Form 10-K

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2014

or

| ¨ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE TRANSITION PERIOD FROM TO

COMMISSION FILE NUMBER 000-22333

NANOPHASE TECHNOLOGIES CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

| Delaware |

|

36-3687863 |

| (State or other jurisdiction

of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

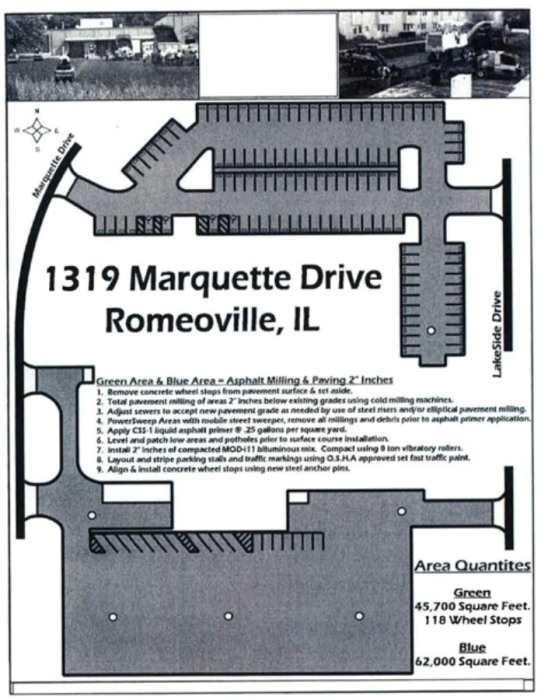

1319 Marquette Drive, Romeoville, Illinois 60446

(Address of principal executive offices) (zip code)

Registrant’s telephone number, including area code: (630) 771-6708

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, par value $.01 per share

Indicate by

check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the

Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such

files). x Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K

is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K

or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller

reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

|

|

|

|

|

|

| Large accelerated filer |

|

¨ |

|

Accelerated filer |

|

¨ |

|

|

|

|

| Non-accelerated filer |

|

¨ |

|

Smaller reporting company |

|

x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange

Act). Yes ¨ No x

The aggregate market value of the registrant’s voting stock held by non-affiliates of the registrant based upon the last reported sale

price of the registrant’s common stock on June 30, 2014 was $6,893,000 as of such date.

The number of shares outstanding of the

registrant’s common stock, par value $.01, as of March 13, 2015 was 28,585,496.

DOCUMENTS INCORPORATED BY REFERENCE

None.

Table of Contents

2

PART I

General

Nanophase Technologies Corporation (“Nanophase” or the “Company”, including “we”, “our” or

“us”) is an advanced materials and applications developer and commercial manufacturer with an integrated family of materials technologies. We produce engineered nano and sub-micron materials for use in a variety of diverse markets:

personal care including sunscreens, architectural coatings, industrial coating applications, abrasion-resistant additives, plastics additives, medical diagnostics, energy and a variety of surface finishing technologies (polishing) applications,

including optics.

While our origin is based on the creation of nanoscale metal oxide products, we have expanded our offerings to include

larger but still sub-micron materials. We have developed techniques for managing attributes including particle size, shape, surface coatings, and other valuable aspects of the material. Our focus is on customer need where we believe we have an

advantage, as opposed to finding uses for one particular technology. Additionally, as the format of delivery is important to customers, we have developed proprietary capabilities for dispersing our materials into both aqueous (water-based) and

solvent-based liquid media. These capabilities allow us to better integrate with the customer’s need and application.

We target

markets in which we believe practical solutions may be found using our products. We work closely with current and potential customers in these target markets to identify their material and performance requirements and market our materials to various

end-use applications manufacturers. Recently developed technologies have made certain new products possible and opened potential new markets. We expect growth in end-user (manufacturing customers, including customers of our customers) adoption in

2015 and beyond. Our initiatives in targeted market areas are progressing at differing rates of speed, but we have been broadly moving through testing and development cycles, and in a number of cases believe we are approaching first revenue or next

stage revenue with particular customers in the industries referenced above. During 2014 we developed new solutions in surface finishing technologies (polishing) and energy-management areas that have been taken to potential customers, with commercial

order flow accelerating in the former and significant commercial testing activities happening in the latter. We believe that successful introduction of our materials with manufacturers may lead to follow-on orders for other materials in their

applications. Although our primary strategic focus has been the North American market, we currently sell material to customers overseas and have been working to expand our reach within foreign markets. The Company was incorporated in Illinois on

November 25, 1989, and became a Delaware corporation during November 1997. Our common stock trades on the OTCQB marketplace under the symbol NANX.

We have created a leading commercial approach to the application of our integrated materials technologies designed to deliver an optimal

engineered solution for a target market or specific customer application. With respect to our products, we have complete capability from application development and laboratory samples through pilot production and, finally, commercial production

currently at rates as high as hundreds of metric tons per year for individual products. We have development and application laboratories and manufacturing capacity in two locations in the Chicago area. Our manufacturing is based on Lean Six Sigma

discipline and is certified to ISO 9001, American National Standard, Quality Management System Requirements; ISO 14001, American National Standard, Environmental Management System Requirements; and is compliant with current Good Manufacturing

Practices (“cGMP”) for products under U.S. Food and Drug Administration (“FDA”) regulation.

We have undergone a

strategic shift during recent years toward penetrating key markets via interactive applications development with end-use customers in these markets. We also supply both

3

nanoscale and larger materials, based on market requirement. We believe this strategy leverages the applications development expertise we have cultivated over the last several years and best

positions us to build direct sales to end-use customers, in addition to translating these advantages through our market partners.

Nanomaterials

Nanomaterials are generally comprised of particles (nanoparticles) that are less than 100 nanometers in diameter and

these nanoparticles have a wide range of unique properties owing to their very small size. A nanometer is one-billionth of a meter, or about 100,000 times smaller in size than the width of a human hair.

Nanotechnology involves manipulating the properties of materials, made up of basic elements or combinations thereof, at the 100-nanometer

level or below. At this scale, the relatively small number of constituent atoms, the large proportion of these atoms on surfaces, and their confined dimensions lead materials to exhibit unique properties that can be used in many applications to

benefit performance.

Nanomaterials are an important and enabling part of the diverse field of nanotechnology and are the building blocks

of our nanotechnology products. The ultimate performance and value of Nanophase’s products in a given application is a function of nanoparticle composition, size, shape, structure, surface chemistry and coating and dispersion potential. Our

technologies for engineering and manufacturing nanomaterials, and our understanding of how to make nanomaterials exhibit desirable performance characteristics in various media, result in commercial nanomaterials solutions that we believe offer

superior performance in many applications.

Nanomaterials have applications in diverse global markets where they are incorporated into a

process, such as optics polishing, or a product, such as an industrial coating to prevent degradation or aid in application, or significantly improve wear resistance, or promote/hamper particular chemical reactions within respective systems.

