Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

Under

The Securities Act of 1933

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

5180

|

|

75-2100622

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(Primary Standard Industrial Classification Code Number)

|

|

(I.R.S. Employer Identification Number)

|

117 West 9th Street, Suite 316

Los Angeles, California 90015

Telephone: (310) 800-4556

Telephone: (310) 800-4556

(Address, including zip code, and telephone number, including area code, of registrant's principal executive offices)

Shannon Masjedi

President and Chief Executive Officer≥

Pacific Ventures Group, Inc.

117 West 9th Street, Suite 316

Los Angeles, California 90015

Telephone: (310) 800-4556

President and Chief Executive Officer≥

Pacific Ventures Group, Inc.

117 West 9th Street, Suite 316

Los Angeles, California 90015

Telephone: (310) 800-4556

(Name, address, including zip code, and telephone number, including area code, of agent for service)

|

Copies to:

|

|

William Mark Levinson, Esq.

Fox Rothschild, LLP.

1800 Century Park E #300

Los Angeles, CA 90067

Phone: (310) 598-4150 / (310) 228-2133

|

______________________

Approximate date of commencement of proposed sale to the public: As soon as practicable after the Registration Statement is declared effective.

________________________

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box: ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

|

Accelerated filer ☐

|

|

|

|

|

|

|

Non-accelerated filer ☐

|

Smaller reporting company ☒

|

|

|

(Do not check if a smaller reporting company)

|

||

|

Emerging growth company ☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act . ☐

|

Title of Each Class

of Securities to

be Registered

|

Amount to be

Registered(1)

|

Estimated Maximum Offering Price per Share(2)

|

Estimated

Maximum

Aggregate

Offering

Price(2)

|

Amount of

Registration

Fee (1)(2)

|

||||||||||

|

Common Stock, par value $0.001 per share

|

3,000,000 shares

|

$

|

0.500

|

$

|

1,500,000

|

$

|

193.20

|

|||||||

|

Total

|

3,000,000 shares

|

$

|

0.500

|

$

|

1,500,000

|

$

|

193.20

|

|||||||

|

(1)

|

Consists of up to 3,000,000 shares of our common stock at par value $0.001 per share.

|

|

(2)

|

Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(o) of the Securities Act, based upon the fixed price of the direct offering.

|

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended (the "Securities Act") or until this registration statement shall become effective on such date as the Securities and Exchange Commission ("SEC"), acting pursuant to said Section 8(a), may determine.

Prospectus

The information contained in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the SEC is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to completion, July 31, 2017

PACIFIC VENTURES GROUP, INC.

Pacific Ventures Group, Inc. (the "Company", "PACV", "we" or "us") is filing this Form S-1 to have the right to sell into the public market 3,000,000 shares of PACV common stock (the "Shares"), with a par value of $0.001 per Share and an aggregate public offering price of approximately $1,500,000. The sale of the Shares will enable PACV to have sufficient available Shares to raise capital from time to time. This offering prospectus (the "Offering", "Prospectus" or "Registration Statement") will permit our President and Chief Executive Officer ("CEO") to sell the shares directly to the public, with no commission or other remuneration payable to her for any shares she may sell. The Shares will be sold pursuant to a schedule determined by PACV management (the "Management") based upon market demand and other factors. The intended methods of communication include, without limitation, telephone and personal contact. For more information, see the section of this Prospectus entitled "Plan of Distribution."

PACV may sell all or a portion of the shares being offered pursuant to this Prospectus at fixed prices, at prevailing market prices at the time of sale, at varying prices or at negotiated prices. In offering the securities on our behalf, we will rely on the safe harbor from broker-dealer registration set out in Rule 3a4-1 under the Securities and Exchange Act of 1934. PACV reserves the right to sell Shares to friends and family at a discounted rate to the offering or market price of the Shares.

There is no minimum number of Shares that must be sold by us for the offering to close, and PACV will retain all the proceeds from the sale of any of the offered shares that are sold and use such proceeds for the purposes set forth herein. The offering is being conducted on a self-underwritten, best efforts direct primary basis, which means our CEO, will attempt to sell the shares herself and also use the services of a broker-dealer whenever the use of a broker-dealer is necessary and at all times if Shares are sold on an exchange. Any Share sold to or through a broker-dealer may diminish the net proceeds to PACV attributable to commissions paid to a broker-dealer.

The offering will conclude on the earlier of when all 3,000,000 shares in this registration statement have been sold, or 360 days after this registration statement becomes effective with the SEC. We may, at our discretion, extend the offering for an additional 360 days.

We have not made any arrangements to place funds in an escrow, trust or similar account. Any funds received, as a part of this Offering will be immediately deposited into our Company's bank account and be available for our use as working capital.

We have operated at a loss since we began business. If we fail to raise sufficient capital to support our operations, investors are likely to lose their entire investment and will not be entitled to a refund.

NEITHER THE SEC NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED THESE SECURITIES OR PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

|

|

Number of

Shares

|

Offering

Price(1)

|

Underwriting

Discounts &

Commissions(2)

|

Proceeds to the

Company

|

||||||||||||

|

Per Share

|

1

|

$

|

0.50

|

$

|

0.00

|

$

|

0.00

|

|||||||||

|

Maximum

|

3,000,000

|

$

|

0.50

|

$

|

150,000

|

$

|

1,350,000

|

|||||||||

|

(1)

|

Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(o) of the Securities Act, based upon the fixed price of the direct offering.

|

|

(2)

|

Estimated commissions and discounts to registered broker dealers, in the event that broker dealers were used to sell some of the 3,000,000 shares.

|

THE INFORMATION IN THIS PROSPECTUS IS NOT COMPLETE AND MAY BE CHANGED. WE MAY NOT SELL THESE SECURITIES UNTIL THE REGISTRATION STATEMENT FILED WITH THE SEC IS EFFECTIVE. THIS PROSPECTUS IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT SOLICITING AN OFFER TO BUY THESE SECURITIES IN ANY STATE WHERE THE OFFER OR SALE IS NOT PERMITTED.

The date of this Prospectus is May 17, 2017.

Table of Contents

|

PROSPECTUS SUMMARY

|

5

|

|

RISK FACTORS

|

18

|

|

FORWARD LOOKING STATEMENTS

|

35

|

|

USE OF PROCEEDS

|

36

|

|

DETERMINATION OF OFFERING PRICE

|

38

|

|

DILUTION

|

38

|

|

PLAN OF DISTRIBUTION

|

40

|

|

DIVIDEND POLICY

|

45

|

|

MARKET FOR OUR SHARES AND SECURITIES

|

46

|

|

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

47

|

|

OUR BUSINESS

|

64

|

|

DIRECTORS, EXECUTIVE OFFICERS, PROMOTERS AND CONTROL PERSONS

|

66

|

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

|

70

|

|

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

|

72

|

|

DESCRIPTION OF SECURITIES

|

73

|

|

INTEREST OF NAMED EXPERTS

|

77

|

|

DISCLOSURE OF COMMISSION POSITION ON INDEMNIFICATION FOR SECURITIES LIABILITIES

|

77

|

|

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

|

78

|

|

WHERE YOU CAN FIND MORE INFORMATION

|

78

|

|

AUDITED INTERIM STATEMENTS

|

79

|

ABOUT THIS PROSPECTUS

You should rely only on the information contained in this Prospectus. We have not authorized anyone to provide you with information that is different from that contained in this Prospectus. This Prospectus is an offer to sell, and seeks offers to buy our Shares of common stock only under circumstances and in jurisdictions where offers and sales are permitted. The information in this Prospectus is complete and accurate only as of the date of the front cover regardless of the time of delivery of this Prospectus or of any sale of Shares. Our business, financial condition, results of operations and prospects may have changed since that date.

