|

|

|

OMB APPROVAL | ||

|

|

|

OMB Number: |

3235-0570 | |

|

|

|

Expires: |

January 31, 2014 | |

|

|

UNITED STATES |

Estimated average burden hours per response. . . . . . . . . . . . . . .20.6 | ||

|

|

SECURITIES AND EXCHANGE COMMISSION |

| ||

|

|

Washington, D.C. 20549 |

| ||

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

|

Investment Company Act file number |

811-06565 | ||||||||

|

| |||||||||

|

H&Q Life Sciences Investors | |||||||||

|

(Exact name of registrant as specified in charter) | |||||||||

|

| |||||||||

|

2 Liberty Square, 9th Floor, Boston, MA |

|

02109 | |||||||

|

(Address of principal executive offices) |

|

(Zip code) | |||||||

|

| |||||||||

|

2 Liberty Square, 9th Floor, Boston, MA 02109 | |||||||||

|

(Name and address of agent for service) | |||||||||

|

| |||||||||

|

Registrant’s telephone number, including area code: |

617-772-8500 |

| |||||||

|

| |||||||||

|

Date of fiscal year end: |

September 30 |

| |||||||

|

| |||||||||

|

Date of reporting period: |

October 1, 2011 to September 30, 2012 |

| |||||||

ITEM 1. REPORTS TO STOCKHOLDERS.

H&Q LIFE SCIENCES INVESTORS

Annual Report

2 0 1 2

To our Shareholders:

On September 30, 2012, the net asset value (NAV) per share of the Fund was $15.74. During the twelve month period ended September 30, 2012, total return at NAV of the Fund was 50.56%, with distributions reinvested. During the most recent six month period ended September 30, 2012, total return at NAV of the Fund was 11.33%, with distributions reinvested. The total investment return at market with distributions reinvested was 64.66% during the twelve month period ended September 30, 2012 and 15.78% during the six month period ended September 30, 2012. Thus, the Fund NAV underperformed the NASDAQ Biotech Index (NBI) for both periods. The Fund's market return exceeded the NBI for the full year while underperforming for the six months period. Comparisons to relevant indices are listed below.

| Investment Returns |

Six Months Ended 9/30/12 |

Year Ended 9/30/12 |

|||||||||

|

Investment Return at Market |

15.78 |

% |

64.66 |

% |

|||||||

|

Net Asset Value |

11.33 |

% |

50.56 |

% |

|||||||

|

NASDAQ Biotech Index |

16.15 |

% |

53.73 |

% |

|||||||

|

S&P 500 Index |

3.42 |

% |

30.21 |

% |

|||||||

Portfolio Highlights

The assets of H&Q Life Sciences Investors are generally invested in the stocks of small and mid sized biotechnology and other healthcare related companies. Typically the majority of the Fund's assets are invested in the stocks of restricted assets (including venture backed companies, PIPEs and related entities) and public biotechnology and life science companies. In general, while the Fund can invest in latter stage companies, it often invests in companies whose products are preclinical or are in early stage clinical evaluation. It is unusual for the Fund to take positions in the stocks of multinational pharmaceutical companies, large health maintenance organizations and/or hospitals.

The year ending September 30, 2012 was one of the most memorable in the history of HQL and the healthcare/biotechnology sectors. In terms of return to investors, the absolute NAV and market performance was the best it has been since fiscal year 2000 and 2003, respectively. We believe this performance has resulted both from what we view as

1

solid stock selection during the period but also note that a significant portion of the Fund's return in the fiscal year was the result of strong performance of the biotechnology sector (as represented by the NBI Index). We note that both the Fund NAV and the NBI substantially outperformed the broader S&P 500 Index in a year when equities also performed well, by historical standards.

While we are happy with the Fund's absolute performance with significant positions in Gilead Sciences, Inc., Alexion Pharmaceuticals, Inc. and Inhibitex, Inc. during the fiscal year, we note that we missed a few key events in the period under review. Namely, we were mostly not invested in Onyx Pharmaceuticals, Inc. in a period when that company received approval for a new hematologic cancer drug. We also were materially underweight in Amgen, Inc., a significant component in the NBI, when its stock price moved higher. To be frank, we did not expect Onyx's Kyprolis to be approved and did not expect strong investor response to Amgen's institution of a dividend at a time when we were not impressed with the potential of the company's pipeline or earnings potential.

The overall performance of the sector was driven by both specific factors and by investor sentiment during the fiscal year: many interesting new medicines were approved by US and ex-US regulatory agencies, a key generic biologic was approved by the FDA suggesting that the path for such approvals is now clear, the potential clinical impact of several new drugs was demonstrated in both early and late stage clinical trials, merger and acquisition activity continued, several newly approved drug products started what we expect to be significant new product launches and the Supreme Court of the United States upheld the Affordable Care Act. In short, in our view, the healthcare sector in general and the biotechnology sector in particular, experienced a year to remember. Moreover, while it is always possible to see some market consolidation in the short term, if we can keep macroeconomic factors from intervening, we think the future of healthcare is bright.

In our view, there are two keys to market performance in the healthcare and biotechnology sectors. These are, of course, demographics and new product discovery/development. We have spoken about the demographics in the past. The American population is getting older. Individuals tend to use more healthcare as they get older so demand for healthcare products and services will inevitably increase in the coming years. Moreover, the Affordable Care Act will provide new health insurance coverage for well more than ten million individuals. With many more people getting older AND many more people covered by health insurances, it is inevitable that demand for healthcare products will increase. There will certainly be pressure to control drug and other product

2

pricing, but so long as new differentiated products are discovered and developed, we expect demographics to drive investor sentiment toward investing in the healthcare sector in general and in biotechnology and medical technology in particular.

In terms of new product discovery and development, it appears to us that we are in the midst of a wave of new product introduction. Many small companies are developing new, differentiated products targeted at ever more patient specific diseases or conditions. Relative to more traditional drugs, it is our observation that such "personalized" medical products tend to be approved a bit more quickly and are able to command higher prices than their traditional counterparts. Medivation, Inc.'s Xtandi for use in second line prostate cancer, Onyx's Kyprolis for use in multiple myeloma and Regeneron Pharmaceuticals, Inc.'s Eylea for use in AMD and retinal vein occlusion are examples of drugs recently developed by mid-sized sponsors and approved by the FDA that have a chance to demonstrate impressive launches. We have also been impressed that the FDA has been willing to recently approve two new products, Qsymia from VIVUS, Inc. and Belviq from Arena Pharmaceuticals, Inc., to treat obesity. It has been quite a few years since any substantive new drug has been approved in this area.

Advancing behind the approvals of these new drugs, we are seeing significant new clinical development in many areas both from new and established drug developers in many new clinical areas. Probably the most notable area has been in Hepatitis C. After many years of limited options to treat Hepatitis C, there have been, in the last two or three years, at least two fundamental changes in the way this disease will be treated. Whereas five years ago relatively few hepatitis patients could achieve a "cure" with any then available therapy, there is now at least one treatment approach (using injectable drugs such as Roche's Interferon and Vertex Pharmaceuticals, Inc.'s Incivek) that can today "cure" Hepatitis C in most patients within a year. It now appears that this approach itself will soon be replaced with a regimen of two drugs, taken orally, that can "cure" the disease in much less than a year. In our view, this pace of improvement is remarkable. Though not as dramatic, we are seeing similar advancements that have the potential to improve the way we treat both common diseases (breast cancer, non small cell lung cancer, etc.) and more rare conditions (e.g., Duchene's Muscular Dystrophy, Morquio A Syndrome, Fabry's disease, Cystic Fibrosis, Paroxysmal Nocturnal Hemoglobinuria, and Atypical Hemolytic Uremic Syndrome).

Coincident with these advances, we are also seeing a continued spate of merger and acquisition (M&A) activity in multiple healthcare sectors involving relatively large companies, both from an acquirer

3

and target company point of view. For example, Aetna, Inc. (an HMO) acquired Coventry Health Care, Inc., Health Care REIT, Inc. acquired Sunrise Senior Living, Inc., Valeant Pharmaceuticals International, Inc. (a specialty pharmaceutical company) acquired Medicis Pharmaceuticals, Inc., Thomas Property Group, Inc. (a private equity firm) acquired Par Pharmaceuticals and Hologic, Inc. (a women's health Company) acquired Gen-Probe, Inc. (a diagnostics company), all in transactions valued at greater than $2 billion. In our view, this multi-subsector M&A interest suggests that there has been and (we would say remains) interest in the healthcare sector. In our experience, healthy M&A activity tends to drive related markets higher.

