| RidgeWorth Large Cap Value Equity Fund | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| LARGE CAP VALUE EQUITY FUND Summary Section A Shares, C Shares and I Shares |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Investment Objective | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Large Cap Value Equity Fund (the “Fund”) seeks to provide a high level of capital appreciation. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| As a secondary goal, the Fund also seeks to provide current income. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Fees and Expenses of the Fund | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in RidgeWorth Funds. More information about these and other discounts is available from your financial professional and in Sales Charges on page 44 of the Fund’s prospectus and Rights of Accumulation on page 45 of the Fund’s statement of additional information. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Shareholder Fees (fees paid directly from your investment) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Example | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same and you reinvest all dividends and distributions. Although your actual costs may be higher or lower, based on these assumptions your costs would be: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| You would pay the following expenses if you did not redeem your shares: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Portfolio Turnover | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 134% of the average value of its portfolio. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Principal Investment Strategies | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Under normal circumstances, the Fund invests at least 80% of its net assets (plus any borrowings for investment purposes) in U.S.-traded equity securities of large-capitalization companies. U.S.-traded equity securities may include American Depositary Receipts (“ADRs”). Ceredex Value Advisors LLC (“Ceredex” or the “Subadviser”) considers large-capitalization companies to be companies with market capitalizations similar to those of companies in the Russell 1000® Value Index. As of July 1, 2011, the market capitalization range of companies in the Russell 1000® Value Index was between approximately $519.1 million and $400.9 billion. In selecting investments for purchase and sale, the Subadviser chooses companies that it believes are undervalued in the market relative to the industry sector and the company’s own valuation history. The Subadviser evaluates potential catalysts that may cause an upward re-rating of the stock’s valuation. Additionally, the common stocks purchased for the Fund generally pay dividends at the time of purchase or are expected to pay dividends soon after their purchase. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Principal Investment Risks | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

You may lose money if you invest in the Fund. A Fund share is not a bank deposit and it is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Equity Securities Risk: The price of equity securities fluctuates from time to time based on changes in a company’s financial condition or overall market and economic conditions. As a result, the value of the Fund’s equity securities may fluctuate drastically from day to day. Large-Capitalization Companies Risk: Large-cap stocks can perform differently from other segments of the equity market or the equity market as a whole. Large-capitalization companies may be less flexible in evolving markets or unable to implement change as quickly as small-capitalization companies. Value Investing Risk: “Value” investing attempts to identify strong companies whose stocks are selling at a discount from their perceived true worth. It is subject to the risk that the stocks’ intrinsic values may never be fully recognized or realized by the market, their prices may go down, or that stocks judged to be undervalued may actually be appropriately priced. ADR Risk: The Fund may invest in ADRs, which are depositary receipts issued in registered form by a U.S. bank or trust company evidencing ownership of underlying securities issued by a foreign company. Investments in ADRs involve risks similar to those accompanying direct investments in foreign securities. These include the risk that political and economic events unique to a country or region will affect those markets and their issuers. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Performance | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

