Summary Prospectus

Growth Allocation Strategy

August 1, 2016

Class / Ticker

Symbol

A / SGIAXC / SGILXI / CLVGX

Before

you invest, you may want to review the Fund’s Prospectus and Statement of Additional Information, which contain more information about the Fund and its risks. You can find the Fund’s Prospectus, Statement of Additional Information and

other information about the Fund online at www.ridgeworth.com/resources/regulatory-taxinfo. You can also get this information at no cost by calling the Funds at 1-888-784-3863 or by sending an email request to info@ridgeworth.com. The current

Prospectus and Statement of Additional Information, dated August 1, 2016, are incorporated by reference into this summary prospectus.

Investment Objective

The Growth Allocation Strategy (the “Fund”)

seeks to provide long-term capital appreciation.

Fees

and Expenses of the Fund

This table describes the fees

and expenses that you may pay if you buy and hold shares of the Fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in RidgeWorth Funds. More information about these and

other discounts is available from your financial professional and in Sales Charges on page 29 of the Fund’s prospectus and Rights of Accumulation on page 89 of the Fund’s statement of additional information.

Shareholder Fees

(fees paid directly from your investment)

(fees paid directly from your investment)

| A Shares | C Shares | I Shares | |

| Maximum Sales Charge (load) Imposed On Purchases (as a % of offering price) | 5.75% | None | None |

| Maximum Deferred Sales Charge (load) (as a % of the net asset value) | None | 1.00% | None |

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the value of your investment)

(expenses that you pay each year as a percentage of the value of your investment)

| A Shares | C Shares | I Shares | |||

| Management Fees | 0.10% | 0.10% | 0.10% | ||

| Distribution (12b-1) Fees | 0.30% | 1.00% | None | ||

| Other Expenses | 0.27% | 0.21% | 0.60% | ||

| Acquired Fund Fees and Expenses(1) | 0.66% | 0.66% | 0.66% | ||

| Total Annual Fund Operating Expenses | 1.33% | 1.97% | 1.36% | ||

| Fee Waivers and/or Expense Reimbursements(2) | — | (0.01)% | (0.20)% | ||

| Total Annual Fund Operating Expenses After Fee Waivers and/or Expense Reimbursements | 1.33% | 1.96% | 1.16% |

| (1) | “Acquired Fund Fees and Expenses” reflect the Fund’s pro rata share of the fees and expenses incurred by investing in other investment companies. The impact of Acquired Fund Fees and Expenses is included in the total returns of the Fund. Acquired Fund Fees and Expenses are not used to calculate the Fund’s net asset value per share (“NAV”) and are not included in the calculation of the ratio of expenses to average net assets shown in the Financial Highlights section of the Fund’s prospectus. |

| (2) | The Adviser has contractually agreed to waive fees and reimburse expenses until at least August 1, 2017 in order to keep Total Annual Fund Operating Expenses (excluding, as applicable, taxes, brokerage commissions, substitute dividend expenses on securities sold short, interest expense, extraordinary expenses and Acquired Fund Fees and Expenses) from exceeding 0.70%, 1.30% and 0.50% for the A, C and I Shares, respectively. This agreement may be terminated upon written notice to the Adviser by RidgeWorth Funds. |

Example

This example is intended to help you compare the cost of

investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example also

assumes that your investment has a 5% return each year, that the Fund’s operating expenses remain the same and that you reinvest all

1

dividends and distributions. The example reflects contractual fee waivers

and reimbursements for the first year only. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 year | 3 years | 5 years | 10 years | |

| A Shares | $703 | $972 | $1,262 | $2,084 |

| C Shares | $299 | $617 | $1,061 | $2,295 |

| I Shares | $118 | $411 | $ 726 | $1,618 |

You would pay the following

expenses if you did not redeem your shares:

| 1 year | 3 years | 5 years | 10 years | |

| A Shares | $703 | $972 | $1,262 | $2,084 |

| C Shares | $199 | $617 | $1,061 | $2,295 |

| I Shares | $118 | $411 | $ 726 | $1,618 |

Portfolio Turnover

The Fund pays transaction costs, when it buys and sells

securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in

annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 29% of the average value of its portfolio.

Principal Investment Strategies

The Fund invests pursuant to an asset allocation strategy in

a combination of RidgeWorth Equity Funds and exchange-traded funds (“ETFs”) that invest in equities (together, “Underlying Equity Funds”), and, to a lesser extent, RidgeWorth Fixed Income Funds and ETFs that invest in bonds

(together, “Underlying Fixed Income Funds”). The Fund invests between 60% and 80% of its assets in Underlying Equity Funds and between 10% and 40% of its assets in Underlying Fixed Income Funds (together, “Underlying Funds”).

