|

|

|

OMB APPROVAL | |

|

|

|

OMB Number: |

3235-0570 |

|

|

|

Expires: |

January 31, 2017 |

|

|

UNITED STATES |

Estimated average burden hours per response. . . . . . . . . . . . . . .20.6 | |

|

|

SECURITIES AND EXCHANGE COMMISSION |

| |

|

|

Washington, D.C. 20549 |

| |

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

|

Investment Company Act file number |

811-06565 | ||||||||

|

| |||||||||

|

Tekla Life Sciences Investors | |||||||||

|

(Exact name of registrant as specified in charter) | |||||||||

|

| |||||||||

|

100 Federal Street, 19th Floor, Boston, MA |

|

02110 | |||||||

|

(Address of principal executive offices) |

|

(Zip code) | |||||||

|

| |||||||||

|

| |||||||||

|

(Name and address of agent for service) | |||||||||

|

| |||||||||

|

Registrant’s telephone number, including area code: |

617-772-8500 |

| |||||||

|

| |||||||||

|

Date of fiscal year end: |

September 30 |

| |||||||

|

| |||||||||

|

Date of reporting period: |

October 1, 2015 to March 31, 2016 |

| |||||||

ITEM 1. REPORTS TO STOCKHOLDERS.

TEKLA LIFE SCIENCES INVESTORS

Semiannual Report

March 31, 2016

(Unaudited)

TEKLA LIFE SCIENCES INVESTORS

DISTRIBUTION POLICY

The Fund has implemented a managed distribution policy (the Policy) that provides for quarterly distributions at a rate set by the Board of Trustees. Under the current Policy, the Fund intends to make quarterly distributions at a rate of 2% of the Fund's net assets to shareholders of record. The Fund intends to use net realized capital gains when making quarterly distributions, if available, but the Policy would result in a return of capital to shareholders, if the amount of the distribution exceeds the Fund's net investment income and realized capital gains. With each distribution, the Fund will issue a notice to shareholders and a press release that will provide detailed information regarding the amount and estimated composition of the distribution. You should not draw any conclusions about the Fund's investment performance from the amount of distributions pursuant to the Policy or from the terms of the Policy. The Policy has been established by the Trustees and may be changed or terminated by them without shareholder approval. The Trustees regularly review the Policy and the frequency and rate of distributions considering the purpose and effect of the Policy, the financial market environment, and the Fund's income, capital gains and capital available to pay distributions. The suspension or termination of the Policy could have the effect of creating a trading discount or widening an existing trading discount. At this time there are no reasonably foreseeable circumstances that might cause the Trustees to terminate the Policy.

To our Shareholders:

On March 31, 2016, the net asset value (NAV) per share of the Fund was $18.37. During the six month period ended March 31, 2016, total return at NAV of the Fund was -15.68%, with distributions reinvested. The total investment return at market with distributions reinvested was -14.07% during the same period. Comparisons to the relevant indices are listed below.

| Investment Returns |

Six Months Ended 3/31/16 |

||||||

|

At Market |

-14.07 |

% |

|||||

|

At Net Asset Value |

-15.68 |

% |

|||||

|

NASDAQ Biotech Index |

-13.77 |

% |

|||||

|

S&P 500 Index |

8.48 |

% |

|||||

Investment Highlights

Despite several challenges in recent months, we continue to be cautiously optimistic about the future of the healthcare and biotech sectors. As we have noted, the longer term secular fundamentals in these industries remain appealing. People spend more money on healthcare as they age and, as has been widely reported, our population is getting older. This combination suggests that demand for healthcare services should continue to rise well into the future. Furthermore, development of new and novel products continues unabated. In the last several years, we have observed a spate of healthcare IPOs and private investment by traditional limited partners. This has produced a new generation of companies poised to develop and market products based on recent scientific discoveries that will treat unmet medical needs, thereby improving the quality of life for and/or extend the lives of patients.

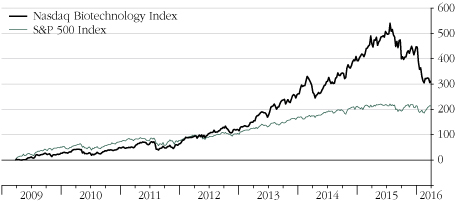

For most of the last seven years these fundamental factors have led to outsized performance by the healthcare sector in general and the biotech sector in particular. As an example, the biotech sector, as measured by the NASDAQ Biotechnology Index (NBI), has, since its March 2009 low amidst the great financial crisis through its mid-2015 market highs, advanced by approximately 500% compared with an approximate 213% advance for the broad market S&P 500 Index. This represented an impressive period for the biotech sector, measured both by the magnitude of the sector's advance as well as by the duration of the outperformance.

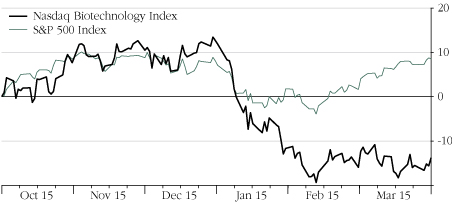

Having said this, since the mid-2015 market highs, performance of the biotech sector has been uneven. As we reported in the Fund's 2015

1

Annual Report, the biotech sector underperformed the broader market in the calendar quarter ending September 30, 2015. In that three month period, the NBI declined by approximately 17.9% compared to a decline of approximately 6.4% for the broad market. The NBI had appeared to stabilize in October and November 2015, but ultimately extended the decline that began in mid-2015. In fact, during the current reporting period (i.e., the six month period ended March 31, 2016), the NBI declined an additional 13.8%, mostly during January 2016. In aggregate, the NBI declined approximately 29.8% from the July 2015 highs to the end of the current report period. This decline has certainly been material. However, despite the decline, it is clear we argue that the performance of the NBI has been impressive over the longer term.

Chart Below: NBI (black) Versus S&P 500 Index (green) March 15, 2009 through March 31, 2016

Chart Below: NBI (black) Versus S&P 500 Index (green) Sept 30, 2015 through March 31, 2016

2

Given recent performance, we think it is appropriate to comment on the current status of the factors we feel have driven sector performance in recent years and those that might have an impact in the near and intermediate future.

We believe that in recent years, population demographics and passage of the Affordable Care Act have increased demand and utilization of Healthcare products and services. Growth in the Healthcare and Biotech sectors had been consistently projected as elevated relative to many other sectors and valuations (particularly on a growth adjusted basis) had seemed to be attractive. In addition, Merger & Acquisition (M&A) activity had been notable, as had new IPO and follow-on financing activity. It is our view that these factors, in combination with accommodative monetary policies, had contributed to the equity performance in general and healthcare/biotech equity performance in particular.

However, in 2015, several mitigating factors have become more prominent. For example, a handful of US drug manufacturers had taken considerable liberties in pricing some of their drugs. As a result, concerns about drug pricing have become generally more common and have become a point of contention in the current US Presidential election discussion. Separately, M&A activity, an important contributor to sector sentiment, has been questioned, particularly for those transactions involving tax inversion. In addition, after several years of outperformance, valuations which we feel had remained attractive, have been considered stretched by others. It is our view that in combination, these and other factors have contributed to the sector downturn seen in the six to nine-month periods ending March 31, 2016. We also note that heightened IPO and follow-on financing activity, additional contributors to positive sentiment, also declined in this period.

The critical question is where are we now? Unfortunately the answer is that one can never know what will happen and that there will always be both encouraging and mitigating factors. But at the moment we think there are more things that make us optimistic than there are that give us pause.

In the near term, we think that the status of the political environment continues to be a significant factor in sentiment toward healthcare/biotech sectors. While we would point out that the vast majority of prescriptions are for relatively low cost generics and that (according to PHRMA) the percentage of each US healthcare dollar spent on drugs has not materially changed in many years, it also appears that out-of-pocket spending on drugs is increasing, particularly on the approximately 10% of prescriptions written on branded drugs. These latter impressions appear to be an important topic in the current presidential election discussion. As a result there has been considerable commentary by presidential candidates and others about methods they can or will use to control growth of drug pricing. It is our view

3

that political pressure to control price increase will continue but that the actual impact of current campaign rhetoric will be moderate. Moreover, it appears to us that in recognition of pricing concerns, thoughtful approaches (e.g. value based pricing approaches wherein the cost of a drug is linked to its effectiveness) are being introduced by the pharmaceutical industry.

On the other hand, there are quite a few factors that cause us, in aggregate, to remain generally optimistic. Population demographics and ACA driven utilization that have each increased demand for healthcare products and services remain positive factors. We continue to think that growth drives price. And while growth of the US economy has generally been weak in recent years, expected growth rates in our sector, particularly in biotech, remain solid. And after the significant pullback described above, valuations have become more attractive of late.

