Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2013

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

COMMISSION FILE NUMBER 0-19871

STEMCELLS, INC.

(Exact name of Registrant as specified in its charter)

| A Delaware Corporation | 94-3078125 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 7707 GATEWAY BLVD NEWARK, CA |

94560 | |

| (Address of principal offices) | (zip code) | |

Registrant’s telephone number, including area code:

(510) 456-4000

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

Name of Each Exchange on Which Registered | |

| Common Stock, $0.01 par value | NASDAQ Capital Market |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | x | |||

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

Aggregate market value of common stock held by non-affiliates at June 30, 2013: $66,836,311. Inclusion of shares held beneficially by any person should not be construed to indicate that such person possesses the power, direct or indirect, to direct or cause the direction of management policies of the registrant, or that such person is controlled by or under common control with the Registrant.

Common stock outstanding at March 3, 2014: 55,419,116 shares.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive Proxy Statement relating to the registrant’s 2014 Annual Meeting of Stockholders to be filed with the Commission pursuant to Regulation 14A are incorporated by reference in Part III of this report.

Table of Contents

FORWARD LOOKING STATEMENTS

THIS REPORT CONTAINS FORWARD-LOOKING STATEMENTS AS DEFINED UNDER THE FEDERAL SECURITIES LAWS. ACTUAL RESULTS COULD VARY MATERIALLY. FACTORS THAT COULD CAUSE ACTUAL RESULTS TO VARY MATERIALLY ARE DESCRIBED HEREIN AND IN OTHER DOCUMENTS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION. READERS SHOULD PAY PARTICULAR ATTENTION TO THE CONSIDERATIONS DESCRIBED IN THE SECTION OF THIS REPORT ENTITLED “MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS” AS WELL AS ITEM 1A UNDER THE HEADING “RISK FACTORS.” FORWARD-LOOKING STATEMENTS SPEAK ONLY AS OF THE DATE OF THIS REPORT. WE DO NOT UNDERTAKE ANY OBLIGATION TO PUBLICLY UPDATE ANY FORWARD-LOOKING STATEMENTS.

2

Table of Contents

| Page | ||||||

| PART I | ||||||

| Item 1. |

4 | |||||

| Item 1A. |

27 | |||||

| Item 1B. |

38 | |||||

| Item 2. |

38 | |||||

| Item 3. |

39 | |||||

| Item 4. |

39 | |||||

| PART II | ||||||

| Item 5. |

40 | |||||

| Item 6. |

42 | |||||

| Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

43 | ||||

| Item 7A. |

60 | |||||

| Item 8. |

61 | |||||

| Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

97 | ||||

| Item 9A. |

97 | |||||

| Item 9B. |

99 | |||||

| PART III | ||||||

| Item 10. |

99 | |||||

| Item 11. |

101 | |||||

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

101 | ||||

| Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

101 | ||||

| Item 14. |

101 | |||||

| PART IV | ||||||

| Item 15. |

102 | |||||

NOTE REGARDING REFERENCES TO OUR COMMON STOCK

Throughout this Form 10-K, the words “we,” “us,” “our,” and “StemCells” refer to StemCells, Inc., including our directly and indirectly wholly-owned subsidiaries. “Common stock” refers to the common stock of StemCells, Inc., $0.01 par value.

3

Table of Contents

PART I

| Item 1. | BUSINESS |

Overview

StemCells, Inc. is engaged in the research, development, and commercialization of stem cell therapeutics and related tools and technologies for academia and industry. We believe that understanding cells and cell biology, and in particular stem cells, will play an increasingly important role in the understanding of human diseases and in the discovery of new medical therapies. Consequently, we are focused on developing and commercializing (i) stem and progenitor cells as the basis for novel therapeutics and therapies, and (ii) cells and related tools and technologies to enable stem cell-based research and drug discovery and development.

Our primary research and development efforts are focused on identifying and developing stem and progenitor cells as potential therapeutic agents. Our lead product development program is our CNS Program, in which we are developing applications for HuCNS-SC® cells, our proprietary human neural platform technology. We estimate that degenerative conditions of the central nervous system (CNS) currently affect more than 30 million people in the United States1.

We are currently in clinical development with our HuCNS-SC cells for a range of diseases and disorders of the central nervous system. The CNS consists of the brain, spinal cord and eye, and we are currently the only stem cell company in clinical development for indications in all three organs comprising the CNS, specifically:

| (i) | with respect to the brain, |

| • | in October 2012, we published in Science Translational Medicine, a peer-reviewed journal, the data from our Phase I clinical trial in Pelizeaus-Merzbacher Disease (PMD), a fatal myelination disorder in the brain. The data showed preliminary evidence of progressive and durable donor cell-derived myelination in all four patients transplanted with HuCNS-SC cells. Three of the four patients showed modest gains in neurological function; the fourth patient remained stable; |

| • | we have completed a Phase I clinical trial in infantile and late infantile neuronal ceroid lipofuscinosis (NCL, also known as Batten disease), which is a neurodegenerative disorder of the brain. The data from that trial showed that our HuCNS-SC cells were well tolerated, non-tumorigenic, and there was evidence of engraftment and long-term survival of the transplanted HuCNS-SC cells; and |

| • | we are also conducting preclinical studies of our HuCNS-SC cells in Alzheimer’s disease; |

| (ii) | with respect to the spinal cord, we are conducting a Phase I/II clinical trial of our HuCNS-SC cells for the treatment of chronic spinal cord injury. To accelerate the trial, we have expanded this trial from a single-site, single-country study to a multi-site, multi-country program. This trial is being conducted in Switzerland, Canada and the United States. Data from the first three patients demonstrated a favorable safety profile and multi-segment gains in sensory function in two of the three patients 12 months after transplantation of HuCNS-SC cells compared to pre-transplant baselines; the third patient remained stable. As of February 2014, a total of eleven patients have been dosed with our HuCNS-SC cells in this trial and we expect to complete enrollment of the final patient in the first quarter of 2014; |

| (iii) | with respect to the eye, in June 2012, we initiated a Phase I/II clinical trial for dry age-related macular degeneration (AMD), the most common form of AMD, with the first patient enrolled and dosed in |

| 1 | This estimate is based on information from the Alzheimer’s Association, the Alzheimer’s Disease Education & Referral Center (National Institute on Aging), the National Parkinson Foundation, the National Institutes of Health’s National Institute on Neurological Disorders and Stroke, the Foundation for Spinal Cord Injury Prevention, Care & Cure, the Travis Roy Foundation, the Centers for Disease Control and Prevention, the Wisconsin Chapter of the Huntington’s Disease Society of America, and the Cincinnati Children’s Hospital Medical Center. |

4

Table of Contents

| October 2012. This trial is being conducted at three sites in the United States, and as of February 2014, we completed enrollment of the first of two planned patient cohorts with our HuCNS-SC cells. This cohort consisted of eight subjects, four of whom each received 200,000 cells and four of whom each received 1,000,000 cells. We expect to complete enrollment of the second cohort consisting of eight patients by the end of the second quarter of 2014. |

In our tools and technologies programs, we are engaged in developing and commercializing applications of our technologies to enable stem cell-based research. We currently market a range of proprietary cell culture products, research grade human cells, and antibody reagents under the SC Proven® brand. Our cell culture products include iSTEM®, GS1-R®, GS2-M®, RHB-A®, RHB-Basal®, NDiff227™, NDiff® N2, and NDiff N27™ supplements. Our cell lines available for research use include human neural stem cells and hFB101™, ultra primary human fibroblasts for genetic reprogramming. Our antibody reagents include STEM24™, STEM101®, STEM121®, and STEM123®, which can be used for cell detection, isolation and characterization. Academic and industrial laboratories conducting stem cell research need specialized cell culture products and reagents for the derivation, growth, maintenance, and manipulation of stem cells, as well as their detection, isolation and characterization in both in vitro and in vivo models. As this type of research continues to grow, the market for such cell culture products and reagents should also continue to expand. We are seeking to leverage our proprietary technologies, including technologies relating to embryonic stem cells, induced pluripotent stem (iPS) cells, and tissue-derived (adult) stem cells, for use in stem cell-based research. Several of the cell technologies and intellectual property related to our enabling cell technologies programs were acquired in April 2009 through our acquisition of substantially all of the operating assets and liabilities of Stem Cell Sciences Plc (SCS).