The combination of new product development, increased demand for products and a healthy M&A environment makes us generally optimistic about the sector. However, we must point out two key facts that have "headline" negative news potential that could derail the sector. First, pharmaceutical product development doesn't always proceed as well. Sometimes products that the market expects to be positive catalysts don't work as expected. And second, the current macroeconomic situation both in the US and elsewhere holds the potential to distract and reverse recent stock market gains.

While there have been many positive developments in recent months, there have also been some negative surprises. Treatment of Alzheimer's disease is a good example. Within the last six months or so, two well publicized drugs which had the potential to greatly benefit Alzheimer's patients failed in late stage clinical trials. Similar clinical trial failures have occurred in the cancer and other spaces in recent months. In our experience, most often the issue is market expectation. When a drug that is generally expected to fail demonstrates a lack of efficacy in clinical trials, the market often passively accommodates such developments. However, when unexpected bad news occurs with respect to one company's product, it can sometimes have a much broader impact driving down the price of other stocks or of the sector in general. We have not seen much of this of late but it is always a possibility. Moreover, in our experience, the breadth and scope of the impact can be even greater after a sharp upward trend, such as what we observed of late in the healthcare/biotechnology sector.

With respect to macroeconomic news, we are often surprised by the impact seemingly unrelated events can have on our sector. We have seen this with recent events in the European Union (EU). We would not expect the kind of correlation we have seen in the last year or so between EU problems and the stock prices of US healthcare/biotechnology stocks. Given what we did see, we would not be surprised if news from the current US budget/taxation

4

discussions has a significant impact on stock prices in our sector. My own view is that in the coming months there are likely to be some headlines that are perceived to be negative for the general market that may impact the healthcare and biotechnology subsectors. In the end, I expect this to be resolved reasonably but we are anticipating a volatile path to a hopefully good outcome.

Separate from our investing efforts, we feel that our efforts to narrow the Fund's discount have been successful. During the 2012 fiscal year, the Fund's discount narrowed from -10.445% to -2.211%. We are quite pleased by this result.

Investment Changes

During the year ended September 30, 2012, within the public portfolio, the Fund established positions in several companies including ACADIA Pharmaceuticals, Inc., Regeneron Pharmaceuticals, Inc. Hologic, Inc., Alere, Inc., VIVUS, Inc., ARIAD Pharmaceuticals, Inc., Watson Pharmaceuticals, Inc., Endo Pharmaceuticals Holdings, Inc. and ImmunoGen, Inc. During the same twelve month period, the Fund exited its position in several companies including Gen-Probe, Inc., Santarus, Inc., Auxillium Pharmaceuticals, Inc., Human Genome Sciences, Inc., Inhibitex, Inc. and Affymax, Inc.

During the same twelve month period, within the venture portfolio, the Fund established positions in Celladon Corporation, Neurovance, Inc., EBI Life Sciences, Inc., Dynex Technologies, Inc. and IlluminOss, Inc. In addition, several previously held companies within the venture portfolio went public. These companies include, Ceres, Inc., Puma Biotechnology, Inc. and Verastem, Inc. The Fund made follow on investments in CardioKinetix, Inc., Tibion Corporation, Euthymics Diagnostics, Inc. and Palyon Medical Corporation. The Fund wrote off its positions in Agilix Corporation and OmniSonics Medical Technologies, Inc. and exited its position in Concentric Medical, Inc. and MZT Holdings, Inc.

As always, if you have questions, please feel free to call us at (617) 772-8500.

Daniel R. Omstead

President

5

H&Q LIFE SCIENCES INVESTORS

LARGEST HOLDINGS BY ISSUER

(Excludes Short-Term Investments)

As of September 30, 2012

| Issuer - Sector |

% of Net Assets |

||||||

|

Gilead Sciences, Inc. Biotechnologies/Biopharmaceuticals |

7.2 |

% |

|||||

|

Regeneron Pharmaceuticals, Inc. Biotechnologies/Biopharmaceuticals |

6.8 |

% |

|||||

|

Celgene Corporation Biotechnologies/Biopharmaceuticals |

5.1 |

% |

|||||

|

Alexion Pharmaceuticals, Inc. Biotechnologies/Biopharmaceuticals |

5.0 |

% |

|||||

|

Biogen Idec, Inc. Biotechnologies/Biopharmaceuticals |

4.1 |

% |

|||||

|

Perrigo Company Generic Pharmaceuticals |

3.8 |

% |

|||||

|

Mylan, Inc. Generic Pharmaceuticals |

3.0 |

% |

|||||

|

Teva Pharmaceutical Industries Ltd. Generic Pharmaceuticals |

2.6 |

% |

|||||

|

Medivation, Inc. Pharmaceuticals |

2.3 |

% |

|||||

|

Puma Biotechnology, Inc. Biotechnologies/Biopharmaceuticals |

2.3 |

% |

|||||

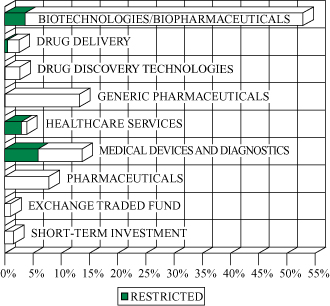

SECTOR DIVERSIFICATION (% of Net Assets)

As of September 30, 2012

6

H&Q LIFE SCIENCES INVESTORS

SCHEDULE OF INVESTMENTS

SEPTEMBER 30, 2012

|

CONVERTIBLE SECURITIES AND WARRANTS - 9.0% of Net Assets |

|||||||||||

|

SHARES |

Convertible Preferred and Warrants (Restricted) (a) (b) - 8.7% |

VALUE |

|||||||||

|

Biotechnologies/Biopharmaceuticals - 2.0% |

|||||||||||

|

3,324,401 |

Celladon Corporation Series A-1 |

$ |

1,492,656 |

||||||||

|

2,568,939 |

EBI Life Sciences, Inc. Series A (c) |

11,303 |

|||||||||

|

2,568,939 |

Euthymics Biosciences, Inc. Series A (c) |

2,606,189 |

|||||||||

|

239,236 |

MacroGenics, Inc. Series D |

156,006 |

|||||||||

|

2,568,939 |

Neurovance, Inc. Series A (c) |

199,863 |

|||||||||

|

4,466,017 |

|||||||||||

|

Healthcare Services - 2.2% |

|||||||||||

|

3,589,744 |

PHT Corporation Series D (c) |

4,020,513 |

|||||||||

|

802,996 |

PHT Corporation Series E (c) |

899,355 |

|||||||||

|

99,455 |

PHT Corporation Series F (c) |

111,390 |

|||||||||

|

5,031,258 |

|||||||||||

|

Medical Devices and Diagnostics - 4.5% |

|||||||||||

|

2,379,916 |

CardioKinetix, Inc. Series C |

0 |

|||||||||

|

4,277,223 |

CardioKinetix, Inc. Series D |

23,953 |

|||||||||

|

8,462,336 |

CardioKinetix, Inc. Series E |

1,606,151 |

|||||||||

|

N/A |

CardioKinetix, Inc. warrants (expiration 12/11/19) (d) |

0 |

|||||||||

|

N/A |

CardioKinetix, Inc. warrants (expiration 6/03/20) (d) |

0 |

|||||||||

|

N/A |

CardioKinetix, Inc. warrants (expiration 7/07/21) (d) |

0 |

|||||||||

|

2,161,090 |

Dynex Technologies, Inc. Series A |

388,996 |

|||||||||

|

98,824 |

Dynex Technologies, Inc. warrants (expiration 4/01/19) |

0 |

|||||||||

|

7,877 |

Dynex Technologies, Inc. warrants (expiration 5/06/19) |

0 |

|||||||||

|

2,021,388 |

IlluminOss Medical, Inc. Series C-1 |

775,000 |

|||||||||

|

2,446,016 |

Labcyte, Inc. Series C |

1,280,000 |

|||||||||

|

2,161,090 |

Magellan Diagnostics, Inc. Series A (i) |

1,480,995 |

|||||||||

|

98,824 |

Magellan Diagnostics, Inc. warrants (expiration 4/01/19) |

0 |

|||||||||

|

7,877 |

Magellan Diagnostics, Inc. warrants (expiration 5/06/19) |

0 |

|||||||||

|

9,606,373 |

Palyon Medical Corporation Series A (c) |

1,316,073 |

|||||||||

|

N/A |

Palyon Medical Corporation warrants (expiration 4/26/19) (c) (d) |

0 |

|||||||||

|

43,478 |

TherOx, Inc. Series H |

435 |

|||||||||

|

99,646 |

TherOx, Inc. Series I |

997 |

|||||||||

|

3,280,000 |

Tibion Corporation Series B |

984,000 |

|||||||||

The accompanying notes are an integral part of these financial statements.

