Summary Prospectus

Seix Georgia Tax-Exempt Bond Fund

August 1, 2015

Class / Ticker

Symbol

A / SGTEXI / SGATX

Before

you invest, you may want to review the Fund’s Prospectus and Statement of Additional Information, which contain more information about the Fund and its risks. You can find the Fund’s Prospectus, Statement of Additional Information and

other information about the Fund online at www.ridgeworth.com/resources/regulatory-taxinfo. You can also get this information at no cost by calling the Funds at 1-888-784-3863 or by sending an email request to info@ridgeworth.com. The current

Prospectus and Statement of Additional Information, dated August 1, 2015, are incorporated by reference into this summary prospectus.

Investment Objective

The Seix Georgia Tax-Exempt Bond Fund (the “Fund”)

seeks current income exempt from federal and state income taxes for Georgia residents consistent with capital preservation.

Fees and Expenses of the Fund

This table describes the fees and expenses that you may pay if

you buy and hold shares of the Fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in RidgeWorth Funds. More information about these and other discounts is available from

your financial professional and in Sales Charges on page 75 of the Fund’s prospectus and Rights of Accumulation on page 73 of the Fund’s statement of additional information.

Shareholder Fees

(fees paid directly from your investment)

(fees paid directly from your investment)

| A Shares | I Shares | |

| Maximum Sales Charge (load) Imposed on Purchases (as a % of offering price) | 4.75% | None |

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the value of your investment)

(expenses that you pay each year as a percentage of the value of your investment)

| A Shares | I Shares | ||

| Management Fees | 0.50% | 0.50% | |

| Distribution (12b-1) Fees | 0.15% | None | |

| Other Expenses | 0.08% | 0.14% | |

| Total Annual Fund Operating Expenses | 0.73% | 0.64% |

Example

This example is intended to help you compare the cost of

investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated. The example also assumes

that

your investment has a 5% return each year, that the Fund’s operating expenses remain the same and that you reinvest all dividends and distributions. The example reflects contractual fee waivers and reimbursements for the first year only.

Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 year | 3 years | 5 years | 10 years | |

| A Shares | $546 | $697 | $862 | $1,338 |

| I Shares | $ 65 | $205 | $357 | $ 798 |

Portfolio Turnover

The Fund pays transaction costs, when it buys and sells

securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in

annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 55% of the average value of its portfolio.

Principal Investment Strategies

Under normal circumstances, the Fund invests at least 80% of

its net assets (plus any borrowings for investment purposes) in municipal securities with income exempt from U.S. federal and Georgia state income taxes. Issuers of these securities can be located in Georgia, Puerto Rico and other U.S. territories

and possessions. The Fund may invest up to 20% of its assets in securities subject to the U.S. federal alternative minimum tax. The Fund may also invest a portion of its net assets in certain taxable debt securities.

In selecting investments for purchase and sale, the

Fund’s Subadviser, Seix Investment Advisors LLC (“Seix” or the “Subadviser”), tries to manage risk as much as possible. Based on the Subadviser’s analysis of municipalities, credit risk, market trends and

investment cycles, the Subadviser attempts

1

to invest more of the Fund’s assets in undervalued market sectors and

less in overvalued sectors taking into consideration maturity, sector, credit, state and supply and demand levels. There are no limits on the Fund’s average-weighted maturity or on the remaining maturities of individual securities. The

Subadviser tries to diversify the Fund’s holdings within the State of Georgia.

The Subadviser also attempts to identify and invest in

municipal issuers with improving credit and avoid those with deteriorating credit. The Fund invests in securities rated investment grade by at least one national securities rating agency or unrated securities that the Subadviser believes are of

comparable quality. The Subadviser may retain securities if the rating of the security falls below investment grade and the Subadviser deems retention of the security to be in the best interests of the Fund.

Principal Investment Risks

You may lose money if you invest in the Fund. A Fund share is not a bank deposit and it is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

Debt Securities Risk: Debt

securities, such as bonds, involve credit risk. Credit risk is the risk that the borrower will not make timely payments of principal or interest or will default. Changes in an issuer’s credit rating or the market’s perception of an

issuer’s creditworthiness may also affect the value of the Fund’s investment in that issuer. The degree of credit risk depends on the issuer’s financial condition and on the terms of the securities.

Debt securities are also subject to interest rate risk, which

is the risk that the value of a debt security may fall when interest rates rise. In general, the market price of debt securities with longer maturities will go up or down more in response to changes in interest rates than the market price of shorter

term securities.