The Potential of Our Tissue-Derived Cell-Based Therapeutics

Stem cells are “building block” cells as they produce all the mature functional cell types found in normal organs. Stem cells have two defining characteristics: (i) they produce all of the mature cell types of the particular organ, and (ii) they self renew — that is, some of the cells developed from stem cells are themselves new stem cells. Progenitor cells are cells that have already developed from stem cells, but can still produce one or more mature cell types within an organ. Stem cells are rare; to date only four human stem cells have been identified and characterized in vivo: (i) the hemotopoietic stem cell, (ii) the mesenchymal stem cell, (iii) the neural stem cell, and (iv) the embryonic stem cell. Because of this self-renewal property, we believe that stem cell-based therapies may have the potential to return an impaired organ to proper function for the life of the patient.

Many degenerative diseases are caused by the loss of normal cellular function in a particular organ. When cells are damaged or destroyed, they no longer produce, metabolize or accurately regulate the many substances essential to life. There is no technology existing today that can deliver these essential substances precisely to the sites of action, under the appropriate physiological regulation, in the appropriate quantity, or for the duration required to cure the degenerative condition. Cells, however, can do all of this naturally. Transplantation of stem or progenitor cells may therefore prevent the loss of, or even generate new, functional cells and thereby potentially maintain or restore organ function and the patient’s health.

We are focused on identifying and purifying tissue-derived stem and progenitor cells for use in homologous therapy. Homologous therapy means the use of cells derived from a particular organ to treat a disease of that same organ (for example, use of brain-derived neural stem cells for treatment of CNS disorders). Tissue-derived stem cells are developmentally pre-programmed to become the mature functional cells of the organ from which they were derived. We believe that homologous use of purified, unmodified tissue-derived cells is the most direct way to provide for engraftment and differentiation into functional cells, and should minimize the risk of transplantation or growth of unwanted cell types.

We use cells derived from donated tissues, which are supplied to us in compliance with all applicable state and federal regulations. We are not involved in any activity directed toward human cloning, nor do we have any

5

Table of Contents

plans to start such activities. We are currently developing embryonic stem cells and iPS cells as potential research tools. We are not currently developing embryonic or induced pluripotent stem cells for therapeutic use.

Business Strategy

Our aim is to create a sustainable business based on our belief that understanding cells and cell biology will play an increasingly important role in life science research and in the discovery, development and implementation of new medical therapies. Our strategy has been to identify multiple types of human stem and progenitor cells with therapeutic and commercial importance, to develop techniques and processes to purify these cells for direct transplant and to expand and bank these cells. We are currently focused on advancing these cells through clinical development and into commercialized cell-based therapeutic products.

The fundamental competencies required to execute this strategy are knowledge and expertise in cell biology, particularly stem cell biology, and a commitment to rigorous and robust research and development. We believe that these competencies are critical to identifying, characterizing and understanding cells with therapeutic potential and importance.

Consequently, we have made significant investments in our research and development, clinical and regulatory, and cell processing and process development capabilities. Our management and staff have many years of experience in the stem cell field and in developing potential cell therapies. Two of the four human stem cells identified and characterized to date (the hematopoietic and neural stem cells) were discovered by scientists who are currently on our staff, and we believe we were the first company to receive authorization from the FDA to conduct a clinical trial of a purified neural stem cell product candidate, as well as the first to complete such a clinical trial. We are committed to proving that “groundbreaking science,” especially in the field of stem cell biology, has the potential to create truly “breakthrough medicine.”

Many of our core competencies in cell biology have applicability beyond the development of therapeutic products. Therefore, another element of our business strategy is to leverage these core competencies to develop non-therapeutic applications for our cell technologies, which we believe represent nearer-term commercial opportunities. As scientific and medical research increasingly focuses on stem cells and cell biology, our technologies are expected to have utility as tools to help enable this research. We currently market specialized cell culture products and antibody reagents through our SC Proven product line and are seeking to develop and commercialize applications of our technologies for use in stem cell-based research.

Further, a key element of our business strategy is to obtain patent protection for the compositions, processes and uses of multiple types of cells, as well as for those technologies that appear applicable and useful to enable cell-based research. We believe that patent protection will be available to the first to identify and isolate any of the finite number of different types of human stem and progenitor cells, and the first to define methods to culture such cells, making the commercial development of cell-based therapeutics and enabling applications financially feasible. In addition to discovering and developing technologies in-house, we have obtained from various academic and commercial institutions rights to certain inventions relating to stem and progenitor cells, cell culture media, and technologies to reprogram, isolate and manipulate cells. We expect to continue to expand our search for, and to seek to acquire rights from third parties relating to, new stem and progenitor cells and cell technologies. We have created an extensive patent estate, see “Patents, Proprietary Rights and Licenses,” below.

6

Table of Contents

Therapeutic Product Development Programs

Overview

The following table summarizes the current status of, and the anticipated initial indications for, our therapeutic product development program. A more detailed discussion of each of these follows the table.

| CNS Program |

Cell-based therapeutics to restore or preserve function to central nervous system tissue by protecting, repairing or replacing dysfunctional or damaged cells. | |

| Diseases and Disorders of the Brain |

Pelizeaus-Merzbacher Disease: | |

| • Four-patient Phase I clinical trial completed February 2012.

• Data from the Phase I trial was published in Science Translational Medicine, a peer-reviewed scientific journal, in October 2012 and showed preliminary evidence of new myelin in all four patients, and three of the four patients showed modest gains in neurological function; the fourth patient remained stable. The data also showed that the HuCNS-SC cells, the transplantation procedure, and the immunosuppression were all well tolerated.

• In August 2013, we presented data which show that, two years after transplantation of our HuCNS-SC cells into patients with PMD, the evidence of myelination, by magnetic resonance imaging (MRI), is more pronounced compared to one year post-transplantation, the gains in neurological function reported after one year were maintained, and there were no safety concerns. The neurological and MRI changes suggest a departure from the natural history of the disease and may represent signals of a clinical effect.

• Demonstrated in vivo proof of principle by showing in the myelin deficient shiverer mouse that transplanted HuCNS-SC cells can:

• generate and integrate myelin producing oligodendrocytes into the mouse brain; and

• tightly wrap the mouse nerve axons to form myelin sheath. | ||

| Neuronal Ceroid Lipofuscinosis (also known as Batten disease): | ||

| • Six-patient Phase I clinical trial completed in January 2009. Trial results showed that the HuCNS-SC cells, the transplantation procedure, and the immunosuppression were well tolerated and the cells were not tumorigenic, and that there was evidence of engraftment and survival of the transplanted cells. | ||

7

Table of Contents

| • Demonstrated in vivo proof of principle by showing in a mouse model for infantile NCL that transplanted HuCNS-SC cells can:

• continuously produce the enzyme that is deficient in infantile NCL;

• protect host neurons from death; and

• delay the loss of motor function in HuCNS-SC transplanted mice. | ||

| Alzheimer’s Disease: | ||

| • In July 2012, reported data that showed our HuCNS-SC cells can restore memory in two mouse models relevant to Alzheimer’s disease.

• Demonstrated that our HuCNS-SC cells are capable of engrafting and surviving in the hostile environment reflective of an Alzheimer’s brain, which characteristically features abnormal accumulations of brain lesions called plaques and tangles.