For investors outside the United States: We have not done anything that would permit this Offering or possession or distribution of this Prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about and to observe any restrictions relating to this Offering and the distribution of this Prospectus.

In this Prospectus, we rely on and refer to information and statistics regarding our industry. We obtained this statistical, market and other industry data and forecasts from publicly available information. While we believe that the statistical data, market data and other industry data and forecasts are reliable, we have not independently verified the data.

This summary highlights information contained elsewhere in this Prospectus and does not contain all of the information you should consider in making your investment decision. You should read this summary together with the more detailed information, including our financial statements and the related notes, elsewhere in this Prospectus. You should carefully consider, among other things, the matters discussed in "Risk Factors." Except where the context requires otherwise, in this Prospectus, the terms the "Company," "PACV," "we," "us" and "our" refer to Pacific Ventures Group, Inc. and, where appropriate, our consolidated subsidiaries.

We intend to use the proceeds of the offering, after expenses set forth in "Use of Proceeds" section, to relaunch our product.

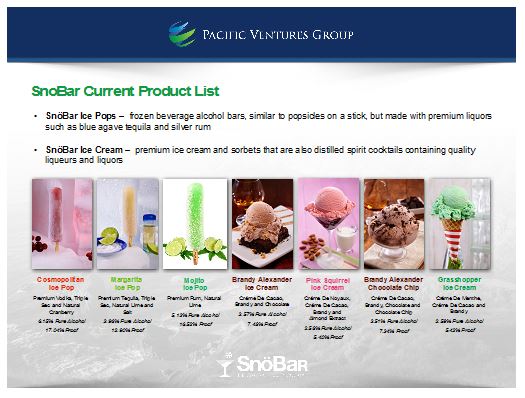

OUR PRODUCT

We believe we distribute one of the only products of its kind in the U.S. The original invention of our frozen alcohol desserts follows the same recipes used by fine bars and restaurants. What makes our liquor ice cream and ice pops different is that the product is solid just like regular ice cream, not semi-soft or in a milk shake consistency like those found at some bars and restaurants. Our Product is ready-to-eat solid or can be blended into a cocktail. While SnöBar Products look like ice cream and frozen ice pops, the Bureau of Alcohol, Tobacco, Firearms and Explosives ("ATF") and Food and Drug Administration ("FDA") have classified SnöBar ice cream and SnöBar ice pops as distilled spirits due to the alcohol content.

We have a proprietary formula and manufacturing technique that allows us to minimize post-manufacture product degradation, which enables us to mass produce alcohol-infused ice cream and ice pops differently than our competitors. Our proprietary formulation and manufacturing method stabilizes the alcohol molecules from interacting with ice crystals and milk proteins making it possible to mass-produce a solid alcohol-infused ice cream that has a flavoring system ranging between 15% to 20% distilled spirits.

We have no control over our co-packers and or other manufacturers. Through these third party manufactures, we are exposed to various product liability and other risks associated with commodity price volatility arising from supply conditions, geopolitical and economic variables, weather, and other unpredictable external factors.

OUR COMPANY:

We acquired PACV through a reverse merger with a predecessor company incorporated under the laws of the State of Delaware on October 3, 1986, under the name AOA Corporation, which was incorporated under the laws of the State of Delaware on October 3, 1986, under the name AOA Corporation who changed its name to American Eagle Group, Inc. on November 12, 1991. On October 22, 2012, we changed the company's name to Pacific Ventures Group, Inc.

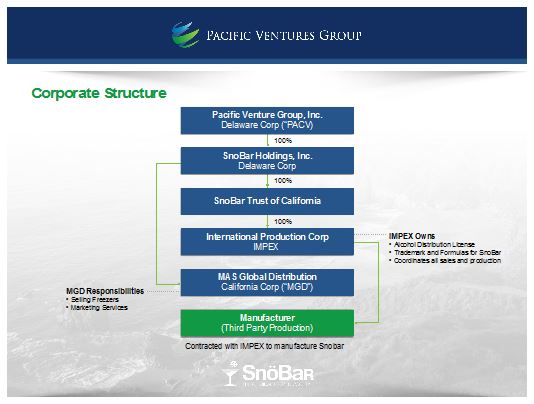

Our current corporate structure resulted from a reverse merger with SnöBar Holdings, Inc. ("SnöBar"), which was formed in Delaware on January 7, 2013. The reverse merger was effected September 25, 2015 through a share exchange agreement with the shareholders of SnöBar, pursuant to which we acquired 100% of the issued and outstanding shares of SnöBar's Class A and Class B common stock in exchange for 22,500,000 of our restricted Shares, while simultaneously issuing 2,500,000 shares of our restricted common Shares to certain other persons as discussed in MD&A section of this Prospectus. We own 100% of SnöBar and its subsidiaries and our organizational structure was established to manage and comply with the unique requirements of various state liquor license laws.

As the result of the preceding transactions, we became the holding company for SnöBar and its affiliates and subsidiaries comprising SnöBar Trust ("Trust"), a California trust formed on June 1, 2013 whose trustee is a family member of our CEO. The Trust owns all of the shares of the stock of International Production Impex Corporation ("IPIC"), a California corporation formed on August 2, 2001 and MAS Global Distributors, Inc. ("MGD") a California corporation. Given the Trust owns all of the shares of stock of IPIC, all income, expense, gains and losses of IPIC flow up to and through to the Trust and Snöbar is the sole beneficiary.

- 1 -

Since the Share Exchange represented a change in control of the Company and a change in business operations, the Company's business operations were primarily managed by SnöBar and the discussions of business operations accompanying this Prospectus are solely that of SnöBar and its affiliates and subsidiaries comprised of Trust, IPIC, and MGD. Table A below sets forth the organizational structure of the Company and SnöBar.

IPIC sells alcohol-infused ice cream and ice-pops (the "Product"), and holds all of the rights to the liquor licenses to sell the Product and use the trade name "SnöBar".

SnöBar owns 99.9% of the sh ares of MGD. MGD sells and leases freezers and provides marketing services and is the sole marketer for SnöBar ice cream and SnöBar ice pops. SnöBar is the primary beneficiary of all assets, liabilities and any income received from the business of the Trust and IPIC through the Trust, and is the parent company of MGD.

The Trust and IPIC are considered variable interest entities ("VIEs") by the United States Financial Accounting Standards Board FASB FIN 46. SnöBar is identified as the primary beneficiary of the Trust and IPIC. Under ASC 810, SnöBar performs ongoing reassessments of whether it is the primary beneficiary of a VIE. SnöBar management has the power to direct the activities of a VIE that most significantly impact the VIE's activities (it is responsible for establishing and operating IPIC). Also, SnöBar has the obligation to absorb losses of the VIE that could potentially be significant to the VIE and the right to receive benefits from the VIE that could potentially be significant to the VIE's economic performance. Given the above, the Trust and IPIC were consolidated in the financial statements of SnöBar since the inception of the Trust and since the inception of SnöBar, in the case of IPIC.

The Company is publicly held and owns 100% of SnöBar and its subsidiaries. The Management team is comprised of:

Shannon Masjedi, President and Chief Executive Officer, founder and product inventor (age 45). Ms. Masjedi has experience in the retail food and beverage industry.