Multiple markets exist for our products since nanomaterials offer advantages in many applications, such as improved properties and performance, longer wear or product life, lower overall product cost, or in the development of new products or

processes.

Most of the raw materials we use are commercially available. In some cases, we rely on sole-source processors of materials

that utilize an array of worldwide sources for the raw materials that they process to our specifications. However, in certain cases we deal with very limited supply of certain elements, such as those classified as “Rare Earth” elements-

specifically cerium oxide for use in surface finishing technologies (polishing) applications. On a worldwide basis, the vast majority of these elements are sourced from China. Due to severe export limitations imposed by China from 2010 through 2012,

the supply of all Rare Earth elements was drastically reduced from previous levels. While prices and availability improved by the end of 2012, the cost remains higher than it was prior to 2010. In addition, this market dynamic created significant

concerns, globally, pertaining to the availability and cost of using these materials, which continue to pose customer acceptance risk for elements of our polishing business going forward.

Our Technologies

We have created an integrated platform of commercial nanomaterial technologies that are patented, patent-pending or proprietary. These

technologies are designed to deliver a nanomaterial solution for a targeted market or a specific customer application. Our platform provides flexibility and capability to engineer nanomaterials that meet a customer’s performance requirements

and delivers our nanomaterial solutions in a readily usable format. Our technologies are scalable and robust, having produced several hundred metric tons annually.

Our nanomaterials platform includes two distinct manufacturing processes (PVS — Plasma Vapor Synthesis and NAS - NanoArc® Synthesis) to make nanomaterials or nanoparticles. These technologies

4

allow us to control critical nanomaterial properties (composition, size, shape, structure, surface chemistry) and engineer these attributes to meet specific application performance. Compared to

other well-developed known nanoparticle processes, our plasma-produced particles are produced as nonporous, dense, discrete single crystals, which we believe possess a unique set of bulk and surface properties.

Perhaps of greater importance, we have developed proprietary technology to disperse nanoparticles in both aqueous (water-based) and several

organic solvent systems. These dispersions are stable at high weight loading (typically 18-55% by weight). These aspects provide distinct market advantages. Dispersed nanomaterials are desired by many customers for use in their processes or products

because of the ease of incorporation. As examples, dispersed nanomaterials are used in architectural coatings, industrial cleaning solutions, industrial coatings, plastic additives and optical and semiconductor polishing. This integration

flexibility allows us to serve more customers and serve them better, and is critical to our role as a solutions provider, not simply that of a materials provider.

We have also developed patented and proprietary technology to coat or surface treat nanoparticles to further engineer surface chemistry by two

main processes. In many applications, such as sunscreens, this technology is vital to ensure formulation compatibility and, in some cases, optimal application performance. We deliver hundreds of metric tons of surface engineered nanoparticles to our

customers annually, including coated nanomaterials that are used by major global consumer products companies for sunscreens and personal care products.

As markets continue to develop and grow, we believe that customers’ preferred delivery formats will often be dispersed and/or coated

nanomaterials. We believe we are well-positioned with our platform of integrated commercial nanomaterial technologies to respond to this demand. We plan to maintain and advance our intellectual property and technologies to remain competitive in the

fields of nanomaterials development, applications development and commercialization.

We have used our expertise in nanoscale materials to

develop larger sub-micron particle–based products that are not considered “nano” in various applications. Controlling aspects including particle size and shape, as well as surface chemistries, allow us to provide superior materials to

the marketplace in various formats, both at the nano level and above.

We have steadily expanded our ability to commercially utilize and

deliver our technologies. Through large-scale manufacturing of nanomaterials utilized in the manufacture of consumer sunscreen and personal care products and architectural coatings, we have developed production expertise that has allowed us to

improve processes relating to those nanomaterials as well as processes relating to other nanomaterials. This experience has translated into additional know-how, intellectual property and advances in the technologies and manufacturing processes that

reduce variable manufacturing costs and improve gross margins.

Marketing and Distribution Methods

We focus our marketing strategy on differentiated solutions that create superior value for our customers. This customer-focused strategy means

we are not solely dependent upon the efforts of a distributor for future sales growth. We have found many cases where our ability to effectively integrate nanomaterials into a customer’s specific chemistry is critical to presenting an effective

solution. Given this reality, we launched a “customer direct” business model during 2009 for those markets that are not conducive to an intermediary. In these markets, we interact with customers directly rather than through intermediaries,

demonstrating the benefits of our solutions in their products. Our deep market knowledge of certain markets and applications has allowed us to understand customer needs and our products’ value proposition, and adapt our offerings accordingly.

This knowledge, combined with our applications development expertise, supports leveraging our development efforts by marketing and selling our solutions to multiple customers within each market. We work closely with each customer to develop a

material solution for that entity’s specific application(s), but we find that as we develop greater applications development expertise in a given area, specific applications development often becomes a

5

routine process within Nanophase. This is where we believe our future customers will perceive the greatest value in working with us, and where we will be able to leverage our product development

efforts into multiple revenue generating customer solutions. Surface finishing technologies (polishing) is an example of such a market.

We see this customer-focused marketing approach increasing our probability of success in many markets, allowing us to use an integrated

platform of material technologies and typically reducing the total time-to-market. The more our applications development scientists and sales team work directly with customers to develop nanomaterial solutions, the more quickly and successfully we

believe we will be able to grow sales.

In addition to serving customers in diverse markets and geographic locations, we will continue to

devote significant resources to maintaining and growing our relationship with BASF Corporation (“BASF”), our largest customer in the personal care market. This has been a successful relationship that we expect will contribute to our future

growth. BASF, which describes itself as the world’s leading chemical company with revenue in excess of $100 billion, is a global leader in the personal care market with recognized brands, significant revenues and sales reach. We have a

long-term exclusive relationship with BASF, primarily to provide our zinc oxide-based products to be used in personal care with sunscreens and daily wear products being the dominant applications.

In addition to the personal care applications described above, our products are used in a variety of other applications, including

architectural coatings, polishing applications (including optical glass and CMP), plastics additives, medical diagnostics, textiles and graphic arts, energy control applications, and others. Recent activities have expanded our presence in the

polishing / surface finishing applications space, and 2013 saw us develop two solutions for the energy sector (consumer) that were taken to market leaders for evaluation during 2014. Our efforts in these areas of recent activity will continue in

2015, and we expect a combination of these new solutions in the surface finishing (polishing) and energy sector (consumer) areas to yield significant incremental revenue going forward.

Because our technology can be applied to a wide variety of applications, we focus our efforts on only a handful of applications to gain a

depth of knowledge and leverage our learning curve. If we find a unique application outside of our core markets that does not require significant development resources then we may pursue it as “opportunistic” business. We believe this

focused approach will contribute to a higher success rate for related opportunities than we would experience by pursuing more opportunities simultaneously.

