UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

or

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ____________ to ____________

Commission file number:

(Exact name of registrant as specified in its charter)

|

||

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

|

||

(Address of principal executive offices) |

|

(Zip Code) |

(

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

|

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined by Rule 405 of the Securities Act.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files.)

Indicate by check mark whether registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer |

|

☐ |

|

|

☒ |

|

Non-accelerated filer |

|

☐ |

|

Smaller reporting company |

|

|

|

|

|

|

Emerging growth company |

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes

The aggregate market value of the Common Stock (based on its closing price per share on such date) held by non-affiliates on the last business day of the registrant’s most recently completed second fiscal quarter (June 30, 2023) was approximately $

Registrant had

Documents Incorporated by Reference

Portions of the Proxy Statement for the Viad Corp Annual Meeting of Shareholders scheduled for May 15, 2024, is incorporated by reference into Part III of this Annual Report.

Auditor Firm Id: |

Auditor Name: |

Auditor Location: |

INDEX

|

|

Page |

|

|

|

Item 1. |

2 |

|

Item 1A. |

10 |

|

Item 1B. |

14 |

|

Item 1C. |

14 |

|

Item 2. |

15 |

|

Item 3. |

15 |

|

Item 4. |

15 |

|

Other. |

16 |

|

|

|

|

Item 5. |

17 |

|

Item 6. |

18 |

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

18 |

Item 7A. |

27 |

|

Item 8. |

29 |

|

Item 9. |

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

78 |

Item 9A. |

78 |

|

Item 9B. |

81 |

|

Item 9C. |

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections |

81 |

|

|

|

Item 10. |

82 |

|

Item 11. |

82 |

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

82 |

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

82 |

Item 14. |

82 |

|

|

|

|

Item 15. |

82 |

|

Item 16. |

86 |

In this report, for periods presented, “we,” “us,” “our,” “the Company,” and “Viad Corp” refer to Viad Corp and its subsidiaries.

PART I

Forward-Looking Statements

This Annual Report on Form 10-K (“2023 Form 10-K”) contains a number of forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements may appear throughout this 2023 Form 10-K, including the following sections: “Business” (Part I, Item 1), “Risk Factors” (Part I, Item 1A), “Management’s Discussion and Analysis of Financial Condition and Results of Operations” (Part II, Item 7), and “Quantitative and Qualitative Disclosures About Market Risk” (Part II, Item 7A). Words, and variations of words, such as “aim,” “anticipate,” “believe,” “could,” “deliver,” “estimate,” “expect,” “intend,” “may,” “might,” “outlook,” “plan,” “potential,” “seek,” “target,” “will,” and similar expressions are intended to identify our forward-looking statements. Similarly, statements that describe our business strategy, outlook, objectives, plans, initiatives, intentions, or goals also are forward-looking statements. These forward-looking statements are not historical facts and are subject to a host of risks and uncertainties, many of which are beyond our control, which could cause actual results to differ materially from those in the forward-looking statements.

Important factors that could cause actual results to differ materially from those described in our forward-looking statements include, but are not limited to, the following:

For a more complete discussion of the risks and uncertainties that may affect our business or financial results, refer to “Risk Factors” (Part I, Item 1A of this 2023 Form 10-K). The forward-looking statements in this 2023 Form 10-K are made as of the date hereof. We disclaim and do not undertake any obligation to update or revise any forward-looking statement in this 2023 Form 10-K except as required by applicable law or regulation.

1

Item 1. Business

We are a leading provider of extraordinary experiences, including hospitality and leisure activities, experiential marketing, and live events. Our mission is to drive significant and sustainable growth by delivering extraordinary experiences for our teams, clients, and guests.

We operate through three reportable business segments: Pursuit, Spiro, and GES Exhibitions. Spiro and GES Exhibitions are both live event businesses and are referred to collectively as “GES.”

Pursuit is a global attractions and hospitality company that owns and operates a collection of inspiring and unforgettable travel experiences in iconic destinations. Pursuit’s mission is to connect guests and staff to iconic places through unforgettable inspiring experiences. From world-class attractions, distinctive hotels, and engaging tours in stunning national parks and renowned global travel locations, Pursuit’s elevated attraction and hospitality experiences enable visitors to discover and connect with these iconic destinations. With a strategic direction to build an expanding portfolio of extraordinary experiences, Pursuit remains focused on refreshing, improving, and growing its collection in outstanding places around the globe. Pursuit draws its guests from major markets, including the United States, Canada, China, the United Kingdom, Australia/New Zealand, Asia Pacific, and Europe. Pursuit markets directly to consumers, as well as through distribution channels that include tour operators, tour wholesalers, destination management companies, and retail travel agencies. Pursuit comprises the following:

Banff Jasper Collection |

The Banff Jasper Collection owns and operates attractions and hospitality experiences in the Canadian Rockies. Featuring lake cruises in Banff and Jasper National Parks, top-of-the-mountain views at the Banff Gondola, glacier exploration at the toe of the Columbia Icefield, the Glacier Skywalk and the Golden SkyBridge spanning over deep canyons, the collection offers visitors unique hotel experiences, attractions, culinary destinations, and retail offerings. The collection is also complemented by a sightseeing tour experience and transportation portfolio. |

Alaska Collection |

The Alaska Collection owns and operates attractions and hospitality experiences including wildlife safaris, whale watching, and glacier cruises complemented by unique lodging experiences in Denali and Kenai Fjords National Parks. From the port town of Seward, to the mountain town of Talkeetna, to the end of the road in Denali National Park, Pursuit offers a collection of unique attractions and hotels, complemented by culinary and retail services. |

Glacier Park Collection |

The Glacier Park Collection owns and operates attractions and hospitality experiences in and around Glacier and Waterton Lakes National Parks. The collection features a guided river rafting attraction, lodging, culinary and retail experiences, all designed to enable guests to experience both Montana and Southern Alberta’s stunning outdoors. |

FlyOver Attractions |

Pursuit’s FlyOver flight ride attractions provide guests with an exhilarating flying ride experience over iconic natural wonders, hard to reach locations, and picturesque scenery. Utilizing state-of-the-art ride and audio-visual technology, each FlyOver experience features moving ride vehicles with six degrees of motion, multi-sensory special effects, and a spherical screen that provides guests with a flight across stunning landscapes. |

Sky Lagoon |

Pursuit’s Sky Lagoon is an oceanfront geothermal lagoon located just minutes from Reykjavik, Iceland. It features an ocean-side infinity-edge in addition to cold pool and sauna experiences. It also features an in-lagoon bar, dining experiences and retail offerings. |

2

Pursuit’s collection of experiences focuses on three distinct lines of business: Attractions (including food and beverage services and retail operations); Hospitality (including food and beverage services and retail operations); and Transportation.

Attractions

|

BANFF JASPER COLLECTION

Banff Gondola transports visitors to an elevation of over 7,000 feet above sea level to the top of Sulphur Mountain in Banff, Alberta, Canada offering an unobstructed view of the Canadian Rockies and overlooking the town of Banff and the Bow Valley. The Banff Gondola and the Sky Bistro restaurant, which is located at the top of the Banff Gondola, were 2023 Trip Advisor Travelers Choice award winners.

