Table of Contents

|

FIXED INCOME FUNDS

A, C, R, & I SHARES PROSPECTUS

August 1, 2011 (as revised April 10, 2012)

Investment Adviser: RidgeWorth Investments® |

| A Shares | C Shares | R Shares | I Shares | |||||

| Investment Grade Funds |

||||||||

| Subadviser: Seix Investment Advisors LLC | ||||||||

| Ÿ Core Bond Fund |

STGIX | SCIGX | STIGX | |||||

| Ÿ Corporate Bond Fund |

SAINX | STIFX | STICX | |||||

| Ÿ Intermediate Bond Fund |

IBASX | IBLSX | SAMIX | |||||

| Ÿ Limited Duration Fund |

SAMLX | |||||||

| Ÿ Limited-Term Federal Mortgage Securities Fund |

SLTMX | SCLFX | SLMTX | |||||

| Ÿ Total Return Bond Fund |

CBPSX | SCBLX | SAMFX | |||||

| Ÿ U.S. Government Securities Fund |

SCUSX | SGUSX | SUGTX | |||||

| High Yield Funds |

||||||||

| Subadviser: Seix Investment Advisors LLC | ||||||||

| Ÿ High Income Fund |

SAHIX | STHIX | STHTX | |||||

| Ÿ Seix Floating Rate High Income Fund |

SFRAX | SFRCX | SAMBX | |||||

| Ÿ Seix High Yield Fund |

HYPSX | HYLSX | SAMHX | |||||

| Municipal Bond Funds |

||||||||

| Subadviser: StableRiver Capital Management LLC | ||||||||

| Ÿ Georgia Tax-Exempt Bond Fund |

SGTEX | SGATX | ||||||

| Ÿ High Grade Municipal Bond Fund |

SFLTX | SCFTX | ||||||

| Ÿ Investment Grade Tax-Exempt Bond Fund |

SISIX | STTBX | ||||||

| Ÿ North Carolina Tax-Exempt Bond Fund |

SNCIX | CNCFX | ||||||

| Ÿ Short-Term Municipal Bond Fund |

SMMAX | CMDTX | ||||||

| Ÿ Virginia Intermediate Municipal Bond Fund |

CVIAX | CRVTX | ||||||

| Short Duration Funds |

||||||||

| Subadviser: StableRiver Capital Management LLC | ||||||||

| Ÿ Short-Term Bond Fund |

STSBX | SCBSX | SSBTX | |||||

| Ÿ Short-Term U.S. Treasury Securities Fund |

STSFX | SSUSX | SUSTX | |||||

| Ÿ Ultra-Short Bond Fund |

SISSX | |||||||

| Ÿ U.S. Government Securities Ultra-Short Bond Fund |

SIGVX | |||||||

The Securities and Exchange Commission has not approved or disapproved these securities or passed upon the adequacy of this prospectus. Any representation to the contrary is a criminal offense.

Table of Contents

| TABLE OF CONTENTS |

| BACK COVER | HOW TO OBTAIN MORE INFORMATION ABOUT RIDGEWORTH FUNDS |

August 1, 2011 (as revised April 10, 2012)

RidgeWorth Investments® is the trade name of RidgeWorth Capital Management, Inc.

Table of Contents

| INVESTMENT GRADE FUNDS | 1 |

| CORE BOND FUND |

Summary Section

A Shares, R Shares and I Shares

Investment Objective

The Core Bond Fund (the “Fund”) seeks total return (comprised of capital appreciation and income) that consistently exceeds the total return of the U.S. dollar-denominated investment grade bond market.

Fees and Expenses of the Fund

This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in RidgeWorth Funds. More information about these and other discounts is available from your financial professional and in Sales Charges on page 90 of the Fund’s prospectus and Rights of Accumulation on page 91 of the Fund’s statement of additional information.

| Shareholder Fees (fees paid directly from your investment) | ||||||

| A Shares | R Shares | I Shares | ||||

| Maximum Sales Charge (load) Imposed on Purchases (as a % of offering price) | 4.75% | None | None | |||

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of | ||||||

| A Shares | R Shares | I Shares | ||||

| Management Fees(1) | 0.25% | 0.25% | 0.25% | |||

| Distribution (12b-1) Fees | 0.30% | 0.50% | None | |||

| Other Expenses | 0.07% | 0.20% | 0.10% | |||

|

|

|

| ||||

| Total Annual Fund Operating Expenses | 0.62% | 0.95% | 0.35% | |||

| (1) | Adjusted to reflect a decrease in the Management Fees effective October 1, 2011. |

Example

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same and you reinvest all dividends and distributions. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |||||||||||||

| A Shares |

$ | 536 | $ | 664 | $ | 805 | $ | 1,216 | ||||||||

| R Shares |

$ | 97 | $ | 303 | $ | 527 | $ | 1,171 | ||||||||

| I Shares | $ | 36 | $ | 113 | $ | 197 | $ | 445 | ||||||||

Portfolio Turnover

The Fund pays transaction costs when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 121% of the average value of its portfolio.

Principal Investment Strategies

The Fund invests in various types of income producing debt securities including mortgage- and asset-backed securities, government and agency obligations, and corporate obligations. The Fund may invest in debt obligations of U.S. and non-U.S. issuers, including investment grade rated emerging market debt. The Fund’s investment in non-U.S. issuers may at times be significant. Under normal circumstances, the Fund invests at least 80% of its net assets in investment grade fixed income securities. These securities will be chosen from the broad universe of available fixed income securities rated investment grade by Standard & Poor’s Ratings Services, Moody’s Investors Service or Fitch Ratings or unrated securities that the Fund’s Subadviser, Seix Investment Advisors LLC (“Seix” or the “Subadviser”), believes are of comparable quality. A security’s rating will be governed by the Barclays Capital methodology as follows. When all three rating agencies provide a rating, Seix will assign the middle rating of the three. If only two of the three rating agencies rate the security, Seix will assign the lowest rating. If only one rating agency assigns a rating, Seix will use that rating. The Fund can hold up to 5% of its net assets in securities that are downgraded below investment grade. The Fund may also invest a portion of its assets in securities that are restricted as to resale.

The Subadviser anticipates that the Fund’s modified adjusted duration will generally range from 3 to 6 years,

Table of Contents

| 2 | INVESTMENT GRADE FUNDS |

| CORE BOND FUND |

similar to that of the Barclays Capital U.S. Aggregate Bond Index, the Fund’s comparative benchmark. Duration measures a bond or Fund’s sensitivity to interest rate changes and is expressed as a number of years. The higher the number, the greater the risk. Under normal circumstances, for example, if a portfolio has a duration of five years, its value will change by 5% if rates change by 1%. Shorter duration bonds result in lower expected volatility. In selecting investments for purchase and sale, the Subadviser generally selects a greater weighting in corporate obligations and mortgage-backed securities relative to the Fund’s comparative benchmark, and a lower relative weighting in U.S. Treasury and government agency issues.

In addition, to implement its investment strategy, the Fund may utilize Exchange Traded Futures to manage interest rate exposures. The Fund may also utilize Treasury Inflation Protected Securities (“TIPS”) opportunistically. The Fund will not buy or sell any other types of derivative instruments (such as foreign currency forward contracts, swaps, including credit default swaps, OTC futures, credit linked notes, options, inverse floaters and warrants). The Fund may count the value of Exchange Traded Futures and TIPS towards its policy to invest, under normal circumstances, at least 80% of its net assets in fixed income securities.

Principal Investment Risks

You may lose money if you invest in the Fund. A Fund share is not a bank deposit and it is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

Debt Securities Risk: Debt securities, such as bonds, involve credit risk. Credit risk is the risk that the borrower will not make timely payments of principal and interest. Changes in an issuer’s credit rating or the market’s perception of an issuer’s creditworthiness may also affect the value of the Fund’s investment in that issuer. The degree of credit risk depends on the issuer’s financial condition and on the terms of the securities. Debt securities are also subject to interest rate risk, which is the risk that the value of a debt security may fall when interest rates rise. In general, the market price of debt securities with longer maturities will go up or down more in response to changes in interest rates than the market price of shorter term securities.

