Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-06557

RidgeWorth Funds

(Exact name of registrant as specified in charter)

RidgeWorth Capital Management LLC

3333 Piedmont Road, Suite 1500

Atlanta, GA 30305

(Address of principal executive offices)(Zip code)

| (Name and Address of Agent for Service) | Copy to: | |

| Julia R. Short RidgeWorth Funds 3333 Piedmont Road, Suite 1500 Atlanta, GA 30305 |

W. John McGuire, Esq. Thomas S. Harman, Esq. Morgan, Lewis & Bockius LLP 2020 K Street, NW Washington, DC 20006 | |

Registrant’s telephone number, including area code: 1-888-784-3863

Date of fiscal year end: March 31

Date of reporting period: March 31, 2015

Table of Contents

| Item 1. | Reports to Shareholders. |

Table of Contents

2015 ANNUAL REPORT

EQUITY FUNDS

MARCH 31, 2015

RidgeWorth Investments is the trade name of RidgeWorth Capital Management LLC.

Collective Strength. Individual Insight. is a federally registered service mark of RidgeWorth Investments.

Table of Contents

RIDGEWORTH FUNDS March 31, 2015

| Letter to Shareholders | 1 | |||

| Management Discussion of Fund Performance | ||||

| Equity Funds: | ||||

| 2 | ||||

| 4 | ||||

| 6 | ||||

| 8 | ||||

| 10 | ||||

| 12 | ||||

| 14 | ||||

| Allocation Strategies: | ||||

| 16 | ||||

| 18 | ||||

| 20 | ||||

| 22 | ||||

| Financial Statements | ||||

| Schedules of Portfolio Investments | 24 | |||

| Statements of Assets and Liabilities | 39 | |||

| Statements of Operations | 42 | |||

| Statements of Changes in Net Assets | 45 | |||

| Financial Highlights | 49 | |||

| Notes to Financial Statements | 55 | |||

| Report of Independent Registered Public Accounting Firm | 75 | |||

| Other Information | ||||

| Other Federal Tax Information | 76 | |||

| Trustees and Officers of the RidgeWorth Funds | 78 | |||

| Additional Information | 80 | |||

Table of Contents

[THIS PAGE INTENTIONALLY LEFT BLANK]

Table of Contents

RIDGEWORTH FUNDS March 31, 2015

Dear Valued Shareholder,

We sincerely thank you for your continued business and support. Our primary objective is to help you achieve your investment goals, and we’re grateful you have placed your confidence in us. We aim to earn your trust through competitive investment performance and excellent client service. We hope we have met your expectations in both of these measures, and we look forward to continuing to serve as your asset manager in the months and years to come.

The 12 months through March 31, 2015 marked the sixth year of continued recovery in the U.S. economy since the Great Recession bottomed out in March of 2009. For the consumer, job gains continued, the unemployment rate fell, inflation-adjusted disposable income rose, auto and home sales increased, and confidence improved. On the business side, profits continued to rise and margins held near cycle highs. Outside the private sector, federal, state and local spending increased, so that all segments of the economy participated in the expansion. Inflation and interest rates remained low. Not surprisingly, all this was positive for the U.S. equity market.

However, while progress has been steady, it has also been measured, and in some cases slower than normal. The economy faces a lingering headwind from excess leverage built up during the economic expansion in the 2000s, which sidelined many consumers. This was compounded by subsequent tighter lending standards. In addition, the growth rate of the labor force slowed to the lowest level in decades. These factors helped contribute to this relatively muted recovery.

Outside the U.S., growth either remained sluggish or slowed significantly from previous levels. The European Union (EU) economy in particular struggled, while growth in China continued to slow as the leadership moved to reorient activity away from exports in favor of internal consumption. The encouraging news was that global central banks began taking measures to jumpstart growth through aggressive stimulus measures. Moreover, the relative strength in the U.S. pushed up the value of the dollar, which, while a headwind for domestic producers, became a tailwind for our trading partners.

Looking ahead, we believe the downside risks to the U.S. economy remain muted despite the recent headwinds mentioned and lowered growth forecasts. We expect additional employment and income growth, and prospects outside the domestic economy have also improved. While unexpected events have the potential to derail the current recovery/expansion and increase market volatility, we are encouraged by the resiliency of the U.S. economy and its trading partners in overcoming the challenges of recent years.

We continue to believe the markets will offer opportunities to investors, but they will be more selective and company-specific, an environment that fits well with RidgeWorth’s bottom-up approach to security selection. We at RidgeWorth wish to thank you again for the trust and confidence you have placed in us, and we look forward to another good year together.

Sincerely,

Ashi Parikh

Chief Executive Officer, Chief Investment Officer

RidgeWorth Investments

1

Table of Contents

Portfolio Managers

| Ÿ | Nancy Zevenbergen, CFA, CIC |

| Ÿ | Brooke de Boutray, CFA, CIC |

| Ÿ | Leslie Tubbs, CFA, CIC |

INVESTMENT CONCERNS

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes. Common stocks, and funds investing in common stocks, generally provide greater return potential when compared with other types of investments.

Small- and mid-capitalization funds typically carry additional risks as smaller companies generally have a higher risk of failure.

MANAGEMENT DISCUSSION OF FUND PERFORMANCE

How did the Fund perform against its benchmark for the fiscal year ended March 31, 2015?

For the fiscal year ended March 31, 2015, the Aggressive Growth Stock Fund (I Shares) delivered a 4.61% return. That compared to a 15.76% return for the Russell 3000™ Growth Index.

What factors influenced the Fund’s performance for the fiscal year ended March 31, 2015?

Stocks performed well during the 12-month period, with relatively strong returns driven by an improving U.S. economy and steady corporate earnings growth. However, stocks faced some headwinds during the period, including a sharp decline in oil prices, which impacted several sectors of the equity market, as well as volatility caused by investors’ shifting expectations for rising interest rates. In absolute terms, the Fund posted positive returns in that environment.

The Fund’s relative performance was hurt by individual holdings in consumer discretionary sector, including shares of a streaming audio service that declined as investors awaited a decision on new industry royalty fees, and an electric car manufacturer that struggled to meet expectations for vehicle deliveries. Stock selection in the financial services sector also hurt performance, particularly a 401(k) management company that failed to convert many of its contracted accounts into paying customers. Exposure to an online local review network detracted from performance due to a decline in the company’s active accounts and increased costs from market expansion.

The Fund benefited from individual holdings in the producer durables sector. In particular, shares of a freight logistics company appreciated 50% after recording strong revenue growth driven primarily by acquisitions.

How do you plan to position the Fund, based on market conditions?

While many investment professionals are making predictions about certain areas of the market—including concern about a potential bubble forming among biotech stocks—we do not weigh in on those discussions. While broader factors can influence our research, evaluating the management teams and fundamentals of individual companies remains our most reliable guide for making investment decisions. As we near our third decade of investing, we have deepened our perspective and increased our confidence in the long-term promise of growth equities. We hold a growing conviction that when we look back five or 10 years from now, we will be grateful to have been invested in the spring of 2015.

2

Table of Contents

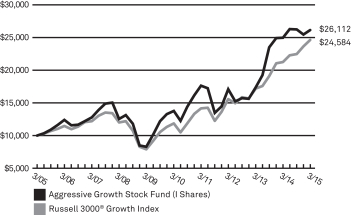

AGGRESSIVE GROWTH STOCK FUND

Growth of a $10,000 Investment (as of March 31, 2015)

|

This chart assumes an initial hypothetical investment of $10,000 made on 3/31/05. Total return is based on net change in the Net Asset Value (“NAV”) assuming reinvestment of distributions. Returns shown on this page include reinvestment of all dividends and other distributions.

The Fund’s performance is compared to the Russell 3000® Growth Index, which measures the performance of the broad growth segment of the U.S. equity universe. It includes those Russell 3000® companies with higher price-to-book ratios and higher forecasted growth values. The Index is unmanaged and does not reflect the deduction of fees, such as investment and fund accounting fees, associated with a mutual fund. Investors cannot invest directly in an index. |

| Average Annual Total Returns as of 3/31/15 | ||||||||||||||||

| Aggressive Growth Stock Fund | 1 Year | 3 Year | 5 Year | 10 Year | ||||||||||||

| A Shares |

without sales charge | 4.47% | 15.06% | 13.40% | 9.80% | |||||||||||

| with sales charge* | –1.53% | 12.80% | 12.07% | 9.15% | ||||||||||||

| I Shares |

4.61% | 15.25% | 13.67% | 10.07% | ||||||||||||

| Russell 3000® Growth Index | 15.76% | 16.45% | 15.71% | 9.41% | ||||||||||||

| Prospectus Expense Ratio1 | Gross | |||||||||||||||

| A Shares | 1.41% | |||||||||||||||

| I Shares | 1.35% | |||||||||||||||

3

Table of Contents

Portfolio Manager

| Ÿ | Chad Deakins, CFA |

INVESTMENT CONCERNS

International investing involves increased risk and volatility.

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes.

MANAGEMENT DISCUSSION OF FUND PERFORMANCE

How did the Fund perform against its benchmark for the fiscal year ended March 31, 2015?

For the fiscal year ended March 31, 2015, the RidgeWorth International Equity Fund (I Shares) delivered a -4.59% return. That compared to a -0.92% return for the MSCI EAFE™ Index.