- 2 -

Frank Igwealor, Chief Financial Officer (age 45). Mr. Igwealor has substantial experience as Accounting and Finance staff with large private and public companies.

Eddie Masjedi, Executive Manager and Business Development (age 46). Mr. Masjedi has experience within the manufacturing and distribution arena.

Marc Shenkman, Chairman of the Board (age 56). Mr. Shenkman has experience within the finance arena.

Capitalization; Shares of the Company

Common Stock. We were authorized on October 22, 2012 to issue up to 100,000,000 shares of our common stock (the "Shares") with a par value $0.001 per share. Shareholders get one vote per Share. As of December 31, 2016, there were 27,297,364 issued and outstanding Shares. There are 27,297,364 and 25,799,031 Shares outstanding as of December 31, 2016 and 2015 respectively.

Series E Preferred Stock. The Company was authorized in October 2006 to issue up to 10,000,000 shares of its Preferred Stock. Under the rights, preferences and privileges of the Series E Preferred Stock, holders of the preferred stock receive a 10 to 1 voting preference over common stock. Accordingly, for every share of Series E Preferred Stock held, the holder received the voting rights equal to 10 Shares. The Series E Preferred Stock is not convertible into any other class of stock of the Company and has no preferences to dividends or liquidation rights. As of December 31, 2016 there are 1,000,000 shares of Preferred Class E Stock issued and outstanding, with 100% thereof owned by our CEO.

There are no other classes of stock issued in PACV.

No Golden Parachutes/CEO Compensation. We have no severance arrangements with any of our officers or employees. Accordingly, the departure of an executive officer or other senior managers would not trigger any contractual obligation on our part to make any special payments to the departing employee or professional. No formal or informal compensation arrangement or agreement exists between the company and any director or officer. However, following this Offering, the company and the employees, officer and/or directors could formalize an employment agreement that would include compensation of reasonable annual salary as well a reasonable amount of stock-based compensation.

Equity Awards to All Employees. We believe that the talents and dedication of all of our employees contribute to our success; we intend to make equity awards to all of our employees on an ongoing basis following this Offering. Equity awards to employees are dilutive to the book value of investors' stake in Shares. The issuance of common stock for current or future services or acquisitions or other corporate actions may have the effect of diluting the value of the shares held by investors in the Offering, and would have an adverse effect on any trading market for our Shares. The equity awards could be assigned to but not limited to the officers, directors and certain key employees.

The dilutive impact on current stockholder of the issuance of authorized-but-unissued shares of the Company's common stock is discussed in more detail in the "Dilution" section of this Offering.

Business Location

Our principal business, executive and registered statutory office is located at 117 West 9th Street Suite 316 Los Angeles, California 90015; Contact Shannon Masjedi at 310-800-4556 or via email at shannon@pacvgroup.com.

- 3 -

SNÖBAR MARKET

We believe the alcohol and distilled spirits market and market for ice cream products and derivative products are growth markets and will continue to grow because these products appeal to a wide range of consumers and competition in the alcohol infused dessert category is not substantial.

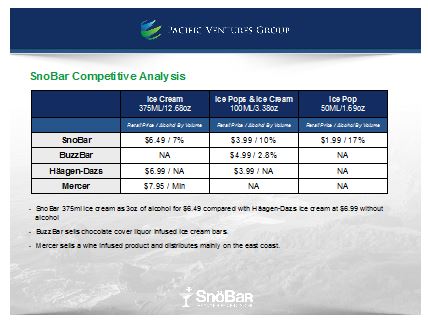

Competition. To competitors currently market alcohol infused and alcohol flavored ice cream (i.e., BuzzBar and Mercer Ice Cream). We believe BuzzBar contains minimal alcohol content and is sold with limited distribution. Mercer Ice Cream is a wine infused ice cream sold primarily in the Eastern and Southeast part of the United States.

Consumer Experience. We have been developing and refining our Product since 2012. The consumer experience with our Product, we believe, finds the products fun and enjoyable to consume. SnöBar Ice Pops and SnöBar Ice Cream product is, we believe, the "original frozen cocktail". In our experience, SnöBar brand products have been well received across all age groups and sexes above the age of 21. We believe SnöBar Product has multiple applications and uses that allow for the creation of exotic and innovative cocktails and unique and delicious desserts. Given the market, we believe we could be positioned, with adequate funding to meet production that has stunted our growth and ability to generate sufficient inventory to fulfill SnöBar product orders, to capture a greater portion of these markets nationally and internationally.

Our strategy for the next five years is to expand SnöBar flavorful ice cream products suffused with distilled spirits through broad distribution and through acquiring or investing in complimentary food, beverage and distribution businesses.

SnöBar Ice Pops and SnöBar Ice Cream Products respectively come in 100ML and 50ML sizes and 375ML and 100ML sizes. We make SnöBar Products with natural ingredients that include up to 15% to 20% distilled spirits. For example, we use tequila, vodka and brandy in different product offerings to make Margarita, Cosmopolitan and Mojito frozen cocktail flavors. We believe that what makes SnöBar Products unique are the ingredients, proprietary formulation, and method of manufacturing. SnöBar Ice Pops and SnöBar Ice Cream utilize a system to stabilize the alcohol molecule, whereby the alcohol content, quality and flavor is not degraded during the production process. In our Ice Cream we strive to use high quality premium dairy which contains a higher concentration on butterfat. This allows SnöBar consumer to enjoy a creamy and delicious alcohol infused dessert.

SnöBar is one of the only spirit associated brands offering incremental revenues that we believe, do not compete with other distilled spirits currently on the market.

- 4 -

Intellectual Property. We have sought to protect SnöBar processing formulas as a trade secret and SnöBar brand is trademarked in the United States and we are currently seeking worldwide trademark rights. We sell SnöBar products under a number of trademarks, brand names and trade names that are important to our Products continued success. Our business could be adversely affected by the loss of any major brand or by material infringement of intellectual property rights. SnöBar Products are subject to intellectual property risks because existing trademark laws offer only limited protection, and the laws of some countries in which SnöBar products are or may be developed, manufactured or sold may not fully protect SnöBar Products from infringement by others.

Competition. We believe that the global distilled spirits and dessert industry is very competitive. SnöBar products compete on the basis of product quality, brand image, price, service and timely innovation in response to consumer preferences. The industry is highly fragmented. Competitors on the alcohol-side of the business include Brown-Forman Corporation, Diageo PLC, Beam, Inc., Pernod Ricard S.A., Bacardi Limited, Davide Campari-Milano S.p.A., Remy Cointreau S.A., and Constellation Brands, Inc. Major competitors on the dessert-side of the business include such premium brands as Haagen-Dazs and Dreyer's, which are respectively owned by Nestlé USA and Ben and Jerry's which is owned by Unilever.

Regulatory Environment. The production, storage, transportation, distribution and sale of SnöBar Products is subject to regulation by federal, state, local and foreign authorities. Various countries and local jurisdictions prohibit or restrict the marketing or sale of products containing alcohol in whole or in part. The Bureau of Alcohol, Tobacco, Firearms and Explosives regulates the U.S. spirits industry with respect to production, blending, bottling, sales, advertising, and transportation of industry products. Also, each state in the United States regulates the advertising, promotion, transportation, sale, and distribution of such products. Many of the key markets for our business, distilled spirits are subject to federal excise taxes and/or customs duties, as well as state/provincial, local and other taxes. Sales of products containing alcohol could be adversely impacted by increases to excise tax rates, which are considered from time-to-time by U.S. states and municipalities and in other key markets for our business. The effect of any future excise tax increases in any jurisdiction cannot be determined, but it is possible that any future excise tax increases could have an adverse effect on our business, financial condition and results of operations.