7

H&Q LIFE SCIENCES INVESTORS

SCHEDULE OF INVESTMENTS

SEPTEMBER 30, 2012

(continued)

|

SHARES |

Convertible Preferred and Warrants (Restricted) (a) (b) - continued |

VALUE |

|||||||||

|

Medical Devices and Diagnostics - continued |

|||||||||||

|

N/A |

Tibion Corporation warrants (Restricted, expiration 7/12/17) (d) |

$ |

0 |

||||||||

|

2,606,033 |

Veniti, Inc. Series A (c) |

2,270,897 |

|||||||||

|

10,127,497 |

|||||||||||

|

19,624,772 |

|||||||||||

|

PRINCIPAL AMOUNT |

Convertible Notes - 0.3% (a) |

|

|||||||||

|

Drug Discovery Technologies - 0.0% |

|||||||||||

|

$ |

700,000 |

deCode Genetics, Inc. (b), 3.50% due 4/15/11 |

0 |

||||||||

|

Medical Devices and Diagnostics - 0.3% |

|||||||||||

|

512,500 |

Palyon Medical Corporation Cvt. Promissory Note, 8.00% due 4/26/13 (Restricted) (c) |

512,500 |

|||||||||

|

245,517 |

Tibion Corporation Cvt. Promissory Note, 6.00% due 7/12/13 (Restricted) |

245,517 |

|||||||||

|

TOTAL CONVERTIBLE NOTES |

758,017 |

||||||||||

|

TOTAL CONVERTIBLE SECURITIES AND WARRANTS (Cost $24,593,354) |

20,382,789 |

||||||||||

|

COMMON STOCKS AND WARRANTS - 85.2% |

|||||||||||

|

SHARES |

Biotechnologies/Biopharmaceuticals - 49.3% |

||||||||||

|

117,800 |

ACADIA Pharmaceuticals, Inc. (b) |

298,034 |

|||||||||

|

51,246 |

Acorda Therapeutics, Inc. (b) |

1,312,410 |

|||||||||

|

101,100 |

Aegerion Pharmaceuticals, Inc. (b) |

1,498,302 |

|||||||||

|

99,214 |

Alexion Pharmaceuticals, Inc. (b) |

11,350,082 |

|||||||||

|

104,752 |

Alkermes plc (b) |

2,173,604 |

|||||||||

|

103,506 |

Amarin Corporation plc (b) (f) |

1,304,176 |

|||||||||

|

3,201 |

Amgen, Inc. |

269,908 |

|||||||||

|

82,482 |

Amicus Therapeutics, Inc. (b) |

428,906 |

|||||||||

|

3,939,544 |

Antisoma plc (b) (e) |

99,559 |

|||||||||

|

99,795 |

ARIAD Pharmaceuticals, Inc. (b) |

2,417,534 |

|||||||||

|

250,000 |

ArQule, Inc. (b) |

1,277,500 |

|||||||||

|

62,030 |

Biogen Idec, Inc. (b) |

9,256,737 |

|||||||||

|

15,918 |

BioMimetic Therapeutics, Inc. (b) |

65,423 |

|||||||||

|

152,700 |

Celgene Corporation (b) |

11,666,280 |

|||||||||

|

168,851 |

Ceres, Inc. (b) |

959,074 |

|||||||||

The accompanying notes are an integral part of these financial statements.

8

H&Q LIFE SCIENCES INVESTORS

SCHEDULE OF INVESTMENTS

SEPTEMBER 30, 2012

(continued)

|

SHARES |

Biotechnologies/ Biopharmaceuticals - continued |

VALUE |

|||||||||

|

1,892 |

Ceres, Inc. warrants (Restricted, expiration 9/05/15) (a) (b) |

$ |

832 |

||||||||

|

66,112 |

Cornerstone Therapeutics, Inc. (b) |

339,155 |

|||||||||

|

60,751 |

Cubist Pharmaceuticals, Inc. (b) |

2,896,608 |

|||||||||

|

370,886 |

Curis, Inc. (b) |

1,535,468 |

|||||||||

|

172,972 |

Dendreon Corporation (b) |

835,455 |

|||||||||

|

247,085 |

Gilead Sciences, Inc. (b) |

16,389,148 |

|||||||||

|

492,394 |

Keryx Biopharmaceuticals, Inc. (b) |

1,388,551 |

|||||||||

|

150,341 |

Nektar Therapeutics (b) |

1,605,642 |

|||||||||

|

406,428 |

Neurocrine Biosciences, Inc. (b) |

3,243,295 |

|||||||||

|

328,257 |

NPS Pharmaceuticals, Inc. (b) |

3,036,377 |

|||||||||

|

113,100 |

OncoGenex Pharmaceutical, Inc. (b) |

1,602,627 |

|||||||||

|

37,500 |

OncoGenex Pharmaceutical, Inc. warrants (Restricted, expiration 10/22/15) (a) (b) |

70,875 |

|||||||||

|

343,067 |

Puma Biotechnology, Inc. (b) |

5,146,005 |

|||||||||

|

48,825 |

Questcor Pharmaceuticals, Inc. |

903,262 |

|||||||||

|

100,799 |

Regeneron Pharmaceuticals, Inc. (b) |

15,387,975 |

|||||||||

|

197,000 |

Threshold Pharmaceuticals, Inc. (b) |

1,426,280 |

|||||||||

|

21,642 |

United Therapeutics Corporation (b) |

1,209,355 |

|||||||||

|

274,325 |

Verastem, Inc. (b) |

2,575,912 |

|||||||||

|

90,861 |

Vertex Pharmaceuticals, Inc. (b) |

5,083,673 |

|||||||||

|

162,061 |

VIVUS, Inc. (b) |

2,887,927 |

|||||||||

|

111,941,951 |

|||||||||||

|

Drug Delivery - 2.5% |

|||||||||||

|

3,962,279 |

A.P. Pharma, Inc. (b) |

2,465,330 |

|||||||||

|

2,066,667 |

A.P. Pharma, Inc. warrants (Restricted, expiration 7/01/16) (a) (b) |

760,534 |

|||||||||

|

711,350 |

IntelliPharmaCeutics International, Inc. (b) (c) |

2,134,050 |

|||||||||

|

319,800 |

IntelliPharmaCeutics International, Inc. warrants (Restricted, expiration 2/01/13) (a) (b) (c) |

127,920 |

|||||||||

|

319,800 |

IntelliPharmaCeutics International, Inc. warrants (Restricted, expiration 2/01/16) (a) (b) (c) |

243,048 |

|||||||||

|

5,730,882 |

|||||||||||

|

Drug Discovery Technologies - 2.7% |

|||||||||||

|

140,000 |

Celldex Therapeutics, Inc. (b) |

882,000 |

|||||||||

|

176,927 |

ImmunoGen, Inc. (b) |

2,583,134 |

|||||||||

|

146,250 |

Incyte Corporation (b) |

2,639,813 |

|||||||||

|

46 |

Zyomyx, Inc. (Restricted) (a) (b) |

11 |

|||||||||

|

6,104,958 |

|||||||||||

|

Generic Pharmaceuticals - 13.2% |

|||||||||||

|

326,448 |

Akorn, Inc. (b) |

4,315,642 |

|||||||||

|

81,243 |

Impax Laboratories, Inc. (b) |

2,109,068 |

|||||||||

The accompanying notes are an integral part of these financial statements.