What factors influenced the Fund’s performance for the fiscal year ended March 31, 2015?

International equity markets generally declined over the period under review. Concerns about the health of the eurozone economy prompted the European Central Bank (ECB) to announce an aggressive quantitative easing program designed to reduce borrowing costs across Europe. While European stocks produced strong returns during the period, the weak euro offset those gains. Taiwan’s dollar gained strength on prospects of increased economic growth, and the Japanese stock market reached 15-year highs. The U.S. dollar gained against most major currencies, and U.S. stocks outperformed international stocks by a wide margin. Amid this environment, the Fund posted negative absolute returns.

The Fund’s relative performance was hurt by weak returns in Japanese stocks, particularly those affected by lower energy and commodity prices. Exposure to a German airline and a German sporting goods company detracted from relative performance, as those companies faced pricing pressure and declining profits, respectively. Investments in a Chinese property developer and financial conglomerates in Italy and France also dragged on the Fund’s returns.

The Fund’s relative returns were aided by strong performance in the consumer staples sector, as well as sizeable underweight positions in the energy and utilities sectors, which were among the worst-performing sectors in the benchmark index. The Fund’s European holdings also benefited from anticipation of the ECB’s quantitative easing program. In addition, the Fund benefited from exposure to a global beer company whose shares appreciated following an upgrade in its credit rating and to a German health care company that was helped by stabilizing reimbursement rates and an upgrade in the status of its manufacturing facility. Exposure to two large Chinese banks also helped performance.

How do you plan to position the Fund, based on market conditions?

We will maintain our underweight position in Australia, which is facing a slowing economy due in part to decreased demand for commodities. In addition, valuations in the utilities sector worldwide continue to appear unattractive. Likewise, most emerging markets appear unattractive due to trade imbalances with the United States; as the Federal Reserve drains liquidity from the system by raising interest rates, we expect that many emerging currencies will weaken against their developed market counterparts. However, we do not expect further significant rerating of the euro versus the U.S. dollar in the near term. We are monitoring the energy and materials sectors closely and may begin to accumulate some undervalued names over the next few months.

4

Table of Contents

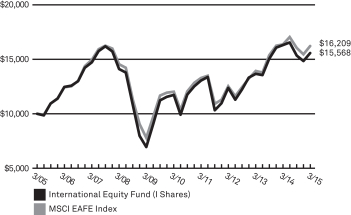

INTERNATIONAL EQUITY FUND

Growth of a $10,000 Investment (as of March 31, 2015)

|

This chart assumes an initial hypothetical investment of $10,000 made on 3/31/05. Total return is based on net change in the Net Asset Value (“NAV”) assuming reinvestment of distributions. Returns shown on this page include reinvestment of all dividends and other distributions.

The Fund’s performance is compared to the Morgan Stanley Capital International Europe, Australasia and Far East (“MSCI EAFE”) Index, which is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the U.S. & Canada. The MSCI EAFE Index consists of 21 developed market country indices. EAFE performance data is calculated in U.S. dollars and in local currency. The Index is unmanaged and does not reflect the deduction of fees, such as investment and fund accounting fees, associated with a mutual fund. Investors cannot invest directly in an index. |

| Average Annual Total Returns as of 3/31/15 | ||||||||||||||||

| International Equity Fund | 1 Year | 3 Year | 5 Year | 10 Year | ||||||||||||

| A Shares |

without sales charge | –4.87% | 7.79% | 5.61% | 4.27% | |||||||||||

| with sales charge* | –10.32% | 5.67% | 4.35% | 3.65% | ||||||||||||

| I Shares |

–4.59% | 7.97% | 5.83% | 4.53% | ||||||||||||

| MSCI EAFE Index | –0.92% | 9.02% | 6.16% | 4.95% | ||||||||||||

| Prospectus Expense Ratio1 | Gross | |||||||||||||||

| A Shares | 1.58% | |||||||||||||||

| I Shares | 1.35% | |||||||||||||||

5

Table of Contents

Portfolio Managers

| Ÿ | Christopher Guinther* |

| Ÿ | Michael A. Sansoterra |

| Ÿ | Sandeep Bhatia, PhD, CFA |

INVESTMENT CONCERNS

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes. Common stocks, and funds investing in common stocks, generally provide greater return potential when compared with other types of investments.

Small- and Mid-capitalization funds typically carry additional risks since smaller companies generally have a higher risk of failure.

Large-capitalization stock can perform differently from other segments of the equity market or the equity market as a whole. Large capitalization companies may be less flexible in evolving markets or unable to implement change as quickly as smaller capitalization companies.

MANAGEMENT DISCUSSION OF FUND PERFORMANCE

How did the Fund perform against its benchmark for the fiscal year ended March 31, 2015?

For the fiscal year ended March 31, 2015, the Large Cap Growth Fund (I Shares) delivered a 15.03% return. That compared to a 16.09% return for the Russell 1000™ Growth Index.

What factors influenced the Fund’s performance for the fiscal year ended March 31, 2015?

Stocks performed well during the 12-month period, with relatively strong returns driven by an improving U.S. economy and steady corporate earnings growth. However, stocks faced some headwinds during the period, including a sharp decline in oil prices, which impacted several sectors of the equity market, and external factors such as bad winter weather on the east coast and a labor strike that affected shipping ports on the west coast. In absolute terms, the Fund performed well in that environment.

The portfolio management team does not attempt to position the Fund based on predictions of macro-economic conditions. Instead, the Fund employs a balanced approach to stock selection and investment strategies to manage active risk through portfolio construction. The Fund also deemphasizes sector rotation and tactical sector allocations and instead attempts to drive performance through bottom-up stock selection.

The Fund’s relative performance was hurt by stock selection in the financial sector, particularly from exposure to a major insurance company and a vehicle financing company. Holdings in the industrials sector, including a global construction firm and a manufacturer of metal components, also hurt relative performance. Lack of exposure to two home-improvement retail chains that had large benchmark weights detracted from performance during the period.

The Fund benefited from stock selection in the consumer staples sector, with shares of a plant-based food and beverage maker and a global retail chain among holdings that contributed to relative results. Individual holdings in the health care sector, particularly among biotechnology companies, also boosted relative performance.

How do you plan to position the Fund, based on market conditions?

The portfolio managers seek to eliminate investment results that are directly attributed to market conditions, and instead attempt to drive performance through stock selection. Therefore, the Fund will continue to invest in companies with reasonable valuations and improving fundamentals. Generally, we look for companies that have shown year-over-year increases in operating margins, revenue growth and return on incremental invested capital. By combining income statement, balance sheet and cash flow metrics to evaluate earnings quality, capital efficiency and relative valuations, we can avoid making investment decisions based on a single factor.

| * | Effective May 14, 2015, Mr. Christopher Guinther is no longer a portfolio manager of the Large Cap Growth Stock Fund. |

6

Table of Contents

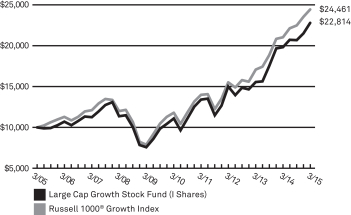

LARGE CAP GROWTH STOCK FUND

Growth of a $10,000 Investment (as of March 31, 2015)

|

This chart assumes an initial hypothetical investment of $10,000 made on 3/31/05. Total return is based on net change in the Net Asset Value (“NAV”) assuming reinvestment of distributions. Returns shown on this page include reinvestment of all dividends and other distributions.

The Fund’s performance is compared to the Russell 1000® Growth Index, which measures the performance of the large-cap growth segment of the U.S. equity universe. It includes those Russell 1000® companies with higher price-to-book ratios and higher forecasted growth values. The Index is unmanaged and does not reflect the deduction of fees, such as investment and fund accounting fees, associated with a mutual fund. Investors cannot invest directly in an index. |

| Average Annual Total Returns as of 3/31/15 | ||||||||||||||||

| Large Cap Growth Stock Fund | 1 Year | 3 Year | 5 Year | 10 Year | ||||||||||||

| A Shares |

without sales charge | 14.83% | 14.68% | 15.15% | 8.29% | |||||||||||

| with sales charge* | 8.22% | 12.44% | 13.80% | 7.65% | ||||||||||||

| C Shares |

without CDSC | 14.20% | 13.93% | 14.40% | 7.56% | |||||||||||

| with CDSC* | 13.20% | 13.93% | 14.40% | 7.56% | ||||||||||||

| I Shares |

15.03% | 14.93% | 15.45% | 8.60% | ||||||||||||

| IS Shares** |

15.14% | 14.97% | 15.47% | 8.61% | ||||||||||||

| Russell 1000® Growth Index | 16.09% | 16.34% | 15.63% | 9.36% | ||||||||||||

| Prospectus Expense Ratio1 | Gross | |||||||||||||||

| A Shares | 1.19% | |||||||||||||||

| C Shares | 1.87% | |||||||||||||||

| I Shares | 1.09% | |||||||||||||||

| IS Shares | 0.87% | |||||||||||||||

7

Table of Contents

Portfolio Manager

| Ÿ | Mills Riddick, CFA |

INVESTMENT CONCERNS

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes.

Value-based investments are subject to the risk that the broad market may not recognize their intrinsic value.

MANAGEMENT DISCUSSION OF FUND PERFORMANCE

How did the Fund perform against its benchmark for the fiscal year ended March 31, 2015?