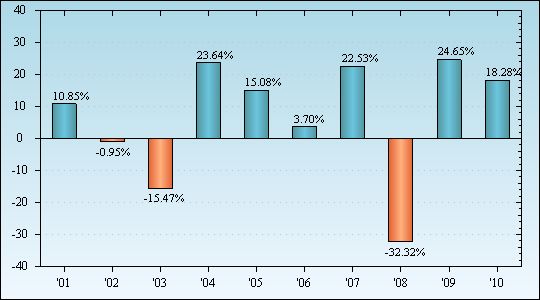

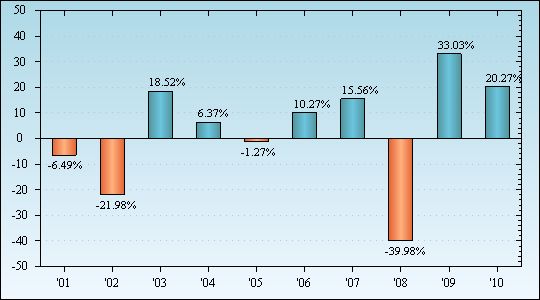

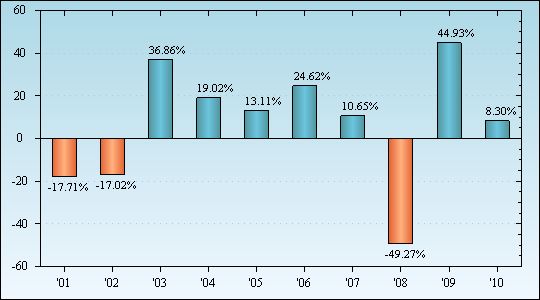

| The bar chart and the performance table that follow illustrate the risks and volatility of an investment in the Fund. The Fund’s past performance (before and after taxes) does not indicate how the Fund will perform in the future. Updated performance information is available by contacting the RidgeWorth Funds at 1-888-784-3863 or by visiting www.ridgeworth.com. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| This bar chart shows changes in the performance of the Fund’s I Shares from year to year. | [1] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Best Quarter 15.26% (6/30/09) Worst Quarter -19.89% (9/30/02) |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The following table compares the Fund’s average annual total returns for the periods indicated with those of a broad measure of market performance. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| AVERAGE ANNUAL TOTAL RETURNS (for periods ended December 31, 2010) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| After-tax returns are calculated using the historical highest individual U.S. federal marginal income tax rates and do not reflect the impact of state and local taxes. Your actual after-tax returns will depend on your tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax deferred arrangements, such as 401(k) plans or individual retirement accounts (“IRAs”). After-tax returns are shown for only the I Shares. After-tax returns for other share classes will vary. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| RidgeWorth Mid-Cap Value Equity Fund | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| MID-CAP VALUE EQUITY FUND Summary Section A Shares, C Shares and I Shares |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Investment Objective | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Mid-Cap Value Equity Fund (the “Fund”) seeks to provide capital appreciation. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| As a secondary goal, the Fund also seeks to provide current income. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Fees and Expenses of the Fund | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in RidgeWorth Funds. More information about these and other discounts is available from your financial professional and in Sales Charges on page 44 of the Fund’s prospectus and Rights of Accumulation on page 45 of the Fund’s statement of additional information. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Shareholder Fees (fees paid directly from your investment) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Example | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same and you reinvest all dividends and distributions. Although your actual costs may be higher or lower, based on these assumptions your costs would be: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| You would pay the following expenses if you did not redeem your shares: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Portfolio Turnover | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 170% of the average value of its portfolio. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Principal Investment Strategies | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Under normal circumstances, the Fund invests at least 80% of its net assets (plus any borrowings for investment purposes) in U.S.-traded equity securities of mid-capitalization companies. U.S.-traded equity securities may include American Depositary Receipts (“ADRs”). Ceredex Value Advisors LLC (“Ceredex” or the “Subadviser”) considers mid-capitalization companies to be companies with market capitalizations similar to those of companies in the Russell Midcap® Value Index. As of July 1, 2011, the market capitalization range of companies in the Russell Midcap® Value Index was between approximately $519.1 million and $17.8 billion. In selecting investments for purchase and sale, the Subadviser chooses companies that it believes are undervalued in the market relative to the industry sector and the company’s own valuation history. The Subadviser evaluates potential catalysts that may cause an upward re-rating of the stock’s valuation. Additionally, the common stocks purchased for the Fund generally pay dividends at the time of purchase or are expected to pay dividends soon after their purchase. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Principal Investment Risks | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

You may lose money if you invest in the Fund. A Fund share is not a bank deposit and it is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Equity Securities Risk: The price of equity securities fluctuates from time to time based on changes in a company’s financial condition or overall market and economic conditions. As a result, the value of the Fund’s equity securities may fluctuate drastically from day to day. Mid-Capitalization Companies Risk: Mid-cap stocks tend to perform differently from other segments of the equity market or the equity market as a whole, and can be more volatile than stocks of large-capitalization companies. Mid-capitalization companies may be newer or less established and may have limited resources, products and markets, and less liquid. Value Investing Risk: “Value” investing attempts to identify strong companies whose stocks are selling at a discount from their perceived true worth. It is subject to the risk that the stocks’ intrinsic values may never be fully recognized or realized by the market, their prices may go down, or that stocks judged to be undervalued may actually be appropriately priced. ADR Risk: The Fund may invest in ADRs, which are depositary receipts issued in registered form by a U.S. bank or trust company evidencing ownership of underlying securities issued by a foreign company. Investments in ADRs involve risks similar to those accompanying direct investments in foreign securities. These include the risk that political and economic events unique to a country or region will affect those markets and their issuers. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Performance | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

