UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-06557

RidgeWorth Funds

(Exact name of registrant as specified in charter)

RidgeWorth Capital Management, Inc.

3333 Piedmont Road NE, Suite 1500

Atlanta, GA 30305

(Address of principal executive offices)(Zip code)

| (Name and Address of Agent for Service) | Copy to: | |

| Julia Short RidgeWorth Funds 3333 Piedmont Road NE, Suite 1500 Atlanta, GA 30305 |

Thomas Harman, Esq. Bingham McCutchen LLP 2020 K Street, NW Washington, DC 20006 |

Registrant’s telephone number, including area code: 1-888-784-3863

Date of fiscal year end: March 31

Date of reporting period: March 31, 2013

| Item 1. | Reports to Shareholders. |

Collective Strength. Individual Insight.®

2013 ANNUAL REPORT

EQUITY FUNDS

MARCH 31, 2013

RidgeWorth Investments® is the trade name of RidgeWorth Capital Management, Inc.

Collective Strength. Individual Insight.® is a federally registered service mark of RidgeWorth Investments.®

TABLE OF CONTENTS

RIDGEWORTH FUNDS March 31, 2013

RIDGEWORTH FUNDS March 31, 2013

Dear Valued Client,

We are pleased to report that both the economy and the broader markets continued to recover over the past year, despite persistent global economic and financial challenges. We are also pleased to report that RidgeWorth Funds maintained its strong long-term investment performance record. This update will discuss recent events and identify what we anticipate for both the broad economy and the capital markets in 2013.

Before we begin, we want to thank you, our valued RidgeWorth Funds’ shareholders, for your continued business and support. We focus all of our efforts on helping you achieve your investment goals, and we are grateful that you have placed your confidence in us. Our sole mission is to earn your trust through providing competitive investment performance and excellent client service. We sincerely hope we have met your expectations in both of these measures and we look forward to continuing as your asset manager in the future.

In last year’s letter, we discussed why we remained positive regarding our outlook for the economy and the markets: improving job growth, a continued recovery in housing, low interest rates, accommodative global monetary policy, and reasonable equity valuations. However, we cautioned that many of the challenges that affected the markets over the past several years would likely remain, including fiscal and financial strains in the European Union (“EU”), persistent unemployment, volatile energy prices, and record federal deficits. We also added to that list the growing political dysfunction in Washington and the potential damage that could result from going over the “fiscal cliff.” We suggested that the net effect of these forces would likely be continued, but slower than normal growth, and that this would persuade the Federal Reserve (“Fed”) to maintain its low interest rate policy.

Indeed, the economy experienced a soft growth patch at the beginning of the latest fiscal year that ended March 31, 2013. This sluggishness countered much of the unexpected strength early in 2012, and prompted many analysts to lower growth and earnings forecasts. While growth slowed noticeably, we believe it is important to note that employers did not use the environment to initiate a new round of corporate restructuring and effect widespread layoffs. Instead, they continued to leverage the improved efficiencies won during the painful recession and maintained cyclically solid profit margins, an important sign of stability. Moreover, underneath the surface strains in the economy, the consumer showed steady improvement as shown in increased auto purchases, higher home sales and prices, and falling loan delinquency rates. The steady, though only modest, growth in employment and incomes along with improving home values allowed the consumer to continue rebuilding his battered balance sheet and confidence.

While the consumer and business segments of the economy continue to recover, the federal government struggled with record budget deficits and unsustainable long-term spending commitments. The fiscal cliff battles resulted in higher payroll and income tax rates at the beginning of 2013, while efforts to reach a long-range budget compromise only resulted in a painful sequester fallback agreement that began on March 1, 2013. The effects on the economy of both of these events are only just beginning.

Against the generally improving domestic economic backdrop, the rest of the global economy experienced some weakness as shown in the recession in the EU and deceleration in the emerging market economies such as China and Brazil. With global economic growth still soft by historic standards, financial strains remained a key focus for central banks, and policy makers around the globe are feeling pressure to contain and alleviate the mounting stress. The banking failure in the tiny island nation of Cyprus in March 2013 reinforced the notion that the work to restore economic and financial stability is not over.

Despite worrisome events, strains, and crosswinds, both here and overseas, U.S. equity markets generated healthy returns and finished at record highs on the last day of March 2013. The benchmark S&P 500 Index returned just under 14% (13.96%) including dividends for the twelve months ended March 31, 2013, which was above the long-term average annual gain. The Russell Mid-Cap and the Russell 2000 (small cap) indices rose an even more impressive 17.30% and 16.30%, respectively. Defensive sectors such as Health Care, Consumer Staples, and Telecommunications outperformed during the 12 months, and the Value style bested the Growth style following an extended period of underperformance. Markets outside the U.S. improved but lagged domestic indices, with the MSCI EAFE and MSCI Emerging Markets indices up 11.27% and 1.96%, respectively.

Fixed income markets also shared in the advance during the past year, helped by the Fed’s decision to continue buying securities and from the global turmoil, supporting the belief that the U.S. Treasury market is the safest haven in the world. However, with Treasury yields hovering near record low levels, many investors preferred higher-yielding corporate and high yield bonds, which significantly outperformed the 3.77% gain in the Barclays Capital U.S. Aggregate Bond Index.

1

LETTER TO SHAREHOLDERS (concluded)

RIDGEWORTH FUNDS March 31, 2013

RidgeWorth Funds continued to maintain its record of strong long-term performance as 75% of our Funds beat their Lipper Peer Group medians for the 5-year period ended March 31, 20131. In addition, 75% of our Funds finished in the first or second quartile for the 10-year period1.

Looking ahead domestically, we expect the below-average growth and low inflation that characterized 2012 to continue in 2013, though we believe many of the economic headwinds of recent years, such as excess consumer leverage, may further dissipate. We anticipate modest job gains with less drag from the state and local governments and we believe housing will remain a neutral to positive influence on growth, wealth, and confidence. Corporate balance sheets are strong, cash positions are substantial, and inventories do not appear bloated, suggesting limited downside risk. Globally, we expect continued accommodative monetary policies and low interest rates. Valuations rose in the first quarter but they are still relatively attractive, in historical terms.

All that said, with the economy expanding the risks of setbacks should not be minimized. Key metrics we are following, in addition to those mentioned above, remain job growth, political, fiscal and monetary policy, EU stability efforts, income growth, housing prices, transportation data, stability in operating and net margins, consensus earnings, and cash flow estimates.

We believe the markets will continue to offer opportunities to investors, but they will be more selective and company-specific, an environment that fits well with RidgeWorth’s bottom-up approach to security selection. We at RidgeWorth wish to again thank you for the trust and confidence you have placed in us, and we look forward to another good year together.

Sincerely,

Ashi Parikh

Chairman, CEO, CIO

RidgeWorth Investments®

| 1 | For the period ended March 31, 2013, 50% (16/32), 56% (18/32), 75% (24/32) and 75% (21/28) of the RidgeWorth Funds (I Shares) beat their Lipper peer group medians for the 1-, 3-, 5- and 10-year periods, respectively. The Lipper rankings are as of March 31, 2013, for I Shares only, based on total returns and do not reflect a sales charge. ©2013 Lipper Leader, Reuters. All Rights Reserved. Lipper Ratings are according to Lipper, a Thomson Reuters Company. Past performance is not indicative of future results. |

2

Portfolio Managers

| Ÿ | Nancy Zevenbergen, CFA, CIC |

| Ÿ | Brooke de Boutray, CFA, CIC |

| Ÿ | Leslie Tubbs, CFA, CIC |

INVESTMENT CONCERNS

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes. Common stocks, and funds investing in common stocks, generally provide greater return potential when compared with other types of investments.

Small- and Mid-capitalization funds typically carry additional risks since smaller companies generally have a higher risk of failure.

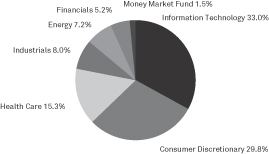

MANAGEMENT DISCUSSIONOF FUND PERFORMANCE

How did the Fund perform against its benchmark for the fiscal year ended March 31, 2013?

With fiscal cliff and sequester headwinds addressed in a relatively undisruptive manner, equity markets were free to run in first quarter 2013, but the preceding nine months were difficult for active managers to deliver alpha in the face of consistently high equity correlations. Though growth strategies advanced, value was clearly favored for the entire year. Early Fund underperformance (primarily May 2012) was unable to be made up over the balance of the year (despite a rebound in first quarter 2013), and the RidgeWorth Aggressive Growth Stock Fund I Shares underperformed the Russell 3000® Growth Index (the Fund’s benchmark), 1.84% versus 10.42% for the fiscal year.

What factors influenced the Fund’s performance for the fiscal year ended March 31, 2013?

Stock selection within Technology and Health Care accounted for nearly 75% of relative underperformance for the period.

