Ridgeworth Funds

As filed with the Securities and Exchange Commission on July 28, 2016

Securities Act File No. 033-45671

Investment Company Act File No. 811-06557

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-1A

REGISTRATION

STATEMENT

UNDER

|

|

|

|

|

|

|

THE SECURITIES ACT OF 1933 |

|

x |

|

|

Post-Effective Amendment No. 108 |

|

x |

and/or

REGISTRATION STATEMENT

UNDER

|

|

|

|

|

|

|

THE INVESTMENT COMPANY ACT OF 1940 |

|

x |

|

|

Amendment No. 110 |

|

x |

RIDGEWORTH FUNDS

(Exact

Name of Registrant as Specified in Charter)

3333 Piedmont

Road, Suite 1500

Atlanta, GA 30305

(Address of Principal Executive Office) (Zip Code)

Registrant’s Telephone Number, including Area Code: 1-888-784-3863

Julia R. Short

President

RidgeWorth

Funds

3333 Piedmont Road, Suite 1500

Atlanta, GA 30305

(Name

and Address of Agent for Service)

Copies to:

|

|

|

| W. John McGuire, Esq.

Morgan, Lewis & Bockius LLP

1111 Pennsylvania Avenue, NW

Washington, DC 20004 |

|

Thomas S. Harman, Esq.

Morgan, Lewis & Bockius LLP

1111 Pennsylvania Avenue, NW

Washington, DC 20004 |

It is proposed that this filing will become effective (check appropriate box):

| ¨ |

Immediately upon filing pursuant to paragraph (b) |

| x |

On August 1, 2016 pursuant to paragraph (b) |

| ¨ |

60 days after filing pursuant to paragraph (a)(1) |

| ¨ |

On pursuant to paragraph (a)(1) |

| ¨ |

75 days after filing pursuant to paragraph (a)(2) |

| ¨ |

On pursuant to paragraph (a)(2) of Rule 485 |

If appropriate, check the following box:

| ¨ |

This post-effective amendment designates a new effective date for a previously-filed post-effective amendment. |

ALLOCATION STRATEGIES

A, C & I SHARES

PROSPECTUS

August 1, 2016

Investment Adviser: RidgeWorth Investments

| |

A

Shares |

|

C

Shares |

|

I

Shares |

| •

Aggressive Growth Allocation Strategy |

SLAAX

|

|

CLVLX

|

|

CVMGX

|

| •

Conservative Allocation Strategy |

SVCAX

|

|

SCCLX

|

|

SCCTX

|

| •

Growth Allocation Strategy |

SGIAX

|

|

SGILX

|

|

CLVGX

|

| •

Moderate Allocation Strategy |

SVMAX

|

|

SVGLX

|

|

CLVBX

|

The Securities and

Exchange Commission has not approved or disapproved these securities or passed upon the adequacy of this prospectus. Any representation to the contrary is a criminal offense.

August 1, 2016

RidgeWorth Investments is the trade name of

RidgeWorth Capital Management LLC

Aggressive Growth

Allocation Strategy

Summary Section

A Shares, C Shares and I Shares

Investment Objective

The Aggressive Growth Allocation Strategy (the

“Fund”) seeks to provide a high level of capital appreciation.

Fees and Expenses of the Fund

This table describes the fees and expenses

that you may pay if you buy and hold shares of the Fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in RidgeWorth Funds. More information about these and other

discounts is available from your financial professional and in Sales Charges on page 29 of the Fund’s prospectus and Rights of Accumulation on page 89 of the Fund’s statement of additional information.

Shareholder Fees

(fees paid directly from your investment)

| |

A

Shares |

C

Shares |

I

Shares |

| Maximum

Sales Charge (load) Imposed On Purchases (as a % of offering price) |

5.75%

|

None

|

None

|

| Maximum

Deferred Sales Charge (load) (as a % of the net asset value) |

None

|

1.00%

|

None

|

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the value of your investment)

| |

A

Shares |

|

C

Shares |

|

I

Shares |

| Management

Fees |

0.10%

|

|

0.10%

|

|

0.10%

|

| Distribution

(12b-1) Fees |

0.30%

|

|

1.00%

|

|

None

|

| Other

Expenses |

1.17%

|

|

1.13%

|

|

1.45%

|

| Acquired

Fund Fees and Expenses(1) |

0.71%

|

|

0.71%

|

|

0.71%

|

| Total

Annual Fund Operating Expenses |

2.28%

|

|

2.94%

|

|

2.26%

|

| Fee

Waivers and/or Expense Reimbursements(2) |

(0.87)%

|

|

(0.93)%

|

|

(1.05)%

|

| Total

Annual Fund Operating Expenses After Fee Waivers and/or Expense Reimbursements |

1.41%

|

|

2.01%

|

|

1.21%

|

| (1)

|

“Acquired Fund Fees and

Expenses” reflect the Fund’s pro rata share of the fees and expenses incurred by investing in other investment companies. The impact of Acquired Fund Fees and Expenses is included in the total returns of the Fund. Acquired Fund Fees and

Expenses are not used to calculate the Fund’s net asset value per share (“NAV”) and are not included in the calculation of the ratio of expenses to average net assets shown in the Financial Highlights section of the Fund’s

prospectus. |

| (2)

|

The Adviser has contractually

agreed to waive fees and reimburse expenses until at least August 1, 2017 in order to keep Total Annual Fund Operating Expenses (excluding, as applicable, taxes, brokerage commissions, substitute dividend expenses on securities sold short,

interest expense, extraordinary expenses and Acquired Fund Fees and Expenses) from exceeding 0.70%, 1.30% and 0.50% for the A, C |

and I Shares, respectively. This agreement may be terminated

upon written notice to the Adviser by RidgeWorth Funds.

Example

This example is intended to help you compare

the cost of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example

also assumes that your investment has a 5% return each year, that the Fund’s operating expenses remain the same and that you reinvest all dividends and distributions. The example reflects contractual fee waivers and reimbursements for the

first year only. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| |

1

year |

3

years |

5

years |

10

years |

| A

Shares |

$710

|

$1,168

|

$1,650

|

$2,977

|

| C

Shares |

$304

|

$

822 |

$1,466

|

$3,195

|

| I

Shares |

$123

|

$

605 |

$1,114

|

$2,513

|

You would pay the

following expenses if you did not redeem your shares:

| |

1

year |

3

years |

5

years |

10

years |

| A

Shares |

$710

|

$1,168

|

$1,650

|

$2,977

|

| C

Shares |

$204

|

$

822 |

$1,466

|

$3,195

|

| I

Shares |

$123

|

$

605 |

$1,114

|

$2,513

|

Portfolio Turnover

The Fund pays transaction costs, when it buys

and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not

reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 43% of the average value of its portfolio.

Principal Investment Strategies

The Fund invests pursuant to an asset allocation strategy in a

combination of RidgeWorth Equity Funds and exchange-traded funds (“ETFs”) that invest in equities (together, “Underlying Equity Funds”), and, to a lesser extent, RidgeWorth Fixed Income Funds and ETFs that invest in bonds

(together, “Underlying Fixed Income Funds”). The Fund invests between 70% and 90% of its assets in Underlying Equity Funds and between 10% and 30% of its assets in Underlying Fixed Income Funds (together, “Underlying Funds”).

The Fund’s remaining assets may be invested in cash and cash equivalents, including unaffiliated money market funds, securities issued by the U.S. government, its agencies or instrumentalities, repurchase agreements and short-term paper.

Aggressive

Growth Allocation Strategy

The Fund may invest in Underlying Funds that:

| –

|

invest in common stocks of

real estate investment trusts and companies principally engaged in the real estate industry. |

| –

|

invest in common stocks,

other equity securities and debt instruments, including mortgage- and asset-backed instruments and securities restricted as to resale, of U.S. and non-U.S. companies. The Underlying Fund may invest in companies of any size and in both developed and

emerging markets. |

| –

|

invest in bank loans and

other below investment grade instruments. |

| –

|

invest in

inflation-protected public obligations of the U.S. Treasury (“TIPS”), which are securities issued by the U.S. Treasury that are designed to provide inflation protection to investors. |

In selecting a diversified portfolio of Underlying Funds, the

Adviser analyzes many factors, including the Underlying Funds’ investment objectives, total return, volatility and expenses. The table that follows shows how the Adviser currently expects to allocate the Fund’s portfolio among asset

classes. The table also shows the sectors within those asset classes to which the Fund may have exposure.

| Asset

Class |

Investment

Range

(Percentage of the

Aggressive Growth

Allocation

Strategy’s Assets) |

| Underlying

Equity Funds |

70-90%

|

| U.S.

Equities |

|

| International

Equities |

|

Emerging

Market Equities

(All Market Capitalizations) |

|

| Underlying

Fixed Income Funds |

10-30%

|

| U.S.

Investment Grade Bonds |

|

| U.S.