• In September 2012 the governing board of the California Institute of Regenerative Medicine (CIRM) approved our application for a Disease Team Therapy Development Research Award for the study of HuCNS-SC cells as a potential treatment for Alzheimer’s disease. CIRM will provide up to approximately $19.3 million as a forgivable loan, in accordance with mutually agreed upon terms and conditions and CIRM regulations. The goal of the research will be to file an Investigational New Drug application with the U.S. Food and Drug Administration within four years. | ||

| Diseases and Disorders of the Spinal Cord |

Spinal Cord Injury: | |

| • Conducting a Phase I/II clinical trial in multiple sites for chronic spinal cord injury. The trial will enroll 12 patients with thoracic (chest-level) spinal cord injury, and will include both complete and incomplete injuries as classified by the American Spinal Injury Association (ASIA) Impairment Scale.

• In February 2013, reported that the first patient cohort had completed the Phase I/II trial, and that two of the three patients in the first cohort showed multi-segment gains in sensory function; the third patient remained stable. The data also showed that the cells, the transplantation procedure, and the immunosuppression were all well tolerated. | ||

8

Table of Contents

| • We expect to complete enrollment of the final patient for this trial in the first quarter of 2014.

• We plan to initiate by the middle of 2014, a controlled Phase II efficacy study to further investigate our HuCNS-SC cells as a treatment for cervical spinal cord injury. | ||

| • Demonstrated in vivo proof of principle by showing in a mouse model for spinal cord injury that transplanted HuCNS-SC cells can:

• restore motor function in injured animals;

• directly contribute to functional recovery (and that when human cells are ablated restored function is lost); and

• become specialized oligodendrocytes and neurons. | ||

| Diseases and Disorders of the Eye |

Age-Related Macular Degeneration: | |

| • 16-patient Phase I/II clinical trial in dry AMD initiated in June 2012.

• Trial is being conducted at three sites in the United States, and as of February 2014, we completed enrollment of the first of two planned patient cohorts. This cohort consisted of eight subjects. We expect to complete enrollment of the second cohort consisting of eight subjects by the end of the second quarter of 2014.

• We plan to initiate by year-end 2014, a controlled Phase II efficacy study to further investigate our HuCNS-SC cells as a treatment for AMD. | ||

| • Demonstrated in vivo proof of principle by showing in the Royal College of Surgeons rat, a widely accepted model for retinal degeneration, that HuCNS-SC cells can:

• protect photoreceptor cells from death; and

• prevent or slow loss of vision. | ||

Many neurodegenerative diseases involve the failure of central nervous system tissue (i.e., the brain, spinal cord and eye) due to the loss of functional cells. Our CNS Program is initially focusing on developing clinical applications in which transplanting HuCNS-SC cells would protect or restore organ function of the patient before such function is irreversibly damaged or lost due to disease progression. Our initial target indications are (i) Pelizeaus-Merzbacher Disease, and more generally, diseases in which deficient myelination plays a central role, such as cerebral palsy or multiple sclerosis; (ii) spinal cord injury; (iii) Alzheimer’s disease, and (iv) disorders in which retinal degeneration plays a central role, such as age-related macular degeneration or retinitis pigmentosa. These disorders affect a significant number of people in the United States and there currently are no effective long-term therapies for them.

9

Table of Contents

Our platform technology, HuCNS-SC cells, is a purified and expanded composition of normal human neural stem cells. Alternative therapies based on cells derived from cancer cells, embryonic stem cells, iPS cells, animal-derived cells, or unpurified mixes of cell types have a significantly higher safety hurdle to overcome and while they may provide an effective therapy, technologies to remove potentially harmful cells are still being developed and tested. Furthermore, our HuCNS-SC cells can be directly transplanted, unlike embryonic stem cells or iPS cells, which require one or more prerequisite differentiation steps prior to administration in order to preclude teratoma formation (tumors of multiple differentiated cell types). It is still unclear whether cellular transplants derived from embryonic stem cells or iPS cells can avoid forming teratomas or other abnormal cellular structures due to contaminating cell types in the transplant product.

Our preclinical research has shown in vivo that HuCNS-SC cells engraft, migrate, differentiate into neurons and glial cells, and survive for as long as one year with no sign of tumor formation or adverse effects. Moreover, the HuCNS-SC cells were still producing progeny cells at the end of the test period. These findings show that our neural stem cells, when transplanted, act like normal neural stem cells, suggesting the possibility of a continual replenishment of normal human neural cells in transplant recipients. In the longer term, then, we believe stem cells have the potential to restore or replace lost cells and cellular function.

We hold a substantial portfolio of issued and allowed patents in the neural stem cell field, which cover the isolation, expansion and use of neural stem and progenitor cells, as well as the compositions of the cells themselves. See “Patents, Proprietary Rights and Licenses,” below.

Diseases and Disorders of the Brain

Pelizaeus-Merzbacher Disease (PMD).

Pelizaeus-Merzbacher disease, a rare, degenerative, central nervous system disorder, is one of a group of genetic disorders known as leukodystrophies. Leukodystrophies involve abnormal growth of the myelin sheath, which is the fatty substance that surrounds nerve fibers in the brain and spinal cord. PMD is most commonly caused by a genetic mutation that affects an important protein found in myelin, proteolipid protein. PMD is most frequently diagnosed in early childhood and is associated with abnormal eye movements, abnormal muscle function, and in some cases, seizures. The course of the disease is marked by progressive neurological deterioration resulting in premature death.

In February 2012, we completed a Phase I clinical trial in PMD. A total of four patients were transplanted with HuCNS-SC cells and were evaluated periodically over a 12-month period. The study was designed to help detect evidence of new myelin, including by magnetic resonance imaging (MRI) of the brain, changes in neuropsychological tests of development and cognitive function, and clinical changes in neurological function. The trial was conducted at the University of California, San Francisco. In October 2012, we published the results of the trial in Science Translational Medicine, a peer-reviewed journal. The clinical data from this study showed evidence of new myelin in all four patients who were transplanted with HuCNS-SC cells. In addition, three of the four patients showed modest gains in neurological function; the fourth patient remained stable. The data also showed that the cells, the transplantation procedure and the immunosuppression regimen were all well tolerated.

In our preclinical research, we have shown that HuCNS-SC cells differentiate into oligodendrocytes, the myelin producing cells, and produce myelin. We have transplanted HuCNS-SC cells into the brain of the mutant shiverer mouse, which is deficient in myelin, and shown widespread engraftment of human cells that matured into oligodendrocytes, and that the human oligodendrocytes myelinated the mouse axons.

Other Myelin Disorders.

Loss of myelin characterizes conditions such as multiple sclerosis, cerebral palsy and certain genetic disorders (for example, Krabbe’s disease and metachromatic leukodystrophy). Loss of myelin can also play a role in certain spinal cord indications. Based on our preclinical data, we believe our HuCNS-SC product candidate may have applicability to a range of myelin disorders.

10

Table of Contents

Neuronal Ceroid Lipofuscinosis (NCL; also known as Batten disease).

Neuronal ceroid lipofuscinosis, which is often referred to as Batten disease, is a neurodegenerative disease that affects infants and young children. Infantile and late infantile NCL are brought on by inherited genetic mutations which result in either a defective or missing enzyme, leading to the accumulation of cellular waste product in various neuronal cell types. This accumulation eventually interferes with normal cellular and tissue function, and leads to seizures and progressive loss of motor skills, sight and mental capacity. Today, NCL is always fatal.

