Summary Prospectus

Seix U.S. Mortgage Fund (Formerly, Limited-Term Federal

Mortgage Securities Fund)

August 1, 2015 (as revised February 1, 2016)

Class / Ticker

Symbol

A / SLTMXC / SCLFXI / SLMTX

Before you invest, you may want to review

the Fund’s Prospectus and Statement of Additional Information, which contain more information about the Fund and its risks. You can find the Fund’s Prospectus, Statement of Additional Information and other information about the Fund

online at www.ridgeworth.com/resources/regulatory-taxinfo. You can also get this information at no cost by calling the Funds at 1-888-784-3863 or by sending an email request to info@ridgeworth.com. The current Prospectus and Statement of Additional

Information, dated August 1, 2015, are incorporated by reference into this summary prospectus.

Investment Objective

The Seix U.S. Mortgage Fund (the “Fund”) seeks to

maximize long term total return through a combination of current income and capital appreciation, consistent with capital preservation.

Fees and Expenses of the Fund

This table describes the fees and expenses that you may pay if

you buy and hold shares of the Fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in RidgeWorth Funds. More information about these and other discounts is available from

your financial professional and in Sales Charges on page 75 of the Fund’s prospectus and Rights of Accumulation on page 73 of the Fund’s statement of additional information.

Shareholder Fees

(fees paid directly from your investment)

(fees paid directly from your investment)

| A Shares | C Shares | I Shares | |

| Maximum Sales Charge (load) Imposed on Purchases (as a % of offering price) | 2.50% | None | None |

| Maximum Deferred Sales Charge (load) (as a % of the net asset value) | None | 1.00% | None |

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the value of your investment)

(expenses that you pay each year as a percentage of the value of your investment)

| A Shares | C Shares | I Shares | |||

| Management Fees | 0.40% | 0.40% | 0.40% | ||

| Distribution (12b-1) Fees | 0.20% | 1.00% | None | ||

| Other Expenses(1) | 0.73% | 0.65% | 0.76% | ||

| Total Annual Fund Operating Expenses | 1.33% | 2.05% | 1.16% | ||

| Fee Waivers and/or Expense Reimbursements(2) | (0.43)% | (0.40)% | (0.46)% | ||

| Total Annual Fund Operating Expenses After Fee Waivers and/or Expense Reimbursements | 0.90% | 1.65% | 0.70% |

| (1) | Restated to reflect current fees. |

| (2) | The Adviser and Subadviser have contractually agreed to waive fees and reimburse expenses until at least August 1, 2016, in order to keep Total Annual Fund Operating Expenses (excluding, as applicable, taxes, brokerage commissions, substitute dividend expenses on securities sold short, interest expense, extraordinary expenses and Acquired Fund Fees and Expenses) from exceeding 0.90%, 1.65% and 0.70% for the A, C and I Shares, respectively. This agreement shall terminate upon the termination of the Investment Advisory Agreement between RidgeWorth Funds and the Adviser, or it may be terminated upon written notice to the Adviser by RidgeWorth Funds. |

Example

This example is intended to help you compare the cost of

investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated. The example also assumes that your investment has a 5% return each year, that the

Fund’s operating expenses remain the same and that you reinvest all dividends and distributions. The example reflects contractual

1

fee waivers and reimbursements for the first year only. Although your actual

costs may be higher or lower, based on these assumptions your costs would be:

| 1 year | 3 years | 5 years | 10 years | |

| A Shares | $340 | $620 | $ 920 | $1,775 |

| C Shares | $268 | $604 | $1,067 | $2,347 |

| I Shares | $ 72 | $323 | $ 594 | $1,368 |

You would pay the following

expenses if you did not redeem your shares:

| 1 year | 3 years | 5 years | 10 years | |

| A Shares | $340 | $620 | $ 920 | $1,775 |

| C Shares | $168 | $604 | $1,067 | $2,347 |

| I Shares | $ 72 | $323 | $ 594 | $1,368 |

Portfolio Turnover

The Fund pays transaction costs, when it buys and sells

securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in

annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 165% of the average value of its portfolio.