- 5 -

Environmental Matters. We are subject to both U.S. and international laws and regulations relating to the protection of the environment. In the U.S., the laws and regulations include the Clean Air Act, the Clean Water Act, the Resource Conservation and Recovery Act and Superfund (the environmental program established in the Comprehensive Environmental Response, Compensation, and Liability Act to address abandoned hazardous waste sites), which imposes joint and severable liability on each potentially responsible party. These regulations may be subject to change with the new Trump administration.

In 2012, SnöBar brand was introduced in Arizona. We believe SnöBar brand was well received with off premises and on premises accounts and placed in restaurants, hospitality properties and retail establishments, including Total Wine and the Bevmo Chains.

In 2013, SnöBar brand was launched in Las Vegas, Nevada and Florida.

In Las Vegas, our Product was marketed in several casinos and hotel resorts including the Bellagio Hotel, Golden Nugget, Rio, Wynn, Encore, TAO, Caesars Palace, Hilton, The M Resort and MGM. In Las Vegas our focus was to place SnöBar brand within all various venues of a hotel property for application in catering and banquets, room service, retail outlets, nightclubs and bars. SnöBar was also placed in all the LEE'S Liquor chain stores in Las Vegas and in Albertsons supermarket and Walgreen pharmacy/markets. SnöBar brand was adapted by several on premises accounts who created proprietary specialty cocktails using SnöBar as the main ingredient. For example, The M Resort fashioned "The Ultimate Root Beer Float" for customers ordering a cocktail pool side.

During the calendar year 2015, our Product was sold throughout Florida in Miami, Tampa, Orlando, Jacksonville and the Florida panhandle. In the south Florida area, SnöBar Products were offered by hotels and resorts, including the Ritz Carlton Hotel, Fontainebleau Hotel, Hilton Hotel, Waldorf Astoria Hotel and The Breakers Resort and was test marketed by the big-box retailer Wal-Mart.

Walmart, the largest retailer in the world, approved SnöBar brand for a three month test marketing in certain Florida Walmart locations. The first Walmart store sold out of more than ten cases of SnöBar Product within the first two weeks prompting an eighty-five case reorder. After a three month trial period, Walmart approved the expansion of SnöBar products into its other Florida locations.

In 2014, we began marketing and selling SnöBar brand in California. We established over 100 accounts within the first ninety days following beginning our selling effort. Our focus in California has been to continue marketing and creating brand awareness through the retail and on premise accounts. Immediately after launching the brand in Southern California, our company entered in to an agreement with a Nestlé USA distributor, Jeff & Tony's. The distributor stored our inventory and distributed the Product to all current and new accounts. SnöBar was placed within the Gelson supermarket stores.

In 2015, we targeted South Carolina for expansion of the Product. We entered into a licensing arrangement with a local distributor and granted the distributor exclusive rights to distribute SnöBar products in South Carolina for a minimum of two years with an aggregate of $500,000 worth of SnöBar products. The brand was sold by retailers and in resorts, stadiums and other professional arenas.

While we believed we were achieving success in marketing our product, we did not have sufficient working capital to fulfill demand and to adequately market our product. Therefore, we were compelled to stop our Product sales until we identified new and substantial sources of investment. During this time, we restructured our approach to distribution and scaled back the operating expenditures.

To be more efficient with our sales and customer service, we incorporated a customer relationship management (CRM) system to more efficiently process orders and address customer service needs. This CRM is able to keep track of sales within the placed accounts and provide critical account data back to our company.

- 6 -

THE MANUFACTURING PROCESS

We are not direct manufacturers. We license the manufacture of SnöBar Products.

Raw Materials and Other Supplies. The principal raw materials for the production, storage and aging of distilled products are primarily corn and other grains for whiskies and other spirits, agave for tequila, molasses for rum, and grapes for cognac, sticks for the popsicles and milk and other dairy products for the ice cream. The company does not currently have any long-term supply agreements with third-party suppliers for the purchase of any of raw materials used in our products. From time to time, these raw materials are affected by weather and other forces that may impact production and quality, and, ultimately, their price.

Manufacturing. Due to the confidentiality of SnöBar ice cream and SnöBar formulas and manufacturing processes, we established a manufacturing agreement with a large frozen dessert manufacturer and packer in Southern California to meet future demand. The Company developed its proprietary technology with a third party co-packer who is also solely responsible for manufacturing all of our Products. The co-packing facility can scale to handle worldwide demand of SnöBar Products. The co-packing facility currently manufactures for such retailers as Trader Joe's and Whole Foods.

Inventory. We maintain inventory of SnöBar Products with a third-party manufacturer/co-packer and distributors of their Products. Products that are in inventory may be subject to spoliation, theft, or other hazards that could adversely affect our financial condition, results of operations or business. The ice pops, for example, require refrigeration to a [certain temperature] and if not maintained, may cause the degradation in the Products consistency. Also, consumers may not maintain their freezers at the required 0 to-5F temperatures, which may lead them to believe the ice-pops have partially melted. In such cases, a consumer may return the ice-pops. IPIC is required to reimburse its distributors and return the Product to inventory or otherwise dispose of the Product. No assurance can be given that individual consumers will be educated in the proper freezing requirements of SnöBar Products.

Ice Cream and Ice Pops; Consumer Attraction. While the majority of ice cream sales have long been regular-fat products, ice cream manufacturers continue to diversify their lines of frozen desserts to fit into various lifestyles. However, we believe that most consumers are looking for an indulgence when eating ice creams, which makes SnöBar Products well situated with its ideal formula of two enjoyable products, ice cream and alcohol in an affordable combination.

Alcohol. The second ingredient in SnöBar ice cream and SnöBar ice pops is alcohol. The U.S. beverage alcohol market is over $400 billion according to The Distilled Spirits Council of the United States ("Discus.org"). SnöBar alcohol-infused ice cream and ice pop products capitalize on the success of the thriving frozen desserts industry and the successful alcohol beverage industry, making SnöBar ice cream and ice pop Products appealing to consumers.

Distribution. To scale distribution, SnöBar anticipates partnering with more food, beverage and alcohol distributors. SnöBar Products are primarily sold through direct sales forces to distributors. Product delivery will occur through frozen distribution channels. Transportation of the Product from a manufacturing facility to customers will be handled by third parties contracted with by us. We will use frozen warehouse facilities in Los Angeles, California and Phoenix, Arizona. Accounts in Las Vegas, Nevada and Miami, Florida will be shipped directly to the distributor.

MDG is the sole marketer for SnöBar ice cream and SnöBar ice pops and handles all the marketing and promotion for SnöBar Product line.

SNÖBAR MARKET OPPORTUNITY & STRATEGY

Our business of marketing, licensing and distributing our SnöBar brand depends on our obtaining sufficient capital to fulfill orders. Many of our industry competitors struggle with this delivery challenge. We have a proprietary formula that provides a solution to the degradation challenge and coupled with our special manufacturing technique to mass produce alcohol-infused ice cream and ice pops and leverage our production facilities, warehousing, distribution, and merchandising methods differently than our competitors. Our proprietary formulation and manufacturing method stabilizes the alcohol molecules from interacting with ice crystals and milk proteins making it possible to mass-produce a solid alcohol-infused ice cream that has a flavoring system comprising 15% to 20% distilled spirits. To date, we believe SnöBar alcohol infused ice cream and alcohol infused ice pops are one of the only products of its kind in the U.S.