It appears the pullback that has occurred in the last nine months or so has had a negative effect on sentiment. In addition, the matters described above have had an impact on the frequency of IPOs and related financings. The deal-a-day frenzy of the last couple years has diminished. But we are optimistic that we are beginning to see signs of a reversal in sentiment. As we write this note in late April 2016, the NBI has been stable or up in the last couple of months, valuations are more attractive than they have been in some time, we are seeing the re-emergence of several interesting IPOs, and we are anticipating both the completion of the US Presidential cycle and the arrival of some important clinical and regulatory events in the second half of 2016. M&A activity may also be picking up. We think this combination of events could on balance improve sentiment and ultimately drive the healthcare/biotech sector upwards. We caution that ours is a volatile sector and that there could be negative events contrary to our expectation, but in general we remain cautiously optimistic.

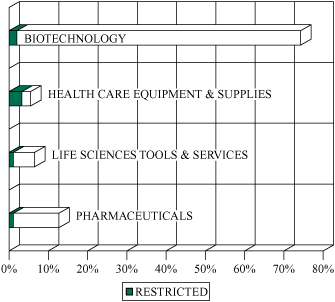

Portfolio Highlights

HQL seeks to invest in growing life sciences companies. The Fund emphasizes investment in biotechnology though at a level somewhat below that of the NBI. Among other things, the Fund also commonly invests in Life Science Tools, Healthcare Equipment and generally smaller pharmaceuticals oriented companies. In recent months, including during the current report period, Fund performance trailed NBI performance.

The Fund was impacted during the current report period by its ownership or non-ownership, relative to the NBI, of a number of individual stocks. Specifically, the Fund benefitted from owning or being overweight positions in Teva Pharmaceutical, Supernus and Cepheid, Inc. It also benefitted from not owning or being underweight Clovis Oncology, Inc. Conversely, the Fund was negatively affected by

4

owning or being overweight Incyte Corporation, Ardelyx, Inc and Chimerix, Inc. The Fund was also negatively affected by not owning Dyax Corporation and by being underweight Amgen Inc and Mylan NV.

Investment Changes

During the six month period ended March 31, 2016, within the public portfolio, the Fund established positions in several companies including Shire plc, Jazz Pharmaceuticals plc, Medivation, Inc., Cepheid, Inc., Retrophin, Inc., Nevro Corp, Celator Pharmaceuticals, Inc., Flamel Technologies SA and Anacor Pharmaceuticals, Inc. During the same six month period, the Fund exited positions in Teva Pharmaceuticals, Inc., BioDelivery Sciences International, Inc., Mylan NV., Karyopharm Therapeutics Inc., Sagent Pharmaceuticals, Inc., Trovagene, Inc., United Therapeutics Corporation, Spectrum Pharmaceuticals, Inc. and TetraLogic Pharmaceuticals Corporation.

During the same six month period, within the venture portfolio, the Fund made initial investments in GenomeDx Biosciences, Inc., and BioClin Therapeutics, Inc. and follow-on investments in IlluminOss Medical, Inc. and Neurovance, Inc. During the report period the Fund exited Magellan Diagnostics, Inc.

As always, if you have questions, please feel free to call us at (617) 772-8500.

Daniel R. Omstead, PhD

President

5

TEKLA LIFE SCIENCES INVESTORS

LARGEST HOLDINGS BY ISSUER

(Excludes Short-Term Investments)

As of March 31, 2016

(Unaudited)

| Issuer - Sector |

% of Net Assets |

||||||

|

Gilead Sciences, Inc. Biotechnology |

11.0 |

% |

|||||

|

Celgene Corporation Biotechnology |

9.5 |

% |

|||||

|

Biogen Inc. Biotechnology |

5.6 |

% |

|||||

|

Incyte Corporation Biotechnology |

5.1 |

% |

|||||

|

Alexion Pharmaceuticals, Inc. Biotechnology |

4.8 |

% |

|||||

|

Illumina, Inc. Life Sciences Tools & Services |

4.4 |

% |

|||||

|

Regeneron Pharmaceuticals, Inc. Biotechnology |

4.4 |

% |

|||||

|

Vertex Pharmaceuticals Incorporated Biotechnology |

4.1 |

% |

|||||

|

BioMarin Pharmaceutical Inc. Biotechnology |

3.4 |

% |

|||||

|

Amgen Inc. Biotechnology |

2.2 |

% |

|||||

SECTOR DIVERSIFICATION (% of Net Assets)

As of March 31, 2016

(Unaudited)

6

TEKLA LIFE SCIENCES INVESTORS

SCHEDULE OF INVESTMENTS

MARCH 31, 2016

(Unaudited)

|

SHARES |

CONVERTBLE PREFERRED AND WARRANTS (Restricted) (a) (b) - 6.7% of Net Assets |

VALUE |

|||||||||

|

Biotechnology - 1.2% |

|||||||||||

|

611,422 |

Afferent Pharmaceuticals, Inc. Series C |

$ |

1,500,002 |

||||||||

|

665,681 |

BioClin Therapeutics, Inc. Series A |

432,693 |

|||||||||

|

2,568,939 |

EBI Life Sciences, Inc. Series A (c) |

13,102 |

|||||||||

|

933,333 |

GenomeDx Biosciences, Inc. Series C |

1,400,000 |

|||||||||

|

149,396 |

Merus B.V. Class C (d) |

1,132,184 |

|||||||||

|

4,477,981 |

|||||||||||

|

Health Care Equipment & Supplies - 3.3% |

|||||||||||

|

2,338,198 |

AlterG, Inc. Series C |

958,661 |

|||||||||

|

79,330 |

CardioKinetix, Inc. Series C |

79 |

|||||||||

|

142,574 |

CardioKinetix, Inc. Series D |

363,279 |

|||||||||

|

439,333 |

CardioKinetix, Inc. Series E |

1,250,781 |

|||||||||

|

403,207 |

CardioKinetix, Inc. Series F |

1,377,355 |

|||||||||

|

N/A (e) |

CardioKinetix, Inc. warrants (expiration 12/11/19) |

0 |

|||||||||

|

N/A (e) |

CardioKinetix, Inc. warrants (expiration 6/03/20) |

0 |

|||||||||

|

8,822 |

CardioKinetix, Inc. warrants (expiration 8/15/24) |

0 |

|||||||||

|

475,500 |

IlluminOss Medical, Inc. Series AA (c) |

475,500 |

|||||||||

|

895,848 |

IlluminOss Medical, Inc. Series Junior Preferred (c) |

895,848 |

|||||||||

|

5,126,388 |

Insightra Medical, Inc. Series C (c) |

2,170,000 |

|||||||||

|

3,891,340 |

Insightra Medical, Inc. Series C-2 (c) |

1,647,204 |

|||||||||

|

366,171 |

Insightra Medical, Inc. warrants (expiration 3/31/25) (c) |

0 |

|||||||||

|

2,013,938 |

Insightra Medical, Inc. warrants (expiration 5/28/25) (c) |

0 |

|||||||||

|

1,464,682 |

Insightra Medical, Inc. warrants (expiration 8/18/25) (c) |

0 |

|||||||||

|

9,606,373 |

Palyon Medical Corporation Series A (c) |

2,046 |

|||||||||

|

18,832,814 |

Palyon Medical Corporation Series B (c) |

1,318 |

|||||||||

|

N/A (e) |

Palyon Medical Corporation warrants (expiration 4/26/19) (c) |

0 |

|||||||||

|

3,280,000 |

Tibion Corporation Series B |

0 |

|||||||||

|

N/A (e) |

Tibion Corporation warrants (expiration 07/12/17) |

0 |

|||||||||

|

N/A (e) |

Tibion Corporation warrants (expiration 10/30/17) |

0 |

|||||||||

|

N/A (e) |

Tibion Corporation warrants (expiration 11/28/17) |

0 |

|||||||||

|

2,606,033 |

Veniti, Inc. Series A (c) |

1,578,474 |

|||||||||

The accompanying notes are an integral part of the financial statements.

