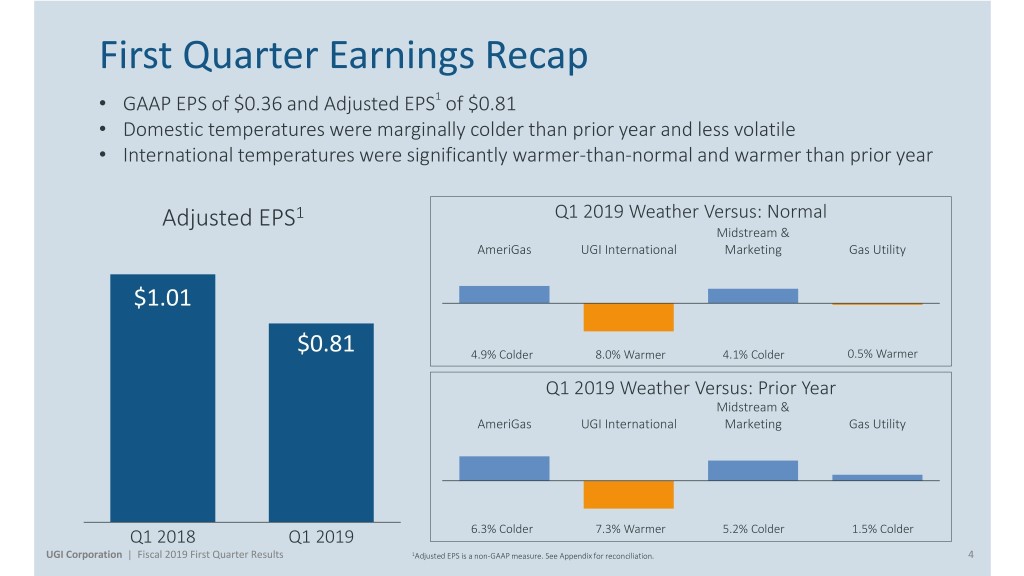

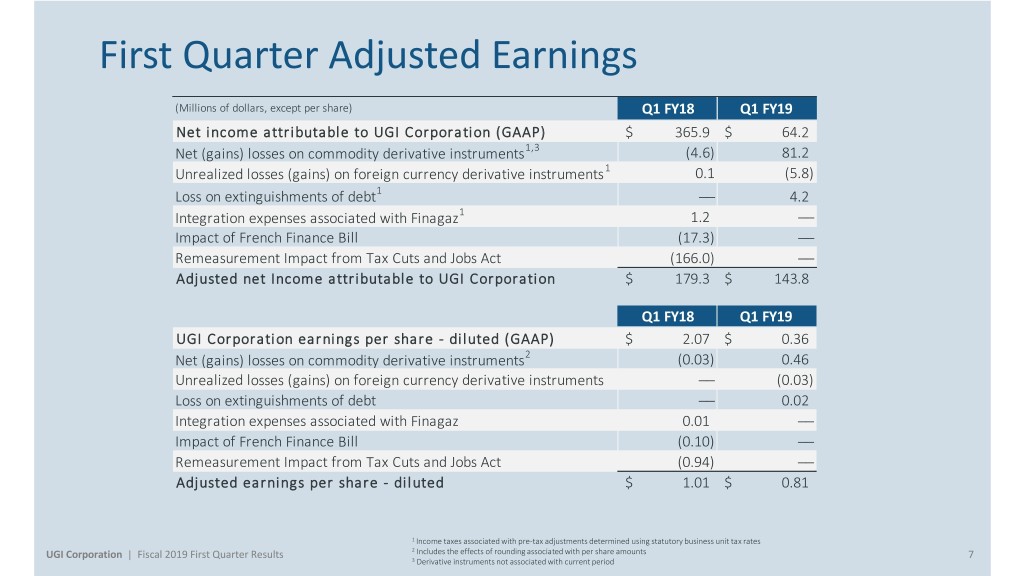

• | GAAP EPS of $0.36 and adjusted EPS of $0.81 per diluted share compared to GAAP EPS of $2.07 and adjusted EPS of $1.01 per diluted share in the prior year |

• | Prolonged warmer than normal weather at UGI International, slightly warmer than normal weather at Utilities, and colder than normal weather at Midstream & Marketing and AmeriGas |

"UGI and AmeriGas delivered a solid first quarter performance while facing some challenging operating conditions," said John L. Walsh, president and chief executive officer of UGI Corporation. "AmeriGas had a strong quarter as volumes, margins, and performance from our growth drivers contributed positively to results. UGI International operations were negatively impacted by warm weather and the effects of an unseasonably warm and dry summer on the crop drying season. The natural gas businesses experienced colder weather than the prior-year period, particularly Midstream & Marketing and to a lesser extent Utilities. A warm December, with limited volatility in capacity management values in the Midstream & Marketing service territory and the prior year non-recurring benefit at the Utility from tax reform decreased comparative results.

