Summary Prospectus

Capital Innovations Global Resources and Infrastructure

Fund

February 8, 2016

Class / Ticker

Symbol

A / INNAXC / INNCXI / INNNX

Before you invest, you may want to review

the Fund’s Prospectus and Statement of Additional Information, which contain more information about the Fund and its risks. You can find the Fund’s Prospectus, Statement of Additional Information and other information about the Fund

online at www.ridgeworth.com/resources/regulatory-taxinfo. You can also get this information at no cost by calling the Funds at 1-888-784-3863 or by sending an email request to info@ridgeworth.com. The current Prospectus and Statement of Additional

Information, dated February 8, 2016, are incorporated by reference into this summary prospectus.

Investment Objective

The Capital Innovations Global Resources and Infrastructure

Fund (the “Fund”) seeks to provide long-term growth of capital.

Fees and Expenses of the Fund

This table describes the fees and expenses that you may pay if

you buy and hold shares of the Fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in RidgeWorth Funds. More information about these and other discounts is available from

your financial professional and in Sales Charges on page 13 of the Fund’s prospectus and Rights of Accumulation on page 63 of the Fund’s statement of additional information.

Shareholder Fees

(fees paid directly from your investment)

(fees paid directly from your investment)

| A Shares | C Shares | I Shares | |

| Maximum Sales Charge (load) Imposed on Purchases (as a % of offering price) | 5.75% | None | None |

| Maximum Deferred Sales Charge (load) (as a % of the net asset value) | None | 1.00% | None |

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the value of your investment)

(expenses that you pay each year as a percentage of the value of your investment)

| A Shares | C Shares | I Shares | |||

| Management Fees | 1.00% | 1.00% | 1.00% | ||

| Distribution (12b-1) Fees | 0.25% | 1.00% | None | ||

| Other Expenses(1) | 1.48% | 1.33% | 1.48% | ||

| Total Annual Fund Operating Expenses | 2.73% | 3.33% | 2.48% | ||

| Fee Waivers and/or Expense Reimbursements(2) | (1.33)% | (1.18)% | (1.33)% | ||

| Total Annual Fund Operating Expenses After Fee Waivers and/or Expense Reimbursements | 1.40% | 2.15% | 1.15% |

| (1) | Other Expenses are based on estimated amounts for the current fiscal year. |

| (2) | The Adviser has contractually agreed to waive fees and reimburse expenses for a period of at least two years from the date of the Reorganization (as such term is defined under Performance) in order to keep Total Annual Fund Operating Expenses (excluding, as applicable, taxes, brokerage commissions, substitute dividend expenses on securities sold short, interest expense, extraordinary expenses and Acquired Fund Fees and Expenses) from exceeding 1.40%, 2.15% and 1.15% for the A, C and I Shares, respectively. This agreement shall terminate upon the termination of the Investment Advisory Agreement between RidgeWorth Funds and the Adviser, or it may be terminated upon written notice to the Adviser by RidgeWorth Funds; provided, however, that any termination of the agreement will not be effective until the end of the one year period after the Reorganization. |

Example

This example is intended to help you compare the cost of

investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated. The example also assumes that your investment has a 5% return each year, that the

Fund’s

1

operating expenses remain the same and that you reinvest all dividends and

distributions. The example reflects contractual fee waivers and reimbursements for the first year only. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 year | 3 years | 5 years | 10 years | |

| A Shares | $709 | $1,255 | $1,825 | $3,368 |

| C Shares | $318 | $ 915 | $1,634 | $3,542 |

| I Shares | $117 | $ 645 | $1,200 | $2,715 |

You would pay the following

expenses if you did not redeem your shares:

| 1 year | 3 years | 5 years | 10 years | |

| A Shares | $709 | $1,255 | $1,825 | $3,368 |

| C Shares | $218 | $ 915 | $1,634 | $3,542 |

| I Shares | $117 | $ 645 | $1,200 | $2,715 |

Portfolio Turnover

The Fund pays transaction costs, when it buys and sells

securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in

annual fund operating expenses or in the example, affect the Fund’s performance.

