Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-06557

RidgeWorth Funds

(Exact name of registrant as specified in charter)

RidgeWorth Capital Management, Inc.

3333 Piedmont Road NE, Suite 1500

Atlanta, GA 30305

(Address of principal executive offices)(Zip code)

| (Name and Address of Agent for Service) |

Copy to: | |||

| Julia Short RidgeWorth Funds 3333 Piedmont Road NE, Suite 1500 Atlanta, GA 30305 |

Thomas Harman, Esq. Bingham McCutchen LLP 2020 K Street, NW Washington, DC 20006 |

Registrant’s telephone number, including area code: 1-888-784-3863

Date of fiscal year end: March 31

Date of reporting period: March 31, 2014

Table of Contents

| Item 1. | Reports to Shareholders. |

Table of Contents

Explanatory Note

This amendment on Form N-CSR/A is filed in order to revise the Report of Independent Registered Public Accounting Firm on page 95 of the Annual Report related to the RidgeWorth Funds; Equity Funds and page 198 of the RidgeWorth Funds; Fixed Income Funds (the “Reports”). Other than the aforementioned changes, these reports on N-CSR/A do not amend or update the N-CSR in any way.

The RidgeWorth Funds; Equity Fund Report is amended to correct a typographical error in the date of May 27, 3014, to be May 27, 2014. In addition, the Reports are amended to include PricewaterhouseCoopers LLP on the bottom of each of the Reports.

Table of Contents

Collective Strength. Individual Insight.®

2014 ANNUAL REPORT

EQUITY FUNDS

MARCH 31, 2014

RidgeWorth Investments® is the trade name of RidgeWorth Capital Management, Inc.

Collective Strength. Individual Insight.® is a federally registered service mark of RidgeWorth Investments.®

Table of Contents

RIDGEWORTH FUNDS March 31, 2014

| Letter to Shareholders | 1 | |||

| Management Discussion of Fund Performance | ||||

| Equity Funds: | ||||

| 3 | ||||

| 5 | ||||

| 7 | ||||

| 9 | ||||

| 11 | ||||

| 13 | ||||

| 15 | ||||

| 17 | ||||

| 19 | ||||

| Allocation Strategies: | ||||

| 21 | ||||

| 23 | ||||

| 25 | ||||

| 27 | ||||

| Financial Statements | ||||

| Schedules of Portfolio Investments | 29 | |||

| Statements of Assets and Liabilities | 59 | |||

| Statements of Operations | 62 | |||

| Statements of Changes in Net Assets | 65 | |||

| Financial Highlights | 70 | |||

| Notes to Financial Statements | 76 | |||

| Report of Independent Registered Public Accounting Firm | 95 | |||

| Other Information | ||||

| Other Federal Tax Information | 96 | |||

| Trustees and Officers of the RidgeWorth Funds | 98 | |||

| Additional Information | 100 | |||

Table of Contents

RIDGEWORTH FUNDS March 31, 2014

Dear Valued Client,

Before we begin, we want to thank you, our valued RidgeWorth Funds’ shareholders, for your continued business and support. We focus our efforts on helping you achieve your investment goals and we are grateful you have placed your confidence in us. Our primary mission is to earn your trust through providing competitive investment performance and excellent client service. We sincerely hope we have met your expectations in both of these measures and we look forward to continuing as your asset manager in the future.

There is an old saying that good things come in threes and we have three good things to discuss. First, we are pleased to report that the economic recovery that began in mid-2009 has continued and the U.S. equity bull market celebrated its fourth anniversary despite both persistent and new global economic and financial challenges. Second, we are pleased to report that RidgeWorth Funds (“Funds”) maintained its strong long-term investment performance record. Third, we are excited to announce our pending partnership with Lightyear Capital LLC which will acquire RidgeWorth Investments (“RidgeWorth”) from SunTrust Banks, Inc. RidgeWorth will become an independent investment firm with significant equity ownership by employees. This update will discuss all three of these topics as well as what we anticipate for both the broad economy and the capital markets in 2014.

In last year’s letter, we discussed why we remained positive regarding our outlook for the economy and the markets: improved job growth, a continued recovery in housing, an improving outlook for the European Union (“EU”), low interest rates, accommodative global monetary policies and strong, cash-rich corporate balance sheets. However, we cautioned that many of the challenges that affected the markets over the past several years would likely remain, including persistent underemployment, impaired consumer balance sheets, regulatory and geopolitical uncertainty and dysfunction in Washington. In such an environment, we stated the market could become more selective, sorting out those companies with disruptive products and services with strong earnings, from those that merely kept pace with a modestly growing economy.

In discussing the macroeconomic environment, we believe that both the economy and the capital markets continued the transition from crisis mode to cyclical growth mode. That said, the markets had their fair share of worries, both old and new, and they surfaced early in the fiscal year. In the second quarter of 2013, some of the developments included then-Federal Reserve Chairman Ben Bernanke’s announcement that the Federal Open Market Committee (“FOMC”) would likely begin reducing its massive and somewhat controversial quantitative easing (“QE”) program. In addition, market participants were concerned over Chinese banking liquidity and slowing growth in emerging markets. In the third quarter, threats of military surgical strikes in Syria, sequestration, threat of government shutdown, the uncertainty surrounding the Detroit bankruptcy and financial strains in Puerto Rico rattled investors. In the fourth quarter, the beginning of FOMC tapering and rising mortgage rates added to the list of concerns. Finally, the first quarter of 2014 saw the initial impact of the Affordable Care Act, concern over the cessation of long-term unemployment insurance benefits and one of the more severe winter seasons in recent memory. Additionally, geo-political turmoil created by Russia’s annexation of Crimea ignited fears of a land grab in Ukraine, and fanned fears of a renewed Cold War.

Despite the numerous concerns, the markets embraced the positives related to the continued post-financial crisis healing and cyclical improvement. These positives included steady and improved job growth, lower unemployment, rising home prices, falling loan-delinquency rates, increased manufacturing output, continued low inflation, steady recovery in the EU and Japan and an almost global commitment to maintaining accommodative monetary policies. In addition, companies enjoyed burgeoning free cash flows which were used for share buybacks, dividend payments, debt reduction and accretive bolt-on mergers and acquisitions. Taken together, this myriad of individual positives collectively reduced downside risks to the macro economy and bolstered investor confidence.

The result of all of these events was another strong year for equities in the U.S. and other developed markets. The S&P 500 Index gained an impressive 21.86% (including dividends) during the year ended March 31, 2014. Pro-cyclical sectors such as Industrials, Technology, Materials and Financials all posted above-market returns for the year, as did Health Care. More defensive and interest rate sensitive sectors such as Consumer Staples and Utilities, lagged. This combination of outperformance favored the Growth style over the Value style, with the Russell 1000 Growth Index gaining 23.22% versus 21.57% for the Russell 1000 Value Index. In other markets, both mid-cap stocks and small cap stocks outperformed the S&P 500 Index, while the MSCI EAFE (a developed, international markets index) lagged. Economic slowing as well as rising inflation pressures hurt emerging market stocks, which fell modestly for the year according to the MSCI Emerging Markets Index.

1

Table of Contents

LETTER TO SHAREHOLDERS (concluded)

RIDGEWORTH FUNDS March 31, 2014

On the fixed income side, the threat and eventual onset of FOMC tapering in response to the stronger economy pushed bond yields up from artificially low levels and the yield curve steepened, sapping strength from the bond market. The Barclays Aggregate Bond Index slipped -0.10% for the year ended March 31, 2014, with most of the weakness attributed to U.S. Treasuries. The strength in the economy, however, helped credit spreads narrow so that corporate and high yield bonds posted gains for the year.

In this economic and financial climate, RidgeWorth Funds continued to maintain its record of strong long-term performance, as two-thirds of our Funds beat their Lipper Peer Group medians for the 1- and 3-year periods, ended March 31, 20141. Moreover, more than 80% of our Funds finished in the first or second quartile for the 10-year period1.

We are very pleased with the continued success of our Funds and the dedicated investment professionals behind them. We want to do even more to meet our clients’ investment needs through expanded product lines, innovative solution development and placing an even greater focus on client and intermediary partner service. To that end, employees of RidgeWorth Investments in partnership with Lightyear Capital LLC, a financial services private equity firm, have entered into an agreement to acquire RidgeWorth from SunTrust Banks, Inc., with closing expected mid-2014. We appreciate our long affiliation with SunTrust, and we are excited to partner with Lightyear since they bring deep industry experience.

This transaction positions RidgeWorth to become a premier independent asset management company. Over the past several years, we have made significant enhancements to our operating platform in areas including risk management, compliance, portfolio accounting, technology infrastructure and client support functions, so we are confident it will be business as usual for our clients.

Looking ahead to the domestic markets, we anticipate continued moderate growth in the economy. Many of the economic and financial headwinds already mentioned should continue to dissipate, and cyclical forces such as job gains and production increases should continue fueling income growth, corporate profits and capital spending. We also believe inflation will remain relatively low which should be a favorable backdrop for the equity markets. As the Federal Reserve winds down QE this year, it is unlikely to actually raise short-term rates anytime soon. We continue to see a modest recovery in both the EU and Japan. Emerging markets continue to have structural problems but monetary and fiscal stabilization efforts are well underway.