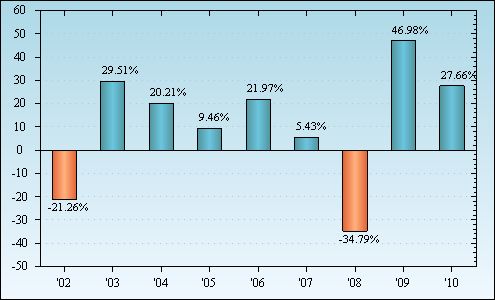

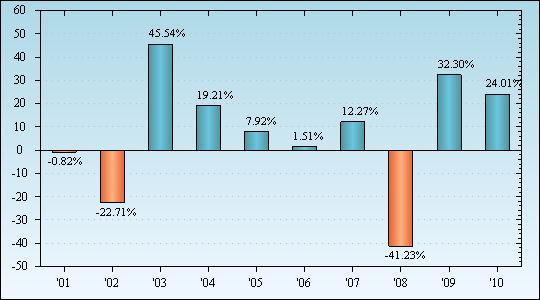

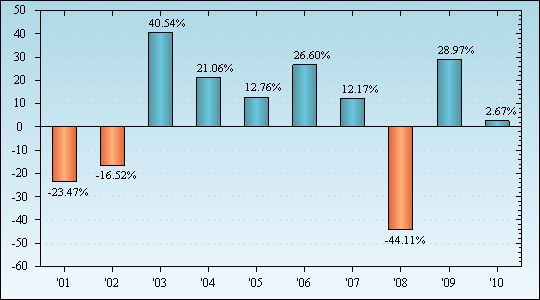

| The bar chart and the performance table that follow illustrate the risks and volatility of an investment in the Fund. The Fund’s past performance (before and after taxes) does not indicate how the Fund will perform in the future. Updated performance information is available by contacting the RidgeWorth Funds at 1-888-784-3863 or by visiting www.ridgeworth.com. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| This bar chart shows changes in the performance of the Fund’s I Shares from year to year. | [2] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Best Quarter 24.79% (9/30/09) Worst Quarter -23.38% (12/31/08) |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The following table compares the Fund’s average annual total returns for the periods indicated with those of a broad measure of market performance. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| AVERAGE ANNUAL TOTAL RETURNS (for periods ended December 31, 2010) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| After-tax returns are calculated using the historical highest individual U.S. federal marginal income tax rates and do not reflect the impact of state and local taxes. Your actual after-tax returns will depend on your tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax deferred arrangements, such as 401(k) plans or individual retirement accounts (“IRAs”). After-tax returns are shown for only the I Shares. After-tax returns for other share classes will vary. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| RidgeWorth Small Cap Value Equity Fund | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SMALL CAP VALUE EQUITY FUND Summary Section A Shares, C Shares and I Shares |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Investment Objective | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Small Cap Value Equity Fund (the “Fund”) seeks to provide capital appreciation. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| As a secondary goal, the Fund also seeks to provide current income. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Fees and Expenses of the Fund | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in RidgeWorth Funds. More information about these and other discounts is available from your financial professional and in Sales Charges on page 44 of the Fund’s prospectus and Rights of Accumulation on page 45 of the Fund’s statement of additional information. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Shareholder Fees (fees paid directly from your investment) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Example | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same and you reinvest all dividends and distributions. Although your actual costs may be higher or lower, based on these assumptions your costs would be: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| You would pay the following expenses if you did not redeem your shares: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Portfolio Turnover | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 72% of the average value of its portfolio. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Principal Investment Strategies | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Under normal circumstances, the Fund invests at least 80% of its net assets (plus any borrowings for investment purposes) in U.S.-traded equity securities of small-capitalization companies. U.S.-traded equity securities may include American Depositary Receipts (“ADRs”). Ceredex Value Advisors LLC (“Ceredex” or the “Subadviser”) considers small-capitalization companies to be companies with market capitalizations between $50 million and $3 billion or with market capitalizations similar to those of companies in the Russell 2000® Value Index. As of July 1, 2011, the market capitalization range of companies in the Russell 2000® Value Index was between approximately $31.3 million and $3.1 billion. In selecting investments for purchase and sale, the Subadviser chooses companies that it believes are undervalued in the market relative to the industry sector and the company’s own valuation history. The Subadviser evaluates potential catalysts that may cause an upward re-rating of the stock’s valuation. Additionally, the common stocks purchased for the Fund generally pay dividends at the time of purchase or are expected to pay dividends soon after their purchase. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Principal Investment Risks | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

You may lose money if you invest in the Fund. A Fund share is not a bank deposit and it is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Equity Securities Risk: The price of equity securities fluctuates from time to time based on changes in a company’s financial condition or overall market and economic conditions. As a result, the value of the Fund’s equity securities may fluctuate drastically from day to day. Small-Capitalization Companies Risk: Small-cap stocks tend to perform differently from other segments of the equity market or the equity market as a whole, and can be more volatile than stocks of mid- or large-capitalization companies. Small-capitalization companies may be newer or less established and may have limited resources, products and markets, and less liquid. Value Investing Risk: “Value” investing attempts to identify strong companies whose stocks are selling at a discount from their perceived true worth. It is subject to the risk that the stocks’ intrinsic values may never be fully recognized or realized by the market, their prices may go down, or that stocks judged to be undervalued may actually be appropriately priced. ADR Risk: The Fund may invest in ADRs, which are depositary receipts issued in registered form by a U.S. bank or trust company evidencing ownership of underlying securities issued by a foreign company. Investments in ADRs involve risks similar to those accompanying direct investments in foreign securities. These include the risk that political and economic events unique to a country or region will affect those markets and their issuers. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Performance | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