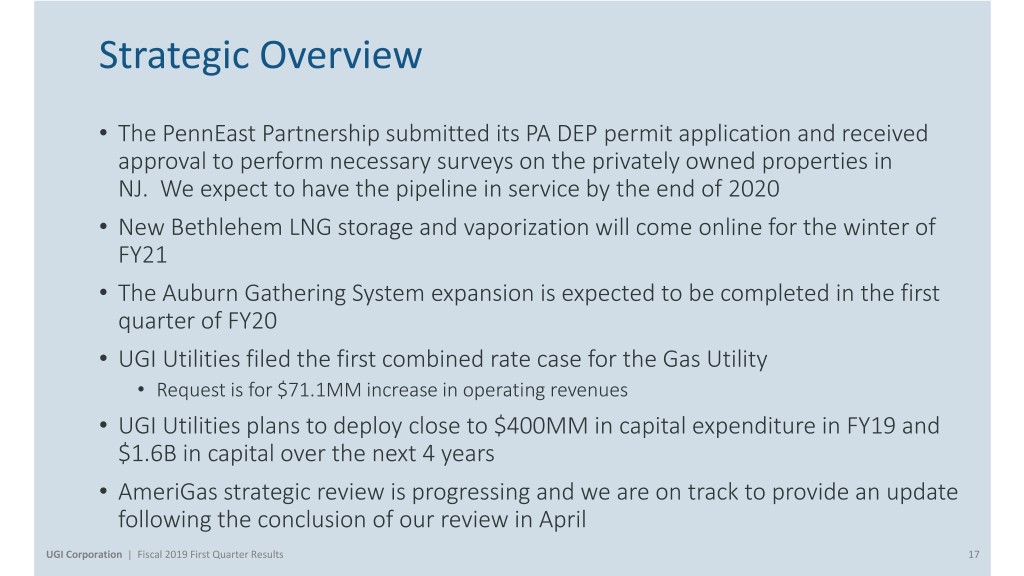

In December, we received a favorable federal court ruling concerning the PennEast Pipeline project as the court granted access necessary to perform surveys to certain properties in New Jersey. This is an important step in the permitting process and will help ensure minimal environmental impact."

KEY DRIVERS OF FIRST QUARTER RESULTS

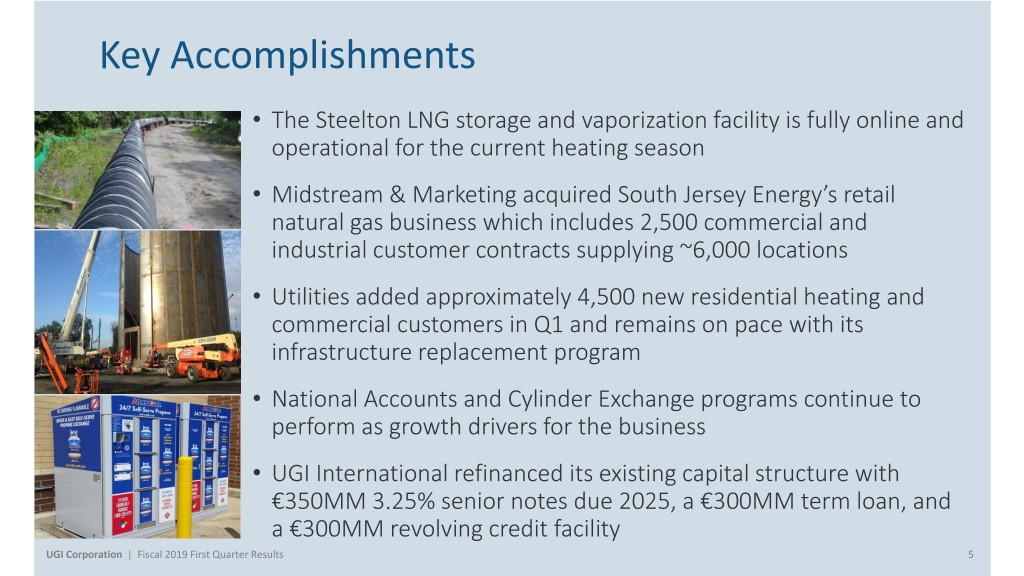

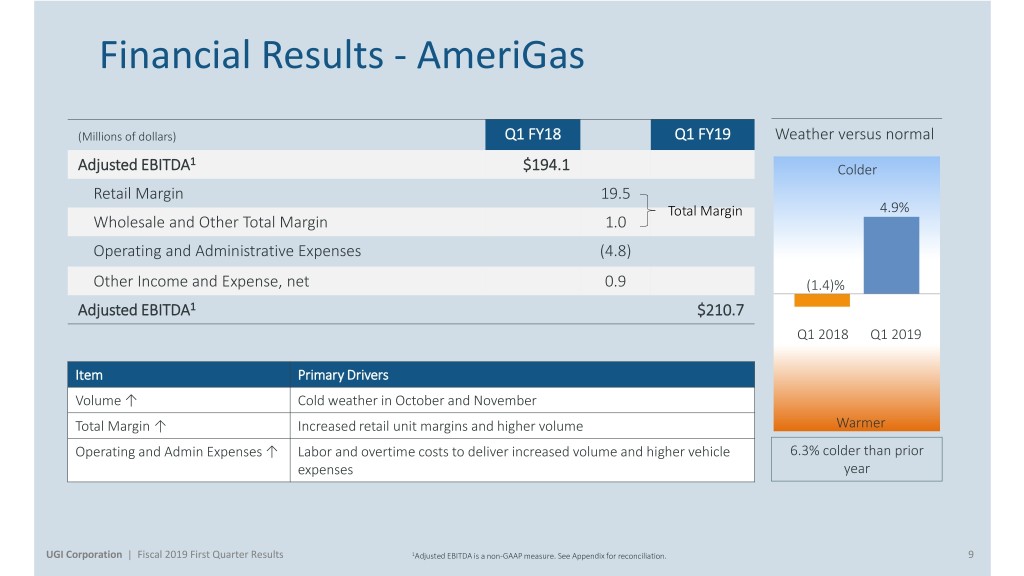

• | AmeriGas: Retail volume up 5 million gallons on weather that was 6% colder than the prior year; National Accounts and ACE volumes up over 10% from last year. |

