Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-06557

RidgeWorth Funds

(Exact name of registrant as specified in charter)

RidgeWorth Capital Management LLC

3333 Piedmont Road, Suite 1500

Atlanta, GA 30305

(Address of principal executive offices)(Zip code)

| (Name and Address of Agent for Service) | Copy to: | |

| Julia R. Short RidgeWorth Funds 3333 Piedmont Road, Suite 1500 Atlanta, GA 30305 |

W. John McGuire, Esq. Thomas S. Harman, Esq. Morgan, Lewis & Bockius LLP 1111 Pennsylvania Avenue, NW Washington, DC 20004 |

Registrant’s telephone number, including area code: 1-888-784-3863

Date of fiscal year end: March 31

Date of reporting period: March 31, 2016

Table of Contents

Item 1. Reports to Shareholders.

Table of Contents

2016 ANNUAL REPORT

EQUITY FUNDS

MARCH 31, 2016

RidgeWorth Investments is the trade name of RidgeWorth Capital Management LLC.

Table of Contents

RIDGEWORTH FUNDS March 31, 2016

| Letter to Shareholders | 1 | |||

| Management Discussion of Fund Performance | ||||

| Equity Funds: | ||||

| 2 | ||||

| Capital Innovations Global Resources and Infrastructure Fund |

4 | |||

| 6 | ||||

| 8 | ||||

| 10 | ||||

| 12 | ||||

| 14 | ||||

| 16 | ||||

| Allocation Strategies: | ||||

| 18 | ||||

| 20 | ||||

| 22 | ||||

| 24 | ||||

| Financial Statements | ||||

| Schedules of Portfolio Investments | 26 | |||

| Statements of Assets and Liabilities | 43 | |||

| Statements of Operations | 46 | |||

| Statements of Changes in Net Assets | 50 | |||

| Financial Highlights | 55 | |||

| Notes to Financial Statements | 62 | |||

| Report of Independent Registered Public Accounting Firm | 83 | |||

| Other Information | ||||

| Other Federal Tax Information | 84 | |||

| Trustees and Officers of the RidgeWorth Funds | 86 | |||

| Additional Information | 91 | |||

Table of Contents

RIDGEWORTH FUNDS March 31, 2016

Dear Valued Shareholder,

We sincerely thank you for your continued business and support. Our primary objective is to help you achieve your investment goals, and we’re grateful you have placed your confidence in us. We aim to earn your trust through competitive investment performance and excellent client service. We hope we have met your expectations in both of these measures, and we look forward to continuing to serve as your asset manager in the months and years to come.

During the 12 months through March 31, 2016, the U.S. economy continued to grow, albeit at a slower pace than last year. The U.S. Federal Reserve in December 2015 took its first steps toward unwinding its long-running stimulus efforts, raising the federal funds rate by 25 basis points. However, the relatively weak improvement of the U.S. economy suggests that the Fed will move slowly to raise interest rates in the near term.

Two major themes during the period were the sharp decline in commodity prices and the strength of the U.S. dollar. These factors caused corporate earnings to struggle, posing headwinds for stocks. However, these headwinds currently appear to be ebbing as commodity prices—particularly the price of oil—have rebounded and the dollar has given back some of the considerable gains experienced since 2014.

Outside the U.S., countries such as China and Brazil struggled to realign economic priorities, contain excess debt and limit political turmoil, while slow economic growth challenged the euro zone. Central banks in many international markets adopted increasingly aggressive stimulus measures. We remain concerned that monetary policies abroad may be nearing the limits of their effectiveness, and we believe the decision by the European Central Bank and other central banks to push interest rates into uncharted negative territory has the potential to disrupt the global economy. We do expect, however, international developed markets to continue to recover, due in part to the continued strength of the U.S. economy, which is shouldering much of the burden of the global economic recovery.

Looking ahead, we believe bond yields will remain relatively low, but the Fed’s intention is to normalize monetary policy. The decline in commodity prices stoked concerns about certain bond issuers over the past year, especially those in the energy sector. This year will be key in terms of observing which ones will be able to service their debt.

Our outlook for the equity markets remains favorable, but with increased volatility due to the presidential race and global macro-headlines. We see opportunities in all equity styles. Finally, we continue to believe that a gradually firming economic environment will offer fresh opportunities to selective investors. We expect this opportunistic environment should mesh well with RidgeWorth’s bottom-up approach to security selection. We at RidgeWorth wish to thank you again for the trust and confidence you have placed in us, and we look forward to another successful year together.

Sincerely,

Ashi Parikh

Chief Executive Officer, Chief Investment Officer

RidgeWorth Investments

1

Table of Contents

Portfolio Managers

| • | Nancy Zevenbergen, CFA, CIC |

| • | Brooke de Boutray, CFA, CIC |

| • | Leslie Tubbs, CFA, CIC |

INVESTMENT CONCERNS

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes. Common stocks, and funds investing in common stocks, generally provide greater return potential when compared with other types of investments.

Small- and mid-capitalization funds typically carry additional risks as smaller companies generally have a higher risk of failure.

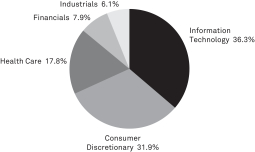

MANAGEMENT DISCUSSION OF FUND PERFORMANCE

How did the Fund perform against its benchmark for the fiscal year ended March 31, 2016?

The Aggressive Growth Stock Fund (I Shares) returned -4.74%. That compared to a 1.34% return for the Russell 3000® Growth Index.

What factors influenced the Fund’s performance for the fiscal year ended March 31, 2016?

Global and domestic economic mayhem created two record-level spikes in equity volatility during the 12-month period. The Fund’s higher beta holdings bore the brunt of selling pressure. While the Fund rebounded significantly two out of four quarters, gains were not enough to compensate for the remaining quarters’ weakness, and absolute returns suffered during the 12 months through March 31, 2016.

The Fund’s underperformance relative to its benchmark was attributable to active stock selection in the financial services, healthcare and technology sectors. Consumer discretionary holdings added positive excess returns.

Among the Fund’s key detractors: XPO Logistics, Inc., underperformed amid negative response to acquisitions and exposure to the industrial business cycle. Chinese macroeconomic issues and competitor-related concerns were reflected in Vipshop Holdings Limited share performance. While concerns over possible legal and regulatory issues pressured shares of LendingClub Corporation.

Key contributors to relative returns included the following: Netflix, Inc., exceeded domestic and international subscriber guidance, while delivering profitability in new markets. Amazon.com, Inc., achieved record revenues through growth in web services, fulfillment and third-party seller participation. Tesla Motors, Inc., shares advanced on unit volume growth, ahead-of-schedule build-out for its Gigafactory and anticipation of its Model 3 automobile debut.

How do you plan to position the Fund, based on market conditions?

Underperformance in the Fund does not necessarily lead us to make position changes as we continue to focus on company fundamentals. Many of the same companies that underperformed during the past year are still in the portfolio, and given the pull-back in stock prices, represent good potential drivers to future returns.

In times of significant stock volatility, we find great comfort in companies with excellent management teams— especially those that are founder-led. These companies tend to be more innovative, likely to make bold investments to renew or adapt business models and demonstrate a willingness to take risk to invent the future. An owner’s mindset is imperative, with speed to act and personal responsibility for risk and cost—a key strategic asset. Nearly 70% of the Fund’s holdings have founders among its leadership teams.

Investors likely still harbor excessive pessimism: Recent short interest figures are higher than the March 2009 nadir. As yet another panic and recovery demonstrates, the price of overreaction—and non-participation—may be the difference between exceeding objectives and being left in the dust. Invest with conviction.

2

Table of Contents

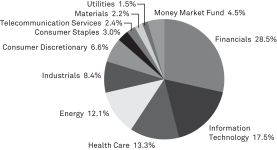

AGGRESSIVE GROWTH STOCK FUND

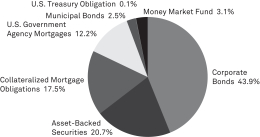

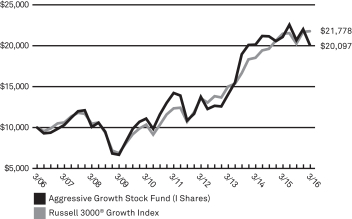

Growth of a $10,000 Investment (as of March 31, 2016)

|

This chart assumes an initial hypothetical investment of $10,000 made on 3/31/06. Total return is based on net change in the Net Asset Value (“NAV”) assuming reinvestment of distributions. Returns shown on this page include reinvestment of all dividends and other distributions.