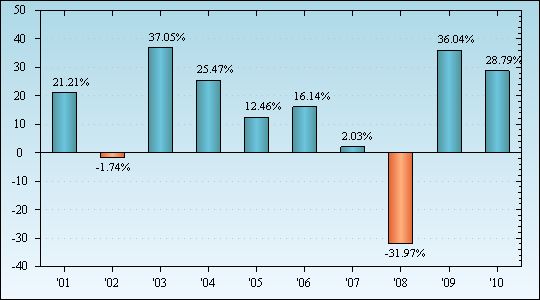

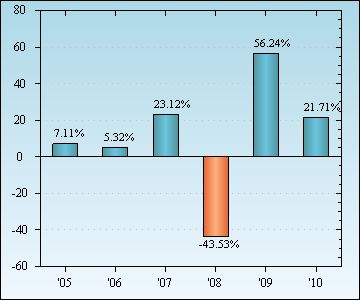

| The bar chart and the performance table that follow illustrate the risks and volatility of an investment in the Fund. The Fund’s past performance (before and after taxes) does not indicate how the Fund will perform in the future. A Shares were offered beginning on October 9, 2003. Performance prior to October 9, 2003, with respect to A Shares, is that of I Shares of the Fund, and has not been adjusted to reflect A Share expenses. If it had been, performance would have been lower. Updated performance information is available by contacting the RidgeWorth Funds at 1-888-784-3863 or by visiting www.ridgeworth.com. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| This bar chart shows changes in the performance of the Fund’s I Shares from year to year. | [3] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Best Quarter 19.65% (9/30/09) Worst Quarter -26.62% (12/31/08) |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The following table compares the Fund’s average annual total returns for the periods indicated with those of a broad measure of market performance. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| AVERAGE ANNUAL TOTAL RETURNS (for periods ended December 31, 2010) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| After-tax returns are calculated using the historical highest individual U.S. federal marginal income tax rates and do not reflect the impact of state and local taxes. Your actual after-tax returns will depend on your tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax deferred arrangements, such as 401(k) plans or individual retirement accounts (“IRAs”). After-tax returns are shown for only the I Shares. After-tax returns for other share classes will vary. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| RidgeWorth Large Cap Core Growth Stock Fund | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| LARGE CAP CORE GROWTH STOCK FUND Summary Section A Shares, C Shares and I Shares |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Investment Objective | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Large Cap Core Growth Stock Fund (formerly, the Large Cap Core Equity Fund) (the “Fund”) seeks to provide long-term capital appreciation. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| As a secondary goal, the Fund also seeks to provide current income. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Fees and Expenses of the Fund | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in RidgeWorth Funds. More information about these and other discounts is available from your financial professional and in Sales Charges on page 44 of the Fund’s prospectus and Rights of Accumulation on page 45 of the Fund’s statement of additional information. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Shareholder Fees (fees paid directly from your investment) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Example | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same and you reinvest all dividends and distributions. Although your actual costs may be higher or lower, based on these assumptions your costs would be: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| You would pay the following expenses if you did not redeem your shares: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Portfolio Turnover | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 136% of the average value of its portfolio. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Principal Investment Strategies | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Under normal circumstances, the Fund invests at least 80% of its net assets (plus any borrowings for investment purposes) in common stocks and other U.S.-traded equity securities of large-capitalization companies. U.S.-traded equity securities may include American Depositary Receipts (“ADRs”). Silvant Capital Management LLC (“Silvant” or the “Subadviser”) considers large-capitalization companies to be companies with market capitalizations similar to those of companies in the S&P 500 Index. As of July 1, 2011, the market capitalization range of companies in the S&P 500 Index was between approximately $1.4 billion and $400.9 billion. The Subadviser applies proprietary quantitative models to rank stocks based on improving fundamentals, valuation, capital deployment and efficiency and sentiment or behavior factors. The Subadviser then uses fundamental research to select the portfolio of stocks it believes has the best current risk/return characteristics. In selecting investments for purchase, the Subadviser seeks companies with strong current earnings, growth in revenue, improving profitability, strong balance sheets, strong current and projected business fundamentals, and reasonable valuation. The Subadviser’s approach attempts to identify a well-defined “investment thesis” (why it believes the company’s current expectations will be increased over the next 3 to 18 months) based on competitive positioning, business model, and potential catalysts and risks. The Subadviser may sell a security when the investment thesis is realized, the investment thesis breaks down, or a more attractive alternative presents itself. The Subadviser believes in executing a very disciplined and objective investment process and controlling risk through a broadly diversified portfolio. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Principal Investment Risks | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

You may lose money if you invest in the Fund. A Fund share is not a bank deposit and it is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Equity Securities Risk: The price of equity securities fluctuates from time to time based on changes in a company’s financial condition or overall market and economic conditions. As a result, the value of the Fund’s equity securities may fluctuate drastically from day to day. Growth Stock Risk: “Growth” stocks can react differently to issuer, political, market and economic developments than the market as a whole and other types of stocks. “Growth” stocks typically are sensitive to market movements because their market prices tend to reflect future expectations. When it appears those expectations will not be met, the prices of growth stocks typically fall. Large-Capitalization Companies Risk: Large-cap stocks can perform differently from other segments of the equity market or the equity market as a whole. Large-capitalization companies may be less flexible in evolving markets or unable to implement change as quickly as small-capitalization companies. ADR Risk: The Fund may invest in ADRs, which are depositary receipts issued in registered form by a U.S. bank or trust company evidencing ownership of underlying securities issued by a foreign company. Investments in ADRs involve risks similar to those accompanying direct investments in foreign securities. These include the risk that political and economic events unique to a country or region will affect those markets and their issuers. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Performance | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