9

H&Q LIFE SCIENCES INVESTORS

SCHEDULE OF INVESTMENTS

SEPTEMBER 30, 2012

(continued)

|

SHARES |

Generic Pharmaceuticals - continued |

VALUE |

|||||||||

|

279,254 |

Mylan, Inc. (b) |

$ |

6,813,798 |

||||||||

|

73,587 |

Perrigo Company |

8,548,602 |

|||||||||

|

141,697 |

Teva Pharmaceutical Industries Ltd. (f) |

5,867,673 |

|||||||||

|

28,365 |

Watson Pharmaceuticals, Inc. (b) |

2,415,563 |

|||||||||

|

30,070,346 |

|||||||||||

|

Healthcare Services - 1.7% |

|||||||||||

|

32,789 |

Addus HomeCare Corporation (b) |

177,061 |

|||||||||

|

148,148 |

Aveta, Inc. (Restricted) (a) (g) |

1,666,665 |

|||||||||

|

43,400 |

Covance, Inc. (b) |

2,026,346 |

|||||||||

|

3,870,072 |

|||||||||||

|

Medical Devices and Diagnostics - 7.9% |

|||||||||||

|

208,296 |

Accuray, Inc. (b) |

1,474,736 |

|||||||||

|

158,022 |

Alere, Inc. (b) |

3,079,849 |

|||||||||

|

114,671 |

Bruker Corporation (b) |

1,501,043 |

|||||||||

|

130,000 |

Cercacor Laboratories, Inc. (Restricted) (a) (b) |

78,349 |

|||||||||

|

251,589 |

Hologic, Inc. (b) |

5,092,161 |

|||||||||

|

30,990 |

iCAD, Inc (b) |

66,938 |

|||||||||

|

5,306 |

iCAD, Inc. (Locked-up until 12/31/12) (Restricted) (a) (b) |

10,888 |

|||||||||

|

17,668 |

IDEXX Laboratories, Inc. (b) |

1,755,316 |

|||||||||

|

53,171 |

Illumina, Inc. (b) |

2,562,842 |

|||||||||

|

447,080 |

Medwave, Inc. (b) |

0 |

|||||||||

|

139 |

Songbird Hearing, Inc. (Restricted) (a) (b) |

93 |

|||||||||

|

37,589 |

Thermo Fisher Scientific, Inc. |

2,211,361 |

|||||||||

|

17,833,576 |

|||||||||||

|

Pharmaceuticals - 7.9% |

|||||||||||

|

122,503 |

Endo Pharmaceuticals Holdings, Inc. (b) |

3,885,795 |

|||||||||

|

64,569 |

Ironwood Pharmaceuticals, Inc. (b) |

825,192 |

|||||||||

|

92,464 |

Medivation, Inc. (b) |

5,211,271 |

|||||||||

|

47,597 |

Sanofi, CVR (expiration 12/31/20) (b) (h) |

79,963 |

|||||||||

|

43,468 |

Shire plc (f) |

3,855,612 |

|||||||||

|

184,315 |

Warner Chilcott plc |

2,488,252 |

|||||||||

|

625,000 |

Zogenix, Inc. (b) |

1,662,500 |

|||||||||

|

18,008,585 |

|||||||||||

|

TOTAL COMMON STOCKS AND WARRANTS (Cost $150,349,550) |

193,560,370 |

||||||||||

|

EXCHANGE TRADED FUND - 1.1% |

|||||||||||

|

16,860 |

iShares Nasdaq Biotechnology Index Fund |

2,401,370 |

|||||||||

|

TOTAL EXCHANGE TRADED FUND (Cost $2,050,784) |

2,401,370 |

||||||||||

The accompanying notes are an integral part of these financial statements.

10

H&Q LIFE SCIENCES INVESTORS

SCHEDULE OF INVESTMENTS

SEPTEMBER 30, 2012

(continued)

|

PRINCIPAL AMOUNT |

SHORT-TERM INVESTMENT - 1.6% |

VALUE |

|||||||||

|

$ |

3,634,000 |

Repurchase Agreement, State Street Bank and Trust Co., repurchase value $3,634,003, 0.01%, dated 09/28/12, due 10/01/12 (collateralized by U.S. Treasury Note 3.125%, due 11/15/41, market value $3,711,796) |

$ |

3,634,000 |

|||||||

|

TOTAL SHORT-TERM INVESTMENT (Cost $3,634,000) |

3,634,000 |

||||||||||

|

TOTAL INVESTMENTS BEFORE MILESTONE INTERESTS - 96.9% (Cost $180,627,688) |

219,978,529 |

||||||||||

|

INTEREST |

MILESTONE INTERESTS (Restricted) (a) (b) - 2.6% |

||||||||||

|

Biotechnologies/Biopharmaceuticals - 1.6% |

|||||||||||

|

1 |

Targegen Milestone Interest |

3,691,931 |

|||||||||

|

Medical Devices and Diagnostics - 1.0% |

|||||||||||

|

1 |

Interlace Medical Milestone Interest |

1,701,046 |

|||||||||

|

1 |

Xoft Milestone Interest |

671,358 |

|||||||||

|

2,372,404 |

|||||||||||

|

TOTAL MILESTONE INTERESTS (Cost $4,297,338) |

6,064,335 |

||||||||||

|

TOTAL INVESTMENTS - 99.5% (Cost $184,925,026) |

226,042,864 |

||||||||||

|

OTHER ASSETS IN EXCESS OF LIABILITIES - 0.5% |

1,037,289 |

||||||||||

|

NET ASSETS - 100% |

$ |

227,080,153 |

|||||||||

(a) Security fair valued.

(b) Non-income producing security.

(c) Affiliated issuers in which the Fund holds 5% or more of the voting securities (total market value of $14,453,101).

(d) Number of warrants to be determined at a future date.

(e) Foreign security.

(f) American Depository Receipt

(g) Security exempt from registration under Rule 144A of the Securities Act of 1933, as amended. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers.

(h) Contingent Value Rights

(i) Income producing security.

The accompanying notes are an integral part of these financial statements.

11

H&Q LIFE SCIENCES INVESTORS

SCHEDULE OF INVESTMENTS

SEPTEMBER 30, 2012

(continued)

Other Information

The Fund uses a three-tier hierarchy to prioritize the assumptions, referred to as inputs, used in valuation techniques to measure fair value. The three-tier hierarchy of inputs is summarized in three broad levels. Level 1 includes quoted prices in active markets for identical investments. Level 2 includes prices determined using other significant observable inputs (including quoted prices for similar investments, interest rates, credit risk, etc.). Level 3 includes prices determined using significant unobservable inputs (including the Fund's own assumptions in determining the fair value of investments). These inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used as of September 30, 2012 to value the Fund's net assets. For the year ended September 30, 2012, there were no transfers between Levels 1 and 2.

|

Assets at Value |

Level 1 |

Level 2 |

Level 3 |

Total |

|||||||||||||||

|

Convertible Securities and Warrants |

|||||||||||||||||||

|

Biotechnologies/Biopharmaceuticals |

$ |

4,466,017 |

$ |

4,466,017 |

|||||||||||||||

|

Drug Discovery Technologies |

0 |

0 |

|||||||||||||||||

|

Healthcare Services |

5,031,258 |

5,031,258 |

|||||||||||||||||

|

Medical Devices and Diagnostics |

10,885,514 |

10,885,514 |

|||||||||||||||||

|

Common Stocks and Warrants |

|||||||||||||||||||

|

Biotechnologies/Biopharmaceuticals |

$ |

111,870,244 |

71,707 |

111,941,951 |

|||||||||||||||

|

Drug Delivery |

4,599,380 |

1,131,502 |

5,730,882 |

||||||||||||||||

|

Drug Discovery Technologies |

6,104,947 |

11 |

6,104,958 |

||||||||||||||||

|

Generic Pharmaceuticals |

30,070,346 |

— |

30,070,346 |

||||||||||||||||

|

Healthcare Services |

2,203,407 |

1,666,665 |

3,870,072 |

||||||||||||||||

|

Medical Devices and Diagnostics |

17,744,246 |

89,330 |

17,833,576 |

||||||||||||||||

|

Pharmaceuticals |

18,008,585 |

— |

18,008,585 |

||||||||||||||||

|

Exchanged Traded Fund |

2,401,370 |

— |

2,401,370 |

||||||||||||||||

|

Short-Term Investment |

— |

$ |

3,634,000 |

— |

3,634,000 |

||||||||||||||

|

Milestone Interests |

|||||||||||||||||||

|

Biotechnologies/Biopharmaceuticals |

— |

— |

3,691,931 |

3,691,931 |

|||||||||||||||

|

Medical Devices and Diagnostics |

— |

— |

2,372,404 |

2,372,404 |

|||||||||||||||

|

Other Assets |

— |

— |

1,219,599 |

1,219,599 |

|||||||||||||||

|

Total |

$ |

193,002,525 |

$ |

3,634,000 |

$ |

30,625,938 |

$ |

227,262,463 |

|||||||||||

The accompanying notes are an integral part of these financial statements.