The Fund’s performance is compared to the Russell 3000® Growth Index, which measures the performance of the broad growth segment of the U.S. equity universe. It includes those Russell 3000® companies with higher price-to-book ratios and higher forecasted growth values. The Index is unmanaged and does not reflect the deduction of fees, such as investment and fund accounting fees, associated with a mutual fund. Investors cannot invest directly in an index. Frank Russell Company is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of Frank Russell Company. |

| Average Annual Total Returns as of 3/31/16 | ||||||||||||||||||

| Aggressive Growth Stock Fund | 1 Year | 3 Year | 5 Year | 10 Year | ||||||||||||||

| A Shares |

without sales charge | –4.96% | 12.51% | 6.92% | 6.96% | |||||||||||||

| with sales charge* | –10.44% | 10.32% | 5.66% | 6.33% | ||||||||||||||

| I Shares |

–4.74% | 12.72% | 7.15% | 7.23% | ||||||||||||||

| Russell 3000® Growth Index | 1.34% | 13.16% | 12.00% | 8.09% | ||||||||||||||

| Prospectus Expense Ratio1 | Gross | |||||||||||||||||

| A Shares | 1.45% | |||||||||||||||||

| I Shares | 1.34% | |||||||||||||||||

3

Table of Contents

CAPITAL INNOVATIONS GLOBAL RESOURCES AND INFRASTRUCTURE FUND

Portfolio Managers

| • | Michael D. Underhill |

| • | Susan L. Dambekaln |

INVESTMENT CONCERNS

Companies within the infrastructure, agribusiness and timber industries are susceptible to adverse economic or regulatory factors which may affect the Fund’s performance.

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes. Common stocks, and funds investing in common stocks, generally provide greater return potential when compared with other types of investments.

Small- and Mid-capitalization funds typically carry additional risks since smaller companies generally have a higher risk of failure.

Large-capitalization stocks can perform differently from other segments of the equity market or the equity market as a whole. Large capitalization companies may be less flexible in evolving markets or unable to implement change as quickly as smaller capitalization companies.

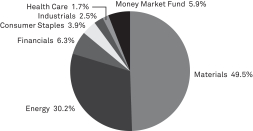

MANAGEMENT DISCUSSION OF FUND PERFORMANCE

How did the Fund perform against its benchmark for the period ended March 31, 2016?

The Capital Innovations Global Resources and Infrastructure Fund (I Shares) delivered a -20.48% return. That compared to a -15.30% return for the S&P Global Natural Resources Index.

What factors influenced the Fund’s performance for the period ended March 31, 2016?

The U.S. dollar gained against most major currencies during the period under review, while commodity prices declined substantially. Oil prices in particular declined sharply; major Middle East oil-producing nations maintained production levels while North American drillers decreased output. This environment contributed to the Fund’s negative absolute returns.

The Fund’s relative performance was hurt by an overweight position in the paper and forest products industry, which was impacted by investors’ fears about falling prices. Exposure to cyclical commodities also detracted from performance, as fertilizers, containerboard and timber came under pressure during the first three quarters of the period. In particular, oversupply of fertilizer, especially in China and India, pushed down fertilizer producers’ valuations. Exposure to shares of a global energy firm detracted from relative performance, as concerns mounted over its long-term earnings ability. An investment in a Texas energy infrastructure company also dragged on the Fund’s returns, as its shares declined following a dividend cut in response to the falling price of crude oil.

An underweight position in metals and mining stocks—part of the materials sector—helped the Fund’s relative returns. That said, the Fund benefited from an overweight position in a Canadian gold mining firm, as fears about a potential global recession drove up prices for gold and shares of gold-mining firms. An underweight position in a multinational metals, mining and petroleum firm also helped performance relative to the benchmark, as the company’s shares dropped following an accident at one of its facilities. In addition, an underweight position in a diversified metals and commodities producer aided relative performance, as investors grew concerned about the firm’s ability to repay its debt.

How do you plan to position the Fund, based on market conditions?

We remain moderately upbeat about the global economic outlook, even as investor skepticism remains widespread. We expect industrial production growth to solidify gradually over the next several months, which we believe will provide a tailwind for commodity demand and prices. In addition, as global growth concerns dwindle we expect commodity prices to move higher.

Our research indicates that we are in the later stages of the economic cycle. As a result, inflation may become more of a concern going forward. Within this framework, sectors such as energy and commodities tend to benefit.

4

Table of Contents

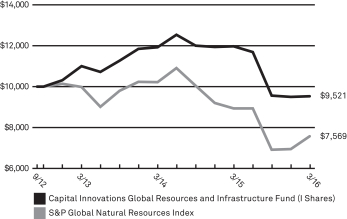

CAPITAL INNOVATIONS GLOBAL RESOURCES AND INFRASTRUCTURE FUND

Growth of a $10,000 Investment (as of March 31, 2016)

|

This chart assumes an initial hypothetical investment of $10,000 made on 9/28/12 (inception date of Predecessor Fund). Total return is based on net change in the Net Asset Value (“NAV”) assuming reinvestment of distributions. Returns shown on this page include reinvestment of all dividends and other distributions.

The Fund’s performance is compared to the S&P Global Natural Resources Index. S&P Global Natural Resources Sector Index includes 90 of the largest publicly-traded companies in natural resources and commodities businesses that meet specific investability requirements, offering investors diversified and investable equity exposure across three primary commodity-related sectors: agribusiness, energy, and metals & mining. Investors cannot invest directly in an index. |

| Average Annual Total Returns as of 3/31/16 | ||||||||||||

| Capital Innovations Global Resources and Infrastructure Fund | 1 Year | 3 Year | Since Inception |

|||||||||

| A Shares |

without sales charge | –20.60% | –4.91% | –1.63% | ||||||||

| with sales charge* | –25.18% | –6.77% | –3.27% | |||||||||

| C Shares |

without CDSC | –21.25% | –5.64% | –2.37% | ||||||||

| with CDSC* | –22.02% | –5.64% | –2.37% | |||||||||

| I Shares |

–20.48% | –4.70% | –1.39% | |||||||||

| S&P Global Natural Resources Index | –15.30% | –8.78% | –7.65% | |||||||||

| Prospectus Expense Ratio1 | Gross | |||||||||||

| A Shares | 2.73% | |||||||||||

| C Shares | 3.33% | |||||||||||

| I Shares | 2.48% | |||||||||||

5

Table of Contents

Portfolio Managers

| • | Paul R. Black |

| • | Peter J. Hunkel |

| • | Michael B. Trigg |

| • | Kurt R. Winrich |

INVESTMENT CONCERNS

International investing involves increased risk and volatility.

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes.

MANAGEMENT DISCUSSION OF FUND PERFORMANCE

How did the Fund perform against its benchmark for the fiscal year ended March 31, 2016?

The International Equity Fund (I Shares) delivered a -1.59% return. That compared to a -9.19% for the MSCI ACWI Ex-U.S. Index.

What factors influenced the Fund’s performance for the fiscal year ended March 31, 2016?

International equity markets generally declined during the period under review. Concerns about the health of the euro zone economy prompted the European Central Bank (ECB) to strengthen stimulus measures intended to spur economic growth. Other central banks around the world, including in China and Japan, also adopted stimulus measures to prop up weak economies. Meanwhile, flagging commodity prices, including sharp declines in the price of oil, put pressure on emerging markets. The U.S. dollar gained against most major currencies, and U.S. stocks outperformed international stocks. In this environment, strong stock selection helped the Fund post positive absolute returns.

The Fund’s relative performance also benefited from effective stock selection. Individual holdings in the health care, information technology and materials sectors particularly helped the Fund out-perform its benchmark. Shares of two Danish companies generated especially strong results. One, a developer of natural ingredients, enjoyed strong demand for its products, especially animal feed; the other, a provider of kidney, gastroenterology, and other intimate health care products and services, debuted a new product in collaboration with another Danish medical technology company. A Canadian software company and a Japanese electronics manufacturer also boosted the Fund’s relative return.

The Fund’s bottom-up structural biases—underweight positions in the financial and energy sectors, and overweight positions in information technology and consumer staples—benefited its return relative to the benchmark. Consumer staples was the best-performing sector in the index, while financial services was the second-worst.

The Fund’s relative performance was dampened by the selection of industrial stocks, chiefly exposure to a Dutch manufacturer of sensors and to a Canadian railway line that failed in its acquisition bid of an American railroad. From a sector perspective, our overweight position in health care and underweight position in telecommunications and utilities softened the Fund’s performance.

How do you plan to position the Fund, based on market conditions?

The firm plans to maintain its bottom-up sector biases, with an overweight position in information technology, health care, and consumer staples, and an underweight position in financial services, energy and telecommunications. We will continue to focus on stock selection through our bottom-up investment approach.

6

Table of Contents

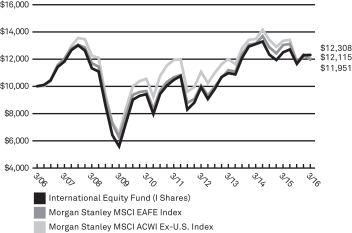

INTERNATIONAL EQUITY FUND

Growth of a $10,000 Investment (as of March 31, 2016)

|

This chart assumes an initial hypothetical investment of $10,000 made on 3/31/06. Total return is based on net change in the Net Asset Value (“NAV”) assuming reinvestment of distributions. Returns shown on this page include reinvestment of all dividends and other distributions.

Effective September 1, 2015 the benchmark index for the Fund changed from the Morgan Stanley Capital International Europe, Australasia and Far East (“MSCI EAFE”) Index to the Morgan Stanley Capital International All Country World Index excluding United States Index (“MSCI ACWI ex-U.S.”) in connection with the change of the Fund’s Subadviser and related investment strategy changes.