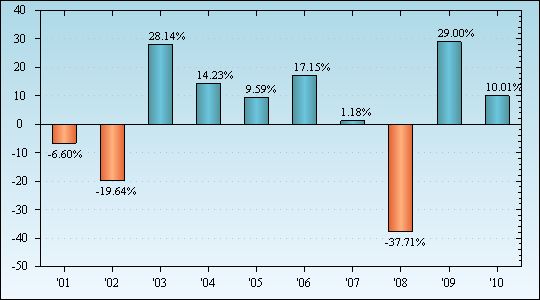

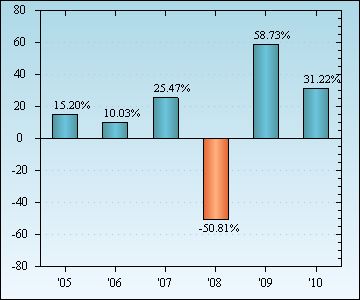

| The bar chart and the performance table that follow illustrate the risks and volatility of an investment in the Fund. The Fund’s past performance (before and after taxes) does not indicate how the Fund will perform in the future. Updated performance information is available by contacting the RidgeWorth Funds at 1-888-784-3863 or by visiting www.ridgeworth.com. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| This bar chart shows changes in the performance of the Fund’s I Shares from year to year. | [4] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Best Quarter 15.73% (6/30/09) Worst Quarter -22.03% (12/31/08) |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The following table compares the Fund’s average annual total returns for the periods indicated with those of a broad measure of market performance. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| AVERAGE ANNUAL TOTAL RETURNS (for periods ended December 31, 2010) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| After-tax returns are calculated using the historical highest individual U.S. federal marginal income tax rates and do not reflect the impact of state and local taxes. Your actual after-tax returns will depend on your tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax deferred arrangements, such as 401(k) plans or individual retirement accounts (“IRAs”). After-tax returns are shown for only the I Shares. After-tax returns for other share classes will vary. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| RidgeWorth Large Cap Growth Stock Fund | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| LARGE CAP GROWTH STOCK FUND Summary Section A Shares, C Shares and I Shares |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Investment Objective | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Large Cap Growth Stock Fund (the “Fund”) seeks to provide capital appreciation. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Fees and Expenses of the Fund | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in RidgeWorth Funds. More information about these and other discounts is available from your financial professional and in Sales Charges on page 44 of the Fund’s prospectus and Rights of Accumulation on page 45 of the Fund’s statement of additional information. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Shareholder Fees (fees paid directly from your investment) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Example | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same and you reinvest all dividends and distributions. Although your actual costs may be higher or lower, based on these assumptions your costs would be: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| You would pay the following expenses if you did not redeem your shares: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Portfolio Turnover | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 30% of the average value of its portfolio. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Principal Investment Strategies | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Under normal circumstances, the Fund invests at least 80% of its net assets (plus any borrowings for investment purposes) in common stocks and other U.S.-traded equity securities of large-capitalization companies. U.S.-traded equity securities may include American Depositary Receipts (“ADRs”). Silvant Capital Management LLC (“Silvant” or the “Subadviser”) considers large-capitalization companies to be companies with market capitalizations similar to those of companies in the Russell 1000® Growth Index. As of July 1, 2011, the market capitalization range of companies in the Russell 1000® Growth Index was between approximately $706.3 million and $400.9 billion. The Subadviser will seek out securities it believes have strong business fundamentals, such as revenue growth, improving cash flows, increasing margins and positive earning trends. In selecting investments for purchase and sale, the Subadviser chooses companies that it believes have above average growth potential to beat expectations. The Subadviser applies proprietary quantitative models to rank stocks based on improving fundamentals, valuation, capital deployment and efficiency and sentiment or behavior factors. It then performs in-depth fundamental analysis to determine the quality and sustainability of expectations to determine whether or not the company is poised to beat expectations. The Subadviser uses a “bottom-up” process based on company fundamentals. Risk controls are in place to assist in maintaining a portfolio that is diversified by sector and minimizes unintended risks relative to the primary benchmark. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Principal Investment Risks | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

You may lose money if you invest in the Fund. A Fund share is not a bank deposit and it is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Equity Securities Risk: The price of equity securities fluctuates from time to time based on changes in a company’s financial condition or overall market and economic conditions. As a result, the value of the Fund’s equity securities may fluctuate drastically from day to day. Growth Stock Risk: “Growth” stocks can react differently to issuer, political, market and economic developments than the market as a whole and other types of stocks. “Growth” stocks typically are sensitive to market movements because their market prices tend to reflect future expectations. When it appears those expectations will not be met, the prices of growth stocks typically fall. Large-Capitalization Companies Risk: Large-cap stocks can perform differently from other segments of the equity market or the equity market as a whole. Large-capitalization companies may be less flexible in evolving markets or unable to implement change as quickly as small-capitalization companies. ADR Risk: The Fund may invest in ADRs, which are depositary receipts issued in registered form by a U.S. bank or trust company evidencing ownership of underlying securities issued by a foreign company. Investments in ADRs involve risks similar to those accompanying direct investments in foreign securities. These include the risk that political and economic events unique to a country or region will affect those markets and their issuers. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Performance | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The bar chart and the performance table that follow illustrate the risks and volatility of an investment in the Fund. The Fund’s past performance (before and after taxes) does not indicate how the Fund will perform in the future. Updated performance information is available by contacting the RidgeWorth Funds at 1-888-784-3863 or by visiting www.ridgeworth.com. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| This bar chart shows changes in the performance of the Fund’s I Shares from year to year. | [5] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Best Quarter 14.85% (9/30/09) Worst Quarter -21.73% (12/31/08) |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The following table compares the Fund’s average annual total returns for the periods indicated with those of a broad measure of market performance. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| AVERAGE ANNUAL TOTAL RETURNS (for periods ended December 31, 2010) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| After-tax returns are calculated using the historical highest individual U.S. federal marginal income tax rates and do not reflect the impact of state and local taxes. Your actual after-tax returns will depend on your tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax deferred arrangements, such as 401(k) plans or individual retirement accounts (“IRAs”). After-tax returns are shown for only the I Shares. After-tax returns for other share classes will vary. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| RidgeWorth Select Large Cap Growth Stock Fund | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SELECT LARGE CAP GROWTH STOCK FUND Summary Section A Shares, C Shares and I Shares |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Investment Objective | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Select Large Cap Growth Stock Fund (the “Fund”) seeks to provide long-term capital appreciation. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Fees and Expenses of the Fund | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in RidgeWorth Funds. More information about these and other discounts is available from your financial professional and in Sales Charges on page 44 of the Fund’s prospectus and Rights of Accumulation on page 45 of the Fund’s statement of additional information. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Shareholder Fees (fees paid directly from your investment) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Example | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same and you reinvest all dividends and distributions. Although your actual costs may be higher or lower, based on these assumptions your costs would be: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| You would pay the following expenses if you did not redeem your shares: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Portfolio Turnover | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 72% of the average value of its portfolio. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Principal Investment Strategies | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Under normal circumstances, the Fund invests at least 80% of its net assets (plus any borrowings for investment purposes) in common stocks and other U.S.-traded equity securities of large-capitalization companies. U.S.-traded equity securities may include American Depositary Receipts (“ADRs”). Silvant Capital Management LLC (“Silvant” or the “Subadviser”) considers large-capitalization companies to be companies with market capitalizations similar to those of companies in the Russell 1000® Growth Index. As of July 1, 2011, the market capitalization range of companies in the Russell 1000® Growth Index was between approximately $706.3 million and $400.9 billion. The Subadviser applies proprietary quantitative models to rank stocks based on improving fundamentals, valuation, capital deployment and efficiency and sentiment or behavior factors. The Subadviser then uses fundamental research to select the portfolio of stocks it believes has the best current risk/return characteristics. In selecting investments for purchase and sale, the Subadviser seeks companies with strong current earnings, growth in revenue, improving profitability, strong balance sheet, strong current and projected business fundamentals, and reasonable valuation. The Subadviser believes in executing a very disciplined and objective investment process in controlling risk through a broadly diversified portfolio. Generally, the Fund will hold 40 securities or less. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Principal Investment Risks | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