High Yield Bonds |

|

U.S.

Floating Rate Securities

(including bank loans) |

|

| International

Bonds |

|

| Emerging

Market Bonds |

|

| Underlying

Money Market Investments |

0-20%

|

Principal Investment Risks

You may lose money if you invest in the Fund. A Fund share is not a bank deposit and it is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

The value of an investment in the Fund is based primarily on

the performance of the Underlying Funds and the allocation of the Fund’s assets among them. The Adviser’s asset allocation decisions may not anticipate market trends successfully. The risks of the Fund will directly correspond to the

risks of the Underlying Funds in which it invests. These risks will vary

depending upon how the assets are allocated among the Underlying Funds.

Certain risks associated with investing in the Underlying Funds are described in this section.

Asset Allocation Risk: Asset

allocation risk is the risk that the Fund could lose money as a result of less than optimal or poor asset allocation decisions as to how its assets are allocated or re-allocated.

Below Investment Grade Securities Risk: Securities that are rated below investment grade (sometimes referred to as “junk bonds”, including those bonds rated lower than “BBB-” by Standard & Poor’s Financial Services LLC and

Fitch, Inc. or “Baa3” by Moody’s Investors Service), or that are unrated but judged by the Subadviser to be of comparable quality at the time of purchase, involve greater risk of default or downgrade and are more volatile than

investment grade securities and are considered speculative.

These instruments have a higher degree of default risk and may

be less liquid than higher-rated bonds. These instruments may be subject to a greater price volatility due to such factors as specific corporate developments, interest rate sensitivity, negative perceptions of high yield investments generally, and

less secondary market liquidity. This potential lack of liquidity may make it more difficult for the Fund to value these instruments accurately.

Debt Securities Risk: Debt

securities, such as bonds, involve credit risk. Credit risk is the risk that the borrower will not make timely payments of principal or interest or will default. Changes in an issuer’s credit rating or the market’s perception of an

issuer’s creditworthiness may also affect the value of the Fund’s investment in that issuer. The degree of credit risk depends on the issuer’s financial condition and on the terms of the securities.

Debt securities are also subject to interest rate risk, which

is the risk that the value of a debt security may fall when interest rates rise. In general, the market price of debt securities with longer maturities will go up or down more in response to changes in interest rates than the market price of shorter

term securities.

Equity Securities Risk: The price of equity securities fluctuates from time to time based on changes in a company’s financial condition or overall market and economic conditions. As a result, the value of the Fund’s equity

securities may fluctuate drastically from day to day.

Exchange-Traded Fund Risk:

ETFs, like mutual funds, have expenses associated with their operation, including advisory fees. When a Fund invests in an ETF, in addition to directly bearing expenses associated with its own operations, the Fund bears its pro rata portion of the

ETF’s expenses. The impact of these additional expenses, if any, would be shown as part of “Acquired Fund Fees and Expenses” in the Annual Fund Operating Expenses table.

Floating Rate Loan Risk: The

value of the collateral securing a floating rate loan can decline, be insufficient to meet the obligations of the borrower, or be difficult to liquidate. As a result, a floating rate loan may not be fully collateralized and

Aggressive Growth

Allocation Strategy

can decline significantly in value. Floating

rate loans generally are subject to contractual restrictions on resale. The liquidity of floating rate loans, including the volume and frequency of secondary market trading in such loans, varies significantly over time and among individual floating

rate loans. During periods of infrequent trading, valuing a floating rate loan can be more difficult, and buying and selling a floating rate loan at an acceptable price can also be more difficult and delayed. Difficulty in selling a floating rate

loan can result in a loss. In addition, floating rate loans generally are subject to extended settlement periods in excess of seven days, which may impair the Fund’s ability to sell or realize the full value of its loans in the event of a need

to liquidate such loans. The Fund participates in a line of credit facility to assist with cash flow management and liquidity. Floating rate loans may not be considered securities and, therefore, the Fund may not have the protections of the federal

securities laws with respect to its holdings of such loans.

Foreign Companies and Securities Risk: Foreign securities and dollar denominated securities of foreign issuers involve special risks such as economic or financial instability, lack of timely or reliable financial information and unfavorable political or

legal developments. Foreign securities also involve risks such as currency fluctuations and delays in enforcement of rights. All of these risks are increased for investments in emerging markets.

Growth Stock Risk:

“Growth” stocks can react differently to issuer, political, market and economic developments than the market as a whole and other types of stocks. “Growth” stocks typically are sensitive to market movements because their

market prices tend to reflect future expectations. When it appears those expectations will not be met, the prices of growth stocks typically fall.

Large-Capitalization Companies Risk: Large-cap stocks can perform differently from other segments of the equity market or the equity market as a whole. Large-capitalization companies may be less flexible in evolving markets or unable to implement change as

quickly as small-capitalization companies.

Mortgage-Backed and Asset-Backed Securities Risk: Mortgage- and asset-backed securities are debt instruments that are secured by interests in pools of mortgage loans or other financial assets. The value of these securities will be influenced by the factors affecting

the assets underlying such securities, swings in interest rates, changes in default rates, or deteriorating economic conditions.

During periods of declining asset values, mortgage-backed and

asset-backed securities may face valuation difficulties and may become more volatile and/or illiquid. The risk of default is generally higher in the case of securities backed by loans made to borrowers with “sub-prime” credit

metrics.

If market interest rates increase substantially

and the Fund’s adjustable-rate securities are not able to reset to market interest rates during any one adjustment period, the value of the Fund’s holdings and its net asset value may decline until the adjustable-rate securities are able

to reset to market rates. In the event of a dramatic increase in interest rates, the lifetime

limit on a security’s interest rate may prevent the rate from adjusting

to prevailing market rates. In such an event, the security could underperform and affect the Fund’s net asset value.

Prepayment and Call Risk:

During periods of falling interest rates, an issuer of a callable bond held by the Fund or an Underlying Fund may “call” or prepay the bond before its stated maturity date. When mortgages and other obligations are prepaid and when

securities are called, the Fund or an Underlying Fund may have to reinvest the proceeds in securities with a lower yield or fail to recover additional amounts paid for securities with higher interest rates, resulting in an unexpected capital loss

and/or a decline in the Fund’s income.

Real

Estate Investment Risk: The Fund or an Underlying ETF invests in companies that invest in real estate (e.g. real estate investment trusts) and is exposed to risks specific to the real estate market, including interest rate risk, leverage risk, property risk and management risk.

Restricted Securities Risk:

Certain debt securities may be restricted securities, which are not registered with the SEC and thus may not be sold publicly until registration has been made. Therefore, there is the absence of a public market and there is limited investor

information.

Small- and Mid-Capitalization Companies

Risk: Small- and mid-capitalization stocks tend to perform differently from other segments of the equity market or the equity market as a whole, and can be more volatile than stocks of large-capitalization

companies. Small- and mid-capitalization companies may be newer or less established, and may have limited resources, products and markets, and may be less liquid.

U.S. Government Securities

Risk: U.S. Treasury securities are backed by the full faith and credit of the U.S. government, while other types of securities issued or guaranteed by federal agencies, instrumentalities, and U.S.

government-sponsored entities may or may not be backed by the full faith and credit of the U.S. government. U.S. government securities may underperform other segments of the fixed income market or the fixed income market as a whole.

Value Investing Risk:

“Value” investing attempts to identify strong companies whose stocks are selling at a discount from their perceived true worth. It is subject to the risk that the stocks’ intrinsic values may never be fully recognized or realized

by the market, their prices may go down, or that stocks judged to be undervalued by the Fund or an Underlying Fund may actually be appropriately priced.

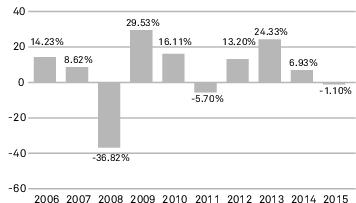

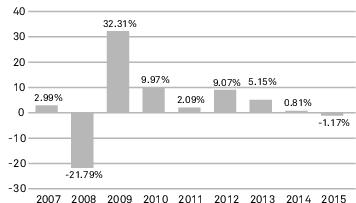

Performance

The bar chart and the performance table that follow illustrate

the risks and volatility of an investment in the Fund. The Fund’s past performance (before and after taxes) does not indicate how the Fund will perform in the future. Updated performance information is available by contacting the RidgeWorth

Funds at 1-888-784-3863 or by visiting www.ridgeworth.com.