In January 2009, we completed a six-patient Phase I clinical trial of our HuCNS-SC cells in infantile and late infantile NCL. We believe that this clinical trial was the first FDA-authorized trial to evaluate purified human neural stem cells as a potential therapeutic agent. The trial data demonstrated that the HuCNS-SC cells, the transplantation procedure and the immunosuppression regimen were well tolerated by all six patients, and the patients’ medical, neurological and neuropsychological conditions, following transplantation, appeared consistent with the normal course of the disease. In addition to this favorable safety profile, there was evidence of engraftment and long-term survival of the HuCNS-SC cells. This Phase I trial was conducted at OHSU Doernbecher Children’s Hospital in Oregon.

Our preclinical data demonstrate that HuCNS-SC cells, when transplanted in a mouse model of infantile NCL, engraft, migrate throughout the brain, produce the relevant missing enzyme, measurably reduce the toxic storage material in the brain, protect host neurons so that more of them survive, and delay the loss of motor function compared to a control group of non-transplanted mice. A summary of this data was published in September 2009 in the peer-reviewed journal Cell Stem Cell. We have also demonstrated in vitro that HuCNS-SC cells produce the enzyme that is deficient in late infantile NCL.

Alzheimer’s Disease.

Alzheimer’s disease is a progressive, fatal neurodegenerative disorder that results in loss of memory and cognitive function. Today, there is no cure or effective treatment option. According to the Alzheimer’s Association, an estimated 5.2 million Americans have Alzheimer’s disease, including nearly 5 million people aged 65 and older. The prevalence of Alzheimer’s disease is expected to increase rapidly as a result of our aging population.

In July 2012, we reported data that showed that our HuCNS-SC cells restored memory and enhanced synaptic function in two animal models relevant to Alzheimer’s disease. This research was a result of a collaboration we entered into with a world renowned leader in Alzheimer’s disease research at the University of California, Irvine (UCI) to study the therapeutic potential of our HuCNS-SC cells in Alzheimer’s disease. Our collaborator’s published research had shown that mouse neural stem cells enhance memory in a mouse model of Alzheimer’s disease, and the goal of the collaboration was to replicate these results using our human neural stem cells.

Previously, we conducted studies of our HuCNS-SC cells in another model of Alzheimer’s disease as part of a collaboration with researchers at the McLaughlin Research Institute. This research, which was funded by a National Institutes of Health (NIH) grant, demonstrated that our HuCNS-SC cells are capable of engrafting and surviving in the hostile environment reflective of an Alzheimer’s brain, which characteristically features abnormal accumulations of brain lesions called plaques and tangles.

In September 2012, the governing board of the California Institute of Regenerative Medicine (CIRM) approved our application for a Disease Team Therapy Development Research Award for the study of HuCNS-SC cells as a potential treatment for Alzheimer’s disease. We committed to filing an IND by mid-2017, however, we are diligently exploring ways to accelerate this milestone and currently anticipate filing by mid-2016. In accordance with the award, in April 2013, we entered into an agreement with the California Institute for

11

Table of Contents

Regenerative Medicine (CIRM) under which CIRM will provide up to approximately $19.3 million as a forgivable loan, in accordance with mutually agreed upon terms and conditions and CIRM regulations. We received, under the CIRM Loan Agreement, an initial disbursement of $3.8 million in July 2013 and a subsequent disbursement of $3.8 million in January 2014.

Diseases and Disorders of the Spinal Cord

According to a study initiated by the Christopher and Dana Reeve Foundation, an estimated 1.3 million people in the United States are living with chronic spinal cord injury. There are no therapies today that can address the paralysis or loss of function caused by a spinal cord injury, but neural stem cells may have the potential to provide a novel therapeutic approach.

We are conducting a Phase I/II clinical trial to evaluate our HuCNS-SC cells as a treatment for chronic spinal cord injury. The trial was initiated at University Hospital Balgrist in Zurich and was authorized by Swissmedic, the regulatory agency for therapeutic products in Switzerland. A total of twelve patients are expected to enroll in the study, all of whom will be three to twelve months post-injury. The study will follow a progressive study design, beginning with patients with complete injuries and then enrolling patients with incomplete injuries, all as classified by the American Spinal Injury Association Impairment Scale (AIS). In addition to assessing safety, the trial will evaluate preliminary efficacy using defined clinical endpoints, such as changes in sensation, motor function, and bowel/bladder function. In February 2013, we reported that the first patient cohort, all of whom had complete injuries classified as AIS A, had completed the trial, and that data from this first cohort showed that two of the three patients showed multi-segment gains in sensory function compared to pre-transplant baseline. The gains in sensory function were first observed at the six month assessment and persisted to the 12 month assessment. The third patient remained stable. To accelerate patient enrollment, we have expanded the trial from a single-site, single-country study to a multi-site, multi-country program. The trial is currently being conducted in Switzerland, Canada and the United States. As of February 2014, a total of eleven patients have been dosed with our HuCNS-SC cells in this trial and we expect to complete enrollment of the final patient in the first quarter of 2014.

The results of numerous preclinical studies demonstrate the therapeutic potential of our human neural stem cells for the treatment of spinal cord injury. Using a mouse model of spinal cord injury, our collaborators at the Reeve-Irvine Research Center at the University of California, Irvine have shown that our HuCNS-SC cells have the potential to protect and regenerate damaged nerves and nerve fibers, and that injured mice transplanted with our HuCNS-SC cells showed improved motor function compared to control animals. Inspection of the spinal cords from the treated mice showed significant levels of human neural cells derived from the transplanted stem cells. Some of these cells were oligodendrocytes, the specialized neural cell that forms the myelin sheath around axons, while others had become neurons and showed evidence of synapse formation, a requirement for proper neuronal function. The researchers then selectively ablated the human cells, and found that the functional improvement was lost, thus demonstrating that the human cells had played a direct role in the functional recovery of the transplanted mice. Moreover, our preclinical studies show that our human neural stem cells enable a significant and persistent recovery of motor function when transplanted in spinal cord-injured mice at both sub-acute and chronic injury time points.

In July 2012, the governing board of CIRM approved our application for a Disease Team Therapy Development Research Award for the study of HuCNS-SC cells as a potential treatment for cervical spinal cord injury. Under this disease team program, CIRM would have provided up to $20 million in the form of a forgivable loan. However, in March 2013, we elected not to borrow these funds from CIRM.

Diseases and Disorders of the Eye

The retina is a thin layer of neural cells that lines the back of the eye and is responsible for converting external light into neural signals. A loss of function in retinal cells leads to impairment or loss of vision. The

12

Table of Contents

most common forms of retinal degeneration are age-related macular degeneration (AMD) and retinitis pigmentosa. AMD is the leading cause of vision loss and blindness in people over the age of 55 and afflicts some 30 million people worldwide.

In June 2012, we initiated a Phase I/II clinical trial in dry age-related macular degeneration, the more common form of AMD, and in October 2012, the first patient was enrolled and dosed with HuCNS-SC cells. The trial, which was authorized by the FDA in January 2012, is expected to enroll a total of 16 patients and will evaluate the safety and preliminary efficacy of our HuCNS-SC cells as a treatment for dry AMD. Patients’ vision will be evaluated using conventional methods of ophthalmological assessment at predetermined intervals over a one-year period. This trial is being conducted at three sites in the United States, and as of February 2014, we completed enrollment of the first of two planned patient cohorts. We expect to complete enrollment of the second cohort consisting of eight patients by the end of the second quarter of 2014.

Our preclinical data have shown that our HuCNS-SC cells, when transplanted in a well-established animal model of retinal degeneration, engraft long-term, can protect photoreceptors (the key cells involved in vision) from progressive degeneration, and can slow or prevent loss of visual function. In this model, called the Royal College of Surgeons (RCS) rat, a genetic mutation causes dysfunction of the retinal pigmented cells, which leads to progressive loss of the photoreceptors and ultimately, loss of visual function in the rat. Our preclinical data shows that our human neural stem cells protect both rod and cone photoreceptors in the eye from progressive degeneration and preserve visual function long term. The cone photoreceptors are light sensing cells that are highly concentrated within the macula of the human eye, and the ability to protect these cells suggests a promising approach to treating AMD. A summary of our preclinical data was featured as the cover article in February 2012 edition of the international peer-reviewed European Journal of Neuroscience.