Municipal Securities Risk: Municipal securities can be significantly affected by litigation, political or economic events, as well as uncertainties in the municipal market related to taxation, legislative changes or the rights of municipal

security holders. Municipal securities backed by current or anticipated revenues from specific projects or assets can be negatively affected by the inability of the issuer to collect revenues for the projects or from the assets.

State Concentration Risk: The

Fund’s concentration of investments in securities of issuers located in the State of Georgia may subject the Fund to economic and government policies within the State.

Performance

The bar chart and the performance table that follow illustrate

the risks and volatility of an investment in the Fund. The Fund’s past performance (before and after taxes) does not indicate how the Fund will perform in the future. Updated performance information is available by contacting the RidgeWorth

Funds at 1-888-784-3863 or by visiting www.ridgeworth.com.

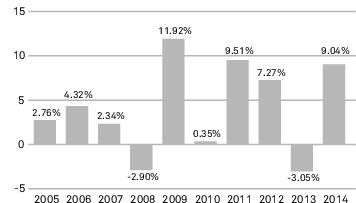

The annual returns in the bar chart which follows are for the I

Shares without reflecting payment of any sales

charge; if they did reflect such payment of sales charges, annual returns would be lower.

charge; if they did reflect such payment of sales charges, annual returns would be lower.

This bar chart shows the changes in performance of the

Fund’s I Shares from year to year.*

| Best Quarter | Worst Quarter |

| 6.69% | -5.43% |

| (9/30/2009) | (12/31/2010) |

| * | The performance information shown above is based on a calendar year. The Fund’s total return for the six months ended June 30, 2015 was -0.06%. |

The following table compares the Fund’s average annual

total returns for the periods indicated with those of a broad measure of market performance.

AVERAGE ANNUAL TOTAL RETURNS

(for periods ended December 31, 2014)

(for periods ended December 31, 2014)

| 1 Year | 5 Years | 10 Years | |

| A Shares Return Before Taxes | 3.64% | 3.32% | 3.36% |

| I Shares Return Before Taxes | 9.04% | 4.50% | 4.04% |

| I Shares Return After Taxes on Distributions | 9.04% | 4.50% | 4.04% |

| I Shares Return After Taxes on Distributions and Sale of Fund Shares | 6.38% | 4.24% | 3.92% |

| Barclays U.S. Municipal Bond Index (reflects no deduction for fees, expenses or taxes) | 9.05% | 5.16% | 4.74% |

After-tax returns are calculated

using the historical highest individual U.S. federal marginal income tax rates and do not reflect the impact of state and local taxes. Your actual after-tax returns will depend on your tax situation and may differ from those shown. After-tax returns

shown are not relevant to investors who hold their Fund shares through tax-advantaged arrangements, such as 401(k) plans or individual retirement accounts (“IRAs”). After-tax returns are shown for only the I Shares. After-tax returns for

other share classes will vary.

2

Investment Adviser and Subadviser

RidgeWorth Investments is the Fund’s investment adviser

(the “Adviser”). Seix Investment Advisors LLC is the Fund’s Subadviser.

Portfolio Management

Mr. Chris Carter, CFA, Director and Portfolio Manager of Seix,

has managed the Fund since August 2003.

Purchasing and

Selling Your Shares

You may purchase or redeem Fund

shares on any business day. You may purchase and redeem A and I Shares of the Fund through financial institutions or intermediaries that are authorized to place transactions in Fund shares for their customers or for their own accounts.

The minimum initial investment amounts for each share class are

shown below, although these minimums may be reduced, waived, or not applicable in some cases.

| Class | Dollar Amount |

| A Shares | $2,000 |

| I Shares | None |

Subsequent investments in A Shares

must be made in amounts of at least $1,000. The Fund may accept investments of smaller amounts at its discretion. There are no minimums for subsequent investments in I Shares.

Tax Information

The Fund intends to distribute income that is exempt from

regular federal and Georgia income taxes. A portion of the Fund’s distributions may be subject to Georgia or federal income taxes or to the federal alternative minimum tax.

Payments to Broker-Dealers and Other Financial

Intermediaries

If you purchase shares of the Fund through

a financial intermediary, such as a broker-dealer or investment adviser, the Fund, the Adviser or the Distributor may pay the intermediary for the sale of Fund shares and related services.

These payments may create a conflict of interest by influencing

the broker-dealer or other financial intermediary and your salesperson to recommend the Fund over another investment. Ask your financial intermediary or visit your financial intermediary’s website for more information.

| RFSUM-GTE-0815 |