12

H&Q LIFE SCIENCES INVESTORS

SCHEDULE OF INVESTMENTS

SEPTEMBER 30, 2012

(continued)

Other Information, continued

The following is a reconciliation of level 3 assets for which significant unobservable inputs were used to determine fair value. Realized and unrealized gain (loss) disclosed in the reconciliation are included in Net Realized and Unrealized Gain (Loss) on the Statement of Operations.

|

Level 3 Assets |

Balance as of September 30, 2011 |

Realized gain/loss and change in unrealized appreciation (depreciation) |

Cost of purchases |

Proceeds from sales |

Net transfers in (out of) Level 3 |

Balance as of September 30, 2012 |

|||||||||||||||||||||

|

Convertible Securities and Warrants |

|||||||||||||||||||||||||||

|

Biotechnologies/ Biopharmaceuticals |

$ |

2,123,763 |

$ |

234,023 |

$ |

2,340,817 |

($ |

232,586 |

) |

$ |

— |

$ |

4,466,017 |

||||||||||||||

|

Drug Discovery Technologies |

3,200,737 |

(779,945 |

) |

28 |

(2,420,820 |

) |

— |

||||||||||||||||||||

|

Healthcare Services |

3,503,912 |

1,527,346 |

— |

— |

— |

5,031,258 |

|||||||||||||||||||||

|

Medical Devices and Diagnostics |

17,269,542 |

(1,706,846 |

) |

2,300,056 |

(6,977,238 |

) |

— |

10,885,514 |

|||||||||||||||||||

|

Common Stocks and Warrants |

|||||||||||||||||||||||||||

|

Biotechnologies/ Biopharmaceuticals |

61,875 |

9,832 |

— |

— |

— |

71,707 |

|||||||||||||||||||||

|

Drug Delivery |

890,798 |

240,474 |

230 |

— |

— |

1,131,502 |

|||||||||||||||||||||

|

Drug Discovery Technologies |

11 |

— |

— |

— |

— |

11 |

|||||||||||||||||||||

|

Healthcare Services |

1,333,332 |

333,333 |

— |

— |

— |

1,666,665 |

|||||||||||||||||||||

|

Medical Devices and Diagnostics |

150,808 |

166,427 |

— |

(227,905 |

) |

— |

89,330 |

||||||||||||||||||||

|

Milestone Interests |

|||||||||||||||||||||||||||

|

Biotechnologies/ Biopharmaceuticals |

4,627,443 |

178,348 |

— |

(1,113,860 |

) |

— |

3,691,931 |

||||||||||||||||||||

|

Medical Devices and Diagnostics |

3,424,284 |

883,043 |

620 |

(1,935,543 |

) |

— |

2,372,404 |

||||||||||||||||||||

|

Other Assets |

746,232 |

— |

1,101,163 |

(627,796 |

) |

— |

1,219,599 |

||||||||||||||||||||

|

Total |

$ |

37,332,737 |

$ |

1,086,035 |

$ |

5,742,914 |

($ |

13,535,748 |

) |

$ |

— |

$ |

30,625,938 |

||||||||||||||

|

Net change in unrealized appreciation (depreciation) from investments still held as of September 30, 2012 |

$ |

1,731,380 |

|||||||||||||||||||||||||

The accompanying notes are an integral part of these financial statements.

13

H&Q LIFE SCIENCES INVESTORS

SCHEDULE OF INVESTMENTS

SEPTEMBER 30, 2012

(continued)

Other Information, continued

The Fund has implemented the new disclosures required by Accounting Standards Update 2011-04 "Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements in U.S. GAAP and International Financial Reporting Standards." The following is a quantitative disclosure about significant unobservable inputs used in the determination of the fair value of level three assets.

|

Fair Value at 9/30/12 |

Valuation Technique |

Unobservable Input |

Range |

||||||||||||||||

|

Private Companies and Other Restricted Securities |

$ |

2,959,111 |

Public market price based |

Estimate of time to liquidity |

6 months |

||||||||||||||

|

Discount for lack of marketability |

5% | ||||||||||||||||||

|

15,119,953 |

Capital asset pricing model based |

Revenue growth rate |

25%-115% | ||||||||||||||||

|

Price to sales multiple |

0.14-7.5 |

||||||||||||||||||

|

5,106,831 |

Independent valuation based |

Revenue growth rate |

9.2%-14.0% | ||||||||||||||||

|

Weighted average cost of capital |

15.5%-27.5% | ||||||||||||||||||

|

Discount rate |

20% | ||||||||||||||||||

|

Relief from royatly rate |

5%-6% | ||||||||||||||||||

|

7,440,043 |

Probability adjusted value based |

Probability of events |

20%-50% | ||||||||||||||||

|

Timing of events |

0.5-5 years | ||||||||||||||||||

|

$ |

30,625,938 |

||||||||||||||||||

The accompanying notes are an integral part of these financial statements.

14

H&Q LIFE SCIENCES INVESTORS

STATEMENT OF ASSETS AND LIABILITIES

SEPTEMBER 30, 2012

|

ASSETS: |

|||||||

|

Investments in unaffiliated issuers, at value (cost $167,876,418) |

$ |

205,525,428 |

|||||

|

Investments in affiliated issuers, at value (cost $12,751,270) |

14,453,101 |

||||||

|

Milestone interests, at value (cost $4,297,338) |

6,064,335 |

||||||

|

Cash |

689 |

||||||

|

Dividends and interest receivable |

29,579 |

||||||

|

Receivable for investments sold |

146,456 |

||||||

|

Prepaid expenses |

45,634 |

||||||

|

Other assets (see Note 1) |

1,219,599 |

||||||

|

Total assets |

227,484,821 |

||||||

|

LIABILITIES: |

|||||||

|

Accrued advisory fee |

207,512 |

||||||

|

Accrued shareholder reporting fees |

29,412 |

||||||

|

Accrued trustee fees |

16,493 |

||||||

|

Accrued other |

151,251 |

||||||

|

Total liabilities |

404,668 |

||||||

|

NET ASSETS |

$ |

227,080,153 |

|||||

|

SOURCES OF NET ASSETS: |

|||||||

|

Shares of beneficial interest, par value $.01 per share, unlimited number of shares authorized, amount paid in on 14,428,625 shares issued and outstanding |

$ |

173,760,871 |

|||||

|

Accumulated net realized gain on investments, milestone interests and options |

12,201,444 |

||||||

|

Net unrealized gain on investments and milestone interests |

41,117,838 |

||||||

|

Total net assets (equivalent to $15.74 per share based on 14,428,625 shares outstanding) |

$ |

227,080,153 |

|||||

The accompanying notes are an integral part of these financial statements.

15

H&Q LIFE SCIENCES INVESTORS

STATEMENT OF OPERATIONS

YEAR ENDED SEPTEMBER 30, 2012

|

INVESTMENT INCOME: |

|||||||

|

Dividend income (net of foreign tax of $40,334) |

$ |

2,122,043 |

|||||

|

Interest income |

4,602 |

||||||

|

Interest income from affiliates |

17,860 |

||||||

|

Total investment income |

2,144,505 |

||||||

|

EXPENSES: |

|||||||

|

Advisory fees |

2,334,885 |

||||||

|

Legal fees |

221,421 |

||||||

|

Trustees' fees and expenses |

190,758 |

||||||

|

Administration and auditing fees |

183,120 |

||||||

|

Shareholder reporting |

151,734 |

||||||

|

Custodian fees |

88,906 |

||||||

|

Transfer agent fees |

55,269 |

||||||

|

Other (see Note 2) |

201,825 |

||||||

|

Total expenses |

3,427,918 |

||||||

|

Net investment loss |

(1,283,413 |

) |

|||||

|

REALIZED AND UNREALIZED GAIN (LOSS): |

|||||||

|

Net realized gain (loss) on: |

|||||||

|

Investments in unaffiliated issuers |

23,145,746 |

||||||

|

Investments in affiliated issuers |

405,514 |

||||||

|

Closed or expired option contracts written |

22,579 |

||||||

|

Net realized gain |

23,573,839 |

||||||

|

Change in unrealized appreciation (depreciation) |

|||||||

|

Investments in unaffiliated issuers |

53,616,527 |

||||||

|

Investments in affiliated issuers |

686,013 |

||||||

|

Milestone interests |

1,061,391 |

||||||

|

Option contracts written |

(24,255 |

) |

|||||

|

Change in unrealized appreciation (depreciation) |

55,339,676 |

||||||

|

Net realized and unrealized gain (loss) |

78,913,515 |

||||||

|

Net increase in net assets resulting from operations |

$ |

77,630,102 |

|||||

The accompanying notes are an integral part of these financial statements.