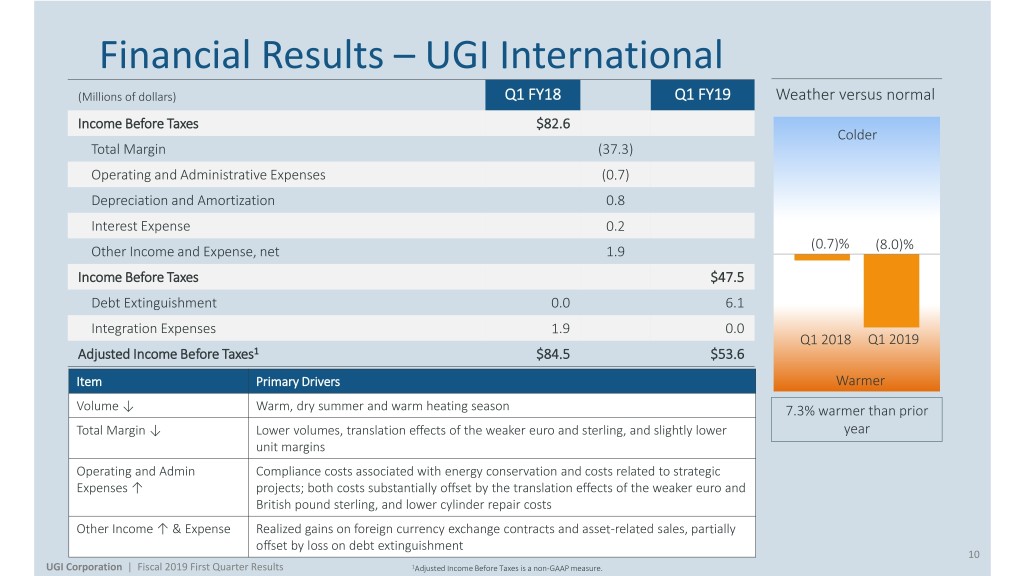

• | UGI International: Retail volume down 9% on weather that was 7% warmer than the prior year, including decreased crop drying volumes due to a warm and dry summer. UGI International has had nine consecutive months of warmer-than-normal weather. |

• | Midstream & Marketing: Warm, less volatile December weather and lower off-peak electric generation volumes negatively impacted total margin. |

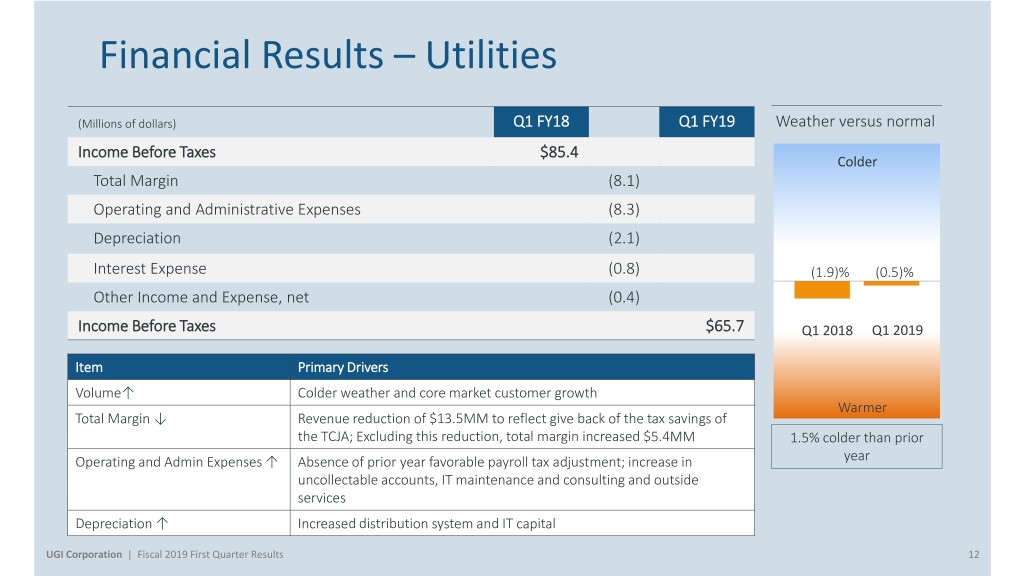

• | UGI Utilities: Core market throughput up 4% on weather that was 2% colder than prior year; total Utility margin was impacted by the revenue reduction associated with the Tax Cuts and Jobs Act (TCJA) which was applicable in the prior year; excluding the revenue reduction associated with TCJA, margin increased $5.4 million. |

EARNINGS CALL and WEBCAST

UGI Corporation will hold a live Internet Audio Webcast of its conference call to discuss first quarter earnings and other current activities at 9:00 AM ET on Wednesday, February 6, 2019. Interested parties may listen to the audio webcast both live and in replay on the Internet at http://www.ugicorp.com/investor-relations/events-and-presentations/default.aspx or at the company website http://

1

www.ugicorp.com under Investor Relations. A telephonic replay will be available from 2:00 PM ET on February 6th through 11:59 PM ET on February 13th. The replay may be accessed at (855) 859-2056, and internationally at 1-404-537-3406, conference ID 2974015.

CONTACT INVESTOR RELATIONS

610-337-1000

Brendan Heck, ext. 6608

Shelly Oates, ext. 3202

ABOUT UGI

UGI is a distributor and marketer of energy products and services. Through subsidiaries, UGI operates natural gas and electric utilities in Pennsylvania, distributes propane both domestically and internationally, manages midstream energy and electric generation assets in Pennsylvania, and engages in energy marketing in eleven eastern sates, the District of Columbia and internationally in France, Belgium, the Netherlands and the UK. UGI, through subsidiaries, is the sole General Partner and owns 26% of AmeriGas Partners, L.P. (NYSE: APU), the nation's largest retail propane distributor.