Other CNS Collaborations.

We have collaborated on a number of research programs to assess both the in vitro potential of the HuCNS-SC cells and the effects of transplanting HuCNS-SC cells into various preclinical animal models. One such collaboration was with researchers at the Stanford University School of Medicine that evaluated our human neural stem cells in animal models of stroke. The results of these studies demonstrated the targeted migration of the cells toward the stroke lesion and differentiation toward the neuronal lineage. Another study with researchers at Stanford’s School of Medicine demonstrated that HuCNS-SC cells labeled with magnetic nanoparticles could non-invasively track the survival and migration of human cells within the brain. We continue to search for and evaluate, promising collaborations to supplement our efforts to develop and commercialize our proprietary human neural platform technology.

Tools and Technologies Programs

Overview

Cells, and stem cells in particular, are an important resource for researchers seeking to understand human diseases, advance medical research and develop more effective therapies. Stem cells provide potentially unlimited sources of different cell types owing to their ability to be expanded and subsequently differentiated into particular cell types. Embryonic stem cells, for example, have the ability to become any one of the more than 200 specialized cell types found in the human body (they are said to be pluripotent); induced pluripotent stem (iPS) cells also possess this ability. Because of this versatility, these cells are valuable tools for examining and researching the fundamental biology of cells and the pathways involved in early development and tissue formation. In recent years, the pharmaceutical industry has become increasingly interested in using stem cell-based assays in its drug discovery and development efforts. Academia and industry use specialty cell culture products and antibody reagents to enable stem cell-based research and drug discovery and development. We sell specialty cell culture products and antibody reagents under our SC Proven brand.

13

Table of Contents

Specialty Cell Culture Products and Antibody Reagents

Stem cell research is a growing and highly specialized field. Because of their nature, stem and progenitor cells are rare and they require specific conditions to survive and thrive. For this reason, researchers require specialized cell culture products that enable the derivation, growth, maintenance, and manipulation of such cells. One of the greatest challenges facing researchers is the limited quality and quantity of available stem and progenitor cells. The challenge is in maintaining the pluripotency or multipotency of stem or progenitor cells in culture, i.e., keeping these cells from differentiating into other cell types, which is their natural tendency. Our cell biology expertise has enabled us to develop and commercialize proprietary cell culture products to optimize the derivation, growth, maintenance, and differentiation of stem cells. In contrast to common industry practice, we have developed media formulations that are free of animal serum and feeder cells (helper cells added to promote cell growth), which are known sources of undesirable agents affecting stem cell performance and safety.

Our current range of cell culture products, which are sold under the SC Proven brand, includes iSTEM, GS1-R, GS2-M, RHB-A, RHB-Basal, NDiff N2, and NDiff 227. The following table describes each of these in more detail:

| iSTEM | A serum-free, feeder-free medium that maintains mouse embryonic stem cells (ESCs) in their pluripotent “ground state” by using selective small molecule inhibitors to block the pathways which induce differentiation. | |

| RHB-A | A defined, serum-free culture medium for the selective culture of human and mouse neural stem cells and their maintenance and expansion as adherent cell populations. | |

| RHB-Basal | A defined, serum-free basal medium. When supplemented with specific growth factors, this media is specifically formulated for the propagation and differentiation of adherent neural stem cells. RHB-Basal can also be tailored to specific-cell type requirements by the addition of customer preferred supplements. | |

| NDiff N2 | A defined serum-free cell culture supplement for the derivation, maintenance, expansion and/or differentiation of human and mouse ESCs and tissue-derived neural stem cells supplement. | |

| NDiff N2-AF | A serum-free and animal component-free version of NDiff N2. | |

| NDiff 227 | A defined, serum-free medium for the differentiation of mouse ESCs to neural cell types. | |

| NDiff N27 | Defined, serum-free cell culture supplement for the derivation, maintenance, expansion and/or differentiation of human and mouse ESCs induced pluripotent stem (iPS) cells and tissue-derived neural stem cells. | |

| NDiff N27-AF | A serum-free and animal component-free version of NDiff N27. | |

| GS1-R | The first defined, serum-free media formulation shown to enable the derivation and long-term maintenance of true, germline competent rat ESCs without the addition of cytokines or growth factors. | |

| GS2-M | A defined, serum- and feeder-free medium for the derivation and long-term maintenance of true, germline competent iPS cells. | |

We also currently market a number of antibody reagents for use in cell detection, isolation and characterization. These reagents are also under the SC Proven brand. The following table describes each of these in more detail:

| STEM24 | A human antibody that recognizes human CD24, also known as Heat Stable Antigen (HSA), a glycoprotein expressed on the surface of many human cell types, including immature human hematopoietic cells, peripheral blood lymphocytes, erythrocytes, and many human carcinomas. CD24 is also a marker of human neural differentiation. | |

| STEM101 | A human-specific mouse antibody that recognizes the Ku80 protein found in human nuclei. | |

14

Table of Contents

| STEM121 | A human-specific mouse antibody that recognizes a cytoplasmic protein of human cells. | |

| STEM123 | A human-specific mouse antibody that recognizes human glial fibrillary acidic protein (GFAP). | |

We also market a number of human cell lines for use in research, including human neural stem cells derived from different areas of the CNS as well as hFB101, ultra primary human fibroblasts for use in genetic reprogramming and the creation of human IPS cells.

Other products marketed under SC Proven include total cell genomic DNA (gDNA), RNA and protein lysate reagents purified from homogenous stem cell populations for intra-comparative studies, such as Epigenetic fingerprinting, Southern, Western and Northern blots, PCR, RT-PCR, and microarrays. This range of purified stem cell line lysates includes:

| • | Mouse ESCs propagated in proprietary SC Proven ‘2i’ inhibitor-based GS2-M media; and |

| • | Mouse ES cell-derived and fetal tissue-derived neural stem cells propagated in proprietary SC Proven RHB-A® media. |

Other Technologies

In addition to our cell therapeutics and research reagent programs, we hold a number of “non-core” technologies which we feel present licensing opportunities, such as technologies for the generation of transgenic rats.

Transgenic Rat Program.

As part of our acquisition of assets from SCS in April 2009, we acquired exclusive rights to an intellectual property portfolio that broadly covers rat pluripotent stem cells, methods for using these cells to generate transgenic rats, and media for the culturing of these cells. This intellectual property was based upon research done at the University of Edinburgh, which showed for the first time the successful derivation and culture of true germline competent rat ES cells required for precise genetic engineering.

In August 2010, researchers demonstrated for the first time the creation of genetically modified rats using rat pluripotent cells that have been gene targeted via homologous recombination, a method which involves adding DNA sequences to the cells to delete (‘knock-out’), add (‘knock-in’) or otherwise modify genes of interest. This work resulted in the successful generation of knock-out rats missing the tumor suppressor gene p53 and served as a proof-of-principle for creating genetically engineered rats using rat ES cells. Prior to this breakthrough, these types of genetic manipulations were only possible in mice, and genetically engineered mice are widely used as disease models. While both mice and rats are used as animal models of human disease, aspects of the rat’s physiology, behavior, and metabolism are closer to the human, making rats the preferred species for drug development and studying human disease. Moreover, the rat cells used to generate these genetically engineered rats were cultured using a proprietary ‘2i’ inhibitor-based media formulation marketed as part of our SC Proven line of specialty cell culture products under the product name “GS1-R.” GS1-R is the first and only commercially available medium shown to enable the derivation and long-term maintenance of the true rat pluripotent cells required for precise genetic manipulation.