- 7 -

MARKET RE-ENTRY

We withdrew from marketing and distributing the Product in 2016.

We intend to use a portion of the proceeds of the Offering, after expenses set forth in "Use of Proceeds" section below, to relaunch our Product with sufficient capitalization to execute our business plan for SnöBar brand to be consumed throughout the year with special holiday flavors and promotions planned offering at differing times. We expect to implement a top down marketing plan where SnöBar Products are placed with larger retailers and then are made available to smaller resellers in each market area.

We believe SnöBar ice cream will be consumed throughout the year with special holiday flavors and promotions. Our strategy includes promoting SnöBar consumption in warm climates, specialty venues, cruise lines, resorts, and other seasonal occasions. We will devote our attention to reestablishing major accounts in four core markets (Southern California, Phoenix, Arizona, Las Vegas, Nevada and Miami, Florida) where we intend to sell into upscale restaurants, resorts, cruise lines and hotels worldwide. We also intend to negotiate celebrity branding arrangements and Product endorsements.

ACQUIRE OR INVEST IN COMPLIMENTARY FOOD, BEVERAGES AND DISTRIBUTION BUSINESSES

We intend to use a portion of the proceeds of this Offering to acquire and invest in complimentary food, beverage and distribution businesses. We expect to devote substantial attention to acquisitions that may be synergetic with SnöBar brand. We expect to improve and grow the acquired businesses over the long term through growing sales and distribution and by identifying and implementing economic efficiencies.

We have currently identified several complimentary food, beverage and distribution businesses that meet our acquisition criteria. Our criteria's are companies with positive cash flow, good revenue stream and big potential for upside and future growth.

No assurance can be given that our business plan, as stated above, if executed, will be successful and even if it is successful, will return the investment or make a profit.

EMPLOYEES

As of April 30, 2017, four (4) executives manage the Company's affairs and operations. The team is made-up of

Shannon Masjedi, President and Chief Executive Officer, founder and product inventor (age 45). Ms. Masjedi has experience in the retail food and beverage industry.

Frank Igwealor, Chief Financial Officer (age 45). Mr. Igwealor has substantial experience as accounting and finance executive with private and public companies.

Eddie Masjedi, Executive Manager and Business Development (age 46). Mr. Masjedi has experience within the manufacturing and distribution arena.

Marc Shenkman, Chairman of the Board (age 56). Mr. Shenkman has experience within the finance arena.

- 8 -

Our Financial Condition

WE CURRENTLY DO NOT HAVE SUFFICIENT CAPITAL TO INDEPENDENTLY FINANCE OUR INVESTMENTS AND ACQUISITIONS. WE INTEND TO RELY ON OUTSIDE SOURCES OF FINANCING FOR MOST OF OUR ACQUISITIONS ACTIVITIES. Our ability to achieve and maintain profitability and positive cash flow is dependent upon our ability to identify and acquire great but undervalued businesses. We believe going public and sharing the benefits of our business model with public investors gives us access to a larger pool of capital from either stock issuances, bond issuances, stock-as-currency and other financial benefits of being a publicly traded company.

Risks Related to Our Business

Our business is subject to numerous business, financial, regulatory and other risks of which investors should be aware and carefully consider before making an investment decision.

One of the specific risks associated with our business model is the risk associated with the use of leverage (borrowing) to enhance returns. To generate enhanced returns on our investments, we intend to employee significant leverage on our balance sheet. We anticipate that our debt-to-equity ratio will eventually rise to levels that could equal or exceed 3:1 to 4:1. Wherever we are able, we intend to utilize up to 100% debt to facilitate our mergers and acquisition transactions. This strategy presents greater risk that is typically associated with the use of substantial leverage, including affecting the credit ratings that may be assigned to our debt by rating agencies should we issue bonds. These risks are discussed more fully in the section of this Prospectus titled "Risk Factors", which begins on page 18 of this Offering.

Information Regarding our Capitalization

As of December 31, 2016, we had 27,297,364 shares of our common stock (the "Shares") with par value $0.001 per share, issued and outstanding.

Common Stock. Shares were authorized on October 22, 2012 for up to 100,000,000 shares, par value $0.001 per share. Shareholders have one vote per Share. As of December 31, 2016, there were 27,297,364 issued and outstanding Shares.

Preferred Stock. Series E Preferred Stock were authorized October 22, 2012 for up to 10,000,000 shares. Under the rights, preferences and privileges of the Series E Preferred Stock, the holders of the preferred stock receive a 10 to 1 voting preference over the Shares. Accordingly, for every share of Series E Preferred Stock held, the holder received the voting rights equal to 10 Shares of the Shares. The Series E Preferred Stock is not convertible into any other class of stock of the Company and has no preferences to dividends or liquidation rights. As of December 31, 2016 there were 1,000,000 shares of Preferred Class E Stock issued and outstanding.

- 9 -

The following is a brief summary of this Offering. Please see the "Plan of Distribution" section for a more detailed description of the terms of the offering.

|

Common Stock Outstanding before this Offering:

|

27,297,364 shares

|

|

|

Common Stock Offered by PACV:

|

3,000,000 shares

|

|

|

Total Offering:

|

3,000,000 shares

|

|

|

Common Stock Outstanding after this Offering:

|

30,297,364 shares

|

|

|

Use of Proceeds:

|

We intend to use approximately 60% of the net proceeds from this Offering for the acquisition of the businesses we believe will be complementary to our business. We intend to use approximately 40% of the proceeds towards SnöBar Product distribution including inventory, raw materials and packaging, among other things. No assurance is given that the anticipated percentages or use of proceeds will actually occur or meet the goals previously set forth. See "Use of Proceeds" for additional information.

|

|

|

Minimum number of shares to be sold in this Offering:

|

None.

|

|

|

Offering Period:

|

The offering will conclude when all 3,000,000 Shares have been sold or 24 months after this becomes effective with the SEC.

|

|

|

Termination of the offering

|

The offering will conclude when all 3,000,000 Shares have been sold or 24 months after this Offering becomes effective with the SEC. We may, at our discretion, extend the offering for an additional twelve (12) months.

|

|

|

Terms of the offering

|

We will sell the SEC offered after the SEC has declared this registration statement effective.

|

|

|

Trading Market:

|

Our shares are quoted by the OTC Markets Group under the symbol "PACV." On April 30, 2017, the closing price of our common stock was $1.00 per share.

|

|

|

Risk Factors:

|

The Shares offered hereby involve a high degree of risk and should not be purchased by investors who cannot afford the loss of their entire investment. See "Risk Factors" beginning on page 18.

|

The offering price of the Shares bears no relationship to any objective criterion of value and has been arbitrarily determined. The price does not bear any relationship to our assets, book value, historical earnings, or net worth. You should rely only upon the information contained in this Prospectus. We have not authorized anyone to provide you with information different from that contained in this Offering prospectus. The Selling Security Holders are offering to sell shares of common stock and seeking offers to buy shares of common stock only in jurisdictions where offers and sales are permitted. The information contained in this Prospectus is accurate only as of the date of this Prospectus, regardless of the time of delivery of this Prospectus, or of any sale of the common stock.

- 10 -

SUMMARY OF HISTORICAL FINANCIAL INFORMATION

The following table sets forth summary financial information derived from our financial statements for the periods stated. The accompanying notes are an integral part of these financial statements and should be read in conjunction with the financial statements, related notes thereto and other financial information included elsewhere in this Prospectus.