Shares of specific Information Technology holdings such as VeriFone Systems, Inc., a secure electronic payment solutions company and F5 Networks, Inc., a network-application delivery equipment company remained dis-favored by investors who believed the capex/investment cycle would further pressure hardware average selling prices and erode competitive advantages. Though equipment prices were not affected, both companies experienced delayed order development due to macro concerns. In conjunction with VeriFone’s reduced forward guidance and unexpected executive management changes, the position was sold during first quarter 2013.

Fund Health Care holding, MAKO Surgical was buffeted by lower than expected system sales and procedures. Management changes, sales compensation adjustments and continued lukewarm adoption of the RIO® system, a robotic arm technology for hip procedures, led us to use the position as a source of funds towards the purchase of other Health Care holdings that added value over the fiscal year.

Financials was the only sector to post annual relative outperformance. Portfolio Recovery Associates, Inc. (outsourced receivables management) reported four sequential quarters of revenue and earnings that exceeded expectations in testament to the company’s ability to recover “uncollectable” assets.

Though Consumer Discretionary holdings experienced modest relative underperformance, the Fund’s top two aggregate contributors hailed from the sector. Netflix, Inc. capped a turbulent year with shares gaining more than 64% for the period. Continued improvements to programming and user experience are driving higher retention and subscriber growth for domestic video streaming. Amazon.com, Inc. continues to benefit from online purchasing experience and demand for digital content. Aggressive investments and innovation by the company make it a disruptor in retail, cloud services, mobile devices, media and digital content. Rapidly growing smartphone and tablet users (proven to have higher propensity to spend online) should also provide a tailwind to revenues.

How do you plan to position the Fund, based on market conditions?

Despite four straight years of significant equity market returns, U.S. stocks still present an appealing risk-reward proposition for the years ahead. A broad-based push to reduce risk and volatility through over diversification provides more reason to believe in individual equity opportunities than any time in recent memory. Volatility creates opportunity. Valuations become extremely distorted when negativity rules. Embracing risk has allowed us to be opportunistic, tune out the noise during difficult environments and take a long-term ownership perspective. Stock specific risk is the lowest it’s been in the last 25 years, which alone could lead to fundamentally based stock selection as a winning strategy in coming years.

3

AGGRESSIVE GROWTH STOCK FUND

Growth of a $10,000 Investment (as of March 31, 2013)

|

This chart assumes an initial hypothetical investment of $10,000 made on 2/23/04 (the inception date). Total return is based on net change in the Net Asset Value (“NAV”) assuming reinvestment of distributions. Returns shown on this page include reinvestment of all dividends and other distributions.

The Fund’s performance is compared to the Russell 3000® Growth Index, which measures the performance of the broad growth segment of the U.S. equity universe. It includes those Russell 3000® companies with higher price-to-book ratios and higher forecasted growth values. The Index is unmanaged and does not reflect the deduction of fees, such as investment and fund accounting fees, associated with a mutual fund. Investors cannot invest directly in an index. |

| Average Annual Total Returns as of 3/31/13 | ||||||||||||||||||||

| Aggressive Growth Stock Fund | Inception Date |

1 Year | 3 Year | 5 Year | Since Inception |

|||||||||||||||

| A Shares |

without sales charge | 2/23/2004 | 1.63% | 7.76% | 6.48% | 5.81% | ||||||||||||||

| with sales charge* | –4.22% | 5.66% | 5.23% | 5.13% | ||||||||||||||||

| I Shares |

2/23/2004 | 1.84% | 8.07% | 6.78% | 6.13% | |||||||||||||||

| Russell 3000® Growth Index | 10.42% | 13.19% | 7.44% | 6.08% | ** | |||||||||||||||

| Prospectus Expense Ratio1 | Gross | |||||||||||||||||||

| A Shares | 1.41% | |||||||||||||||||||

| I Shares | 1.03% | |||||||||||||||||||

4

Portfolio Manager

| Ÿ | Chad Deakins, CFA |

INVESTMENT CONCERNS

International investing involves increased risk and volatility due to interest rate, currency exchange rate, economic, and political risks.

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes.

MANAGEMENT DISCUSSION OF FUND PERFORMANCE

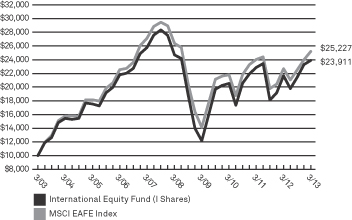

How did the Fund perform against its benchmark for the fiscal year ended March 31, 2013?

The MSCI EAFE Index (the Fund’s benchmark) had an 11.27% net return for the one-year period ended March 31, 2013. The Belgian market led other international markets with a return of 27.69%. New Zealand, Australia and Switzerland followed with returns of 22.71%, 22.20% and 21.65% respectively. Italy and Israel lagged other markets with negative returns for the year, -6.81% and -6.09% respectively. MSCI EAFE Growth stocks led versus MSCI EAFE Value stocks marginally. Large caps beat small caps and developed markets led emerging markets.

The RidgeWorth International Equity Fund I Shares returned 10.38% for the fiscal year ended March 31, 2013.

What factors influenced the fund’s performance for the fiscal year ended March 31, 2013?

The Fund’s attention to the business cycle, strategic allocation and risk control resulted in an uneven outcome this year as the global economic recovery, while intact, softened. The Fund maintained an overweighting in cyclical sectors with the belief that the global economic recovery will continue. The global equity markets continue to rise. However, the defensive sectors such as Health Care and Consumer Staples led other sectors with returns of 26.24% and 20.96%, respectively.

How do you plan to position the Fund, based on market conditions?

As the global economic expansion matures, it remains clear that economic and fiscal health varies from country to country. While such an incident as a banking crisis in Cyprus could still emerge, central banks around the world have shown the resolve that they will act in a crisis and stimulate the economy in weakness. Global equity markets have priced in some positive trends in the global economy as markets are trading close to historic averages in terms of valuations. We are selective and await the earnings momentum improvements, which should support market trends while keeping valuations in check.

5

INTERNATIONAL EQUITY FUND

Growth of a $10,000 Investment (as of March 31, 2013)

|

This chart assumes an initial hypothetical investment of $10,000 made on 3/31/03. Total return is based on net change in the Net Asset Value (“NAV”) assuming reinvestment of distributions. Returns shown on this page include reinvestment of all dividends and other distributions.

The Fund’s performance is compared to the Morgan Stanley Capital International Europe, Australasia and Far East (“MSCI EAFE”) Index, which is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the U.S. & Canada. The MSCI EAFE Index consists of 21 developed market country indices. EAFE performance data is calculated in U.S. dollars and in local currency. The Index is unmanaged and does not reflect the deduction of fees, such as investment and fund accounting fees, associated with a mutual fund. Investors cannot invest directly in an index. |

| Average Annual Total Returns as of 3/31/13 | ||||||||||||||||

| International Equity Fund | 1 Year | 3 Year | 5 Year | 10 Year | ||||||||||||

| A Shares |

without sales charge | 9.95% | 4.87% | –0.96% | 8.76% | |||||||||||

| with sales charge* | 3.62% | 2.81% | –2.12% | 8.11% | ||||||||||||

| I Shares |

10.38% | 5.19% | –0.64% | 9.11% | ||||||||||||

| MSCI EAFE Index | 11.27% | 5.01% | –0.88% | 9.70% | ||||||||||||

| Prospectus Expense Ratio1 | Gross | |||||||||||||||

| A Shares | 1.40% | |||||||||||||||

| I Shares | 1.07% | |||||||||||||||

6

INTERNATIONAL EQUITY INDEX FUND

Portfolio Managers

| Ÿ | Chad Deakins, CFA |

INVESTMENT CONCERNS

International investing involves increased risk and volatility due to interest rate, currency exchange rate, economic, and political risks.

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes.

Small- and Mid-capitalization funds typically carry additional risks since smaller companies generally have a higher risk of failure.

It is important to remember that there are risks associated with index investing, including the potential risk of market decline, as well as the risks associated with investing in specific companies.

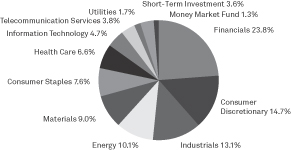

MANAGEMENT DISCUSSIONOF FUND PERFORMANCE

How did the Fund perform against its benchmark for the fiscal year ended March 31, 2013?

The MSCI EAFE GDP Weighted Index Net Dividend (the Fund’s benchmark) had a 9.40% net return for the one-year period ended March 31, 2013. The Belgian market led other international markets with a return of 27.69%. New Zealand, Australia and Switzerland followed with returns of 22.71%, 22.20% and 21.65%, respectively. Italy and Israel lagged other markets with negative returns for the year, -6.81% and -6.09%, respectively. MSCI EAFE Growth stocks led versus MSCI EAFE Value stocks marginally. Large caps beat small caps and developed markets led emerging markets.

The RidgeWorth International Equity Index Fund I Shares returned 8.62 % for the fiscal year ended March 31, 2013.

What factors influenced the fund’s performance for the fiscal year ended March 31, 2013?