Lake Minnewanka Cruise provides guests a unique sightseeing experience through interpretive boat cruises on Lake Minnewanka in the Canadian Rockies. The Lake Minnewanka Cruise operations are located adjacent to the town of Banff and include boat tours, small boat rentals, and charter fishing expeditions. The Lake Minnewanka Cruise was a 2023 Trip Advisor Travelers Choice award winner.

Glacier Adventure is a tour of the Athabasca Glacier on the Columbia Icefield, which provides guests a view of one of the largest accumulations of ice and snow south of the Arctic Circle. Guests ride in a giant “Ice Explorer,” a unique vehicle specially designed for glacier travel. The Glacier Adventure was a 2023 Trip Advisor Travelers Choice award winner.

Columbia Icefield Skywalk is a 1,312-foot guided interpretive walkway with a 98-foot glass-floored observation area overlooking the Sunwapta Valley, near our Glacier Adventure attraction in Jasper National Park, Alberta, Canada.

Maligne Lake Cruise provides interpretive boat tours at Maligne Lake, the largest lake in Jasper National Park, Alberta, Canada. In addition to boat tours, Maligne Lake has a marina and day lodge that offers food and beverage and retail services, an historic chalet complex and boat house that offers canoes, kayaks, and rowboats for rental. The Maligne Lake Cruise was a 2023 Trip Advisor Travelers Choice award winner.

Golden Skybridge is in the mountain town of Golden, British Columbia, which is 90 minutes from Banff. It consists of two suspension bridges that are connected through forested trails. The upper skybridge is 426 feet above the canyon floor while the lower skybridge is 262 feet above the canyon floor. The attraction also includes a zip line, a canyon challenge course, and a mountain coaster. The Golden Skybridge was a 2023 Trip Advisor Travelers Choice award winner.

Open Top Touring is a guided sightseeing tour of Banff with a historic twist. Guests ride in a custom-made, open-topped automobile inspired by local tours from the 1930s. Open Top Touring was a 2023 Trip Advisor Travelers Choice award winner.

ALASKA COLLECTION

Kenai Fjords Tours is a wildlife, whale watching, and glacier cruise, offering guests unforgettable sights of towering glaciers, humpback and grey whales, orcas, arctic birdlife, sea lions, seals, and porpoises in Kenai Fjords National Park. Tours range from a few hours to full days, with some tours including a culinary experience and visit to Fox Island. Kenai Fjords Tours was a 2023 Trip Advisor Travelers Choice award winner.

SKY LAGOON

Sky Lagoon is a 230-foot premium oceanfront geothermal lagoon that is located in Kársnes Harbour, Kópavogur, just minutes from Reykjavik. Sky Lagoon showcases expansive ocean vistas punctuated by awe-inspiring sunsets, Northern Lights, and dark sky views. Sky Lagoon was a 2023 Trip Advisor Travelers Choice award winner.

3

FLYOVER ATTRACTIONS

FlyOver flight ride attractions provide guests with an exhilarating flying experience over iconic natural wonders, hard to reach locations, and picturesque scenery. Utilizing state-of-the-art ride and audio-visual technology, each FlyOver experience features moving ride vehicles with six degrees of motion and multi-sensory special effects before a spherical screen.

GLACIER PARK COLLECTION

Glacier Raft Company provides guided river rafting trips in West Glacier, Montana.

Hospitality

|

BANFF JASPER COLLECTION |

|

GLACIER PARK COLLECTION |

|

ALASKA COLLECTION |

|||

Elk + Avenue Hotel |

164 rooms |

|

Glacier Park Lodge |

162 rooms |

|

Seward Windsong Lodge |

216 rooms |

Forest Park Woodland |

152 rooms |

|

Grouse Mountain Lodge |

145 rooms |

|

Talkeetna Alaskan Lodge |

212 rooms |

Lobstick Lodge |

139 rooms |

|

St. Mary Lodge |

116 rooms |

|

Denali Cabins |

46 rooms |

Mount Royal Hotel |

133 rooms |

|

Prince of Wales Hotel |

86 rooms |

|

Denali Backcountry Lodge |

42 rooms |

Chateau Jasper Hotel |

119 rooms |

|

Apgar Village Lodge & Cabins |

48 rooms |

|

Kenai Fjords Wilderness Lodge |

8 rooms |

The Crimson Hotel |

99 rooms |

|

West Glacier Village |

18 rooms |

|

|

524 rooms |

Forest Park Alpine |

88 rooms |

|

Glacier Basecamp Lodge |

29 rooms |

|

|

|

Marmot Lodge |

81 rooms |

|

Belton Chalet |

27 rooms |

|

|

|

Pyramid Lake Resort |

68 rooms |

|

Motel Lake McDonald |

27 rooms |

|

|

|

Miette Mountain Cabins |

56 rooms |

|

Glacier Raft Co. Lodging |

23 rooms |

|

|

|

Glacier View Lodge |

32 rooms |

|

West Glacier RV Park & Cabins |

25 rooms |

|

|

|

|

1,131 rooms |

|

|

706 rooms |

|

|

|

Transportation

|

BANFF JASPER COLLECTION

Transportation operations include sightseeing tours, airport shuttle services, and seasonal charter motorcoach services. The sightseeing services include seasonal half- and full-day tours from Calgary, Banff, Lake Louise, and Jasper, Canada and bring guests to the most scenic areas of Banff, Jasper, and Yoho National Parks. The charter business operates a fleet of luxury motorcoaches, available for groups of any size, for travel throughout the Canadian provinces of Alberta and British Columbia during the winter months.

ALASKA COLLECTION

Transportation includes a Denali Backcountry Adventure, which is a unique photo safari tour 92 miles deep into Denali National Park.

4

Pursuit Seasonality

Pursuit’s peak activity occurs during the summer months. During 2023, 79% of Pursuit’s revenue was earned in the second and third quarters.

Pursuit Competition

Pursuit generally competes based on location, uniqueness of facilities, service, quality, and price. Competition exists both locally and regionally across all three lines of business. The hospitality industry has a large number of competitors and competes for leisure travelers (both individual and tour groups) across the United States and Canada. Pursuit’s competitive advantages are its distinctive attractions, iconic destinations, and strong culture of hospitality and guest services.

Pursuit Growth Strategy

Pursuit’s growth strategy is to become a leading attractions hospitality company through its Refresh, Build, Buy initiatives:

We continue to search for opportunities to acquire or to build high return tourism assets in iconic natural and cultural destinations that enjoy perennial demand, bring meaningful scale and market share, and offer cross-selling advantages with a combination of attractions and hotels.

Recent Pursuit Development

5

GES is a global, full-service live events company offering a comprehensive range of services to the world’s leading brands and event organizers from the design and production of compelling, immersive live and digital experiences that engage audiences and build brand awareness, through to logistics, including material handling, rigging, electrical, and other on-site event services. GES’ mission is to create the most meaningful and memorable experiences for marketers, organizers, and attendees.

GES has a leading position in the United States, serving every major exhibition market, including Las Vegas, Chicago, and Orlando. Additionally, GES produces events at many of the most active and popular international event destinations and venues in the United Kingdom, Canada, the Middle East, the Netherlands, and Germany.