Comprehensive information about UGI Corporation is available on the Internet at http://www.ugicorp.com.

USE OF NON-GAAP MEASURES

Management uses "adjusted net income attributable to UGI Corporation" and "adjusted diluted earnings per share," both of which are non-GAAP financial measures, when evaluating UGI's overall performance. For the periods presented, adjusted net income attributable to UGI Corporation is net income attributable to UGI Corporation after excluding net after-tax gains and losses on commodity and certain foreign currency derivative instruments not associated with current-period transactions (principally comprising changes in unrealized gains and losses on such derivative instruments), losses associated with extinguishments of debt, Finagaz integration expenses, and the remeasurement impact on net deferred tax liabilities from changes in U.S. and French tax rates. Volatility in net income at UGI can occur as a result of gains and losses on commodity and certain foreign currency derivative instruments not associated with current-period transactions but included in earnings in accordance with U.S. generally accepted accounting principles ("GAAP").

Non-GAAP financial measures are not in accordance with, or an alternative to, GAAP and should be considered in addition to, and not as a substitute for, the comparable GAAP measures. Management believes that these non-GAAP measures provide meaningful information to investors about UGI’s performance because they eliminate the impact of (1) gains and losses on commodity and certain foreign currency derivative instruments not associated with current-period transactions and (2) other significant discrete items that can affect the comparison of period-over-period results.

Tables on the last page reconcile net income attributable to UGI Corporation, the most directly comparable GAAP measure, to adjusted net income attributable to UGI Corporation, and diluted earnings per share, the most comparable GAAP measure, to adjusted diluted earnings per share, to reflect the adjustments referred to above.

USE OF FORWARD-LOOKING STATEMENTS

This press release contains certain forward-looking statements that management believes to be reasonable as of today’s date only. Actual results may differ significantly because of risks and uncertainties that are difficult to predict and many of which are beyond management’s control. You should read UGI’s Annual Report on Form 10-K for a more extensive list of factors that could affect results. Among them are adverse weather conditions, cost volatility and availability of all energy products, including propane, natural gas, electricity and fuel oil, increased customer conservation measures, the impact of pending and future legal proceedings, continued analysis of recent tax legislation, liability for uninsured claims and for claims in excess of insurance coverage, domestic and international political, regulatory and economic conditions in the United States and in foreign countries, including the current conflicts in the Middle East, and foreign currency exchange rate fluctuations (particularly the euro), the timing of development of Marcellus Shale gas production, the availability, timing and success of our acquisitions, commercial initiatives and investments to grow our business, our ability to successfully integrate acquired businesses and achieve anticipated synergies, and the interruption, disruption, failure, malfunction, or breach of our information technology systems, including due to cyber-attack. UGI undertakes no obligation to release revisions to its forward-looking statements to reflect events or circumstances occurring after today.

2

SEGMENT RESULTS ($ in millions, except where otherwise indicated)

AmeriGas Propane1

For the fiscal quarter ended December 31, | 2018 | 2017 | Increase | ||||||||||||

Revenues | $ | 820.2 | $ | 787.3 | $ | 32.9 | 4.2 | % | |||||||

Total margin (a) | $ | 441.7 | $ | 421.2 | $ | 20.5 | 4.9 | % | |||||||

Partnership operating and administrative expenses | $ | 235.1 | $ | 230.3 | $ | 4.8 | 2.1 | % | |||||||

Operating income | $ | 166.6 | $ | 147.9 | $ | 18.7 | 12.6 | % | |||||||

Partnership Adjusted EBITDA | $ | 210.7 | $ | 194.1 | $ | 16.6 | 8.6 | % | |||||||

Retail gallons sold (millions) | 310.3 | 305.0 | 5.3 | 1.7 | % | ||||||||||

Heating degree days - % colder (warmer) than normal | 4.9 | % | (1.4 | )% | |||||||||||

Capital expenditures | $ | 31.0 | $ | 23.6 | $ | 7.4 | 31.4 | % | |||||||

• | Retail gallons sold increased 2% due to colder weather compared to the prior-year period. |

• | Total margin increased primarily reflecting higher retail propane unit margin, slightly higher volume, and slightly higher non-propane total margin. The higher retail propane unit margin includes the effects of declining wholesale propane prices later in the 2018 period. |

• | Partnership operating and administrative expenses increased due to higher labor and overtime costs to deliver increased volume and higher vehicle expenses. |

• | Partnership Adjusted EBITDA increased $17 million primarily due to higher total margin ($21 million) and slightly higher other operating income ($1million), partially offset by a $5 million increase in operating and administrative expenses. |

1 UGI, through subsidiaries, is the sole General Partner and owns 26% of AmeriGas Partners, L.P.

UGI International

For the fiscal quarter ended December 31, | 2018 | 2017 | Increase (Decrease) | ||||||||||||

Revenues | $ | 710.7 | $ | 784.2 | $ | (73.5 | ) | (9.4 | )% | ||||||

Total margin (a) | $ | 262.1 | $ | 299.4 | $ | (37.3 | ) | (12.5 | )% | ||||||

Operating and administrative expenses | $ | 174.4 | $ | 173.7 | $ | 0.7 | 0.4 | % | |||||||

Operating income | $ | 58.3 | $ | 93.2 | $ | (34.9 | ) | (37.4 | )% | ||||||

Income before income taxes | $ | 47.5 | $ | 82.6 | $ | (35.1 | ) | (42.5 | )% | ||||||

Loss on extinguishments of debt | $ | 6.1 | $ | — | $ | 6.1 | N.M. | ||||||||

Finagaz integration expenses | $ | — | $ | 1.9 | $ | (1.9 | ) | (100.0 | )% | ||||||