The Fund’s stratified sampling methodology and efficient management of cash flows allowed the Fund to perform as expected, in line with the index on a gross performance basis. The underperformance relative to the benchmark is a result of expenses incurred by the Fund.

How do you plan to position the Fund, based on market conditions?

As the global economic expansion matures, it remains clear that economic and fiscal health varies from country to country. While such an incident as a banking crisis in Cyprus could still emerge, central banks around the world have shown the resolve that they will act in a crisis and stimulate the economy in weakness. Global equity markets have priced in some positive trends in the global economy as markets are trading close to historic averages in terms of valuations. We await the earnings momentum improvements, which should support market trends while keeping valuations in check.

7

INTERNATIONAL EQUITY INDEX FUND

Growth of a $10,000 Investment (as of March 31, 2013)

|

This chart assumes an initial hypothetical investment of $10,000 made on 3/31/03. Total return is based on net change in the Net Asset Value (“NAV”) assuming reinvestment of distributions. Returns shown on this page include reinvestment of all dividends and other distributions.

The Fund’s performance is compared to the Morgan Stanley Europe Australasia and Far East (“MSCI EAFE”) GDP Weighted Index Net Dividend, which is a market capitalization index that measures market equity performance based upon indices from foreign and developed countries. The country weighting of the Index is calculated using the gross domestic product of each of the various countries and then with respect of the market capitalization of the various companies operating in each country. The Index is unmanaged and does not reflect the deduction of fees, such as investment and fund accounting fees, associated with a mutual fund. Investors cannot invest directly in an index. |

| Average Annual Total Returns as of 3/31/13 | ||||||||||||||||

| International Equity Index Fund | 1 Year | 3 Year | 5 Year | 10 Year | ||||||||||||

| A Shares |

without sales charge | 8.33% | 2.10% | –3.74% | 8.17% | |||||||||||

| with sales charge* | 2.08% | 0.10% | –4.87% | 7.54% | ||||||||||||

| I Shares |

8.62% | 2.40% | –3.45% | 8.53% | ||||||||||||

| MSCI EAFE GDP Weighted Index Net Dividend | 9.40% | 2.88% | –3.11% | 9.20% | ||||||||||||

| Prospectus Expense Ratio1 | Gross | |||||||||||||||

| A Shares | 1.04% | |||||||||||||||

| I Shares | 0.78% | |||||||||||||||

8

Portfolio Managers

| Ÿ | Christopher Guinther |

| Ÿ | Joe Ransom, CFA |

| Ÿ | Michael A. Sansoterra |

| Ÿ | Sandeep Bhatia, PhD, CFA |

INVESTMENT CONCERNS

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes. Common stocks, and funds investing in common stocks, generally provide greater return potential when compared with other types of investments.

Small- and Mid-capitalization funds typically carry additional risks since smaller companies generally have a higher risk of failure.

Large cap stock can perform differently from other segments of the equity market or the equity market as a whole. Large capitalization companies may be less flexible in evolving markets or unable to implement change as quickly as smaller capitalization companies.

MANAGEMENT DISCUSSION OF FUND PERFORMANCE

How did the Fund perform against its benchmark for the fiscal year ended March 31, 2013?

For the fiscal year ended March 31, 2013, the RidgeWorth Large Cap Growth Stock Fund I Shares returned 3.64% while the Russell 1000® Growth Index (“benchmark”) returned 10.09%. The Fund underperformed the benchmark for the fiscal year as the defensive sectors of the benchmark performed well. Three of the Fund’s economic sectors lagged the returns for their comparable sectors within the Russell 1000® Growth Index—Health Care, Consumer Staples and Consumer Discretionary. The bright spot for the last 12 months was good stock selection within the Industrials sector.

What factors influenced the Fund’s performance for the fiscal year ended March 31, 2013?

The S&P 500 Index reached an all-time new high on the final trading day of March, while the Russell 1000® Growth Index broke out to the upside earlier during the fiscal year. Better than expected economic news coupled with reasonable valuations, steady job growth, rising home prices, monetary stimulus and improving global economic momentum propelled the market to a new high. While the new record for the market is good news, the power behind the move came mostly from the defensive sectors of the market—Health Care, Utilities and Consumer Staples. The pro-cyclical sectors dramatically lagged the broader market giving further evidence that investors are still nervous and climbing “the wall of worry”.

Problematic stock selection within the Consumer area of the market hampered short term results. Monster Beverage Corp., a Consumer Staples company selling energy drinks, declined in a rising market due to the product’s safety concerns and worries over slowing growth. Investors have been punishing the stock since the company reported disappointing earnings in November 2012. Green Mountain Coffee Roasters Inc., another Consumer Staples holding, also declined after reporting weaker than expected sales and earnings. Within the Consumer Discretionary sector, Coach Inc., a designer, marketer and distributor of handbags and accessories has been losing market share to a new competitor. Investors punished the stock fearing that the future growth will be less than expected. Several of the Fund’s Health Care holdings also lost value. Intuitive Surgical Inc., a robotic surgical systems company, declined by more than 10% as the company made cautionary remarks about the European Union’s macroeconomic weakness negatively impacting European procedure growth. In addition, several biotechnology stocks within the benchmark that were not owned in the Fund rallied causing additional relative underperformance.

How do you plan to position the Fund, based on market conditions?

The portfolio management team does not attempt to position the Fund based on predictions of macroeconomic conditions. The strategy utilizes a balanced approach to stock selection. This balanced approach, combined with multi-dimensional risk decomposition tools, allows the portfolio managers to control active risk through portfolio construction. The portfolio managers actively monitor the components of the systematic risk and aim to ensure that most of the risk relative to the index is derived from non-systematic (stock specific) risk. Sector rotation and tactical sector allocations are generally not utilized. The portfolio will be relatively sector and characteristic neutral to the index as the investment team attempts to generate alpha through superior, bottom-up stock selection. The team believes that its investment strategy is objective, balanced and designed to enable outperformance in most market cycles.

9

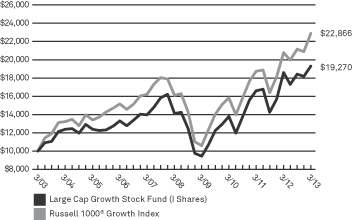

LARGE CAP GROWTH STOCK FUND

The Fund will invest in companies with reasonable valuations and improving fundamentals. Generally, the companies invested in will have shown year-over- year increases in operating margins, growth in revenues and exhibit improving financial returns as measured by return on incremental invested capital. By combining the income statement, balance sheet and cash flow metrics to evaluate earnings quality, capital efficiency and relative valuations, the portfolio managers avoid concentrating on a single attribute. Therefore, the team seeks to eliminate investment results that are directly attributed to market conditions and add alpha through stock selection.

Growth of a $10,000 Investment (as of March 31, 2013)

|

This chart assumes an initial hypothetical investment of $10,000 made on 3/31/03. Total return is based on net change in the Net Asset Value (“NAV”) assuming reinvestment of distributions. Returns shown on this page include reinvestment of all dividends and other distributions.

The Fund’s performance is compared to the Russell 1000® Growth Index, which measures the performance of the large-cap growth segment of the U.S. equity universe. It includes those Russell 1000® companies with higher price-to-book ratios and higher forecasted growth values. The Index is unmanaged and does not reflect the deduction of fees, such as investment and fund accounting fees, associated with a mutual fund. Investors cannot invest directly in an index. |

| Average Annual Total Returns as of 3/31/13 | ||||||||||||||||

| Large Cap Growth Stock Fund | 1 Year | 3 Year | 5 Year | 10 Year | ||||||||||||

| A Shares |

without sales charge | 3.43% | 11.56% | 6.17% | 6.37% | |||||||||||

| with sales charge* | –2.52% | 9.39% | 4.91% | 5.75% | ||||||||||||

| C Shares |

without CDSC | 2.69% | 10.81% | 5.44% | 5.70% | |||||||||||

| with CDSC* | 2.15% | 10.81% | 5.44% | 5.70% | ||||||||||||

| I Shares |

3.64% | 11.87% | 6.47% | 6.78% | ||||||||||||

| Russell 1000® Growth Index | 10.09% | 13.06% | 7.30% | 8.62% | ||||||||||||

| Prospectus Expense Ratio1 | Gross | |||||||||||||||

| A Shares | 1.22% | |||||||||||||||

| C Shares | 1.80% | |||||||||||||||

| I Shares | 0.83% | |||||||||||||||

10

Portfolio Manager

| Ÿ | Mills Riddick, CFA |

INVESTMENT CONCERNS

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes.

Value-based investments are subject to the risk that the broad market may not recognize their intrinsic value.

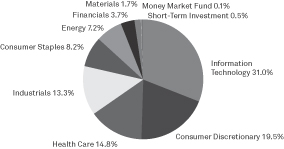

MANAGEMENT DISCUSSION OF FUND PERFORMANCE

How did the Fund perform against its benchmark for the fiscal year ended March 31, 2013?

For the fiscal year ended March 31, 2013, the RidgeWorth Large Cap Value Equity Fund I Shares returned 16.24% compared to a 18.77% return for the Russell 1000® Value Index (“benchmark”).