Mortgage-Backed and Asset-Backed Securities Risk: Mortgage- and asset-backed securities are debt instruments that are secured by interests in pools of mortgage loans or other financial assets. The value of these securities will be influenced by the factors affecting the assets underlying such securities, swings in interest rates, changes in default rates, or deteriorating economic conditions. During periods of declining asset values, mortgage-backed and asset-backed securities may face valuation difficulties, become more volatile and/or illiquid. The risk of default is generally higher in the case of securities backed by loans made to borrowers with “sub-prime” credit metrics.

If market interest rates increase substantially and the Fund’s adjustable-rate securities are not able to reset to market interest rates during any one adjustment period, the value of the Fund’s holdings and its net asset value may decline until the adjustable-rate securities are able to reset to market rates. In the event of a dramatic increase in interest rates, the lifetime limit on a security’s interest rate may prevent the rate from adjusting to prevailing market rates. In such an event the security could underperform and affect the Fund’s net asset value.

Prepayment and Call Risk: During periods of falling interest rates, an issuer of a callable bond held by the Fund may “call” or prepay the bond before its stated maturity date. When mortgages and other obligations are prepaid and when securities are called, the Fund may have to reinvest the proceeds in securities with a lower yield or fail to recover additional amounts paid for securities with higher interest rates, resulting in an unexpected capital loss and/or a decline in the Fund’s income.

Foreign Securities Risk: Foreign securities involve special risks such as currency fluctuations, economic or financial instability, lack of timely or reliable financial information and unfavorable political or legal developments and delays in enforcement of rights. These risks are increased for investments in emerging markets.

Futures Contract Risk: The risks associated with futures include: the Subadviser’s ability to manage these instruments, the potential inability to terminate or sell a position and the lack of a liquid secondary market for the Fund’s position.

Leverage Risk: The use of exchange traded futures may create leveraging risk. Leverage may cause the Fund to be more volatile than if the Fund had not been leveraged. This is because leverage tends to exaggerate the effect of any increase or decrease in the value of the Fund’s portfolio securities.

U.S. Government Issuers Risk: U.S. Treasury obligations may differ in their interest rates, maturities, times of issuance and other characteristics. Similar to other issuers, changes to the financial condition or

Table of Contents

| INVESTMENT GRADE FUNDS | 3 |

| CORE BOND FUND |

credit rating of the U.S. government may cause the value of its Treasury obligations to decline. Obligations of U.S. government agencies and authorities are supported by varying degrees of credit, but generally are not backed by the full faith and credit of the U.S. government. U.S. government debt securities may underperform other segments of the fixed income market or the fixed income market as a whole.

Performance

The bar chart and the performance table that follow illustrate the risks and volatility of an investment in the Fund. The Fund’s past performance (before and after taxes) does not indicate how the Fund will perform in the future. At the close of business on July 31, 2009, all outstanding C Shares converted to R Shares. R Share performance shown prior to that date is that of C Shares and has not been adjusted to reflect R Shares expenses. Updated performance information is available by contacting the RidgeWorth Funds at 1-888-784-3863 or by visiting www.ridgeworth.com.

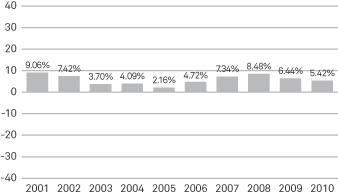

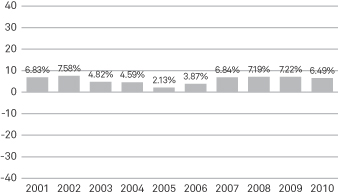

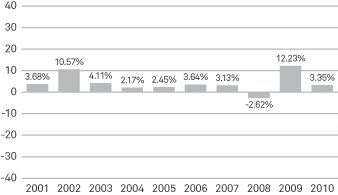

This bar chart shows the changes in performance of the Fund’s I Shares from year to year.*

| Best Quarter | Worst Quarter | |

| 8.51% | -3.47% | |

| (12/31/08) | (6/30/04) |

| * | The performance information shown above is based on a calendar year. The Fund’s total return for the six months ended June 30, 2011 was 2.17%. |

The following table compares the Fund’s average annual total returns for the periods indicated with those of a broad measure of market performance.

| AVERAGE ANNUAL TOTAL RETURNS (for periods ended December 31, 2010) |

||||||||||||

| 1 Year | 5 Years | 10 Years | ||||||||||

| A Shares Returns Before Taxes | 5.03% | 6.13% | 5.49% | |||||||||

| R Shares Returns Before Taxes | 4.85% | 5.55% | 4.92% | |||||||||

| I Shares Returns Before Taxes | 5.42% | 6.47% | 5.86% | |||||||||

| I Shares Returns After Taxes on Distributions | 3.17% | 4.68% | 4.16% | |||||||||

| I Shares Returns After Taxes on Distributions and Sale of Fund Shares | 4.01% | 4.53% | 4.04% | |||||||||

| Barclays Capital U.S. Government/Credit Bond Index (reflects no deduction for fees, expenses or taxes) | 6.59% | 5.56% | 5.83% | |||||||||

| Barclays Capital U.S. Aggregate Bond Index (reflects no deduction for fees, expenses or taxes) (1) | 6.54% | 5.80% | 5.84% | |||||||||

| (1) | Effective September 30, 2011, the Fund changed its benchmark index to the Barclays Capital U.S. Aggregate Bond Index. The Subadviser believes the Barclays Capital U.S. Aggregate Bond Index better reflects the Fund’s investment style. |

After-tax returns are calculated using the historical highest individual U.S. federal marginal income tax rates and do not reflect the impact of state and local taxes. Your actual after-tax returns will depend on your tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax deferred arrangements, such as 401(k) plans or individual retirement accounts (“IRAs”). After-tax returns are shown for only the I Shares. After-tax returns for other share classes will vary.

Investment Adviser and Subadviser

RidgeWorth Investments is the Fund’s investment adviser (the “Adviser”). Seix Investment Advisors LLC is the Fund’s Subadviser.

Portfolio Management

Mr. James F. Keegan, Chief Investment Officer and Chief Executive Officer, has been a member of the Fund’s management team since 2008. Mr. Adrien Webb, CFA, Managing Director and Senior Portfolio Manager, has been a member of the Fund’s management team since 2004. Mr. Perry Troisi, Managing Director and Senior Portfolio Manager, has been a member of the Fund’s management team since 2004. Mr. Michael Rieger, Managing Director and Senior Portfolio Manager, has been a member of the Fund’s management team since 2007.

Table of Contents

| 4 | INVESTMENT GRADE FUNDS |

| CORE BOND FUND |

Purchasing and Selling Your Shares

You may purchase or redeem Fund shares on any business day. You may purchase and redeem A and R Shares of the Fund through financial institutions or intermediaries that are authorized to place transactions in Fund shares for their customers. Please contact your financial institution or intermediary directly and follow its procedures for fund share transactions. The Fund offers I Shares to financial institutions and intermediaries for their own accounts or for the accounts of customers for whom they may act as fiduciary agent, investment adviser, or custodian. Please consult your financial institution or intermediary to find out about how to purchase I Shares of the Fund.

The minimum initial investment amounts for each share class are shown below, although these minimums may be reduced or waived in some cases.

| Class | Dollar Amount | |

| A Shares | $2,000 | |

| R Shares | $5,000 ($2,000 for IRAs or other tax qualified accounts) | |

| I Shares | None |

Subsequent investments in A Shares must be made in amounts of at least $1,000. The Fund may accept investments of smaller amounts at its discretion. There are no minimums for subsequent investments in R or I Shares.

Tax Information

The Fund’s distributions are generally taxable and will be taxed as ordinary income or capital gains unless you are investing through a tax-deferred arrangement, such as a 401(k) plan or an IRA.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase shares of the Fund through a financial intermediary, such as a broker-dealer or investment adviser, the Fund, the Adviser or the Distributor may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other financial intermediary and your salesperson to recommend the Fund over another investment. Ask your financial intermediary or visit your financial intermediary’s website for more information.

Table of Contents

| INVESTMENT GRADE FUNDS | 5 |

| CORPORATE BOND FUND |

Summary Section

A Shares, C Shares and I Shares

Investment Objective

The Corporate Bond Fund (the “Fund”) seeks current income and, secondarily, preservation of capital.