7

TEKLA LIFE SCIENCES INVESTORS

SCHEDULE OF INVESTMENTS

MARCH 31, 2016

(Unaudited, continued)

|

SHARES |

Health Care Equipment & Supplies - continued |

VALUE |

|||||||||

|

1,307,169 |

Veniti, Inc. Series B (c) |

$ |

837,503 |

||||||||

|

716,720 |

Veniti, Inc. Series C (c) |

574,021 |

|||||||||

|

12,132,069 |

|||||||||||

|

Life Sciences Tools & Services - 1.1% |

|||||||||||

|

2,161,090 |

Dynex Technologies, Inc. Series A |

1,080,545 |

|||||||||

|

98,824 |

Dynex Technologies, Inc. warrants (expiration 4/01/19) |

0 |

|||||||||

|

7,877 |

Dynex Technologies, Inc. warrants (expiration 5/06/19) |

0 |

|||||||||

|

2,446,016 |

Labcyte, Inc. Series C |

2,849,609 |

|||||||||

|

107,178 |

Labcyte, Inc. Series D |

112,323 |

|||||||||

|

4,042,477 |

|||||||||||

|

Pharmaceuticals - 1.1% |

|||||||||||

|

2,862,324 |

Euthymics Biosciences, Inc. Series A (c) |

2,862 |

|||||||||

|

53,948 |

Neurovance, Inc. Series A (c) |

200,147 |

|||||||||

|

670,837 |

Neurovance, Inc. Series A-1 (c) |

2,488,805 |

|||||||||

|

240,770 |

Ovid Therapeutics, Inc. Series B |

1,499,997 |

|||||||||

|

4,191,811 |

|||||||||||

|

TOTAL CONVERTIBLE PREFERRED AND WARRANTS (RESTRICTED) (Cost $33,536,221) |

24,844,338 |

||||||||||

|

PRINCIPAL AMOUNT |

CONVERTIBLE AND NON- CONVERTIBLE NOTES - 2.3% |

|

|||||||||

Convertible Notes - 2.3%

|

Biotechnology - 0.6% |

|||||||||||

|

1,485,000 |

Merrimack Pharmaceuticals, Inc., 4.50%, due 7/15/20 |

2,205,225 |

|||||||||

|

2,205,225 |

|||||||||||

|

Health Care Equipment & Supplies - 0.0% |

|||||||||||

|

37,399 |

Palyon Medical Corporation Promissory Note, 8.00%, due 5/15/16 (Restricted) (a) (c) |

0 |

|||||||||

|

30,339 |

Palyon Medical Corporation Promissory Note, 8.00%, due 7/15/16 (Restricted) (a) (c) |

0 |

|||||||||

|

0 |

|||||||||||

The accompanying notes are an integral part of the financial statements.

8

TEKLA LIFE SCIENCES INVESTORS

SCHEDULE OF INVESTMENTS

MARCH 31, 2016

(Unaudited, continued)

|

PRINCIPAL AMOUNT |

Pharmaceuticals - 1.7% |

VALUE |

|||||||||

|

93,551 |

Neurovance, Inc. Cvt. Promissory Note, 6.00%, due 3/1/17 (Restricted) (a) (c) |

$ |

93,551 |

||||||||

|

280,652 |

Neurovance, Inc. Cvt. Promissory Note, 6.00%, due 3/1/17 (Restricted) (a) (c) |

280,652 |

|||||||||

|

2,000,000 |

Supernus Pharmaceuticals, Inc., 7.50% due 5/1/19 (g) |

6,026,250 |

|||||||||

|

6,400,453 |

|||||||||||

|

TOTAL CONVERTIBLE NOTES |

8,605,678 |

||||||||||

|

Non-Convertible Notes (Restricted)(a) - 0.0% |

|||||||||||

|

Health Care Equipment & Supplies - 0.0% |

|||||||||||

|

238,286 |

Tibion Corporation Non-Cvt. Promissory Note, 0.00%, due 12/31/18 |

0 |

|||||||||

|

28,211 |

Tibion Corporation Non-Cvt. Promissory Note, 0.00%, due 12/31/18 |

0 |

|||||||||

|

TOTAL NON-CONVERTIBLE NOTES |

0 |

||||||||||

|

TOTAL CONVERTIBLE NOTES AND NON-CONVERTIBLE NOTES (Cost $4,221,200) |

8,605,678 |

||||||||||

|

SHARES |

COMMON STOCKS AND WARRANTS - 90.0% |

|

|||||||||

|

Biotechnology - 72.5% |

|||||||||||

|

163,719 |

ACADIA Pharmaceuticals Inc. (b) |

4,577,583 |

|||||||||

|

27,500 |

Adaptimmune Therapeutics plc (b) (f) |

223,575 |

|||||||||

|

127,799 |

Alexion Pharmaceuticals, Inc. (b) |

17,792,177 |

|||||||||

|

116,453 |

Alkermes plc (b) |

3,981,528 |

|||||||||

|

73,025 |

Alnylam Pharmaceuticals, Inc. (b) |

4,583,779 |

|||||||||

|

53,557 |

Amgen Inc. |

8,029,801 |

|||||||||

|

258,000 |

Amicus Therapeutics, Inc. (b) |

2,180,100 |

|||||||||

|

44,638 |

Anacor Pharmaceuticals, Inc. (b) |

2,385,901 |

|||||||||

|

811,227 |

ARCA biopharma, Inc. (b) (c) |

2,782,510 |

|||||||||

|

324,491 |

ARCA biopharma, Inc. warrants (Restricted, expiration 6/11/22) (a) (c) |

155,756 |

|||||||||

|

477,635 |

Ardelyx, Inc. (b) |

3,711,224 |

|||||||||

|

60,000 |

Bellicum Pharmaceuticals, Inc. (b) |

561,000 |

|||||||||

|

79,512 |

Biogen Inc. (b) |

20,698,564 |

|||||||||

|

154,100 |

BioMarin Pharmaceutical Inc. (b) |

12,710,168 |

|||||||||

|

26,545 |

bluebird bio, Inc. (b) |

1,128,163 |

|||||||||

The accompanying notes are an integral part of the financial statements.

9

TEKLA LIFE SCIENCES INVESTORS

SCHEDULE OF INVESTMENTS

MARCH 31, 2016

(Unaudited, continued)

|

SHARES |

Biotechnology - continued |

VALUE |

|||||||||

|

236,000 |

Celator Pharmaceuticals, Inc (b) |

$ |

2,603,080 |

||||||||

|

351,122 |

Celgene Corporation (b) |

35,143,801 |

|||||||||

|

40,000 |

Cellectis S.A. (b) (d) (f) |

1,100,000 |

|||||||||

|

174,590 |

Cepheid, Inc. (b) |

5,824,322 |

|||||||||

|

308,892 |

Chimerix, Inc. (b) |

1,578,438 |

|||||||||

|

37,500 |

Cidara Therapeutics, Inc. (b) |

476,250 |

|||||||||

|

98,417 |

CytomX Therapeutics, Inc. (b) |

1,269,579 |

|||||||||

|

128,409 |

CytomX Therapeutics, Inc. (Restricted) (a) (b) |

1,490,828 |

|||||||||

|

120,475 |

Dynavax Technologies Corporation (b) |

2,317,939 |

|||||||||

|

4,940 |

Eiger BioPharmaceuticals, Inc. warrants (Restricted, expiration 10/10/18) (a) (b) |

0 |

|||||||||

|

84,000 |

Epizyme, Inc. (b) |

1,018,080 |

|||||||||

|

420,599 |

Exelixis, Inc. (b) |

1,682,396 |

|||||||||

|

46,000 |

Galapagos NV (b) (f) |

1,936,182 |

|||||||||

|

6,000 |

Galapagos NV (b) (d) |

250,920 |

|||||||||

|

443,120 |

Gilead Sciences, Inc. |

40,705,003 |

|||||||||

|

200,000 |

Halozyme Therapeutics, Inc. (b) |

1,894,000 |

|||||||||

|

103,333 |

Heron Therapeutics, Inc. warrants (Restricted, expiration 7/01/16) (a) (b) |

1,304,067 |

|||||||||

|

259,915 |

Incyte Corporation (b) |

18,836,040 |

|||||||||

|

255,205 |

Inotek Pharmaceuticals Corporation (b) |

1,888,517 |

|||||||||

|

178,600 |

Insmed Incorporated (b) |

2,262,862 |

|||||||||

|

138,500 |

Medivation, Inc. (b) |

6,368,230 |

|||||||||

|

283,894 |

Merrimack Pharmaceuticals, Inc. (b) |

2,376,193 |

|||||||||

|

170,641 |

Natera, Inc. (b) |

1,624,502 |

|||||||||

|

138,357 |

Neurocrine Biosciences, Inc. (b) |

5,472,019 |

|||||||||

|

358,000 |

Novavax, Inc. (b) |

1,847,280 |

|||||||||

|

769,638 |

Pieris Pharmaceuticals, Inc. (b) |

1,462,312 |

|||||||||

|

44,622 |

Regeneron Pharmaceuticals, Inc. (b) |

16,083,554 |

|||||||||

|

329,949 |

Retrophin, Inc. (b) |

4,507,103 |

|||||||||

|

64,000 |

Sage Therapeutics, Inc. (b) |

2,051,840 |

|||||||||

|

26,520 |

Ultragenyx Pharmaceutical Inc. (b) |

1,678,981 |

|||||||||

|

191,377 |

Vertex Pharmaceuticals Incorporated (b) |

15,212,558 |

|||||||||

|

20,000 |

Xencor, Inc. (b) |

268,400 |

|||||||||

|

13,307 |

Zafgen, Inc. (b) |

88,891 |

|||||||||

|

268,125,996 |

|||||||||||

|

Health Care Equipment & Supplies - 2.2% |

|||||||||||

|

495,000 |

Alliqua BioMedical, Inc. (b) |

405,900 |

|||||||||

|

130,000 |

Cercacor Laboratories, Inc. (Restricted) (a) (b) |

146,315 |

|||||||||

|

93,349 |

GenMark Diagnostics, Inc. (b) |

491,949 |

|||||||||

The accompanying notes are an integral part of the financial statements.