What factors influenced the Fund’s performance for the fiscal year ended March 31, 2013?

The primary reasons for underperformance relative to the benchmark was stock selection in the Information Technology, Telecommunication Services and Energy sectors. In Information Technology, Hewlett-Packard Co. detracted from performance owing to worse than expected personal computer sales as Windows 8 was not the catalyst analysts anticipated. In Telecommunication Services, Windstream Corp. detracted from performance following the announcement that the company was discontinuing certain segments of business from its Paetec acquisition. As a result, investors feared that the company would have to cut its dividend, as similar companies had already cut their dividends. This put pressure on the company’s share price, leading to its underperformance. In Energy, Occidental Petroleum Corp. detracted from performance as returns deteriorated due to cost inflation. Management has since initiated a cost reduction plan.

Positive contributors to performance were stock selection and our underweight positions in the Utilities and Financials sectors. Stock selection in the Consumer Staples sector was also a positive contributor to performance. In Utilities, PG&E Corp. outperformed as risks surrounding the San Bruno fire began to dissipate. In Financials, BlackRock Inc. outperformed, beating first quarter earnings expectations and experienced increased asset growth in its active and passive funds. Additionally, BlackRock increased its quarterly dividend and share repurchase program. In Consumer Staples, ConAgra Foods Inc. positively contributed to performance as investor sentiment benefited from (1) the accretive realization of the Ralcorp. acquisition, plus (2) overall packaged food industry dynamics turning favorable given earlier elevated input costs which ultimately declined. Consequently, volumes improved on less pricing being necessary.

How do you plan to position the Fund, based on market conditions?

We believe that rising home prices, strong corporate balance sheets, accommodative fiscal and monetary policies and stabilizing global economic momentum will continue to drive equity markets. We take into account a number of near-term risks which include the perennial Eurozone crisis, rising geopolitical risks, specifically Iran and North Korea, the impact of a stronger dollar on corporate profits and the potential impact inflation may have if/when China’s economic growth accelerates. Defensive sectors have outperformed recently, primarily in the Health Care and Utilities sectors, but we believe mid to late stage cyclical stocks will drive near term performance and our Fund is positioned accordingly. As a result, our Fund is overweight Industrials and underweight the Financials and Utilities sectors.

11

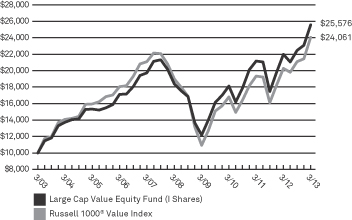

LARGE CAP VALUE EQUITY FUND

Growth of a $10,000 Investment (as of March 31, 2013)

|

This chart assumes an initial hypothetical investment of $10,000 made on 3/31/03. Total return is based on net change in the Net Asset Value (“NAV”) assuming reinvestment of distributions. Returns shown on this page include reinvestment of all dividends and other distributions. The Fund’s performance is compared to the Russell 1000® Value Index, which measures the performance of the large-cap value segment of the U.S. equity universe. It includes those Russell 1000® companies with lower price-to-book ratios and lower expected growth values. The Index is unmanaged and does not reflect the deduction of fees, such as investment and fund accounting fees, associated with a mutual fund. Investors cannot invest directly in an index. |

| Average Annual Total Returns as of 3/31/13 | ||||||||||||||||

| Large Cap Value Equity Fund | 1 Year | 3 Year | 5 Year | 10 Year | ||||||||||||

| A Shares |

without sales charge | 15.93% | 11.80% | 6.56% | 9.50% | |||||||||||

| with sales charge* | 9.23% | 9.62% | 5.31% | 8.85% | ||||||||||||

| C Shares |

without CDSC | 15.25% | 11.05% | 5.82% | 8.74% | |||||||||||

| with CDSC* | 14.25% | 11.05% | 5.82% | 8.74% | ||||||||||||

| I Shares |

16.24% | 12.12% | 6.87% | 9.85% | ||||||||||||

| Russell 1000® Value Index | 18.77% | 12.74% | 4.85% | 9.18% | ||||||||||||

| Prospectus Expense Ratio1 | Gross | |||||||||||||||

| A Shares | 1.40% | |||||||||||||||

| C Shares | 1.73% | |||||||||||||||

| I Shares | 0.89% | |||||||||||||||

12

Portfolio Manager

| Ÿ | Don Wordell, CFA |

INVESTMENT CONCERNS

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes.

Mid-capitalization funds typically carry additional risks since smaller companies generally have a higher risk of failure.

Value-based investments are subject to the risk that the broad market may not recognize their intrinsic value.

MANAGEMENT DISCUSSION OF FUND PERFORMANCE

How did the Fund perform against its benchmark for the fiscal year ended March 31, 2013?

The RidgeWorth Mid-Cap Value Equity Fund I Shares appreciated 19.73% for the fiscal year ended March 31, 2013, underperforming the Russell Midcap® Value Index which returned 21.49% for the period.

What factors influenced the Fund’s performance for the fiscal year ended March 31, 2013?

Relative results during the period lagged due primarily to stock selection in the Materials and Energy sectors. In Materials, Cabot Corp. underperformed due to weak demand and modest pricing erosion in their business that serves the tires end market, as well as lower accretion estimates for their recent acquisition. In Energy, CARBO Ceramics Inc. detracted from performance as a result of declining drilling activity in the second half of 2012 and high inventories of competing products. This led to lower volumes and pricing pressure for their products.

Positive contributors to performance were stock selection in the Financials, Industrials and Utilities sectors. In Financials, Hartford Financial Services Group Inc. outperformed owing to several catalysts occurring in the back half of 2012 as the company sold off non-core business segments in an effort to transition to a group and property/casualty centric insurer. In Industrials, Cummins Inc. outperformed as investors were more optimistic about the Chinese economy and U.S. industrial destocking neared completion. In Utilities, NRG Energy Inc. contributed to performance due to improving sentiment in the stock from the execution of the GenOn acquisition and improvement in forward electricity prices.

How do you plan to position the Fund, based on market conditions?

We believe that rising home prices, strong corporate balance sheets, accommodative fiscal and monetary policies, and stabilizing global economic momentum will continue to drive equity markets. We take into account a number of near-term risks which include the perennial Eurozone crisis, rising geopolitical risks, specifically Iran and North Korea, the impact of a stronger dollar on corporate profits and the potential impact inflation may have if/when China’s economic growth accelerates. Defensive sectors have outperformed recently, primarily in the Health Care and Utilities sectors, but we believe mid to late stage cyclical stocks will drive near-term performance and our Fund is positioned accordingly. As a result, our Fund is overweight Industrials, Materials and Energy and underweight Utilities.

13

MID-CAP VALUE EQUITY FUND

Growth of a $10,000 Investment (as of March 31, 2013)

|

This chart assumes an initial hypothetical investment of $10,000 made on 3/31/03. Total return is based on net change in the Net Asset Value (“NAV”) assuming reinvestment of distributions. Returns shown on this page include reinvestment of all dividends and other distributions.

The Fund’s performance is compared to the Russell Midcap® Value Index, which measures the performance of the mid-cap value segment of the U.S. equity universe. It includes those Russell Midcap Index companies with lower price-to-book ratios and lower forecasted growth values. The Index is unmanaged and does not reflect the deduction of fees, such as investment and fund accounting fees, associated with a mutual fund. Investors cannot invest directly in an index. |

| Average Annual Total Returns as of 3/31/13 | ||||||||||||||||||||||||

| Mid-Cap Value Equity Fund | Inception Date | 1 Year | 3 Year | 5 Year | 10 Year | Since Inception |

||||||||||||||||||

| A Shares |

without sales charge | 10/27/03 | 19.43% | 12.23% | 11.06% | N/A | 11.50% | |||||||||||||||||

| with sales charge* | 12.56% | 10.03% | 9.76% | N/A | 10.80% | |||||||||||||||||||

| C Shares |

without CDSC | 18.75% | 11.49% | 10.33% | 12.86% | N/A | ||||||||||||||||||

| with CDSC* | 17.75% | 11.49% | 10.33% | 12.86% | N/A | |||||||||||||||||||

| I Shares |

19.73% | 12.54% | 11.37% | 13.87% | N/A | |||||||||||||||||||

| Russell Midcap® Value Index | 21.49% | 14.96% | 8.53% | 12.57% | 10.20% | ** | ||||||||||||||||||

| Prospectus Expense Ratio1 | Gross | |||||||||||||||||||||||

| A Shares | 1.45% | |||||||||||||||||||||||

| C Shares | 1.80% | |||||||||||||||||||||||

| I Shares | 1.07% | |||||||||||||||||||||||

14

SELECT LARGE CAP GROWTH STOCK FUND

Portfolio Managers

| Ÿ | Christopher Guinther |

| Ÿ | Joe Ransom, CFA |

| Ÿ | Michael A. Sansoterra |

| Ÿ | Sandeep Bhatia, PhD, CFA |

INVESTMENT CONCERNS

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes.