Adjusted income before income taxes | $ | 53.6 | $ | 84.5 | $ | (30.9 | ) | (36.6 | )% | ||||||

LPG retail gallons sold (millions) | 237.6 | 260.6 | (23.0 | ) | (8.8 | )% | |||||||||

Heating degree days - % (warmer) than normal | (8.0 | )% | (0.7 | )% | |||||||||||

Capital expenditures | $ | 27.8 | $ | 21.7 | $ | 6.1 | 28.1 | % | |||||||

N.M. - variance is not meaningful

Base-currency results are translated into U.S. dollars based upon exchange rates experienced during the reporting periods. During the first quarter, the euro and British pound sterling were approximately 3% weaker, versus the U.S. dollar, compared with the prior-year period. Although the slightly weaker euro and British pound sterling affects line item comparisons above, the impact of the weaker currencies on net income was substantially offset by net gains on foreign currency exchange contracts.

• | Retail volume decreased nearly 9% due to lower volumes associated with crop drying as a result of a very warm and dry summer and the effects of warmer weather on heating-related bulk sales. UGI International has had nine consecutive months of warmer-than-normal weather. |

• | Total margin decreased $37 million primarily reflecting lower retail LPG volumes sold, the translation effects of the weaker euro and British pound sterling and slightly lower LPG unit margins. |

• | Operating expenses were essentially flat due to higher compliance costs associated with energy conservation and costs related to strategic projects, substantially offset by both the translation effects of the weaker euro and British pound sterling and lower cylinder repair costs. The prior-year period included $2 million of Finagaz integration expenses. |

3

• | Operating income decreased primarily reflecting the lower total margin, partially offset by slightly higher other operating income and lower depreciation and amortization expense. |

• | Income before income taxes was lower due to lower operating income and a loss on debt extinguishment, partially offset by realized gains on foreign currency exchange contracts. |

SEGMENT RESULTS ($ in millions, except where otherwise indicated)

Midstream & Marketing

For the fiscal quarter ended December 31, | 2018 | 2017 | Increase (Decrease) | ||||||||||||

Revenues | $ | 459.4 | $ | 328.0 | $ | 131.4 | 40.1 | % | |||||||

Total margin (a) | $ | 81.9 | $ | 89.0 | $ | (7.1 | ) | (8.0 | )% | ||||||

Operating and administrative expenses | $ | 29.2 | $ | 25.6 | $ | 3.6 | 14.1 | % | |||||||

Operating income | $ | 41.1 | $ | 53.4 | $ | (12.3 | ) | (23.0 | )% | ||||||

Income before income taxes | $ | 42.1 | $ | 52.6 | $ | (10.5 | ) | (20.0 | )% | ||||||

Heating degree days - % colder (warmer) than normal | 4.1 | % | (1.1 | )% | |||||||||||

Capital expenditures | $ | 25.1 | $ | 11.3 | $ | 13.8 | 122.1 | % | |||||||

• | Temperatures across Midstream & Marketing's service territory were 4% colder than normal and 5% colder than the prior-year period. |

• | Total margin decreased primarily reflecting lower total margin from midstream assets ($4 million) and lower electric generation margin ($3 million). The decrease in total margin from midstream assets is principally the result of lower capacity management total margin ($9 million), partially offset by higher peaking and natural gas gathering total margin. Capacity management total margin in the prior-year period includes higher capacity values as a result of extremely cold and more volatile December 2017 weather. Lower total margin from electric generation principally reflects lower volumes primarily from our Hunlock Station generating facility reflecting lower off-peak volumes. |

• | Operating expenses increased principally reflecting higher compensation and benefit expenses, higher expenses associated with greater peaking, LNG, and natural gas gathering activities, and planned maintenance of the Conemaugh electric generation unit. |

• | Operating income and income before taxes decreased due to the lower total margin, higher operating and administrative expenses, and higher depreciation expense. |

UGI Utilities

For the fiscal quarter ended December 31, | 2018 | 2017 | Increase (Decrease) | ||||||||||||

Revenues | $ | 322.7 | $ | 323.1 | $ | (0.4 | ) | (0.1 | )% | ||||||

Total margin (a) | $ | 161.9 | $ | 170.0 | $ | (8.1 | ) | (4.8 | )% | ||||||

Operating and administrative expenses | $ | 61.2 | $ | 52.9 | $ | 8.3 | 15.7 | % | |||||||

Operating income | $ | 77.0 | $ | 96.9 | $ | (19.9 | ) | (20.5 | )% | ||||||

Income before income taxes | $ | 65.7 | $ | 85.4 | $ | (19.7 | ) | (23.1 | )% | ||||||

Gas Utility system throughput - billions of cubic feet | |||||||||||||||

Core market | 26.5 | 25.5 | 1.0 | 3.9 | % | ||||||||||

Total | 75.7 | 69.2 | 6.5 | 9.4 | % | ||||||||||

Gas Utility heating degree days - %(warmer) than normal | (0.5 | )% | (1.9 | )% | |||||||||||

Capital expenditures | $ | 77.3 | $ | 71.7 | $ | 5.6 | 7.8 | % | |||||||

• | Gas Utility service territory experienced temperatures that were slightly warmer than normal and 2% colder than the prior-year period. |

• | Core market volumes increased due to colder weather and customer growth. |

• | In accordance with the May 17, 2018 PA PUC Order, revenues, and associated margin, were reduced by $14 million in the quarter ended December 31, 2018 to reflect the give back of tax savings resulting from the TCJA. |

• | Excluding the reduction in Gas Utility margin resulting from the TCJA, total margin increased $5 million principally reflecting higher total margin from Gas Utility core market customers, Electric Utility margin, and higher other margin. |