Technology and Engineering

Our efforts in research and development, process engineering and advanced engineering groups are focused in three major areas: 1) application

development for our products; 2) creating or obtaining additional core material technologies and/or materials that have the capability to serve multiple markets; and 3) continuing to improve our core technologies to improve manufacturing operations

and reduce costs.

Most of our research and development is directly related to applications development. We endeavor to either meet

specific customer needs or to develop applications solutions to address unmet needs in a particular market where we believe our materials will offer a distinct performance advantage. We believe that aggressively pursuing applications in targeted

areas will help us compete as a technical and commercial innovator using our materials expertise, and more importantly, become perceived as a solutions provider by our customers and not simply as another materials supplier.

Our total research and development expense, which includes all expenses relating to our technology and advanced engineering groups, during the

years ended December 31, 2014 and 2013, was $1.3 million and $1.7 million, respectively. This represents our share of these expenses only and does not take into account amounts spent by any of our customers in support of new product

development. Our

6

future success will depend in large part upon our ability to develop products which bring a high degree of value to our customers’ products. Through the three-year period ended

December 31, 2014, we had cumulative research and development expenses of approximately $5 million and cumulative expenditures on equipment and leasehold improvements of approximately $0.4 million.

Manufacturing Operations

We have manufacturing capacity based in two locations in the Chicago area. At each of these facilities, we are able to develop and supply

nanomaterials in quantities ranging from grams to metric tons. Our facilities are certified to ISO 9001:2008 international standards and are cGMP compliant for applicable bulk pharmaceutical manufacturing. We are also in the process of registering

some of the chemicals we ship to customers in Europe pursuant to the European Chemical Agency’s regulations issued to date pertaining to Registration Evaluation and Authorization of Chemicals (“REACH”). We have registered Zinc Oxide

under REACH and filed preliminary registrations for other materials. Our facilities are also certified to the international standard for environmental management, ISO 14001:2004.

Our operations employ a cellular, team-based manufacturing approach, where workers operate in work “cells,” under a lean

manufacturing environment to continuously advance and improve production capabilities. We have also developed a highly flexible workforce that has been cross-trained to allow it to be employed broadly across our manufacturing processes. Our

manufacturing approach and targeted engineering actions have resulted in continuing process innovations and improvements that have reduced the variable manufacturing cost significantly over the past several years.

We are committed to a lean manufacturing approach, to the extent possible given a certain measure of irregular demand, where we are able to

reduce excess labor and manage the lowest practical inventory and supply levels in order to minimize working capital demands. This approach complements two of our major operational goals - (1) to increase output without adding unnecessarily to

existing equipment and (2) to continually reduce production costs while consistently producing high quality products.

Intellectual Property and Proprietary Rights

We rely on a combination of patent, trademark, copyright, trade secret and other intellectual property laws, nondisclosure agreements and other

protective measures to protect our intellectual property. In addition to obtaining patent and trademarks based on our inventions and products, we may also license certain third-party patents from time-to-time to expand our technology base.

As of the date of this filing, we own 11 U.S. patents and 2 pending U.S. patent applications. We also own 35 foreign patents and patent

applications consisting of 30 issued or allowed foreign patents and 5 pending foreign patent applications. All of the pending and owned foreign patents are counterparts to domestic filings covering our platform of nanotechnologies. Our oldest issued

patents began to expire during 2013. We do not believe that the expiration of these patents will have a material impact on our business or financial condition.

Competition

Within each of our targeted markets and product applications, we face potential competition from advanced materials and chemical companies, and

suppliers of traditional materials. In many markets, the actual or potential competitors are larger and more diversified than we are; however, we believe we focus in market segments and opportunities where our materials and related technologies are

superior to those

7

of our competitors, often due to our ability to produce highly engineered products to meet specific performance requirements and develop nanomaterial solutions for customers’ specific

applications.

With respect to traditional suppliers, we may compete against lower priced traditional materials for certain customer

applications. In some product or process applications the benefits of using nanomaterials do not always justify a process change or outweigh their frequently higher costs.

With respect to larger producers of nanomaterials, while many of these producers do not currently offer directly competitive products, these

companies may have greater financial and technical resources, larger research and development staffs, and greater manufacturing and marketing capabilities, and could compete directly against us. In addition, the number of development-stage companies

involved in nanocrystalline materials continues to grow on a global basis, posing increasing competitive risks. Many of these companies are associated with university or national laboratories and use chemical and physical methods to produce

nanocrystalline materials. We believe that most of these companies are engaged primarily in funded research and not commercial production; however, they may represent competitive risks in the future. Some development-stage companies, especially in

other countries, receive significant government assistance or enjoy other benefits due to their location. We anticipate that foreign competition will play a greater role in the nanomaterials arena in the future, something we are increasingly seeing

today, albeit indirectly.

We believe that our nanomaterial technologies and manufacturing platforms are strong. We believe we are

well-positioned with our platform of integrated commercial nanomaterial technologies and track record of technology improvement and evolution.

Governmental Regulations, Including Climate Change

The manufacture and use of certain of the products that contain our

nanocrystalline materials are subject to governmental regulations. As a result, we are required to adhere to the cGMP requirements of the FDA and similar regulations that include testing, control and documentation requirements enforced by periodic

inspections. We are also in the process of registering some of the chemicals we ship to customers in Europe in compliance with the European Chemical Agency’s regulations issued to date pertaining to REACH (to date, we have registered Zinc Oxide

under REACH and filed preliminary registrations for other materials).

We are committed to environmental health and safety

(“EH&S”). We believe we comply with all applicable exposure limit standards issued by OSHA. Because nanotechnology remains an emerging and evolving science, there are no currently accepted standards, measurements or personal protective

equipment available that are specific to nanoparticle safety. Accordingly, we rely on general chemical safety and process safety practices to identify safe personal protective equipment and appropriate handling protocols. We believe that we have

taken a leadership position on EH&S in our operations and have internal and external review and monitoring of our practices.

In

addition, our facilities and operations are subject to the plant and laboratory safety requirements of various environmental and occupational safety and health laws. We believe we are in compliance with all such laws and regulations, and to date,

those regulations have not materially restricted or impeded operations. Further, we believe our processes to be highly efficient, generating very low levels of waste and emissions. For this reason, we do not view issues surrounding climate change

and any currently foreseeable related regulations as materially impacting our business and financial statements, beyond any inestimable impact on the macro-economic environment.

We have taken a responsible, proactive approach to EH&S by implementing appropriate procedures and processes to have our facilities

certified to ISO 14001, American National Standard, Environmental Management System Requirements. We are also involved with leading industry groups that are defining nanomaterial standards and protocols. These currently include the ASTM

International

8

Committee on Nanotechnology, Nanoscale Materials Stewardship Program under the Toxic Substances Control Act, and the US TAG to ISO TC 229 Nanotechnology committee managed by the American National

Standards Institute committee (ANSI). We also participate in FDA reviews relative to cosmetic applications. We have a full-time, advanced degreed professional who spends a significant amount of time managing governmental regulation compliance and

EH&S. We believe that our Company has an exemplary safety record.