Small- and Mid-capitalization funds typically carry additional risks since smaller companies generally have a higher risk of failure.

Large cap stock can perform differently from other segments of the equity market or the equity market as a whole. Large capitalization companies may be less flexible in evolving markets or unable to implement change as quickly as smaller capitalization companies.

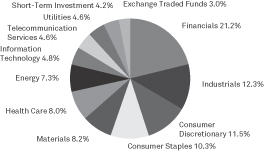

MANAGEMENT DISCUSSION OF FUND PERFORMANCE

How did the Fund perform against its benchmark for the fiscal year ended March 31, 2013?

For the fiscal year ended March 31, 2013 the RidgeWorth Select Large Cap Growth Stock Fund I Shares returned 0.37% while the Russell 1000® Growth Index (“benchmark”) returned 10.09%. The Fund underperformed the benchmark for the fiscal year as the defensive sectors of the benchmark performed well. Three of the Fund’s economic sectors lagged the returns for their comparable sectors within the Russell 1000 Growth Index – Health Care, Consumer Staples and Consumer Discretionary.

What factors influenced the Fund’s performance for the fiscal year ended March 31, 2013?

The S&P 500 Index reached an all-time new high on the final trading day of March, while the Russell 1000® Growth Index broke out to the upside earlier during the fiscal year. Better than expected economic news coupled with reasonable valuations, steady job growth, rising home prices, monetary stimulus and improving global economic momentum propelled the market to a new high. While the new record for the market is good news, the power behind the move came mostly from the defensive sectors of the market – Health Care, Utilities and Consumer Staples. The pro-cyclical sectors dramatically lagged the broader market giving further evidence that investors are still nervous and climbing “the wall of worry”.

Problematic stock selection within the Consumer area of the market hampered short term results. Monster Beverage Corp., a Consumer Staples company selling energy drinks, declined in a rising market due to the product’s safety concerns and worries over slowing growth. Investors have been punishing the stock since the company reported disappointing earnings in November 2012. Mead Johnson Nutrition LLC, another Consumer Staples holding, also declined after Chinese authorities questioned product safety relating to tainted baby formula. The claim was without merit. Within the Consumer Discretionary sector, Coach Inc., a designer, marketer and distributor of handbags and accessories has been losing market share to a new competitor. Investors punished the stock fearing that the future growth will be less than expected. BorgWarner Inc. and Priceline.com Inc., Consumer Discretionary holdings, also declined over the previous 12 months. Several of the Fund’s Health Care holdings also lost value. Intuitive Surgical Inc., a robotic surgical systems company, declined by more than 10% as the company made cautionary remarks about the European Union’s macroeconomic weakness negatively impacting European procedure growth. Agilent Technologies Inc. and Alexion Pharmaceuticals Inc. also negatively impacted relative performance.

How do you plan to position the Fund, based on market conditions?

The portfolio management team does not attempt to position the Fund based on predictions of macroeconomic conditions. The strategy utilizes a balanced approach to stock selection. This balanced approach, combined with multi-dimensional risk decomposition tools allows the portfolio managers to control active risk through portfolio construction. The portfolio managers actively monitor the components of the systematic risk and aim to ensure that most of the risk relative to the index is derived from non-systematic (stock specific) risk. Sector rotation and tactical sector allocations are generally not utilized. The portfolio will be relatively sector and characteristic neutral to the index as the investment team attempts to generate alpha through superior, bottom-up stock selection. The team believes that its investment strategy is objective, balanced and designed to enable outperformance in most market cycles.

15

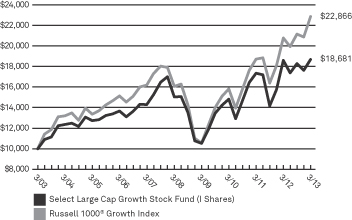

SELECT LARGE CAP GROWTH STOCK FUND

The Fund will invest in companies with reasonable valuations and improving fundamentals. Generally, the companies invested in will have shown year-over- year increases in operating margins, growth in revenues and exhibit improving financial returns as measured by return on incremental invested capital. By combining the income statement, balance sheet and cash flow metrics to evaluate earnings quality, capital efficiency and relative valuations, the portfolio managers avoid concentrating on a single attribute. Therefore, the team seeks to eliminate investment results that are directly attributed to market conditions and add alpha through stock selection.

Growth of a $10,000 Investment (as of March 31, 2013)

|

This chart assumes an initial hypothetical investment of $10,000 made on 3/31/03. Total return is based on net change in the Net Asset Value (“NAV”) assuming reinvestment of distributions. Returns shown on this page include reinvestment of all dividends and other distributions.

The Fund’s performance is compared to the Russell 1000® Growth Index, which measures the performance of the large-cap growth segment of the U.S. equity universe. It includes those Russell 1000® companies with higher price-to-book ratios and higher forecasted growth values. The Index is unmanaged and does not reflect the deduction of fees, such as investment and fund accounting fees, associated with a mutual fund. Investors cannot invest directly in an index. |

| Average Annual Total Returns as of 3/31/13 | ||||||||||||||||

| Select Large Cap Growth Stock Fund | 1 Year | 3 Year | 5 Year | 10 Year | ||||||||||||

| A Shares* |

without sales charge | 0.13% | 7.70% | 4.14% | 6.15% | |||||||||||

| with sales charge** | –5.63% | 5.59% | 2.92% | 5.53% | ||||||||||||

| C Shares |

without CDSC | –0.58% | 6.96% | 3.41% | 5.39% | |||||||||||

| with CDSC** | –1.33% | 6.96% | 3.41% | 5.39% | ||||||||||||

| I Shares |

0.37% | 8.01% | 4.43% | 6.45% | ||||||||||||

| Russell 1000® Growth Index | 10.09% | 13.06% | 7.30% | 8.62% | ||||||||||||

| Prospectus Expense Ratio1 | Gross | |||||||||||||||

| A Shares | 1.23% | |||||||||||||||

| C Shares | 1.91% | |||||||||||||||

| I Shares | 0.96% | |||||||||||||||

16

Portfolio Managers

| Ÿ | Christopher Guinther |

| Ÿ | Joe Ransom, CFA |

| Ÿ | Michael A. Sansoterra |

| Ÿ | Sandeep Bhatia, PhD, CFA |

INVESTMENT CONCERNS

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes.

Small capitalization funds typically carry additional risks since smaller companies generally have a higher risk of failure.

MANAGEMENT DISCUSSION OF FUND PERFORMANCE

How did the Fund perform against its benchmark for the fiscal year ended March 31, 2013?

For the fiscal year ended March 31, 2013 the RidgeWorth Small Cap Growth Stock Fund I Shares returned 14.20% while the Russell 2000® Growth Index (“benchmark”) returned 14.52%. The Fund slightly underperformed the benchmark by 0.32%. The Fund had particularly good stock selection in Health Care, Technology and the Telecommunication sectors relative the Russell 2000® Growth Index.

What factors influenced the Fund’s performance for the fiscal year ended March 31, 2013?

The S&P 500 Index reached an all-time new high on the final trading day of March. Better than expected economic news coupled with reasonable valuations, steady job growth, rising home prices, monetary stimulus and improving global economic momentum propelled the market to a new high. While the new record for the broader market is good news, the power behind the move came in the final quarter and mostly from the defensive sectors of the market—Health Care, Utilities and Staples. The pro-cyclical sectors dramatically lagged giving further evidence that investors are still nervous as the market climbs “the wall of worry”. Additionally, small cap growth stocks continue to rally strongly from their 2008 lows exceeding the broader market as measured by the S&P 500 Index.

Fund investments within cloud based services and high speed internet access companies lead to a positive 55% return within the Telecommunication Services sector, beating the benchmark sector by 44%. In addition, the Fund’s Health Care stocks averaged more than 26% return during the year while the average Health Care stock within the Russell 2000® Growth Index was up nearly 17%. Stock selection was especially strong within the Health Care sector; 16 stocks rose more than 25% during the year. For example, Onyx Pharmaceuticals Inc., a biotechnology company, rose 94% during the year after a Food and Drug Administration panel voted to approve a cancer drug for multiple myeloma. Positions within the medical device and pharmaceutical industries also reported strong operating results which lead to market value appreciation. The Fund also benefited from several Technology holdings which were acquired at very large premiums. For example, the acquisition of Ariba Inc., a cloud based technology company rose more than 35% on the offer.

How do you plan to position the Fund, based on market conditions?

The portfolio management team does not attempt to position the Fund based on predictions of macroeconomic conditions. The strategy utilizes a balanced approach to stock selection. This balanced approach, combined with multi-dimensional risk decomposition tools allows the portfolio managers to control active risk through portfolio construction. The portfolio managers actively monitor the components of the systematic risk and aim to ensure that most of the risk relative to the index is derived from non-systematic (stock specific) risk. Sector rotation and tactical sector allocations are deemphasized. The portfolio will be relatively sector and characteristic neutral relative to the Russell 2000 Growth index as the investment team attempts to generate alpha through bottom-up stock selection. The team believes that its investment strategy is objective, balanced and designed to enable outperformance in most market cycles.