MSCI ACWI Ex-U.S. is a market capitalization-weighted index maintained by Morgan Stanley Capital International (MSCI) and designed to provide a broad measure of stock performance throughout the world, with the exception of U.S.-based companies. The MSCI All Country World Index Ex-U.S. includes both developed and emerging markets. MSCI EAFE Index is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the U.S. & Canada. The MSCI EAFE Index consists of 21 developed market country indices. EAFE performance data is calculated in U.S. dollars and in local currency. |

| Average Annual Total Returns as of 3/31/16 | ||||||||||||||||

| International Equity Fund | 1 Year | 3 Year | 5 Year | 10 Year | ||||||||||||

| A Shares |

without sales charge | –1.77% | 3.81% | 3.06% | 1.86% | |||||||||||

| with sales charge* | –7.41% | 1.79% | 1.85% | 1.26% | ||||||||||||

| I Shares |

–1.59% | 3.91% | 3.25% | 2.10% | ||||||||||||

| IS Shares** |

–1.49% | 3.95% | 3.28% | 2.11% | ||||||||||||

| Morgan Stanley MSCI ACWI Ex-U.S. Index | –9.19% | 0.32% | 0.31% | 1.94% | ||||||||||||

| Morgan Stanley MSCI EAFE Index | –8.27% | 2.23% | 2.29% | 1.80% | ||||||||||||

| Prospectus Expense Ratio1 | Gross | |||||||||||||||

| A Shares | 1.57% | |||||||||||||||

| I Shares | 1.39% | |||||||||||||||

| IS Shares | 1.26% | |||||||||||||||

7

Table of Contents

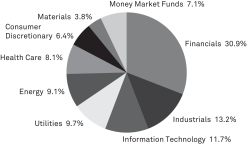

Portfolio Managers

| • | Michael A. Sansoterra |

| • | Sandeep Bhatia, PhD, CFA |

INVESTMENT CONCERNS

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes. Common stocks, and funds investing in common stocks, generally provide greater return potential when compared with other types of investments.

Small- and Mid-capitalization funds typically carry additional risks since smaller companies generally have a higher risk of failure.

Large-capitalization stocks can perform differently from other segments of the equity market or the equity market as a whole. Large capitalization companies may be less flexible in evolving markets or unable to implement change as quickly as smaller capitalization companies.

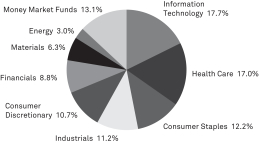

MANAGEMENT DISCUSSION OF FUND PERFORMANCE

How did the Fund perform against its benchmark for the fiscal year ended March 31, 2016?

The Large Cap Growth Stock Fund (I Shares) returned -1.79%. That compared to a 2.52% return for the Russell 1000 Growth Index.

What factors influenced the Fund’s performance for the fiscal year ended March 31, 2016?

The period was marked by economic challenges both domestically and internationally. Investors worried about slowing economic growth in the U.S., Europe and China, as well as about volatile commodities prices and the U.S. Federal Reserve’s interest rate strategy. These factors contributed to record-level spikes in market volatility during the 12-month period. The Fund’s absolute returns suffered in this environment.

The majority of the Fund’s underperformance relative to the benchmark index was due to stock selection within the consumer staples, financials and healthcare sectors. The healthcare sector was the largest relative underperformer, as biotechnology stocks sold off amid election-year rhetoric about prescription drug price controls.

The Fund’s relative performance also suffered from lack of exposure to the telecommunications sector, which led sector performance during the period under review. An underweight position in consumer staples relative to the benchmark also dragged on performance. In addition, a position in a major financial services firm hurt relative returns.

How do you plan to position the Fund, based on market conditions?

The portfolio managers seek to eliminate investment results that are directly attributed to market conditions, and instead attempt to drive performance through stock selection. Therefore, the Fund will continue to invest in companies with reasonable valuations and improving fundamentals. Generally, we look for companies that have shown year-over-year increases in operating margins, revenue growth and return on incremental invested capital. By combining income statement, balance sheet and cash flow metrics to evaluate earnings quality, capital efficiency and relative valuations, we can avoid making investment decisions based on a single factor.

8

Table of Contents

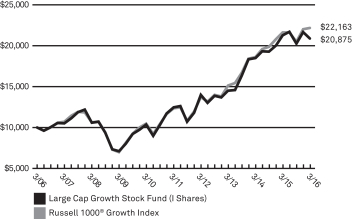

LARGE CAP GROWTH STOCK FUND

Growth of a $10,000 Investment (as of March 31, 2016)

|

This chart assumes an initial hypothetical investment of $10,000 made on 3/31/06. Total return is based on net change in the Net Asset Value (“NAV”) assuming reinvestment of distributions. Returns shown on this page include reinvestment of all dividends and other distributions.

The Fund’s performance is compared to the Russell 1000® Growth Index, which measures the performance of the large-cap growth segment of the U.S. equity universe. It includes those Russell 1000® companies with higher price-to-book ratios and higher forecasted growth values. The Index is unmanaged and does not reflect the deduction of fees, such as investment and fund accounting fees, associated with a mutual fund. Investors cannot invest directly in an index. Frank Russell Company is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of Frank Russell Company. |

| Average Annual Total Returns as of 3/31/16 | ||||||||||||||||||

| Large Cap Growth Stock Fund | 1 Year | 3 Year | 5 Year | 10 Year | ||||||||||||||

| A Shares |

without sales charge | –2.13% | 12.59% | 10.53% | 7.33% | |||||||||||||

| with sales charge* | –7.72% | 10.40% | 9.24% | 6.70% | ||||||||||||||

| C Shares |

without CDSC | –2.77% | 11.87% | 9.79% | 6.60% | |||||||||||||

| with CDSC* | –3.62% | 11.87% | 9.79% | 6.60% | ||||||||||||||

| I Shares |

–1.79% | 12.89% | 10.83% | 7.64% | ||||||||||||||

| IS Shares** |

–1.80% | 12.92% | 10.84% | 7.65% | ||||||||||||||

| Russell 1000® Growth Index | 2.52% | 13.61% | 12.38% | 8.28% | ||||||||||||||

| Prospectus Expense Ratio1 | Gross | |||||||||||||||||

| A Shares | 1.19% | |||||||||||||||||

| C Shares | 1.87% | |||||||||||||||||

| I Shares | 1.17% | |||||||||||||||||

| IS Shares | 0.87% | |||||||||||||||||

9

Table of Contents

Portfolio Manager

| • | Mills Riddick, CFA |

INVESTMENT CONCERNS

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes.

Value-based investments are subject to the risk that the broad market may not recognize their intrinsic value.

MANAGEMENT DISCUSSION OF FUND PERFORMANCE

How did the Fund perform against its benchmark for the fiscal year ended March 31, 2016?

The Large Cap Value Equity Fund (I Shares) delivered a -2.19% return. That compared to a -1.54% return for the Russell 1000 Value Index.

What factors influenced the Fund’s performance for the fiscal year ended March 31, 2016?

During the 12-month period, stocks faced major headwinds, including debt negotiations between Greece and the euro zone, Puerto Rico’s debt restructuring, re-emerging volatility in oil prices, and anxiety surrounding the U.S. Federal Reserve’s strategy for raising interest rates. Instability in international and U.S. markets weighed on the Fund’s absolute returns.

The portfolio management team does not attempt to position the Fund based on predictions of macro-economic conditions. The Fund employs a bottom-up investment approach to stock selection that seeks out dividend-paying stocks trading at the lower end of their historical trading ranges, and which display characteristics of financial strength and possess an improving fundamental situation. The Fund does not make active sector allocations but allows its bottom-up investment process to define sector weights.

The Fund’s relative performance was hurt by underweight positions in the consumer staples and utilities sectors. Exposure to three energy companies during a time of volatility in that sector detracted from relative performance, as did holdings in a global mass media company and a financial services company.

The Fund benefited from individual exposure to shares of a leading technology and software company, a healthcare company, a telecommunications company, and a supplier of semiconductor materials.

How do you plan to position the Fund, based on market conditions?

We will continue to maintain our disciplined, bottom-up fundamental stock analysis when choosing investments for the Fund. Our investment philosophy seeks out investments that meet three key criteria: the existence of a dividend, low valuations and improving fundamentals. In the current environment, we expect to maintain a pro-cyclical bias that includes overweight positions in the information technology and healthcare sectors, and underweight positions in the utilities and consumer staples sectors.

10

Table of Contents

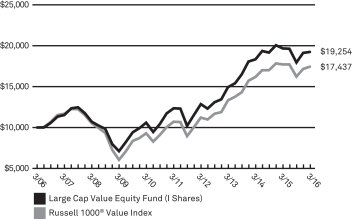

LARGE CAP VALUE EQUITY FUND

Growth of a $10,000 Investment (as of March 31, 2016)

|

This chart assumes an initial hypothetical investment of $10,000 made on 3/31/06. Total return is based on net change in the Net Asset Value (“NAV”) assuming reinvestment of distributions. Returns shown on this page include reinvestment of all dividends and other distributions.