We believe that over the past few years a number of researchers have used our rat pluripotent cell technology to derive different knock-out and knock-in rat models. And, over this time, the first of the patents in this portfolio issued (GB Patent No. 2451523), and the proprietary media patent application was allowed in Europe (EPO Patent No. 1999249). We are therefore exploring our rat pluripotent cell technology and our inhibitor-based media as licensing and commercial opportunities.

15

Table of Contents

Contract Services and Supply Agreements

Our team members have been at the forefront of the research, development, manufacture, and clinical translation of various different stem cells and cell-based therapies for over 20 years. We have demonstrated expertise in the development and implementation of state-of-the-art cell separation devices, bioreactors, closed systems, and robotic platforms for manufacture of cells at the required scales. Leveraging this expertise, we now offer contract services for process development, process scale-up/scale-out and production, including use of our automated TAP Biosystems CompacT® SelecT Robotic platform.

In an extension of the process development and production services we have been contracted to scale-up and supply quantities of cell lines, reagents, cell line derivatives, and assay protocols for use in client’s drug development and other programs.

Our clients include the service division of a global biotechnology company developing new medicines, and a world-renowned scientific research institute.

Operations

Manufacturing

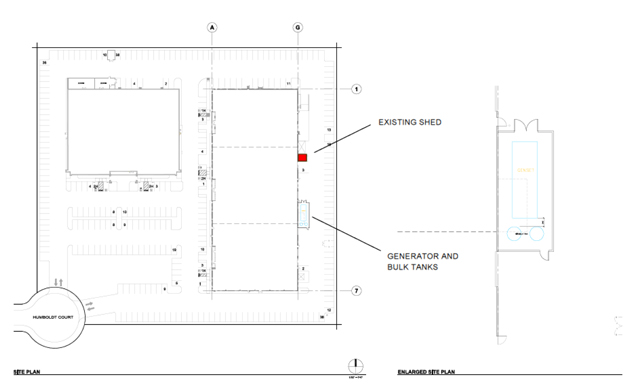

We have made considerable investments in our manufacturing operations. Our team includes world-recognized experts with proven track records in the development, manufacture and delivery of a range of different cell-based products. For clinical trials, our highly-qualified personnel manufacture cell products in clean room environments in compliance with current Good Manufacturing Practice (cGMP) and to quality standards that meet US as well as international regulatory requirements. By combining expertise and experience, we believe our expandable and bankable cell products can ultimately be manufactured and distributed at commercial scale as “stem cells in a bottle,” much like an off-the-shelf pharmaceutical product. We believe we also have sufficient ability to manufacture the cell culture media and reagent products that we are currently selling commercially, and that we have sufficient resources to add additional media and reagent manufacturing capacity should the business need arise.

Marketing

Because of the early stage of our stem and progenitor cell-based therapeutic product development programs, we have not yet addressed questions of channels of distribution or marketing of potential future products. We sell and ship our proprietary cell culture products directly from our facility in Cambridge, U.K. Customers can order these products through our dedicated website (www.scproven.com). In addition, we have a number of co-exclusive distribution agreements with Millipore Corporation for the marketing and sale of certain of our cell culture products, including HEScGRO and ESGRO Complete.

Employees

As of December 31, 2013, we had 58 full-time employees, 13 of whom have Ph.D., M.D. or D.V.M. degrees. 47 full-time employees work in research and development and laboratory support services. No employees are covered by collective bargaining agreements. We consider our employee relations in general to be good.

Patents, Proprietary Rights and Licenses

We believe that proprietary protection of our inventions will be critical to our future business. We vigorously seek out intellectual property that we believe might be useful in connection with our products, and have an active program of protecting our intellectual property. We may also from time to time seek to acquire licenses to important externally developed technologies.

16

Table of Contents

We have exclusive or non-exclusive rights to a portfolio of patents and patent applications related to various stem and progenitor cells and methods of deriving and using them. These patents and patent applications relate to compositions of matter, methods of obtaining such cells, and methods for preparing, transplanting and utilizing these cells. We also own or have exclusive rights to exploit a number of patents that claim tools and techniques important to cell-based research. A number of these patents were acquired from SCS in April 2009. Additional patents were acquired from NsGene A/S, a Danish company, in February 2013. These patents claim GFAP+ Nestin+ precursor cells capable of differentiating into neurons. Among our significant U.S. patents covering stem and progenitor cells are:

| • | U.S. Patent No. 5,968,829, entitled “Human CNS Neural Stem Cells,” which covers our composition of matter for human CNS stem cells; |

| • | U.S. Patent No. 7,361,505, entitled “Multipotent neural stem cell compositions,” which covers mammalian neural stem cells derived from any tissue source, including embryonic, fetal, juvenile, or adult tissue; |

| • | U.S. Patent No. 7,153,686, entitled “Enriched Central Nervous System Stem Cell and Progenitor Cell Populations, and Methods for Identifying, Isolating and Enriching such Populations,” which claims the composition of matter of various antibody-selected neural stem cell populations; |

| • | U.S. Patent No. 6,777,233, entitled “Cultures of Human CNS Neural Stem Cells,” which discloses a neural stem cell culture with a doubling rate faster than days; |

| • | U.S. Patent No. 6,497,872, entitled “Neural transplantation using proliferated multipotent neural stem cells and their progeny,” which covers transplanting any neural stem cells or their differentiated progeny, whether the cells have been cultured in suspension or as adherent cells, for the treatment of any disease; |

| • | U.S. Patent No. 6,468,794, entitled “Enriched central nervous system stem cell and progenitor cell populations, and methods for identifying, isolating and enriching for such populations,” which covers the identification and purification of the human CNS stem cell; |

| • | U.S. Patent No. 5,851,832, entitled “In Vitro growth and proliferation of multipotent neural stem cells and their progeny,” which covers methods and compositions of proliferating and expanding human CNS cell cultures; and |

| • | U.S. Patent No. 6,294,346, entitled “Use of multipotent neural stem cells and their progeny for the screening of drugs and other biological agents,” which describes the use of human neural stem cells as a tool for screening the effects of drugs and other biological agents on such cells, such as small molecule toxicology studies. |

Among our significant U.S. patents covering cell-based research tools and technologies are:

| • | U.S. Patent Nos. 7,005,299 and 6,150,169, both entitled “Expression of heterologous genes according to a targeted expression profile,” which cover the use of a gene sequence called IRES (internal ribosome entry site), a pivotal technology to target exogenous gene expression in stem cells, thereby facilitating their identification and use; and |

| • | U.S. Patent Nos. 6,878,542 and 7,256,041, both entitled “Isolation, selection and propagation of animal transgenic stem cells,” and U.S. Patent No. 6,146,888, entitled “Method of enriching for mammalian stem cells,” which cover the isolation of stem cells using a nucleic acid construct including a selectable marker. |

In October 2013, we acquired a portfolio of issued patents claiming compositions of human neural stem cells and their proliferation and use from NeuroSpheres Holdings, a Canadian holding company affiliated with the University of Calgary. Accordingly, of the patents identified above as being amongst our “significant” patents, eight are owned by us and five are exclusively licensed to us. The table below sets out the anticipated expiration

17

Table of Contents

dates of these patents absent the grant of any patent term extension, whether under the Hatch Waxman Act (Pub. L. 98-417) or otherwise:

| Patents Owned | 7,361,505 (2015); 6,497,872 (2019); 5,851,832 (2015); 6,294,346 (2018); 5,968,829 (2017); 7,153,686 (2019); 6,777,233 (2017); 6,468,794 (2019) | |

| Patents Exclusively Licensed (licensor included): |

7,005,299 (University of Edinburgh, 2014); 6,150,169 (University of Edinburgh, 2014); 6,878,542 (University of Edinburgh 2014); 7,256,041 (University of Edinburgh, 2014); 6,146,888 (University of Edinburgh, 2014) | |

We also rely upon trade secret protection for our proprietary information and know-how, and we take active measures to control access to this information. We believe that our know-how will also provide a significant competitive advantage.