For the fiscal year ended March 31, 2015, the Large Cap Value Equity Fund (I Shares) delivered a 7.25% return. That compared to a 9.33% return for the Russell 1000™ Value Index.

What factors influenced the Fund’s performance for the fiscal year ended March 31, 2015?

Stocks performed well during the 12-month period, with relatively strong returns driven by an improving U.S. economy and steady corporate earnings growth. However, stocks faced some headwinds during the period, including a sharp decline in oil prices, which impacted several sectors of the equity market, and external factors such as bad winter weather on the east coast and a labor strike that affected shipping ports on the west coast. In absolute terms, the Fund performed well in that environment.

The portfolio management team does not attempt to position the Fund based on predictions of macro-economic conditions. The Fund employs a bottom-up investment approach to stock selection that seeks out dividend-paying stocks trading at the lower end of their historical trading ranges, and which display characteristics of financial strength and possess an improving fundamental situation. The Fund does not make active sector allocations but allows its bottom-up investment process to define sector weights.

The Fund’s relative performance was hurt by individual holdings in the energy sector, including shares of two large oil firms, and in the industrial sector, where a maker of pumping equipment saw sales suffer due to commodity price declines. Exposure to a toy manufacturer and a memory and software maker detracted from relative performance.

The Fund benefited from individual stock selection in the health care sector, particularly among shares of several insurance companies that benefited from solid earnings, low inflation and speculation among investors that the industry would see increased mergers-and-acquisition activity. The Fund also benefited from exposure to a commercial property group and a major airline that was helped by increased pricing power and lower commodity prices.

How do you plan to position the Fund, based on market conditions?

Market volatility and investor uncertainty remain elevated, and may become more unpredictable. We are carefully watching a range of macroeconomic factors including oil prices, geopolitical issues in the middle east, and the pace of economic growth in China. We believe these macroeconomic issues can distract investors from focusing on company fundamentals, which may contribute to a challenging stock picking environment.

That said, we remain resolute that individual company fundamentals will remain an important component in stock selection once the macroeconomic environment normalizes for the equity markets. In the current environment, we expect to continue to maintain an underweight position in the financials and industrials sectors, and to continue an overweight position among information technology stocks.

8

Table of Contents

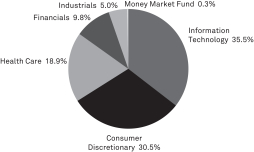

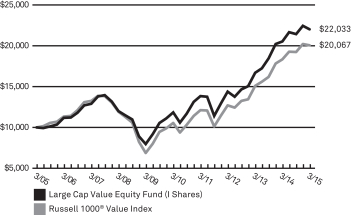

LARGE CAP VALUE EQUITY FUND

Growth of a $10,000 Investment (as of March 31, 2015)

|

|

This chart assumes an initial hypothetical investment of $10,000 made on 3/31/05. Total return is based on net change in the Net Asset Value (“NAV”) assuming reinvestment of distributions. Returns shown on this page include reinvestment of all dividends and other distributions.

The Fund’s performance is compared to the Russell 1000® Value Index, which measures the performance of the large-cap value segment of the U.S. equity universe. It includes those Russell 1000® companies with lower price-to-book ratios and lower expected growth values. The Index is unmanaged and does not reflect the deduction of fees, such as investment and fund accounting fees, associated with a mutual fund. Investors cannot invest directly in an index. |

| Average Annual Total Returns as of 3/31/15 | ||||||||||||||||||

| Large Cap Value Equity Fund | 1 Year | 3 Year | 5 Year | 10 Year | ||||||||||||||

| A Shares |

without sales charge | 6.98% | 14.99% | 12.88% | 7.90% | |||||||||||||

| with sales charge* | 0.83% | 12.73% | 11.55% | 7.26% | ||||||||||||||

| C Shares |

without CDSC | 6.50% | 14.40% | 12.21% | 7.21% | |||||||||||||

| with CDSC* | 5.52% | 14.40% | 12.21% | 7.21% | ||||||||||||||

| I Shares |

7.25% | 15.30% | 13.20% | 8.22% | ||||||||||||||

| IS Shares** | 7.45% | 15.37% | 13.24% | 8.24% | ||||||||||||||

| Russell 1000® Value Index | 9.33% | 16.44% | 13.75% | 7.21% | ||||||||||||||

| Prospectus Expense Ratio1 | Gross | |||||||||||||||||

| A Shares | 1.37% | |||||||||||||||||

| C Shares | 1.71% | |||||||||||||||||

| I Shares | 1.06% | |||||||||||||||||

| IS Shares | 0.71% | |||||||||||||||||

9

Table of Contents

Portfolio Manager

| Ÿ | Don Wordell, CFA |

INVESTMENT CONCERNS

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes.

Mid-capitalization funds typically carry additional risks since smaller companies generally have a higher risk of failure.

Value-based investments are subject to the risk that the broad market may not recognize their intrinsic value.

MANAGEMENT DISCUSSION OF FUND PERFORMANCE

How did the Fund perform against its benchmark for the fiscal year ended March 31, 2015?

For the fiscal year ended March 31, 2015, the Mid-Cap Value Equity Fund (I Shares) delivered a 7.76% return. That compared to a 11.70% return for the Russell Midcap™ Value Index.

What factors influenced the Fund’s performance for the fiscal year ended March 31, 2015?

Stocks performed well during the 12-month period, with relatively strong returns driven by an improving U.S. economy and steady corporate earnings growth. However, stocks faced some headwinds during the period, including a sharp decline in oil prices, which impacted several sectors of the equity market, and external factors such as bad winter weather on the east coast and a labor strike that affected shipping ports on the west coast. In absolute terms, the Fund performed well in that environment.

The portfolio management team does not attempt to position the Fund based on predictions of macro-economic conditions. The Fund employs a bottom-up investment approach to stock selection that seeks out dividend-paying stocks trading at the lower end of their historical trading ranges, and which display characteristics of financial strength and possess an improving fundamental situation. The Fund does not make active sector allocations but allows its bottom-up investment process to define sector weights.

Stock selection in the consumer discretionary, utilities and information technology sectors detracted from the Fund’s relative performance. An overweight position and stock selection in the energy sector also dragged on returns, as several energy holdings suffered from factors such as a decline in oil prices, mild winter weather and weak electricity pricing. Exposure to a toy manufacturer and a memory and software maker also detracted from relative performance.

The Fund benefited from an overweight position and individual stock selection in the health care sector, particularly among shares of several insurance companies that benefited from solid earnings, low inflation and speculation among investors that the industry would see increased mergers-and-acquisition activity. The Fund also benefited from exposure to a medical device company, a health care services company and a financial services firm that benefited from higher operating margins.

How do you plan to position the Fund, based on market conditions?

Market volatility and investor uncertainty remain elevated, and may become more unpredictable. We are carefully watching a range of macroeconomic factors including oil prices, geopolitical issues in the middle east, and the pace of economic growth in China. We believe these macroeconomic issues can distract investors from focusing on company fundamentals, which may contribute to a challenging stockpicking environment.

That said, we remain resolute that individual company fundamentals will remain an important component in stock selection once the macroeconomic environment normalizes for the equity markets. In the current environment, we expect to continue to maintain an underweight position in the financials and utilities sectors, and to continue an overweight position among information technology and health care stocks.

10

Table of Contents

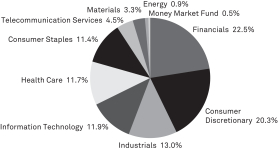

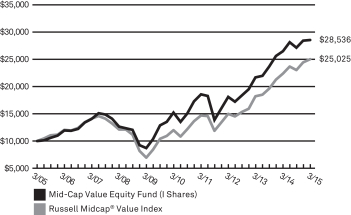

MID-CAP VALUE EQUITY FUND

Growth of a $10,000 Investment (as of March 31, 2015)

|

This chart assumes an initial hypothetical investment of $10,000 made on 3/31/05. Total return is based on net change in the Net Asset Value (“NAV”) assuming reinvestment of distributions. Returns shown on this page include reinvestment of all dividends and other distributions.

The Fund’s performance is compared to the Russell Midcap® Value Index, which measures the performance of the mid-cap value segment of the U.S. equity universe. It includes those Russell Midcap Index companies with lower price-to-book ratios and lower forecasted growth values. The Index is unmanaged and does not reflect the deduction of fees, such as investment and fund accounting fees, associated with a mutual fund. Investors cannot invest directly in an index. |

| Average Annual Total Returns as of 3/31/15 | ||||||||||||||||

| Mid-Cap Value Equity Fund | 1 Year | 3 Year | 5 Year | 10 Year | ||||||||||||

| A Shares |

without sales charge | 7.45% | 16.01% | 13.07% | 10.73% | |||||||||||

| with sales charge* | 1.28% | 13.75% | 11.73% | 10.08% | ||||||||||||

| C Shares |

without CDSC | 7.06% | 15.52% | 12.46% | 10.07% | |||||||||||

| with CDSC* | 6.08% | 15.52% | 12.46% | 10.07% | ||||||||||||

| I Shares |

7.76% | 16.34% | 13.39% | 11.06% | ||||||||||||

| IS Shares** |

7.98% | 16.41% | 13.44% | 11.08% | ||||||||||||

| Russell Midcap® Value Index | 11.70% | 18.60% | 15.84% | 9.61% | ||||||||||||

| Prospectus Expense Ratio1 | Gross | |||||||||||||||

| A Shares | 1.40% | |||||||||||||||

| C Shares | 1.76% | |||||||||||||||

| I Shares | 1.10% | |||||||||||||||

| IS Shares | 0.76% | |||||||||||||||

11

Table of Contents

Portfolio Managers

| Ÿ | Christopher Guinther* |

| Ÿ | Michael A. Sansoterra |

| Ÿ | Sandeep Bhatia, PhD, CFA |

INVESTMENT CONCERNS

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes.