The Fund’s performance is compared to the Russell 1000® Value Index, which measures the performance of the large-cap value segment of the U.S. equity universe. It includes those Russell 1000® companies with lower price-to-book ratios and lower expected growth values. The Index is unmanaged and does not reflect the deduction of fees, such as investment and fund accounting fees, associated with a mutual fund. Investors cannot invest directly in an index. Frank Russell Company is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of Frank Russell Company. |

| Average Annual Total Returns as of 3/31/16 | ||||||||||||||||

| Large Cap Value Equity Fund | 1 Year | 3 Year | 5 Year | 10 Year | ||||||||||||

| A Shares |

without sales charge | –2.46% | 8.55% | 8.96% | 6.46% | |||||||||||

| with sales charge* | –8.09% | 6.42% | 7.68% | 5.83% | ||||||||||||

| C Shares |

without CDSC | –2.88% | 8.06% | 8.38% | 5.80% | |||||||||||

| with CDSC* | –3.76% | 8.06% | 8.38% | 5.80% | ||||||||||||

| I Shares |

–2.19% | 8.85% | 9.27% | 6.77% | ||||||||||||

| IS Shares** |

–1.90% | 9.03% | 9.38% | 6.82% | ||||||||||||

| Russell 1000® Value Index | –1.54% | 9.38% | 10.25% | 5.72% | ||||||||||||

| Prospectus Expense Ratio1 | Gross | |||||||||||||||

| A Shares | 1.36% | |||||||||||||||

| C Shares | 1.71% | |||||||||||||||

| I Shares | 1.07% | |||||||||||||||

| IS Shares | 0.71% | |||||||||||||||

11

Table of Contents

Portfolio Manager

| • | Don Wordell, CFA |

INVESTMENT CONCERNS

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes.

Mid-capitalization funds typically carry additional risks since smaller companies generally have a higher risk of failure.

Value-based investments are subject to the risk that the broad market may not recognize their intrinsic value.

MANAGEMENT DISCUSSION OF FUND PERFORMANCE

How did the Fund perform against its benchmark for the fiscal year ended March 31, 2016?

The Mid-Cap Value Equity Fund (I Shares) delivered a -3.85% return. That compared to a -3.39% return for the Russell Midcap Value Index.

What factors influenced the Fund’s performance for the fiscal year ended March 31, 2016?

During the 12-month period, stocks faced major headwinds, including debt negotiations between Greece and the euro zone, Puerto Rico’s debt restructuring, re-emerging volatility in oil prices, and anxiety surrounding the U.S. Federal Reserve’s strategy for raising interest rates. Instability in international and U.S. markets weighed on the Fund’s absolute returns.

The portfolio management team does not attempt to position the Fund based on predictions of macro-economic conditions. The Fund employs a bottom-up investment approach to stock selection that seeks out dividend-paying stocks trading at the lower end of their historical trading ranges, and which display characteristics of financial strength and possess an improving fundamental situation. The Fund does not make active sector allocations but allows its bottom-up investment process to define sector weights.

An overweight position and stock selection in the energy sector detracted from the Fund’s relative performance, as several energy holdings suffered from oil price volatility. An underweight position in the consumer staples sector also dragged on relative returns, as did exposure to a global mass media company, a packaging company and a semiconductor manufacturing company.

The Fund benefited from individual exposure to shares of an information technology company, a biopharmaceutical company, a healthcare company and a utility company.

How do you plan to position the Fund, based on market conditions?

We will continue to maintain our disciplined, bottom-up fundamental stock analysis when choosing investments for the Fund. Our investment philosophy seeks out investments that meet three key criteria: the existence of a dividend, low valuations and improving fundamentals. In the current environment, we expect to maintain a pro-cyclical bias includes overweight positions in the information technology, industrial and healthcare sectors, and underweight positions in the utilities and consumer staples sectors. We also expect to maintain an underweight position in REIT investments in the financials sector.

12

Table of Contents

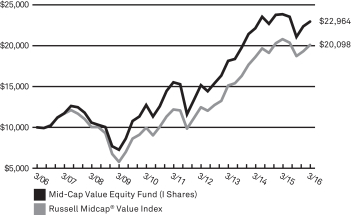

MID-CAP VALUE EQUITY FUND

Growth of a $10,000 Investment (as of March 31, 2016)

|

This chart assumes an initial hypothetical investment of $10,000 made on 3/31/06. Total return is based on net change in the Net Asset Value (“NAV”) assuming reinvestment of distributions. Returns shown on this page include reinvestment of all dividends and other distributions.

The Fund’s performance is compared to the Russell Midcap® Value Index, which measures the performance of the mid-cap value segment of the U.S. equity universe. It includes those Russell Midcap Index companies with lower price-to-book ratios and lower forecasted growth values. The Index is unmanaged and does not reflect the deduction of fees, such as investment and fund accounting fees, associated with a mutual fund. Investors cannot invest directly in an index. Frank Russell Company is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of Frank Russell Company. |

| Average Annual Total Returns as of 3/31/16 | ||||||||||||||||||

| Mid-Cap Value Equity Fund | 1 Year | 3 Year | 5 Year | 10 Year | ||||||||||||||

| A Shares |

without sales charge | –4.11% | 7.83% | 7.83% | 8.36% | |||||||||||||

| with sales charge* | –9.63% | 5.72% | 6.56% | 7.72% | ||||||||||||||

| C Shares |

without CDSC | –4.49% | 7.43% | 7.32% | 7.72% | |||||||||||||

| with CDSC* | –5.39% | 7.43% | 7.32% | 7.72% | ||||||||||||||

| I Shares |

–3.85% | 8.14% | 8.14% | 8.67% | ||||||||||||||

| IS Shares** |

–3.45% | 8.36% | 8.27% | 8.73% | ||||||||||||||

| Russell Midcap® Value Index | –3.39% | 9.88% | 10.52% | 7.23% | ||||||||||||||

| Prospectus Expense Ratio1 | Gross | |||||||||||||||||

| A Shares | 1.41% | |||||||||||||||||

| C Shares | 1.75% | |||||||||||||||||

| I Shares | 1.10% | |||||||||||||||||

| IS Shares | 0.75% | |||||||||||||||||

13

Table of Contents

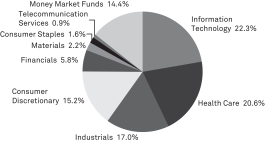

Portfolio Managers

| • | Sandeep Bhatia, PhD, CFA |

| • | Michael A. Sansoterra |

INVESTMENT CONCERNS

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes.

Small-capitalization funds typically carry additional risks since smaller companies generally have a higher risk of failure.

MANAGEMENT DISCUSSION OF FUND PERFORMANCE

How did the Fund perform against its benchmark for the fiscal year ended March 31, 2016?

The Small Cap Growth Stock Fund (I Shares) returned -13.30%. That compared to a -11.84% return for the Russell 2000 Growth Index.

What factors influenced the Fund’s performance for the fiscal year ended March 31, 2016?

The period was marked by economic challenges both domestically and internationally. Investors worried about slowing economic growth in the U.S., Europe and China, as well as about volatile commodities prices and the U.S. Federal Reserve’s interest rate strategy. These factors contributed to record-level spikes in market volatility during the 12-month period. The Fund’s absolute returns suffered in this environment.

Stock selection within the consumer discretionary sector was responsible for most of the Fund’s underperformance relative to the benchmark index. Specifically, holdings in an educational services provider, a home décor chain and automobile components manufacturer dragged on returns, as did holdings in a new home builder and an automotive sales and service firm. The Fund’s relative performance also was hurt by lack of exposure to a ski resort company that contributed to the benchmark’s performance.

How do you plan to position the Fund, based on market conditions?

The portfolio managers seek to eliminate investment results that are directly attributed to market conditions, and instead attempt to drive performance through stock selection. Therefore, the Fund will continue to invest in companies with reasonable valuations and improving fundamentals. Generally, we look for companies that have shown year-over-year increases in operating margins, revenue growth and return on incremental invested capital. By combining income statement, balance sheet and cash flow metrics to evaluate earnings quality, capital efficiency and relative valuations, we can avoid making investment decisions based on a single factor.

14

Table of Contents

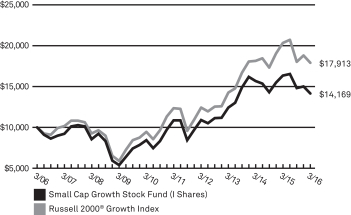

SMALL CAP GROWTH STOCK FUND

Growth of a $10,000 Investment (as of March 31, 2016)

|

This chart assumes an initial hypothetical investment of $10,000 made on 3/31/06. Total return is based on net change in the Net Asset Value (“NAV”) assuming reinvestment of distributions. Returns shown on this page include reinvestment of all dividends and other distributions.

The Fund’s performance is compared to the Russell 2000® Growth Index, which measures the performance of the small-cap growth segment of the U.S. equity universe. It includes those Russell 2000® companies with higher price-to-book ratios and higher forecasted growth values. The Index is unmanaged and does not reflect the deduction of fees, such as investment and fund accounting fees, associated with a mutual fund. Investors cannot invest directly in an index. Frank Russell Company is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of Frank Russell Company. |

| Average Annual Total Returns as of 3/31/16 | ||||||||||||||||

| Small Cap Growth Stock Fund | 1 Year | 3 Year | 5 Year | 10 Year | ||||||||||||

| A Shares |

without sales charge | –13.38% | 4.36% | 5.32% | 3.33% | |||||||||||

| with sales charge* | –18.38% | 2.33% | 4.08% | 2.72% | ||||||||||||

| C Shares |

without CDSC | –13.91% | 3.70% | 4.64% | 2.64% | |||||||||||

| with CDSC* | –14.32% | 3.70% | 4.64% | 2.64% | ||||||||||||

| I Shares |

–13.30% | 4.42% | 5.44% | 3.55% | ||||||||||||

| IS Shares** |

–13.13% | 4.56% | 5.52% | 3.59% | ||||||||||||

| Russell 2000® Growth Index | –11.84% | 7.91% | 7.70% | 6.00% | ||||||||||||

| Prospectus Expense Ratio1 | Gross | |||||||||||||||

| A Shares | 1.32% | |||||||||||||||

| C Shares | 1.96% | |||||||||||||||

| I Shares | 1.34% | |||||||||||||||

| IS Shares | 0.96% | |||||||||||||||

15

Table of Contents

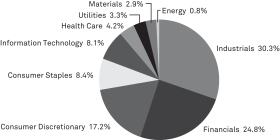

Portfolio Manager

| • | Brett Barner, CFA |

INVESTMENT CONCERNS

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes.