The Fund’s remaining assets may be invested in cash and cash equivalents, including unaffiliated money market funds, securities issued by the U.S. government, its agencies or instrumentalities, repurchase agreements and short-term paper.

The Fund may invest in Underlying Funds that:

| – | invest in common stocks, other equity securities and debt instruments, including mortgage- and asset-backed instruments and securities restricted as to resale, of U.S. and non-U.S. companies. The Underlying Fund may invest in companies of any size and in both developed and emerging markets. |

| – | invest in bank loans and other below investment grade instruments. |

| – | invest in inflation-protected public obligations of the U.S. Treasury (“TIPS”), which are securities issued by the U.S. Treasury that are designed to provide inflation protection to investors. |

In selecting a diversified portfolio of Underlying Funds,

the Adviser analyzes many factors, including the Underlying Funds’ investment objectives, total returns, volatility and expenses. The table that follows shows how the Adviser currently expects

to allocate the Fund’s portfolio among asset classes. The table also

shows the sectors within those asset classes to which the Fund will currently have exposure.

| Asset Class | Investment

Range (Percentage of the Growth Allocation Strategy’s Assets) |

| Underlying Equity Funds | 60-80% |

| U.S. Equities | |

| International Equities | |

| Emerging

Market Equities (All Market Capitalizations) |

|

| Underlying Fixed Income Funds | 10-40% |

| U.S. Investment Grade Bonds | |

| U.S. High Yield Bonds | |

| U.S.

Floating Rate Securities (including bank loans) |

|

| International Bonds | |

| Emerging Market Bonds | |

| Underlying Money Market Investments | 0-20% |

Principal Investment Risks

You may lose money if you invest in the Fund. A Fund share is not a bank deposit and it is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

The value of an investment in the Fund is based primarily on

the performance of the Underlying Funds and the allocation of the Fund’s assets among them. The Adviser’s asset allocation decisions may not anticipate market trends successfully. The risks of the Fund will directly correspond to the

risks of the Underlying Funds in which it invests. These risks will vary depending upon how the assets are allocated among the Underlying Funds. Certain risks associated with investing in the Underlying Funds are described in this section.

Asset Allocation Risk: Asset

allocation risk is the risk that the Fund could lose money as a result of less than optimal or poor asset allocation decisions as to how its assets are allocated or re-allocated.

Below Investment Grade Securities Risk: Securities that are rated below investment grade (sometimes referred to as “junk bonds”, including those bonds rated lower than “BBB-” by Standard & Poor’s Financial Services LLC and

Fitch, Inc. or “Baa3” by Moody’s Investors Service), or that are unrated but judged by the Subadviser to be of comparable quality at the time of purchase, involve greater risk of default or downgrade and are more volatile than

investment grade securities and are considered speculative.

These instruments have a higher degree of default risk and

may be less liquid than higher-rated bonds. These instruments may be subject to a greater price volatility due to such factors as specific corporate developments, interest rate sensitivity, negative perceptions of high yield investments generally,

and less secondary market liquidity. This potential lack of liquidity may make it more difficult for the Fund to value these instruments accurately.

Debt Securities Risk: Debt

securities, such as bonds, involve credit risk. Credit risk is the risk that the borrower will not make timely payments of principal or interest or will default. Changes in an issuer’s credit rating or the market’s perception of

an

2

issuer’s creditworthiness may also affect the value of the Fund’s

investment in that issuer. The degree of credit risk depends on the issuer’s financial condition and on the terms of the securities.

Debt securities are also subject to interest rate risk,

which is the risk that the value of a debt security may fall when interest rates rise. In general, the market price of debt securities with longer maturities will go up or down more in response to changes in interest rates than the market price of

shorter term securities.

Equity Securities Risk: The price of equity securities fluctuates from time to time based on changes in a company’s financial condition or overall market and economic conditions. As a result, the value of the Fund’s equity

securities may fluctuate drastically from day to day.

Exchange-Traded Fund Risk:

ETFs, like mutual funds, have expenses associated with their operation, including advisory fees. When a Fund invests in an ETF, in addition to directly bearing expenses associated with its own operations, the Fund bears its pro rata portion of the

ETF’s expenses. The impact of these additional expenses, if any, would be shown as part of “Acquired Fund Fees and Expenses” in the Annual Fund Operating Expenses table.