We derived the balance sheet data and operating data for the years ended December 31, 2016 and 2015 from our audited consolidated financial statements included elsewhere in this Prospectus. The balance sheet data and operating data for the twelve months ended December 31, 2016 has been derived from our audited financial statements included elsewhere in this Prospectus. We have prepared the audited financial statements in conformity with accounting principles generally accepted in the United States of America ("U.S. GAAP") and have included all adjustments, consisting only of normal recurring adjustments that, in our opinion, are necessary to state fairly the financial information set forth in those statements. Our historical results are not necessarily indicative of the results we expect in the future, and our interim results should not necessarily be considered indicative of results we expect for the full year or any other period.

|

Year ended December 31,

|

||||||||

|

Balance Sheet Data:

|

2016

|

2015 | ||||||

|

Current assets

|

$

|

27,767

|

$

|

3,730

|

||||

|

Total assets

|

59,605

|

39,561

|

||||||

|

|

||||||||

|

Total liabilities

|

1,646,590

|

1,427,661

|

||||||

|

Shareholders' equity

|

$ |

(1,586,984

|

)

|

$ |

(1,388,100

|

)

|

||

|

Operating Data:

|

||||||||

|

Year ended December 31,

|

||||||||

|

2016

|

2015

|

|||||||

|

Revenues

|

$

|

4,763

|

$

|

255,213

|

||||

|

Operating expenses

|

373,846

|

192,896

|

||||||

|

Net loss

|

(487,089

|

)

|

(64,552

|

)

|

||||

|

Net loss per share per common share – basic and diluted (27,297,364 and 25,799,031)

|

(0.01784

|

)

|

(0.00250

|

)

|

||||

|

Weighted average number of shares outstanding – basic and diluted

|

$

|

27,297,364

|

$

|

25,799,031

|

||||

- 11 -

There is no required minimum amount of Shares that must be sold in this Offering. As a result, potential investors will not know how many Shares will ultimately be sold and the amount of proceeds we will receive from this Offering. If we sell only a few Shares, potential investors may end up holding shares in a company that:

|

·

|

has not received enough proceeds from the offering to start/sustain operations; and

|

|

·

|

has none, limited, volatile, and sporadic trading market for its common stock.

|

This should be considered a substantial risk of investment, taken together with the "Risk Factors" section presented in this Prospectus starting on page 18.

Rule 405 – "Shell Company"

We are not a "shell company" as defined by Rule 405 of the Securities Act of 1933, as amended (the "Securities Act"), and therefore the registration statement need not comply with the requirements of Rule 405 of the Securities Act, as amended, and Rule 12b-2 of the Exchange Act of 1934, as amended. Securities Act Rule 405 and Exchange Act Rule 12b-2 define a Shell Company as a company, other than an asset-backed issuer, with no or nominal operations; and either:

|

·

|

no or nominal assets;

|

|

·

|

assets consisting of cash and cash equivalents; or

|

|

·

|

assets consisting of any amount of cash and cash equivalents and nominal other assets.

|

None of the above definition applies to PACV. Since September 25, 2015, PACV and its stockholders entered into a share exchange agreement with SnöBar pursuant to which PACV acquired 100% of the issued and outstanding shares of SnöBar's Class A and Class B common stock in exchange for 22,500,000 restricted shares of PACV common stock while simultaneously issuing 2,500,000 shares of PACV's restricted common stock to certain other persons.

Rule 419 – "Blank Check Company"

We are not a "blank check company" as defined by Rule 419 of the Securities Act of 1933, as amended, and therefore the registration statement need not comply with the requirements of Rule 419. Rule 419 defines a "blank check company" as a company that:

(1) is a development stage company that has no specific business plan or purpose or has indicated that its business plan is to engage in a merger or acquisition with an unidentified company or companies, or other entity or person; and

(2) is issuing "penny stock," as defined in Rule 3a51-1 under the Securities Exchange Act of 1934.

We are not a development stage company because we have been in operation for a while and have significant assets and liabilities. As noted in our consolidated financial statements, from our past operations, we had an accumulated stockholders' deficit of approximately $5,357,734 and recurring losses from operations as of December 31, 2016. We also had a working capital need of approximately $944,645 as of December 31, 2016.

- 12 -

RISK FACTORS

We are subject to financial, operational and risks generally associated with development stage enterprises. We have sustained financial losses since we began our business and we will require substantial additional financing to fund our development activities and support our business operations for some time. We also intend to seek additional debt financing. We may be unable to obtain such financing. The following risks list some, but not all, of the material risks involved you should carefully consider before investing in the Company because an investment in our Shares (whether shares or otherwise) involves an exceptionally high degree of risk and is extremely speculative in nature. If any one or more of the following risks occur, our business, operating results and financial condition would likely be seriously harmed and you could lose all or part of your investment. In addition to the other information regarding us contained in this Offering prospectus, you should consider many important factors in determining whether to purchase the Shares ofOCIATED WITH OUR COMPANY AND INDUSTRY

1. We have a history of operating losses and we may not be able to manage our future businesses on a profitable basis.

We have a history of operating losses and may not achieve or sustain profitability ever. Marketing costs associated with research and development and product placement are substantial, among other costs. We cannot and do not guarantee that we will become profitable. Even if we achieve profitability, given the competitive and evolving nature of the industry in which we operate, we may be unable to sustain or increase profitability and our failure to do so would adversely affect the Company's business, including our ability to raise additional funds. Our Management is responsible for managing routine Company operations and strategic planning associated with our current and future businesses, subject to the oversight of our Board of Directors. If we do not develop effective systems and procedures, including accounting and financial reporting systems, to manage our operations as a consolidated public company, we may not be able to manage the combined enterprise on a profitable basis, which could adversely affect our ability to pay distributions or dividends to our shareholders.

2. An investment in the Shares offered herein is highly risky and could result in a complete loss of your investment if we unsuccessfully execute in our business plan.

As noted in our consolidated financial statements, as of December 31, 2016, we had an accumulated stockholders' deficit of approximately $5,357,734 and recurring losses from operations. We experienced a working capital deficit of approximately $944,645, as of December 31, 2016. We intend to fund our immediate and long term operations by raising additional capital through debt financing, equity issuances and other related activities. These efforts may be insufficient to fund our capital expenditures, working capital or other cash requirements for the year ending December 31, 2017 and beyond. The successful outcome of future financing activities cannot be determined at this time and there is no assurance that if achieved, we will have sufficient funds to execute our strategic business plan of promoting our Product or acquiring complimentary businesses that could generate positive operating results.

The above factors, among others, raise substantial doubt about our ability to continue as a going concern. The audit report for the fiscal years ended December 31, 2016 and 2015 expresses substantial doubt as to our continuance as a going concern. Our prospects of becoming a profitable company must be considered in light of the substantial risks, expenses and difficulties encountered by new entrants into our industry. Our ability to achieve and maintain profitability and positive cash flow is highly dependent upon a number of factors, including our ability to secure adequate financing for our acquisitions and investments and increase the sales of our Product, identify attractive targets, attract managerial talents and produce effective business-turnaround models for the businesses we acquire. Based upon current plans, we expect to incur operating losses in future periods as we incur expenses associated with our business.

We cannot and do not guarantee we will be successful in realizing revenues or in achieving or sustaining positive cash flow. Any such failure could result in the possible closure and wind-up of PACV, its affiliates and their respective businesses or force us to seek additional capital through loans or additional sales of our equity securities to continue business operations, which would dilute the value of any Shares you purchase in this Offering Prospectus.

- 13 -

3. A worsening of economic conditions or a decrease in consumer spending may adversely impact our ability to implement our business strategy.