Aggressive

Growth Allocation Strategy

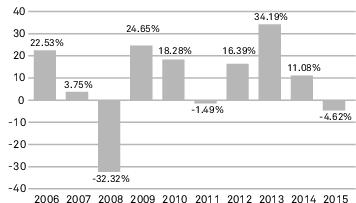

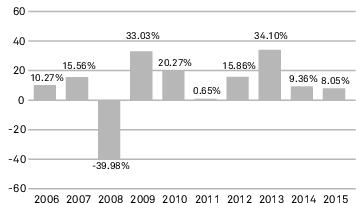

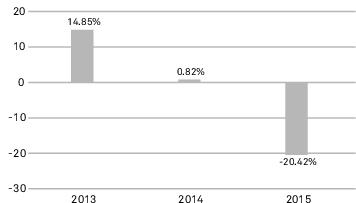

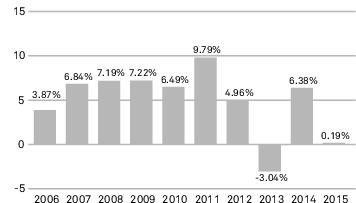

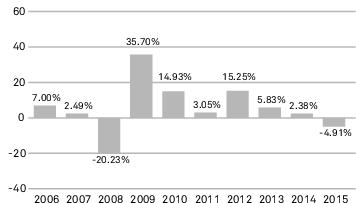

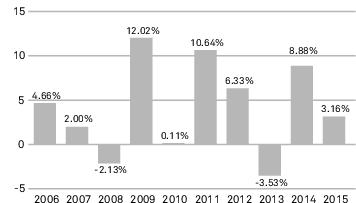

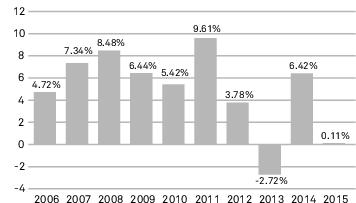

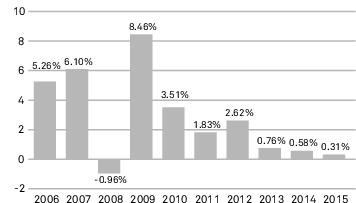

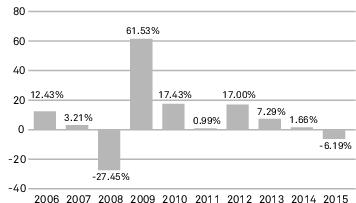

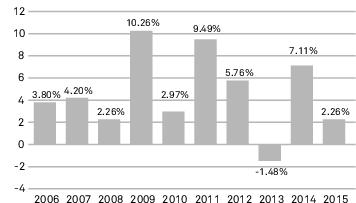

The annual returns in the bar chart which follows are for the

I Shares without reflecting payment of any sales

charge; if they did reflect such payment of sales charges, annual returns would be lower.

This bar chart shows the changes in performance of the

Fund’s I Shares from year to year.*

| Best

Quarter |

Worst

Quarter |

| 16.09%

|

-21.29%

|

| (6/30/2009)

|

(12/31/2008)

|

* The performance information shown above is

based on a calendar year. The Fund's total return for the six months ended June 30, 2016 was 0.33%.

The following table compares the Fund’s average annual

total returns for the periods indicated with those of a broad measure of market performance.

AVERAGE ANNUAL TOTAL RETURNS

(for periods ended December 31, 2015)

| |

1

Year |

5

Years |

10

Years |

| A

Shares Return Before Taxes |

(6.90)%

|

5.52%

|

4.27%

|

| C

Shares Return Before Taxes |

(2.44)%

|

6.13%

|

4.20%

|

| I

Shares Return Before Taxes |

(1.10)%

|

7.02%

|

5.17%

|

| I

Shares Return After Taxes on Distributions |

(6.15)%

|

3.82%

|

2.67%

|

| I

Shares Return After Taxes on Distributions and Sale of Fund Shares |

3.35%

|

5.15%

|

3.83%

|

| Hybrid

80/20 Blend of the two Indices below (reflects no deduction for fees, expenses or taxes) |

1.37%

|

10.78%

|

6.95%

|

| S&P

500 Index (reflects no deduction for fees, expenses or taxes) |

1.38%

|

12.57%

|

7.31%

|

| Barclays

U.S. Aggregate Bond Index (reflects no deduction for fees, expenses or taxes) |

0.55%

|

3.25%

|

4.51%

|

After-tax returns are

calculated using the historical highest individual U.S. federal marginal income tax rates and do not reflect the impact of state and local taxes. Your actual after-tax returns will depend on your tax situation and may differ from

those shown. After-tax returns shown are not relevant to investors who hold

their Fund shares through tax-advantaged arrangements, such as 401(k) plans or individual retirement accounts (“IRAs”). After-tax returns are shown for only the I Shares. After-tax returns for other share classes will vary.

In some cases, average annual return after

taxes on distributions and sale of fund shares is higher than the average annual return after taxes on distributions because of realized losses that would have been sustained upon the sale of fund shares immediately after the relevant periods.

The calculations assume that an investor holds the shares in a taxable account, is in the actual historical highest individual federal marginal income tax bracket for each year and would have been able to immediately utilize the full realized

loss to reduce his or her federal tax liability. However, actual individual tax results may vary and investors should consult their tax advisers regarding their personal tax situations.

Investment Adviser

RidgeWorth Investments is the Fund’s investment adviser

(the “Adviser”).

Portfolio Management

Mr. Alan Gayle, Managing Director of the Adviser, has managed

the Fund since its inception.

Purchasing and Selling Your

Shares

You may purchase or redeem Fund shares on any

business day. You may purchase and redeem A, C and I Shares of the Fund through financial institutions or intermediaries that are authorized to place transactions in Fund shares for their customers or for their own accounts.

The minimum initial investment amounts for each share class are

shown below, although these minimums may be reduced, waived, or not applicable in some cases.

Aggressive Growth

Allocation Strategy

| Class

|

Dollar

Amount |

| A

Shares |

$2,000

|

| C

Shares |

$5,000

($2,000 for IRAs or other tax-advantaged accounts) |

| I

Shares |

None

|

Subsequent investments in A or C

Shares must be made in amounts of at least $1,000. The Fund may accept investments of smaller amounts for either class of shares at its discretion. There are no minimums for subsequent investments in I Shares.

Tax Information

The Fund’s distributions are generally taxable as

ordinary income, qualified dividend income, or capital gains unless you are investing through a tax-advantaged arrangement, such as a 401(k) plan or an IRA, which may be taxed upon withdrawal.

Payments to Broker-Dealers and Other Financial

Intermediaries

If you purchase shares of the Fund through

a financial intermediary, such as a broker-dealer or investment adviser, the Fund, the Adviser or the Distributor may pay the intermediary for the sale of Fund shares and related services.

These payments may create a conflict of interest by influencing

the broker-dealer or other financial intermediary and your salesperson to recommend the Fund over another investment. Ask your financial intermediary or visit your financial intermediary’s website for more information.

Conservative

Allocation Strategy

Summary Section

A Shares, C Shares and I Shares

Investment Objective

The Conservative Allocation Strategy (the “Fund”)

seeks to provide a high level of capital appreciation and current income.

Fees and Expenses of the Fund

This table describes the fees and expenses

that you may pay if you buy and hold shares of the Fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in RidgeWorth Funds. More information about these and other

discounts is available from your financial professional and in Sales Charges on page 29 of the Fund’s prospectus and Rights of Accumulation on page 89 of the Fund’s statement of additional information.

Shareholder Fees

(fees paid directly from your investment)

| |

A

Shares |

C

Shares |

I

Shares |

| Maximum

Sales Charge (load) Imposed On Purchases (as a % of offering price) |

4.75%

|

None

|

None

|

| Maximum

Deferred Sales Charge (load) (as a % of the net asset value) |

None

|

1.00%

|

None

|

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the value of your investment)

| |

A

Shares |

|

C

Shares |

|

I

Shares |

| Management

Fees |

0.10%

|

|

0.10%

|

|

0.10%

|

| Distribution

(12b-1) Fees |

0.30%

|

|

1.00%

|

|

None

|

| Other

Expenses |

0.27%

|

|

0.22%

|

|

0.34%

|

| Acquired

Fund Fees and Expenses(1) |

0.46%

|

|

0.46%

|

|

0.46%

|

| Total

Annual Fund Operating Expenses |

1.13%

|

|

1.78%

|

|

0.90%

|

| Fee

Waivers and/or Expense Reimbursements(2) |

(0.07)%

|

|

(0.02)%

|

|

(0.14)%

|

| Total

Annual Fund Operating Expenses After Fee Waivers and/or Expense Reimbursements |

1.06%

|

|

1.76%

|

|

0.76%

|

| (1)

|

“Acquired Fund Fees and

Expenses” reflect the Fund’s pro rata share of the fees and expenses incurred by investing in other investment companies. The impact of Acquired Fund Fees and Expenses is included in the total returns of the Fund. Acquired Fund Fees and

Expenses are not used to calculate the Fund’s net asset value per share (“NAV”) and are not included in the calculation of the ratio of expenses to average net assets shown in the Financial Highlights section of the Fund’s

prospectus. |

| (2)

|

The Adviser has contractually

agreed to waive fees and reimburse expenses until at least August 1, 2017 in order to keep Total Annual Fund Operating Expenses (excluding, as applicable, taxes, brokerage commissions, substitute dividend expenses on securities sold short,

interest expense, extraordinary expenses and Acquired Fund Fees and Expenses) from exceeding 0.60%, 1.30% and 0.30% for the A, C |

and I Shares, respectively. This agreement may be terminated

upon written notice to the Adviser by RidgeWorth Funds.