Employees

On December 31, 2014, we had a total of 39 full-time employees, 5 of whom hold advanced degrees. We have no collective bargaining

agreements and believe that we have a strong relationship with our employees.

Backlog

We do not believe that a backlog as of any particular date is indicative of future results. Our sales are primarily pursuant to purchase orders

for delivery of our nanomaterials. We have some agreements that give customers the right to purchase a specific quantity of nanomaterials during a specified time period. These agreements, however, do not obligate the customers to purchase any

minimum quantity of such nanomaterials. The quantities actually purchased by the customer, as well as the shipment schedules, are frequently revised during the agreement term to reflect changes in the customer’s needs. For these reasons we do

not believe that such agreements are meaningful for determining backlog amounts.

Business Segment and Geographical

Information

Our operations comprise a single business segment and all of our long-lived assets are located within the United States.

See Note 13 to the accompanying Financial Statements for additional information.

Key Customers

A limited number of key customers account for a substantial portion of our commercial revenue. In particular, revenue from three customers -

our largest customer in personal care applications (BASF), our medical diagnostics application customer, and our largest coatings customer - constituted approximately 72%, 6% and 5%, respectively, of our 2014 total revenue. Many of our customers are

significantly larger than we are and, therefore, may be able to exert a high degree of influence over us. While our agreements with BASF are long-term agreements, they may be terminated by BASF under certain circumstances with reasonable notice and

do not provide any guarantees that BASF will buy our products. The loss of one of our largest customers or the failure to attract new customers could have a material adverse effect on our business, results of operations and financial condition. Due

to the high concentration of sales to a limited number of customers, we have aggressively pursued new customers through our customer direct business model. To the extent we are successful in adding a large number of customers through this model and

maintaining or expanding our existing partners, we believe we will be able to best manage the risks associated with customer concentration.

Forward-Looking Statements

We want to provide investors with more meaningful and useful information. As a result, this Annual

Report on Form 10-K (the “Form 10-K”) contains certain “forward-looking statements”, as defined in Section 21E of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”). These statements reflect our current expectations of the future results of our operations, performance and achievements. Forward-looking statements are covered under the safe harbor

provisions of the Private

9

Securities Litigation Reform Act of 1995. We have tried, wherever possible, to identify these statements by using words such as “anticipates”, “believes”,

“estimates”, “expects”, “plans”, “intends” and similar expressions. These statements reflect management’s current beliefs and are based on information now available to it. Accordingly, these statements

are subject to certain risks, uncertainties and contingencies that could cause our actual results, performance or achievements in 2015 and beyond to differ materially from those expressed in, or implied by, such statements. These risks,

uncertainties and factors include, without limitation: our ability to become profitable despite the losses we have incurred since our incorporation; our dependence on our principal customers and the terms of our supply agreement with BASF which

could trigger a requirement to transfer technology and/or sell equipment to that customer; our potential inability to obtain working capital when needed on acceptable terms or at all; our ability to obtain materials at costs we can pass through to

our customers, including Rare Earth elements, specifically cerium oxide; uncertain demand for, and acceptance of, our nanocrystalline materials; our manufacturing capacity and product mix flexibility in light of customer demand; our limited

marketing experience; changes in development and distribution relationships; the impact of competitive products and technologies; our dependence on patents and protection of proprietary information; our ability to maintain an appropriate electronic

trading venue for our securities; the impact of any potential new governmental regulations that could be difficult to respond to or costly to comply with; and the resolution of litigation or other legal proceedings in which we may become involved.

In addition, our forward-looking statements could be affected by general industry and market conditions and growth rates. Readers of this Form 10-K should not place undue reliance on any forward-looking statements. Except as required by federal

securities laws, we undertake no obligation to update or revise these forward-looking statements to reflect new events or uncertainties.

Investor Information

We are subject to the informational requirements of the Exchange Act and, accordingly, file periodic reports,

proxy statements and other information with the Securities and Exchange Commission (the “SEC”). Such reports, proxy statements and other information may be obtained by visiting the Public Reference Room of the SEC at 100 F Street, N.E.,

Washington, DC 20549 or by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains an Internet site (http://www.sec.gov) that contains reports, proxy and information statements and other information regarding issuers that file

electronically.

Financial and other information may also be accessed at our website. The address is www.nanophase.com. We make

available, free of charge, copies of our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act as soon

as reasonably practicable after filing such material electronically with, or otherwise furnishing it to, the SEC, and intend to make all such reports and amendments to reports available free of charge on our website. We have included our website

address throughout this Form 10-K as textual references only. The information contained on our website is not incorporated into this Form 10-K.

The following factors, among others, could cause

actual results to differ materially from those contained in forward-looking statements made in this Annual Report on Form 10-K and presented elsewhere by management from time to time. Such factors may have a material adverse effect on our business,

financial condition, and results of operations, and you should carefully consider them before deciding to invest in, or retain, shares of our common stock. Additional risks and uncertainties not presently known to us or which are currently not

believed to be material or which we have not predicted may also harm our business operations or affect our actual results. Because of these and other factors, past performance should not be considered an indication of future performance.

10

We have a history of losses that may continue in the future.

We have incurred net losses in each year since our inception, with net losses of $1.7 million in 2014 and $2.5 million in 2013. As of

December 31, 2014, we had an accumulated deficit of approximately $92 million and may incur a loss on an annual basis during 2015. We believe that our business depends, among other things, on our ability to significantly increase revenue.

If revenue fails to grow at anticipated rates or if operating expenses increase without a commensurate increase in revenue, or if we fail to adjust operating expense levels accordingly, then the imbalance between revenue and operating expenses will

negatively impact our cash balances and our ability to achieve profitability in future periods.

We depend on a few major customers for a high

percentage of our sales, and the loss of orders from a significant customer could cause a decline in revenue and/or increases in the level of losses incurred.

Sales to our customers are executed pursuant to purchase orders and long-term supply contracts; however, customers can cease doing business

with us at any time with limited advance notice. It is possible that a significant portion of our future sales may remain concentrated within a limited number of strategic customers. We may not be able to retain our strategic customers, such

customers may cancel or reschedule orders, or in the event of canceled orders, such orders may not be replaced by other sales or by sales that are on as favorable terms. In addition, sales to any particular customer may fluctuate significantly from

quarter to quarter, which could affect our ability to achieve anticipated revenues on a quarterly basis.

Sales to our three largest

customers accounted for 72%, 6% and 5%, respectively, of our total revenue in 2014 and sales to these same customers accounted for 72%, 3% and 6%, respectively, of our total revenue in 2013.