That said, there are always risks to any financial forecast. In addition to those mentioned previously, a significant potential drag on the economy continues to exist from the Affordable Care Act as it becomes fully implemented. Many companies and employees will have higher premiums and deductibles which could, in turn, suppress disposable incomes. We will also closely monitor the housing market—both new home sales and refinancing activity—given its significant impact on the economy. Finally, we note that mid-term congressional elections have a long history of disrupting market advances.

We continue to believe the markets will offer opportunities to investors, but they will be more selective and company-specific, an environment that fits well with RidgeWorth’s bottom-up approach to security selection. We at RidgeWorth wish to thank you again for the trust and confidence you have placed in us, and we look forward to another good year together.

Sincerely,

Ashi Parikh

Chairman, CEO, CIO

RidgeWorth Investments

| 1 | For the period ended March 31, 2014, 66% (21/32), 66% (21/32), 44% (14/32) and 81% (25/31) of the RidgeWorth Funds (I Shares) beat their Lipper peer group medians for the 1-, 3-, 5- and 10-year periods, respectively. The Lipper rankings are as of March 31, 2014, for I Shares only, based on total returns and do not reflect a sales charge. ©2014 Lipper Leader, Reuters. All Rights Reserved. Lipper Ratings are according to Lipper, a Thomson Reuters Company. Past performance is not indicative of future results. |

2

Table of Contents

Portfolio Managers

| Ÿ | Nancy Zevenbergen, CFA, CIC |

| Ÿ | Brooke de Boutray, CFA, CIC |

| Ÿ | Leslie Tubbs, CFA, CIC |

INVESTMENT CONCERNS

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes. Common stocks, and funds investing in common stocks, generally provide greater return potential when compared with other types of investments.

Small- and Mid-capitalization funds typically carry additional risks since smaller companies generally have a higher risk of failure.

MANAGEMENT DISCUSSION OF FUND PERFORMANCE

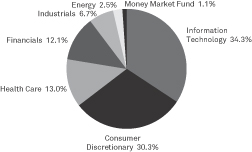

How did the Fund perform against its benchmark for the fiscal year ended March 31, 2014?

The RidgeWorth Aggressive Growth Stock Fund I Shares posted returns nearly double the Russell 3000® Growth Index (the Fund’s benchmark), up 43.70%, versus 23.53% for the fiscal year ended March 31, 2014.

What factors influenced the Fund’s performance for the fiscal year ended March 31, 2014?

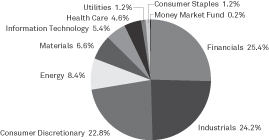

Strong stock selection in Consumer Discretionary and Information Technology sectors produced outperformance relative to the benchmark. Both the Health Care and Energy sector returns were positive but still the greatest detractors, failing to keep pace with benchmark sector gains. Individually, Consumer Discretionary holdings Tesla Motors, Inc., Netflix, Inc., and Priceline.com Inc., were three of the top five performers for the period, while the Information Technology and Financials sectors contributed the remainder via Facebook, Inc. and Zillow, Inc.

Top-weighted Tesla shares finally woke up from nearly three years of slumber. Patient investors witnessed the shares notable appreciation as production and revenue goals were exceeded, and the map to future growth catalysts grew clearer. We elected to trim shares opportunistically, as interim stock prices reached near-term targets. Shares of Tesla were the most significant contributor to performance for three of the four quarters during the fiscal year.

Left for dead in 2011, Netflix CEO Reed Hastings remained steadfast in playing by his own rules by making ambitious investments in original programming, including “House of Cards” and “Orange is the New Black,” and international growth. Both actions were well received by consumers and investors. The 86% share price rebound in Netflix made it the third-highest Fund contributor.

The Information Technology sector delivered the second highest contribution to performance with significant returns led by Facebook. The company’s ascendancy in mobile advertising constitutes an ever-increasing component of its core revenue, catching most investors off guard. Arguably, digital advertising could be at an inflection point; after years of constrained interest, advertisers finally became convinced mobile was not only a viable investment, but a critical, necessary component of any marketing campaign, as U.S. adults spend an average 2.5 hours a day on mobile devices. As digital media continues to siphon dollars from traditional media, the options within digital advertising are also expanding. Social media (ranking number one in budget prioritizing) and mobile video are positioned to garner an increasing share of company budgets.

As U.S. home values have increased by the largest amount in eight years, Zillow shares mirrored that enthusiasm and appreciated significantly. Within the company, the addition of Premier Agent and the StreetEasy® support continuing secular growth. Zillow’s online data aggregation platform exhibits formidable reach and return on investment.

How do you plan to position the Fund, based on market conditions?

What should investors expect after a year like 2013 and headlines that warn the current bull market may be nearing its end? Aside from the usual market alarmists, pundits cite all sorts of statistics. However, there is seldom historical precedent that provides accurate insight into what will eventually unfold. Up, down, or sideways, we believe individual company fundamentals will be the primary influence on stock prices. The lessons we’ve learned after more than 25 years of portfolio management are being put to use today. We continue to research soundly and have patience, giving adequate time for investments to prosper.

3

Table of Contents

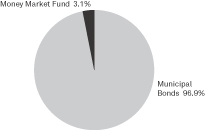

AGGRESSIVE GROWTH STOCK FUND

Growth of a $10,000 Investment (as of March 31, 2014)

|

This chart assumes an initial hypothetical investment of $10,000 made on 3/31/04. Total return is based on net change in the Net Asset Value (“NAV”) assuming reinvestment of distributions. Returns shown on this page include reinvestment of all dividends and other distributions.

The Fund’s performance is compared to the Russell 3000® Growth Index, which measures the performance of the broad growth segment of the U.S. equity universe. It includes those Russell 3000® companies with higher price-to-book ratios and higher forecasted growth values. The Index is unmanaged and does not reflect the deduction of fees, such as investment and fund accounting fees, associated with a mutual fund. Investors cannot invest directly in an index. |

| Average Annual Total Returns as of 3/31/14 | ||||||||||||||||

| Aggressive Growth Stock Fund | 1 Year | 3 Year | 5 Year | 10 Year | ||||||||||||

| A Shares |

without sales charge | 43.45% | 12.06% | 24.38% | 9.29% | |||||||||||

| with sales charge* | 35.24% | 9.88% | 22.93% | 8.65% | ||||||||||||

| I Shares |

43.70% | 12.33% | 24.72% | 9.59% | ||||||||||||

| Russell 3000® Growth Index | 23.53% | 14.53% | 21.94% | 7.95% | ||||||||||||

| Prospectus Expense Ratio1 | Gross | |||||||||||||||

| A Shares | 1.35% | |||||||||||||||

| I Shares | 1.39% | |||||||||||||||

4

Table of Contents

Portfolio Manager

| Ÿ | Chad Deakins, CFA |

INVESTMENT CONCERNS

International investing involves increased risk and volatility.

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes.

MANAGEMENT DISCUSSION OF FUND PERFORMANCE

How did the Fund perform against its benchmark for the fiscal year ended March 31, 2014?

The RidgeWorth International Equity Fund I Shares returned 19.52% for the fiscal year ended March 31, 2014. The Morgan Stanley Capital International Europe, Australasia and Far East (“MSCI EAFE”) Index, the RidgeWorth International Equity Fund’s benchmark, had a net return of 17.54% for the fiscal year ended March 31, 2014. During the year, the strongest-performing markets were Italy, Spain, Ireland, and Finland, returning 52.95%, 45.72%, 42.91%, and 42.21%, respectively. The worst-performing markets were Australia (up 1.17%), Hong Kong (up 3.74%), and Singapore (down -2.17%). MSCI EAFE Growth stocks led versus MSCI EAFE Value stocks by more than 5%. Small cap stocks modestly beat large cap stocks and developed markets led emerging markets (“EM”) by more than 20%.

What factors influenced the fund’s performance for the fiscal year ended March 31, 2014?

The Fund’s attention to the business cycle, strategic allocation, and risk control resulted in a solid outcome for the year as the global economic recovery continued. The Fund maintained overweight positions in cyclical sectors with the belief that the global economic recovery still has a few years to run and the global equity markets continue to rise. We were able to reduce our EM exposure early in the year, as we saw most EM stocks as fully-valued.

Performance was strong in Europe with good stock selection in the Consumer Discretionary, Materials, and Industrials sectors.

How do you plan to position the Fund, based on market conditions?

We believe there is still an opportunity for value investors to outperform with diligent stock selection. Global equity markets have priced in some positive trends in the global economy, as markets are trading close to historic averages in terms of valuations. As always, we are selective and try to purchase high quality securities at a discount to their true value when they are out of favor with the market. We will maintain our cyclical tilt and build our exposure to deep value names that are nearing some type of catalyst.

5

Table of Contents

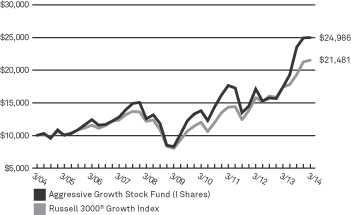

Growth of a $10,000 Investment (as of March 31, 2014)

|

This chart assumes an initial hypothetical investment of $10,000 made on 3/31/04. Total return is based on net change in the Net Asset Value (“NAV”) assuming reinvestment of distributions. Returns shown on this page include reinvestment of all dividends and other distributions.