Our policy is to require our employees, consultants and significant scientific collaborators and sponsored researchers to execute confidentiality agreements upon the commencement of any employment or consulting relationship with us. These agreements generally provide that all confidential information disclosed by us or developed during the course of the individual’s relationship with us is to be kept confidential and not disclosed to third parties except in specific circumstances. In the case of employees and consultants, the agreements generally provide that all inventions conceived by the individual in the course of rendering services to us will be our exclusive property.

Licenses Agreements

Since inception, we have entered into a number of license agreements with academic organizations and commercial entities, including NeuroSpheres, Ltd. (Neurospheres), ReNeuron Ltd. (ReNeuron), Stem Cell Therapeutics Corp. (SCT), genOway SA (genOway), and the University of Edinburgh, to either acquire or license out intellectual property rights. Under these license agreements, there are typically obligations of due diligence and the requirement to pay royalties on products that use patented technology licensed under these agreements. The license agreements with some of these institutions relate largely to stem or progenitor cells or to processes and methods for the isolation, identification, expansion, or culturing of stem or progenitor cells. Generally speaking, these license agreements will terminate upon expiration, revocation or invalidation of the licensed patents, unless governmental regulations require a shorter term. Typically, the licensee under each of these license agreements can terminate the agreement at any time upon notice. At this time, we do not believe the future success of our research and development efforts depend significantly on any particular license agreement or research collaboration. Nevertheless, we describe the more important license agreements below.

NeuroSpheres

In March 1994, we entered into a contract research and license agreement with NeuroSpheres, which was clarified in a license agreement dated as of April 1, 1997. Under the agreement as clarified, we obtained an exclusive patent license from NeuroSpheres in the field of transplantation, subject to a limited right of NeuroSpheres to purchase a nonexclusive license from us, which right was not exercised and has expired. We then developed additional intellectual property relating to the subject matter of the license. We entered into an additional license agreement with NeuroSpheres as of October 30, 2000, under which we obtained an exclusive license in the field of non-transplant uses, such as drug discovery. Together, our rights under these licenses were exclusive for all uses of the technology. All of the product-based royalty rates in the license agreement between the Company and NeuroSpheres were in the single digits. We made up-front payments to NeuroSpheres of 6,500 shares of our common stock in October 2000 and $50,000 in January 2001, and were required to make additional cash payments when milestones are achieved under the terms of the October 2000 agreement. In addition, in October 2000 we reimbursed NeuroSpheres for patent costs amounting to $341,000. Milestone payments, payable at various stages in the development of potential products, would total $500,000 for each

18

Table of Contents

product that is approved for market. In addition, beginning in 2004, annual payments of $50,000 became due, payable by the last day of the year and fully creditable against royalties due to NeuroSpheres under the October 2000 Agreement. In July 2008, we amended our 1997 and 2000 license agreements with NeuroSpheres. Six of the patents covered by the license agreements are the basis of our patent infringement suits against Neuralstem. Under the terms of the amendment, we agreed to pay all reasonable litigation costs, expenses and attorney’s fees incurred by NeuroSpheres in the declaratory judgment suit between us and Neuralstem. In return, we were entitled to off-set all litigation costs incurred in that suit against amounts that would otherwise be owed under the license agreements, such as annual maintenance fees, milestones and royalty payments.

In October, 2013, we acquired from NeuroSpheres the patent portfolio we licensed. As consideration for the patents, we issued 139,548 shares of unregistered common stock to NeuroSpheres. The acquisition relieves us from further milestone and royalty payments to NeuroSpheres., and all preexisting agreements were terminated.

University of Edinburgh

In January 2006, we entered into an exclusive, world-wide license agreement with the University of Edinburgh covering approximately twelve separate patent families in the stem cell field. Since then, the parties added some additional patent families and dropped some patent families which were not considered core to our business activities. Today, the license agreement patent families, including several that cover culture media and research technologies, one that covers purified populations of neural stem cells, some that cover cell reprogramming technologies, and one that covers the manipulation and use of embryonic stem cells for the derivation of research animal models, such as knock-out rats, with one or more missing genes. Under the license agreement, we have the exclusive right to commercialize the technologies in all fields. We have been paying royalties to the University of Edinburgh on the commercial sale of certain SC Proven products, and will pay royalties on all net sales of products covered by any of the intellectual property licensed under this agreement. All of the product-based royalty rates in the license agreement between the Company and the University of Edinburgh are in the single digits and there are no provisions under the University of Edinburgh license agreement for the payment of potential milestones by the Company.

ReNeuron

In July 2005, we entered into an agreement with ReNeuron under which we granted ReNeuron a license that allows ReNeuron to exploit its “c-mycER” conditionally immortalized adult human neural stem cell technology for therapy and other purposes. We received shares of ReNeuron common stock, as well as a cross-license to the exclusive use of ReNeuron’s technology for certain diseases and conditions, including lysosomal storage diseases, spinal cord injury, cerebral palsy, and multiple sclerosis. The agreement also provides for full settlement of any potential claims that either we or ReNeuron might have had against the other in connection with any putative infringement of certain of each party’s patent rights prior to the effective date of the agreement. As part of the agreement, we received in aggregate, approximately 10,097,000 ordinary shares of ReNeuron common stock, net of approximately 122,000 shares that were transferred to NeuroSpheres. Between 2007 and 2011, we sold our entire holdings of shares of ReNeuron common stock for aggregate net proceeds of approximately $3,743,000. As of June 30, 2011, we no longer hold any shares of ReNeuron.

Stem Cell Therapeutics

In August 2006, we entered into an agreement with Stem Cell Therapeutics, a Canadian corporation listed on the Toronto Stock Exchange, granting it a non-exclusive, royalty-bearing license to use several of our patents for treating specified diseases of the central nervous system; the grant does not include any rights to cell transplantation. SCT granted us a royalty-free non-exclusive license to certain of its patents for research and development and a royalty-bearing non-exclusive license for certain commercial purposes. SCT paid an up-front license fee; the license also provides for other payments including annual maintenance, milestones and royalties.

19

Table of Contents

genOway

In October 2008, we entered into a license agreement with genOway, a leading transgenics company located in France, in which we granted a non-exclusive sublicense to genOway for the use of Internal Ribosome Entry Site (IRES) technology. The IRES technology enables the dual expression of a protein of interest and a selectable marker, thereby enabling researchers to genetically modify any mammalian cell and monitor the activity of a particular gene of interest in living cells or tissues without blocking the normal function of the gene. The IRES technology is particularly important for evaluating the success of gene knock-outs or knock-ins in stem cells and for the successful creation of transgenic rodent disease models. The IRES technology has been used to develop hundreds of genetically modified models in the past decade, and the technology is now considered to be the reference technology for transgene expression in some key rodent animal models, such as humanized models, reporter model, and cell trafficking models. The IRES technology is covered by one of the patent families exclusively licensed to us by the University of Edinburgh, specifically U.S. Patents No. 7,005,299 and 6,150,169 and their foreign counterparts.

In March 2012, we agreed to amend the genOway license agreement to give genOway exclusive worldwide rights, including a right to grant sublicenses, under the IRES patent family in order to commercialize transgenic mice, and provide related services such as the genetic engineering of such mice. Under this exclusive license agreement, as amended, we received a six figure lump sum payment in lieu of annual maintenance fees, and will receive single digit royalties on licensed products and services.