10

TEKLA LIFE SCIENCES INVESTORS

SCHEDULE OF INVESTMENTS

MARCH 31, 2016

(Unaudited, continued)

|

SHARES |

Health Care Equipment & Supplies - continued |

VALUE |

|||||||||

|

55,158 |

IDEXX Laboratories, Inc. (b) |

$ |

4,319,975 |

||||||||

|

49,800 |

Nevro Corp. (b) |

2,801,748 |

|||||||||

|

143,124 |

TherOx, Inc. (Restricted) (a) (b) |

143 |

|||||||||

|

8,166,030 |

|||||||||||

|

Health Care Providers & Services - 0.0% |

|||||||||||

|

148,148 |

InnovaCare Health, Inc. (Restricted) (a) (b) (g) |

67,852 |

|||||||||

|

67,852 |

|||||||||||

|

Life Sciences Tools & Services - 5.4% |

|||||||||||

|

264,625 |

Accelerate Diagnostics, Inc. (b) |

3,802,661 |

|||||||||

|

99,728 |

Illumina, Inc. (b) |

16,166,906 |

|||||||||

|

19,969,567 |

|||||||||||

|

Pharmaceuticals - 9.9% |

|||||||||||

|

53,342 |

Akorn, Inc. (b) |

1,255,137 |

|||||||||

|

17,915 |

Allergan plc (b) |

4,801,757 |

|||||||||

|

250,279 |

Auris Medical Holding AG (b) |

911,016 |

|||||||||

|

200,000 |

Depomed, Inc. (b) |

2,786,000 |

|||||||||

|

29,100 |

Endo International plc (b) |

819,165 |

|||||||||

|

233,000 |

Flamel Technologies SA (b) (f) |

2,572,320 |

|||||||||

|

63,780 |

Flex Pharma, Inc. (b) |

699,667 |

|||||||||

|

124,140 |

Foamix Pharmaceuticals Ltd. (b) |

809,393 |

|||||||||

|

35,949 |

Impax Laboratories, Inc. (b) |

1,151,087 |

|||||||||

|

56,340 |

Intra-Cellular Therapies, Inc. (b) |

1,566,252 |

|||||||||

|

39,692 |

Jazz Pharmaceuticals plc (b) |

5,181,791 |

|||||||||

|

207,300 |

Paratek Pharmaceuticals, Inc. (b) |

3,144,741 |

|||||||||

|

45,000 |

Revance Therapeutics, Inc (b) |

785,700 |

|||||||||

|

21,315 |

Shire plc (f) |

3,664,049 |

|||||||||

|

88,764 |

Tetraphase Pharmaceuticals Inc. (b) |

410,977 |

|||||||||

|

181,570 |

The Medicines Company (b) |

5,768,479 |

|||||||||

|

36,327,531 |

|||||||||||

|

TOTAL COMMON STOCKS AND WARRANTS (Cost $258,311,517) |

332,656,976 |

||||||||||

The accompanying notes are an integral part of the financial statements.

11

TEKLA LIFE SCIENCES INVESTORS

SCHEDULE OF INVESTMENTS

MARCH 31, 2016

(Unaudited, continued)

|

PRINCIPAL AMOUNT |

SHORT-TERM INVESTMENT - 1.1% |

VALUE |

|||||||||

|

$ |

3,859,000 |

Repurchase Agreement, Fixed Income Clearing Corp., repurchase value $3,859,000, 0.03%, dated 03/31/16, due 04/01/16 (collateralized by U.S. Treasury Notes 7.250%, due 08/15/22, market value $3,940,819) |

3,859,000 |

||||||||

|

TOTAL SHORT-TERM INVESTMENTS (Cost $3,859,000) |

3,859,000 |

||||||||||

|

TOTAL INVESTMENTS BEFORE MILESTONE INTEREST - 100.1% (Cost $299,927,938) |

369,965,992 |

||||||||||

|

INTEREST |

MILESTONE INTEREST (Restricted) (a) (b) - 0.0% |

||||||||||

|

Pharmaceuticals - 0.0% |

|||||||||||

|

1 |

Targegen Milestone Interest |

$ |

0 |

||||||||

|

TOTAL MILESTONE INTEREST (Cost $2,962,363) |

0 |

||||||||||

|

TOTAL INVESTMENTS - 100.1% (Cost $302,890,301) |

369,965,992 |

||||||||||

|

OTHER ASSETS IN EXCESS OF LIABILITIES - (0.1)% |

(198,448 |

) |

|||||||||

|

NET ASSETS - 100% |

$ |

369,767,544 |

|||||||||

(a) Security fair valued. See Investment Valuation and Fair Value Measurements.

(b) Non-income producing security.

(c) Affiliated issuers in which the Fund holds 5% or more of the voting securities

(total market value of $14,199,299).

(d) Foreign security.

(e) Number of warrants to be determined at a future date.

(f) American Depository Receipt

(g) Security exempt from registration under Rule 144A of the Securities Act of 1933, as amended. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers.

The accompanying notes are an integral part of the financial statements.

12

TEKLA LIFE SCIENCES INVESTORS

STATEMENT OF ASSETS AND LIABILITIES

MARCH 31, 2016

(Unaudited)

|

ASSETS: |

|||||||

|

Investments in unaffiliated issuers, at value (cost $275,602,677) |

$ |

355,766,693 |

|||||

|

Investments in affiliated issuers, at value (cost $24,325,261) |

14,199,299 |

||||||

|

Milestone interests, at value (cost $2,962,363) |

— |

||||||

|

Total investments |

369,965,992 |

||||||

|

Cash |

541 |

||||||

|

Dividends and interest receivable |

92,159 |

||||||

|

Receivable for investments sold |

149,148 |

||||||

|

Prepaid expenses |

29,616 |

||||||

|

Other assets (see Note 1) |

185,894 |

||||||

|

Total assets |

370,423,350 |

||||||

|

LIABILITIES: |

|||||||

|

Accrued advisory fee |

347,558 |

||||||

|

Accrued investor support service fees |

15,523 |

||||||

|

Accrued shareholder reporting fees |

52,045 |

||||||

|

Accrued trustee fees |

34,441 |

||||||

|

Accrued other |

206,239 |

||||||

|

Total liabilities |

655,806 |

||||||

|

Commitments and Contingencies (see Notes 1) |

|||||||

|

NET ASSETS |

$ |

369,767,544 |

|||||

|

SOURCES OF NET ASSETS: |

|||||||

|

Shares of beneficial interest, par value $.01 per share, unlimited number of shares authorized, amount paid in on 20,123,437 shares issued and outstanding |

$ |

290,443,983 |

|||||

|

Undistributed net investment loss |

(2,033,044 |

) |

|||||

|

Accumulated net realized gain on investments and milestone interest |

14,280,914 |

||||||

|

Net unrealized gain on investments and milestone interest |

67,075,691 |

||||||

|

Total net assets (equivalent to $18.37 per share based on 20,123,437 shares outstanding) |

$ |

369,767,544 |

|||||

The accompanying notes are an integral part of these financial statements.

13

TEKLA LIFE SCIENCES INVESTORS

STATEMENT OF OPERATIONS

SIX MONTHS ENDED MARCH 31, 2016

(Unaudited)

|

INVESTMENT INCOME: |

|||||||

|

Dividend income (net of foreign tax of $19,323) |

$ |

600,620 |

|||||

|

Interest and other income |

114,943 |

||||||

|

Total investment income |

715,563 |

||||||

|

EXPENSES: |

|||||||

|

Advisory fees |

2,255,650 |

||||||

|

Administration and auditing fees |

108,756 |

||||||

|

Trustees' fees and expenses |

76,063 |

||||||

|

Legal fees |

58,095 |

||||||

|

Custodian fees |

57,972 |

||||||

|

Shareholder reporting |

51,945 |

||||||

|

Investor support service fees |

47,791 |

||||||

|

Transfer agent fees |

28,166 |

||||||

|

Other (see Note 2) |

64,169 |

||||||

|

Total expenses |

2,748,607 |

||||||

|

Net investment loss |

(2,033,044 |

) |

|||||

|

REALIZED AND UNREALIZED GAIN (LOSS): |

|||||||

|

Net realized gain (loss) on: |

|||||||

|

Investments in unaffiliated issuers |

(10,100,883 |

) |

|||||

|

Investments in affiliated issuers |

(37,224 |

) |

|||||

|

Net realized loss |

(10,138,107 |

) |

|||||

|

Change in unrealized appreciation (depreciation) |

|||||||

|

Investments in unaffiliated issuers |

(52,645,780 |

) |

|||||

|

Investments in affiliated issuers |

(4,475,085 |

) |

|||||

|

Change in unrealized appreciation (depreciation) |

(57,120,865 |

) |

|||||

|

Net realized and unrealized gain (loss) |

(67,258,972 |

) |

|||||

|

Net decrease in net assets resulting from operations |

($ |

69,292,016 |

) |

||||

The accompanying notes are an integral part of these financial statements.