Small-capitalization funds typically carry additional risks since smaller companies generally have a higher risk of failure.

MANAGEMENT DISCUSSION OF FUND PERFORMANCE

How did the Fund perform against its benchmark for the fiscal year ended March 31, 2015?

For the fiscal year ended March 31, 2015, the Small Cap Growth Stock Fund (I Shares) delivered a 4.24% return. That compared to a 12.06% return for the Russell 2000™ Growth Index.

What factors influenced the Fund’s performance for the fiscal year ended March 31, 2015?

Small-cap stocks performed well during the 12-month period, despite their returns lagging those of large-cap stocks. The market’s strong returns were driven by an improving U.S. economy and steady corporate earnings growth. However, stocks faced some headwinds during the period, including a sharp decline in oil prices, which impacted several sectors of the equity market, and external factors such as bad winter weather on the east coast and a labor strike that affected shipping ports on the west coast. In absolute terms, the Fund posted positive returns in that environment.

The portfolio management team does not attempt to position the Fund based on predictions of macro-economic conditions. Instead, the Fund employs a balanced approach to Stock selection and investment strategies to manage active risk through portfolio construction. The Fund also de-emphasizes sector rotation and tactical sector allocations and instead attempts to drive performance through bottom-up stock selection.

The Fund’s relative performance was hurt by stock selection in the energy and financial sectors. Holdings in the consumer discretionary sector, including a hardwood flooring retailer and a fast-casual restaurant chain, also hurt relative performance. The Fund suffered early in the period when holdings that had performed well over the previous 12-18 months—particularly within the technology sector—severely corrected, as their management teams reinvested earnings to grow revenues and improve market share.

The Fund benefited from stock selection in the health care sector, particular among biotech holdings, as well as a medical device manufacturer and a company that provides products and services to aid in pharmaceutical development. The Fund also benefited from certain technology holdings, including a maker of software for the mortgage industry.

How do you plan to position the Fund, based on market conditions?

The portfolio managers seek to eliminate investment results that are directly attributed to market conditions, and instead attempt to drive performance through stock selection. Therefore, the Fund will continue to invest in companies with reasonable valuations and improving fundamentals. Generally, we look for companies that have shown year-over-year increases in operating margins, revenue growth and return on incremental invested capital. By combining income statement, balance sheet and cash flow metrics to evaluate earnings quality, capital efficiency and relative valuations, we can avoid making investment decisions based on a single factor.

| * | Effective May 14, 2015, Mr. Christopher Guinther is no longer a portfolio manager of the Small Cap Growth Stock Fund. |

12

Table of Contents

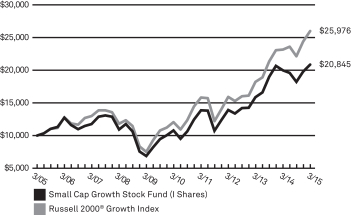

SMALL CAP GROWTH STOCK FUND

Growth of a $10,000 Investment (as of March 31, 2015)

|

This chart assumes an initial hypothetical investment of $10,000 made on 3/31/05. Total return is based on net change in the Net Asset Value (“NAV”) assuming reinvestment of distributions. Returns shown on this page include reinvestment of all dividends and other distributions.

The Fund’s performance is compared to the Russell 2000® Growth Index, which measures the performance of the small-cap growth segment of the U.S. equity universe. It includes those Russell 2000® companies with higher price-to-book ratios and higher forecasted growth values. The Index is unmanaged and does not reflect the deduction of fees, such as investment and fund accounting fees, associated with a mutual fund. Investors cannot invest directly in an index. |

| Average Annual Total Returns as of 3/31/15 | ||||||||||||||||

| Small Cap Growth Stock Fund | 1 Year | 3 Year | 5 Year | 10 Year | ||||||||||||

| A Shares |

without sales charge | 4.21% | 14.39% | 13.98% | 7.37% | |||||||||||

| with sales charge* | –1.76% | 12.15% | 12.63% | 6.74% | ||||||||||||

| C Shares |

without CDSC | 3.55% | 13.64% | 13.20% | 6.64% | |||||||||||

| with CDSC* | 2.74% | 13.64% | 13.20% | 6.64% | ||||||||||||

| I Shares |

4.24% | 14.46% | 14.15% | 7.62% | ||||||||||||

| IS Shares** |

4.44% | 14.54% | 14.19% | 7.64% | ||||||||||||

| Russell 2000® Growth Index | 12.06% | 17.74% | 16.58% | 10.02% | ||||||||||||

| Prospectus Expense Ratio1 | Gross | |||||||||||||||

| A Shares | 1.29% | |||||||||||||||

| C Shares | 1.94% | |||||||||||||||

| I Shares | 1.31% | |||||||||||||||

| IS Shares | 0.94% | |||||||||||||||

13

Table of Contents

Portfolio Manager

| Ÿ | Brett Barner, CFA |

INVESTMENT CONCERNS

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes.

Small-capitalization funds typically carry additional risks since smaller companies generally have a higher risk of failure.

Value-based investments are subject to the risk that the broad market may not recognize their intrinsic value.

MANAGEMENT DISCUSSION OF FUND PERFORMANCE

How did the Fund perform against its benchmark for the fiscal year ended March 31, 2015?

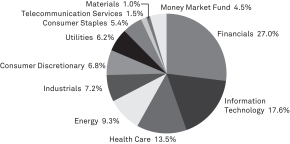

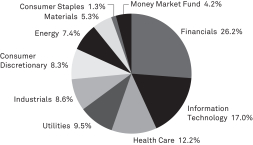

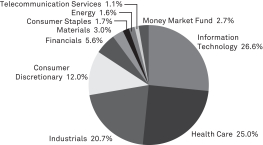

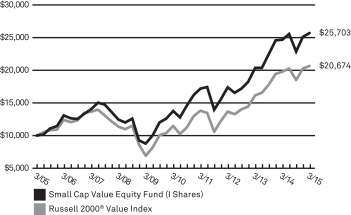

For the fiscal year ended March 31, 2015, the Small Cap Value Equity Fund (I Shares) delivered a 4.07% return. That compared to a 4.43% return for the Russell 2000™ Value Index.

What factors influenced the Fund’s performance for the fiscal year ended March 31, 2015?

Stocks performed well during the 12-month period, with relatively strong returns driven by an improving U.S. economy and steady corporate earnings growth. However, stocks faced some headwinds during the period, including a sharp decline in oil prices, which impacted several sectors of the equity market, and external factors such as bad winter weather on the east coast and a labor strike that affected shipping ports on the west coast. In absolute terms, the Fund performed well in that environment.

The portfolio management team does not attempt to position the Fund based on predictions of macro-economic conditions. The Fund employs a bottom-up investment approach to stock selection that seeks out dividend-paying stocks trading at the lower end of their historical trading ranges, and which display characteristics of financial strength and possess an improving fundamental situation. The Fund does not make active sector allocations but allows its bottom-up investment process to define sector weights.

An overweight position and stock selection in the energy sector detracted from the Fund’s relative performance, as did an overweight position in the industrials sector and underweight positions in the financials and utilities sectors. Stock selection in the materials sector also hurt relative results. Among individual holdings, exposure to several energy firms dragged on performance due in part to sharp declines in oil prices.

The Fund benefited from an overweight position and stock selection in the consumer discretionary sector, and from individual holdings in the industrials and information technology sectors. The Fund’s relative results were helped by exposure to shares of a consumer credit score firm, a self-storage company and a medical device company.

How do you plan to position the Fund, based on market conditions?

Market volatility and investor uncertainty remain elevated, and may become more unpredictable. We are carefully watching a range of macroeconomic factors including oil prices, geopolitical issues in the middle east, and the pace of economic growth in China. We believe these macroeconomic issues can distract investors from focusing on company fundamentals, which may contribute to a challenging stockpicking environment.

That said, we remain resolute that individual company fundamentals will remain an important component in stock selection once the macroeconomic environment normalizes for the equity markets. In the current environment, we expect to continue to maintain an underweight position in the financials and utilities sectors, and to continue an overweight position among industrials and consumer discretionary stocks.

14

Table of Contents

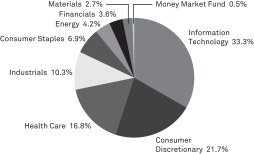

SMALL CAP VALUE EQUITY FUND

Growth of a $10,000 Investment (as of March 31, 2015)

|

|

This chart assumes an initial hypothetical investment of $10,000 made on 3/31/05. Total return is based on net change in the Net Asset Value (“NAV”) assuming reinvestment of distributions. Returns shown on this page include reinvestment of all dividends and other distributions.