You may lose money if you invest in the Fund. A Fund share is not a bank deposit and it is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Equity Securities Risk: The price of equity securities fluctuates from time to time based on changes in a company’s financial condition or overall market and economic conditions. As a result, the value of the Fund’s equity securities may fluctuate drastically from day to day. Growth Stock Risk: “Growth” stocks can react differently to issuer, political, market and economic developments than the market as a whole and other types of stocks. “Growth” stocks typically are sensitive to market movements because their market prices tend to reflect future expectations. When it appears those expectations will not be met, the prices of growth stocks typically fall. Large-Capitalization Companies Risk: Large-cap stocks can perform differently from other segments of the equity market or the equity market as a whole. Large-capitalization companies may be less flexible in evolving markets or unable to implement change as quickly as small-capitalization companies. ADR Risk: The Fund may invest in ADRs, which are depositary receipts issued in registered form by a U.S. bank or trust company evidencing ownership of underlying securities issued by a foreign company. Investments in ADRs involve risks similar to those accompanying direct investments in foreign securities. These include the risk that political and economic events unique to a country or region will affect those markets and their issuers. Holdings Risk: Because the Fund targets holdings of a more limited number of stocks, performance may be more volatile than a similar fund with a greater number of holdings or the Fund’s respective benchmark. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Performance | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The bar chart and the performance table that follow illustrate the risks and volatility of an investment in the Fund. The Fund’s past performance (before and after taxes) does not indicate how the Fund will perform in the future. A Shares were offered beginning October 14, 2003. Performance prior to October 14, 2003 with respect to the A Shares is that of I Shares of the Fund, and has not been adjusted to reflect A Share expenses. If it had been, performance would have been lower. Updated performance information is available by contacting the RidgeWorth Funds at 1-888-784-3863 or by visiting www.ridgeworth.com. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| This bar chart shows changes in the performance of the Fund’s I Shares from year to year. | [6] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Best Quarter 13.55% (9/30/10) Worst Quarter -20.29% (12/31/08) |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The following table compares the Fund’s average annual total returns for the periods indicated with those of a broad measure of market performance. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| AVERAGE ANNUAL TOTAL RETURNS (for periods ended December 31, 2010) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| After-tax returns are calculated using the historical highest individual U.S. federal marginal income tax rates and do not reflect the impact of state and local taxes. Your actual after-tax returns will depend on your tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax deferred arrangements, such as 401(k) plans or individual retirement accounts (“IRAs”). After-tax returns are shown for only the I Shares. After-tax returns for other share classes will vary. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| RidgeWorth Small Cap Growth Stock Fund | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SMALL CAP GROWTH STOCK FUND Summary Section A Shares, C Shares and I Shares |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Investment Objective | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Small Cap Growth Stock Fund (the “Fund”) seeks to provide long-term capital appreciation. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Fees and Expenses of the Fund | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in RidgeWorth Funds. More information about these and other discounts is available from your financial professional and in Sales Charges on page 44 of the Fund’s prospectus and Rights of Accumulation on page 45 of the Fund’s statement of additional information. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Shareholder Fees (fees paid directly from your investment) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Example | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same and you reinvest all dividends and distributions. Although your actual costs may be higher or lower, based on these assumptions your costs would be: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| You would pay the following expenses if you did not redeem your shares: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Portfolio Turnover | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 112% of the average value of its portfolio. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Principal Investment Strategies | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Under normal circumstances, the Fund invests at least 80% of its net assets (plus any borrowings for investment purposes) in U.S.-traded equity securities of small-capitalization companies. U.S.-traded equity securities may include American Depositary Receipts (“ADRs”). Silvant Capital Management LLC (“Silvant” or the “Subadviser”) considers small-capitalization companies to be companies with market capitalizations similar to those of companies in the Russell 2000® Growth Index. As of July 1, 2011, the market capitalization range of companies in the Russell 2000® Growth Index was between approximately $31.3 million and $3.1 billion. In selecting investments for purchase and sale, the Subadviser chooses companies that it believes have above average growth potential to beat expectations as a result of strong business fundamentals, such as revenue growth, improving cash flows, increasing margins and positive earning trends. The Subadviser applies proprietary quantitative models to rank stocks based on improving fundamentals, valuation, capital deployment and efficiency and sentiment or behavior factors. It then performs in-depth fundamental analysis to determine the quality and sustainability of expectations to determine whether or not the company is poised to beat expectations. The Subadviser uses a “bottom-up” process based on company fundamentals. Risk controls are in place to assist in maintaining a portfolio that is diversified by sector and minimizes unintended risks relative to the primary benchmark. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Principal Investment Risks | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