We believe our success depends on discretionary consumer spending, which spending is influenced by, among other things, general economic conditions and the availability of consumer discretionary income. There is no certainty regarding economic conditions in the United States. Credit and financial markets and consumer confidence in economic conditions could deteriorate at any time. There are political risks associated with the new United States Presidential administration that impact economic and tax policy which could diminish consumer confidence and spending trends. We may experience declines in revenue during any period of economic turmoil or uncertainty. Any decline in the amount of consumer discretionary spending, heightened consumer selectivity or otherwise, could have a material adverse effect on our revenue, results of operations, business and financial condition.

4. We seek to market and advertise alcohol infused frozen products and may not be able to accomplish our goal.

A key feature of our growth strategy is to restart and substantially increase our marketing, advertising and distribution of alcohol infused frozen products. Execution of this strategy presents significant challenges and subjects our business to significant risks. For example, we face substantial competition in these areas, and do not have as extensive a history of operating in these areas as some of our competitors, we have a limited staff, among other things. If we are unsuccessful, our ability to grow our business could be significantly limited.

5. The alcohol and dessert industries are highly competitive and if we are unable to compete successfully, our business will be harmed.

The alcoholic beverage and dessert industry are highly competitive. If we are unable to compete successfully against current or future competitors in such industries, our revenues, margins and market share could be adversely affected, any of which could significantly harm our business, operating results or financial condition.

|

6. The costs of being a public company could result in us being unable to continue as a going concern.

|

As a public company, we are obligated to comply with numerous financial reporting and legal requirements, including those pertaining to audits and internal control. The costs of this compliance are substantial and may preclude us from seeking financing or equity investment on acceptable terms. We estimate these costs will be at least $150,000 for FY 2017 and may be greater in future years and if our business volume and activity increases. Our estimate of costs do not include the necessary compliance, documentation and reporting requirements for Section 404 as we will not be subject to the full reporting requirements of Section 404 until we exceed $75 million in market capitalization. If our revenues are insufficient, and/or we cannot satisfy many of these costs through the issuance of our shares, we may be unable to satisfy these costs in the normal course of business that would result in our being unable to continue as a going concern.

7. If securities or industry analysts do not publish research, or publish inaccurate or unfavorable research, about our business, our share price and trading volume could decline.

The trading market for our common stock may be impacted, in part, by the research and reports that securities or industry analysts publish about our business or us. Our common stock is not currently followed by any financial analyst nor is there a trading market made for our common stock. If we eventually are followed by analysts, if one or more analysts cease coverage of our Company or fail to regularly publish reports on us, we could lose visibility in the financial markets, which could cause our share price or trading volume to decline. There can be no assurance that analysts will ever cover us or our business segment, continue to cover us once begun or provide favorable coverage of us, the Shares or any of our securities. If our stock is rated, if one or more analysts downgrade our stock or changes their opinion of our stock, our Share price may decline.

- 14 -

8. Having only three directors limits our ability to establish effective independent corporate governance procedures.

We have only three directors who also serve as Company's officers and no employees. We have not established any committees, including an Audit Committee, a Compensation Committee or a Nominating Committee, any committee performing a similar function. The functions of those committees are being undertaken by Board of Directors as a whole. Because we have only three directors, none of whom are independent, we believe that the establishment of these committees would be more form over substance. Our CEO has control of PACV, among other things, to determine her own level of compensation and otherwise control the Company because of her Series E Preferred Stock holdings. Until we have a larger board of directors that would include some independent members, if ever, there will be limited oversight of our CEO's decisions and activities and little ability for minority shareholders to challenge or reverse those activities and decisions, even if they are not in the best interests of minority shareholders.

9. Our success depends on certain key personnel.

Our performance to date has been and will continue to be largely dependent on the talents, efforts and performance of our senior management. Our Management has limited depth and breadth of experience in the consumer alcohol and food and beverage industry. We currently do not have any employment agreements with key Management, which are used as a method of retaining the services of key personnel. These agreements do not guarantee us the continued services of such employees. We anticipate our executive officers will enter into employment agreements in 2017. The loss of our executive officers or our other key personnel, particularly with little or no notice, could cause delays on projects and could have an adverse impact on our client and industry relationships as we build those relationships, our business, operating results or financial condition.

10. We frequently hire individuals and companies on a project-by-project basis because we have limited staff and expect to continue to engage skilled and qualified personnel as our business expands and if we are unable to attract or continue to attract and retain qualified personnel our business will be adversely affected.

Our success depends on our ability to identify, attract, hire, train and retain qualified creative, technical and managerial personnel familiar with distribution and finance, the food industry and distilled spirits. We expect keen competition for personnel with the specialized creative and technical skills needed to create products and further enhance and develop our Product and provide our services. We hire individuals to assist us on a project-by-project basis. Individuals who work on one or more projects for us may not be available to work on future projects, which impedes our efficient operations. If we have difficulty identifying, attracting, hiring, training and retaining qualified personnel, or incur significant costs to do so, our business and financial results could be negatively impacted.

11. Risks associated with commodity price volatility and energy availability could adversely affect our business.

We engage third parties to manufacture our Products. We have no control over our co-packers and or other manufacturers in the manufacturing or distribution process. Through these third party manufactures, we are exposed to product liability risk and risks associated with commodity price volatility arising from supply commodities, like corn and other grains, molasses, grapes, popsicle sticks and plastic wrapping for the production, packaging and distribution of our Products in addition to geopolitical and economic variables, weather, and other unpredictable factors. Increases and volatility in the prices of these commodities, as well as products sourced from third parties and energy used in making, distributing and transporting our Products, could increase the manufacturing and distribution costs of our Products. We continually evaluate our organizational productivity and supply chains and assess opportunities to reduce costs and have previously mitigated the impact of these cost increases through enhancing quality, speed and flexibility to meet changing and uncertain market conditions and pricing adjustments. However, there is no assurance that we will be able to take the actions necessary to, among other things, offset such cost increases in the future.

- 15 -

12. We rely on the performance of wholesale distributors and other marketing arrangements and could be adversely affected by consolidation, poor performance or other disruptions in our distribution channels and customers.

Our Products are sold primarily through wholesale distributors for resale to retail outlets. The replacement, poor performance or financial default of a major distributor or one of its major customers could adversely affect our business. Industry consolidation could also adversely affect our margins and profitability. Though large customers can offer efficiencies and unique opportunities, they can also seek to make significant changes in their volume of purchases, represent a large number of competing products, negotiate more favorable terms and seek price reductions, which could negatively impact our financial results.

13. If we are unable to provide future officers with sufficient equity interests in our business to the same extent or with the same tax consequences as our existing officer, we may not be able to retain or motivate key personnel or hire qualified personnel.

We are very thinly staffed. Our staff consists of our Board of Directors and investors. When we do hire more employees, our philosophy is to recognize that our employees and key personnel are our most important asset and our success will be highly dependent upon their efforts and commitment and other professionals. Our future success and growth will depend to a substantial degree on our ability to retain and motivate our officers, senior managers and other key personnel and to strategically recruit, retain and motivate new talented personnel, including new officers.

Following this Offering, we might not be able to provide future officers with sufficient equity interests in our business to the same extent or with the same tax consequences as our existing officers. To recruit and retain existing and future officers, we may need to increase the level of compensation we pay them, which would cause our total employee compensation and benefits expense as a percentage of our total revenue to increase and adversely affect our profitability. In addition, issuance of equity interests in our business to future officers would dilute existing public shareholders' stake in the Company.