The Fund’s performance is compared to the Russell 2000® Value Index, which measures the performance of the small-cap value segment of the U.S. equity universe. It includes those Russell 2000® companies with lower price-to-book ratios and lower forecasted growth values. The Index is unmanaged and does not reflect the deduction of fees, such as investment and fund accounting fees, associated with a mutual fund. Investors cannot invest directly in an index. |

| Average Annual Total Returns as of 3/31/15 | ||||||||||||||||

| Small Cap Value Equity Fund | 1 Year | 3 Year | 5 Year | 10 Year | ||||||||||||

| A Shares |

without sales charge | 3.79% | 13.60% | 12.95% | 9.60% | |||||||||||

| with sales charge* | –2.15% | 11.38% | 11.61% | 8.96% | ||||||||||||

| C Shares |

without CDSC | 3.42% | 13.14% | 12.36% | 9.18% | |||||||||||

| with CDSC* | 2.56% | 13.14% | 12.36% | 9.18% | ||||||||||||

| I Shares |

4.07% | 13.92% | 13.27% | 9.90% | ||||||||||||

| Russell 2000® Value Index | 4.43% | 14.79% | 12.54% | 7.53% | ||||||||||||

| Prospectus Expense Ratio1 | Gross | |||||||||||||||

| A Shares | 1.50% | |||||||||||||||

| C Shares | 1.87% | |||||||||||||||

| I Shares | 1.22% | |||||||||||||||

15

Table of Contents

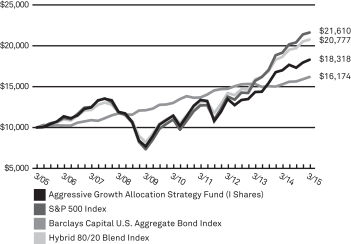

AGGRESSIVE GROWTH ALLOCATION STRATEGY

Portfolio Manager

| Ÿ | Alan Gayle |

INVESTMENT CONCERNS

Equity Securities (Stocks) are more volatile and carry more risk and return potential than other forms of investments. Bonds offer a relatively stable level of income, although bond prices will fluctuate, providing the potential for principal gain or loss. Cash equivalents offer low risk and low return potential.

MANAGEMENT DISCUSSION OF FUND PERFORMANCE

How did the Fund perform against its benchmark for the fiscal year ended March 31, 2015?

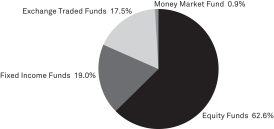

For the fiscal year ended March 31, 2015, the RidgeWorth Aggressive Growth Allocation Strategy (I Shares) returned 7.79%. That compared to a 6.59% return for the Lipper Mixed-Asset Target Allocation (Growth Classification), and a 11.38% return for its hybrid benchmark made up of an 80% weighting in the S&P 500 Index and a 20% weighting in the Barclays Capital U.S. Aggregate Bond Index.

What factors influenced the Fund’s performance for the fiscal year ended March 31, 2015?

RidgeWorth Investments manages four distinct asset allocation strategies, each structured to align investment portfolios with specific levels of investor risk tolerance and income requirements. Each strategy’s underlying mutual funds and ETFs are typically the same across the strategies, but the varying stock, bond and alternative allocations create noticeably different total return characteristics intended to align with investor needs and constraints.

Stocks performed well during the 12-month period, with relatively strong returns driven by an improving U.S. economy and steady corporate earnings growth. However, stocks faced some headwinds during the period, including a sharp decline in oil prices, which impacted several sectors of the equity market, as well as volatility caused by investors’ shifting expectations for rising interest rates. Fixed-income investments also rallied during the period. Investors favored high-quality bonds—including those issued by the U.S. government—in the wake of rising geopolitical tensions in areas such as Ukraine and the Middle East. In absolute terms, the Fund performed well in that environment.

The Fund’s performance relative to its hybrid benchmark was hurt by underperformance of several of the Fund’s underlying equity funds. In particular, funds focused on large-cap value, mid-cap value and small-cap equities lagged.

However, several of the Fund’s underlying fixed-income funds performed in line with the Barclays U.S. Aggregate Index, and exposure to a long-duration ETF benefited relative performance.

How do you plan to position the Fund, based on market conditions?

In the near term, we expect to maintain an overweight position in equities relative to the Fund’s target benchmarks, predicated upon our positive outlook. We believe global equity markets will benefit from central bank stimulus efforts in Europe and other regions, and we raised portfolio exposure from an underweight in 2014 to an overweight in early 2015.

Bond yields are likely to remain near the low end of historical ranges, and we expect investors will continue to venture farther out on the equity and fixed-income risk spectrums in search of income and total returns in this low-rate environment. Among the Fund’s fixed-income allocation, we expect to maintain a somewhat shorter duration than the fixed-income portion of the Fund’s hybrid index. We also have improved the overall credit quality of the bond portfolio, given notably tighter credit spreads, by reducing exposure to high-yield positions.

16

Table of Contents

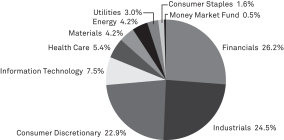

AGGRESSIVE GROWTH ALLOCATION STRATEGY

Growth of a $10,000 Investment (as of March 31, 2015)

|

|

This chart assumes an initial hypothetical investment of $10,000 made on 3/31/05. Total return is based on net change in the Net Asset Value (“NAV”) assuming reinvestment of distributions. Returns shown on this page include reinvestment of all dividends and other distributions.

The Fund’s performance is compared to the Hybrid 80/20 Blend Index. The Standard & Poor’s 500 Index (“S&P 500 Index”) is widely regarded as a gauge of the U.S. equities market. This index includes 500 leading companies in leading industries of the U.S. economy. Although the S&P 500 Index focuses on the large cap segment of the market, with approximately 75% coverage of U.S. equities, it is also an ideal proxy for the total market. The Barclays Capital U.S. Aggregate Bond Index is a measure of the overall performance of the U.S. bond market. These indices are unmanaged and do not reflect the deduction of fees, such as investment and fund accounting fees, associated with a mutual fund. Investors cannot invest directly in an index. |

| Average Annual Total Returns as of 3/31/15 | ||||||||||||||||||

| Aggressive Growth Allocation Strategy | 1 Year | 3 Year | 5 Year | 10 Year | ||||||||||||||

| A Shares |

without sales charge | 7.56% | 10.53% | 9.57% | 5.94% | |||||||||||||

| with sales charge** | 1.40% | 8.39% | 8.29% | 5.31% | ||||||||||||||

| C Shares* |

without CDSC | 6.89% | 9.82% | 8.87% | 5.23% | |||||||||||||

| with CDSC** | 6.01% | 9.82% | 8.87% | 5.23% | ||||||||||||||

| I Shares |

7.79% | 10.76% | 9.86% | 6.24% | ||||||||||||||

| Hybrid 80/20 Blend Index (80% of the S&P 500 Index, 20% of the Barclays Capital U.S. Aggregate Bond Index) |

11.38% | 13.49% | 12.56% | 7.59% | ||||||||||||||

| S&P 500 Index | 12.73% | 16.11% | 14.47% | 8.01% | ||||||||||||||

| Barclays Capital U.S. Aggregate Bond Index | 5.72% | 3.10% | 4.41% | 4.93% | ||||||||||||||

| Prospectus Expense Ratio1 | Gross | |||||||||||||||||

| A Shares | 1.76% | |||||||||||||||||

| C Shares | 2.37% | |||||||||||||||||

| I Shares | 1.75% | |||||||||||||||||

17

Table of Contents

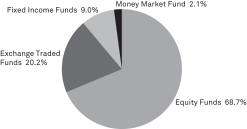

CONSERVATIVE ALLOCATION STRATEGY

Portfolio Manager

| Ÿ | Alan Gayle |

INVESTMENT CONCERNS

Equity Securities (Stocks) are more volatile and carry more risk and return potential than other forms of investments. Bonds offer a relatively stable level of income, although bond prices will fluctuate, providing the potential for principal gain or loss. Cash equivalents offer low risk and low return potential.

MANAGEMENT DISCUSSION OF FUND PERFORMANCE

How did the Fund perform against its benchmark for the fiscal year ended March 31, 2015?

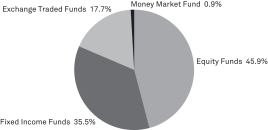

For the fiscal year ended March 31, 2015, the RidgeWorth Conservative Allocation Strategy (I Shares) returned 6.25%. That compared to a 4.10% return for the Lipper Mixed-Asset Target Allocation (Conservative Classification), and a 7.88% return for its hybrid benchmark made up of a 30% weighting in the S&P 500 Index and a 70% weighting in the Barclays Capital U.S. Aggregate Bond Index.

What factors influenced the Fund’s performance for the fiscal year ended March 31, 2015?

RidgeWorth Investments manages four distinct asset allocation strategies, each structured to align investment portfolios with specific levels of investor risk tolerance and income requirements. Each strategy’s underlying mutual funds and ETFs are typically the same across the strategies, but the varying stock, bond and alternative allocations create noticeably different total return characteristics intended to align with investor needs and constraints.

Stocks performed well during the 12-month period, with relatively strong returns driven by an improving U.S. economy and steady corporate earnings growth. However, stocks faced some headwinds during the period, including a sharp decline in oil prices, which impacted several sectors of the equity market, as well as volatility caused by investors’ shifting expectations for rising interest rates. Fixed-income investments also rallied during the period. Investors favored high-quality bonds—including those issued by the U.S. government—in the wake of rising geopolitical tensions in areas such as Ukraine and the Middle East. In absolute terms, the Fund performed well in that environment.