We plan to expand both our marketing and business development efforts and our production efficiency in order to address the issues of our

dependence upon a limited amount of customers, enhancement of gross profit and operating cash flows, and the achievement of profitability. Given the nature of our products, and the fact that markets for them are not yet fully developed, it is

difficult to accurately predict when additional large customers will materialize. Going forward, our margins, as a percentage of revenue, will be dependent upon revenue mix, revenue volume, raw materials pricing, and our ability to continue to cut

costs. The extent of the growth in revenue volume and the related gross profit that this revenue generates will be the main drivers in generating positive operating cash flows and, ultimately, net income.

Any downturn in the product markets served by us would harm our business.

A majority of our products are incorporated into products such as personal care applications including sunscreens, architectural coatings,

surface finishing technologies (polishing), and to a lesser extent, medical diagnostics, abrasion-resistant coatings and other products. These markets have from time to time experienced cyclical, depressed business conditions, often in connection

with, or in anticipation of, a decline in general economic conditions. These industry downturns often result in reduced product demand and declining average selling prices. Our business would be harmed by a continuation of any downturn and/or any

future downturns in the markets that we serve.

Our products often have long adoption cycles, which could make it difficult to achieve market

acceptance and makes it difficult to forecast revenues.

Due to their often novel characteristics and potential unfamiliarity with

them that exists in the marketplace, our nanomaterials may require longer adoption cycles than existing materials technologies, to the point that adoption cycles typically require one to five years. Our nanomaterials have to receive appropriate

attention within any potential customer’s organization, and then they must be tested to prove a performance advantage over existing materials, typically on a systems-cost basis. Once we have proven initial commercial viability, pilot scale

production runs are typically required and completed by the customer, followed by further testing. Once production-level commercial viability is established, then our nanomaterials can be introduced, often to a downstream marketplace that needs to

be familiarized with them. If we are unable to demonstrate to our potential customers the performance advantages and economic value of our nanomaterials over existing and competing materials and technologies, we will be unable to generate

significant sales. Our long adoption cycle makes it difficult to predict when sales will occur.

11

We frequently depend on collaborative development relationships with our customers. If we are unable to

initiate or sustain such collaborative relationships or if the terms of these relationships limit the distribution of our products, then we may be unable to successfully develop, manufacture or market our current and future nanomaterials or

applications.

We have established, and will continue to pursue, strategic relationships with many of our customers and do not have

a substantial direct sales force or an established distribution network (other than distribution arrangements for research samples). Through these relationships, we seek to develop new applications for our nanomaterials and share development and

manufacturing resources. We also seek to coordinate the development, manufacture and marketing of our nanomaterials products, particularly as a result of our selling additives that must be integrated into complete formulations by the customer.

Future success will depend, in part, on our continued relationships with these customers and our ability to enter into similar strategic relationships with other customers. Our customers may not continue in these collaborative development

relationships, may not devote sufficient resources to the development or sale of our materials or may enter into strategic development relationships with our competitors. These customers may also require a share of control of these collaborative

programs. While less prevalent than in the past, some of our agreements with these customers limit our ability to license our technology to others and/or limit our ability to engage in certain product development or marketing activities with others.

These relationships generally can be terminated unilaterally by customers.

If we are unable to initiate or sustain such collaborative

relationships or if the terms of these relationships materially limit our access to distribution channels for our products, then we may be unable to successfully develop, manufacture or market our current and future nanomaterials or applications.

If commodity metal prices increase at such a rate that we are unable to recover lost margins on a timely basis or that our products became

uncompetitive in their current marketplaces, our financial and liquidity position and results of operations would be substantially harmed.

Many of our significant raw materials come from commodity metal markets that may be subject to rapid price increases. While we generally are

able to pass a significant portion of commodity “price-related” increases on to our customers, it is possible that, given our limited customer base and the limited control we have over it, commodity metal prices could increase at such a

rate that could hinder our ability to recover lost margins from our customers. It is also possible that such drastic cost increases could render some of our materials uncompetitive in their current marketplaces when considered relative to other

materials on a cost benefit basis. If either of these potential results occurred, our financial and liquidity position and results of operations would be substantially harmed.

From 2010-2012, the availability of one of the materials we use, cerium oxide, a “Rare Earth” material, was constrained by a change

in Chinese export policy, causing a dramatic increase in material cost. While prices and availability improved by the end of 2012, the cost of this material remains higher than it was prior to 2010. While cerium oxide continues to be used for many

applications, polishing applications in our case, customers are more inclined to look for alternative solutions today as they consider the supply (including cost) risk of this material. Failure of customers to either adopt solutions utilizing cerium

oxide or continue to use solutions containing cerium oxide could harm one of our business areas, and thus negatively impact our financial and liquidity position and results of operations.

Protection of our intellectual property is limited and uncertain.

Our intellectual property is important to our business. We seek to protect our intellectual property through patent, trademark, copyright, and

trade secret protection and confidentiality or license agreements with our employees, customers, suppliers and others. Our means of protecting our intellectual property rights in the United States or abroad may not be adequate and others, including

our competitors, may use our proprietary technology without our consent. We may not receive the necessary patent protection for any applications pending with the U.S. Patent and Trademark Office (“USPTO”) and any of the patents

12

that we currently own or license may not be sufficient to keep competitors from using our materials or processes. In addition, patents that we currently own or license may not be held valid if

subsequently challenged by others and others may claim rights in the patents and other proprietary technology that we own or license. Additionally, others may have already developed or may subsequently develop similar products or technologies

without violating any of our proprietary rights. If we fail to obtain or maintain patent protection or preserve our trade secrets, we may be unable to effectively compete against others offering similar products and services. In addition, if we fail

to operate without infringing the proprietary rights of others or lose any license to technology that we currently have or will acquire in the future, we may be unable to continue making the products that we currently make.

Moreover, at times, attempts may be made to challenge the prior issuance of our patents. Furthermore, litigation may be necessary to enforce

our intellectual property rights, to protect our trade secrets, to determine the validity and scope of the proprietary rights of others, or to defend against claims of infringement or invalidity. Such litigation could result in substantial costs and

diversion of resources and could harm our business, operating results and financial condition. Such litigation might occur with parties that have substantially greater resources, and thus more capability to engage and continue litigation. In

addition, if others assert that our technology infringes their intellectual property rights, resolving the dispute could divert our management team and financial resources.

Due to the expanding length of time required in order to obtain a patent, and the inherent ongoing risks of the protections truly provided by

any patent, we made a decision during 2008 that we could no longer place a value on these intangible assets. In the future, we may license certain of our intellectual property, such as trademarks, to third parties. While we would attempt to ensure

that any licensees maintain the quality and value of our brand, these licenses might diminish this quality and value.

If a catastrophe strikes

either of our manufacturing facilities or if we were to lose our lease for either facility due to non-renewal or other unforeseen events, we may be unable to manufacture our materials to meet customers’ demands.