Floating Rate Loan Risk: The

value of the collateral securing a floating rate loan can decline, be insufficient to meet the obligations of the borrower, or be difficult to liquidate. As a result, a floating rate loan may not be fully collateralized and can decline significantly

in value. Floating rate loans generally are subject to contractual restrictions on resale. The liquidity of floating rate loans, including the volume and frequency of secondary market trading in such loans, varies significantly over time and among

individual floating rate loans. During periods of infrequent trading, valuing a floating rate loan can be more difficult, and buying and selling a floating rate loan at an acceptable price can also be more difficult and delayed. Difficulty in

selling a floating rate loan can result in a loss. In addition, floating rate loans generally are subject to extended settlement periods in excess of seven days, which may impair the Fund’s ability to sell or realize the full value of its

loans in the event of a need to liquidate such loans. The Fund participates in a line of credit facility to assist with cash flow management and liquidity. Floating rate loans may not be considered securities and, therefore, the Fund may not have

the protections of the federal securities laws with respect to its holdings of such loans.

Foreign Companies and Securities Risk: Foreign securities and dollar denominated securities of foreign issuers involve special risks such as economic or financial instability, lack of timely or reliable financial information and unfavorable political or

legal developments. Foreign securities also involve risks such as currency fluctuations and delays in enforcement of rights. All of these risks are increased for investments in emerging markets.

Growth Stock Risk:

“Growth” stocks can react differently to issuer, political, market and economic developments than the market as a whole and other types of stocks. “Growth” stocks typically are sensitive to market movements because their

market prices tend to reflect future expectations. When it appears those expectations will not be met, the prices of growth stocks typically fall.

Large-Capitalization Companies Risk: Large-cap stocks can perform differently from other segments of the equity market or the equity market as a whole. Large-capitalization companies may be less flexible in evolving markets or unable to implement change as

quickly as small-capitalization companies.

Mortgage-Backed and Asset-Backed Securities Risk: Mortgage- and asset-backed securities are debt instruments that are secured by interests in pools of mortgage loans or other financial assets. The value of these securities will be influenced by the factors affecting

the assets underlying such securities, swings in interest rates, changes in default rates, or deteriorating economic conditions.

During periods of declining asset values, mortgage-backed

and asset-backed securities may face valuation difficulties and may become more volatile and/or illiquid. The risk of default is generally higher in the case of securities backed by loans made to borrowers with “sub-prime” credit

metrics.

If market interest rates increase

substantially and the Fund’s adjustable-rate securities are not able to reset to market interest rates during any one adjustment period, the value of the Fund’s holdings and its net asset value may decline until the adjustable-rate

securities are able to reset to market rates. In the event of a dramatic increase in interest rates, the lifetime limit on a security’s interest rate may prevent the rate from adjusting to prevailing market rates. In such an event, the

security could underperform and affect the Fund’s net asset value.

Prepayment and Call Risk:

During periods of falling interest rates, an issuer of a callable bond held by the Fund or an Underlying Fund may “call” or prepay the bond before its stated maturity date. When mortgages and other obligations are prepaid and when

securities are called, the Fund or an Underlying Fund may have to reinvest the proceeds in securities with a lower yield or fail to recover additional amounts paid for securities with higher interest rates, resulting in an unexpected capital loss

and/or a decline in the Fund’s income.

Real

Estate Investment Risk: The Fund or an Underlying ETF invests in companies that invest in real estate (e.g. real estate investment trusts) and is exposed to risks specific to the real estate market, including interest rate risk, leverage risk, property risk and management risk.

Restricted Securities Risk:

Certain debt securities may be restricted securities, which are not registered with the SEC and thus may not be sold publicly until registration has been made. Therefore, there is the absence of a public market and there is limited investor

information.

U.S. Government Securities Risk: U.S. Treasury securities are backed by the full faith and credit of the U.S. government, while other types of securities issued or guaranteed by federal agencies, instrumentalities, and U.S. government-sponsored

entities may or may not be backed by the full faith and credit of the U.S. government. U.S. government securities may underperform other segments of the fixed income market or the fixed income market as a whole.

Value Investing Risk:

“Value” investing attempts to identify strong companies whose stocks are selling at a discount from their perceived true worth. It is subject to the risk that the stocks’ intrinsic values may never be fully recognized or

realized

3

by the market, their prices may go down, or that stocks judged to be

undervalued by the Fund or an Underlying Fund may actually be appropriately priced.

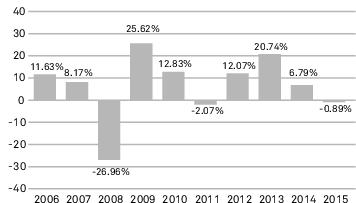

Performance

The bar chart and the performance table that follow

illustrate the risks and volatility of an investment in the Fund. The Fund’s past performance (before and after taxes) does not indicate how the Fund will perform in the future. A Shares commenced operations on November 5, 2003 and C

Shares commenced operations on April 5, 2005. Performance prior to the commencement of operations of each respective class, is that of I Shares of the Fund, and has not been adjusted to reflect expenses associated with other classes. If it had

been, performance would have been lower. Updated performance information is available by contacting the RidgeWorth Funds at 1-888-784-3863 or by visiting www.ridgeworth.com.