14

TEKLA LIFE SCIENCES INVESTORS

STATEMENTS OF CHANGES IN NET ASSETS

|

Six months ended March 31, 2016 (Unaudited) |

Year ended September 30, 2015 |

||||||||||

|

NET INCREASE (DECREASE) IN NET ASSETS RESULTING FROM OPERATIONS: |

|||||||||||

|

Net investment loss |

($ |

2,033,044 |

) |

($ |

4,722,227 |

) |

|||||

|

Net realized gain (loss) |

(10,138,107 |

) |

89,719,889 |

||||||||

|

Change in net unrealized depreciation |

(57,120,865 |

) |

(44,498,340 |

) |

|||||||

|

Net increase (decrease) in net assets resulting from operations |

(69,292,016 |

) |

40,499,322 |

||||||||

|

DISTRIBUTIONS TO SHAREHOLDERS FROM: |

|||||||||||

|

Net realized capital gains |

(32,767,490 |

) |

(40,251,147 |

) |

|||||||

|

Total distributions |

(32,767,490 |

) |

(40,251,147 |

) |

|||||||

|

CAPITAL SHARE TRANSACTIONS: |

|||||||||||

|

Reinvestment of distributions (437,073 and 680,458 shares, respectively) |

8,986,912 |

18,504,747 |

|||||||||

|

Total capital share transactions |

8,986,912 |

18,504,747 |

|||||||||

|

Net increase (decrease) in net assets |

(93,072,594 |

) |

18,752,922 |

||||||||

|

NET ASSETS: |

|||||||||||

|

Beginning of period |

462,840,138 |

444,087,216 |

|||||||||

|

End of period |

369,767,544 |

462,840,138 |

|||||||||

|

Accumulated net investment loss included in net assets at end of period |

($ |

2,033,044 |

) |

$ |

0 |

(a) |

|||||

(a) Reflects reclassifications to the Fund's capital accounts to reflect income and gains available for distribution under income tax regulations.

The accompanying notes are an integral part of these financial statements.

15

TEKLA LIFE SCIENCES INVESTORS

FINANCIAL HIGHLIGHTS

|

Six months ended March 31, 2016 |

Years ended September 30, |

||||||||||||||||||||||||||

|

(Unaudited) |

2015 |

2014 |

2013 |

2012 |

2011 |

||||||||||||||||||||||

|

OPERATING PERFORMANCE FOR A SHARE OUTSTANDING THROUGHOUT EACH PERIOD |

|||||||||||||||||||||||||||

|

Net asset value per share, Beginning of period |

$ |

23.51 |

$ |

23.37 |

$ |

20.16 |

$ |

15.74 |

$ |

11.70 |

$ |

11.51 |

|||||||||||||||

|

Net investment loss (1) |

(0.10 |

) |

(0.25 |

) |

(0.23 |

) |

(0.22 |

) |

(0.09 |

)(2) |

(0.19 |

)(3) |

|||||||||||||||

|

Net realized and unrealized gain (loss) |

(3.38 |

) |

2.48 |

5.71 |

5.94 |

5.54 |

1.26 |

||||||||||||||||||||

|

Total increase (decrease) from investment operations |

(3.48 |

) |

2.23 |

5.48 |

5.72 |

5.45 |

1.07 |

||||||||||||||||||||

|

Distributions to shareholders from: |

|||||||||||||||||||||||||||

|

Net realized capital gains |

(1.66 |

) |

(2.09 |

) |

(1.70 |

) |

(1.30 |

) |

(1.49 |

) |

(1.01 |

) |

|||||||||||||||

|

Total distributions |

(1.66 |

) |

(2.09 |

) |

(1.70 |

) |

(1.30 |

) |

(1.49 |

) |

(1.01 |

) |

|||||||||||||||

|

Increase resulting from shares repurchased |

— |

— |

— |

— |

0.08 |

0.13 |

|||||||||||||||||||||

|

Change due to rights offering |

— |

— |

(0.57 |

)(4) |

— |

— |

— |

||||||||||||||||||||

|

Net asset value per share, end of period |

$ |

18.37 |

$ |

23.51 |

$ |

23.37 |

$ |

20.16 |

$ |

15.74 |

$ |

11.70 |

|||||||||||||||

|

Per share market value, end of period |

$ |

17.94 |

$ |

22.51 |

$ |

22.10 |

$ |

19.25 |

$ |

15.39 |

$ |

10.46 |

|||||||||||||||

|

Total investment return at market value |

(14.07 |

%)* |

9.92 |

% |

24.20 |

% |

34.96 |

% |

64.66 |

% |

19.15 |

% |

|||||||||||||||

|

Total investment return at net asset value |

(15.68 |

%)* |

8.56 |

% |

25.40 |

% |

38.19 |

% |

50.56 |

% |

11.05 |

% |

|||||||||||||||

|

RATIOS |

|||||||||||||||||||||||||||

|

Expenses to average net assets |

1.27 |

%** |

1.21 |

% |

1.34 |

% |

1.47 |

% |

1.72 |

% |

1.77 |

% |

|||||||||||||||

|

Expenses to average net assets with waiver |

— |

1.17 |

% |

1.32 |

% |

— |

— |

— |

|||||||||||||||||||

|

Net investment loss to average net assets |

(0.94 |

%)** |

(0.91 |

%) |

(1.07 |

%) |

(1.26 |

%) |

(0.64 |

%)(2) |

(1.54 |

%)(3) |

|||||||||||||||

|

SUPPLEMENTAL DATA |

|||||||||||||||||||||||||||

|

Net assets at end of period (in millions) |

$ |

370 |

$ |

463 |

$ |

444 |

$ |

302 |

$ |

227 |

$ |

171 |

|||||||||||||||

|

Portfolio turnover rate |

20.05 |

%* |

45.94 |

% |

30.62 |

% |

42.23 |

% |

77.70 |

% |

93.57 |

% |

|||||||||||||||

* Not Annualized.

** Annualized.

(1) Computed using average shares outstanding.

(2) Includes special dividends from three issuers in the aggregate amount of $0.13 per share. Excluding the special dividends, the ratio of net investment loss to average net assets would have been (1.58%).

(3) Includes a special dividend from an issuer in the amount of $0.02 per share. Excluding the special dividend, the ratio of net investment loss to average net assets would have been (1.66%).

(4) See Note 1. The rights offering shares were issued at a subscription price of $19.750 which was less than the Fund's net asset value of $22.78 on June 27, 2014 thus creating a dilution effect on the net asset value per share.

The accompanying notes are an integral part of these financial statements.

16

TEKLA LIFE SCIENCES INVESTORS

NOTES TO FINANCIAL STATEMENTS

MARCH 31, 2016

(Unaudited)

(1) Organization and Significant Accounting Policies

Tekla Life Sciences Investors (the Fund) is a Massachusetts business trust formed on February 20, 1992, and registered under the Investment Company Act of 1940 as a diversified closed-end management investment company. The Fund commenced operations on May 8, 1992. The Fund's investment objective is long-term capital appreciation through investment in U.S. and foreign companies in the life sciences industry (including biotechnology, pharmaceutical, diagnostics, managed healthcare and medical equipment, hospitals, healthcare information technology and services, devices and supplies), agriculture and environmental management. The Fund invests primarily in securities of public and private companies that are believed by the Fund's Investment Adviser, Tekla Capital Management LLC (the Adviser), to have significant potential for above-average growth. The Fund may invest up to 20% of its net assets in securities of foreign issuers, expected to be located primarily in Western Europe, Canada and Japan, and securities of U.S. issuers that are traded primarily in foreign markets.

The preparation of these financial statements requires the use of certain estimates by management in determining the Fund's assets, liabilities, revenues and expenses. Actual results could differ from these estimates and such differences could be material. The following is a summary of significant accounting policies followed by the Fund, which are in conformity with accounting principles generally accepted in the United States of America ("GAAP"). The Fund is an investment company and follows accounting and reporting guidance in the Financial Accounting Standards Board Accounting Standards Codification 946. Events or transactions occurring after March 31, 2016, through the date that the financial statements were issued, have been evaluated in the preparation of these financial statements.