Our manufacturing facilities are located near Chicago—in Romeoville and Burr Ridge, Illinois. These facilities and some of our

manufacturing and testing equipment would be difficult to replace in a timely manner. Therefore, any material disruption at one of our facilities due to a natural or man-made disaster or a loss of lease due to non-renewal or other unforeseen events

could have a material adverse effect on our ability to manufacture products to meet customers’ demands. While we maintain property insurance, this insurance may not adequately compensate us for all losses that we may incur in the event of a

material interruption in our business.

If we are unable to expand our production capabilities to meet unexpected demand, we may be unable to manage

our growth and our business would suffer.

Our success will depend, in part, on our ability to manufacture nanomaterials in

significant quantities, with consistent quality and in an efficient and timely manner. We expect to be able to expand our current facilities or obtain additional facilities in the future, and outsource production aspects as necessary, available and

appropriate, in order to respond to unexpected demand for existing materials or for new materials that we do not currently make in quantity. Such unplanned demand, if it resulted in rapid expansion, could create a situation where growth could become

difficult to manage, which could cause us to lose potential revenue.

Our industry is experiencing rapid changes in technology. If we are unable to

keep pace with these changes, our business may not grow.

Rapid changes have occurred, and are likely to continue to occur, in the

development of advanced materials and processes. Our success will depend, in large part, upon our ability to keep pace with advanced materials technologies, industry standards and market trends and to develop and introduce new and improved products

on a timely basis. We expect to commit substantial resources to develop our technologies and product applications and, in the future, to expand our commercial manufacturing capacity as volume grows. Our development efforts may be rendered obsolete

by the research efforts and technological advances of others and other advanced materials may prove more advantageous than those we produce.

13

The markets we serve are highly competitive, and if we are unable to compete effectively, then our business

will not grow.

The advanced materials industry is new, rapidly evolving and intensely competitive, and we expect competition to

intensify in the future. The market for materials having the characteristics and potential uses of our nanomaterials is the subject of intensive research and development efforts by both governmental entities and private enterprises around the world.

We believe that the level of competition will increase further as more product applications with significant commercial potential are developed. The nanomaterials product applications that we are developing will compete directly with products

incorporating both conventional and advanced materials and technologies. While commercially available competitive products may not possess the same attributes as those we offer, other companies may develop and introduce new or competitive products.

Our competitors may succeed in developing or marketing materials, technologies and better or less expensive products than the ones we offer. In addition, many of our potential competitors have substantially greater financial and technical resources,

and greater manufacturing and marketing capabilities than we do. If we fail to provide nanomaterials at an acceptable price, or otherwise compete on a commodity basis with producers of conventional materials, we will lose market share and revenue to

our competitors.

We may need to raise additional capital in the future. If we are unable to obtain adequate funds, we may be required to delay,

scale-back or eliminate some of our manufacturing and marketing operations or we may need to obtain funds through arrangements on less favorable terms or we may be required to sell key production equipment to our largest customer.

We expect to expend resources on research, development and product testing, and in expanding current capacity or capability for new business.

In addition, we may incur significant costs in preparing, filing, prosecuting, maintaining and enforcing our patents and other proprietary rights. If necessary, we may seek funding through public or private financing and through contracts with

governmental entities or other companies. Additional financing may not be available on acceptable terms or at all. If we are unable to obtain adequate funds, we may be required to delay, scale-back or eliminate some of our manufacturing and

marketing operations or we may need to obtain funds through arrangements on less favorable terms. If we obtain funding on unfavorable terms, we may be required to relinquish rights to some of our intellectual property.

To raise additional funds in the future, we would likely sell our equity or debt securities or enter into loan agreements. To the extent that

we issue debt securities or enter into loan agreements, we may become subject to financial, operational and other covenants that we must observe. In the event that we were to breach any of these covenants, then the amounts due under such loans or

debt securities could become immediately payable by us, which could significantly harm us. To the extent that we sell additional shares of our equity securities, our stockholders may face economic dilution and dilution of their percentage of

ownership.

We currently have a supply agreement with BASF that contains provisions which could potentially result in a mandatory license

of technology and/or sale of production equipment to BASF, providing capacity sufficient to meet BASF’s production needs. Under our supply agreement with BASF, a “triggering event” also would occur:

| |

• |

|

if our earnings for a twelve month period ending with our most recently published quarterly financial statements are less than zero and our cash, cash equivalents and certain investments are less than $1 million, or

|

| |

• |

|

upon the acceleration of any debt maturity having a principal amount of more than $10 million, or if we become insolvent as defined in the supply agreement. |

14

In the event of a triggering event where we are required to sell to BASF production equipment

providing capacity sufficient to meet BASF’s production needs, the equipment would be sold at either 115% of the equipment’s net book value or at the greater of 30% of the original book value of such equipment (including any associated

upgrades to it) or 115% of the equipment’s net book value, depending on the particular equipment and contract.

If we were determined

to have materially breached certain other provisions of our supply agreement with BASF, we similarly could be subject to a “triggering event” that potentially could result in a mandatory license of technology and/or sale of certain

production equipment to the customer.

We believe that our current cash balances and other assets that might be monetized if and as

needed, as well as unused capacity that might be available for short-term borrowings, will be sufficient to avoid the first triggering event under the BASF supply agreement for the foreseeable future, and because we are debt-free, the second

triggering event is not currently applicable to us.

If a triggering event were to occur and BASF elected to proceed with the license and

related sale mentioned above, we would lose both significant revenue and the ability to generate significant revenue to replace that which was lost in the near term. Replacement of necessary equipment that would be purchased and removed by the

customer pursuant to this triggering event could take in excess of 12 months. Any additional capital outlays required to rebuild capacity would probably be greater than the proceeds from the purchase of the assets pursuant to our agreement with

BASF. This potential shortfall might put us in a position where it would be difficult to secure additional funding given what would then be an already tenuous cash position. Such an event would also likely result in the loss of many of our key staff

and line employees due to economic realities. We believe that our employees are a critical component of our success and would be difficult to quickly replace and train. Upon the occurrence of such an event, we might not be able to hire and retrain

skilled employees given the stigma relating to such an event and its impact on us. We might elect to effectively reduce our size and staffing to a point where we could remain a going concern in the near term.

We depend on key personnel, and their unplanned departure could harm our business.

Our success will depend, in large part, upon our ability to attract and retain highly qualified research and development, management,

manufacturing, marketing and sales personnel on favorable terms. Due to the specialized nature of our business, we may have difficulty locating, hiring and retaining qualified personnel on favorable terms. If we were to lose the services of any of

our key executive officers or other key personnel, or if we are unable to attract and retain other skilled and experienced personnel on acceptable terms in the future, or if we are unable to implement a succession plan to prepare qualified

individuals to assume key roles upon any loss of our key personnel, then our business, results of operations and financial condition could be materially harmed.

We face potential product liability risks which could result in significant costs that exceed our insurance coverage, damage our reputation and harm our

business.