The Fund will invest in companies with reasonable valuations and improving fundamentals. Generally, the companies invested in will have shown year-over- year increases in operating margins, growth in revenues and exhibit improving financial returns as measured by return on incremental invested capital. By combining the income statement, balance sheet and cash flow metrics to evaluate earnings quality, capital efficiency and relative valuations, the portfolio managers avoid concentrating on a single attribute. Therefore, the team seeks to eliminate investment results that are directly attributed to market conditions and add alpha through stock selection.

17

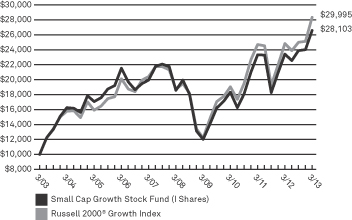

SMALL CAP GROWTH STOCK FUND

Growth of a $10,000 Investment (as of March 31, 2013)

|

This chart assumes an initial hypothetical investment of $10,000 made on 3/31/03. Total return is based on net change in the Net Asset Value (“NAV”) assuming reinvestment of distributions. Returns shown on this page include reinvestment of all dividends and other distributions.

The Fund’s performance is compared to the Russell 2000® Growth Index, which measures the performance of the small-cap growth segment of the U.S. equity universe. It includes those Russell 2000® companies with higher price-to-book ratios and higher forecasted growth values. The Index is unmanaged and does not reflect the deduction of fees, such as investment and fund accounting fees, associated with a mutual fund. Investors cannot invest directly in an index. |

| Average Annual Total Returns as of 3/31/13 | ||||||||||||||||

| Small Cap Growth Stock Fund | 1 Year | 3 Year | 5 Year | 10 Year | ||||||||||||

| A Shares |

without sales charge | 14.07% | 13.60% | 7.46% | 10.55% | |||||||||||

| with sales charge* | 7.49% | 11.37% | 6.19% | 9.90% | ||||||||||||

| C Shares |

without CDSC | 13.30% | 12.80% | 6.73% | 9.81% | |||||||||||

| with CDSC* | 12.45% | 12.80% | 6.73% | 9.81% | ||||||||||||

| I Shares |

14.20% | 13.85% | 7.75% | 10.89% | ||||||||||||

| Russell 2000® Growth Index | 14.52% | 14.75% | 9.04% | 11.61% | ||||||||||||

| Prospectus Expense Ratio1 | Gross | |||||||||||||||

| A Shares | 1.29% | |||||||||||||||

| C Shares | 1.94% | |||||||||||||||

| I Shares | 1.16% | |||||||||||||||

18

Portfolio Manager

| Ÿ | Brett Barner, CFA |

INVESTMENT CONCERNS

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes.

Small capitalization funds typically carry additional risks since smaller companies generally have a higher risk of failure.

Value-based investments are subject to the risk that the broad market may not recognize their intrinsic value.

MANAGEMENT DISCUSSION OF FUND PERFORMANCE

How did the Fund perform against its benchmark for the fiscal year ended March 31, 2013?

For the fiscal year ended March 31, 2013, the RidgeWorth Small Cap Value Equity Fund I Shares returned 17.07% versus 18.09% for the benchmark, the Russell 2000® Value Index.

What factors influenced the Fund’s performance for the fiscal year ended March 31, 2013?

The primary reason for underperformance relative to the index was stock selection in the Materials, Financials and Consumer Discretionary sectors. In Materials, Cabot Corp. underperformed due to weak demand and modest pricing erosion in their business that serves the tires end market, as well as, lower accretion estimates for their recent acquisition. In Financials, Hancock Holding Co. detracted from performance on muted investor enthusiasm after management guided to higher than expected non-interest expenses. In Consumer Discretionary, Guess? Inc. negatively contributed as investor sentiment worsened due to challenges at its North American and European Union businesses.

Positive contributors to performance were stock selection in the Industrials, Information Technology and Health Care sectors. In Industrials, A.O. Smith Corp. outperformed owing to strong residential construction data in the U.S. and high single digit growth in Chinese water heater demand. In Information Technology, Booz Allen Hamilton Holding Corp. outperformed on the announcement of several large one time dividends in the second half of 2012. In Health Care, Teleflex Inc. contributed to performance when new management continued to execute on their plan of increasing pricing and expanding margins.

How do you plan to position the Fund, based on market conditions?

We believe that rising home prices, strong corporate balance sheets, accommodative fiscal and monetary policies, and stabilizing global economic momentum will continue to drive equity markets. We take into account a number of near term risks which include the perennial Eurozone crisis, rising geopolitical risks, specifically Iran and North Korea, the impact of a stronger dollar on corporate profits and the potential impact inflation may have if/when China’s economic growth accelerates. Defensive sectors have outperformed recently, primarily in the Health Care and Utilities sectors, but we believe mid to late stage cyclical stocks will drive near-term performance and our Fund is positioned accordingly. As a result, our Fund is overweight Industrials and underweight the Financials and Utilities sectors.

The Fund utilizes a bottom-up approach to stock selection. The process seeks dividend-paying stocks trading at the lower end of historical trading ranges which display characteristics of financial strength and possess an identifiable catalyst to assist in realizing true value. The Fund does not make active sector allocations but allows the process to define sector weights.

19

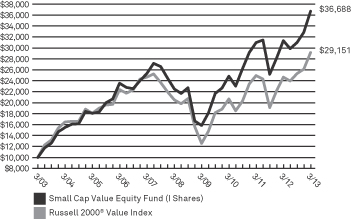

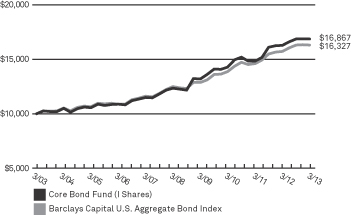

SMALL CAP VALUE EQUITY FUND

Growth of a $10,000 Investment (as of March 31, 2013)

|

This chart assumes an initial hypothetical investment of $10,000 made on 3/31/03. Total return is based on net change in the Net Asset Value (“NAV”) assuming reinvestment of distributions. Returns shown on this page include reinvestment of all dividends and other distributions.

The Fund’s performance is compared to the Russell 2000® Value Index, which measures the performance of the small-cap value segment of the U.S. equity universe. It includes those Russell 2000® companies with lower price-to-book ratios and lower forecasted growth values. The Index is unmanaged and does not reflect the deduction of fees, such as investment and fund accounting fees, associated with a mutual fund. Investors cannot invest directly in an index. |

| Average Annual Total Returns as of 3/31/13 | ||||||||||||||||

| Small Cap Value Equity Fund | 1 Year | 3 Year | 5 Year | 10 Year | ||||||||||||

| A Shares* |

without sales charge | 16.77% | 13.56% | 9.99% | 13.55% | |||||||||||

| with sales charge** | 10.05% | 11.33% | 8.70% | 12.88% | ||||||||||||

| C Shares |

without CDSC | 16.17% | 12.83% | 9.31% | 13.11% | |||||||||||

| with CDSC** | 15.17% | 12.83% | 9.31% | 13.11% | ||||||||||||

| I Shares |

17.07% | 13.87% | 10.31% | 13.88% | ||||||||||||

| Russell 2000® Value Index | 18.09% | 12.12% | 7.29% | 11.29% | ||||||||||||

| Prospectus Expense Ratio1 | Gross | |||||||||||||||

| A Shares | 1.53% | |||||||||||||||

| C Shares | 1.91% | |||||||||||||||

| I Shares | 1.20% | |||||||||||||||

20

AGGRESSIVE GROWTH ALLOCATION STRATEGY

Portfolio Manager

| Ÿ | Alan Gayle |

INVESTMENT CONCERNS

Stocks are more volatile and carry more risk and return potential than other forms of investments. Bonds offer a relatively stable level of income, although bond prices will fluctuate, providing the potential for principal gain or loss. Cash equivalents offer low risk and low return potential.

MANAGEMENT DISCUSSION OF FUND PERFORMANCE

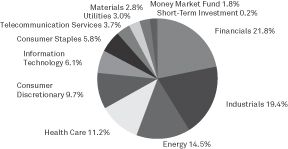

How did the Fund perform against its benchmark for the fiscal year ended March 31, 2013?

The RidgeWorth Aggressive Growth Allocation Strategy I Shares returned 6.45% for the fiscal year ended March 31, 2013, behind the 11.97% return for the hybrid benchmark (80% S&P 500 Index / 20% Barclays Capital U.S. Aggregate Bond Index) and behind the Lipper Mixed-Asset Target Allocation–Growth Classification Index return of 9.96% in the same period, placing it in the 96th percentile.

What factors influenced the Fund’s performance for the fiscal year ended March 31, 2013?