Small-capitalization funds typically carry additional risks since smaller companies generally have a higher risk of failure.

Value-based investments are subject to the risk that the broad market may not recognize their intrinsic value.

MANAGEMENT DISCUSSION OF FUND PERFORMANCE

How did the Fund perform against its benchmark for the fiscal year ended March 31, 2016?

The Small Cap Value Equity Fund (I Shares) delivered a -0.64% return. That compared to a -7.72% return for the Russell Small Cap Value Index.

What factors influenced the Fund’s performance for the fiscal year ended March 31, 2016?

During the 12-month period, stocks faced major headwinds, including debt negotiations between Greece and the euro zone, Puerto Rico’s debt restructuring, re-emerging volatility in oil prices, and anxiety surrounding the U.S. Federal Reserve’s strategy for raising interest rates. Instability in international and U.S. markets weighed on the Fund’s absolute returns.

The portfolio management team does not attempt to position the Fund based on predictions of macro-economic conditions. The Fund employs a bottom-up investment approach to stock selection that seeks out dividend-paying stocks trading at the lower end of their historical trading ranges, and which display characteristics of financial strength and possess an improving fundamental situation. The Fund does not make active sector allocations but allows its bottom-up investment process to define sector weights.

The Fund’s relative performance was boosted by exposure to individual stocks in the financial services sector, including three insurance companies. Holdings in a waste management company and a software company that measures consumer credit risk also contributed to the Fund’s relative returns.

An underweight position and stock selection in the energy sector detracted from the Fund’s relative performance. An overweight position in consumer discretionary stocks also dragged on relative returns, as did exposure to shares of an entertainment company, an interactive retailer and an electronics company.

How do you plan to position the Fund, based on market conditions?

We will continue to maintain our disciplined, bottom-up fundamental stock analysis when choosing investments for the Fund. Our investment philosophy seeks out investments that meet three key criteria: the existence of a dividend, low valuations and improving fundamentals. In the current environment, we expect to maintain a pro-cyclical bias that includes overweight positions in the consumer discretionary and industrials sectors, and underweight positions in the utilities sector. We also expect to maintain an underweight position in REITs and banks in the financials sector.

16

Table of Contents

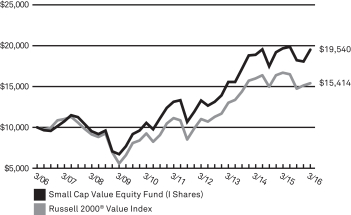

SMALL CAP VALUE EQUITY FUND

Growth of a $10,000 Investment (as of March 31, 2016)

|

This chart assumes an initial hypothetical investment of $10,000 made on 3/31/06. Total return is based on net change in the Net Asset Value (“NAV”) assuming reinvestment of distributions. Returns shown on this page include reinvestment of all dividends and other distributions.

The Fund’s performance is compared to the Russell 2000® Value Index, which measures the performance of the small-cap value segment of the U.S. equity universe. It includes those Russell 2000® companies with lower price-to-book ratios and lower forecasted growth values. The Index is unmanaged and does not reflect the deduction of fees, such as investment and fund accounting fees, associated with a mutual fund. Investors cannot invest directly in an index. Frank Russell Company is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of Frank Russell Company. |

| Average Annual Total Returns as of 3/31/16 | ||||||||||||||||

| Small Cap Value Equity Fund | 1 Year | 3 Year | 5 Year | 10 Year | ||||||||||||

| A Shares |

without sales charge | –0.98% | 7.53% | 7.91% | 6.62% | |||||||||||

| with sales charge* | –6.67% | 5.42% | 6.65% | 5.99% | ||||||||||||

| C Shares |

without CDSC | –1.34% | 7.14% | 7.42% | 6.18% | |||||||||||

| with CDSC* | –2.04% | 7.14% | 7.42% | 6.18% | ||||||||||||

| I Shares |

–0.64% | 7.86% | 8.24% | 6.93% | ||||||||||||

| Russell 2000® Value Index | –7.72% | 5.73% | 6.67% | 4.42% | ||||||||||||

| Prospectus Expense Ratio1 | Gross | |||||||||||||||

| A Shares | 1.52% | |||||||||||||||

| C Shares | 1.88% | |||||||||||||||

| I Shares | 1.21% | |||||||||||||||

17

Table of Contents

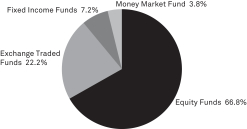

AGGRESSIVE GROWTH ALLOCATION STRATEGY

Portfolio Manager

| • | Alan Gayle |

INVESTMENT CONCERNS

Equity Securities (Stocks) are more volatile and carry more risk and return potential than other forms of investments. Bonds offer a relatively stable level of income, although bond prices will fluctuate, providing the potential for principal gain or loss. Cash equivalents offer low risk and low return potential.

MANAGEMENT DISCUSSION OF FUND PERFORMANCE

How did the Fund perform against its benchmark for the fiscal year ended March 31, 2016?

The Aggressive Growth Allocation Strategy (I Shares) returned -4.67%, compared to a -4.67% return for the Lipper Mixed-Asset Target Allocation (Growth Classification)*, and a 1.98% return for its hybrid benchmark made up of an 80% weighting in the S&P 500 Index and a 20% weighting in the Barclays U.S. Aggregate Bond Index.

What factors influenced the Fund’s performance for the fiscal year ended March 31, 2016?

RidgeWorth Investments manages four distinct asset allocation strategies, each structured to align investment portfolios with specific levels of investor risk tolerance and income requirements. The underlying mutual funds and ETFs typically are the same across the Strategies, but different stock, bond and alternatives allocations create noticeably different total return characteristics, which are intended to align with investor needs and constraints.

The equity market rose very modestly during the 12-month period, despite being buffeted by a drop in oil prices and global economic uncertainty. Stocks gained when the Federal Reserve raised its target short-term interest rate in December, but then fell due to fears about the economy’s strength.

Amid those concerns, risk-averse investors sought relatively conservative options and defensive sectors. While large-cap stocks and longer-duration fixed income positions faired moderately well over the period, small-, mid-cap, and international stocks and high yield bonds struggled. Commodities declined sharply during the year, but erased some declines late in the period. That environment challenged the Fund’s absolute return.

Broadly speaking, since the S&P 500 equity index slightly underperformed the Barclays U.S. Aggregate bond index for the year, the strategy’s overweight to stocks was a net detractor in terms of relative performance versus its hybrid index. However, selected funds also detracted from relative total returns versus the blended benchmark, most notably from pronounced weakness in international mandates, as well as large-cap and small-cap growth mandates. In the fixed income space, exposure to cash, core, high yield and ultra-short mandates detracted from performance.

We actively and opportunistically reduced risk in the Fund throughout the period by trimming equities, rebuilding a long-dormant position in the GDX (Gold Miners) ETF, and maintaining bond portfolio durations close that of the Barclays U.S. Aggregate index.

How do you plan to position the Fund, based on market conditions?

We believe equities remain attractive relative to bonds in a period of rising rates, especially given historically low interest rates and upticks in inflation and wages. As such, we are maintaining a slightly overweight position in equities relative to the Fund’s target benchmarks, with a core equity position tilted slightly towards growth. The Fund holds overweight stakes in the technology, financials, industrials and consumer discretionary sectors, while maintaining relatively low exposures to developed international and emerging markets equities.

The Fund holds a nearly neutral duration to the Barclays U.S. Aggregate Index. We would not be surprised to see the equity and fixed income markets undergo a period of consolidation in the short run, but we think it could be short-lived. In our estimation, investors facing near-zero interest rates are likely to continue to venture out the risk spectrum in search of income and total return.

| * | Lipper Mixed-Asset Target Allocation (Growth Classification): Funds that, by portfolio practice, maintain a mix of between 60%-80% equity securities, with the remainder invested in bonds, cash, and cash equivalents. |

18

Table of Contents

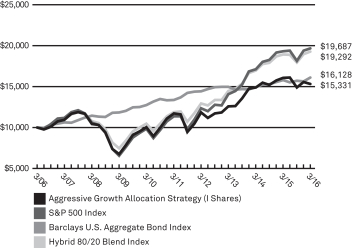

AGGRESSIVE GROWTH ALLOCATION STRATEGY

Growth of a $10,000 Investment (as of March 31, 2016)

|

This chart assumes an initial hypothetical investment of $10,000 made on 3/31/06. Total return is based on net change in the Net Asset Value (“NAV”) assuming reinvestment of distributions. Returns shown on this page include reinvestment of all dividends and other distributions.