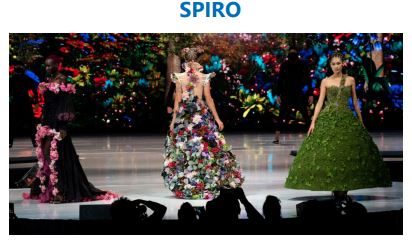

SPIRO

Spiro is an experiential marketing agency that partners with leading brands around the world to manage and elevate their global experiential marketing activities. Spiro builds immersive experiences with its clients starting with the strategic plan, creating the content and design, and finishing with the delivery and execution. Spiro delivers a broad range of unique and impactful experiences for its clients, including meetings and events, exhibition and program management, environments and permanent installations, brand and product activations, and marketing and measurement.

Spiro Competition

Within brand experiences, Spiro generally competes on the basis of creative design, value, quality, and service offerings. Spiro maintains competitive advantages through its breadth of service offerings, worldwide network of resources, state-of-the-art creative solutions, advanced technology platforms, longstanding reputation for customer service and execution, and financial strength. Most known competitors are privately-held companies that provide limited public information regarding their operations. There is substantial competition from a large number of service providers, however Spiro’s primary competitors are experiential marketing agencies and trade show design-and-build companies.

GES EXHIBITIONS

GES Exhibitions is a global exhibition services company with a legacy spanning over 90 years and teams throughout North America, Europe, and the Middle East. GES Exhibitions partners with leading exhibition and conference organizers as a full-service provider of strategic and logistics solutions to manage the complexity of their shows, including strategy, creative & design, registration & engagement, accommodations, logistics & management, material handling, overhead sign hanging, graphics and other rental and labor services. GES Exhibitions also serves as an in-house or preferred provider of electrical and other event services within event venues, including convention centers and conference hotels.

GES Exhibitions Competition

In the live events industry, GES Exhibitions generally competes across all classes of services and all markets on the basis of discernible differences, value, quality, price, convenience, and service. GES Exhibitions has a competitive advantage through its worldwide network of resources, history of serving as an extension of clients’ teams, experienced and knowledgeable personnel, client focus, creativity, reliable execution, proprietary technology platforms, and financial strength. All known United States competitors and most international

6

competitors are privately held companies that provide limited public information regarding their operations. GES Exhibition’s primary competitor is a privately-held, United States-headquartered company; however, there is substantial competition from a large number of service providers in GES Exhibition’s other service offerings.

GES Seasonality and Show Rotation

GES’ live event activity can vary significantly from quarter to quarter and year to year depending on the frequency and timing of shows. Some shows are not held annually and some shift between quarters. Show rotation refers to shows that occur less frequently than annually, as well as annual shows that shift quarters from one year to the next.

GES Strategic Transformation

Over the past few years, we accelerated our transformation and streamlining efforts at GES to significantly reduce costs and create a lower cost structure focused on servicing GES’ more profitable market segments.

Intellectual Property

Our intellectual property rights (including trademarks, patents, copyrights, registered designs, technology, and know-how) are material to our business.

We own or have the right to use numerous trademarks and patents in many countries. Depending on the country, trademarks remain valid for as long as we use them, or as long as we maintain their registration status. Trademark registrations are generally for renewable, fixed terms. We also have patents for current and potential products. Our patents cover inventions ranging from a modular structure having a load-bearing surface that we use in our event and exhibition services, to a surface-covering installation tool and method that reduces our labor costs and improves worker safety. Our United States issued utility patents extend for 20 years from the patent application filing date, and our United States issued design patents are currently granted for 14 years from the grant date. We also have an extensive design library. Many of the designs have copyright protection and we have also registered many of the copyrights. In the United States, copyright protection is for 95 years from the date of publication or 120 years from creation, whichever is shorter. While we believe that certain of our patents, trademarks, and copyrights have substantial value, we do not believe the loss of any one of them would have a material adverse effect on our financial condition or results of operations.

Our Trademarks

Our United States registered trademarks and trademarks pending registration include Global Experience Specialists & design®, Spiro, GES®, Viad ®, GES Servicenter®, GES National Servicenter®, GES Connect®, GES Exhibit Ready®, GES Measurement & Insight®, GES Project Central,Trade Show Rigging TSR®, TSE Trade Show Electrical & design®, Earth Explorers®, Compass Direct®, ethnoMetrics®, FLYOVER® & design, FLYOVER Canada & design®, FLYOVER Iceland & design®, FLYOVER LAS VEGAS®, ONPEAK®, Above Banff®, , Kenai Fjords Wilderness Lodge® & design, Explore Rockies®, Denali Backcountry Adventure®, Denali Backcountry Lodge®, and Denali Cabins & design®

We also own or have the right to use many registered trademarks and trademarks pending registration outside of the United States, including GES®, Spiro®, ShowTech®, Visit®, Visit by GES®, Brewster Inc. & design®, Brewster Attractions Explore & design®, Brewster Hospitality Refresh & design®, Glacier Skywalk®, Above Banff®, Banff Gondola®, Explore Rockies®, FLYOVER & design®, FLYOVER ICELAND & design, FLYOVER Canada & design, Forest Park Hotel®, Mount Royal, GES Event Intelligence AG®, Pursuit®, by Pursuit®, Kaffi Grandi, Ský Lagoon®, Soaring Over Canada®, Elk + Avenue Hotel®, Brewster Epic Summer Pass®, and escape.connect.refresh.explore®.

Government Regulation and Compliance

The principal rules and regulations affecting our day-to-day business relate to our employees (such as regulations implemented by the Occupational Safety and Health Administration, equal employment opportunity laws, guidelines implemented pursuant to the Americans with Disabilities Act, and general federal and state employment laws), unionized labor (such as guidelines imposed by the National Labor Relations Act), United States and Canadian regulations relating to national parks (such as regulations established by Parks Canada, the United States Department of the Interior, and the United States National Park Service), United States and Canadian regulations relating to boating (such as regulations implemented by the United States Coast Guard and Canadian Coast Guard and state boating laws), transportation (such as regulations promulgated by the United States Department of Transportation and its state counterparts), and consumer and employee privacy regulations implemented by agencies in the jurisdictions where we operate.

Our current and former businesses are subject to federal and state environmental regulations. Compliance with these provisions, and environmental stewardship generally, is key to our ongoing operations. To date, these provisions have not had, and we do not expect them to have, a material effect on our results of current and discontinued operations.

7

On July 18, 2020, an off-road Ice Explorer operated by our Pursuit business was involved in an accident while enroute to the Athabasca Glacier, resulting in three fatalities and multiple other serious injuries. We immediately reported the accident to our relevant insurance carriers, who have supported our investigation and subsequent claims relating to the accident. In May 2023, we resolved charges from the Canadian office of Occupational Health and Safety in relation to this accident, resulting in fines and related payments in an aggregate amount of $0.5 million Canadian dollars (approximately $0.3 million U.S. dollars). We continue to manage our legal defense of various claims from the victims and their families. In addition, we believe that our reserves and, subject to customary deductibles, our insurance coverage is sufficient to cover potential claims related to this accident.

Human Capital

Our people drive our success. We foster a culture that is equitable and inclusive, celebrates our talent, and prioritizes the safety and wellness of our teams, clients, and guests. We are committed to cultivating an environment where people of all different backgrounds feel a sense of belonging and contribute to our continued success.

We had the following number of employees as of December 31, 2023:

|

|

Number of |

|

|

GES |

|

|

2,765 |

|

Pursuit |

|

|

1,237 |

|

Viad Corporate |

|

|

33 |

|

Total |

|

|

4,035 |

|

GES hires temporary employees on a show-by-show basis. The number of temporary employees fluctuates depending on the size and location of the exhibition or event. Pursuit hires approximately 2,000 seasonal employees during the peak summer months to help operate its attractions and hospitality properties.