The RidgeWorth Aggressive Growth Allocation Strategy I Shares relative performance benefitted modestly against its benchmark due to its overweight to equities versus its target weighting of 80%, as equities broadly outperformed fixed income mandates in the quarter. It also benefitted from outperformance by several selected RidgeWorth funds, notably large cap and mid cap value funds. Similar to the broader S&P 500 Index, in which Value style mandates outperformed Growth style mandates, the Fund’s exposure to growth securities was a detractor, as were exposures to alternative securities in gold miners and to international markets, which collectively lagged in the quarter. All in, several underlying equity funds lagged the S&P 500 Index, which led to an aggregate lagging performance in the equity space. In the fixed income space, the Fund’s exposure to longer duration, corporate fixed income oriented securities, as well as to the high yield funds, was additive to relative fixed income performance. However, the shorter-duration fixed-income and cash positions lagged the benchmark. Despite some positive relative returns in both the equity and fixed income spaces, the strategy experienced subpar relative total returns versus its hybrid benchmark and its Lipper category.

How do you plan to position the Fund, based on market conditions?

Although the economy is experiencing a quite sluggish 2% to 2.5% growth rate, the broad S&P 500 Index still trades slightly below its 10 and 15 year medians on key valuation metrics. Moreover, given the “Global Fed’s” (Federal Reserve, Bank of China, Bank of Japan, European Central Bank, et al) stimulus, there appears to be increased confidence that the current expansion is relatively sustainable with limited downside risks.

As long as ample accommodation continues, and inflation stays at the low end of the Fed comfort zone, equities have at least a modicum of tailwinds. Equity index valuations were more compelling last year, but vigorous fundamental stock picking and sector rotations should return into vogue.

As a consequence, we believe that when headwinds dissipate and 2013 metrics are recalibrated, the equity market indeed has the potential for further improvement; however, we would not be surprised to see at least a small amount of consolidation in the short run, or at least until economic traction becomes more visible.

21

AGGRESSIVE GROWTH ALLOCATION STRATEGY

Growth of a $10,000 Investment (as of March 31, 2013)

|

This chart assumes an initial hypothetical investment of $10,000 made on 3/31/03. Total return is based on net change in the Net Asset Value (“NAV”) assuming reinvestment of distributions. Returns shown on this page include reinvestment of all dividends and other distributions.

Effective September 30, 2012, the benchmark index for the Fund changed from the Standard & Poors 500 Index (“S&P 500 Index”) to the Hybrid 80/20 Blend Index. The Fund’s performance is compared to the Hybrid 80/20 Blend Index.

The S&P 500 Index is widely regarded as a gauge of the U.S. equities market. This index includes 500 leading companies in leading industries of the U.S. economy. Although the S&P 500 Index focuses on the large cap segment of the market, with approximately 75% coverage of U.S. equities, it is also an ideal proxy for the total market. The Barclays Capital U.S. Aggregate Bond Index is a measure of the overall performance of the U.S. bond market. These indices are unmanaged and do not reflect the deduction of fees, such as investment and fund accounting fees, associated with a mutual fund. Investors cannot invest directly in an index. |

| Average Annual Total Returns as of 3/31/13 | ||||||||||||||||

| Aggressive Growth Allocation Strategy | 1 Year | 3 Year | 5 Year | 10 Year | ||||||||||||

| A Shares* |

without sales charge | 6.30% | 7.53% | 3.49% | 7.54% | |||||||||||

| with sales charge** | 0.24% | 5.43% | 2.27% | 6.91% | ||||||||||||

| C Shares* |

without CDSC | 5.47% | 6.79% | 2.77% | 7.00% | |||||||||||

| with CDSC** | 4.47% | 6.79% | 2.77% | 7.00% | ||||||||||||

| I Shares |

6.45% | 7.83% | 3.80% | 7.85% | ||||||||||||

| Hybrid 80/20 Blend Index (80% of the S&P 500 Index, 20% of the Barclays Capital U.S. Aggregate Bond Index) | 11.97% | 11.44% | 6.05% | 8.02% | ||||||||||||

| S&P 500 Index | 13.96% | 12.67% | 5.81% | 8.53% | ||||||||||||

| Barclays Capital U.S. Aggregate Bond Index | 3.77% | 5.52% | 5.47% | 5.02% | ||||||||||||

| Prospectus Expense Ratio1 | Gross | |||||||||||||||

| A Shares | 1.69% | |||||||||||||||

| C Shares | 2.34% | |||||||||||||||

| I Shares | 1.69% | |||||||||||||||

22

CONSERVATIVE ALLOCATION STRATEGY

Portfolio Manager

| Ÿ | Alan Gayle |

INVESTMENT CONCERNS

Stocks are more volatile and carry more risk and return potential than other forms of investments. Bonds offer a relatively stable level of income, although bond prices will fluctuate, providing the potential for principal gain or loss. Cash equivalents offer low risk and low return potential.

MANAGEMENT DISCUSSION OF FUND PERFORMANCE

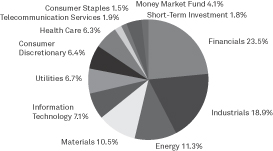

How did the Fund perform against its benchmark for the fiscal year ended March 31, 2013?

The RidgeWorth Conservative Allocation Strategy I Shares returned 5.55% for the fiscal year ended March 31, 2013, behind the 6.88% return for the hybrid benchmark (30% S&P 500 / 70% Barclays Capital U.S. Aggregate Bond Index) and behind the Lipper Mixed-Asset Target Allocation–Conservative Classification return of 7.34% in the same period, placing it in the 84th percentile.

What factors influenced the Fund’s performance for the fiscal year ended March 31, 2013?

The RidgeWorth Conservative Allocation Strategy I Shares relative performance benefitted modestly against its benchmark due to its overweight to equities versus its target weighting of 30%, as equities broadly outperformed fixed income mandates for the year. It also benefitted from outperformance by several selected RidgeWorth funds, notably large cap and mid cap value funds. Similar to the broader S&P 500 Index, in which Value style mandates outperformed Growth style mandates, the Fund’s exposure to growth securities was a detractor, as were exposures to alternative securities in gold miners and to international markets, which collectively lagged in the quarter. All in, several underlying equity funds lagged the S&P 500 Index, which led to an aggregate lagging performance in the equity space. In the fixed income space the Fund’s exposure to longer duration, corporate fixed income oriented securities, as well as to the high yield funds, was additive to relative fixed-income performance. However, the shorter-duration fixed-income and cash positions lagged the benchmark. Despite some positive relative returns in both the equity and fixed income spaces, the strategy experienced subpar relative total returns versus its hybrid benchmark and its Lipper category.

How do you plan to position the Fund, based on market conditions?

Although the economy is experiencing a quite sluggish 2% to 2.5% growth rate, the broad S&P 500 Index still trades slightly below its 10 and 15 year medians on key valuation metrics. Moreover, given the “Global Fed’s” (Federal Reserve, Bank of China, Bank of Japan, European Central Bank, et al) stimulus, there appears to be increased confidence that the current expansion is relatively sustainable with limited downside risks.

As long as ample accommodation continues, and inflation stays at the low-end of the Fed comfort zone, equities have at least a modicum of tailwinds. Equity index valuations were more compelling last year, but vigorous fundamental stock picking and sector rotations should return to vogue.

As a consequence, we believe that when headwinds dissipate and 2013 metrics are recalibrated, the equity market indeed has the potential for further improvement; however, we would not be surprised to see at least a small amount of consolidation in the short run, or at least until economic traction becomes more visible.

23

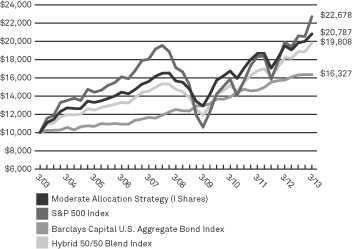

CONSERVATIVE ALLOCATION STRATEGY

Growth of a $10,000 Investment (as of March 31, 2013)

|

This chart assumes an initial hypothetical investment of $10,000 made on 3/31/03. Total return is based on net change in the Net Asset Value (“NAV”) assuming reinvestment of distributions. Returns shown on this page include reinvestment of all dividends and other distributions.