Example

This example is intended to help you compare

the cost of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example

also assumes that your investment has a 5% return each year, that the Fund’s operating expenses remain the same and that you reinvest all dividends and distributions. The example reflects contractual fee waivers and reimbursements for the

first year only. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| |

1

year |

3

years |

5

years |

10

years |

| A

Shares |

$578

|

$810

|

$1,061

|

$1,778

|

| C

Shares |

$279

|

$558

|

$

963 |

$2,093

|

| I

Shares |

$

78 |

$273

|

$

485 |

$1,095

|

You would pay the

following expenses if you did not redeem your shares:

| |

1

year |

3

years |

5

years |

10

years |

| A

Shares |

$578

|

$810

|

$1,061

|

$1,778

|

| C

Shares |

$179

|

$558

|

$

963 |

$2,093

|

| I

Shares |

$

78 |

$273

|

$

485 |

$1,095

|

Portfolio Turnover

The Fund pays transaction costs, when it buys

and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not

reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 40% of the average value of its portfolio.

Principal Investment Strategies

The Fund invests pursuant to an asset allocation strategy in a

combination of RidgeWorth Fixed Income Funds and exchange-traded funds (“ETFs”) that invest in bonds (together, “Underlying Fixed Income Funds”), and to a lesser extent, RidgeWorth Equity Funds and ETFs that invest in

equities (together, “Underlying Equity Funds”). The Fund invests between 50% and 80% of its assets in Underlying Fixed Income Funds, and between 20% and 40% of its assets in Underlying Equity Funds (together, “Underlying

Funds”). The Fund’s remaining assets may be invested in cash and cash equivalents, including unaffiliated money market funds, securities issued by the U.S. government, its agencies or instrumentalities, repurchase agreements and

short-term paper.

Conservative Allocation

Strategy

The Fund may invest in Underlying Funds that:

| –

|

invest in debt instruments,

including mortgage- and asset-backed instruments, securities restricted as to resale, common stocks and other equity securities of U.S. and non-U.S. companies including those in both developed and emerging markets. |

| –

|

invest in bank loans and

other below investment grade instruments. |

| –

|

invest in

inflation-protected public obligations of the U.S. Treasury (“TIPS”), which are securities issued by the U.S. Treasury that are designed to provide inflation protection to investors. |

In selecting a diversified portfolio of Underlying Fixed Income

Funds and Underlying Equity Funds (together, “Underlying Funds”), the Adviser analyzes many factors, including the Underlying Funds’ investment objectives, total return, volatility and expenses.

The table that follows shows how the Adviser currently expects

to allocate the Fund’s portfolio among asset classes. The table also shows the sectors within those asset classes to which the Fund will currently have exposure.

| Asset

Class |

Investment

Range

(Percentage of the

Conservative Allocation

Strategy’s Assets) |

| Underlying

Fixed Income Funds |

50-80%

|

| U.S.

Investment Grade Bonds |

|

| U.S.

High Yield Bonds |

|

U.S.

Floating Rate Securities

(including bank loans) |

|

| International

Bonds |

|

| Emerging

Market Bonds |

|

| Underlying

Equity Funds |

20-40%

|

| U.S.

Equities |

|

| International

Equities |

|

Emerging

Market Equities

(All Market Capitalizations) |

|

| Underlying

Money Market Investments |

0-20%

|

Principal Investment Risks

You may lose money if you invest in the Fund. A Fund share is not a bank deposit and it is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

The value of an investment in the Fund is based primarily on

the performance of the Underlying Funds and the allocation of the Fund’s assets among them. The Adviser’s asset allocation decisions may not anticipate market trends successfully. The risks of the Fund will directly correspond to the

risks of the Underlying Funds in which it invests. These risks will vary depending upon how the assets are allocated among the Underlying Funds. Certain risks associated with investing in the Underlying Funds are described in this section.

Asset Allocation Risk: Asset allocation risk

is the risk that the Fund could lose money as a result of less than optimal or poor asset allocation decisions as to how its assets are allocated or re-allocated.

Below Investment Grade Securities Risk: Securities that are rated below investment grade (sometimes referred to as “junk bonds”, including those bonds rated lower than “BBB-” by Standard & Poor’s Financial Services LLC and

Fitch, Inc. or “Baa3” by Moody’s Investors Service), or that are unrated but judged by the Subadviser to be of comparable quality at the time of purchase, involve greater risk of default or downgrade and are more volatile than

investment grade securities and are considered speculative.

These instruments have a higher degree of default risk and may

be less liquid than higher-rated bonds. These instruments may be subject to a greater price volatility due to such factors as specific corporate developments, interest rate sensitivity, negative perceptions of high yield investments generally, and

less secondary market liquidity. This potential lack of liquidity may make it more difficult for the Fund to value these instruments accurately.

Debt Securities Risk: Debt

securities, such as bonds, involve credit risk. Credit risk is the risk that the borrower will not make timely payments of principal or interest or will default. Changes in an issuer’s credit rating or the market’s perception of an

issuer’s creditworthiness may also affect the value of the Fund’s investment in that issuer. The degree of credit risk depends on the issuer’s financial condition and on the terms of the securities.

Debt securities are also subject to interest rate risk, which

is the risk that the value of a debt security may fall when interest rates rise. In general, the market price of debt securities with longer maturities will go up or down more in response to changes in interest rates than the market price of shorter

term securities.

Equity Securities Risk: The price of equity securities fluctuates from time to time based on changes in a company’s financial condition or overall market and economic conditions. As a result, the value of the Fund’s equity

securities may fluctuate drastically from day to day.

Exchange-Traded Fund Risk:

ETFs, like mutual funds, have expenses associated with their operation, including advisory fees. When a Fund invests in an ETF, in addition to directly bearing expenses associated with its own operations, the Fund bears its pro rata portion of the

ETF’s expenses. The impact of these additional expenses, if any, would be shown as part of “Acquired Fund Fees and Expenses” in the Annual Fund Operating Expenses table.

Floating Rate Loan Risk: The

value of the collateral securing a floating rate loan can decline, be insufficient to meet the obligations of the borrower, or be difficult to liquidate. As a result, a floating rate loan may not be fully collateralized and can decline significantly

in value. Floating rate loans generally are subject to contractual restrictions on resale. The liquidity of floating rate loans, including the volume and frequency of secondary market trading in such loans, varies significantly

Conservative

Allocation Strategy

over time and among individual floating rate

loans. During periods of infrequent trading, valuing a floating rate loan can be more difficult, and buying and selling a floating rate loan at an acceptable price can also be more difficult and delayed. Difficulty in selling a floating rate loan

can result in a loss. In addition, floating rate loans generally are subject to extended settlement periods in excess of seven days, which may impair the Fund’s ability to sell or realize the full value of its loans in the event of a need to

liquidate such loans. The Fund participates in a line of credit facility to assist with cash flow management and liquidity. Floating rate loans may not be considered securities and, therefore, the Fund may not have the protections of the federal

securities laws with respect to its holdings of such loans.

Foreign Companies and Securities Risk: Foreign securities and dollar denominated securities of foreign issuers involve special risks such as economic or financial instability, lack of timely or reliable financial information and unfavorable political or

legal developments. Foreign securities also involve risks such as currency fluctuations and delays in enforcement of rights. All of these risks are increased for investments in emerging markets.

Growth Stock Risk:

“Growth” stocks can react differently to issuer, political, market and economic developments than the market as a whole and other types of stocks. “Growth” stocks typically are sensitive to market movements because their

market prices tend to reflect future expectations. When it appears those expectations will not be met, the prices of growth stocks typically fall.

Large-Capitalization Companies Risk: Large-cap stocks can perform differently from other segments of the equity market or the equity market as a whole. Large-capitalization companies may be less flexible in evolving markets or unable to implement change as

quickly as small-capitalization companies.

Mortgage-Backed and Asset-Backed Securities Risk: Mortgage- and asset-backed securities are debt instruments that are secured by interests in pools of mortgage loans or other financial assets. The value of these securities will be influenced by the factors affecting

the assets underlying such securities, swings in interest rates, changes in default rates, or deteriorating economic conditions.

During periods of declining asset values, mortgage-backed and

asset-backed securities may face valuation difficulties and may become more volatile and/or illiquid. The risk of default is generally higher in the case of securities backed by loans made to borrowers with “sub-prime” credit

metrics.