Principal Investment Strategies

Under normal circumstances, the Fund invests at least 80% of

its net assets (plus any borrowings for investment purposes) in U.S. government agency mortgage-backed securities, such as the Federal National Mortgage Association (“FNMA”), Government National Mortgage Association (“GNMA”)

and collateralized mortgage obligations. The Fund may invest a portion of its assets in securities that are restricted as to resale. As a result of its investment strategy, the Fund’s portfolio turnover rate may be 100% or more.

Buy and sell decisions are based on a wide number of factors

that determine the risk-reward profile of each security within the context of the broader portfolio. In selecting investments for purchase and sale the Subadviser attempts to identify mortgage securities that it expects to perform well in rising and

falling markets, such as those which have stable pre-payments, call protection, below par prices, and refinancing barriers. The Subadviser also attempts to reduce the risk that the underlying mortgages are prepaid by focusing on securities that it

believes are less prone to this risk. For example, FNMA or GNMA securities that were issued years ago may be less prone to prepayment risk because there have been many opportunities for refinancing.

The Fund’s Subadviser, Seix Investment Advisors LLC

(“Seix” or the “Subadviser”) anticipates that the Fund’s modified-adjusted duration will mirror that of the Barclays U.S. Mortgage-Backed Securities Index, plus or minus 20%. For example, if the duration of the Barclays

U.S. Mortgage-Backed Securities Index is 5 years, the Fund’s duration may be 4–6 years. Duration measures a bond or Fund’s sensitivity to interest rate changes and is expressed as a number of years.

The

higher the number, the greater the risk. Under normal circumstances, for example, if a portfolio has a duration of 5 years, its value will change by 5% if rates change by 1%. Shorter duration bonds result in lower expected volatility. The Fund may

invest a portion of its assets in securities that are restricted as to resale.

In addition, to implement its investment strategy, the Fund may

buy or sell, to a limited extent, derivative instruments (such as credit linked notes, futures, options, inverse floaters, swaps and warrants) to use as a substitute for a purchase or sale of a position in the underlying assets and/or as part of a

strategy designed to reduce exposure to other risks, such as interest rate risk and credit risk. Further, the Fund may utilize exchange traded futures to manage interest rate exposure.

Principal Investment Risks

You may lose money if you invest in the Fund. A Fund share is not a bank deposit and it is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

Debt Securities Risk: Debt

securities, such as bonds, involve credit risk. Credit risk is the risk that the borrower will not make timely payments of principal or interest or will default. Changes in an issuer’s credit rating or the market’s perception of an

issuer’s creditworthiness may also affect the value of the Fund’s investment in that issuer. The degree of credit risk depends on the issuer’s financial condition and on the terms of the securities.

Debt securities are also subject to interest rate risk, which

is the risk that the value of a debt security may fall when interest rates rise. In general, the market price of debt securities with longer maturities will go up or down more in response to changes in interest rates than the market price of shorter

term securities.

Derivatives Risk: In the course of pursuing its investment strategies, the Fund may invest in certain types of derivatives including swaps, foreign currency forward contracts and futures. The Fund is exposed to additional volatility and

potential loss with these investments. Losses in these investments may exceed the Fund’s initial investment. Derivatives may be difficult to value, may become illiquid and may not correlate perfectly with the overall securities

market.

Frequent Trading Risk: Frequent buying and selling of investments may involve higher trading costs and other expenses and may affect the Fund's performance over time. High rates of portfolio turnover may result in the realization of

short-term capital gains and losses. The payment of taxes on these gains could adversely affect your after tax return on your investment in the Fund. Any distributions resulting from such gains or losses may be considered ordinary income for federal

income tax purposes.