16

H&Q LIFE SCIENCES INVESTORS

STATEMENTS OF CHANGES IN NET ASSETS

|

Year ended September 30, 2012 |

Year ended September 30, 2011 |

||||||||||

|

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS: |

|||||||||||

|

Net investment loss |

($ |

1,283,413 |

) |

($ |

3,801,035 |

) |

|||||

|

Net realized gain |

23,573,839 |

32,456,390 |

|||||||||

|

Change in net unrealized appreciation |

55,339,676 |

8,811,693 |

|||||||||

|

Net increase in net assets resulting from operations |

77,630,102 |

37,467,048 |

|||||||||

|

DISTRIBUTIONS TO SHAREHOLDERS FROM: |

|||||||||||

|

Net realized capital gains |

(20,969,603 |

) |

(20,290,994 |

) |

|||||||

|

Total distributions |

(20,969,603 |

) |

(20,290,994 |

) |

|||||||

|

CAPITAL SHARE TRANSACTIONS: |

|||||||||||

|

Fund shares repurchased (975,059 and 8,068,135 shares, respectively) (See Notes 1 and 5) |

(10,877,720 |

) |

(107,138,775 |

) |

|||||||

|

Reinvestment of distributions (825,270 and 804,408 shares, respectively) |

10,742,341 |

9,089,235 |

|||||||||

|

Total capital share transactions |

(135,379 |

) |

(98,049,540 |

) |

|||||||

|

Net increase (decrease) in net assets |

56,525,120 |

(80,873,486 |

) |

||||||||

|

NET ASSETS: |

|||||||||||

|

Beginning of year |

170,555,033 |

251,428,519 |

|||||||||

|

End of year |

$ |

227,080,153 |

$ |

170,555,033 |

|||||||

The accompanying notes are an integral part of these financial statements.

17

H&Q LIFE SCIENCES INVESTORS

STATEMENT OF CASH FLOWS

YEAR ENDED SEPTEMBER 30, 2012

|

CASH FLOWS FROM OPERATING ACTIVITIES: |

|||||||

|

Purchases of portfolio securities |

$ |

(150,282,299 |

) |

||||

|

Purchases to close option contracts written |

(32,115 |

) |

|||||

|

Net maturities of short-term investments |

787,433 |

||||||

|

Sales of portfolio securities |

172,349,737 |

||||||

|

Proceeds from option contracts written |

29,921 |

||||||

|

Interest income received |

898 |

||||||

|

Dividend income received |

2,118,348 |

||||||

|

Other operating receipts (expenses paid) |

(3,866,824 |

) |

|||||

|

Net cash provided from operating activities |

21,105,099 |

||||||

|

CASH FLOWS FROM FINANCING ACTIVITIES: |

|||||||

|

Cash distributions paid |

(10,227,262 |

) |

|||||

|

Fund shares repurchased |

(10,877,720 |

) |

|||||

|

Net cash used for financing activities |

(21,104,982 |

) |

|||||

|

NET INCREASE IN CASH |

117 |

||||||

|

CASH AT BEGINNING OF YEAR |

572 |

||||||

|

CASH AT END OF YEAR |

$ |

689 |

|||||

|

RECONCILIATION OF NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS TO NET CASH PROVIDED FROM OPERATING ACTIVITIES: |

|||||||

|

Net increase in net assets resulting from operations |

$ |

77,630,102 |

|||||

|

Purchases of portfolio securities |

(150,282,299 |

) |

|||||

|

Purchases to close option contracts written |

(32,115 |

) |

|||||

|

Net maturities of short-term investments |

787,433 |

||||||

|

Sales of portfolio securities |

172,349,737 |

||||||

|

Proceeds from option contracts written |

29,921 |

||||||

|

Accretion of discount |

(433 |

) |

|||||

|

Net realized gain on investments and options |

(23,573,839 |

) |

|||||

|

Decrease in net unrealized appreciation (depreciation) on investments and options |

(55,339,676 |

) |

|||||

|

Increase in dividends and interest receivable |

(24,826 |

) |

|||||

|

Increase in accrued expenses |

36,637 |

||||||

|

Increase in prepaid expenses and other assets |

(475,543 |

) |

|||||

|

Net cash provided from operating activities |

$ |

21,105,099 |

|||||

Noncash financing activities not included herein consist of reinvested distributions to shareholders of $10,742,341.

The accompanying notes are an integral part of these financial statements.

18

H&Q LIFE SCIENCES INVESTORS

FINANCIAL HIGHLIGHTS

|

For the years ended September 30, |

|||||||||||||||||||||||

|

2012 |

2011 |

2010 |

2009 |

2008 |

|||||||||||||||||||

|

OPERATING PERFORMANCE FOR A SHARE OUTSTANDING THROUGHOUT EACH YEAR |

|||||||||||||||||||||||

|

Net asset value per share, Beginning of year |

$ |

11.70 |

$ |

11.51 |

$ |

11.32 |

$ |

13.18 |

$ |

15.34 |

|||||||||||||

|

Net investment loss (1) |

(0.09 |

)(2) |

(0.19 |

)(3) |

(0.09 |

)(4) |

(0.15 |

) |

(0.14 |

) |

|||||||||||||

|

Net realized and unrealized gain (loss) |

5.54 |

1.26 |

0.53 |

(1.03 |

) |

(0.87 |

) |

||||||||||||||||

|

Total increase (decrease) from investment operations |

5.45 |

1.07 |

0.44 |

(1.18 |

) |

(1.01 |

) |

||||||||||||||||

|

Distributions to shareholders from: |

|||||||||||||||||||||||

|

Net realized capital gains |

(1.49 |

) |

(1.01 |

) |

(0.29 |

) |

(0.10 |

) |

(1.15 |

) |

|||||||||||||

|

Return of capital (tax basis) |

— |

— |

— |

(0.58 |

) |

— |

|||||||||||||||||

|

Total distributions |

(1.49 |

) |

(1.01 |

) |

(0.29 |

) |

(0.68 |

) |

(1.15 |

) |

|||||||||||||

|

Increase resulting from shares repurchased (1) |

0.08 |

0.13 |

0.04 |

— |

— |

||||||||||||||||||

|

Net asset value per share, End of year |

$ |

15.74 |

$ |

11.70 |

$ |

11.51 |

$ |

11.32 |

$ |

13.18 |

|||||||||||||

|

Per share market value, End of year |

$ |

15.39 |

$ |

10.46 |

$ |

9.59 |

$ |

9.23 |

$ |

10.62 |

|||||||||||||

|

Total investment return at market value |

64.66 |

% |

19.15 |

% |

7.05 |

% |

(5.56 |

%) |

(13.52 |

%) |

|||||||||||||

|

RATIOS |

|||||||||||||||||||||||

|

Expenses to average net assets |

1.72 |

% |

1.77 |

% |

1.52 |

% |

1.58 |

% |

1.56 |

% |

|||||||||||||

|

Net investment loss to average net assets |

(0.64 |

%)(2) |

(1.54 |

%)(3) |

(0.79 |

%)(4) |

(1.38 |

%) |

(0.99 |

%) |

|||||||||||||

|

SUPPLEMENTAL DATA |

|||||||||||||||||||||||

|

Net assets, end of year (in millions) |

$ |

227 |

$ |

171 |

$ |

251 |

$ |

249 |

$ |

278 |

|||||||||||||

|

Portfolio turnover rate |

77.70 |

% |

93.57 |

% |

57.45 |

% |

82.88 |

% |

73.89 |

% |

|||||||||||||

(1) Computed using average shares outstanding.

(2) Includes special dividends from three issuers in the aggregate amount of $0.13 per share. Excluding the special dividends, the ratio of net investment loss to average net assets would have been (1.58%).

(3) Includes a special dividend from an issuer in the amount of $0.02 per share. Excluding the special dividend, the ratio of net investment loss to average net assets would have been (1.66%).

(4) Includes a special dividend from an issuer in the amount of $0.06 per share. Excluding the special dividend, the ratio of net investment loss to average net assets would have been (1.28%).

The accompanying notes are an integral part of these financial statements.

19

H&Q LIFE SCIENCES INVESTORS

NOTES TO FINANCIAL STATEMENTS

SEPTEMBER 30, 2012

(1) Organization and Significant Accounting Policies

H&Q Life Sciences Investors (the Fund) is a Massachusetts business trust registered under the Investment Company Act of 1940 as a diversified closed-end management investment company. The Fund's investment objective is long-term capital appreciation through investment in companies in the life sciences industry (including biotechnology, pharmaceutical, diagnostics, managed healthcare and medical equipment, hospitals, healthcare information technology and services, devices and supplies), agriculture and environmental management. The Fund invests primarily in securities of public and private companies that are believed by the Fund's Investment Adviser, Tekla Capital Management LLC (formerly Hambrecht & Quist Capital Management LLC) (the Adviser), to have significant potential for above-average growth. Effective June 25th 2012, Hambrecht & Quist Capital Management LLC changed its name to Tekla Capital Management LLC.

The preparation of these financial statements requires the use of certain estimates by management in determining the Fund's assets, liabilities, revenues and expenses. Actual results could differ from these estimates and such differences could be material. The following is a summary of significant accounting policies followed by the Fund, which are in conformity with accounting principles generally accepted in the United States of America ("GAAP"). Events or transactions occurring after September 30, 2012, through the date that the financial statements were issued, have been evaluated in the preparation of these financial statements.