Fees and Expenses of the Fund

This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in RidgeWorth Funds. More information about these and other discounts is available from your financial professional and in Sales Charges on page 90 of the Fund’s prospectus and Rights of Accumulation on page 91 of the Fund’s statement of additional information.

| Shareholder Fees (fees paid directly from your investment) | ||||||

| A Shares | C Shares | I Shares | ||||

| Maximum Sales Charge (load) Imposed on Purchases (as a % of offering price) | 4.75% | None | None | |||

| Maximum Deferred Sales Charge (load) (as a % of net asset value) | None | 1.00% | None | |||

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of | ||||||

| A Shares | C Shares | I Shares | ||||

| Management Fees | 0.40% | 0.40% | 0.40% | |||

| Distribution (12b-1) Fees | 0.30% | 1.00% | None | |||

| Other Expenses | 0.13% | 0.10% | 0.12% | |||

|

|

|

| ||||

| Total Annual Fund Operating Expenses | 0.83% | 1.50% | 0.52% | |||

Example

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same and you reinvest all dividends and distributions. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |||||||||||||

| A Shares |

$ | 556 | $ | 728 | $ | 915 | $ | 1,456 | ||||||||

| C Shares |

$ | 253 | $ | 475 | $ | 820 | $ | 1,796 | ||||||||

| I Shares | $ | 53 | $ | 167 | $ | 291 | $ | 656 | ||||||||

You would pay the following expenses if you did not redeem your shares:

| 1 Year | 3 Years | 5 Years | 10 Years | |||||||||||||

| A Shares |

$ | 556 | $ | 728 | $ | 915 | $ | 1,456 | ||||||||

| C Shares |

$ | 153 | $ | 475 | $ | 820 | $ | 1,796 | ||||||||

| I Shares | $ | 53 | $ | 167 | $ | 291 | $ | 656 | ||||||||

Portfolio Turnover

The Fund pays transaction costs, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 47% of the average value of its portfolio.

Principal Investment Strategies

The Fund invests in a diversified portfolio of U.S. dollar denominated corporate obligations and other fixed income securities that are rated BBB-/Baa3 or better by Standard & Poor’s Ratings Services, Moody’s Investors Service or Fitch Ratings or unrated securities that the Fund’s Subadviser, Seix Investment Advisors LLC (“Seix” or the “Subadviser”), believes are of comparable quality. Under normal circumstances, the Fund invests at least 80% of its net assets (plus any borrowings for investment purposes) in corporate bonds. The Fund may also invest in U.S. Treasury and agency obligations. The Fund may invest in U.S. dollar denominated obligations of U.S. and non-U.S. issuers. The Fund may invest a portion of its assets in securities that are restricted as to resale.

The Fund will maintain an overall credit quality of A- or better. Securities downgraded below BBB-/Baa3 after purchase by all agencies that rate the securities can be retained so long as in the aggregate securities that are rated below BBB-/Baa3 do not constitute more than 10% of the Fund’s total net assets.

Table of Contents

| 6 | INVESTMENT GRADE FUNDS |

| CORPORATE BOND FUND |

The Subadviser attempts to identify investment grade corporate bonds offering above average total return. In selecting corporate debt investments for purchase and sale, the Subadviser seeks out companies with good fundamentals and above average return prospects that are currently priced at attractive levels. The primary basis for security selection is the potential income offered by the security relative to the Subadviser’s assessment of the issuer’s ability to generate the cash flow required to meet its obligations. The Subadviser employs a “bottom-up” approach, identifying investment opportunities based on the underlying financial and economic fundamentals of the specific issuer.

Principal Investment Risks

You may lose money if you invest in the Fund. A Fund share is not a bank deposit and it is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

Below Investment Grade Securities Risk: Securities that are rated below investment grade (sometimes referred to as “junk bonds”), including those bonds rated lower than “BBB-” by Standard and Poor’s and Fitch, Inc. or “Baa3” by Moody’s Investors Services, Inc.), or that are unrated but judged by the Subadviser to be of comparable quality, at the time of purchase, involve greater risk of default or downgrade and are more volatile than investment grade securities. Below investment grade securities may also be less liquid than higher quality securities, and may cause income and principal losses for the Fund.

Debt Securities Risk: Debt securities, such as bonds, involve credit risk. Credit risk is the risk that the borrower will not make timely payments of principal and interest. Changes in an issuer’s credit rating or the market’s perception of an issuer’s creditworthiness may also affect the value of the Fund’s investment in that issuer. The degree of credit risk depends on the issuer’s financial condition and on the terms of the securities. Debt securities are also subject to interest rate risk, which is the risk that the value of a debt security may fall when interest rates rise. In general, the market price of debt securities with longer maturities will go up or down more in response to changes in interest rates than the market price of shorter term securities.

Foreign Companies Risk: Dollar denominated securities of foreign issuers involve special risks such as economic or financial instability, lack of timely or reliable financial information and unfavorable political or legal developments.

U.S. Government Agencies Risk: Obligations of U.S. government agencies and authorities are supported by varying degrees of credit, but generally are not backed by the full faith and credit of the U.S. government. U.S. government agencies debt securities may underperform other segments of the fixed income market or the fixed income market as a whole.

Performance

The bar chart and the performance table that follow illustrate the risks and volatility of an investment in the Fund. The Fund’s past performance (before and after taxes) does not indicate how the Fund will perform in the future. The Fund began operating April 1, 2009. Performance prior to April 1, 2009 is that of the Strategic Income Fund, the Fund’s predecessor, which began operations on November 30, 2001. Updated performance information is available by contacting the RidgeWorth Funds at 1-888-784-3863 or by visiting www.ridgeworth.com.

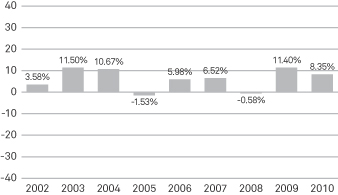

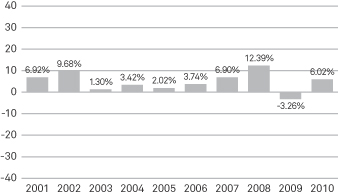

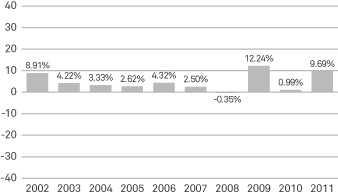

This bar chart shows the changes in performance of the Fund’s I Shares from year to year.*

| Best Quarter | Worst Quarter | |

| 7.54% | -3.98% | |

| (6/30/09) | (3/31/09) |

| * | The performance information shown above is based on a calendar year. The Fund’s total return for the six months ended June 30, 2011 was 3.02%. |

Table of Contents

| INVESTMENT GRADE FUNDS | 7 |

| CORPORATE BOND FUND |

The following table compares the Fund’s average annual total returns for the periods indicated with those of a broad measure of market performance.

| AVERAGE ANNUAL TOTAL RETURNS (for periods ended December 31, 2010) |

||||||||||||||||

| 1 Year | 5 Years | Since Inception of the A Shares* |

Since Inception** |

|||||||||||||

| A Shares Returns Before Taxes | 7.88% | 5.93% | 5.69% | N/A | ||||||||||||

| C Shares Returns Before Taxes | 7.29% | 5.22% | N/A | 5.10% | ||||||||||||

| I Shares Returns Before Taxes | 8.35% | 6.27% | N/A | 5.94% | ||||||||||||

| I Shares Returns After Taxes on Distributions | 6.23% | 4.07% | N/A | 3.75% | ||||||||||||

| I Shares Returns After Taxes on Distributions and Sale of Fund Shares | 5.93% | 4.09% | N/A | 3.80% | ||||||||||||

| Barclays Capital U.S. Corporate Index (reflects no deduction for fees, expenses or taxes) | 9.00% | 6.05% | 5.45% | 6.02% | ||||||||||||

| * | Since inception of the A Shares on October 8, 2003. |

| ** | Since inception of the C Shares and the I Shares on November 30, 2001. |

After-tax returns are calculated using the historical highest individual U.S. federal marginal income tax rates and do not reflect the impact of state and local taxes. Your actual after-tax returns will depend on your tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax deferred arrangements, such as 401(k) plans or individual retirement accounts (“IRAs”). After-tax returns are shown for only the I Shares. After-tax returns for other share classes will vary.