Simultaneous with the Fund’s commencement of operation,

the Fund will acquire the assets and assume the liabilities of the Capital Innovations Global Agri, Timber, Infrastructure Fund, a series of Investment Managers Series Trust (the “Predecessor Fund”). For the year ended November 30, 2015,

the portfolio turnover rate for the Predecessor Fund was 19%.

Principal Investment Strategies

Under normal circumstances, the Fund invests at least 80% of

its net assets (plus any borrowings for investment purposes) in the securities of issuers that are primarily engaged in the ownership, development, exploration, production, distribution or processing of natural resources, as well as in securities of

companies that are suppliers to firms producing natural resources, and in instruments with economic characteristics similar to natural resources securities. Natural resources may include, for example, energy sources, precious and other metals,

forest products, real estate, food and agriculture, and other basic commodities.

In selecting investments for purchase and sale, Capital

Innovations, LLC (“Capital Innovations” or the “Subadviser”) employs an in-depth analysis which consists of researching historical performance, characteristics, and long-term fundamental outlook of infrastructure, timber, and

agribusiness companies to construct a diversified portfolio representing exposure to these asset classes. To achieve the Fund’s investment objective, the Subadviser generally allocates the Fund’s assets among the following three of its

existing investment strategies: the Capital Innovations Global Listed Infrastructure strategy, the Capital Innovations Global Listed Timber strategy and the Capital Innovations Global Listed Agribusiness strategy. The Subadviser has appointed

a

committee consisting of senior management (the “Allocation

Committee”) to determine the percentage of the Fund’s assets to be allocated to each such asset class. On a periodic basis the Allocation Committee reviews and may adjust the specific allocation ranges based upon its judgment of

economic, market and regulatory conditions. Actual allocations may vary at any time due to market movements, cash flows into or out of the Fund and other factors.

The Subadviser seeks to capitalize on market inefficiencies by

adhering to a systematic and disciplined investment approach. The Subadviser first screens the infrastructure, timber, and agribusiness industry universes based on specific guidelines, and then applies fundamental analysis to each potential

investment. After an Allocation Committee review of the best ideas, the Subadviser invests in companies it believes have sustainable competitive advantages, based on the Subadviser’s assessment of the durability of cash flows, relative market

valuation and growth potential.

The Fund may invest in

securities of issuers located anywhere in the world. Under normal market conditions, the Fund will invest in issuers listed in at least three countries outside the United States, and will invest at least 40% of its assets in foreign issuers.

However, when market conditions warrant, the Fund may invest a higher percentage in U.S. issuers. In such cases, the Fund will invest at least 30% in foreign issuers. Investments are deemed to be “foreign” if: (a) an issuer’s

domicile or location of headquarters is in a foreign country; (b) an issuer derives a significant proportion (at least 50%) of its revenues or profits from goods produced or sold, investments made, or services performed in a foreign country or has

at least 50% of its assets situated in a foreign country; (c) the principal trading market for a security is located in a foreign country; or (d) it is a foreign currency.

The Fund may invest in companies of any market capitalization

but the majority of the Fund’s investments are generally in large and mid-cap securities. Potential investments include all types of equities, and American depositary receipts (“ADRs”) and global depositary receipts

(“GDRs”) of global infrastructure, timber, and agribusiness companies, trading on U.S. and global exchanges and market places. In addition, the Fund may invest in domestic master limited partnership (“MLPs”) and real estate

investment trusts (“REITs”). MLPs are publicly traded companies organized as limited partnerships or limited liability companies and treated as partnerships for federal income tax purposes. REITs are companies that own interests in real

estate or in real estate related loans or other interests and that qualify for favorable federal income tax treatment.

The Fund may purchase the securities of an exchange-traded fund

(“ETF”) to temporarily gain exposure to a portion of the market while awaiting purchase of securities or as an efficient means of gaining exposure to a particular asset class. The Fund might also purchase shares of an ETF to gain

exposure to the securities in the ETF’s portfolio at times when the Fund may not be able to buy those securities directly. Any investment in an ETF would be consistent with the Fund’s objective and investment program.