Investment Valuation

Shares of publicly traded companies listed on national securities exchanges or trading in the over-the-counter market are typically valued at the last sale price, as of the close of trading, generally 4 p.m., Eastern time. The Board of Trustees of the Fund (the "Trustees") have established and approved fair valuation policies and procedures with respect to securities for which quoted prices may not be available or which do not reflect fair value. Shares of publicly traded companies for which market quotations are not readily available, such as stocks for which trading has been halted or for which there are no current day sales, or whose quoted price may otherwise not reflect fair value, are valued in good faith by the Adviser using a fair value process pursuant to policies and procedures approved by the Trustees described below. Restricted securities of companies that are publicly traded are typically valued based on the closing market quote on the valuation date adjusted for the impact of the restriction as determined in good faith by the Adviser also using fair valuation policies and procedures approved by the Trustees described below. Non-exchange traded warrants of publicly traded companies are typically valued using the Black-Scholes model, which incorporates both observable and unobservable inputs. Short-term investments with a maturity of 60 days or less are valued at amortized cost, which approximates fair value.

Convertible preferred shares, warrants or convertible note interests in private companies, milestone interests, other restricted securities, as well as shares of publicly traded companies for which market quotations are not available or which do not reflect fair value, are typically valued in good faith, based upon the recommendations made by the Adviser pursuant to fair valuation policies and procedures approved by the Trustees. The Adviser has a Valuation Sub-Committee comprised of senior management which reports to the Valuation Committee of the Board at least quarterly. Each fair value determination is based on a consideration of relevant factors, including both observable and unobservable inputs. Observable and

20

H&Q LIFE SCIENCES INVESTORS

NOTES TO FINANCIAL STATEMENTS

SEPTEMBER 30, 2012

(continued)

unobservable inputs the Adviser considers may include (i) the existence of any contractual restrictions on the disposition of securities; (ii) information obtained from the company, which may include an analysis of the company's financial statements, the company's products or intended markets or the company's technologies; (iii) the price of the same or similar security negotiated at arm's length in an issuer's completed subsequent round of financing; (iv) the price and extent of public trading in similar securities of the issuer or of comparable companies; or (v) a probability and time value adjusted analysis of contractual term. Where appropriate, multiple valuation methodologies are applied to confirm fair value. Significant unobservable inputs identified by the Adviser are often used in the fair value determination. A significant change in any of these inputs may result in a significant change in the fair value measurement. Due to the uncertainty inherent in the valuation process, such estimates of fair value may differ significantly from the values that would have been used had a ready market for the investments existed, and differences could be material. Additionally, changes in the market environment and other events that may occur over the life of the investments may cause the gains or losses ultimately realized on these investments to be different from the valuations used at the date of these financial statements.

Options on Securities

An option contract is a contract in which the writer (seller) of the option grants the buyer of the option, upon payment of a premium, the right to purchase from (call option) or sell to (put option) the writer a designated instrument at a specified price within a specified period of time. Certain options, including options on indices, will require cash settlement by the Fund if the option is exercised. The Fund may enter into option contracts in order to hedge against potential adverse price movements in the value of portfolio assets, as a temporary substitute for selling selected investments to lock in the purchase price of a security or currency which it expects to purchase in the near future as a temporary substitute for purchasing selected investments, or to enhance potential gain.

The Fund's obligation under an exchange traded written option or investment in an exchange-traded purchased option is valued at the last sale price or in the absence of a sale, the mean between the closing bid and asked prices. Gain or loss is recognized when the option contract expires, is exercised or is closed.

If the Fund writes a covered call option, the Fund foregoes, in exchange for the premium, the opportunity to profit during the option period from an increase in the market value of the underlying security above the exercise price. If the Fund writes a put option it accepts the risk of a decline in the market value of the underlying security below the exercise price. Over-the-counter options have the risk of the potential inability of counterparties to meet the terms of their contracts. The Fund's maximum exposure to purchased options is limited to the premium initially paid. In addition, certain risks may arise upon entering into option contracts including the risk that an illiquid secondary market will limit the Fund's ability to close out an option contract prior to the expiration date and that a change in the value of the option contract may not correlate exactly with changes in the value of the securities or currencies hedged.

All options on securities and securities indices written by the Fund are required to be covered. When the Fund writes a call option, this means that during the life of the option the Fund may own or have the contractual right to acquire the securities subject to the option or may maintain with the Fund's custodian in a segregated account appropriate liquid securities in an

21

H&Q LIFE SCIENCES INVESTORS

NOTES TO FINANCIAL STATEMENTS

SEPTEMBER 30, 2012

(continued)

amount at least equal to the market value of the securities underlying the option. When the Fund writes a put option, this means that the Fund will maintain with the Fund's custodian in a segregated account appropriate liquid securities in an amount at least equal to the exercise price of the option. The Fund may use option contracts to gain or hedge exposure to financial market risk.

Transactions in call options written for the year ended September 30, 2012 were as follows:

|

Contracts |

Premiums |

||||||||||

|

Options outstanding, September 30, 2011 |

194 |

$ |

43,073 |

||||||||

|

Options written |

372 |

29,921 |

|||||||||

|

Options terminated in closing purchase transactions |

(194 |

) |

(43,074 |

) |

|||||||

|

Options exercised |

(261 |

) |

(18,300 |

) |

|||||||

|

Options expired |

(111 |

) |

(11,620 |

) |

|||||||

|

Options outstanding, September 30, 2012 |

— |

$ |

— |

||||||||

|

Derivatives not accounted for as hedging instruments under ASC 815 |

Statement of Assets and Liabilities Location |

Statement of Operations Location |

|||||||||||||||||||||

|

The Fund held no open written option contracts at September 30, 2012. |

Net realized gain on investments in unaffiliated issuers |

$ |

0 |

||||||||||||||||||||

|

Net realized gain on closed or expired option contracts written |

$ |

22,579 |

|||||||||||||||||||||

|

Change in unrealized appreciation (depreciation) on investments in unaffiliated issuers |

$ |

0 |

|||||||||||||||||||||

|

Change in unrealized appreciation (depreciation) on option contracts written |

($ |

24,255 |

) |

||||||||||||||||||||

Milestone Interests

The Fund holds financial instruments which reflect the current value of future milestone payments the Fund may receive as a result of contractual obligations from other parties. The value of such payments are adjusted to reflect the estimated risk with the relative uncertainty of both the timing and the achievement of individual milestones. A risk to the Fund is that the milestones will not be achieved and no payment will be received by the Fund. The milestone interests were received as part of the proceeds from the sale of three private companies. Any payments received are treated as a reduction of the cost basis of the milestone interest with payments received in excess of the cost basis treated as a realized gain. The contractual obligations with respect to the TargeGen Milestone Interest provide for payments at various stages of the development of TargeGen's principal product candidate as of the date of the sale. The contractual obligations with respect to the Interlace Medical Milestone Interest provide for two annual payments following the sale, each to be calculated as a multiple of the incremental revenue growth of the company over the prior year. The contractual obligations with respect to the Xoft Milestone Interest provide for a payment based upon the cumulative net revenue of certain of the company's products over a three-year period following the sale.

22

H&Q LIFE SCIENCES INVESTORS

NOTES TO FINANCIAL STATEMENTS

SEPTEMBER 30, 2012

(continued)

The following is a summary of the impact of the milestone interests on the financial statements as of and for the year ended September 30, 2012:

|

Statement of Assets and Liabilities, Milestone interests, at value |

$ |

6,064,335 |

|||||

|

Statement of Assets and Liabilities, Net unrealized gain on investments and milestone interests |

$ |

1,766,997 |

|||||

|

Statement of Operations, Change in unrealized appreciation (depreciation) on milestone interests |

$ |

1,061,391 |

|||||

Other Assets

Other assets in the Statement of Assets and Liabilities consists of amounts due to the Fund at various times in the future in connection with the sale of investments in five private companies.

Investment Transactions and Income

Investment transactions are recorded on a trade date basis. Gains and losses from sales of investments are recorded using the "identified cost" method. Interest income is recorded on the accrual basis, adjusted for amortization of premiums and accretion of discounts. Dividend income is recorded on the ex-dividend date, less any foreign taxes withheld. Upon notification from issuers, some of the dividend income received may be redesignated as a reduction of cost of the related investment.

The aggregate cost of purchases and proceeds from sales of investment securities (other than short-term investments) for the year ended September 30, 2012 totaled $148,878,043 and $169,098,948, respectively.

Repurchase Agreements

In managing short-term investments the Fund may from time to time enter into transactions in repurchase agreements. In a repurchase agreement, the Fund's custodian takes possession of the underlying collateral securities from the counterparty, the market value of which is at least equal to the principal, including accrued interest, of the repurchase transaction at all times. In the event of default or bankruptcy by the other party to the agreement, realization and/or retention of the collateral by the Fund may be delayed.