Effective September 30, 2012, the benchmark index for the Fund changed from the Standard & Poors 500 Index (“S&P 500 Index”) to the Hybrid 80/20 Blend Index. The Fund's performance is compared to the Hybrid 80/20 Blend Index.

The S&P 500 Index is widely regarded as a gauge of the U.S. equities market. This index includes 500 leading companies in leading industries of the U.S. economy. Although the S&P 500 Index focuses on the large cap segment of the market, with approximately 75% coverage of U.S. equities, it is also an ideal proxy for the total market. The Barclays U.S. Aggregate Bond Index is a measure of the overall performance of the U.S. bond market. These indices are unmanaged and do not reflect the deduction of fees, such as investment and fund accounting fees, associated with a mutual fund. Investors cannot invest directly in an index. |

| Average Annual Total Returns as of 3/31/16 | ||||||||||||||||||

| Aggressive Growth Allocation Strategy | 1 Year | 3 Year | 5 Year | 10 Year | ||||||||||||||

| A Shares |

without sales charge | –4.88% | 6.51% | 5.22% | 4.08% | |||||||||||||

| with sales charge** | –10.35% | 4.44% | 3.98% | 3.47% | ||||||||||||||

| C Shares* |

without CDSC | –5.31% | 5.95% | 4.59% | 3.40% | |||||||||||||

| with CDSC** | –6.06% | 5.95% | 4.59% | 3.40% | ||||||||||||||

| I Shares |

–4.67% | 6.76% | 5.50% | 4.37% | ||||||||||||||

| Hybrid 80/20 Blend Index (80% of the S&P 500 Index, 20% of the Barclays U.S. Aggregate Bond Index) | 1.98% | 10.01% | 10.12% | 6.79% | ||||||||||||||

| S&P 500 Index | 1.78% | 11.82% | 11.58% | 7.01% | ||||||||||||||

| Barclays U.S. Aggregate Bond Index | 1.96% | 2.50% | 3.78% | 4.90% | ||||||||||||||

| Prospectus Expense Ratio1 | Gross | |||||||||||||||||

| A Shares | 1.85% | |||||||||||||||||

| C Shares | 2.46% | |||||||||||||||||

| I Shares | 1.85% | |||||||||||||||||

19

Table of Contents

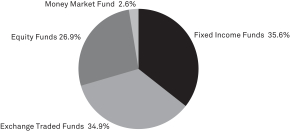

CONSERVATIVE ALLOCATION STRATEGY

Portfolio Manager

| • | Alan Gayle |

INVESTMENT CONCERNS

Equity Securities (Stocks) are more volatile and carry more risk and return potential than other forms of investments. Bonds offer a relatively stable level of income, although bond prices will fluctuate, providing the potential for principal gain or loss. Cash equivalents offer low risk and low return potential.

MANAGEMENT DISCUSSION OF FUND PERFORMANCE

How did the Fund perform against its benchmark for the fiscal year ended March 31, 2016?

The Conservative Allocation Strategy (I Shares) returned -1.73%, compared to a -1.73% return for the Lipper Mixed-Asset Target Allocation (Conservative Classification)*, and a 2.12% return for its hybrid benchmark made up of a 30% weighting in the S&P 500 Index and a 70% weighting in the Barclays U.S. Aggregate Bond Index.

What factors influenced the Fund’s performance for the fiscal year ended March 31, 2016?

RidgeWorth Investments manages four distinct asset allocation strategies, each structured to align investment portfolios with specific levels of investor risk tolerance and income requirements. The underlying mutual funds and ETFs typically are the same across the Strategies, but different stock, bond and alternatives allocations create noticeably different total return characteristics, which are intended to align with investor needs and constraints.

The equity market rose very modestly during the 12-month period, despite being buffeted by a drop in oil prices and global economic uncertainty. Stocks gained when the Federal Reserve raised its target short-term interest rate in December, but then fell due to fears about the economy’s strength.

Amid those concerns, risk-averse investors sought relatively conservative options and defensive sectors. While large-cap stocks and longer-duration fixed income positions faired moderately well over the period, small-, mid-cap, and international stocks and high yield bonds struggled. Commodities declined sharply during the year, but erased some declines late in the period. That environment challenged the Fund’s absolute return.

Broadly speaking, since the S&P 500 equity index slightly underperformed the Barclays U.S. Aggregate bond index for the year, the strategy’s overweight to stocks was a net detractor in terms of relative performance versus its hybrid index. However, selected funds also detracted from relative total returns versus the blended benchmark, most notably from pronounced weakness in international mandates, as well as large-cap and small-cap growth mandates. In the fixed income space, exposure to cash, core, high yield and ultra-short mandates detracted from performance.

We actively and opportunistically reduced risk in the Fund throughout the period by trimming equities, rebuilding a long-dormant position in the GDX (Gold Miners) ETF, and maintaining bond portfolio durations close that of the Barclays U.S. Aggregate index.

How do you plan to position the Fund, based on market conditions?

We believe equities remain attractive relative to bonds in a period of rising rates, especially given historically low interest rates and upticks in inflation and wages. As such, we are maintaining a slightly overweight position in equities relative to the Fund’s target benchmarks, with a core equity position tilted slightly towards growth. The Fund holds overweight stakes in the technology, financials, industrials and consumer discretionary sectors, while maintaining relatively low exposures to developed international and emerging markets equities.

The Fund holds a nearly neutral duration to the Barclays U.S. Aggregate Index. We would not be surprised to see the equity and fixed income markets undergo a period of consolidation in the short run, but we think it could be short-lived. In our estimation, investors facing near-zero interest rates are likely to continue to venture out the risk spectrum in search of income and total return.

| * | Lipper Mixed-Asset Target Allocation (Conservative Classification): Funds that, by portfolio practice, maintain a mix of between 20%-40% equity securities, with the remainder invested in bonds, cash, and cash equivalents. |

20

Table of Contents

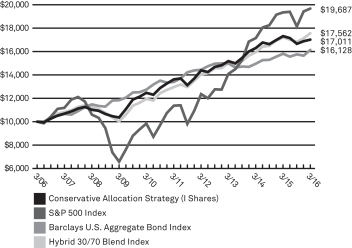

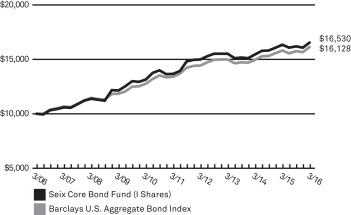

CONSERVATIVE ALLOCATION STRATEGY

Growth of a $10,000 Investment (as of March 31, 2016)

|

This chart assumes an initial hypothetical investment of $10,000 made on 3/31/06. Total return is based on net change in the Net Asset Value (“NAV”) assuming reinvestment of distributions. Returns shown on this page include reinvestment of all dividends and other distributions.

The Fund’s performance is compared to the Hybrid 30/70 Blend Index. The Standard & Poors 500 Index (“S&P 500 Index”) is widely regarded as a gauge of the U.S. equities market. This index includes 500 leading companies in leading industries of the U.S. economy. Although the S&P 500 Index focuses on the large cap segment of the market, with approximately 75% coverage of U.S. equities, it is also an ideal proxy for the total market. The Barclays U.S. Aggregate Bond Index is a measure of the overall performance of the U.S. bond market. These indices are unmanaged and do not reflect the deduction of fees, such as investment and fund accounting fees, associated with a mutual fund. Investors cannot invest directly in an index. |

| Average Annual Total Returns as of 3/31/16 | ||||||||||||||||||

| Conservative Allocation Strategy | 1 Year | 3 Year | 5 Year | 10 Year | ||||||||||||||

| A Shares |

without sales charge | –1.98% | 3.59% | 4.27% | 5.15% | |||||||||||||

| with sales charge** | –6.66% | 1.94% | 3.27% | 4.64% | ||||||||||||||

| C Shares* |

without CDSC | –2.71% | 2.85% | 3.53% | 4.41% | |||||||||||||

| with CDSC** | –3.65% | 2.85% | 3.53% | 4.41% | ||||||||||||||

| I Shares |

–1.73% | 3.89% | 4.56% | 5.46% | ||||||||||||||

| Hybrid 30/70 Blend Index (30% of the S&P 500 Index, 70% of the Barclays U.S. Aggregate Bond Index) |

2.12% | 5.37% | 6.25% | 5.79% | ||||||||||||||

| S&P 500 Index |

1.78% | 11.82% | 11.58% | 7.01% | ||||||||||||||

| Barclays U.S. Aggregate Bond Index |

1.96% | 2.50% | 3.78% | 4.90% | ||||||||||||||

| Prospectus Expense Ratio1 | Gross | |||||||||||||||||

| A Shares | 1.17% | |||||||||||||||||

| C Shares | 1.83% | |||||||||||||||||

| I Shares | 0.95% | |||||||||||||||||

21

Table of Contents

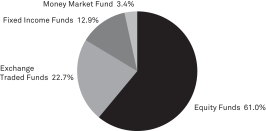

Portfolio Manager

| • | Alan Gayle |

INVESTMENT CONCERNS

Equity Securities (Stocks) are more volatile and carry more risk and return potential than other forms of investments. Bonds offer a relatively stable level of income, although bond prices will fluctuate, providing the potential for principal gain or loss. Cash equivalents offer low risk and low return potential.