Futures Contract Risk: The risks associated with futures include: the Subadviser’s ability to manage these instruments, the potential inability to terminate or sell a position, the lack of a liquid secondary market for the Fund’s

position, mispricing or improper valuation and that the other party to a derivative transaction will not meet its obligations. The prices of

2

derivatives may move in unexpected ways, especially in unusual market

conditions, and may result in increased volatility and unexpected losses.

A liquid secondary market may not always exist for the

Fund’s derivative positions at any time. In fact, many over-the-counter instruments (instruments not traded on exchange) may not be liquid. Over-the-counter instruments also involve the risk that the other party to the derivative transaction

will not meet its obligations.

Mortgage-Backed and

Asset-Backed Securities Risk: Mortgage- and asset-backed securities are debt instruments that are secured by interests in pools of mortgage loans or other financial assets. The value of these securities will be

influenced by the factors affecting the assets underlying such securities, swings in interest rates, changes in default rates, or deteriorating economic conditions.

During periods of declining asset values, mortgage-backed and

asset-backed securities may face valuation difficulties and may become more volatile and/or illiquid. The risk of default is generally higher in the case of securities backed by loans made to borrowers with “sub-prime” credit

metrics.

If market interest rates increase substantially

and the Fund’s adjustable-rate securities are not able to reset to market interest rates during any one adjustment period, the value of the Fund’s holdings and its net asset value may decline until the adjustable-rate securities are able

to reset to market rates. In the event of a dramatic increase in interest rates, the lifetime limit on a security’s interest rate may prevent the rate from adjusting to prevailing market rates. In such an event, the security could underperform

and affect the Fund’s net asset value.

Prepayment and

Call Risk: During periods of falling interest rates, an issuer of a callable bond held by the Fund may “call” or prepay the bond before its stated maturity date. When mortgages and other obligations are

prepaid and when securities are called, the Fund may have to reinvest the proceeds in securities with a lower yield or fail to recover additional amounts paid for securities with higher interest rates, resulting in an unexpected capital loss and/or

a decline in the Fund’s income.

Restricted

Securities Risk: Certain debt securities may be restricted securities, which are not registered with the SEC and thus may not be sold publicly until registration has been made. Therefore, there is the absence of a

public market and there is limited investor information.

Swap Risk: The Fund may enter

into swap agreements, including credit default and interest rate swaps, for purposes of attempting to gain exposure to a particular asset without actually purchasing that asset or to hedge a position. Credit default swaps may increase or decrease

the Fund’s exposure to credit risk and could result in losses if the Subadviser does not correctly evaluate the creditworthiness of the entity on which the credit default swap is based. Swap agreements may also subject the Fund to the risk

that the counterparty to the transaction may not meet its obligations.

U.S. Government Securities

Risk: U.S. Treasury securities are backed by the full faith and credit of the U.S. government, while other types of securities issued or guaranteed by federal agencies, instrumentalities, and U.S.

government-sponsored entities may or may not be backed by the full faith and credit of the U.S. government. U.S. government securities may underperform other segments of the fixed income market or the fixed income market as a whole.

Performance

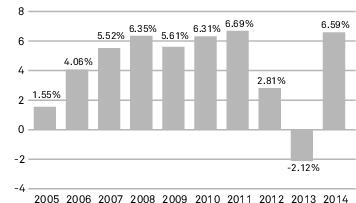

The bar chart and the performance table that follow illustrate

the risks and volatility of an investment in the Fund. The Fund’s past performance (before and after taxes) does not indicate how the Fund will perform in the future. Updated performance information is available by contacting the RidgeWorth

Funds at 1-888-784-3863 or by visiting www.ridgeworth.com.

The annual returns in the bar chart which follows are for the I

Shares without reflecting payment of any sales

charge; if they did reflect such payment of sales charges, annual returns would be lower.

charge; if they did reflect such payment of sales charges, annual returns would be lower.

This bar chart shows the changes in performance of the

Fund’s I Shares from year to year.*

| Best Quarter | Worst Quarter |

| 4.10% | -2.46% |

| (12/31/2008) | (6/30/2013) |

* The performance information shown

above is based on a calendar year. The Fund's total return for the six months ended June 30, 2015 was 0.68%.