Distribution Policy

Pursuant to a Securities and Exchange Commission exemptive order, the Fund has implemented a fixed distribution policy (the Policy) that permits the Fund to make quarterly distributions at a rate set by the Board of Trustees. Under the current Policy, the Fund intends to make quarterly distributions at a rate of 2% of the Fund's net assets to shareholders of record. The Fund intends to use net realized capital gains when making quarterly distributions, if available, but the Policy would result in a return of capital to shareholders if the amount of the distribution exceeds the Fund's net investment income and realized capital gains. If taxable income and net long-term realized gains exceed the amount required to be distributed under the Policy, the Fund will at a minimum make distributions necessary to comply with the requirements of the Internal Revenue Code. Previously, for the period April 5, 2010 to November 1, 2010, the Fund had made quarterly distributions at a rate of 1.25% of the Fund's net assets. The Trustees suspended the Policy on August 4, 2009 and reinstated the Policy on April 5, 2010. Prior to August 4, 2009, the Fund made quarterly distributions at a rate of 2% of the Fund's net assets. The Policy has been established by the Board of Trustees and may be changed by them without shareholder approval. The Trustees regularly review the Policy and

23

H&Q LIFE SCIENCES INVESTORS

NOTES TO FINANCIAL STATEMENTS

SEPTEMBER 30, 2012

(continued)

the distribution rate considering the purpose and effect of the Policy, the financial market environment, and the Fund's income, capital gains and capital available to pay distributions.

The Fund's policy is to declare distributions in stock. The distributions are automatically paid in newly-issued full shares of the Fund unless otherwise instructed by the shareholder. Fractional shares will generally be settled in cash, except for registered shareholders with book entry accounts of the Fund's transfer agent who will have whole and fractional shares added to their accounts. The Fund's transfer agent delivers an election card and instructions to each registered shareholder in connection with each distribution. The number of shares issued will be determined by dividing the dollar amount of the distribution by the lower of net asset value or market price on the pricing date. If a shareholder elects to receive a distribution in cash, rather than in shares, the shareholder's relative ownership in the Fund will be reduced. The shares reinvested will be valued at the lower of the net asset value or market price on the pricing date. Distributions in stock will not relieve shareholders of any federal, state or local income taxes that may be payable on such distributions.

Share Repurchase Program

In March 2012, the Trustees approved the renewal of the repurchase program to allow the Fund to repurchase up to 12% of its outstanding shares in the open market for a one year period beginning July 11, 2012. Prior to this renewal, in June 2011, the Trustees authorized a share repurchase program to allow the Fund to repurchase up to 12% of its outstanding shares for a one year period beginning July 11, 2011. The share repurchase program is intended to enhance shareholder value and potentially reduce the discount between the market price of the Fund's shares and the Fund's net asset value.

During the year ended September 30, 2012, the Fund repurchased 975,059 shares at a total cost of $10,877,720. The weighted average discount per share between the cost of repurchase and the net asset value applicable to such shares at the date of repurchase was 9.85%.

During the year ended September 30, 2011, the Fund repurchased 271,823 shares at a total cost of $2,923,913. The weighted average discount per share between the cost of repurchase and the net asset value applicable to such shares at the date of repurchase was 10.40%. The Fund also repurchased shares during the year under a tender offer. See Note 5.

Federal Taxes

It is the Fund's policy to comply with the requirements of the Internal Revenue Code applicable to regulated investment companies and to distribute to its shareholders substantially all of its taxable income and its net realized capital gains, if any. Therefore, no Federal income or excise tax provision is required.

As of September 30, 2012, the Fund had no uncertain tax positions that would require financial statement recognition or disclosure. The Fund's federal tax returns are subject to examination by the Internal Revenue Service for a period of three years.

Distributions

The Fund records all distributions to shareholders on the ex-dividend date. Such distributions are determined in conformity with income tax regulations, which may differ from GAAP. These differences include temporary and permanent differences from losses on wash sale transactions,

24

H&Q LIFE SCIENCES INVESTORS

NOTES TO FINANCIAL STATEMENTS

SEPTEMBER 30, 2012

(continued)

installment sale adjustments and ordinary loss netting to reduce short term capital gains. Reclassifications are made to the Fund's capital accounts to reflect income and gains available for distribution under income tax regulations. At September 30, 2012, the Fund reclassified $1,283,413 from accumulated net realized gain on investment to undistributed net investment loss for current period book/tax differences.

The tax basis components of distributable earnings and the tax cost as of September 30, 2012 were as follows:

|

Cost of investments for tax purposes |

$ |

185,533,445 |

|||||

|

Gross tax unrealized appreciation |

$ |

62,698,847 |

|||||

|

Gross tax unrealized depreciation |

($ |

22,189,428 |

) |

||||

|

Net tax unrealized depreciation on investments |

$ |

40,509,419 |

|||||

|

Undistributed long-term capital gains |

$ |

12,461,369 |

|||||

|

Undistributed ordinary income |

$ |

348,494 |

|||||

The Fund has designated the distributions for its taxable years ended September 30, 2012 and 2011 as follows:

|

Distributions paid from: |

2012 |

2011 |

|||||||||

|

Ordinary income (includes short-term capital gains) |

$ |

12,024,766 |

$ |

11,722,298 |

|||||||

|

Long-term capital gain |

$ |

8,944,837 |

$ |

8,568,696 |

|||||||

Statement of Cash Flows

The cash amount shown in the Statement of Cash Flows is the amount included in the Fund's Statement of Assets and Liabilities and represents cash on hand at September 30, 2012.

Indemnifications

Under the Fund's organizational documents, its officers and Trustees may be indemnified against certain liabilities and expenses arising out of the performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into agreements with service providers that may contain indemnification clauses. The Fund's maximum exposure under these agreements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on experience, the Fund expects the risk of loss to be remote.

(2) Investment Advisory and Other Affiliated Fees

The Fund has entered into an Investment Advisory Agreement (the Advisory Agreement) with the Adviser. Pursuant to the terms of the Advisory Agreement, the Fund pays the Adviser a monthly fee at the rate when annualized of (i) 2.50% of the average net assets for the month of its venture capital and other restricted securities up to 25% of net assets and (ii) for all other net assets, 0.98% of the average net assets up to $250 million, 0.88% of the average net assets for the next $250 million, 0.80% of the average net assets for the next $500 million and 0.70% of the average net assets thereafter. The aggregate fee would not exceed a rate when annualized of 1.36%.

The Fund has entered into a Services Agreement (the Agreement) with the Adviser. Pursuant to the terms of the Agreement, the Fund reimburses the Adviser for certain services related to a portion of the payment of salary and provision of benefits to the Fund's Chief Compliance Officer. During the year ended September 30, 2012 these payments amounted to $49,175 and

25

H&Q LIFE SCIENCES INVESTORS

NOTES TO FINANCIAL STATEMENTS

SEPTEMBER 30, 2012

(continued)

are included in the other category in the Statement of Operations, together with insurance and other expenses incurred to unaffiliated entities. Expenses incurred pursuant to the Agreement as well as certain expenses paid for by the Adviser are allocated to the Fund in an equitable fashion as approved by the Trustees of the Fund.

The Fund pays compensation to Independent Trustees in the form of a retainer, attendance fees, and additional compensation to Board and Committee chairpersons. The Fund does not pay compensation directly to Trustees or officers of the Fund who are also officers of the Adviser.

(3) Other Transactions with Affiliates

An affiliate company is a company in which the Fund holds 5% or more of the voting securities. Transactions with such companies during the year ended September 30, 2012 were as follows:

|

Issuer |

Value on September 30, 2011 |

Purchases |

Sales |

Income |

Value on September 30, 2012 |

||||||||||||||||||

|

Agilix Corporation |

$ |

2,635 |

$ |

2,644 |

— |

||||||||||||||||||

|

Concentric Medical, Inc. |

6,792,332 |

6,778,583 |

— |

||||||||||||||||||||

|

EBI Life Sciences, Inc. |

— |

$ |

44,395 |

30,798 |

$ |

11,303 |

|||||||||||||||||

|

Euthymics Biosciences, Inc. |

1,967,757 |

591,492 |

197,425 |

2,606,189 |

|||||||||||||||||||

|

IntelliPharmaCeutics International, Inc. |

2,785,458 |

197,798 |

— |

2,505,018 |

|||||||||||||||||||

|

MZT Holdings, Inc. |

45,630 |

— |

— |

— |

|||||||||||||||||||

|

Neurovance, Inc. |

— |

206,971 |

4,343 |