The Fund’s performance is compared to the Morgan Stanley Capital International Europe, Australasia and Far East (“MSCI EAFE”) Index, which is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the U.S. & Canada. The MSCI EAFE Index consists of 21 developed market country indices. EAFE performance data is calculated in U.S. dollars and in local currency. The Index is unmanaged and does not reflect the deduction of fees, such as investment and fund accounting fees, associated with a mutual fund. Investors cannot invest directly in an index. |

| Average Annual Total Returns as of 3/31/14 | ||||||||||||||||

| International Equity Fund | 1 Year | 3 Year | 5 Year | 10 Year | ||||||||||||

| A Shares |

without sales charge | 19.72% | 7.56% | 18.34% | 6.10% | |||||||||||

| with sales charge* | 12.86% | 5.46% | 16.93% | 5.47% | ||||||||||||

| I Shares |

19.52% | 7.73% | 18.60% | 6.36% | ||||||||||||

| MSCI EAFE Index | 17.54% | 7.21% | 16.02% | 6.53% | ||||||||||||

| Prospectus Expense Ratio1 | Gross | |||||||||||||||

| A Shares | 1.33% | |||||||||||||||

| I Shares | 1.15% | |||||||||||||||

6

Table of Contents

INTERNATIONAL EQUITY INDEX FUND

Portfolio Managers

| Ÿ | Chad Deakins, CFA |

INVESTMENT CONCERNS

International investing involves increased risk and volatility.

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes.

Small- and Mid-capitalization funds typically carry additional risks since smaller companies generally have a higher risk of failure.

It is important to remember that there are risks associated with index investing, including the potential risk of market decline, as well as the risks associated with investing in specific companies.

MANAGEMENT DISCUSSION OF FUND PERFORMANCE

How did the Fund perform against its benchmark for the fiscal year ended March 31, 2014?

The RidgeWorth International Equity Index Fund I Shares returned 22.52% for the fiscal year ended March 31, 2014. The Morgan Stanley Europe, Australasia and Far East (“MSCI EAFE”) GDP Weighted Index Net Dividend, the RidgeWorth International Equity Index Fund’s benchmark, had a net return of 22.16% for the fiscal year ended March 31, 2014. During the year, the strongest-performing markets were Italy, Spain, Ireland, and Finland, returning 52.95%, 45.72%, 42.91%, and 42.21%, respectively. The worst-performing markets were Australia (up 1.17%), Hong Kong (up 3.74%), and Singapore (down -2.17%). MSCI EAFE Growth stocks led versus MSCI EAFE Value stocks by more than 5%. Small cap stocks modestly beat large cap stocks and developed markets led emerging markets by more than 20%.

What factors influenced the fund’s performance for the fiscal year ended March 31, 2014?

The Fund’s investment methodology and efficient management of cash flows allowed it to perform as expected, closely tracking its benchmark.

How do you plan to position the Fund, based on market conditions?

As the global economic expansion continues, it remains clear that economic and fiscal health vary from country-to-country. While some type of financial crisis could still emerge, central banks around the world have shown the resolve to act in a crisis, and stimulate the economy in weakness. Global equity markets have priced in some positive trends in the global economy, as markets are trading close to historic averages in terms of valuations. We await the earnings momentum improvements, which should support market trends while keeping valuations in check.

7

Table of Contents

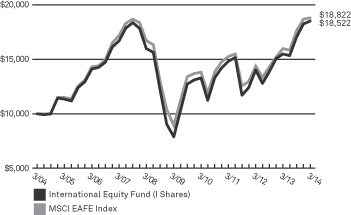

INTERNATIONAL EQUITY INDEX FUND

Growth of a $10,000 Investment (as of March 31, 2014)

|

This chart assumes an initial hypothetical investment of $10,000 made on 3/31/04. Total return is based on net change in the Net Asset Value (“NAV”) assuming reinvestment of distributions. Returns shown on this page include reinvestment of all dividends and other distributions.

The Fund’s performance is compared to the Morgan Stanley Europe Australasia and Far East (“MSCI EAFE”) GDP Weighted Index Net Dividend, which is a market capitalization index that measures market equity performance based upon indices from foreign and developed countries. The country weighting of the Index is calculated using the gross domestic product of each of the various countries and then with respect of the market capitalization of the various companies operating in each country. The Index is unmanaged and does not reflect the deduction of fees, such as investment and fund accounting fees, associated with a mutual fund. Investors cannot invest directly in an index. |

| Average Annual Total Returns as of 3/31/14 | ||||||||||||||||

| International Equity Index Fund | 1 Year | 3 Year | 5 Year | 10 Year | ||||||||||||

| A Shares |

without sales charge | 22.11% | 5.96% | 14.20% | 5.34% | |||||||||||

| with sales charge* | 15.07% | 3.89% | 12.86% | 4.71% | ||||||||||||

| I Shares |

22.52% | 6.29% | 14.55% | 5.65% | ||||||||||||

| MSCI EAFE GDP Weighted Index Net Dividend | 22.16% | 6.62% | 15.11% | 6.07% | ||||||||||||

| Prospectus Expense Ratio1 | Gross | |||||||||||||||

| A Shares | 1.09% | |||||||||||||||

| I Shares | 1.05% | |||||||||||||||

8

Table of Contents

Portfolio Managers

| Ÿ | Christopher Guinther |

| Ÿ | Joe Ransom, CFA |

| Ÿ | Michael A. Sansoterra |

| Ÿ | Sandeep Bhatia, PhD, CFA |

INVESTMENT CONCERNS

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes. Common stocks, and funds investing in common stocks, generally provide greater return potential when compared with other types of investments.

Small- and Mid-capitalization funds typically carry additional risks since smaller companies generally have a higher risk of failure.

Large-capitalization stock can perform differently from other segments of the equity market or the equity market as a whole. Large capitalization companies may be less flexible in evolving markets or unable to implement change as quickly as smaller capitalization companies.

MANAGEMENT DISCUSSION OF FUND PERFORMANCE

How did the Fund perform against its benchmark for the fiscal year ended March 31, 2014?

For the fiscal year ended March 31, 2014, the RidgeWorth Large Cap Growth Stock Fund returned 27.35% (I Shares), while the Russell 1000® Growth Index returned 23.22%. The Fund outperformed the benchmark by 413 basis points.

For the fiscal year ended March 31, 2014, equities continued their five-year bull market run with strong results. Under this backdrop, the Fund’s investment in the Financials, Healthcare, Consumer Discretionary, and Consumer Staples sectors did well. In particular, stocks selection remained strong across various industries as 21 different stocks from 6 different major economic sectors gained more than 40% during the year.

What factors influenced the Fund’s performance for the fiscal year ended March 31, 2014?

Although weather had a negative impact on reported macroeconomic data in the fourth quarter of 2013, the general direction of the overall U.S. domestic economic growth remained positive. Investors saw economic activity continue to exceed expectations, highlighted by stronger gains in jobs and industrial production during the year. The steady improvement in the labor market and a modest 2014 budget compromise in Washington were likely key factors prompting the Federal Open Market Committee (“FOMC”) to decide to begin scaling back on securities purchased into 2014. There are still concerns as to the impact about potential damage from this shift in Federal Reserve policy. However, when the FOMC delivered the news that tapering will begin in January, stocks soared to record highs with the S&P 500 Index reaching another new high during the year. More recently, geopolitical risks have arisen as Russia’s decision to annex Crimea and threaten Ukraine still looms fresh in the mind of many investors.

As the U.S. economy continued to heal, the Fund’s investments in the Consumer Discretionary sector were among some of the strongest performers for the year, gaining 42.11%, while the benchmark’s Consumer Discretionary stocks rose by 26.23%. The Fund’s Consumer Discretionary related investments continued to report strong operating results throughout the year which exceeded investor expectations. The Fund’s shareholders benefited from holdings in Under Armour (specialty apparel), Priceline Group (online travel), Michael Kors (specialty apparel), BorgWarner (automotive parts), Netflix (online media), and Chipotle Mexican Grill (fast casual dining).

How do you plan to position the Fund, based on market conditions?

The investment team does not attempt to position the Fund based on predictions of macroeconomic conditions. The Fund’s strategy utilizes a balanced approach to stock selection, which, combined with multi-dimensional risk decomposition tools, allows the portfolio managers to control active risk through portfolio construction. The portfolio managers actively monitor the components of systematic risk, and aim to ensure that most of the risk relative to the index is derived from non-systematic (stock-specific) risk. Sector-rotation and tactical-sector allocations are de-emphasized. The Fund will be relatively sector and characteristic neutral relative to the Russell 1000 Growth Index, as the investment team attempts to generate alpha through bottom-up stock selection. The team believes that its investment strategy is objective, balanced, and designed to enable outperformance in most market cycles.

The Fund will invest in companies with reasonable valuations and improving fundamentals. Generally, the companies invested in will have shown year-over-year increases in operating margins, growth in revenues, and will exhibit improving financial returns as measured by return on incremental invested capital. By combining the income statement, balance sheet, and cash flow metrics to evaluate earnings quality, capital efficiency, and relative valuations, the portfolio managers avoid concentrating on any single attribute. Therefore, the team seeks to eliminate investment results that are directly attributable to market conditions, and add alpha through stock selection.