Investment Valuation

Shares of publicly traded companies listed on national securities exchanges or trading in the over-the-counter market are typically valued at the last sale price, as of the close of trading, generally 4 p.m., Eastern time. The Board of Trustees of the Fund (the "Trustees") has established and approved fair valuation policies and procedures with respect to securities for which quoted prices may not be available or which do not reflect fair value. Convertible bonds, corporate and government bonds are valued using a third-party pricing system. Convertible bonds are valued using this pricing system only on days when there is no sale reported. Restricted securities of companies that are publicly traded are typically valued based on the closing market quote on the valuation date adjusted for the impact of the restriction as determined in good faith by the Adviser also using fair valuation policies and procedures approved by the Trustees described below. Non-exchange traded warrants of publicly traded companies are generally valued using the Black-Scholes model, which incorporates both observable and unobservable inputs. Short-term investments with a maturity of 60 days or less are generally valued at amortized cost, which approximates fair value.

Convertible preferred shares, warrants or convertible note interests in private companies, milestone interests, and other restricted securities, as well as shares of publicly traded companies for which market quotations are not readily available, such as stocks for which trading has been halted or for which there are no current day sales, or which do not reflect fair value, are typically valued in good faith, based upon the recommendations made by the Adviser pursuant to fair valuation policies and procedures approved by the Trustees.

17

TEKLA LIFE SCIENCES INVESTORS

NOTES TO FINANCIAL STATEMENTS

MARCH 31, 2016

(continued)

The Adviser has a Valuation Sub-Committee comprised of senior management which reports to the Valuation Committee of the Board at least quarterly. Each fair value determination is based on a consideration of relevant factors, including both observable and unobservable inputs. Observable and unobservable inputs the Adviser considers may include (i) the existence of any contractual restrictions on the disposition of securities; (ii) information obtained from the company, which may include an analysis of the company's financial statements, the company's products or intended markets or the company's technologies; (iii) the price of the same or similar security negotiated at arm's length in an issuer's completed subsequent round of financing; (iv) the price and extent of public trading in similar securities of the issuer or of comparable companies; or (v) a probability and time value adjusted analysis of contractual terms. Where available and appropriate, multiple valuation methodologies are applied to confirm fair value. Significant unobservable inputs identified by the Adviser are often used in the fair value determination. A significant change in any of these inputs may result in a significant change in the fair value measurement. Due to the uncertainty inherent in the valuation process, such estimates of fair value may differ significantly from the values that would have been used had a ready market for the investments existed, and differences could be material. Additionally, changes in the market environment and other events that may occur over the life of the investments may cause the gains or losses ultimately realized on these investments to be different from the valuations used at the date of these financial statements.

Options on Securities

An option contract is a contract in which the writer (seller) of the option grants the buyer of the option, upon payment of a premium, the right to purchase from (call option) or sell to (put option) the writer a designated instrument at a specified price within a specified period of time. Certain options, including options on indices, will require cash settlement by the Fund if the option is exercised. The Fund enters into option contracts in order to hedge against potential adverse price movements in the value of portfolio assets, as a temporary substitute for selling selected investments, to lock in the purchase price of a security or currency which it expects to purchase in the near future, as a temporary substitute for purchasing selected investments, or to enhance potential gain or to gain or hedge exposure to financial market risk.

The Fund's obligation under an exchange traded written option or investment in an exchange-traded purchased option is valued at the last sale price or in the absence of a sale, the mean between the closing bid and asked prices. Gain or loss is recognized when the option contract expires, is exercised or is closed.

If the Fund writes a covered call option, the Fund foregoes, in exchange for the premium, the opportunity to profit during the option period from an increase in the market value of the underlying security above the exercise price. If the Fund writes a put option it accepts the risk of a decline in the market value of the underlying security below the exercise price. Over-the-counter options have the risk of the potential inability of counterparties to meet the terms of their contracts. The Fund's maximum exposure to purchased options is limited to the premium initially paid. In addition, certain risks may arise upon entering into option contracts including the risk that an illiquid secondary market will limit the Fund's ability to close out an option contract prior to the expiration date and that a change in the value of the option contract may not correlate exactly with changes in the value of the securities or currencies hedged.

18

TEKLA LIFE SCIENCES INVESTORS

NOTES TO FINANCIAL STATEMENTS

MARCH 31, 2016

(continued)

All options on securities and securities indices written by the Fund are required to be covered. When the Fund writes a call option, this means that during the life of the option the Fund may own or have the contractual right to acquire the securities subject to the option or may maintain with the Fund's custodian in a segregated account appropriate liquid securities in an amount at least equal to the market value of the securities underlying the option. When the Fund writes a put option, this means that the Fund will maintain with the Fund's custodian in a segregated account appropriate liquid securities in an amount at least equal to the exercise price of the option.

Milestone Interest

The Fund holds a financial instrument which reflects the current value of future milestone payments the Fund may receive as a result of contractual obligations from other parties. The value of such payments are adjusted to reflect the estimated risk based on the relative uncertainty of both the timing and the achievement of individual milestones. A risk to the Fund is that the milestone will not be achieved and no payment will be received by the Fund. The milestone interest was received as part of the proceeds from the sale of one private company. Any payments received are treated as a reduction of the cost basis of the milestone interest with payments received in excess of the cost basis treated as a realized gain. The contractual obligations with respect to the TargeGen Milestone Interest provide for payments at various stages of the development of TargeGen's principal product candidate as of the date of the sale.

The following is a summary of the impact of the milestone interest on the financial statements as of and for the six months ended March 31, 2016:

|

Statement of Assets and Liabilities, Milestone interest, at value |

$ |

0 |

|||||

|

Statement of Assets and Liabilities, Net unrealized gain on investments and milestone interest |

($ |

2,962,363 |

) |

||||

|

Statement of Operations, Change in unrealized appreciation (depreciation) |

|||||||

|

on milestone interest |

$ |

0 |

|||||

Other Assets

Other assets in the Statement of Assets and Liabilities consists of amounts due to the Fund at various times in the future in connection with the sale of investments in four private companies.

Investment Transactions and Income

Investment transactions are recorded on a trade date basis. Gains and losses from sales of investments are recorded using the "identified cost" method. Interest income is recorded on the accrual basis, adjusted for amortization of premiums and accretion of discounts. Dividend income is recorded on the ex-dividend date, less any foreign taxes withheld. Upon notification from issuers, some of the dividend income received may be redesignated as a reduction of cost of the related investment if it represents a return of capital.

The aggregate cost of purchases and proceeds from sales of investment securities (other than short-term investments) for the six months ended March 31, 2016 totaled $83,740,405 and $96,505,833, respectively.

19

TEKLA LIFE SCIENCES INVESTORS

NOTES TO FINANCIAL STATEMENTS

MARCH 31, 2016

(continued)

Repurchase Agreements

In managing short-term investments the Fund may from time to time enter into transactions in repurchase agreements. In a repurchase agreement, the Fund's custodian takes possession of the underlying collateral securities from the counterparty, the market value of which is at least equal to the principal, including accrued interest, of the repurchase transaction at all times. In the event of default or bankruptcy by the other party to the agreement, realization and/or retention of the collateral by the Fund may be delayed. The Fund may enter into repurchase transactions with any broker, dealer, registered clearing agency or bank. Repurchase agreement transactions are not counted for purposes of the limitations imposed on the Fund's investment in debt securities.

Distribution Policy

Pursuant to a Securities and Exchange Commission exemptive order, the Fund may make periodic distributions that include capital gains as frequently as 12 times in any one taxable year in respect of its common shares, and the Fund has implemented a managed distribution policy (the Policy) providing for quarterly distributions at a rate set by the Board of Trustees. Under the current Policy, the Fund intends to make quarterly distributions at a rate of 2% of the Fund's net assets to shareholders of record. The Fund intends to use net realized capital gains when making quarterly distributions, if available, but the Policy would result in a return of capital to shareholders if the amount of the distribution exceeds the Fund's net investment income and realized capital gains. If taxable income and net long-term realized gains exceed the amount required to be distributed under the Policy, the Fund will at a minimum make distributions necessary to comply with the requirements of the Internal Revenue Code. The Policy has been established by the Trustees and may be changed by them without shareholder approval. The Trustees regularly review the Policy and the frequency and rate of distribution considering the purpose and effect of the Policy, the financial market environment, and the Fund's income, capital gains and capital available to pay distributions. The Trustees initially adopted a distribution policy in May, 1999, and since then the Fund has made quarterly distributions at a rate of 2.00% of the Fund's net assets, except for the periods from August 4, 2009, to April 5, 2010 (during which distributions were suspended) and from April 5, 2010, to November 1, 2010 (during which the Fund made distributions at a rate of l.25% of the Fund's net assets).