• | Operating and administrative expenses increased primarily reflecting the absence of a favorable payroll tax adjustment in the prior-year period, higher uncollectible accounts expense, higher IT maintenance and consulting expenses, and higher compensation and benefits expense. |

4

• | Operating income decreased reflecting lower total margin, higher operating and administrative expenses, greater depreciation expense , and higher other operating expense. |

(a) | Total margin represents total revenue less total cost of sales and excludes pre-tax gains and losses on commodity derivative instruments not associated with current period transactions. In the case of UGI Utilities, total margin is reduced by revenue-related tax expenses (which have been excluded from UGI Utilities' operating and administrative expenses presented). |

REPORT OF EARNINGS – UGI CORPORATION

(Millions of dollars, except per share)

5

(Unaudited)

Three Months Ended December 31, | Twelve Months Ended December 31, | ||||||||||||||

2018 | 2017 | 2018 | 2017 | ||||||||||||

Revenues: | |||||||||||||||

AmeriGas Propane | $ | 820.2 | $ | 787.3 | $ | 2,855.9 | $ | 2,563.6 | |||||||

UGI International | 710.7 | 784.2 | 2,610.3 | 2,122.6 | |||||||||||

Midstream & Marketing | 459.4 | 328.0 | 1,553.1 | 1,179.4 | |||||||||||

UGI Utilities | 322.7 | 323.1 | 1,092.0 | 949.3 | |||||||||||

Corporate & Other (a) | (112.8 | ) | (97.4 | ) | (385.1 | ) | (248.5 | ) | |||||||

Total revenues | $ | 2,200.2 | $ | 2,125.2 | $ | 7,726.2 | $ | 6,566.4 | |||||||

Operating income (loss) (b): | |||||||||||||||

AmeriGas Propane (c) | $ | 166.6 | $ | 147.9 | $ | 365.9 | $ | 361.3 | |||||||

UGI International | 58.3 | 93.2 | 182.5 | 198.6 | |||||||||||

Midstream & Marketing | 41.1 | 53.4 | 161.7 | 143.0 | |||||||||||

UGI Utilities | 77.0 | 96.9 | 220.1 | 246.4 | |||||||||||

Corporate & Other (a) | (175.3 | ) | 3.6 | (92.9 | ) | (12.4 | ) | ||||||||

Total operating income | 167.7 | 395.0 | 837.3 | 936.9 | |||||||||||

Income from equity investees | 1.5 | 1.0 | 4.8 | 5.5 | |||||||||||

Loss on extinguishments of debt | (6.1 | ) | — | (6.1 | ) | (26.5 | ) | ||||||||

Other non-operating income (expense), net (b) | 9.0 | (8.0 | ) | 32.7 | (37.1 | ) | |||||||||

Interest expense: | |||||||||||||||

AmeriGas Propane | (42.4 | ) | (40.6 | ) | (164.9 | ) | (160.8 | ) | |||||||

UGI International | (5.4 | ) | (5.6 | ) | (20.9 | ) | (21.4 | ) | |||||||

Midstream & Marketing | (0.5 | ) | (0.9 | ) | (2.0 | ) | (2.4 | ) | |||||||

UGI Utilities | (11.7 | ) | (10.9 | ) | (43.7 | ) | (41.1 | ) | |||||||

Corporate & Other, net (a) | (0.2 | ) | (0.2 | ) | (0.6 | ) | (0.6 | ) | |||||||

Total interest expense | (60.2 | ) | (58.2 | ) | (232.1 | ) | (226.3 | ) | |||||||

Income before income taxes | 111.9 | 329.8 | 636.6 | 652.5 | |||||||||||

Income tax (expense) benefit (d) | (23.4 | ) | 104.4 | (159.9 | ) | 14.6 | |||||||||

Net income including noncontrolling interests | 88.5 | 434.2 | 476.7 | 667.1 | |||||||||||

Deduct net income attributable to noncontrolling interests, principally in AmeriGas Partners, L.P. | (24.3 | ) | (68.3 | ) | (59.7 | ) | (95.3 | ) | |||||||

Net income attributable to UGI Corporation (c) | $ | 64.2 | $ | 365.9 | $ | 417.0 | $ | 571.8 | |||||||

Earnings per share attributable to UGI shareholders: | |||||||||||||||

Basic | $ | 0.37 | $ | 2.11 | $ | 2.40 | $ | 3.29 | |||||||

Diluted | $ | 0.36 | $ | 2.07 | $ | 2.36 | $ | 3.23 | |||||||

Weighted Average common shares outstanding (thousands): | |||||||||||||||

Basic | 174,413 | 173,670 | 174,099 | 173,701 | |||||||||||

Diluted | 177,566 | 176,948 | 177,065 | 177,138 | |||||||||||

Supplemental information: | |||||||||||||||

Net income (loss) attributable to UGI Corporation: | |||||||||||||||

AmeriGas Propane | $ | 30.6 | $ | 141.6 | $ | 63.7 | $ | 169.6 | |||||||

UGI International | 32.5 | 61.1 | 110.0 | 131.4 | |||||||||||

Midstream & Marketing | 31.0 | 112.0 | 115.8 | 169.0 | |||||||||||

UGI Utilities | 49.9 | 68.3 | 130.5 | 140.0 | |||||||||||

Corporate & Other (a) | (79.8 | ) | (17.1 | ) | (3.0 | ) | (38.2 | ) | |||||||

Total net income attributable to UGI Corporation | $ | 64.2 | $ | 365.9 | $ | 417.0 | $ | 571.8 | |||||||