9

Table of Contents

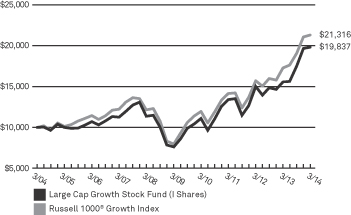

LARGE CAP GROWTH STOCK FUND

Growth of a $10,000 Investment (as of March 31, 2014)

|

This chart assumes an initial hypothetical investment of $10,000 made on 3/31/04. Total return is based on net change in the Net Asset Value (“NAV”) assuming reinvestment of distributions. Returns shown on this page include reinvestment of all dividends and other distributions.

The Fund’s performance is compared to the Russell 1000® Growth Index, which measures the performance of the large-cap growth segment of the U.S. equity universe. It includes those Russell 1000® companies with higher price-to-book ratios and higher forecasted growth values. The Index is unmanaged and does not reflect the deduction of fees, such as investment and fund accounting fees, associated with a mutual fund. Investors cannot invest directly in an index. |

| Average Annual Total Returns as of 3/31/14 | ||||||||||||||||

| Large Cap Growth Stock Fund | 1 Year | 3 Year | 5 Year | 10 Year | ||||||||||||

| A Shares |

without sales charge | 26.99% | 13.66% | 20.80% | 6.73% | |||||||||||

| with sales charge* | 19.74% | 11.44% | 19.39% | 6.10% | ||||||||||||

| C Shares |

without CDSC | 26.09% | 12.84% | 19.93% | 6.03% | |||||||||||

| with CDSC* | 25.09% | 12.84% | 19.93% | 6.03% | ||||||||||||

| I Shares |

27.35% | 13.96% | 21.12% | 7.09% | ||||||||||||

| Russell 1000® Growth Index | 23.22% | 14.62% | 21.68% | 7.86% | ||||||||||||

| Prospectus Expense Ratio1 | Gross | |||||||||||||||

| A Shares | 1.12% | |||||||||||||||

| C Shares | 1.81% | |||||||||||||||

| I Shares | 0.92% | |||||||||||||||

10

Table of Contents

Portfolio Manager

| Ÿ | Mills Riddick, CFA |

INVESTMENT CONCERNS

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes.

Value-based investments are subject to the risk that the broad market may not recognize their intrinsic value.

MANAGEMENT DISCUSSION OF FUND PERFORMANCE

How did the Fund perform against its benchmark for the fiscal year ended March 31, 2014?

For the fiscal year ended March 31, 2014, the RidgeWorth Large Cap Value Equity Fund I Shares returned 22.94%, compared to a 21.57% return for the Russell 1000® Value Index.

What factors influenced the Fund’s performance for the fiscal year ended March 31, 2014?

The primary reasons for the Fund’s outperformance relative to the benchmark were stock selection in the Energy, Consumer Discretionary, and Materials sectors. In addition, the Fund benefitted from an underweight in the Utilities sector. Within the Energy sector, Occidental Petroleum Corp. contributed to returns as shareholders voted out the company’s former CEO and senior board member, Ray Irani, paving the way for the new management to enact a cost-cutting/asset-divesture program to improve returns. In the Consumer Discretionary sector, Johnson Controls Inc. aided results as new management came aboard and unlocked value at the corporation by selling off non-core assets, in order to maximize shareholder value, and investors rerated the firm to multi-industrial. In the Materials sector, Ashland Inc. improved Fund results as the company continued to execute on rationalizing its portfolio and focusing on higher margin businesses to improve returns for investors.

Detractors from performance were stock selection in the Consumer Staples, Financials, and Telecommunication Services sectors. Within the Consumer Staples sector, Phillip Morris International Inc. negatively contributed to performance as investors became concerned about the company’s exposure to the emerging market region, coupled with the headwinds regarding foreign exchange rates. In the Financials sector, Citigroup Inc. adversely impacted returns as investors became concerned with the company’s emerging market exposure, coupled with the poor comprehensive capital analysis and review results released to the market. In the Telecommunication Services sector AT&T Inc. underperformed due to competitive pressures increasing in the wireless arena and interest rate volatility.

How do you plan to position the Fund, based on market conditions?

During this volatile time, we remain steadfast in executing our bottom-up stock selection process. However, the investment landscape is not without pitfalls, such as the emerging geopolitical risks, the unknown adjustments related to tax/regulatory changes still pending in Congress, and headwinds that may arise during the upcoming mid-term elections. As we have communicated in the past, these macroeconomic distractions can cause investors to pull away from the focus on company fundamentals during a market cycle. Our investment mindset remains the same—that individual company fundamentals are the most important component in stock selection, once the macroeconomic environment normalizes for equity markets. We maintain the view that mid- to late-stage cyclical stocks will drive near-term performance and the Fund is positioned accordingly. As a result, the Fund is overweight the Industrials sector and underweight the Financials and Utilities sectors.

The Fund utilizes a bottom-up investment approach to stock selection, which seeks dividend-paying stocks trading at the lower end of historical trading ranges that display characteristics of financial strength and possess an identifiable catalyst to assist in realizing true value. The Fund does not make active sector allocations but allows the process to define sector weights.

11

Table of Contents

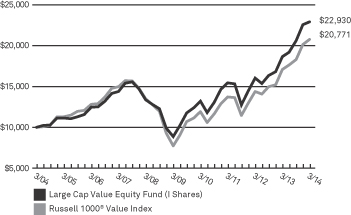

LARGE CAP VALUE EQUITY FUND

Growth of a $10,000 Investment (as of March 31, 2014)

|

This chart assumes an initial hypothetical investment of $10,000 made on 3/31/04. Total return is based on net change in the Net Asset Value (“NAV”) assuming reinvestment of distributions. Returns shown on this page include reinvestment of all dividends and other distributions.

The Fund’s performance is compared to the Russell 1000® Value Index, which measures the performance of the large-cap value segment of the U.S. equity universe. It includes those Russell 1000® companies with lower price-to-book ratios and lower expected growth values. The Index is unmanaged and does not reflect the deduction of fees, such as investment and fund accounting fees, associated with a mutual fund. Investors cannot invest directly in an index. |

| Average Annual Total Returns as of 3/31/14 | ||||||||||||||||||

| Large Cap Value Equity Fund | 1 Year | 3 Year | 5 Year | 10 Year | ||||||||||||||

| A Shares |

without sales charge | 22.60% | 13.76% | 20.55% | 8.32% | |||||||||||||

| with sales charge* | 15.52% | 11.53% | 19.11% | 7.68% | ||||||||||||||

| C Shares |

without CDSC | 21.98% | 13.08% | 19.75% | 7.60% | |||||||||||||

| with CDSC* | 20.98% | 13.08% | 19.75% | 7.60% | ||||||||||||||

| I Shares |

22.94% | 14.09% | 20.90% | 8.65% | ||||||||||||||

| Russell 1000® Value Index | 21.57% | 14.80% | 21.75% | 7.58% | ||||||||||||||

| Prospectus Expense Ratio1 | Gross | |||||||||||||||||

| A Shares | 1.34% | |||||||||||||||||

| C Shares | 1.71% | |||||||||||||||||

| I Shares | 1.05% | |||||||||||||||||

12

Table of Contents

Portfolio Manager

| Ÿ | Don Wordell, CFA |

INVESTMENT CONCERNS

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes.

Mid capitalization funds typically carry additional risks since smaller companies generally have a higher risk of failure.

Value-based investments are subject to the risk that the broad market may not recognize their intrinsic value.

MANAGEMENT DISCUSSION OF FUND PERFORMANCE

How did the Fund perform against its benchmark for the fiscal year ended March 31, 2014?

The RidgeWorth Mid-Cap Value Equity Fund I Shares appreciated 22.03% for the fiscal year ended March 31, 2014, underperforming the Russell Midcap® Value Index, which returned 22.95% for the fiscal year.

What factors influenced the Fund’s performance for the fiscal year ended March 31, 2014?

Relative results during the period lagged, primarily due to stock selection in the Industrials, Information Technology, and Health Care sectors. Within the Industrials sector, ADT Corp. underperformed as increased competition, a deteriorating customer base, and surging marketing costs disenchanted investors. In the Information Technology sector, Symantec Corporation detracted from performance as a result of reporting a disappointing quarter as well as announcing that the board of directors was relieving the company’s CEO of his duties. Within the Health Care sector, Zoetis Inc. reported poor quarterly results and the company issued 2014 guidance that stepped away from the margin expansion and tax savings goals that were discussed during the company’s initial public offering roadshow.

Positive contributors to performance were stock selection in the Financials, Energy, and Materials sectors. In the Financials sector, Hartford Financial Services Group Inc. outperformed as the company sold-off non-core business segments, in an effort to transition to a pure property/casualty centric insurer. In the Energy sector, Baker Hughes Inc. outperformed as rig counts increased, margins improved, and free cash flow increased. In the Materials sector, Cabot Corporation contributed to performance as tire shipments rebounded, and coal generation surprised to the upside this winter due to the extreme cold weather experienced in the United States.

How do you plan to position the Fund, based on market conditions?