2

Principal Investment Risks

You may lose money if you invest in the Fund. A Fund share is not a bank deposit and it is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

Agribusiness Industry Risk:

Economic forces, including forces affecting the agricultural commodity, energy and financial markets, as well as government policies and regulations affecting the agricultural industry and related industries, could

adversely affect agribusiness companies. Agricultural production and trade flows are significantly affected by government policies and regulations. In addition, agribusiness companies must comply with a broad range of environmental laws and

regulation. Additional or more stringent environmental laws and regulations may be enacted in the future and such changes could have a material adverse effect on agribusiness companies and may affect the Fund’s performance.

Equity Securities Risk: The

price of equity securities fluctuates from time to time based on changes in a company’s financial condition or overall market and economic conditions. As a result, the value of the Fund’s equity securities may fluctuate drastically from

day to day.

Exchange-Traded Fund Risk: ETFs, like mutual funds, have expenses associated with their operation, including advisory fees. When the Fund invests in an ETF, in addition to directly bearing expenses associated with its own operations, the Fund

bears its pro rata portion of the ETF’s expenses. The impact of these additional expenses, if any, would be shown as part of “Acquired Fund Fees and Expenses” in the Annual Fund Operating Expenses table.

Foreign Companies and Securities Risk: Foreign securities, including depositary receipts such as ADRs, involve special risks such as currency fluctuations (with the exception of ADRs), economic or financial instability, lack of timely or reliable financial

information and unfavorable political or legal developments. Investments in securities of foreign companies or governments can be more volatile than investments in U.S. companies or governments. Diplomatic, political, or economic developments,

including nationalization or appropriation unique to a country or region will affect those markets and their issuers. Foreign securities markets generally have less trading volume and less liquidity than U.S. markets. These risks are increased for

investments in emerging markets.

Industry

Concentration Risk: The Fund’s investments will be concentrated in each of the natural resources and infrastructure groups of industries. The focus of the Fund’s portfolio on these specific groups of

industries may present more risks than if the portfolio were broadly diversified over numerous groups of industries.

Infrastructure Industry Risk: Companies within the infrastructure industry are susceptible to adverse economic or regulatory occurrences. Infrastructure companies may be subject to a variety

of factors that may adversely affect their business or operations, including high interest costs in connection with capital construction programs, high leverage, costs associated with environmental and other regulations, the

effects

of economic slowdown, surplus capacity, increased competition from other providers of services, uncertainties concerning the availability of fuel at reasonable prices, the effects of energy conservation policies and other factors. Infrastructure

companies may also be affected by or subject to regulation by various government authorities; government regulation of rates charged to customers; service interruption due to environmental, operational or other mishaps; the imposition of special

tariffs and changes in tax laws, regulatory policies and accounting standards; and general changes in market sentiment towards infrastructure and utilities assets. Any market price movements, regulatory or technological changes, or economic

conditions affecting infrastructure-related companies may have a significant impact on the Fund’s performance.

Large-Capitalization Companies Risk: Large-capitalization stocks can perform differently from other segments of the equity market or the equity market as a whole. Large-capitalization companies may be less flexible in evolving markets or unable to

implement change as quickly as small-capitalization companies.

Master Limited Partnership Risk: An investment in MLP units involves risks in addition to the risks associated with a similar investment in equity securities, such as common stock, of a corporation. As compared to common shareholders of a corporation,

holders of MLP units have more limited control and limited rights to vote on matters affecting the partnership. Additional risks inherent to investments in MLP units include cash flow risk, tax risk, risk associated with a potential conflict of

interest between unit holders and the MLP’s general partner, and capital markets risk. Moreover, the value of the Fund’s investment in MLPs depends largely on the MLPs being treated as partnerships for U.S. federal income tax purposes.

If an MLP does not meet current legal requirements to maintain eligibility for partnership tax treatment, or if it is unable to do so because of tax law changes, it could be taxed as a corporation and there could be a material decrease in the value

of its securities.