We are governed by a Board of Directors comprising eight non-employee directors and one employee director, and we have an executive management team with seven executive officers.

Diversity, equity, and inclusion

We take pride in our diverse community. We believe diversity and gender equality are critical to building a thriving workplace. We strive to create an environment where people of all different backgrounds feel a sense of belonging and contribute to our continued success. To make our workplace as inclusive and safe as possible, we have diversity and inclusion training integrated into our Always Honest Compliance and Ethics Program.

We do not discriminate against employees or applicants based on race, color, age, disability, ethnicity, citizenship, religion, sex, national origin, sexual orientation, genetics or genetic information, or any other categories protected by applicable law. We are committed to equal opportunity in all of our employment activities, including, but not limited to, recruitment, hiring, compensation, determination of benefits, training, promotion, and discipline. We also provide reasonable accommodations to disabled persons, so all employees can achieve success in the workplace.

As a devoted steward to our communities, we are committed to increasing the diversity of our workforce to better reflect the communities in which we operate. We have undertaken initiatives, which go beyond legal compliance, to recruit from diverse audiences, such as minorities, women, and veterans. These efforts include leveraging inclusive job-posting sites and sharing job postings with community partners.

As part of our commitment to developing our employees and furthering their professional growth, we have programs in place including GES’ Business Development Mentor Program and newly launched training platforms for people leaders, including “Spiro.You” at Spiro, “Sales Leadership Program” at GES Exhibitions, and “Leaders’ Journey” at Pursuit. These programs connect employees with leaders within our organization and are designed to accelerate their career trajectory.

Our emphasis on a positive employee experience permeates throughout the organization and helps drive our success. For example, we conduct periodic employee engagement surveys to help us understand, recognize, and respect the diversity within our team. These

8

surveys help shape our training and development plans to ensure we are maintaining an inclusive culture by engaging, developing, and retaining our talented team members across the globe.

We believe that diversity, equity, and inclusion (“DEI”) is an ongoing journey, and we are proud of our DEI achievements so far, yet also cognizant of the work we still have ahead.

We take pride in the diverse and talented group of people that make up our Board of Directors, executive management, and employees. We understand the value that a diverse workforce of varying genders, ethnicity, background, and experience brings to the Company and we are focused on improving diversity at all levels.

An important part of our work and how we will ensure continual progress is by monitoring our diversity metrics. Out of a total of eight non-employee Board members, two are minorities of which one is a female for a total of three females on the Board. In 2023, almost 50% of our overall global workforce was female.

Workplace safety

The safety and well-being of team members, clients, and guests is a leading core value. We believe that maintaining strong standards of health and safety improves employee productivity and operational efficiency and enhances employee well-being.

We have a responsibility to maintain a safe and healthy work environment. We take prompt action to correct unsafe or hazardous conditions; we promptly report work-related accidents and injuries in accordance with established procedures and applicable laws; we strive to follow all established work rules related to safety; and we educate our workers to ensure they understand the risks, know how to handle hazardous products safely, and are familiar with available information for all hazardous materials used.

Both Pursuit and GES have implemented business-specific programs that support our commitment to the safety and well-being of our team members, clients, and guests.

Pursuit’s Safety Promise is our commitment to the safety and well-being of our guests and staff. Through this program, we ensure that everyone feels safe when visiting or working at our experiences and that these places can continue to make a positive impact.

GES’ Always On Health and Safety Program was designed by our safety team to protect our employees, customers, partners, and event attendees. GES employees are committed to adhering to all local government and facility requirements and those established in conjunction with our partners and clients. Safe, reliable delivery of events is one of our most significant responsibilities.

In 2023, Viad had a global reportable incident rate of 1.2, which is below the U.S. industry standard average rate of 2.7. Global reportable incident rate is defined as employee incidents reportable in the operating jurisdiction. It is calculated as reportable incidents divided by payroll hours, multiplied by 200,000 to normalize the results. The overall industry average of incidence rates of non-fatal occupational injuries and illnesses for all industries including private, state, and local government, provided by U.S. Bureau of Labor Statistics 2022. Published data lags one calendar year. We continue to strive toward our goal of zero reportable incidents.

Always honest compliance and ethics program

We believe that maintaining a culture of high ethical standards gives us a distinct advantage in recruiting and retaining top talent, delivering the best experience for our customers, and attracting shareholders. Our Always Honest Compliance and Ethics Program, with the full support of our Board of Directors, has guided us since 1994 to translate integrity into our everyday behavior and actions. The Always Honest Compliance and Ethics Program guides our employees to act honestly, ethically, and always in compliance with the law.

Community involvement

Giving back to the community is very important to us. We are committed to making a positive impact within the communities we serve through educational programs such as GES’ Exhibition Sponsorships, volunteer services, and environmental/economic sustainable efforts in the community. Many of our locations pull together to volunteer and support local and national organizations. The Banff Jasper Collection was awarded the 2022 Corporate Citizen of the Year in Jasper, Alberta in recognition of its community building efforts. Pursuit also supported an exchange of learning and renewed its dedication to reconciliation with local Indigenous communities through a variety of initiatives and programs.

Rewards and performance management

Beyond a competitive salary, we offer a range of healthcare benefits to full-time employees, their spouses, and dependents. We encourage our employees to grow professionally with ongoing training and internal career opportunities. We utilize a performance review process, which aligns our core competencies to our core values, and a performance management cycle, which provides a framework designed to maximize performance and cultivate talent. Short- and long-term incentive compensation for senior managers and executives is based on the Company’s performance and/or stock performance.

9

Available Information

We were incorporated in Delaware in 1991. Our common stock trades on the New York Stock Exchange under the symbol “VVI.”

Our website address is www.viad.com. All of our Securities and Exchange Commission (“SEC”) filings, including our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports, are available free of charge on our website as soon as reasonably practicable after we electronically file that material with, or furnish it to, the SEC. The information contained on our website is neither a part of, nor incorporated by reference into, this 2023 Form 10-K.

Item 1A. Risk Factors

Our operations and financial results are subject to known and unknown risks. As a result, past financial performance and historical trends may not be reliable indicators of our future performance.

Macroeconomic Risks

We are vulnerable to deterioration in general economic conditions. Our business is particularly sensitive to fluctuations in general economic conditions in the United States and other global markets in which we operate. A decline in global or regional economic conditions, or consumers’ fears that economic conditions will decline, whether due to inflation, elevated interest rates, or other economic, pandemic or geopolitical uncertainties could cause declining consumer or corporate spending, travel disruptions, unemployment, fluctuations in stock markets and interest rates, contraction of credit availability, or other dynamic factors generally affecting economic conditions. For example, high inflation and the resulting rise in interest rates have increased our interest expense on our variable rate debt. The additional impacts of these macroeconomic developments on our operations cannot be predicted with certainty. The success of our GES business largely depends on the number of exhibitions or other live events held, exhibitor presence and attendee volume at those events, the size of marketing expenditures at those events, and on the strength of particular industries that support those events. The number and size of live events and related marketing expenditures generally decrease when the economy weakens. We also could suffer from reduced spending for our services because many live event marketing budgets are partly discretionary and are frequently among the first expenditures reduced when economic conditions deteriorate. In addition, revenue from our Pursuit operations depends largely on the amount of disposable income that consumers have available for travel and vacations, which decreases during periods of weak general economic conditions. As a result, any deterioration in general economic conditions could materially and adversely affect our business, financial condition, and results of operations.