During this volatile time, we remain steadfast in executing our bottom-up stock selection process. However, the investment landscape is not without pitfalls, such as the emerging geopolitical risks, the unknown adjustments related to tax/regulatory changes still pending in Congress, and headwinds that may arise during the upcoming mid-term elections. As we have communicated in the past, these macroeconomic distractions can cause investors to pull away from the focus on company fundamentals during a market cycle. Our investment mindset remains the same—that individual company fundamentals are the most important component in stock selection, once the macroeconomic environment normalizes for equity markets. We maintain the view that mid- to late-stage cyclical stocks will drive near-term performance and the Fund is positioned accordingly. As a result, the Fund is overweight the Industrials, Materials, and Energy sectors and underweight the Utilities sector.

The Fund utilizes a bottom-up investment approach to stock selection, which seeks dividend-paying stocks trading at the lower end of historical trading ranges that display characteristics of financial strength and possess an identifiable catalyst to assist in realizing true value. The Fund does not make active sector allocations but allows the process to define sector weights.

13

Table of Contents

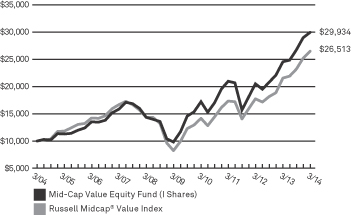

MID-CAP VALUE EQUITY FUND

Growth of a $10,000 Investment (as of March 31, 2014)

|

This chart assumes an initial hypothetical investment of $10,000 made on 3/31/04. Total return is based on net change in the Net Asset Value (“NAV”) assuming reinvestment of distributions. Returns shown on this page include reinvestment of all dividends and other distributions.

The Fund’s performance is compared to the Russell Midcap® Value Index, which measures the performance of the mid-cap value segment of the U.S. equity universe. It includes those Russell Midcap Index companies with lower price-to-book ratios and lower forecasted growth values. The Index is unmanaged and does not reflect the deduction of fees, such as investment and fund accounting fees, associated with a mutual fund. Investors cannot invest directly in an index. |

| Average Annual Total Returns as of 3/31/14 | ||||||||||||||||

| Mid-Cap Value Equity Fund | 1 Year | 3 Year | 5 Year | 10 Year | ||||||||||||

| A Shares |

without sales charge | 21.68% | 12.27% | 24.64% | 11.25% | |||||||||||

| with sales charge* | 14.69% | 10.07% | 23.17% | 10.59% | ||||||||||||

| C Shares |

without CDSC | 21.26% | 11.66% | 23.89% | 10.59% | |||||||||||

| with CDSC* | 20.26% | 11.66% | 23.89% | 10.59% | ||||||||||||

| I Shares |

22.03% | 12.58% | 24.99% | 11.59% | ||||||||||||

| Russell Midcap® Value Index | 22.95% | 15.17% | 26.35% | 10.24% | ||||||||||||

| Prospectus Expense Ratio1 | Gross | |||||||||||||||

| A Shares | 1.41% | |||||||||||||||

| C Shares | 1.78% | |||||||||||||||

| I Shares | 1.09% | |||||||||||||||

14

Table of Contents

SELECT LARGE CAP GROWTH STOCK FUND

Portfolio Managers

| Ÿ | Christopher Guinther |

| Ÿ | Joe Ransom, CFA |

| Ÿ | Michael A. Sansoterra |

| Ÿ | Sandeep Bhatia, PhD, CFA |

INVESTMENT CONCERNS

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments inhigh-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes.

Small- and Mid-capitalization funds typically carry additional risks since smaller companies generally have a higher risk of failure.

Large-capitalization stock can perform differently from other segments of the equity market or the equity market as a whole. Large capitalization companies may be less flexible in evolving markets or unable to implement change as quickly as smaller capitalization companies.

MANAGEMENT DISCUSSION OF FUND PERFORMANCE

How did the Fund perform against its benchmark for the fiscal year ended March 31, 2014?

For the fiscal year ended March 31, 2014, the RidgeWorth Select Large Cap Growth Stock Fund (I Shares) outperformed its benchmark, the Russell 1000® Growth Index, by 75 basis points. The Fund returned 23.97%, while the benchmark returned 23.22%.

For the fiscal year ended March 31, 2014, equities continued their five-year bull market run with strong results. Under this back drop, the Fund’s investment in stocks in the Financials, Health Care, Energy, and Consumer Discretionary sectors performed well. In particular, stock selection remained strong across various industries as 13 different stocks from 5 different major economic sectors each gained more than 35% during the year.

What factors influenced the Fund’s performance for the fiscal year ended March 31, 2014?

Although weather had a negative impact on reported macroeconomic data in the fourth quarter, the general direction of the overall U.S. domestic economic growth remained positive. Investors saw economic activity continue to exceed expectations, highlighted by stronger gains in jobs and industrial production during the year. The steady improvement in the labor market and a modest 2014 budget compromise in Washington were likely key factors prompting the Federal Open Market Committee (“FOMC”) to decide to begin scaling back on securities purchased into 2014. There are still concerns as to the impact regarding potential damage from this shift in Federal Reserve policy. However, when the FOMC delivered the news that tapering will begin in January, stocks soared to record highs, with the S&P 500 Index reaching another new high during the year. More recently, geopolitical risks have arisen, as Russia’s decision to annex Crimea and threaten Ukraine, still looms fresh in the mind of many investors.

As the U.S. economy continued to heal, the Fund’s stocks in the Consumer Discretionary and Health Care sectors were among some of the strongest performers for the year. The Fund’s holdings within the Health Care sector gained 45.49%, while the benchmark’s Health Care stocks rose by 31.10%. Investments within the Biotechnology sector continued to exceed expectations throughout the year. Specifically, Biogen Idec Inc. was up 58.7%, Alexion Pharmaceuticals Inc. was up 65.5%, and Gilead Sciences, Inc. was up 44.3%. All three of these investments’ growth prospects remain strong into 2014. Additionally, Mylan Laboratories Inc., a generic pharmaceutical company, rose 68.5% as their penetration into European markets continued to gain strength while exceeding investor expectations. In the Consumer Discretionary sector, Priceline Group Inc. (online travel), Las Vegas Sands Corp. (gaming), and VF Corp (specialty apparel) also had strong positive price gains.

How do you plan to position the Fund, based on market conditions?

The investment team does not attempt to position the Fund based on predictions of macroeconomic conditions. The Fund’s strategy utilizes a balanced approach to stock selection, which, combined with multi-dimensional risk decomposition tools, allows the portfolio managers to control active risk through portfolio construction. The portfolio managers actively monitor the components of systematic risk, and aim to ensure that most of the risk relative to the index is derived from non-systematic (stock-specific) risk. Sector-rotation and tactical-sector allocations are de-emphasized. The Fund will be relatively sector and characteristic neutral relative to the Russell 1000® Growth Index, as the investment team attempts to generate alpha through bottom-up stock selection. The team believes that its investment strategy is objective, balanced, and designed to enable outperformance in most market cycles.

The Fund will invest in companies with reasonable valuations and improving fundamentals. Generally, the companies invested in will have shown year-over-year increases in operating margins, growth in revenues, and will exhibit improving financial returns as measured by return on incremental invested capital. By combining the income statement, balance sheet, and cash flow metrics to evaluate earnings quality, capital efficiency, and relative valuations, the portfolio managers avoid concentrating on any single attribute. Therefore, the team seeks to eliminate investment results that are directly attributable to market conditions, and add alpha through stock selection.

15

Table of Contents

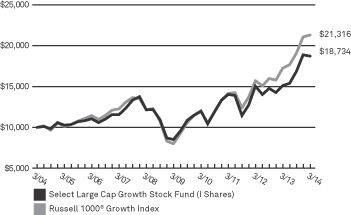

SELECT LARGE CAP GROWTH STOCK FUND

Growth of a $10,000 Investment (as of March 31, 2014)

|

This chart assumes an initial hypothetical investment of $10,000 made on 3/31/04. Total return is based on net change in the Net Asset Value (“NAV”) assuming reinvestment of distributions. Returns shown on this page include reinvestment of all dividends and other distributions.

The Fund’s performance is compared to the Russell 1000® Growth Index, which measures the performance of the large-cap growth segment of the U.S. equity universe. It includes those Russell 1000® companies with higher price-to-book ratios and higher forecasted growth values. The Index is unmanaged and does not reflect the deduction of fees, such as investment and fund accounting fees, associated with a mutual fund. Investors cannot invest directly in an index. |

| Average Annual Total Returns as of 3/31/14 | ||||||||||||||||

| Select Large Cap Growth Stock Fund | 1 Year | 3 Year | 5 Year | 10 Year | ||||||||||||

| A Shares |

without sales charge | 23.58% | 9.80% | 16.78% | 6.16% | |||||||||||

| with sales charge* | 16.48% | 7.66% | 15.40% | 5.54% | ||||||||||||

| C Shares |

without CDSC | 22.72% | 9.03% | 15.94% | 5.42% | |||||||||||

| with CDSC* | 21.72% | 9.03% | 15.94% | 5.42% | ||||||||||||

| I Shares |

23.97% | 10.12% | 17.09% | 6.48% | ||||||||||||

| Russell 1000® Growth Index | 23.22% | 14.62% | 21.68% | 7.86% | ||||||||||||

| Prospectus Expense Ratio1 | Gross | |||||||||||||||

| A Shares | 1.28% | |||||||||||||||

| C Shares | 1.98% | |||||||||||||||

| I Shares | 1.05% | |||||||||||||||

16

Table of Contents

Portfolio Managers

| Ÿ | Christopher Guinther |

| Ÿ | Joe Ransom, CFA |

| Ÿ | Michael A. Sansoterra |

| Ÿ | Sandeep Bhatia, PhD, CFA |

INVESTMENT CONCERNS

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes.