Certain MLP securities may

trade in lower volumes due to their smaller capitalizations. Accordingly, those MLPs may be subject to more abrupt or erratic price movements and may lack sufficient market liquidity to enable the Fund to effect sales at an advantageous time or

without a substantial drop in price. MLPs are generally considered interest-rate sensitive investments. During periods of interest rate volatility, these investments may not provide attractive returns.

Preferred Stock Risk: Preferred

stock represents an equity interest in a company that generally entitles the holder to receive, in preference to the holders of other stocks such as common stocks, dividends and a fixed share of the proceeds resulting from a liquidation of the

company. The market value of preferred stock is subject to company-specific and market risks applicable generally to equity securities and is also sensitive to changes in the company’s creditworthiness, the ability of the company to make

payments on the preferred stock, and changes in interest rates, typically declining in value if interest rates rise.

Real Estate Investment Trust Risk: In addition to the risks associated with securities linked to the real estate industry, such as declines in the value of real estate, risks related to

3

general and local economic conditions, decreases in property revenues, and

increases in prevailing interest rates, property taxes and operating expenses, REITs are subject to certain other risks related to their structure and focus. REITs are dependent upon management skills and generally may not be diversified. REITs are

also subject to heavy cash flow dependency, defaults by borrowers and self-liquidation. A REIT could possibly fail to qualify for favorable U.S. federal income tax treatment, or to maintain its exemption from registration under the 1940 Act. The

above factors may also adversely affect a borrower’s or a lessee’s ability to meet its obligations to the REIT. In addition, the REIT may experience delays in enforcing its rights as a lessor and may incur substantial costs associated

with protecting its investments.

Small- and

Mid-Capitalization Companies Risk: Small- and mid-capitalization stocks tend to perform differently from other segments of the equity market or the equity market as a whole, and can be more volatile than stocks of

large-capitalization companies. Small- and mid-capitalization companies may be newer or less established, and may have limited resources, products and markets, and may be less liquid.

Timber Industry Risk. Timber

companies may be affected by numerous factors, including events occurring in nature and international politics. For example, the volume and value of timber that can be harvested from timberlands may be limited by natural disasters and other events

such as fire, volcanic eruptions, insect infestation, disease, ice storms, wind storms, flooding, other weather conditions and other causes. In periods of poor logging conditions, timber companies may harvest less timber than expected. Timber

companies are subject to many federal, state and local environmental, health and safety laws and regulations. In addition, rising interest rates and general economic conditions may affect the demand for timber products. Any factors affecting timber

companies could have a significant effect on the Fund’s performance.

Performance

Simultaneous with the Fund’s commencement of operation,

all of the assets and liabilities of the Predecessor Fund were transferred to the Fund in a reorganization (the “Reorganization”). The Fund assumed the performance and accounting history of the Predecessor Fund on the date of the

Reorganization.

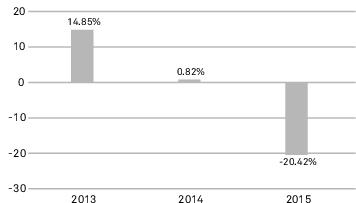

The performance information below

provides some indication of the risks of investing in the Fund by showing changes in the Predecessor Fund’s performance from year to year and by showing how the Predecessor Fund’s average annual returns for the one year and since

inception periods compare with those of a broad measure of market performance. Past performance, before and after taxes, is not necessarily an indication of how the Fund will perform in the future. Updated performance information is available by

contacting the RidgeWorth Funds at 1-888-784-3863 or by visiting www.ridgeworth.com.

Predecessor Fund

Institutional Class Shares1

Institutional Class Shares1

Calendar Year Returns as of December 31

1The annual returns shown in the bar chart are for the Predecessor Fund’s

Institutional Class Shares. The other classes of shares, net of any applicable sales charges, would have substantially similar annual returns to those of Institutional Class Shares because all of the classes of shares are invested in the same

portfolio of securities, and the returns would differ only to the extent that the classes have different sales charges, distribution fees and/or service fees and expenses.

| Best Quarter | Worst Quarter |

| 6.69% | -18.23% |

| (3/31/2013) | (9/30/2015) |

The following table compares the

Predecessor Fund’s average annual total returns for the periods indicated with those of a broad measure of market performance.