The Fund’s performance relative to its hybrid benchmark was hurt by underperformance of several of the Fund’s underlying equity funds. In particular, funds focused on large-cap value, mid-cap value and small-cap equities lagged.

However, several of the Fund’s underlying fixed-income funds performed in line with the Barclays U.S. Aggregate Index, and exposure to a long-duration ETF benefited relative performance.

How do you plan to position the Fund, based on market conditions?

In the near term, we expect to maintain an overweight position in equities relative to the Fund’s target benchmarks, predicated upon our positive outlook. We believe global equity markets will benefit from central bank stimulus efforts in Europe and other regions, and we raised portfolio exposure from an underweight in 2014 to an overweight in early 2015.

Bond yields are likely to remain near the low end of historical ranges, and we expect investors will continue to venture farther out on the equity and fixed-income risk spectrums in search of income and total returns in this low-rate environment. Among the Fund’s fixed-income allocation, we expect to maintain a somewhat shorter duration than the fixed-income portion of the Fund’s hybrid index. We also have improved the overall credit quality of the bond portfolio, given notably tighter credit spreads, by reducing exposure to high-yield positions.

18

Table of Contents

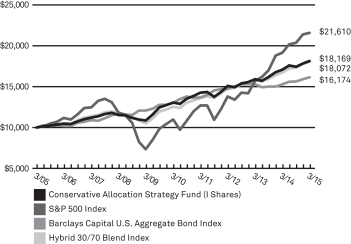

CONSERVATIVE ALLOCATION STRATEGY

Growth of a $10,000 Investment (as of March 31, 2015)

|

This chart assumes an initial hypothetical investment of $10,000 made on 3/31/05. Total return is based on net change in the Net Asset Value (“NAV”) assuming reinvestment of distributions. Returns shown on this page include reinvestment of all dividends and other distributions.

The Fund’s performance is compared to the Hybrid 30/70 Blend Index. The Standard & Poor’s 500 Index (“S&P 500 Index”) is widely regarded as a guage of the U.S. equities market. This index includes 500 leading companies in leading industries of the U.S. economy. Although the S&P 500 Index focuses on the large cap segment of the market, with approximately 75% coverage of U.S. equities, it is also an ideal proxy for the total market. The Barclays Capital U.S. Aggregate Bond Index is a measure of the overall performance of the U.S. bond market. These indices are unmanaged and do not reflect the deduction of fees, such as investment and fund accounting fees, associated with a mutual fund. Investors cannot invest directly in an index. |

| Average Annual Total Returns as of 3/31/15 | ||||||||||||||||

| Conservative Allocation Strategy | 1 Year | 3 Year | 5 Year | 10 Year | ||||||||||||

| A Shares* |

without sales charge | 5.86% | 6.09% | 6.46% | 5.84% | |||||||||||

| with sales charge*** | 0.81% | 4.39% | 5.44% | 5.33% | ||||||||||||

| C Shares** |

without CDSC | 5.20% | 5.36% | 5.73% | 5.12% | |||||||||||

| with CDSC*** | 4.20% | 5.36% | 5.73% | 5.12% | ||||||||||||

| I Shares |

6.25% | 6.39% | 6.78% | 6.15% | ||||||||||||

| Hybrid 30/70 Blend Index (30% of the S&P 500 Index, 70% of the Barclays Capital U.S. Aggregate Bond Index) | 7.88% | 6.98% | 7.56% | 6.10% | ||||||||||||

| S&P 500 Index | 12.73% | 16.11% | 14.47% | 8.01% | ||||||||||||

| Barclays Capital U.S. Aggregate Bond Index | 5.72% | 3.10% | 4.41% | 4.93% | ||||||||||||

| Prospectus Expense Ratio1 | Gross | |||||||||||||||

| A Shares | 1.24% | |||||||||||||||

| C Shares | 1.90% | |||||||||||||||

| I Shares | 0.96% | |||||||||||||||

19

Table of Contents

Portfolio Manager

| Ÿ | Alan Gayle |

INVESTMENT CONCERNS

Equity Securities (Stocks) are more volatile and carry more risk and return potential than other forms of investments. Bonds offer a relatively stable level of income, although bond prices will fluctuate, providing the potential for principal gain or loss. Cash equivalents offer low risk and low return potential.

MANAGEMENT DISCUSSION OF FUND PERFORMANCE

How did the Fund perform against its benchmark for the fiscal year ended March 31, 2015?

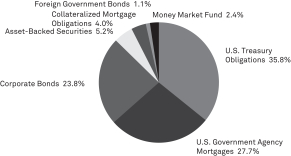

For the fiscal year ended March 31, 2015, the RidgeWorth Growth Allocation Strategy (I Shares) returned 7.54%. That compared to a 6.75% return for the Lipper Mixed-Asset Target Allocation (Growth Classification), and a 10.69% return for its hybrid benchmark made up of a 70% weighting in the S&P 500 Index and a 30% weighting in the Barclays Capital U.S. Aggregate Bond Index.

What factors influenced the Fund’s performance for the fiscal year ended March 31, 2015?

RidgeWorth Investments manages four distinct asset allocation strategies, each structured to align investment portfolios with specific levels of investor risk tolerance and income requirements. Each strategy’s underlying mutual funds and ETFs are typically the same across the strategies, but the varying stock, bond and alternative allocations create noticeably different total return characteristics intended to align with investor needs and constraints.

Stocks performed well during the 12-month period, with relatively strong returns driven by an improving U.S. economy and steady corporate earnings growth. However, stocks faced some headwinds during the period, including a sharp decline in oil prices, which impacted several sectors of the equity market, as well as volatility caused by investors’ shifting expectations for rising interest rates. Fixed-income investments also rallied during the period. Investors favored high-quality bonds—including those issued by the U.S. government—in the wake of rising geopolitical tensions in areas such as Ukraine and the Middle East. In absolute terms, the Fund performed well in that environment.

The Fund’s performance relative to its hybrid benchmark was hurt by underperformance of several of the Fund’s underlying equity funds. In particular, funds focused on large-cap value, mid-cap value and small-cap equities lagged.

However, several of the Fund’s underlying fixed-income funds performed in line with the Barclays U.S. Aggregate Index, and exposure to a long-duration ETF benefited relative performance.

How do you plan to position the Fund, based on market conditions?

In the near term, we expect to maintain an overweight position in equities relative to the Fund’s target benchmarks, predicated upon our positive outlook. We believe global equity markets will benefit from central bank stimulus efforts in Europe and other regions, and we raised portfolio exposure from an underweight in 2014 to an overweight in early 2015.

Bond yields are likely to remain near the low end of historical ranges, and we expect investors will continue to venture farther out on the equity and fixed-income risk spectrums in search of income and total returns in this low-rate environment. Among the Fund’s fixed-income allocation, we expect to maintain a somewhat shorter duration than the fixed-income portion of the Fund’s hybrid index. We also have improved the overall credit quality of the bond portfolio, given notably tighter credit spreads, by reducing exposure to high-yield positions.

20

Table of Contents

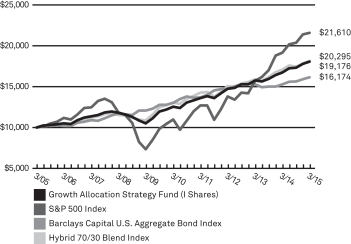

GROWTH ALLOCATION STRATEGY

Growth of a $10,000 Investment (as of March 31, 2015)

|

This chart assumes an initial hypothetical investment of $10,000 made on 3/31/05. Total return is based on net change in the Net Asset Value (“NAV”) assuming reinvestment of distributions. Returns shown on this page include reinvestment of all dividends and other distributions.

The Fund’s performance is compared to the Hybrid 70/30 Blend Index. The Standard & Poor’s 500 Index (“S&P 500 Index”) is widely regarded as a guage of the U.S. equities market. This index includes 500 leading companies in leading industries of the U.S. economy. Although the S&P 500 Index focuses on the large cap segment of the market, with approximately 75% coverage of U.S. equities, it is also an ideal proxy for the total market. The Barclays Capital U.S. Aggregate Bond Index is a measure of the overall performance of the U.S. bond market. These indices are unmanaged and do not reflect the deduction of fees, such as investment and fund accounting fees, associated with a mutual fund. Investors cannot invest directly in an index. |

| Average Annual Total Returns as of 3/31/15 | ||||||||||||||||

| Growth Allocation Strategy | 1 Year | 3 Year | 5 Year | 10 Year | ||||||||||||

| A Shares |

without sales charge | 7.38% | 10.06% | 9.20% | 6.45% | |||||||||||

| with sales charge** | 1.22% | 7.90% | 7.91% | 5.83% | ||||||||||||

| C Shares* |

without CDSC | 6.70% | 9.36% | 8.47% | 5.66% | |||||||||||

| with CDSC** | 5.70% | 9.36% | 8.47% | 5.66% | ||||||||||||

| I Shares |

7.54% | 10.27% | 9.43% | 6.73% | ||||||||||||

| Hybrid 70/30 Blend Index (70% of the S&P 500 Index, 30% of the Barclays Capital U.S. Aggregate Bond Index) | 10.69% | 12.19% | 11.59% | 7.34% | ||||||||||||

| S&P 500 Index | 12.73% | 16.11% | 14.47% | 8.01% | ||||||||||||

| Barclays Capital U.S. Aggregate Bond Index | 5.72% | 3.10% | 4.41% | 4.93% | ||||||||||||

| Prospectus Expense Ratio1 | Gross | |||||||||||||||

| A Shares | 1.43% | |||||||||||||||

| C Shares | 2.04% | |||||||||||||||

| I Shares | 1.43% | |||||||||||||||

21

Table of Contents

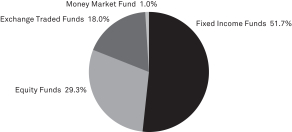

Portfolio Manager

| Ÿ | Alan Gayle |

INVESTMENT CONCERNS

Equity Securities (Stocks) are more volatile and carry more risk and return potential than other forms of investments. Bonds offer a relatively stable level of income, although bond prices will fluctuate, providing the potential for principal gain or loss. Cash equivalent offer low risk and low return potential.