MANAGEMENT DISCUSSION OF FUND PERFORMANCE

How did the Fund perform against its benchmark for the fiscal year ended March 31, 2016?

The Growth Allocation Strategy (I Shares) returned -3.74%, compared to a -3.09% return for the Lipper Mixed-Asset Target Allocation (Growth Classification)*, and a 2.04% return for its hybrid benchmark made up of a 70% weighting in the S&P 500 Index and a 30% weighting in the Barclays U.S. Aggregate Bond Index.

What factors influenced the Fund’s performance for the fiscal year ended March 31, 2016?

RidgeWorth Investments manages four distinct asset allocation strategies, each structured to align investment portfolios with specific levels of investor risk tolerance and income requirements. The underlying mutual funds and ETFs typically are the same across the Strategies, but different stock, bond and alternatives allocations create noticeably different total return characteristics, which are intended to align with investor needs and constraints.

The equity market rose very modestly during the 12-month period, despite being buffeted by a drop in oil prices and global economic uncertainty. Stocks gained when the Federal Reserve raised its target short-term interest rate in December, but then fell due to fears about the economy’s strength.

Amid those concerns, risk-averse investors sought relatively conservative options and defensive sectors. While large-cap stocks and longer-duration fixed income positions faired moderately well over the period, small-, mid-cap, and international stocks and high yield bonds struggled. Commodities declined sharply during the year, but erased some declines late in the period. That environment challenged the Fund’s absolute return.

Broadly speaking, since the S&P 500 equity index slightly underperformed the Barclays U.S. Aggregate bond index for the year, the strategy’s overweight to stocks was a net detractor in terms of relative performance versus its hybrid index. However, selected funds also detracted from relative total returns versus the blended benchmark, most notably from pronounced weakness in international mandates, as well as large-cap and small-cap growth mandates. In the fixed income space, exposure to cash, core, high yield and ultra-short mandates detracted from performance.

We actively and opportunistically reduced risk in the Fund throughout the period by trimming equities, rebuilding a long-dormant position in the GDX (Gold Miners) ETF, and maintaining bond portfolio durations close that of the Barclays U.S. Aggregate index.

How do you plan to position the Fund, based on market conditions?

We believe equities remain attractive relative to bonds in a period of rising rates, especially given historically low interest rates and upticks in inflation and wages. As such, we are maintaining a slightly overweight position in equities relative to the Fund’s target benchmarks, with a core equity position tilted slightly towards growth. The Fund holds overweight stakes in the technology, financials, industrials and consumer discretionary sectors, while maintaining relatively low exposures to developed international and emerging markets equities.

The Fund holds a nearly neutral duration to the Barclays U.S. Aggregate Index. We would not be surprised to see the equity and fixed income markets undergo a period of consolidation in the short run, but we think it could be short-lived. In our estimation, investors facing near-zero interest rates are likely to continue to venture out the risk spectrum in search of income and total return.

| * | Lipper Mixed-Asset Target Allocation (Growth Classification): Funds that, by portfolio practice, maintain a mix of between 60%-80% equity securities, with the remainder invested in bonds, cash, and cash equivalents. |

22

Table of Contents

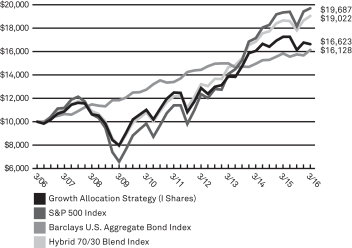

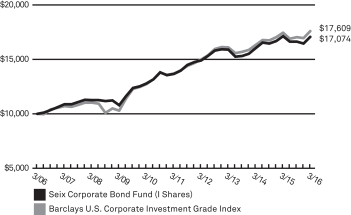

GROWTH ALLOCATION STRATEGY

Growth of a $10,000 Investment (as of March 31, 2016)

|

This chart assumes an initial hypothetical investment of $10,000 made on 3/31/06. Total return is based on net change in the Net Asset Value (“NAV”) assuming reinvestment of distributions. Returns shown on this page include reinvestment of all dividends and other distributions.

The Fund’s performance is compared to the Hybrid 70/30 Blend Index. The Standard & Poors 500 Index (“S&P 500 Index”) is widely regarded as a gauge of the U.S. equities market. This index includes 500 leading companies in leading industries of the U.S. economy. Although the S&P 500 Index focuses on the large cap segment of the market, with approximately 75% coverage of U.S. equities, it is also an ideal proxy for the total market. The Barclays U.S. Aggregate Bond Index is a measure of the overall performance of the U.S. bond market. These indices are unmanaged and do not reflect the deduction of fees, such as investment and fund accounting fees, associated with a mutual fund. Investors cannot invest directly in an index. |

| Average Annual Total Returns as of 3/31/16 | ||||||||||||||||||

| Growth Allocation Strategy | 1 Year | 3 Year | 5 Year | 10 Year | ||||||||||||||

| A Shares |

without sales charge | –4.02% | 6.09% | 5.63% | 4.94% | |||||||||||||

| with sales charge** | –9.57% | 4.00% | 4.39% | 4.32% | ||||||||||||||

| C Shares* |

without CDSC | –4.60% | 5.41% | 4.95% | 4.22% | |||||||||||||

| with CDSC** | –5.48% | 5.41% | 4.95% | 4.22% | ||||||||||||||

| I Shares |

–3.74% | 6.28% | 5.87% | 5.21% | ||||||||||||||

| Hybrid 70/30 Blend Index (70% of the S&P 500 Index, 30% of the Barclays U.S. Aggregate Bond Index) | 2.04% | 9.10% | 9.37% | 6.64% | ||||||||||||||

| S&P 500 Index | 1.78% | 11.82% | 11.58% | 7.01% | ||||||||||||||

| Barclays U.S. Aggregate Bond Index | 1.96% | 2.50% | 3.78% | 4.90% | ||||||||||||||

| Prospectus Expense Ratio1 | Gross | |||||||||||||||||

| A Shares | 1.36% | |||||||||||||||||

| C Shares | 1.98% | |||||||||||||||||

| I Shares | 1.37% | |||||||||||||||||

23

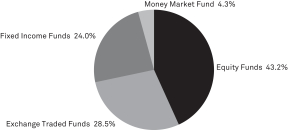

Table of Contents

Portfolio Manager

| • | Alan Gayle |

INVESTMENT CONCERNS

Equity Securities (Stocks) are more volatile and carry more risk and return potential than other forms of investments. Bonds offer a relatively stable level of income, although bond prices will fluctuate, providing the potential for principal gain or loss. Cash equivalent offer low risk and low return potential.

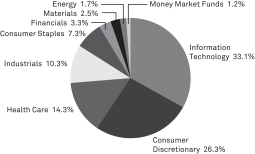

MANAGEMENT DISCUSSION OF FUND PERFORMANCE

How did the Fund perform against its benchmark for the fiscal year ended March 31, 2016?

The Moderate Allocation Strategy (I Shares) returned -2.96%, compared to a -2.70% return for the Lipper Mixed-Asset Target Allocation (Moderate Classification)*, and a 2.12% return for its hybrid benchmark made up of a 50% weighting in the S&P 500 Index and a 50% weighting in the Barclays U.S. Aggregate Bond Index.

What factors influenced the Fund’s performance for the fiscal year ended March 31, 2016?

RidgeWorth Investments manages four distinct asset allocation strategies, each structured to align investment portfolios with specific levels of investor risk tolerance and income requirements. The underlying mutual funds and ETFs typically are the same across the Strategies, but different stock, bond and alternatives allocations create noticeably different total return characteristics, which are intended to align with investor needs and constraints.

The equity market rose very modestly during the 12-month period, despite being buffeted by a drop in oil prices and global economic uncertainty. Stocks gained when the Federal Reserve raised its target short-term interest rate in December, but then fell due to fears about the economy’s strength.

Amid those concerns, risk-averse investors sought relatively conservative options and defensive sectors. While large-cap stocks and longer-duration fixed income positions faired moderately well over the period, small-, mid-cap, and international stocks and high yield bonds struggled. Commodities declined sharply during the year, but erased some declines late in the period. That environment challenged the Fund’s absolute return.

Broadly speaking, since the S&P 500 equity index slightly underperformed the Barclays U.S. Aggregate bond index for the year, the strategy’s overweight to stocks was a net detractor in terms of relative performance versus its hybrid index. However, selected funds also detracted from relative total returns versus the blended benchmark, most notably from pronounced weakness in international mandates, as well as large-cap and small-cap growth mandates. In the fixed income space, exposure to cash, core, high yield and ultra-short mandates detracted from performance.

We actively and opportunistically reduced risk in the Fund throughout the period by trimming equities, rebuilding a long-dormant position in the GDX (Gold Miners) ETF, and maintaining bond portfolio durations close that of the Barclays U.S. Aggregate index.

How do you plan to position the Fund, based on market conditions?

We believe equities remain attractive relative to bonds in a period of rising rates, especially given historically low interest rates and upticks in inflation and wages. As such, we are maintaining a slightly overweight position in equities relative to the Fund’s target benchmarks, with a core equity position tilted slightly towards growth. The Fund holds overweight stakes in the technology, financials, industrials and consumer discretionary sectors, while maintaining relatively low exposures to developed international and emerging markets equities.