AVERAGE ANNUAL TOTAL RETURNS

(for periods ended December 31, 2015)

(for periods ended December 31, 2015)

| 1 Year | Since

Inception* | |

| A Shares Return Before Taxes | (25.15)% | (3.55)% |

| C Shares Return Before Taxes | (21.93)% | (2.52)% |

| I Shares Return Before Taxes | (20.42)% | (1.56)% |

| I Shares Return After Taxes on Distributions | (21.08)% | (1.92)% |

| I Shares Return After Taxes on Distributions and Sale of Fund Shares | (10.98)% | (1.17)% |

| S&P Global Natural Resources Index (reflects no deduction for fees, expenses or taxes) | (24.50)% | (10.62)% |

| * | Since inception of the Predecessor Fund on September 28, 2012. Returns of the A Shares, C Shares, and I Shares are those of the Class A Shares, Class C Shares, and Institutional Shares of the Predecessor Fund, respectively. |

After-tax returns are calculated using the historical highest

individual U.S. federal marginal income tax rates and do not reflect the impact of state and local taxes. Your actual after-tax returns will depend on your tax situation and may differ from those shown. After-tax returns shown are not relevant to

investors who hold their Fund shares through tax-advantaged

4

arrangements, such as 401(k) plans or individual retirement accounts

(“IRAs”). After-tax returns are shown for only the I Shares. After-tax returns for other share classes will vary.

Investment Adviser and Subadviser

RidgeWorth Investments is the Fund’s investment adviser

(the “Adviser”). Capital Innovations, LLC is the Fund’s Subadviser.

Portfolio Management

Mr. Michael D. Underhill, Chief Investment Officer and

co-founder of CI, and Ms. Susan L. Dambekaln, co-founder of CI, are the portfolio managers for the Fund. The Subadviser utilizes a team-based approach in managing the Fund. Mr. Underhill and Ms. Dambekaln are the leaders of this team and comprise

the Allocation Committee, which is responsible for the allocations of the Fund’s investments among the various asset classes. Mr. Underhill and Ms. Dambekaln have co-managed the Predecessor Fund since its commencement on September 28,

2012.

Purchasing and Selling Your Shares

You may purchase or redeem Fund shares on any business day. You

may purchase and redeem A, C and I Shares of the Fund through financial institutions or intermediaries that are authorized to place transactions in Fund shares for their customers or for their own accounts.

The minimum initial investment amounts for each share class are

shown below, although these minimums may be reduced, waived, or not applicable in some cases.

| Class | Dollar Amount |

| A Shares | $2,000 |

| C Shares | $5,000 ($2,000 for IRAs or other tax-advantaged accounts) |

| I Shares | None |

Subsequent investments in A or C

Shares must be made in amounts of at least $1,000. The Fund may accept investments of smaller amounts for either class of shares at its discretion. There are no minimums for subsequent investments in I Shares.

Tax Information

The Fund’s distributions are generally taxable as

ordinary income, qualified dividend income, or capital gains unless you are investing through a tax-advantaged arrangement, such as a

401(k) plan or an IRA, which may be taxed upon withdrawal. Certain

distributions may be treated as a return of capital for tax purposes.

Payments to Broker-Dealers and Other Financial

Intermediaries

If you purchase shares of the Fund through

a financial intermediary, such as a broker-dealer or investment adviser, the Fund, the Adviser or the Distributor may pay the intermediary for the sale of Fund shares and related services.

These payments may create a conflict of interest by influencing

the broker-dealer or other financial intermediary and your salesperson to recommend the Fund over another investment. Ask your financial intermediary or visit your financial intermediary’s website for more information.

| RFSUM-GATI-0216 |