The annual returns in the bar chart which follows are for

the I Shares without reflecting payment of any sales

charge; if they did reflect such payment of sales charges, annual returns would be lower.

charge; if they did reflect such payment of sales charges, annual returns would be lower.

This bar chart shows the changes in performance of the

Fund’s I Shares from year to year.*

| Best Quarter | Worst Quarter |

| 13.13% | -14.19% |

| (9/30/2009) | (12/31/2008) |

* The performance information

shown above is based on a calendar year. The Fund's total return for the six months ended June 30, 2016 was 1.17%.

The following table compares the Fund’s average annual

total returns for the periods indicated with those of a broad measure of market performance.

AVERAGE ANNUAL TOTAL RETURNS

(for periods ended December 31, 2015)

(for periods ended December 31, 2015)

| 1 Year | 5 Years | 10 Years | |

| A Shares Return Before Taxes | (6.65)% | 5.51% | 4.88% |

| C Shares Return Before Taxes | (2.50)% | 6.09% | 4.78% |

| I Shares Return Before Taxes | (0.89)% | 7.00% | 5.78% |

| I Shares Return After Taxes on Distributions | (2.94)% | 5.09% | 4.01% |

| I Shares Return After Taxes on Distributions and Sale of Fund Shares | 0.96% | 5.12% | 4.24% |

| Hybrid 70/30 Blend of the two Indices below (reflects no deduction for fees, expenses or taxes) | 1.34% | 9.87% | 6.73% |

| S&P 500 Index (reflects no deduction for fees, expenses or taxes) | 1.38% | 12.57% | 7.31% |

| Barclays U.S. Aggregate Bond Index (reflects no deduction for fees, expenses or taxes) | 0.55% | 3.25% | 4.51% |

After-tax returns are calculated

using the historical highest individual U.S. federal marginal income tax rates and do not reflect the impact of state and local taxes. Your actual after-tax returns will depend on your tax situation and may differ from those shown. After-tax returns

shown are not relevant to investors who hold their Fund shares through tax-advantaged arrangements, such as 401(k) plans or individual retirement accounts (“IRAs”). After-tax returns are shown for only the I Shares. After-tax returns for

other share classes will vary.

In some cases, average

annual return after taxes on distributions and sale of fund shares is higher than the average annual return after taxes on distributions because of realized losses that would have been sustained upon the sale of fund shares immediately after the

relevant periods. The calculations assume that an investor holds the shares in a taxable account, is in the actual historical highest individual federal marginal income tax bracket for each year and would have been able to immediately utilize

the full realized loss to reduce his or her federal tax liability. However, actual individual tax results may vary and investors should consult their tax advisers regarding their personal tax situations.

Investment Adviser

RidgeWorth Investments is the Fund’s investment

adviser (the “Adviser”).

Portfolio

Management

Mr. Alan Gayle, Managing Director of the

Adviser, has managed the Fund since its inception.

Purchasing and Selling Your Shares

You may purchase or redeem Fund shares on any business day.

You may purchase and redeem A, C and I Shares of the Fund through financial institutions or intermediaries that are authorized to place transactions in Fund shares for their customers or for their own accounts.

4

The minimum initial investment amounts for each share class

are shown below, although these minimums may be reduced, waived, or not applicable in some cases.

| Class | Dollar Amount |

| A Shares | $2,000 |

| C Shares | $5,000 ($2,000 for IRAs or other tax-advantaged accounts) |

| I Shares | None |

Subsequent investments in A or C

Shares must be made in amounts of at least $1,000. The Fund may accept investments of smaller amounts for either class of shares at its discretion. There are no minimums for subsequent investments in I Shares.

Tax Information

The Fund’s distributions are generally taxable as

ordinary income, qualified dividend income, or capital gains unless you are investing through a tax-advantaged arrangement, such as a 401(k) plan or an IRA, which may be taxed upon withdrawal.

Payments to Broker-Dealers and Other Financial

Intermediaries

If you purchase shares of the Fund

through a financial intermediary, such as a broker-dealer or investment adviser, the Fund, the Adviser or the Distributor may pay the intermediary for the sale of Fund shares and related services.

These payments may create a conflict of interest by

influencing the broker-dealer or other financial intermediary and your salesperson to recommend the Fund over another investment. Ask your financial intermediary or visit your financial intermediary’s website for more information.

| RFSUM-LVG-0816 |