The following table compares the Fund’s average annual

total returns for the periods indicated with those of a broad measure of market performance.

3

AVERAGE ANNUAL TOTAL RETURNS

(for periods ended December 31, 2014)

(for periods ended December 31, 2014)

| 1 Year | 5 Years | 10 Years | |

| A Shares Return Before Taxes | 3.68% | 3.28% | 3.84% |

| C Shares Return Before Taxes | 4.56% | 2.97% | 3.29% |

| I Shares Return Before Taxes | 6.59% | 4.00% | 4.30% |

| I Shares Return After Taxes on Distributions | 5.54% | 3.15% | 3.07% |

| I Shares Return After Taxes on Distributions and Sale of Fund Shares | 3.71% | 2.75% | 2.86% |

| Barclays U.S. Mortgage-Backed Securities Index (reflects no deduction for fees, expenses or taxes) | 6.08% | 3.73% | 4.75% |

After-tax returns are calculated

using the historical highest individual U.S. federal marginal income tax rates and do not reflect the impact of state and local taxes. Your actual after-tax returns will depend on your tax situation and may differ from those shown. After-tax returns

shown are not relevant to investors who hold their Fund shares through tax-advantaged arrangements, such as 401(k) plans or individual retirement accounts (“IRAs”). After-tax returns are shown for only the I Shares. After-tax returns for

other share classes will vary.

Investment Adviser and

Subadviser

RidgeWorth Investments is the Fund’s

investment adviser (the “Adviser”). Seix Investment Advisors LLC is the Fund’s Subadviser.

Portfolio Management

Mr. James F. Keegan, Chairman, Chief Investment Officer and

Senior Portfolio Manager of Seix, has been a member of the Fund’s management team since 2008. Mr. Perry Troisi, Managing Director and Senior Portfolio Manager of Seix, has been a member of the Fund’s management team since 2007. Mr.

Michael Rieger, Managing Director and Senior Portfolio Manager of Seix, has been a member of the Fund’s management team since 2007. Mr. Seth Antiles, Ph.D., Managing Director and Senior Portfolio Manager of Seix, has been a member of the

Fund’s management team since 2009. Mr. Jon Yozzo, Head of Investment Grade Corporate Bond Trading, has been a member of the Fund’s management team since 2015. Mr. Carlos Catoya, Head of Investment Grade Credit Research, has been a member

of the Fund’s management team since 2015.

Purchasing and Selling Your Shares

You may purchase or redeem Fund shares on any business day. You

may purchase and redeem A, C and I Shares of the Fund through financial institutions or intermediaries that are authorized to place transactions in Fund shares for their customers or for their own accounts.

The minimum initial investment amounts for each share class are

shown below, although these minimums may be reduced, waived, or not applicable in some cases.

| Class | Dollar Amount |

| A Shares | $2,000 |

| C Shares | $5,000 ($2,000 for IRAs or other tax-advantaged accounts) |

| I Shares | None |

Subsequent investments in A or C

Shares must be made in amounts of at least $1,000. The Fund may accept investments of smaller amounts for either class of shares at its discretion. There are no minimums for subsequent investments in I Shares.

Tax Information

The Fund’s distributions are generally taxable as

ordinary income or capital gains unless you are investing through a tax-advantaged arrangement, such as a 401(k) plan or an IRA, which may be taxed upon withdrawal.

Payments to Broker-Dealers and Other Financial

Intermediaries

If you purchase shares of the Fund through

a financial intermediary, such as a broker-dealer or investment adviser, the Fund, the Adviser or the Distributor may pay the intermediary for the sale of Fund shares and related services.

These payments may create a conflict of interest by influencing

the broker-dealer or other financial intermediary and your salesperson to recommend the Fund over another investment. Ask your financial intermediary or visit your financial intermediary’s website for more information.

| RFSUM-LF-0216 |