Travel industry disruptions, particularly those affecting the hotel and airline industries, could adversely affect our business. Our business depends largely on the ability and willingness of people, whether exhibitors, event attendees, tourists, or others, to travel. Factors adversely affecting the travel industry, and particularly the airline and hotel industries, generally also adversely affect our business and results of operations. Factors that could adversely affect the travel industry include high or rising fuel prices, levels of consumer discretionary or corporate marketing spendings, international political instability and hostilities, acts of terrorism, weather conditions, health epidemics, pandemics and endemics, and airline accidents. For example, our business, operations and financial results were negatively impacted by dramatically reduced travel, demand for travel-related services, and live event experiences resulting from lockdowns and other restrictions related to the COVID-19 pandemic. A decline in travel-related consumer discretionary or corporate marketing spend, or the occurrence of other pandemic or geopolitical events or hostilities that affect the availability and pricing of air travel and accommodations, could materially and adversely affect our business and results of operations.

Our overall level of indebtedness, as well as our financial covenants under our revolving credit facility, could limit our operational and financial flexibility and make us more vulnerable to adverse economic conditions. As of December 31, 2023, our debt totaled $462.1 million, including $378 million outstanding on our $500 million credit facility (the “2021 Credit Facility”), financing lease obligations of $63.9 million, and $20.2 million in other debt. The 2021 Credit Facility includes a term loan (“Term Loan B”) with an outstanding balance of $321 million as of December 31, 2023 and a $170 million revolving credit facility (“Revolving Credit Facility”). As of December 31, 2023, capacity remaining under the Revolving Credit Facility was $108.0 million. As a result of our indebtedness, we are required to make interest and principal payments on our borrowings, which are significant. These payments reduce our cash available, which could limit our ability to respond to market conditions or take advantage of potential acquisitions and strategic investments. To manage our exposure to interest rate movements, we entered into an interest rate cap agreement that provides an interest rate hedge on $300 million of borrowings for a two-year period, which commenced on January 31, 2023. We also we entered into an amendment to the 2021 Credit Facility on October 6, 2023, which among other things, increased the principal amount of the revolving credit facility by $70 million, bringing the total amount of revolving capacity to $170 million. In connection with the amendment, we prepaid $70 million of the outstanding balance on our existing Term Loan B.

In addition, our ability to draw on our revolving credit facility depends on our ability to meet certain financial covenants. This exposes us to various risks, uncertainties, and events beyond our control, including but not limited to the impact of adverse economic conditions (including inflation, rising interest rates, or a recession), public health crises, and other factors described herein. If we are unable to maintain compliance with these covenants, our lenders may exercise remedies against us, including the acceleration of any outstanding

10

indebtedness on our revolving credit facility. Under this circumstance, we might not have sufficient funds or other resources to satisfy all of our obligations, which could materially and adversely affect our business and results of operations.

Transportation disruptions and increases in transportation costs could adversely affect our business and results of operations. GES relies on independent transportation carriers to send materials and exhibits to and from exhibitions, warehouses, and customer facilities. If our customers and suppliers are unable to secure the services of those independent transportation carriers at favorable rates, it could materially and adversely affect our business and results of operations. In addition, disruption of transportation services, including import/export services due to weather-related problems; labor strikes; lockouts; or other events could adversely affect our ability to supply services to customers and could cause the cancellation or curtailment of exhibitions, which could materially and adversely affect our business and results of operations.

Natural disasters, weather conditions, accidents, and other catastrophic events could negatively affect our business. The occurrence of catastrophic events ranging from natural disasters (such as hurricanes, fires, floods, volcanoes, and earthquakes), acts of war or terrorism, accidents involving our travel offerings or experiences, the effects of climate change, including any impact of global warming, or the prospect of these events could disrupt our business. Changes in climates may increase the frequency and intensity of adverse weather patterns and make certain destinations less desirable.

Such catastrophic events have had, and could in the future have, an adverse impact on Pursuit, which is heavily dependent on the ability and willingness of its guests to travel and/or visit our attractions. Pursuit guests tend to delay or postpone vacations if natural conditions differ from those that typically prevail at competing lodges, resorts, and attractions, and catastrophic events and heightened travel security measures instituted in response to such events could impede the guests’ ability to travel, and interrupt our business operations, including damaging our properties. For example, the accident on July 18, 2020, at Pursuit’s Glacier Adventure attraction, which involved one of our off-road Ice Explorers and resulted in three fatalities and other serious injuries, may have a negative impact on our reputation and traveler willingness to visit that attraction in the future.

Such catastrophic events could also have a negative impact on GES, causing a cancellation or relocation of exhibitions and other events held in public venues or disrupt the services we provide to our customers at convention centers, exhibition halls, hotels, and other public venues. Such events could also have a negative impact on GES’ production facilities, preventing us from timely completing exhibit fabrication and other projects for customers. In addition, unfavorable media attention, or negative publicity, in the wake of any catastrophic event or accident could damage our reputation or reduce the demand for our services. If the conditions arising from such events persist or worsen, they could materially and adversely affect our results of operations and financial condition.

Strategic, Business, and Operational Risks

The seasonality of our business makes us particularly sensitive to adverse events during peak periods. The peak activity for our Pursuit business is during the summer months, as the vast majority of Pursuit’s revenue is earned in the second and third quarters. Our GES exhibition and event activity varies significantly because it is based on the frequency and timing of shows, many of which are not held each year, and which may shift between quarters. If adverse events or conditions occur during these peak periods, for example natural disasters such as hurricanes, volcanoes, forest fires and/or smoke resulting from those events or a similar event, our results of operations could be materially and adversely affected.

New capital projects may not be commercially successful. From time to time, we pursue capital projects in order to enhance and expand our business, such as FlyOver, which includes FlyOver Canada in Vancouver, FlyOver Iceland, FlyOver Las Vegas, and the current development of FlyOver Chicago and FlyOver Canada Toronto, as well as other efforts to upgrade and update some of our Pursuit offerings. Capital projects are subject to a number of risks, including the failure to achieve established financial and strategic goals. For example, our FlyOver attractions are all considered one reporting unit and goodwill is assigned to, and tested at, the reporting unit level. Significant reductions in FlyOver’s expected future revenue, operating income, or cash flow forecasts and projections, or changes in macroeconomic facts and circumstances, particularly high inflation and the resulting rise in interest rates, may result in impairment charges in the future. Capital projects are also subject to unanticipated delays and cost overruns as well as additional project-specific risks. For example, we had to postpone FlyOver Canada Toronto due to permitting and other related delays. A prolonged delay in a capital project, or our failure to accurately predict the revenue or profit that will be generated from a project, could prevent it from performing in accordance with our commercial expectations and could materially and adversely affect our business and results of operations.

We operate in a highly competitive and dynamic industry. Competition in the live events markets is driven by price and service quality, among other factors. To the extent competitors seek to gain or retain market presence through aggressive underpricing strategies, we may be required to lower our prices and rates to avoid the loss of related business. Moreover, customer consolidations and other actions within the industry have caused downward pricing pressure for our products and services and could affect our ability to negotiate favorable terms with our customers. If we are unable to anticipate and respond as effectively as our competitors to changing business conditions, including new technologies and business models, we could lose market share. Our inability to meet the challenges presented by the competitive and dynamic environment of our industry could materially and adversely affect our results of operations.