Investment Adviser and Subadviser

RidgeWorth Investments is the Fund’s investment adviser (the “Adviser”). Seix Investment Advisors LLC is the Fund’s Subadviser.

Portfolio Management

Mr. James F. Keegan, Chief Investment Officer and Chief Executive Officer, has been a member of the Fund’s management team since 2008. Mr. Adrien Webb, CFA, Managing Director and Senior Portfolio Manager, has been a member of the Fund’s management team since 2004. Mr. Perry Troisi, Managing Director and Senior Portfolio Manager, has been a member of the Fund’s management team since 2004.

Purchasing and Selling Your Shares

You may purchase or redeem Fund shares on any business day. You may purchase and redeem A and C Shares of the Fund through financial institutions or intermediaries that are authorized to place transactions in Fund shares for their customers. Please contact your financial institution or intermediary directly and follow its procedures for fund share transactions. The Fund offers I Shares to financial institutions and intermediaries for their own accounts or for the accounts of customers for whom they may act as fiduciary agent, investment adviser, or custodian. Please consult your financial institution or intermediary to find out about how to purchase I Shares of the Fund.

The minimum initial investment amounts for each share class are shown below, although these minimums may be reduced or waived in some cases.

| Class | Dollar Amount | |

| A Shares | $2,000 | |

| C Shares | $5,000 ($2,000 for IRAs or other tax qualified accounts) | |

| I Shares | None |

Subsequent investments in A or C Shares must be made in amounts of at least $1,000. The Fund may accept investments of smaller amounts for either class of shares at its discretion. There are no minimums for subsequent investments in I Shares.

Tax Information

The Fund’s distributions are generally taxable and will be taxed as ordinary income or capital gains unless you are investing through a tax-deferred arrangement, such as a 401(k) plan or an IRA.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase shares of the Fund through a financial intermediary, such as a broker-dealer or investment adviser, the Fund, the Adviser or the Distributor may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other financial intermediary and your salesperson to recommend the Fund over another investment. Ask your financial intermediary or visit your financial intermediary’s website for more information.

Table of Contents

| 8 | INVESTMENT GRADE FUNDS |

| INTERMEDIATE BOND FUND |

Summary Section

A Shares, R Shares and I Shares

Investment Objective

The Intermediate Bond Fund (the “Fund”) seeks total return (comprised of capital appreciation and income) that consistently exceeds the total return of the broad U.S. dollar denominated, investment grade market of intermediate term government and corporate bonds.

Fees and Expenses of the Fund

This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in RidgeWorth Funds. More information about these and other discounts is available from your financial professional and in Sales Charges on page 90 of the Fund’s prospectus and Rights of Accumulation on page 91 of the Fund’s statement of additional information.

| Shareholder Fees (fees paid directly from your investment) | ||||||

| A Shares | R Shares | I Shares | ||||

| Maximum Sales Charge (load) Imposed on Purchases (as a % of offering price) | 4.75% | None | None | |||

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | ||||||

| A Shares | R Shares | I Shares | ||||

| Management Fees | 0.24% | 0.24% | 0.24% | |||

| Distribution (12b-1) Fees | 0.25% | 0.50% | None | |||

| Other Expenses | 0.11% | 0.36% | 0.10% | |||

|

|

|

| ||||

| Total Annual Fund Operating Expenses | 0.60% | 1.10% | 0.34% | |||

Example

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same and you reinvest all dividends and distributions. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |||||||||||||

| A Shares |

$ | 534 | $ | 658 | $ | 795 | $ | 1,193 | ||||||||

| R Shares |

$ | 112 | $ | 350 | $ | 607 | $ | 1,345 | ||||||||

| I Shares | $ | 35 | $ | 109 | $ | 191 | $ | 433 | ||||||||

Portfolio Turnover

The Fund pays transaction costs, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 128% of the average value of its portfolio.

Principal Investment Strategies

The Fund invests in various types of income producing debt securities including mortgage-and asset-backed securities, government and agency obligations, corporate obligations and floating rate loans. The Fund may invest in debt securities of U.S. and non-U.S. issuers, including emerging market debt. The Fund’s investment in non-U.S. issuers may at times be significant. Under normal circumstances, the Fund invests at least 80% of its net assets (plus any borrowings for investment purposes) in fixed- income securities. These securities will be chosen from the broad universe of available intermediate term fixed-income securities rated investment grade by Standard & Poor’s Ratings Services, Moody’s Investors Service or Fitch Ratings or unrated securities that the Fund’s Subadviser, Seix Investment Advisors LLC, (“Seix” or the “Subadviser”), believes are of comparable quality. The Fund may invest up to 20% of its net assets in below investment grade, high yield debt obligations. The Fund may also invest a portion of its assets in securities that are restricted as to resale.

The Subadviser invests in intermediate term fixed-income securities with an emphasis on corporate and mortgage backed securities. The Subadviser anticipates that the Fund will maintain an average weighted maturity of 3 to 10 years and the Fund will be managed with a duration that is close to that of its comparative benchmark, the Barclays Capital Intermediate

Table of Contents

| INVESTMENT GRADE FUNDS | 9 |

| INTERMEDIATE BOND FUND |

U.S. Government/Credit Bond Index, which is generally between 3 to 4 years. In selecting investments for purchase and sale, the Subadviser generally selects a greater weighting in corporate obligations and mortgage-backed securities relative to the Fund’s comparative benchmark, and a lower relative weighting in U.S. Treasury and government agency issues.

In addition, to implement its investment strategy, the Fund may buy or sell derivative instruments (such as foreign currency forward contracts, swaps, including credit default swaps, futures, credit linked notes, options, inverse floaters and warrants) to use as a substitute for a purchase or sale of a position in the underlying assets and/or as part of a strategy designed to reduce exposure to other risks, such as interest rate or credit risks. The Fund may count the value of certain derivatives with investment grade intermediate-term fixed income characteristics towards its policy to invest, under normal circumstances, at least 80% of its net assets in fixed-income securities.

Principal Investment Risks

You may lose money if you invest in the Fund. A Fund share is not a bank deposit and it is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

Debt Securities Risk: Debt securities, such as bonds, involve credit risk. Credit risk is the risk that the borrower will not make timely payments of principal and interest. Changes in an issuer’s credit rating or the market’s perception of an issuer’s creditworthiness may also affect the value of the Fund’s investment in that issuer. The degree of credit risk depends on the issuer’s financial condition and on the terms of the securities. Debt securities are also subject to interest rate risk, which is the risk that the value of a debt security may fall when interest rates rise. In general, the market price of debt securities with longer maturities will go up or down more in response to changes in interest rates than the market price of shorter term securities.

Mortgage-Backed and Asset-Backed Securities Risk: Mortgage- and asset-backed securities are debt instruments that are secured by interests in pools of mortgage loans or other financial assets. The value of these securities will be influenced by the factors affecting the assets underlying such securities, swings in interest rates, changes in default rates, or deteriorating economic conditions. During periods of declining asset values, mortgage-backed and asset-backed securities may face valuation difficulties, become more volatile and/or illiquid. The risk of default is generally higher in the case of securities backed by loans made to borrowers with “sub-prime” credit metrics.

If market interest rates increase substantially and the Fund’s adjustable-rate securities are not able to reset to market interest rates during any one adjustment period, the value of the Fund’s holdings and its net asset value may decline until the adjustable-rate securities are able to reset to market rates. In the event of a dramatic increase in interest rates, the lifetime limit on a security’s interest rate may prevent the rate from adjusting to prevailing market rates. In such an event the security could underperform and affect the Fund’s net asset value.

Prepayment and Call Risk: During periods of falling interest rates, an issuer of a callable bond held by the Fund may “call” or prepay the bond before its stated maturity date. When mortgages and other obligations are prepaid and when securities are called, the Fund may have to reinvest the proceeds in securities with a lower yield or fail to recover additional amounts paid for securities with higher interest rates, resulting in an unexpected capital loss and/or a decline in the Fund’s income.