The Fund's policy is to declare quarterly distributions in stock. The distributions are automatically paid in newly-issued full shares of the Fund unless otherwise instructed by the shareholder. Fractional shares will generally be settled in cash, except for registered shareholders with book entry accounts of the Fund's transfer agent who will have whole and fractional shares added to their accounts. The Fund's transfer agent delivers an election card and instructions to each registered shareholder in connection with each distribution. The number of shares issued will be determined by dividing the dollar amount of the distribution by the lower of net asset value or market price on the pricing date. If a shareholder elects to receive a distribution in cash, rather than in shares, the shareholder's relative ownership in the Fund will be reduced. The shares reinvested will be valued at the lower of the net asset value or market price on the pricing date. Distributions in stock will not relieve shareholders of any federal, state or local income taxes that may be payable on such distributions. Additional distributions, if any, made to satisfy requirements of the Internal Revenue Code may be paid in stock, as described above, or in cash.

20

TEKLA LIFE SCIENCES INVESTORS

NOTES TO FINANCIAL STATEMENTS

MARCH 31, 2016

(continued)

Share Repurchase Program

In March 2016, the Trustees approved the renewal of the repurchase program to allow the Fund to repurchase up to 12% of its outstanding shares in the open market for a one-year period beginning July 11, 2016. Prior to this renewal, in March 2015, the Trustees approved the renewal of the share repurchase program to allow the Fund to repurchase up to 12% of its outstanding shares for a one-year period beginning July 11, 2015. The share repurchase program is intended to enhance shareholder value and potentially reduce the discount between the market price of the Fund's shares and the Fund's net asset value.

During the six months ended March 31, 2016 and the year ended September 30, 2015, the Fund did not repurchase any shares through the repurchase program.

Federal Taxes

It is the Fund's policy to comply with the requirements of the Internal Revenue Code applicable to regulated investment companies and to distribute to its shareholders substantially all of its taxable income and its net realized capital gains, if any. Therefore, no Federal income or excise tax provision is required.

As of March 31, 2016, the Fund had no uncertain tax positions that would require financial statement recognition or disclosure. The Fund's federal tax returns are subject to examination by the Internal Revenue Service for a period of three years.

Distributions

The Fund records all distributions to shareholders on the ex-dividend date. Such distributions are determined in conformity with income tax regulations, which may differ from GAAP. These differences include temporary and permanent differences from losses on wash sale transactions, installment sale adjustments and ordinary loss netting to reduce short term capital gains. Reclassifications are made to the Fund's capital accounts to reflect income and gains available for distribution under income tax regulations.

Commitments and Contingencies

Under the Fund's organizational documents, its officers and Trustees may be indemnified against certain liabilities and expenses arising out of the performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into agreements with service providers that may contain indemnification clauses. The Fund's maximum exposure under these agreements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on experience, the Fund expects the risk of loss to be remote.

Investor Support Services

The Fund has retained Destra Capital Investment LLC to provide investor support services in connection with the ongoing operation of the Fund. The Fund will pay Destra a fee in an annual amount equal to 0.05% of the average aggregate daily value of the Fund's Managed Assets from January 1, 2016, through the remaining term of the investor support services agreement.

(2) Investment Advisory and Other Affiliated Fees

The Fund has entered into an Investment Advisory Agreement (the Advisory Agreement) with the Adviser. Pursuant to the terms of the Advisory Agreement, the Fund pays the Adviser a

21

TEKLA LIFE SCIENCES INVESTORS

NOTES TO FINANCIAL STATEMENTS

MARCH 31, 2016

(continued)

monthly fee at the rate when annualized of (i) 2.50% of the average net assets for the month of its venture capital and other restricted securities up to 25% of net assets and (ii) for all other net assets, 0.98% of the average net assets up to $250 million, 0.88% of the average net assets for the next $250 million, 0.80% of the average net assets for the next $500 million and 0.70% of the average net assets thereafter. The aggregate fee would not exceed a rate when annualized of 1.36%.

The Fund has entered into a Services Agreement (the Agreement) with the Adviser. Pursuant to the terms of the Agreement, the Fund reimburses the Adviser for certain services related to a portion of the payment of salary and provision of benefits to the Fund's Chief Compliance Officer. During the six months ended March 31, 2016, these payments amounted to $13,121 and are included in the other category in the Statement of Operations, together with insurance and other expenses incurred to unaffiliated entities. Expenses incurred pursuant to the Agreement as well as certain expenses paid for by the Adviser are allocated to the Fund in an equitable fashion as approved by the Trustees of the Fund.

The Fund pays compensation to Independent Trustees in the form of a retainer, attendance fees, and additional compensation to Board and Committee chairpersons. The Fund does not pay compensation directly to Trustees or officers of the Fund who are also officers of the Adviser.

(3) Other Transactions with Affiliates

An affiliate company is a company in which the Fund holds 5% or more of the voting securities. Transactions involving such companies during the six months ended March 31, 2016 were as follows:

|

Issuer |

Value on September 30, 2015 |

Purchases |

Sales |

Income |

Value on March 31, 2016 |

||||||||||||||||||

|

ARCA Biopharma, Inc. |

$ |

4,408,210 |

$ |

2,938,266 |

|||||||||||||||||||

|

EBI Life Sciences, Inc. |

13,102 |

13,102 |

|||||||||||||||||||||

|

Euthymics Biosciences, Inc. |

1,099,991 |

2,862 |

|||||||||||||||||||||

|

IlluminOss Medical, Inc. |

— |

* |

$ |

574,000 |

$ |

99,000 |

1,371,348 |

||||||||||||||||

|

Insightra Medical, Inc. |

3,817,204 |

— |

— |

3,817,204 |

|||||||||||||||||||

|

Neurovance, Inc. |

3,964,574 |

374,203 |

— |

$ |

1,378 |

3,063,155 |

|||||||||||||||||

|

Palyon Medical Corporation |

3,469 |

— |

— |

— |

3,364 |

||||||||||||||||||

|

Veniti, Inc. |

2,989,998 |

— |

— |

— |

2,989,998 |

||||||||||||||||||

|

$ |

16,296,548 |

$ |

948,203 |

$ |

99,000 |

$ |

1,378 |

$ |

14,199,299 |

||||||||||||||

* Not an affiliated holding at September 30, 2015.

(4) Fair Value Measurements

The Fund uses a three-tier hierarchy to prioritize the assumptions, referred to as inputs, used in valuation techniques to measure fair value. The three-tier hierarchy of inputs is summarized in the three broad levels. Level 1 includes quoted prices in active markets for identical investments. Level 2 includes prices determined using other significant observable inputs (including quoted prices for similar investments, interest rates, credit risk, etc.). The Independent pricing vendor may value bank loans and debt securities at an evaluated bid price by employing methodologies that utilize actual market transactions, broker-supplied valuations, and/or other

22

TEKLA LIFE SCIENCES INVESTORS

NOTES TO FINANCIAL STATEMENTS

MARCH 31, 2016

(continued)

methodologies designed to identify the market value for such securities and such securities are considered Level 2 in the fair value hierarchy. Level 3 includes prices determined using significant unobservable inputs (including the Fund's own assumptions in determining the fair value of investments). These inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used as of March 31, 2016 to value the Fund's net assets. For the six months ended March 31, 2016, there were no transfers between Levels 1 and 2. The Fund accounts for transfers between levels at the beginning of the period.

|

Assets at Value |

Level 1 |

Level 2 |

Level 3 |

Total |

|||||||||||||||

|

Convertible Preferred and Warrants |

|||||||||||||||||||

|

Biotechnology |

$ |

4,477,981 |

$ |

4,477,981 |

|||||||||||||||

|

Health Care Equipment & Supplies |

12,132,069 |

12,132,069 |

|||||||||||||||||

|

Life Sciences Tools & Services |

4,042,477 |

4,042,477 |

|||||||||||||||||

|

Pharmaceuticals |

4,191,811 |

4,191,811 |

|||||||||||||||||

|

Convertible Notes |

|||||||||||||||||||

|

Biotechnology |

$ |

2,205,225 |

— |

2,205,225 |

|||||||||||||||

|

Health Care Equipment & Supplies |

— |

0 |

0 |

||||||||||||||||

|

Pharmaceuticals |

6,026,250 |

374,203 |

6,400,453 |

||||||||||||||||

|

Non-Convertible Notes |

|||||||||||||||||||

|

Health Care Equipment & Supplies |

— |

0 |

0 |

||||||||||||||||

|

Common Stocks and Warrants |

|||||||||||||||||||

|

Biotechnology |

$ |

265,175,345 |

— |

2,950,651 |

268,125,996 |

||||||||||||||

|

Health Care Equipment & Supplies |

8,019,572 |

— |

146,458 |

8,166,030 |

|||||||||||||||

|

Health Care Providers & Services |

— |

— |

67,852 |

67,852 |

|||||||||||||||

|

Life Sciences Tools & Services |

19,969,567 |

— |

— |

19,969,567 |

|||||||||||||||

|

Pharmaceuticals |

36,327,531 |

— |

— |

36,327,531 |

|||||||||||||||

|

Short-term Investment |

— |

3,859,000 |

— |

3,859,000 |

|||||||||||||||

|

Other Assets |

— |

— |

185,894 |

185,894 |

|||||||||||||||

|

Total |

$ |

329,492,015 |

$ |

12,090,475 |

$ |

28,569,396 |

$ |

370,151,886 |

|||||||||||

The following is a reconciliation of Level 3 assets for which significant unobservable inputs were used to determine fair value.