11

We depend on our large exhibition event clients to renew their service contracts and on our exclusive right to provide those services. GES has a number of large exhibition event organizers and large customer accounts. If any of these large clients do not renew their service contracts, our results of operations could be materially and adversely affected.

Moreover, when event organizers hire GES as the official services contractor, they usually also grant GES an exclusive right to perform material handling, electrical, rigging, and other services at the exhibition facility. However, some exhibition facilities have taken certain steps to in-source certain event services (either by performing the services themselves or by hiring a separate service provider) as a result of conditions generally affecting their industry, such as an increased supply of or reduced demand for exhibition space. If exhibition facilities choose to in-source certain event services, GES will lose the ability to provide certain event services, and our results of operations could be materially and adversely affected.

Show rotation affects our profitability and makes comparisons between periods difficult. GES results are largely dependent upon the frequency, timing, and location of exhibitions and events. Some large exhibitions are not held annually (they may be held once every two, three, or four years) or may be held at different times of the year from when they were previously held. In addition, the same exhibition may change locations from year to year resulting in lower margins if the exhibition shifts to a higher-cost location. Any of these factors could cause our results of operations to fluctuate significantly from quarter to quarter or from year to year, making periodic comparisons difficult.

Completed acquisitions may not perform as anticipated or be integrated as planned. We regularly evaluate and pursue opportunities to acquire businesses that complement, enhance, or expand our current business, or offer growth opportunities. Our acquired businesses might not meet our financial and non-financial expectations or yield anticipated benefits. Our success depends, in part, on our ability to conform controls, policies and procedures, and business cultures; consolidate and streamline operations and infrastructures; identify and eliminate redundant and underperforming operations and assets; manage inefficiencies associated with the integration of operations; and retain the acquired business’s key personnel and customers. Moreover, our acquisition activity may subject us to new regulatory requirements, distract our senior management and employees, and expose us to unknown liabilities or contingencies that we may fail to identify prior to closing. If we are forced to make changes to our business strategy or if external conditions adversely affect our business operations, such as unfavorable macroeconomic conditions (particularly high inflation and the resulting rise in interest rates), it may be difficult for us to accurately forecast revenue, operating income, or cash flow, and we may be required to record impairment charges in the future. Additionally, we may borrow funds to finance strategic acquisitions. Debt leverage resulting from future acquisitions would reduce our debt capacity, increase our interest expense, and limit our ability to capitalize on future business opportunities. Such borrowings may also be subject to fluctuations in interest rates. Any of these risks could materially and adversely affect our business, product and service sales, financial condition, and results of operations.

We are subject to currency exchange rate fluctuations. We have operations outside of the United States primarily in Canada, the United Kingdom, Iceland, the Netherlands, the Middle East, and Germany. During 2023, our international operations accounted for approximately 44% of our consolidated revenue and 89% of our segment operating income. Consequently, a significant portion of our business is exposed to currency exchange rate fluctuations. We do not currently hedge equity risk arising from the translation of non-United States denominated assets and liabilities. Our financial results and capital ratios are sensitive to movements in currency exchange rates because a large portion of our assets, liabilities, revenue, and expenses must be translated into U.S. dollars for reporting purposes. The unrealized gains or losses resulting from the currency translation are included as a component of accumulated other comprehensive income (loss) in our Consolidated Balance Sheets. We also have certain loans and leases in currencies other than the entity’s functional currency, which results in gains or losses as exchange rates fluctuate. As a result, significant fluctuations in currency exchange rates could result in material changes to our results of operations and the net equity position we report in our Consolidated Financial Statements.

Liabilities relating to prior and discontinued operations may adversely affect our results of operations. We and our predecessors have a corporate history spanning decades and involving diverse businesses. Some of those businesses owned properties and used raw materials that have been, and may continue to be, subject to litigation. Moreover, some of the raw materials used and the waste produced by those businesses have been and are the subject of United States federal and state environmental regulations, including laws enacted under the Comprehensive Environmental Response, Compensation and Liability Act, or its state law counterparts. In addition, we may incur other liabilities resulting from indemnification claims involving previously sold properties and subsidiaries, or obligations under defined benefit plans or other employee plans, as well as claims from past operations of predecessors or their subsidiaries. Although we believe we have adequate reserves and sufficient insurance coverage to cover those potential liabilities, future events or proceedings could render our reserves or insurance protections inadequate, any of which could materially and adversely affect our business and results of operations.

Our insurance coverage may not be adequate to cover all possible losses that we could suffer, and our insurance costs may increase. Although we carry liability insurance to cover possible incidents, there can be no assurance that our insurance coverage will be sufficient to cover the full extent of all losses or liabilities, that we will be able to obtain coverage at commercially reasonable rates, or that we will be able to obtain adequate coverage should a catastrophic incident occur at our attractions or hospitality properties. We may be sued

12

for substantial damages in the event of an actual or alleged incident. An incident occurring at our attractions or hospitality properties could reduce visitation, increase insurance premiums, and could materially and adversely affect our business and results of operations.

Labor and Employment Risks

Our business is relationship driven. Our GES business is heavily focused on client relationships, and, specifically, on having close collaboration and interaction with our clients. To be successful, our account teams must be able to understand clients’ desires and expectations in order to provide top-quality service. If we are unable to maintain our client relationships, including due to the loss of key members of our account teams, we could also lose customers and our results of operations could be materially and adversely affected.

If we lose any of our key personnel, our ability to manage our business and continue our growth could be negatively impacted. Our success, at least in part, depends on the continued contributions of our executive team and key personnel. If one or more of our key personnel were to resign or otherwise terminate employment with us, we could experience operational disruptions. In addition, we do not maintain key person insurance on any of our executive employees or key personnel.

Union-represented labor increases our risk of higher labor costs and work stoppages. Significant portions of our employees are unionized. We have approximately 100 collective bargaining agreements, and we are required to renegotiate approximately one-third of those each year. If we increase wages or benefits as a result of labor negotiations, either our operating margins will suffer, or we could increase the cost of our services to our customers, which could lead those customers to turn to other vendors with lower prices. Either event could materially and adversely affect our business and results of operations.

Additionally, if we are unable to reach an agreement with a union during the collective bargaining process, the union may strike or carry out other types of work stoppages. If this were to occur, we might be unable to find substitute workers with the necessary skills to perform many of the services, or we may incur additional costs to do so, both of which could materially and adversely affect our business and results of operations.

Our participation in multi-employer pension plans could substantially increase our pension costs. We sponsor a number of defined benefit plans for our United States and Canada-based employees. In addition, we are obligated to contribute to multi-employer pension plans under collective bargaining agreements covering our union-represented employees. We contributed $19.0 million in 2023, $17.5 million in 2022, and $7.1 million in 2021 to those multi-employer pension plans. Third-party boards of trustees manage these multi-employer plans. Based upon the information we receive from plan administrators, we believe that several of those multi-employer plans are underfunded. The Pension Protection Act of 2006 requires us to reduce the underfunded status over defined time periods. Moreover, we would be required to make additional payments of our proportionate share of a plan’s unfunded vested liabilities if a plan terminates, or other contributing employers withdraw, due to insolvency or other reasons, or if we voluntarily withdraw from a plan. At this time, we do not anticipate triggering any significant withdrawal from any multi-employer pension plan to which we currently contribute. However, significant plan contribution increases could materially and adversely affect our consolidated financial condition, results of operations, and cash flows. Refer to Note 19 – Pension and Postretirement Benefits of the Notes to Consolidated Financial Statements (Part II, Item 8 of our 2023 Form 10-K) for further information.