(a) | Corporate & Other includes, among other things, net gains and (losses) on commodity and certain foreign currency derivative instruments not associated with current-period transactions and the elimination of certain intercompany transactions. |

(b) | The three and twelve months ended December 2017 have been restated to reflect the adoption of new accounting guidance in 2018, which resulted in the presentation of $(3.2) million and $(7.1) million, respectively, of pension and other postretirement benefit plans income (expense) in “Other non-operating income (expense), net", rather than in Operating income, with no change in net income. |

(c) | AmeriGas operating income for the twelves months ended December 31, 2018 includes an impairment charge of $75.0 million as a result of a plan to discontinue the use of Heritage tradenames and trademarks. |

(d) | Income tax (expense) benefit for the three and twelve months ended December 31, 2017 includes a benefit from adjustments to tax-related amounts resulting from the TCJA enacted on December 22, 2017 of $166.0 million, and a benefit from adjustments to net deferred income tax liabilities in France as a result of tax legislation in France of $17.3 million. |

6

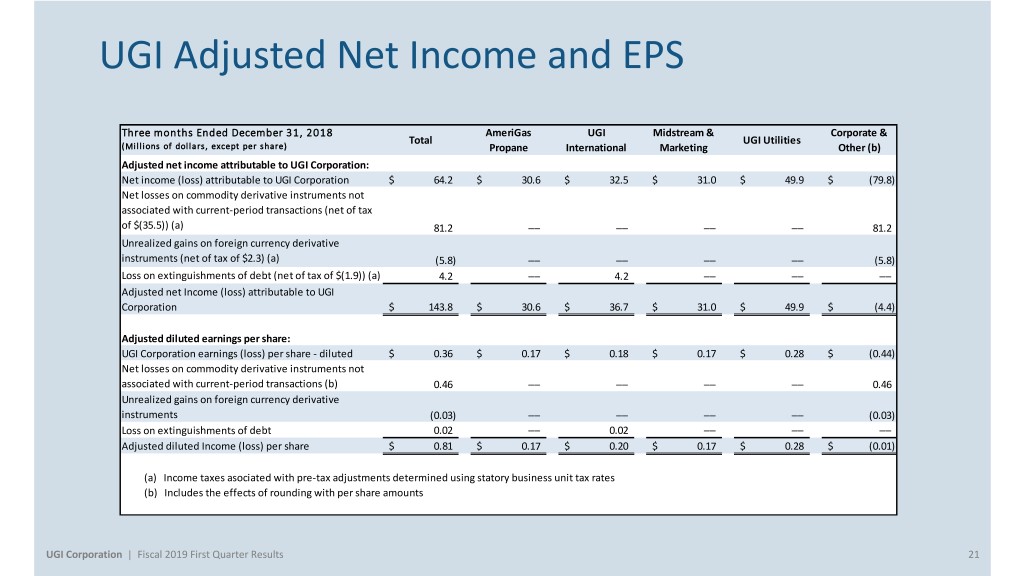

Non-GAAP Financial Measures - Adjusted Net Income Attributable to UGI and Adjusted Diluted Earnings Per Share

The following tables reconcile net income attributable to UGI Corporation, the most directly comparable GAAP measure, to adjusted net income attributable to UGI Corporation, and reconciles diluted earnings per share, the most comparable GAAP measure, to adjusted diluted earnings per share, to reflect the adjustments referred to previously:

Three Months Ended December 31, | Twelve Months Ended December 31, | |||||||||||||||

2018 | 2017 | 2018 | 2017 | |||||||||||||

Adjusted net income attributable to UGI Corporation (millions): | ||||||||||||||||

Net income attributable to UGI Corporation | $ | 64.2 | $ | 365.9 | $ | 417.0 | $ | 571.8 | ||||||||

Net losses (gains) on commodity derivative instruments not associated with current-period transactions (net of tax of $(35.5), $2.1, $(10.9) and $0.7, respectively) (1)(2) | 81.2 | (4.6 | ) | 17.7 | (3.6 | ) | ||||||||||

Unrealized (gains) losses on foreign currency derivative instruments (net of tax of $2.3, $(0.0) $11.6, and $(10.3), respectively) (2) | (5.8 | ) | 0.1 | (25.5 | ) | 14.8 | ||||||||||

Impairment of Partnership tradenames and trademarks (net of tax of $0.0, $0.0, $(5.8) and $0.0, respectively) (2) | — | — | 14.5 | — | ||||||||||||

Loss on extinguishments of debt (net of tax of $(1.9), $0.0, $(1.9), and $(2.7), respectively) (2) | 4.2 | — | 4.2 | 4.3 | ||||||||||||

Integration expenses associated with Finagaz (net of tax of $0.0, $(0.7), $(11.3), and $(11.6) respectively) (2) | — | 1.2 | 17.3 | 22.1 | ||||||||||||

Impact from French Finance Bills | — | (17.3 | ) | 5.2 | (18.9 | ) | ||||||||||

Remeasurement impact from TCJA | — | (166.0 | ) | (0.3 | ) | (166.0 | ) | |||||||||

Adjusted net income attributable to UGI Corporation | $ | 143.8 | $ | 179.3 | $ | 450.1 | $ | 424.5 | ||||||||

Adjusted diluted earnings per share: | ||||||||||||||||

UGI Corporation earnings per share — diluted | $ | 0.36 | $ | 2.07 | $ | 2.36 | $ | 3.23 | ||||||||

Net losses (gains) on commodity derivative instruments not associated with current-period transactions (1) | 0.46 | (0.03 | ) | 0.09 | (0.02 | ) | ||||||||||

Unrealized (gains) losses on foreign currency derivative instruments | (0.03 | ) | — | (0.14 | ) | 0.08 | ||||||||||

Impairment of Partnership tradenames and trademarks | — | — | 0.08 | — | ||||||||||||

Loss on extinguishments of debt | 0.02 | — | 0.02 | 0.02 | ||||||||||||

Integration expenses associated with Finagaz (1) | — | 0.01 | 0.10 | 0.13 | ||||||||||||

Impact from French Finance Bills (1) | — | (0.10 | ) | 0.03 | (0.10 | ) | ||||||||||

Remeasurement impact from TCJA | — | (0.94 | ) | — | (0.94 | ) | ||||||||||

Adjusted diluted earnings per share | $ | 0.81 | $ | 1.01 | $ | 2.54 | $ | 2.40 | ||||||||

7

Three Months Ended December 31, 2018 | Total | AmeriGas Propane | UGI International | Midstream & Marketing | UGI Utilities | Corporate & Other (1) | ||||||||||||||||||

Adjusted net income attributable to UGI Corporation (millions): | ||||||||||||||||||||||||

Net income (loss) attributable to UGI Corporation | $ | 64.2 | $ | 30.6 | $ | 32.5 | $ | 31.0 | $ | 49.9 | $ | (79.8 | ) | |||||||||||

Net losses on commodity derivative instruments not associated with current-period transactions (net of tax of $(35.5)) (2) | 81.2 | — | — | — | — | 81.2 | ||||||||||||||||||

Unrealized gains on foreign currency derivative instruments (net of tax of $2.3) (2) | (5.8 | ) | — | — | — | — | (5.8 | ) | ||||||||||||||||

Loss on extinguishment of debt (net of tax of $(1.9)) (a) (2) | 4.2 | — | 4.2 | — | — | — | ||||||||||||||||||

Adjusted net income (loss) attributable to UGI Corporation | $ | 143.8 | $ | 30.6 | $ | 36.7 | $ | 31.0 | $ | 49.9 | $ | (4.4 | ) | |||||||||||

Adjusted diluted earnings per share: | ||||||||||||||||||||||||

UGI Corporation earnings (loss) per share — diluted | $ | 0.36 | $ | 0.17 | $ | 0.18 | $ | 0.17 | $ | 0.28 | $ | (0.44 | ) | |||||||||||

Net losses on commodity derivative instruments not associated with current-period transactions (1) | 0.46 | — | — | — | — | 0.46 | ||||||||||||||||||

Unrealized gains on foreign currency derivative instruments | (0.03 | ) | — | — | — | — | (0.03 | ) | ||||||||||||||||

Loss on extinguishments of debt | 0.02 | — | 0.02 | — | — | — | ||||||||||||||||||

Adjusted diluted earnings (loss) per share | $ | 0.81 | $ | 0.17 | $ | 0.20 | $ | 0.17 | $ | 0.28 | $ | (0.01 | ) | |||||||||||

Three Months Ended December 31, 2017 | Total | AmeriGas Propane | UGI International | Midstream & Marketing | UGI Utilities | Corporate & Other | ||||||||||||||||||

Adjusted net income attributable to UGI Corporation (millions): | ||||||||||||||||||||||||

Net income (loss) attributable to UGI Corporation | $ | 365.9 | $ | 141.6 | $ | 61.1 | $ | 112.0 | $ | 68.3 | $ | (17.1 | ) | |||||||||||

Net gains on commodity derivative instruments not associated with current-period transactions (net of tax of $2.1) (2) | (4.6 | ) | — | — | — | — | (4.6 | ) | ||||||||||||||||

Unrealized losses on foreign currency derivative instruments (net of tax of $(0.0)) (2) | 0.1 | — | — | — | — | 0.1 | ||||||||||||||||||

Integration expenses associated with Finagaz (net of tax of $(0.7)) (2) | 1.2 | — | 1.2 | — | — | — | ||||||||||||||||||

Impact of French Finance Bill | (17.3 | ) | — | (17.3 | ) | — | — | — | ||||||||||||||||

Remeasurement impact of TCJA | (166.0 | ) | (113.1 | ) | 9.3 | (74.3 | ) | (8.1 | ) | 20.2 | ||||||||||||||

Adjusted net income (loss) attributable to UGI Corporation | $ | 179.3 | $ | 28.5 | $ | 54.3 | $ | 37.7 | $ | 60.2 | $ | (1.4 | ) | |||||||||||

Adjusted diluted earnings per share: | ||||||||||||||||||||||||

UGI Corporation earnings (loss) per share - diluted | $ | 2.07 | $ | 0.80 | $ | 0.35 | $ | 0.63 | $ | 0.39 | $ | (0.10 | ) | |||||||||||

Net gains on commodity derivative instruments not associated with current-period transactions | (0.03 | ) | — | — | — | — | (0.03 | ) | ||||||||||||||||

Unrealized losses on foreign currency derivative instruments | — | — | — | — | — | — | ||||||||||||||||||

Integration expenses associated with Finagaz | 0.01 | — | 0.01 | — | — | — | ||||||||||||||||||

Impact of French Finance Bill | (0.10 | ) | — | (0.10 | ) | — | — | — | ||||||||||||||||

Remeasurement impact of TCJA (1) | (0.94 | ) | (0.64 | ) | 0.05 | (0.42 | ) | (0.05 | ) | 0.12 | ||||||||||||||

Adjusted diluted earnings (loss) per share | $ | 1.01 | $ | 0.16 | $ | 0.31 | $ | 0.21 | $ | 0.34 | $ | (0.01 | ) | |||||||||||

(1) Includes the impact of rounding.

(2) Income taxes associated with pre-tax adjustments determined using statutory business unit tax rates.

8