MANAGEMENT DISCUSSION OF FUND PERFORMANCE

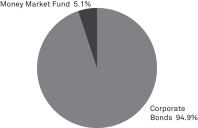

How did the Fund perform against its benchmark for the fiscal year ended March 31, 2015?

For the fiscal year ended March 31, 2015, the RidgeWorth Moderate Allocation Strategy (I Shares) returned 6.77%. That compared to a 5.07% return for the Lipper Mixed-Asset Target Allocation (Moderate Classification), and a 9.30% return for its hybrid benchmark made up of a 50% weighting in the S&P 500 Index and a 50% weighting in the Barclays Capital U.S. Aggregate Bond Index.

What factors influenced the Fund’s performance for the fiscal year ended March 31, 2015?

RidgeWorth Investments manages four distinct asset allocation strategies, each structured to align investment portfolios with specific levels of investor risk tolerance and income requirements. Each strategy’s underlying mutual funds and ETFs are typically the same across the strategies, but the varying stock, bond and alternative allocations create noticeably different total return characteristics intended to align with investor needs and constraints.

Stocks performed well during the 12-month period, with relatively strong returns driven by an improving U.S. economy and steady corporate earnings growth. However, stocks faced some headwinds during the period, including a sharp decline in oil prices, which impacted several sectors of the equity market, as well as volatility caused by investors’ shifting expectations for rising interest rates. Fixed-income investments also rallied during the period. Investors favored high-quality bonds—including those issued by the U.S. government—in the wake of rising geopolitical tensions in areas such as Ukraine and the Middle East. In absolute terms, the Fund performed well in that environment.

The Fund’s performance relative to its hybrid benchmark was hurt by underperformance of several of the Fund’s underlying equity funds. In particular, funds focused on large-cap value, mid-cap value and small-cap equities lagged.

However, several of the Fund’s underlying fixed-income funds performed in line with the Barclays U.S. Aggregate Index, and exposure to a long-duration ETF benefited relative performance.

How do you plan to position the Fund, based on market conditions?

In the near term, we expect to maintain an overweight position in equities relative to the Fund’s target benchmarks, predicated upon our positive outlook. We believe global equity markets will benefit from central bank stimulus efforts in Europe and other regions, and we raised portfolio exposure from an underweight in 2014 to an overweight in early 2015.

Bond yields are likely to remain near the low end of historical ranges, and we expect investors will continue to venture farther out on the equity and fixed-income risk spectrums in search of income and total returns in this low-rate environment. Among the Fund’s fixed-income allocation, we expect to maintain a somewhat shorter duration than the fixed-income portion of the Fund’s hybrid index. We also have improved the overall credit quality of the bond portfolio, given notably tighter credit spreads, by reducing exposure to high-yield positions.

22

Table of Contents

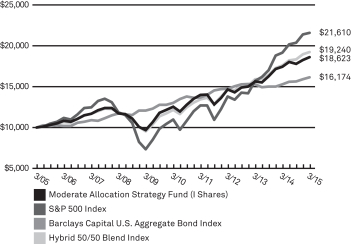

MODERATE ALLOCATION STRATEGY

Growth of a $10,000 Investment (as of March 31, 2015)

|

This chart assumes an initial hypothetical investment of $10,000 made on 3/31/05. Total return is based on net change in the Net Asset Value (“NAV”) assuming reinvestment of distributions. Returns shown on this page include reinvestment of all dividends and other distributions.

The Fund’s performance is compared to the Hybrid 50/50 Blend Index. The Standard & Poor’s 500 Index (“S&P 500 Index”) is widely regarded as a guage of the U.S. equities market. This index includes 500 leading companies in leading industries of the U.S. economy. Although the S&P 500 Index focuses on the large cap segment of the market, with approximately 75% coverage of U.S. equities, it is also an ideal proxy for the total market. The Barclays Capital U.S. Aggregate Bond Index is a measure of the overall performance of the U.S. bond market. These indices are unmanaged and do not reflect the deduction of fees, such as investment and fund accounting fees, associated with a mutual fund. Investors cannot invest directly in an index. |

| Average Annual Total Returns as of 3/31/15 | ||||||||||||||||

| Moderate Allocation Strategy | 1 Year | 3 Year | 5 Year | 10 Year | ||||||||||||

| A Shares |

without sales charge | 6.65% | 8.14% | 7.95% | 6.15% | |||||||||||

| with sales charge** | 0.52% | 6.01% | 6.68% | 5.52% | ||||||||||||

| C Shares* |

without CDSC | 6.07% | 7.50% | 7.26% | 5.41% | |||||||||||

| with CDSC** | 5.08% | 7.50% | 7.26% | 5.41% | ||||||||||||

| I Shares |

6.77% | 8.29% | 8.17% | 6.42% | ||||||||||||

| Hybrid 50/50 Blend Index (50% of the Barclays Capital U.S. Aggregate Bond Index, 50% of the S&P 500 Index ) | 9.30% | 9.58% | 9.60% | 6.76% | ||||||||||||

| S&P 500 Index | 12.73% | 16.11% | 14.47% | 8.01% | ||||||||||||

| Barclays Capital U.S. Aggregate Bond Index | 5.72% | 3.10% | 4.41% | 4.93% | ||||||||||||

| Prospectus Expense Ratio1 | Gross | |||||||||||||||

| A Shares | 1.29% | |||||||||||||||

| C Shares | 1.88% | |||||||||||||||

| I Shares | 1.21% | |||||||||||||||

23

Table of Contents

SCHEDULES OF PORTFOLIO INVESTMENTS

RIDGEWORTH FUNDS March 31, 2015

Aggressive Growth Stock Fund

See Notes to Financial Statements.

24

Table of Contents

SCHEDULES OF PORTFOLIO INVESTMENTS

RIDGEWORTH FUNDS March 31, 2015

International Equity Fund

See Notes to Financial Statements.

25

Table of Contents

SCHEDULES OF PORTFOLIO INVESTMENTS

RIDGEWORTH FUNDS March 31, 2015

International Equity Fund — concluded

See Notes to Financial Statements.

26

Table of Contents

SCHEDULES OF PORTFOLIO INVESTMENTS

RIDGEWORTH FUNDS March 31, 2015

Large Cap Growth Stock Fund

See Notes to Financial Statements.

27

Table of Contents

SCHEDULES OF PORTFOLIO INVESTMENTS

RIDGEWORTH FUNDS March 31, 2015

Large Cap Growth Stock Fund — concluded

See Notes to Financial Statements.

28

Table of Contents

SCHEDULES OF PORTFOLIO INVESTMENTS

RIDGEWORTH FUNDS March 31, 2015

Large Cap Value Equity Fund

See Notes to Financial Statements.

29

Table of Contents

SCHEDULES OF PORTFOLIO INVESTMENTS

RIDGEWORTH FUNDS March 31, 2015

Mid-Cap Value Equity Fund

See Notes to Financial Statements.

30

Table of Contents

SCHEDULES OF PORTFOLIO INVESTMENTS

RIDGEWORTH FUNDS March 31, 2015

Small Cap Growth Stock Fund

See Notes to Financial Statements.

31

Table of Contents

SCHEDULES OF PORTFOLIO INVESTMENTS

RIDGEWORTH FUNDS March 31, 2015

Small Cap Growth Stock Fund — concluded

See Notes to Financial Statements.

32

Table of Contents

SCHEDULES OF PORTFOLIO INVESTMENTS

RIDGEWORTH FUNDS March 31, 2015

Small Cap Value Equity Fund

See Notes to Financial Statements.

33

Table of Contents

SCHEDULES OF PORTFOLIO INVESTMENTS

RIDGEWORTH FUNDS March 31, 2015

Small Cap Value Equity Fund — concluded

See Notes to Financial Statements.

34

Table of Contents

SCHEDULES OF PORTFOLIO INVESTMENTS

RIDGEWORTH FUNDS March 31, 2015

Aggressive Growth Allocation Strategy

See Notes to Financial Statements.

35

Table of Contents

SCHEDULES OF PORTFOLIO INVESTMENTS

RIDGEWORTH FUNDS March 31, 2015

Conservative Allocation Strategy

See Notes to Financial Statements.

36

Table of Contents

SCHEDULES OF PORTFOLIO INVESTMENTS

RIDGEWORTH FUNDS March 31, 2015

Growth Allocation Strategy

See Notes to Financial Statements.