Small-capitalization funds typically carry additional risks since smaller companies generally have a higher risk of failure.

MANAGEMENT DISCUSSION OF FUND PERFORMANCE

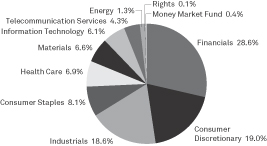

How did the Fund perform against its benchmark for the fiscal year ended March 31, 2014?

For the fiscal year ended March 31, 2014, the RidgeWorth Small Cap Growth Stock Fund I shares returned 25.98%, while the Russell 2000® Growth Index returned 27.19%. The Fund underperformed its benchmark by 121 basis points.

For the fiscal year ended March 31, 2014, equities continued their five-year bull market run with strong results. Under this backdrop, the Fund’s investments in the Financials and Consumer Discretionary sectors did particularly well, while holdings in the Healthcare, Industrials, and Technology sectors lagged the Fund’s benchmark.

What factors influenced the Fund’s performance for the fiscal year ended March 31, 2014?

Although weather had a negative impact on reported macroeconomic data in the fourth quarter of 2013, the general direction of the overall U.S. domestic economic growth remained positive. Investors saw economic activity continue to exceed expectations, highlighted by stronger gains in jobs and industrial production during the year. Steady improvement in the labor market combined with a modest 2014 budget compromise in Washington, were likely key factors prompting the Federal Open Market Committee (“FOMC”) to decide to begin scaling back on securities purchased into 2014. There are still concerns regarding the impact and potential damage from this shift in Federal Reserve (Fed) policy. However, when the FOMC delivered the news that its tapering would begin in January, stocks soared to record highs. The S&P 500 Index reached another new high during the year. More recently, geopolitical risks have risen as Russia’s decision to annex Crimea and threaten Ukraine still looms fresh in the mind of many investors.

As the U.S. economy continued to heal, the Fund’s Financials stocks were among some of the strongest outperformers, gaining 45.55%, while in comparison, the benchmark’s Financials stocks rose by 15.39%. The Fund’s holdings within insurance, debt collection, banking and financial services continued to be especially profitable, adding great value for shareholders. In addition, investments within the Consumer Discretionary sector also enhanced results. These investments included holdings in media/entertainment, fast casual restaurants, automotive, and apparel. A common theme among these investments was the ability of company management to exceed investor expectations with earnings growth above what was anticipated.

One of the Fund’s largest disappointments was an investment in Aruba Networks, a technology company that provides network access solutions for mobile enterprises worldwide. The stock price declined by more than 30% after negatively preannouncing quarterly financial results. Revenue and earnings growth were cut in half, as management sited a material softening in China as well as delayed deployments of projects at service providers within the Americas. The stock has been sold from the Fund.

How do you plan to position the Fund, based on market conditions?

The investment team does not attempt to position the Fund based on predictions of macroeconomic conditions. The Fund utilizes a balanced approach to stock selection, which, combined with multi-dimensional risk decomposition tools, allows the portfolio managers to control active risk through portfolio construction. The portfolio managers actively monitor the components of systematic risk, and aim to ensure that most of the risk relative to the index is derived from non-systematic (stock-specific) risk. Sector rotation and tactical sector allocations are de-emphasized. The Fund will be relatively sector and characteristic neutral relative to the Russell 2000® Growth Index, as the investment team attempts to generate alpha through bottom-up stock selection. The team believes that its investment strategy is objective, balanced, and designed to enable outperformance in most market cycles.

The Fund will continue to invest in companies with reasonable valuations and improving fundamentals. Generally, the companies invested in will have shown year-over-year increases in operating margins, growth in revenues, and exhibit improving financial returns as measured by return on incremental invested capital. By combining the income statement, balance sheet, and cash flow metrics to evaluate earnings quality, capital efficiency, and relative valuations, the portfolio managers avoid concentrating on a single attribute. Therefore, the investment team seeks to eliminate investment results that are directly attributed to market conditions, and add alpha through stock selection.

17

Table of Contents

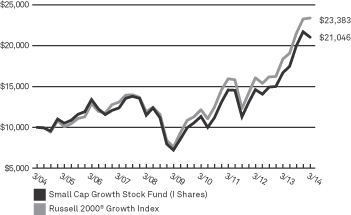

SMALL CAP GROWTH STOCK FUND

Growth of a $10,000 Investment (as of March 31, 2014)

|

This chart assumes an initial hypothetical investment of $10,000 made on 3/31/04. Total return is based on net change in the Net Asset Value (“NAV”) assuming reinvestment of distributions. Returns shown on this page include reinvestment of all dividends and other distributions.

The Fund’s performance is compared to the Russell 2000® Growth Index, which measures the performance of the small-cap growth segment of the U.S. equity universe. It includes those Russell 2000® companies with higher price-to-book ratios and higher forecasted growth values. The Index is unmanaged and does not reflect the deduction of fees, such as investment and fund accounting fees, associated with a mutual fund. Investors cannot invest directly in an index. |

| Average Annual Total Returns as of 3/31/14 | ||||||||||||||||||

| Small Cap Growth Stock Fund | 1 Year | 3 Year | 5 Year | 10 Year | ||||||||||||||

| A Shares |

without sales charge | 25.92% | 12.81% | 23.53% | 7.43% | |||||||||||||

| with sales charge* | 18.70% | 10.60% | 22.08% | 6.80% | ||||||||||||||

| C Shares |

without CDSC | 25.10% | 12.06% | 22.66% | 6.71% | |||||||||||||

| with CDSC* | 24.10% | 12.06% | 22.66% | 6.71% | ||||||||||||||

| I Shares |

25.98% | 12.98% | 23.78% | 7.73% | ||||||||||||||

| Russell 2000® Growth Index | 27.19% | 13.61% | 25.24% | 8.87% | ||||||||||||||

| Prospectus Expense Ratio1 | Gross | |||||||||||||||||

| A Shares | 1.28% | |||||||||||||||||

| C Shares | 1.93% | |||||||||||||||||

| I Shares | 1.29% | |||||||||||||||||

18

Table of Contents

Portfolio Manager

| Ÿ | Brett Barner, CFA |

INVESTMENT CONCERNS

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes.

Small-capitalization funds typically carry additional risks since smaller companies generally have a higher risk of failure.

Value-based investments are subject to the risk that the broad market may not recognize their intrinsic value.

MANAGEMENT DISCUSSION OF FUND PERFORMANCE

How did the Fund perform against its benchmark for the fiscal year ended March 31, 2014?

For the fiscal year ended March 31, 2014, the RidgeWorth Small Cap Value Equity Fund I Shares returned 21.34%, versus 22.65% for the Russell 2000® Value Index.

What factors influenced the Fund’s performance for the fiscal year ended March 31, 2014?

The primary reason for underperformance relative to the index was stock selection in the Consumer Discretionary, Health Care, and Industrials sectors. In the Consumer Discretionary sector, Arcos Dorados Holdings, Inc. underperformed due to weakening foreign exchange dynamics and macroeconomic challenges present in Latin America. Within the Health Care sector, Landauer Inc. detracted from performance as the company missed its earnings expectations, coupled with the rise in costs associated with the launch of new products. Within the Industrials sector, Titan International Inc. negatively contributed to performance as the company dealt with the destocking of inventory and the downturn of coal/agriculture markets.

Positive contributors to performance were stock selection in the Materials and Energy sectors. In the Materials sector, Cabot Corporation outperformed due to a strong rebound in tire shipments and coal generation surprised to the upside. In addition, Carpenter Technology Corporation contributed to results as the aerospace destocking ended, nickel prices rebounded, and there was improvement seen in oil/gas drilling. In the Energy sector, Carbo Ceramics Inc. outperformed as the North American rig count continued to exceed investor expectations. Bristow Group Inc. contributed to returns as the company won a large United Kingdom search-and-rescue contract and increased pricing to customers for the use their fleet of aircraft.

How do you plan to position the Fund, based on market conditions?

During this volatile time, we remain steadfast in executing our bottom-up stock selection process. However, the investment landscape is not without pitfalls, such as the emerging geopolitical risks, the unknown adjustments related to tax/regulatory changes still pending in Congress, and headwinds that may arise during the upcoming mid-term elections. As we have communicated in the past, these macroeconomic distractions can cause investors to pull away from the focus on company fundamentals during a market cycle. Our investment mindset remains the same—that individual company fundamentals are the most important component in stock selection, once the macroeconomic environment normalizes for equity markets. We maintain the view that mid- to late-stage cyclical stocks will drive near-term performance and the Fund is positioned accordingly. As a result, the Fund is overweight the Industrials sector and underweight the Financials and Utilities sectors.

The Fund utilizes a bottom-up investment approach to stock selection, which seeks dividend-paying stocks trading at the lower end of historical trading ranges that display characteristics of financial strength and possess an identifiable catalyst to assist in realizing true value. The Fund does not make active sector allocations but allows the process to define sector weights.