Other Commercial Licenses

We have approximately thirteen other license agreements with commercial entities, which we entered into in the ordinary course of business to monetize certain of our patents. A number of these include sublicenses to certain patents exclusively licensed to us from either NeuroSpheres or the University of Edinburgh. Some of these are license agreements to commercialize cells. A number of these are license agreements to our research tools patents, such as the IRES and selectable marker technologies described above. We have an on-going licensing program at the Company with the goal of identifying likely infringers of our intellectual property rights in order to generate license revenues.

Scientific Advisory Board

Members of our Scientific Advisory Board provide us with strategic guidance primarily in regard to our therapeutic products research and development programs, as well as assistance in recruiting employees and collaborators. Each Scientific Advisory Board member has entered into a consulting agreement with us. These consulting agreements specify the compensation to be paid and require that all information about our products and technology be kept confidential. All of the Scientific Advisory Board members are employed by employers other than us and may have commitments to, or consulting or advising agreements with, other entities that limit their availability to us. The Scientific Advisory Board members have generally agreed, however, for so long as they serve as consultants to us, not to provide any services to any other entities that would conflict with the services the member provides to us. We are entitled to terminate the arrangements if we determine that there is such a conflict.

The following persons are members of our Scientific Advisory Board:

| • | Irving L. Weissman, M.D., Chairman of our Scientific Advisory Board, is the Virginia and Daniel K. Ludwig Professor of Cancer Research, Professor of Pathology and Professor of Developmental Biology at Stanford University, Director of the Stanford University Institute for Stem Cell Biology and Regenerative Medicine, and Director of the Stanford Ludwig Center for Cancer Stem Cell Research and Medicine, all in Stanford, California. Dr. Weissman’s lab was responsible for the discovery and isolation of the first ever mammalian tissue stem cell, the hematopoietic (blood-forming) stem cell. Dr. Weissman was responsible for the formation of three stem cell companies, SyStemix, Inc., |

20

Table of Contents

| StemCells, Inc. and Cellerant, Inc. Dr. Weissman co-discovered the mammalian and human hematopoietic stem cells and the human neural stem cell. He has extended these stem cell discoveries to cancer and leukemia, discovering the leukemic stem cells in human and mouse acute or blast crisis myeloid leukemias, and has enriched the cancer stem cells in several human brain cancers as well as human head and neck squamous cell carcinoma. Past achievements of Dr. Weissman’s laboratory include identification of the states of development between stem cells and mature blood cells, the discovery and molecular isolation and characterization of lymphocyte and stem cell homing receptors, and identification of the states of thymic lymphocyte development. His laboratory at Stanford has developed accurate mouse models of human leukemias, and has shown the central role of inhibition of programmed cell death in that process. He has also established the evolutionary origins of pre-vertebrate stem cells, and identified and cloned the transplantation genes that prevent their passage from one organism to another. Dr. Weissman has been elected to the National Academy of Science, the Institute of Medicine of the National Academies, the American Academy of Arts and Sciences, the American Society of Microbiology, and several other societies. He has received the Kaiser Award for Excellence in Preclinical Teaching, the Pasarow Foundation Award for Cancer Research, the California Scientist of the Year (2002), the Kovalenko Medal of the National Academy of Sciences, the Elliott Joslin Medal for Diabetes Research, the de Villiers Award for Leukemia Research, the Irvington Award for Immunologist of the Year, the Bass Award of the Society of Neurosurgeons, the New York Academy of Medicine Award for Medical Research, the Alan Cranston Award for Aging Research, the Linus Pauling Award for Biomedical Research, the E. Donnall Thomas Award for Hematology Research, the van Bekkum Award for Stem Cell Research, the Outstanding Investigator Award from the National Institutes of Health, Robert Koch Award for research in the hemopoieteic system, and many other awards. In 2010, Dr. Weissman was appointed as an Honorary Director of the Center for Biotech and BioMedicine and the Shenzhen Key Lab of Gene and Antibody Therapy at the Graduate School of Shenzhen at Tsinghua University. He was also appointed as an Honorary Professor at Peking Union Medical College and an Honorary Investigator at the State Key Laboratory of Experimental Hematology, Institute of Hematology and Blood Disease Hospital at the Chinese Academy of Medical Sciences and Peking Union Medical College. In 2011, Dr. Weissman was elected to the National Academy of Sciences Council. |

| • | David J. Anderson, Ph.D., is Seymour Benzer Professor of Biology, California Institute of Technology, Pasadena, California and Investigator, Howard Hughes Medical Institute. His laboratory was the first to isolate a multipotent, self-renewing, stem cell for the peripheral nervous system, the first to identify instructive signals that promote the differentiation of these stem cells along various lineages, and the first to accomplish a direct purification of peripheral neural stem cells from uncultured tissue. Dr. Anderson’s laboratory also was the first to isolate transcription factors that act as master regulators of neuronal fate. More recently, he has identified signals that tell a neural stem cell to differentiate to oligodendrocytes, the myelinating glia of the central nervous system, as well as factors for astrocyte differentiation. Dr. Anderson is a co-founder of the Company and was a founding member of the scientific advisory board of the International Society for Stem Cell Research. Dr. Anderson also serves on the scientific advisory board of Allen Institute for Brain Science. He has held a presidential Young Investigator Award from the National Science Foundation, a Sloan foundation Fellowship in Neuroscience, and has been Donald D. Matson lecturer at Harvard Medical School. He has received the Charles Judson Herrick Award from the American Association of Anatomy, the 1999 W. Alden Spencer Award in Neurobiology from Columbia University, and the Alexander von Humboldt Foundation Award. Dr. Anderson has been elected to the National Academy of Science and is a member of the American Academy of Arts and Sciences. |

| • | Fred H. Gage, Ph.D., is Professor, Laboratory of Genetics, The Salk Institute for Biological Studies, La Jolla, California and Adjunct Professor, Department of Neurosciences, University of California, San Diego, California. Dr. Gage’s lab was the first to discover Neurogenesis in the adult human brain. His research focus is on the development of strategies to induce recovery of function following central nervous system damage. Dr. Gage is a co-founder of StemCells and of BrainCells, Inc., and a member |

21

Table of Contents

| of the scientific advisory board of each. Dr. Gage also serves on the Scientific Advisory Board of Ceregene, Inc, and he is a founding member of the scientific advisory board of the International Society for Stem Cell Research. Dr. Gage has been the recipient of numerous awards, including the 1993 Charles A. Dana Award for Pioneering Achievements in Health and Education, the Christopher Reeves Medal, the Decade of the Brain Medal, the Max-Planck research Prize, and the Pasarow Foundation Award. Professor Gage is a member of the Institute of Medicine, a member of the National Academy of Science, and a Fellow of the American Academy of Arts and Science. |

Government Regulation

Our research and development activities and the future manufacturing and marketing of our potential therapeutic products are, and will continue to be, subject to regulation for safety and efficacy by numerous governmental authorities in the United States and other countries.

U.S. Regulations

In the United States, pharmaceuticals, biologicals and medical devices are subject to rigorous regulation by the U.S. Food and Drug Administration (FDA). The Federal Food, Drug and Cosmetic Act, the Public Health Service Act, applicable FDA regulations, and other federal and state statutes and regulations govern, among other things, the testing, manufacture, labeling, storage, export, record keeping, approval, marketing, advertising, and promotion of our potential products. Product development and approval within this regulatory framework takes a number of years and involves significant uncertainty combined with the expenditure of substantial resources. In addition, many jurisdictions, both federal and state, have restrictions on the use of fetal tissue.

FDA Marketing Approval

The steps required before our potential therapeutic products may be marketed in the United States include:

| Steps |

Considerations | |

| 1. Preclinical laboratory and animal tests |

Preclinical tests include laboratory evaluation of the cells and the formulation intended for use in humans for quality and consistency. In vivo studies are performed in normal animals and specific disease models to assess the potential safety and efficacy of the cell therapy product. | |

| 2. Submission of an Investigational New Drug (IND) application |