Cybersecurity and Data Privacy Risks

We are vulnerable to cybersecurity attacks and threats. Our devices, servers, cloud-based solutions, computer systems, and business systems are vulnerable to cybersecurity risk, including cyberattacks, or we may be the target of email scams that attempt to acquire personal information and company assets. Many of our employees work remotely, which magnifies the importance of integrity of our remote access security measures. Despite our efforts to create security barriers to such threats, including regularly reviewing our systems for vulnerabilities and continually updating our protections, and protect ourselves with insurance, we might not be able to entirely mitigate these risks. Our failure to effectively prevent, detect, and recover from the increasing number and sophistication of information security threats could lead to business interruptions, delays or loss of critical data, misuse, modification, or destruction of information, including trade secrets and confidential business information, reputational damage, and third-party claims, any of which could materially and adversely affect our results of operations. Moreover, the cost of protecting against cybersecurity attacks and threats is expensive and expected to increase going forward.

Laws and regulations relating to the handling of personal data are evolving and could result in increased costs, legal claims, or fines. We store and process the personally identifiable information of our customers, employees, and third parties with whom we have business relationships. The legal requirements restricting the way we store, collect, handle, and transfer personal data continue to evolve, and there are an increasing number of authorities issuing privacy laws and regulations. These data privacy laws and regulations are subject to differing interpretations, creating uncertainty and inconsistency across jurisdictions. Our compliance with these myriad requirements could involve making changes in our services, business practices, or internal systems, any of which could increase our costs, lower revenue, or reduce efficiency. Our failure to comply with existing or new rules could result in significant penalties or orders to stop the alleged noncompliant activity, litigation, adverse publicity, or could cause our customers to lose trust in our services. In addition, if the third parties we work with violate applicable laws, contractual obligations to us, or suffer a security breach, those violations could also

13

put us in breach of our obligations under privacy laws and regulations. In addition, the costs of maintaining adequate protection, including insurance protection against such threats, as they develop in the future (or as legal requirements related to data security increase) are expected to increase and could be material. Any of these risks could materially and adversely affect our business and results of operations.

Item 1B. Unresolved Staff Comments

None.

Item 1C. CYBERSECURITY

Cybersecurity Risk Management and Strategy

We maintain a team, tools, policies, and processes for identifying, assessing, and managing material risks from cybersecurity threats. Threats like malware attacks, system vulnerabilities, and data breaches are actively identified, monitored, evaluated, and mitigated along with other Company risks. Our security team maintains centralized documentation regarding known security risks and mitigation. Consideration of material risks from cyber threats is integrated into our enterprise risk management processes and is a standing agenda item for discussion at our Audit Committee meetings. An Information Security Executive Committee representing multiple areas of the Company is responsible for assessing material risks from cybersecurity threats and represents multiple functions of the business including Finance, Human Resources, Legal, and the Information Technology (“IT”) departments. We have certain employee cybersecurity awareness campaigns and training designed to help promote a culture of cybersecurity awareness throughout the organization. Cybersecurity tools, processes, policies, and controls are periodically reviewed and updated in response to changes in the business environment and evolving threats, as well as to align with broader risk management objectives.

Our information security function, led by our Chief Information Officer (“CIO”), implements and maintains the processes and controls to help identify, assess, and manage material risks from cybersecurity threats. These controls include, but are not limited to, the following Center for Internet Security (“CIS”) controls:

Supporting these controls are specific security measures that include threat intelligence monitoring, vulnerability scanning, and policy enforcement.

We use third-party service providers to assist us in identifying, assessing, and managing material risks from cybersecurity threats, including professional service firms, legal counsel, threat intelligence service providers, cybersecurity consultants, cybersecurity software providers, and forensic investigators. We have a Cybersecurity Incident Response Plan (“IRP”) that includes procedures for responding to and, to the extent applicable, disclosing material cybersecurity incidents in a timely manner. We have third-party risk management processes designed to assess risks from key vendors and suppliers, including application providers and hosting companies. Key software service providers utilized by the Company undergo a review process for security, reliability, and effectiveness. We have processes in place to address access to our network by such third parties, to the extent applicable, including network access controls designed to provide access on a ‘least privilege’ basis.

For a discussion of risks from cybersecurity threats that may materially affect the Company, see “Risk Factors” under the heading “Cybersecurity and Data Privacy Risks.” (Part I, Item 1A of this 2023 Form 10-K).

Cybersecurity Governance

Cybersecurity risk management is a part of our risk management process and is subject to oversight by our Board of Directors and management. Our Board of Directors has delegated oversight and mitigation of risks from cybersecurity threats to our Audit Committee. Our Audit Committee receives quarterly reports from either our CIO or our General Counsel concerning any significant cybersecurity threats, risks, and the tools and processes we have implemented for mitigation. Our cybersecurity risk assessment and management processes are implemented and maintained by certain members of management including the following:

14

Item 2. Properties

We lease our corporate headquarters in Scottsdale, Arizona. Our other principal properties are owned or leased by Pursuit and GES.

Pursuit primarily owns its properties, both domestically and internationally, other than its leases for properties related to the FlyOver attractions. Pursuit’s properties mainly include attractions, hotels and lodges, retail stores, and offices. Properties located in Canada are subject to multiple long-term ground leases with their respective governments. For further information on Pursuit’s attractions and hospitality assets, refer to “Business” (Part I, Item 1 of this 2023 Form 10-K), which information is incorporated by reference herein.

GES leases its properties, both domestically and internationally. GES properties consist of offices and multi-use facilities. Multi-use facilities include manufacturing, sales and design, office, storage and/or warehouse, and truck marshaling yards. Multi-use facilities vary in size. Our largest multi-use facility in the United States is approximately 1,447,000 square feet and our largest foreign multi-use facility is in Canada at approximately 81,000 square feet.

We believe our owned and leased properties are adequate and suitable for our business operations and that capacity is sufficient for current needs. For additional information related to our lease obligations, refer to Note 12 – Debt and Finance Obligations and Note 21 – Leases and Other of the Notes to Consolidated Financial Statements (Part II, Item 8 of this 2023 Form 10-K), which information is incorporated by reference herein.

Item 3. Legal Proceedings

Refer to Note 22 – Litigation, Claims, Contingencies, and Other of the Notes to Consolidated Financial Statements (Part II, Item 8 of this 2023 Form 10-K) for information regarding legal proceedings in which we are involved, which information is incorporated by reference herein.

Item 4. Mine Safety Disclosures

Not applicable.