19

Table of Contents

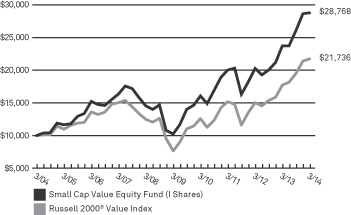

SMALL CAP VALUE EQUITY FUND

Growth of a $10,000 Investment (as of March 31, 2014)

|

This chart assumes an initial hypothetical investment of $10,000 made on 3/31/04. Total return is based on net change in the Net Asset Value (“NAV”) assuming reinvestment of distributions. Returns shown on this page include reinvestment of all dividends and other distributions.

The Fund’s performance is compared to the Russell 2000® Value Index, which measures the performance of the small-cap value segment of the U.S. equity universe. It includes those Russell 2000® companies with lower price-to-book ratios and lower forecasted growth values. The Index is unmanaged and does not reflect the deduction of fees, such as investment and fund accounting fees, associated with a mutual fund. Investors cannot invest directly in an index. |

| Average Annual Total Returns as of 3/31/14 | ||||||||||||||||||

| Small Cap Value Equity Fund | 1 Year | 3 Year | 5 Year | 10 Year | ||||||||||||||

| A Shares |

without sales charge | 20.96% | 12.50% | 22.64% | 10.84% | |||||||||||||

| with sales charge* | 13.98% | 10.31% | 21.19% | 10.18% | ||||||||||||||

| C Shares |

without CDSC | 20.53% | 11.92% | 21.90% | 10.44% | |||||||||||||

| with CDSC* | 19.53% | 11.92% | 21.90% | 10.44% | ||||||||||||||

| I Shares |

21.34% | 12.84% | 23.00% | 11.15% | ||||||||||||||

| Russell 2000® Value Index | 22.65% | 12.74% | 23.33% | 8.07% | ||||||||||||||

| Prospectus Expense Ratio1 | Gross | |||||||||||||||||

| A Shares | 1.53% | |||||||||||||||||

| C Shares | 1.89% | |||||||||||||||||

| I Shares | 1.24% | |||||||||||||||||

20

Table of Contents

AGGRESSIVE GROWTH ALLOCATION STRATEGY

Portfolio Manager

| Ÿ | Alan Gayle |

INVESTMENT CONCERNS

Stocks are more volatile and carry more risk and return potential than other forms of investments. Bonds offer a relatively stable level of income, although bond prices will fluctuate, providing the potential for principal gain or loss. Cash equivalents offer low risk and low return potential.

MANAGEMENT DISCUSSION OF FUND PERFORMANCE

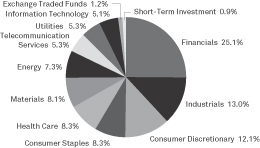

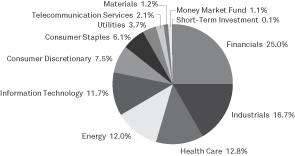

How did the Fund perform against its benchmark for the fiscal year ended March 31, 2014?

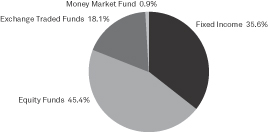

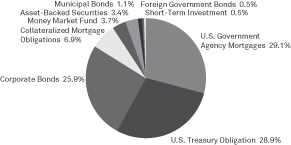

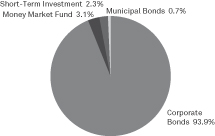

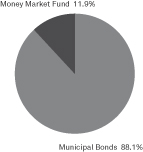

For the fiscal year ended March 31, 2014, the Fund placed in the fifth percentile, returning 18.41% versus 13.76% for its Lipper peer group, while its hybrid benchmark returned 17.23% during the same time period. In the first quarter of 2014, the RidgeWorth Aggressive Growth Allocation Strategy I Shares returned 1.24%, lagging its benchmark (80% S&P 500 Index / 20% Barclay’s U.S. Aggregate Bond Index) which returned 1.85%, and underperformed versus the Lipper Mixed-Asset Target Allocation–Growth Classification, the Fund’s peer group, which returned 1.60%.

What factors influenced the Fund’s performance for the fiscal year ended March 31, 2014?

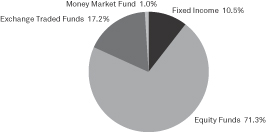

Broadly speaking, the asset allocation decision (equity/fixed/cash) had modest impact for the quarter, as the S&P 500 Index and the Barclays Aggregate Bond Index returns were comparable (1.81% and 1.84%, respectively). However, certain exposures had significant value-adds to performance, including mid cap exposure in the equity space, as well as high-yield, long-duration U.S. Treasury Exchange-Traded Funds (ETF), and exposure to the RidgeWorth Total Return Bond Fund, on the fixed-income side. Modest detractors to relative performance in the equity space included exposure to large-cap, small-cap, international mandates, and alternative securities, while short-term mandates and cash were modest detractors on the fixed income side.

For the trailing one year period, the Fund experienced positive relative total return versus its hybrid benchmark and its Lipper category, due to its asset allocation decision (equity/fixed/cash) and positive style selection (growth, core, value decision, with exposure to large-cap growth) combined with slightly negative relative returns in both the equity and fixed income spaces (manager selection decision).

How do you plan to position the Fund, based on market conditions?

We believe that the equity market has the potential for further improvement as numerous “headwinds” (geo-political flash points), including the Russian annexation of Crimea, continued rattling in Iran and North Korea, a constrained consumer, sub-par global economic growth, unintended impacts of the Affordable Care Act, unknown reforms to the U.S. tax code and other regulations, and a Capital Beltway still in the throes of dysfunction (this time linked to coming mid-term elections), continue to dissipate and 2014 metrics are recalibrated during-and-after the first quarter earnings cycle.

“Tailwinds” that could have a positive impact on the Fund include, additional job gains, incremental consumer balance sheet repair, continued European Union and Japanese recovery, Federal Reserve Chair Janet Yellen assuaging markets that accommodation will remain in place for a “prolonged period,” a percolation of accretive merger and acquisition activity, high free cash flow levels facilitating substantial buybacks, and potential reacceleration of earnings and capital expenditures. However, we would not be surprised to see at least a small amount of consolidation in the short-term, or at least until economic traction becomes more visible. A typical long-term consolidation would be roughly 4 to 5%, but may be short-lived since equity valuations are still attractive versus long-term medians, and fixed income alternatives are just not as favorable as in recent years.

21

Table of Contents

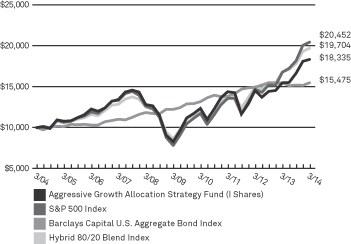

AGGRESSIVE GROWTH ALLOCATION STRATEGY

Growth of a $10,000 Investment (as of March 31, 2014)

|

This chart assumes an initial hypothetical investment of $10,000 made on 3/31/04. Total return is based on net change in the Net Asset Value (“NAV”) assuming reinvestment of distributions. Returns shown on this page include reinvestment of all dividends and other distributions.

Effective September 30, 2012, the benchmark index for the Fund changed from the Standard & Poors 500 Index (“S&P 500 Index”) to the Hybrid 80/20 Blend Index. The Fund’s performance is compared to the Hybrid 80/20 Blend Index.

The S&P 500 Index is widely regarded as a guage of the U.S. equities market. This index includes 500 leading companies in leading industries of the U.S. economy. Although the S&P 500 Index focuses on the large cap segment of the market, with approximately 75% coverage of U.S. equities, it is also an ideal proxy for the total market. The Barclays Capital U.S. Aggregate Bond Index is a measure of the overall performance of the U.S. bond market. These indices are unmanaged and do not reflect the deduction of fees, such as investment and fund accounting fees, associated with a mutual fund. Investors cannot invest directly in an index. |

| Average Annual Total Returns as of 3/31/14 | ||||||||||||||||

| Aggressive Growth Allocation Strategy | 1 Year | 3 Year | 5 Year | 10 Year | ||||||||||||

| A Shares |

without sales charge | 18.11% | 8.03% | 16.80% | 5.94% | |||||||||||

| with sales charge** | 11.34% | 5.92% | 15.41% | 5.32% | ||||||||||||

| C Shares* |

without CDSC | 17.50% | 7.34% | 16.06% | 5.33% | |||||||||||

| with CDSC** | 16.50% | 7.34% | 16.06% | 5.33% | ||||||||||||

| I Shares |

18.41% | 8.34% | 17.17% | 6.25% | ||||||||||||

| Hybrid 80/20 Blend Index (80% of the S&P 500 Index, 20% of the Barclays Capital U.S. Aggregate Bond Index) | 17.23% | 12.55% | 17.91% | 7.02% | ||||||||||||

| S&P 500 Index | 21.86% | 14.66% | 21.16% | 7.42% | ||||||||||||

| Barclays Capital U.S. Aggregate Bond Index | –0.10% | 3.75% | 4.80% | 4.46% | ||||||||||||

| Prospectus Expense Ratio1 | Gross | |||||||||||||||

| A Shares | 1.75% | |||||||||||||||

| C Shares | 2.37% | |||||||||||||||

| I Shares | 1.73% | |||||||||||||||

22

Table of Contents

CONSERVATIVE ALLOCATION STRATEGY

Portfolio Manager

| Ÿ | Alan Gayle |

INVESTMENT CONCERNS

Stocks are more volatile and carry more risk and return potential than other forms of investments. Bonds offer a relatively stable level of income, although bond prices will fluctuate, providing the potential for principal gain or loss. Cash equivalents offer low risk and low return potential.

MANAGEMENT DISCUSSION OF FUND PERFORMANCE

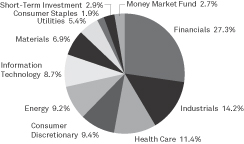

How did the Fund perform against its benchmark for the fiscal year ended March 31, 2014?

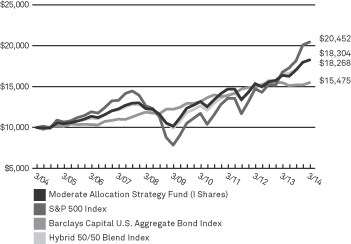

For the fiscal year ended March 31, 2014, the Fund placed it in the 22nd percentile, returning 7.40%, versus 6.18% for its hybrid benchmark, and 5.52% for its Lipper peer group. In the first quarter of 2014, the RidgeWorth Conservative Allocation Strategy I Shares returned 1.86%, slightly behind the 1.88% return for its hybrid benchmark (30% S&P 500 Index/70% Barclays U.S. Aggregate Bond Index) and ahead of the Lipper Mixed-Asset Target Allocation–Conservative Classification, the Fund’s peer group, which returned 1.83%.

What factors influenced the Fund’s performance for the fiscal year ended March 31, 2014?

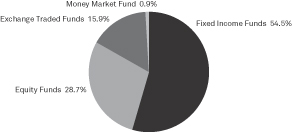

Broadly speaking, the asset allocation decision (equity/fixed/cash) had modest impact for the quarter, as the S&P 500 Index and the Barclays Aggregate Bond Index returns were comparable (1.81% and 1.84%, respectively). However, certain exposures had significant value-adds to performance, including mid cap exposure in the equity space, as well as high-yield, long-duration U.S. Treasury Exchange-Traded Funds (ETF), and exposure to the RidgeWorth Total Return Bond Fund, on the fixed income side. Modest detractors to relative performance in the equity space included exposure to large cap, small-cap, international mandates, and alternative securities, while short-term mandates and cash were modest detractors on the fixed income side.

For the trailing one year period, the Fund experienced positive relative total return versus its hybrid benchmark and its Lipper category, due to its asset allocation decision (equity/fixed/cash) and positive style selection (growth, core, value decision, with exposure to large-cap growth) combined with slightly negative relative returns in both the equity and fixed income spaces (manager selection decision).

How do you plan to position the Fund, based on market conditions?

We believe that the equity market has the potential for further improvement as numerous “headwinds” (geo-political flash points), including the Russian annexation of Crimea, continued rattling in Iran and North Korea, a constrained consumer, sub-par global economic growth, unintended impacts of the Affordable Care Act, unknown reforms to the U.S. tax code and other regulations, and a Capital Beltway still in the throes of dysfunction (this time linked to coming mid-term elections), continue to dissipate and 2014 metrics are recalibrated during-and-after the first quarter earnings cycle.

“Tailwinds” that could have a positive impact on the Fund include, additional job gains, incremental consumer balance sheet repair, continued European Union and Japanese recovery, Federal Reserve Chair Janet Yellen assuaging markets that accommodation will remain in place for a “prolonged period,” a percolation of accretive merger and acquisition activity, high free cash flow levels facilitating substantial buybacks, and potential reacceleration of earnings and capital expenditures. However, we would not be surprised to see at least a small amount of consolidation in the short-term, or at least until economic traction becomes more visible. A typical long-term consolidation would be roughly 4 to 5%, but may be short-lived since equity valuations are still attractive versus long term medians, and fixed income alternatives are just not as favorable as in recent years.

23

Table of Contents

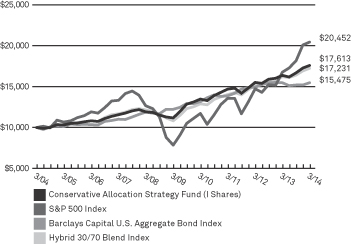

CONSERVATIVE ALLOCATION STRATEGY

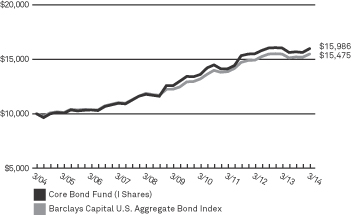

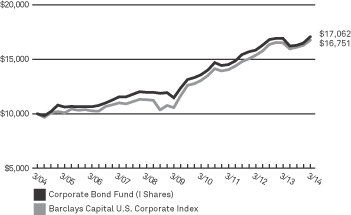

Growth of a $10,000 Investment (as of March 31, 2014)

|

This chart assumes an initial hypothetical investment of $10,000 made on 3/31/04. Total return is based on net change in the Net Asset Value (“NAV”) assuming reinvestment of distributions. Returns shown on this page include reinvestment of all dividends and other distributions.

The Fund’s performance is compared to the Hybrid 30/70 Blend Index. The Standard & Poors 500 Index (“S&P 500 Index”) is widely regarded as a guage of the U.S. equities market. This index includes 500 leading companies in leading industries of the U.S. economy. Although the S&P 500 Index focuses on the large cap segment of the market, with approximately 75% coverage of U.S. equities, it is also an ideal proxy for the total market. The Barclays Capital U.S. Aggregate Bond Index is a measure of the overall performance of the U.S. bond market. These indices are unmanaged and do not reflect the deduction of fees, such as investment and fund accounting fees, associated with a mutual fund. Investors cannot invest directly in an index. |

| Average Annual Total Returns as of 3/31/14 | ||||||||||||||||

| Conservative Allocation Strategy | 1 Year | 3 Year | 5 Year | 10 Year | ||||||||||||

| A Shares |

without sales charge | 7.14% | 5.91% | 9.21% | 5.51% | |||||||||||

| with sales charge** | 2.09% | 4.21% | 8.15% | 5.00% | ||||||||||||

| C Shares* |

without CDSC | 6.29% | 5.14% | 8.42% | 4.90% | |||||||||||

| with CDSC** | 5.29% | 5.14% | 8.42% | 4.90% | ||||||||||||

| I Shares |

7.40% | 6.18% | 9.51% | 5.82% | ||||||||||||

| Hybrid 30/70 Blend Index (30% of the S&P 500 Index, 70% of the Barclays Capital U.S. Aggregate Bond Index) | 6.18% | 7.11% | 9.73% | 5.59% | ||||||||||||

| S&P 500 Index | 21.86% | 14.66% | 21.16% | 7.42% | ||||||||||||

| Barclays Capital U.S. Aggregate Bond Index | -0.10% | 3.75% | 4.80% | 4.46% | ||||||||||||

| Prospectus Expense Ratio1 | Gross | |||||||||||||||

| A Shares | 1.25% | |||||||||||||||

| C Shares | 1.90% | |||||||||||||||

| I Shares | 0.96% | |||||||||||||||

24

Table of Contents

Portfolio Manager

| Ÿ | Alan Gayle |

INVESTMENT CONCERNS

Stocks are more volatile and carry more risk and return potential than other forms of investments. Bonds offer a relatively stable level of income, although bond prices will fluctuate, providing the potential for principal gain or loss. Cash equivalents offer low risk and low return potential.

MANAGEMENT DISCUSSION OF FUND PERFORMANCE

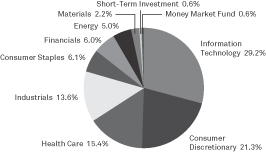

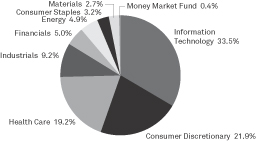

How did the Fund perform against its benchmark for the fiscal year ended March 31, 2014?

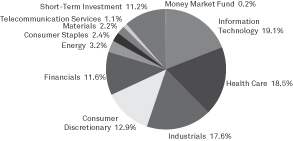

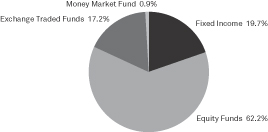

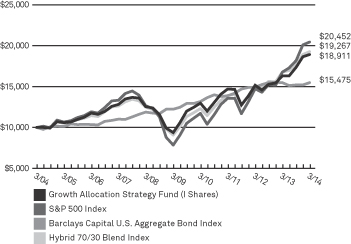

For the fiscal year ended March 31, 2014, the Fund placed in the 20th percentile, returning 15.96%, versus 13.76% for its Lipper peer group, while its hybrid benchmark returned 14.96% during the same period. In the first quarter of 2014, the RidgeWorth Growth Allocation Strategy I Shares returned 1.34%, lagging its benchmark (70% S&P 500 Index / 30% Barclays US Aggregate Bond Index) which returned 1.86%, and underperformed versus the Lipper Mixed-Asset Target Allocation–Growth Classification, the Fund’s peer group, which returned 1.60%.