The Fund holds a nearly neutral duration to the Barclays U.S. Aggregate Index. We would not be surprised to see the equity and fixed income markets undergo a period of consolidation in the short run, but we think it could be short-lived. In our estimation, investors facing near-zero interest rates are likely to continue to venture out the risk spectrum in search of income and total return.

| * | Lipper Mixed-Asset Target Allocation (Moderate Classification): Funds that, by portfolio practice, maintain a mix of between 40%-60% equity securities, with the remainder invested in bonds, cash, and cash equivalents. |

24

Table of Contents

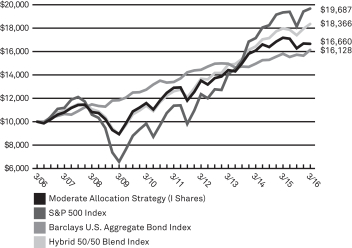

MODERATE ALLOCATION STRATEGY

Growth of a $10,000 Investment (as of March 31, 2016)

|

This chart assumes an initial hypothetical investment of $10,000 made on 3/31/06. Total return is based on net change in the Net Asset Value (“NAV”) assuming reinvestment of distributions. Returns shown on this page include reinvestment of all dividends and other distributions.

The Fund’s performance is compared to the Hybrid 50/50 Blend Index. The Standard & Poors 500 Index (“S&P 500 Index”) is widely regarded as a gauge of the U.S. equities market. This index includes 500 leading companies in leading industries of the U.S. economy. Although the S&P 500 Index focuses on the large cap segment of the market, with approximately 75% coverage of U.S. equities, it is also an ideal proxy for the total market. The Barclays U.S. Aggregate Bond Index is a measure of the overall performance of the U.S. bond market. These indices are unmanaged and do not reflect the deduction of fees, such as investment and fund accounting fees, associated with a mutual fund. Investors cannot invest directly in an index. |

| Average Annual Total Returns as of 3/31/16 | ||||||||||||||||||

| Moderate Allocation Strategy | 1 Year | 3 Year | 5 Year | 10 Year | ||||||||||||||

| A Shares |

without sales charge | –3.13% | 4.82% | 5.03% | 4.99% | |||||||||||||

| with sales charge** | –8.67% | 2.76% | 3.79% | 4.37% | ||||||||||||||

| C Shares* |

without CDSC | –3.65% | 4.24% | 4.40% | 4.30% | |||||||||||||

| with CDSC** | –4.46% | 4.24% | 4.40% | 4.30% | ||||||||||||||

| I Shares |

–2.96% | 4.95% | 5.21% | 5.24% | ||||||||||||||

| Hybrid 50/50 Blend Index (50% of the Barclays U.S. Aggregate Bond Index, 50% of the S&P 500 Index ) | 2.12% | 7.25% | 7.83% | 6.27% | ||||||||||||||

| S&P 500 Index | 1.78% | 11.82% | 11.58% | 7.01% | ||||||||||||||

| Barclays U.S. Aggregate Bond Index | 1.96% | 2.50% | 3.78% | 4.90% | ||||||||||||||

| Prospectus Expense Ratio1 | Gross | |||||||||||||||||

| A Shares | 1.26% | |||||||||||||||||

| C Shares | 1.82% | |||||||||||||||||

| I Shares | 1.11% | |||||||||||||||||

25

Table of Contents

SCHEDULES OF PORTFOLIO INVESTMENTS

RIDGEWORTH FUNDS March 31, 2016

Aggressive Growth Stock Fund

See Notes to Financial Statements.

26

Table of Contents

SCHEDULES OF PORTFOLIO INVESTMENTS

RIDGEWORTH FUNDS March 31, 2016

Capital Innovations Global Resources and Infrastructure Fund

See Notes to Financial Statements.

27

Table of Contents

SCHEDULES OF PORTFOLIO INVESTMENTS

RIDGEWORTH FUNDS March 31, 2016

International Equity Fund

See Notes to Financial Statements.

28

Table of Contents

SCHEDULES OF PORTFOLIO INVESTMENTS

RIDGEWORTH FUNDS March 31, 2016

International Equity Fund — concluded

Investment Abbreviations

| ADR | — | American Depositary Receipt | ||

| BS | — | Bearer Shares | ||

| SAB de CV | — | Sociedad Anónima Bursátil de Capital Variable is the Spanish equivalent to Variable Capital Company | ||

| SP ADR | — | Sponsored American Depositary Receipt |

See Notes to Financial Statements.

29

Table of Contents

SCHEDULES OF PORTFOLIO INVESTMENTS

RIDGEWORTH FUNDS March 31, 2016

Large Cap Growth Stock Fund

See Notes to Financial Statements.

30

Table of Contents

SCHEDULES OF PORTFOLIO INVESTMENTS

RIDGEWORTH FUNDS March 31, 2016

Large Cap Growth Stock Fund — concluded

| * | Non-income producing security. |

| (a) | The security or a partial position of the security was on loan as of March 31, 2016. The total value of securities on loan as of March 31, 2016 was $7,711,018. |

| (b) | Rate disclosed, the 7 day yield, is as of March 31, 2016. |

| (c) | Purchased with cash collateral held from securities lending. The total value of the collateral held by the Fund was $7,895,080. The total value of the collateral includes non-cash U.S. Government securities collateral having a value of $5,141,780. The value of the collateral could include collateral held for securities that were sold on or before March 31, 2016 (See Note 2(g)). |

Investment Abbreviation

SP ADR — Sponsored American Depositary Receipt

See Notes to Financial Statements.

31

Table of Contents

SCHEDULES OF PORTFOLIO INVESTMENTS

RIDGEWORTH FUNDS March 31, 2016

Large Cap Value Equity Fund

See Notes to Financial Statements.

32

Table of Contents

SCHEDULES OF PORTFOLIO INVESTMENTS

RIDGEWORTH FUNDS March 31, 2016

Mid-Cap Value Equity Fund

See Notes to Financial Statements.

33

Table of Contents

SCHEDULES OF PORTFOLIO INVESTMENTS

RIDGEWORTH FUNDS March 31, 2016

Mid-Cap Value Equity Fund — concluded

See Notes to Financial Statements.

34

Table of Contents

SCHEDULES OF PORTFOLIO INVESTMENTS

RIDGEWORTH FUNDS March 31, 2016

Small Cap Growth Stock Fund

See Notes to Financial Statements.

35

Table of Contents

SCHEDULES OF PORTFOLIO INVESTMENTS

RIDGEWORTH FUNDS March 31, 2016

Small Cap Growth Stock Fund — concluded

See Notes to Financial Statements.

36

Table of Contents

SCHEDULES OF PORTFOLIO INVESTMENTS

RIDGEWORTH FUNDS March 31, 2016

Small Cap Value Equity Fund

See Notes to Financial Statements.

37

Table of Contents

SCHEDULES OF PORTFOLIO INVESTMENTS

RIDGEWORTH FUNDS March 31, 2016

Small Cap Value Equity Fund — concluded

See Notes to Financial Statements.

38

Table of Contents

SCHEDULES OF PORTFOLIO INVESTMENTS

RIDGEWORTH FUNDS March 31, 2016

Aggressive Growth Allocation Strategy

See Notes to Financial Statements.

39

Table of Contents

SCHEDULES OF PORTFOLIO INVESTMENTS

RIDGEWORTH FUNDS March 31, 2016

Conservative Allocation Strategy

See Notes to Financial Statements.

40

Table of Contents

SCHEDULES OF PORTFOLIO INVESTMENTS

RIDGEWORTH FUNDS March 31, 2016

Growth Allocation Strategy

See Notes to Financial Statements.

41

Table of Contents

SCHEDULES OF PORTFOLIO INVESTMENTS

RIDGEWORTH FUNDS March 31, 2016

Moderate Allocation Strategy

See Notes to Financial Statements.

42

Table of Contents

STATEMENTS OF ASSETS AND LIABILITIES

RIDGEWORTH FUNDS March 31, 2016

| Aggressive Growth Stock Fund |

Capital Innovations Global Resources and Infrastructure Fund |

International Equity Fund |

Large Cap Growth Stock Fund |

|||||||||||||

| Assets: |

||||||||||||||||

| Total Investments, at Cost |

$16,602,924 | $3,570,177 | $40,087,598 | $137,611,128 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Investments, at Value* |

$26,228,878 | $3,386,294 | $41,454,557 | $252,651,016 | ||||||||||||

| Cash |

— | 976 | — | — | ||||||||||||

| Interest and Dividends Receivable |

2,274 | 13,653 | 28,560 | 38,904 | ||||||||||||

| Securities Lending Income Receivable |

— | — | 1,499 | 1,301 | ||||||||||||

| Receivable for Capital Shares Issued |

61,303 | 60 | 79,296 | 139,022 | ||||||||||||

| Receivable for Investment Securities Sold |

272,240 | — | — | 5,389,386 | ||||||||||||

| Reclaims Receivable |

— | 2,789 | 164,540 | — | ||||||||||||

| Receivable from Investment Adviser |

2,481 | 73,143 | 27,561 | 26,360 | ||||||||||||

| Prepaid Expenses and Other Assets |

10,108 | 11,865 | 21,776 | 25,623 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||