15

Other. Information about our executive Officers

Our executive officers as of the date of this 2023 Form 10-K were as follows:

Name |

|

Age |

|

Business Experience During the Past Five Years and Other Information |

Steven W. Moster |

|

54 |

|

President and Chief Executive Officer of Viad since 2014; President of GES from November 2010 to February 2019; prior thereto, held various executive management roles within the GES organization, including Executive Vice President-Chief Sales & Marketing Officer from 2008 to February 2010; Executive Vice President-Products and Services from 2006 to 2008; and Vice President-Products & Services Business from 2005 to 2006; and prior thereto, Engagement Manager, Management Strategy Consulting for McKinsey & Company, a global management consulting firm, from 2000 to 2004. Mr. Moster is a director of Cavco Industries, Inc (NASDAQ: CVCO), which designs and produces factory-built housing products, and serves as the Chair of the Compensation Committee. |

|

|

|

|

|

Ellen M. Ingersoll |

|

59 |

|

Chief Financial Officer since July 2002; prior thereto, Vice President-Controller or similar position since 2002; prior thereto, Controller of CashX, Inc., a service provider of stored value internet cards, from June 2001 through October 2001; prior thereto, Operations Finance Director of LeapSource, Inc., a provider of business process outsourcing, since January 2000; and prior thereto, Vice President and Controller of Franchise Finance Corporation of America, a real estate investment trust, from 1992 to 2000. |

|

|

|

|

|

David W. Barry |

|

61 |

|

President of Pursuit since June 2015; prior thereto, Chief Executive Officer and President of Trust Company of America, an independent registered investment adviser custodian, from 2011 to June 2015; prior thereto, Chief Executive Officer of Alpine/CMH, a helicopter skiing company, from 2007 to 2011; and prior thereto, Chief Operating Officer for all United States resort operations of Intrawest Corporation (formerly NYSE: IDR) (now Alterra Mountain Company) a North American mountain resort and adventure company, from 2004 to 2007. |

|

|

|

|

|

Derek P. Linde |

|

48 |

|

Chief Operating Officer since March 2022, and also served as General Counsel and Corporate Secretary from April 2018 to October 2023; prior thereto, senior legal leadership roles at Illinois Tool Works Inc. (NYSE: ITW), a global diversified industrial manufacturer, from 2011 to 2018; and prior thereto, a partner at the international law firm of Winston & Strawn LLP. |

|

|

|

|

|

Jeffrey A. Stelmach |

|

56 |

|

President of GES Brand Experiences since August 2021; prior thereto, Group President of Stadium Red Group, a collective of specialist agencies, from 2020 to 2021; prior thereto, President of Opus Holding Group of Opus Agency, a global event design and experiential agency, from 2018 to 2020; and prior thereto, President of U.S. Experiential Marketing and Shopper Marketing of Mosaic, a sales and merchandising, experiential marketing and interactive firm, from 2009 to 2018. |

|

|

|

|

|

Leslie S. Striedel

|

|

61 |

|

Chief Accounting Officer since 2014; prior thereto, Vice President of Finance and Administration or similar positions with Colt Defense LLC, a firearms manufacturer, from 2010 to 2013; prior thereto, Vice President of Finance, Director of Financial Reporting and Compliance, and Corporate Controller of White Electronics Designs Corp. (formerly NASDAQ: WEDC) (now a wholly owned subsidiary of Microchip Technology Inc.), a circuits and semiconductors manufacturer, from 2004 to 2010; prior thereto, Corporate Controller of MD Helicopters, an international helicopter manufacturer, from 2002 to 2004; prior thereto, Corporate Controller of Fluke Networks (formerly Microtest, Inc. NASDAQ: MTST), a manufacturing and technology company, from 1999 to 2002; and prior thereto, Senior Tax Manager for KPMG LLP, a global firm providing audit, tax, and advisory services, from 1998 to 1999. |

|

|

|

|

|

Jonathan A. Massimino |

|

45 |

|

General Counsel and Corporate Secretary since October 2023; prior thereto, General Counsel of Moon Valley Nurseries, a national nursery business, from April 2023 to October 2023; prior thereto, Deputy General Counsel from November 2020 to April 2023 and Assistant General Counsel from July 2011 to November 2020 of Viad Corp; and prior thereto, associate at the law firms of Watt, Tieder, Hoffar & Fitzgerald from March 2007 to July 2011, and Fisher & Phillips from August 2004 to March 2007. |

Our executive officers’ term of office is until our next Board of Directors annual organization meeting scheduled to be held on May 15, 2024.

16

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Market Information

Our common stock is traded on the New York Stock Exchange under the symbol VVI.

Holders

As of February 26, 2024, there were 4,161 shareholders of record of our common stock, including 120 shareholders that had not converted their shares following a reverse stock split effective on July 1, 2004.

Issuer Purchases of Equity Securities

Pursuant to previously announced authorizations, our Board of Directors has authorized us to repurchase shares of our common stock from time to time at prevailing market prices. As of December 31, 2023, 546,283 shares remained available for repurchase under all prior authorizations. In March 2020, our Board of Directors suspended future dividend payments and our share repurchase program for the foreseeable future. During the three months ended December 31, 2023, we did not repurchase any equity securities. The Board of Directors’ authorization does not have an expiration date.

17

Performance Graph

The following graph compares the change in the cumulative total shareholder return, from December 31, 2018 to December 31, 2023, on our common stock, the Standard & Poor’s SmallCap 600 Hotels, Restaurants & Leisure, the Standard & Poor’s SmallCap 600 Media Index, the Standard & Poor’s SmallCap 600 Commercial Services & Supplies Index, the Standard & Poor’s SmallCap 600 Index, the Russell 2000 Index, and Standard & Poor’s 500 Index (assuming reinvestment of dividends, as applicable). The graph assumes $100 was invested on December 31, 2018.

|

|

Year Ended December 31, |

|

|||||||||||||||||||||

|

|

2018 |

|

|

2019 |

|

|

2020 |

|

|

2021 |

|

|

2022 |

|

|

2023 |

|

||||||

Viad Corp |

|

$ |

100.00 |

|

|

$ |

135.62 |

|

|

$ |

72.92 |

|

|

$ |

86.27 |

|

|

$ |

49.17 |

|

|

$ |

72.98 |

|

S&P 500 |

|

$ |

100.00 |

|

|

$ |

131.47 |

|

|

$ |

155.65 |

|

|

$ |

200.29 |

|

|

$ |

163.97 |

|

|

$ |

207.03 |

|

Russell 2000 |

|

$ |

100.00 |

|

|

$ |

125.49 |

|

|

$ |

150.50 |

|

|

$ |

172.74 |

|

|

$ |

137.40 |

|

|

$ |

160.59 |

|

S&P SmallCap 600 |

|

$ |

100.00 |

|

|

$ |

122.74 |

|

|

$ |

136.54 |

|

|

$ |

173.05 |

|

|

$ |

145.10 |

|

|

$ |

168.23 |

|

S&P SmallCap 600 Comm. Services & Supplies |

|

$ |

100.00 |

|

|

$ |

123.48 |

|

|

$ |

108.55 |

|

|

$ |

116.24 |

|

|

$ |

101.29 |

|

|

$ |

119.66 |

|

S&P SmallCap 600 Media |

|

$ |

100.00 |

|

|

$ |

107.38 |

|

|

$ |

101.65 |

|

|

$ |

165.09 |

|

|

$ |

88.56 |

|

|

$ |

76.82 |

|

S&P SmallCap 600 Hotels, Restaurants & Leisure |

|

$ |

100.00 |

|

|

$ |

110.45 |

|

|

$ |

140.08 |

|

|

$ |

136.01 |

|

|

$ |

108.30 |

|

|

$ |

131.04 |

|

Item 6. RESERVED

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations