UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTIONS 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE FISCAL YEAR ENDED SEPTEMBER 30, 2016

Commission file number 1-11071

UGI CORPORATION

(Exact name of registrant as specified in its charter)

Pennsylvania | 23-2668356 | |

(State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) | |

460 North Gulph Road, King of Prussia, PA 19406

(Address of Principal Executive Offices) (Zip Code)

(610) 337-1000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | Name of each Exchange on Which Registered | |

Common Stock, without par value | New York Stock Exchange, Inc. | |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes þ No o

Yes þ No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer þ | Accelerated filer o | Non-accelerated filer o | Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No þ

The aggregate market value of UGI Corporation Common Stock held by non-affiliates of the registrant on March 31, 2016 was $6,917,708,915.

At November 15, 2016, there were 172,983,624 shares of UGI Corporation Common Stock issued and outstanding.

Portions of the Proxy Statement for the Annual Meeting of Shareholders to be held on January 24, 2017 are incorporated by reference into Part III of this Form 10-K.

TABLE OF CONTENTS

Page | |

1

FORWARD-LOOKING INFORMATION

Information contained in this Annual Report on Form 10-K may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Such statements use forward-looking words such as “believe,” “plan,” “anticipate,” “continue,” “estimate,” “expect,” “may,” or other similar words. These statements discuss plans, strategies, events or developments that we expect or anticipate will or may occur in the future.

A forward-looking statement may include a statement of the assumptions or bases underlying the forward-looking statement. We believe that we have chosen these assumptions or bases in good faith and that they are reasonable. However, we caution you that actual results almost always vary from assumed facts or bases, and the differences between actual results and assumed facts or bases can be material, depending on the circumstances. When considering forward-looking statements, you should keep in mind our Risk Factors included in Item 1A herein and the following important factors which could affect our future results and could cause those results to differ materially from those expressed in our forward-looking statements: (1) adverse weather conditions resulting in reduced demand; (2) cost volatility and availability of propane and other liquefied petroleum gases (“LPG”), oil, electricity, and natural gas and the capacity to transport product to our customers; (3) changes in domestic and foreign laws and regulations, including safety, tax, consumer protection, environmental, and accounting matters; (4) inability to timely recover costs through utility rate proceedings; (5) the impact of pending and future legal proceedings; (6) competitive pressures from the same and alternative energy sources; (7) failure to acquire new customers and retain current customers thereby reducing or limiting any increase in revenues; (8) liability for environmental claims; (9) increased customer conservation measures due to high energy prices and improvements in energy efficiency and technology resulting in reduced demand; (10) adverse labor relations; (11) customer, counterparty, supplier, or vendor defaults; (12) liability for uninsured claims and for claims in excess of insurance coverage, including those for personal injury and property damage arising from explosions, terrorism, and other catastrophic events that may result from operating hazards and risks incidental to generating and distributing electricity and transporting, storing and distributing natural gas and LPG; (13) transmission or distribution system service interruptions; (14) political, regulatory and economic conditions in the United States and in foreign countries, including the current conflicts in the Middle East, and foreign currency exchange rate fluctuations, particularly the euro; (15) capital market conditions, including reduced access to capital markets and interest rate fluctuations; (16) changes in commodity market prices resulting in significantly higher cash collateral requirements; (17) reduced distributions from subsidiaries impacting the ability to pay dividends; (18) changes in Marcellus Shale gas production; (19) the availability, timing and success of our acquisitions, commercial initiatives and investments to grow our businesses; (20) our ability to successfully integrate acquired businesses and achieve anticipated synergies; and (21) the interruption, disruption, failure or malfunction of our information technology systems, including due to cyber attack.

These factors are not necessarily all of the important factors that could cause actual results to differ materially from those expressed in any of our forward-looking statements. Other unknown or unpredictable factors could also have material adverse effects on future results. We undertake no obligation to update publicly any forward-looking statement whether as a result of new information or future events except as required by the federal securities laws.

PART I:

ITEMS 1. AND 2. BUSINESS AND PROPERTIES

CORPORATE OVERVIEW

UGI Corporation (the “Company”) is a holding company that, through subsidiaries and affiliates, distributes, stores, transports and markets energy products and related services. In the United States, we (1) are the general partner and own limited partner interests in a retail propane marketing and distribution business; (2) own and operate natural gas and electric distribution utilities; (3) own all or a portion of electricity generation facilities; and (4) own and operate an energy marketing, midstream infrastructure, storage, natural gas gathering, natural gas production and energy services business. Internationally, we market and distribute propane and other LPG in Europe. Our subsidiaries and affiliates operate principally in the following six business segments:

• | AmeriGas Propane |

• | UGI International - UGI France |

• | UGI International - Flaga & AvantiGas |

• | Energy Services |

• | Electric Generation |

• | UGI Utilities |

2

The AmeriGas Propane segment consists of the propane distribution business of AmeriGas Partners, L.P. (“AmeriGas Partners” or the “Partnership”). The Partnership conducts its propane distribution business through its principal operating subsidiary, AmeriGas Propane, L.P., and is the nation’s largest retail propane distributor. The Partnership’s sole general partner is our subsidiary, AmeriGas Propane, Inc. (“AmeriGas Propane” or the “General Partner”). The common units of AmeriGas Partners represent limited partner interests in a Delaware limited partnership and trade on the New York Stock Exchange under the symbol “APU.” We have an effective 26% ownership interest in the Partnership and the remaining interest is publicly held. See Note 1 to Consolidated Financial Statements.

The UGI International - UGI France segment consists of the French LPG distribution business of our wholly-owned subsidiaries, Antargaz, a French société anonyme, and Finagaz, a French société par actions simplifiée, and our LPG distribution businesses in the Benelux countries (consisting of Belgium, the Netherlands, and Luxembourg) (collectively, “UGI France”). UGI France is the largest LPG distributor in France and one of the largest LPG distributors in Belgium, the Netherlands and Luxembourg.

The UGI International - Flaga & AvantiGas segment consists of the LPG distribution businesses of (i) Flaga GmbH, an Austrian limited liability company, and its subsidiaries (collectively, “Flaga”) and (ii) AvantiGas Limited, a United Kingdom private limited company (“AvantiGas”). Flaga is the largest retail LPG distributor in Austria, Denmark, and Hungary and one of the largest in Poland, the Czech Republic, Slovakia, Norway, and Sweden. Flaga also distributes LPG in Finland, Romania, and Switzerland. AvantiGas is an LPG distributor in the United Kingdom. The UGI France and Flaga & AvantiGas segments are collectively referred to as “UGI International.”

The Energy Services segment consists of energy-related businesses conducted by our wholly-owned subsidiary, UGI Energy Services, LLC (“Energy Services”). These businesses include (i) energy marketing in the Mid-Atlantic region of the United States (the “U.S.”), (ii) operating and owning a natural gas liquefaction, storage and vaporization facility and propane-air mixing assets, (iii) managing natural gas pipeline and storage contracts, and (iv) developing, owning and operating pipelines, gathering infrastructure and gas storage facilities primarily in the Marcellus Shale region of Pennsylvania. The Energy Services segment also includes a heating, ventilation, air conditioning, refrigeration, mechanical and electrical contracting, and project management service business in portions of eastern and central Pennsylvania and portions of New Jersey and Northern Delaware.

The Electric Generation segment consists of electric generation facilities conducted by Energy Services’ wholly-owned subsidiary, UGI Development Company (“UGID”). UGID owns and operates (i) a 130 megawatt natural gas-fueled generating station in Pennsylvania, (ii) an 11 megawatt landfill gas-fueled generation plant in Pennsylvania, and (iii) 13.5 megawatts of solar-powered generation capacity in Pennsylvania, Maryland, and New Jersey. UGID also has an approximate 5.97% (approximately 102 megawatt) ownership interest in a coal-fired generation station in Pennsylvania. The Energy Services and Electric Generation segments are collectively referred to as “Midstream & Marketing.”

The UGI Utilities segment consists of the regulated natural gas distribution businesses (“Gas Utility”) of our subsidiary, UGI Utilities, Inc. (“UGI Utilities”), UGI Utilities’ subsidiaries, UGI Penn Natural Gas, Inc. (“PNG”) and UGI Central Penn Gas, Inc. (“CPG”), and UGI Utilities’ regulated electric distribution business in Pennsylvania (“Electric Utility”). Gas Utility serves over 626,000 customers in eastern and central Pennsylvania and more than five hundred customers in portions of one Maryland county. UGI Utilities’ natural gas distribution utility is referred to as “UGI Gas.” Electric Utility serves approximately 62,000 customers in portions of Luzerne and Wyoming counties in northeastern Pennsylvania. Gas Utility is regulated by the Pennsylvania Public Utility Commission (“PUC”) and, with respect to its several hundred customers in Maryland, the Maryland Public Service Commission. Electric Utility is regulated by the PUC.

Business Strategy

Our business strategy is to grow the Company by focusing on our core competencies of distributing, storing, transporting and marketing energy products and services. We are utilizing our core competencies from our existing businesses and our national scope, international experience, extensive asset base and access to customers to accelerate both internal growth and growth through acquisitions in our existing businesses, as well as in related and complementary businesses. During Fiscal 2016, we completed a number of transactions in pursuit of this strategy and made progress on larger internally generated capital projects, including infrastructure projects to further support the development of natural gas in the Marcellus Shale region of Pennsylvania. A few of these transactions and projects are described below.

In Fiscal 2016, Energy Services received Federal Energy Regulatory Commission (“FERC”) approval for the Sunbury Pipeline project to construct and operate an approximately 35-mile pipeline. The Sunbury Pipeline will transport natural gas to the Hummel Station combined-cycle 1,000 megawatt power generation facility near the Shamokin Dam in Snyder County, Pennsylvania. The project is expected to be completed in Fiscal 2017. In Fiscal 2016, Energy Services also made progress on the PennEast Pipeline project to develop an approximately 118-mile pipeline from Luzerne County, Pennsylvania to the Trenton-Woodbury

3

interconnection in New Jersey. Energy Services expects to receive a Final Environmental Impact Statement and FERC Certificate for the PennEast Pipeline project in Fiscal 2017.

In Fiscal 2016, Energy Services also began construction of the Manning LNG liquefaction plant, which is designed to produce 10,000 dekatherms of liquefied natural gas (“LNG”) per day and provide 280,000 gallons of storage and trucking-loading capability, and the Steelton LNG peak shaving facility, which is designed to provide 75,000 dekatherms per day of peaking capacity and two million gallons of LNG storage. Construction of the Manning LNG Liquefaction plant is expected to be completed in Fiscal 2017 and construction of the Steelton LNG peak shaving facility is expected to be completed in the fiscal year ending September 30, 2018. In addition, an expansion of Energy Services’ Auburn Gathering System in the Marcellus Shale region was completed in Fiscal 2016, adding 150,000 dekatherms of capacity per day.

In May 2015, our indirect wholly owned French subsidiary, UGI France SAS (a Société par actions Simplifée) (“France SAS”) acquired all of the outstanding shares of Totalgaz, Total’s LPG distribution business in France (now known as Finagaz) (the “Totalgaz Acquisition”). In Fiscal 2016, UGI France made substantial progress on the integration efforts related to Finagaz. In addition, UGI International continued to expand its presence in Europe with the completion of smaller but strategic acquisitions in Norway, the United Kingdom, and Austria.

In January 2016, UGI Gas filed a request with the PUC for its first base rate increase in over 21 years. On October 14, 2016, the PUC approved a settlement that was effective October 19, 2016 and will result in a $27.0 million increase in annual base rate revenues.

Corporate Information

UGI Corporation was incorporated in Pennsylvania in 1991. UGI Corporation is not subject to regulation by the PUC. UGI Corporation is a “holding company” under the Public Utility Holding Company Act of 2005 (“PUHCA 2005”). PUHCA 2005 and the implementing regulations of the FERC give FERC access to certain holding company books and records and impose certain accounting, record-keeping, and reporting requirements on holding companies. PUHCA 2005 also provides state utility regulatory commissions with access to holding company books and records in certain circumstances. Pursuant to a waiver granted in accordance with FERC’s regulations on the basis of UGI Corporation’s status as a single-state holding company system, UGI Corporation is not subject to certain of the accounting, record-keeping, and reporting requirements prescribed by FERC’s regulations.

Our executive offices are located at 460 North Gulph Road, King of Prussia, Pennsylvania 19406, and our telephone number is (610) 337-1000. In this report, the terms “Company” and “UGI,” as well as the terms “our,” “we,” “us,” and “its,” are sometimes used as abbreviated references to UGI Corporation or, collectively, UGI Corporation and its consolidated subsidiaries. Similarly, the terms “AmeriGas Partners” and the “Partnership” are sometimes used as abbreviated references to AmeriGas Partners, L.P. or, collectively, AmeriGas Partners, L.P. and its subsidiaries, and the term “UGI Utilities” is sometimes used as an abbreviated reference to UGI Utilities, Inc. or, collectively, UGI Utilities, Inc. and its subsidiaries. The terms “Fiscal 2017”, “Fiscal 2016”, and “Fiscal 2015” refer to the fiscal years ended September 30, 2017, September 30, 2016, and September 30, 2015, respectively.

The Company’s corporate website can be found at www.ugicorp.com. Information on our website is not intended to be incorporated into this report. The Company makes available free of charge at this website (under the “Investor Relations - Financial Reports - SEC Filings and Proxy” caption) copies of its reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act, including its Annual Reports on Form 10-K, its Quarterly Reports on Form 10-Q and its Current Reports on Form 8-K. The Company’s Principles of Corporate Governance, Code of Ethics for the Chief Executive Officer and Senior Financial Officers, Code of Business Conduct and Ethics for Directors, Officers and Employees, and charters of the Corporate Governance, Audit, Compensation and Management Development, and Safety, Environmental and Regulatory Compliance Committees of the Board of Directors are also available on the Company’s website, under the captions “Investor Relations - Corporate Governance - Committees.” All of these documents are also available free of charge by writing to Treasurer, UGI Corporation, P.O. Box 858, Valley Forge, PA 19482.

4

AMERIGAS PROPANE

Products, Services and Marketing

Our domestic propane distribution business is conducted through AmeriGas Partners. AmeriGas Propane is responsible for managing the Partnership. The Partnership serves over 1.9 million customers in all 50 states from approximately 1,900 propane distribution locations. In addition to distributing propane, the Partnership also sells, installs and services propane appliances, including heating systems, and operates a residential heating, ventilation, air conditioning, plumbing, and related services business in certain counties of Pennsylvania, Delaware, and Maryland. Typically, the Partnership’s propane distribution locations are in suburban and rural areas where natural gas is not readily available. Our local offices generally consist of a business office and propane storage. As part of its overall transportation and distribution infrastructure, the Partnership operates as an interstate carrier in all states throughout the continental U.S.

The Partnership sells propane primarily to residential, commercial/industrial, motor fuel, agricultural and wholesale customers. The Partnership distributed over 1.1 billion gallons of propane in Fiscal 2016. Approximately 96% of the Partnership’s Fiscal 2016 sales (based on gallons sold) were to retail accounts and approximately 4% were to wholesale and supply customers. Sales to residential customers in Fiscal 2016 represented approximately 38% of retail gallons sold; commercial/industrial customers 36%; motor fuel customers 17%; and agricultural customers 5%. Transport gallons, which are large-scale deliveries to retail customers other than residential, accounted for 4% of Fiscal 2016 retail gallons. No single customer represents, or is anticipated to represent, more than 5% of the Partnership’s consolidated revenues.

The Partnership continues to expand its AmeriGas Cylinder Exchange (“ACE”) program. At September 30, 2016, ACE cylinders were available at nearly 54,000 retail locations throughout the U.S. Sales of our ACE cylinders to retailers are included in commercial/industrial sales. The ACE program enables consumers to purchase or exchange propane cylinders at various retail locations such as home centers, gas stations, mass merchandisers and grocery and convenience stores. We also supply retailers with large propane tanks to enable retailers to replenish customers’ propane cylinders directly at the retailer’s location.

Residential and commercial customers use propane primarily for home heating, water heating and cooking purposes. Commercial users include hotels, restaurants, churches, warehouses, and retail stores. Industrial customers use propane to fire furnaces, as a cutting gas and in other process applications. Other industrial customers are large-scale heating accounts and local gas utility customers who use propane as a supplemental fuel to meet peak load deliverability requirements. As a motor fuel, propane is burned in internal combustion engines that power over-the-road vehicles, forklifts, commercial lawn mowers, and stationary engines. Agricultural uses include tobacco curing, chicken brooding, crop drying, and orchard heating. In its wholesale operations, the Partnership principally sells propane to large industrial end-users and other propane distributors.

Retail deliveries of propane are usually made to customers by means of bobtail and rack trucks. Propane is pumped from the bobtail truck, which generally holds 2,400 to 3,000 gallons of propane, into a stationary storage tank on the customer’s premises. The Partnership owns most of these storage tanks and leases them to its customers. The capacity of these tanks ranges from approximately 120 gallons to approximately 1,200 gallons. The Partnership also delivers propane in portable cylinders, including ACE cylinders. Some of these deliveries are made to the customer’s location, where cylinders are either picked up or replenished in place.

During Fiscal 2016, we made significant investments in technology to reduce operational costs while improving customer experience. For example, we (i) redesigned our website, enabling customers to pay bills online and seek customer support, (ii) increased our use of mobility to more efficiently deploy our drivers and make deliveries to customers, and (iii) networked our call centers, enabling employees to reroute calls based on volume and customer wait times.

Propane Supply and Storage

The United States propane market has over 250 domestic and international sources of supply, including the spot market. Supplies of propane from the Partnership’s sources historically have been readily available. Volatility in the U.S. propane market stabilized in Fiscal 2016 and the propane industry experienced record inventory levels and low propane prices in the U.S. during the Fiscal 2016 winter heating season. The availability and pricing of propane supply is dependent upon, among other things, the severity of winter weather, the price and availability of competing fuels such as natural gas and crude oil, and the amount and availability of imported and exported supply. In recent years, there has been an increase in overseas demand for U.S. propane exports. While U.S. propane exports exceeded the size of the entire U.S. retail propane sector in Fiscal 2016, U.S. propane inventory levels were at record levels during that period.

5

During Fiscal 2016, approximately 85% of the Partnership’s propane supply was purchased under supply agreements with terms of 1 to 3 years. Although no assurance can be given that supplies of propane will be readily available in the future, management currently expects to be able to secure adequate supplies during Fiscal 2017. If supply from major sources were interrupted, however, the cost of procuring replacement supplies and transporting those supplies from alternative locations might be materially higher and, at least on a short-term basis, margins could be adversely affected. Enterprise Products Operating LLC, Plains Marketing, L.P., and Targa Liquids Marketing & Trade LLC supplied approximately 40% of the Partnership’s Fiscal 2016 propane supply. No other single supplier provided more than 10% of the Partnership’s total propane supply in Fiscal 2016. In certain geographic areas, however, a single supplier provides more than 50% of the Partnership’s requirements. Disruptions in supply in these areas could also have an adverse impact on the Partnership’s margins.

The Partnership’s supply contracts typically provide for pricing based upon (i) index formulas using the current prices established at a major storage point such as Mont Belvieu, Texas, or Conway, Kansas, or (ii) posted prices at the time of delivery. In addition, some agreements provide maximum and minimum seasonal purchase volume guidelines. The percentage of contract purchases, and the amount of supply contracted for at fixed prices, will vary from year to year as determined by the General Partner. The Partnership uses a number of interstate pipelines, as well as railroad tank cars, delivery trucks, and barges, to transport propane from suppliers to storage and distribution facilities. The Partnership stores propane at various storage facilities and terminals located in strategic areas across the U.S.

Because the Partnership’s profitability is sensitive to changes in wholesale propane costs, the Partnership generally seeks to pass on increases in the cost of propane to customers. There is no assurance, however, that the Partnership will always be able to pass on product cost increases fully, or keep pace with such increases, particularly when product costs rise rapidly. Product cost increases can be triggered by periods of severe cold weather, supply interruptions, increases in the prices of base commodities such as crude oil and natural gas, or other unforeseen events. The General Partner has adopted supply acquisition and product cost risk management practices to reduce the effect of volatility on selling prices. These practices currently include the use of summer storage, forward purchases and derivative commodity instruments, such as options and propane price swaps. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations - Market Risk Disclosures.”

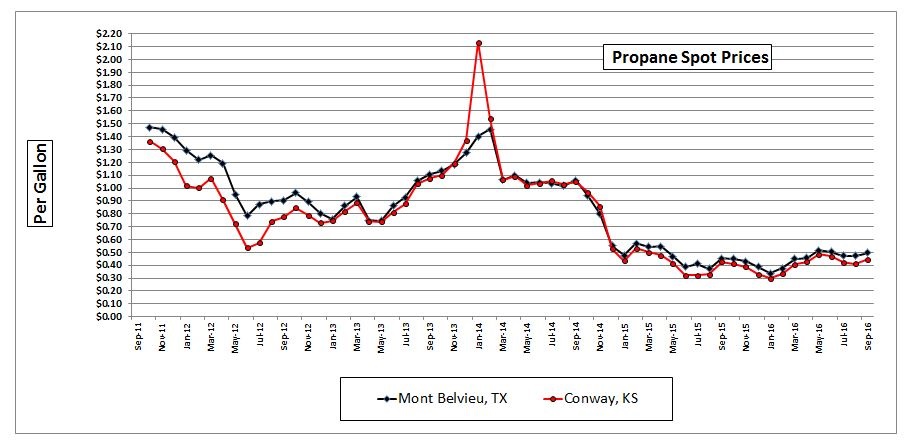

The following graph shows the average prices of propane on the propane spot market during the last five fiscal years at Mont Belvieu, Texas and Conway, Kansas, both major storage areas.

Average Propane Spot Market Prices

General Industry Information

Propane is separated from crude oil during the refining process and also extracted from natural gas or oil wellhead gas at processing plants. Propane is normally transported and stored in a liquid state under moderate pressure or refrigeration for economy and ease of handling in shipping and distribution. When the pressure is released or the temperature is increased, it is usable as a flammable

6

gas. Propane is colorless and odorless; an odorant is added to allow for its detection. Propane is considered a clean alternative fuel under the Clean Air Act Amendments of 1990, producing negligible amounts of pollutants when properly consumed.

Competition

Propane competes with other sources of energy, some of which are less costly for equivalent energy value. Propane distributors compete for customers with suppliers of electricity, fuel oil and natural gas, principally on the basis of price, service, availability and portability. Electricity is generally more expensive than propane on a British thermal unit (“Btu”) equivalent basis, but the convenience and efficiency of electricity make it an attractive energy source for consumers and developers of new homes. Fuel oil is also a major competitor of propane and, although a less environmentally attractive energy source, is currently less expensive than propane. Furnaces and appliances that burn propane will not operate on fuel oil, and vice versa, and, therefore, a conversion from one fuel to the other requires the installation of new equipment. Propane serves as an alternative to natural gas in rural and suburban areas where natural gas is unavailable or portability of product is required. Natural gas is generally a significantly less expensive source of energy than propane, although in areas where natural gas is available, propane is used for certain industrial and commercial applications and as a standby fuel during interruptions in natural gas service. The gradual expansion of the nation’s natural gas distribution systems has resulted in the availability of natural gas in some areas that previously depended upon propane. However, natural gas pipelines are not present in many areas of the country where propane is sold for heating and cooking purposes.

For motor fuel customers, propane competes with gasoline, diesel fuel, electric batteries, fuel cells and, in certain applications, liquefied natural gas and compressed natural gas. Wholesale propane distribution is a highly competitive, low margin business. Propane sales to other retail distributors and large-volume, direct-shipment industrial end-users are price sensitive and frequently involve a competitive bidding process.

Retail propane industry volumes have been declining for several years and no or modest growth in total demand is foreseen in the next several years. Therefore, the Partnership’s ability to grow within the industry is dependent on its ability to acquire other retail distributors and to achieve internal growth, which includes expansion of the ACE program and the National Accounts program (through which the Partnership encourages multi-location propane users to enter into a single AmeriGas Propane supply agreement rather than agreements with multiple suppliers), as well as the success of its sales and marketing programs designed to attract and retain customers. The failure of the Partnership to retain and grow its customer base would have an adverse effect on its long-term results.

The domestic propane retail distribution business is highly competitive. The Partnership competes in this business with other large propane marketers, including other full-service marketers, and thousands of small independent operators. Some farm cooperatives, rural electric cooperatives, and fuel oil distributors include propane distribution in their businesses and the Partnership competes with them as well. The ability to compete effectively depends on providing high quality customer service, maintaining competitive retail prices and controlling operating expenses. The Partnership also offers customers various payment and service options, including guaranteed price programs, fixed price arrangements and pricing arrangements based on published propane prices at specified terminals.

In Fiscal 2016, the Partnership’s retail propane sales totaled nearly 1.1 billion gallons. Based on the most recent annual survey by the American Petroleum Institute, 2014 domestic retail propane sales (annual sales for other than chemical uses) in the U.S. totaled approximately 9.3 billion gallons. Based on LP-GAS magazine rankings, 2014 sales volume of the ten largest propane distribution companies (including AmeriGas Partners) represented approximately 39% of domestic retail sales.

Properties

As of September 30, 2016, the Partnership owned approximately 85% of its nearly 690 local offices throughout the country. The transportation of propane requires specialized equipment. The trucks and railroad tank cars utilized for this purpose carry specialized steel tanks that maintain the propane in a liquefied state. As of September 30, 2016, the Partnership operated a transportation fleet with the following assets:

Approximate Quantity & Equipment Type | % Owned | % Leased | |

920 | Trailers | 79% | 21% |

360 | Tractors | 7% | 93% |

515 | Railroad tank cars | 2% | 98% |

3,400 | Bobtail trucks | 36% | 64% |

400 | Rack trucks | 36% | 64% |

4,000 | Service and delivery trucks | 45% | 55% |

7

Other assets owned at September 30, 2016 included approximately 1.8 million stationary storage tanks with typical capacities of more than 120 gallons, approximately 4.9 million portable propane cylinders with typical capacities of 1 to 120 gallons, 22 terminals, 9 transflow sites, and 12 transflow units.

Trade Names, Trade and Service Marks

The Partnership markets propane and other services principally under the “AmeriGas®”, “America’s Propane Company®”, “Heritage Propane®”, “Relationships Matter®”, “Metro Lawn” and “ServiceMark®” trade names and related service marks. The Partnership also markets propane under various other trade names throughout the United States. UGI owns, directly or indirectly, all the right, title and interest in the “AmeriGas” name and related trade and service marks. The General Partner owns all right, title and interest in the “America’s Propane Company” trade name and related service marks. The Partnership has an exclusive (except for use by UGI, AmeriGas, Inc., AmeriGas Polska Sp. z.o.o. and the General Partner), royalty-free license to use these trade names and related service marks. UGI and the General Partner each have the option to terminate its respective license agreement (except its licenses with permitted transferees and on 12 months prior notice in the case of UGI), without penalty, if the General Partner is removed as general partner of the Partnership for cause. If the General Partner ceases to serve as the general partner of the Partnership other than for cause, the General Partner has the option to terminate its license agreement upon payment of a fee to AmeriGas Propane, L.P. equal to the fair market value of the licensed trade names. UGI has a similar termination option; however, UGI must provide 12 months prior notice in addition to paying the fee to AmeriGas Propane, L.P. UGI and the General Partner each also have the right to terminate its respective license agreement in order to settle any claim of infringement, unfair competition or similar claim or if the agreement has been materially breached without appropriate cure.

Seasonality

Because many customers use propane for heating purposes, the Partnership’s retail sales volume is seasonal. During Fiscal 2016, approximately 64% of the Partnership’s retail sales volume occurred, and substantially all of the Partnership’s operating income was earned, during the peak heating season from October through March. As a result of this seasonality, sales are typically higher in the Partnership’s first and second fiscal quarters (October 1 through March 31). Cash receipts are generally greatest during the second and third fiscal quarters when customers pay for propane purchased during the winter heating season.

Sales volume for the Partnership traditionally fluctuates from year-to-year in response to variations in weather, prices, competition, customer mix and other factors, such as conservation efforts and general economic conditions. For information on national weather statistics, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Government Regulation

The Partnership is subject to various federal, state and local environmental, health, safety and transportation laws and regulations governing the storage, distribution and transportation of propane and the operation of bulk storage propane terminals. Generally, these laws impose limitations on the discharge of pollutants, establish standards for the handling of solid and hazardous substances, and require the investigation and cleanup of environmental contamination. These laws include, among others, the federal Resource Conservation and Recovery Act, the Comprehensive Environmental Response, Compensation and Liability Act (“CERCLA”), the Clean Air Act, the Occupational Safety and Health Act (“OSHA”), the Homeland Security Act of 2002, the Emergency Planning and Community Right-to-Know Act, the Clean Water Act, and comparable state statutes. We incur expenses associated with compliance with our obligations under federal and state environmental laws and regulations, and we believe that we are in material compliance with all of our obligations. We maintain various permits that are necessary to operate our facilities, some of which may be material to our operations. We continually monitor our operations with respect to potential environmental issues, including changes in legal requirements.

Hazardous Substances and Wastes

The Partnership is investigating and remediating contamination at a number of present and former operating sites in the United States, including former sites where it or its former subsidiaries operated manufactured gas plants. CERCLA and similar state laws impose joint and several liability on certain classes of persons considered to have contributed to the release or threatened release of a “hazardous substance” into the environment without regard to fault or the legality of the original conduct. Propane is not a hazardous substance within the meaning of CERCLA.

8

Health and Safety

The Partnership is subject to the requirements of OSHA and comparable state laws that regulate the protection of the health and safety of our workers. These laws require the Partnership, among other things, to maintain information about materials, some of which may be hazardous or toxic, that are used, released, or produced in the course of our operations. Certain portions of this information must be provided to employees, state and local governmental authorities and responders, commercial and industrial customers, and local citizens in accordance with applicable federal and state Emergency Planning and Community Right-to-Know Act requirements. The Partnership’s operations are also subject to the safety hazard communication requirements and reporting obligations set forth in federal workplace standards.

All states in which the Partnership operates have adopted fire safety codes that regulate the storage, distribution, and use of propane. In some states, these laws are administered by state agencies, and in others they are administered on a municipal level. The Partnership conducts training programs to help ensure that its operations are in compliance with applicable governmental regulations. With respect to general operations, National Fire Protection Association (“NFPA”) Pamphlets No. 54 and No. 58 and/or one or more of various international codes (including international fire, building and fuel gas codes) establish rules and procedures governing the safe handling of propane, or comparable regulations, which have been adopted by all states in which the Partnership operates. Management believes that the policies and procedures currently in effect at all of its facilities for the handling, storage, distribution, and use of propane are consistent with industry standards and are in compliance, in all material respects, with applicable environmental, health and safety laws.

With respect to the transportation of propane by truck, the Partnership is subject to regulations promulgated under federal legislation, including the Federal Motor Carrier Safety Act, the Hazardous Materials & Transportation Act, and the Homeland Security Act of 2002. Regulations under these statutes cover the security and transportation of hazardous materials, including propane for purposes of these regulations, and are administered by the Pipeline and Hazardous Materials Safety Administration of the U.S. Department of Transportation (“DOT”). The Natural Gas Safety Act of 1968 required the DOT to develop and enforce minimum safety regulations for the transportation of gases by pipeline. The DOT's pipeline safety regulations apply, among other things, to a propane gas system that supplies 10 or more residential customers or two or more commercial customers from a single source and to a propane gas system any portion of which is located in a public place. The DOT’s pipeline safety regulations require operators of all gas systems to provide operator qualification standards and training and written instructions for employees and third party contractors working on covered pipelines and facilities, establish written procedures to minimize the hazards resulting from gas pipeline emergencies, and conduct and keep records of inspections and testing. Operators are subject to the Pipeline Safety Improvement Act of 2002. Management believes that the procedures currently in effect at all of the Partnership’s facilities for the handling, storage, transportation and distribution of propane are consistent with industry standards and are in compliance, in all material respects, with applicable laws and regulations.

Climate Change

There continues to be concern, both nationally and internationally, about climate change and the contribution of greenhouse gas (“GHG”) emissions, most notably carbon dioxide, to global warming. Because propane is considered a clean alternative fuel under the federal Clean Air Act Amendments of 1990, we anticipate that this will provide us with a competitive advantage over other sources of energy, such as fuel oil and coal, to the extent new climate change regulations become effective. At the same time, increased regulation of GHG emissions, especially in the transportation sector, could impose significant additional costs on the Partnership, suppliers and customers. In recent years, there has been an increase in state initiatives aimed at regulating GHG emissions. For example, the California Environmental Protection Agency established a Cap & Trade program that requires certain covered entities, including propane distribution companies, to purchase allowances to compensate for the GHG emissions created by their business operations. The impact of new legislation and regulations will depend on a number of factors, including (i) which industry sectors would be impacted, (ii) the timing of required compliance, (iii) the overall GHG emissions cap level, (iv) the allocation of emission allowances to specific sources, and (v) the costs and opportunities associated with compliance.

Employees

The Partnership does not directly employ any persons responsible for managing or operating the Partnership. The General Partner provides these services and is reimbursed for its direct and indirect costs and expenses, including all compensation and benefit costs. At September 30, 2016, the General Partner had nearly 8,300 employees, including over 430 part-time, seasonal and temporary employees, working on behalf of the Partnership. UGI also performs certain financial and administrative services for the General Partner on behalf of the Partnership and is reimbursed by the Partnership.

9

UGI INTERNATIONAL

UGI FRANCE

Our UGI France LPG distribution business is conducted in France and the Benelux countries (consisting of Belgium, the Netherlands, and Luxembourg). UGI France also operates a natural gas marketing business in France and Belgium and sold approximately 17 million dekatherms of natural gas during Fiscal 2016.

Products, Services and Marketing

During Fiscal 2016, UGI France sold approximately 451 million gallons of LPG in France and approximately 46 million gallons of LPG in the Benelux countries. UGI France is the largest LPG distributor in France and one of the largest LPG distributors in Belgium, the Netherlands and Luxembourg. UGI France’s customer base consists of residential, commercial, industrial, agricultural and motor fuel customer accounts that use LPG for space heating, cooking, water heating, process heat, forklift operations, and transportation. UGI France sells LPG in cylinders, and in small, medium and large tanks. Sales of LPG are also made to service stations to accommodate vehicles that run on LPG. UGI France sells LPG in cylinders to approximately 20,000 retail outlets, such as supermarkets, individually owned stores and gas stations. Supermarket sales represented approximately 76% of UGI France’s butane cylinder sales volume and approximately 16% of UGI France’s propane cylinder sales volume in Fiscal 2016. At September 30, 2016, UGI France had approximately 404,000 bulk customers, approximately 28,000 natural gas customers and over 15 million cylinders in circulation. Approximately 59% of UGI France’s Fiscal 2016 sales (based on volumes) were cylinder and small bulk, 15% medium bulk, 22% large bulk and 4% to service stations for automobiles. UGI France also engages in wholesale sales of LPG and provides logistics, storage and other services to third-party LPG distributors. In addition, UGI France operates a natural gas marketing business in France and Belgium that serves both commercial and residential customers. No single customer represents, or is anticipated to represent, more than 10% of total revenues for UGI France.

Sales to small bulk customers represent the largest segment of UGI France’s business in terms of volume, revenue and total margin. Small bulk customers are primarily residential and small business users, such as restaurants, that use LPG mainly for heating and cooking. Small bulk customers also include municipalities, which use LPG for heating certain sports facilities and swimming pools, and the poultry industry for use in chicken brooding.

Medium bulk customers use propane only, and consist mainly of large residential developments such as housing developments, hospitals, municipalities and medium-sized industrial enterprises, and poultry brooders. Large bulk customers include agricultural companies and companies that use LPG in their industrial processes.

The principal end-users of cylinders are residential customers who use LPG supplied in this form for domestic applications such as cooking and heating. Butane cylinders accounted for approximately 52% of all LPG cylinders distributed by UGI France in Fiscal 2016, with propane cylinders accounting for 48% of all LPG cylinders distributed by UGI France in Fiscal 2016. Propane cylinders are also used to supply fuel for forklift trucks. The market demand for cylinders continues to decline, due primarily to customers gradually changing to other household energy sources for cooking and heating, such as natural gas and electricity.

LPG Supply and Storage

UGI France had an agreement with Total France for the supply of propane and butane in France, with pricing based on internationally quoted market prices. Under this agreement, during Fiscal 2016 approximately 50% of UGI France’s propane and butane requirements in France were guaranteed until September 2016. In Fiscal 2016, UGI France purchased substantially all of its propane supply for its operations in France from Total France, SHV, and TOTSA and substantially all of its butane and propane supply for its operations in the Benelux countries from SHV and GUNVOR. The balance of its propane and butane requirements were purchased on the international market and on the domestic spot market.

UGI France has interests in three primary storage facilities that are located at deep sea harbor facilities, and 54 secondary storage facilities. It also manages an extensive logistics and transportation network. Access to seaborne facilities allows UGI France to diversify its LPG supplies through imports. LPG stored in primary storage facilities is transported to smaller storage facilities by rail, sea and road. At secondary storage facilities, LPG is loaded into cylinders or trucks equipped with tanks and then delivered to customers.

10

Competition and Seasonality

The LPG markets in France and the Benelux countries are mature, with modest declines in total demand due to competition with other fuels and other energy sources, conservation and the economic climate. Sales volumes are affected principally by the severity of the weather and customer migration to alternative energy forms, including natural gas and electricity. Because UGI France’s profitability is sensitive to changes in wholesale LPG costs, UGI France generally seeks to pass on increases in the cost of LPG to customers. There is no assurance, however, that UGI France will always be able to pass on product cost increases fully when product costs rise rapidly. Product cost increases can be triggered by periods of severe cold weather, supply interruptions, increases in the prices of base commodities such as crude oil and natural gas, or other unforeseen events. High LPG prices also may result in slower than expected growth due to customer conservation and customers seeking less expensive alternative energy sources. France derives a significant portion of its electricity from nuclear power plants. Due to the nuclear power plants, as well as the regulation of electricity prices by the French government, electricity prices in France are generally less expensive than LPG. As a result, electricity has increasingly become a more significant competitor to LPG in France than in other countries where we operate. In addition, government policies and incentives that favor alternative energy sources can result in customers migrating to energy sources other than LPG in both France and the Benelux countries.

In Fiscal 2016, UGI France competed in all of its product markets in France on a national level, principally with two LPG distribution companies, Butagaz (owned by DCC Energy) and Compagnie des Gaz de Petrole Primagaz (owned by SHV Holding NV), as well as with a regional competitor, Vitogaz. UGI France also competes with supermarket chains that affiliate with LPG distributors to offer their own brands of cylinders. UGI France has partnered with two supermarket chains in France in this market. If UGI France is unsuccessful in expanding its services to other supermarket chains, its market share through supermarket sales may decline in France. In the Benelux countries, UGI France competes in all of its product markets on a national level, principally with Compagnie des Gaz de Petrole Primagaz, as well as with several regional competitors. In recent years, competition has increased in the Benelux countries as small competitors have reduced their price offerings. In the Netherlands, several LPG distributors offer their own brands of cylinders. UGI France seeks to increase demand for its butane and propane cylinders through marketing and product innovations. Some of UGI France’s competitors are affiliates of its LPG suppliers. As a result, its competitors may obtain product at more competitive prices.

Because many of UGI France’s customers use LPG for heating, sales volume is affected principally by the severity of the temperatures during the heating season months and traditionally fluctuates from year-to-year in response to variations in weather, prices and other factors, such as conservation efforts and the challenging economic climate. Demand for LPG is higher during the colder months of the year. During Fiscal 2016, approximately 63% of UGI France’s retail sales volume occurred, and substantially all of UGI France’s operating income was earned, during the six months from October through March. For historical information on weather statistics for UGI France, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Government Regulation

UGI France’s business is subject to various laws and regulations at the national and European levels with respect to matters such as protection of the environment, the storage and handling of hazardous materials and flammable substances, the discharge of contaminants into the environment and the safety of persons and property. In Belgium and Luxembourg, UGI France is also subject to price regulations that permit UGI France to increase the price of LPG sold to small bulk, medium bulk, large bulk and cylinder customers (up to a defined maximum price) when UGI France’s costs fluctuate.

Properties

UGI France has interests in three primary storage facilities, one of which is a refrigerated facility. In addition, UGI France is able to use 30,000 cubic meters of capacity of a storage facility, Donges, by virtue of Antargaz’ 50% ownership of GIE Donges.

In connection with the Totalgaz Acquisition and pursuant to the République Française Autorité de la Concurrence’s decision to approve the acquisition in May 2015, UGI France agreed to sell certain depots and a portion of its interests in GIE Norgal and Cobogal; the sale related to GIE Norgal was completed in October 2015 and the sale of Cobogal was completed in April 2016. The table below sets forth details of UGI France’s current ownership in its three primary storage facilities, including GIE Norgal and Cobogal:

11

Ownership % | UGI France Storage Capacity - Propane (m3) (1) | UGI France Storage Capacity - Butane (m3) (1) | ||||||

GIE Norgal | 61.1 | 25,600 | 10,800 | |||||

Geogaz-Lavera | 21.6 | 20,200 | 44,300 | |||||

Cobogal | 50.0 | 4,500 | 1,500 | |||||

_________________

(1) | Cubic meters (1 cubic meter is equivalent to approximately 264 gallons). |

UGI France has 54 secondary storage facilities, 42 of which are wholly-owned. The others are partially owned through joint ventures.

Employees

At September 30, 2016, UGI France had over 1,570 employees.

FLAGA & AVANTIGAS

During Fiscal 2016, our UGI International - Flaga & AvantiGas LPG distribution businesses were conducted principally in Europe through our wholly-owned subsidiaries, Flaga and AvantiGas. Flaga is referred to in this section collectively with its subsidiaries as “Flaga” unless the context otherwise requires. Flaga operates in Austria, the Czech Republic, Denmark, Finland, Hungary, Norway, Poland, Romania, Slovakia, Sweden and Switzerland. AvantiGas operates in the United Kingdom.

During Fiscal 2016, Flaga sold approximately 272 million gallons of LPG. Flaga is the largest distributor of LPG in Austria, Denmark, and Hungary and one of the largest distributors of LPG in Poland, the Czech Republic, Slovakia, Norway, and Sweden. During Fiscal 2016, AvantiGas sold over 163 million gallons of LPG.

FLAGA

Products, Services and Marketing

During Fiscal 2016, Flaga sold approximately 272 million gallons of LPG (of which approximately 14 million gallons were to wholesale customers). Flaga serves customers that use LPG for residential, commercial, industrial, agricultural, resale, and automobile fuel (“auto gas”) purposes. Flaga’s customers primarily use LPG for heating, cooking, motor fuel (including forklifts), leisure activities, construction work, manufacturing, crop and grain drying, power generation and irrigation. Flaga sells LPG in cylinders and in small, medium, and large bulk tanks. At September 30, 2016, Flaga had nearly 64,000 customers and nearly 4.4 million cylinders in circulation. Approximately 34% of Flaga’s Fiscal 2016 sales (based on volumes) were cylinder and small bulk, 15% auto gas, 45% large bulk, and 6% medium bulk.

Flaga has a total of 17 sales offices throughout the countries it serves. Sales offices generally consist of an office location where customers can directly purchase LPG. Except for Poland (33%), no single country represented more than approximately 15% of Flaga’s total LPG gallons sold in Fiscal 2016. Flaga distributes cylinders directly to its customers and through the use of distributors who resell the cylinders to end users under the distributor’s pricing and terms. No single customer represents or is anticipated to represent more than 5% of total revenues for Flaga.

LPG Supply and Storage

Flaga typically enters into an annual LPG supply agreement with TCO/Chevron. During Fiscal 2016, TCO/Chevron supplied approximately 41% of Flaga’s LPG requirements, with pricing based on internationally quoted market prices, and 29 suppliers accounted for the remaining 59% of Flaga’s LPG supply. Flaga also purchases LPG on the international market and on the domestic markets, under annual term agreements with international oil and gas trading companies, including SIBUR, NOVATEK, LOTOS, and PGNIG, and from domestic refineries, primarily OMV, Shell, MOL, and Statoil. In addition, LPG purchases are made on the spot market from international oil and gas traders.

Flaga operates 16 main storage facilities, including one in Denmark and one in Finland that are located at deep sea harbor facilities, two LPG import terminals in Poland, and 22 secondary storage facilities. Flaga manages a widespread logistics and transportation network including approximately 205 leased railcars, and also maintains various transloading and filling agreements with third

12

parties. LPG stored in primary storage facilities is transported to smaller storage facilities by rail or truck.

Competition and Seasonality

The retail propane industry in the Western European countries in which Flaga operates is mature, with slight declines in overall demand in recent years, due primarily to the expansion of natural gas, customer conservation and economic conditions. In the Eastern European countries in which Flaga operates, the demand for LPG is expected to grow in certain segments. Competition for customers is based on contract terms as well as on product prices. Flaga competes with other LPG marketers, including competitors located in other European countries, and also competes with providers of other sources of energy, principally natural gas, electricity and wood.

Because many of Flaga’s customers use LPG for heating, sales volumes in Flaga’s sales territories are affected by the severity of the temperatures during the heating season months and traditionally fluctuate from year-to-year in response to variations in weather, prices and other factors, such as conservation efforts and the economic climate. Because Flaga’s profitability is sensitive to changes in wholesale LPG costs, Flaga generally seeks to pass on increases in the cost of LPG to customers. There is no assurance, however, that Flaga will always be able to pass on product cost increases fully when product costs rise. In parts of Flaga’s sales territories, it is particularly difficult to pass on rapid increases in the price of LPG due to the low per capita income of customers in several of its territories and the intensity of competition. Product cost increases can be triggered by periods of severe cold weather, supply interruptions, increases in the prices of base commodities such as crude oil and natural gas, or other unforeseen events. High LPG prices may result in slower than expected growth due to customer conservation and customers seeking less expensive alternative energy sources. In many of Flaga’s sales territories, government policies and incentives that favor alternative energy sources may result in customers migrating to energy sources other than LPG. Rules and regulations applicable to LPG industry operations in many of the Eastern European countries where Flaga operates are still evolving, causing intensified competitive conditions in those areas.

Government Regulation

Flaga’s business is subject to various laws and regulations at both the national and European levels with respect to matters such as protection of the environment and the storage and handling of hazardous materials and flammable substances.

Employees

At September 30, 2016, Flaga had approximately 950 employees.

AVANTIGAS

Products, Services and Marketing

During Fiscal 2016, AvantiGas sold over 163 million gallons of LPG (of which approximately 98 million gallons were wholesale gallons). At September 30, 2016, AvantiGas had over 16,450 customers. AvantiGas serves customers that use LPG for wholesale, aerosol, agricultural, residential, commercial, industrial, and auto gas purposes. AvantiGas’ customers primarily use LPG for heating, cooking, motor fuel (including forklifts), leisure activities, industrial processes and aerosol propellant. AvantiGas sells LPG in cylinders and small, medium, and large bulk tanks with small bulk and cylinder sales representing approximately 8% of Fiscal 2016 sales (based on volumes), medium bulk sales representing approximately 2% of Fiscal 2016 sales and large bulk sales representing approximately 90% of Fiscal 2016 sales.

AvantiGas serves its customer base through a centralized customer service center and, therefore, does not have sales offices in the United Kingdom. Sales to wholesale customers represented approximately 60% of gallons sold; aerosol customers 21%; agricultural customers 4%; residential customers 6%; and commercial, industrial and autogas 9%. Three wholesale customers and two aerosol customers collectively represented nearly 53% of AvantiGas’ total revenues in Fiscal 2016. No other customer represents or is anticipated to represent more than 5% of total revenues for AvantiGas.

LPG Supply and Storage

AvantiGas has a five-year agreement with Essar Energy plc’s Stanlow refinery, terminating in the fiscal year ending September 30, 2020, and a one-year agreement with Statoil UK Ltd.’s Mossmorran terminal for the supply of more than 90% of AvantiGas’ LPG requirements, terminating in Fiscal 2017. Pricing for such agreements is based on internationally quoted market prices. In Fiscal 2016, AvantiGas purchased the remainder of its LPG requirements from other third party suppliers.

13

AvantiGas operates ten main storage facilities in England, Scotland and Wales. AvantiGas manages a logistics and transportation network, consisting of approximately 50 trucks, and also maintains various transportation agreements with third parties. LPG stored in primary storage facilities is transported to smaller storage facilities or customers by truck.

Competition and Seasonality

The retail propane industry in the United Kingdom is highly concentrated and is mature, with slight declines in overall demand in recent years, due primarily to the expansion of natural gas, customer conservation and challenging economic conditions. Competition for customers is based on contract terms as well as on product prices. AvantiGas competes with other LPG marketers in the United Kingdom.

Because many of AvantiGas’ customers use gas for heating purposes, sales volumes in AvantiGas’ sales territories are affected principally by the severity of the temperatures during the heating season months and traditionally fluctuate from year-to-year in response to variations in weather, prices and other factors, such as energy conservation efforts and the economic climate. During Fiscal 2016, approximately 55% of AvantiGas’ retail sales volume occurred, and approximately 70% of AvantiGas’ operating income was earned, during the peak heating season of October to March. Because AvantiGas’ profitability is sensitive to changes in wholesale LPG costs, AvantiGas generally seeks to pass on increases in the cost of LPG to customers. There is no assurance, however, that AvantiGas will always be able to pass on product cost increases fully when product costs rise. Product cost increases can be triggered by periods of severe cold weather, supply interruptions, increases in the prices of base commodities, such as crude oil and natural gas, or other unforeseen events. High LPG prices may result in slower than expected growth due to customer conservation and customers seeking less expensive alternative energy sources.

Government Regulation

AvantiGas’ business is subject to various laws and regulations at both the national and European levels with respect to matters such as competition, protection of the environment and the storage and handling of hazardous materials and flammable substances.

Employees

At September 30, 2016, AvantiGas had approximately 235 employees.

MIDSTREAM & MARKETING

ENERGY SERVICES

Retail Energy Marketing

Energy Services sells natural gas, liquid fuels and electricity to approximately 16,000 residential, commercial and industrial customers at approximately 40,000 locations. Energy Services serves customers in all or portions of Pennsylvania, New Jersey, Delaware, New York, Ohio, Maryland, Massachusetts, Virginia, North Carolina, South Carolina and the District of Columbia. Energy Services distributes natural gas through the use of the distribution systems of 37 local gas utilities. It supplies power to customers through the use of the transmission lines of 20 utility systems.

Historically, a majority of Energy Services’ commodity sales have been made under fixed-price agreements, which typically contain a take-or-pay arrangement that permits customers to purchase a fixed amount of product for a fixed price during a specified period, and requires payment for the product even if the customer does not take delivery of the product. However, a growing number of Energy Services’ commodity sales are currently being made under requirements contracts, under which Energy Services is typically an exclusive supplier and will supply as much product at a fixed price as the customer requires. Energy Services manages supply cost volatility related to these agreements by (i) entering into fixed-price supply arrangements with a diverse group of suppliers, (ii) holding its own interstate pipeline transportation and storage contracts to efficiently utilize gas supplies, (iii) entering into exchange-traded futures contracts on the New York Mercantile Exchange (NYMEX) and Intercontinental Exchange (ICE), (iv) entering into over-the-counter derivative arrangements with major international banks and major suppliers, (v) utilizing supply assets that it owns or manages, and (vi) utilizing financial transmission rights to hedge price risk against certain transmission costs. Energy Services also bears the risk for balancing and delivering natural gas and power to its customers under various gas pipeline and utility company tariffs. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations - Market Risk Disclosures.”

14

Midstream Assets

Energy Services operates a natural gas liquefaction, storage and vaporization facility in Temple, Pennsylvania (“Temple Facility”), and propane storage and propane-air mixing stations in Bethlehem, Reading, Hunlock Creek, and White Deer, Pennsylvania. It also operates propane storage, rail transshipment terminals, and propane-air mixing stations in Steelton and Williamsport, Pennsylvania. These assets are used in Energy Services’ energy peaking business that provides supplemental energy, primarily liquefied natural gas and propane-air mixtures, to gas utilities on interstate pipelines at times of high demand (generally during periods of coldest winter weather). In addition, Energy Services sells LNG to customers for use by trucks, drilling rigs, other motor vehicles and facilities located off the gas grid. Energy Services also manages natural gas pipeline and storage contracts for UGI Utilities and Frontier Natural Gas, subject to a competitive bid process.

In Fiscal 2016, Energy Services continued making investments to expand its energy peaking and LNG fuels business by initiating the construction of two infrastructure projects, the Manning LNG liquefaction plant and the Steelton LNG peak shaving facility. The Manning LNG liquefaction plant has been designed to produce 10,000 dekatherms of LNG per day with 280,000 gallons of storage and trucking-loading capability and is expected to be completed in Fiscal 2017. The Steelton LNG peak shaving facility has been designed to provide 75,000 dekatherms per day of peaking capacity and two million gallons of LNG storage and is expected to be completed in the fiscal year ending September 30, 2018.

A wholly-owned subsidiary of Energy Services owns and operates underground natural gas storage and related high pressure pipeline facilities, which have FERC approval to sell storage services at market-based rates. The storage facilities are located in the Marcellus Shale region of north-central Pennsylvania and have a total storage capacity of 15 million dekatherms and a maximum daily withdrawal quantity of 224,000 dekatherms. In Fiscal 2016, Energy Services leased more than 85% of the firm capacity at its underground natural gas facilities to third parties.

In Fiscal 2016, Energy Services continued making investments in infrastructure projects to support the development of natural gas in the Marcellus Shale region of Pennsylvania. An expansion of Energy Services’ Auburn Gathering System in the Marcellus Shale region was completed, adding 150,000 dekatherms of capacity per day. The Auburn gathering system includes a new 24” pipeline that will loop the original 12” Auburn line. With this expansion, the Auburn gathering system is now capable of delivering up to 470,000 dekatherms of capacity per day to both the Tennessee Gas Pipeline and the Transcontinental Gas Pipeline.

In Fiscal 2016, Energy Services also made progress on its participation in the PennEast Pipeline project to develop an approximately 118-mile pipeline from Luzerne County, Pennsylvania to the Trenton-Woodbury interconnection in New Jersey. When completed, the pipeline will transport approximately 1 billion cubic feet of lower cost natural gas to residential and commercial customers each day. In July 2016, FERC issued a Draft Environmental Impact Statement with respect to the PennEast Pipeline project and Energy Services expects to receive a Final Environmental Impact Statement and FERC Certificate in Fiscal 2017.

During Fiscal 2016, Energy Services, through its wholly-owned subsidiary, UGI Sunbury, LLC, started construction on an approximately 35-mile interstate natural gas pipeline in central Pennsylvania to serve the proposed Hummel Station combined-cycle 1,000 megawatt power generation facility near the Shamokin Dam in Snyder County, Pennsylvania (Sunbury Pipeline project). The project is expected to be completed in Fiscal 2017.

Future planned investments are expected to cover a range of midstream asset opportunities, including interstate pipelines, local gathering systems and gas storage facilities and complementary and related investments.

HVAC Business

Energy Services also conducts a heating, ventilation, air conditioning, refrigeration, mechanical & electrical contracting, and project management service business through its HVAC business unit, which serves portions of eastern and central Pennsylvania and portions of New Jersey and northern Delaware. This business serves customers in residential, commercial, industrial and new construction markets.

Competition

Energy Services competes with other midstream operators to sell gathering, compression, storage, and pipeline transportation services. Energy Services competes in both the regulated and non-regulated environment against interstate and intrastate pipelines that gather, compress, process, transport, and market natural gas. Energy Services sells midstream services primarily to producers, marketers, and utilities on the basis of price, customer service, flexibility, reliability, and operational experience. The competition in the midstream segment is significant and has grown recently in the northeast U.S. as more competitors seek opportunities offered

15

by the development of the Marcellus and Utica Shales.

Energy Services also competes with other marketers, consultants, and local utilities to sell natural gas, liquid fuels, electric power, and related services to customers in its service area principally on the basis of price, customer service, and reliability. Energy Services has faced an increase in competition in recent years as new markets for natural gas, liquid fuels, electric power, and related services have emerged.

Government Regulation

FERC has jurisdiction over the rates and terms and conditions of service of wholesale sales of electric capacity and energy, as well as the sales for resale of natural gas and related storage and transportation services. Energy Services has a tariff on file with FERC pursuant to which it may make power sales to wholesale customers at market-based rates. Energy Services also has market-based rate authority for power sales to wholesale customers, to the extent that Energy Services purchases power in excess of its retail customer needs. Two subsidiaries of Energy Services currently operate natural gas storage facilities under FERC certificate approvals and offer services to wholesale customers at FERC-approved market-based rates. In May 2016, Energy Services received FERC approval for UGI Mt. Bethel Pipeline Company, LLC, a newly created, wholly-owned subsidiary of Energy Services, to acquire an existing 12.5 mile, 12-inch-diameter pipeline located in Northampton County, Pennsylvania. The acquisition was completed and the Mt. Bethel Pipeline was placed into interstate service in July 2016. As a result of the acquisition, Energy Services and its subsidiaries were required to achieve compliance with the FERC Standards of Conduct (“SOC”). Energy Services developed a compliance policy, relocated employee offices, adopted new IT security measures and conducted employee training to achieve full SOC compliance by July 2, 2016. UGI Sunbury, LLC also received FERC approval for the Sunbury Pipeline project in April 2016. The Sunbury Pipeline is currently under construction, subject to a FERC-approved implementation plan and inspection procedures, and is expected to be placed into service in Fiscal 2017. In addition, the PennEast Pipeline project filed an application for FERC approval in September 2015 and the application remains pending. Energy Services is also subject to FERC reporting requirements, market manipulation rules and other FERC enforcement and regulatory powers with respect to its wholesale commodity business.

Energy Services’ midstream operations include natural gas gathering pipelines and compression in northeastern Pennsylvania that are regulated under the Pipeline Safety Improvement Act of 2002 and subject to operational oversight by both the Pipeline and Hazardous Materials Safety Administration and the PUC.

Energy Services is subject to various federal, state and local environmental, safety and transportation laws and regulations governing the storage, distribution and transportation of propane and the operation of bulk storage LPG terminals. These laws include, among others, the Resource Conservation and Recovery Act, CERCLA, the Clean Air Act, OSHA, the Homeland Security Act of 2002, the Emergency Planning and Community Right-to-Know Act, the Clean Water Act and comparable state statutes. CERCLA imposes joint and several liability on certain classes of persons considered to have contributed to the release or threatened release of a “hazardous substance” into the environment without regard to fault or the legality of the original conduct. With respect to the operation of natural gas gathering and transportation pipelines, Energy Services also is required to comply with the provisions of the Pipeline Safety Improvement Act of 2002 and the regulations of the U.S. DOT.

Employees

At September 30, 2016, Energy Services had approximately 550 employees, including its HVAC business which had approximately 300 employees.

ELECTRIC GENERATION

Products and Services

UGID has an approximate 5.97% (approximately 102 megawatt) ownership interest in the Conemaugh generation station (“Conemaugh”), a 1,711-megawatt, coal-fired generation station located near Johnstown, Pennsylvania. Conemaugh is owned by a consortium of energy companies and operated by a unit of NRG Energy. UGID also owns and operates the Hunlock Station located near Wilkes-Barre, Pennsylvania, a 130-megawatt natural gas-fueled generating station which was converted to natural gas operations in July 2011.

In addition, UGID owns and operates a landfill gas-fueled generation plant near Hegins, Pennsylvania, with gross generating capacity of 11 megawatts. The plant qualifies for renewable energy credits.

UGID also owns and operates 13.5 megawatts of solar-powered generation capacity in Pennsylvania, Maryland and New Jersey.

16

Competition

UGID competes with other generation stations on the interface of PJM Interconnection, LLC (“PJM”), a regional transmission organization that coordinates the movement of wholesale electricity in certain states, including the states in which we operate, and bases sales on bid pricing. Generally, each power generator has a small share of the total market on PJM.

Government Regulation

UGID owns electric generation facilities that are within the control area of PJM and are dispatched in accordance with a FERC-approved open access tariff and associated agreements administered by PJM. UGID receives certain revenues collected by PJM, determined under an approved rate schedule. Like Energy Services, UGID has a tariff on file with FERC pursuant to which it may make power sales to wholesale customers at market-based rates. UGID is also subject to FERC reporting requirements, market manipulation rules and other FERC enforcement and regulatory powers.

Employees

At September 30, 2016, UGID had approximately 25 employees.

UGI UTILITIES

GAS UTILITY

Gas Utility consists of the regulated natural gas distribution businesses of our subsidiary, UGI Utilities, and UGI Utilities’ subsidiaries, PNG and CPG. Gas Utility serves over 626,000 customers in eastern and central Pennsylvania and more than five hundred customers in portions of one Maryland county. Gas Utility is regulated by the PUC and, with respect to its customers in Maryland, the Maryland Public Service Commission.

Service Area; Revenue Analysis