If market interest rates increase substantially

and the Fund’s adjustable-rate securities are not able to reset to market interest rates during any one adjustment period, the value of the Fund’s holdings and its net asset value may decline until the adjustable-rate securities are able

to reset to market rates. In the event of a dramatic increase in interest rates, the lifetime limit on a security’s interest rate may prevent the rate from adjusting to prevailing market rates. In such an event, the security could underperform

and affect the Fund’s net asset value.

Prepayment and Call Risk: During periods of

falling interest rates, an issuer of a callable bond held by the Fund or an Underlying Fund may “call” or prepay the bond before its stated maturity date. When mortgages and other obligations are prepaid and when securities are called,

the Fund or an Underlying Fund may have to reinvest the proceeds in securities with a lower yield or fail to recover additional amounts paid for securities with higher interest rates, resulting in an unexpected capital loss and/or a decline in the

Fund’s income.

Real Estate Investment Risk: The Fund or an Underlying ETF invests in companies that invest in real estate (e.g. real estate investment trusts) and

is exposed to risks specific to the real estate market, including interest rate risk, leverage risk, property risk and management risk.

Restricted Securities Risk:

Certain debt securities may be restricted securities, which are not registered with the SEC and thus may not be sold publicly until registration has been made. Therefore, there is the absence of a public market and there is limited investor

information.

Small- and Mid-Capitalization Companies

Risk: Small- and mid-capitalization stocks tend to perform differently from other segments of the equity market or the equity market as a whole, and can be more volatile than stocks of large-capitalization

companies. Small- and mid-capitalization companies may be newer or less established, and may have limited resources, products and markets, and may be less liquid.

U.S. Government Securities

Risk: U.S. Treasury securities are backed by the full faith and credit of the U.S. government, while other types of securities issued or guaranteed by federal agencies, instrumentalities, and U.S.

government-sponsored entities may or may not be backed by the full faith and credit of the U.S. government. U.S. government securities may underperform other segments of the fixed income market or the fixed income market as a whole.

Value Investing Risk:

“Value” investing attempts to identify strong companies whose stocks are selling at a discount from their perceived true worth. It is subject to the risk that the stocks’ intrinsic values may never be fully recognized or realized

by the market, their prices may go down, or that stocks judged to be undervalued by the Fund or an Underlying Fund may actually be appropriately priced.

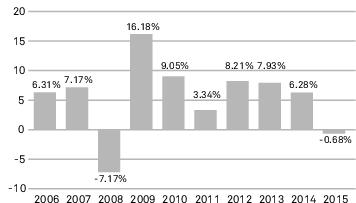

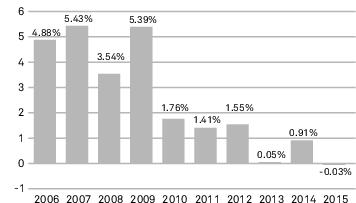

Performance

The bar chart and the performance table that follow illustrate

the risks and volatility of an investment in the Fund. The Fund’s past performance (before and after taxes) does not indicate how the Fund will perform in the future. I Shares commenced operations on November 6, 2003, A Shares

commenced operations on November 11, 2003 and C Shares commenced operations on April 3, 2005. Performance between March 11, 2003 and the commencement of operations of A Shares, C Shares and I Shares is that of the B Shares of the

Fund, which converted into A Shares of the Fund on July 16, 2010, and has not been adjusted to reflect A Share, C Share or I Share expenses. If it had been performance for the C Shares would

Conservative Allocation

Strategy

have been lower.) Updated performance information is available

by contacting the RidgeWorth Funds at 1-888-784-3863 or by visiting www.ridgeworth.com.

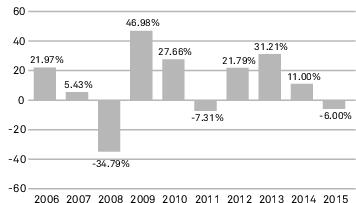

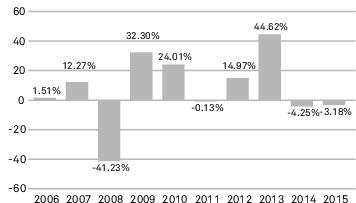

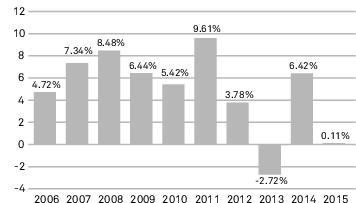

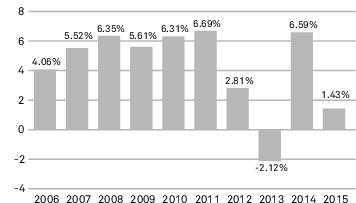

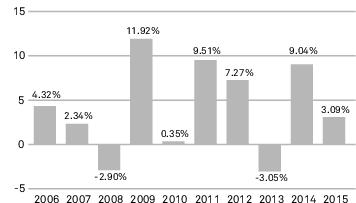

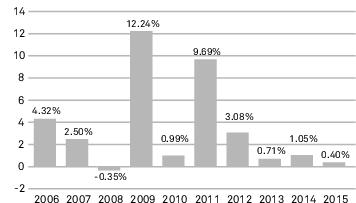

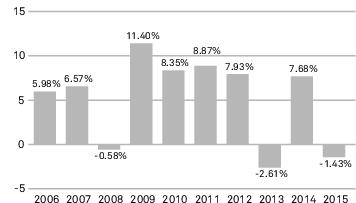

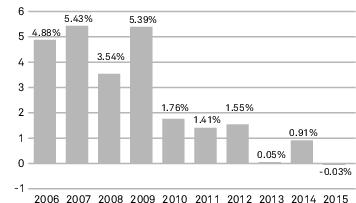

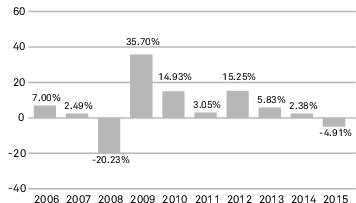

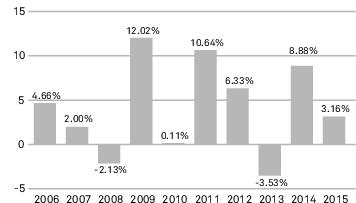

The annual returns in the bar chart which follows are for the I

Shares without reflecting payment of any sales

charge; if they did reflect such payment of sales charges, annual returns would be lower.

This bar chart shows the changes in performance of the

Fund’s I Shares from year to year.*

| Best

Quarter |

Worst

Quarter |

| 7.57%

|

-4.15%

|

| (9/30/2009)

|

(9/30/2011)

|

* The performance information shown above is

based on a calendar year. The Fund's total return for the six months ended June 30, 2016 was 3.02%.

The following table compares the Fund’s average annual

total returns for the periods indicated with those of a broad measure of market performance.

AVERAGE ANNUAL TOTAL RETURNS

(for periods ended December 31, 2015)

| |

1

Year |

5

Years |

10

Years |

| A

Shares Return Before Taxes |

(5.59)%

|

3.64%

|

4.68%

|

| C

Shares Return Before Taxes |

(2.59)%

|

3.92%

|

4.44%

|

| I

Shares Return Before Taxes |

(0.68)%

|

4.96%

|

5.49%

|

| I

Shares Return After Taxes on Distributions |

(1.96)%

|

3.46%

|

3.97%

|

| I

Shares Return After Taxes on Distributions and Sale of Fund Shares |

0.15%

|

3.44%

|

3.84%

|

| Hybrid

30/70 Blend of the two Indices below (reflects no deduction for fees, expenses or taxes) |

1.01%

|

6.13%

|

5.61%

|

| S&P

500 Index (reflects no deduction for fees, expenses or taxes) |

1.38%

|

12.57%

|

7.31%

|

| Barclays

U.S. Aggregate Bond Index (reflects no deduction for fees, expenses or taxes) |

0.55%

|

3.25%

|

4.51%

|

After-tax returns are calculated using the historical highest individual U.S.

federal marginal income tax rates and do not reflect the impact of state and local taxes. Your actual after-tax returns will depend on your tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold

their Fund shares through tax-advantaged arrangements, such as 401(k) plans or individual retirement accounts (“IRAs”). After-tax returns are shown for only the I Shares. After-tax returns for other share classes will vary.

In some cases, average annual return after

taxes on distributions and sale of fund shares is higher than the average annual return after taxes on distributions because of realized losses that would have been sustained upon the sale of fund shares immediately after the relevant periods.

The calculations assume that an investor holds the shares in a taxable account, is in the actual historical highest individual federal marginal income tax bracket for each year and would have been able to immediately utilize the full realized

loss to reduce his or her federal tax liability. However, actual individual tax results may vary and investors should consult their tax advisers regarding their personal tax situations.

Investment Adviser

RidgeWorth Investments is the Fund’s investment adviser

(the “Adviser”).

Portfolio Management

Mr. Alan Gayle, Managing Director of the Adviser, has managed

the Fund since its inception.

Purchasing and Selling Your

Shares

You may purchase or redeem Fund shares on any

business day. You may purchase and redeem A, C and I Shares of the Fund through financial institutions or intermediaries that are authorized to place transactions in Fund shares for their customers or for their own accounts.

The minimum initial investment amounts for each share class are

shown below, although these minimums may be reduced, waived, or not applicable in some cases.

Conservative

Allocation Strategy

| Class

|

Dollar

Amount |

| A

Shares |

$2,000

|

| C

Shares |

$5,000

($2,000 for IRAs or other tax-advantaged accounts) |

| I

Shares |

None

|

Subsequent investments in A or C

Shares must be made in amounts of at least $1,000. The Fund may accept investments of smaller amounts for either class of shares at its discretion. There are no minimums for subsequent investments in I Shares.

Tax Information

The Fund’s distributions are generally taxable as

ordinary income, qualified dividend income, or capital gains unless you are investing through a tax-advantaged arrangement, such as a 401(k) plan or an IRA, which may be taxed upon withdrawal.

Payments to Broker-Dealers and Other Financial

Intermediaries

If you purchase shares of the Fund through

a financial intermediary, such as a broker-dealer or investment adviser, the Fund, the Adviser or the Distributor may pay the intermediary for the sale of Fund shares and related services.

These payments may create a conflict of interest by influencing

the broker-dealer or other financial intermediary and your salesperson to recommend the Fund over another investment. Ask your financial intermediary or visit your financial intermediary’s website for more information.

Growth Allocation

Strategy

Summary Section

A Shares, C Shares and I Shares

Investment Objective

The Growth Allocation Strategy (the “Fund”) seeks

to provide long-term capital appreciation.

Fees and

Expenses of the Fund

This table describes the fees and expenses

that you may pay if you buy and hold shares of the Fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in RidgeWorth Funds. More information about these and other

discounts is available from your financial professional and in Sales Charges on page 29 of the Fund’s prospectus and Rights of Accumulation on page 89 of the Fund’s statement of additional information.

Shareholder Fees

(fees paid directly from your investment)

| |

A

Shares |

C

Shares |

I

Shares |

| Maximum

Sales Charge (load) Imposed On Purchases (as a % of offering price) |

5.75%

|

None

|

None

|

| Maximum

Deferred Sales Charge (load) (as a % of the net asset value) |

None

|

1.00%

|

None

|

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the value of your investment)

| |

A

Shares |

|

C

Shares |

|

I

Shares |

| Management

Fees |

0.10%

|

|

0.10%

|

|

0.10%

|

| Distribution

(12b-1) Fees |

0.30%

|

|

1.00%

|

|

None

|

| Other

Expenses |

0.27%

|

|

0.21%

|

|

0.60%

|

| Acquired

Fund Fees and Expenses(1) |

0.66%

|

|

0.66%

|

|

0.66%

|

| Total

Annual Fund Operating Expenses |

1.33%

|

|

1.97%

|

|

1.36%

|

| Fee

Waivers and/or Expense Reimbursements(2) |

—

|

|

(0.01)%

|

|

(0.20)%

|

| Total

Annual Fund Operating Expenses After Fee Waivers and/or Expense Reimbursements |

1.33%

|

|

1.96%

|

|

1.16%

|

| (1)

|

“Acquired Fund Fees and

Expenses” reflect the Fund’s pro rata share of the fees and expenses incurred by investing in other investment companies. The impact of Acquired Fund Fees and Expenses is included in the total returns of the Fund. Acquired Fund Fees and

Expenses are not used to calculate the Fund’s net asset value per share (“NAV”) and are not included in the calculation of the ratio of expenses to average net assets shown in the Financial Highlights section of the Fund’s

prospectus. |

| (2)

|

The Adviser has contractually

agreed to waive fees and reimburse expenses until at least August 1, 2017 in order to keep Total Annual Fund Operating Expenses (excluding, as applicable, taxes, brokerage commissions, substitute dividend expenses on securities sold short,

interest expense, extraordinary expenses and Acquired Fund Fees and Expenses) from exceeding 0.70%, 1.30% and 0.50% for the A, C |

and I Shares, respectively. This agreement may be terminated

upon written notice to the Adviser by RidgeWorth Funds.

Example

This example is intended to help you compare

the cost of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example

also assumes that your investment has a 5% return each year, that the Fund’s operating expenses remain the same and that you reinvest all dividends and distributions. The example reflects contractual fee waivers and reimbursements for the

first year only. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| |

1

year |

3

years |

5

years |

10

years |

| A

Shares |

$703

|

$972

|

$1,262

|

$2,084

|

| C

Shares |

$299

|

$617

|

$1,061

|

$2,295

|

| I

Shares |

$118

|

$411

|

$

726 |

$1,618

|

You would pay the

following expenses if you did not redeem your shares:

| |

1

year |

3

years |

5

years |

10

years |

| A

Shares |

$703

|

$972

|

$1,262

|

$2,084

|

| C

Shares |

$199

|

$617

|

$1,061

|

$2,295

|

| I

Shares |

$118

|

$411

|

$

726 |

$1,618

|

Portfolio Turnover

The Fund pays transaction costs, when it buys

and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not

reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 29% of the average value of its portfolio.

Principal Investment Strategies

The Fund invests pursuant to an asset allocation strategy in a

combination of RidgeWorth Equity Funds and exchange-traded funds (“ETFs”) that invest in equities (together, “Underlying Equity Funds”), and, to a lesser extent, RidgeWorth Fixed Income Funds and ETFs that invest in bonds

(together, “Underlying Fixed Income Funds”). The Fund invests between 60% and 80% of its assets in Underlying Equity Funds and between 10% and 40% of its assets in Underlying Fixed Income Funds (together, “Underlying Funds”).

The Fund’s remaining assets may be invested in cash and cash equivalents, including unaffiliated money market funds, securities issued by the U.S. government, its agencies or instrumentalities, repurchase agreements and short-term paper.

Growth

Allocation Strategy

The Fund may invest in Underlying Funds that:

| –

|

invest in common stocks,

other equity securities and debt instruments, including mortgage- and asset-backed instruments and securities restricted as to resale, of U.S. and non-U.S. companies. The Underlying Fund may invest in companies of any size and in both developed and

emerging markets. |

| –

|

invest in bank loans and

other below investment grade instruments. |

| –

|

invest in

inflation-protected public obligations of the U.S. Treasury (“TIPS”), which are securities issued by the U.S. Treasury that are designed to provide inflation protection to investors. |

In selecting a diversified portfolio of Underlying Funds, the

Adviser analyzes many factors, including the Underlying Funds’ investment objectives, total returns, volatility and expenses. The table that follows shows how the Adviser currently expects to allocate the Fund’s portfolio among asset

classes. The table also shows the sectors within those asset classes to which the Fund will currently have exposure.

| Asset

Class |

Investment

Range

(Percentage of the

Growth Allocation

Strategy’s Assets) |

| Underlying

Equity Funds |

60-80%

|

| U.S.

Equities |

|

| International

Equities |

|

Emerging

Market Equities

(All Market Capitalizations) |

|

| Underlying

Fixed Income Funds |

10-40%

|

| U.S.

Investment Grade Bonds |

|

| U.S.

High Yield Bonds |

|

U.S.

Floating Rate Securities

(including bank loans) |

|

| International

Bonds |

|

| Emerging

Market Bonds |

|

| Underlying

Money Market Investments |

0-20%

|

Principal Investment Risks

You may lose money if you invest in the Fund. A Fund share is not a bank deposit and it is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

The value of an investment in the Fund is based primarily on

the performance of the Underlying Funds and the allocation of the Fund’s assets among them. The Adviser’s asset allocation decisions may not anticipate market trends successfully. The risks of the Fund will directly correspond to the

risks of the Underlying Funds in which it invests. These risks will vary depending upon how the assets are allocated among the Underlying Funds. Certain risks associated with investing in the Underlying Funds are described in this section.

Asset Allocation Risk: Asset allocation risk

is the risk that the Fund could lose money as a result of less than optimal or poor asset allocation decisions as to how its assets are allocated or re-allocated.

Below Investment Grade Securities Risk: Securities that are rated below investment grade (sometimes referred to as “junk bonds”, including those bonds rated lower than “BBB-” by Standard & Poor’s Financial Services LLC and

Fitch, Inc. or “Baa3” by Moody’s Investors Service), or that are unrated but judged by the Subadviser to be of comparable quality at the time of purchase, involve greater risk of default or downgrade and are more volatile than

investment grade securities and are considered speculative.

These instruments have a higher degree of default risk and may

be less liquid than higher-rated bonds. These instruments may be subject to a greater price volatility due to such factors as specific corporate developments, interest rate sensitivity, negative perceptions of high yield investments generally, and

less secondary market liquidity. This potential lack of liquidity may make it more difficult for the Fund to value these instruments accurately.

Debt Securities Risk: Debt

securities, such as bonds, involve credit risk. Credit risk is the risk that the borrower will not make timely payments of principal or interest or will default. Changes in an issuer’s credit rating or the market’s perception of an

issuer’s creditworthiness may also affect the value of the Fund’s investment in that issuer. The degree of credit risk depends on the issuer’s financial condition and on the terms of the securities.

Debt securities are also subject to interest rate risk, which

is the risk that the value of a debt security may fall when interest rates rise. In general, the market price of debt securities with longer maturities will go up or down more in response to changes in interest rates than the market price of shorter

term securities.

Equity Securities Risk: The price of equity securities fluctuates from time to time based on changes in a company’s financial condition or overall market and economic conditions. As a result, the value of the Fund’s equity

securities may fluctuate drastically from day to day.

Exchange-Traded Fund Risk:

ETFs, like mutual funds, have expenses associated with their operation, including advisory fees. When a Fund invests in an ETF, in addition to directly bearing expenses associated with its own operations, the Fund bears its pro rata portion of the

ETF’s expenses. The impact of these additional expenses, if any, would be shown as part of “Acquired Fund Fees and Expenses” in the Annual Fund Operating Expenses table.

Floating Rate Loan Risk: The

value of the collateral securing a floating rate loan can decline, be insufficient to meet the obligations of the borrower, or be difficult to liquidate. As a result, a floating rate loan may not be fully collateralized and can decline significantly

in value. Floating rate loans generally are subject to contractual restrictions on resale. The liquidity of floating rate loans, including the volume and frequency of secondary market trading in such loans, varies significantly

Growth Allocation

Strategy

over time and among individual floating rate

loans. During periods of infrequent trading, valuing a floating rate loan can be more difficult, and buying and selling a floating rate loan at an acceptable price can also be more difficult and delayed. Difficulty in selling a floating rate loan

can result in a loss. In addition, floating rate loans generally are subject to extended settlement periods in excess of seven days, which may impair the Fund’s ability to sell or realize the full value of its loans in the event of a need to

liquidate such loans. The Fund participates in a line of credit facility to assist with cash flow management and liquidity. Floating rate loans may not be considered securities and, therefore, the Fund may not have the protections of the federal

securities laws with respect to its holdings of such loans.

Foreign Companies and Securities Risk: Foreign securities and dollar denominated securities of foreign issuers involve special risks such as economic or financial instability, lack of timely or reliable financial information and unfavorable political or

legal developments. Foreign securities also involve risks such as currency fluctuations and delays in enforcement of rights. All of these risks are increased for investments in emerging markets.

Growth Stock Risk:

“Growth” stocks can react differently to issuer, political, market and economic developments than the market as a whole and other types of stocks. “Growth” stocks typically are sensitive to market movements because their

market prices tend to reflect future expectations. When it appears those expectations will not be met, the prices of growth stocks typically fall.

Large-Capitalization Companies Risk: Large-cap stocks can perform differently from other segments of the equity market or the equity market as a whole. Large-capitalization companies may be less flexible in evolving markets or unable to implement change as

quickly as small-capitalization companies.

Mortgage-Backed and Asset-Backed Securities Risk: Mortgage- and asset-backed securities are debt instruments that are secured by interests in pools of mortgage loans or other financial assets. The value of these securities will be influenced by the factors affecting

the assets underlying such securities, swings in interest rates, changes in default rates, or deteriorating economic conditions.

During periods of declining asset values, mortgage-backed and

asset-backed securities may face valuation difficulties and may become more volatile and/or illiquid. The risk of default is generally higher in the case of securities backed by loans made to borrowers with “sub-prime” credit

metrics.

If market interest rates increase substantially

and the Fund’s adjustable-rate securities are not able to reset to market interest rates during any one adjustment period, the value of the Fund’s holdings and its net asset value may decline until the adjustable-rate securities are able

to reset to market rates. In the event of a dramatic increase in interest rates, the lifetime limit on a security’s interest rate may prevent the rate from adjusting to prevailing market rates. In such an event, the security could underperform

and affect the Fund’s net asset value.

Prepayment and Call Risk: During periods of

falling interest rates, an issuer of a callable bond held by the Fund or an Underlying Fund may “call” or prepay the bond before its stated maturity date. When mortgages and other obligations are prepaid and when securities are called,

the Fund or an Underlying Fund may have to reinvest the proceeds in securities with a lower yield or fail to recover additional amounts paid for securities with higher interest rates, resulting in an unexpected capital loss and/or a decline in the

Fund’s income.

Real Estate Investment Risk: The Fund or an Underlying ETF invests in companies that invest in real estate (e.g. real estate investment trusts) and

is exposed to risks specific to the real estate market, including interest rate risk, leverage risk, property risk and management risk.

Restricted Securities Risk:

Certain debt securities may be restricted securities, which are not registered with the SEC and thus may not be sold publicly until registration has been made. Therefore, there is the absence of a public market and there is limited investor

information.

U.S. Government Securities Risk: U.S. Treasury securities are backed by the full faith and credit of the U.S. government, while other types of securities issued or guaranteed by federal agencies, instrumentalities, and U.S. government-sponsored

entities may or may not be backed by the full faith and credit of the U.S. government. U.S. government securities may underperform other segments of the fixed income market or the fixed income market as a whole.

Value Investing Risk:

“Value” investing attempts to identify strong companies whose stocks are selling at a discount from their perceived true worth. It is subject to the risk that the stocks’ intrinsic values may never be fully recognized or realized

by the market, their prices may go down, or that stocks judged to be undervalued by the Fund or an Underlying Fund may actually be appropriately priced.

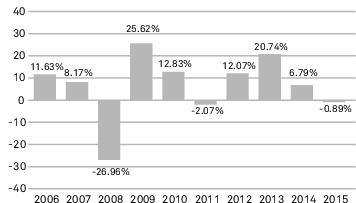

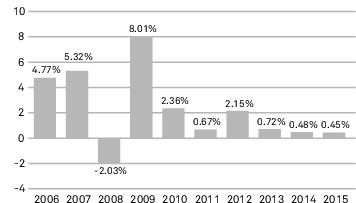

Performance

The bar chart and the performance table that follow illustrate

the risks and volatility of an investment in the Fund. The Fund’s past performance (before and after taxes) does not indicate how the Fund will perform in the future. A Shares commenced operations on November 5, 2003 and C Shares

commenced operations on April 5, 2005. Performance prior to the commencement of operations of each respective class, is that of I Shares of the Fund, and has not been adjusted to reflect expenses associated with other classes. If it had been,

performance would have been lower. Updated performance information is available by contacting the RidgeWorth Funds at 1-888-784-3863 or by visiting www.ridgeworth.com.

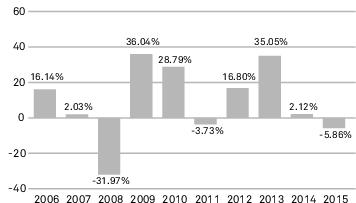

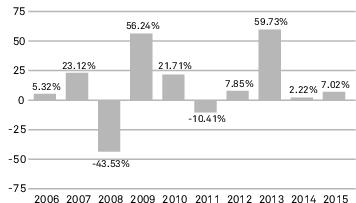

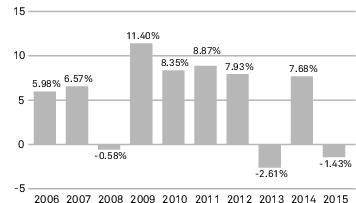

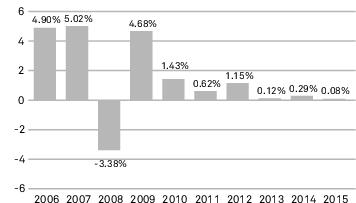

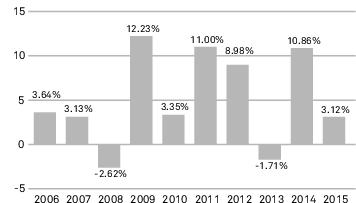

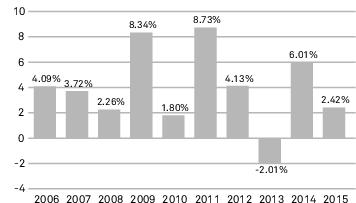

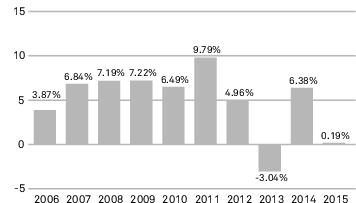

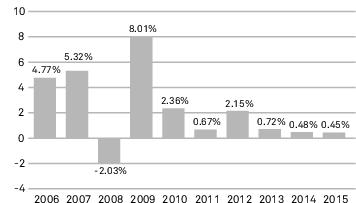

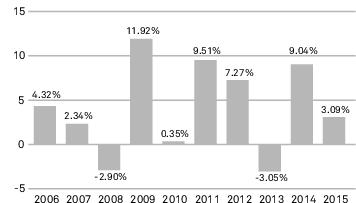

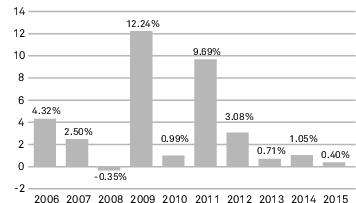

The annual returns in the bar chart which follows are for the I

Shares without reflecting payment of any sales

charge; if they did reflect such payment of sales charges, annual returns would be lower.

Growth

Allocation Strategy

This bar chart shows the changes in performance of the

Fund’s I Shares from year to year.*

| Best

Quarter |

Worst

Quarter |

| 13.13%

|

-14.19%

|

| (9/30/2009)

|

(12/31/2008)

|

* The performance information shown above is

based on a calendar year. The Fund's total return for the six months ended June 30, 2016 was 1.17%.

The following table compares the Fund’s average annual

total returns for the periods indicated with those of a broad measure of market performance.

AVERAGE ANNUAL TOTAL RETURNS

(for periods ended December 31, 2015)

| |

1

Year |

5

Years |

10

Years |

| A

Shares Return Before Taxes |

(6.65)%

|

5.51%

|

4.88%

|

| C

Shares Return Before Taxes |

(2.50)%

|

6.09%

|

4.78%

|

| I

Shares Return Before Taxes |

(0.89)%

|

7.00%

|

5.78%

|

| I

Shares Return After Taxes on Distributions |

(2.94)%

|

5.09%

|

4.01%

|

| I

Shares Return After Taxes on Distributions and Sale of Fund Shares |

0.96%

|

5.12%

|

4.24%

|

| Hybrid

70/30 Blend of the two Indices below (reflects no deduction for fees, expenses or taxes) |

1.34%

|

9.87%

|

6.73%

|

| S&P

500 Index (reflects no deduction for fees, expenses or taxes) |

1.38%

|

12.57%

|

7.31%

|

| Barclays

U.S. Aggregate Bond Index (reflects no deduction for fees, expenses or taxes) |

0.55%

|

3.25%

|

4.51%

|

After-tax returns are

calculated using the historical highest individual U.S. federal marginal income tax rates and do not reflect the impact of state and local taxes. Your actual after-tax returns will depend on your tax situation and may differ from those shown.

After-tax returns shown are not relevant to investors who hold their Fund shares through tax-advantaged arrangements, such as 401(k) plans or individual retirement accounts (“IRAs”). After-tax returns are shown for only the I Shares.

After-tax returns for other share classes will vary.

In some cases, average annual return after

taxes on distributions and sale of fund shares is higher than the average annual return after taxes on distributions because of realized losses that would have been sustained upon the sale of fund shares immediately after the relevant periods.

The calculations assume that an investor holds the shares in a taxable account, is in the actual historical highest individual federal marginal income tax bracket for each year and would have been able to immediately utilize the full realized

loss to reduce his or her federal tax liability. However, actual individual tax results may vary and investors should consult their tax advisers regarding their personal tax situations.

Investment Adviser

RidgeWorth Investments is the Fund’s investment adviser

(the “Adviser”).

Portfolio Management

Mr. Alan Gayle, Managing Director of the Adviser, has managed

the Fund since its inception.

Purchasing and Selling Your

Shares

You may purchase or redeem Fund shares on any

business day. You may purchase and redeem A, C and I Shares of the Fund through financial institutions or intermediaries that are authorized to place transactions in Fund shares for their customers or for their own accounts.

The minimum initial investment amounts for each share class are

shown below, although these minimums may be reduced, waived, or not applicable in some cases.

Growth Allocation

Strategy

| Class

|

Dollar

Amount |

| A

Shares |

$2,000

|

| C

Shares |

$5,000

($2,000 for IRAs or other tax-advantaged accounts) |

| I

Shares |

None

|

Subsequent investments in A or C

Shares must be made in amounts of at least $1,000. The Fund may accept investments of smaller amounts for either class of shares at its discretion. There are no minimums for subsequent investments in I Shares.

Tax Information

The Fund’s distributions are generally taxable as

ordinary income, qualified dividend income, or capital gains unless you are investing through a tax-advantaged arrangement, such as a 401(k) plan or an IRA, which may be taxed upon withdrawal.

Payments to Broker-Dealers and Other Financial

Intermediaries

If you purchase shares of the Fund through

a financial intermediary, such as a broker-dealer or investment adviser, the Fund, the Adviser or the Distributor may pay the intermediary for the sale of Fund shares and related services.

These payments may create a conflict of interest by influencing

the broker-dealer or other financial intermediary and your salesperson to recommend the Fund over another investment. Ask your financial intermediary or visit your financial intermediary’s website for more information.

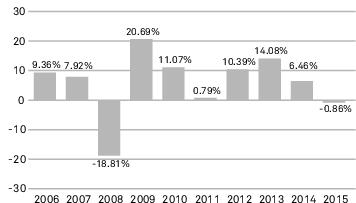

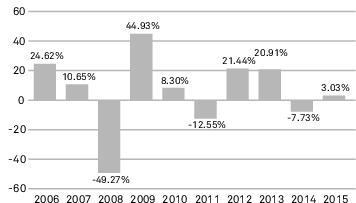

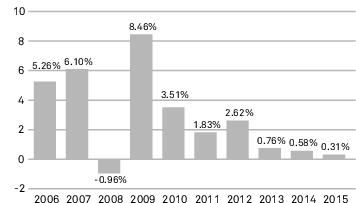

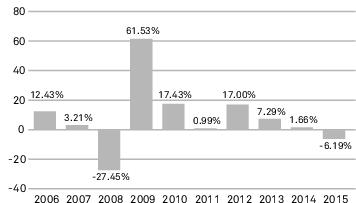

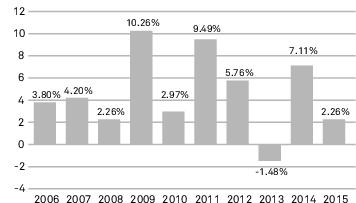

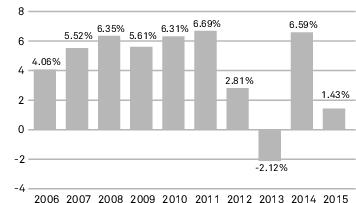

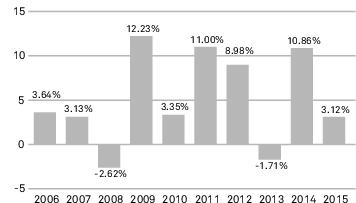

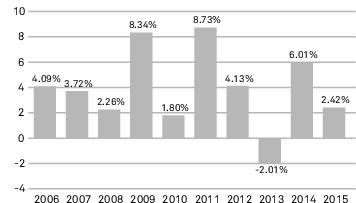

Moderate

Allocation Strategy

Summary Section

A Shares, C Shares and I Shares

Investment Objective

The Moderate Allocation Strategy (the “Fund”) seeks

to provide capital appreciation and current income.

Fees

and Expenses of the Fund

This table describes the fees and expenses

that you may pay if you buy and hold shares of the Fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in RidgeWorth Funds. More information about these and other

discounts is available from your financial professional and in Sales Charges on page 29 of the Fund’s prospectus and Rights of Accumulation on page 89 of the Fund’s statement of additional information.

Shareholder Fees

(fees paid directly from your investment)

| |

A

Shares |

C

Shares |

I

Shares |

| Maximum

Sales Charge (load) Imposed On Purchases (as a % of offering price) |

5.75%

|

None

|

None

|

| Maximum

Deferred Sales Charge (load) (as a % of the net asset value) |

None

|

1.00%

|

None

|

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the value of your investment)

| |

A

Shares |

|

C

Shares |

|

I

Shares |

| Management

Fees |

0.10%

|

|

0.10%

|

|

0.10%

|

| Distribution

(12b-1) Fees |

0.30%

|

|

1.00%

|

|

None

|

| Other

Expenses |

0.28%

|

|

0.16%

|

|

0.47%

|

| Acquired

Fund Fees and Expenses(1) |

0.56%

|

|

0.56%

|

|

0.56%

|

| Total

Annual Fund Operating Expenses |

1.24%

|

|

1.82%

|

|

1.13%

|

| Fee

Waivers and/or Expense Reimbursements(2) |

—

|

|

—

|

|

(0.07)%

|

| Total

Annual Fund Operating Expenses After Fee Waivers and/or Expense Reimbursements |

1.24%

|

|

1.82%

|

|

1.06%

|

| (1)

|

“Acquired Fund Fees and