37

Table of Contents

SCHEDULES OF PORTFOLIO INVESTMENTS

RIDGEWORTH FUNDS March 31, 2015

Moderate Allocation Strategy

See Notes to Financial Statements.

38

Table of Contents

STATEMENTS OF ASSETS AND LIABILITIES

RIDGEWORTH FUNDS March 31, 2015

| Aggressive Growth Stock Fund |

International Equity Fund |

Large Cap Growth Stock Fund |

Large Cap Value Equity Fund |

|||||||||||||

| Assets: |

||||||||||||||||

| Total Investments, at Cost |

$20,367,664 | $17,484,422 | $161,003,590 | $1,999,885,908 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Investments, at Value |

$34,834,502 | $22,412,603 | $292,869,316 | $2,469,078,817 | ||||||||||||

| Interest and Dividends Receivable |

812 | 133,637 | 98,976 | 3,617,162 | ||||||||||||

| Securities Lending Income Receivable |

— | — | 12 | — | ||||||||||||

| Foreign Currency, at Value (Cost $—, $380,222, $— and $—, respectively) |

— | 386,663 | — | — | ||||||||||||

| Receivable for Capital Shares Issued |

14,456 | 18,486 | 30,031 | 3,368,457 | ||||||||||||

| Receivable for Investment Securities Sold |

158,107 | 267,558 | 11,893,448 | 920,345 | ||||||||||||

| Reclaims Receivable |

— | 151,361 | — | — | ||||||||||||

| Receivable from Investment Adviser |

— | — | 46,407 | 326,377 | ||||||||||||

| Prepaid Expenses and Other Assets |

9,665 | 13,274 | 24,419 | 55,441 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Assets |

35,017,542 | 23,383,582 | 304,962,609 | 2,477,366,599 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Liabilities: |

||||||||||||||||

| Payable for Investment Securities Purchased |

— | 164,107 | 11,498,787 | 23,004,586 | ||||||||||||

| Payable for Capital Shares Redeemed |

100,098 | 24,559 | 214,425 | 3,298,542 | ||||||||||||

| Investment Advisory Fees Payable |

30,081 | 18,056 | 175,907 | 1,358,833 | ||||||||||||

| Compliance and Fund Services Fees Payable |

694 | 419 | 5,403 | 44,657 | ||||||||||||

| Distribution and Service Fees Payable |

2,797 | 1,072 | 57,159 | 133,564 | ||||||||||||

| Trustee Fees Payable |

73 | 40 | 727 | 4,382 | ||||||||||||

| Other Accrued Expenses |

27,168 | 29,872 | 175,410 | 2,064,424 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Liabilities |

160,911 | 238,125 | 12,127,818 | 29,908,988 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Net Assets |

$34,856,631 | $23,145,457 | $292,834,791 | $2,447,457,611 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net Assets Consist of: |

||||||||||||||||

| Capital |

$21,445,106 | $20,576,870 | $148,785,752 | $1,916,280,055 | ||||||||||||

| Accumulated Net Investment Income (Loss) |

(129,949 | ) | 226,301 | (5,858 | ) | 7,175,285 | ||||||||||

| Accumulated Net Realized Gain (Loss) from Investments and Foreign Currency Transactions |

(925,364 | ) | (2,594,807 | ) | 12,189,171 | 54,809,362 | ||||||||||

| Net Unrealized Appreciation on Investments and Foreign Currencies |

14,466,838 | 4,937,093 | 131,865,726 | 469,192,909 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net Assets |

$34,856,631 | $23,145,457 | $292,834,791 | $2,447,457,611 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net Assets: |

||||||||||||||||

| I Shares |

$24,321,333 | $19,022,565 | $127,236,431 | $1,927,038,582 | ||||||||||||

| A Shares |

10,535,298 | 4,122,892 | 65,952,978 | 461,641,577 | ||||||||||||

| C Shares |

— | — | 46,678,280 | 21,207,321 | ||||||||||||

| IS Shares |

— | — | 52,967,102 | 37,570,131 | ||||||||||||

| Shares Outstanding (unlimited number of shares authorized, no par value) |

||||||||||||||||

| I Shares |

1,131,861 | 1,820,717 | 12,328,074 | 116,080,794 | ||||||||||||

| A Shares |

507,586 | 398,688 | 7,539,689 | 28,014,275 | ||||||||||||

| C Shares |

— | — | 7,321,909 | 1,313,486 | ||||||||||||

| IS Shares |

— | — | 5,127,010 | 2,255,378 | ||||||||||||

| Net Asset Value and Redemption Price Per Share: |

||||||||||||||||

| I Shares |

$21.49 | $10.45 | $10.32 | $16.60 | ||||||||||||

| A Shares |

20.76 | 10.34 | 8.75 | 16.48 | ||||||||||||

| C Shares(a) |

— | — | 6.38 | 16.15 | ||||||||||||

| IS Shares |

— | — | 10.33 | 16.66 | ||||||||||||

| Offering Price per Share (100%/(100%-maximum sales charge x net asset value) adjusted to the nearest cent): |

||||||||||||||||

| A Shares |

$22.03 | $10.97 | $9.28 | $17.49 | ||||||||||||

| Maximum Sales Charge — A Shares |

5.75 | % | 5.75 | % | 5.75 | % | 5.75 | % | ||||||||

| (a) | Redemption price per share varies based on length of time shares are held. |

See Notes to Financial Statements.

39

Table of Contents

STATEMENTS OF ASSETS AND LIABILITIES

RIDGEWORTH FUNDS March 31, 2015

| Mid-Cap Value Equity Fund |

Small Cap Growth Stock Fund |

Small Cap Value Equity Fund |

||||||||||

| Assets: |

||||||||||||

| Total Investments, at Cost |

$3,739,769,598 | $110,185,876 | $973,027,066 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total Investments, at Value |

$4,269,144,347 | $149,558,302 | $1,318,595,436 | |||||||||

| Interest and Dividends Receivable |

5,656,732 | 27,047 | 1,860,535 | |||||||||

| Securities Lending Income Receivable |

29,721 | 3,989 | — | |||||||||

| Receivable for Capital Shares Issued |

2,903,171 | 95,309 | 825,882 | |||||||||

| Receivable for Investment Securities Sold |

9,934,654 | 562,191 | 7,295,305 | |||||||||

| Reclaims Receivable |

— | — | 38,346 | |||||||||

| Receivable from Investment Adviser |

24,739 | — | — | |||||||||

| Prepaid Expenses and Other Assets |

79,944 | 25,847 | 39,136 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total Assets |

4,287,773,308 | 150,272,685 | 1,328,654,640 | |||||||||

|

|

|

|

|

|

|

|||||||

| Liabilities: |

||||||||||||

| Payable for Investment Securities Purchased |

16,707,036 | 1,094,659 | 7,600,149 | |||||||||

| Payable for Capital Shares Redeemed |

11,820,053 | 161,329 | 4,160,096 | |||||||||

| Investment Advisory Fees Payable |

2,474,267 | 117,183 | 903,647 | |||||||||

| Compliance and Fund Services Fees Payable |

78,402 | 2,731 | 24,939 | |||||||||

| Distribution and Service Fees Payable |

227,124 | 7,915 | 70,084 | |||||||||

| Trustee Fees Payable |

8,384 | 273 | 2,095 | |||||||||

| Other Accrued Expenses |

3,328,809 | 144,814 | 1,178,702 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total Liabilities |

34,644,075 | 1,528,904 | 13,939,712 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total Net Assets |

$4,253,129,233 | $148,743,781 | $1,314,714,928 | |||||||||

|

|

|

|

|

|

|

|||||||

| Net Assets Consist of: |

||||||||||||

| Capital |

$3,640,176,061 | $109,066,001 | $904,648,018 | |||||||||

| Accumulated Net Investment Income (Loss) |

9,380,404 | (349,877 | ) | 6,099,362 | ||||||||

| Accumulated Net Realized Gain from Investments Transactions |

74,198,019 | 655,231 | 58,400,315 | |||||||||

| Net Unrealized Appreciation on Investments |

529,374,749 | 39,372,426 | 345,567,233 | |||||||||

|

|

|

|

|

|

|

|||||||

| Net Assets |

$4,253,129,233 | $148,743,781 | $1,314,714,928 | |||||||||

|

|

|

|

|

|

|

|||||||

| Net Assets: |

||||||||||||

| I Shares |

$3,552,288,498 | $126,223,093 | $1,118,190,335 | |||||||||

| A Shares |

590,327,110 | 9,888,822 | 162,731,906 | |||||||||

| C Shares |

87,115,236 | 6,396,639 | 33,792,687 | |||||||||

| IS Shares |

23,398,389 | 6,235,227 | — | |||||||||

| Shares Outstanding (unlimited number of shares authorized, no par value) |

||||||||||||

| I Shares |

258,557,590 | 8,513,629 | 71,709,645 | |||||||||

| A Shares |

43,412,533 | 747,379 | 10,673,337 | |||||||||

| C Shares |

6,531,519 | 671,113 | 2,361,721 | |||||||||

| IS Shares |

1,700,780 | 419,768 | — | |||||||||

| Net Asset Value and Redemption Price Per Share: |

||||||||||||

| I Shares |

$13.74 | $14.83 | $15.59 | |||||||||

| A Shares |

13.60 | 13.23 | 15.25 | |||||||||

| C Shares(a) |

13.34 | 9.53 | 14.31 | |||||||||

| IS Shares |