The Fund’s performance is compared to the Hybrid 30/70 Blend Index. The Standard & Poors 500 Index (“S&P 500 Index”) is widely regarded as a gauge of the U.S. equities market. This index includes 500 leading companies in leading industries of the U.S. economy. Although the S&P 500 Index focuses on the large cap segment of the market, with approximately 75% coverage of U.S. equities, it is also an ideal proxy for the total market. The Barclays Capital U.S. Aggregate Bond Index is a measure of the overall performance of the U.S. bond market. These indices are unmanaged and do not reflect the deduction of fees, such as investment and fund accounting fees, associated with a mutual fund. Investors cannot invest directly in an index. |

| Average Annual Total Returns as of 3/31/13 | ||||||||||||||||

| Conservative Allocation Strategy | 1 Year | 3 Year | 5 Year | 10 Year | ||||||||||||

| A Shares* |

without sales charge | 5.29% | 6.44% | 6.29% | 6.09% | |||||||||||

| with sales charge** | 0.30% | 4.73% | 5.27% | 5.57% | ||||||||||||

| C Shares* |

without CDSC | 4.58% | 5.73% | 5.55% | 5.57% | |||||||||||

| with CDSC** | 3.58% | 5.73% | 5.55% | 5.57% | ||||||||||||

| I Shares* |

5.55% | 6.76% | 6.61% | 6.39% | ||||||||||||

| Hybrid 30/70 Blend Index (30% of the S&P 500 Index, 70% of the Barclays Capital U.S. Aggregate Bond Index) | 6.88% | 7.91% | 5.97% | 6.32% | ||||||||||||

| S&P 500 Index | 13.96% | 12.67% | 5.81% | 8.53% | ||||||||||||

| Barclays Capital U.S. Aggregate Bond Index | 3.77% | 5.52% | 5.47% | 5.02% | ||||||||||||

| Prospectus Expense Ratio1 | Gross | |||||||||||||||

| A Shares | 1.37% | |||||||||||||||

| C Shares | 1.99% | |||||||||||||||

| I Shares | 1.04% | |||||||||||||||

24

Portfolio Manager

| Ÿ | Alan Gayle |

INVESTMENT CONCERNS

Stocks are more volatile and carry more risk and return potential than other forms of investments. Bonds offer a relatively stable level of income, although bond prices will fluctuate, providing the potential for principal gain or loss. Cash equivalents offer low risk and low return potential.

MANAGEMENT DISCUSSION OF FUND PERFORMANCE

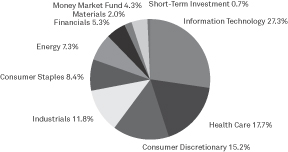

How did the Fund perform against its benchmark for the fiscal year ended March 31, 2013?

The RidgeWorth Growth Allocation Strategy I Shares returned 7.52% for the fiscal year ended March 31, 2013, behind the 10.96% return for the hybrid benchmark (70% S&P 500 Index / 30% Barclays Capital U.S. Aggregate Bond Index) and behind the Lipper Mixed-Asset Target Allocation–Growth Classification return of 9.96% in the same period, placing it in the 87th percentile.

What factors influenced the Fund’s performance for the fiscal year ended March 31, 2013?

The RidgeWorth Growth Allocation Strategy I Shares relative performance benefitted modestly against its benchmark due to its overweight to equities versus its target weighting of 70%, as equities broadly outperformed fixed income mandates for the year. It also benefitted from outperformance by several selected RidgeWorth funds, notably large cap and mid cap value funds. Similar to the broader S&P 500 Index, in which Value style mandates outperformed Growth style mandates, the Fund’s exposure to growth securities was a detractor, as were exposures to alternative securities in gold miners and to international markets, which collectively lagged in the quarter. All in, several underlying equity funds lagged the S&P 500 Index, which led to an aggregate lagging performance in the equity space. In the fixed income space the Fund’s exposure to longer duration, corporate fixed income oriented securities, as well as to the high yield funds, was additive to relative fixed-income performance. However, the shorter-duration fixed-income and cash positions lagged the benchmark. Despite some positive relative returns in both the equity and fixed income spaces, the strategy experienced subpar relative total returns versus its hybrid benchmark and its Lipper category.

How do you plan to position the Fund, based on market conditions?

Although the economy is experiencing a quite sluggish 2% to 2.5% growth rate, the broad S&P 500 Index still trades slightly below its 10 and 15 year medians on key valuation metrics. Moreover, given the “Global Fed’s” (Federal Reserve, Bank of China, Bank of Japan, European Central Bank, et al) stimulus, there appears to be increased confidence that the current expansion is relatively sustainable with limited downside risks.

As long as ample accommodation continues, and inflation stays at the low-end of the Fed comfort zone, equities have at least a modicum of tailwinds. Equity index valuations were more compelling last year, but vigorous fundamental stock picking and sector rotations should return to vogue.

As a consequence, we believe that when headwinds dissipate and 2013 metrics are recalibrated, the equity market indeed has the potential for further improvement; however, we would not be surprised to see at least a small amount of consolidation in the short run, or at least until economic traction becomes more visible.

25

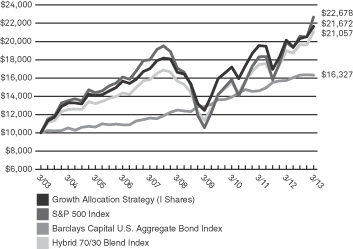

GROWTH ALLOCATION STRATEGY

Growth of a $10,000 Investment (as of March 31, 2013)

|

This chart assumes an initial hypothetical investment of $10,000 made on 3/31/03. Total return is based on net change in the Net Asset Value (“NAV”) assuming reinvestment of distributions. Returns shown on this page include reinvestment of all dividends and other distributions.

The Fund’s performance is compared to the Hybrid 70/30 Blend Index. The Standard & Poors 500 Index (“S&P 500 Index”) is widely regarded as a gauge of the U.S. equities market. This index includes 500 leading companies in leading industries of the U.S. economy. Although the S&P 500 Index focuses on the large cap segment of the market, with approximately 75% coverage of U.S. equities, it is also an ideal proxy for the total market. The Barclays Capital U.S. Aggregate Bond Index is a measure of the overall performance of the U.S. bond market. These indices are unmanaged and do not reflect the deduction of fees, such as investment and fund accounting fees, associated with a mutual fund. Investors cannot invest directly in an index. |

| Average Annual Total Returns as of 3/31/13 | ||||||||||||||||||

| Growth Allocation Strategy | 1 Year | 3 Year | 5 Year | 10 Year | ||||||||||||||

| A Shares* |

without sales charge | 7.16% | 7.67% | 5.11% | 7.73% | |||||||||||||

| with sales charge** | 0.98% | 5.56% | 3.87% | 7.10% | ||||||||||||||

| C Shares* |

without CDSC | 6.55% | 6.94% | 4.36% | 7.13% | |||||||||||||

| with CDSC** | 5.55% | 6.94% | 4.36% | 7.13% | ||||||||||||||

| I Shares |

7.52% | 7.97% | 5.42% | 8.04% | ||||||||||||||

| Hybrid 70/30 Blend Index (70% of the S&P 500 Index, 30% of the Barclays Capital U.S. Aggregate Bond Index) | 10.96% | 10.78% | 6.11% | 7.73% | ||||||||||||||

| S&P 500 Index | 13.96% | 12.67% | 5.81% | 8.53% | ||||||||||||||

| Barclays Capital U.S. Aggregate Bond Index | 3.77% | 5.52% | 5.47% | 5.02% | ||||||||||||||

| Prospectus Expense Ratio1 | Gross | |||||||||||||||||

| A Shares | 1.40% | |||||||||||||||||

| C Shares | 2.03% | |||||||||||||||||

| I Shares | 1.41% | |||||||||||||||||

26

Portfolio Manager

| Ÿ | Alan Gayle |

INVESTMENT CONCERNS

Stocks are more volatile and carry more risk and return potential than other forms of investments. Bonds offer a relatively stable level of income, although bond prices will fluctuate, providing the potential for principal gain or loss. Cash equivalent offer low risk and low return potential.

MANAGEMENT DISCUSSION OF FUND PERFORMANCE

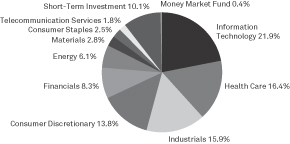

How did the Fund perform against its benchmark for the fiscal year ended March 31, 2013?

The RidgeWorth Moderate Allocation Strategy I Shares returned 6.60% for the fiscal year ended March 31, 2013, behind the 8.93% return for the hybrid benchmark (50% S&P 500 / 50% Barclays Capital U.S. Aggregate Bond Index) and behind the Lipper Mixed-Asset Target Allocation–Moderate Classification return of 9.11% in the same period, placing it in the 88th percentile.

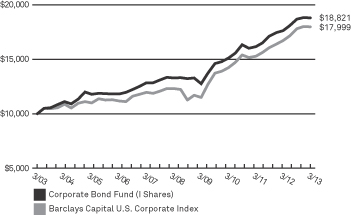

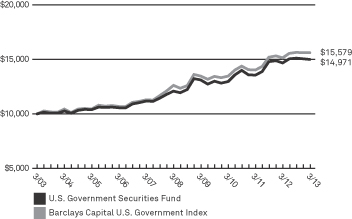

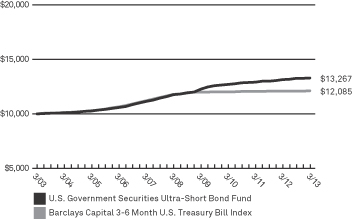

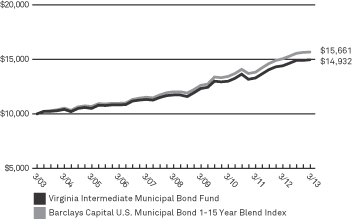

What factors influenced the Fund’s performance for the fiscal year ended March 31, 2013?