If we do not continue to develop and implement the right processes and tools to manage our changing enterprise and maintain this culture, our ability to compete successfully and achieve our business objectives could be impaired, which could negatively impact our business, financial condition and results of operations.

14. Because we intend to make equity awards to all of our employees on an ongoing basis following this Offering, these equity awards to employees will be dilutive to the book value of investors' shares of our common stock.

We intend to make equity awards to all of our employees on an ongoing basis. "Dilution" represents the difference between the offering price of the Shares being offered pursuant to this Prospectus and the net book value per share of common stock immediately after completion of this Offering. "Net book value" is the amount that results from subtracting total liabilities from total assets.

15. Our operating results may fluctuate significantly, which may cause the market price of our common stock to decrease significantly.

Our operating results may fluctuate for many reasons and factors, many of which are outside of our control. As a result of these fluctuations, financial planning and forecasting may be more difficult and comparisons of our operating results on a period-to-period basis may not be meaningful. You should not rely on our annual and quarterly results of operations as any indication of future performance. Each of the risk factors described in this "Risks Related to Our Business" section, and the following factors, may affect our operating results:

- 16 -

|

·

|

our ability to continue to attract customers, buyers for our services and products;

|

|

·

|

the amount and timing of operating costs and capital expenditures related to the maintenance and expansion of our businesses, operations and infrastructure;

|

|

·

|

our focus on long-term goals over short-term results;

|

|

·

|

general economic conditions and those economic conditions specific to our industry;

|

|

·

|

changes in business cycles that affect the markets in which we sell our products and services; and

|

|

·

|

geopolitical events such as war, threat of war or terrorist actions.

|

In response to these fluctuations, the value of our common stock could decrease significantly in spite of our operating performance. In addition, our business and the alcoholic beverage business, has historically been cyclical and seasonal in nature, reflecting overall economic conditions as well as client budgeting and buying patterns.

The cyclicality and seasonality in our business could become more pronounced and may cause our operating results to fluctuate more widely.

16. We have a five year history of losses, have generated limited revenue to date and may continue to incur financial losses in the future.

Our history of losses extends back five years and we have generated limited revenue to date. We expect to continue to incur losses for the foreseeable future. If we cannot become profitable, our financial condition will deteriorate and we may be unable to achieve our business objectives, including without limitation, having to cease operations and close the Company due to a lack of capital.

17. We will require substantial additional funding, which may not be available to us on acceptable terms, or at all, and, if not available may require us to delay, scale back or cease our marketing or product development activities and operations.

We will require substantial additional capital to continue our Product marketing and acquisition strategy and development of new flavors and products. Raising funds in the current economic climate may be difficult and additional funding may not be available on acceptable terms, or at all. The amount and timing of our future funding requirements, both near-term and long-term, will depend on many factors, including, but not limited to:

|

·

|

our need to expand our research and development activities, including the hiring of additional employees;

|

|

·

|

the costs of licensing, acquiring or investing in complimentary businesses, products, product candidates and technologies;

|

|

·

|

our ability to maintain, expand and defend the scope of our intellectual product portfolio, including the amount and timing of any payments we may be required to make, or that we may receive, in connection with the licensing, filing, prosecution, defense and enforcement of any intellectual property rights;

|

|

·

|

the effect of any competing technological or market developments;

|

|

·

|

the need to implement additional internal systems and infrastructure, including financial and reporting systems;

|

|

·

|

the economic and other terms, timing of and success of our co-branding, licensing, collaboration or marketing relationships into which we have entered or may enter in the future.

|

- 17 -

Some of the factors above are outside of our control. We believe we will require additional capital to expand the marketing of our alcohol-infused popsicles and ice cream throughout the United States. Such additional fundraising efforts may distract our Management from daily operational, management and other activities, which may adversely affect our ability to develop and market our alcohol-infused products. We cannot guarantee that future financing will be available in sufficient amounts or on terms acceptable to us, if at all. If we are unable to raise additional capital when required or on acceptable terms, we may be required to significantly delay, scale back or discontinue the development or marketing of one or more of our products or product candidates or curtail our operations, which will have a material adverse effect on our business, operating results and prospects.

18. We may sell additional equity or debt securities or enter into other arrangements to fund our operations, which may result in dilution to our stockholders and impose restrictions or limitations on our business.

Additional funding may be a mix of equity offerings, debt-financings, or other third party fundings or other collaborations, strategic alliances or licensing arrangements. These financing activities may have an adverse impact on our stockholders' rights as well as our operations. For instance, any debt financing may impose restrictive covenants on our operations or otherwise adversely affect the holdings or the rights of our stockholders. In addition, if we seek funds through arrangements with partners, these arrangements may require us to relinquish rights to some of our technologies, products or product candidates or otherwise agree to terms unfavorable to us.

19. Acquisitions of companies in our industry and related industries could result in operating difficulties, dilution to our stockholders and other consequences harmful to us.

Our business strategy includes pursuing strategic and complimentary business acquisitions and investments. We may not be able to consummate such acquisitions or investments, which could adversely impact our growth. If we do consummate acquisitions, integrating an acquired company, business or technology may result in unforeseen operating difficulties and expenditures, including:

|

·

|

increased expenses due to transaction and integration costs;

|

|

·

|

potential liabilities of the acquired businesses;

|

|

·

|

potential adverse tax and accounting effects of the acquisitions;

|

|

·

|

diversion of capital and other resources from our existing businesses;

|

|

·

|

diversion of our management's attention during the acquisition process and any transition periods;

|

|

·

|

loss of key employees of the acquired businesses following the acquisition; and

|

|

·

|

inaccurate budgets and projected financial statements due to inaccurate valuation assessments of the acquired businesses.

|

Our evaluations of potential acquisitions may not accurately assess the value or prospects of acquisition candidates, and the anticipated benefits from our future acquisitions may not materialize. In addition, future acquisitions or dispositions could result in potentially dilutive issuances of our equity securities, including our common stock, the incurrence of debt, contingent liabilities or amortization expenses, or write-offs of goodwill, any of which could harm our financial condition.

- 18 -

20. We may not be able to successfully fund future acquisitions of new businesses due to the unavailability of debt or equity financing on acceptable terms, which could impede the implementation of our acquisition strategy.

To complete future acquisitions, we intend to raise capital primarily through debt financing at the PACV level, additional equity offerings, the sale of equity or assets of our businesses, offering equity in the Company or our businesses to sellers of target businesses or by undertaking a combination of any of the above. We cannot predict the timing and size of acquisitions and we may need to be able to obtain funding on short notice to benefit fully from attractive acquisition opportunities. Such funding may not be available on acceptable terms. In addition, the level of our indebtedness may impact our ability to borrow at the PACV level. The sale of additional common shares will also be subject to market conditions and investor demand for the common shares at prices that may not be in the best interest of our shareholders. These risks may materially adversely affect our ability to pursue our acquisition strategy.

21. We may change our management and acquisition strategies without the consent of our shareholders, which may result in a determination by us to pursue riskier business activities.

We may change our business strategy anytime without the consent of our shareholders. Such action may result in our acquiring businesses or assets that are different from, and possibly riskier than, the business strategy described in this Prospectus. A change in our business strategy may increase our exposure to interest rate and currency fluctuations, subject us to regulation under the Investment Company Act of 1940, as amended, which we refer to as the Investment Company Act, or subject us to other risks and uncertainties that affect our operations and profitability.

22. We cannot predict the effect that rapid changes in consumer taste may have on our business or industry.