We may be subject to product liability claims in the event that any of our products are alleged to be defective or cause

harmful effects to humans or physical environments. Because our nanomaterials are used in other companies’ products, to the extent our customers become subject to suits relating to their products, these claims may also be asserted against us.

We may incur significant costs including payment of significant damages, in defending or settling product liability claims. Although we maintain insurance for product liability claims, our coverage may not prove sufficient. Even if a suit is without

merit and regardless of the outcome, claims can divert management time and attention, injure our reputation and adversely affect demand for our nanomaterials.

We may be subject to periodic litigation and other regulatory proceedings or governmental investigations, which could result in the unexpected

expenditure of time and resources.

From time to time, we may be a defendant in lawsuits and regulatory proceedings or are the

subject of governmental investigations relating to our business. Due to the inherent uncertainties of litigation, regulatory proceedings and governmental investigations, we cannot accurately predict the ultimate

15

outcome of any such proceedings or investigations. An unfavorable outcome could have a material adverse impact on our business, financial condition and results of operations. In addition,

regardless of the outcome of any litigation, regulatory proceedings or governmental investigations, such matters are expensive and will require that we devote substantial resources and executive time to defend, thereby diverting management’s

attention and resources that are needed to successfully run our business.

The disclosure requirements under the “conflict minerals”

provisions of the Dodd-Frank Act could increase our costs and limit the supply of certain metals used in our products and affect our reputation with customers and shareholders.

Under the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, as amended, or the Dodd-Frank Act, the SEC adopted disclosure

requirements, which became effective in 2014, for public companies using certain minerals and metals in their products. These minerals and metals are generally referred to as “conflict minerals” regardless of their country of origin. We

anticipate commercial sales of one or more products containing these materials to begin during 2015 (energy application). Under these rules, we are required to perform due diligence and disclose our efforts to prevent the sourcing of such conflict

minerals from the Democratic Republic of Congo or adjoining countries. As a result of these new regulations, we expect to incur, additional costs to comply with the disclosure requirements, including costs related to determining the source of any of

the conflict minerals used in our products. These new requirements could also adversely affect the sourcing, availability and pricing of such minerals, and the pool of suppliers who provide “conflict free” metals may be limited. As a

result, we or our suppliers may not be able to obtain materials necessary for production of our products in sufficient quantities or at competitive prices. In addition, we may not be able to sufficiently verify the origins of all metals used in our

products and confirm that they are “conflict free,” which may adversely affect our reputation.

We are subject to governmental

regulations. The costs of compliance and liability for noncompliance with governmental regulations could have a material adverse effect on our business, results of operations and financial condition.

Current and future laws and regulations may require us to make substantial expenditures for preventive or remedial action. Our operations,

business or assets may be materially and adversely affected by governmental interpretation and enforcement of current or future environmental, health and safety laws and regulations. In addition, our coating and dispersion operations may pose a risk

of accidental contamination or injury. The damages in the event of an accident or the costs to prevent or remediate a related event could exceed both the amount of our liability insurance and our resources or otherwise have a material adverse effect

on our business, results of operations and financial condition.

In addition, both of our facilities and all of our operations are subject

to the plant and laboratory safety requirements of various occupational safety and health laws. We believe we have complied in all material respects with governmental regulations applicable to us. However, we may have to incur significant costs in

defending or settling future claims of alleged violations of governmental regulations and compliance with these regulations may materially restrict or impede our operations in the future. In addition, our efforts to comply with or contest any

regulatory actions may distract personnel or divert resources from other important initiatives.

The manufacture and use of certain

products that contain our nanomaterials are subject to extensive governmental regulation, including regulations promulgated by the FDA, the U.S. Environmental Protection Agency and OSHA. As a result, we are required to adhere to the

requirements of the regulations of governmental authorities in the United States and other countries, including regulations issued to date pertaining to REACH. These regulations could increase our cost of doing business and may render some potential

markets prohibitively expensive. In addition, new rules or regulations could impose restrictions or prohibitions on certain materials being marketed with or incorporated into certain applications, which could limit our ability to sell our

nanomaterials in the marketplace.

A large investor and his affiliates have significant influence on all matters requiring stockholder approval

because they beneficially own a large percentage of our common stock and they may vote their shares of common stock in ways with which other stockholders disagree.

16

As of December 31, 2014, Bradford T. Whitmore, together with his affiliates, Grace

Brothers, Ltd. and Grace Investments, Ltd., beneficially owned approximately 38% of the outstanding shares of our common stock. The current ownership position of Mr. Whitmore and his affiliates could delay, deter or prevent a

change of control or adversely affect the price that investors might be willing to pay in the future for shares of our common stock. The interests of Mr. Whitmore and his affiliates may differ from the interests of our other

stockholders and they may vote the common stock they beneficially own in ways with which our other stockholders disagree. R. Janet Whitmore, one of our directors since 2003 and a stockholder, is the sister of Mr. Whitmore.

We have never paid dividends.

We

currently intend to retain earnings, if any, to support our growth strategy. We do not anticipate paying dividends on our stock in the foreseeable future.

Sales, or the availability for sale, of substantial amounts of our common stock could adversely affect the value of our common stock.

No prediction can be made as to the effect, if any, that future sales of our common stock, or the availability of our common stock for future

sales, will have on the market price of our common stock. Sales of substantial amounts of our common stock in the public market and the availability of shares for future sale could adversely affect the prevailing market price of our common stock.

This in turn could impair our future ability to raise capital through an offering of our equity securities.

There may be future sales or other

dilution of our equity, which may adversely affect the market price of our common stock.

We are not restricted from issuing

additional shares of common stock, including any securities that are convertible into or exchangeable for, or that represent the right to receive, common stock. The market price of our common stock could decline as a result of future sales of our

common stock or the perception that such sales could occur.

Provisions in our certificate of incorporation, our by-laws, and Delaware law could

make it more difficult for a third party to acquire us, discourage a takeover, and adversely affect existing stockholders.

Our

certificate of incorporation, our by-laws and the Delaware General Corporation Law (the “DGCL”) contain provisions that may have the effect of making more difficult, delaying or deterring attempts by others to obtain control of our

Company, even when these attempts may be in the best interests of stockholders. These include provisions on our maintaining a classified Board of Directors and limiting the stockholders’ powers to remove directors or take action by written

consent instead of at a stockholders’ meeting. Our certificate of incorporation also authorizes our Board of Directors, without stockholder approval, to issue one or more series of preferred stock, which could have voting and conversion rights

that adversely affect or dilute the voting power of the holders of common stock. The DGCL also imposes conditions on certain business combination transactions with “interested stockholders.”

These provisions and others that could be adopted in the future could deter unsolicited takeovers or delay or prevent changes in our control

or management, including transactions in which stockholders might otherwise receive a premium for their shares over then current market prices. These provisions may also limit the ability of stockholders to approve transactions that they may deem to

be in their best interests.

Failure to protect the integrity and security of individually identifiable data of our customers, vendors and employees

could expose us to litigation and damage our reputation.

We receive and maintain certain personal, sensitive and confidential

information about our customers, vendors and employees. The collection and use of this information is regulated at the international, federal and state levels, and is subject to certain contractual restrictions in third party

17

contracts. Although we have implemented processes to collect and protect the integrity and security of this personal information, there can be no assurance that this information will not be

obtained by unauthorized persons, or collected or used inappropriately. If our security and information systems or the systems of our employees or external business associates are compromised or our employees or external business associates fail to

comply with these laws and regulations and this information is obtained by unauthorized persons, or collected or used inappropriately, it could negatively affect our reputation, as well as our operations and financial results, and could result in

litigation or regulatory action against us or the imposition of costs, fines or other penalties. As privacy and information security laws and regulations change, we may incur additional costs to remain in compliance.

| Item 1B. |

Unresolved Staff Comments |

There are currently no open

comments from the SEC Staff.

We operate two facilities in the Chicago suburbs -

a 36,000 square-foot production, research and headquarters facility in Romeoville, Illinois and a 20,000 square-foot production facility in Burr Ridge, Illinois. We also lease a 9,000 square-foot offsite warehouse in the vicinity of the Romeoville

facility.

Our manufacturing operations in Burr Ridge are certified under ISO 9001:2008, and we believe that our manufacturing operations

are within the cGMP requirements of the FDA for products that require such compliance. Our facilities are also ISO 14001:2004 certified which is the international standard for environmental management. The Burr Ridge facility has a quality control

laboratory designed for the dual purposes of validating operations to cGMP and ISO standards and production process control. This laboratory is equipped to handle many routine analytical and in-process techniques that are currently required.

The Romeoville facility houses our headquarters, advanced engineering, manufacturing (including nanoparticle coating, nanoparticle dispersion

and pilot-scale manufacturing) and research and development with three applications development laboratories. All Romeoville manufacturing processes are certified to ISO 9001:2008 and ISO 14001:2004, and we believe that the manufacturing of

nanoparticle coating used for sunscreens and personal care is in compliance with the cGMP requirements of the FDA.

We lease our

Romeoville and Burr Ridge facilities. During November 2014 we entered into a Lease Amendment amending the then-current lease for the facility in Romeoville, Illinois, which, among other things, extended the term of such lease through

December 31, 2019 (with our option to extend the term for an additional five-year period). We renewed the Burr Ridge facility lease in September 2010, extending the terms through September 2014 (we subsequently exercised our option to extend

the term through September 2016, and have the option to extend the term for one additional one-year period). During 2013 we also renewed the lease for our offsite warehouse through August 2016.

We believe that our leased facilities provide sufficient capacity to fulfill current known customer demand as well as allow for the creation

of substantial additional space to enable expansion of key production processes. We believe additional facilities could be obtained in the area at competitive prices if necessary to support growth. We believe that our capital expenditures made in

2014, and projected for 2015, will support currently anticipated demand from existing customers. Our actual future capacity requirements will depend on many factors, including new and potential customer acceptance of our current and potential

nanomaterials and product applications, both expected and currently unplanned growth from existing customers, continued progress in our research and development activities and product testing programs and the magnitude of these activities and

programs.

18

| Item 3. |

Legal Proceedings |

We are not a party to any pending legal

proceedings or claims that we believe will result in a material adverse effect on our business, financial condition, or operating results.

| Item 4. |

Mine Safety Disclosures |

Not applicable.

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Market Information; Holders; Dividends

Our common stock is traded on the OTCQB marketplace, operated by OTC Markets Group, since voluntarily delisting from the NASDAQ Capital Market

on March 20, 2012. Our symbol, “NANX”, did not change as a result of this venue transfer. The following table sets forth, for the periods indicated, the range of high and low sale prices for our common stock on the OTCQB marketplace:

|

|

|

|

|

|

|

|

|

| |

|

High |

|

|

Low |

|

| Fiscal year ended December 31, 2014: |

|

|

|

|

|

|

|

|

| First Quarter |

|

$ |

0.56 |

|

|

$ |

0.44 |

|

| Second Quarter |

|

|

0.56 |

|

|

|

0.40 |

|

| Third Quarter |

|

|

0.51 |

|

|

|

0.40 |

|

| Fourth Quarter |

|

|

0.56 |

|

|

|

0.40 |

|

| Fiscal year ended December 31, 2013: |

|

|

|

|

|

|

|

|

| First Quarter |

|

$ |

0.59 |

|

|

$ |

0.40 |

|

| Second Quarter |

|

|

0.63 |

|

|

|

0.28 |

|

| Third Quarter |

|

|

0.61 |

|

|

|

0.40 |

|

| Fourth Quarter |

|

|

0.55 |

|

|

|

0.26 |

|

On March 13, 2015, the last reported sale price of our common stock was $0.51 per share, and there were

approximately 118 holders of record of our common stock.

We have never declared or paid any cash dividends on our common stock and do not

currently anticipate paying any cash dividends or other distributions on our common stock in the foreseeable future. We intend instead to retain any future earnings for reinvestment in its business. Any future determination to pay cash dividends

will be at the discretion of our Board of Directors and will be dependent upon our financial condition, results of operations, capital requirements and such other factors deemed relevant by our Board of Directors.

Securities Authorized for Issuance under Equity Compensation Plan

The following table gives information about our common stock that may be issued upon the exercise of options and rights under our 2010 Equity

Compensation Plan (the “2010 Equity Plan”) on December 31, 2014. The 2010 Equity Plan replaced the 2004 Equity Compensation Plan (the “2004

19

Plan”), the 2005 Non-Employee Director Restricted Stock Plan (as amended, the “2005 Plan”), and the Amended and Restated 2006 Stock Appreciation Rights Plan (the “2006

Plan”).

|

|

|

|

|

|

|

|

|

|

|

|

|

| Plan Category |

|

(a) Number of securities to

be issued upon exercise of

outstanding options,

warrants and rights |

|

|

(b) Weighted -

average exercise

price of

outstanding

options, warrants

and rights |

|

|

(c) Number of securities

remaining available for future

issuance under equity

compensation plans

(excluding

securities reflected

in column (a)) |

|

| Plans Approved by Shareholders |

|

|

2,534,000 |

|

|

$ |

1.31 |

|

|

|

599,000 |

|

| Plans Not Approved by Shareholders |

|

|

None |

|

|

$ |

— |

|

|

|

None |

|

| Item 6. |

Selected Financial Data |

Not required for a smaller reporting

company.

| Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

The following discussion and analysis should be read in conjunction with risks discussed in Part I, Item 1A, Risk Factors of this Form

10-K, and the financial statements and related notes thereto appearing elsewhere in this Form 10-K. When used in the following discussions, the words “anticipates,” “believes,”