You may lose money if you invest in the Fund. A Fund share is not a bank deposit and it is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Equity Securities Risk: The price of equity securities fluctuates from time to time based on changes in a company’s financial condition or overall market and economic conditions. As a result, the value of the Fund’s equity securities may fluctuate drastically from day to day. Growth Stock Risk: “Growth” stocks can react differently to issuer, political, market and economic developments than the market as a whole and other types of stocks. “Growth” stocks typically are sensitive to market movements because their market prices tend to reflect future expectations. When it appears those expectations will not be met, the prices of growth stocks typically fall. Small-Capitalization Companies Risk: Small-cap stocks tend to perform differently from other segments of the equity market or the equity market as a whole, and can be more volatile than stocks of mid- or large-capitalization companies. Small-capitalization companies may be newer or less established and may have limited resources, products and markets, and less liquid. ADR Risk: The Fund may invest in ADRs, which are depositary receipts issued in registered form by a U.S. bank or trust company evidencing ownership of underlying securities issued by a foreign company. Investments in ADRs involve risks similar to those accompanying direct investments in foreign securities. These include the risk that political and economic events unique to a country or region will affect those markets and their issuers. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Performance | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The bar chart and the performance table that follow illustrate the risks and volatility of an investment in the Fund. The Fund’s past performance (before and after taxes) does not indicate how the Fund will perform in the future. Updated performance information is available by contacting the RidgeWorth Funds at 1-888-784-3863 or by visiting www.ridgeworth.com. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| This bar chart shows changes in the performance of the Fund’s I Shares from year to year. | [7] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Best Quarter 24.19% (6/30/03) Worst Quarter -28.61% (12/31/08) |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The following table compares the Fund’s average annual total returns for the periods indicated with those of a broad measure of market performance. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| AVERAGE ANNUAL TOTAL RETURNS (for periods ended December 31, 2010) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| After-tax returns are calculated using the historical highest individual U.S. federal marginal income tax rates and do not reflect the impact of state and local taxes. Your actual after-tax returns will depend on your tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax deferred arrangements, such as 401(k) plans or individual retirement accounts (“IRAs”). After-tax returns are shown for only the I Shares. After-tax returns for other share classes will vary. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| RidgeWorth Aggressive Growth Stock Fund | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| AGGRESSIVE GROWTH STOCK FUND Summary Section A Shares and I Shares |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Investment Objective | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Aggressive Growth Stock Fund (the “Fund”) seeks to provide long-term capital appreciation. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Fees and Expenses of the Fund | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in RidgeWorth Funds. More information about these and other discounts is available from your financial professional and in Sales Charges on page 44 of the Fund’s prospectus and Rights of Accumulation on page 45 of the Fund’s statement of additional information. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Shareholder Fees (fees paid directly from your investment) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Example | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same and you reinvest all dividends and distributions. Although your actual costs may be higher or lower, based on these assumptions your costs would be: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Portfolio Turnover | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 53% of the average value of its portfolio. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Principal Investment Strategies | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Under normal circumstances, the Fund invests at least 80% of its net assets (plus any borrowings for investment purposes) in common stocks and other U.S.-traded equity securities. U.S.-traded equity securities may include American Depositary Receipts (“ADRs”). The Fund may invest in companies of any size and may invest a portion of its assets in non-U.S. issued securities. The Fund invests primarily in common stocks of companies that exhibit strong growth characteristics. In selecting investments for purchase and sale, Zevenbergen Capital Investments LLC (“Zevenbergen” or the “Subadviser”) uses a fundamental research approach to identify companies with favorable prospects for future revenue, earnings, and/or cash flow growth. Growth “drivers” are identified for each company and become critical to the ongoing evaluation process. Industry growth dynamics, company competitive positioning, pricing flexibility, and diversified product offerings are evaluated, providing the foundation for further fundamental research to determine the weighting of the Fund’s investments. Generally the Fund will hold a limited number of securities. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Principal Investment Risks | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