Foreign Securities Risk: Foreign securities involve special risks such as currency fluctuations, economic or financial instability, lack of timely or reliable financial information and unfavorable political or legal developments and delays in enforcement of rights. These risks are increased for investments in emerging markets.

Below Investment Grade Securities Risk: Securities that are rated below investment grade (sometimes referred to as “junk bonds”), including those bonds rated lower than “BBB-” by Standard and Poor’s and Fitch, Inc. or “Baa3” by Moody’s Investors Services, Inc.), or that are unrated but judged by the Subadviser to be of comparable quality, at the time of purchase, involve

greater risk of default or downgrade and are more volatile than investment grade securities. Below investment grade securities may also be less liquid than higher quality securities, and may cause income and principal losses for the Fund.

Floating Rate Loan Risk: The value of the collateral securing a floating rate loan can decline, be insufficient to meet the obligations of the borrower, or be difficult to liquidate. As a result, a floating rate loan may not be fully collateralized and can decline significantly in value. Floating rate loans generally are subject to contractual restrictions on resale. The liquidity of floating rate loans, including the volume and frequency of secondary market trading in such loans, varies significantly over time and among individual floating

Table of Contents

| 10 | INVESTMENT GRADE FUNDS |

| INTERMEDIATE BOND FUND |

rate loans. During periods of infrequent trading, valuing a floating rate loan can be more difficult; and buying and selling a floating rate loan at an acceptable price can also be more difficult and delayed. Difficulty in selling a floating rate loan can result in a loss.

Derivatives Risk: In the course of pursuing its investment strategies, the Fund may invest in certain types of derivatives including swaps, foreign currency forward contracts and futures. The Fund is exposed to additional volatility and potential loss with these investments. Losses in these investments may exceed the Fund’s initial investment. Derivatives may be difficult to value, may become illiquid and may not correlate perfectly with the overall securities market.

Foreign Currency Forward Contracts Risk: The technique of purchasing foreign currency forward contracts to obtain exposure to currencies or manage currency risk may not be effective. In addition, currency markets generally are not as regulated as securities markets.

Swap Risk: The Fund may enter into swap agreements, including credit default and interest rate swaps, for purposes of attempting to gain exposure to a particular asset without actually purchasing that asset or to hedge a position. Credit default swaps may increase or decrease the Fund’s exposure to credit risk and could result in losses if the Subadviser does not correctly evaluate the creditworthiness of the entity on which the credit default swap is based. Swap agreements may also subject the Fund to the risk that the counterparty to the transaction may not meet its obligations.

Futures Contract Risk: The risks associated with futures include: the Subadviser’s ability to manage these instruments, the potential inability to terminate or sell a position and the lack of a liquid secondary market for the Fund’s position.

Leverage Risk: Certain transactions and the use of derivatives such as foreign currency forward contracts, swaps and futures may create leveraging risk. Leverage may cause the Fund to be more volatile than if the Fund had not been leveraged. This is because leverage tends to exaggerate the effect of any increase or decrease in the value of the Fund’s portfolio securities.

U.S. Government Issuers Risk: U.S. Treasury obligations may differ in their interest rates, maturities, times of issuance and other characteristics. Similar to other issuers, changes to the financial condition or credit rating of the U.S. government may cause the value of its Treasury obligations to decline. Obligations of U.S. government agencies and authorities are supported by varying degrees of credit, but generally are not backed by the full faith and credit of the U.S. government. U.S. government debt securities may underperform other segments of the fixed income market or the fixed income market as a whole.

Performance

The bar chart and the performance table that follow illustrate the risks and volatility of an investment in the Fund. The Fund’s past performance (before and after taxes) does not indicate how the Fund will perform in the future. The Fund began operating on October 11, 2004. Performance prior to October 11, 2004 is that of the I Shares of the Seix Intermediate Bond Fund, the Fund’s predecessor, and has not been adjusted to reflect A Share or R Share expenses. If it had been, performance would have been lower. Updated performance information is available by contacting the RidgeWorth Funds at 1-888-784-3863 or by visiting www.ridgeworth.com.

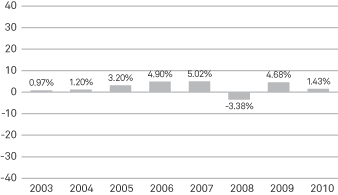

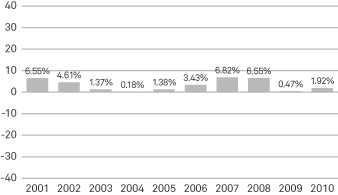

This bar chart shows the changes in performance of the Fund’s I Shares from year to year.*

| Best Quarter | Worst Quarter | |

| 6.44% | -2.33% | |

| (12/31/08) | (06/30/04) |

| * | The performance information shown above is based on a calendar year. The Fund’s total return for the six months ended June 30, 2011 was 2.36%. |

Table of Contents

| INVESTMENT GRADE FUNDS | 11 |

| INTERMEDIATE BOND FUND |

The following table compares the Fund’s average annual total returns for the periods indicated with those of a broad measure of market performance.

| AVERAGE ANNUAL TOTAL RETURNS (for periods ended December 31, 2010) |

||||||||||||

| 1 Year | 5 Years | 10 Years | ||||||||||

| A Shares Returns Before Taxes | 4.71% | 5.78% | 5.16% | |||||||||

| R Shares Returns Before Taxes* | 4.25% | 5.21% | 4.81% | |||||||||

| I Shares Returns Before Taxes | 4.97% | 6.05% | 5.34% | |||||||||

| I Shares Returns After Taxes on Distributions | 3.28% | 4.23% | 3.53% | |||||||||

| I Shares Returns After Taxes on Distributions and Sale of Fund Shares | 3.50% | 4.13% | 3.49% | |||||||||

| Barclays Capital Intermediate U.S. Government/Credit Bond Index (reflects no deduction for fees, expenses or taxes) | 5.89% | 5.53% | 5.51% | |||||||||

| * | The average annual total return information shown above, prior to the conversion of C Shares to R Shares at the close of business on February 12, 2009, is that of C Shares except for the period from October 16, 2007 through January 17, 2008, which is that of I Shares, not adjusted for C Share expenses. If expenses were adjusted performance would have been lower. |

After-tax returns are calculated using the historical highest individual U.S. federal marginal income tax rates and do not reflect the impact of state and local taxes. Your actual after-tax returns will depend on your tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax deferred arrangements, such as 401(k) plans or individual retirement accounts (“IRAs”). After-tax returns are shown for only the I Shares. After-tax returns for other share classes will vary.

Investment Adviser and Subadviser

RidgeWorth Investments is the Fund’s investment adviser (the “Adviser”). Seix Investment Advisors LLC is the Fund’s Subadviser.

Portfolio Management

Mr. James F. Keegan, Chief Investment Officer and Chief Executive Officer, has been a member of the Fund’s management team since 2008. Mr. Adrien Webb, CFA, Managing Director and Senior Portfolio Manager, has been a member of the Fund’s management team since 2002. Mr. Perry Troisi, Managing Director and Senior Portfolio Manager, has been a member of the Fund’s management team since 2002. Mr. Michael Rieger, Managing Director and Senior Portfolio Manager, has been a member of the Fund’s management team since 2007. Mr. Seth Antiles, Ph.D., Managing Director and Portfolio Manager, has been a member of the management team for the Fund since 2005.

Purchasing and Selling Your Shares

You may purchase or redeem Fund shares on any business day. You may purchase and redeem A and R Shares of the Fund through financial institutions or intermediaries that are authorized to place transactions in Fund shares for their customers. Please contact your financial institution or intermediary directly and follow its procedures for fund share transactions. The Fund offers I Shares to financial institutions and intermediaries for their own accounts or for the accounts of customers for whom they may act as fiduciary agent, investment adviser, or custodian. Please consult your financial institution or intermediary to find out about how to purchase I Shares of the Fund.

The minimum initial investment amounts for each share class are shown below, although these minimums may be reduced or waived in some cases.

| Class | Dollar Amount | |

| A Shares | $2,000 | |

| R Shares | $5,000 ($2,000 for IRAs or other tax qualified accounts) | |

| I Shares | None |

Subsequent investments in A Shares must be made in amounts of at least $1,000. The Fund may accept investments of smaller amounts at its discretion. There are no minimums for subsequent investments in R or I Shares.

Tax Information

The Fund’s distributions are generally taxable and will be taxed as ordinary income or capital gains unless you are investing through a tax-deferred arrangement, such as a 401(k) plan or an IRA.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase shares of the Fund through a financial intermediary, such as a broker-dealer or investment adviser, the Fund, the Adviser or the Distributor may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other financial intermediary and your salesperson to recommend the Fund over another investment. Ask your financial intermediary or visit your financial intermediary’s website for more information.

Table of Contents

| 12 | INVESTMENT GRADE FUNDS |

| LIMITED DURATION FUND |

Summary Section

I Shares

Investment Objective

The Limited Duration Fund (the “Fund”) seeks current income, while preserving liquidity and principal.

Fees and Expenses of the Fund

This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund.

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | ||

| I Shares | ||

| Management Fees | 0.10% | |

| Other Expenses | 0.12% | |

|

| ||

| Total Annual Fund Operating Expenses | 0.22% | |

Example

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same and you reinvest all dividends and distributions. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |||||||||||||

| I Shares | $ | 23 | $ | 71 | $ | 124 | $ | 282 | ||||||||

Portfolio Turnover

The Fund pays transaction costs when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 76% of the average value of its portfolio.

Principal Investment Strategies

The Fund invests in U.S. dollar-denominated, investment grade fixed income securities, including corporate and bank obligations, government securities, and mortgage-and asset-backed securities of U.S. and non-U.S. issuers, rated A or better by Standard & Poor’s Ratings Services, Moody’s Investors Service or Fitch Ratings or unrated securities that the Fund’s Subadviser, Seix Investment Advisors LLC (“Seix” or the “Subadviser”), believes are of comparable quality. The Fund’s investment in non-U.S. issuers may at times be significant.

The Fund will maintain an average credit quality of AA or Aa and all securities held in the Fund will have interest rate durations of 180 days or less. For floating rate notes, the interest rate duration will be based on the next interest rate reset date. Duration measures a bond or Fund’s sensitivity to interest rate changes and is expressed as a number of years. The higher the number, the greater the risk. Under normal circumstances, for example, if a portfolio has a duration of 5 years, its value will change by 5% if rates change by 1%. Shorter duration bonds result in lower expected volatility.

The Subadviser attempts to identify U.S. dollar-denominated, investment grade fixed income securities that offer high current income while preserving liquidity and principal. In selecting investments for purchase and sale, the Subadviser emphasizes securities that are within the targeted segment of the U.S. dollar-denominated, fixed income securities markets and will generally focus on investments that have good business prospects, credit strength, stable cash flows and effective management. The Subadviser may retain securities if the rating of the security falls below investment grade and the Subadviser deems retention of the security to be in the best interests of the Fund.

In addition, to implement its investment strategy, the Fund may buy or sell, to a limited extent, derivative instruments (such as credit linked notes, futures, options, inverse floaters, swaps and warrants) to use as a substitute for a purchase or sale of a position in the underlying asset and/or as part of a strategy designed to reduce exposure to other risks, such as interest rate risk and credit risk.

Principal Investment Risks

You may lose money if you invest in the Fund. A Fund share is not a bank deposit and it is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

Debt Securities Risk: Debt securities, such as bonds, involve credit risk. Credit risk is the risk that the borrower will not make timely payments of principal

Table of Contents

| INVESTMENT GRADE FUNDS | 13 |

| LIMITED DURATION FUND |

and interest. Changes in an issuer’s credit rating or the market’s perception of an issuer’s creditworthiness may also affect the value of the Fund’s investment in that issuer. The degree of credit risk depends on the issuer’s financial condition and on the terms of the securities. Debt securities are also subject to interest rate risk, which is the risk that the value of a debt security may fall when interest rates rise. In general, the market price of debt securities with longer maturities will go up or down more in response to changes in interest rates than the market price of shorter term securities.

Mortgage-Backed and Asset-Backed Securities Risk: Mortgage- and asset-backed securities are debt instruments that are secured by interests in pools of mortgage loans or other financial assets. The value of these securities will be influenced by the factors affecting the assets underlying such securities, swings in interest rates, changes in default rates, or deteriorating economic conditions. During periods of declining asset values, mortgage-backed and asset-backed securities may face valuation difficulties, become more volatile and/or illiquid. The risk of default is generally higher in the case of securities backed by loans made to borrowers with “sub-prime” credit metrics.

If market interest rates increase substantially and the Fund’s adjustable-rate securities are not able to reset to market interest rates during any one adjustment period, the value of the Fund’s holdings and its net asset value may decline until the adjustable-rate securities are able to reset to market rates. In the event of a dramatic increase in interest rates, the lifetime limit on a security’s interest rate may prevent the rate from adjusting to prevailing market rates. In such an event the security could underperform and affect the Fund’s net asset value.

Prepayment and Call Risk: During periods of falling interest rates, an issuer of a callable bond held by the Fund may “call” or prepay the bond before its stated maturity date. When mortgages and other obligations are prepaid and when securities are called, the Fund may have to reinvest the proceeds in securities with a lower yield or fail to recover additional amounts paid for securities with higher interest rates, resulting in an unexpected capital loss and/or a decline in the Fund’s income.

Floating Rate Notes Risk: Securities with floating or variable interest rates can be less sensitive to interest rate changes than securities with fixed interest rates, but may decline in value if their coupon rates do not reset as high, or as quickly, as comparable market interest rates.

Foreign Securities Risk: Foreign securities involve special risks such as economic or financial instability, lack of timely or reliable financial information and unfavorable political or legal developments and delays in enforcement of rights. These risks are increased for investments in emerging markets.

U.S. Government Issuers Risk: U.S. Treasury obligations may differ in their interest rates, maturities, times of issuance and other characteristics. Similar to other issuers, changes to the financial condition or credit rating of the U.S. government may cause the value of its Treasury obligations to decline. Obligations of U.S. government agencies and authorities are supported by varying degrees of credit, but generally are not backed by the full faith and credit of the U.S. government. U.S. government debt securities may underperform other segments of the fixed income market or the fixed income market as a whole.

Performance

The bar chart and the performance table that follow illustrate the risks and volatility of an investment in the Fund. The Fund’s past performance (before and after taxes) does not indicate how the Fund will perform in the future. The Fund began operating on October 11, 2004. Performance prior to October 11, 2004 is that of the I Shares of the Seix Limited Duration Fund, the Fund’s predecessor, which began operations on October 25, 2002. Updated performance information is available by contacting the RidgeWorth Funds at 1-888-784-3863 or by visiting www.ridgeworth.com.

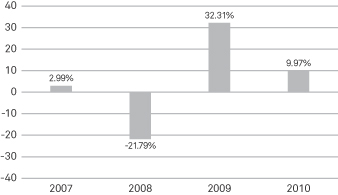

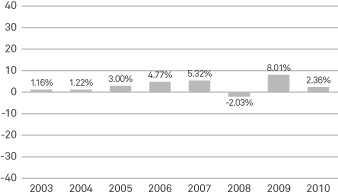

This bar chart shows the changes in performance of the Fund’s I Shares from year to year.*

| Best Quarter | Worst Quarter | |

| 2.18% | -3.37% | |

| (3/31/09) | (12/31/08) |

| * | The performance information shown above is based on a calendar year. The Fund’s total return for the six months ended June 30, 2011 was 0.23%. |

Table of Contents

| 14 | INVESTMENT GRADE FUNDS |

| LIMITED DURATION FUND |

The following table compares the Fund’s average annual total returns for the periods indicated with those of a broad measure of market performance.

| AVERAGE ANNUAL TOTAL RETURNS (for periods ended December 31, 2010) |

||||||||||||

| 1 Year | 5 Years | Since Inception* |

||||||||||

| I Shares Returns Before Taxes | 1.43 | % | 2.48 | % | 2.18 | % | ||||||

| I Shares Returns After Taxes on Distributions | 1.15 | % | 1.44 | % | 1.31 | % | ||||||

| I Shares Returns After Taxes on Distributions and Sale of Fund Shares | 0.93 | % | 1.51 | % | 1.35 | % | ||||||

| Bank of America Merrill Lynch 3 Month U.S. Treasury Bill Index (reflects no deduction for fees, expenses or taxes) | 0.13 | % | 2.43 | % | 2.20 | % | ||||||

| * | Since inception of the predecessor fund on October 25, 2002. Benchmark return since October 31, 2002. |

After-tax returns are calculated using the historical highest individual U.S. federal marginal income tax rates and do not reflect the impact of state and local taxes. Your actual after-tax returns will depend on your tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax deferred arrangements, such as 401(k) plans or individual retirement accounts (“IRAs”).

Investment Adviser and Subadviser

RidgeWorth Investments is the Fund’s investment adviser (the “Adviser”). Seix Investment Advisors LLC is the Fund’s Subadviser.

Portfolio Management

Mr. James F. Keegan, Chief Investment Officer and Chief Executive Officer, has been a member of the Fund’s management team since 2008. Mr. Adrien Webb, CFA, Managing Director and Senior Portfolio Manager, has been a member of the Fund’s management team since 2007. Mr. Perry Troisi, Managing Director and Senior Portfolio Manager, has been a member of the Fund’s management team since the Fund’s inception. Mr. Michael Rieger, Managing Director and Senior Portfolio Manager, has been a member of the Fund’s management team since 2007. Mr. Seth Antiles, Ph.D., Managing Director and Portfolio Manager, has been a member of the management team for the Fund since 2009.

Purchasing and Selling Your Shares

Effective June 30, 2011, the Limited Duration Fund is open solely to (i) clients of Seix Investment Advisors LLC, the Fund’s Subadviser, and its affiliates, and (ii) such other investors as Ridgeworth Capital Management Inc., shall approve in its discretion. All shareholders of the Limited Duration Fund as of June 30, 2011, however, can continue to hold and purchase additional shares. You may purchase or redeem Fund shares on any business day. The Fund offers I Shares to financial institutions and intermediaries for their own accounts or for the accounts of customers for whom they may act as fiduciary agent, investment adviser, or custodian. Please consult your financial institution or intermediary to find out about how to purchase I Shares of the Fund.

There is no minimum initial investment amount for the Fund’s I Shares. There are no minimums for subsequent investments.

Tax Information

The Fund’s distributions are generally taxable and will be taxed as ordinary income or capital gains unless you are investing through a tax-deferred arrangement, such as a 401(k) plan or an IRA.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase shares of the Fund through a financial intermediary, such as a broker-dealer or investment adviser, the Fund, the Adviser or the Distributor may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other financial intermediary and your salesperson to recommend the Fund over another investment. Ask your financial intermediary or visit your financial intermediary’s website for more information.

Table of Contents

| INVESTMENT GRADE FUNDS | 15 |

| LIMITED-TERM FEDERAL MORTGAGE SECURITIES FUND |

Summary Section

A Shares, C Shares and I Shares

Investment Objective

The Limited-Term Federal Mortgage Securities Fund (the “Fund”) seeks high current income, while preserving capital.

Fees and Expenses of the Fund

This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in RidgeWorth Funds. More information about these and other discounts is available from your financial professional and in Sales Charges on page 90 of the Fund’s prospectus and Rights of Accumulation on page 91 of the Fund’s statement of additional information.

| Shareholder Fees (fees paid directly from your investment) | ||||||

| A Shares | C Shares | I Shares | ||||

| Maximum Sales Charge (load) Imposed on Purchases (as a % of offering price) | 2.50% | None | None | |||

| Maximum Deferred Sales Charge (load) (as a % of net asset value) | None | 1.00% | None | |||

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | ||||||

| A Shares | C Shares | I Shares | ||||

| Management Fees | 0.50% | 0.50% | 0.50% | |||

| Distribution (12b-1) Fees | 0.20% | 1.00% | None | |||

| Other Expenses | 0.31% | 0.32% | 0.30% | |||

| Acquired Fund Fees and Expenses(1) | 0.03% | 0.03% | 0.03% | |||

|

|

|

| ||||

| Total Annual Fund Operating Expenses | 1.04% | 1.85% | 0.83% | |||

| Fee Waivers and/or Expense Reimbursements(2) | (0.15)% | (0.16)% | (0.14)% | |||

|

|

|

| ||||

| Total Annual Fund Operating Expenses After Fee Waivers and/or Expense Reimbursements | 0.89% | 1.69% | 0.69% | |||

| (1) | “Acquired Fund Fees and Expenses” reflect the Fund’s pro rata share of the fees and expenses incurred by investing in other investment companies. The impact of Acquired Fund Fees and Expenses is included in the total returns of the Fund. Acquired Fund Fees and Expenses are not used to calculate the Fund’s net asset value per share (“NAV”) and are not included in the calculation of the ratio of expenses to average net assets shown in the Financial Highlights section of the Fund’s prospectus. |

| (2) | The Adviser and the Subadviser have contractually agreed to waive fees and reimburse expenses until at least August 1, 2012 in order to keep Total Annual Fund Operating Expenses (excluding, as applicable, taxes, brokerage commissions, substitute dividend expenses on securities sold short, extraordinary expenses and acquired fund fees and expenses) from exceeding 0.86%, 1.66% and 0.66% for the A, C and I Shares, respectively. This agreement shall terminate upon the termination of the Investment Advisory Agreement between RidgeWorth Funds and the Adviser, or it may be terminated upon written notice to the Adviser by RidgeWorth Funds. |

Example

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same and you reinvest all dividends and distributions. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |||||||||||||

| A Shares |

$ | 339 | $ | 559 | $ | 797 | $ | 1,481 | ||||||||

| C Shares |

$ | 272 | $ | 567 | $ | 988 | $ | 2,162 | ||||||||

| I Shares | $ | 71 | $ | 251 | $ | 448 | $ | 1,017 | ||||||||

You would pay the following expenses if you did not redeem your shares:

| 1 Year | 3 Years | 5 Years | 10 Years | |||||||||||||

| A Shares |

$ | 339 | $ | 559 | $ | 797 | $ | 1,481 | ||||||||

| C Shares |

$ | 172 | $ | 567 | $ | 988 | $ | 2,162 | ||||||||

| I Shares | $ | 71 | $ | 251 | $ | 448 | $ | 1,017 | ||||||||

Portfolio Turnover

The Fund pays transaction costs when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 452% of the average value of its portfolio.

Table of Contents

| 16 | INVESTMENT GRADE FUNDS |

| LIMITED-TERM FEDERAL MORTGAGE SECURITIES FUND |

Principal Investment Strategies

Under normal circumstances, the Fund invests at least 80% of its net assets (plus any borrowings for investment purposes) in U.S. government agency mortgage-backed securities, such as the Federal National Mortgage Association (“Fannie Mae”), Government National Mortgage Association (“GNMA”) and collateralized mortgage obligations.

In selecting investments for purchase and sale, the Fund’s Subadviser, Seix Investment Advisors LLC (“Seix” or the “Subadviser”), attempts to identify securities that it expects to perform well in rising and falling markets. The Subadviser also attempts to reduce the risk that the underlying mortgages are prepaid by focusing on securities that it believes are less prone to this risk. For example, Fannie Mae or GNMA securities that were issued years ago may be less prone to prepayment risk because there have been many opportunities for refinancing.

In addition, to implement its investment strategy, the Fund may buy or sell, to a limited extent, derivative instruments (such as credit linked notes, futures, options, inverse floaters, swaps and warrants) to use as a substitute for a purchase or sale of a position in the underlying assets and/or as part of a strategy designed to reduce exposure to other risks, such as interest rate risk and credit risk.

Principal Investment Risks

You may lose money if you invest in the Fund. A Fund share is not a bank deposit and it is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

Debt Securities Risk: Debt securities, such as bonds, involve credit risk. Credit risk is the risk that the borrower will not make timely payments of principal and interest. Changes in an issuer’s credit rating or the market’s perception of an issuer’s creditworthiness may also affect the value of the Fund’s investment in that issuer. The degree of credit risk depends on the issuer’s financial condition and on the terms of the securities. Debt securities are also subject to interest rate risk, which is the risk that the value of a debt security may fall when interest rates rise. In general, the market price of debt securities with longer maturities will go up or down more in response to changes in interest rates than the market price of shorter term securities.

Mortgage-Backed and Asset-Backed Securities Risk: Mortgage- and asset-backed securities are debt instruments that are secured by interests in pools of mortgage loans or other financial assets. The value of these securities will be influenced by the factors affecting the assets underlying such securities, swings in interest rates, changes in default rates, or deteriorating economic conditions. During periods of declining asset values, mortgage-backed and asset-backed securities may face valuation difficulties, become more volatile and/or illiquid. The risk of default is generally higher in the case of securities backed by loans made to borrowers with “sub-prime” credit metrics.

If market interest rates increase substantially and the Fund’s adjustable-rate securities are not able to reset to market interest rates during any one adjustment period, the value of the Fund’s holdings and its net asset value may decline until the adjustable-rate securities are able to reset to market rates. In the event of a dramatic increase in interest rates, the lifetime limit on a security’s interest rate may prevent the rate from adjusting to prevailing market rates. In such an event the security could underperform and affect the Fund’s net asset value.

Prepayment and Call Risk: During periods of falling interest rates, an issuer of a callable bond held by the Fund may “call” or prepay the bond before its stated maturity date. When mortgages and other obligations are prepaid and when securities are called, the Fund may have to reinvest the proceeds in securities with a lower yield or fail to recover additional amounts paid for securities with higher interest rates, resulting in an unexpected capital loss and/or a decline in the Fund’s income.

U.S. Government Issuers Risk: U.S. Treasury obligations may differ in their interest rates, maturities, times of issuance and other characteristics. Similar to other issuers, changes to the financial condition or credit rating of the U.S. government may cause the value of its Treasury obligations to decline. Obligations of U.S. government agencies and authorities are supported by varying degrees of credit, but generally are not backed by the full faith and credit of the U.S. government. U.S. government debt securities may underperform other segments of the fixed income market or the fixed income market as a whole.

Obligations of certain agencies, authorities, instrumentalities and sponsored enterprises of the U.S. government are backed by the full faith and credit of the United States (e.g., Fannie Mae); other obligations are backed by the right of the issuer to borrow from the U.S. Treasury (e.g., the Federal Home Loan Banks); and others are supported by the discretionary authority of the U.S. government to purchase an agency’s obligations. Still others are backed only by the credit of

Table of Contents

| INVESTMENT GRADE FUNDS | 17 |

| LIMITED-TERM FEDERAL MORTGAGE SECURITIES FUND |

the agency, authority, instrumentality or sponsored enterprise issuing the obligation. No assurance can be given that the U.S. government would provide financial support to any of these entities if it is not obligated to do so by law.

Performance

The bar chart and the performance table that follow illustrate the risks and volatility of an investment in the Fund. The Fund’s past performance (before and after taxes) does not indicate how the Fund will perform in the future. Updated performance information is available by contacting the RidgeWorth Funds at 1-888-784-3863 or by visiting www.ridgeworth.com.

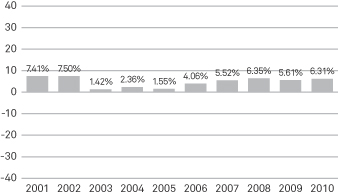

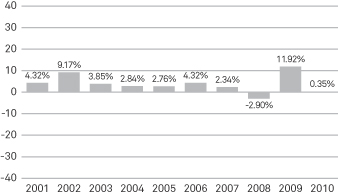

This bar chart shows the changes in performance of the Fund’s I Shares from year to year.*

| Best Quarter | Worst Quarter | |

| 4.36% | -1.70% | |

| (9/30/01) | (6/30/04) |

| * | The performance information shown above is based on a calendar year. The Fund’s total return for the six months ended June 30, 2011 was 2.59%. |

The following table compares the Fund’s average annual total returns for the periods indicated with those of a broad measure of market performance.

| AVERAGE ANNUAL TOTAL RETURNS (for periods ended December 31, 2010) |

||||||||||||

| 1 Year | 5 Years | 10 Years | ||||||||||

| A Shares Returns Before Taxes | 6.11 | % | 5.36 | % | 4.55 | % | ||||||

| C Shares Returns Before Taxes | 5.26 | % | 4.52 | % | 3.93 | % | ||||||

| I Shares Returns Before Taxes | 6.31 | % | 5.56 | % | 4.78 | % | ||||||

| I Shares Returns After Taxes on Distributions | 5.32 | % | 4.04 | % | 3.28 | % | ||||||

| I Shares Returns After Taxes on Distributions and Sale of Fund Shares | 4.09 | % | 3.85 | % | 3.19 | % | ||||||

| Barclays Capital U.S. Mortgage-Backed Securities Index (reflects no deduction for fees, expenses or taxes) | 5.37 | % | 6.34 | % | 5.89 | % | ||||||

After-tax returns are calculated using the historical highest individual U.S. federal marginal income tax rates and do not reflect the impact of state and local taxes. Your actual after-tax returns will depend on your tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax deferred arrangements, such as 401(k) plans or individual retirement accounts (“IRAs”). After-tax returns are shown for only the I Shares. After-tax returns for other share classes will vary.

Investment Adviser and Subadviser

RidgeWorth Investments is the Fund’s investment adviser (the “Adviser”). Seix Investment Advisors LLC is the Fund’s Subadviser.

Portfolio Management

Mr. James F. Keegan, Chief Investment Officer and Chief Executive Officer, has been a member of the Fund’s management team since 2008. Mr. Adrien Webb, CFA, Managing Director and Senior Portfolio Manager, has been a member of The Fund’s management team since 2007. Mr. Perry Troisi, Managing Director and Senior Portfolio Manager, has been a member of the Fund’s management team since 2007. Mr. Michael Rieger, Managing Director and Senior Portfolio Manager, has been a member of the Fund’s management team since 2007. Mr. Seth Antiles, Ph.D., Managing Director and Portfolio Manager, has been a member of the Fund’s Management team since 2009.

Purchasing and Selling Your Shares

You may purchase or redeem Fund shares on any business day. You may purchase and redeem A and C Shares of the Fund through financial institutions or intermediaries that are authorized to place transactions in Fund shares for their customers. Please contact your financial institution or intermediary directly and follow its procedures for fund share transactions. The Fund offers I Shares to financial institutions and intermediaries for their own accounts or for the accounts of customers for whom they may act as fiduciary agent, investment adviser, or custodian. Please consult your financial institution or intermediary to find out about how to purchase I Shares of the Fund.

Table of Contents

| 18 | INVESTMENT GRADE FUNDS |

| LIMITED-TERM FEDERAL MORTGAGE SECURITIES FUND |

The minimum initial investment amounts for each share class are shown below, although these minimums may be reduced or waived in some cases.

| Class | Dollar Amount | |

| A Shares | $2,000 | |

| C Shares | $5,000 ($2,000 for IRAs or other tax qualified accounts) | |

| I Shares | None |

Subsequent investments in A or C Shares must be made in amounts of at least $1,000. The Fund may accept investments of smaller amounts for either class of shares at its discretion. There are no minimums for subsequent investments in I Shares.

Tax Information

The Fund’s distributions are generally taxable and will be taxed as ordinary income or capital gains unless you are investing through a tax-deferred arrangement, such as a 401(k) plan or an IRA.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase shares of the Fund through a financial intermediary, such as a broker-dealer or investment adviser, the Fund, the Adviser or the Distributor may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other financial intermediary and your salesperson to recommend the Fund over another investment. Ask your financial intermediary or visit your financial intermediary’s website for more information.

Table of Contents

| INVESTMENT GRADE FUNDS | 19 |

| TOTAL RETURN BOND FUND |

Summary Section

A Shares, R Shares and I Shares

Investment Objective

The Total Return Bond Fund (the “Fund”) seeks total return (comprised of capital appreciation and income) that consistently exceeds the total return of the broad U.S. investment grade bond market.

Fees and Expenses of the Fund