|

Level 3 Assets |

Balance as of September 30, 2015 |

Net realized gain (loss) and change in unrealized appreciation (depreciation) |

Cost of purchases and conversions |

Proceeds from sales and conversions |

Net transfers in (out of) Level 3 |

Balance as of March 31, 2016 |

|||||||||||||||||||||

|

Convertible Preferred and Warrants |

|||||||||||||||||||||||||||

|

Biotechnology |

$ |

2,624,891 |

$ |

17,219 |

$ |

1,835,871 |

$ |

0 |

$ |

4,477,981 |

|||||||||||||||||

|

Health Care Equipment & Supplies |

15,337,282 |

(1,690,910 |

) |

485,956 |

(2,000,259 |

) |

12,132,069 |

||||||||||||||||||||

|

Life Sciences Tools & Services |

2,913,225 |

1,129,252 |

0 |

0 |

4,042,477 |

||||||||||||||||||||||

|

Pharmaceuticals |

6,564,562 |

(2,374,403 |

) |

1,652 |

0 |

4,191,811 |

|||||||||||||||||||||

23

TEKLA LIFE SCIENCES INVESTORS

NOTES TO FINANCIAL STATEMENTS

MARCH 31, 2016

(continued)

|

Level 3 Assets |

Balance as of September 30, 2015 |

Net realized gain (loss) and change in unrealized appreciation (depreciation) |

Cost of purchases and conversions |

Proceeds from sales and conversions |

Net transfers in (out of) Level 3 |

Balance as of March 31, 2016 |

|||||||||||||||||||||

|

Convertible and Non-Convertible Notes |

|||||||||||||||||||||||||||

|

Health Care Equipment & Supplies |

$ |

105 |

($ |

105 |

) |

$ |

0 |

$ |

0 |

$ |

$ |

0 |

|||||||||||||||

|

Pharmaceuticals |

0 |

0 |

374,203 |

0 |

374,203 |

||||||||||||||||||||||

|

Common Stocks and Warrants |

0 |

||||||||||||||||||||||||||

|

Biotechnology |

3,051,084 |

(101,477 |

) |

1,050 |

(6 |

) |

2,950,651 |

||||||||||||||||||||

|

Health Care Equipment & Supplies |

118,144 |

28,314 |

— |

0 |

146,458 |

||||||||||||||||||||||

|

Health Care Providers & Services |

314,074 |

(246,222 |

) |

— |

0 |

67,852 |

|||||||||||||||||||||

|

Pharmaceuticals |

22,386 |

(22,386 |

) |

— |

0 |

0 |

|||||||||||||||||||||

|

Other Assets |

255,284 |

— |

50,054 |

(119,444 |

) |

185,894 |

|||||||||||||||||||||

|

Total |

$ |

31,171,037 |

($ |

3,260,718 |

) |

$ |

2,748,786 |

($ |

2,119,709 |

) |

$ |

0 |

$ |

28,569,396 |

|||||||||||||

|

Net change in unrealized appreciation (depreciation) from investments still held as March 31, 2016 |

( |

$3,572,353 |

) |

||||||||||||||||||||||||

The following is a quantitative disclosure about significant unobservable inputs used in the determination of the fair value of Level 3 assets.

|

Fair Value at 3/31/2016 |

Valuation Technique |

Unobservable Input |

Range (Weighted Average) |

||||||||||||||||

|

Private Companies and Other Restricted Securities |

$ |

1,606,138 |

Income approach, Black-Scholes |

Discount for lack of marketability |

20%-50%(23.20%) |

||||||||||||||

|

16,252,136 |

Adjusted Capital asset pricing model |

Discount rate |

13.51%-39.85% (20.81%) |

||||||||||||||||

|

Price to sales multiple |

1.12-4.42 (2.11) | ||||||||||||||||||

|

10,525,228 |

Market approach, |

(a) |

N/A |

||||||||||||||||

|

|

recent transaction |

|

|

||||||||||||||||

|

185,894 |

Probability adjusted value |

Probability of events |

20%-90% (43.72%) |

||||||||||||||||

|

Timing of events |

0.13-2.58 (1.20) years | ||||||||||||||||||

|

$ |

28,569,396 |

||||||||||||||||||

(a) The valuation technique used as a basis to approximate fair value of these investments is based upon subsequent financing rounds. There is no quantitative information to provide as these methods of measure are investment specific.

(5) Private Companies and Other Restricted Securities

The Fund may invest in private companies and other restricted securities if these securities would currently comprise 40% or less of net assets. The value of these securities represented 8% of the Fund's net assets at March 31, 2016.

24

TEKLA LIFE SCIENCES INVESTORS

NOTES TO FINANCIAL STATEMENTS

MARCH 31, 2016

(continued)

The following table details the acquisition date, cost, carrying value per unit, and value of the Fund's private companies and other restricted securities at March 31, 2016. The Fund on its own does not have the right to demand that such securities be registered.

|

Security (#) |

Acquisition Date |

Cost |

Carrying Value per Unit |

Value |

|||||||||||||||

|

Afferent Pharmaceuticals, Inc. |

|||||||||||||||||||

|

Series C Cvt. Pfd |

7/1/15 |

$ |

1,501,707 |

$ |

2.45 |

$ |

1,500,002 |

||||||||||||

|

AlterG, Inc. |

|||||||||||||||||||

|

Series C Cvt. Pfd |

4/12/13 |

1,427,310 |

0.41 |

958,661 |

|||||||||||||||

|

ARCA biopharma, Inc. |

|||||||||||||||||||

|

Warrants (expiration 6/11/22) |

6/11/15 |

521 |

0.48 |

155,756 |

|||||||||||||||

|

BioClin Therapeutics, Inc. |

|||||||||||||||||||

|

Series A Cvt. Pfd |

1/19/16 |

432,693 |

0.65 |

432,693 |

|||||||||||||||

|

CardioKinetix, Inc. |

|||||||||||||||||||

|

Series C Cvt. Pfd |

5/22/08 |

1,653,315 |

0.00 |

† |

79 |

||||||||||||||

|

Series D Cvt. Pfd |

12/10/10 |

545,940 |

2.55 |

363,279 |

|||||||||||||||

|

Series E Cvt. Pfd |

9/14/11 |

1,253,611 |

2.85 |

1,250,781 |

|||||||||||||||

|

Series F Cvt. Pfd |

12/04/14 |

1,377,518 |

3.42 |

1,377,355 |

|||||||||||||||

|

Warrants (expiration 12/11/19) |

12/10/09, 2/11/10 |

123 |

0.00 |

0 |

|||||||||||||||

|

Warrants (expiration 6/03/20) |

6/03/10, 9/01/10 |

123 |

0.00 |

0 |

|||||||||||||||

|

Warrants (expiration 8/15/24) |

8/15/14 |

126 |

0.00 |

0 |

|||||||||||||||

|

Cercacor Laboratories, Inc. Common |

3/31/98 |

0 |

1.13 |

146,315 |

|||||||||||||||

|

CytomX Therapeutics, Inc. |

6/12/15 |

1,200,524 |

11.61 |

1,490,828 |

|||||||||||||||

|

Dynex Technologies, Inc. |

|||||||||||||||||||

|

Series A Cvt. Pfd |

1/03/12†† |

199,963 |

0.50 |

1,080,545 |

|||||||||||||||

|

Warrants (expiration 4/01/19) |

1/03/12†† |

60 |

0.00 |

0 |

|||||||||||||||

|

Warrants (expiration 5/06/19) |

1/03/12†† |

5 |

0.00 |

0 |

|||||||||||||||

|

EBI Life Sciences, Inc. |

|||||||||||||||||||

|

Series A Cvt. Pfd |

12/29/11†† |

13,597 |

0.01 |

† |

13,102 |

||||||||||||||

|

Eiger BioPharmaceuticals, Inc. |

|||||||||||||||||||

|

Warrants (expiration 10/10/18) |

10/10/13 |

65 |

0.00 |

0 |

|||||||||||||||

|

Euthymics Biosciences, Inc. |

|||||||||||||||||||

|

Series A Cvt. Pfd |

7/14/10 - 5/21/12 |

2,635,558 |

0.00 |

† |

2,862 |

||||||||||||||

|

GenomeDx Biosciences, Inc. |