You may lose money if you invest in the Fund. A Fund share is not a bank deposit and it is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Equity Securities Risk: The price of equity securities fluctuates from time to time based on changes in a company’s financial condition or overall market and economic conditions. As a result, the value of the Fund’s equity securities may fluctuate drastically from day to day. Holdings Risk: Because the Fund targets holdings of a more limited number of stocks, performance may be more volatile than a similar fund with a greater number of holdings or the Fund’s respective benchmark. Growth Stock Risk: “Growth” stocks can react differently to issuer, political, market and economic developments than the market as a whole and other types of stocks. “Growth” stocks typically are sensitive to market movements because their market prices tend to reflect future expectations. When it appears those expectations will not be met, the prices of growth stocks typically fall. Small- and Mid-Capitalization Companies Risk: Small- and mid-cap stocks tend to perform differently from other segments of the equity market or the equity market as a whole, and can be more volatile than stocks of large-capitalization companies. Small- and mid-capitalization companies may be newer or less established and may have limited resources, products and markets, and less liquid. Large-Capitalization Companies Risk: Large-cap stocks can perform differently from other segments of the equity market or the equity market as a whole. Large-capitalization companies may be less flexible in evolving markets or unable to implement change as quickly as small-capitalization companies. Foreign Securities Risk: Foreign securities involve special risks such as currency fluctuations, economic or financial instability, lack of timely or reliable financial information and unfavorable political or legal developments. These risks are increased for investments in emerging markets. The Fund is also subject to the risk that foreign equity securities may underperform other segments of the equity market or the equity market as a whole. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Performance | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The bar chart and the performance table that follow illustrate the risks and volatility of an investment in the Fund. The Fund’s past performance (before and after taxes) does not indicate how the Fund will perform in the future. Updated performance information is available by contacting the RidgeWorth Funds at 1-888-784-3863 or by visiting www.ridgeworth.com. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| This bar chart shows changes in the performance of the Fund’s I Shares from year to year. | [8] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Best Quarter 23.29% (6/30/09) Worst Quarter -27.98% (12/31/08) |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The following table compares the Fund’s average annual total returns for the periods indicated with those of a broad measure of market performance. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| AVERAGE ANNUAL TOTAL RETURNS (for periods ended December 31, 2010) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| After-tax returns are calculated using the historical highest individual U.S. federal marginal income tax rates and do not reflect the impact of state and local taxes. Your actual after-tax returns will depend on your tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax deferred arrangements, such as 401(k) plans or individual retirement accounts (“IRAs”). After-tax returns are shown for only the I Shares. After-tax returns for other share classes will vary. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| RidgeWorth Emerging Growth Stock Fund | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| EMERGING GROWTH STOCK FUND Summary Section A Shares and I Shares |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Investment Objective | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Emerging Growth Stock Fund (the “Fund”) seeks to provide long-term capital appreciation. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Fees and Expenses of the Fund | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in RidgeWorth Funds. More information about these and other discounts is available from your financial professional and in Sales Charges on page 44 of the Fund’s prospectus and Rights of Accumulation on page 45 of the Fund’s statement of additional information. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Shareholder Fees (fees paid directly from your investment) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Example | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same and you reinvest all dividends and distributions. Although your actual costs may be higher or lower, based on these assumptions your costs would be: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Portfolio Turnover | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 133% of the average value of its portfolio. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Principal Investment Strategies | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Under normal circumstances, the Fund invests at least 80% of its net assets (plus any borrowings for investment purposes) in common stocks and other U.S.-traded equity securities. U.S.-traded equity securities may include American Depositary Receipts (“ADRs”). The Fund invests primarily in stocks of small and mid-cap growth companies. Zevenbergen Capital Investments LLC (“Zevenbergen” or the “Subadviser”) considers small and mid-cap growth companies to be primarily companies with market capitalizations from $300 million up to the highest capitalization of those companies included in the Russell Midcap® Growth Index (and as annually reconstituted). As of June 24, 2011, the highest capitalization of a company in the Russell Midcap® Growth Index was approximately $17.2 billion. The Subadviser emphasizes initial investment in companies with market capitalizations of $5 billion or less. The Fund may also invest a portion of its assets in non-U.S. issued securities. In selecting investments for purchase and sale, the Subadviser looks for companies that exhibit strong growth characteristics. Using a fundamental research approach, the Subadviser identifies companies with favorable prospects for future revenue, earnings, and/or cash flow growth. Growth “drivers” are identified for each company and become critical to the ongoing evaluation process. Industry growth dynamics, company competitive positioning, pricing flexibility, and diversified product offerings are evaluated, providing the foundation for further fundamental research to determine the weighting of the Fund’s investments. Generally, the Fund will hold a limited number of securities. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Principal Investment Risks | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

You may lose money if you invest in the Fund. A Fund share is not a bank deposit and it is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Equity Securities Risk: The price of equity securities fluctuates from time to time based on changes in a company’s financial condition or overall market and economic conditions. As a result, the value of the Fund’s equity securities may fluctuate drastically from day to day. Holdings Risk: Because the Fund targets holdings of a more limited number of stocks, performance may be more volatile than a similar fund with a greater number of holdings or the Fund’s respective benchmark. Growth Stock Risk: “Growth” stocks can react differently to issuer, political, market and economic developments than the market as a whole and other types of stocks. “Growth” stocks typically are sensitive to market movements because their market prices tend to reflect future expectations. When it appears those expectations will not be met, the prices of growth stocks typically fall. Small- and Mid-Capitalization Companies Risk: Small- and mid-cap stocks tend to perform differently from other segments of the equity market or the equity market as a whole, and can be more volatile than stocks of large-capitalization companies. Small- and mid-capitalization companies may be newer or less established and may have limited resources, products and markets, and less liquid. Foreign Securities Risk: Foreign securities involve special risks such as currency fluctuations, economic or financial instability, lack of timely or reliable financial information and unfavorable political or legal developments. These risks are increased for investments in emerging markets. The Fund is also subject to the risk that foreign equity securities may underperform other segments of the equity market or the equity market as a whole. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Performance | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The bar chart and the performance table that follow illustrate the risks and volatility of an investment in the Fund. The Fund’s past performance (before and after taxes) does not indicate how the Fund will perform in the future. Updated performance information is available by contacting the RidgeWorth Funds at 1-888-784-3863 or by visiting www.ridgeworth.com. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| This bar chart shows changes in the performance of the Fund’s I Shares from year to year. | [9] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Best Quarter 29.24% (6/30/09) Worst Quarter -35.52% (12/31/08) |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The following table compares the Fund’s average annual total returns for the periods indicated with those of a broad measure of market performance. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| AVERAGE ANNUAL TOTAL RETURNS (for periods ended December 31, 2010) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| After-tax returns are calculated using the historical highest individual U.S. federal marginal income tax rates and do not reflect the impact of state and local taxes. Your actual after-tax returns will depend on your tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax deferred arrangements, such as 401(k) plans or individual retirement accounts (“IRAs”). After-tax returns are shown for only the I Shares. After-tax returns for other share classes will vary. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| RidgeWorth International Equity Fund | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| INTERNATIONAL EQUITY FUND Summary Section A Shares and I Shares |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Investment Objective | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The International Equity Fund (the “Fund”) seeks to provide long-term capital appreciation. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Fees and Expenses of the Fund | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in RidgeWorth Funds. More information about these and other discounts is available from your financial professional and in Sales Charges on page 44 of the Fund’s prospectus and Rights of Accumulation on page 45 of the Fund’s statement of additional information. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Shareholder Fees (fees paid directly from your investment) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||